Stagflation – back to the 1970s?

Last year, the outbreak of the Covid-19 pandemic rocked the global economy. A simultaneous negative supply and demand shock triggered a collapse in worldwide aggregate demand, reduced economic activity to a minimum, and disrupted major supply chains. Then the rapid and unprecedented monetary and fiscal policy response, together with the roll-out of effective vaccines, propelled a powerful economic recovery driven by the rebound of aggregate demand.

The strong pick-up in economic activity, accompanied by rising energy prices and supply shortages, has fuelled the acceleration of inflationary pressures on a global scale. The price of oil has surged to a seven-year high and natural gas costs have risen more than 500% in Europe. After the strong rebound of the first half of 2021, the global economy is now losing momentum. The appearance of new Covid-19 variants, fading policy support, inflationary pressures, and the deceleration of the Chinese economy are among the main uncertainties threatening the economic outlook.

The combination of slow growth and inflationary pressures is both concerning and particularly challenging for policymakers. Recently, there have been suggestions that the global economy may soon enter a period of stagflation, similar to the one experienced in the 1970s.

What is stagflation?

Stagflation is defined as a period of high inflation rates accompanied by sluggish economic growth and steadily high unemployment. In the worst cases, stagflation can also mean a period of inflation combined with a decline in gross domestic product (GDP).

The main theories on the origin of stagflation suggest that it arises from supply shocks, from poor economic policies, or from a combination of both. Sudden disruptions in the supply of a commodity can result in a rapid increase not only of its price but also the general price level. The price surge makes production more expensive and less profitable, thereby slowing economic growth. Stagflation can also occur as a result of poor economic policies implemented in response to a surge in inflation. These then exacerbate the economic contraction or the inflationary pressures.

Stagflation is particularly challenging for policymakers, as most measures to lower inflation may have a detrimental impact on output and increase unemployment levels, whiles policies designed to decrease unemployment may make inflation worse. However, stagflation is a rare phenomenon, as weak demand tends to drive prices down, which means that a self-correcting mechanism should mitigate the duration of the recessionary period.

When discussing stagflation, it is useful to understand that there are two types of inflation. Demand-pull inflation is the increase in prices as a result of macroeconomic policies. This is usually the result of central banks cutting interest rates or governments increasing spending or cutting taxes. These policies produce an increase in aggregate demand that goes beyond the economy’s productive capacity. On the other hand, cost-push inflation is the result of supply shortages and disruptions that mainly originate in the food and energy markets. Cost-push inflation impacts retail prices through the production chain. Monetary policy tends to have little impact on curbing it, as tighter policies would not help to restore supply. Instead they risk exacerbating the negative effects of inflation by reducing aggregate demand.

The stagflation of the 1970s

The ‘Great Inflation’ and the stagflation of the 1970s were the result of a unique series of historical events and policy missteps:

1) The painful memories of the economic depression of the 1930s, created a policy environment in the 1960s and the 1970s dominated by the pursuit of full employment. The Keynesian stabilisation policies emphasised a stable and long-term trade-off between damaging unemployment and inflation, where the latter was considered a mere inconvenience. It was believed that lower rates of unemployment could be permanently achieved with modestly higher rates of inflation. Motivated by the mandate of full employment, the Federal Reserve accommodated large and rising fiscal imbalances. The Fed policies accelerated the expansion of money supply and increased overall prices without reducing unemployment.

2) During the late 1960s and the early 1970s, the US economy was characterised by growing budget and current account deficits. President Johnson’s ‘Great Society’ legislation introduced major spending programmes for a number of social initiatives, including Medicare and Medicaid. The US fiscal situation was also severely strained by the country’s involvement in the Vietnam war. In 1968, Lyndon Johnson’s fiscal policies boosted economic growth to 4.9% but, coupled with a complacent Federal Reserve, this led to a disturbing annual inflation rate of 4.7%.

3) President Nixon’s policies (1969 - 1974) contributed to weakening growth and increasing price pressures. To counteract the mild inflation generated by President Johnson’s policies, he imposed damaging wage-price controls, which had negative effects on aggregate demand and squeezed businesses margins. The US economy, which was already suffering from a loss of competitiveness, went into a severe recession between 1973 and 1975. By ending the convertibility of the US dollar (USD) into gold, President Nixon also contributed to the collapse of Bretton-Woods - a system of fixed exchange rate parities that provided a solid anchor to the post-war Federal Reserve policies. The decision to unpeg the USD from gold removed the Fed’s policy anchor and, combined with expansionary policies aimed at reducing unemployment, contributed to inflation swelling to above 12% in 1974.

4) The energy crises, which are typically blamed for causing the US recession, were actually an aggravating factor that contributed to the deterioration of an economy already severely damaged by recession. First came the OPEC oil embargo in 1973, during which oil prices quadrupled. Then in 1979, we saw the second energy crisis in the aftermath of the Iranian revolution, during which the oil price tripled. The oil shocks of the 1970s contributed to cost-push inflation that reached a peak of 14.8% in 1980.

Back to the 1970s?

There is no doubt that the current environment of slowing growth and stubbornly high inflation poses both significant risks to global growth and a challenge for policymakers. Persistent high inflation may lead to tighter financial conditions and weaker growth momentum by constraining production and denting consumer confidence. However, an unwarranted pre-emptive policy tightening could derail economic recovery, while having little effect on containing cost-push inflationary pressures.

Although the challenges of the current environment cannot be dismissed, persistent high inflation should be seen as a tail risk. The current situation appears to be quite different from the situation in the 1970s in several respects.

Timing perspective

The timing and sequencing of the events of the Covid-19 crisis differ markedly from the recessions of the 1970s and 1980s. In 2020, the Covid-19 shock hit inflation and growth, both of which collapsed simultaneously and abruptly. The unprecedented policy response prevented a global depression and produced a very unusual and rapid global recovery. Yet the strong rebound in aggregate demand could not be matched by an impaired supply and the global economy is now going through a delicate adjustment period. However, economic growth is solid and unemployment rates are approaching their pre-pandemic levels. Despite the recent downgrade revisions, analysts point out that growth rates in 2021 and 2022 will be solid and will outpace the trend growth of the recent past.

Monetary policy

The Fed’s dovish policies and a lack of a clear anchor for its policy framework contributed to the loss of credibility that caused the Great Inflation of the 1970s. Credibility loss can be very costly, and the deep recession of the early 1980s was associated with policies adopted to control inflation and restore the Fed’s credibility.

Since the early 1990s, central bank independence and the progressive adoption of the inflation targeting framework have greatly enhanced the credentials of central banks in terms of fighting inflation. Together, anchoring monetary policy to an inflation targeting objective and the central bank policies of the last 30 years have been key to both ensuring central banks’ credibility and taming inflationary pressures.

Origin of inflationary pressures

The stagflation of the 1970s was the result of a unique combination of policy missteps, dovish Federal Reserve policies, and a historic change of the international monetary system, accompanied by two severe oil shocks. While inflationary pressures are not homogeneous across countries, recent inflation drivers reflect the strong pick-up in economic activity, rising energy prices, and unusual pandemic-related mismatches between demand and supply that are likely to be temporary.

Input shortages and supply chain disruptions should progressively level out as progress is made in combatting the pandemic and higher prices spur investments in production capacity. High energy prices should also be short-lived. The world can produce sufficient energy and, when prices become high enough, new supply from US shale producers and other non-OPEC members flood the market. Over time, energy transition and the rise of renewable energies will also help to dampen the increase in energy prices.

For the time being, there is also little evidence that the current inflationary pressures are generating second-round effects and feeding into generalised salary increases. Salary increases are primarily concentrated in the pandemic-affected sectors and mainly impact low-wage earners. Automation is replacing labour at a rapid pace and the current labour shortage could even force companies to speed up the automation process.

In the short term, there are many uncertainties about inflationary development, but overall there are few signs of a repeat of the Great Inflation of the 1970s. Overall, the current situation does not point to a change in the long-term inflation dynamics. Structural forces, such as demographics, technology, rising inequality, and globalisation are likely to maintain disinflationary pressures over the longer term.

There are still risks to consider

While a repeat of the stagflation of the 1970s seems unlikely, the current environment still presents a number of risks that should not be underestimated.

Inflation risks are skewed to the upside and could materialise if supply-demand mismatches continue for longer than expected. Persistently higher inflation may derail the recovery by constraining production or denting consumer confidence. Moreover, the longer the supply disruption persists, the greater the risk that it will translate into second round effects and generalised inflation. Rising inflation expectations could lead to a faster-than-anticipated monetary normalisation in advanced economies, which could also derail the economic recovery.

Policymakers will have to walk a fine line between patient support for the economic recovery and a willingness to act quickly to curb any potential entrenched inflationary pressures. It will be particularly important to avoid de-anchoring medium-term inflationary expectations and prevent an inflationary spiral that would require abrupt policy tightening. Should current inflationary pressures generate persistent second-round effects that trigger wage increases, central banks will need to act decisively and tighten their policies.

Portfolio Manager Update & Fondspositionierung

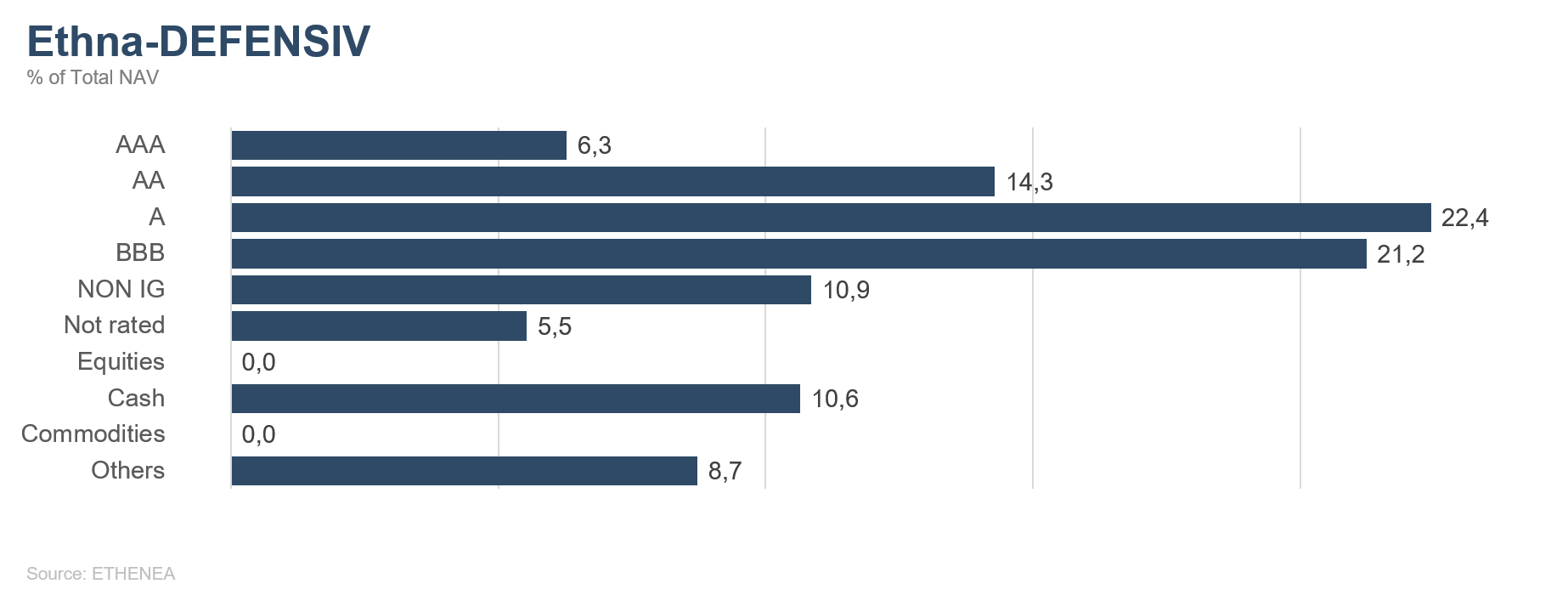

Ethna-DEFENSIV

“I do think it's time to taper; I don't think it's time to raise rates.” This statement from Jerome Powell in October again made it clear what monetary course the Fed will take. In all likelihood, the U.S. central bank will officially announce the tapering of its monthly sovereign bond purchases on 3 November, which currently stand at USD 120 billion. At the same time, Mr Powell has stressed repeatedly that it is too soon to raise interest rates. The market takes a somewhat different view. Eurodollar futures have already priced in three rate hikes for September 2022 and two more for 2023, to 1.5% at that point.

In the euro zone too, investors are sticking to their guns that the ECB will raise interest rates at least once next year due to sustained inflationary pressure. This would mean a radical change away from ultra-accommodative monetary policy, but we believe this is extremely unlikely. The pandemic emergency purchase programme (PEPP) officially ends in March 2022, and the ECB will probably let it peter out beyond March, perhaps in the form of PEPP bridge financing or a top-up of the regular asset purchase programme (APP) before raising interest rates for the first time in 2023 at the earliest. However, there remains the negative scenario where inflation is much higher than expected, which would force the ECB to raise interest rates early.

It remains to be seen whether the market or the central banks will be proven right. One thing for certain is that the high rates of inflation, and in particular the higher costs of intermediate products and energy, will continue to pose a challenge for some companies. Not since 1981 have the prices of imported goods into Germany been so high as in October; timber and steel in particular have soared. This puts pressure on margins and creates headaches especially for companies that operate in highly competitive markets and cannot easily pass on higher prices to customers. Within the Ethna-DEFENSIV, therefore, we continue to invest in well-capitalised companies that, given their position in the market, are well able to translate higher raw material prices into higher prices for their products and get through dry spells caused by supply shortages without any problems.

Given the ongoing uncertainty in bond markets and the slightly increased yields in October (10-year Bunds went from -0.20% to -0.10% and U.S. Treasuries went from 1.49% to 1.60%), the Ethna-DEFENSIV retained its strategy of keeping duration below 2. Hedging in the form of futures absorbed the higher yields in euro and U.S. dollar to some extent. We also retained the equity allocation of 10%, which contributed 0.43% to performance. Having reduced the gold position in September, we completely closed it last month, since the trend of rising yields is putting pressure on the precious metal. Overall, the Ethna-DEFENSIV (T class) produced a slightly negative performance of -0.12% in October, which, given the higher yields, is quite a respectable result for a defensive balanced fund like the Ethna-DEFENSIV. Therefore, the fund is up 1.08% year-to-date.

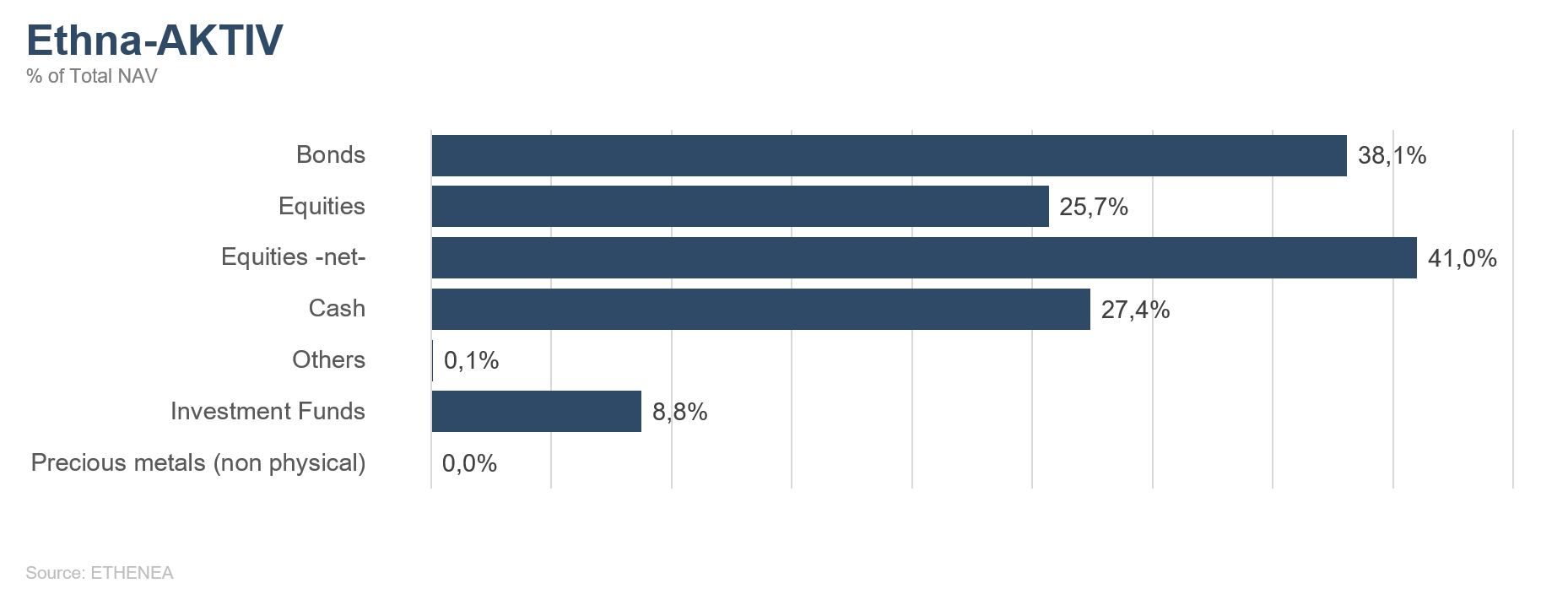

Ethna-AKTIV

Given the ongoing supply shortages, which now affect much more than just electronic chips, the current reporting season was eagerly anticipated. The most pressing question was whether the ambitious growth expectations, both for revenue and earnings, could be met. Approximately half of companies on both sides of the Atlantic had published their figures by month-end. While surprising, this figure was not as big compared to the previous quarter, and analysts’ expectations for revenue and earnings were beaten by more than 10%, which is still outstanding historically. So it’s no wonder that the MSCI World, the broadest global equity index, climbed to new all-time highs in October, driven particularly by the U.S. leading indices, after a weak September. Our belief, as stated in last month’s Market Commentary, that the correction in prices we were seeing was temporary and wouldn’t lead to a lasting trend reversal, has borne out so far. Despite the known challenges, the fundamentals are simply still too good. Nor could the further slow rise in global interest rates dampen the positive mood on the equity market. We expect this trend to continue. Even though we are confident that expectations of high inflation will push interest rates upwards, we do not expect a massive overshooting in interest rates. This view is supported by the rhetoric from the European Central Bank, among others, which indicated no change in its monetary policy during its latest meeting. Central bankers at the U.S. Federal Reserve, who will meet at the beginning of November, also made it very clear in the lead-up that the start of tapering will not involve imminent interest rate hikes. We expect growth figures to stabilise at a low level, and thus an ongoing reflationary environment. Given the comprehensive economic packages, both already in place and in the pipeline, we believe the present concern about stagflation to be overblown. On the whole, this points to a continuation of the risk-on phase, which will increasingly come down to the selection of the sectors that benefit and also individual securities, especially in equities.

What this consequently means for the positioning of the Ethna-AKTIV is adhering to the historically high equity allocation, which was increased to the maximum level of 49% in the period of weakness. Because we remain confident of the market position and potential for growth of U.S. companies, the U.S. accounts for most of our equity exposure. By gradually switching from investment in futures to individual securities, not only are we following our own selection rationale, but we have also managed to reduce the cash allocation to less than 30%. We are striving to reduce this percentage to less than 20% in the coming weeks. As announced a month ago, we expanded the U.S. dollar allocation to above 40%. Despite the bull markets, the strength of the U.S. dollar was very noteworthy. We see this is a sign of the relative strength of the currency. On the bond front, we barely had to make any changes as we consider the fixed-income portfolio to be well positioned in relation to both quantity and quality in this environment. We have rightly continued to reduce the duration. Only a few sovereign bonds were added, which also helped to reduce the cash allocation.

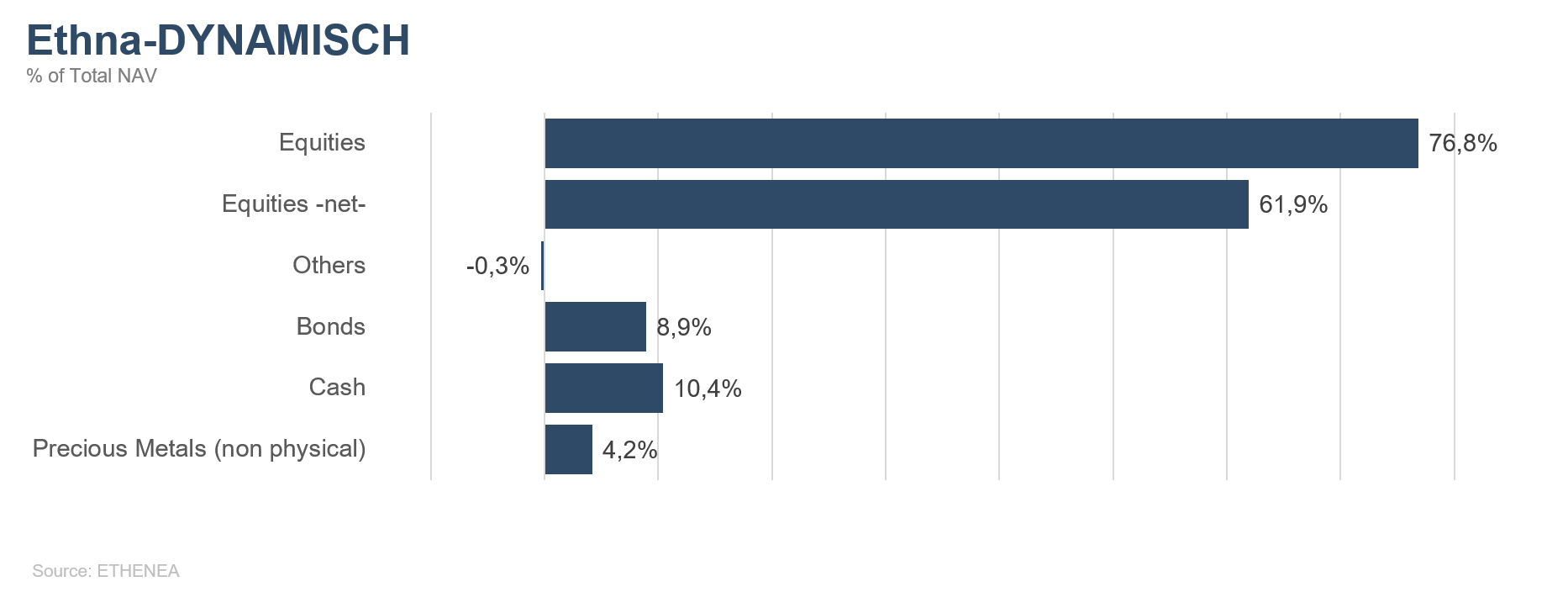

Ethna-DYNAMISCH

Towards the end of the month, a good 50% of S&P 500 companies had reported their third quarter results. This halfway point in the reporting season gives us a good opportunity to take stock: what we are seeing is a mixed picture. On the one hand, the majority of companies have exceeded analysts’ consensus estimates, in terms of both revenue and earnings, in some cases by a clear margin. However, the immediate market reaction – as measured by price movements within a day of results being published – is extremely low, at an average of 0.01%. The European STOXX Europe 600 index paints a similar picture.

One reason for this apparent discrepancy is the high degree of forecast uncertainty inherent in the current quarter. After the very high growth in the second quarter, company growth rates are normalising. This process of normalisation is relatively hard to predict. Global supply chain problems and inflationary pressure are additional uncertainty factors. Analysts’ wide range of expectations for fundamental revenue and earnings performance shows that they are finding it difficult to deal with this complex set of factors. There is even little consensus in relation to companies that are not directly affected by the consequences of the supply chain issues. Take Google’s parent company Alphabet Inc. for example: there was a difference of almost 15% between the most optimistic and the most pessimistic estimate for revenue – the biggest difference of opinion in more than a decade. The range is so wide that the consensus estimate – a proxy for the average expectation of the market as a whole – loses some of its relevance. Moreover, market expectations as a whole can also diverge from the analysts’ consensus estimate and anticipate a surprise positive quarterly report. In determining how the price reacts after publication of quarterly results, the outlook also plays an important, generally more decisive role. The supply chain problems in particular are a factor in many companies issuing a conservative outlook for business performance in coming quarters and prevent excessive euphoria. For this and other reasons, bearing in mind a hard-to-predict reporting season, we reduced the net equity allocation to almost 60% at the beginning of October.

So what’s next? It’s clear that the supply chain problems and the resulting price rises will subside. What is less clear is when this will happen. Against this backdrop, the Ethna-DYNAMISCH’s focus on quality companies helps. The stocks in our portfolio occupy a position in the market that enables them to pass on or absorb price rises. They also have the flexibility to react to dynamic procurement markets. The current reporting season confirms this. For that reason, the composition of the Ethna-DYNAMISCH did not change significantly in October. As such, even in the current market environment, we offer risk-controlled access to equity markets.

HESPER FUND - Global Solutions (*)

In October, the combination of slowing economic momentum and stubbornly high inflation not only became the primary concern for markets but also put central banks in the spotlight. Rapidly rising inflation triggered a sell-off in local debt markets, pushing up yields. Many of the central banks in emerging markets, along with a few of the smaller central banks in advanced economies, started hiking interest rates. Markets are now challenging the view held by the major central banks that the current inflationary spike is only transitory. There is a particularly high degree of uncertainty about the future path of inflation. Unwinding the unprecedented policy stimulus is a delicate process and policy missteps are a risk that should not be underestimated.

Although growth concerns dampened market sentiment in September and at the beginning of October, the surprisingly positive earnings season came to the rescue, with stocks first recovering then rising to new highs. Despite the initial volatility, October turned out to be an excellent month for equities, as most broad indices posted strong gains. This strength was underpinned by the fact that profit margins held up quite well in the third-quarter results, despite soaring commodity prices and supply chain disruptions. Many companies have been able to pass rising costs on to consumers, with more than 80% of them beating Wall Street’s earnings estimates.

In October, the major US stock indices rebounded to close the month at new all-time highs. For the month, the S&P 500 rose by 6.9%, the Dow Jones Industrial Average (DIJA) went up by 5.8% and the Nasdaq Composite increased by 7.3%. Conversely, small-caps, as measured by the Russell 2000 Index, gained 4.2% but remained below their mid-March highs.

In Europe, the Euro Stoxx 50 Index rose by 5% (an increase of 4.7% when calculated in USD) while in the UK, the FTSE 100 gained 2.1% (+3.7% in USD). Despite a strong Swiss franc, the Swiss Market Index performed very well, rising by 4% (+6% in dollar terms) over the month.

Asian markets lagged, with the Shanghai Shenzhen CSI 300 Index gaining 0.9% (+1.8% in USD terms). The Hang Seng Index in Hong Kong rebounded by 3.3%. In Japan, the blue-chip Nikkei 225 lost 1.9% (-3.7% in USD terms).

The HESPER FUND – Global Solutions continues to operate under the scenario of solid global growth supported by accommodative monetary and fiscal policies and vaccination rollouts. However, headwinds, such as skyrocketing energy costs and supply chain bottlenecks, forced us to take a more cautious stance and dynamically adapt our portfolio.

As volatility rose, the fund reduced its long equity exposure significantly at the beginning of the month. By the middle of October, the HESPER FUND – Global Solutions started to gradually increase its equity allocation, ending the month with a 48% net exposure. The fund kept its high-yield bond exposure but completely hedged the duration to protect performance from the volatility in bond yields. The fund increased its commodity exposure slightly to more than 11%. Exposure to the various asset classes is monitored and calibrated on an ongoing basis to adapt to market sentiment and changes in the macroeconomic baseline scenario.

On the currency front, the fund has been very active, increasing its long USD exposure to 85%. This is partly due to our significant short exposure to sterling (-40% net exposure) primarily against the USD. Despite the various problems impacting the British economy (shortages, Brexit, high inflation, etc.), sterling has remained strong, sustained by the central bank guidance that rate hikes are needed to rein in the rising inflation. The Bank of England (BOE) will soon face the market and prove how hawkish its stance really is. The fund has been also long Swiss franc and to a lesser extent Norwegian krone, which appreciated nicely during the month.

In October, the HESPER FUND - Global Solutions EUR T-6 rose by 0.89%. Year-to-date performance was 7.05%. Over the last 12 months, the fund has gained 9.75%. Volatility has remained stable and low at 6.5%, retaining an interesting risk/reward profile.

*Der HESPER FUND - Global Solutions ist aktuell nur zum Vertrieb in Deutschland, Italien, Luxemburg, Frankreich und der Schweiz zugelassen.

Figure 1: Portfolio structure* of the Ethna-DEFENSIV

Figure 2: Portfolio structure* of the Ethna-AKTIV

Figure 3: Portfolio structure* of the Ethna-DYNAMISCH

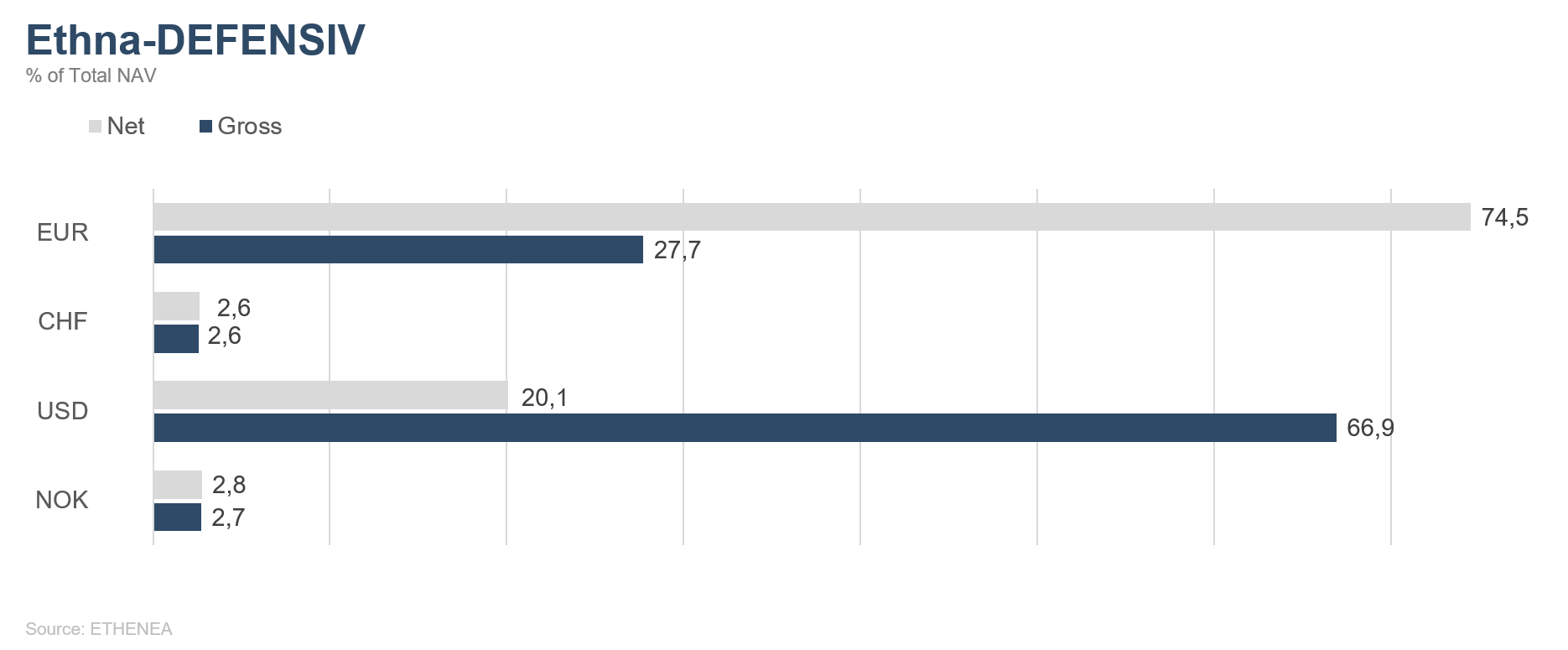

Figure 4: Portfolio composition of the Ethna-DEFENSIV by currency

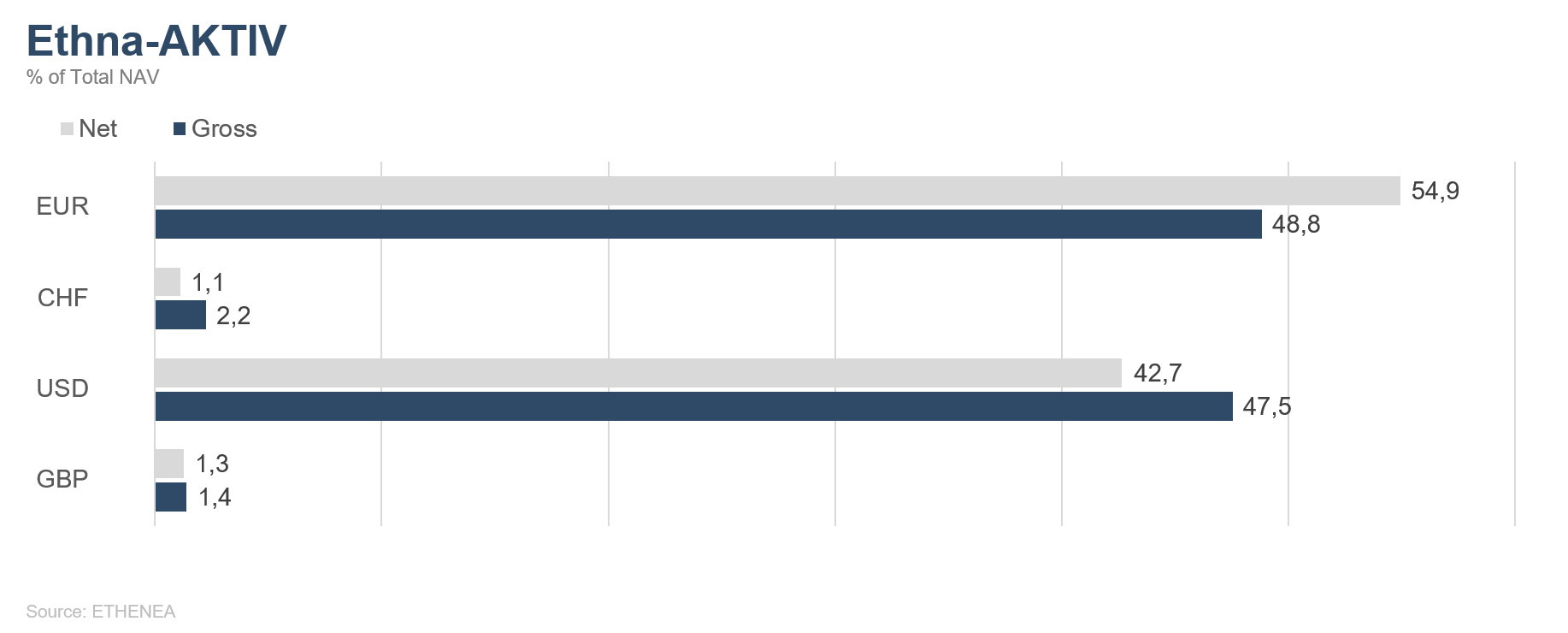

Figure 5: Portfolio composition of the Ethna-AKTIV by currency

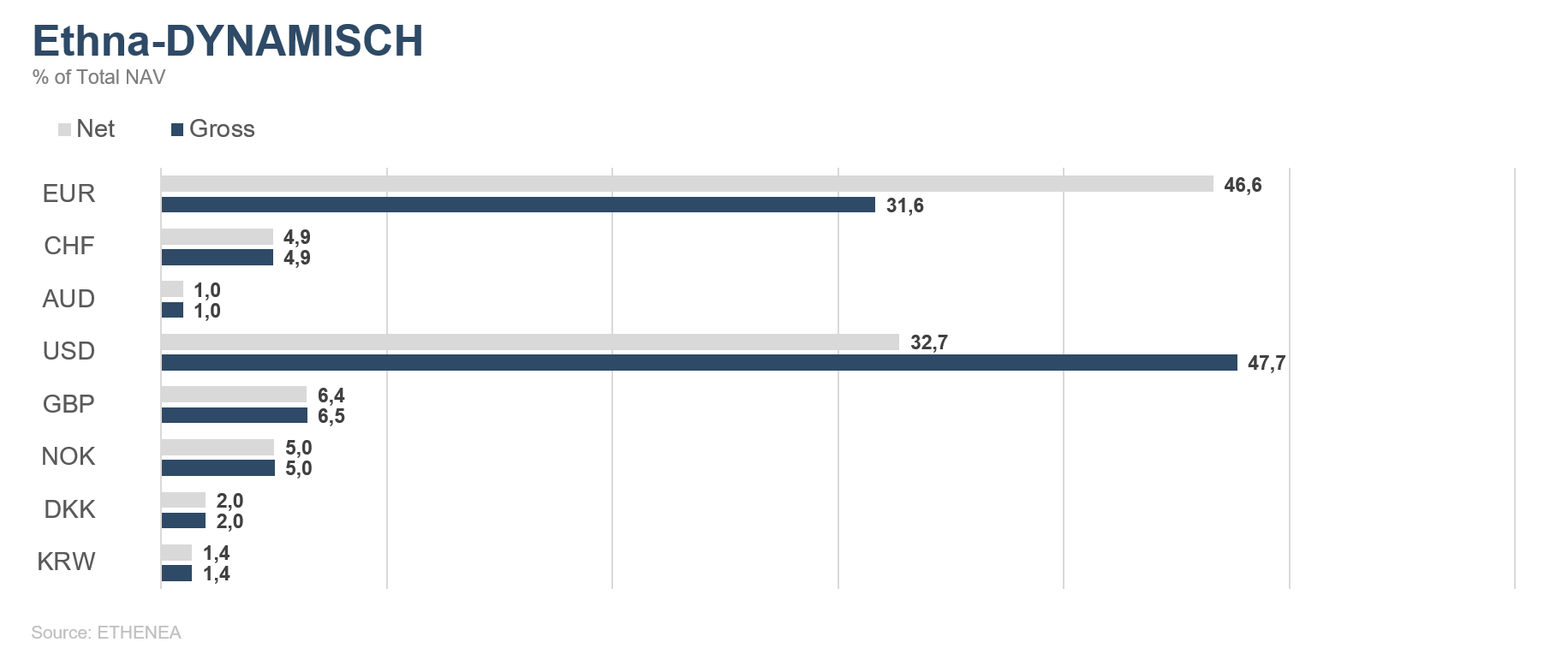

Figure 6: Portfolio composition of the Ethna-DYNAMISCH by currency

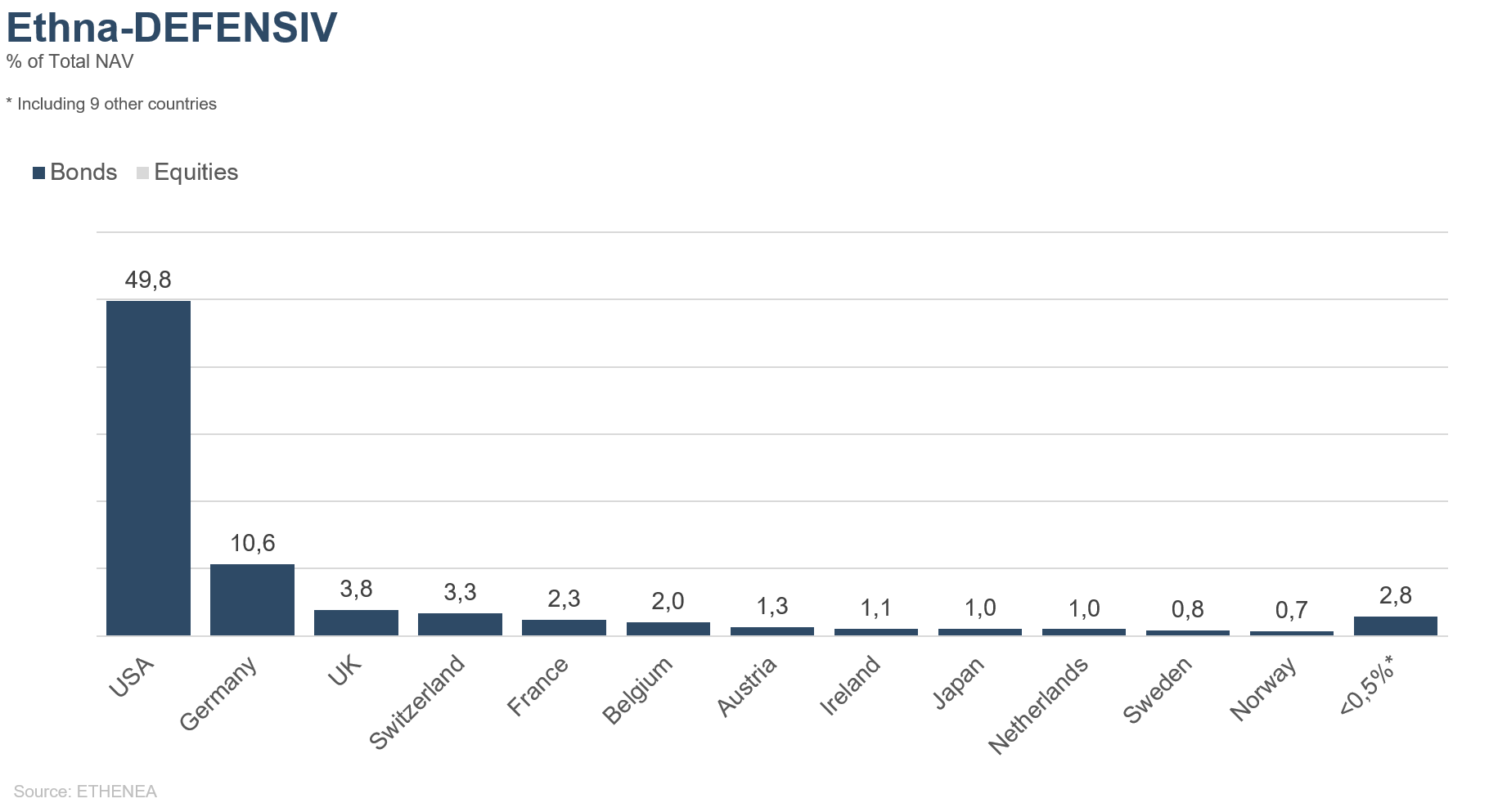

Figure 7: Portfolio composition of the Ethna-DEFENSIV by country

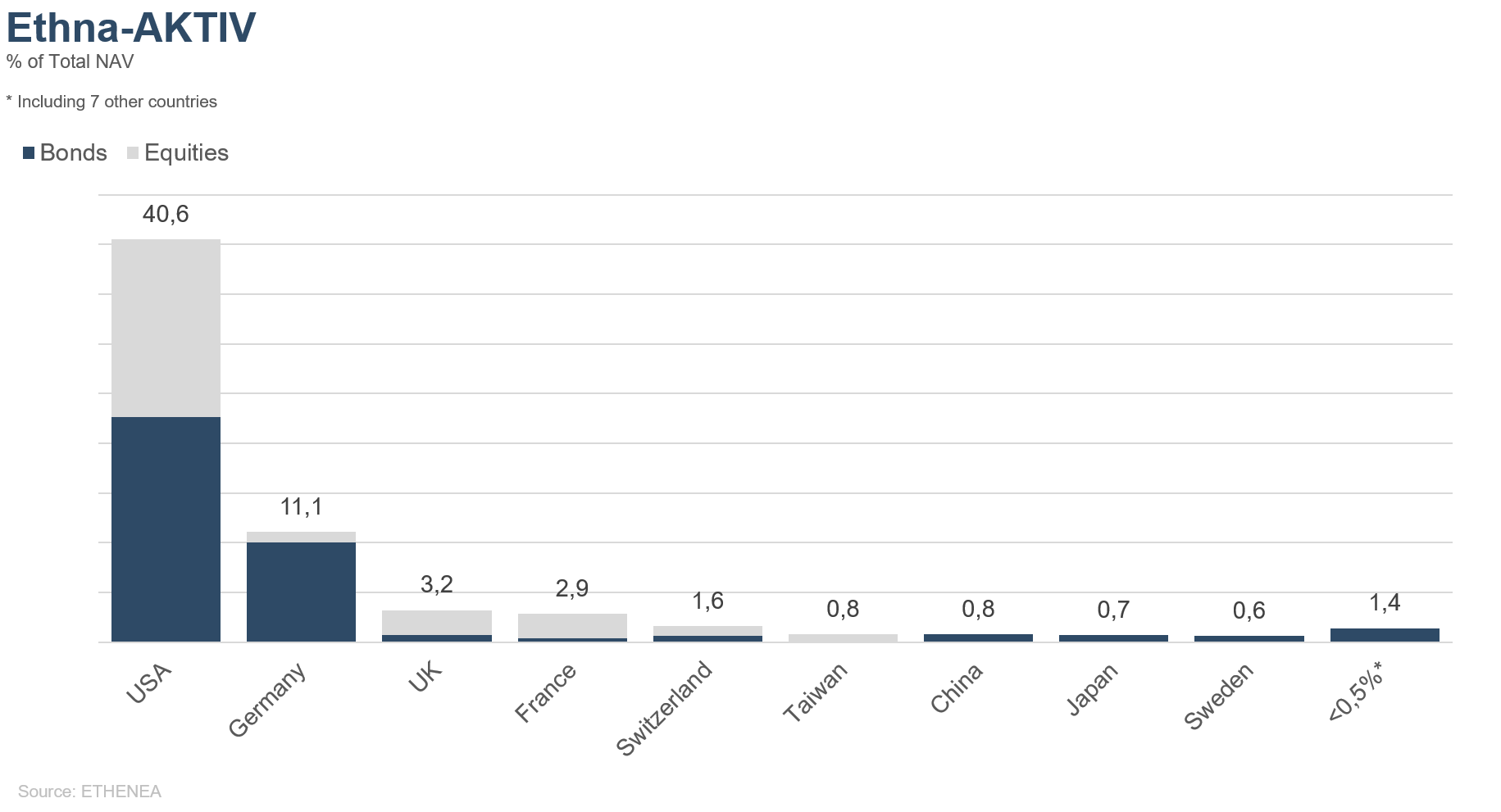

Figure 8: Portfolio composition of the Ethna-AKTIV by country

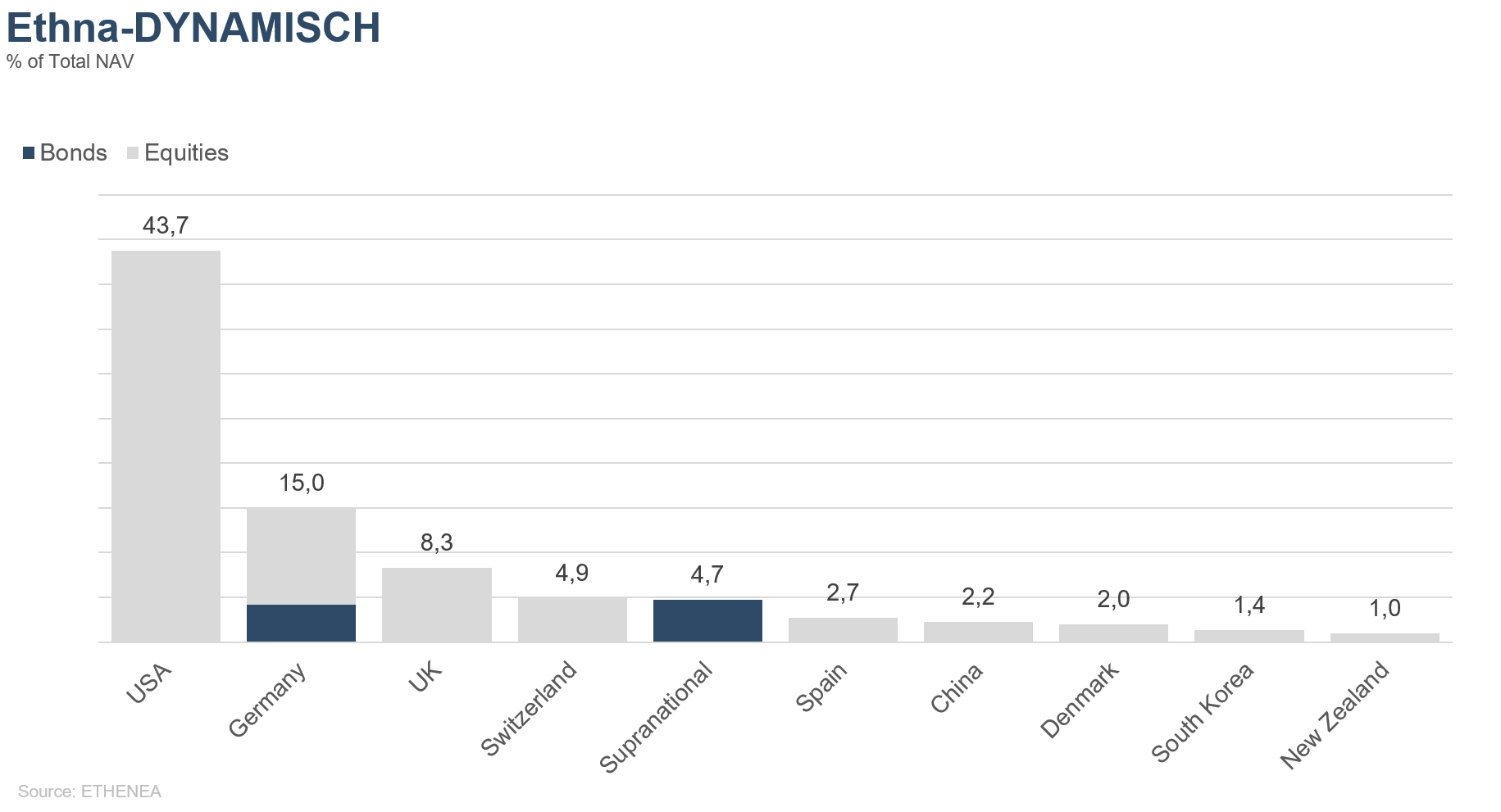

Figure 9: Portfolio composition of the Ethna-DYNAMISCH by country

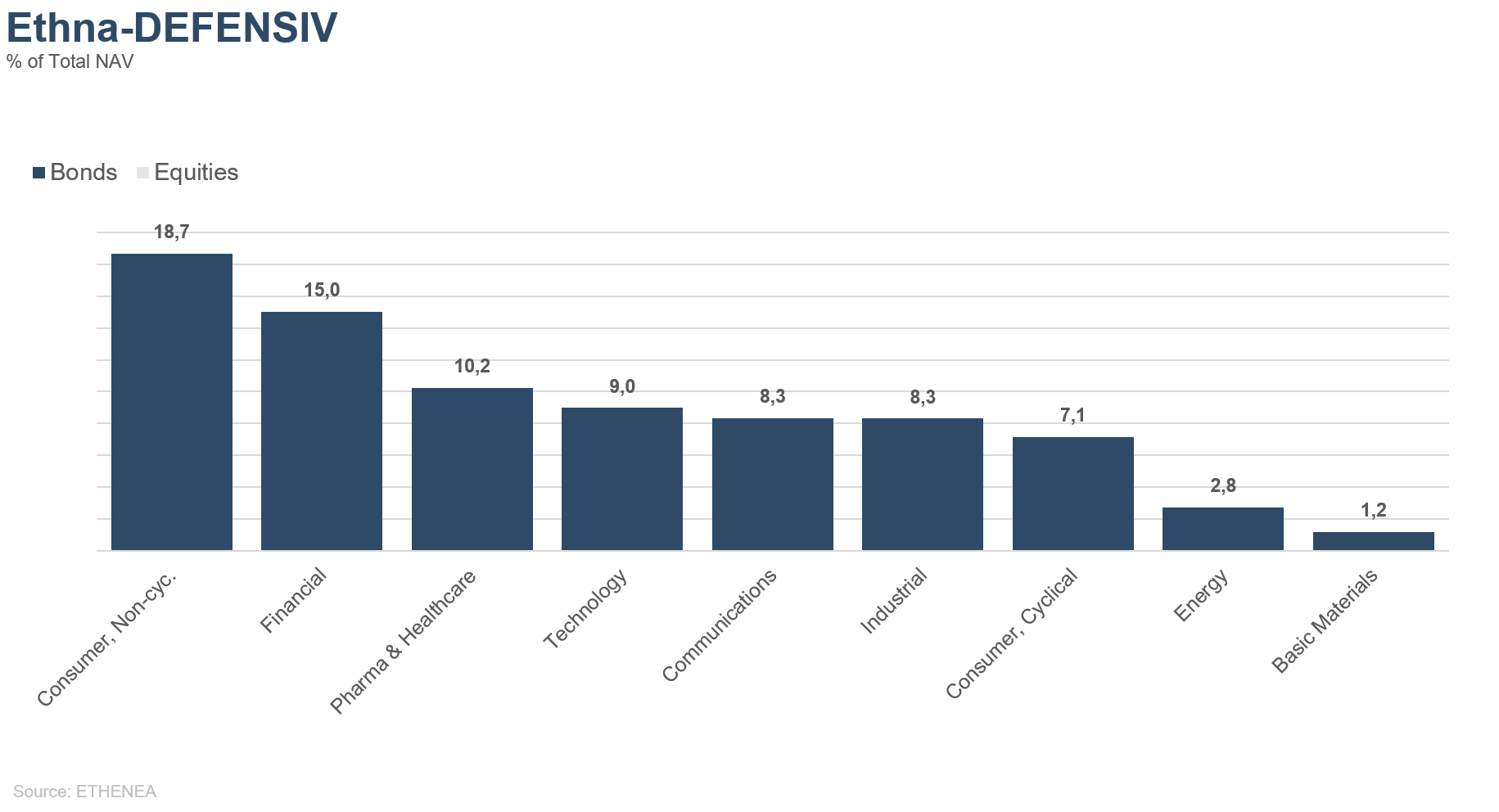

Figure 10: Portfolio composition of the Ethna-DEFENSIV by issuer sector

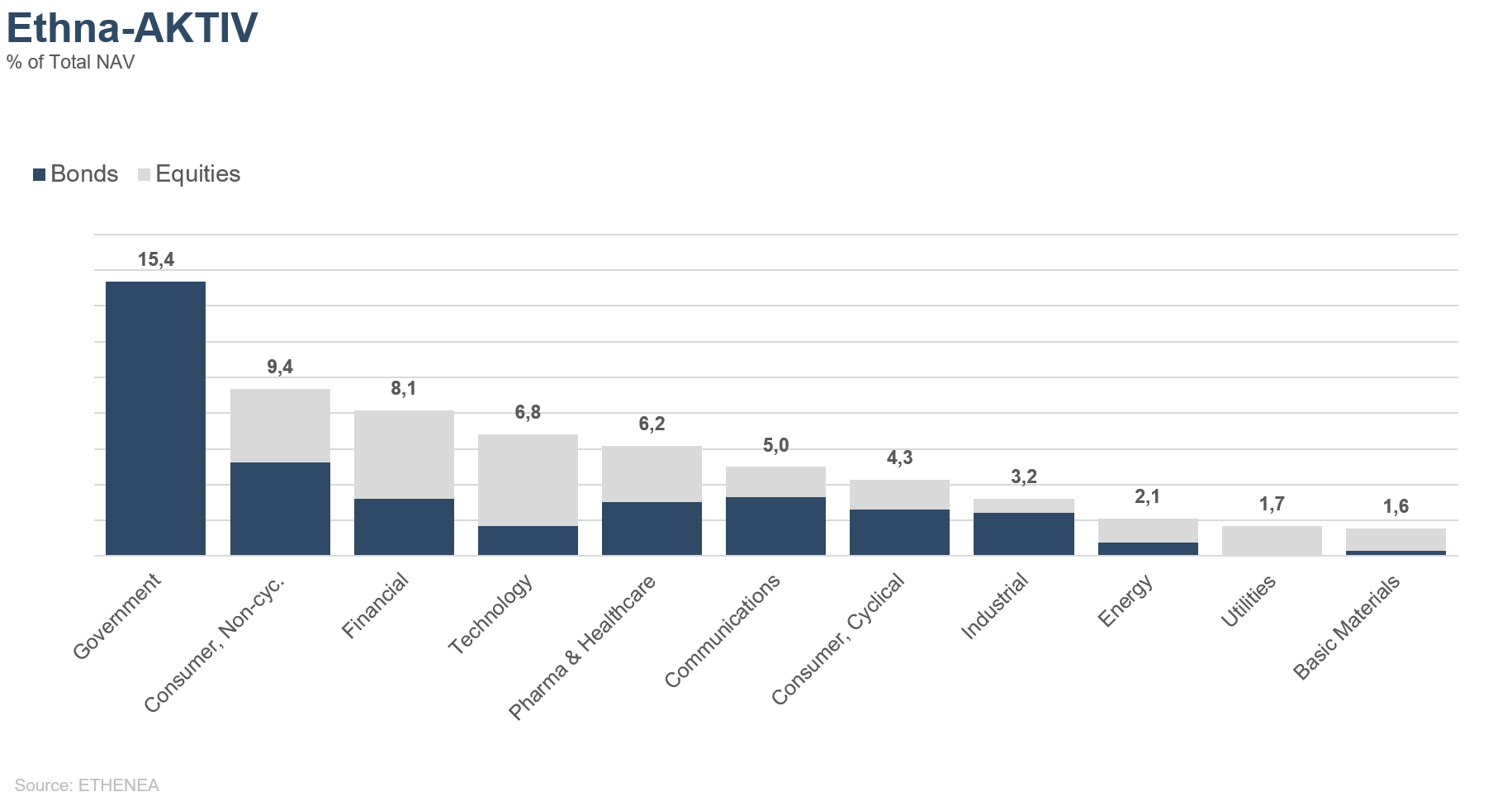

Figure 11: Portfolio composition of the Ethna-AKTIV by issuer sector

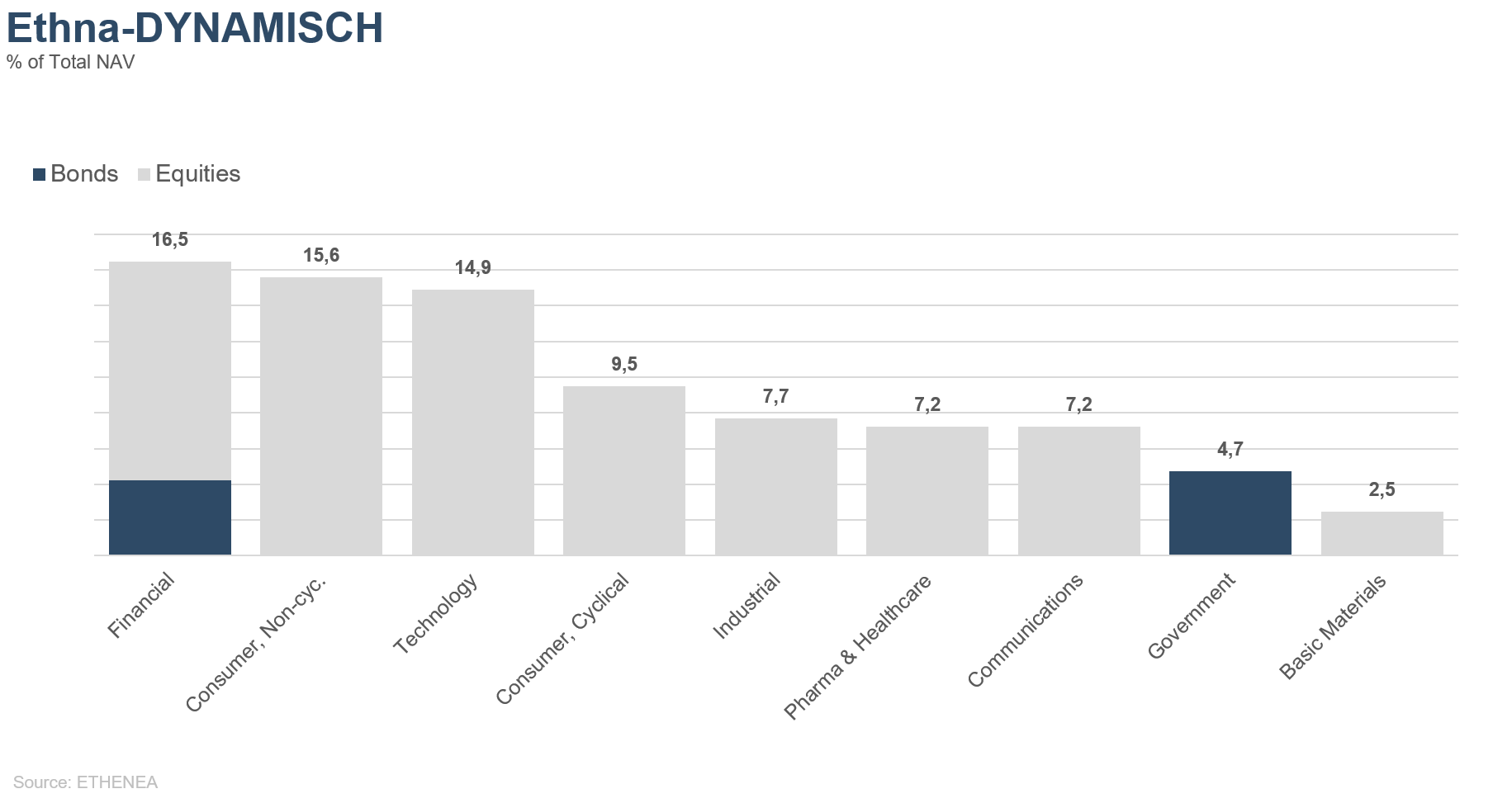

Figure 12: Portfolio composition of the Ethna-DYNAMISCH by issuer sector

* “Cash” comprises term deposits, call money and current accounts/other accounts. “Equities net” comprises direct investments and exposure resulting from equity derivatives.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

This marketing communication is for information purposes only. It may not be passed on to persons in countries where the fund is not authorized for distribution, in particular in the USA or to US persons. The information does not constitute an offer or solicitation to buy or sell securities or financial instruments and does not replace investor- and product-related advice. It does not take into account the individual investment objectives, financial situation, or particular needs of the recipient. Before making an investment decision, the valid sales documents (prospectus, key information documents/PRIIPs-KIDs, semi-annual and annual reports) must be read carefully. These documents are available in German and as non-official translations from ETHENEA Independent Investors S.A., the custodian, the national paying or information agents, and at www.ethenea.com. The most important technical terms can be found in the glossary at www.ethenea.com/glossary/. Detailed information on opportunities and risks relating to our products can be found in the currently valid prospectus. Past performance is not a reliable indicator of future performance. Prices, values, and returns may rise or fall and can lead to a total loss of the capital invested. Investments in foreign currencies are subject to additional currency risks. No binding commitments or guarantees for future results can be derived from the information provided. Assumptions and content may change without prior notice. The composition of the portfolio may change at any time. This document does not constitute a complete risk disclosure. The distribution of the product may result in remuneration to the management company, affiliated companies, or distribution partners. The information on remuneration and costs in the current prospectus is decisive. A list of national paying and information agents, a summary of investor rights, and information on the risks of incorrect net asset value calculation can be found at www.ethenea.com/legal-notices/. In the event of an incorrect NAV calculation, compensation will be provided in accordance with CSSF Circular 24/856; for shares subscribed through financial intermediaries, compensation may be limited. Information for investors in Switzerland: The home country of the collective investment scheme is Luxembourg. The representative in Switzerland is IPConcept (Suisse) AG, Bellerivestrasse 36, CH-8008 Zurich. The paying agent in Switzerland is DZ PRIVATBANK (Suisse) AG, Bellerivestrasse 36, CH-8008 Zurich. Prospectus, key information documents (PRIIPs-KIDs), articles of association, and the annual and semi-annual reports can be obtained free of charge from the representative. Information for investors in Belgium: The prospectus, key information documents (PRIIPs-KIDs), annual reports, and semi-annual reports of the sub-fund are available free of charge in German upon request from ETHENEA Independent Investors S.A., 16, rue Gabriel Lippmann, 5365 Munsbach, Luxembourg, and from the representative: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg. Despite the greatest care, no guarantee is given for the accuracy, completeness, or timeliness of the information. Only the original German documents are legally binding; translations are for information purposes only. The use of digital advertising formats is at your own risk; the management company assumes no liability for technical malfunctions or data protection breaches by external information providers. The use is only permitted in countries where this is legally allowed. All content is protected by copyright. Any reproduction, distribution, or publication, in whole or in part, is only permitted with the prior written consent of the management company. Copyright © ETHENEA Independent Investors S.A. (2025). All rights reserved. 03/11/2021