The ebb and flow of the bond markets

The liquidity of corporate bonds on the capital markets is like the ebb and flow of the tide. One major difference between bond markets and the tide, however, is that there are tide charts for coastal locations around the world, which exactly predict the height of the tide at any particular time. Even if one doesn’t have access to a tide chart, with the right knowledge and a pocket calculator one can work out the water level because the causalities are well-known.

Unfortunately, the same cannot be said for corporate bond liquidity.

We can only guess the causes of current liquidity bottlenecks in markets and use our powers of deduction to try to determine the causalities. Since we last dealt with this topic at the end of 2013, the situation has deteriorated further. We can only speculate why.

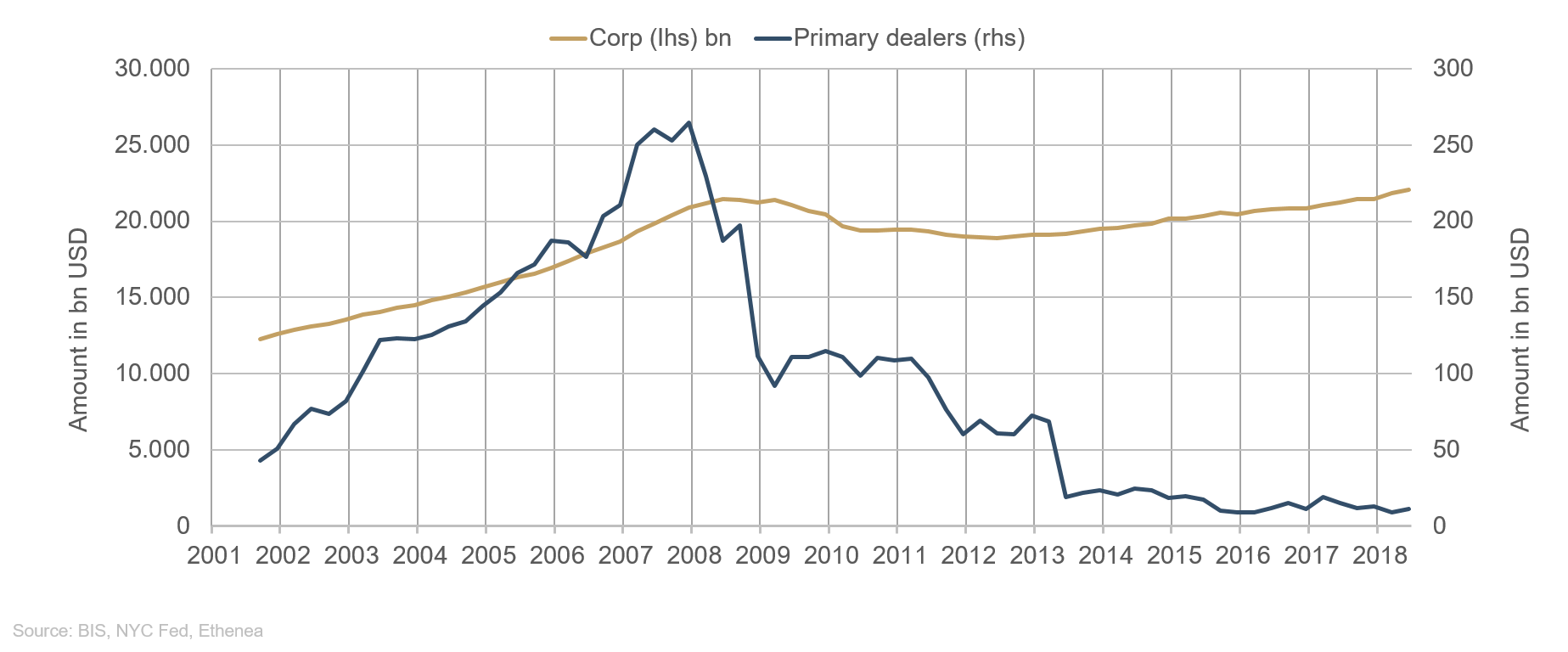

Before we do that, however, we would like to reprise our theory of the reasons for the (temporary) absence of liquidity for corporate bonds in general and for certain bond types, such as subordinates and high yield in particular. The only truly reliable data for our theory is to be found in the database of the New York Federal Reserve Bank. The designated market makers for U.S. Treasuries – the primary dealers – report their trading book holdings to the central bank every Thursday. Records show that the amount of USD corporate bonds held by primary dealers (Figure 1, blue line) has fallen drastically since the beginning of the financial crisis (early 2007), from USD 264 billion to just USD 11 billion most recently: a mere approx. 4% of what it was. Over the same period, the overall market in USD-denominated corporate bonds (USD 21,000 billion) has grown by USD 1,000 billion (Figure 1, gold line). Until the start of 2008, both the overall size of the market and individual trading book volume had grown steadily.

Figure 1: Primary dealer trading book volumes and the size of the USD corporate bond market.

So, what happened? For one, the banks reacted to the sharp increase in the cost of refinancing in the market, which, of course, ultimately caused the collapse of Lehman Brothers in September 2008. While at that time banks were not yet required to back their trading books with capital, they did become increasingly cautious. It wasn’t until the introduction of Basel III in 2014 that capital allocation to the trading books became a legal requirement, which, of course, made them significantly less attractive.

The supervisory authorities had taken action and, in their view, made the capital market that bit safer. Up to this point, the same could be said for the banking sector. More liable capital prevents banks from springing up which actually function more like hedge funds, of which there were a few prior to the financial crisis. However, Basel III may have been a case of the authorities throwing the baby out with the bathwater. Banks have largely lost their role as buffer. Before the financial crisis, when the economy was weakening and credit spreads on bonds widening, the banks successively filled their books and survived the episode with the aid of risk management. Today, on the other hand, banks act more like brokers, i.e. they more or less simply continue to trade these positions. So, when, facing a period of weakness, institutional investors all go to offload credit risks at once, it becomes almost impossible to trade these positions simply because there are no buyers. The selling pressure then causes yields to rise without any revenue to speak of or else prices plummet.

In the case of funds, such a pronounced herd mentality has only emerged in recent years. Extremely low yields and a correspondingly low current rate of return, partly due to the ECB’s purchase programme, force fund managers to trade. Adverse market movements have to be avoided if at all possible in order to collect the meagre returns. The entire herd is therefore almost always moving in the same direction, intensifying the trends and upping the amplitude.

The great success of passive funds, including those specialising in corporate bonds, is another exacerbating factor. Passive fund managers have little room to manoeuvre with inflows or outflows and thus intensify every trend.

What we are dealing with, therefore, is a market of very delicate health, where a sniffle can quickly progress to full-blown pneumonia. That said, the pneumonia can clear up just as quickly as it developed. Figure 2 shows the progression of spreads on the three ratings buckets AA, A and BBB. In November and December 2018, the corporate bond market was suffering from a heavy cold. There was hardly any liquidity, especially for sellers. Spreads widened distinctly before narrowing again considerably in January 2019. Despite the high volume of corporate bond issues, many new bonds are oversubscribed, which leads to a distinct narrowing of spreads even during the issue process. Buyers are currently acting as if the final two months of last year hadn’t happened. How quickly we forget!

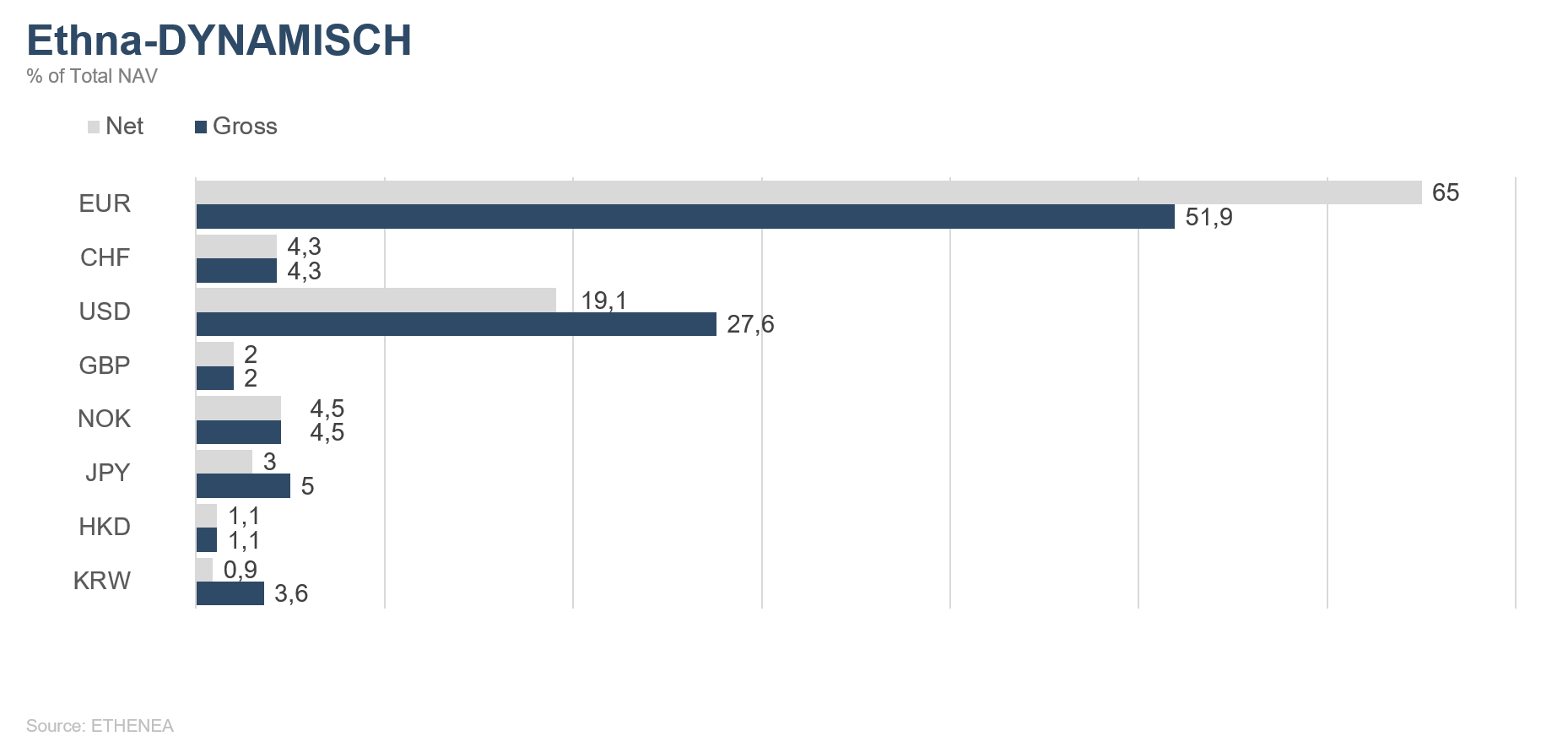

Figure 2: Spreads in the AA, A and BBB ratings buckets over the past 10 years.

Another particular development affecting many banks raises another dilemma. Many securities dealers are under the strain of progressive capital costs. This means that the longer a security is held in the dealer’s books, the higher the (notional) costs. This fact further distorts the market in favour of frequent issuers. The liquidity of infrequent issuers, poorer ratings or subordinated debt is greatly limited.

So, what does this mean for portfolio management?

Ideally, one should be able to spot the first signs of ill health to adjust the fund to harder times ahead of the herd: better ratings, shorter maturities, better-known names. Jump the gun and it will cost too much performance in the end and neither the portfolio manager nor the client will be happy. Leave it too late and, again, it will cost too much performance and neither the portfolio manager nor the client will be happy. Therefore, the right balance between risk and opportunity must be struck for investments in this asset class, and this is a long-standing motto at ETHENEA.

Last but not least, there are two other aspects we would like to discuss.

Firstly, economic growth, as we outlined back in our January Market Commentary, seems to be developing a serious soft spot. German economic growth was barely 0% in the fourth quarter of 2018, meaning that unlike Italy it narrowly avoided a technical recession. Industrial production is faltering badly all across Europe. In the U.S., too, consumption has fallen of late.

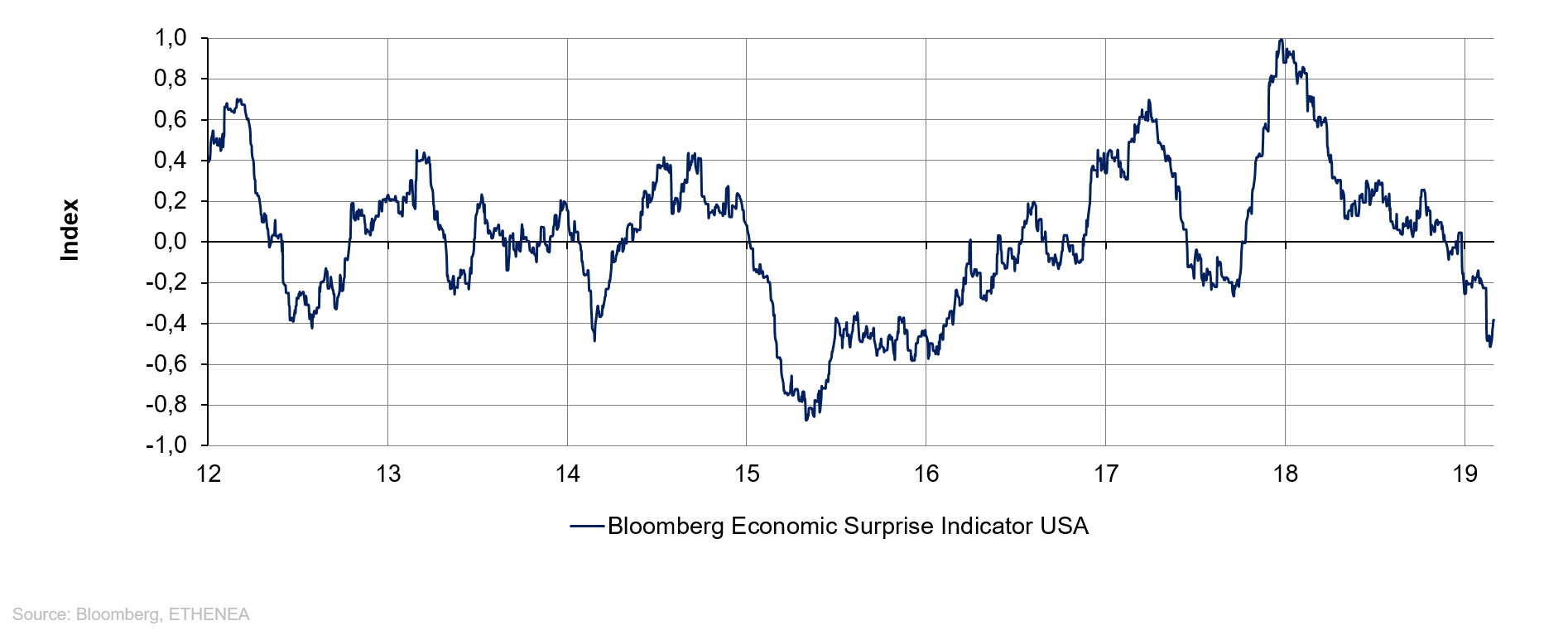

Figure 3: U.S. surprise indicator.

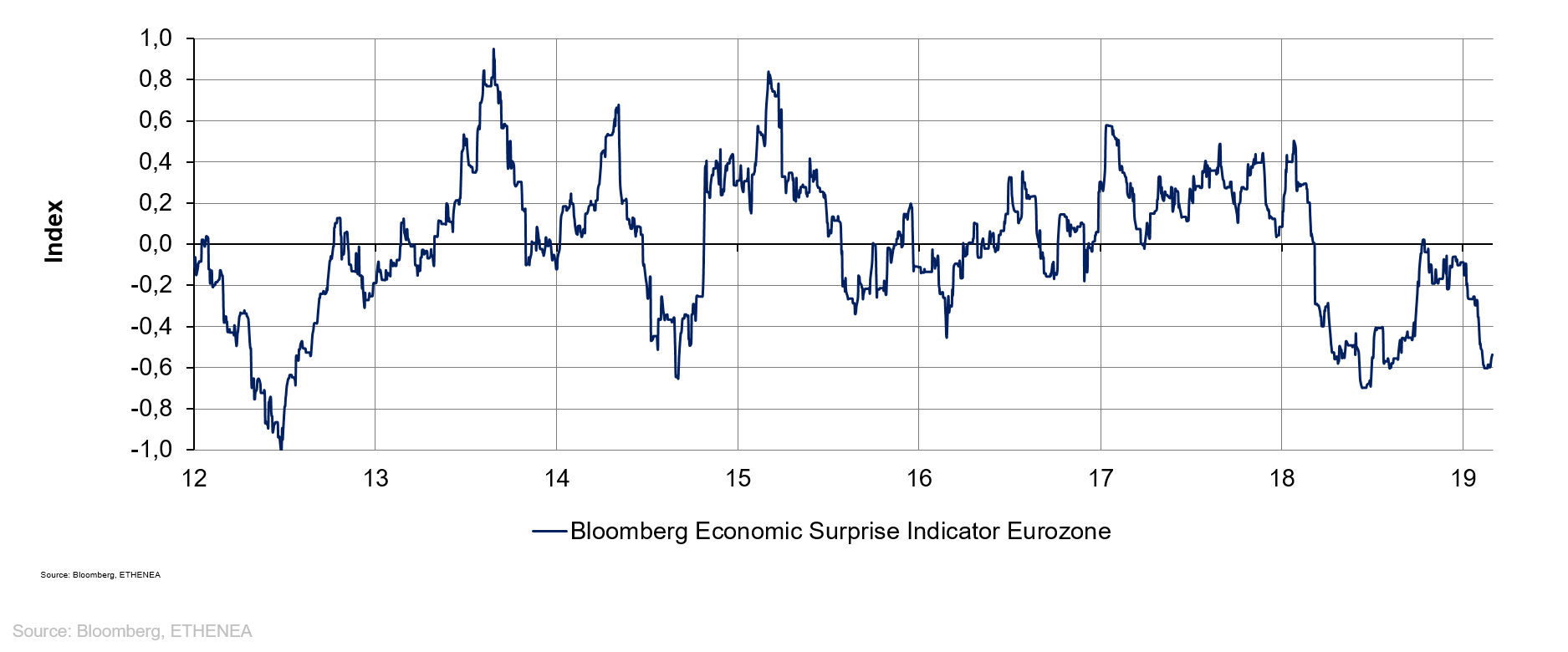

Figure 4: Eurozone surprise indicator.

However, rather than go into every single variable, we can just look at Figures 3 and 4. The Bloomberg surprise indicators for the U.S. and for the eurozone make for a sobering sight. While the reading for the U.S. has only been negative since the beginning of the year, the eurozone has been falling short of expectations for more than a year. It is becoming harder and harder to understand the optimism of equity markets. The DAX is up 9.06% for the year to date; the S&P 500 11.08%. Credit spreads are narrowing (Figure 2) and only sovereign bond yields seem to be feeling the effects of the weak economy. It’s a mystery that is yet unsolved.

Lastly, let’s take a look at our European neighbours.

Brexit – which for many seems to stand for chaos and confusion – is entering the closing stages. Even though many consider it unlikely, there is every indication that the UK is committing collective economic suicide and will leave the EU without a deal. According to unofficial figures, the UK has already suffered irreversible damage with the loss of several hundred thousand jobs so far. Dyson, a Brexiteer, even blithely moved production to Singapore! There are countless other examples of hypocrisy from known Brexiteers. It seems very odd that after all the unpleasantness, the misled average men and women of Britain have not long gone to the barricades. It probably isn’t in their nature. But keeping a stiff upper lip is not to everyone’s taste; one can only imagine how, say, our strike-happy neighbour France would handle the situation!

Meanwhile, the acclaimed UK Parliament seems incapable of getting closer to a solution, never mind defining what the solution is in the first place. We are seeing a complete failure of representative democracy. Theresa May seems to be almost helpless: without a majority in Parliament she is the quintessential lame duck. Her most recent attempt to bring order to the voting confusion was another failure. Perhaps things will go better on 12 March, 13 March or 14 March? It’s hard to believe they will. We can only hope that the UK will see the light before the eleventh hour and Brexit will simply be halted. However, a second referendum should not be held. The country is deeply divided into Leavers and Remainers and there doesn’t seem to be much point in increasing the divisions. I still think that a referendum is a totally unsuitable way to decide such a complex problem as Brexit, and that goes for the second – or even third – time round as well. Let’s cross our fingers and hope that the Queen steps in.

Figure 5: Premium on Spain’s credit default swaps.

Meanwhile, another situation altogether is developing on the Iberian peninsula. On 15 February, leader of the minority government, Prime Minister Sánchez, called fresh elections after just eight months in office. The market seems to welcome this, going by the price of Spanish credit default swaps (see Figure 5). After the premium shot up early last year amid the crisis in Catalonia, the market seems to see fresh elections as a positive. Really the only explanation is that the instability of a minority government is worse than the possibility of a stable majority, even at the risk of the right-wing populists gaining a stronger foothold. What may be good for Spain, however, will be bad for Europe. The European elections, coming just one month after the early elections in Spain, may give more Eurosceptics seats in the European Parliament at a time when many are making the case for a stronger Europe, especially in light of competition from the U.S., China, Russia and India. To represent the special interests of one state or even one region in the short-term is just that: short-sighted and narrow-minded. In order to secure Europe’s position in the global competitive environment so as to protect markets and interests, Europe needs to be strong.

Equity exposure with futures and options – how does it work?

As one of the Lead Portfolio Managers of the Ethna-AKTIV, Michael Blümke is responsible for the equity allocation of the portfolio. In our latest video, the derivatives expert explains how the use of such products can optimise portfolio return on a sustained basis.If you are having video playback issues, please click HERE.

Positioning of the Ethna Funds

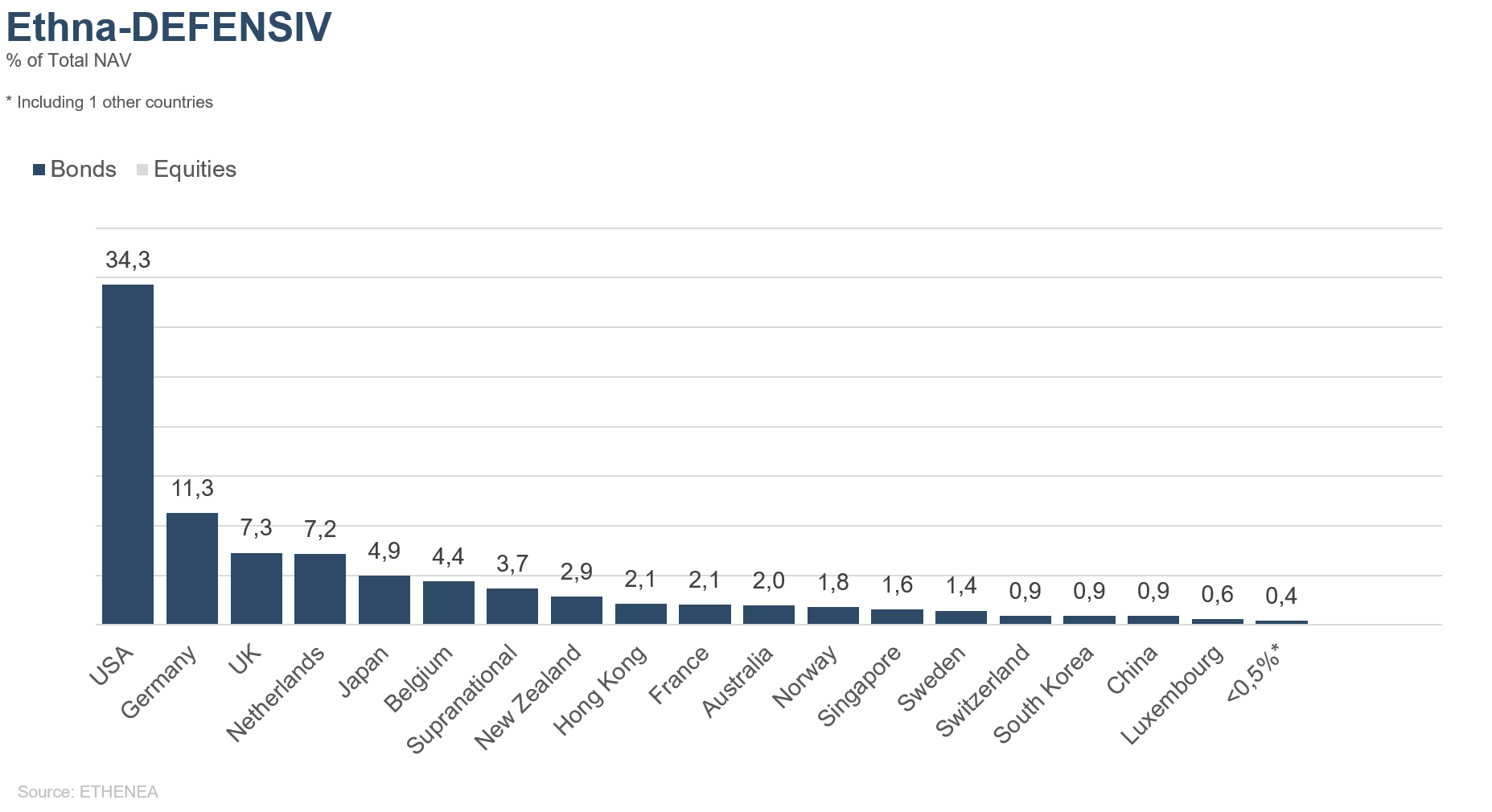

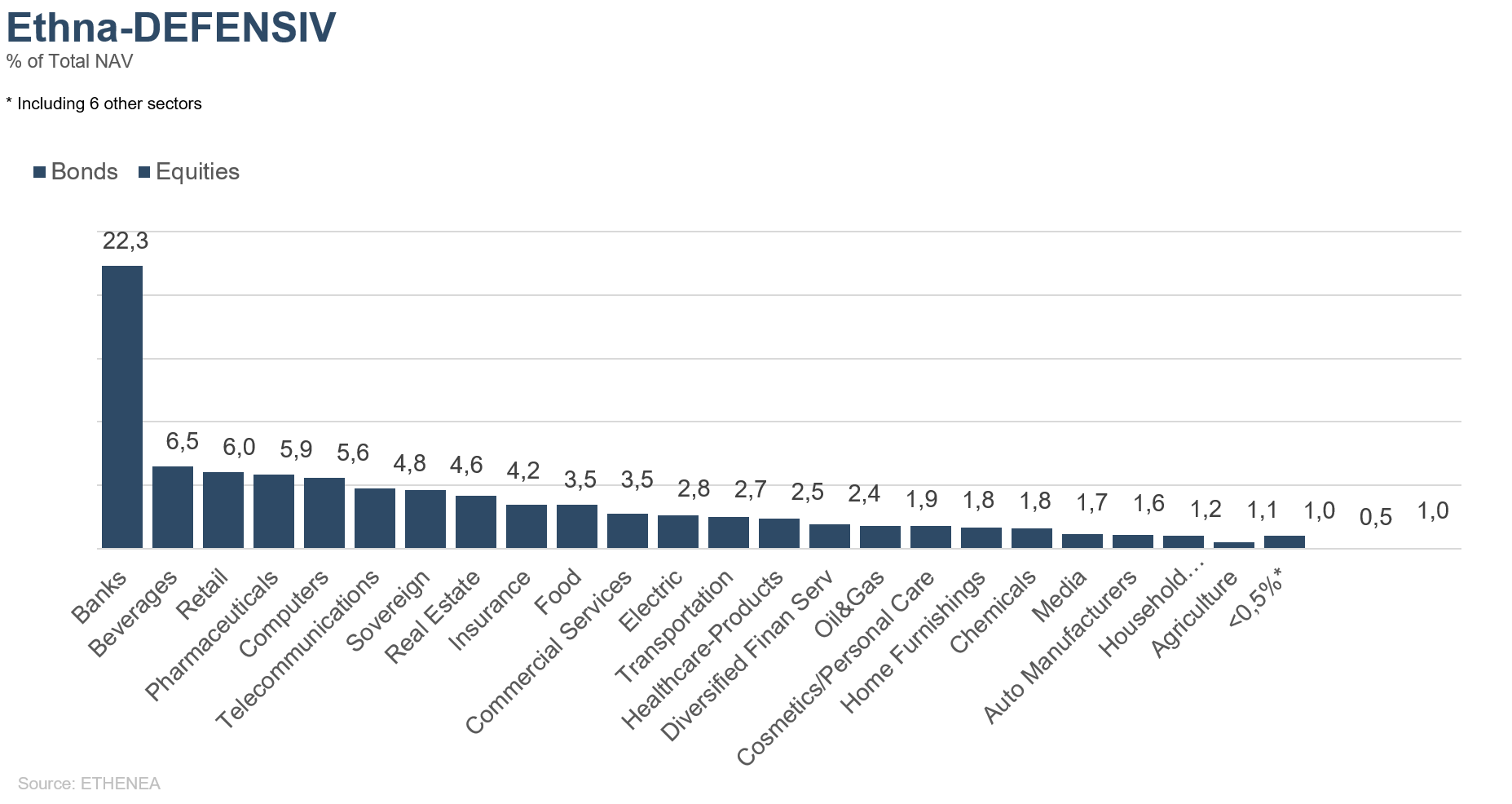

Ethna-DEFENSIV

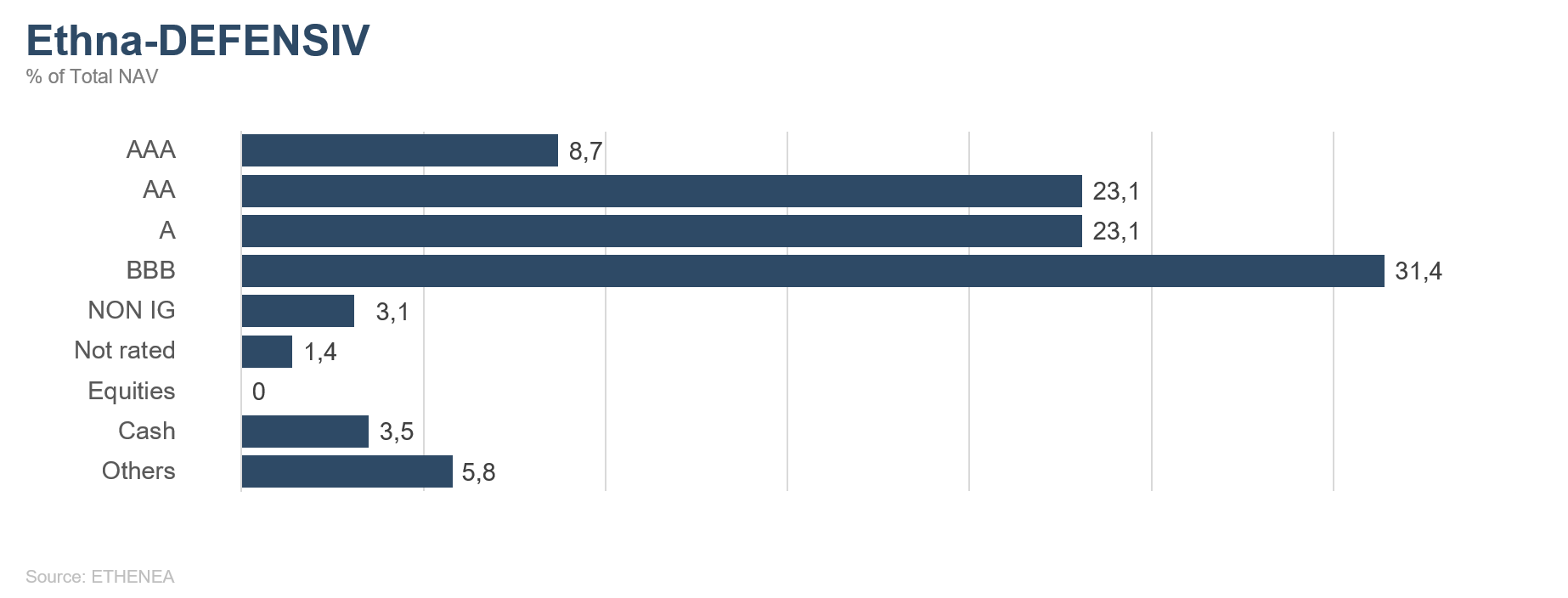

In the current market environment in which growth rates are flagging – in Germany and elsewhere – it was high time to divest ourselves of a couple of bonds with a very good rating, the yields on which were heading into the red after the most recent price rises. The fact that we had positioned our portfolio with an average rating of A to A+ paid off, because we were able to take profits on the sale of those bonds. To improve the carry, we added well-known bonds in the A to BBB+ category to the portfolio. However, at the moment, 79% of the bonds in our portfolio still have a rating of between AAA and BBB+.

For investors, the still unresolved Brexit situation presents a further uncertainty, which is why we increased our gold position again over last month’s level. At the end of February, it was 6.3%.

We were also able to further reduce the maturities of holdings to the extent that almost 80% of bonds have a residual maturity of less than seven years.

In addition, bond markets developed in our favour and credit spreads narrowed, which had a positive effect on portfolio performance in February.

Our equity position at the end of February remained at 0%, since we saw no adequate entry levels for the Ethna-DEFENSIV.

Fund currency allocation remains unchanged, with a euro weighting of more than 90%.

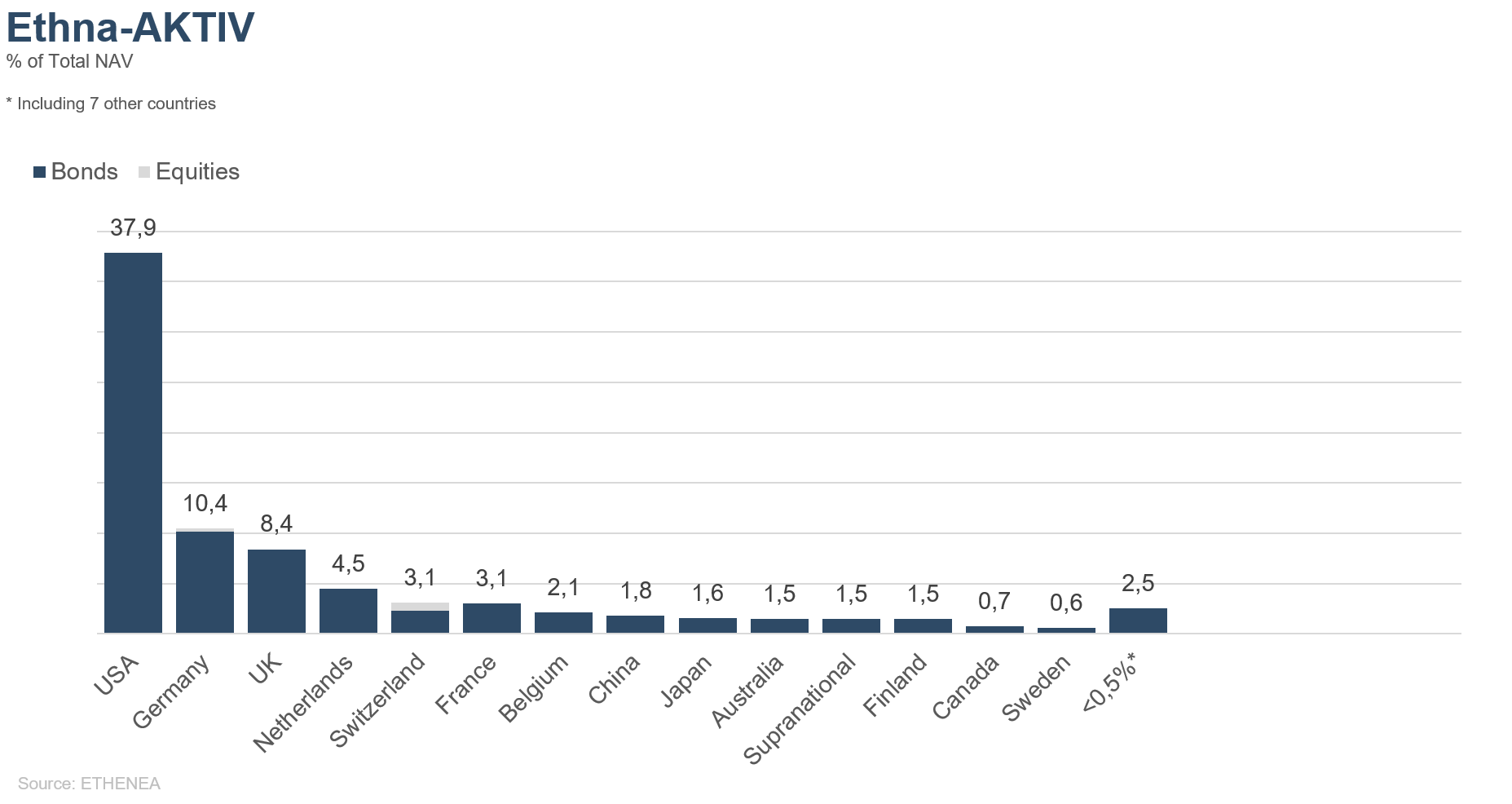

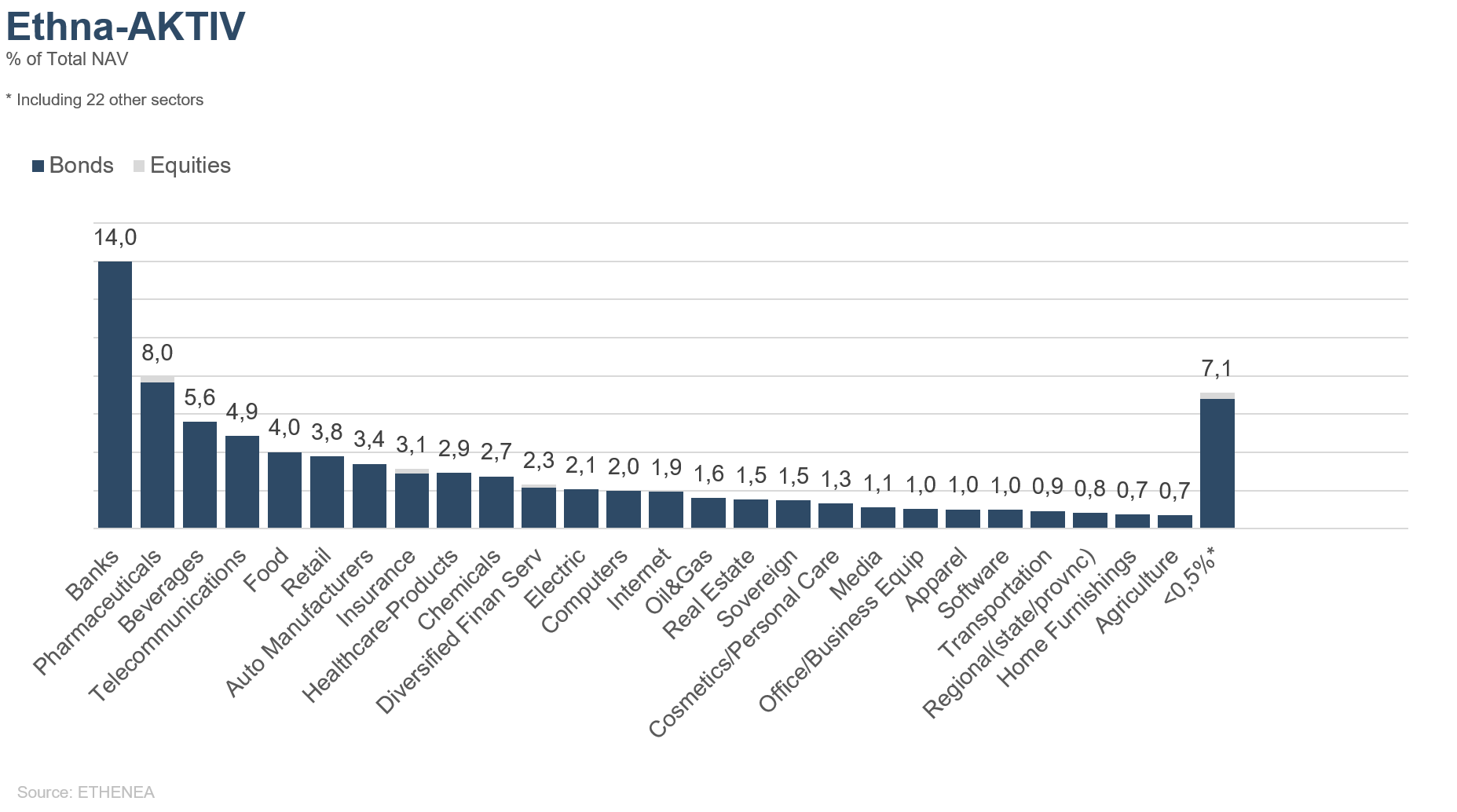

Ethna-AKTIV

On the back of a general risk-on mentality, the recovery in global equity and credit markets continued in February after the heavy losses of the fourth quarter of 2018. However, the pace of recovery has slowed markedly, not least because of some disappointing political developments. Weak economic numbers out of Europe and, in particular, the still unresolved trade conflict and the ongoing wrangling over Brexit brought about high-level consolidation. In this context, the fact that Trump lifted his ultimatum to increase tariffs further only helped the Chinese equity market, and shows once again who must be prepared to make concessions in these negotiations. A resumption of the Kashmir conflict caused geopolitical unrest and the totally fruitless summit between the North Korean leader and the U.S. President also brought disappointment to the capital markets.

Against this backdrop, we are still sticking with our assessment that the current global slowdown in growth is more of a bump in the road than the path to recession. However, the arguments and data for and against the necessary growth dynamic which we have gathered as part of our market assessment are evenly balanced. Much will depend upon future fiscal and monetary measures. Seeing that Fed Chair Powell reiterated the U.S. central bank’s patient stance, we can at least expect no headwind from these quarters. We subsequently closed our positioning in relation to an interest rise, and do not expect any further interest rate moves this year. In reducing our dollar exposure from 12.2% to 5.1%, the no longer expected rate increment was less of a deciding factor than the apparent effort to avoid a hard Brexit at all costs and the resulting fact that there is less uncertainty about the future of the euro. As announced in last month’s Market Commentary, we took advantage of the peaks in prices at the end of the month to bring our equity exposure back down below 10%. As long as the future path of growth of the global economy remains unclear, we will keep securing profits on equities and interest rates using appropriate overlay strategies. In the current environment, we still assume that unless there is strong stimulus, neither equity prices nor interest rates will move up or down much. There are many possible catalysts for movement in either direction. It is therefore all the more important to act prudently in the meantime and not to get infected by the market euphoria.

Thanks to this conservative approach, the Ethna-AKTIV (A) gained 0.95% over the course of the month.

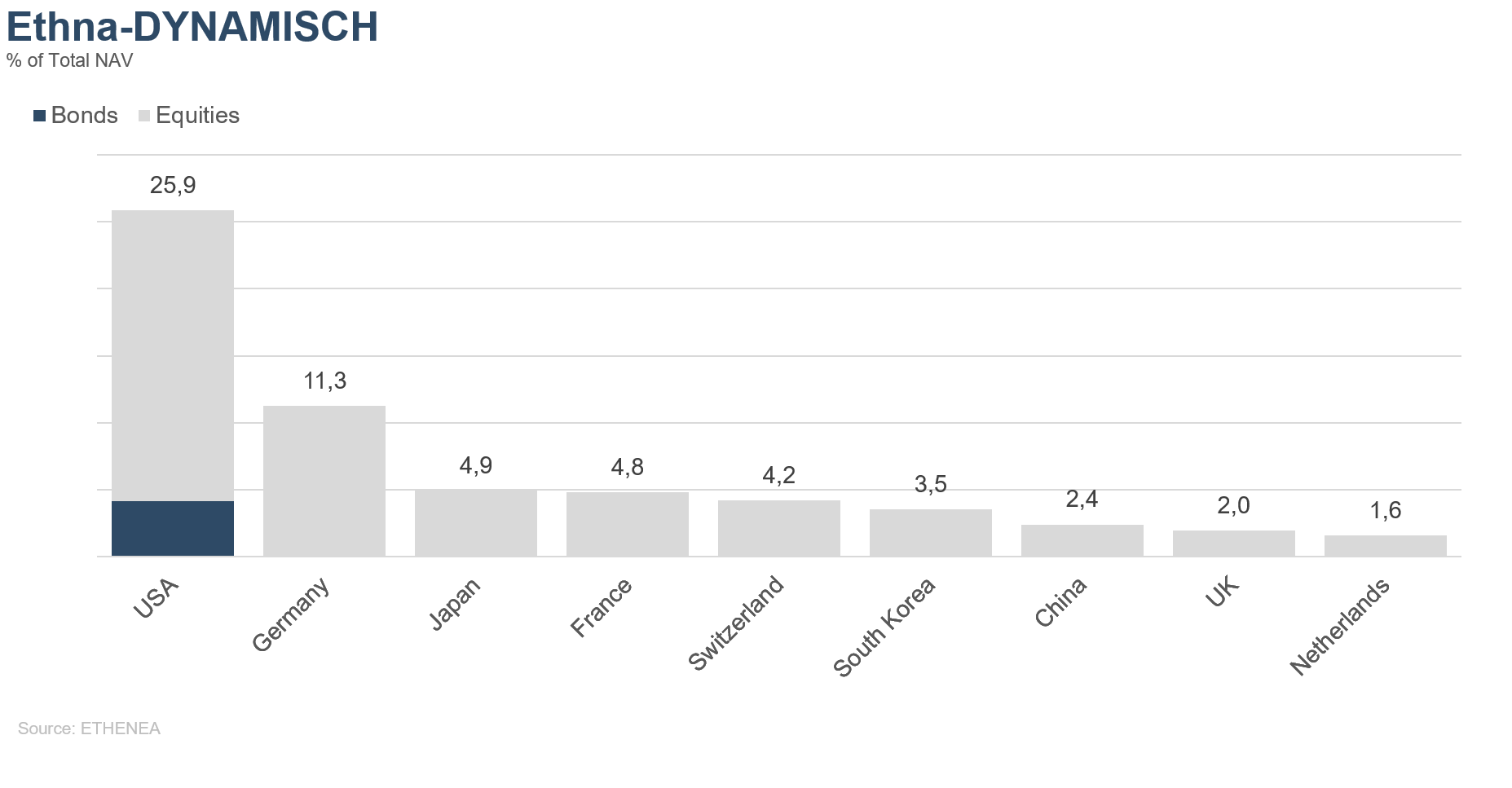

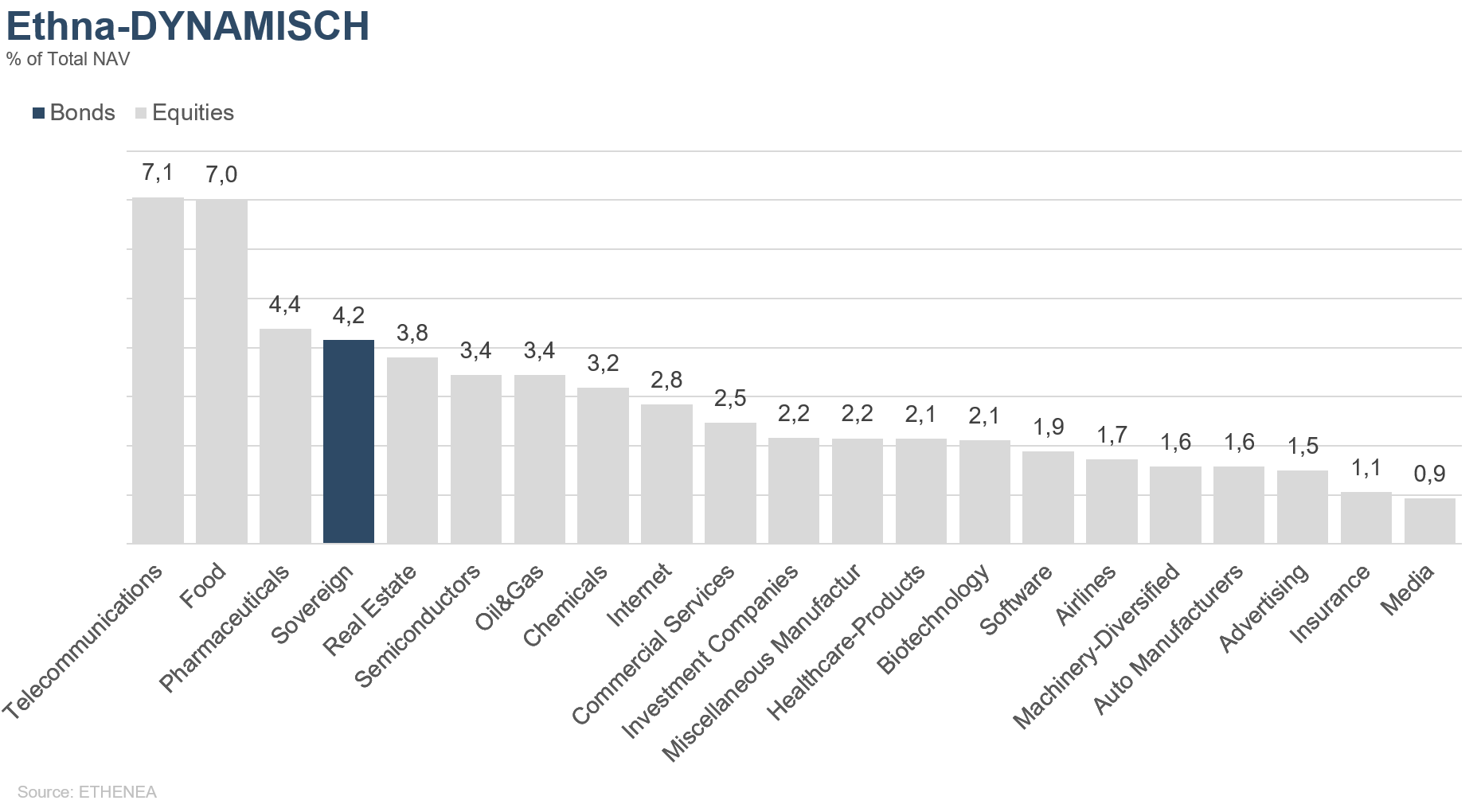

Ethna-DYNAMISCH

If one were to try to put global equity market developments in the first two months of 2019 in a nutshell, a fireworks display would certainly be a fitting description. Fireworks are usually put on to celebrate something. However, we do not believe there are any real reasons to celebrate at the moment; we have already had a wild pre-party! Still, the ongoing solid economic environment, strong labour markets, market-friendly central bank policies and attractive valuations make for sufficient supporting factors for the positive trend in stock markets to continue. Counterbalancing these are the negative factors which, though they have lessened of late, have not disappeared. Of course, the wilder the party, the greater the risk of a hangover the following day. We shall have to keep a close eye on the situation in the coming weeks.

In the past 28 days, the positioning of the Ethna-DYNAMISCH has changed relatively little. As before, the Ethna-DYNAMISCH’s key focus is on an equity portfolio with a balanced regional and sector allocation, where both the quality and the long-term prospects of the business models of the holdings are in due proportion to the current valuation. We found an attractive entry point in February in the German payment provider Wirecard, which straight away became the top-performing individual security, with gains of more than 20%. Unfortunately, this positive outlier was countered by the even greater negative outlier of U.S. food company Kraft Heinz, which detracted more than 60 basis points from the result for the month after an unexpectedly poor quarterly report. In addition, the hedging components – which we use in the Ethna-DYNAMISCH to absorb potential losses – are by definition of no benefit in this environment of high-flying prices. Overall, participation in the positive market trend of late has been far below our expectations, even though year-to-date performance of the Ethna-DYNAMISCH is positive, at 3.42%.

Regardless of these short-term influencing factors, the portfolio construction of the Ethna-DYNAMISCH is still suitable to give investors risk-controlled access to opportunities in global equity markets in an environment where economic and geopolitical uncertainties persist.

Figure 6: Portfolio ratings for Ethna-DEFENSIV

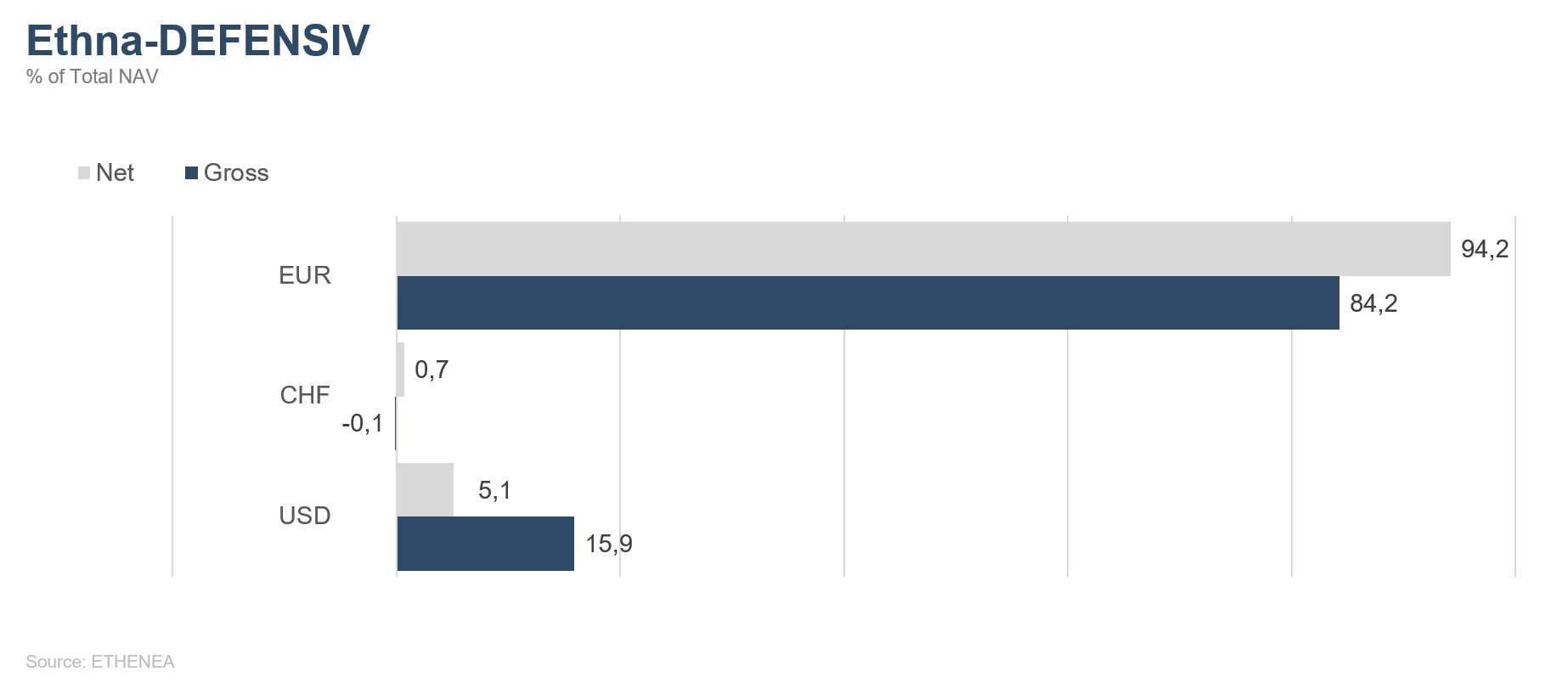

Figure 7: Portfolio composition of Ethna-DEFENSIV by currency

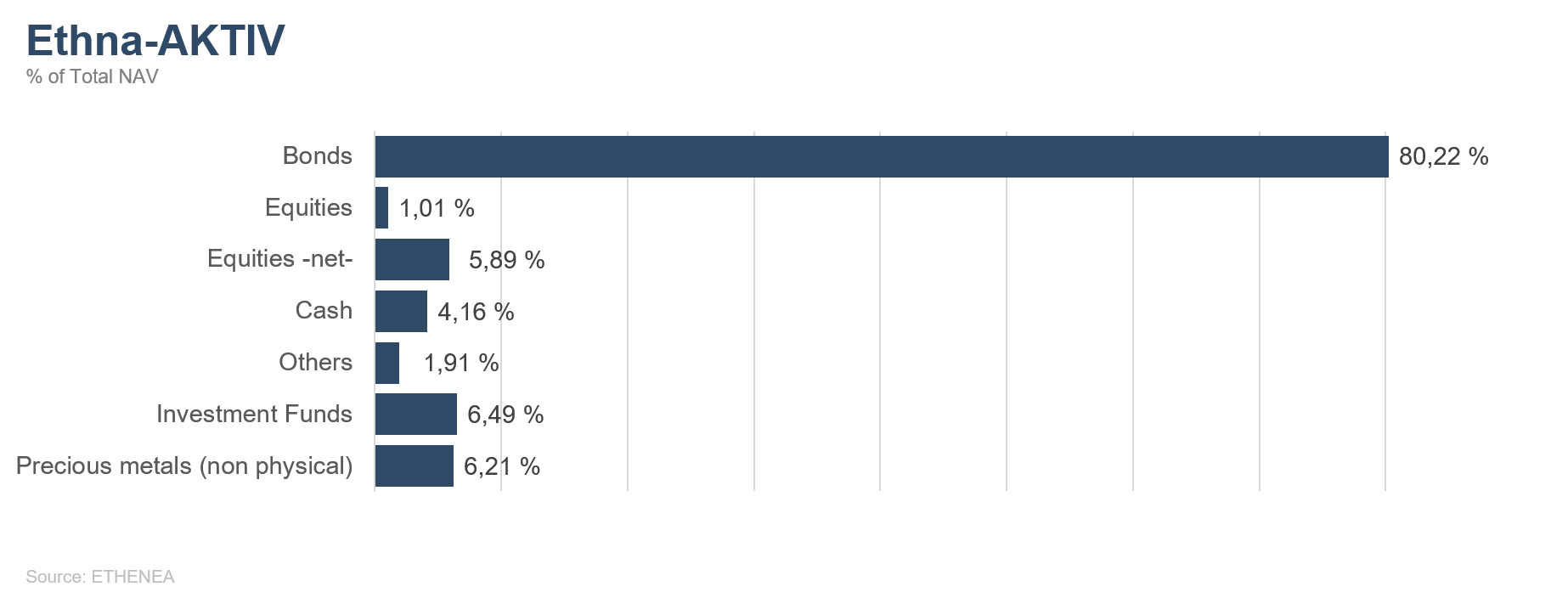

Figure 8: Portfolio structure* of Ethna-AKTIV

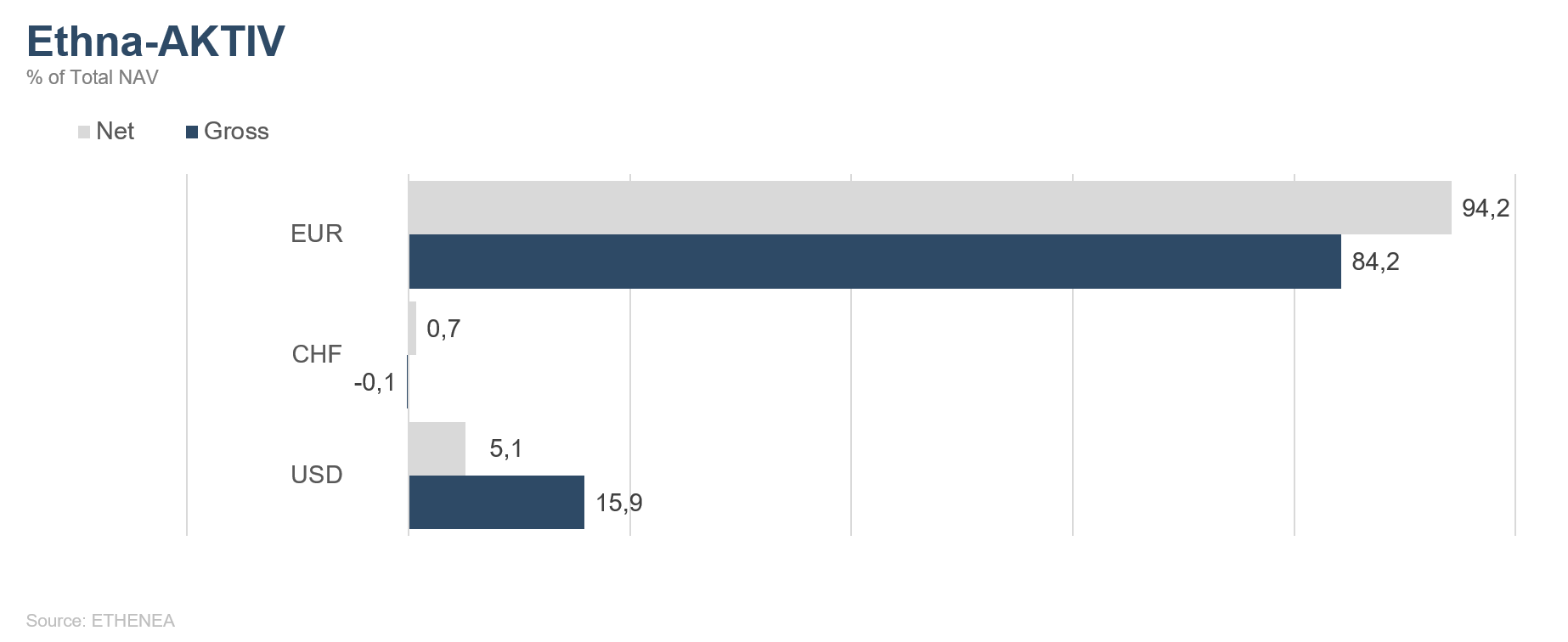

Figure 9: Portfolio composition of Ethna-AKTIV by currency

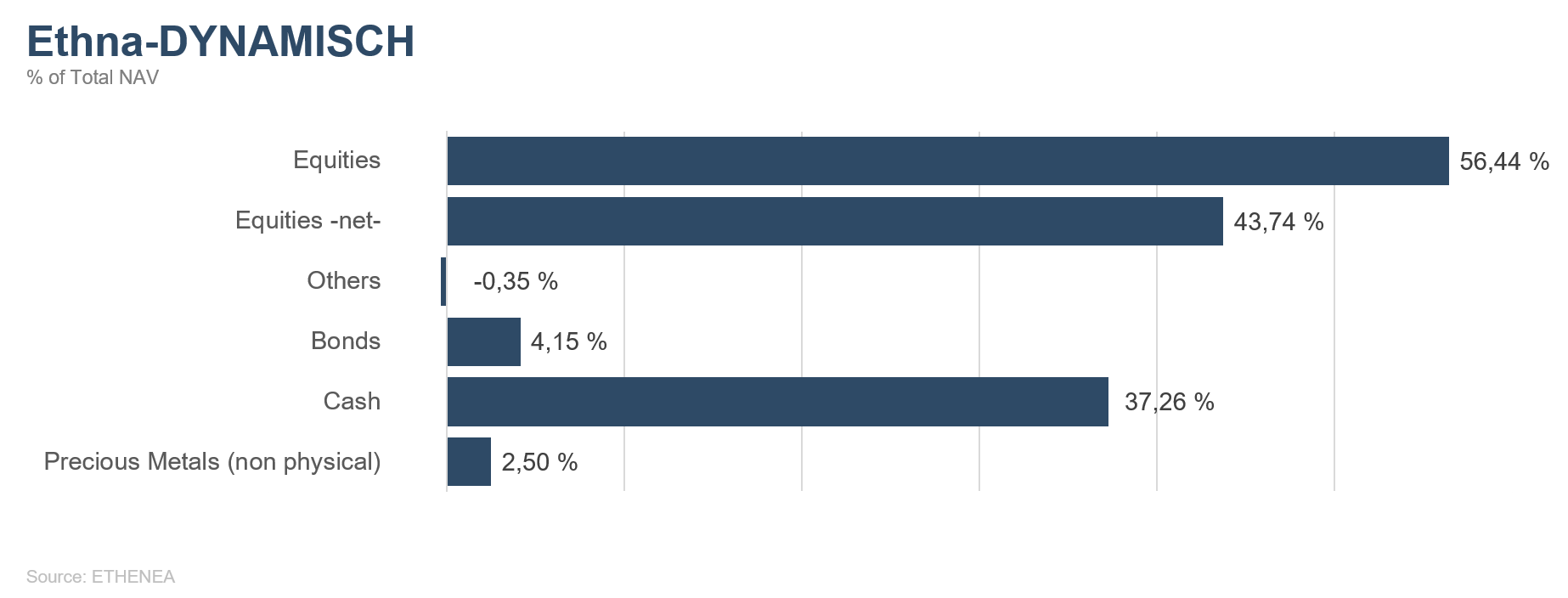

Figure 10: Portfolio structure* of Ethna-DYNAMISCH

Figure 11: Portfolio composition of Ethna-DYNAMISCH by currency

Figure 12: Portfolio composition of Ethna-DEFENSIV by country

Figure 13: Portfolio composition of Ethna-AKTIV by country

Figure 14: Portfolio composition of Ethna-DYNAMISCH by country

Figure 15: Portfolio composition of Ethna-DEFENSIV by issuer sector

Figure 16: Portfolio composition of Ethna-AKTIV by issuer sector

Figure 17: Portfolio composition of Ethna-DYNAMISCH by issuer sector

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

This marketing communication is for information purposes only. It may not be passed on to persons in countries where the fund is not authorized for distribution, in particular in the USA or to US persons. The information does not constitute an offer or solicitation to buy or sell securities or financial instruments and does not replace investor- and product-related advice. It does not take into account the individual investment objectives, financial situation, or particular needs of the recipient. Before making an investment decision, the valid sales documents (prospectus, key information documents/PRIIPs-KIDs, semi-annual and annual reports) must be read carefully. These documents are available in German and as non-official translations from ETHENEA Independent Investors S.A., the custodian, the national paying or information agents, and at www.ethenea.com. The most important technical terms can be found in the glossary at www.ethenea.com/glossary/. Detailed information on opportunities and risks relating to our products can be found in the currently valid prospectus. Past performance is not a reliable indicator of future performance. Prices, values, and returns may rise or fall and can lead to a total loss of the capital invested. Investments in foreign currencies are subject to additional currency risks. No binding commitments or guarantees for future results can be derived from the information provided. Assumptions and content may change without prior notice. The composition of the portfolio may change at any time. This document does not constitute a complete risk disclosure. The distribution of the product may result in remuneration to the management company, affiliated companies, or distribution partners. The information on remuneration and costs in the current prospectus is decisive. A list of national paying and information agents, a summary of investor rights, and information on the risks of incorrect net asset value calculation can be found at www.ethenea.com/legal-notices/. In the event of an incorrect NAV calculation, compensation will be provided in accordance with CSSF Circular 24/856; for shares subscribed through financial intermediaries, compensation may be limited. Information for investors in Switzerland: The home country of the collective investment scheme is Luxembourg. The representative in Switzerland is IPConcept (Suisse) AG, Bellerivestrasse 36, CH-8008 Zurich. The paying agent in Switzerland is DZ PRIVATBANK (Suisse) AG, Bellerivestrasse 36, CH-8008 Zurich. Prospectus, key information documents (PRIIPs-KIDs), articles of association, and the annual and semi-annual reports can be obtained free of charge from the representative. Information for investors in Belgium: The prospectus, key information documents (PRIIPs-KIDs), annual reports, and semi-annual reports of the sub-fund are available free of charge in French upon request from ETHENEA Independent Investors S.A., 16, rue Gabriel Lippmann, 5365 Munsbach, Luxembourg, and from the representative: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg. Despite the greatest care, no guarantee is given for the accuracy, completeness, or timeliness of the information. Only the original German documents are legally binding; translations are for information purposes only. The use of digital advertising formats is at your own risk; the management company assumes no liability for technical malfunctions or data protection breaches by external information providers. The use is only permitted in countries where this is legally allowed. All content is protected by copyright. Any reproduction, distribution, or publication, in whole or in part, is only permitted with the prior written consent of the management company. Copyright © ETHENEA Independent Investors S.A. (2025). All rights reserved. 04/03/2019