Brexit: the final countdown

Although there’s little to show for it yet, the Withdrawal Agreement between the European Union and United Kingdom entered into force in January of this year. While the UK is currently somewhat in a state of limbo due to the one-year transition period, it will finally be over by 31 December at the latest and the UK will leave the European Economic Area – with or without a deal.

The biggest points of contention remain fishing rights and fair competition rules, referred to as a level playing field. A level playing field would give UK companies almost unlimited access to the EU single market. In return, however, Brussels is demanding that the UK adhere to the zero dumping rule. In other words, it must not, for instance, increase subsidies for UK companies or lower environmental and social standards, thereby giving UK-based companies a competitive advantage. However, London feels that this compromises its sovereignty and under no circumstances does it want to sign a deal with such competition arrangements. Neither can the parties agree on how and to what extent breaches of the deal are to be sanctioned.

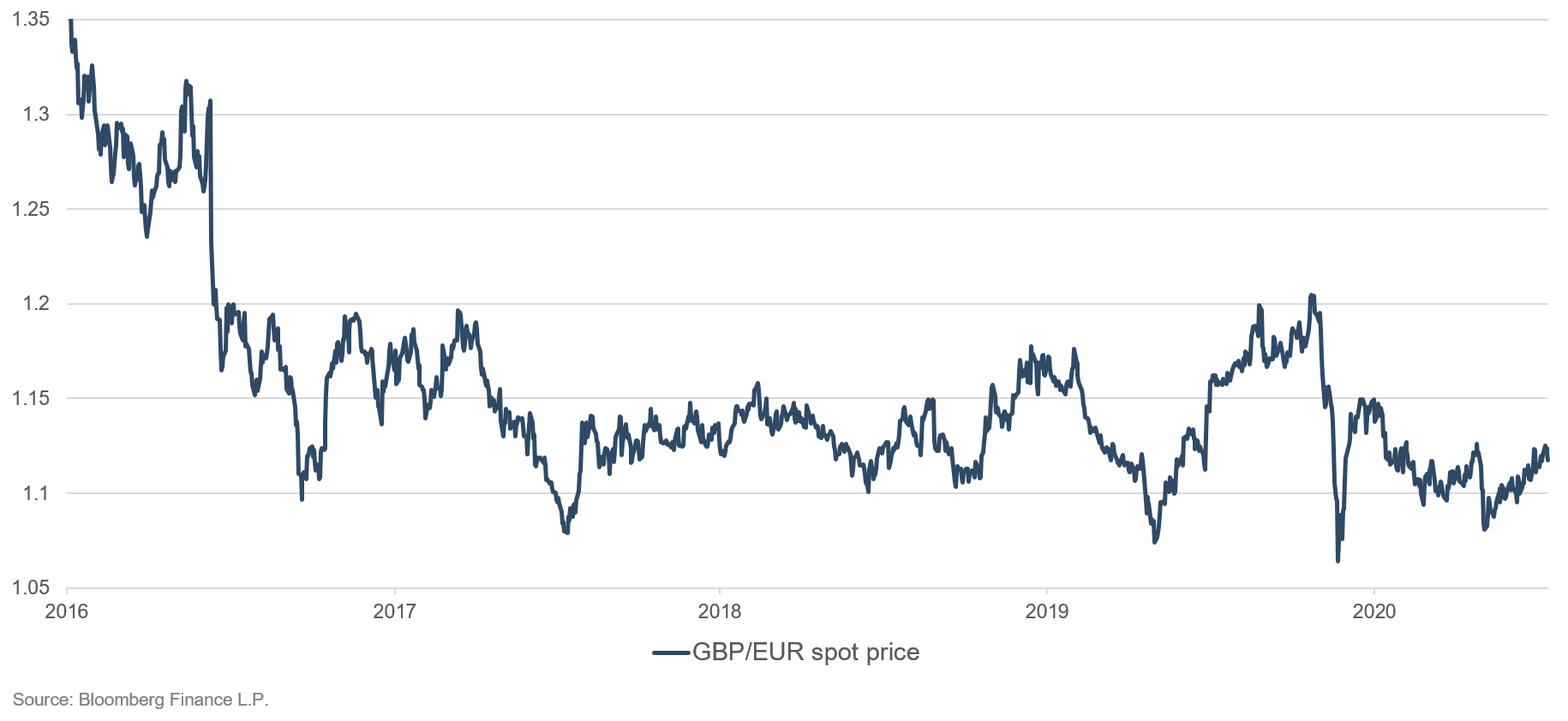

We looked at the economic situation in the UK in a previous Market Commentary. But what impact is Brexit having on the pound sterling and UK sovereign bonds? As is so often the case, it’s worth looking to the past to identify trends in how prices could develop in the future. The pound sterling plummeted after the Brexit referendum and has since been unable to regain its previous price levels. There is growing optimism again that the two parties will be able to reach a deal, which has led to the pound sterling regaining some ground. It is currently trading at just over EUR 1.10. However, it’s a far cry from a recovery to pre-Brexit level, nor does this seem like a realistic prospect for the foreseeable future. The same can be said for UK sovereign bonds, albeit in the opposite direction. Here, too, we expect persistently low yields for the time being.

Figure 1: Pound sterling to euro exchange rate since January 2016

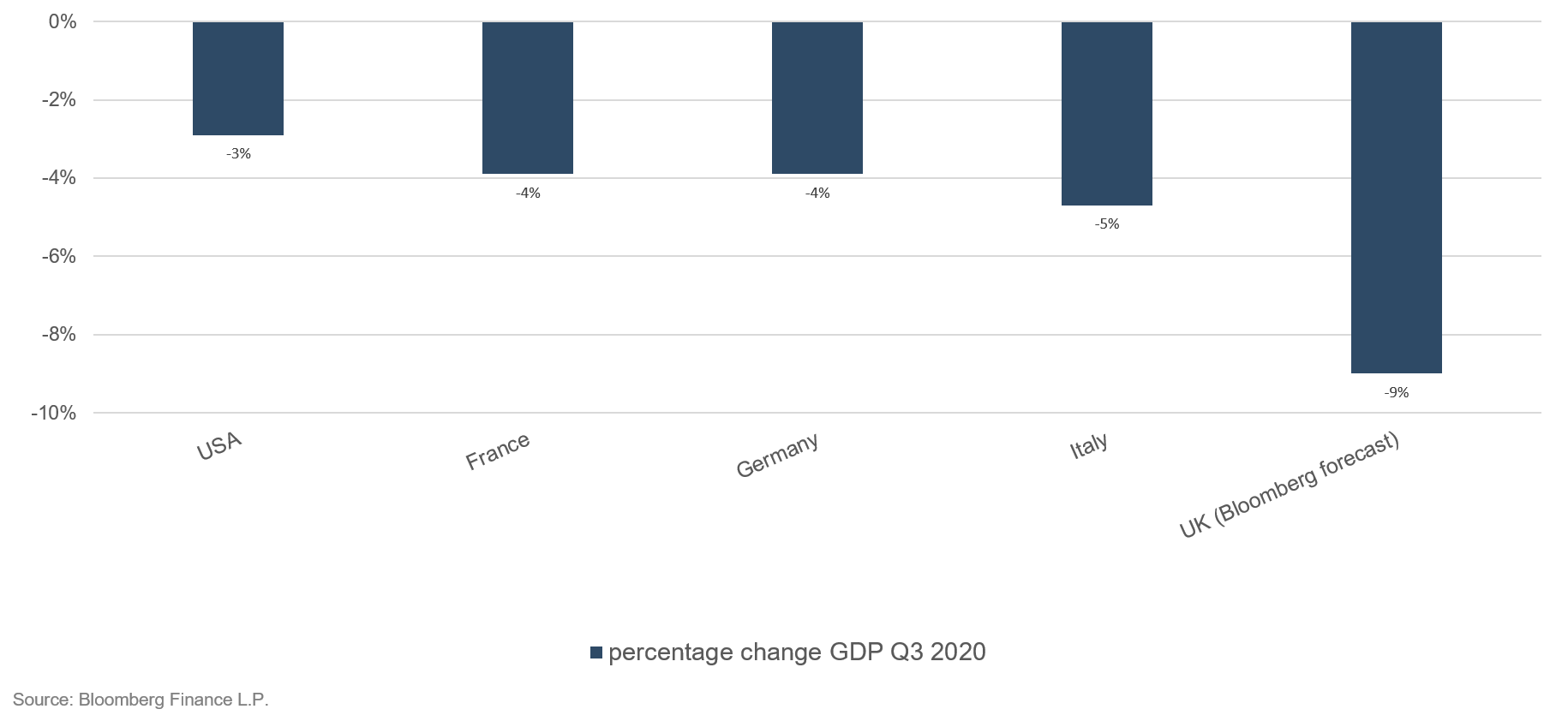

One factor giving rise to these two expectations is that the UK economy has been particularly hard hit by the double shocks of Brexit and the coronavirus pandemic. A rise in the unemployment rate, reduced turnover and job losses, especially in retail and the entertainment sectors, caused a greater decline in the UK’s GDP than in any other major industrialised country. Then there’s the fact that the UK is much more dependent on trade relations with the EU than vice versa. While around half of the UK’s trade in goods and services is with the EU, the EU’s trade balance is much more diversified. Even a Brexit deal with the best possible outcome for the UK would mean significant investment in production and supply chain restructuring, as well as adaptation to the new border controls and documentation requirements. In turn, this would weaken the UK economy further and, coupled with the prevailing uncertainty (a recent survey found that around half of SMEs have no idea what effect the end of the transition period will have on their business) exert further downward pressure on the pound sterling. UK sovereign bonds, on the other hand, should continue to be regarded as a safe haven.

Figure 2: The UK’s GDP continues to lag behind – % change in GDP Q3 2020 vs Q3 2019

Furthermore, this year the Bank of England has already cut the key rate twice from 0.75% to 0.1% and recently increased its government bond purchases by an additional GBP 150 billion to GBP 875 billion at present. The purpose of creating such demand is to stabilise the bond market and keep interest rates low, thus facilitating public-sector financing. Ultimately, investors can be almost certain that, if need be, the government bonds purchased can be sold back to the Bank of England.

Chancellor of the Exchequer Rishi Sunak recently reaffirmed the serious state the economy is in. Economic output is expected to fall by 11.3% in 2020, a figure that is unprecedented in the past three centuries. He does not expect the economy to fully recover until shortly before the end of 2022 at the earliest. To complicate matters further, a reasonable agreement on future trade relations between the EU and the UK still hasn’t been reached a mere month before the end of the Brexit transition period. The pressure on the pound sterling will persist. The central bank will do everything it can to alleviate the impact of the UK’s exit from the EU and of the coronavirus pandemic. Additional bond purchases have been announced, and there is talk of further measures. However, the Bank of England has so far rejected the idea of introducing negative central bank rates. Financing the enormous additional national debt will require the central bank’s attention, especially since the Chancellor of the Exchequer plans to take on almost GBP 400 billion in additional debt this fiscal year, which ends on 31 March 2021. This equates to around 19% of GNP.

Below-average economic growth, an enormous budget deficit, the continued lack of clarity on the relationship with the EU, an even more expansionary monetary policy – there are many indicators pointing towards a further fall in the pound sterling against the euro. While the UK central bank has so far rejected the notion of introducing negative interest rates, we believe that the Bank of England will break the taboo and follow the ECB’s example. This would put further pressure on the pound sterling and lead to a further depreciation.

And then there’s the scenario that’s least discussed in the public debate but which no longer seems all that unlikely considering that Brexit negotiations have been going on for more than four years now and the deadline is fast approaching – that the 31 December 2020 deadline will once again be missed and negotiations will be delayed into the new year. This would prolong the agony and, looking ahead, would probably be the worst-possible scenario due to the ongoing uncertainty. This combined with coronavirus would hold even more challenges for a UK economy that is already flagging. All we can do is hope that the UK economy and people are spared this scenario.

Positioning of the Ethna Funds

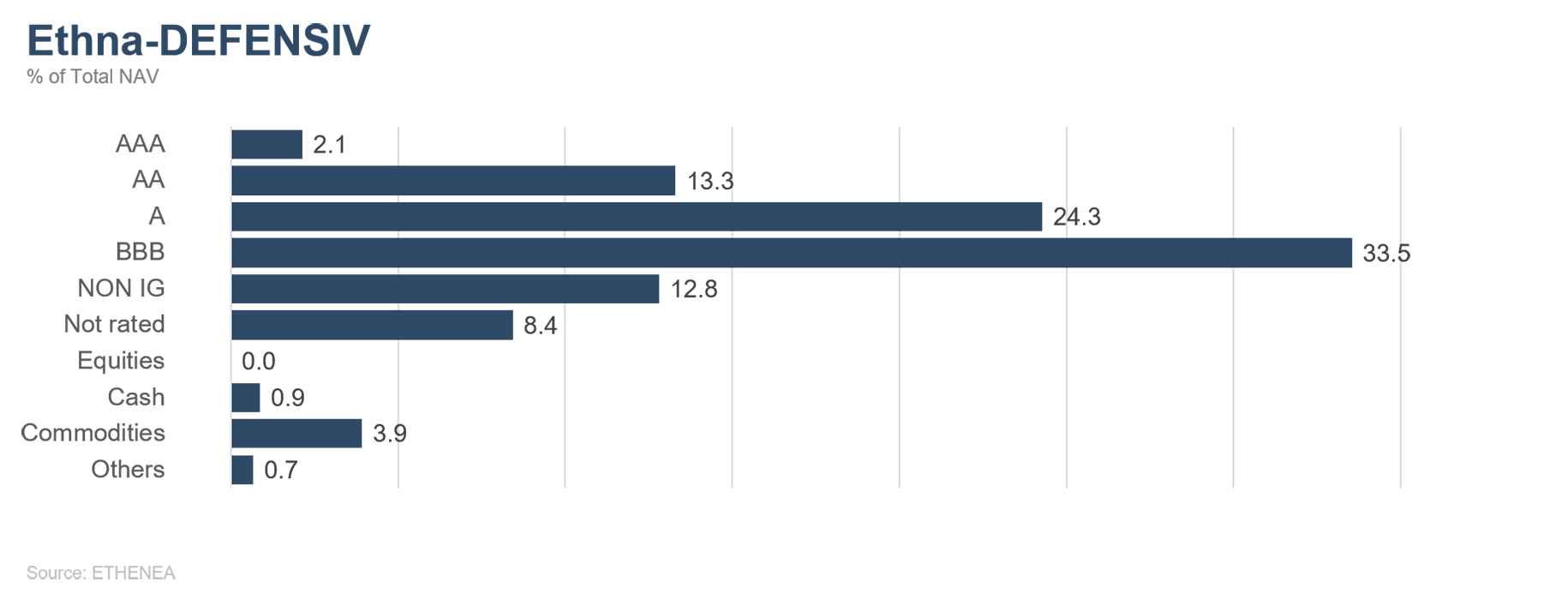

Ethna-DEFENSIV

The prospect of having coronavirus vaccines soon, and thus a means of controlling the pandemic, caused the markets to positively soar last month. Both corporate bonds denominated in USD and EUR benefited, gaining on average around 2.40% and 1.05% respectively last month.

The financial market turbulence feared by almost all market participants in connection with the U.S. election was fleeting and fears relatively quickly proved to be unfounded. This once again goes to show that political markets are short-lived and that investors can very quickly look beyond the events and adapt to new realities. The consensus view is that, ultimately, a Democrat majority in the House and a Republican majority in the Senate is perhaps not all that bad because they combine the best of both worlds, at least from a market perspective: a more moderate foreign policy and likely fewer tax hikes and regulatory measures. At the same time, the nomination of Janet Yellen as Treasury Secretary points to a progressive economic policy. During her time at the helm of the U.S. central bank, Janet Yellen pursued an ultra-accommodative monetary policy and is generally regarded as a Keynesian – a proponent of fiscal easing in economically difficult times. Her nomination would therefore suggest that the next aid package to support the U.S. economy might turn out to be larger than expected.

Central banks continue to provide additional support. Under the multibillion PEPP emergency measure introduced by the European Central Bank in March 2020, around EUR 20 billion in bonds was purchased every week last month. This is slightly higher than the average in recent months but, given that bond markets are traditionally quiet over the Christmas holidays, it should not be overrated. Thus the ECB has around half of the EUR 1,350 billion PEPP envelope left. Under normal conditions, this should last until well beyond the middle of next year and provide good support for both the investment grade and high yield European bond markets. Of course, in the long term, the European Central Bank’s intervention also overrides all pricing mechanisms, which increases the risk of corporate bankruptcies after the aid programmes end. On the other side of the Atlantic, the U.S. central bank has exercised restraint and purchased corporate bonds in smaller volumes, including AT&T and Walmart bonds as well as mainly listed bond index funds. Recently, the unused funds under the PMCCF and SMCCF facilities were even returned at the request of Secretary of the Treasury Steven Mnuchin. However, they could be re-instated under Janet Yellen.

In addition, meetings of the U.S. central bank and the European Central Bank are due in December. Christine Lagarde has already announced that the ECB is planning fresh measures. It is conceivable that we could see an expansion of the pandemic emergency programme as well as the stepping-up of targeted long-term refinancing operations (TLTRO), which ensure highly favourable lending terms for commercial banks. Another key rate cut is not out of the question either.

The Ethna-DEFENSIV (T class) had a very positive November, with a performance of 0.72%. This puts it at +2.35% overall in the year to date, a very gratifying result for a defensive product focused on preserving capital and minimising risk such as the Ethna-DEFENSIV. The bond portfolio denominated in EUR and USD again made a positive contribution of 1.25% to fund performance. At the same time, the bond selection, which focuses on sound, sustainably growing companies, provided stability and low volatility. To minimise the risks associated with the resurgence of coronavirus cases and Brexit uncertainty, we retain small positions in gold, the Swiss franc and Japanese sovereign bonds. The latter position in particular should get a boost from the recently signed Regional Comprehensive Economic Partnership (RCEP) free trade agreement, which in one fell swoop will become the largest free trading bloc in the world. According to estimates from the renowned Peterson Institute for International Economics (PIIE), the members will benefit from overall annual GDP growth of USD 200 billion from 2030, of which Japan will account for around 25%. In the long term, this is likely to increase investment in the Japanese economic area in general and thus increase the value of the Japanese yen.

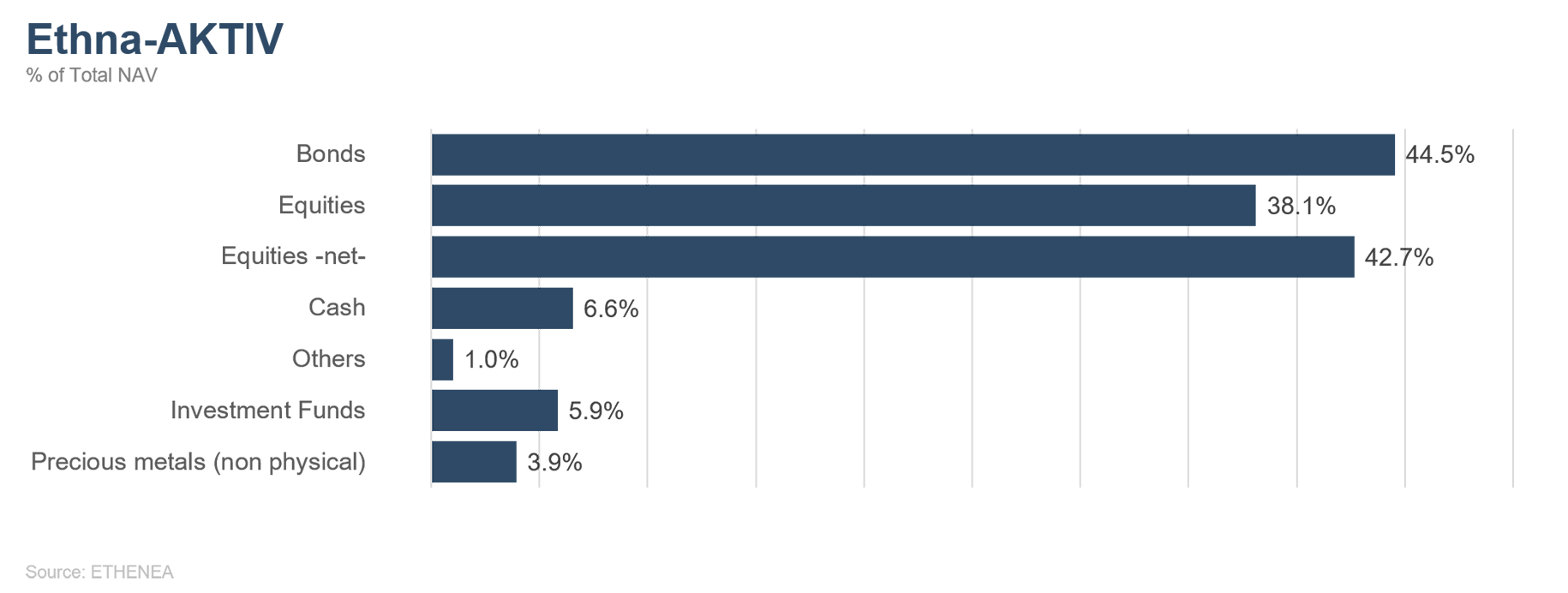

Ethna-AKTIV

After October made for a very modest start to the fourth quarter of the year, November made a good showing in terms of investor risk appetite. In November, multiple positive stimuli led to a risk-on rally that is unparalleled in recent history. In fact, it was the best month ever for the STOXX Europe 600 and the Russell 2000 in the U.S., up 13.7% and 18.3% respectively. People can form their own opinion regarding the significance of the catalysts. However, the fact is that shortly after the election of the new U.S. President – which eliminated one source of uncertainty hanging over the market – the positive news from various vaccine developers sparked hope of a return to some degree of normality soon. So, it should come as no surprise that this rally was underpinned mainly by those who lost out in the crisis so far. The fact that this rotation of stocks and the shift in outperformance of value over growth coincided with record numbers of Covid-19 cases, the return of tighter restrictions and a potential economic double-dip in Europe is a manifestation of the current market euphoria and is also reflected in the sentiment indicators.

We are also conscious of the potential risk of overexuberance, but we are confident that, in addition to the generally positive seasonal factor and the ongoing support from central banks, the cumulative good news will ensure further equity gains in the next two to three months. Having tactically reduced our equity allocation ahead of the U.S. election, we very quickly closed the hedges with a small gain and increased the equity exposure to the maximum possible extent. In addition to an attractive mix of technology stocks and cyclicals, we turned to the emerging market index to construct the equity portfolio for the first time in a long time. We further reduced the exposure to bonds. In particular, we sold short-dated European securities with a very low yield. Even though interest rate hopes that were sparked by the imminent prospect of a vaccine quickly faded, we must honestly expect the economic recovery that is under way to cause the yield curve to steepen slightly. However, we do not consider it necessary to engage in duration management on that front.

Where we did need to act, however, was in relation to our gold allocation. We had anticipated the price to consolidate above the 200-day moving average line, but this did not happen. After temporarily breaking out above this line, we reduced the exposure to a neutral allocation of 4%. We would have to have good fundamental reasons and there would have to be a reversal in the price trend for us to overweight it again.

There were no major changes in the currency exposure. We retain our Swiss franc and Japanese yen positions for diversification purposes.

Overall, the Ethna-AKTIV was able to participate in the market gains with very positive results, thanks to our having rapidly adapted the portfolio – which had been relatively neutral at the beginning of the month – to the prevailing market environment.

Ethna-DYNAMISCH

The U.S. presidential election and global developments in the Covid-19 pandemic made it an eventful month. The growing certainty that Joe Biden would become the 46th President of the U.S on 20 January 2021 caused global equity markets to advance strongly at the beginning of November. The return of political rectitude to the office of the President and the likelihood of a split Congress contributed in no small measure to the euphoria. With the House of Representatives held by the Democrats and a Republican majority in the Senate, the implementation of single-party policies, such as the tightening of corporate tax legislation, will be curtailed in the coming legislative term. The positive results released on 9 November in relation to the efficacy of the Pfizer/BioNTech coronavirus vaccine also provided a boost. Bolstered by the results of further trials by Moderna and AstraZeneca/Oxford, the news triggered a sustained rally in November, in particular in the stocks of those who had lost out in the Covid-19 crisis.

At the beginning of November, we built up tactical exposure to one market segment of these very Covid-19 losers – European banks – using call options. Once their prices had substantially recovered over the course of the month from their excessive falls due to the pandemic, we successively closed these opportunistic positions at the end of November. Similarly, our stock selection – with its focus on companies with lasting quality, which, although they are suffering under the current Covid-19 restrictions, should exhibit long-term structural growth – paid off in the recent rise. We took advantage of the market reactions to the prospect of overcoming the pandemic to take profits on companies directly affected by the lockdown (e.g. fitness centre chain Planet Fitness) and to expand on our positions in cyclicals (e.g. BASF). In addition, we took advantage of Activision Blizzard’s months of consolidation to take up a position in the computer and video game company. Even though the pandemic clearly gave Activision Blizzard a tailwind, we are also confident of the company’s long-term success heading into a new console cycle and a series of new game enhancements.

On the back of the above series of market-friendly events, current sentiment has become (almost) overly optimistic. Bad news stories and the ongoing concerns about Covid-19 (especially in the winter months) may lead to temporary setbacks in equity markets. In the coming days and weeks, we will keep a close eye on this trend and employ tactical hedging instruments if necessary. However, we remain confident of the medium- and long-term arguments in favour of equity investment. Once we have effective vaccines the pandemic will pass, economic recovery will be expedited by monetary and fiscal policy, companies will benefit next reporting season from pent-up demand and favourable base effects and it will still be the case that, in an environment of low interest rates, equities will remain the instrument of choice with an adequate risk/return profile.

Figure 3: Portfolio structure* of the Ethna-DEFENSIV

Figure 4: Portfolio structure* of the Ethna-AKTIV

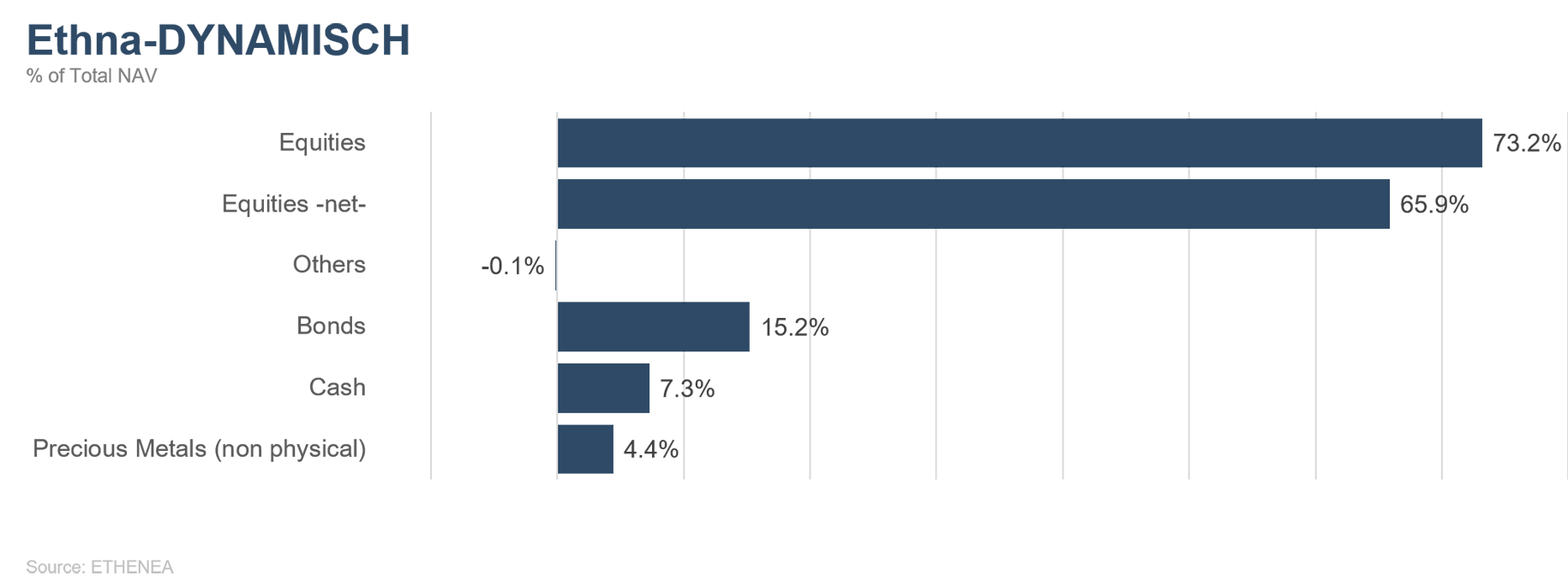

Figure 5: Portfolio structure* of the Ethna-DYNAMISCH

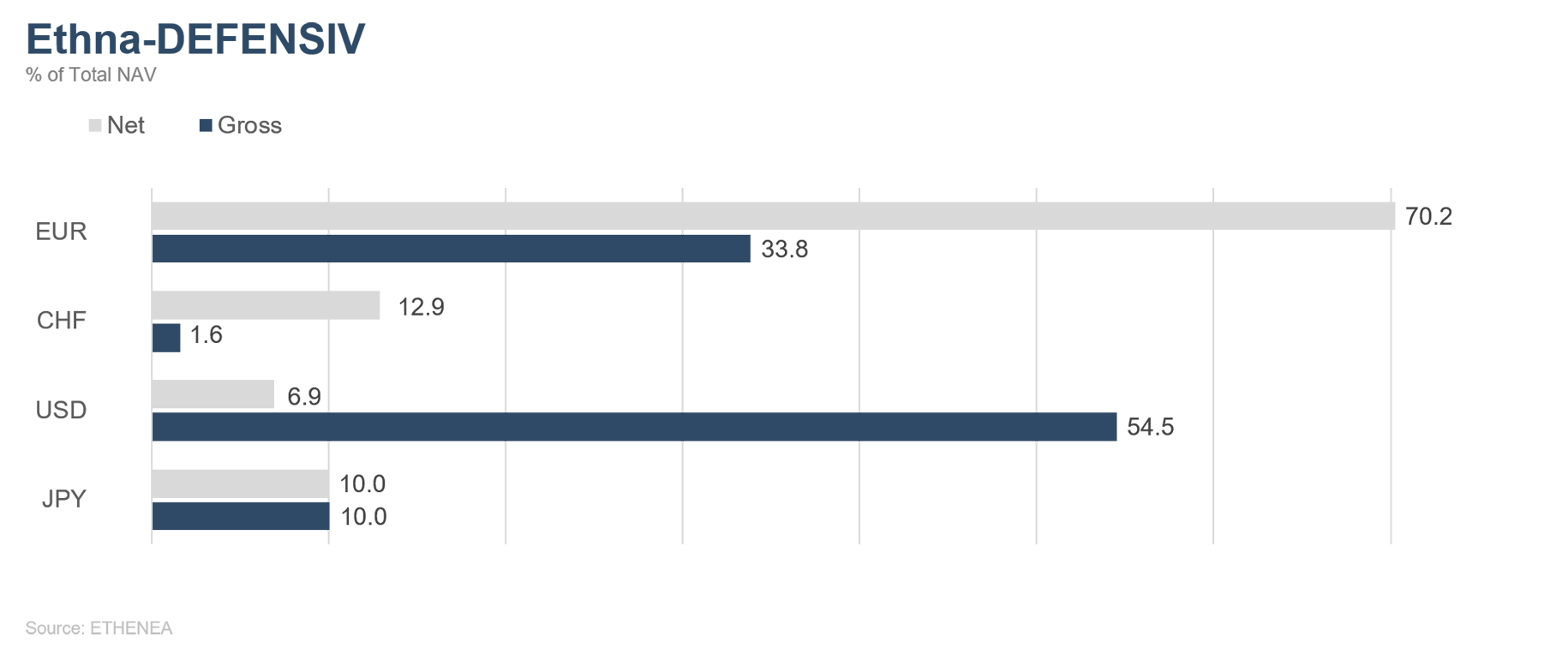

Figure 6: Portfolio composition of the Ethna-DEFENSIV by currency

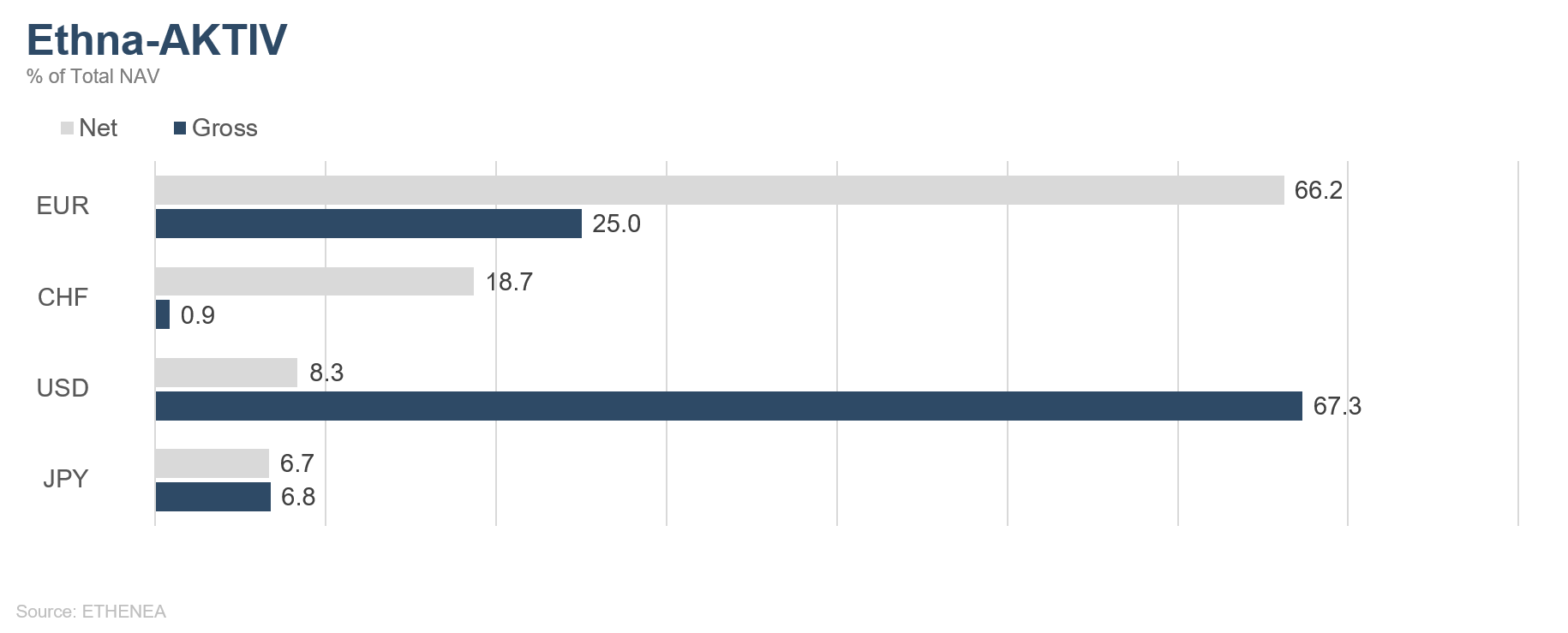

Figure 7: Portfolio composition of the Ethna-AKTIV by currency

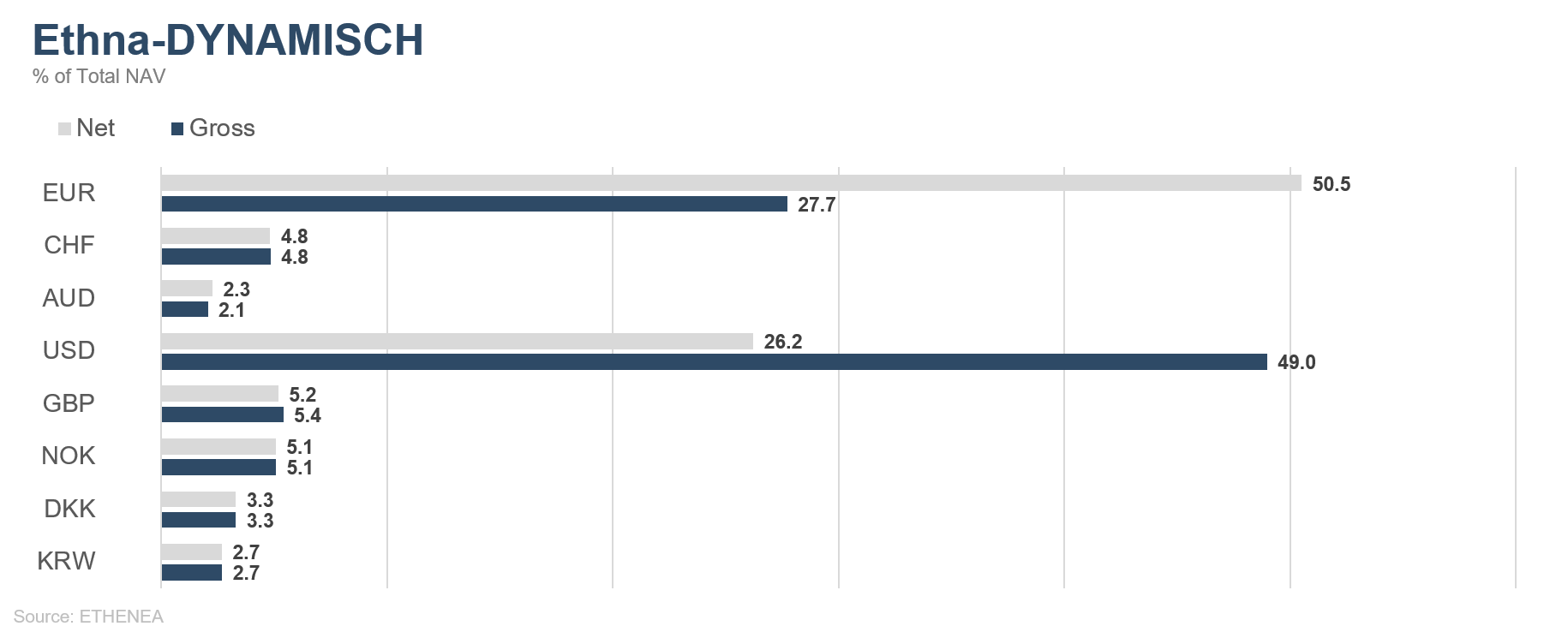

Figure 8: Portfolio composition of the Ethna-DYNAMISCH by currency

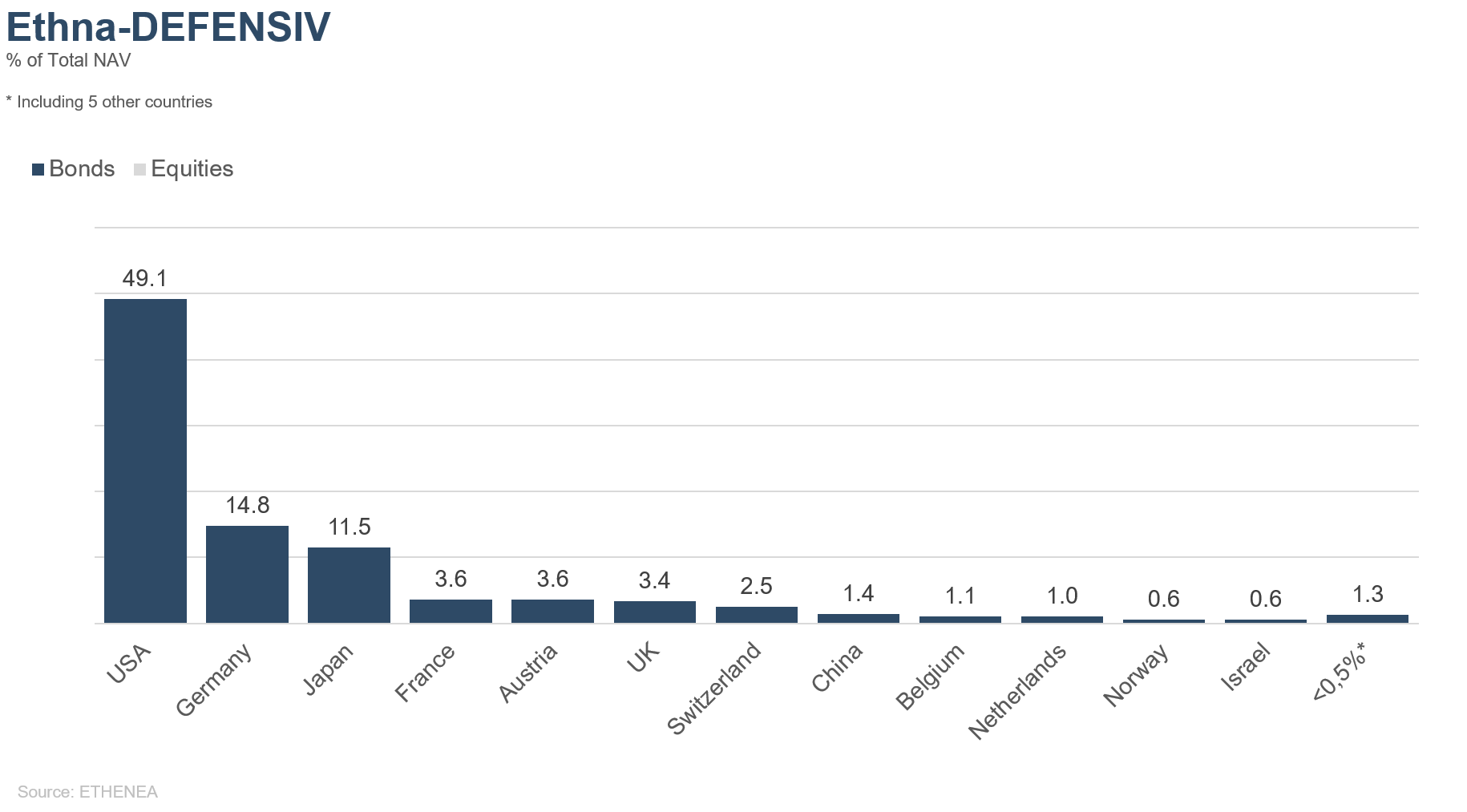

Figure 9: Portfolio composition of the Ethna-DEFENSIV by country

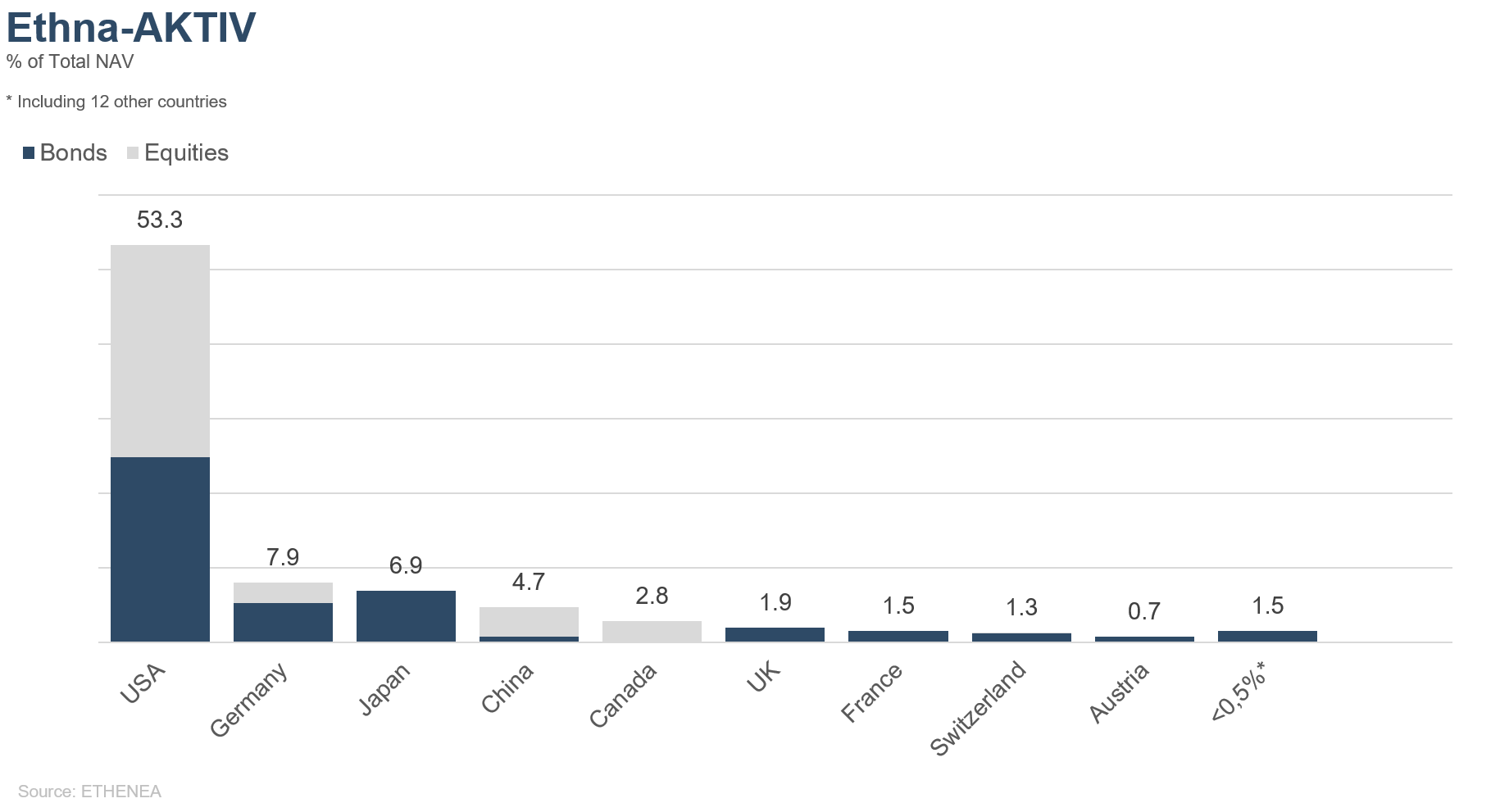

Figure 10: Portfolio composition of the Ethna-AKTIV by country

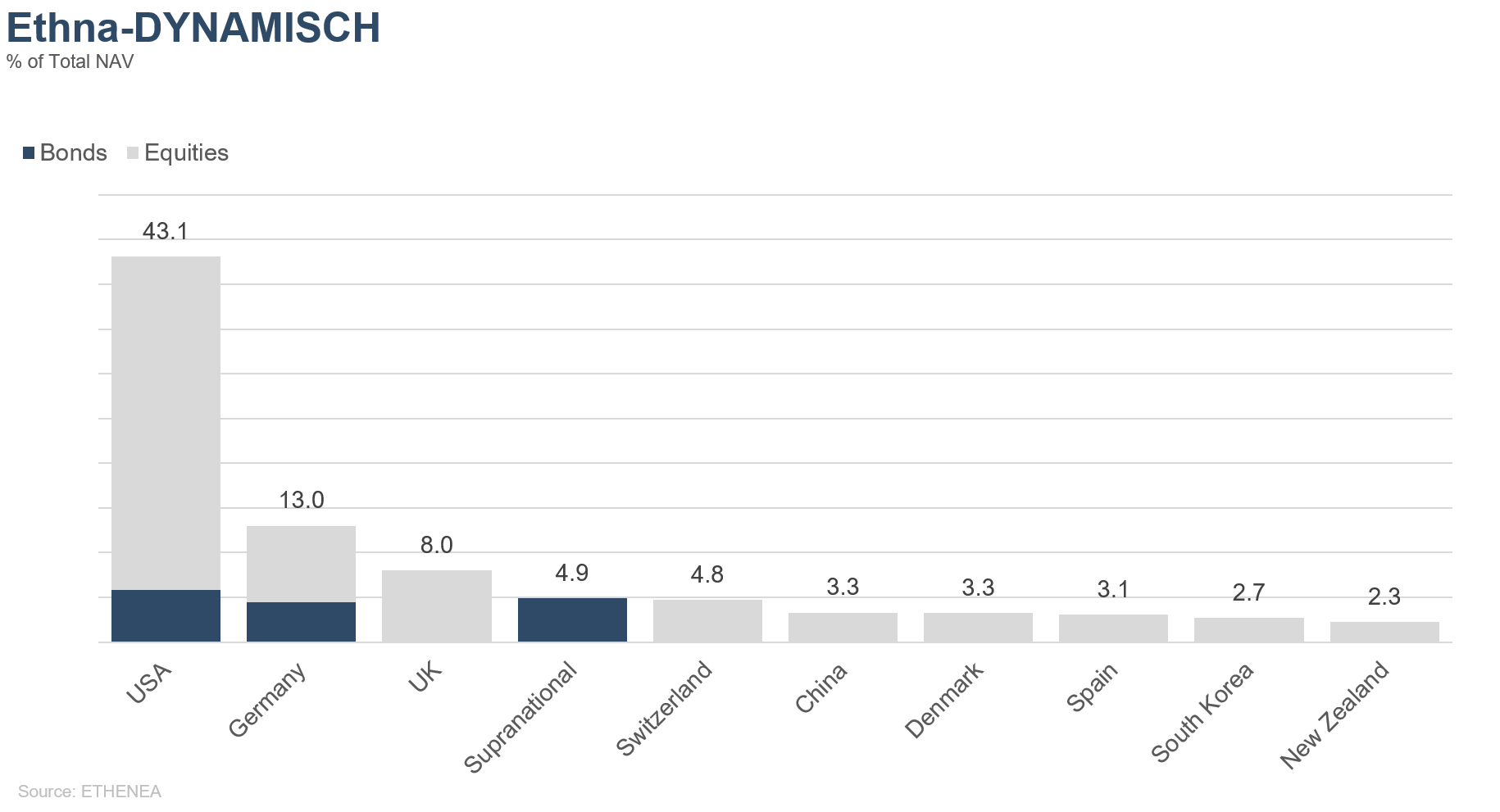

Figure 11: Portfolio composition of the Ethna-DYNAMISCH by country

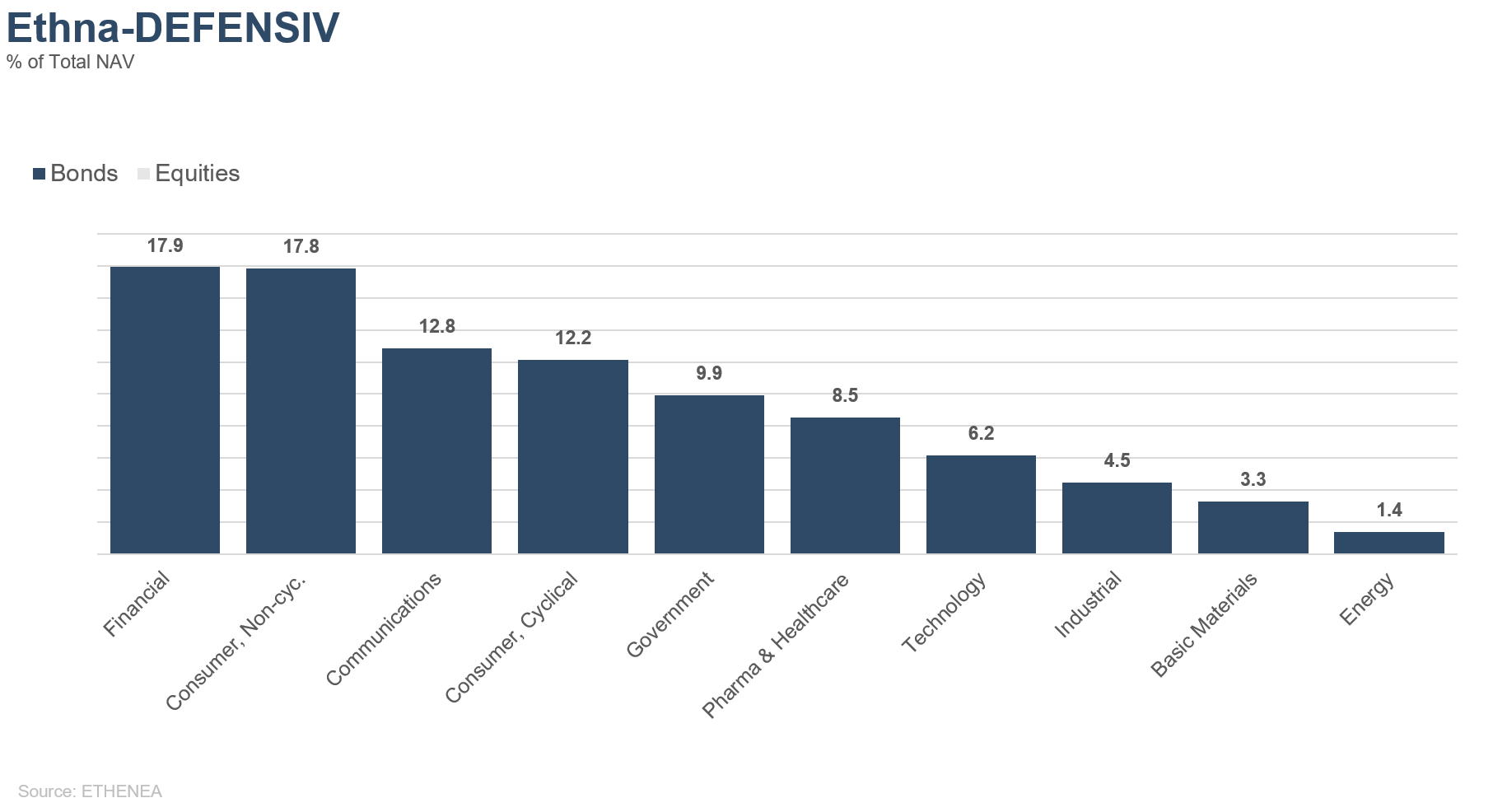

Figure 12: Portfolio composition of the Ethna-DEFENSIV by issuer sector

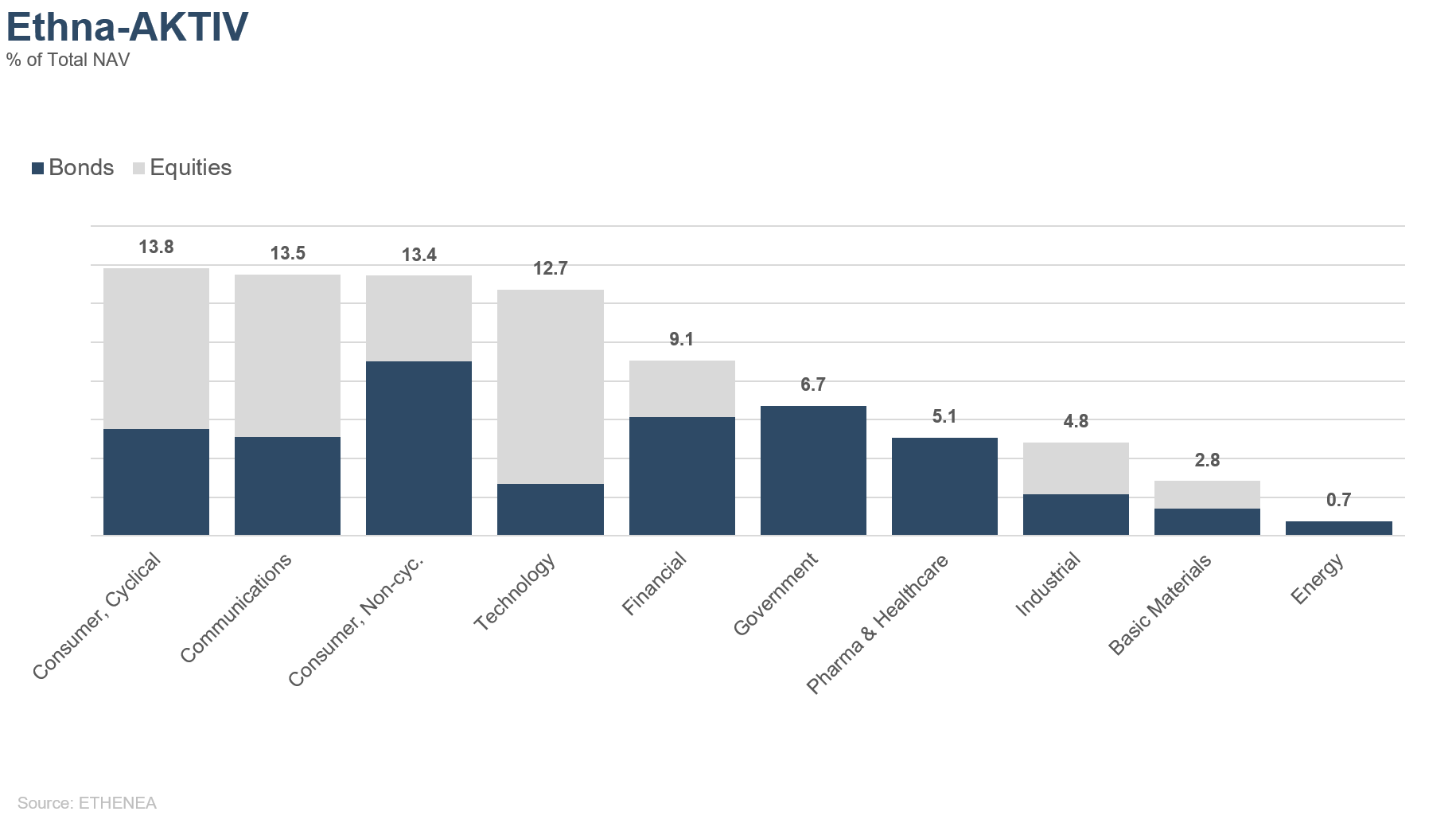

Figure 13: Portfolio composition of the Ethna-AKTIV by issuer sector

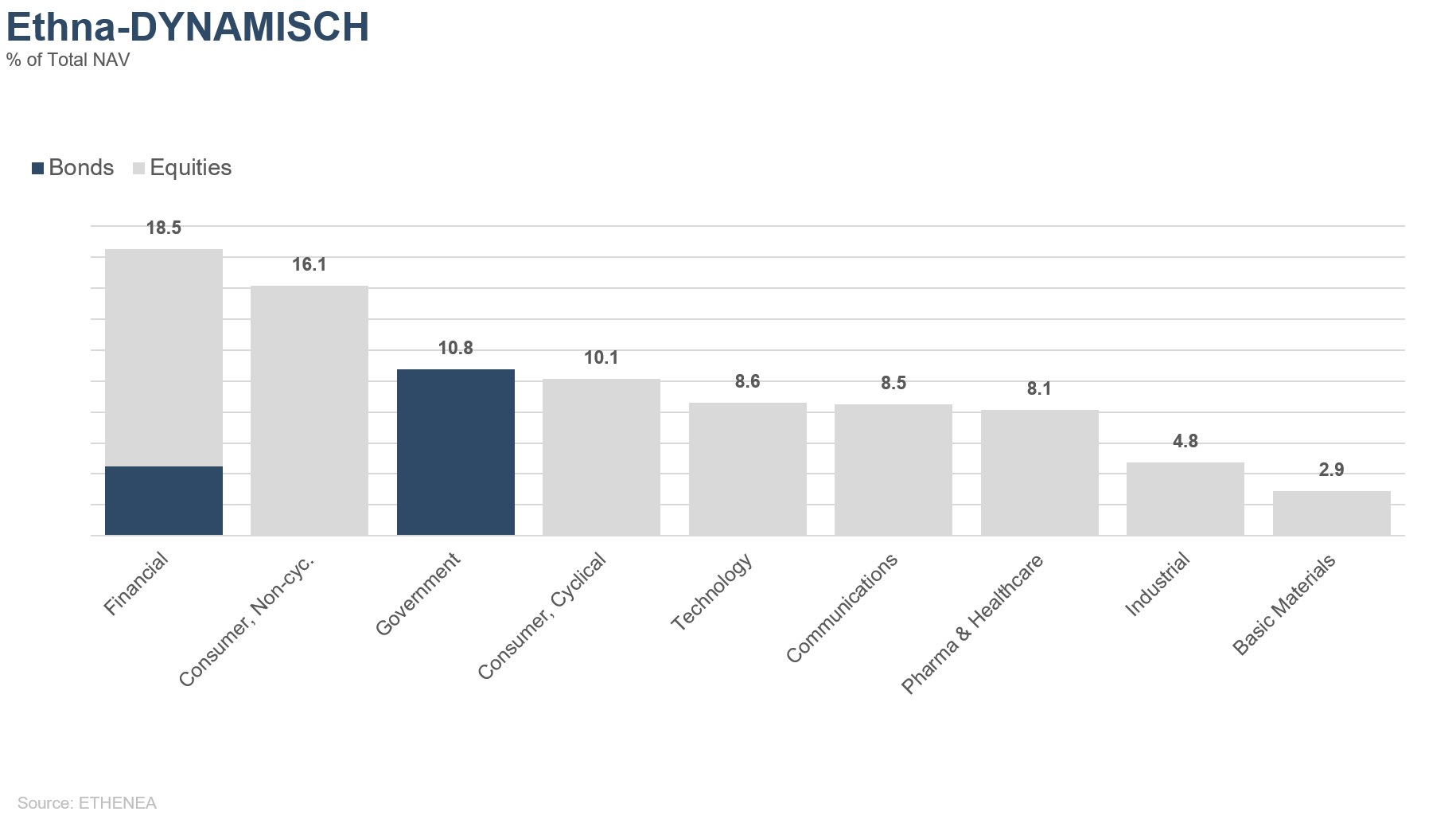

Figure 14: Portfolio composition of the Ethna-DYNAMISCH by issuer sector

* “Cash” comprises term deposits, call money and current accounts/other accounts. “Equities net” comprises direct investments and exposure resulting from equity derivatives.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

La presente es una comunicación promocional. Tiene exclusivamente para transmitir información del producto y no constituye un documento exigido por la ley o la normativa. La información incluida en el presente documento no representa una solicitud, oferta o recomendación para comprar o vender acciones del fondo o para realizar cualquier otra transacción. Su objetivo no es otro que ayudar al lector a entender las características principales del fondo como, por ejemplo, el proceso de inversión y no pretende ser, en todo o en parte, una recomendación de inversión. No sustituye a su propia consideración ni a otra información y asesoramiento de carácter legal, fiscal o financiero. Ni la sociedad gestora ni sus empleados u órganos podrán ser considerados responsables de las pérdidas incurridas, directa o indirectamente, por el uso del contenido del presente documento o en relación con este. Los documentos de venta actualmente vigentes en alemán (folleto, documentos de datos fundamentales (PRIIPs-KIDs), junto con los informes anual y semestral), en los que figura información detallada sobre la suscripción del fondo y los riesgos y las oportunidades y riesgos relacionados, constituyen la única base vinculante para la suscripción de acciones. Los mencionados documentos de venta en alemán (así como sus versiones no oficiales traducidas a otros idiomas) pueden consultarse en www.ethenea.com y obtenerse de forma gratuita en la sociedad gestora, ETHENEA Independent Investors S.A. y el depositario, así como en los respectivos agentes de pago o de información de cada país y el representante en Suiza. Los agentes de pago o de información son los siguientes para los fondos Ethna-AKTIV, Ethna-DEFENSIV y Ethna-DYNAMISCH: Alemania, Austria, Bélgica, Liechtenstein, Luxemburgo: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxemburgo; España: ALLFUNDS BANK, S.A., C/ Estafeta, 6 (la Moraleja), Edificio 3 – Complejo Plaza de la Fuente, ES-28109 Alcobendas (Madrid); Francia: CACEIS Bank France, 1-3 place Valhubert, F-75013 Paris; Italia: State Street Bank International – Succursale Italia, Via Ferrante Aporti, 10, IT-20125 Milano; Société Génerale Securities Services, Via Benigno Crespi, 19/A - MAC 2, IT-20123 Milano; Banca Sella Holding S.p.A., Piazza Gaudenzio Sella 1, IT-13900 Biella; Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Suiza: Representante: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Agente de pagos: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. Los agentes de pago o de información son los siguientes para HESPER FUND, SICAV - Global Solutions: Alemania, Austria, Bélgica, Francia, Luxemburgo: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxemburgo; Italia: Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Suiza: Representante: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Agente de pagos: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. La sociedad gestora podrá rescindir los acuerdos de distribución vigentes con terceros o retirar los permisos de distribución por razones estratégicas o exigidas por ley, respetando los plazos. Los inversores pueden obtener información sobre sus derechos en el sitio web www.ethenea.com y en el folleto. La información se encuentra disponible en alemán e inglés y, en ciertos casos, también otros idiomas. Creado por: ETHENEA Independent Investors S.A. Se prohíbe transmitir el presente documento a personas domiciliadas en países en los que la distribución del fondo no está permitida o en los que se requiere autorización para su distribución. Las acciones únicamente podrán ofrecerse a personas de dichos países si la oferta cumple con las disposiciones legales aplicables y se garantiza que la distribución y publicación del presente documento, así como la oferta o venta de acciones, no están sujetas a ninguna restricción en la jurisdicción en cuestión. En particular, el fondo no se ofrece ni en Estados Unidos de América ni a personas estadounidenses (en el sentido de la norma 902 del Reglamento S de la Ley de valores de EE. UU. de 1933, en su versión vigente) ni a personas que actúen en representación, por cuenta o en beneficio de una persona estadounidense. La rentabilidad histórica no debe considerarse una indicación o garantía de la rentabilidad futura. Las fluctuaciones del valor de los instrumentos financieros subyacentes, sus rendimientos y las variaciones de los tipos de interés y los tipos de cambio implican que el valor de las acciones de un fondo y los rendimientos que de ellas se derivan pueden incrementarse o disminuir, y no están garantizados. Las valoraciones incluidas en el presente documento se basan en varios factores, entre los que cabe incluir los precios actuales, la estimación del valor de los activos subyacentes y la liquidez del mercado, así como otros supuestos e información disponible al público. En general, los precios, los valores y los rendimientos pueden incrementarse o disminuir, hasta la pérdida total del capital invertido, y los supuestos y la información pueden cambiar sin previo aviso. El valor del capital invertido o el precio de las acciones del fondo, así como los rendimientos y los importes de reparto derivados de este, pueden oscilar o quedar totalmente anulados. Por tanto, una rentabilidad histórica positiva (revalorización) no constituye una garantía de una rentabilidad positiva en el futuro. En particular, no puede garantizarse la preservación del capital invertido, por lo que, en caso de venta o reembolso, no se garantiza que el valor del capital invertido o de las acciones mantenidas en el fondo se corresponderá con el capital invertido inicialmente. Las inversiones en divisas están sujetas a fluctuaciones adicionales del tipo de cambio o riesgos cambiarios, es decir, la rentabilidad de dichas inversiones depende también de la volatilidad de la divisa, lo que puede incidir de forma negativa en el valor del capital invertido. Las posiciones y asignaciones pueden variar. En el cálculo se incluyen las comisiones de gestión y custodia, así como todos los demás gastos aplicados al fondo según lo estipulado en el contrato. El cálculo de la rentabilidad se basa en método BVI, es decir, no incluye la comisión de venta, los costes de transacción (como las comisiones de órdenes e intermediación) ni las comisiones de custodia y otros gastos de gestión. El resultado de la inversión sería inferior si se tuviese en cuenta la comisión de venta. No puede garantizarse que las previsiones del mercado vayan a cumplirse. Cualquier alusión a los riesgos en esta publicación no debe considerarse que constituye la divulgación de todos los riesgos o la gestión definitiva de los riesgos mencionados. En el folleto figura la descripción detallada expresa de los riesgos. No puede garantizarse la exactitud, integridad o vigencia. El contenido y la información están sujetos a la protección de los derechos de autor. No puede garantizarse que el documento cumpla todos los requisitos legales o reglamentarios estipulados para él en países distintos a Luxemburgo. Nota: los términos técnicos más importantes pueden consultarse en el glosario que figura en www.ethenea.com/glossar. Información para los inversores en Suiza: El país de origen de la institución de inversión colectiva es Luxemburgo. El representante en Suiza es IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zúrich. El agente de pagos en Suiza es DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zúrich. El folleto, los documentos de datos fundamentales (PRIIPs-KIDs), los estatutos y los informes anual y semestral pueden obtenerse de forma gratuita a través del representante. Copyright © ETHENEA Independent Investors S.A. (2024) Todos los derechos reservados. 01/12/2020