A resurgence in European equities!?

Without doubt, it is one of the hottest topics of recent weeks: is it time for European equities to shine? Since the 2008/09 global financial crisis, the major European equity indices have consistently trended weaker than their U.S. counterparts. In the around 20 years prior – that is, since the launch of the German DAX index or indeed how far back the European STOXX indices have been calculated – relative performance was much more even. However, European equities did not structurally outperform U.S. equities then either. Could European equity markets have their heyday in the 2020s?

The performance of equities, both at individual security level and, on an aggregate basis, at index level, depends on the fundamental development of the underlying companies as well as what they are valued at. The longer the period in question, the more meaningful the trend in revenues, earnings, cash flows and other fundamental indicators. In other words, valuation differences can be a good (tactical) starting point for relative outperformance. However, for longer-term (strategic) outperformance, the fundamental growth must be much better.

A picture is worth a thousand words. So let’s first have a look at the starting situation and the relative trend in the factors mentioned in recent years.

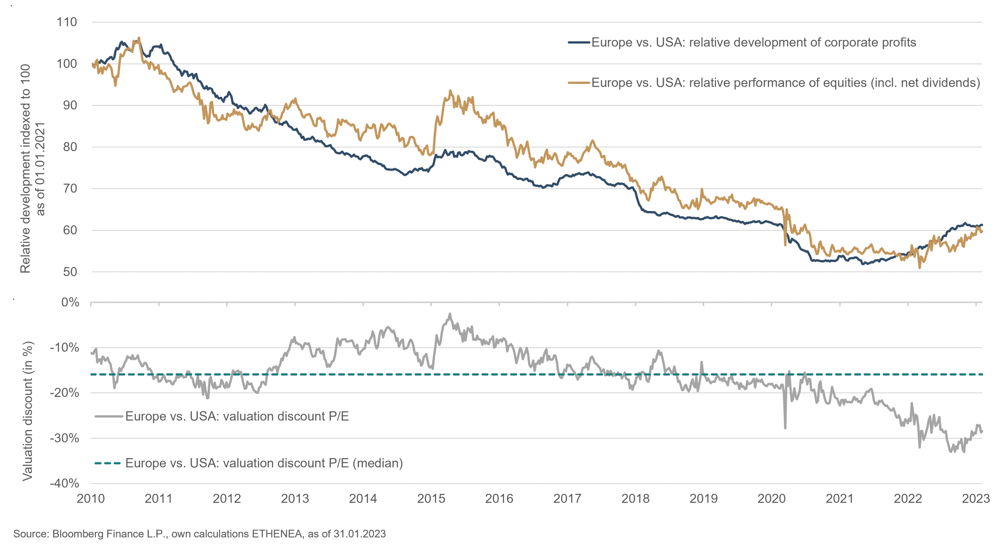

The top of the chart plots the relative price performance of European equities compared with U.S. equities (gold line). The blue line shows the relative performance of expected company earnings over the next 12 months. Both time series are indexed to 100 as at 1 January 2010. For example, movement from 100 to 90 means that Europe was 10% weaker than the U.S. The bottom of the chart reflects Europe’s discount relative to the U.S. based on the price/earnings ratio. While European equities are valued at a multiple of 12.7 based on expected earnings over the next 12 months, the multiple of expected earnings for U.S. equities is 17.8. From a European perspective, this gives a current discount of -29% (grey line). The median for the past 13 years, however, was 16% (turquoise dashed line).

The chart shows two things: over the long term, the much better performance of U.S. equities was largely underpinned by a much better trend in fundamentals. In addition, a certain discounting of European equities seems justified based among other things on differences in the structures of sectors, lower levels of profitability, domestic markets that have tighter regulation and are smaller scale, less energy self-sufficiency as well as a more social form of capitalism. It also seems, however, that the discounting of Europe reached whole new levels when war broke out in Ukraine last year (if not before). At the same time, the fundamental trend relative to the U.S. was amazingly strong. In addition, in many global portfolios, there is a tendency to underweight Europe. This combination of factors explains the strong performance of European equity indices in recent months, especially since the energy crisis turned out less severe as many expected due to the mild winter.

In future, there is further potential for European equities to outperform, as the discount remains exceptionally high. Even a return to the median mentioned above would mean a further outperformance of around 18%. Conditions for the (relative) fundamental momentum to continue are not quite as positive. A few special circumstances existed last year that have since largely been resolved. For example, there was a boom in tech-heavy U.S. equity indices in the pandemic years 2020/21, the huge basis effects of which made for a brisk headwind in 2022. A significant proportion of investments and purchases that were made turned out to be early rather than additional sales. In addition, the strong U.S. dollar impacted on global U.S. corporations whereas many European exporters benefited from the weak euro. Once these trends petered out, the last three months has seen a cancelling out of the relative earnings expectations. It therefore seems unlikely that the positive fundamental momentum will continue in 2023. But nor is there any sign of an opposing trend to Europe’s detriment.

On the whole, therefore, the valuation argument in particular remains valid, but this can only shore up the relative strength of Europe to a limited extent. Unfortunately, the current situation is not enough to assume a sustained resurgence in European equities.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com