Jumping the gun in the stock market

In a race, runners anticipate the firing of the gun and sometimes react too soon, known as “jumping the gun”. Also, sometimes the slightest twitch from one runner sets off the other runners in an example of group dynamics. Indeed, group dynamics is the only explanation for some of the significant fluctuations in the global stock markets. It’s not always the case that behind every major decline there is a truly sustained economic downturn. Often the fear alone is enough to send markets into a tailspin. So there’s some truth to the saying “The markets have predicted 10 of the last 5 recessions.” A recession is defined as two successive quarters with negative economic growth. Market reactions to the various recessionary periods were highly varied in the past. In some cases, the falls in markets in non-recessionary periods were steeper and more pronounced than in recessionary periods. Small cap indices, the like of which one tends to find in smaller European countries or in emerging markets, can easily lose up to 30% without the economy going into recession. In the case of broader indices, such as the S&P 500 or the STOXX Europe 600, declines on this scale in the absence of recession are rare, but not unheard of. Losses of 10% or more, on the other hand, occur every year, sometimes more than once. Words of warning from a central bank or weak economic data can be enough to trigger a correction in markets. Even very strong economic data can lead to sharp falls in prices if a more restrictive monetary policy is introduced as a result of an overly strong economy. The markets’ reactions of varying degrees to these events can be seen as jumping the gun. Since its foundation on 1 January 1988, the DAX has been through a number of such phases. The following chart shows the strongest declines in the DAX since 1988.

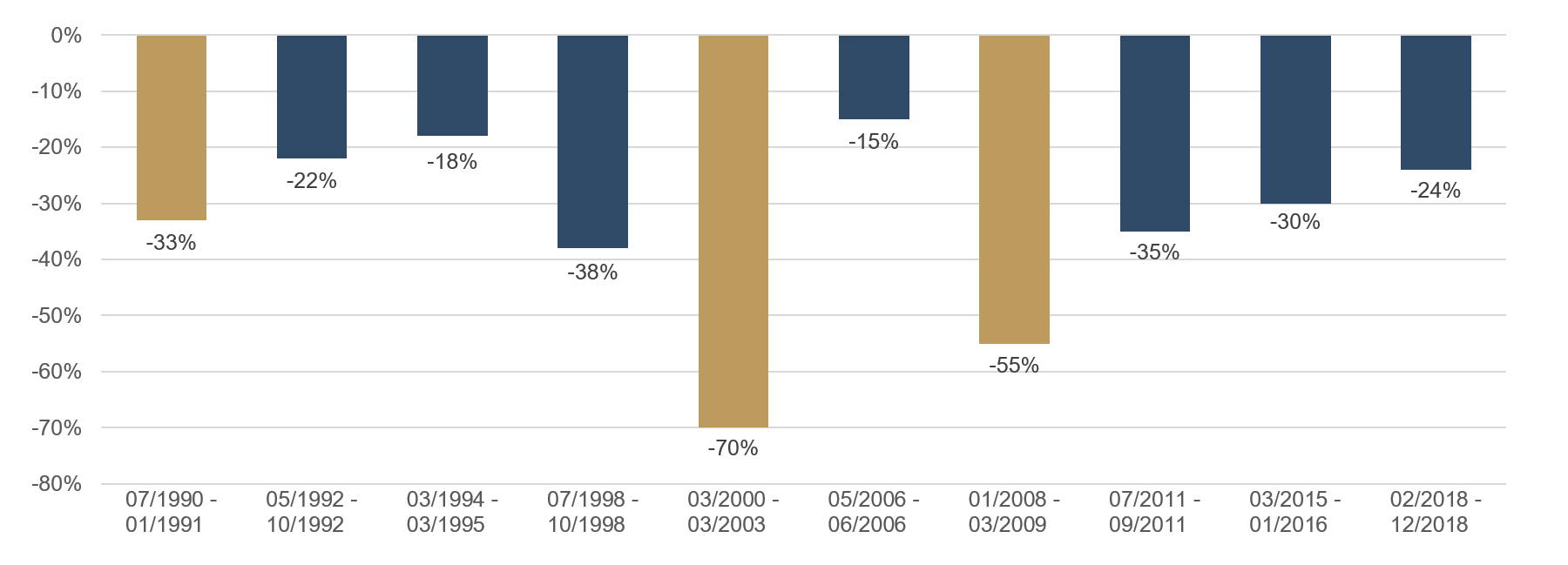

Figure 1: Falls in the DAX since 1988

The gold bars represent recessionary periods in Germany, painting the expected picture. Not every steep fall in prices is accompanied by a recession. There were no major consequences of the huge declines in 2011 and 1998, while there certainly were considerable economic impacts in the periods 2000–2003 and 2008. Observant readers will notice the absence of the 1987 stock market crash. This happened before the first official calculation of the DAX on 1 January 1988. Retrospectively, however, a loss of 40% was calculated for the index in that period. By and large, there were no major economic consequences of this dramatic loss either; the expected recession failed to materialise. It’s a similar situation with the broader U.S. market index, the S&P 500. Not every major decline in prices is accompanied by a recession here either. Again, the market has overdone it and jumped the gun. The following chart shows the strongest declines in the S&P 500 since 1987.

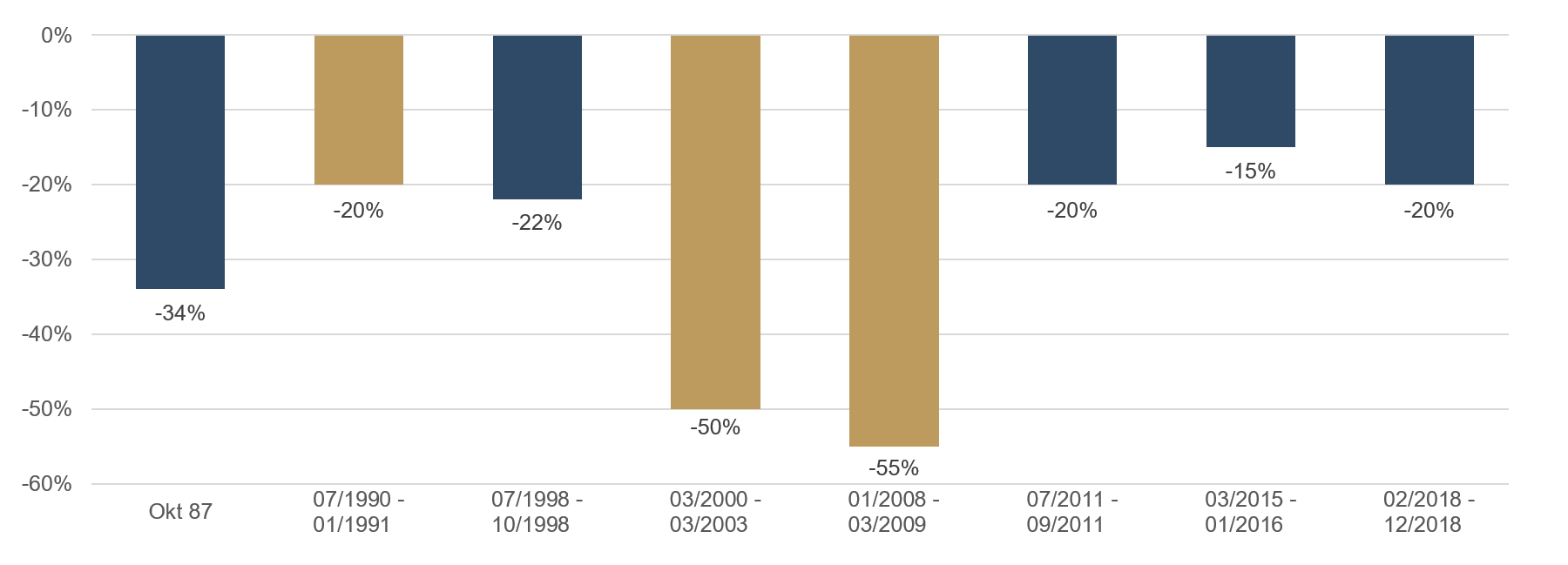

Figure 2: Falls in the S&P 500 since 1987

The gold bars represent recessionary periods in the U.S. Compared with the previous chart, one can see that there are significantly fewer declines over the period in question. The falls in the S&P 500 in the years 1992, 1994/95 and 2006 were less than 10% and because they were so moderate, they do not appear in the above chart. But the same is true here – not every sharp decline is accompanied by a recession. Jumping the gun thus appears slightly more pronounced in Germany than in the U.S., but this is also likely to be due to the companies’ much smaller market capitalisation. The phenomenon of group dynamics, incidentally, works in both directions. In other words, jumping the gun also happens with a positive economic outlook, where the good news stories are priced in ad infinitum, ratcheting up the market far too high. As long as the markets are driven by human psychology, there will always be peculiar movements – both positive and negative.

Markets jumped the gun in the fourth quarter of 2018 out of fear of recession, and went into a tailspin. In anticipation of a more accommodative monetary policy and better economic data, the markets recovered in the first half of 2019 and are almost at new highs at the moment. This recovery was rapid and unexpected. In the near term, the markets have priced in all the positive news. On that note, we refer you to our Market Commentary No. 4 from April 2019, in which we highlighted the increased risk of recessionary tendencies in the global economy. At present, there is no sign of the negative sentiment of the fourth quarter. It would appear that we are jumping the gun leading to positive exaggeration at the moment. Over the summer, we expect high volatility in equity markets and, accordingly, our positioning of the Ethna funds is cautious. For the market to exceed the previous highs, it needs further stimulus, which we do not expect until near the end of the year. A resolution in the China-U.S. trade conflict and the economy-boosting effect of the U.S. presidential campaign, which is now getting under way, could support the markets in the fourth quarter.

Gold in focus

The price of gold reached a significant high recently. In our latest video, ETHENEA Senior Portfolio Manager Michael Blümke gives our assessment of the increase in the precious metal, what tactical implications this has within the Ethna-AKTIV portfolio and what our long-term strategy is in relation to gold.If you are having video playback issues, please click HERE.

Positioning of the Ethna Funds

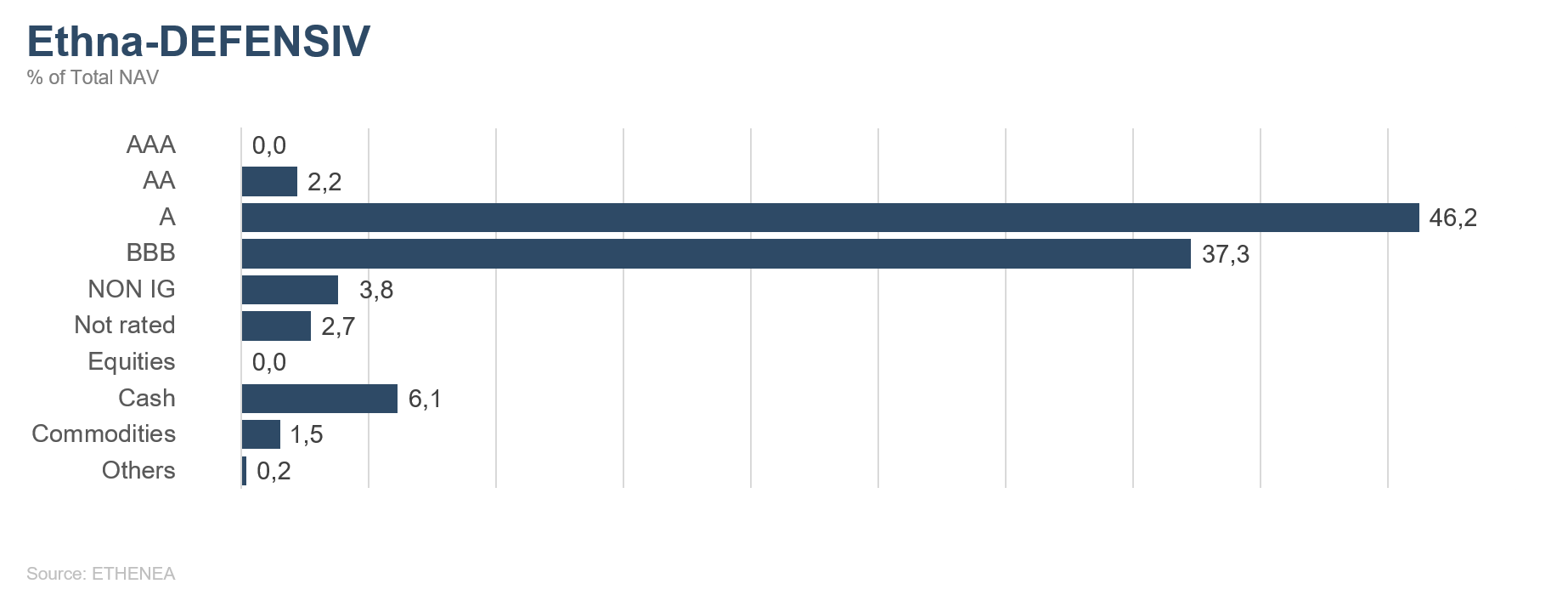

Ethna-DEFENSIV

In June, fears of a further escalation of the trade conflict between China and the U.S. gave way to hope that no new tariffs would be introduced for now and negotiations for a long-term solution would be reopened. However, the uncertainties it brought about have already left their mark on global trade and in the plans of many businesses. For instance, at the beginning of June the World Bank reduced its estimate for global economic growth in 2019 to 2.6%, having forecast growth of 2.9% in January. This, in turn, prompted the ECB and the Fed to revisit their interest rate policy. In his speech at Sintra in Portugal, Mario Draghi affirmed the ECB’s willingness to counter the current sluggish growth and persistently weak inflation with further expansionary monetary measures. At its latest meeting, the Fed let it be known that it is prepared to adjust its current policy to ensure the economic upturn continues, from which the financial markets concluded that the Fed will lower its key rate at the end of July. Further rate cuts do not appear to be out of the question. Reacting to the statements from the central banks, long-term interest rates fell once again. The yields on 10-year German sovereign bonds fell to a record low of -0.33%. Yields on their U.S. equivalents (10-year Treasuries) dropped below 2% for a time, and closed last month just slightly above 2%.

The high duration of 6.5 enabled the Ethna-DEFENSIV’s bond portfolio to benefit to a considerable extent from falling interest rates. Duration was increased to 7.2 using U.S. Treasury futures, and this was a major contributor to the fund’s exceptionally positive performance in May (+2.07%). The narrowing of risk premia on corporate bonds also made a significant contribution to the positive fund performance.

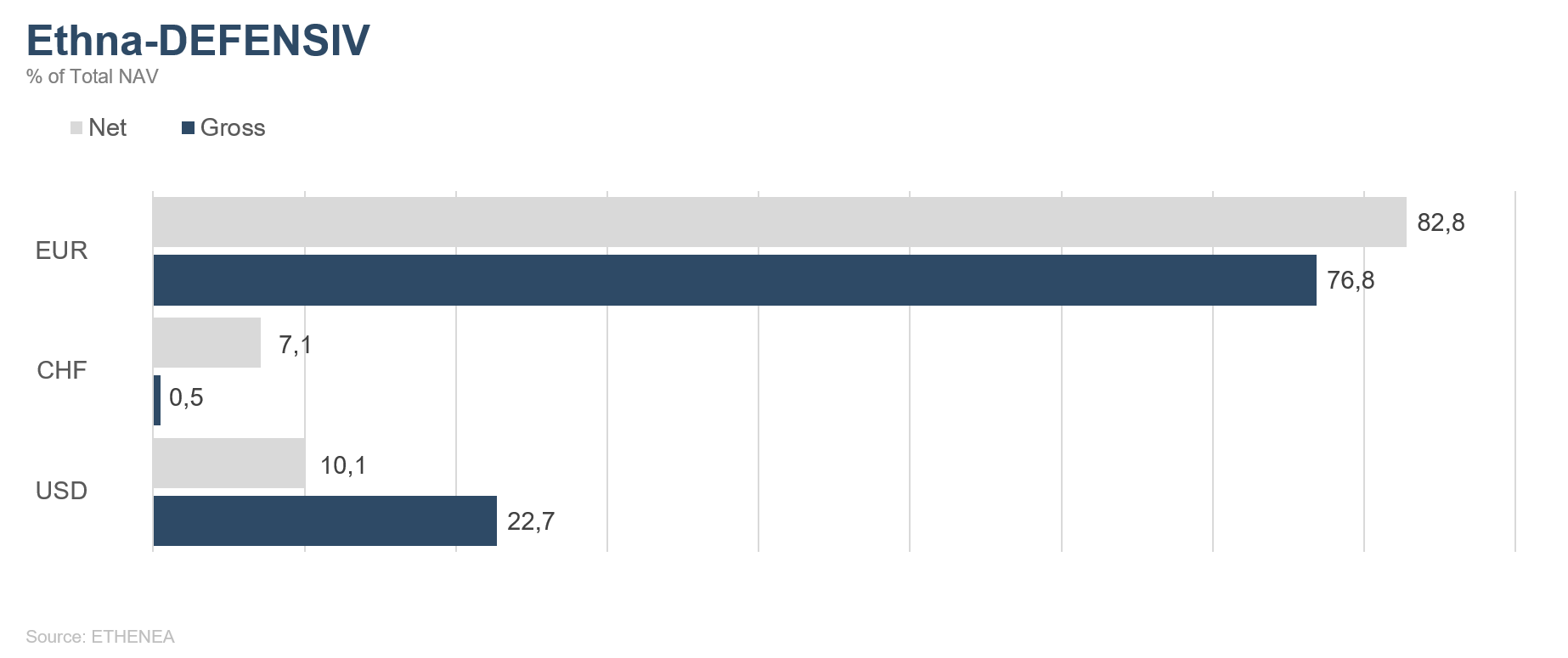

The highly anticipated G20 summit in Japan took place at the end of June. The general expectation of the meeting between presidents Trump and Xi at the summit was that it would at least herald an easing of tensions in the trade conflict, without there being a major breakthrough yet. However, since President Trump’s actions are highly unpredictable, we have decided to minimise various risks outside of our bond portfolio, so we have reduced our open USD position to 10%. We have completely closed the equity position within the Ethna-DEFENSIV and taken last month’s profits. We also reduced the gold position to 1.5%.

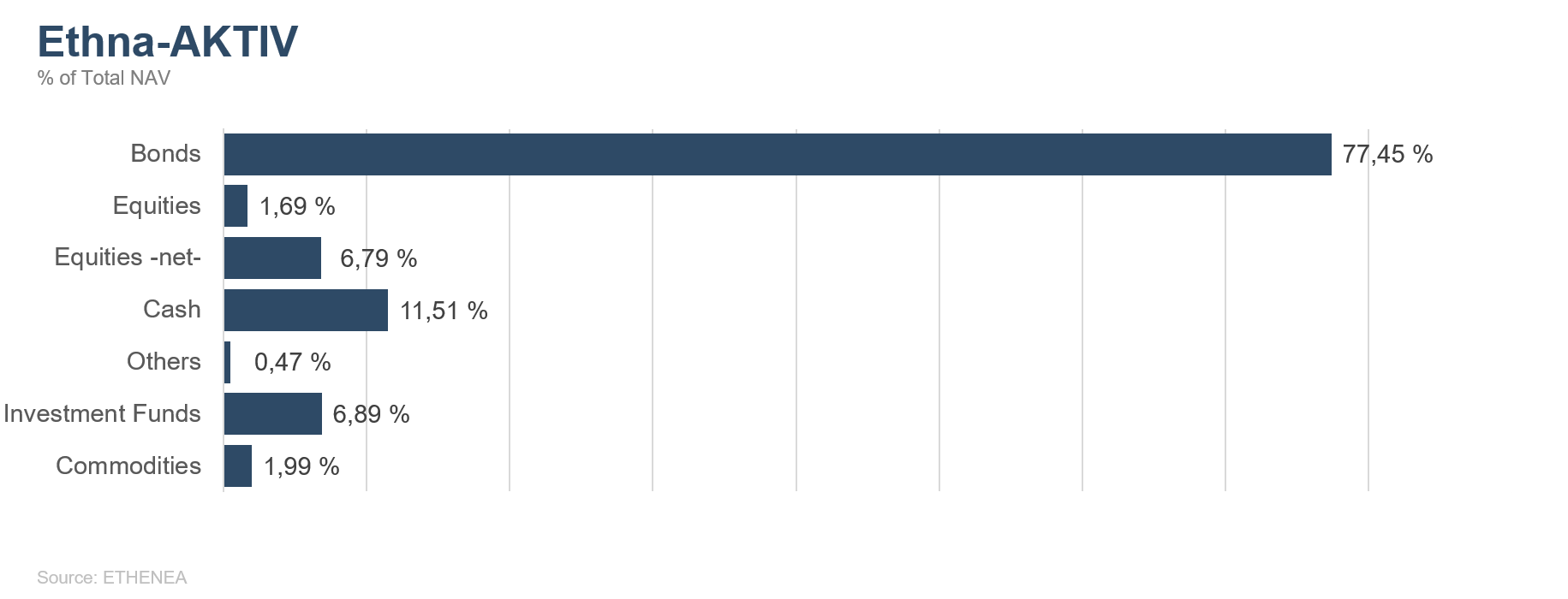

Ethna-AKTIV

June, like the preceding months, was all about the trade war between China and the U.S. The key players on the world stage this month, featuring central bank meetings and the G20 summit in Osaka, one again included the U.S. President – but also the heads of the ECB and the Federal Reserve, who now feel compelled to take monetary countermeasures within their spheres of responsibility. While Mario Draghi, in his much-acclaimed speech at Sintra in Portugal, called additional stimulus into play with talk of interest rate cuts and fresh quantitative easing from the ECB, Jerome Powell announced at the regular Fed meeting a departure from a “patient” stance, and virtually paved the way for the next cycle of rate cuts by the Fed. As one would expect, the reaction from the markets was euphoric, dampened only slightly (if at all) by the then unknown outcome of the G20 summit. Both short-term and long-term interest rates in Europe and the U.S. fell further, and risk assets rose the whole month through. The U.S. semi-conductor index is a good example of the extent of the influence of the trade tensions on certain sectors. After this index recorded its worst month since 2008 in May following the break-down of talks (-16.7%), it put in its best monthly performance since 2012 in June in anticipation of a resumption of negotiations (+12.6%). Even though the settlement of the dispute would be advantageous for both sides, we do not believe there will be a resolution soon. There is too much distance between the parties as yet. However, in an attempt to convince not just us, but the whole world, of his abilities as a great dealmaker, after the positive G20 summit Trump met for the third time with Kim Jong-Un at the Korean Demilitarised Zone. But similar to the trade conflict, the only thing the U.S. President has to show for these negotiations is empty declarations instead of hard-and-fast agreements. Economic data were rather patchy during the month, including weak labour market figures and fresh falls in the Purchasing Managers’ Index for the manufacturing sector. The crucial question will be whether the interplay of supportive central bank policy and the return to more cordial trade relations will be enough to sustain the current economic cycle and associated positive stock markets. Though it may appear that the current upward trend is attributable to the central banks’ dialling up the money supply, naturally, we would still never wish to stand in its way.

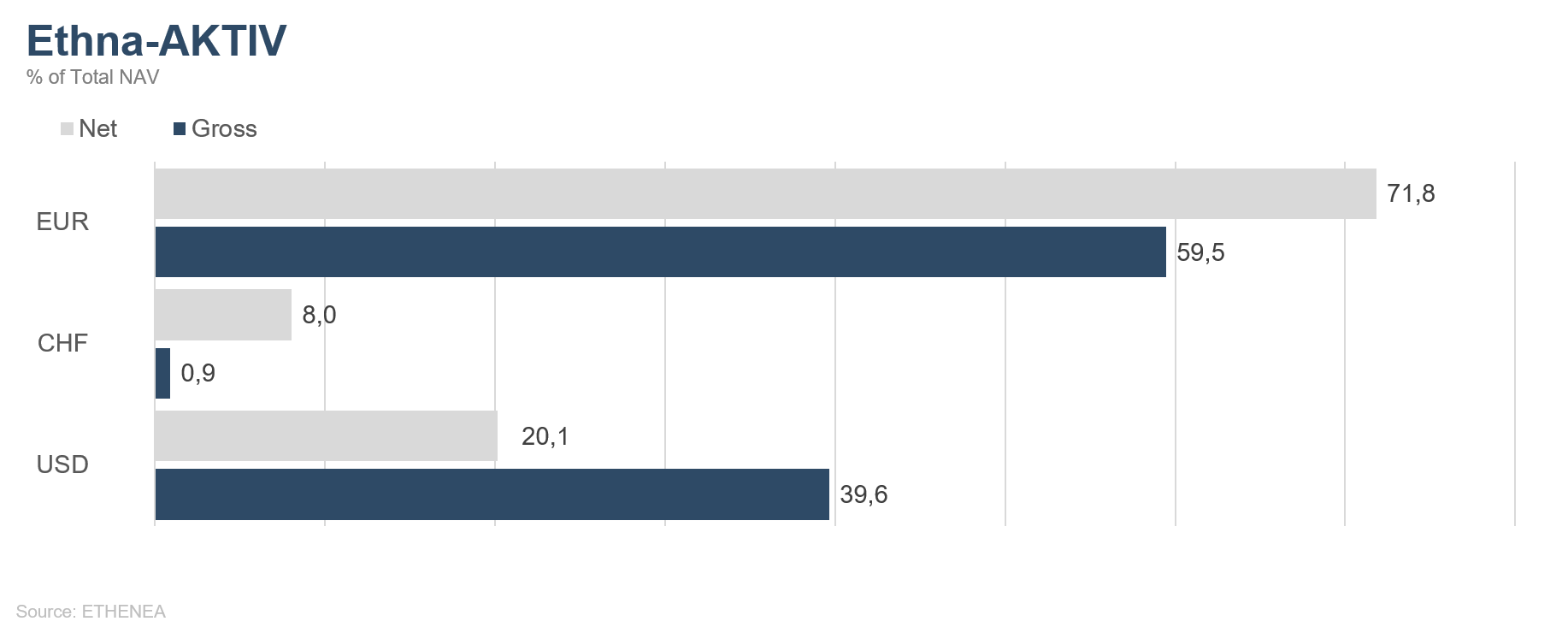

Given its positioning, in June the fund was able to benefit from this positive environment and achieved its best monthly result so far this year. The bond portfolio benefited both from narrowing spreads and from falling interest rates, and was again the main driver behind fund performance. The extension of duration – via futures – further boosted the contribution to performance of the fixed-income portfolio. Although we expect the interest rate trend to continue long-term, we took the opportunity to close out the duration overlay at around 2% for 10-year U.S. Treasuries for the time being. The low interest rates coupled with moderate inflation to disinflation have broken gold out of a consolidation phase that lasted years. We have taken advantage of the price gains of almost 10% this year, to more than halve our 5% allocation at close to its annual high for tactical reasons. Strategically, we are still positively disposed towards the precious metal and will expand the position again in the longer term. We had reduced the equity allocation in May: this we increased once again in a disciplined fashion, with the result that this asset class also made a positive contribution last month. However, we took the tactical decision to reduce the allocation substantially ahead of the G20 meeting due to the high level of uncertainty. Unless the situation deteriorates, we will immediately increase the equity allocation once again, in the direction of 20%. The biggest change in our positioning is the reduction of the U.S. dollar allocation from over 30% to 20%. This move takes account of the fact that the USD is currently exposed to a strong headwind, both from the Fed and indirectly from the country’s President. Due to economic and political challenges in Europe, the weaker trend in the single currency will continue. This negative view of the euro is reflected in our Swiss franc allocation, which is 8% at the moment.

Ethna-DYNAMISCH

Developments in capital markets are constantly affected by a number of influences. However, seldom have they been so closely intertwined as is currently the case. While May was dominated by strong restraint in equity markets, in June the positive take on the headlines was predominant. Once again, one of the most important drivers was the central banks. Both the U.S. Fed and the European ECB sent out clear signals during the month that they would continue to support markets. The fact that the reasons for these supportive measures are weaker-trending fundamentals and higher macro-economic risks was ignored – or at least has been so far. U.S. President Donald Trump has contributed a great deal to the current high level of uncertainty: with his unpredictable threats of tariffs, he is making it almost impossible for global companies to make major long-term investment plans. The markets are reacting commensurately to news from this front. However, the latest example from the beginning of June also shows the flip side of this policy: Trump proudly announced that the planned U.S. tariffs in the dispute over illegal immigration from Mexico into the U.S. would be suspended indefinitely. While this gave equity markets an extra boost, it merely prolongs the uncertainty for companies.

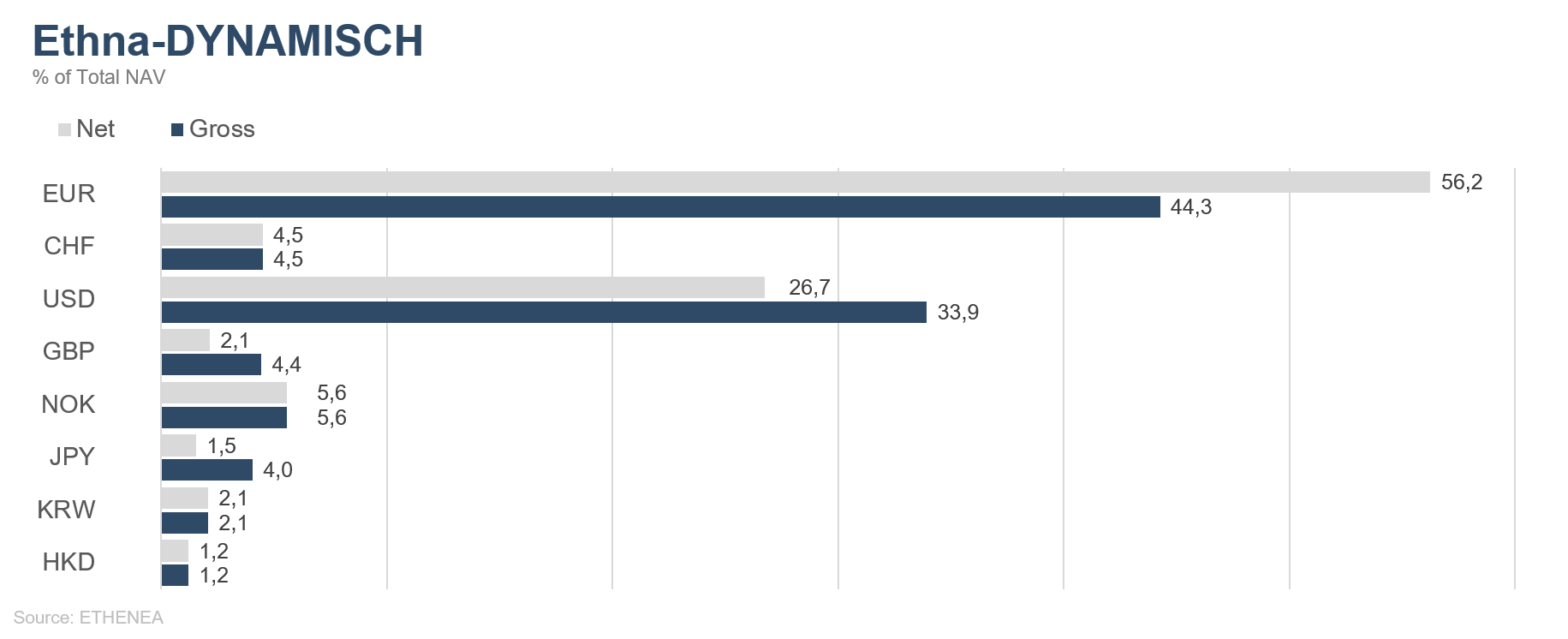

This discrepancy between the market’s superficially very positive interpretation of the headlines and the ongoing clear warning signs below the surface has been growing of late, leading us to adjust the hedging components within the Ethna-DYNAMISCH. While we made hardly any changes to the equity portfolio’s gross allocation – that is, at the single stock level – the recent high volatility presented us with opportunities to make tactical adjustments to the net equity allocation. Investor sentiment continues to be an important pointer in overall risk management. At the beginning of June, the mood of U.S. private investors, for instance, reached its lowest point of the year. This was one of a number of good and accurate indicators for us to close the additional hedges we had built up in May. However, the markets were again powered by excessive euphoria after the Fed meeting on 19 May, if not before, so we once again greatly increased the hedges towards the end of the month.

Looking ahead, in the second half of 2019 we want to focus on the single stock portfolio of the Ethna-DYNAMISCH to a greater extent. The overriding valuation advantages of equities as an asset class over potential alternatives are in strong evidence in the single stocks selected by us. Since 1 July 2019, we have been permitted to increase the equity allocation of the Ethna-DYNAMISCH beyond 70%, meaning that we can give a positive view of equity markets a stronger bearing on our asset allocation in future. We also plan to take advantage of this over the coming months in order to expand the portfolio of selected single stocks towards 80% (gross). At the same time, the hedging components of the Ethna-DYNAMISCH will continue to play an important role in keeping the overriding market risks under control.

Figure 3: Portfolio structure* of the Ethna-DEFENSIV

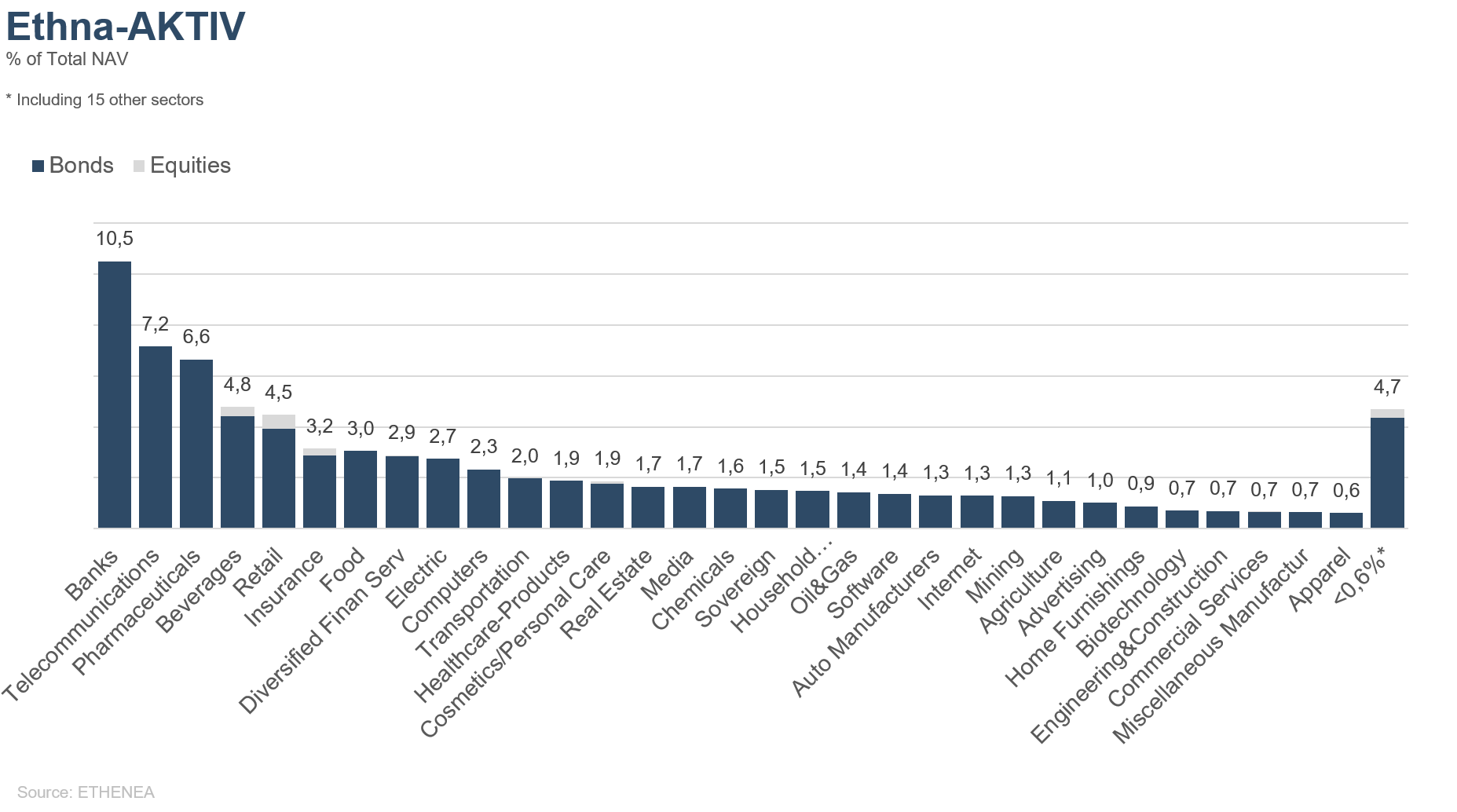

Figure 4: Portfolio structure* of the Ethna-AKTIV

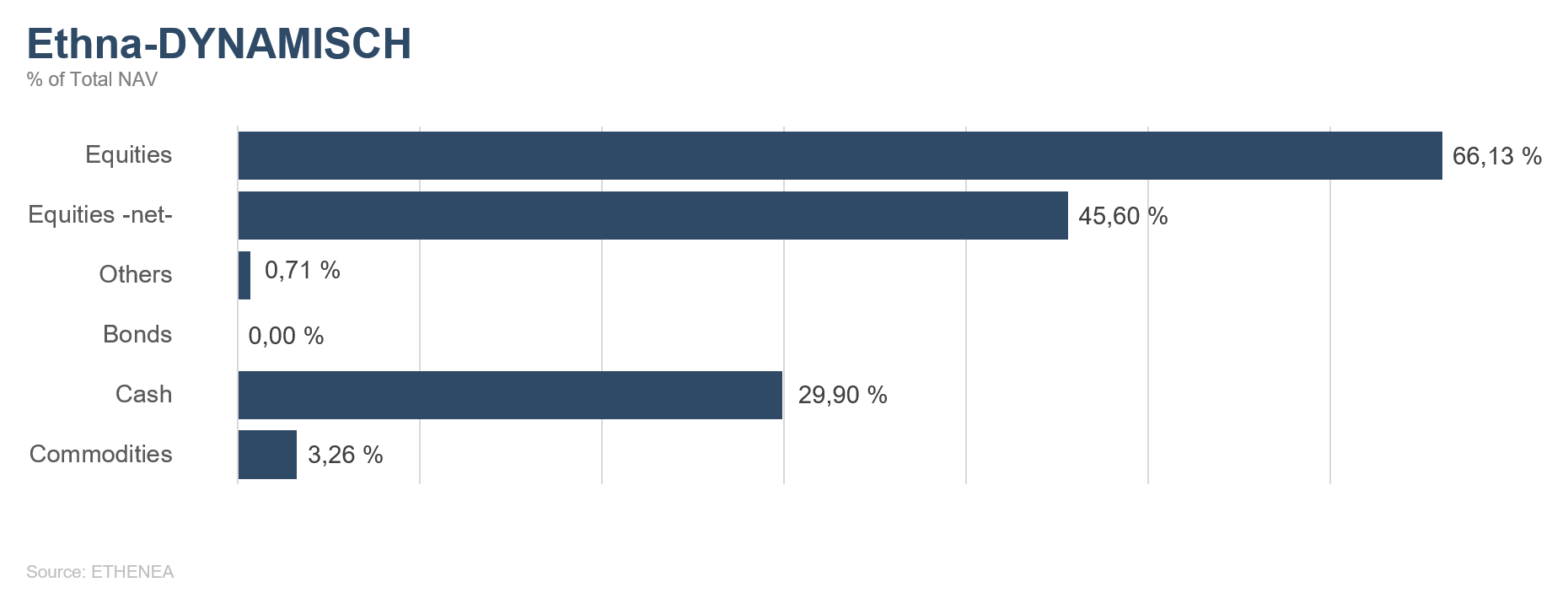

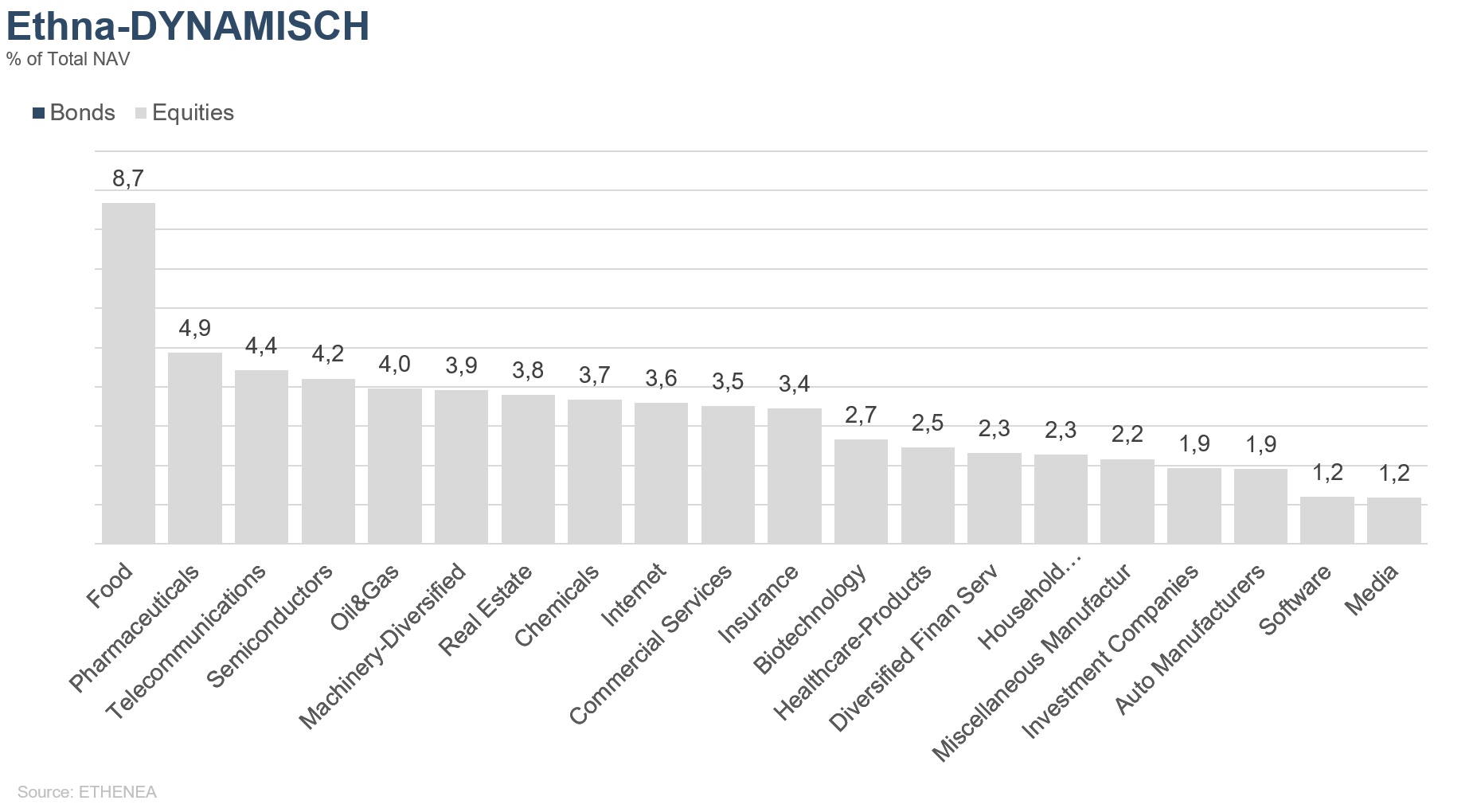

Figure 5: Portfolio structure* of the Ethna-DYNAMISCH

Figure 6: Portfolio composition of the Ethna-DEFENSIV by currency

Figure 7: Portfolio composition of the Ethna-AKTIV by currency

Figure 8: Portfolio composition of the Ethna-DYNAMISCH by currency

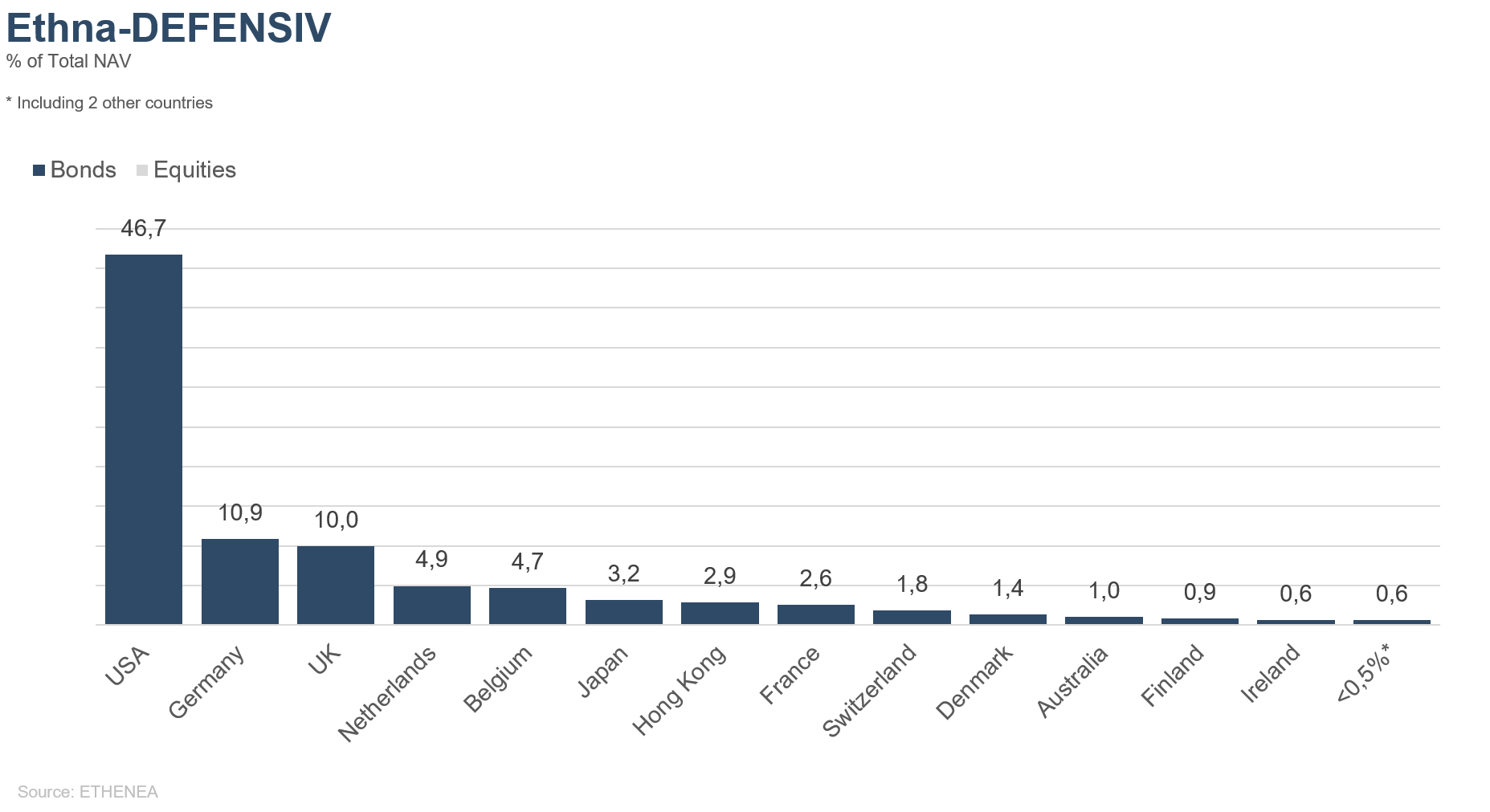

Figure 9: Portfolio composition of the Ethna-DEFENSIV by country

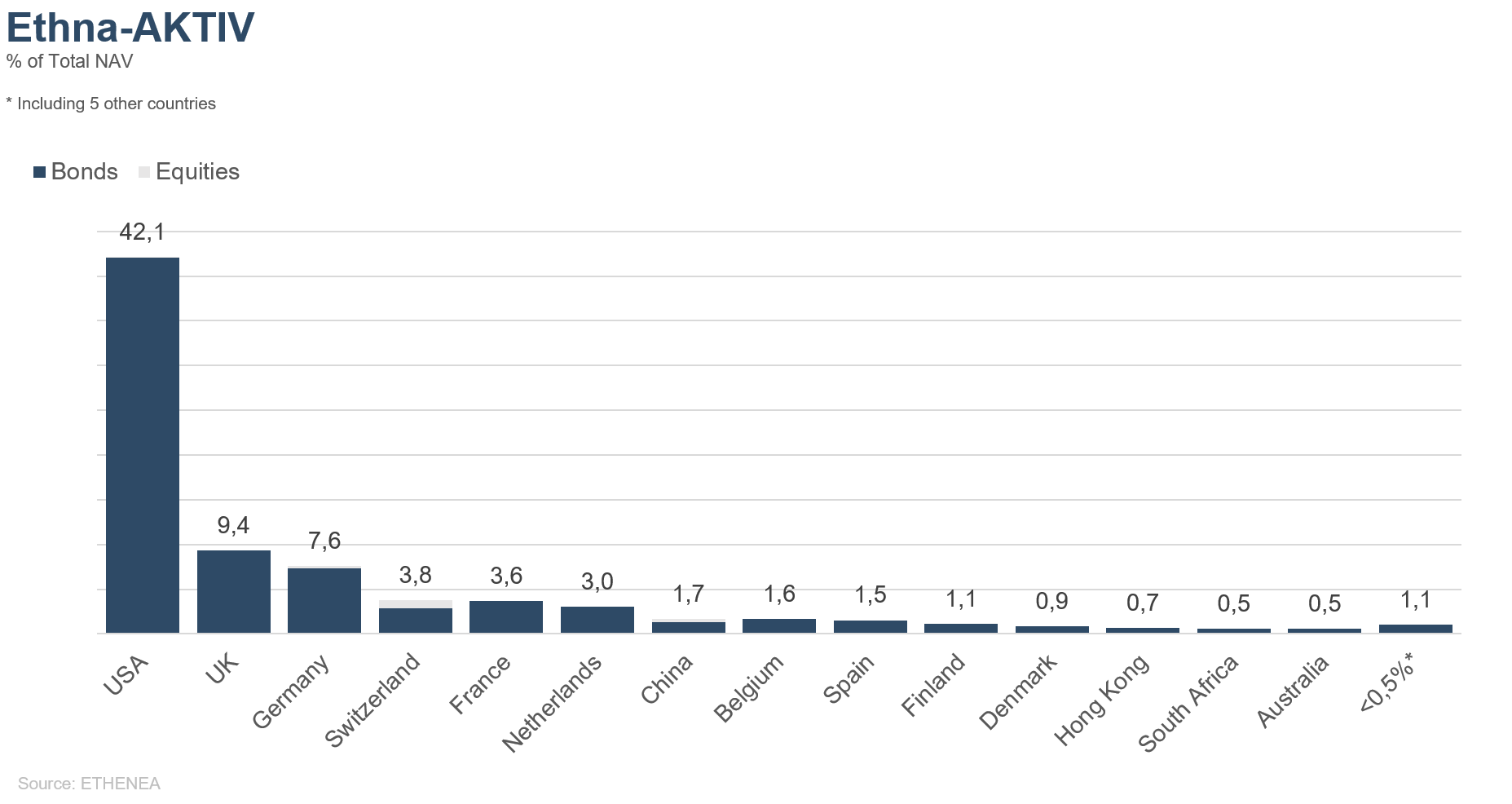

Figure 10: Portfolio composition of the Ethna-AKTIV by country

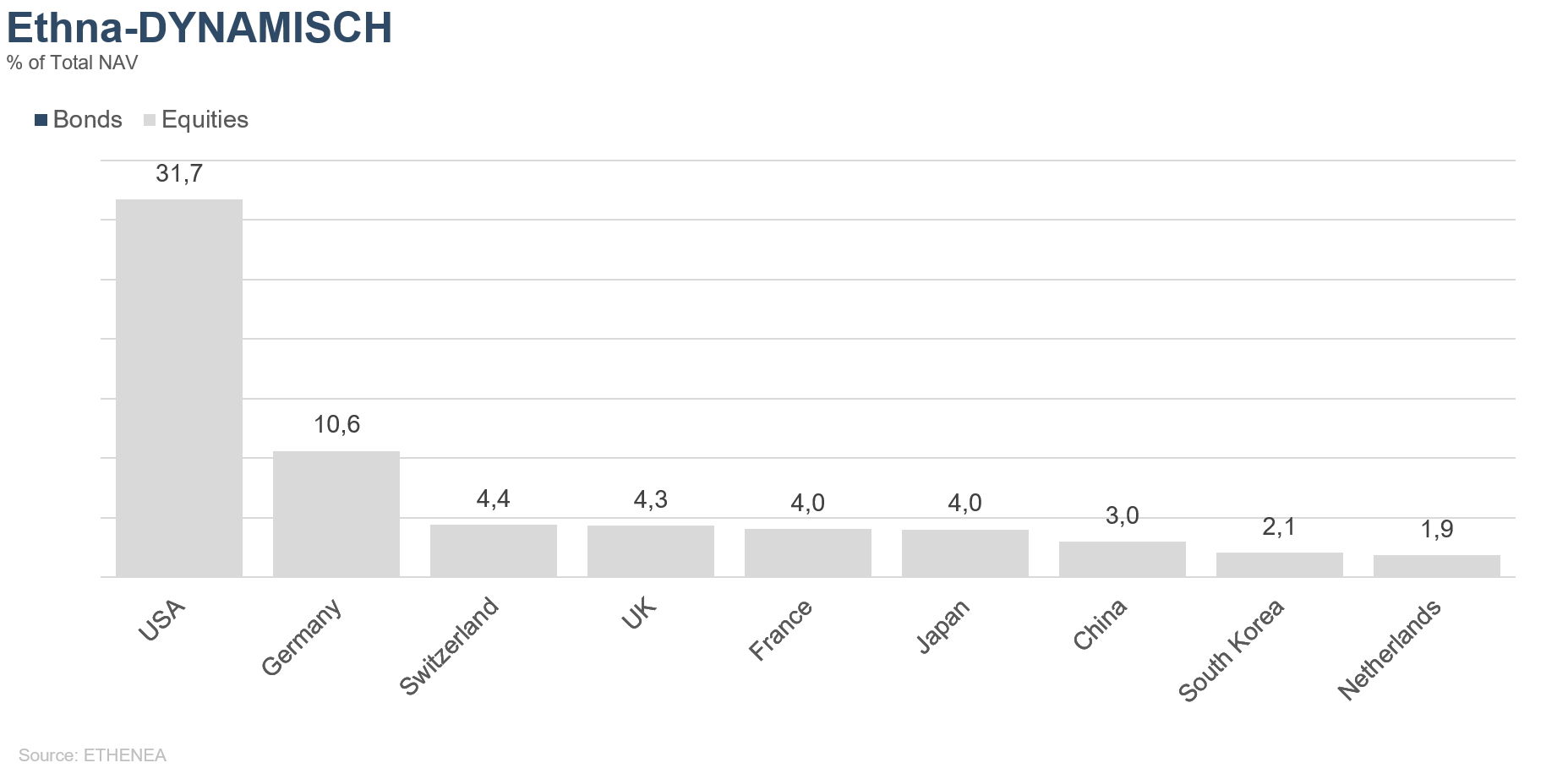

Figure 11: Portfolio composition of the Ethna-DYNAMISCH by country

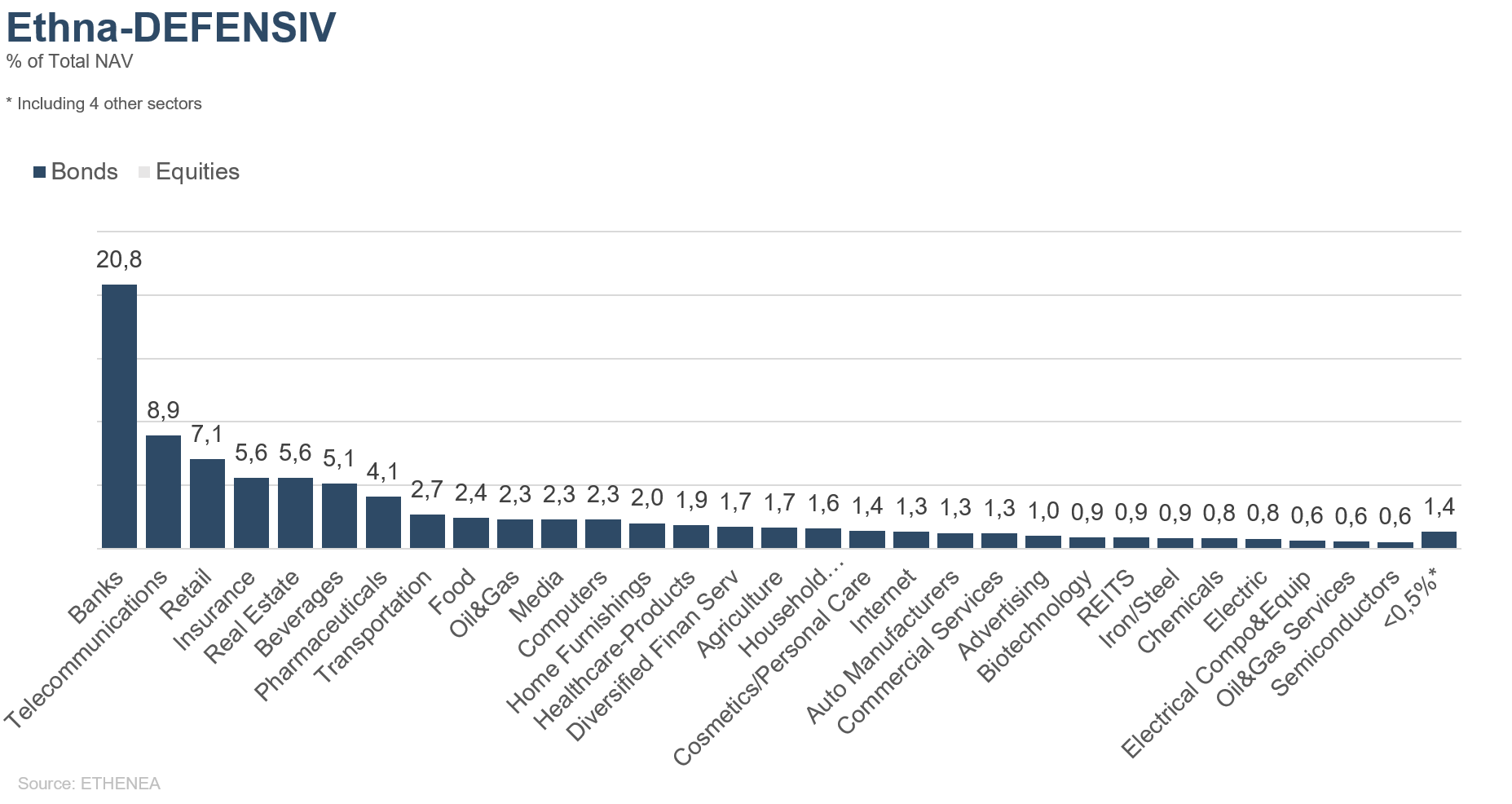

Figure 12: Portfolio composition of the Ethna-DEFENSIV by issuer sector

Figure 13: Portfolio composition of the Ethna-AKTIV by issuer sector

Figure 14: Portfolio composition of the Ethna-DYNAMISCH by issuer sector

* “Cash” comprises term deposits, call money and current accounts/other accounts. “Equities net” comprises direct investments and exposure resulting from equity derivatives.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

This marketing communication is for information purposes only. It may not be passed on to persons in countries where the fund is not authorized for distribution, in particular in the USA or to US persons. The information does not constitute an offer or solicitation to buy or sell securities or financial instruments and does not replace investor- and product-related advice. It does not take into account the individual investment objectives, financial situation, or particular needs of the recipient. Before making an investment decision, the valid sales documents (prospectus, key information documents/PRIIPs-KIDs, semi-annual and annual reports) must be read carefully. These documents are available in German and as non-official translations from ETHENEA Independent Investors S.A., the custodian, the national paying or information agents, and at www.ethenea.com. The most important technical terms can be found in the glossary at www.ethenea.com/glossary/. Detailed information on opportunities and risks relating to our products can be found in the currently valid prospectus. Past performance is not a reliable indicator of future performance. Prices, values, and returns may rise or fall and can lead to a total loss of the capital invested. Investments in foreign currencies are subject to additional currency risks. No binding commitments or guarantees for future results can be derived from the information provided. Assumptions and content may change without prior notice. The composition of the portfolio may change at any time. This document does not constitute a complete risk disclosure. The distribution of the product may result in remuneration to the management company, affiliated companies, or distribution partners. The information on remuneration and costs in the current prospectus is decisive. A list of national paying and information agents, a summary of investor rights, and information on the risks of incorrect net asset value calculation can be found at www.ethenea.com/legal-notices/. In the event of an incorrect NAV calculation, compensation will be provided in accordance with CSSF Circular 24/856; for shares subscribed through financial intermediaries, compensation may be limited. Information for investors in Switzerland: The home country of the collective investment scheme is Luxembourg. The representative in Switzerland is IPConcept (Suisse) AG, Bellerivestrasse 36, CH-8008 Zurich. The paying agent in Switzerland is DZ PRIVATBANK (Suisse) AG, Bellerivestrasse 36, CH-8008 Zurich. Prospectus, key information documents (PRIIPs-KIDs), articles of association, and the annual and semi-annual reports can be obtained free of charge from the representative. Information for investors in Belgium: The prospectus, key information documents (PRIIPs-KIDs), annual reports, and semi-annual reports of the sub-fund are available free of charge in German upon request from ETHENEA Independent Investors S.A., 16, rue Gabriel Lippmann, 5365 Munsbach, Luxembourg, and from the representative: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg. Despite the greatest care, no guarantee is given for the accuracy, completeness, or timeliness of the information. Only the original German documents are legally binding; translations are for information purposes only. The use of digital advertising formats is at your own risk; the management company assumes no liability for technical malfunctions or data protection breaches by external information providers. The use is only permitted in countries where this is legally allowed. All content is protected by copyright. Any reproduction, distribution, or publication, in whole or in part, is only permitted with the prior written consent of the management company. Copyright © ETHENEA Independent Investors S.A. (2025). All rights reserved. 02/07/2019