Whatever it takes 2.0

Key points at a glance

- The phrase “whatever it takes” has become something of a mantra since the euro crisis around ten years ago and means being prepared to do anything and everything required to contain a crisis and restore confidence in the economy.

- In our opinion, given where inflation is at the moment, it is again necessary to do “whatever it takes”. It is time for the European Central Bank to take a clear position and take its price stability mandate seriously again.

- The bond markets show that a turnaround in monetary policy has well and truly arrived. They have already priced in most of the expected interest rate rises.

- Other major central banks – first and foremost the U.S. Federal Reserve – are also showing how things should be done. The European Central Bank will have to raise interest rates considerably in the coming weeks and months if they don’t want to jeopardise their credibility.

“It is time for the ECB to call a halt

to the monetary policy of the past ten years

and start to take consistent and credible measures

to curb inflation.”

Dr Volker Schmidt

“Within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough.” – Mario Draghi Speech at the Global Investment Conference in London.

Around ten years ago, on 26 July 2012, the then President of the ECB and now President of Italy Mario Draghi spoke those famous words that were to turn the tide in the euro crisis. Back in 2012, southern European countries like Greece, Italy, Spain and Portugal were having huge debt refinancing problems arising out of persistently high balance of payments deficits, the trend in national debt in the lead-up to the financial crisis and the fact that monetary union did away with exchange rate mechanisms. Yields on 10-year Italian sovereign paper shot up above 6% in no time. Only the decisive intervention of politicians and the European Central Bank – at the core of which was Mario Draghi’s announcement in September 2012 of unlimited purchases of EU member state government bonds – managed to curb the huge widening of spreads on southern European paper and stabilise the economy in the eurozone.

Since then, the phrase “whatever it takes” has become a mantra and refers to being prepared to do anything and everything required to contain a crisis and restore the trust of the people and of businesses. Current inflation rates show that “whatever it takes” is now urgently needed once again: 7.9% inflation in Germany in June; for full year 2022 economists expect inflation to average 6.8% in the eurozone and, in 2023, subsiding, but still high, inflation due to base effects. In light of this, the words of ECB Board member Isabel Schnabel, who in an interview in November 2021 said that there was no indication that inflation was getting out of control and that it had likely peaked, seem very behind the times. At the time she said that inflation could fall even below the inflation target of 2% in 2022.

Of course, it is difficult to make predictions in the current economic environment. The combination of Ukraine crisis, coronavirus measures and supply chain issues make for a hard-to-predict mix of constantly changing variables and the desire not to straightaway snuff out the tentative economic recovery in the eurozone in the wake of the coronavirus crisis is very understandable. Nevertheless, key rates of -0.5% no longer wash with broad swathes of the population given current inflation figures and, at worst, will lead to substantial loss of trust and societal divides. Forecasting errors are human; nobody has a crystal ball that can precisely predict the future. Thus, it is all the more important to admit one’s mistakes and adapt to the new situation. This also involves taking a clear position on monetary policy and taking the price stability mandate seriously again.

The Schweizerische Nationalbank (SNB) recently showed how things should be done. Last Thursday it surprised everybody by raising the key rate by 0.5% to -0.25% in response to an inflation rate that did reach a 14-year high in May but, at 2.9%, is still much lower than Switzerland’s European neighbours. The surprise key rate hike should not just be seen as a response to the turnaround in monetary policy in the U.S. In making this move, the Swiss central bank also pre-empted the European Central Bank, which will probably announce its first rate increment of 0.25% in the upcoming July meeting. If the SNB hadn’t implemented the hike, the Swiss franc would probably have lost considerable value, which would have further upped inflationary pressure by way of higher import prices. To further underscore the SNB’s position, Chair of the SNB Thomas Jordan, indicated that they would keep a close eye on the currency markets going forward and, if need be, intervene to strengthen the Swiss franc by purchasing eurozone sovereign bonds, in particular Bunds.

This shows that the turnaround in monetary policy has well and truly arrived. The U.S. Federal Reserve recently increased the Fed Funds Rate target range by 0.75% to between 1.50% and 1.75%. Despite growing recession concerns, the Bank of England (BoE) has raised the key rate for the fifth time in succession by 0.25% to 1.25%, and even the Swiss central bank in a surprise move raised interest rates by 0.5% despite inflation being a low single-digit figure. Only the European Central Bank seems to be paralysed and is sticking to its low interest rate policy. However, the ECB will have no option but to embark on a new course as the central bank across the water is too dominant for the ECB to go against its monetary policy, risk the euro losing value and, at worst, further fan the flames of inflation.

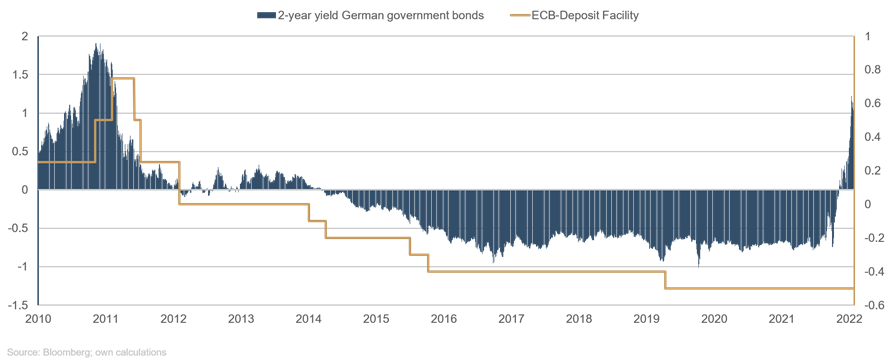

As is well known, stocks trade on the future, but that goes for bonds as well. 2-year sovereign bond yields have proved to be a useful gauge of where investors expect interest rates to go. A look back reveals that these have in the past been a reliable indicator of the European Central Bank’s deposit rate (Figure 1). At the same time, the chart clearly shows there has been a strong decoupling between sovereign bond yields and the key rate since March of this year (German bill 0.86%, ECB deposit rate -0.5%). So the market is anticipating at least five interest rate hikes of a good 1.25% in total. We even believe that this will not be enough and the European Central Bank will have to raise the key rate over the course of the coming year well above the 1.5% mark, towards 2%, to prevent the euro losing further value, as outlined above. We therefore see potential here for short-term yields to rise further (falling bond prices) and have positioned our portfolios accordingly by purchasing euro interest rate futures.

Figure: Chart plotting 2-year sovereign bond yields and key rate

It is time for the ECB to call a halt to the monetary policy of the past ten years and start to take consistent and credible measures to curb inflation. The most important instruments in a central bank’s toolbox are, in fact, not bond purchases or key rates, but integrity and credibility. The ECB has lost a great deal of both in recent years but it is not too late to regain the trust of the citizens of Europe. That will take a consistent change of monetary policy, or “whatever it takes”.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

This marketing communication is for information purposes only. It may not be passed on to persons in countries where the fund is not authorized for distribution, in particular in the USA or to US persons. The information does not constitute an offer or solicitation to buy or sell securities or financial instruments and does not replace investor- and product-related advice. It does not take into account the individual investment objectives, financial situation, or particular needs of the recipient. Before making an investment decision, the valid sales documents (prospectus, key information documents/PRIIPs-KIDs, semi-annual and annual reports) must be read carefully. These documents are available in German and as non-official translations from ETHENEA Independent Investors S.A., the custodian, the national paying or information agents, and at www.ethenea.com. The most important technical terms can be found in the glossary at www.ethenea.com/glossary/. Detailed information on opportunities and risks relating to our products can be found in the currently valid prospectus. Past performance is not a reliable indicator of future performance. Prices, values, and returns may rise or fall and can lead to a total loss of the capital invested. Investments in foreign currencies are subject to additional currency risks. No binding commitments or guarantees for future results can be derived from the information provided. Assumptions and content may change without prior notice. The composition of the portfolio may change at any time. This document does not constitute a complete risk disclosure. The distribution of the product may result in remuneration to the management company, affiliated companies, or distribution partners. The information on remuneration and costs in the current prospectus is decisive. A list of national paying and information agents, a summary of investor rights, and information on the risks of incorrect net asset value calculation can be found at www.ethenea.com/legal-notices/. In the event of an incorrect NAV calculation, compensation will be provided in accordance with CSSF Circular 24/856; for shares subscribed through financial intermediaries, compensation may be limited. Information for investors in Switzerland: The home country of the collective investment scheme is Luxembourg. The representative in Switzerland is IPConcept (Suisse) AG, Bellerivestrasse 36, CH-8008 Zurich. The paying agent in Switzerland is DZ PRIVATBANK (Suisse) AG, Bellerivestrasse 36, CH-8008 Zurich. Prospectus, key information documents (PRIIPs-KIDs), articles of association, and the annual and semi-annual reports can be obtained free of charge from the representative. Information for investors in Belgium: The prospectus, key information documents (PRIIPs-KIDs), annual reports, and semi-annual reports of the sub-fund are available free of charge in German upon request from ETHENEA Independent Investors S.A., 16, rue Gabriel Lippmann, 5365 Munsbach, Luxembourg, and from the representative: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg. Despite the greatest care, no guarantee is given for the accuracy, completeness, or timeliness of the information. Only the original German documents are legally binding; translations are for information purposes only. The use of digital advertising formats is at your own risk; the management company assumes no liability for technical malfunctions or data protection breaches by external information providers. The use is only permitted in countries where this is legally allowed. All content is protected by copyright. Any reproduction, distribution, or publication, in whole or in part, is only permitted with the prior written consent of the management company. Copyright © ETHENEA Independent Investors S.A. (2025). All rights reserved. 04/07/2022