Inflation and long-term interest rates – looking ahead

Key points at a glance

- The longer-term inflation trend in 2023 and 2024, and the resulting progression of central bank interest rates, is key to how long-term interest rates will develop.

- Inflation rates in Europe and the U.S. are likely to rise in the current quarter but come back down towards the end of the year and especially at the beginning of 2023.

- Both the Fed and the ECB will raise their interest rates.

- An at least temporary increase in 10-year Bund yields to 1.25% and in 10-year Treasury yields to 3.25% is likely in the second quarter of 2022.

- A further rise in central-bank as well as long-term interest rates is possible.

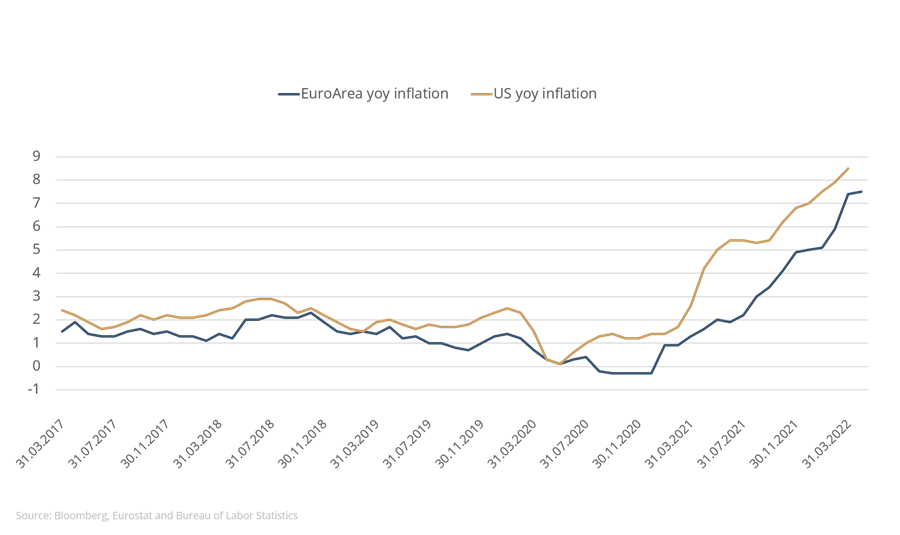

Inflation in the U.S. rose to 8.3%, while in the eurozone it rose to 7.5% in April of this year. It’s clear that inflation will remain very high for the time being; the question is how much further it will climb in the coming months. The ECB and the Fed are alarmed by developments. What will the central banks do to combat inflation and how high could long-term interest rates go?

Figure 1: Inflation eurozone vs U.S.

What we know

The Fed has already terminated its bond-buying programme and in March and May 2022 raised the Fed Funds rates in order to break the inflation dynamic. What’s certain is that further rate hikes will follow. In addition, the Fed will reduce its balance sheet by selling holdings of sovereign and mortgage-backed bonds or by not reinvesting the proceeds of maturing securities. However, the actions and announcements of the central bank alone have so far hardly done anything to curb the inflation rate. While inflation in January 2022 was 7.5%, it rose to 7.9% in February and in April hit 8.3% - a level last seen at the beginning of the 1980s. It’s a similar story in the eurozone. Inflation rose from 5.1% in January to 7.5% in April. The ECB has reduced the pace of its net bond-buying without ending it entirely, but has left its interest rates unchanged.

“10-year yields are out of the negative zone.”

Yields on long-dated bonds have risen sharply, as have rates for new credits. For property loans with first-class collateral and a 10-year fixed term, investors are already paying well over 2% in Germany. Interest rates for the 30-year mortgages common in the U.S. stand at 5.25% – the highest rate since 2010.

What we can expect

Given what we know, it is comparatively easy to predict what the central banks will do: both the Fed and the ECB will raise their interest rates. The Fed will raise the Fed Funds Rate significantly by the end of the year. A new target range of 2.5% to 2.75%, or even slightly higher, is likely. In a similar vein, the ECB is likely to end negative interest rates for its deposit facility by the end of the year. It’s even possible that the repo rate will be raised before the year is out. The outlook for the future inflation trend is more complicated. While in the U.S. individual inflation components have already fallen or are only rising slowly, rents and the cost of building an owner-occupied home are only just taking off. Second-round effects due to higher wages, energy prices and transport costs will continue to push up prices of goods and services. However, the pace is hard to predict. In Europe, the explosion in energy prices is hugely important for inflation. Given the possibility of boycotts and the fact that electricity generation relies on wind and water levels, it’s very hard to say how things will develop on this front. On the other side of the ledger is – as yet unquantifiable – state intervention, which, while reducing inflation, will lead to higher national debt. In our view, however, it is quite likely that annualised inflation both in the U.S. and in Europe will increase slightly further in the second quarter but not exceed the 10% mark. We expect inflation to fall again slightly at the end of the year. Inflation rates of over 5% - perhaps even 6% - should still be expected for December 2022.

What we don’t know (yet)

However, the longer-term inflation trend in 2023 and 2024 and the resulting progression of central bank interest rates is even more key to how long-term interest rates will develop. We can speculate on this no end, but not much is certain. Even the reduction of the Fed’s balance sheet in the U.S. and the discontinuation of purchases by the ECB could cause upheaval. Nobody knows who will replace the central banks as purchasers. An at least temporary increase in 10-year Bund yields to 1.25% and in 10-year Treasury yields to 3.25% is likely in the second quarter. After that, however, the market is likely to take a breather for the time being. Yields have already soared and there is huge uncertainty about what 2023 will bring. At any rate, given exorbitant rates of inflation, we are ruling out the possibility of further economic upturn both in the eurozone and in the U.S. Either the economy will weaken first, bringing about lower inflation and less need for the central banks to act, or persistently high inflation will affect consumer sentiment, thus leading to a sharp economic downturn. In any case, growth in the first quarter of 2022 has already declined sharply; GDP in the U.S. has even fallen slightly compared with the previous quarter.

Figure 2: Yields on 10-year sovereign bonds

Even if inflation rates in Europe and the U.S. rise slightly further in the current quarter they will come back down towards the end of the year and especially at the beginning of 2023. But it seems uncertain to us whether inflation will fall to the desired 2% region as a result of the restrictive measures expected from the central banks. If the expectation arises that inflation in 2023 and 2024 will tend to level off between 3% and 4%, then the central banks would be compelled to adjust their policy once again. A further increase in central bank interest rates and long-term interest rates would then ensue.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

This is a marketing communication. It is for product information purposes only and is not a mandatory statutory or regulatory document. The information contained in this document does not constitute a solicitation, offer or recommendation to buy or sell units in the fund or to engage in any other transaction. It is intended solely to provide the reader with an understanding of the key features of the fund, such as the investment process, and is not deemed, either in whole or in part, to be an investment recommendation. The information provided is not a substitute for the reader's own deliberations or for any other legal, tax or financial information and advice. Neither the investment company nor its employees or Directors can be held liable for losses incurred directly or indirectly through the use of the contents of this document or in any other connection with this document. The currently valid sales documents in German (sales prospectus, key information documents (PRIIPs-KIDs) and, in addition, the semi-annual and annual reports), which provide detailed information about the purchase of units in the fund and the associated opportunities and risks, form the sole legal basis for the purchase of units. The aforementioned sales documents in German (as well as in unofficial translations in other languages) can be found at www.ethenea.com and are available free of charge from the investment company ETHENEA Independent Investors S.A. and the custodian bank, as well as from the respective national paying or information agents and from the representative in Switzerland. The paying or information agents for the funds Ethna-AKTIV, Ethna-DEFENSIV and Ethna-DYNAMISCH are the following: Austria, Belgium, Germany, Liechtenstein, Luxembourg: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg; France: CACEIS Bank France, 1-3 place Valhubert, F-75013 Paris; Italy: State Street Bank International – Succursale Italia, Via Ferrante Aporti, 10, IT-20125 Milano; Société Génerale Securities Services, Via Benigno Crespi, 19/A - MAC 2, IT-20123 Milano; Banca Sella Holding S.p.A., Piazza Gaudenzio Sella 1, IT-13900 Biella; Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Spain: ALLFUNDS BANK, S.A., C/ Estafeta, 6 (la Moraleja), Edificio 3 – Complejo Plaza de la Fuente, ES-28109 Alcobendas (Madrid); Switzerland: Representative: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Paying Agent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. The paying or information agents for HESPER FUND, SICAV - Global Solutions are the following: Austria, Belgium, France, Germany, Luxembourg: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg; Italy: Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Switzerland: Representative: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Paying Agent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. The investment company may terminate existing distribution agreements with third parties or withdraw distribution licences for strategic or statutory reasons, subject to compliance with any deadlines. Investors can obtain information about their rights from the website www.ethenea.com and from the sales prospectus. The information is available in both German and English, as well as in other languages in individual cases. Producer: ETHENEA Independent Investors S.A.. Distribution of this document to persons domiciled in countries in which the fund is not authorised for distribution, or in which authorisation for distribution is required, is prohibited. Units may only be offered to persons in such countries if this offer is in accordance with the applicable legal provisions and it is ensured that the distribution and publication of this document, as well as an offer or sale of units, is not subject to any restrictions in the respective jurisdiction. In particular, the fund is not offered in the United States of America or to US persons (within the meaning of Rule 902 of Regulation S of the U.S. Securities Act of 1933, in its current version) or persons acting on their behalf, on their account or for the benefit of a US person. Past performance should not be taken as an indication or guarantee of future performance. Fluctuations in the value of the underlying financial instruments or their returns, as well as changes in interest rates and currency exchange rates, mean that the value of units in a fund, as well as the returns derived from them, may fall as well as rise and are not guaranteed. The valuations contained herein are based on a number of factors, including, but not limited to, current prices, estimates of the value of the underlying assets and market liquidity, as well as other assumptions and publicly available information. In principle, prices, values, and returns can both rise and fall, up to and including the total loss of the capital invested, and assumptions and information are subject to change without prior notice. The value of the invested capital or the price of fund units, as well as the resulting returns and distribution amounts, are subject to fluctuations or may cease altogether. Positive performance in the past is therefore no guarantee of positive performance in the future. In particular, the preservation of the invested capital cannot be guaranteed; there is therefore no warranty given that the value of the invested capital or the fund units held will correspond to the originally invested capital in the event of a sale or redemption. Investments in foreign currencies are subject to additional exchange rate fluctuations or currency risks, i.e. the performance of such investments also depends on the volatility of the foreign currency, which may have a negative impact on the value of the invested capital. Holdings and allocations are subject to change. The management and custodian fees, as well as all other costs charged to the fund in accordance with the contractual provisions, are included in the calculation. The performance calculation is based on the BVI (German federal association for investment and asset management) method, i.e. an issuing charge, transaction costs (such as order fees and brokerage fees), as well as custodian and other management fees are not included in the calculation. The investment performance would be lower if the issuing surcharge were taken into account. No guarantee can be given that the market forecasts will be achieved. Any discussion of risks in this publication should not be considered a disclosure of all risks or a conclusive handling of the risks mentioned. Explicit reference is made to the detailed risk descriptions in the sales prospectus. No guarantee can be given that the information is correct, complete or up to date. The content and information are subject to copyright protection. No guarantee can be given that the document complies with all statutory or regulatory requirements which countries other than Luxembourg have defined for it. Note: The most important technical terms can be found in the glossary at www.ethenea.com/glossary. Information for investors in Belgium: The prospectus, the key information documents (PRIIPs-KIDs), the annual reports and the semi-annual reports of the sub-fund are available in French free of charge upon request from the investment company ETHENEA Independent Investors S.A., 16, rue Gabriel Lippmann, 5365 Munsbach, Luxembourg and from the representative: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg. Information for investors in Switzerland: The country of origin of the collective investment scheme is Luxembourg. The representative in Switzerland is IPConcept (Schweiz) AG, Münsterhof 12, P.O. Box, CH-8022 Zurich. The paying agent in Switzerland is DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zurich. The prospectus, the key information documents (PRIIPs-KIDs), and the Articles of Association, as well as the annual and semi-annual reports, can be obtained free of charge from the representative. Copyright © ETHENEA Independent Investors S.A. (2024) All rights reserved. 03/05/2022