Emerging from the “annus horribilis”

In November 1992, in a speech commemorating her Ruby Jubilee on the throne, Queen Elizabeth II referred to the year as her annus horribilis. For those of us not familiar with Latin, this means a horrible year. Now that was no doubt true for Her Majesty back then, given the separations, book deals, and bad press that plagued the House of Windsor at the time, but today, a little more than 28 years later, I think most of us would agree that the mantle of horrible year has well and truly been passed on to 2020.

Last year will go down in the annals of history as the year in which the Sars-CoV-2 virus pandemic infected more than 50 million people, resulted in the loss of upwards of a million lives, and caused considerable suffering worldwide. It will also be remembered as the year of the ‘great lockdown’ – a necessary measure, but one that had significant repercussions for the global economy. Never before has the modern globalised world had to grapple with a crisis of this nature – a large-scale health emergency coupled with an extensive negative economic shock that impacted both the supply and demand sides. This shock primarily resulted from the measures put in place to protect lives, curb the pandemic, and prevent public health systems around the world from becoming overwhelmed or even collapsing. Yet widespread factory closures disrupted supply chains, while job losses and containment measures have curtailed overall demand, in particular in the service sector.

On the plus side, policy makers responded very quickly and in an unprecedented manner to what can be only be described as the worst economic crisis since the Great Depression. In doing so, they not only provided global fiscal support to the tune of USD 12 trillion and counting, but they also introduced extremely supportive monetary policy measures, such as interest rate cuts, asset purchase programmes and liquidity injections. These measures have been instrumental in preventing the current crisis from becoming an economic depression.

An ever-evolving situation

We are still facing an extremely challenging situation that is constantly evolving. Although the global economy experienced a strong rebound in the third quarter of 2020, due to eased lockdowns and the rapid deployment of policy support, we have only seen a partial and uneven recovery. With it now being hit by a second wave, we expect the fourth quarter to show a further contraction in economic activity. Hardest hit by the pandemic, and the resulting containment and social distancing measures, has been the service sector, in particular the hospitality and leisure sectors. With the exception of China, which was able to control the spread of COVID -19, we expect the output in both the advanced and emerging economies to remain well below the 2019 level as we head into 2021.

With the world now experiencing a second COVID -19 wave, in which the European and US economies are being hit particularly hard, it is clear that full economic recovery is dependent on our ability to control and cure the virus. More specifically, this means effective, reliable and affordable vaccines that are distributed on a global level. The news towards the end of last year about the development and initial roll-out of effective COVID -19 vaccines gave hope that the situation would progressively improve going into 2021. However, the road to the commercialisation and distribution of the vaccines is still a long and uncertain one, and we could see cycles of accelerating viral spread and increasing containment measures before widespread immunity is achieved. It is also essential that sufficient policy support remains in place for an extended period in order to mitigate the economic impact of the crisis and, in effect, bridge the gap until a large-scale vaccine roll-out.

How does the coronavirus crisis compare to the Global Financial Crisis?

Before we take a look at our expectations for the coming year, let’s briefly discuss how the Global Financial Crisis (GFC) of 2008/2009 compares to the current situation.

A decade ago, during the GFC, we experienced a crisis of the system. It was triggered by an endogenous (or internal) shock – a combination of financial deregulation, a long period of accommodative monetary policy, a credit boom, and high levels of debt associated with the effects of large and increasing global imbalances. The global economy expanded by 3% in 2008 then contracted by -0.6% in 2009, with the recession largely centred in the US, Europe and the advanced economies. By and large, financial crises tend to result in long-lasting damage to the economy and permanent losses in output. Following a financial crisis, economies need both time and the appropriate policies to repair balance sheets and reduce the leverage that accompanies a credit boom. However, in the aftermath of the GFC, fiscal policies were not particularly supportive, as the authorities were concerned about the high levels of private and public debt, while the ECB – troubled by a temporary increase in inflation – even raised interest rates.

This time, however, the situation is different. The crisis originated from an exogenous (or external) shock, comparable to a natural disaster or war. Economic policy has been extremely supportive and with the financial sector (so far) not only relatively unaffected but also benefitting from very supportive monetary tools, we can expect the effects of the crisis to be more profound but shorter-lived than those of the GFC. To illustrate this, in October 2020 the IMF projected that the global economy will contract by -4.4% in 2020 and will rebound to +5.2% in 2021.

So, what can we expect in 2021?

Our base scenario for 2021, is one of a progressive economic recovery supported by advances in the development of effective COVID-19 vaccines and the extension of expansionary economic policies. However, the initial rebound will be asynchronous and uneven across regions and countries. As a result, we expect to see outperformance from those countries that are best able to control the pandemic (and emerge from it earlier), countries with the financial resources to provide sufficient fiscal support, and from the most flexible economies.

However, the crisis is likely to leave its mark well into the medium term. Precautionary savings are likely to increase and consumer spending will remain moderate for some time, particularly in the service sector and other areas impacted by social distancing measures. Uncertainty and balance sheet issues will affect corporate investment and the labour market will need time to recover. Therefore, the anticipated rebound in global economic activity in 2021 of between +4.5% and +5.0% could be followed by a more moderate growth path.

In our view, there are several areas that will play an important role in 2021.

The development of COVID-19 vaccines

As mentioned previously, the development and distribution of coronavirus vaccines will play a crucial role in both reducing the uncertainties on the road to economic recovery and in supporting the financial markets. Although the news so far in this respect has been positive, we believe that in the near-term we will face further volatility before effective vaccines are systematically rolled out globally. Following the news late last year of a vaccine that demonstrated a more than 90% efficacy in preventing symptomatic infections, we saw a strong reaction from the markets. Risk assets were propelled to new highs while safe havens were sent into a tailspin. The news also resulted in a geographical and sectoral rotation from the leaders of 2020 to the laggards, as the latter are likely to benefit most from a normalisation of the health situation and a reopening of the economies. This phenomenon could continue for some time, as the valuation gaps are quite significant. However, growth dynamics and the ability of sectors to generate returns, will determine outperformance ability once things begin to normalise.

The Biden Presidency

Although the dominant story for most of the year was the coronavirus, in the final quarter of 2020 all eyes turned towards the US presidential race. With Joe Biden now confirmed as the 46th President of the United States, the big question is what impact this change in administration will have on the financial markets.

In November, the Democrats retained control of the House of Representatives and, in a surprising turn of events, took both Senate seats in Georgia’s run-off elections this month, giving them the narrowest margin of control in the Senate. With the Democrats now controlling both the House and the Senate, the Biden administration will have a greater scope for enacting its political agenda. This so-called “blue sweep” - the Democrats holding the Presidency and both chambers of Congress - is initially seen as positive for the markets, as it is likely that the Democrats will provide the US economy with a larger fiscal stimulus. However, the markets will need to balance the positive effects resulting from the stimulus against the risk that the Biden administration will be more likely to pass some of the most controversial items from its campaign agenda, such as reversing corporate tax cuts or imposing tougher antitrust legislations.

In terms of international affairs, we expect the Biden administration to be less controversial and confrontational than that of Trump. It is likely to undo some of the previous administration’s policies, such as re-joining the World Health Organization and the Paris climate accord. And it will definitely be a stronger supporter of multilateralism. On the trade front, we expect the Biden administration to recalibrate the US approach with traditional partners. In the near term, we don’t expect any major changes in the US – Chinese relationship but a more reliable and programmatic approach, which should avoid reigniting the recent trade war.

Economic policy support

Monetary and fiscal policy support will continue to be a key factor for economic performance in 2021. Given the current environment of depressed economic growth, along with inflation that continuously undershoots central bank targets, we expect monetary policy to remain accommodative over the long term. In our view, central banks will continue to develop and implement unconventional policies to achieve their targets of price stability and maximum employment. Despite the large (and ever increasing) fiscal deficits, particularly in the advanced economies, the authorities have so far avoided the mistake of tightening fiscal policies too soon. The closer alignment between fiscal and monetary policies that we have seen so far in this crisis (together with the development of effective and reliable vaccines) could be successful in pulling the global economy out of the recession and avoiding the risk that western advanced economies will experience a ‘japanification’¹. Once the economic recovery takes hold, it will be interesting to see whether and how central banks will be able to withdraw the monetary stimulus and tighten monetary policy in an environment of very high public and private debt.

So, what does all of this mean for the markets? In the event of a successful roll-out of coronavirus vaccines, along with proven efficacy in the field, we expect a relatively benign scenario of synchronized global recovery for the second half of the year. Supported by expansive economic policies and the easing of COVID-19 related restrictions, this should result in a re-emergence of investors’ risk appetites and an overall positive year for the stock markets and other risk assets, including the corporate credit markets and high yields. This scenario would also be positive for emerging markets, which would see a recovery of capital inflows to their economies. We would also expect government yields to increase from the very low levels reached last year in the aftermath of the crisis. However, with low inflation, an uncertain recovery, and high debt levels, central banks will be (very) patient before raising interest rates and will avoid higher yields that could prematurely disrupt the recovery. We therefore expect only a moderate steepening of the yield curves in the advanced economies.

So far so good. However, there are several risks that could impact this scenario. The first, and most obvious, is an increase in the global spread of the coronavirus. This would lead to a rise in the number of hospitalisations and could spur governments in those areas hit hardest to introduce new, stricter and more prolonged lockdowns, with the result that we would see a slower and even more uncertain recovery.

Were we to see a premature withdrawal of policy support before the economic recovery has firmly taken hold, in particular a fiscal policy tightening in the major economies, this would also negatively impact both the global economy and financial markets. Premature tightening of monetary policies would also have very negative effects on the global economies and on financial markets that are particularly vulnerable in a highly leveraged environment.

And finally, geopolitical risks will again be instrumental in shaping the markets in 2021. Although with the change in US administration, we could expect to see fewer international tensions, there are still several areas for concern. These include the rise of hostility towards China, the result of the Brexit negotiations and the impact this will have on the future UK – EU relationship, the fragile situation in the Middle East and South East Asia (including North Korea) and possible tensions among the EU members relating to competition policies and the use of recovery funds.

So, what does this mean in a nutshell? The conditions for global economic recovery – low inflation coupled with very expansionary economic policies (fiscal and monetary) – are providing support for both the markets and risk assets. However, this positive market scenario could still be derailed by policy missteps, geopolitical accidents, negative news about the pandemic (such as finding out that the vaccines are ineffective or cause significant and unexpected side effects), or a disappointing economic recovery that gives rise to corporate bankruptcies. That being said, our baseline is that the positive scenario should hold firm for approximately the first six months of 2021. Should one of the aforementioned risks become more prominent, however, the balance of risks could easily tilt towards the downside at a later stage. We definitely expect 2021 to be a better year both in terms of human impact and for the global economy. Yet, only time will tell if it will also be better for the financial markets and whether it will become an annus mirabilis (wonderful year).

¹ ‘Japanification’ is a term used by economists to describe a state of chronically anaemic economic growth and feeble inflation or even deflation similar to the conditions faced by Japan since a giant real-estate bubble popped in the early 1990s. Source Bloomberg Businessweek: https://www.bloomberg.com/news/articles/2020-01-17/japanification-secular-stagnation-and-bad-bad-news-quicktake

Positioning of the Ethna Funds

Ethna-DEFENSIV

The coronavirus pandemic was the defining event of the last financial year. After a solid start to the year, with performance slightly up, the outbreak of the COVID-19 virus led to concerns about the maintenance of supply chains in addition to fears of infection. The latter resulted in the large-scale shutdown of the economy and social life in many parts of the world. In this phase, the value of the Ethna-DEFENSIV’s bonds fell dramatically. Corporate bonds became unsellable for a short period. As a result of the massive indiscriminate sell-off, even sovereign bonds lost a considerable amount of value. The price of gold also weakened significantly during this phase and even briefly dipped below its value at the beginning of the year. The Ethna-DEFENSIV was also swept up by this development, plus the hedge in the form of a long position in the Bobl future did not have the desired effect, with the result that the value of the fund fell almost 10% between 6 and 20 March.

The central banks, in particular the ECB and the Federal Reserve, quickly intervened to stabilise the bond market. Existing bond purchase programmes were extended and new ones launched. The Pandemic Emergency Purchase Programme (PEPP) was expanded multiple times, and under this scheme alone the ECB will purchase EUR 1.85 trillion in bonds by March 2022. While the programme’s focus is on bonds issued by sovereigns and supranational institutions, corporate bonds are also being purchased. In the months since the beginning of the crisis, the Federal Reserve has purchased USD 2 trillion in U.S. Treasuries and a smaller volume of corporate bonds. In addition, it cut its key rate, its target for the Fed Funds Rate, by 150 basis points back in March 2020 to its current range of 0% to 0.25%. Therefore, bonds denominated in USD benefit doubly, both from the Federal Reserve’s direct purchases and from the rate cuts. The Ethna-DEFENSIV also benefited hugely back in the first phase of the recovery from having a corporate bond weighting in the region of 80%, and year-to-date performance moved back into positive territory (T class) as early as June.

Companies with global operations in particular were affected by the uncertainty and liquidity shortages triggered by the coronavirus crisis, and they reacted quickly when central bank support began to take effect. They issued corporate bonds in record volumes to shore up their liquidity. With its cash reserves and early analyses, the Ethna-DEFENSIV was well prepared for this wave of issuance and, particularly from April to September, participated in many bond issues that had attractive interest rates from an investor point of view. This was one of the main reasons why bonds contributed more than 6% to performance for the year. However, ongoing charges, hedging transactions and the euro’s renewed strength against the Swiss franc, the U.S. dollar and the Japanese yen since March 2020 detracted from performance, bringing the Ethna-DEFENSIV’s performance for 2020 to 2.57%.

Central banks will continue with their bond purchases in 2021. This will make bonds a very secure, albeit less lucrative, source of performance for the Ethna-DEFENSIV than they were last year. Thanks to the support provided by monetary easing and government spending programmes and also due to the already very low bond yields, equities should exhibit a better risk/reward profile in 2021. For that reason, we are prepared to utilise the maximum allocation of 10% equities set out in the prospectus. We expect a positive contribution to performance from currency positions in the coming year as well. We believe that the Japanese yen in particular will do well in 2021. This view is supported firstly by the fact that Japan, and indeed the whole of Asia, better handled the coronavirus pandemic. Secondly, the creation of the largest free trading bloc in Asia, numbering 15 countries and accounting for around 30% of global economic activity as well as around 2.2 billion people, will strengthen Japan’s economy and thus the yen as well.

Ethna-AKTIV

“There are decades where nothing happens, and there are weeks where decades happen.” Attributed to Lenin (though there’s no evidence that he said it), this statement nicely sums up the events of 2020. At the end of the first quarter, the outbreak of the Covid-19 virus seemed to turn the real economy and the capital markets completely upside down. At the point when almost the entire world had ordered an economic shutdown, equity markets had already lost more than 30% in record time, despite the fact that they, like the leading U.S. S&P500 index, had just reached a new all-time high not quite four weeks beforehand. However, fiscal and monetary measures, which were approved and implemented with unprecedented speed and on a scale never seen before, not only softened the blow to the real economy but also soon brought calm to the capital markets, and new all-time highs were even recorded. The optimism that hitherto only manifested in soaring stock prices became reality once the first vaccines became available in the fourth quarter.

In terms of active participation in the capital market, last year offered a good deal of challenges and, of course, opportunities as well. Against this backdrop of uncertainty, the multi-asset fund concept adhered to by the Ethna-AKTIV once again proved successful. Equities, bonds and commodities made positive contributions to performance for the year. At the peak of the crisis, the currencies asset class delivered the greatest diversification effect, thanks to the status of the Swiss franc and the U.S. dollar as safe havens. Interestingly – and following a certain logic – it was however the only asset class to detract from performance at the end of the year, to the tune of -1.8%. On the positive side, by fully hedging the U.S. dollar exposure for much of the second half of the year we were able to avoid further losses. While selection on the equities front in 2020 had a positive effect on performance, we lost performance on allocation. Overall, equities contributed 1.83% to performance. The good allocation decisions up to the peak of the upheaval in the equity market and during the end-of-year rally were not enough to offset the initially overly cautious risk-taking in the immediate aftermath of the crisis. The movements of prices in the underinvested recovery phase were simply too great in too little time to allow for that. In terms of selection, the focus on the winners in the crisis from the technology sector helped, especially in the second half of the year. The contribution to performance of the Ethna-AKTIV’s bond portfolio paints a similar picture. The securities selected managed to avoid unexpected defaults and, in light of the measures taken by central banks, even delivered an astonishing return compared to expectations at the beginning of the year. The contribution to portfolio performance was 3.63%. However, in this case, the duration overlay to mitigate risk in the stress phase detracted 1.34% from performance. Overall, it can be said that the combination of selection, allocation and diversification decisions ultimately steered the Ethna-AKTIV relatively smoothly through very rough waters to a positive performance for the year of 1.16% (T class).

Portfolio composition for the coming year is a logical continuation of the reallocations already made over the course of the year. Due to the low interest rates, the very low risk premia and the increasingly unattractive risk/return ratio of corporate bonds as a result, we will successively further reduce their proportion of the portfolio. The proceeds will be invested in sovereign bonds and equities in such a way as to implement a sort of barbell strategy for the portfolio. On the one side, we have equities as a potential performance generator and on the other, a very conservative and robust bond portfolio with relatively few spread risks. Complementing this profile, we are maintaining our high proportion of foreign currencies for diversification purposes, but also to generate performance. This portfolio construction enables us to ensure, now and in the future, that we have the required liquidity to act and that the Ethna-AKTIV’s core pledges – active management, capital preservation and achieving an attractive risk-adjusted return – can be kept in 2021 too.

Ethna-DYNAMISCH

2020, the year of the global once-in-a-century pandemic, provided a whole decade’s worth of material on the capital market and was one thing above all else: unpredictable. That goes for the outbreak of the pandemic itself, but even more so for the worldwide measures to curb the virus. The lockdowns across much of the globe plunged the global economy into the deepest and fastest recession since World War II. Share prices also fell with record speed. In a matter of a few days of trading, the normally resilient U.S. S&P 500 Index fell into a bear market quicker than ever before in its history. In April, the stagnant global economy led to such a collapse in demand for oil that the WTI crude oil futures price closed in negative territory for the first time: USD -37.60 per barrel. But the reactions of governments and central banks were also extremely rapid and – especially in terms of the scale of the aid – simply impossible to predict. The same goes for the medical achievements in 2020. While for much of the year it was impossible to predict whether global efforts to develop a vaccine would be any way successful, at the end of year we can now report that several million people have already been vaccinated. With that said, it may not be all that surprising (or at least not all that surprising any more) that most equity markets even managed to recoup their – temporarily heavy – losses and have resumed a bull market.

Given the sheer unpredictability of events in society and in the capital markets last year, we are very pleased with the performance of the Ethna-DYNAMISCH. The concept of giving our investors risk-controlled access to the global equity markets was also a success in the exceptional year that was 2020. The fund thus brought an element of predictability to a world full of uncertainty for those investors who otherwise could not tolerate the uncontrolled market fluctuations. All three core elements of the Ethna-DYNAMISCH – active asset allocation, focused single stock selection and additional hedging components – both individually and combined made a positive contribution and helped the fund to a gain of +4.48% (T class) in 2020. In spring, bold and well-founded allocation decisions, as well as the high quality of the underlying equity portfolio and the hedging transactions helped to keep price losses to a manageable level at a time when capital markets were collapsing. At the same time, we never lost sight of the opportunities that began to emerge in the medium term from the temporary panic in the markets. Giving due consideration to risk at all times, over the summer months we further extended the cyclical components of the portfolio at the expense of more defensive elements to enable us to benefit accordingly from a subsequent economic upturn and a greater appetite for risk among market participants. In addition, the portfolio’s clear focus was on short-term losers in the crisis which should return to their structural growth paths once again in the long term. This strategy also yielded results once the vaccine breakthroughs were reported, if not before. What was important to us here was the balance between attractive growth and an appealing valuation. We deliberately left out the extremes in both cases – both in traditional value stocks and feted growth stocks. Looking back, the same can be said about the, once again surprisingly successful, bond market. Here too we were invested to a minimal extent in selected exceptional cases. Compared with the opportunities in the equity markets, in many cases we found the expected return too unattractive to consider the purchase of such securities at all as a significant investment for the Ethna-DYNAMISCH, the most offensive of the Ethna Funds.

We will conclude with a brief outlook on the forthcoming year 2021. Given the unpredictability of this past pandemic year, 2021 seems almost too predictable. A number of factors argue in favour of a continuation of the upward trends in the global equity markets that have been strengthening of late: the starting situation where it seems possible for the pandemic gradually to be brought under control, signs of strong economic growth, positive effects of the immense fiscal programmes, record-low interest rates and ongoing bond purchase programmes from the central banks as well as more and more investor groups regaining an appetite for risk. Meanwhile, at the beginning of the year, hardly anything seems to oppose this trend. We are keeping potential dangers in check mainly by weighing up (growth) opportunities against (valuation) risks in a disciplined fashion. For the time being, we see any price corrections that arise in the overall market mainly as an attractive opportunity to expand the portfolio. That said, no trend lasts forever, and so we are also curious to seeing how the relevant parameters will develop over the course of the year. The tools required to navigate these waters successfully – the Ethna-DYNAMISCH having the necessary flexibility and a well-positioned portfolio at the turn of the year – are in place and make us optimistic about the future.

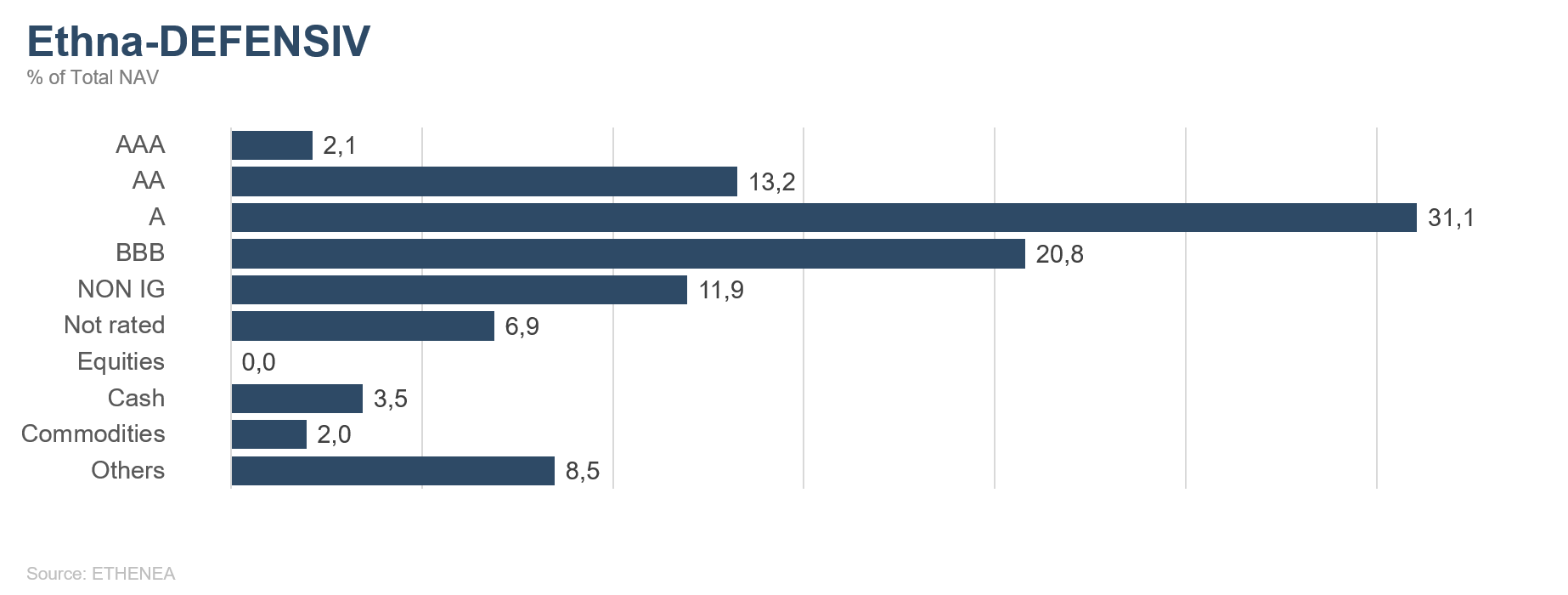

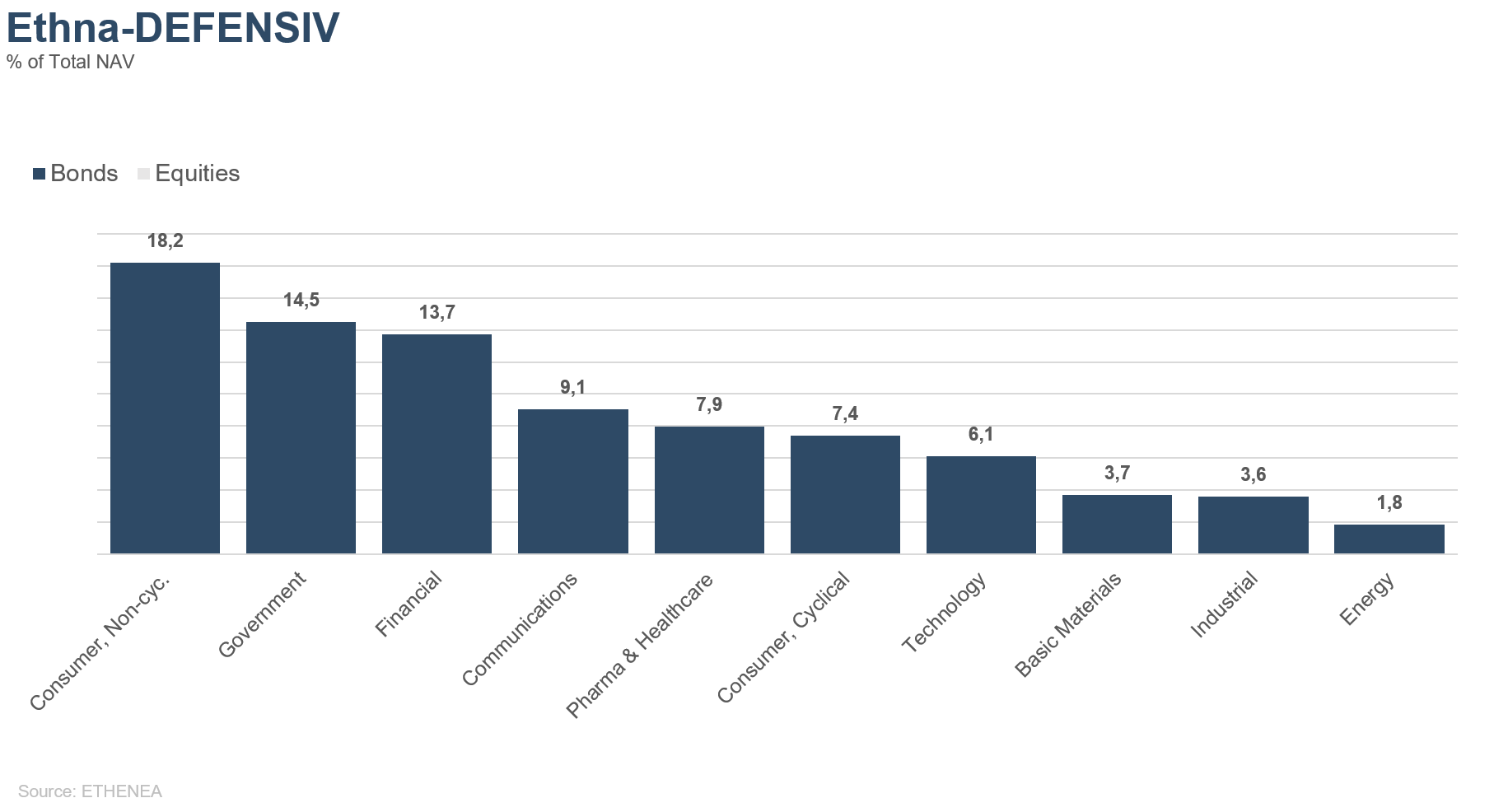

Figure 1: Portfolio structure* of the Ethna-DEFENSIV

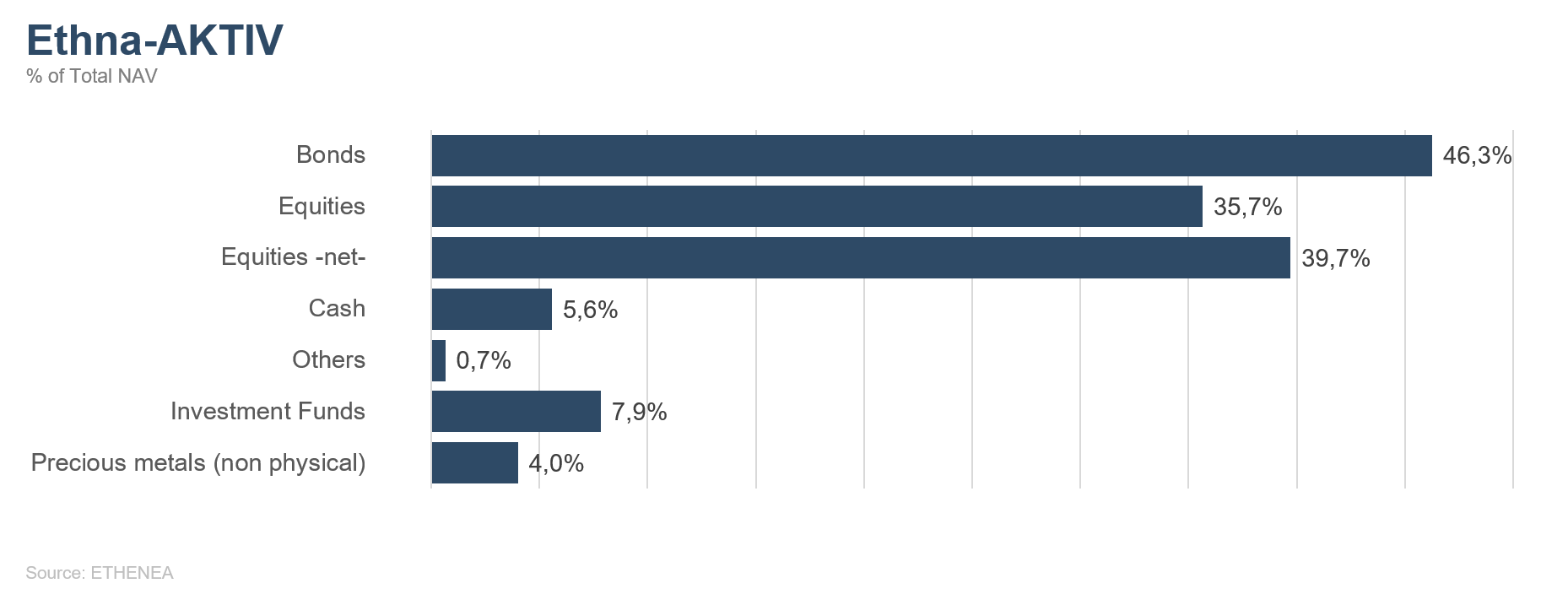

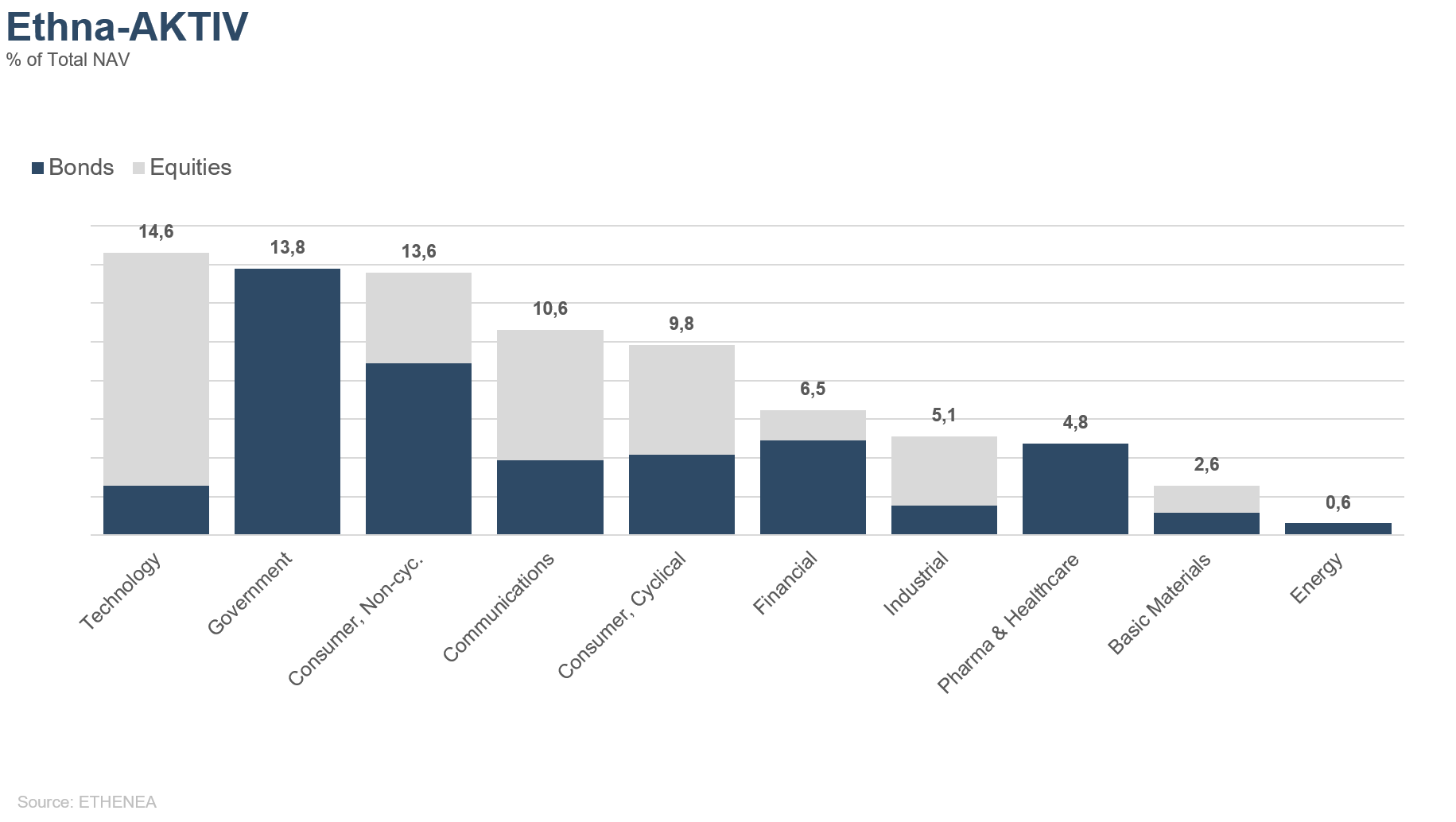

Figure 2: Portfolio structure* of the Ethna-AKTIV

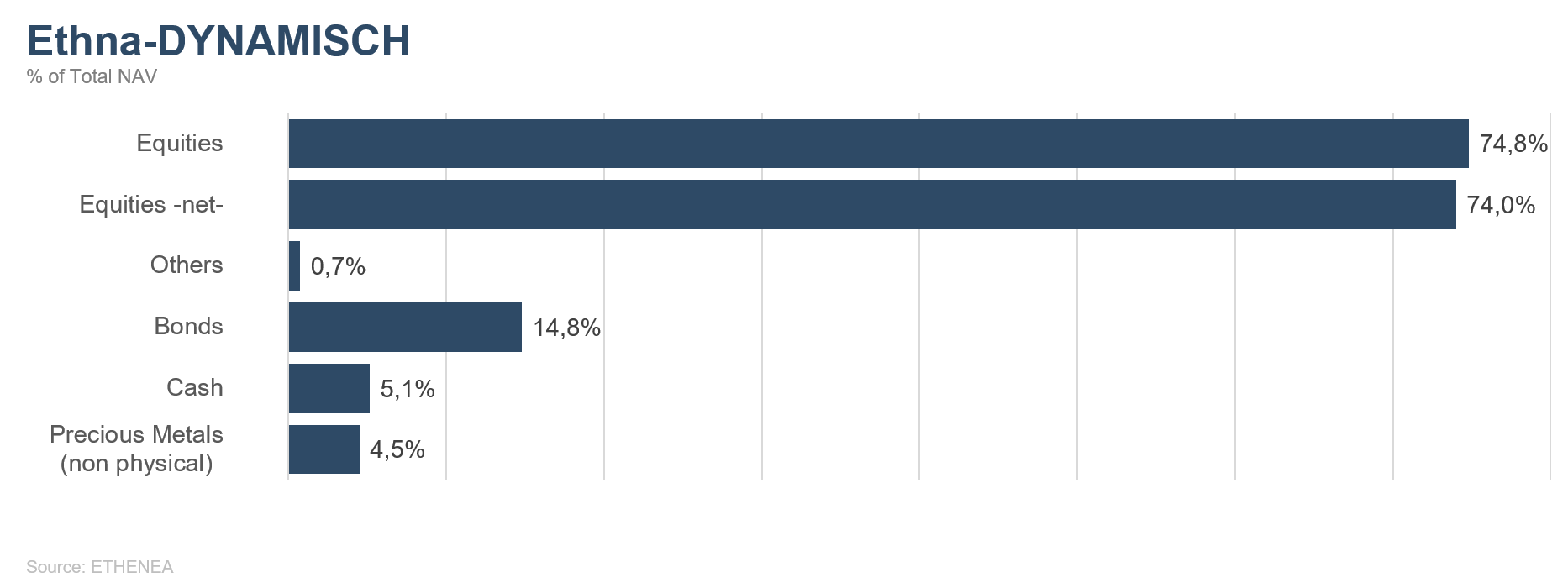

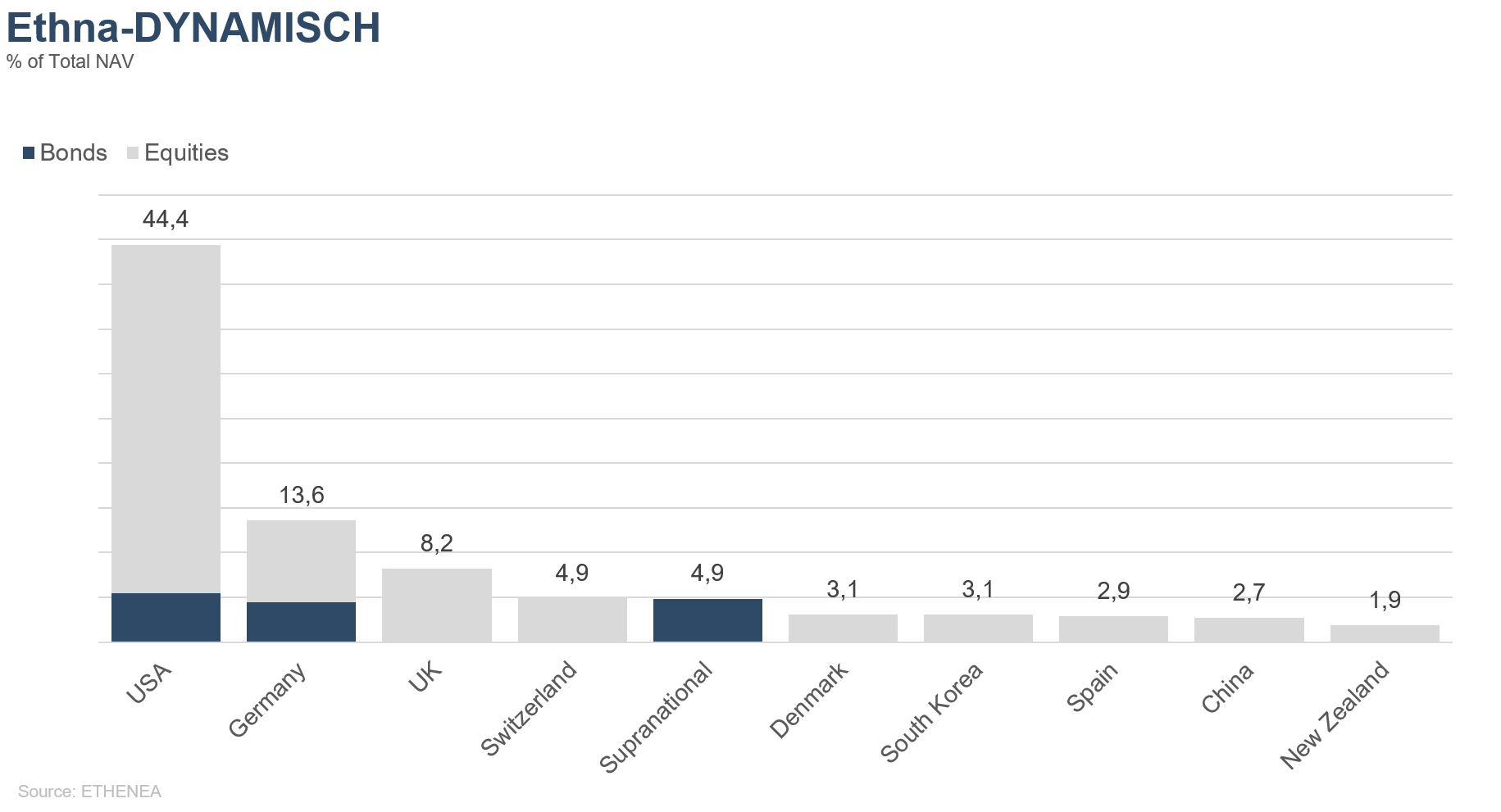

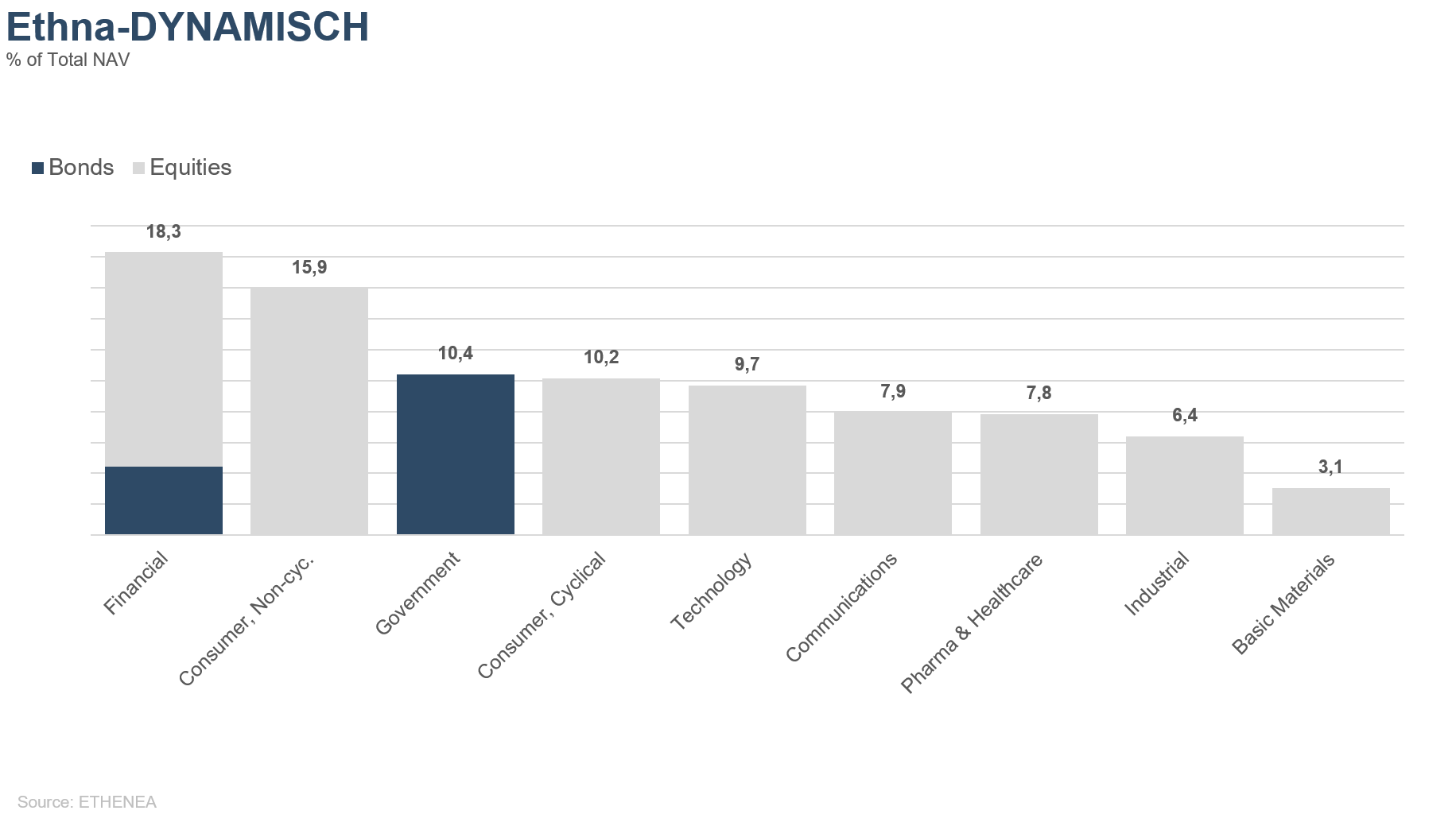

Figure 3: Portfolio structure* of the Ethna-DYNAMISCH

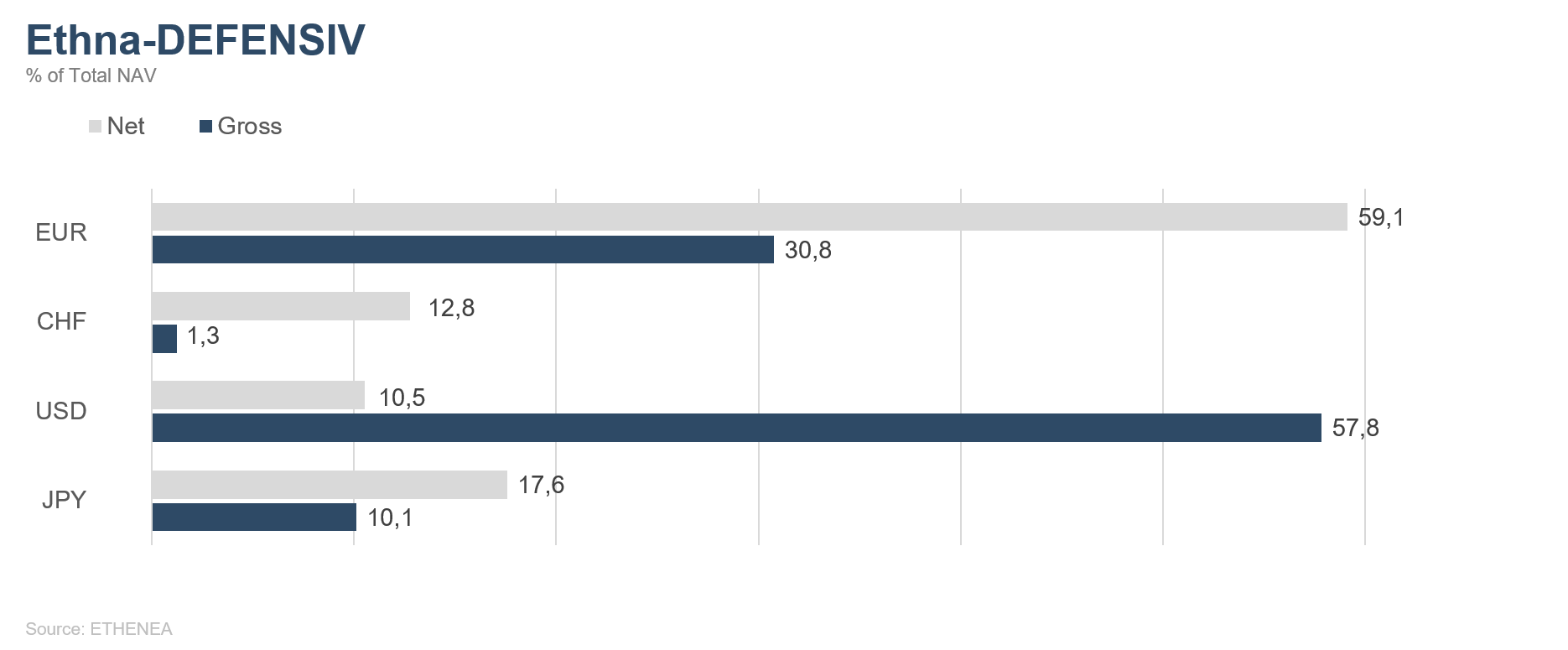

Figure 4: Portfolio composition of the Ethna-DEFENSIV by currency

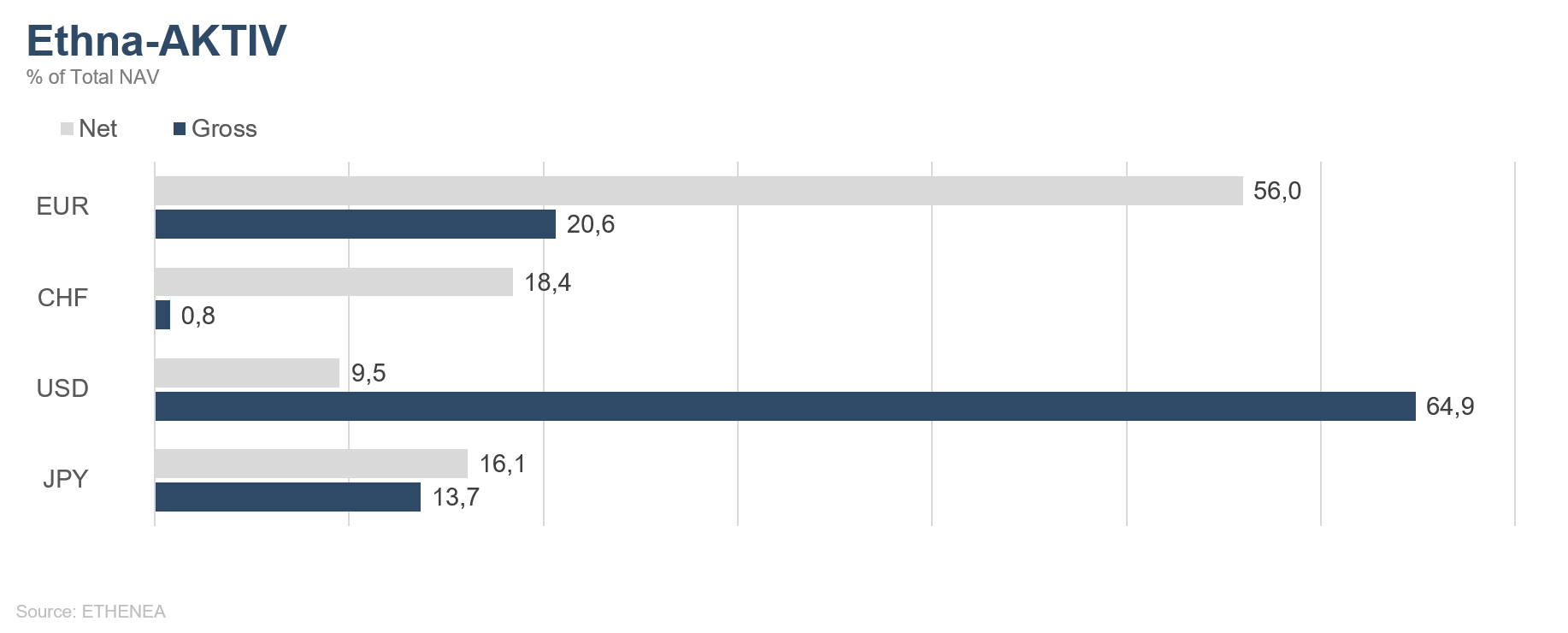

Figure 5: Portfolio composition of the Ethna-AKTIV by currency

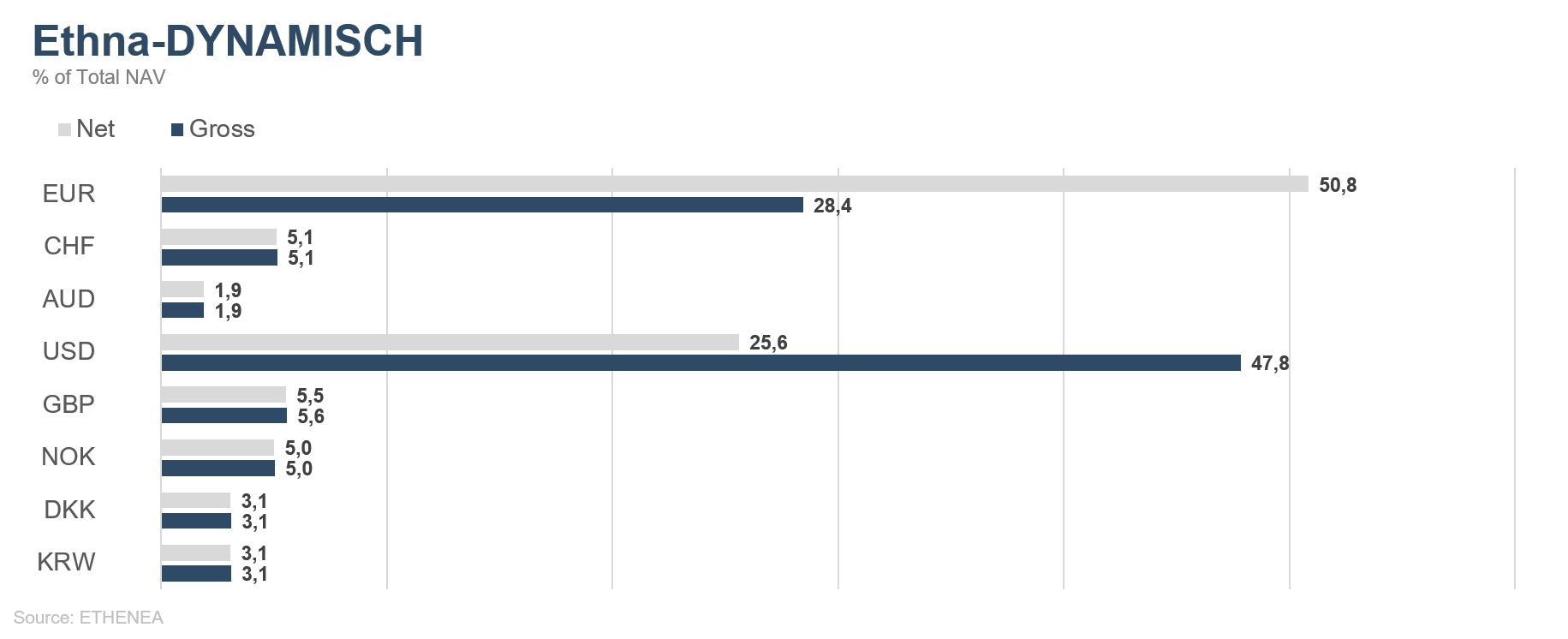

Figure 6: Portfolio composition of the Ethna-DYNAMISCH by currency

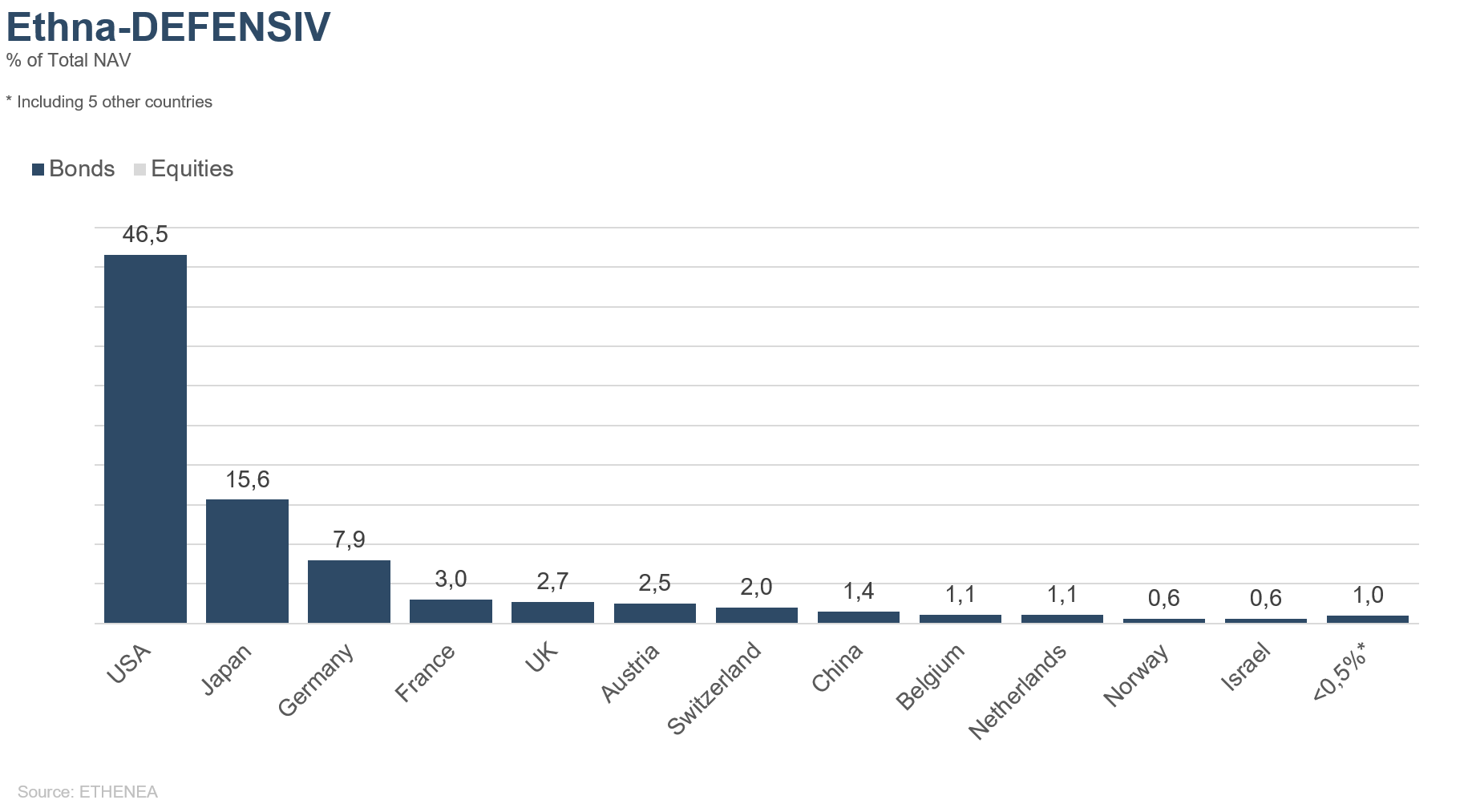

Figure 7: Portfolio composition of the Ethna-DEFENSIV by country

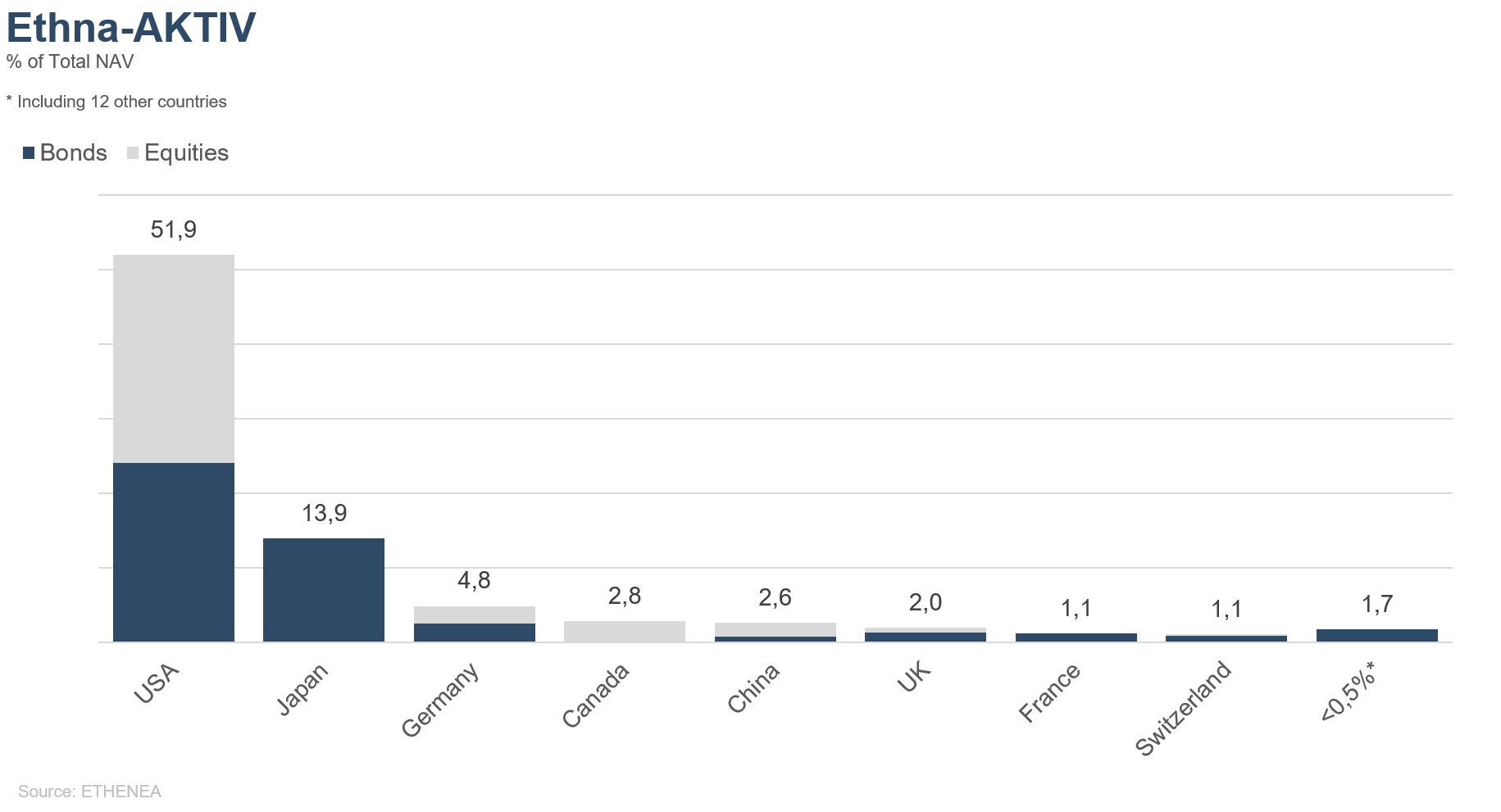

Figure 8: Portfolio composition of the Ethna-AKTIV by country

Figure 9: Portfolio composition of the Ethna-DYNAMISCH by country

Figure 10: Portfolio composition of the Ethna-DEFENSIV by issuer sector

Figure 11: Portfolio composition of the Ethna-AKTIV by issuer sector

Figure 12: Portfolio composition of the Ethna-DYNAMISCH by issuer sector

* “Cash” comprises term deposits, call money and current accounts/other accounts. “Equities net” comprises direct investments and exposure resulting from equity derivatives.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

La presente es una comunicación promocional. Tiene exclusivamente para transmitir información del producto y no constituye un documento exigido por la ley o la normativa. La información incluida en el presente documento no representa una solicitud, oferta o recomendación para comprar o vender acciones del fondo o para realizar cualquier otra transacción. Su objetivo no es otro que ayudar al lector a entender las características principales del fondo como, por ejemplo, el proceso de inversión y no pretende ser, en todo o en parte, una recomendación de inversión. No sustituye a su propia consideración ni a otra información y asesoramiento de carácter legal, fiscal o financiero. Ni la sociedad gestora ni sus empleados u órganos podrán ser considerados responsables de las pérdidas incurridas, directa o indirectamente, por el uso del contenido del presente documento o en relación con este. Los documentos de venta actualmente vigentes en alemán (folleto, documentos de datos fundamentales (PRIIPs-KIDs), junto con los informes anual y semestral), en los que figura información detallada sobre la suscripción del fondo y los riesgos y las oportunidades y riesgos relacionados, constituyen la única base vinculante para la suscripción de acciones. Los mencionados documentos de venta en alemán (así como sus versiones no oficiales traducidas a otros idiomas) pueden consultarse en www.ethenea.com y obtenerse de forma gratuita en la sociedad gestora, ETHENEA Independent Investors S.A. y el depositario, así como en los respectivos agentes de pago o de información de cada país y el representante en Suiza. Los agentes de pago o de información son los siguientes para los fondos Ethna-AKTIV, Ethna-DEFENSIV y Ethna-DYNAMISCH: Alemania, Austria, Bélgica, Liechtenstein, Luxemburgo: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxemburgo; España: ALLFUNDS BANK, S.A., C/ Estafeta, 6 (la Moraleja), Edificio 3 – Complejo Plaza de la Fuente, ES-28109 Alcobendas (Madrid); Francia: CACEIS Bank France, 1-3 place Valhubert, F-75013 Paris; Italia: State Street Bank International – Succursale Italia, Via Ferrante Aporti, 10, IT-20125 Milano; Société Génerale Securities Services, Via Benigno Crespi, 19/A - MAC 2, IT-20123 Milano; Banca Sella Holding S.p.A., Piazza Gaudenzio Sella 1, IT-13900 Biella; Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Suiza: Representante: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Agente de pagos: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. Los agentes de pago o de información son los siguientes para HESPER FUND, SICAV - Global Solutions: Alemania, Austria, Bélgica, Francia, Luxemburgo: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxemburgo; Italia: Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Suiza: Representante: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Agente de pagos: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. La sociedad gestora podrá rescindir los acuerdos de distribución vigentes con terceros o retirar los permisos de distribución por razones estratégicas o exigidas por ley, respetando los plazos. Los inversores pueden obtener información sobre sus derechos en el sitio web www.ethenea.com y en el folleto. La información se encuentra disponible en alemán e inglés y, en ciertos casos, también otros idiomas. Creado por: ETHENEA Independent Investors S.A. Se prohíbe transmitir el presente documento a personas domiciliadas en países en los que la distribución del fondo no está permitida o en los que se requiere autorización para su distribución. Las acciones únicamente podrán ofrecerse a personas de dichos países si la oferta cumple con las disposiciones legales aplicables y se garantiza que la distribución y publicación del presente documento, así como la oferta o venta de acciones, no están sujetas a ninguna restricción en la jurisdicción en cuestión. En particular, el fondo no se ofrece ni en Estados Unidos de América ni a personas estadounidenses (en el sentido de la norma 902 del Reglamento S de la Ley de valores de EE. UU. de 1933, en su versión vigente) ni a personas que actúen en representación, por cuenta o en beneficio de una persona estadounidense. La rentabilidad histórica no debe considerarse una indicación o garantía de la rentabilidad futura. Las fluctuaciones del valor de los instrumentos financieros subyacentes, sus rendimientos y las variaciones de los tipos de interés y los tipos de cambio implican que el valor de las acciones de un fondo y los rendimientos que de ellas se derivan pueden incrementarse o disminuir, y no están garantizados. Las valoraciones incluidas en el presente documento se basan en varios factores, entre los que cabe incluir los precios actuales, la estimación del valor de los activos subyacentes y la liquidez del mercado, así como otros supuestos e información disponible al público. En general, los precios, los valores y los rendimientos pueden incrementarse o disminuir, hasta la pérdida total del capital invertido, y los supuestos y la información pueden cambiar sin previo aviso. El valor del capital invertido o el precio de las acciones del fondo, así como los rendimientos y los importes de reparto derivados de este, pueden oscilar o quedar totalmente anulados. Por tanto, una rentabilidad histórica positiva (revalorización) no constituye una garantía de una rentabilidad positiva en el futuro. En particular, no puede garantizarse la preservación del capital invertido, por lo que, en caso de venta o reembolso, no se garantiza que el valor del capital invertido o de las acciones mantenidas en el fondo se corresponderá con el capital invertido inicialmente. Las inversiones en divisas están sujetas a fluctuaciones adicionales del tipo de cambio o riesgos cambiarios, es decir, la rentabilidad de dichas inversiones depende también de la volatilidad de la divisa, lo que puede incidir de forma negativa en el valor del capital invertido. Las posiciones y asignaciones pueden variar. En el cálculo se incluyen las comisiones de gestión y custodia, así como todos los demás gastos aplicados al fondo según lo estipulado en el contrato. El cálculo de la rentabilidad se basa en método BVI, es decir, no incluye la comisión de venta, los costes de transacción (como las comisiones de órdenes e intermediación) ni las comisiones de custodia y otros gastos de gestión. El resultado de la inversión sería inferior si se tuviese en cuenta la comisión de venta. No puede garantizarse que las previsiones del mercado vayan a cumplirse. Cualquier alusión a los riesgos en esta publicación no debe considerarse que constituye la divulgación de todos los riesgos o la gestión definitiva de los riesgos mencionados. En el folleto figura la descripción detallada expresa de los riesgos. No puede garantizarse la exactitud, integridad o vigencia. El contenido y la información están sujetos a la protección de los derechos de autor. No puede garantizarse que el documento cumpla todos los requisitos legales o reglamentarios estipulados para él en países distintos a Luxemburgo. Nota: los términos técnicos más importantes pueden consultarse en el glosario que figura en www.ethenea.com/glossar. Información para los inversores en Suiza: El país de origen de la institución de inversión colectiva es Luxemburgo. El representante en Suiza es IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zúrich. El agente de pagos en Suiza es DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zúrich. El folleto, los documentos de datos fundamentales (PRIIPs-KIDs), los estatutos y los informes anual y semestral pueden obtenerse de forma gratuita a través del representante. Copyright © ETHENEA Independent Investors S.A. (2024) Todos los derechos reservados. 05/01/2021