Inflation and long-term interest rates – looking ahead

Key points at a glance

- The longer-term inflation trend in 2023 and 2024, and the resulting progression of central bank interest rates, is key to how long-term interest rates will develop.

- Inflation rates in Europe and the U.S. are likely to rise in the current quarter but come back down towards the end of the year and especially at the beginning of 2023.

- Both the Fed and the ECB will raise their interest rates.

- An at least temporary increase in 10-year Bund yields to 1.25% and in 10-year Treasury yields to 3.25% is likely in the second quarter of 2022.

- A further rise in central-bank as well as long-term interest rates is possible.

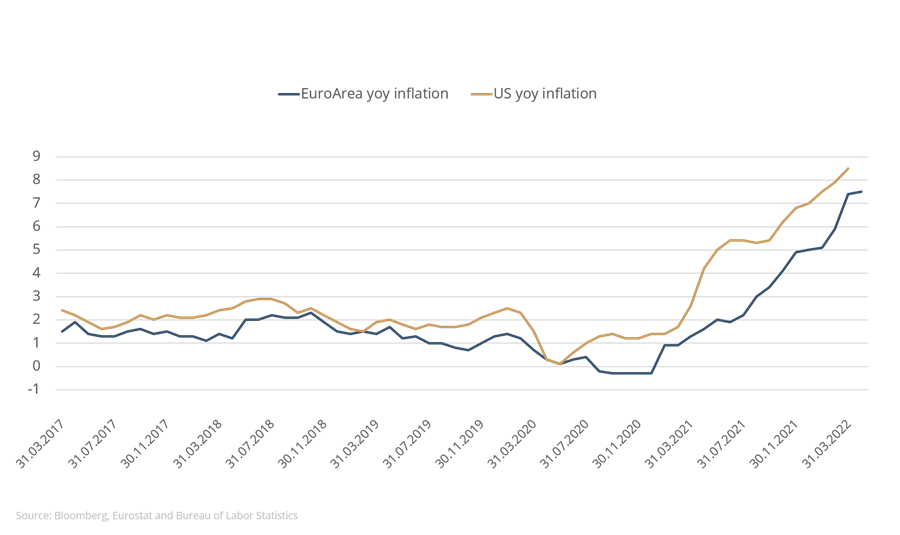

Inflation in the U.S. rose to 8.3%, while in the eurozone it rose to 7.5% in April of this year. It’s clear that inflation will remain very high for the time being; the question is how much further it will climb in the coming months. The ECB and the Fed are alarmed by developments. What will the central banks do to combat inflation and how high could long-term interest rates go?

Figure 1: Inflation eurozone vs U.S.

What we know

The Fed has already terminated its bond-buying programme and in March and May 2022 raised the Fed Funds rates in order to break the inflation dynamic. What’s certain is that further rate hikes will follow. In addition, the Fed will reduce its balance sheet by selling holdings of sovereign and mortgage-backed bonds or by not reinvesting the proceeds of maturing securities. However, the actions and announcements of the central bank alone have so far hardly done anything to curb the inflation rate. While inflation in January 2022 was 7.5%, it rose to 7.9% in February and in April hit 8.3% - a level last seen at the beginning of the 1980s. It’s a similar story in the eurozone. Inflation rose from 5.1% in January to 7.5% in April. The ECB has reduced the pace of its net bond-buying without ending it entirely, but has left its interest rates unchanged.

“10-year yields are out of the negative zone.”

Yields on long-dated bonds have risen sharply, as have rates for new credits. For property loans with first-class collateral and a 10-year fixed term, investors are already paying well over 2% in Germany. Interest rates for the 30-year mortgages common in the U.S. stand at 5.25% – the highest rate since 2010.

What we can expect

Given what we know, it is comparatively easy to predict what the central banks will do: both the Fed and the ECB will raise their interest rates. The Fed will raise the Fed Funds Rate significantly by the end of the year. A new target range of 2.5% to 2.75%, or even slightly higher, is likely. In a similar vein, the ECB is likely to end negative interest rates for its deposit facility by the end of the year. It’s even possible that the repo rate will be raised before the year is out. The outlook for the future inflation trend is more complicated. While in the U.S. individual inflation components have already fallen or are only rising slowly, rents and the cost of building an owner-occupied home are only just taking off. Second-round effects due to higher wages, energy prices and transport costs will continue to push up prices of goods and services. However, the pace is hard to predict. In Europe, the explosion in energy prices is hugely important for inflation. Given the possibility of boycotts and the fact that electricity generation relies on wind and water levels, it’s very hard to say how things will develop on this front. On the other side of the ledger is – as yet unquantifiable – state intervention, which, while reducing inflation, will lead to higher national debt. In our view, however, it is quite likely that annualised inflation both in the U.S. and in Europe will increase slightly further in the second quarter but not exceed the 10% mark. We expect inflation to fall again slightly at the end of the year. Inflation rates of over 5% - perhaps even 6% - should still be expected for December 2022.

What we don’t know (yet)

However, the longer-term inflation trend in 2023 and 2024 and the resulting progression of central bank interest rates is even more key to how long-term interest rates will develop. We can speculate on this no end, but not much is certain. Even the reduction of the Fed’s balance sheet in the U.S. and the discontinuation of purchases by the ECB could cause upheaval. Nobody knows who will replace the central banks as purchasers. An at least temporary increase in 10-year Bund yields to 1.25% and in 10-year Treasury yields to 3.25% is likely in the second quarter. After that, however, the market is likely to take a breather for the time being. Yields have already soared and there is huge uncertainty about what 2023 will bring. At any rate, given exorbitant rates of inflation, we are ruling out the possibility of further economic upturn both in the eurozone and in the U.S. Either the economy will weaken first, bringing about lower inflation and less need for the central banks to act, or persistently high inflation will affect consumer sentiment, thus leading to a sharp economic downturn. In any case, growth in the first quarter of 2022 has already declined sharply; GDP in the U.S. has even fallen slightly compared with the previous quarter.

Figure 2: Yields on 10-year sovereign bonds

Even if inflation rates in Europe and the U.S. rise slightly further in the current quarter they will come back down towards the end of the year and especially at the beginning of 2023. But it seems uncertain to us whether inflation will fall to the desired 2% region as a result of the restrictive measures expected from the central banks. If the expectation arises that inflation in 2023 and 2024 will tend to level off between 3% and 4%, then the central banks would be compelled to adjust their policy once again. A further increase in central bank interest rates and long-term interest rates would then ensue.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

This marketing communication is for information purposes only. It may not be passed on to persons in countries where the fund is not authorized for distribution, in particular in the USA or to US persons. The information does not constitute an offer or solicitation to buy or sell securities or financial instruments and does not replace investor- and product-related advice. It does not take into account the individual investment objectives, financial situation, or particular needs of the recipient. Before making an investment decision, the valid sales documents (prospectus, key information documents/PRIIPs-KIDs, semi-annual and annual reports) must be read carefully. These documents are available in German and as non-official translations from ETHENEA Independent Investors S.A., the custodian, the national paying or information agents, and at www.ethenea.com. The most important technical terms can be found in the glossary at www.ethenea.com/glossary/. Detailed information on opportunities and risks relating to our products can be found in the currently valid prospectus. Past performance is not a reliable indicator of future performance. Prices, values, and returns may rise or fall and can lead to a total loss of the capital invested. Investments in foreign currencies are subject to additional currency risks. No binding commitments or guarantees for future results can be derived from the information provided. Assumptions and content may change without prior notice. The composition of the portfolio may change at any time. This document does not constitute a complete risk disclosure. The distribution of the product may result in remuneration to the management company, affiliated companies, or distribution partners. The information on remuneration and costs in the current prospectus is decisive. A list of national paying and information agents, a summary of investor rights, and information on the risks of incorrect net asset value calculation can be found at www.ethenea.com/legal-notices/. In the event of an incorrect NAV calculation, compensation will be provided in accordance with CSSF Circular 24/856; for shares subscribed through financial intermediaries, compensation may be limited. Information for investors in Switzerland: The home country of the collective investment scheme is Luxembourg. The representative in Switzerland is IPConcept (Suisse) AG, Bellerivestrasse 36, CH-8008 Zurich. The paying agent in Switzerland is DZ PRIVATBANK (Suisse) AG, Bellerivestrasse 36, CH-8008 Zurich. Prospectus, key information documents (PRIIPs-KIDs), articles of association, and the annual and semi-annual reports can be obtained free of charge from the representative. Information for investors in Belgium: The prospectus, key information documents (PRIIPs-KIDs), annual reports, and semi-annual reports of the sub-fund are available free of charge in French upon request from ETHENEA Independent Investors S.A., 16, rue Gabriel Lippmann, 5365 Munsbach, Luxembourg, and from the representative: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg. Despite the greatest care, no guarantee is given for the accuracy, completeness, or timeliness of the information. Only the original German documents are legally binding; translations are for information purposes only. The use of digital advertising formats is at your own risk; the management company assumes no liability for technical malfunctions or data protection breaches by external information providers. The use is only permitted in countries where this is legally allowed. All content is protected by copyright. Any reproduction, distribution, or publication, in whole or in part, is only permitted with the prior written consent of the management company. Copyright © ETHENEA Independent Investors S.A. (2025). All rights reserved. 03/05/2022