Endless purchase programmes?

The central banks are using ever-larger purchase programmes to tackle the recession caused by the COVID-19 pandemic and the upheaval in the capital markets. Central bank balance sheets are continuing to record new highs. But is all this purchasing really necessary? Do the central banks actually have a plan to extricate themselves from constant programme expansion? One option would be to gain control over the yield curve instead of investing large amounts in buying up bonds, as has been the case. With this policy, the central banks not only determine their short-term interest rates, as set administratively through their current interest rate policy, but also try to limit yields on the sovereign bond curve.

Examples of this can be found in Japan, Australia, and in the U.S. Back in 2016, the Japanese central bank (the Bank of Japan) shifted its policy from purchase programmes to yield curve control. The key rate at which the central bank pays interest on commercial bank deposits was set at -0.1%. In addition, it aims to keep the Japanese 10-year sovereign bond yield in a narrow range between -0.2% and +0.2%. The Australian central bank also began to take similar measures in March of this year. The interbank overnight rate was lowered to 0.25%. At the same time, the central bank is striving to limit the yield on Australian three-year sovereign bonds to 0.25%, and is supporting this by making purchases on the secondary market. In this way, it is trying to keep the cost of refinancing down for the whole economy. The Federal Reserve in the U.S. has also had experience with this kind of interest rate policy in the past. In the 1940s, it controlled the entire U.S. Treasuries yield curve and thereby helped the government to keep the cost of financing the war effort down.

Yield curve control: the wiser policy choice?

Of course, effective yield curve control requires that the central bank has sufficient funds to be able to implement such a policy convincingly. In Japan, for example, since yield curve control was introduced by the Bank of Japan in Autumn 2019, the yield has fallen below the target range only once for a short time. Since the majority of Japanese 10-year sovereign bonds are now held by the Bank of Japan (88% according to HSBC’s calculations), there is no doubt that it is indeed capable of effectively controlling the interest rates. If yields fall too far, they can reduce their own holdings. Conversely, pressure to sell is unlikely ever to get so great that massive interventions in the market would be required. The fact that the Bank of Japan is purchasing sovereign bonds to a much lesser extent than other central banks during the current crisis has also recently often been cited as another benefit of yield curve control. Monthly purchases have fallen from almost JPY 10 trillion in 2016 to approximately JPY 5 trillion at the moment. The reason for this is that in the past four years the Bank of Japan has already bought its own sovereign bonds on a large scale, and is able to control (not to mention manipulate) the yield curve at will. In order to keep yields at the desired level it is therefore no longer necessary to continue to spend large sums of money.

Of course, this central bank policy also raises questions concerning sustainability and longer-term implications. Does it really create a further incentive for companies to invest? Can we expect higher inflation or even a reduction of national debt? Japan has shown us that this policy enables the Japanese government to raise money cheaply and thus support consumption or investment. In addition, it has not led to a rise in inflation or a reduction of national debt in Japan so far. On the other hand, it is only possible to exit this policy if investors are prepared to buy these bonds back off the Bank of Japan. At the current yield level, this can really only happen by compulsion or because the alternatives are even more unattractive.

A study from this year by the New York Fed¹ examines the yield curve control by the Federal Reserve in conjunction with the Department of the Treasury from 1940 to 1945. At that time, the rates for Treasury Bills with a maturity of 13 weeks up to 30-year Treasuries were fixed and always kept below the set value by means of purchases and sales. In particular, this study examines whether fixing a rising yield curve was the correct choice at the time or if a flat yield curve would have been a better choice. In addition, it discusses how best to exit this policy. Whatever conclusions the Fed draws from this study for its future interest rate policy, one thing is clear: today, too, the Federal Reserve would certainly have no difficulties controlling the long end of the yield curve. In the first four months of this year, around USD 200 billion was issued in U.S. Treasuries with a maturity of 10 years or more. However, the Fed has already purchased more than USD 1.5 trillion in U.S. Treasuries since March alone. If they focus their purchases specifically on the long end of the curve it should be easy to control any rise in yields.

Yield curve control: not a magic bullet!

Yield curve control can only be successful if the central bank is permitted to buy up any amount of sovereign bonds and has sufficient bonds to sell them again if there is a likelihood that yields will fall. Therefore, yield curve control is only possible if large-scale purchases were made beforehand. This gives central banks slightly more flexibility and allows them to suspend their purchases during times of strong investor demand, meaning they do not have to stick rigidly to the schedule and volume of their programmes. Ultimately, both the purchase programmes and yield curve control aim to facilitate the refinancing of growing government deficits at tolerable interest rates. If national deficits rose further even yield curve control could not avoid further purchases. So, it is not a true alternative.

¹ https://www.newyorkfed.org/medialibrary/media/research/staff_reports/sr913.pdf

Positioning of the Ethna Funds

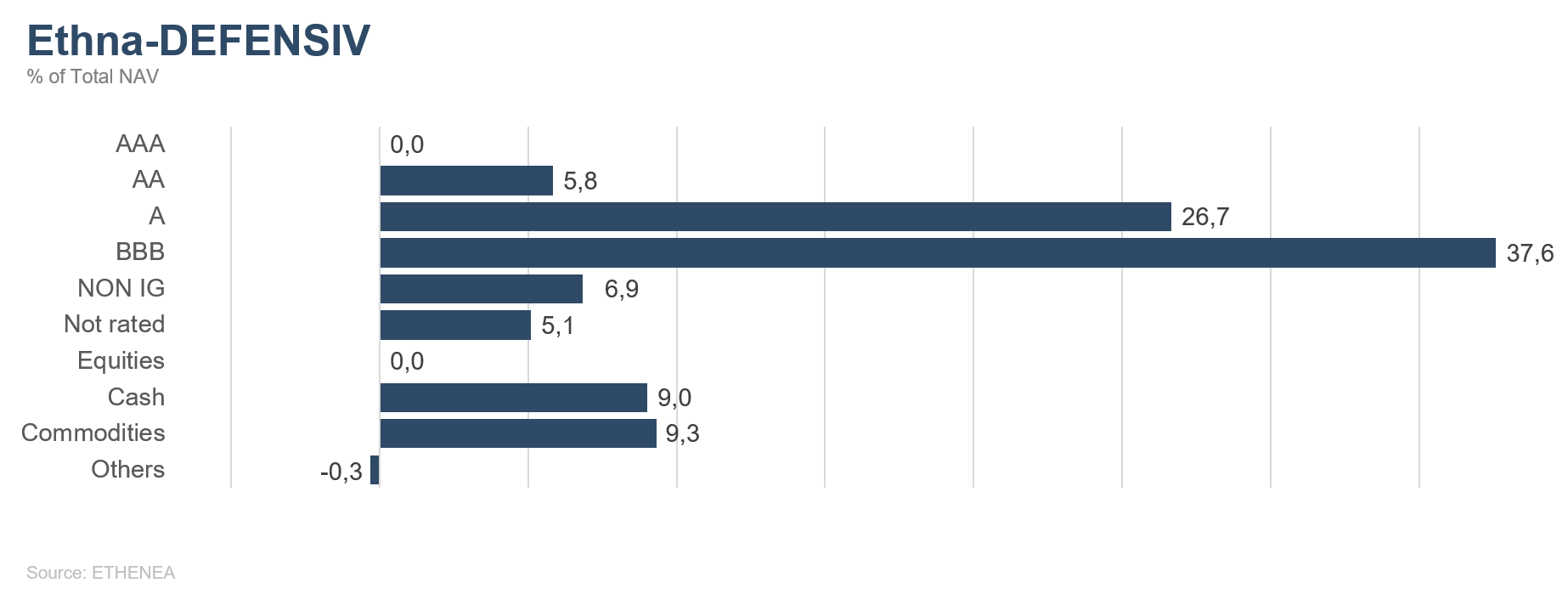

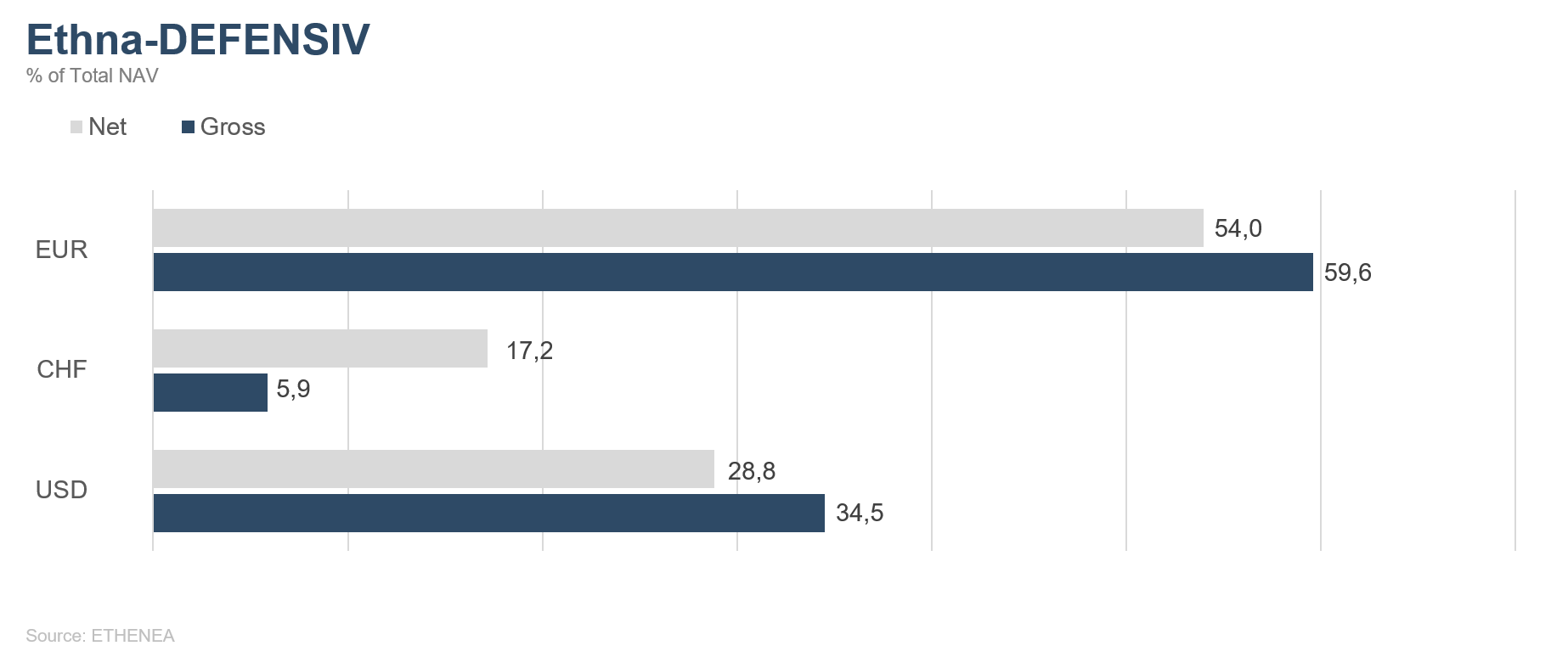

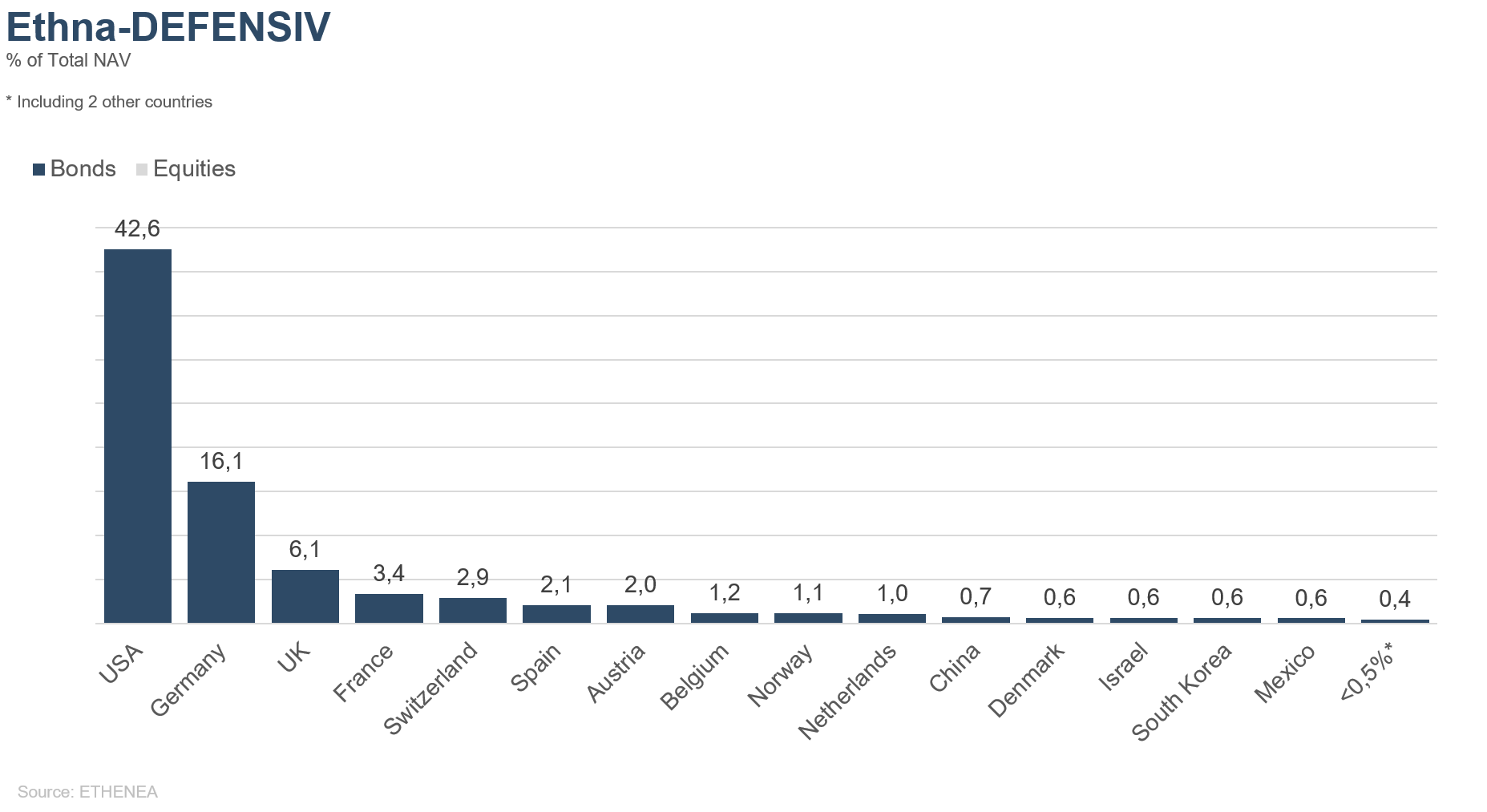

Ethna-DEFENSIV

The COVID-19 pandemic is certainly not over, but due to falling rates of infection many countries currently feel that they are in a position to ease the restrictions they had imposed on their citizens and economies. The hope that the economy would pick up soon led to sharp price gains for corporate bonds. These hopes were also raised in Europe by talk of a EUR 750 billion economic recovery fund proposed by EU Commission President Ursula von der Leyen. This fund amounts to approximately 5% of EU GDP last year.

In addition, the central banks’ purchase programmes are now taking full effect. Under the PEPP (Pandemic Emergency Purchase Programme), the ECB has already purchased more than EUR 200 billion in bonds since the end of March. Even though sovereign bonds accounted for most of it, it had an even greater effect on the corporate bond market. This may also be due to the fact that there is a much smaller supply of corporate bonds. Having already bought more than USD 1.5 trillion in U.S. Treasuries, the Federal Reserve began to purchase corporate bonds in May. So far, the Federal Reserve is only doing so indirectly, by purchasing ETFs that contain corporate bonds.

U.S. Treasury yields hardly changed at all over the course of May and are currently around the ten-year average of 0.65%. The higher issuance and the recently much-reduced Federal Reserve purchases did not create upward pressure on yields. It must be borne in mind, however, that only a comparatively small proportion of U.S. sovereign debt with a maturity of 10 years is being issued. From January to April, approximately USD 113 billion in U.S. 10-year Treasuries was issued – less than 2% of total issuance by the U.S. Treasury Department. Yields on German 10-year sovereign bonds increases only slightly, and remain below zero at -0.4%.

At the end of the month, German retail sales were finally published for the month of April. They were only 6.5% below the previous year’s figure and thus much higher than the pessimistic predictions, which had forecasted a fall well into double digits. The latest ifo index for the German economy, which predicts a fall of 6.6% for this year but also a rapid recovery by 10.2% for next year, is a glimmer of hope. Of course, much depends on how the COVID-19 pandemic will progress and on whether, when and to what extent there is a second or even a third wave of infections. At least the predictions for the German economy are anything but devastating. At the same time, inflation remains low and price development could even become slightly deflationary. At any rate, consumer prices in the European Union fell 0.1% in May.

The Ethna-DEFENSIV (T class) gained further ground over the month, with a performance of +0.61%. With that, YTD performance is only slightly negative, at -1.31%. We did not change much in relation to portfolio allocation. We increased the bond allocation to just above 80% again, and the gold allocation is now almost 10%. Diversification in USD (29%) and CHF (17%) has been in place since as far back as the beginning of the year, with slight variations in weighting. In May both currencies fell against the euro and thus detracted from performance for the month. However, due to the problems in the eurozone, we do not expect this development to last.

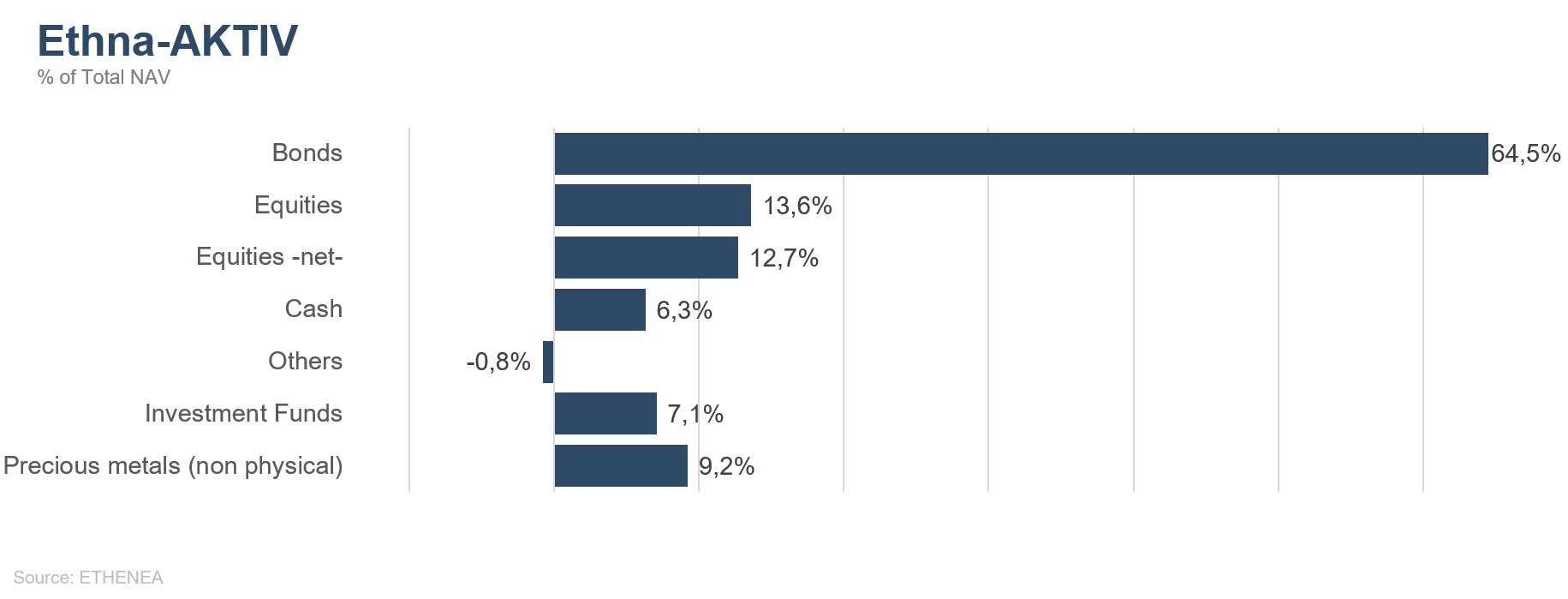

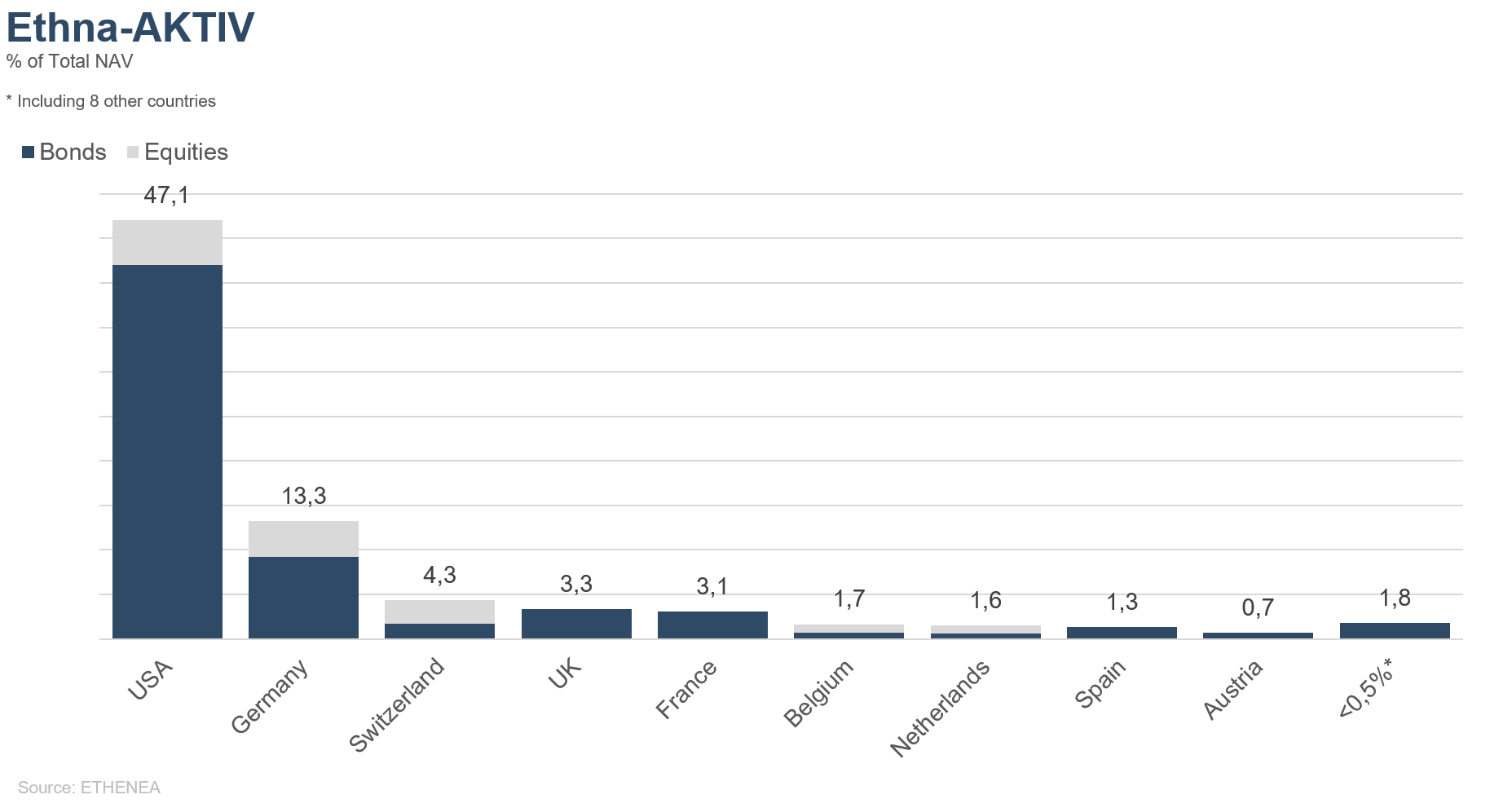

Ethna-AKTIV

The rally in international financial markets continued in May, too. Equities and corporate bonds alike benefited from a mix of negative sentiment, positive news about reopening and – above all – a much improved liquidity situation. That said, the investor community is rarely as divided as it seems to be over the subjective gap between current equity market valuations and economic realities. With lockdown restrictions being lifted, the bulls are already emphasising the growth figures for next year and are also feeling the tailwind from the largest monetary and fiscal packages in history, whereas the bears are pointing to the damage that has already been done by unemployment, businesses going under and the corresponding impact on consumption and investment. We are leaning more towards the second position in our view of the situation, granted that the current situation and any conclusion drawn from it for the markets entail a high degree of uncertainty due to their complexity. For this reason, we believe it to be all the more important to focus positioning on the asset classes and themes that are not entirely dependent on the COVID-19 pandemic ending soon.

In practical terms, this means continuing to underweight equities despite the change in preference that occurred at the end of the month, which could provide the necessary momentum for further strength. We are still working under the assumption that the complete turnaround on equities is unlikely. The fact that the equity market is impervious even to an obvious escalation in the trade conflict that had lain dormant for six months and the nationwide demonstrations in the U.S. is remarkable, but for us it is still not a reason to buy. We continue to favour corporate bonds and have also added select higher-yielding bonds to the portfolio during the market correction. In principle, we think that the central bank programmes with their real purchases will have more of a positive effect in the fixed income segment than on equities, since the transfer mechanism does not work quite so directly in the case of equities.

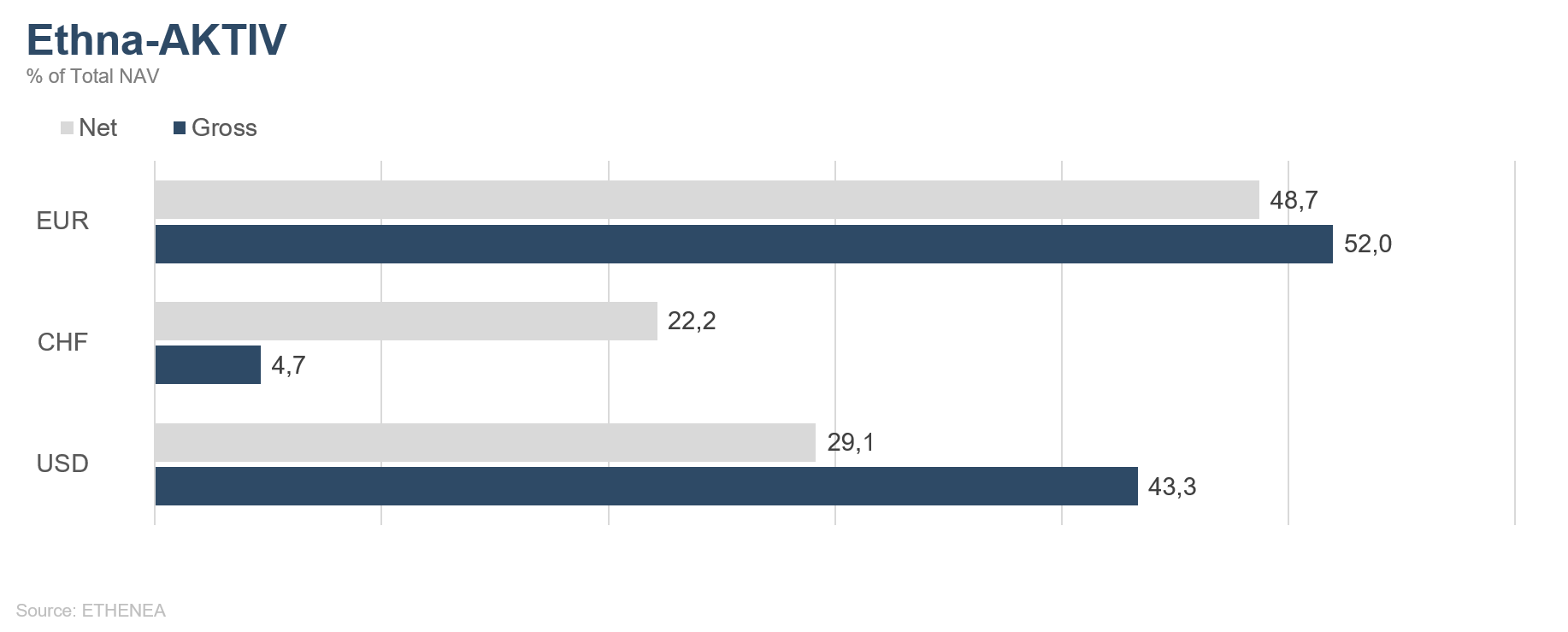

There were slight changes in the positioning of gold and currencies. While the precious metal was up to just below the maximum of 10%, we reduced both the U.S. dollar and the Swiss franc positions by approximately one third in light of the European recovery fund that is yet to come. In the long term, even this package – if it actually materialises – will not change anything about the eurozone’s problems; in the short term, however, there is hope that it will bring us one step closer to fiscal union. We do not share this hope, but cannot rule out the possibility that it will increase the value of the euro in the short term. As soon as the euro’s original trend towards weakness resumes, we will increase our position once again.

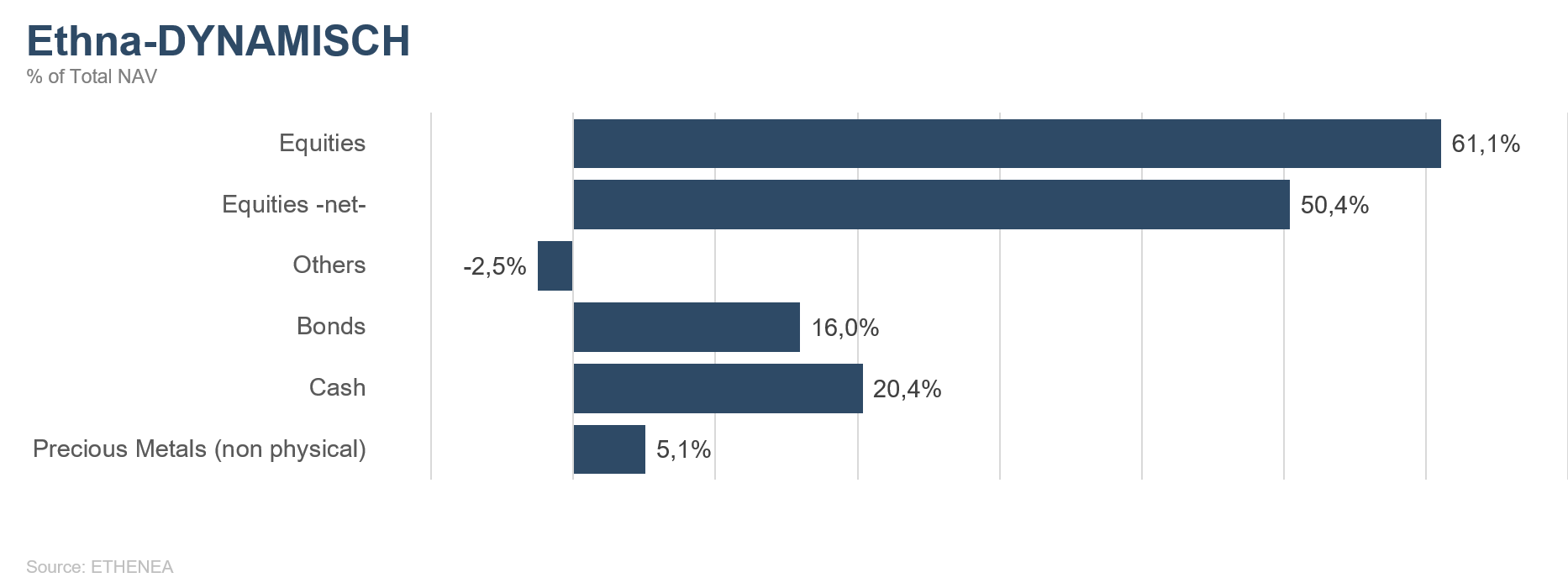

Ethna-DYNAMISCH

Humans are creatures of habit. While the severe impact on all aspects of our social lives at the beginning of the year were unimaginable, they are slowly but surely becoming routine. The same seems to apply to market participants, who are apparently taking an increasingly more relaxed attitude to the economic challenge before us. The dynamics of the equity market rally in May could not match those of the previous month. That said, the fundamental direction of prices tended to remain upward.

The positive development since March can be explained by a series of influencing factors, all of which are having a very supportive effect on the prices of equities, and have been discussed in the past two months’ market commentaries. First and foremost, there are the central bank responses and economic stimulus packages that have been unique in both scale and speed. Economically, too, there have been a few rays of hope of late, though the uncertainty concerning economic development is greater than ever due to the complexity of the overall situation. Ultimately, it was once again investor sentiment that tipped the scales, leading over the course of the month to palpable pressure to buy among many investors. At the beginning of the month, both the market outlook and the positioning of most investors were very defensive and geared towards falling prices. The extent of this one-sided positioning meanwhile became as extreme as ever we have seen, leading – at least briefly – to precisely the opposite in the markets and at the end of the month, in particular the stocks that had been losing out in the crisis to date positively skyrocketed. Investors in turn lost interest in the more defensive equities – the relative winners to date in the coronavirus crash – and those equities thus lost value.

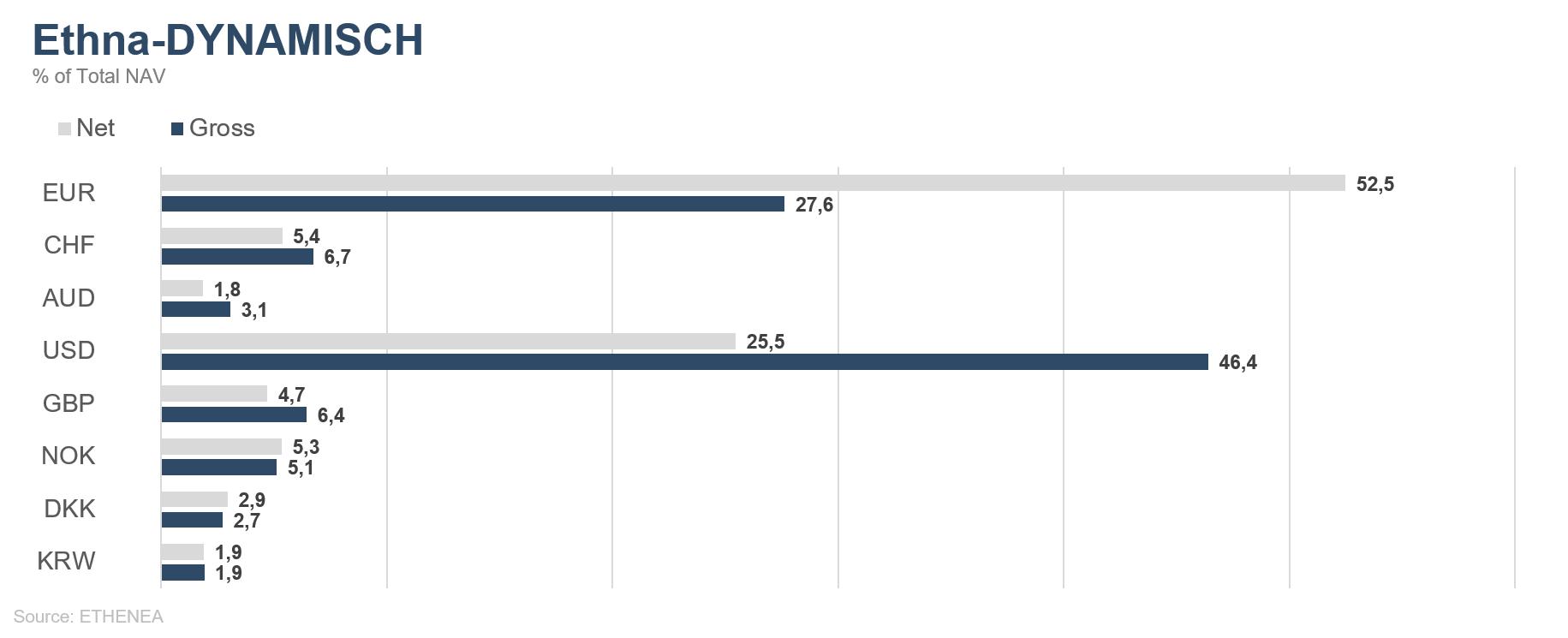

In the Ethna-DYNAMISCH we managed to anticipate many of these market developments early and position the fund portfolio accordingly. We significantly reduced the size of the single stock portfolio by around 20 percentage points from 77% at the end of April to less than 60% now. Subsequent price gains brought gross equity exposure at the end of the month to 61%. The reduction in the portfolio was realised primarily by scaling back positions in defensive securities, such as those in the healthcare or counter-cyclical consumer sectors. We completely divested ourselves of LEG Immobilien, Kraft Heinz and Pfizer. At the same time, these measures enabled us to considerably reduce our hedges against price risks – via very cost-effective broad equity index futures – without changing the actual net equity allocation very much from around 50%. Weighing up the risks and potential opportunities, we deem this percentage to be appropriate lately. Making this adjustment meant the overall portfolio construction was better balanced and took account of the insights we gained in time, which was apparent as early as the second half of the month.

At the end of the month, we once again invested some of the proceeds of the equity sales in long-dated U.S. Treasuries. With yields just below 1.50%, in our view these once again offer a more attractive risk/return ratio, to stabilise the fund portfolio in the event that economic fears flare up to a considerable degree. At 5%, the position is of a similar size to the gold position. We can imagine building up both positions towards 10% in due course.

Howard Marks, an investment legend from the U.S. who is known for his memos on the capital market, recently summed up his attitude to the current uncertainties as follows: “we may not be able to predict the future, but that doesn’t mean we’re powerless to deal with it.” We couldn’t have put it better ourselves. Despite all the uncertainties out there at the moment, in the Ethna-DYNAMISCH we, too, strive to have an attractive as possible composition of investments in order to utilise the opportunities that arise but also to keep the risks that no doubt exist under control.

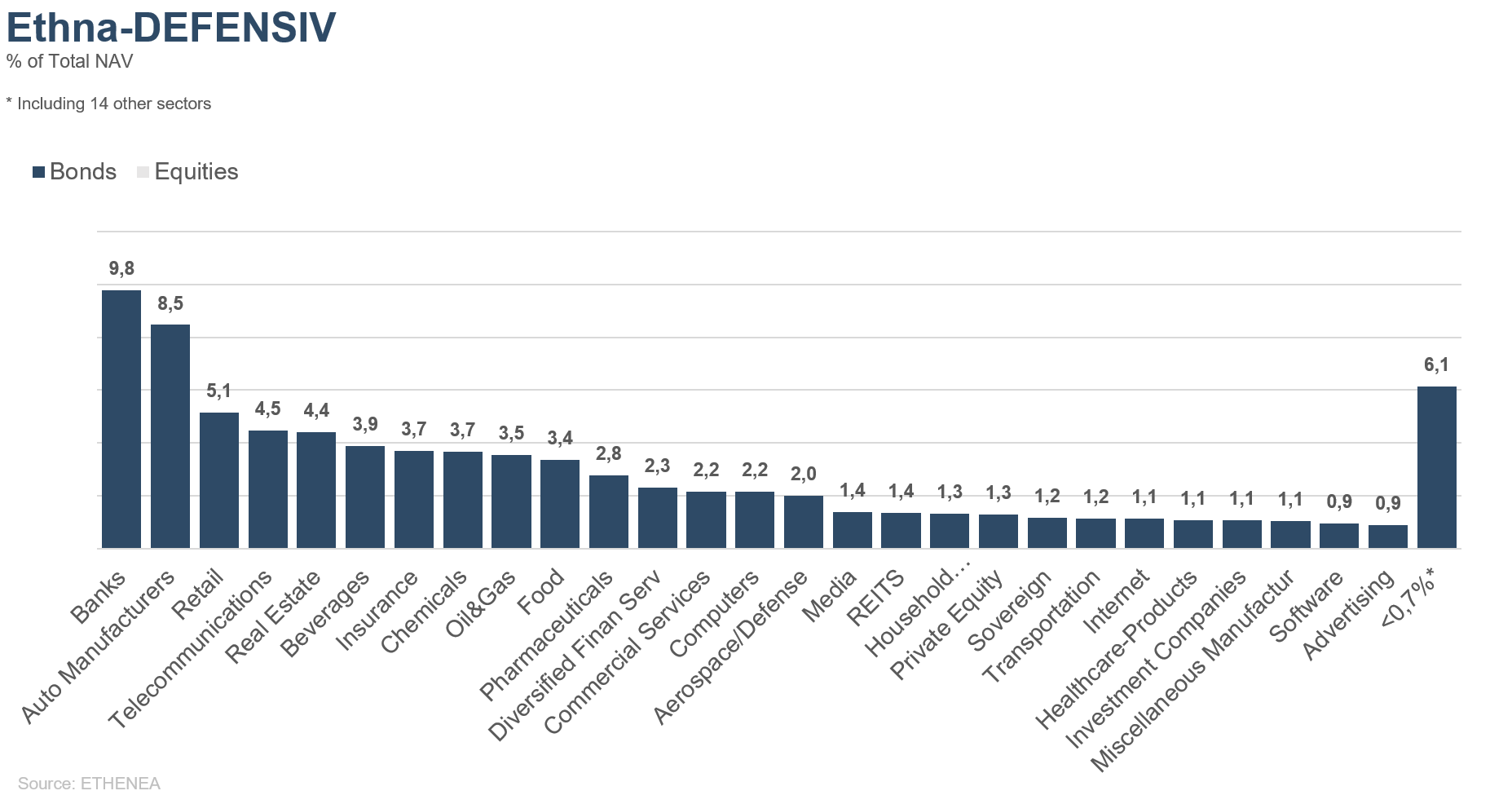

Figure 1: Portfolio structure* of the Ethna-DEFENSIV

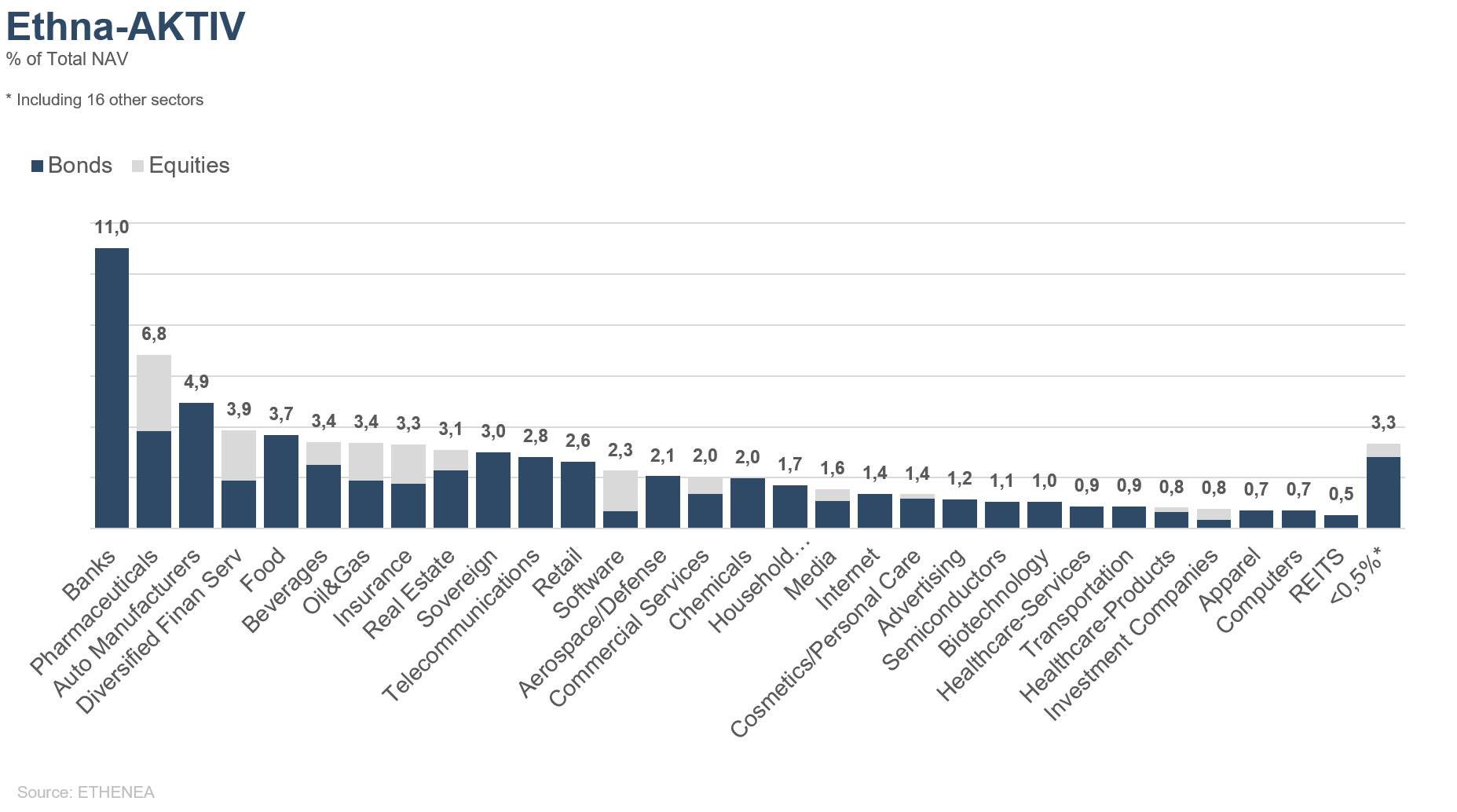

Figure 2: Portfolio structure* of the Ethna-AKTIV

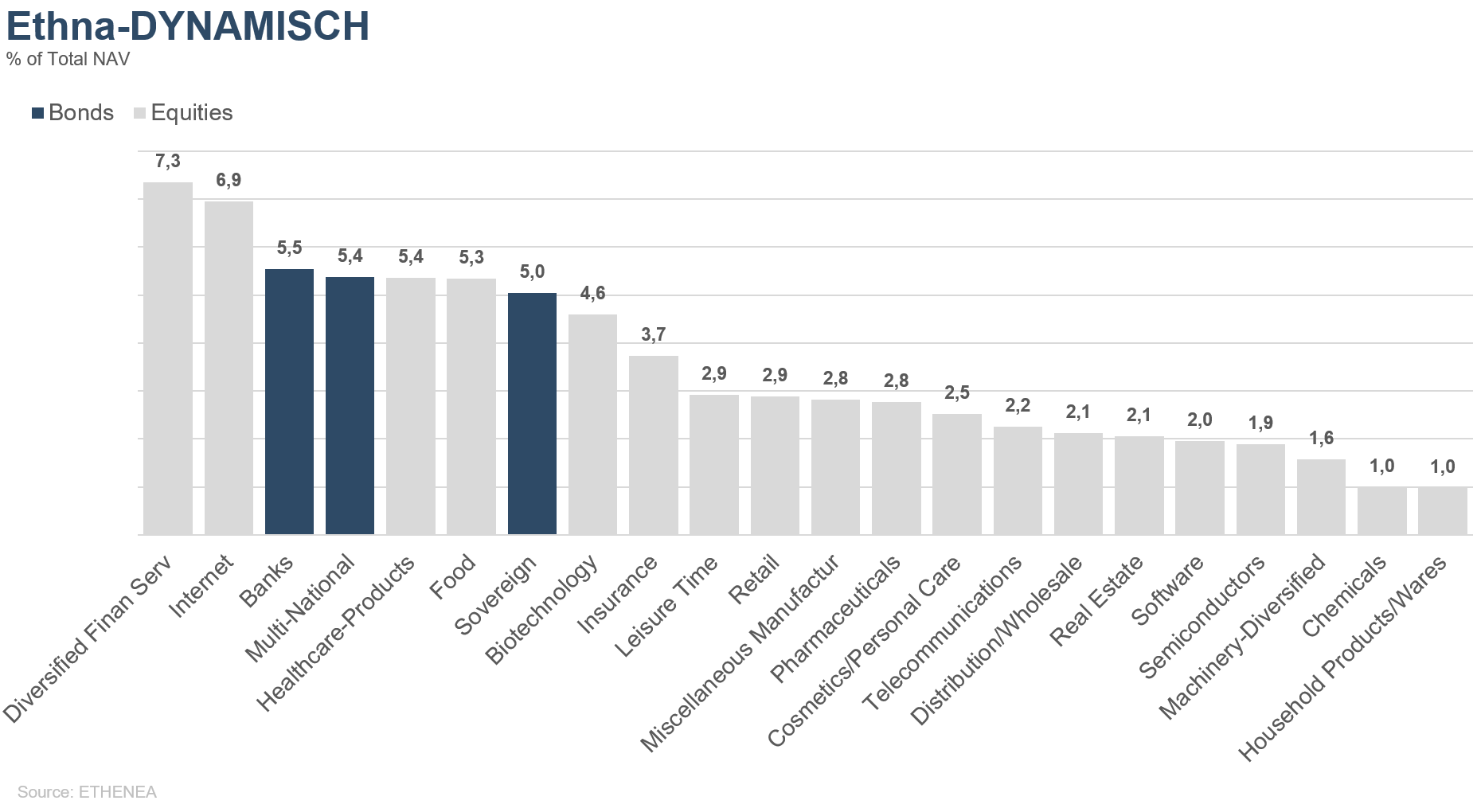

Figure 3: Portfolio structure* of the Ethna-DYNAMISCH

Figure 4: Portfolio composition of the Ethna-DEFENSIV by currency

Figure 5: Portfolio composition of the Ethna-AKTIV by currency

Figure 6: Portfolio composition of the Ethna-DYNAMISCH by currency

Figure 7: Portfolio composition of the Ethna-DEFENSIV by country

Figure 8: Portfolio composition of the Ethna-AKTIV by country

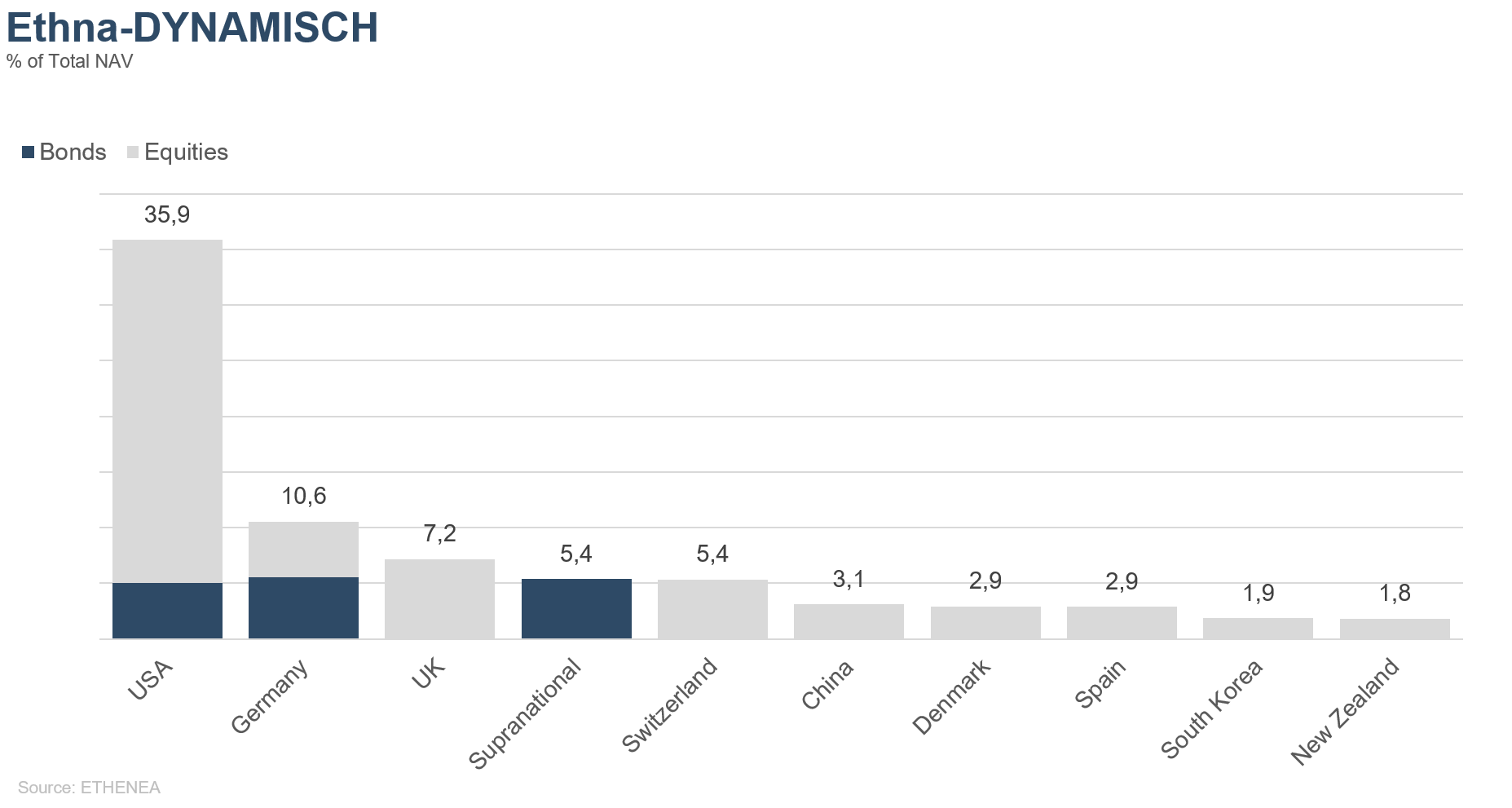

Figure 9: Portfolio composition of the Ethna-DYNAMISCH by country

Figure 10: Portfolio composition of the Ethna-DEFENSIV by issuer sector

Figure 11: Portfolio composition of the Ethna-AKTIV by issuer sector

Figure 12: Portfolio composition of the Ethna-DYNAMISCH by issuer sector

* “Cash” comprises term deposits, call money and current accounts/other accounts. “Equities net” comprises direct investments and exposure resulting from equity derivatives.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

This marketing communication is for information purposes only. It may not be passed on to persons in countries where the fund is not authorized for distribution, in particular in the USA or to US persons. The information does not constitute an offer or solicitation to buy or sell securities or financial instruments and does not replace investor- and product-related advice. It does not take into account the individual investment objectives, financial situation, or particular needs of the recipient. Before making an investment decision, the valid sales documents (prospectus, key information documents/PRIIPs-KIDs, semi-annual and annual reports) must be read carefully. These documents are available in German and as non-official translations from ETHENEA Independent Investors S.A., the custodian, the national paying or information agents, and at www.ethenea.com. The most important technical terms can be found in the glossary at www.ethenea.com/glossary/. Detailed information on opportunities and risks relating to our products can be found in the currently valid prospectus. Past performance is not a reliable indicator of future performance. Prices, values, and returns may rise or fall and can lead to a total loss of the capital invested. Investments in foreign currencies are subject to additional currency risks. No binding commitments or guarantees for future results can be derived from the information provided. Assumptions and content may change without prior notice. The composition of the portfolio may change at any time. This document does not constitute a complete risk disclosure. The distribution of the product may result in remuneration to the management company, affiliated companies, or distribution partners. The information on remuneration and costs in the current prospectus is decisive. A list of national paying and information agents, a summary of investor rights, and information on the risks of incorrect net asset value calculation can be found at www.ethenea.com/legal-notices/. In the event of an incorrect NAV calculation, compensation will be provided in accordance with CSSF Circular 24/856; for shares subscribed through financial intermediaries, compensation may be limited. Information for investors in Switzerland: The home country of the collective investment scheme is Luxembourg. The representative in Switzerland is IPConcept (Suisse) AG, Bellerivestrasse 36, CH-8008 Zurich. The paying agent in Switzerland is DZ PRIVATBANK (Suisse) AG, Bellerivestrasse 36, CH-8008 Zurich. Prospectus, key information documents (PRIIPs-KIDs), articles of association, and the annual and semi-annual reports can be obtained free of charge from the representative. Information for investors in Belgium: The prospectus, key information documents (PRIIPs-KIDs), annual reports, and semi-annual reports of the sub-fund are available free of charge in French upon request from ETHENEA Independent Investors S.A., 16, rue Gabriel Lippmann, 5365 Munsbach, Luxembourg, and from the representative: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg. Despite the greatest care, no guarantee is given for the accuracy, completeness, or timeliness of the information. Only the original German documents are legally binding; translations are for information purposes only. The use of digital advertising formats is at your own risk; the management company assumes no liability for technical malfunctions or data protection breaches by external information providers. The use is only permitted in countries where this is legally allowed. All content is protected by copyright. Any reproduction, distribution, or publication, in whole or in part, is only permitted with the prior written consent of the management company. Copyright © ETHENEA Independent Investors S.A. (2025). All rights reserved. 03/06/2020