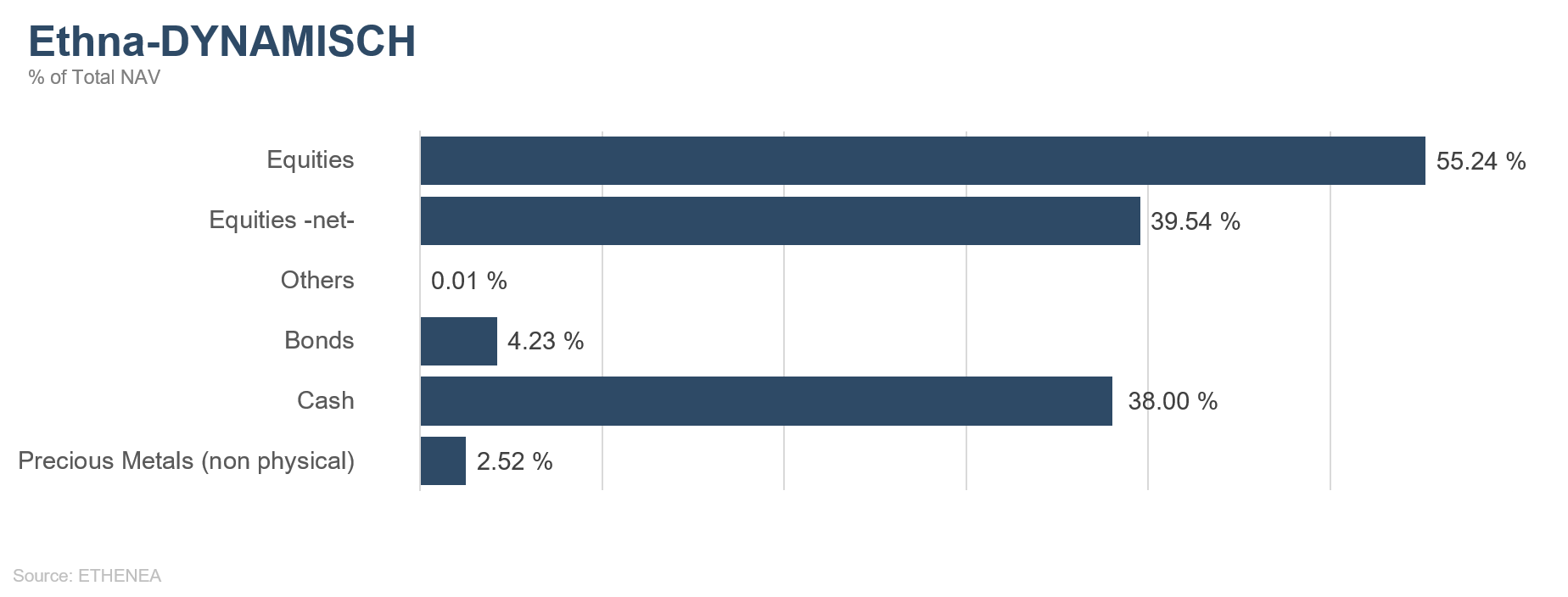

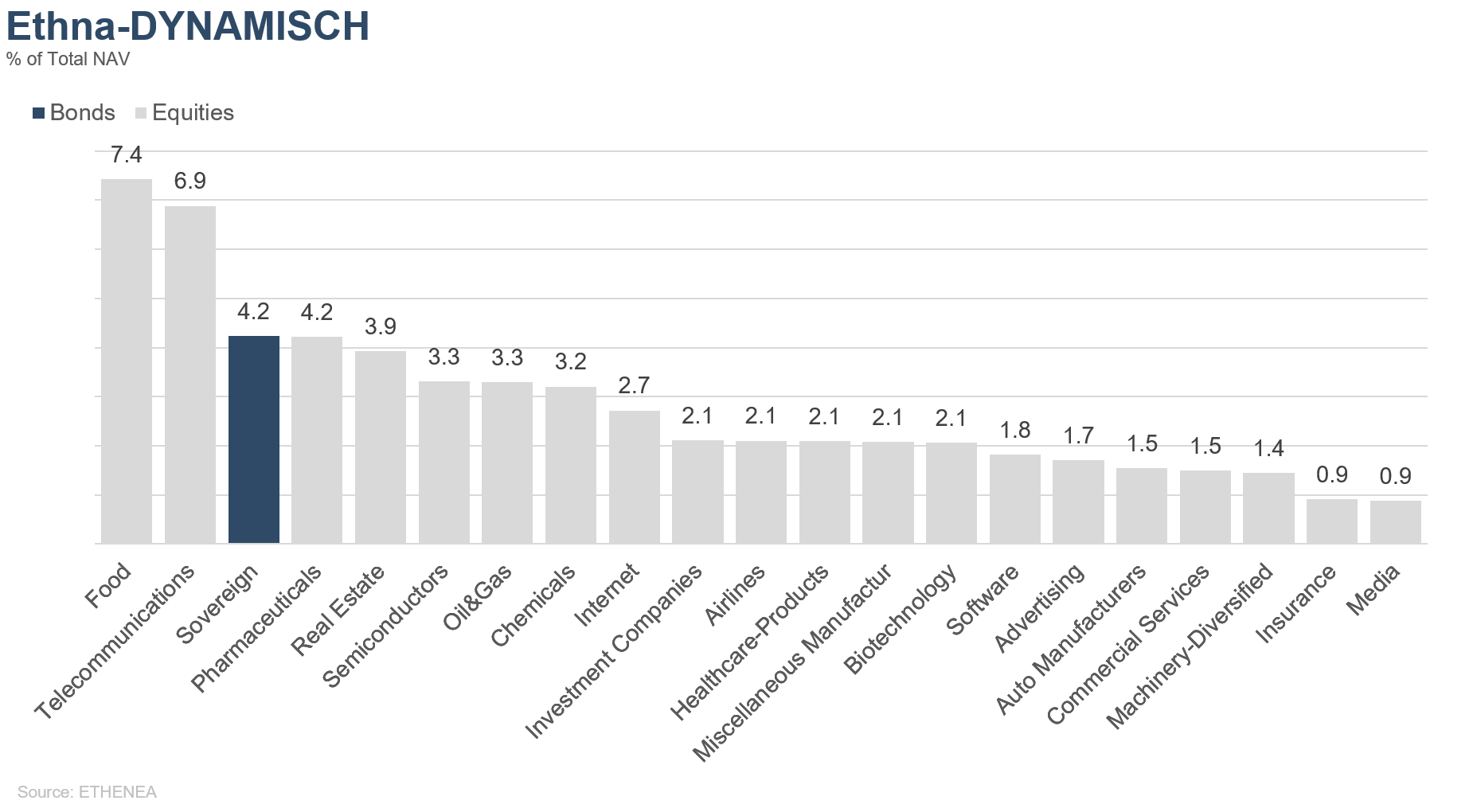

Figure 16: Portfolio composition of Ethna-DYNAMISCH by issuer sector

* “Cash” comprises term deposits, call money and current accounts/other accounts. “Equities net” comprises direct investments and exposure resulting from equity derivatives.

In the eye of the storm?

Under the shadow of the fourth quarter of 2018, we hazarded a look ahead to the new year and forecasted turmoil. But then the first month of 2019 turned out quite benign, at least in terms of what happened in capital markets. On the political front, on the other hand, it was same old, same old. The chaos surrounding Brexit makes it almost impossible to predict what will happen after 29 March. In Italy, the populists are doing what populists always do, and the danger of a fresh election is increasing. However, to speak of danger in this context is overstating it somewhat, considering that Italy has had no fewer than 65 governments since 1946. The yellow vest movement in France is continuing to cause unrest. Donald Trump’s wish for a wall still hasn’t been granted. The resulting government shutdown has come to an end, at least for the time being, but it’s likely to have cost U.S. economic growth more than the controversial wall. As before, China is not expected to spring any growth surprises. The media spotlight has shifted away from Syria and Yemen to some extent and onto the new topic of the chaos in Venezuela. Since interim president Guaidó has been openly opposing sitting president Maduro, the Caribbean nation’s (self-imposed) hardship has gripped the world’s attention. There is no news from eastern Ukraine either, other than the football match of Shakhtar Donetsk against Eintracht Frankfurt won’t be a home game but will be moved to the safer city of Kharkiv, 300 km away.

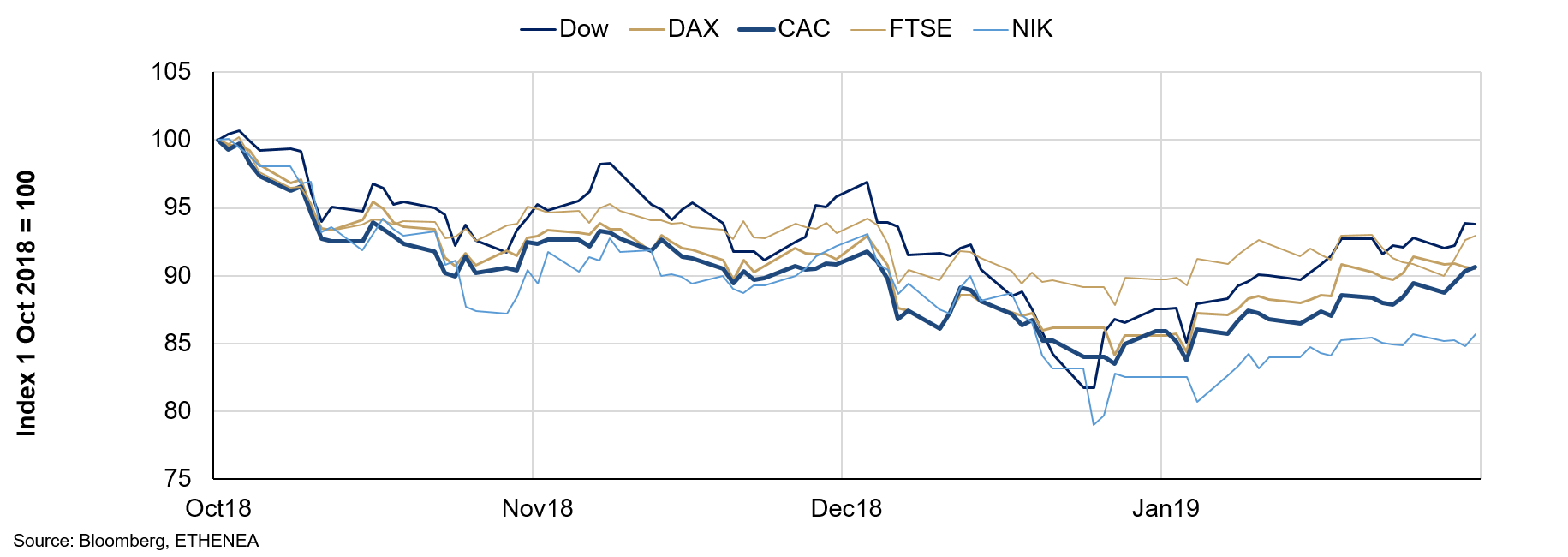

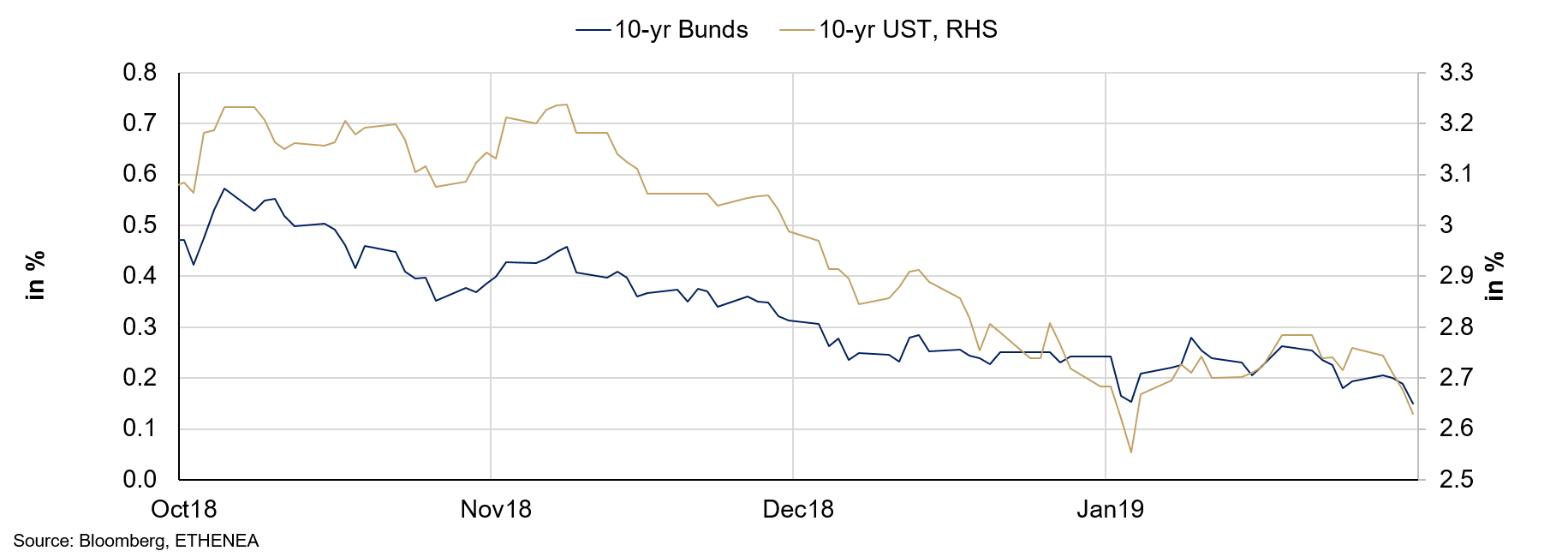

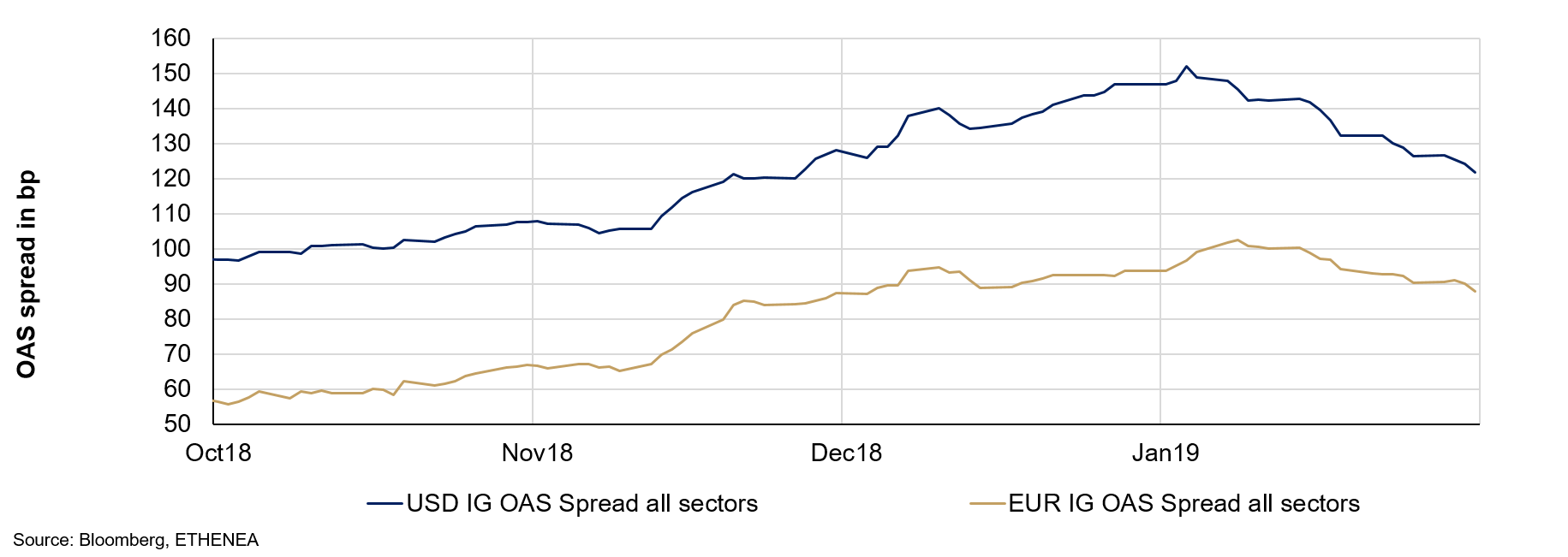

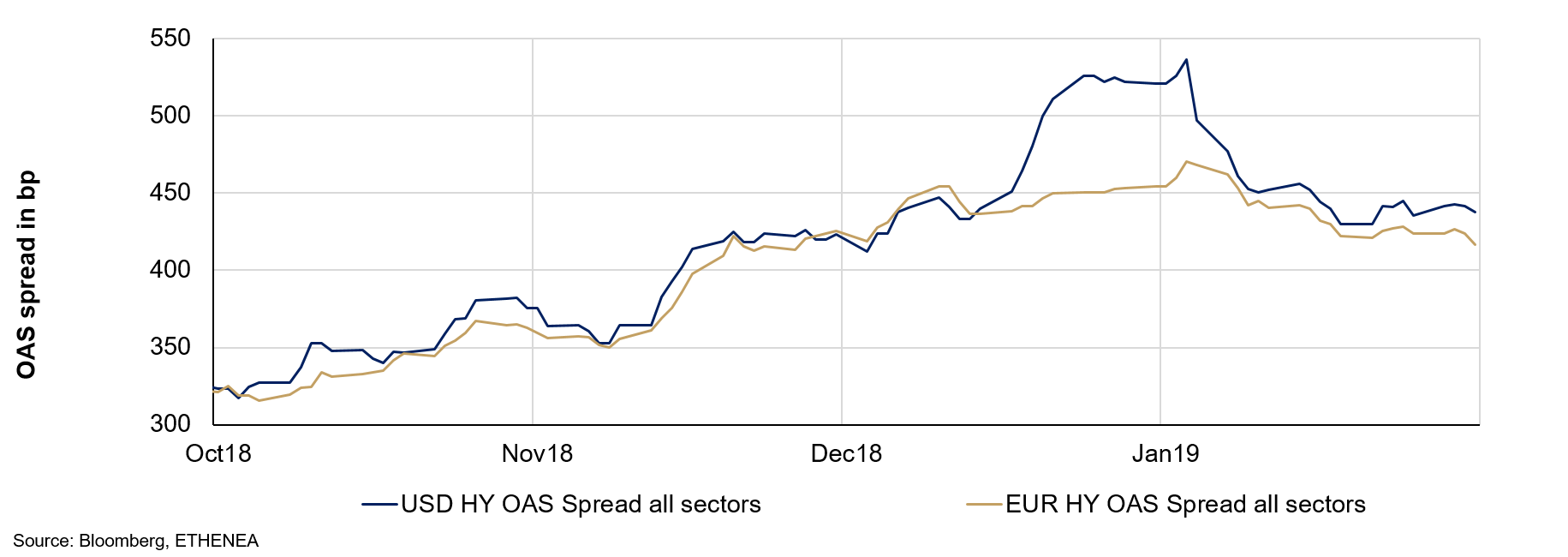

However, in January the markets were more or less untouched by the political goings-on. Equity markets recovered from their lows in December (Figure 1), concerns about recession in interest rate markets seem to have abated for now (Figure 2), spreads on better corporate bonds are rapidly falling from their highs (Figure 3) and even the collapse in high yield bonds seems to have passed (Figure 4).

Figure 1: Equity market performance

Figure 2: Interest rate market development

Figure 3: Corporate bond spreads

Figure 4: High yield bond spreads

However, in its first meeting of 2019 the U.S. central bank shifted policy towards a neutral stance for the first time in this cycle of interest rate hikes. It is therefore just as likely that the next rate change will be a hike as a cut. The Powell Put, as it were, has come into effect, which means that the central bank seems to have done the equity markets a favour. The fact is, however, that the Federal Reserve was able to spot a weakness in growth. The longest government shutdown in U.S. history alone has cost up to 1% in economic growth according to estimates from various sources. In this context, the central bank’s wait-and-see stance seems totally understandable. In the risk markets, the shift has caused equities to rise and the spreads on corporate bonds to decrease again.

What next? In January 2019’s Market Commentary we explained in detail that, to all appearances, we are entering a phase of economic weakness. So far, nothing has happened to change this assessment. Indeed, in the U.S. the central bank has come to the same conclusion. Various indicators confirm this expectation, including the Chicago Purchasing Manager Index for January. In the eurozone, Italy has once again slipped into a technical recession. Considering that since the euro was introduced Italy has achieved real quarterly growth of only 0.12% on average, one can understand – at least from Italy’s perspective – why there are certain doubts about the success of the euro for the country. But we are not going to delve further into that here. In Germany, the government’s rather optimistic growth estimate for 2019 of 1.8% in October 2018 was revised to a mere 1% in January 2019. The import/export data for China published mid-January gives us another indication that the global economy is weakening, pointing to a noticeable weakening in Chinese growth. Last but not least, let’s not forget about Donald Trump. The Department of Commerce is still probing whether car imports from the EU pose a national security risk and, if so, it would levy a 25% tariff on them. The results of this probe are expected to be announced before 17 February 2019.

All in all, our expectation of a phase of global economic weakness seems accurate without painting a picture of immediate global recession. After all, central banks do seem prepared to slightly prolong the longest period of economic growth in history, if they follow the example set by the U.S. central bank.

For the capital markets, however, this means that now and again we will probably have another January with periods of recovery but just as often we will have more Decembers in which risk markets get punished. On the whole, therefore, we are likely to have little more than a lot of fuss and volatility. In this respect, a steady hand is required and a fund structure that can adapt to this environment. All three Ethna funds have precisely this aim and each one pursues this in its own way.

If you are having video playback issues, please click HERE.

In January, we at last managed to put the final touches on the bond portion of the Ethna-DEFENSIV. We sold the last remaining long maturity bonds denominated in USD (-16%) and also sold the rest of the old-style subordinated bonds (-2.4%), thanks to the opportunity the brief recovery in bond markets presented. Over 90% of the bond portfolio is now denominated in EUR, which greatly reduces our currency hedging costs. Furthermore, we were able to reduce the maturities of holdings to the extent that more than 78% of bonds now have a residual maturity of less than seven years. This substantially reduces the cost of duration hedging because we can now use shorter-dated futures with a lower negative carry. Apart from a few remaining subordinates (1.6%), the Ethna-DEFENSIV is largely free of (incalculable) risks in this respect.

We increased the gold position to just over 5% because we remain confident that prices will rise in times of greater uncertainty.

Our equity position at the end of January was 0% because we are still waiting for suitable entry levels.

“Why should I care about what I said before?” Fed Chair Jerome Powell must have been thinking along these lines when making his almost complete about-turn following on from a statement in December that was found to be overly hawkish. He is now much more dovish about forthcoming rate rises, which brought about broad-based price gains over the course of January. As a result, the corresponding U.S. interest rate futures no longer imply an interest rate rise for this year. However, we think the market is overly euphoric in this regard. In our estimation, if the capital market appears, on the face of it, to be calming and (wage) inflation is resurgent due to full employment, the central bank will once again have reason to raise interest rates over the course of the year. The fact is that the about-turn in the central bank’s statements demonstrated earlier than expected that a Powell Put is in force. However, we mustn’t forget on this point that while such a put limits the potential of the market to correct, it does not determine the upside potential. Rather, the actual and expected rates of growth in corporate turnovers and profits are the determining factors. The current reporting season is painting a mixed picture in this regard. To sum up so far, we can say that the published figures have not been as bad as the sharp falls in the equity market implied as recently as mid-December. On the other hand, however, the trend towards slower growth is being confirmed. On the subject of a slowdown, it’s no longer a secret that the longest government shutdown in U.S. history and the still unresolved trade conflict with China are having an impact on real figures and on the general mood as well. We expect that global economic growth for 2019 – revised to 3.5% – will slow further, which does not boost upside potential. As such, we expect the equity market to remain highly volatile, with limited upside and downside potential.

Performance in January can largely be attributed to the bond portfolio and the extended duration we carried into the first week of January. Having limited losses in December by reducing the equity allocation, we saw the flip side of this positioning in January, participating less in rising markets. At the moment, the equity allocation is approx. 8%, with option structures in the U.S. equity market accounting for almost all of this. In keeping with the picture painted above of a volatile trading range, we will take advantage of declines to make purchases and rallies to make sales via index futures. In the course of January, we also re-established a gold position of 5%. In our view, last year’s prevailing correlation between gold and various asset classes has been broken, meaning that the addition of gold to the mix both for diversification and performance reasons is once again an attractive prospect. Both our relatively substantial dollar position of 17.5% and our tendency to reduce U.S. duration reflect our interest rate opinion as described at the outset, which is that U.S. interest rates will tend to rise.

The new year for the stock markets started as positively as the last year closed negatively. This is what we in the industry call volatility. What’s behind the high levels of volatility in capital markets is the ongoing considerable uncertainty about future economic growth. The macroeconomic environment has rarely been as hazy as it is at the moment. The economic barometer tends still to point towards a slowdown in growth in the key economies. After the sharp falls in prices, however, a great deal is priced in at the moment and trading the capital markets has always been a matter of weighing up risk against opportunity. This balance – potential reward vs possible risk – is gradually tipping back slightly into the positive. In interpreting the parameters, it’s important to remember the leading nature of stock markets. Stock markets do not wait until the uncertainty has subsided and official growth figures have been revised upwards. Share prices react positively even if things turn out less badly than feared. And an array of the indicators we have analysed are now heading in that direction. Here’s a good example of what we mean: rarely has the uncertainty in planning for companies been as pronounced as it is now. The lack of clarity surrounding Brexit and the simmering trade conflict are hampering investment in the real economy across the board. Slowly but surely this is manifesting in the relevant micro- and macroeconomic figures. That said, whichever Brexit scenario we end up with – a hard Brexit, a perfectly negotiated Brexit or no Brexit at all – companies will soon have certainty in planning again, and they will be able to adapt to the circumstances and make the necessary investments they postponed. After all, in the past the times we had the greatest uncertainty were the times we had more attractive entry points in equity markets.

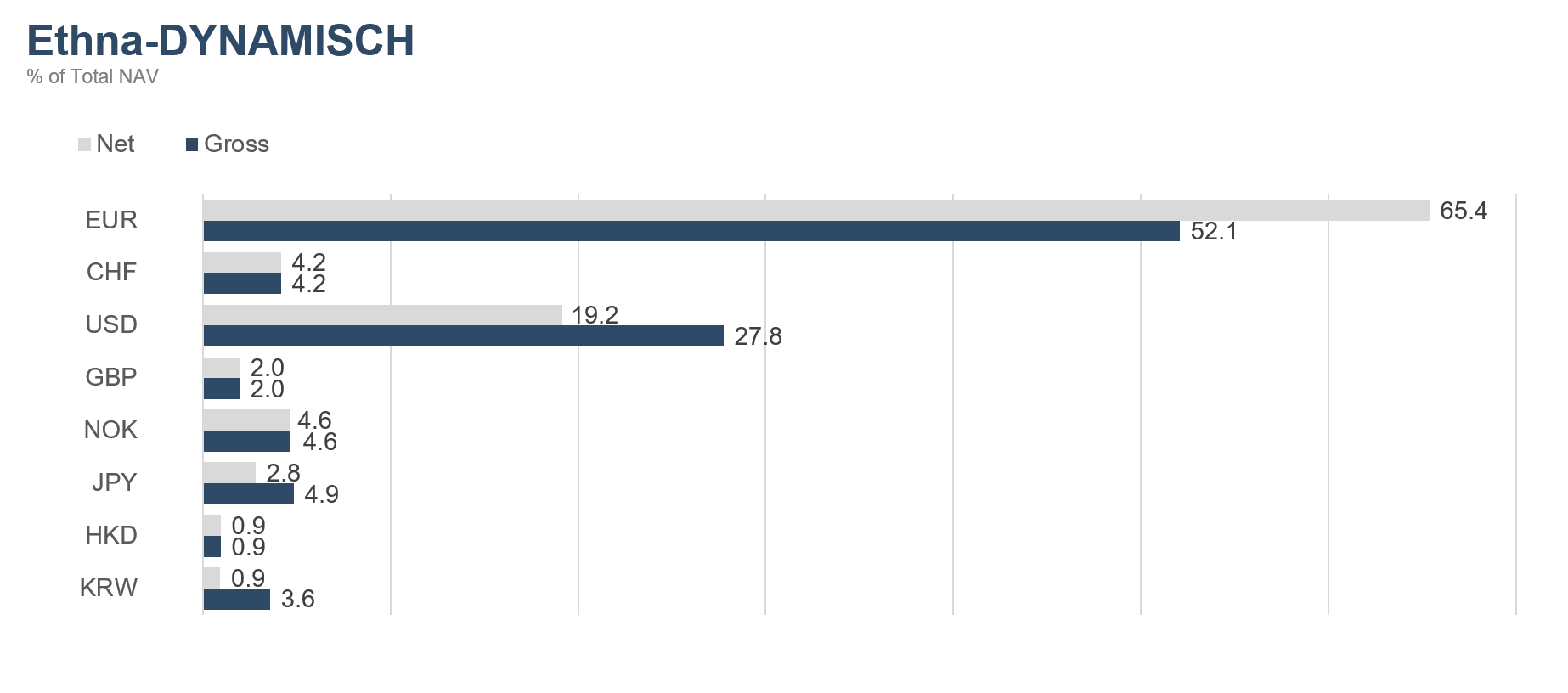

Given the fund positioning as outlined above and the small gold position, which still makes up around 2.5% of the portfolio mix, we believe the Ethna-DYNAMISCH remains well set up for times of high – and possibly soon falling – uncertainty and volatility.

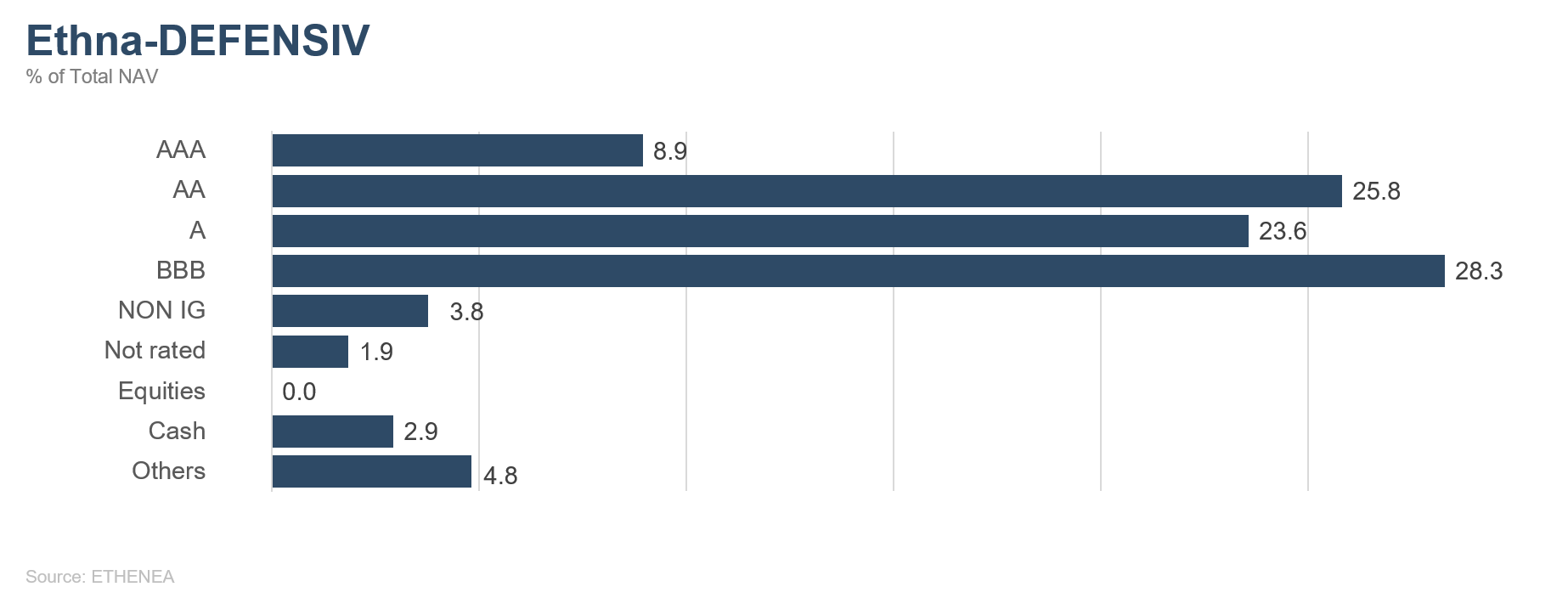

Figure 5: Portfolio ratings for Ethna-DEFENSIV

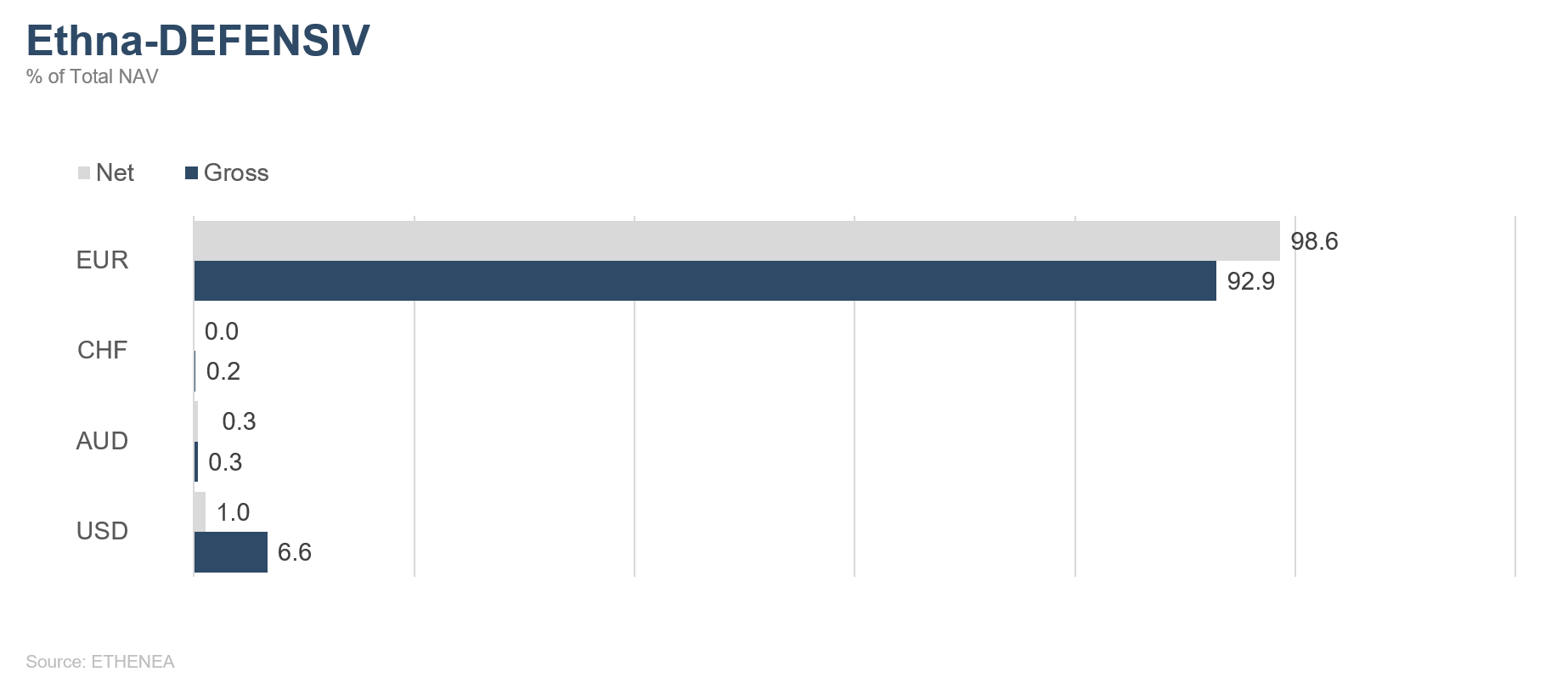

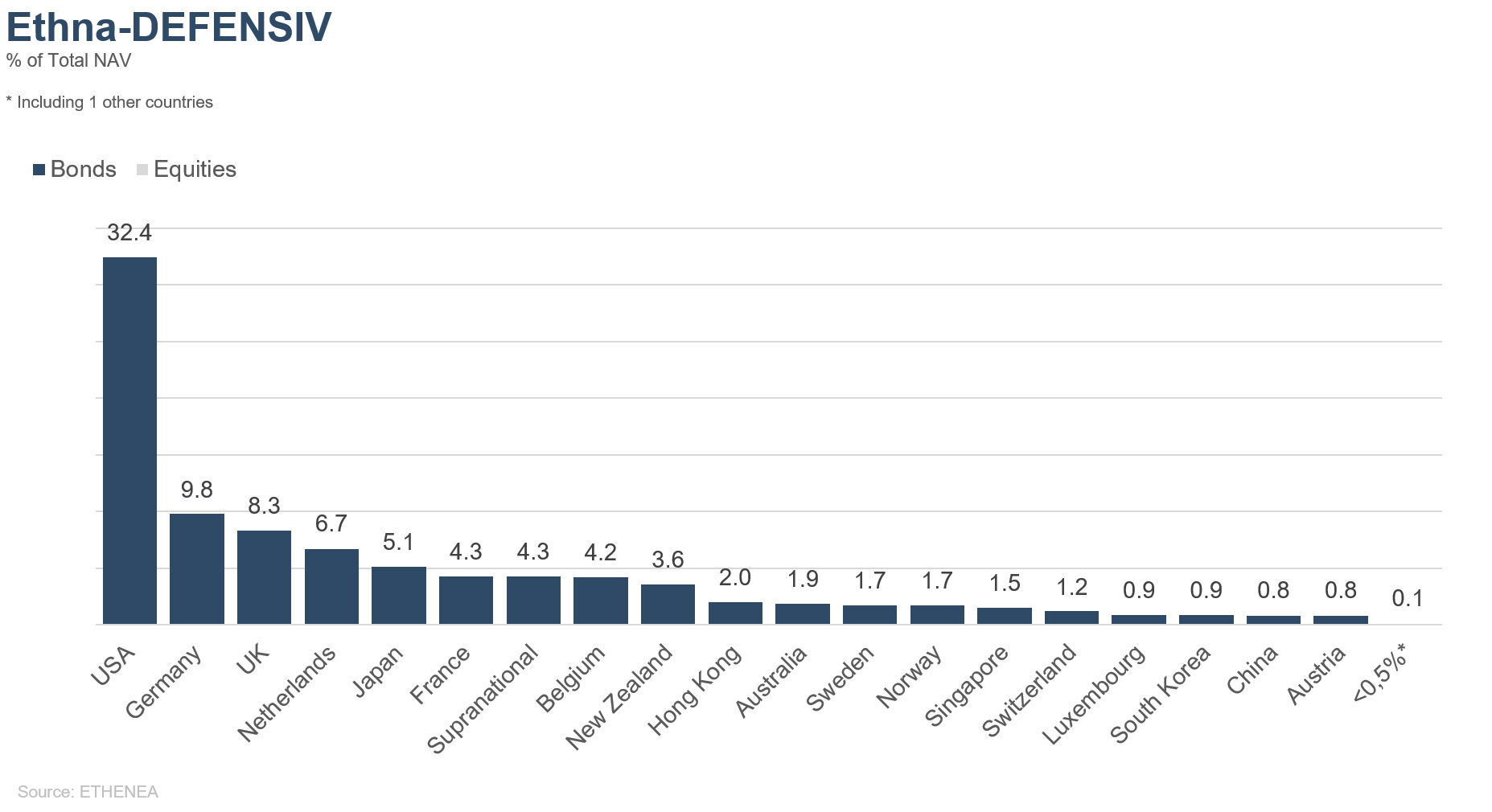

Figure 6: Portfolio composition of Ethna-DEFENSIV by currency

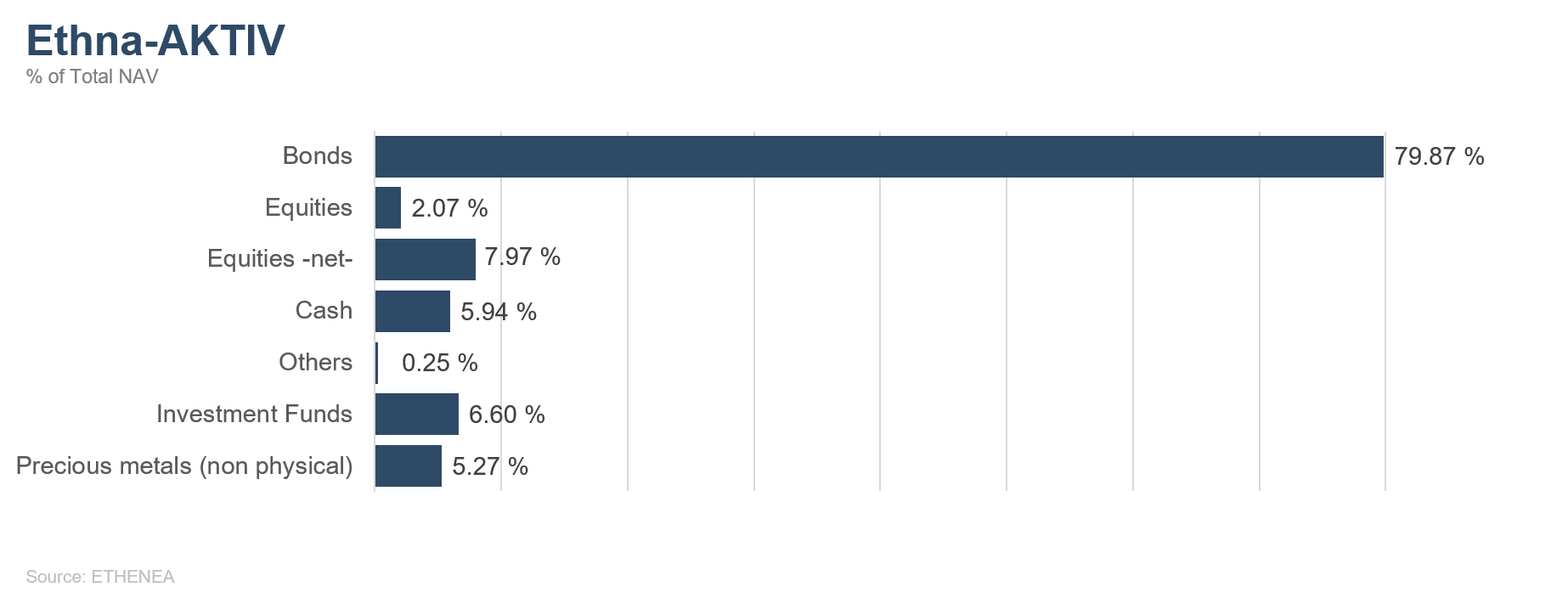

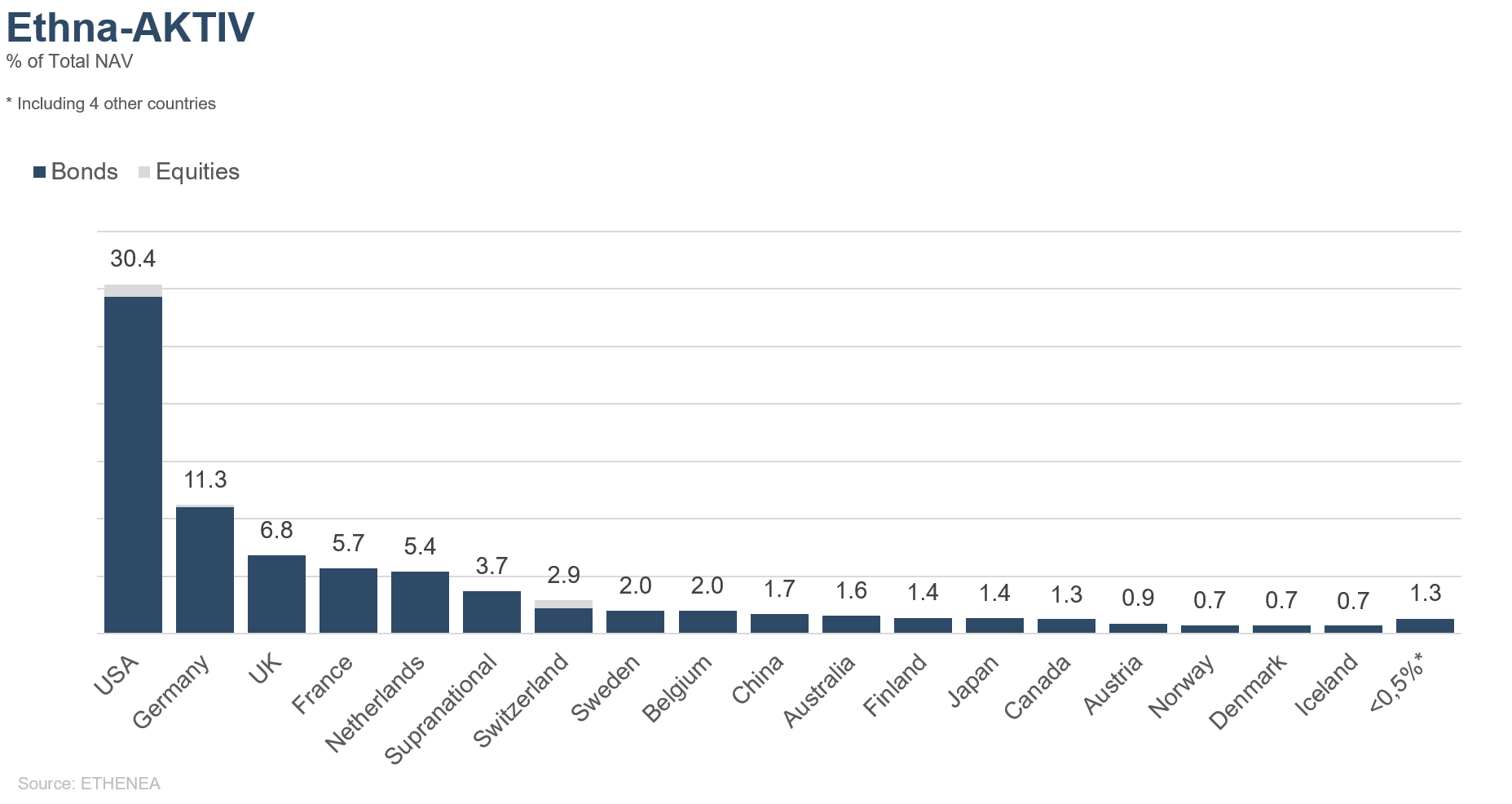

Figure 7: Portfolio structure* of Ethna-AKTIV

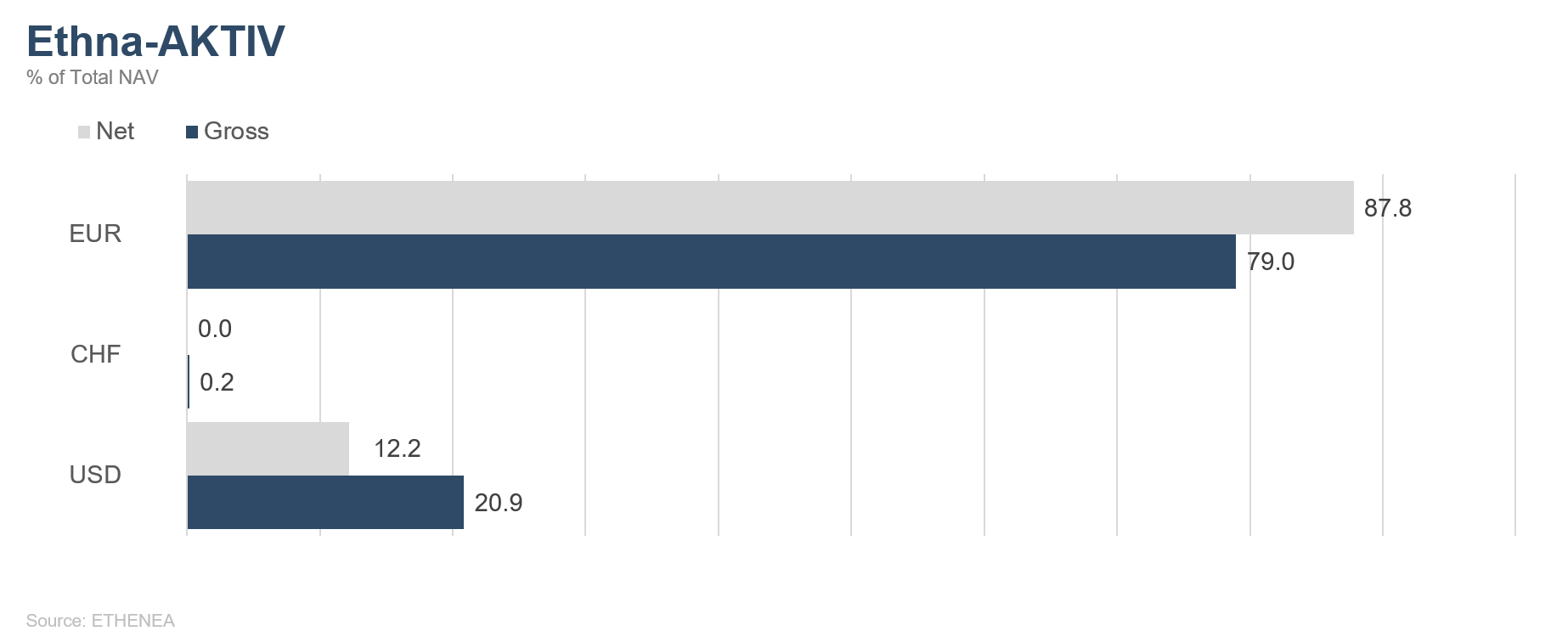

Figure 8: Portfolio composition of Ethna-AKTIV by currency

Figure 9: Portfolio structure* of Ethna-DYNAMISCH

Figure 10: Portfolio composition of Ethna-DYNAMISCH by currency

Figure 11: Portfolio composition of Ethna-AKTIV by country

Figure 12: Portfolio composition of Ethna-DEFENSIV by country

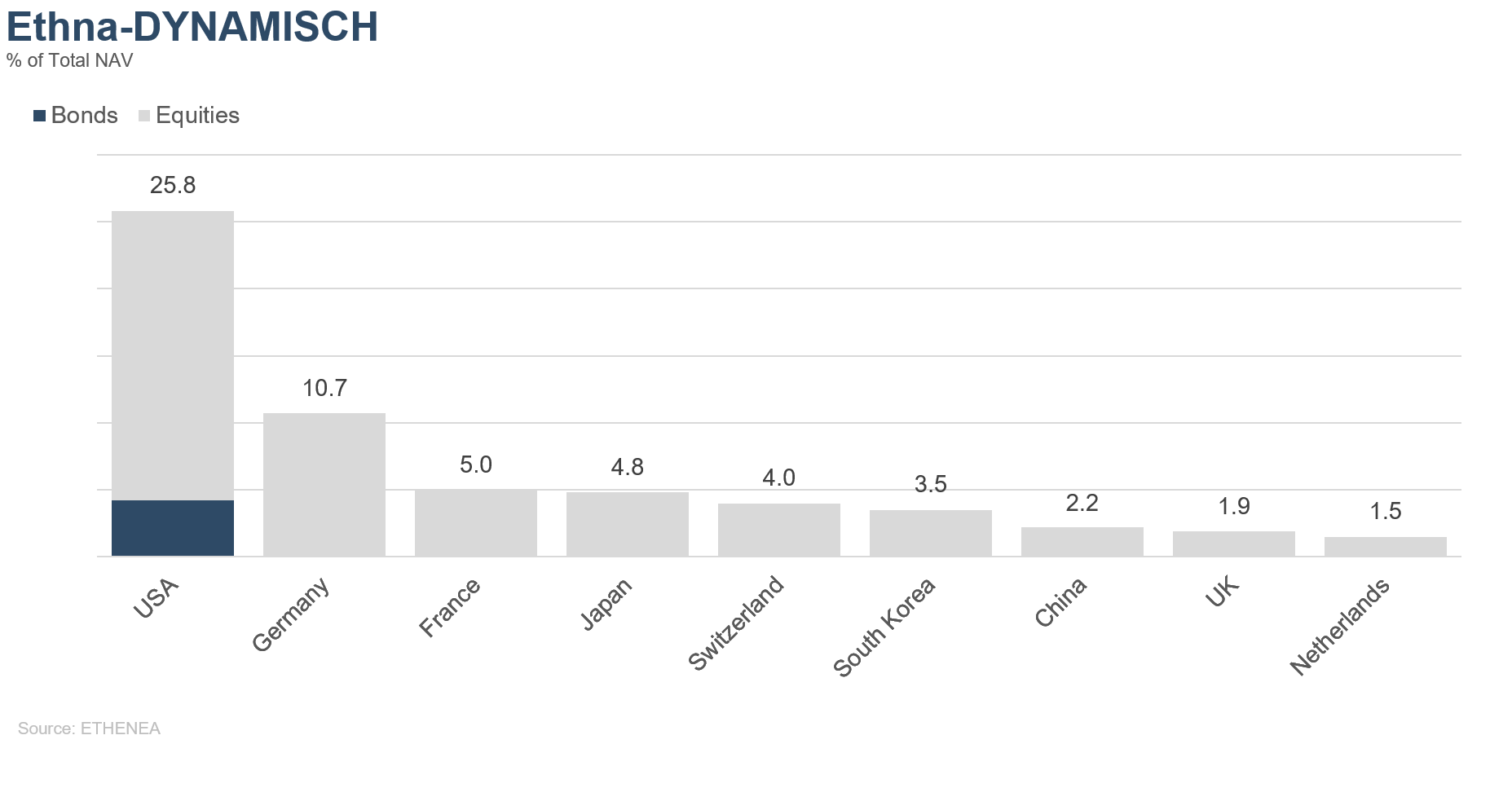

Figure 13: Portfolio composition of Ethna-DYNAMISCH by country

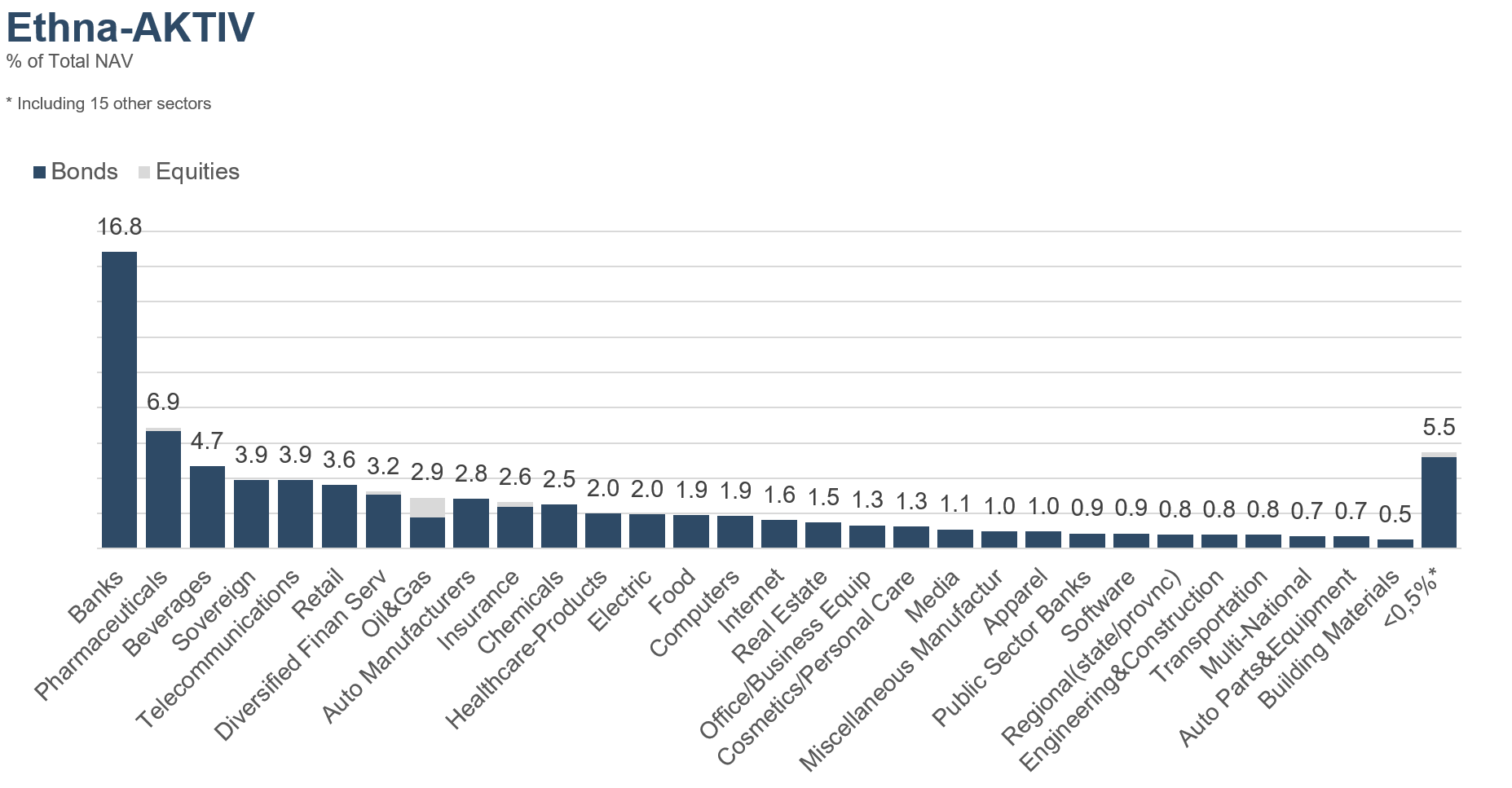

Figure 14: Portfolio composition of Ethna-AKTIV by issuer sector

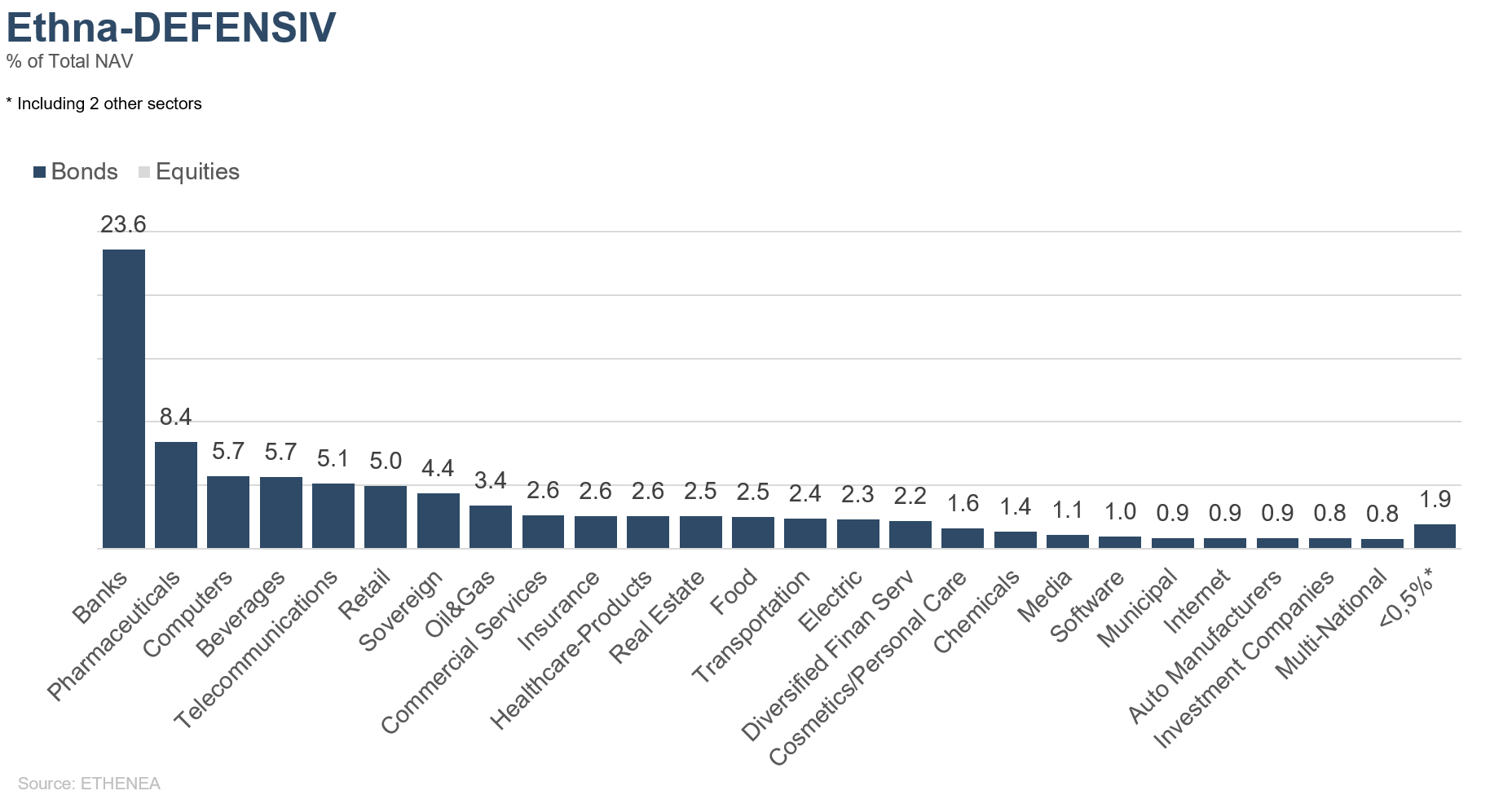

Figure 15: Portfolio composition of Ethna-DEFENSIV by issuer sector

Figure 16: Portfolio composition of Ethna-DYNAMISCH by issuer sector

* “Cash” comprises term deposits, call money and current accounts/other accounts. “Equities net” comprises direct investments and exposure resulting from equity derivatives.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

This marketing communication is for information purposes only. It may not be passed on to persons in countries where the fund is not authorized for distribution, in particular in the USA or to US persons. The information does not constitute an offer or solicitation to buy or sell securities or financial instruments and does not replace investor- and product-related advice. It does not take into account the individual investment objectives, financial situation, or particular needs of the recipient. Before making an investment decision, the valid sales documents (prospectus, key information documents/PRIIPs-KIDs, semi-annual and annual reports) must be read carefully. These documents are available in German and as non-official translations from ETHENEA Independent Investors S.A., the custodian, the national paying or information agents, and at www.ethenea.com. The most important technical terms can be found in the glossary at www.ethenea.com/glossary/. Detailed information on opportunities and risks relating to our products can be found in the currently valid prospectus. Past performance is not a reliable indicator of future performance. Prices, values, and returns may rise or fall and can lead to a total loss of the capital invested. Investments in foreign currencies are subject to additional currency risks. No binding commitments or guarantees for future results can be derived from the information provided. Assumptions and content may change without prior notice. The composition of the portfolio may change at any time. This document does not constitute a complete risk disclosure. The distribution of the product may result in remuneration to the management company, affiliated companies, or distribution partners. The information on remuneration and costs in the current prospectus is decisive. A list of national paying and information agents, a summary of investor rights, and information on the risks of incorrect net asset value calculation can be found at www.ethenea.com/legal-notices/. In the event of an incorrect NAV calculation, compensation will be provided in accordance with CSSF Circular 24/856; for shares subscribed through financial intermediaries, compensation may be limited. Information for investors in Switzerland: The home country of the collective investment scheme is Luxembourg. The representative in Switzerland is IPConcept (Suisse) AG, Bellerivestrasse 36, CH-8008 Zurich. The paying agent in Switzerland is DZ PRIVATBANK (Suisse) AG, Bellerivestrasse 36, CH-8008 Zurich. Prospectus, key information documents (PRIIPs-KIDs), articles of association, and the annual and semi-annual reports can be obtained free of charge from the representative. Information for investors in Belgium: The prospectus, key information documents (PRIIPs-KIDs), annual reports, and semi-annual reports of the sub-fund are available free of charge in German upon request from ETHENEA Independent Investors S.A., 16, rue Gabriel Lippmann, 5365 Munsbach, Luxembourg, and from the representative: DZ PRIVATBANK AG, Niederlassung Luxemburg, 4, rue Thomas Edison, L-1445 Strassen, Luxembourg. Despite the greatest care, no guarantee is given for the accuracy, completeness, or timeliness of the information. Only the original German documents are legally binding; translations are for information purposes only. The use of digital advertising formats is at your own risk; the management company assumes no liability for technical malfunctions or data protection breaches by external information providers. The use is only permitted in countries where this is legally allowed. All content is protected by copyright. Any reproduction, distribution, or publication, in whole or in part, is only permitted with the prior written consent of the management company. Copyright © ETHENEA Independent Investors S.A. (2025). All rights reserved. 04/02/2019

Select your profile