Below you will find the answers to some of the questions we are commonly asked:

Are the Ethna Funds and HESPER FUND – Global Solutions offered as part of a savings plan?

The mentioned funds can be acquired from all cooperative banks, from independent financial services providers, as well as from banks and savings banks. Many of our partners also offer our funds within the framework of a savings or withdrawal plan, or as part of a life insurance wrapper.

You can obtain professional advice and sales documentation free of charge from your investment advisor.

Do the Ethna Funds and HESPER FUND – Global Solutions conform to the UCITS directive?

The funds are issued as a Luxembourg investment fund in accordance with Part I of the latest version of the Luxembourg Law of 17 December 2010 relating to the UCITS directive.

If you would like to find out more, please don't hesitate to contact usHow and where can I subscribe to the Ethna Funds and HESPER FUND – Global Solutions?

You can acquire the mentioned funds from nearly every bank - we work closely with private banks in the major/specialist banking sector, cooperative banks, savings banks, and insurance undertakings - as well as numerous financial service providers. To subscribe to one of our funds, simply contact your bank or investment advisor.

ETHENEA’s funds are clearable securities, i.e. you can easily acquire the desired number of shares or amount in euro in the funds using the internal order routes of your bank.

Alternatively you can make an order by fax or SWIFT payment to DZ PRIVATBANK S.A., the registrar and transfer agency of the funds. In addition, you have the opportunity to open an account with our registrar and transfer agency DZ PRIVATBANK S.A directly.

The above mentioned funds are mutual funds, which are calculated daily (on each business day in Luxembourg except 24 December and 31 December). Subscriptions and redemptions can be placed every day before the cut-off time of 17:00 (CET). The order will be settled with the fund price calculated one day after the cut-off date and the value date will be 3 days after the cut-off date.

ETHENEA does not charge any front-end loads. Banks, savings banks or agents, however, are at liberty to charge a fee up to the maximum amount stated in the sales prospectus.

What distinguishes the HESPER FUND – Global Solutions from the Ethna Funds, and how does it fit within ETHENEA?

Although the investment strategy of the HESPER FUND – Global Solutions differs fundamentally from the investment philosophy of the Ethna Funds, it is still an optimal addition to the fund concepts offered by ETHENEA. An essential component of ETHENEA’s cross-product management approach is its flexible asset allocation, which enables its Portfolio Managers to manage risks effectively, to take advantage of opportunities, and to react appropriately to changing market situations.

Furthermore, the HESPER FUND – Global Solutions follows a highly flexible, opportunistic investment approach, which aims to achieve an absolute increase in value with volatility that is similar to that of the equity markets. At the same time, as a multi-asset fund, it uses a top-down approach to asset allocation, as well as hedging instruments - just like the Ethna Funds. Overall, the risk profile of the HESPER FUND – Global Solutions is significantly more offensive than that of the Ethna Funds.

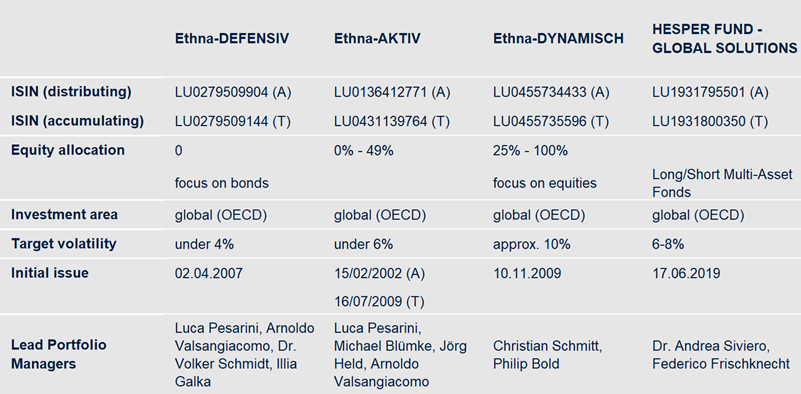

What are the differences between the Ethna Funds and HESPER FUND – Global Solutions?

Is the management company affiliated with any bank?

ETHENEA Independent Investors S.A.is a non-bank affiliated management company.

Read more about usWhat is the investment philosophy of the Ethna Funds?

What is the legal structure of ETHENEA?

ETHENEA Independent Investors S.A. is a company organised under the laws of Luxembourg (Société Anonyme) with its registered office in Luxembourg. It was formed on 10 September 2010 and is recorded in the Luxembourg Commercial Register (Registre de Commerce) under No. Luxembourg B 155427. It is authorised as a management company pursuant to Chapter 15 of the Law of 17 December 2010 on undertakings for collective investment and as an alternative investment fund manager (AIFM) pursuant to Chapter 2 of the Law of 12 July 2013 and particularly authorized to the management of portfolios of investments and the reception and transmission of orders within the meaning of Art. 5 (4) of the law of 12 July 2013. The company is subject to the supervision of the Commission de Surveillance du Secteur Financier (CSSF), 283, route d’Arlon, L-1150 Luxembourg.

What type of reporting do you provide to your clients?

You can download the public fund reporting for retail investors from our fund detail pages.

In addition, we offer an email service for special reports depending on the client group.

List of documents available:

• Factsheet update

• Portfolio overview

• VAR report & Stress Tests

• Solvency II reports

• Individual requests

• and others

Please do not hesitate to contact us for more information.

Which paying and information agents are available in my home country?

You can find information about your local paying and information agents on our Legal Notices page.

Visit Legal Notices pageWho is the custodian bank of the funds?

We have entered into a strong partnership with our custodian bank DZ PRIVATBANK S.A.

Who can I turn to in relation to a due diligence process?

We are available to answer any questions you may have about a due diligence audit. Please do not hesitate to contact our team in Luxembourg.

Get in touch with us