Sustainable bonds

There has been a veritable boom in sustainable bonds in recent years. The first green Bund was launched in September 2020. The proceeds are earmarked for charging stations for e-cars, industrial power generated from hydrogen and climate change mitigation projects in developing countries. At the same time, the intention of the German federal government was to test market uptake, as well as “gain new investors and issuers for the green bond market.” According to Jörg Kukies, State Secretary at the Federal Ministry of Finance, the green Bund was intended as a catalyst “to channel more investment into the environmentally friendly economy.” The issuance was indeed a great success and the German green fixed-income security was oversubscribed multiple times. According to the Federal Ministry of Finance, there was more than EUR 33 billion in bids for the EUR 6.5 billion issuance. However, by European standards, Germany came late to the party. France has been issuing green sovereign bonds since the beginning of 2017, while Poland entered this market segment at the end of 2016.

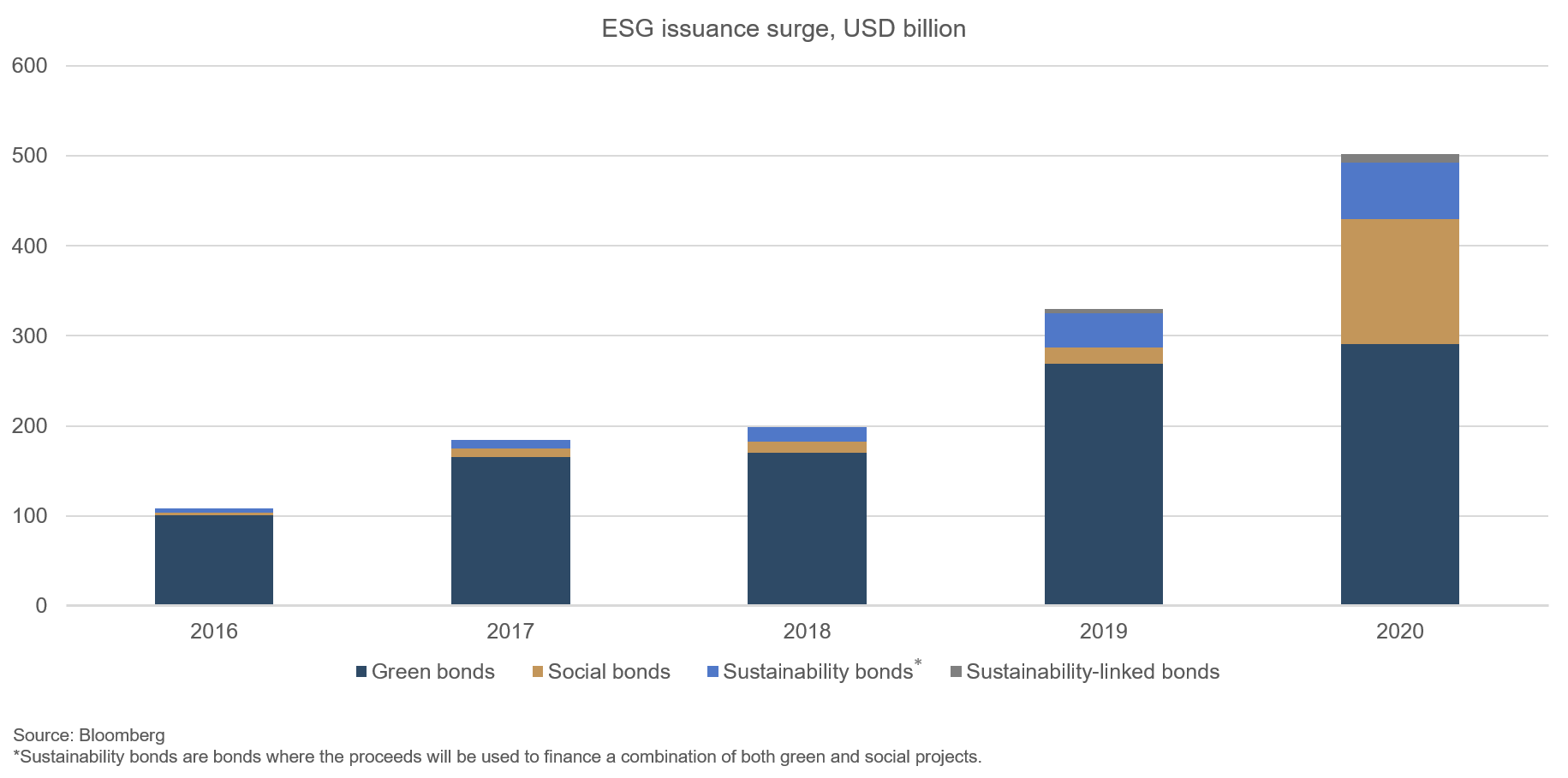

Figure 1: Surge in ESG issuance, in USD billions

In addition to bonds issued by governments and supranationals, green corporate bonds are on the rise. Between 2017 and 2020, the total volume has climbed from EUR 178 billion to more than EUR 400 billion. In 2021, issuance is expected to reach EUR 500 billion for the first time. Not only has the volume been growing steadily for years, but the range of sectors represented and the projects to be funded by the issuance are becoming more varied. For example, one Dutch issuer’s objective was a healthier lifestyle. However, not all sustainable products are created equal. There are basically three different kinds of sustainable bonds:

Green bonds: These are bonds whose proceeds are used solely to fund eligible green projects. These include, for instance, climate protection, conservation of natural resources and biodiversity as well as avoidance and reduction of environmental pollution.

Social bonds: Similar to green bonds, their proceeds are only used to fund eligible social projects. These may be projects to expand the infrastructure in developing countries (e.g. clean drinking water, sewerage, wastewater disposal, transportation, energy), but also the funding of affordable housing, job creation and the active promotion of gender equality and empowerment of women. By far the biggest issuer of social bonds is the European Union with its SURE programme, which supports measures to mitigate or reduce unemployment risks associated with the pandemic in the EU.

Sustainability-linked bonds: Sustainability-linked bonds (SLBs) are not tied to a specific sustainability project like green and social bonds; rather, the proceeds can be used for general business purposes. However, the issuer undertakes to achieve predefined key performance indicators (KPIs) in relation to Environmental, Social and Governance (ESG) criteria. These may be KPIs such as reducing carbon emissions by 2% per year by a set date or switching production over to at least 80% recyclable materials. If these targets are not reached, additional payments, mostly in the form of step-up coupons, have to be paid.

Sustainable bonds are not only good for the environment and society, but also have a performance edge. Contrary to popular belief, many analyses and studies have shown that green investments don’t necessarily have lower performance. In fact, in 2019 green bonds yielded 7.4%, compared to 6.0% for conventional bonds.

The ECB has always acquired green and social bonds under its various asset purchase programmes. However, until this year it had excluded sustainability-linked bonds from its purchases due to the step-up coupon. The central bank changed its stance at the beginning of the year and now also purchases these bonds, but only if the KPIs are in accordance with the UN’s environmental sustainability goals. However, KPIs that are based on social targets are not considered, and the corresponding bonds are not purchased.

For investors, close critical analysis of the bond documentation and active management are paramount, since there are too many “light green” bond issuers that use the sustainable label to secure attractive financing terms without make a genuine contribution to climate protection or social projects. In the past, green bonds could generally be issued at a lower yield than their non-green equivalent bonds, as demand always outstripped supply. This makes it all the more important in each and every investment case to ensure that the projects the issuance funds make a measurable contribution, including to the environment, and to check whether the issuer has only set itself targets that it would have achieved anyway in the course of time. Transparent communication and ongoing reporting on the implementation of the measures is at least as important. We go through an established process to consider ESG criteria in every investment decision in order to fulfil our aspiration to offer our clients responsible investment solutions with a competitive and sustainable return.

Positioning of our funds

Ethna-DEFENSIV

March was dominated by the central banks. First, the European Central Bank announced at the beginning of March that it would step up its asset purchases to enable it to respond better to tougher financing conditions (increase in yields). The U.S. central bank followed suit in the week after, making it clear that, although it had revised its growth forecasts upwards considerably and expects higher inflation rates in future, it would be sticking with its accommodative monetary policy for the time being. In concrete terms, the key rate remains in the range of 0% to 0.25% and is not expected to be raised before 2023. The bond purchase programme, which currently stands at USD 80 billion for sovereign bonds and USD 40 billion for mortgage-backed securities, also remains untouched.

Thus, the two major central banks are taking different paths. While the European Central Bank announced that it would significantly increase its asset purchases under the Pandemic Emergency Purchase Programme (PEPP) from the current level of almost EUR 20 billion a week in an effort to counteract a rise in bond yields, the Fed sees no need for action yet, arguing that a moderate rise in yields is a positive sign or rather a consequence of an economic upturn. Accordingly, the yield curve in the U.S. became much steeper (the difference between 2-year and 10-year yields rose by 30 bps to 160 bps) and is therefore trending higher than it has since the end of 2015. The spread between Treasuries and Bunds is also widening further. While U.S. fixed-income securities are now yielding around 1.75% (compared to around 1.0% in January), the yield on German Bunds remains negative at around -0.25% (versus -0.55% in January).

The U.S. dollar gained almost 3.0% and is thus around 4.0% up on the euro since the beginning of the year. The growth in yields makes U.S. Treasuries increasingly attractive to international investors and, at the same time, progress on the vaccination front in the U.S. should speed up the reopening of the economy. Both are giving the U.S. dollar a boost in the short term. In the long term, the high budget deficit and a current account deficit are likely to put further pressure on the greenback.

U.S. investment grade bonds remain under pressure and have lost 2% over the course of the month, bringing them to -5% year-to-date. Unlike at the beginning of the pandemic, the U.S. central bank seems to be making no move at present to help investors with further bond purchases. Normally, an increase in U.S. yields is accompanied by a reduction in credit spreads – i.e. the premium on corporate bonds over sovereign bond yields – as confidence in the economy and companies’ creditworthiness returns. However, spreads are already very low, which is due to the Fed’s swift and bold intervention at the beginning of the crisis, with the result that they couldn’t really narrow further in March. This leaves little room to cushion the rise in interest rates associated with the economic recovery. At the same time, U.S. high yield bonds have benefited, with the spreads on bonds rated between BB- and CCC- tightening in March by around 5 bps on average to 3.2%. It’s a different story for bonds from European issuers. These benefited from the ECB’s support and actually gained around 0.2% on average.

The current market environment is therefore quite challenging for bond investors and can be very punishing in the short term. At the same time, active portfolio management also provides opportunities to absorb short-term setbacks in the bond market – for instance, using an active duration overlay and fundamental security selection. Thus, the Ethna-DEFENSIV got through March relatively well, since we reduced portfolio duration early to around 5.4, and used the high cash allocation to buy into companies with a good business model and solid balance sheet at favourable prices or stock up on existing positions. At the moment, the allocation is still 12%, which we will put to use when good opportunities arise. Tactical positions that banked on short-term declines in U.S. yields contributed a small additional amount to performance. The equity exposure of around 9%, which is mainly allocated to sustainable ETFs, contributed 0.14% in March while our currency positions in the Japanese yen (4%), the Norwegian krone (2.5%) and in the U.S. dollar (10%) provided additional portfolio diversification, accounting for around 0.42% of performance. Bonds contributed -0.12%. The Ethna-DEFENSIV had a positive performance of 0.33% in March, bringing it to -0.42% year-to-date. We believe that the rise in interest rates driven by concerns about inflation will lose momentum in the medium term, enabling the Ethna-DEFENSIV to achieve a positive performance over the course of the year.

Ethna-AKTIV

One year has passed since the index lows of the crisis brought on by the pandemic. In all honesty, it has to be said that the majority of the price forecasts made at the time, including our own, were far too pessimistic. A great deal has happened since then. In addition to the progress on the development of vaccines, the fiscal and monetary measures in particular not only meant that the recession was one of the shortest but also led to one of the sharpest rises in the prices of financial instruments of all kinds. Therefore, it remains hugely important both to follow unfolding economic developments and to observe the measures taken by the major central banks. Against the backdrop of further increases in growth and inflation expectations, additionally supported by the approval of the USD 1.9 trillion fiscal package in the U.S., the rise in interest rates at the long end of the yield curve (as outlined last month) continued. While this bodes well for expected corporate earnings, there is a danger that the central banks will dial back their ultra-accommodative monetary policy sooner than hoped. In their regular meetings this month, the Fed and ECB central bankers tried to convince investors otherwise. The fact that long-term interest rates still closed not far from the high for the year following a brief hiatus casts doubt over the success of these measures. Nevertheless, for the equity market, this development meant a continuation of the previous months’ movement. Even though not much has happened in the broad indices, there were quite large divergences below the surface. It’s hard to say how long the outperformance of value over growth – which we have been seeing for months now across all major indices – will last. The Ethna-AKTIV therefore holds positions in both styles. With risk premia remaining so low, the weighting on the bond side of the portfolio was reduced further. Only 30% of the portfolio is allocated to bonds, of which 10% are Japanese sovereign bonds. While in February a positive contribution to performance was achieved by reducing interest rate sensitivity as part of a tactical duration overlay, in March an increase achieved the same effect. Essentially, neither risk premia on bonds nor the movements in safe-haven currencies are a cause for concern. The current foreign currency allocation is therefore only just shy of 15% but will immediately be increased if need be.

Looking ahead, it’s important to acknowledge that we are entering a more difficult period in seasonal terms, but at the same time, from a cyclical point of view, this is only the second year of a bull market. The Ethna-AKTIV, which doesn’t follow any benchmarks and offers investment flexibility, is all set to navigate these waters successfully.

Ethna-DYNAMISCH

The structural drivers of the equity markets – fiscal and monetary support as well as pent-up demand and the base effects following the recession caused by the pandemic – remain intact. Global markets were correspondingly robust in March. Some equity indices even reached new highs. However, if we look below the surface, we see that there are still major fluctuations in certain market segments. On the one hand, we are still seeing an overall rotation along the investment styles – from growth to value stocks – which was initiated partly by the rising yields on long-dated (U.S.) Treasuries. The latter are enticing investors back to conventional valuation criteria and are leading to adjustments in the valuations of companies whose profits or revenues will largely be generated in the distant future. On the other hand, this sparked a phase of correction and consolidation of investment themes that have overheated of late. We welcome the departure from (in some cases) exorbitant valuations and regard the market movements going on below the surface as having a cleansing effect.

The Ethna-DYNAMISCH is relatively immune to such upheavals. Our positioning is neither one-sided, in terms of investment style or sector, nor do we engage in popular investment themes if the parameters, including the fundamental data in particular, are not right. Each of our equity positions results from weighing up growth opportunities and valuation risks in every individual case. For us, growth at a reasonable price (GARP) is part of responsible investing. On the other hand, we see growth at any price (GAAP) as an unattractive (and unnecessary) risk. Thanks to the inherent balance of our GARP stocks – regardless of whether they come under the heading of value, growth or a particular theme – we also managed to keep volatility in our portfolio low in March and, at the same time, with our equity allocation of around 77%, benefit from the structural drivers of the equity market, as listed previously.

One stock that meets this GARP criterion and which was added to our portfolio in March is the UK advertising and marketing services provider S4 Capital. By focusing exclusively on digital channels, S4 Capital is at the heart of structural change in the sector. The company is pursuing an expansive acquisition strategy and dynamic organic growth. As a result, it managed to grow its revenue by 59%, despite tight advertising budgets in 2020. If you were to categorise its investment style, S4 Capital would fall into the growth category. But this is growth at a reasonable price. For this reason, we took advantage of the recent fall in the price to build up the position.

Due to the Ethna-DYNAMISCH’s balanced positioning, we found March rather quiet despite the volatility below the surface. We took advantage of this quiet period to further expand our investment ideas both at individual position level and at tactical overall market level. Our watchlist now contains a number of market scenarios and companies that we systematically observe. This enables us to maintain a level head in turbulent market phases and take advantage of appropriate entry prices – in line with the GARP strategy – to build up positions. Thus we remain true to our motto: to offer investors risk-controlled access to the global equity markets.

HESPER FUND - Global Solutions (*)

In March, trading of US stocks was somewhat choppy amid an intense sector rotation, but most of the broad indices still ended the month near historic highs. Equity markets were also able to progressively digest a further increase in US Treasury yields which, after having hit a high of 1.77%, calmed down to end the month at just above 1.7%. In March, the Dow Jones Industrial Average (DJIA) rose 6.6%, the S&P500 gained 4.2%, the Russell 2000 increased by 0.9% and the Nasdaq Composite gained 0.4%. The Euro Stoxx 50 rose by 7.8% to end the month very close to its year-to-date high. The Shanghai Shenzhen CSI 300 index, on the other hand, lost 5.4% for the month and 13% from the all-time high it achieved on February 10, 2021.

The world economy is clearly in a recovery phase but its engine is still not running on all cylinders. While manufacturing is experiencing a global surge, supported by strong international demand, contact-intensive sectors are still struggling because of restrictions and lockdowns. The combined effect of the EU pandemic setbacks in the middle of the third wave of Covid-19 infections and the acceleration of the US vaccine roll-out programme is widening the economic performance gap between the two main Western economies. As a result, during the month, the USD extended its January reversal and appreciated a further 2.5% against the euro (ytd +4.5%).

The strength of the USD, volatile commodity markets, and another wave of new and more contagious strains of Covid-19 have started to hurt emerging markets. Erdogan sacking the country’s third central bank governor sent the Turkish lira plunging 15%, while the Russian rouble suffered from political tensions with the US, despite a sooner than expected rate hike. In Brazil, the larger-than-expected monetary tightening enacted by the Central Bank of Brazil, was not enough to ease investors’ worries, given the worsening pandemic, budget concerns, and inflation threats.

The pace and strength of the cyclical recovery will continue to depend on the momentum of the pandemic. A full recovery will not only require complete control of the pandemic but also ongoing economic policy support. However, the massive additional fiscal stimulus and the significant acceleration of the vaccine roll-out in the US leaves little doubt about the country’s economic rebound in 2021. It is worth pointing out that we are still in the initial phase of this cyclical recovery and are still a long way from output and inflation in developed countries returning to their long-term trends. Central banks in advanced economies have reiterated that they view a possible spike in inflation in the first half of this year as a temporary phenomenon and are not planning on pre-emptively tightening their policies. At this point, inflation fears are premature and rising yields (from very depressed levels) are consistent with the ongoing economic recovery and still compatible with an expansionary monetary policy.

The HESPER FUND – Global Solutions is sticking with the recovery and the reflation trade scenario. In line with its macro baseline scenario, the fund has increased its short US Treasury position, bringing the overall duration of the fixed income portfolio into negative territory. Meanwhile the fund has increased its exposure in high-yield bonds to 15%. With regard to equity exposure, the HESPER FUND – Global Solutions has increased this from 40% to 50%, while reducing the exposure to emerging markets. In addition, we retained a diversified 10% exposure in commodities. On the currency front, the fund has increased its long USD exposure, which rose to 27% over the course of the month before ending it at 22%. The fund also doubled its exposure in Norwegian krone to 4%.

As pointed out in the last Market Commentary, the HESPER FUND – Global Solutions was building an opportunistic position in Russian rouble. Supported by commodity prices, which were lagging the performance of other emerging currencies, and with the spot exchange rate crossing the 200-day moving average - a compelling technical signal, we moved to profit from the trend. At a certain point, the position reached 16% and was profitable. We were trading in and out when US President Joe Biden unexpectedly accused Russia of meddling in the US elections during an interview with the ABC Network and threatened further sanctions. Stop losses were immediately triggered and the position was closed with a small loss. By the end of month, the fund restarted building this trading position, which was sitting at 7% at the end of March.

In March, the HESPER FUND - Global Solutions EUR T-6 shares rose 1.3% for the month, and +2.8% year to date. For the last 12 months the fund is up 8.5%.

*The HESPER FUND - Global Solutions is currently only distributed in Germany, Luxembourg, France and Switzerland.

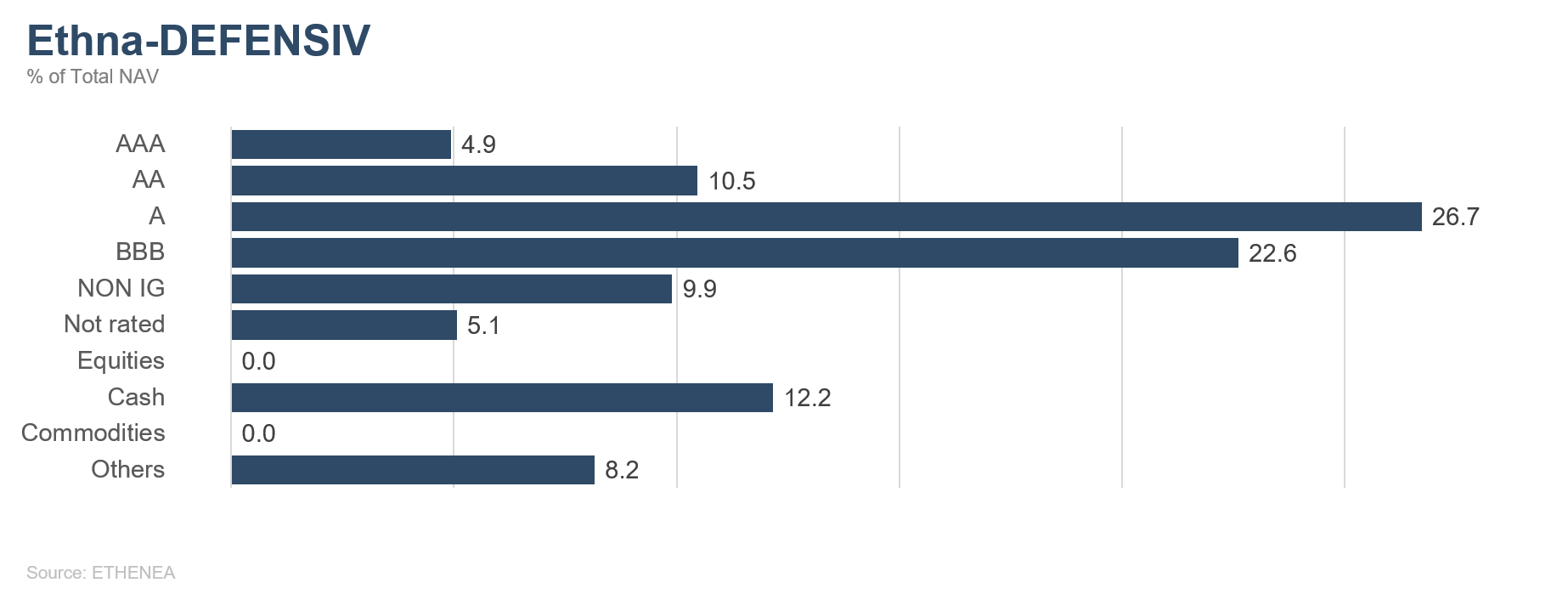

Figure 2: Portfolio structure* of the Ethna-DEFENSIV

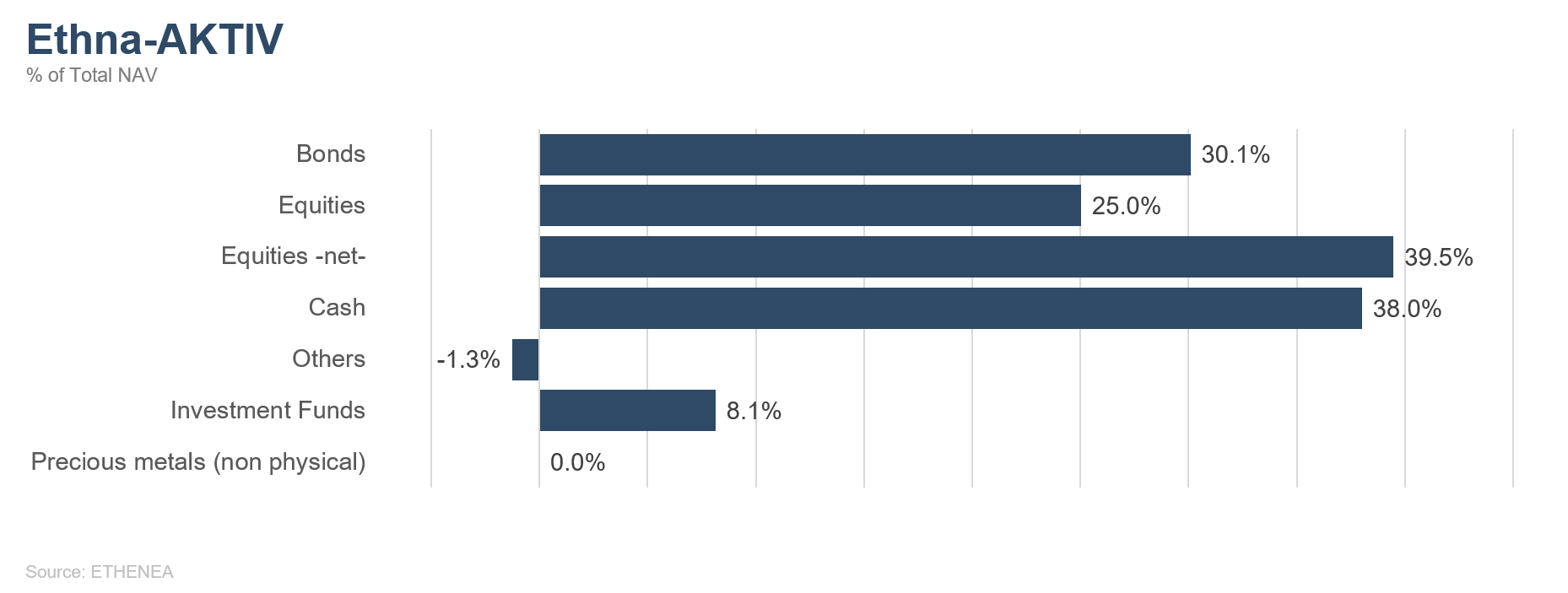

Figure 3: Portfolio structure* of the Ethna-AKTIV

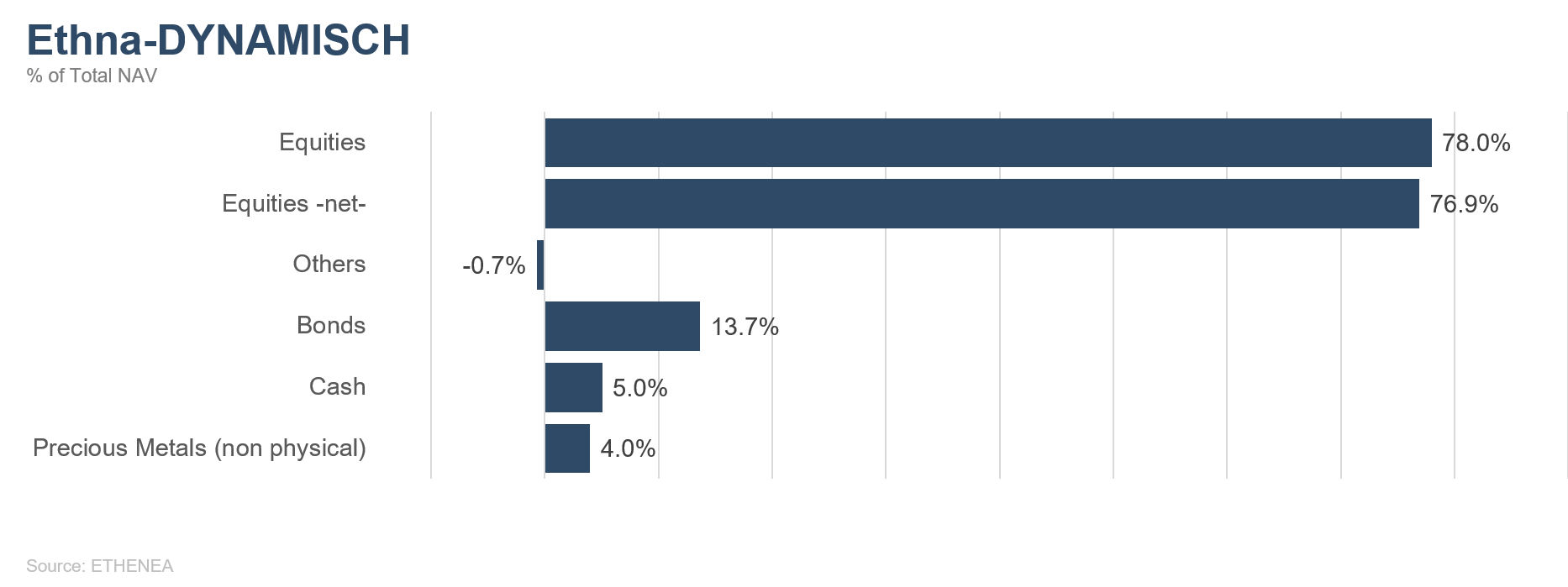

Figure 4: Portfolio structure* of the Ethna-DYNAMISCH

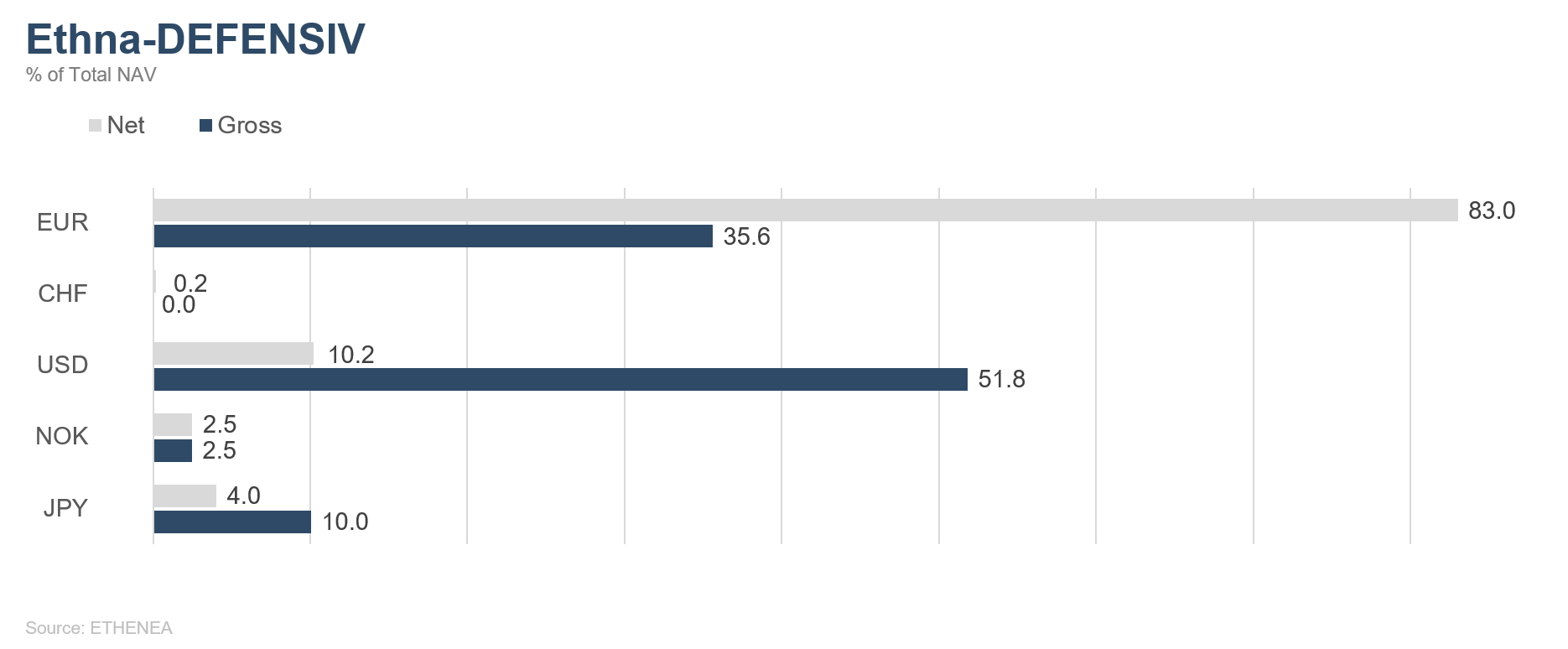

Figure 5: Portfolio composition of the Ethna-DEFENSIV by currency

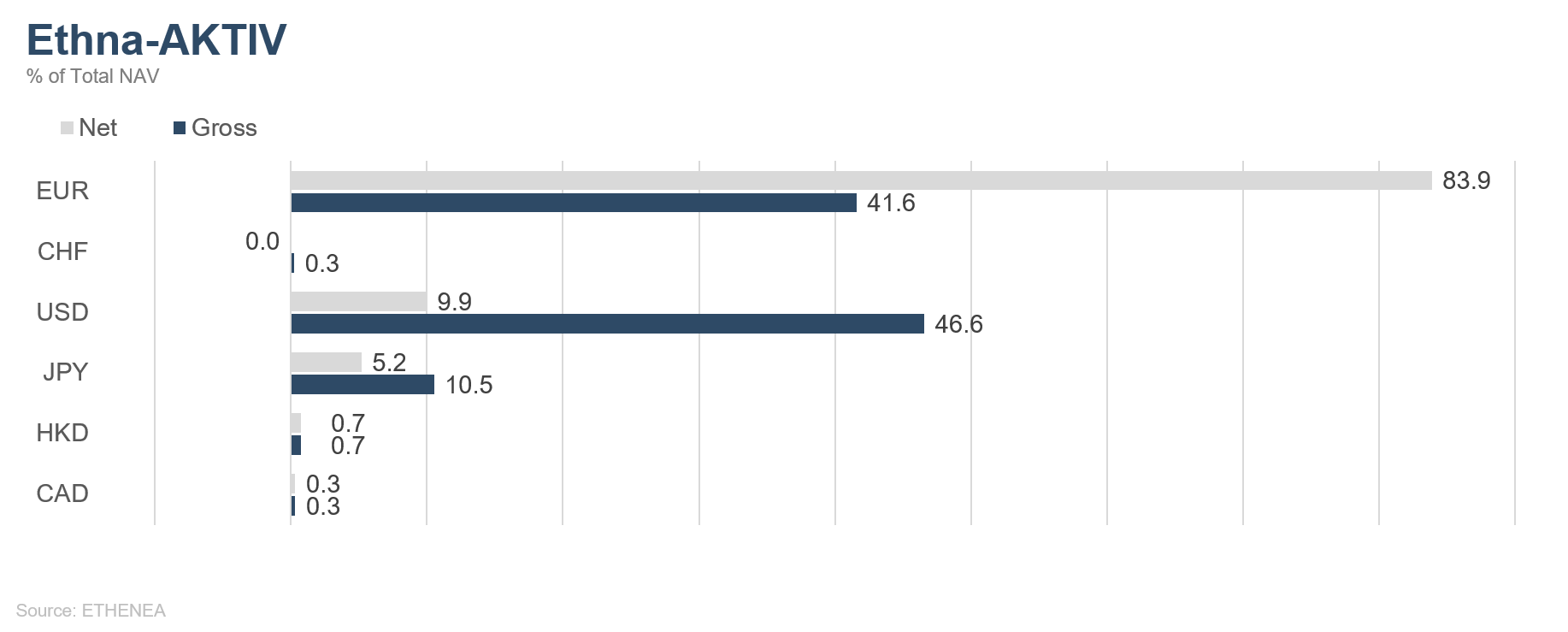

Figure 6: Portfolio composition of the Ethna-AKTIV by currency

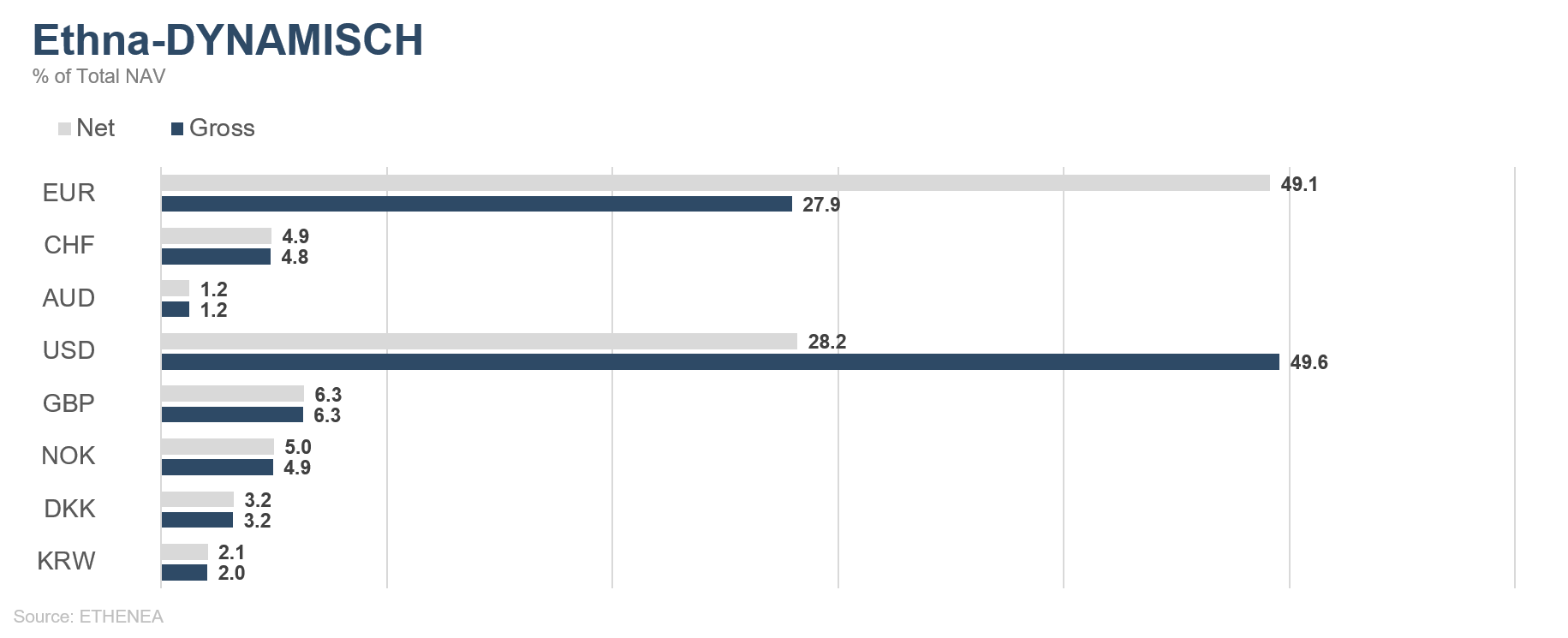

Figure 7: Portfolio composition of the Ethna-DYNAMISCH by currency

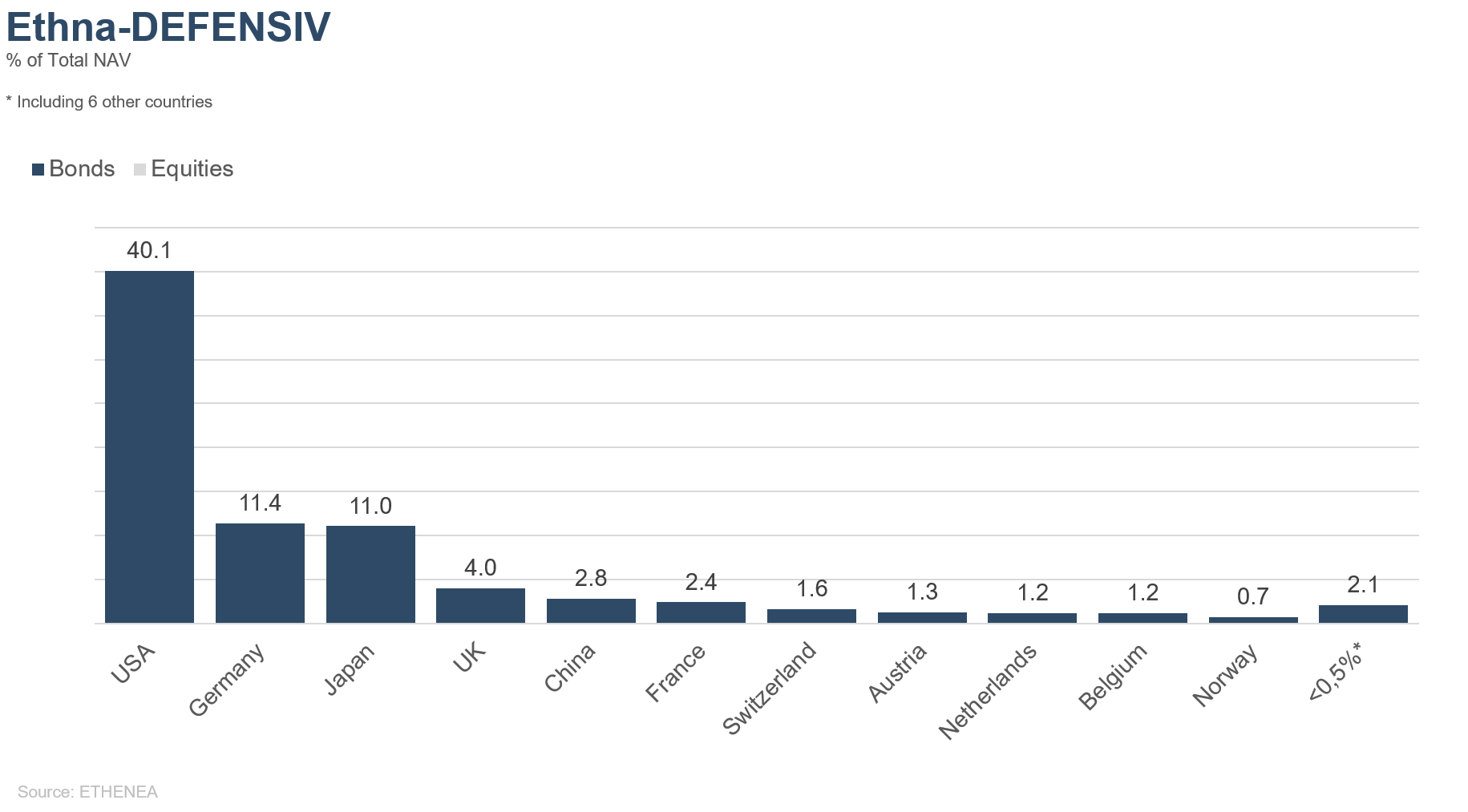

Figure 8: Portfolio composition of the Ethna-DEFENSIV by country

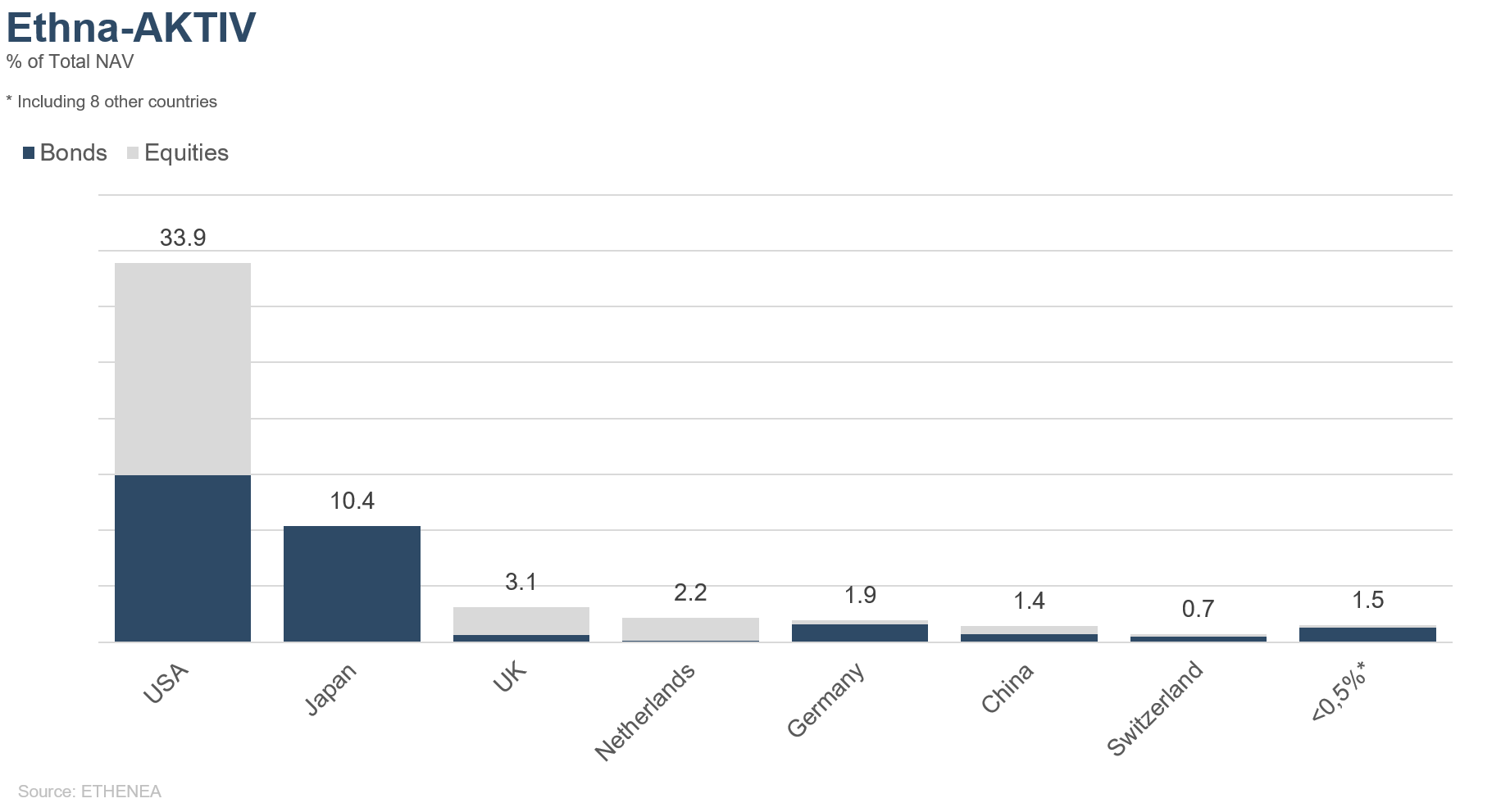

Figure 9: Portfolio composition of the Ethna-AKTIV by country

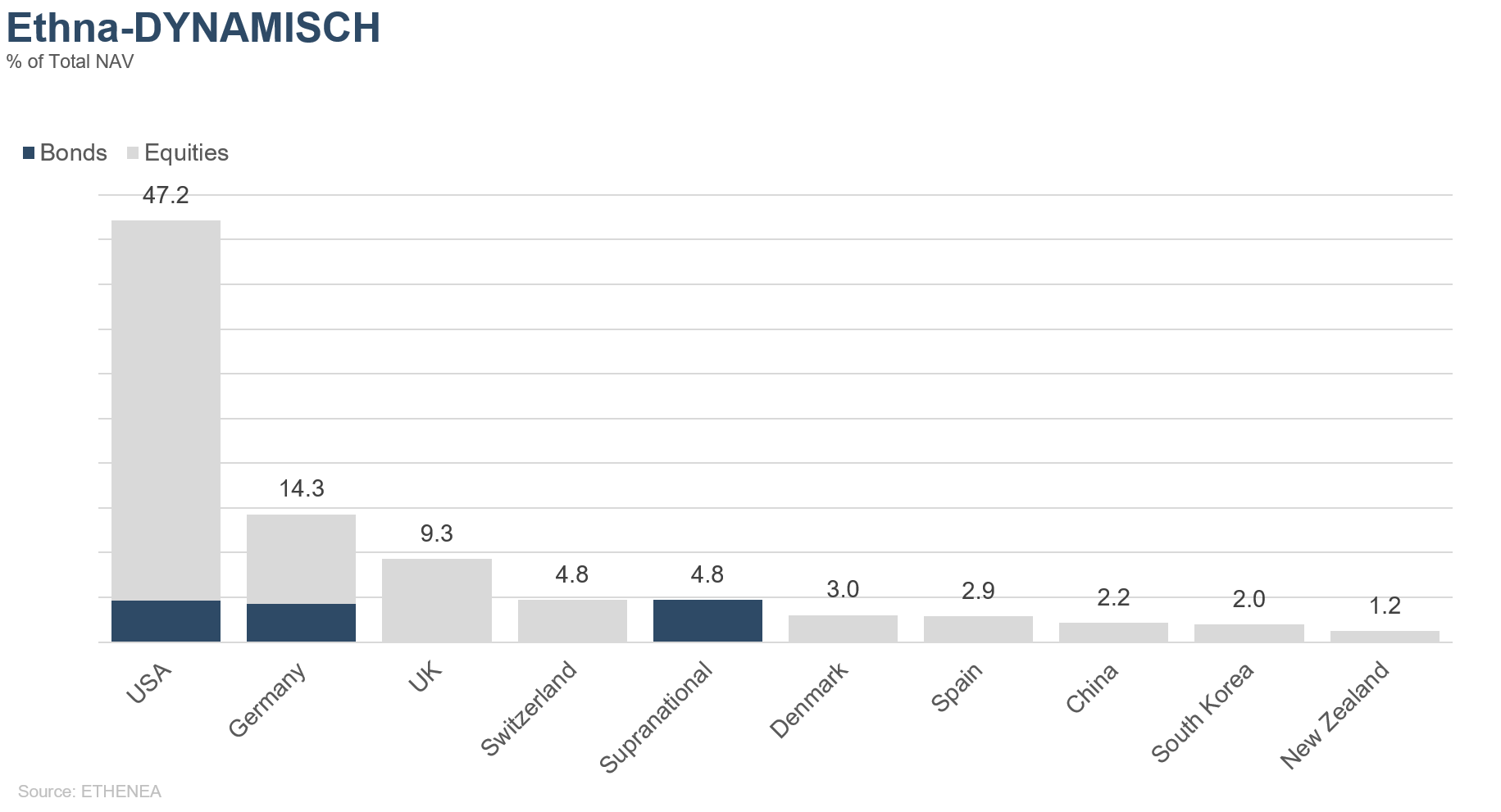

Figure 10: Portfolio composition of the Ethna-DYNAMISCH by country

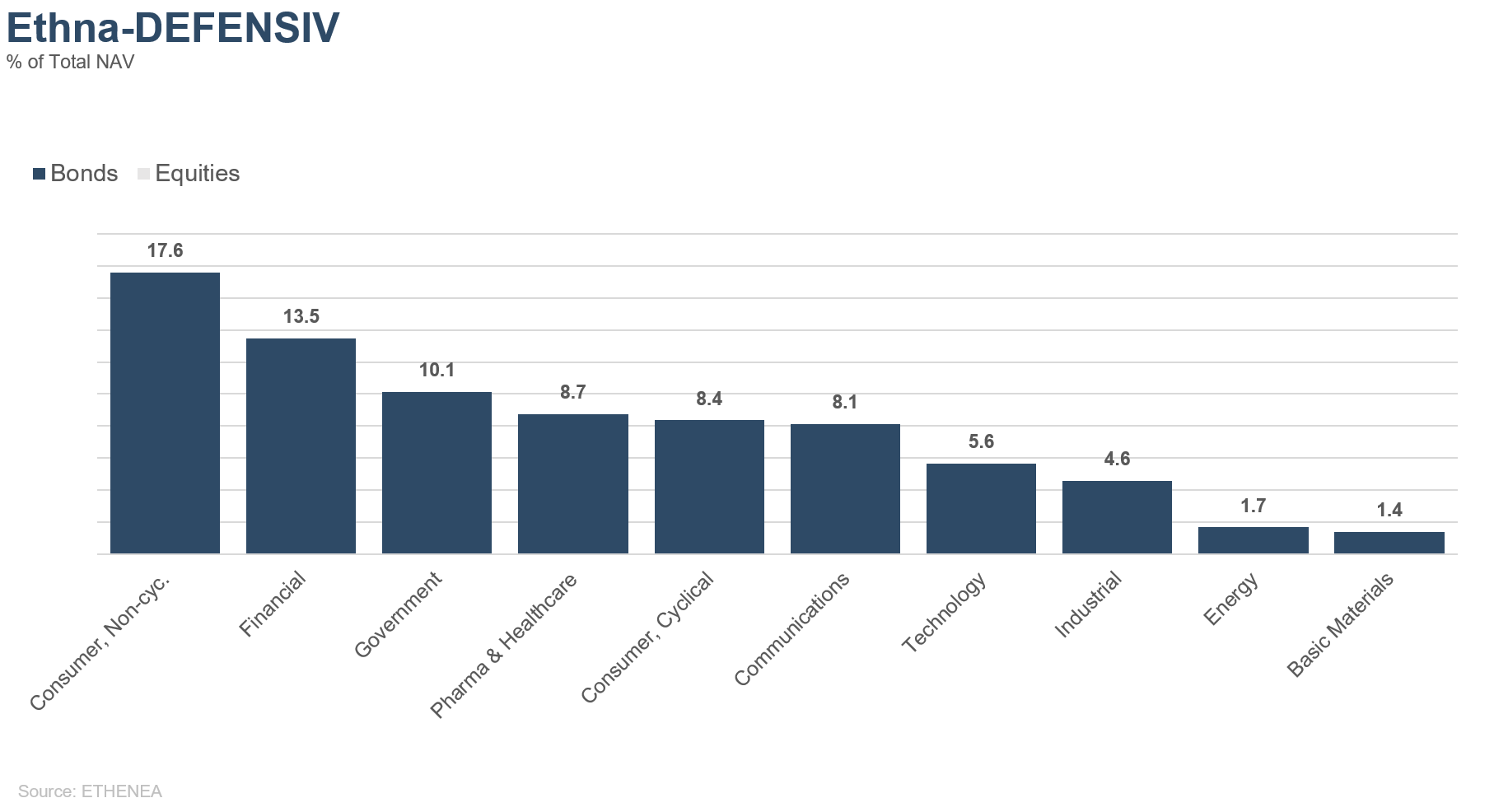

Figure 11: Portfolio composition of the Ethna-DEFENSIV by issuer sector

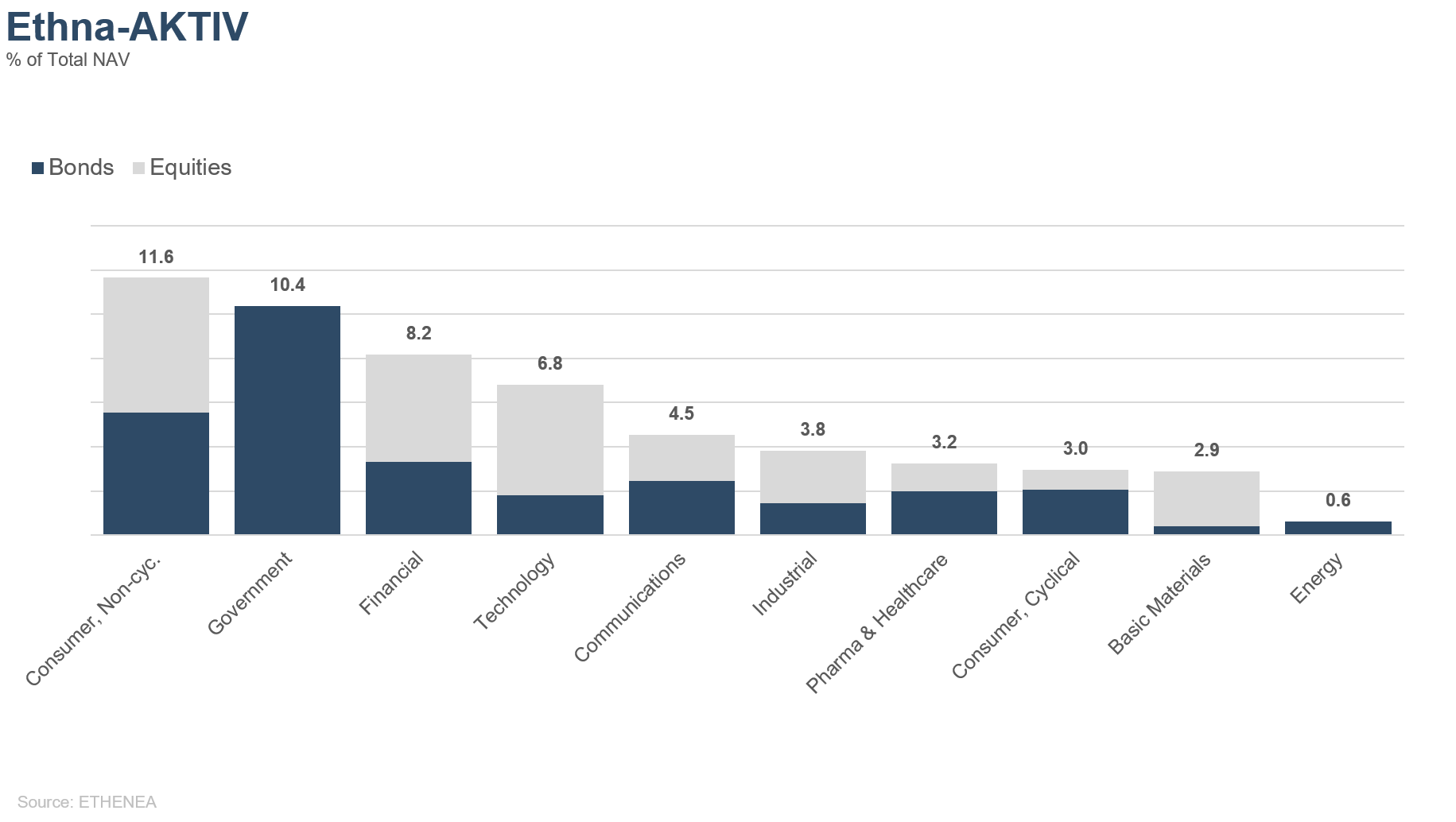

Figure 12: Portfolio composition of the Ethna-AKTIV by issuer sector

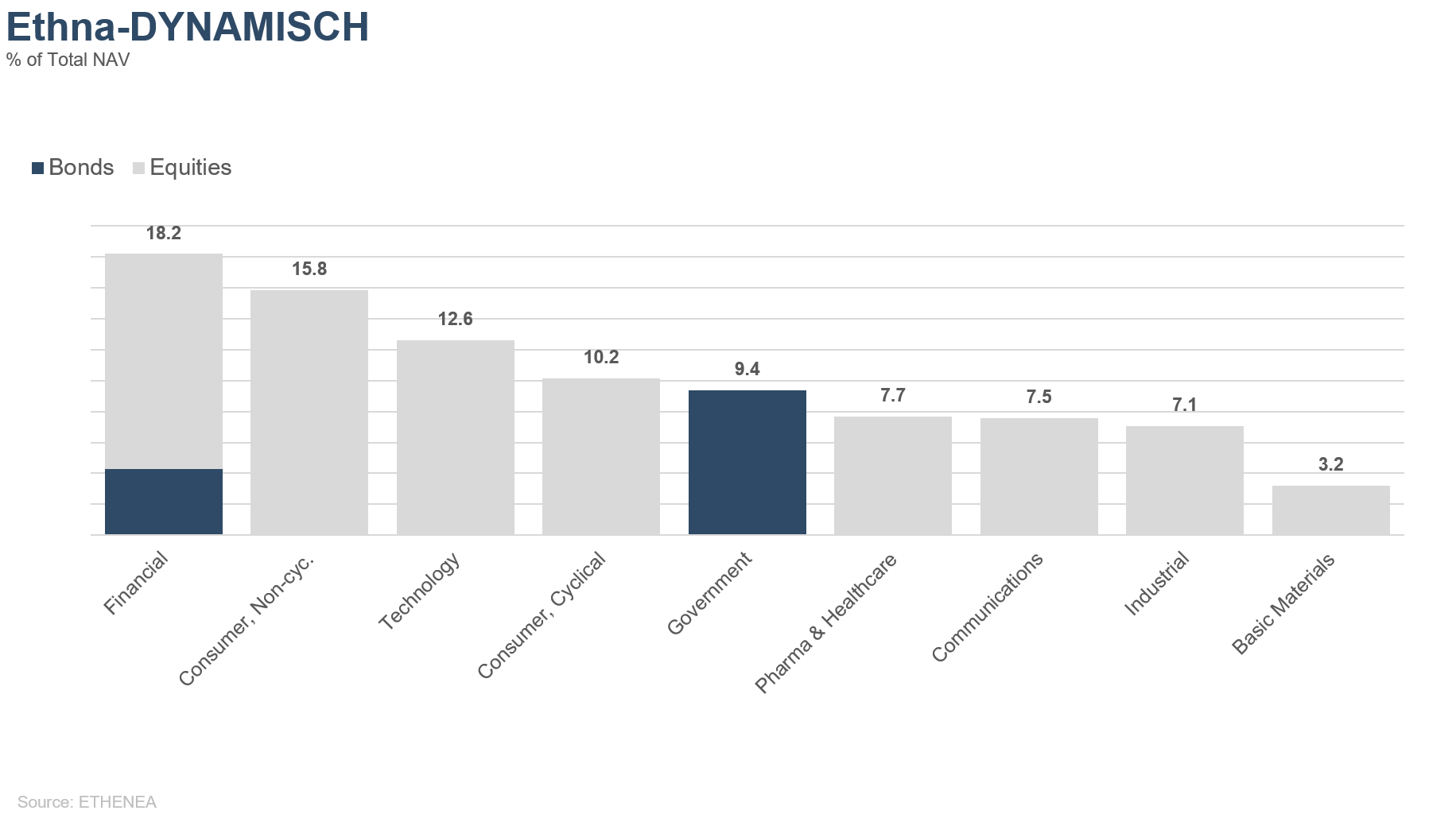

Figure 13: Portfolio composition of the Ethna-DYNAMISCH by issuer sector

* “Cash” comprises term deposits, call money and current accounts/other accounts. “Equities net” comprises direct investments and exposure resulting from equity derivatives.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

Dit is een marketing communicatie. Het is uitsluitend bedoeld om productinformatie te verstrekken en is geen verplicht wettelijk of regelgevend document. De informatie in dit document vormt geen verzoek, aanbod of aanbeveling om participaties in het fonds te kopen, te verkopen of om enige andere transactie aan te gaan. Het is uitsluitend bedoeld om de lezer inzicht te geven in de belangrijkste kenmerken van het fonds, zoals het beleggingsproces, en wordt noch geheel noch gedeeltelijk beschouwd als een beleggingsaanbeveling. De verstrekte informatie is geen vervanging voor de eigen overwegingen van de lezer of voor enige andere juridische, fiscale of financiële informatie en advies. Noch de beleggingsmaatschappij, noch haar werknemers of bestuurders kunnen aansprakelijk worden gesteld voor verliezen die rechtsreeks of onrechtstreeks worden geleden door het gebruik van de inhoud van dit document of in enig ander verband met dit document. De verkoopdocumenten in het Duits die op dit moment geldig zijn (verkoopprospectus, essentiële-informatiedocumenten (PRIIPs-KIDs) en de halfjaar- en jaarverslagen), die gedetailleerde informatie geven over de aankoop van participaties in het fonds en de bijbehorende kansen en risico's, vormen de enige wettelijke basis voor de aankoop van participaties. De bovengenoemde verkoopdocumenten in het Duits (evenals in onofficiële vertalingen in andere talen) zijn te vinden op www.ethenea.com en zijn naast de beleggingsmaatschappij ETHENEA Independent Investors S.A. en de depothoudende bank, ook gratis verkrijgbaar bij de respectieve nationale betaal- of informatieagenten en van de vertegenwoordiger in Zwitserland. De betaal- of informatieagenten voor de fondsen Ethna-AKTIV, Ethna-DEFENSIV en Ethna-DYNAMISCH zijn de volgende: België, Duitsland, Liechtenstein, Luxemburg, Oostenrijk: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxemburg; Frankrijk: CACEIS Bank France, 1-3 place Valhubert, F-75013 Paris; Italië: State Street Bank International – Succursale Italia, Via Ferrante Aporti, 10, IT-20125 Milano; Société Génerale Securities Services, Via Benigno Crespi, 19/A - MAC 2, IT-20123 Milano; Banca Sella Holding S.p.A., Piazza Gaudenzio Sella 1, IT-13900 Biella; Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Spanje: ALLFUNDS BANK, S.A., C/ Estafeta, 6 (la Moraleja), Edificio 3 – Complejo Plaza de la Fuente, ES-28109 Alcobendas (Madrid); Zwitserland: Vertegenwoordiger: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Betaalagent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. De betaal- of informatieagenten voor HESPER FUND, SICAV - Global Solutions zijn de volgende: België, Duitsland, Frankrijk, Luxemburg, Oostenrijk: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxemburg; Italië: Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Zwitserland: Vertegenwoordiger: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Betaalagent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. De beleggingsmaatschappij kan bestaande distributieovereenkomsten met derden beëindigen of distributievergunningen intrekken om strategische of statutaire redenen, mits inachtneming van eventuele deadlines. Beleggers kunnen informatie over hun rechten verkrijgen op de website www.ethenea.com en in de verkoopprospectus. De informatie is zowel in het Duits als in het Engels beschikbaar, en in individuele gevallen ook in andere talen. Opgemaakt door: ETHENEA Independent Investors S.A. Het is verboden om dit document te verspreiden aan personen die wonen in landen waar het fonds geen vergunning heeft of waar er een toestemming vereist is voor verspreiding. Participaties mogen enkel aangeboden worden aan personen in landen waarin dit aanbod in overeenstemming is met de toepasselijke wettelijke bepalingen en waar ervoor wordt gezorgd dat de verspreiding en publicatie van dit document, evenals een aanbod of verkoop van participaties, aan geen enkele beperking is onderworpen in het betreffende rechtsgebied. Het fonds wordt met name niet aangeboden in de Verenigde Staten van Amerika of aan Amerikaanse burgers (volgens Rule 902 of Regulation S of the U.S. Securities Act of 1933, in de huidige versie) of personen die namens hen, in hun rekening of ten voordele van een Amerikaanse burger handelen. Resultaten die in het verleden behaald zijn, mogen niet worden opgevat als indicatie of garantie voor toekomstige prestaties. Schommelingen in de waarde van onderliggende financiële instrumenten of hun rendementen, evenals veranderingen in rentetarieven en valutakoersen, zorgen ervoor dat de waarde van participaties in een fonds, evenals de daaruit voortvloeiende rendementen, zowel kunnen dalen als stijgen en zijn niet gegarandeerd. De waarderingen die hierin opgenomen zijn, zijn gebaseerd op een aantal factoren, waaronder, maar niet beperkt tot, huidige prijzen, schattingen van de waarde van de onderliggende activa en marktliquiditeit, evenals andere veronderstellingen en openbaar beschikbare informatie. In principe kunnen prijzen, waarden en rendementen zowel stijgen als dalen, tot en met het totale verlies van het geïnvesteerde kapitaal, en aannames en informatie kunnen zonder voorafgaande kennisgeving worden gewijzigd. De waarde van het belegde vermogen of de prijs van participaties, evenals de daaruit voortvloeiende rendementen en uitkeringsbedragen, zijn onderhevig aan schommelingen of kunnen geheel verdwijnen. Positieve prestaties in het verleden zijn daarom geen garantie voor positieve prestaties in de toekomst. Met name het behoud van het geïnvesteerde vermogen kan niet worden gegarandeerd; er is dan ook geen garantie dat de waarde van het belegde kapitaal of de aangehouden participaties bij verkoop of terugkoop zal overeenkomen met het oorspronkelijk belegde kapitaal. Beleggingen in vreemde valuta zijn onderhevig aan bijkomende wisselkoersschommelingen of valutarisico's, d.w.z. het rendement van dergelijke beleggingen hangt ook af van de volatiliteit van de vreemde valuta, wat een negatieve impact kan hebben op de waarde van het belegde kapitaal. Beleggingen en toewijzingen kunnen gewijzigd worden. De beheer- en depotvergoedingen, evenals alle andere kosten die overeenkomstig de contractuele bepalingen ten laste van het fonds zijn, worden in de berekening opgenomen. De prestatieberekening is gebaseerd op de BVI-methode (Duitse Federale Vereniging voor Beleggings- en Vermogensbeheer), dat wil zeggen dat uitgiftekosten, transactiekosten (zoals order- en makelaarskosten), evenals bewaar- en andere beheervergoedingen niet inbegrepen zijn in de berekening. Het beleggingsrendement zou lager zijn indien rekening zou worden gehouden met de uitgiftetoeslag. Er kan geen garantie worden gegeven dat de marktprognoses gehaald worden. Om het even welke risicobehandeling in deze publicatie mag niet worden beschouwd als een onthulling van alle risico's of een sluitende behandeling van de genoemde risico's. In de verkoopprospectus wordt expliciet verwezen naar de gedetailleerde risicobeschrijvingen. Er kan geen garantie worden gegeven dat de informatie juist, volledig of actueel is. De inhoud en de informatie zijn auteursrechtelijk beschermd. Er kan geen garantie worden gegeven dat het document voldoet aan alle wettelijke of regelgevende vereisten die andere landen dan Luxemburg hebben vastgesteld. Opmerking: De belangrijkste technische termen kunnen worden gevonden in de woordenlijst op www.ethenea.com/lexicon. Informatie voor beleggers in België: Het prospectus, de statuten en de periodieke verslagen, alsmede de essentiële-informatiedocumenten (PRIIPs-KIDs), zijn kosteloos verkrijgbaar in het Frans bij de beheermaatschappij, ETHENEA Independent Investors S.A., 16, rue Gabriel Lippmann, 5365 Munsbach, Luxemburg en bij de vertegenwoordiger: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxemburg. Informatie voor beleggers in Zwitserland: Het vestigingsland van de collectieve beleggingsregeling is Luxemburg. De vertegenwoordiger in Zwitserland is IPConcept (Schweiz) AG, Münsterhof 12, P.O. Box, CH-8022 Zürich. De betaalagent in Zwitserland is DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zurich. Het prospectus, de essentiële-informatiedocumenten (PRIIPs-KIDs) en de statuten, evenals de jaar- en halfjaarverslagen zijn kosteloos verkrijgbaar bij de vertegenwoordiger. Copyright © ETHENEA Independent Investors S.A. (2024) Alle rechten voorbehouden. 02-04-2021