Inverted yield curve: the unexpected effect

The story behind the yield curve that didn’t occur

For conservative investors, the situation is complex. The necessary balance between stable returns, capital preservation and consistent payouts requires smart decisions. This makes the situation challenging for many market participants. And it is not getting any easier in an environment where many asset classes are suffering from the asymmetry of the inverted yield curve and a recession that has not materialised. Under these difficult circumstances, the portfolio managers of the Ethna-DEFENSIV have proven how attractive and low-risk returns can be generated despite the new ‘normal’. However, the next transformation is already on the horizon and may hold new surprises.

Resilience in times of interest rate reversals

In retrospect, the past few years can be summarised as challenging and yet successful. In 2022, central banks began to implement interest rate hikes on an almost unprecedented scale – a particular challenge for funds focused on bonds. Negative yields quickly were no longer a topic of discussion. Instead, there were new records in terms of price losses, caused by the central banks' drastic actions. In November 2022, the die was eventually cast: the yield curve for German government bonds inverted. The fact that the economy remained robust despite the rapid pace of rate hikes is unprecedented in history. All bond fund managers found themselves in uncharted territory and not only had to protect the capital entrusted to them but also to determine where this money would be best placed.

Laws suspended: inverted yield curve and no recession?

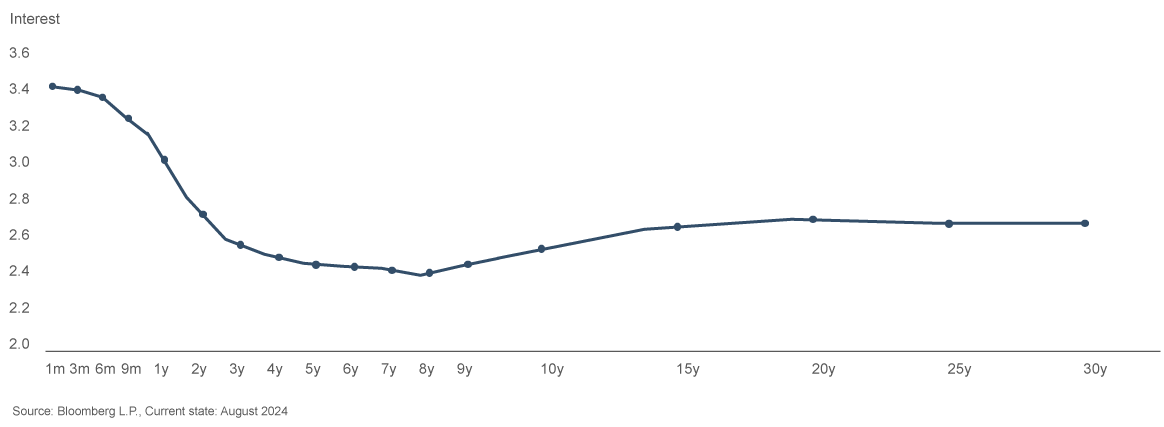

An inverted yield curve is not normal – in the truest sense of the word. A normal yield curve has a positive slope: the longer the maturity, the higher the yield. Currently, however, the situation is reversed. But the consequences of this seem to be suspended.

The positive slope of the yield curve is the foundation of the lending business. Banks borrow money on a short term basis (at a low cost) and lend it out long term at higher interest rates – this is known as maturity transformation. An inverted yield curve makes long-term lending unattractive. Credit growth and investment are being curbed. These are classic signs of a contracting economy. This is why the inverted yield curve has always been a flawless early indicator of an impending recession in the past. This inverted curve structure suggests that bond market participants do not believe that the current high level of interest rates can be sustained in the long term, whether due to an expected decline in inflation or a slowdown in economic growth.

As extraordinary as the market situation was, the response to it has been equally extraordinary so far. In case of the Ethna-DEFENSIV, the economic and geopolitical disruptions of 2022 led to the decision not to take on any new equity positions and to shorten the duration of the bonds in the portfolio. The portfolio managers of the Ethna-DEFENSIV fund thus implemented a consistent change in strategy – a decision that, in retrospect, proved to be a good one. A significant outperformance was generated compared to the euro-denominated investment-grade bond universe. This was achieved through shorter duration and safer bonds, as well as an additional futures overlay. The saved risk premiums were subsequently used to take advantage of additional opportunities. The transition from a multi-asset strategy to a 100% bond fund should prove its worth.

Step by step towards normality: The ECB’s policy shift brings the yield curve into balance

At ETHENEA, we believe that the Eurozone economy has passed its lowest point without slipping into a recession. While economic activity remains weak, the latest data indicate a notable improvement, reflecting a much more favourable macroeconomic situation. Leading indicators and figures on future economic activity are recovering from a low level, which should lead to a change in the yield curve. This is happening against the backdrop of simultaneous ECB rate cuts at the short end and a tightening at the long end of the yield curve. The duration of this process will depend on the intensity and speed of the interest rate cuts. If the deposit rate falls below 3%, the yield curve should resume its normal form.

Leading indicators and their impact on the real economy

This could close the gap; the historically documented spheres of influence could be reactivated as much possible. The labour market in Europe is likely to gain momentum. Although the unemployment rate remains low, an economic upturn will require additional jobs, and accordingly, the labour demand will rise. This results in a stronger position in salary negotiations. Those with more money in their pockets are likely to spend more, whether on groceries, dining out, or purchasing mobile phones and computers. The interest rate cuts announced by the central bank have already resulted in more favourable credit and loan interest rates. Good news for house builders and the entire construction and property sector, as the desire to own a home has recently often been a difficult goal to achieve.

"Ethna-DEFENSIV: a fund built for stability"

The actively managed and benchmark-independent Ethna-DEFENSIV was launched 2007 as a multi-asset fund with a focus on bonds. Today, it concentrates exclusively on its core competence: the bond selection. Since 2022, there have been no equities in the portfolio. This strategy has proven successful, and the fund has been officially managed as a pure bond fund since 2023.

The Ethna-DEFENSIV is characterised by its conservative nature and approach with a credo of capital preservation. Its commitment to delivering stable returns is complemented by maintaining low volatility of less than 4%. The underlying investment process and allocation are adjusted and determined by the portfolio management team using a top-down approach based on an assessment of macroeconomic developments and the potential risk dynamics of exogenous influencing factors. Combined with a bottom-up bond selection process, this approach allows the fund to select the most attractive investment opportunities while limiting potential risks and actively managing volatility and drawdowns.

It is precisely this approach that characterises and distinguishes the fund. Rigorous market observation and thus the screening of various influencing factors have contributed to its performance. As a result, our bond fund ranks among the top 10% of its peer group.

The core of the portfolio consists of issuers from OECD countries with a focus on government and corporate bonds with very good to good credit ratings – these form the basis of the returns (“core income”). In addition, the Ethna-DEFENSIV can use the entire range of the bond segment, in line with the principle of maximum flexibility, and thus increase the return potential. By selecting maturities, currencies and quality, the portfolio management team adjusts the fund’s portfolio to keep interest rate and spread sensitivity low, for example in times of crisis. Additionally, interest rate sensitivity is optimised through the use of futures contracts to seize opportunities and limit risks. As an article 8 fund, the Ethna-DEFENSIV pursues an ESG strategy in accordance with the EU Regulation (SFDR) 2019/2088, implemented through a three-step process that includes comprehensive exclusions based on ESG assessments as well as individual ESG analysis.

A firm eye on fixed income: the Ethna-DEFENSIV as stability factor in both challenging and calm times

Simple, understandable and transparent: The Ethna-DEFENSIV is the risk-optimised investment solution and an ideal addition to a balanced, conservative portfolio. The fund's investment strategy is focused on capital preservation and a clear distribution promise, guiding investors safely through both challenging and calm times. Daily liquidity and daily revaluation of assets protect investors from unpleasant surprises. The interest income from bonds (≈4%; as of 30/08/2024) provides a strong foundation for consistent growth. Additionally, active management offers a certain 'extra' for your assets. It's no coincidence that the bond fund has navigated the interest rate turnaround exceptionally well and quickly recovered from losses. Following the rate turnaround, the fund price continues to grow steadily, with minor setbacks seen as opportunities to drive long-term performance.

Why the Ethna-DEFENSIV should not be missing from any portfolio:

- A solid investment with five stars across all time periods

- Strong performance with low volatility

- Diversified, high quality bond portfolio

- Daily liquidity

- Conservative character with a focus on capital preservation and solid performance

- Experienced bond specialists with a long track record

- Stable portfolio management team

The current 5-star rating from Morningstar proves that we have nothing to hide when it comes to generating returns. The Ethna-DEFENSIV is a suitable core investment for existing and potential investors, navigating them through both turbulent and calm times.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

Cette communication publicitaire est uniquement à titre informatif. Sa transmission à des personnes dans des pays où le fonds n'est pas autorisé à la distribution, en particulier aux États-Unis ou à des personnes américaines, est interdite. Les informations ne constituent ni une offre ni une sollicitation d'achat ou de vente de titres ou d'instruments financiers et ne remplacent pas un conseil adapté à l'investisseur ou au produit. Elles ne tiennent pas compte des objectifs d'investissement individuels, de la situation financière ou des besoins particuliers du destinataire. Avant toute décision d'investissement, il convient de lire attentivement les documents de vente en vigueur (prospectus, documents d'informations clés/PRIIPs-KIDs, rapports semestriels et annuels). Ces documents sont disponibles en allemand ainsi qu'en traduction non officielle auprès de la société de gestion ETHENEA Independent Investors S.A., du dépositaire, des agents payeurs ou d'information nationaux, ainsi que sur www.ethenea.com. Les principaux termes techniques sont expliqués dans le glossaire sur www.ethenea.com/glossaire/. Des informations détaillées sur les opportunités et les risques de nos produits figurent dans le prospectus en vigueur. Les performances passées ne préjugent pas des performances futures. Les prix, valeurs et revenus peuvent augmenter ou diminuer et conduire à une perte totale du capital investi. Les investissements en devises étrangères comportent des risques de change supplémentaires. Aucune garantie ou engagement contraignant pour les résultats futurs ne peut être déduit des informations fournies. Les hypothèses et le contenu peuvent changer sans préavis. La composition du portefeuille peut changer à tout moment. Ce document ne constitue pas une information complète sur les risques. La distribution du produit peut donner lieu à des rémunérations versées à la société de gestion, à des sociétés affiliées ou à des partenaires de distribution. Les informations relatives aux rémunérations et aux coûts figurant dans le prospectus en vigueur font foi. Une liste des agents payeurs et d'information nationaux, un résumé des droits des investisseurs ainsi que des informations sur les risques liés à une erreur de calcul de la valeur nette d'inventaire sont disponibles sur www.ethenea.com/informations-réglementaires/. En cas d'erreur de calcul de la VNI, une indemnisation est prévue conformément à la circulaire CSSF 24/856 ; pour les parts souscrites via des intermédiaires financiers, l'indemnisation peut être limitée. Informations pour les investisseurs en Suisse : Le pays d'origine du fonds d'investissement collectif est le Luxembourg. Le représentant en Suisse est IPConcept (Suisse) AG, Bellerivestrasse 36, CH-8008 Zurich. L'agent payeur en Suisse est DZ PRIVATBANK (Suisse) AG, Bellerivestrasse 36, CH-8008 Zurich. Le prospectus, les documents d'informations clés (PRIIPs-KIDs), les statuts ainsi que les rapports annuels et semestriels peuvent être obtenus gratuitement auprès du représentant. Informations pour les investisseurs en Belgique : Le prospectus, les documents d'informations clés (PRIIPs-KIDs), les rapports annuels et semestriels du compartiment sont disponibles gratuitement en français sur demande auprès de ETHENEA Independent Investors S.A., 16, rue Gabriel Lippmann, 5365 Munsbach, Luxembourg et auprès du représentant : DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg. Malgré le plus grand soin apporté, aucune garantie n'est donnée quant à l'exactitude, l'exhaustivité ou l'actualité des informations. Seuls les documents originaux en allemand font foi ; les traductions sont fournies à titre informatif uniquement. L'utilisation de formats publicitaires numériques se fait à vos propres risques ; la société de gestion décline toute responsabilité en cas de dysfonctionnements techniques ou de violations de la protection des données par des fournisseurs d'informations externes. L'utilisation n'est autorisée que dans les pays où la loi le permet. Tous les contenus sont protégés par le droit d'auteur. Toute reproduction, diffusion ou publication, totale ou partielle, n'est autorisée qu'avec l'accord écrit préalable de la société de gestion. Copyright © ETHENEA Independent Investors S.A. (2025). Tous droits réservés. 27/08/2024