Index forecasts – gazing into the crystal ball

In the new year it’s traditional for financial institutions to gaze into the crystal ball and give their economic expectations for the coming 12 months. Their expectations for the equity market are consolidated into one figure – the price target of the selected equity index. On the one hand, this process of forecasting is a valuable exercise. Analysts formalise and systematise their thoughts on what factors will influence the real economy and the equity market and which is the most likely scenario. These insights and the conclusions drawn from them in turn contribute to informational efficiency of the capital market. But on the other hand, the mere expression of an index price target is not much help.

An average year in the equity market is the exception rather than the rule

The average year in the equity market is based on the statistical concept of the expected value. Here, possible, but uncertain, economic scenarios and their effects on the equity market are weighted by their individual probabilities of occurrence. The following simple example illustrates the problem with consolidation of information: if you choose heads or tails correctly (or incorrectly) in a coin toss, you win (or lose) EUR 1. So the average expected gain is EUR 0 – a result that cannot occur with any coin toss. Now, the index forecast is not a binary question like the coin toss, but the same problems apply. The forecasted index level is the average expected value, but this average generally does not arise once economic reality manifests – that is, when a scenario becomes certainty.

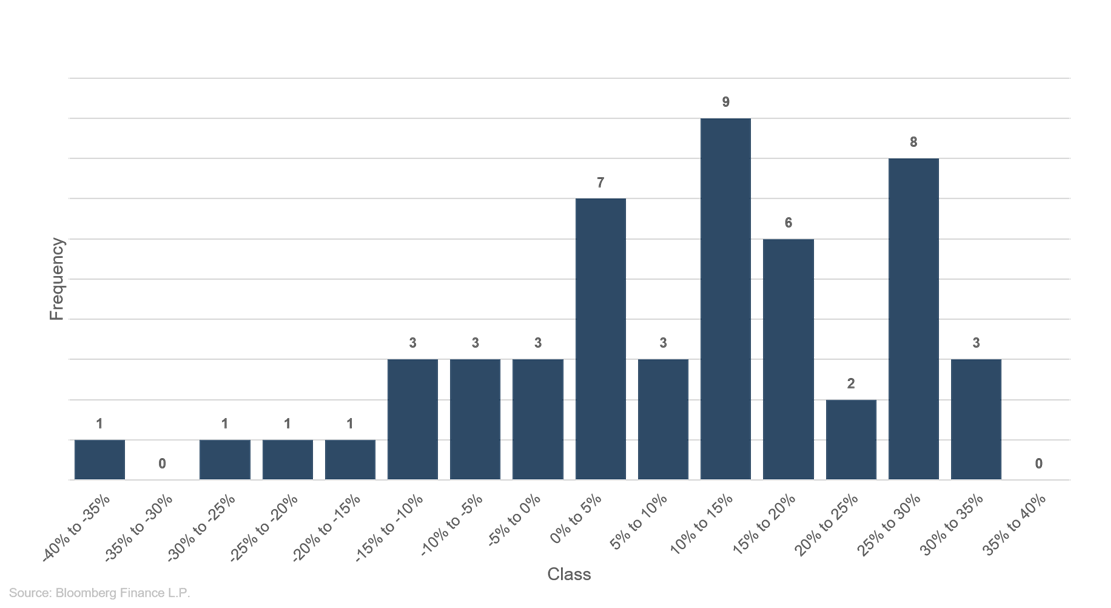

The frequency distribution of S&P 500 annual returns shows that equity markets, based on the realisation of positive or negative scenarios, regularly overshoot in one direction or another. In the past 50 years (1970 to 2020) the U.S. equity market has risen at an average annualised rate of around 7.7%. Therefore, this is the return to be expected in an average year in the equity market. However, the histogram shows that returns do not follow a normal distribution. Therefore, the mean loses some of its significance as a measure of central tendency. Only three times in the past 50 years has the annual return averaged between 5% and 10%, whereas lower single-digit returns (0% to 5%) and low (10% to 15) and medium (25% to 30%) double-digit returns were much more frequent. Thus, an average year in the equity market is the exception rather than the rule

Figure 1: Histogram of S&P 500 annual returns (1970-2020)

A qualitative assessment of expected equity market performance is time-dependent

Despite the infrequency of an average year in the equity markets, many analysts forecast just that for the coming year as well. A Bloomberg survey found that 7 out of the 19 financial and research institutions who took the survey expect an annual return of between 5% and 10%. The mean price target of all analysts – that is, a consolidation of the consolidation – at around 6%, lies in the average year range. This return target is based on the level of the S&P 500 on 16 December 2021: the date the Bloomberg survey was published. This highlights another problem with index forecasts, based on the discrepancy between the time of estimation and the forecast period. On 31 December 2021, after a strong end of year, the S&P 500 stood at 4,766 index points, reducing the implied expectation for the average annual return to 3.85%. Therefore, we can no longer expect an average equity performance for 2022; rather, a below-average performance must be expected. However, in fundamental terms, little changed in closing weeks of the year.

Our approach

For reasons including these basic problems – consolidation of information and time contextualisation – we consider index price targets to be of limited benefit, quite apart from the many smaller problems with scenario analysis. For this reason, at ETHENEA we do not publish such price targets.

For us, it’s much more important to consider supportive and negative factors for equity markets – and not just at the turn of the year, but continually. This includes conventional fundamental and macro data, as well as market sentiment indicators and information derived from other asset classes. By getting a sense of the bigger picture thus, we can take advantage of the strengths of the active management style and be flexible to the opportunities and risks, regardless of where the market stands in relation to any price targets.

Portfolio Manager Update & Fund positioning

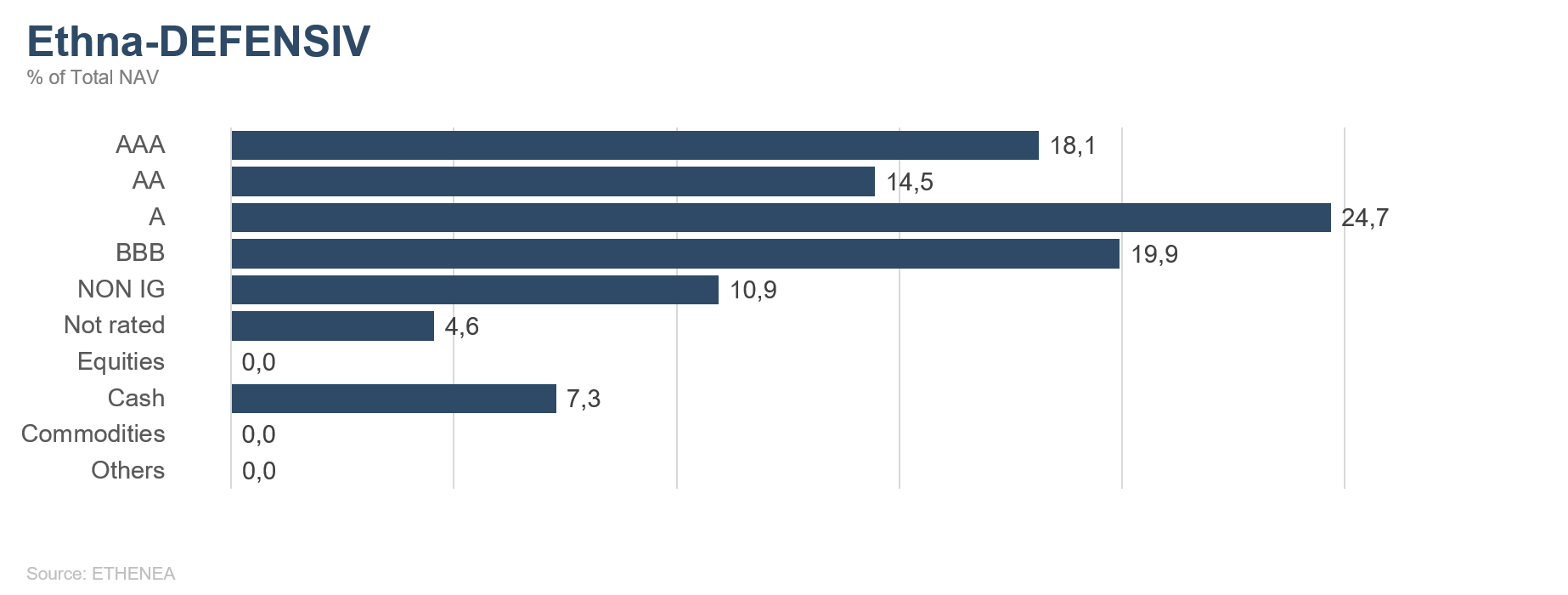

Ethna-DEFENSIV

Volatile bond markets dominated in 2021. For investors this meant finding a positioning amid hopes of reopening, concerns about Covid-19 and central banks hinting at tighter monetary policy. Sovereign bond yields mirrored these ups and downs. At the beginning of the year, investors offloaded long-dated sovereign bonds in reflation trades, in the expectation that the recovery from the pandemic would usher in a period of sustained growth and high inflation rates. In Autumn, shorter-dated bonds then increasingly came under pressure when central banks signalled that they would increase interest rates in response to high inflation. Rising yields and little potential for any further narrowing of credit spreads on corporate bonds impacted the bond market and resulted in a slightly negative performance.

Looking ahead, central bank policy will be the deciding factor for bond markets in the coming year as well. With inflation having reached its highest level for decades, many a market participant fears that central banks will continue to disengage in the form of raising key rates and cutting the supply of liquidity. While central banks will tighten monetary policy to a much greater extent over the coming year, even with three to four interest rate hikes in the U.S. the nominal interest rate will remain well below the inflation rate and thus keep the investment crisis going. Europe is much further from its first interest rate hike; in fact, the ECB’s balance sheet will be further expanded until at least October 2022. This is a positive omen for equities, even though equity markets are not likely to skyrocket over the coming year given the high valuations. Bonds, on the other hand, will remain volatile. We expect a slight rise in 10-year sovereign bond yields, which are likely to level off at around 2% in the U.S. and 0% in Germany. We think it unrealistic that they will overshoot by a clear margin. Credit spreads on investment grade corporate bonds will remain low in the coming year as well, since companies are fully financed for years and are resorting to the bond market on an opportunistic basis; for instance, when financing terms are particularly favourable. In addition, they are only reliant on the absorption capacity of the bond market for refinancing mergers and acquisitions. The same goes for the high yield market, which we essentially consider to be stable. However, it is possible that credit spreads will widen in a domino effect in the event of a sharp correction in equity markets. Ultimately, in light of the difficult market environment, portfolio managers will have to manage interest rate and credit risks more actively and be very selective in choosing between the various sectors and issuers. In our corporate analysis, we will continue to pursue a fundamental bottom-up approach and favour companies with robust business models and solid margins, which, thanks to their market position, are better able to pass on higher raw material costs to their customers.

In December the Ethna-DEFENSIV (T class) delivered a solid performance of +0.08% despite slightly higher yields and temporarily higher credit spreads on corporate bonds versus safer sovereign bonds. Our hedge against rising U.S. dollar yields contributed to performance, while we left the interest rate risk for euro-denominated bonds unhedged. Our U.S. dollar currency position of 20% detracted slightly from performance in December. The Swiss franc and the Norwegian krone, on the other hand, contributed to fund performance. For the year, therefore, the Ethna-DEFENSIV posted a very positive performance of 1.39% (T class) with a very low volatility of approx. 2%. This makes it clear that conservative investments such as the Ethna-DEFENSIV can make a positive contribution to return and can be an important asset building block even when interest rates are rising.

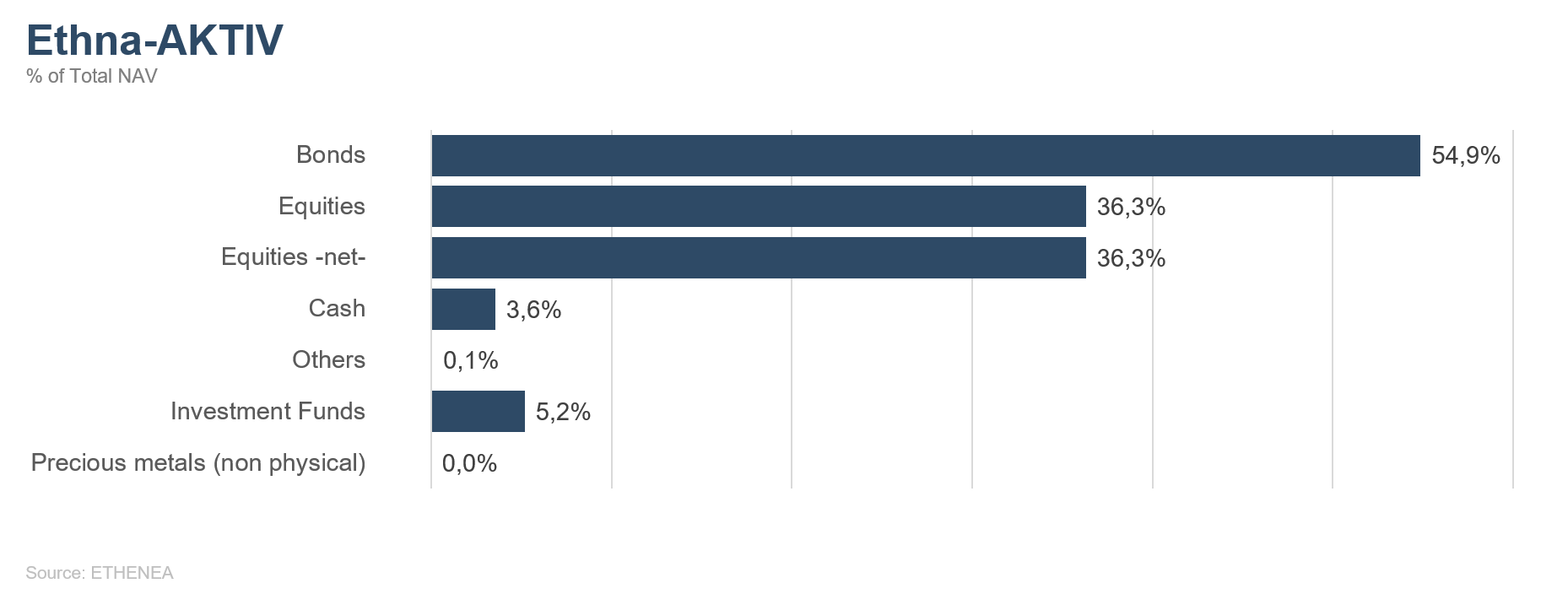

Ethna-AKTIV

What a year! Despite it being not quite two years since the outbreak of the biggest pandemic in recent history, international equity markets are close to their all-time highs and the global economy is growing stronger than any time in the past 40 years. Even though Covid-19 continued to have a negative impact on social and economic life, the concerted efforts of central banks and governments not only brought about a rapid end to the recession but also led to economic growth that is trending higher than pre-crisis. The negative corollary of this almost textbook growth is inflation that is overshooting upward in a similarly textbook manner.

Our positive macro and market assessment at the beginning of last year has thus proved true. That said, from the point of view of capital investors, 2021 brought a few challenges with it. The rise in interest rates that was to be expected came much sooner than anticipated, which led to a mini-crash in the bond market. And in addition to this movement in interest rates, frequent changes of thematic focus also led to multiple changes of favoured equity styles and factors that happened so quickly that overly active portfolio adjustment proved to be counterproductive. Against this backdrop, it’s no surprise that in 2021 a broad index investment such as the S&P 500 was the be-all and end-all. Even though the Ethna-AKTIV is benchmark agnostic, we were spot on last year to resort mainly to U.S. large caps for the equity portfolio. U.S. equities therefore accounted for the majority of the more than 5% annual performance. On the bond front, gains on minimal spread narrowing and coupons were just enough to make up for the losses on the aforementioned movements in interest rates. That said, it is worth stressing that particularly in periods of high volatility, bonds stabilised the portfolio again this year. Also, the U.S. dollar position, which increased over the course of the year, contributed more than 1% to fund performance.

Looking ahead, we must rise to the challenge that the current economic cycle is still in the very early stages, the conditions in terms of monetary and fiscal policy suggest a more advanced stage and valuations would in fact be suggestive of cycle-end. We therefore do not expect the bull run to end, merely a deterioration in the risk/return ratio. But it is in light of this fact in particular that equities continue to be the most affordable in relative terms. Consequently, the Ethna-AKTIV’s equity allocation at the beginning of this year, at 40%, is also close to the maximum of 49%. However, the successive reduction of the massive amounts of liquidity makes it all the more important to construct a stable portfolio of large stocks that are not very sensitive to interest rates. This year’s price gains will come not from excessive liquidity but from compelling business models. We expect quite a bit more volatility than in 2021. Not least the political agenda – with an election in France and mid-terms in the U.S. – will cause a great deal of unrest. In our view, the U.S. dollar will continue to strengthen. This is why we are starting the year with an exposure of 40%, since the strong (but weakening compared with last year) economic growth and the interest rate differential are good arguments in favour of the U.S. dollar. Rounded out by a very conservative portfolio of corporate and sovereign bonds, the Ethna-AKTIV will start the new year effectively fully invested and it is hoped that this balanced portfolio will form the basis for more all-time highs following on from that achieved at year-end.

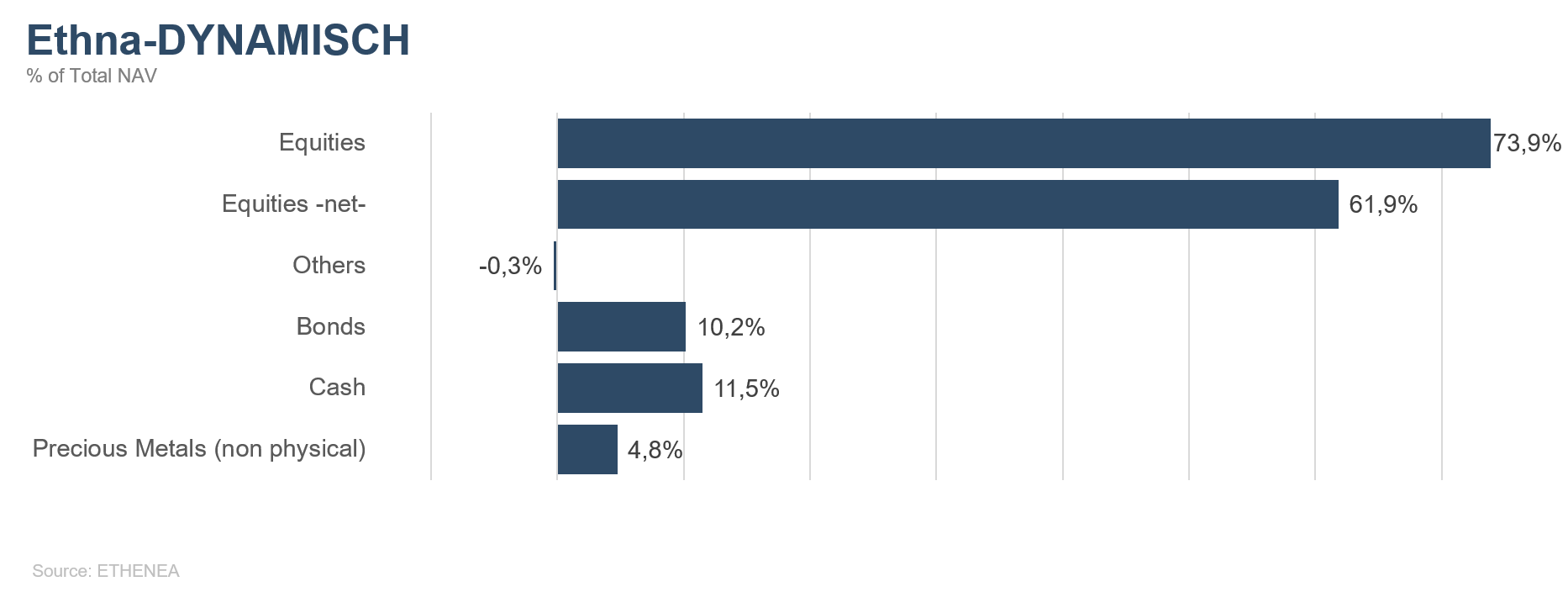

Ethna-DYNAMISCH

2021 in the capital markets is now history. The question is, did it make history? Not really, as 2020 – the year in which the global pandemic began – overwhelmingly influenced developments in 2021. Hardly any economic, monetary, fiscal or fundamental development in 2021 can be described or understood in isolation, without making reference to 2020. One year ago, in the January Market Commentary, we largely summed up the exceptional year that was 2020 as unpredictable and speculated that 2021 would be almost too predictable. The starting situation back then was that it seemed possible for the pandemic to be gradually brought under control, there were signs of strong economic growth, positive effects of the immense fiscal programmes, record-low interest rates and ongoing bond purchase programmes from the central banks, as well as more and more investor groups regaining their risk appetite. The combination of all these factors initially pointed towards a continuation of the upward trends in global equity markets that had started during 2020. Today – one year later – 2021 in the equity markets can be described in very similar terms. The many supportive factors mentioned above led to much higher prices in the first few months of the year. With a correspondingly high net equity allocation of around 75% to 80%, the Ethna-DYNAMISCH was well able to participate in the bull run and quite regularly recorded fresh highs into the summer. Offensive though our equity allocation was, we were disciplined behind it all when it came to opportunities and risks. While we did not fully take advantage of opportunities in more cyclical, structurally more unattractive sectors such as oil, commodities and financials, we did steer clear of significant valuation risks in growth segments and previous winners in the crisis, many of which had reached their highs for the year as early as mid-February and subsequently corrected sharply in some cases.

As the year progressed the strength of the tailwind then gradually abated. Within the Ethna-DYNAMISCH, we therefore shifted down a gear and kept the net equity allocation at roughly 60% by upping the weight of the hedging components. The decline in attractiveness of the market environment was reflected in equity markets; in particular, in a decline in market breadth. While well-known market-cap-weighted equity indices such as the S&P 500 and the MSCI World were pushed up to fresh all-time highs, the performance gap between them and their equal-weighted index variants (containing the same individual stocks, just weighted differently) opened up starting in the summer. The performance of various other well-known indices such as the German DAX, the U.S. Russell 2000 and the MSCI Emerging Markets completely stagnated in the second half of the year. Unfortunately, the single stock portfolio of the Ethna-DYNAMISCH did not escape this broad trend, resulting in a fund performance (taking the second half of the year in isolation) that was just inside positive territory. The reasons why are manifold but, in our opinion, not lasting. For example, the stocks in the portfolio that are benefiting from a normalisation of economic and social activities again came under pressure as a result of the spread of the Delta and Omicron variants of the virus. Despite record-breaking case numbers in many places at the moment there is little to contradict our baseline scenario that a return to social normality thanks to vaccinations and new advances in treatment is only a matter of time.

In contrast to equities, fixed income securities and gold again played a much lesser role in portfolio construction for the Ethna-DYNAMISCH in 2021. In view of the unappealing development of both asset classes, this was a good decision, not just in hindsight.

Compared with the opportunities in the equity markets, at the beginning of the new year we still find the bond yields too unattractive to consider significant investment in debt instruments for the Ethna-DYNAMISCH, the most offensive of the Ethna Funds because the chances that the current bull run will continue – even a more moderate one – are not bad. Thus, global economic growth should again be above average in 2022. Central banks in the U.S. and Europe remain extremely cautious despite high inflation rates. In parallel, the ongoing low expected returns on fixed-income investments should bring about structurally high demand for equities in 2022 as well and the current valuation levels should remain intact for the time being. Thus, we would put the most important price drivers of recent times, as well as solid company earnings and profit growth, on the plus side for equity markets in 2022 as well. On the other hand, any further, continual weakening of these supportive factors is likely to gradually increase uncertainty and nervousness among market participants, which can lead to repeated rapid and sharp rotations in terms of sector and/or style. Accordingly, the Ethna-DYNAMISCH’s high degree of flexibility remains important for it to be well-positioned to deal with alternative scenarios as well.

HESPER FUND - Global Solutions (*)

2021 - a wild year for stocks

2021 will be remembered as the year of the ‘Great Recovery’ following the Covid-19 shock that rocked the global economy in 2020. Despite considerable progress in the fight against the pandemic, the appearance of new coronavirus variants had a considerable impact on both economic performance and the markets. The Delta and Omicron strains not only resulted in new restrictions being imposed but also hampered economic growth in the third and fourth quarters of the year - and there is still a high degree of uncertainty about the development of the pandemic and the effect it will have on the global economy. For economists and market commentators, 2021 was also the year inflation made a comeback. The jury is still out on whether the current high rates of inflation will progressively decline once the pandemic-induced disturbances impacting global supply and demand are absorbed or whether inflation will become entrenched and we will see a change in the long-term inflation dynamics. However, it is clear that a mismatch between the strong upswing in aggregate demand (supported by unprecedented policy stimulus) and an impaired supply currently represents the most significant downside risk for growth and the primary upside risk for inflation.

Thanks to very accommodative monetary and fiscal conditions, Wall Street had a very good run in 2021. Stocks in the US posted double-digit returns for the third year in a row, pulling the equity markets in most advanced economies with them. The S&P 500 Index led the pack, posting a solid 26.9% return. In Europe, the blue-chip index, the Euro Stoxx 50, rose 21% (12.7% in USD terms). 2021 was also the year when US equity markets posted their record all-time high for the last 26 years. The S&P 500 set 70 records last year, the highest number since 1995. A frenzy surrounding so-called ‘meme stocks’ , a record number of IPOs worldwide, and a downturn of the Chinese equity market amidst a regulatory crackdown and a slowing economy also contributed to an eventful year. However, strong stock rotation made stock picking extremely difficult. Keeping pace with the S&P 500 was tough – while it surged ahead, led by a number of very large caps, under the surface, a number of stocks suffered heavy losses. The strength of the US dollar surprised the markets, as it was not one of the main recommendations of market pundits at the beginning of the year. The US Dollar Index (DXY), that averages the exchange rates of the USD and other major world currencies, surged by 6.6% in 2021. The euro, on the other hand, lost almost 8% against the USD during the year. The direction of yields followed a similar pattern, as market consensus pointed to much higher rates for Treasuries than were actually achieved. Despite a very strong inflation spike and supply chain disruptions, Treasury yields barely rose last year, sending confusing signals to investors, observers, policymakers, and the general public about future economic growth.

December 2021

In the end, December was a good month for stocks worldwide, although the Christmas rally was not as strong as expected due to the Omicron outbreak and inflation fears. Most equity markets posted positive returns during the month, delivering strong gains for the year. As was the case for most of the year, it was difficult to keep pace with the S&P 500, as the index ended the year close to a record high.

In December, we saw fluctuations in the major US stock indices, but most ended the month up and not far from their all-time highs. For the month, the S&P 500 increased by 4.4%, the Dow Jones Industrial Average (DIJA) surged by 5.4% and small-caps, as measured by the Russell 2000 Index, rose by 2.1%. The technology-weighted Nasdaq Composite lagged, only rising 0.7%. However, it did overcome a few days of heavy sell-off in the technology space in December.

In Europe, stock markets followed the mood in the US. The large-cap Euro Stoxx 50 Index surged by 5.8% (an increase of 6.4% when calculated in USD), while in the UK, the FTSE 100 rose by 4.6% (6.7%% in USD). Despite a strong Swiss franc, the Swiss Market Index performed extremely well, increasing by 5.9% (6.6% in dollar terms) over the month.

Asian markets were mixed, with the Shanghai Shenzhen CSI 300 Index gaining 2.2% (+2.5% in USD terms). The Hang Seng Index in Hong Kong decreased by 0.3% amid a regulatory crackdown and geopolitical tension. In Japan, the blue-chip Nikkei 225 surged by 3.5% (1.3% in USD terms).

Markets in emerging countries were particularly volatile during the month, as many central banks – for example in most Eastern European countries and in Brazil – continued to hike interest rates aggressively to cope with higher inflation. Turkey caught the attention of the press and forex markets for the last few weeks of the month, as Erdogan’s push for lower interest rates first sent the Turkish lira to a free fall and then to a wild reversal, when the government launched exchange-rate protected lira time deposits to attract depositors in the domestic currency. However, the attempt has largely backfired, as borrowing costs continued to rise and the lira depreciated quickly and steadily in the last week of the year. In Chile, politics also took a heavy toll on the domestic markets. Chilean assets tumbled after left-wing president-elect Boric won a broad mandate to push ahead with an overhaul of Latin America’s most open economy.

The HESPER FUND – Global Solutions’ macro scenario is under review, due to the highly uncertain situation (consisting of higher inflation, lower growth, and the emergence of the Omicron variant) that appears to be seriously challenging policymakers. In December, central banks in advanced economies indicated a hawkish pivot, which, combined with the emergence of the Omicron strain, has generated bouts of markets volatility. We are currently assessing the macro assumption of economic policy divergence and growth expectations in the major economic zones. For the moment, we are taking note of the risk of increased volatility stemming from the central banks accelerating the pace of policy normalisation and the change in sentiment as a result of the spread of the Omicron variant. We have also been carefully managing the equity exposure to benefit from the Christmas rally, while retaining tight stop limits.

The fund performed well in December thanks to a dynamic exposure in equities. The strength of the Swiss franc and the rebound of the Norwegian krone also added to the positive monthly performance. Our trade against the British pound in favour of the US dollar was closed, as the market again incorporated a series of interest rate hikes and the stop limits were triggered. Therefore, our exposure to the USD has decreased to 48%.

As always, our exposure to the various asset classes is monitored and calibrated on an ongoing basis to adapt to market sentiment and changes in the macroeconomic baseline scenario.

In December, the HESPER FUND - Global Solutions EUR T-6 rose by 1.01%. Performance in 2021 was 11.29% and net inflows amounted to EUR 4 million, to reach EUR 41.6 million in total assets under management (AuM) by year-end. During the year, the fund posted positive monthly returns in 10 out of the 12 months, the only exceptions were May and September. Volatility for the last 250 days increased a little, but still remained low at 7%, retaining an interesting risk/reward profile for the fund. Its annualised return since inception was at 8.6%.

What to expect in 2022

For asset managers, next year is shaping up to be challenging, to say the least. Faster inflation will prompt central banks to slow, stop and possibly reverse the monetary support they have thus far provided to the global economies, making financial markets trickier to navigate. The pandemic is far from over and a number of political tensions are still evident. The asset management industry will face even more pressure to allocate assets in environmentally-friendly ways, without slipping into greenwashing.

*The HESPER FUND – Global Solutions is currently only authorised for distribution in Germany, Luxembourg, Italy, France, and Switzerland.

Figure 2: Portfolio structure* of the Ethna-DEFENSIV

Figure 3: Portfolio structure* of the Ethna-AKTIV

Figure 4: Portfolio structure* of the Ethna-DYNAMISCH

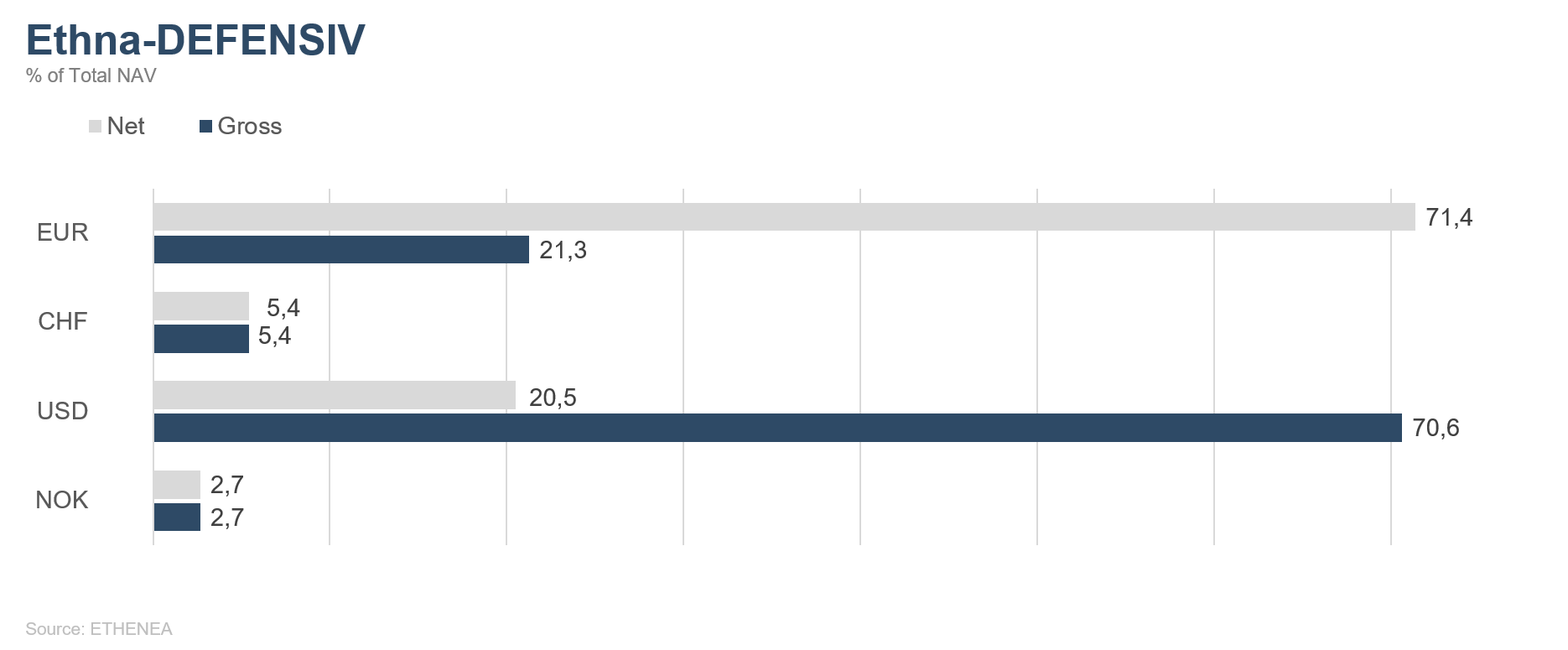

Figure 5: Portfolio composition of the Ethna-DEFENSIV by currency

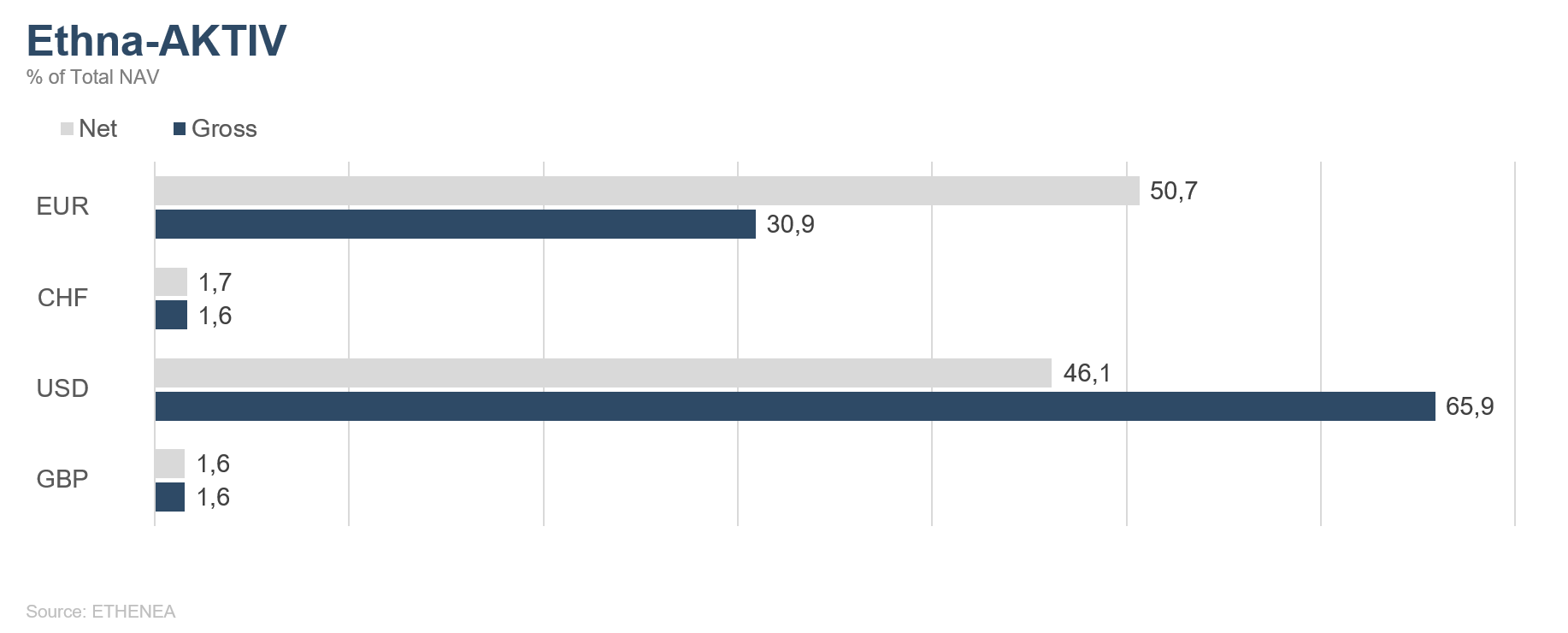

Figure 6: Portfolio composition of the Ethna-AKTIV by currency

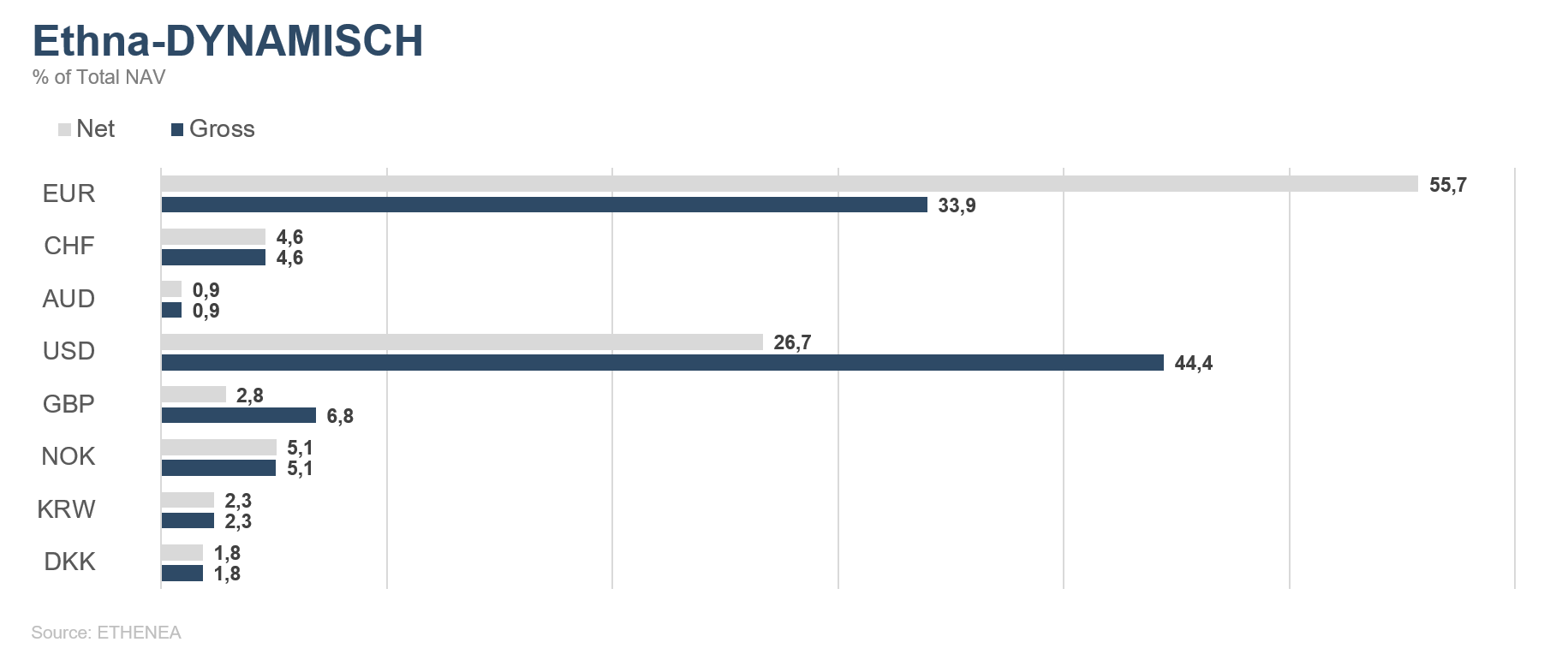

Figure 7: Portfolio composition of the Ethna-DYNAMISCH by currency

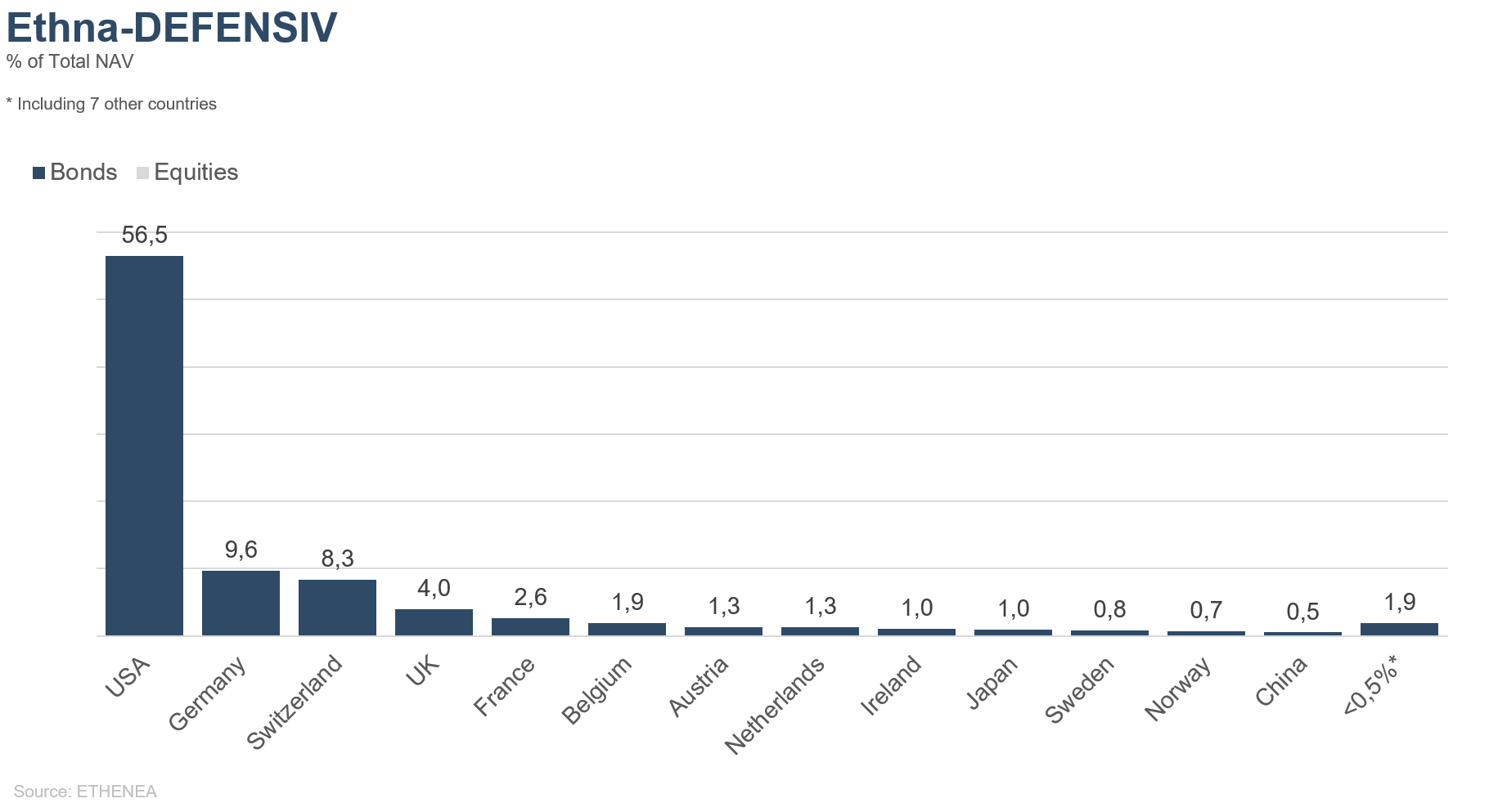

Figure 8: Portfolio composition of the Ethna-DEFENSIV by country

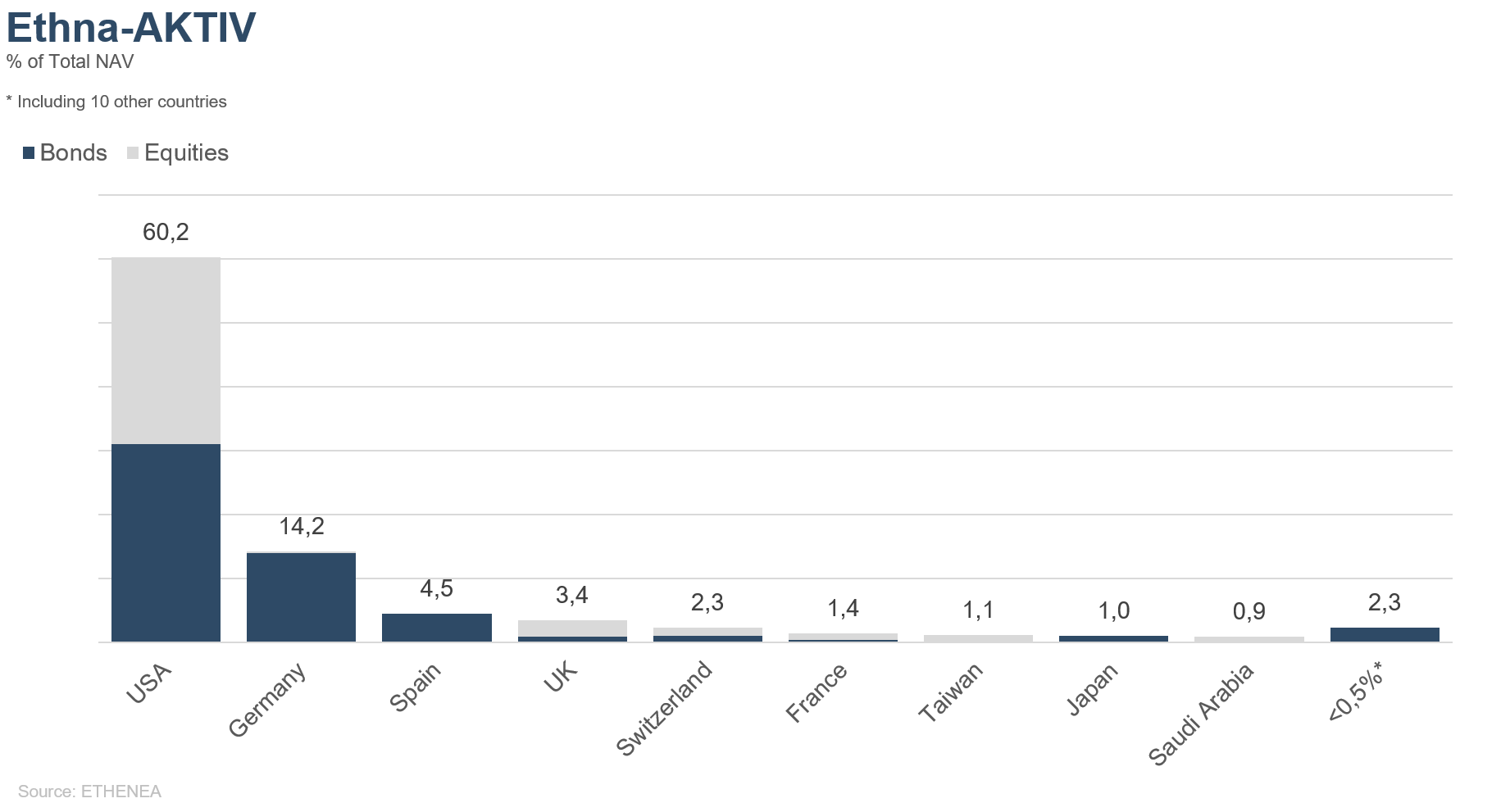

Figure 9: Portfolio composition of the Ethna-AKTIV by country

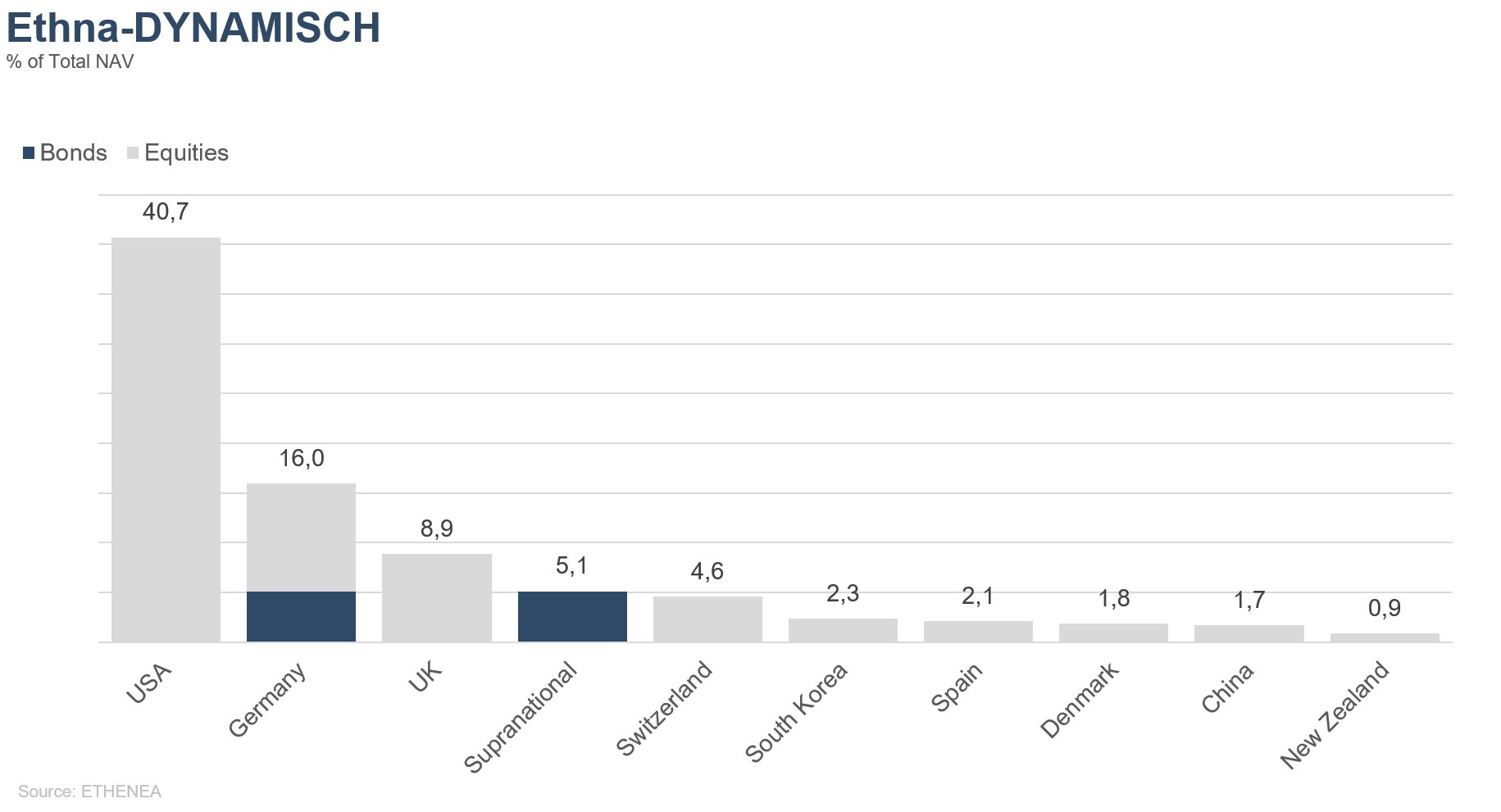

Figure 10: Portfolio composition of the Ethna-DYNAMISCH by country

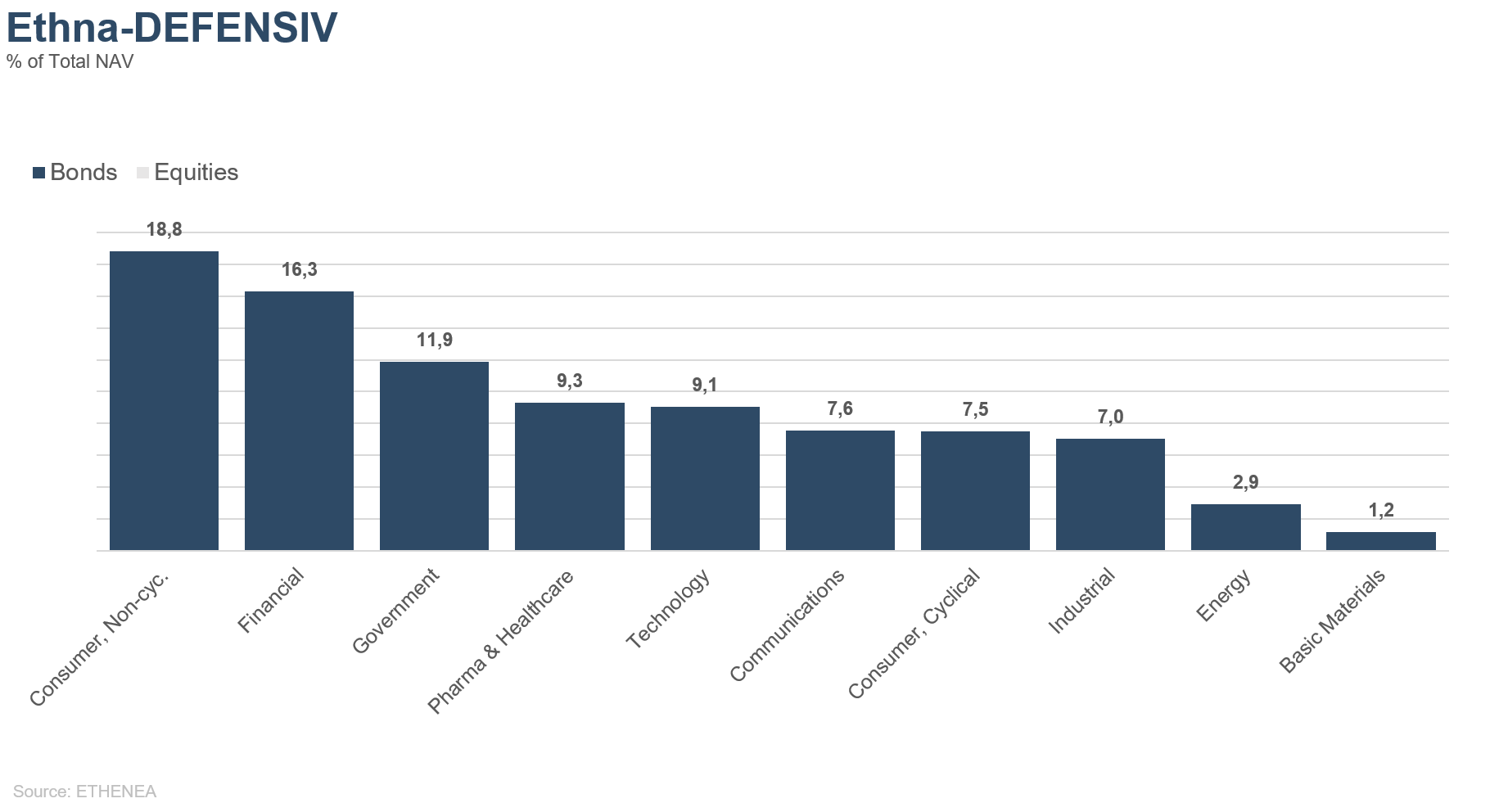

Figure 11: Portfolio composition of the Ethna-DEFENSIV by issuer sector

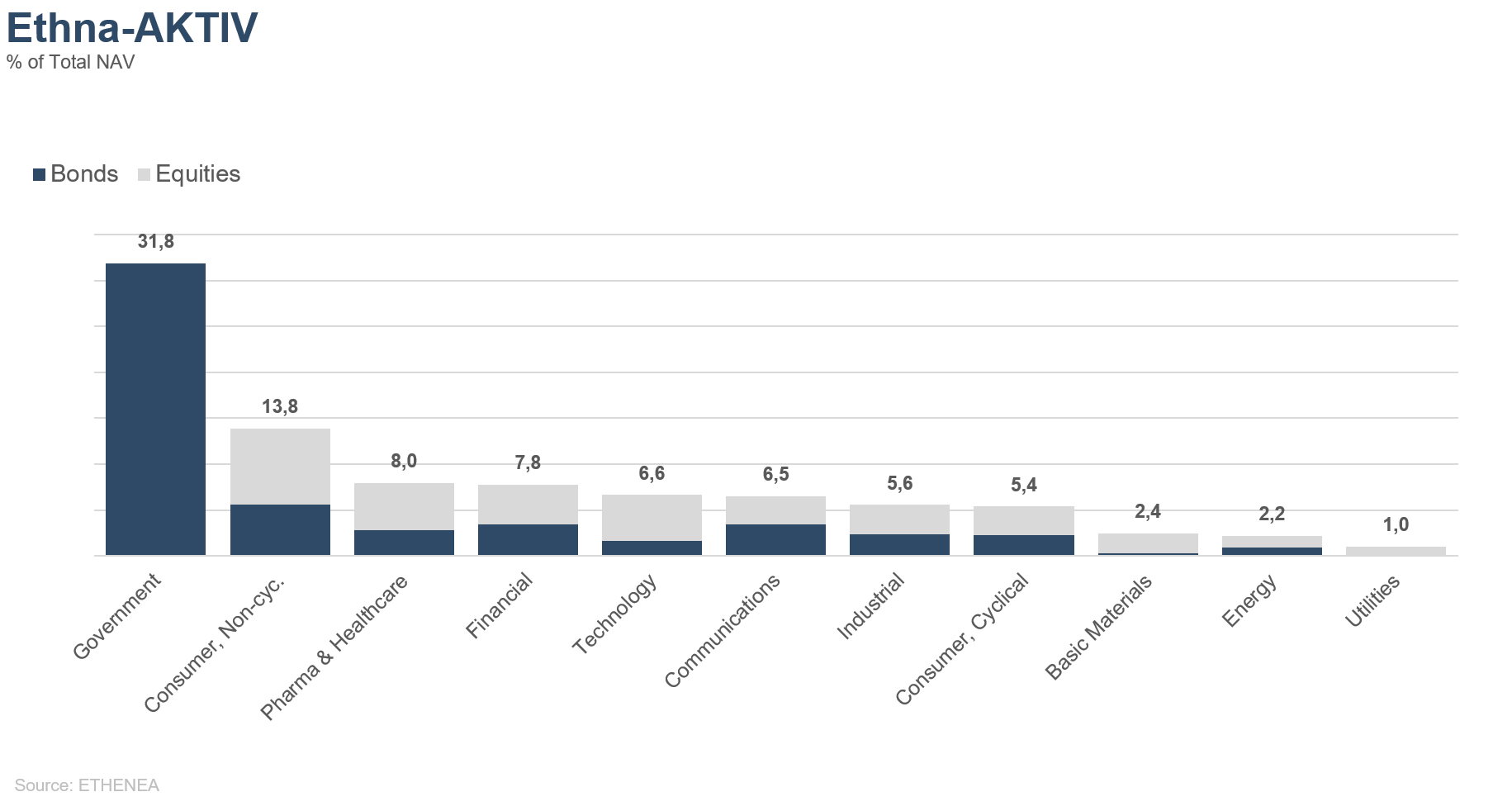

Figure 12: Portfolio composition of the Ethna-AKTIV by issuer sector

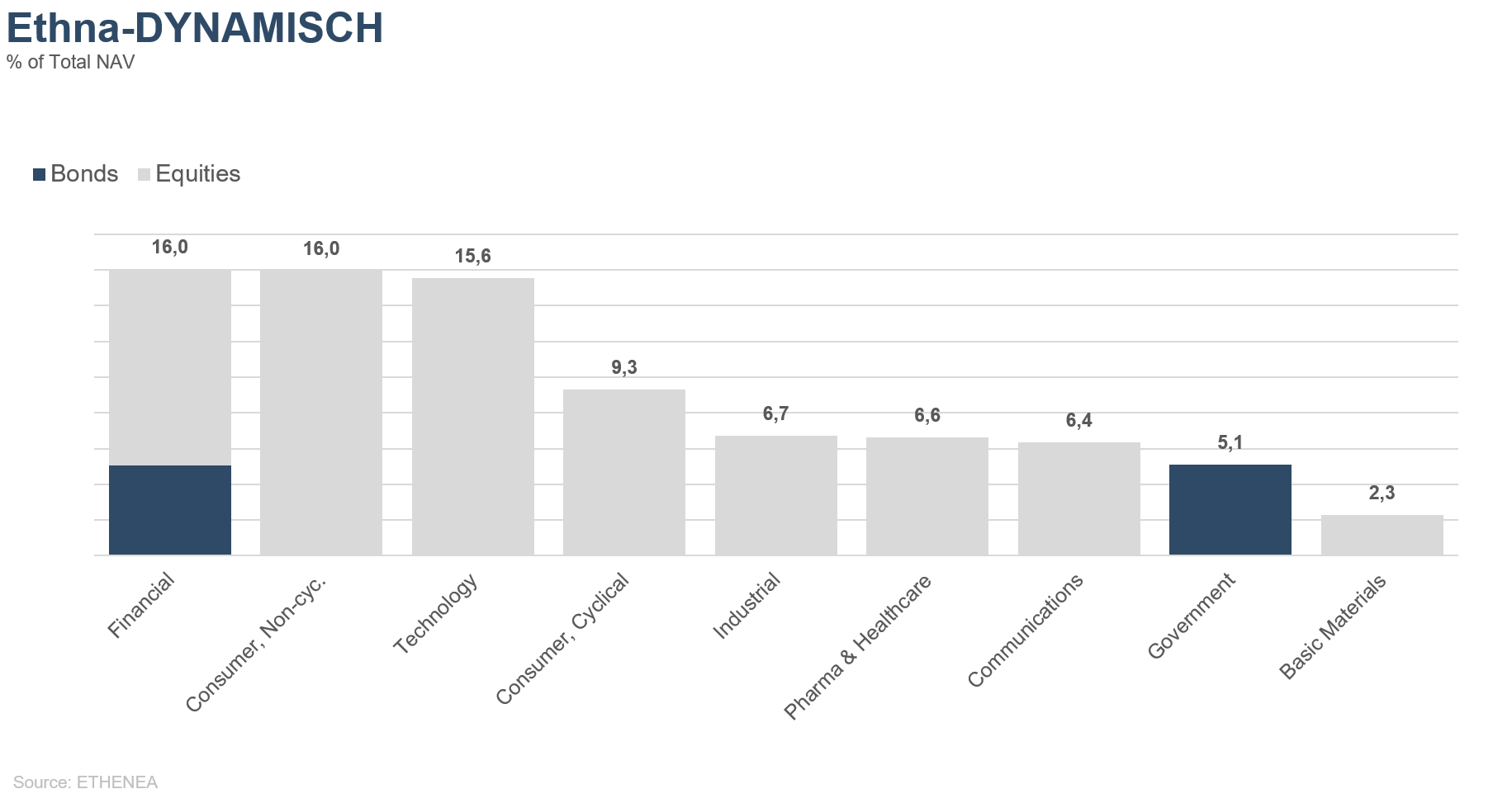

Figure 13: Portfolio composition of the Ethna-DYNAMISCH by issuer sector

* “Cash” comprises term deposits, call money and current accounts/other accounts. “Equities net” comprises direct investments and exposure resulting from equity derivatives.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

This is a marketing communication. It is for product information purposes only and is not a mandatory statutory or regulatory document. The information contained in this document does not constitute a solicitation, offer or recommendation to buy or sell units in the fund or to engage in any other transaction. It is intended solely to provide the reader with an understanding of the key features of the fund, such as the investment process, and is not deemed, either in whole or in part, to be an investment recommendation. The information provided is not a substitute for the reader's own deliberations or for any other legal, tax or financial information and advice. Neither the investment company nor its employees or Directors can be held liable for losses incurred directly or indirectly through the use of the contents of this document or in any other connection with this document. The currently valid sales documents in German (sales prospectus, key information documents (PRIIPs-KIDs) and, in addition, the semi-annual and annual reports), which provide detailed information about the purchase of units in the fund and the associated opportunities and risks, form the sole legal basis for the purchase of units. The aforementioned sales documents in German (as well as in unofficial translations in other languages) can be found at www.ethenea.com and are available free of charge from the investment company ETHENEA Independent Investors S.A. and the custodian bank, as well as from the respective national paying or information agents and from the representative in Switzerland. The paying or information agents for the funds Ethna-AKTIV, Ethna-DEFENSIV and Ethna-DYNAMISCH are the following: Austria, Belgium, Germany, Liechtenstein, Luxembourg: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg; France: CACEIS Bank France, 1-3 place Valhubert, F-75013 Paris; Italy: State Street Bank International – Succursale Italia, Via Ferrante Aporti, 10, IT-20125 Milano; Société Génerale Securities Services, Via Benigno Crespi, 19/A - MAC 2, IT-20123 Milano; Banca Sella Holding S.p.A., Piazza Gaudenzio Sella 1, IT-13900 Biella; Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Spain: ALLFUNDS BANK, S.A., C/ Estafeta, 6 (la Moraleja), Edificio 3 – Complejo Plaza de la Fuente, ES-28109 Alcobendas (Madrid); Switzerland: Representative: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Paying Agent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. The paying or information agents for HESPER FUND, SICAV - Global Solutions are the following: Austria, Belgium, France, Germany, Luxembourg: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg; Italy: Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Switzerland: Representative: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Paying Agent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. The investment company may terminate existing distribution agreements with third parties or withdraw distribution licences for strategic or statutory reasons, subject to compliance with any deadlines. Investors can obtain information about their rights from the website www.ethenea.com and from the sales prospectus. The information is available in both German and English, as well as in other languages in individual cases. Producer: ETHENEA Independent Investors S.A.. Distribution of this document to persons domiciled in countries in which the fund is not authorised for distribution, or in which authorisation for distribution is required, is prohibited. Units may only be offered to persons in such countries if this offer is in accordance with the applicable legal provisions and it is ensured that the distribution and publication of this document, as well as an offer or sale of units, is not subject to any restrictions in the respective jurisdiction. In particular, the fund is not offered in the United States of America or to US persons (within the meaning of Rule 902 of Regulation S of the U.S. Securities Act of 1933, in its current version) or persons acting on their behalf, on their account or for the benefit of a US person. Past performance should not be taken as an indication or guarantee of future performance. Fluctuations in the value of the underlying financial instruments or their returns, as well as changes in interest rates and currency exchange rates, mean that the value of units in a fund, as well as the returns derived from them, may fall as well as rise and are not guaranteed. The valuations contained herein are based on a number of factors, including, but not limited to, current prices, estimates of the value of the underlying assets and market liquidity, as well as other assumptions and publicly available information. In principle, prices, values, and returns can both rise and fall, up to and including the total loss of the capital invested, and assumptions and information are subject to change without prior notice. The value of the invested capital or the price of fund units, as well as the resulting returns and distribution amounts, are subject to fluctuations or may cease altogether. Positive performance in the past is therefore no guarantee of positive performance in the future. In particular, the preservation of the invested capital cannot be guaranteed; there is therefore no warranty given that the value of the invested capital or the fund units held will correspond to the originally invested capital in the event of a sale or redemption. Investments in foreign currencies are subject to additional exchange rate fluctuations or currency risks, i.e. the performance of such investments also depends on the volatility of the foreign currency, which may have a negative impact on the value of the invested capital. Holdings and allocations are subject to change. The management and custodian fees, as well as all other costs charged to the fund in accordance with the contractual provisions, are included in the calculation. The performance calculation is based on the BVI (German federal association for investment and asset management) method, i.e. an issuing charge, transaction costs (such as order fees and brokerage fees), as well as custodian and other management fees are not included in the calculation. The investment performance would be lower if the issuing surcharge were taken into account. No guarantee can be given that the market forecasts will be achieved. Any discussion of risks in this publication should not be considered a disclosure of all risks or a conclusive handling of the risks mentioned. Explicit reference is made to the detailed risk descriptions in the sales prospectus. No guarantee can be given that the information is correct, complete or up to date. The content and information are subject to copyright protection. No guarantee can be given that the document complies with all statutory or regulatory requirements which countries other than Luxembourg have defined for it. Note: The most important technical terms can be found in the glossary at www.ethenea.com/glossary. Information for investors in Belgium: The prospectus, the key information documents (PRIIPs-KIDs), the annual reports and the semi-annual reports of the sub-fund are available in French free of charge upon request from the investment company ETHENEA Independent Investors S.A., 16, rue Gabriel Lippmann, 5365 Munsbach, Luxembourg and from the representative: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg. Information for investors in Switzerland: The country of origin of the collective investment scheme is Luxembourg. The representative in Switzerland is IPConcept (Schweiz) AG, Münsterhof 12, P.O. Box, CH-8022 Zurich. The paying agent in Switzerland is DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zurich. The prospectus, the key information documents (PRIIPs-KIDs), and the Articles of Association, as well as the annual and semi-annual reports, can be obtained free of charge from the representative. Copyright © ETHENEA Independent Investors S.A. (2024) All rights reserved. 04/01/2022