Growing imbalances in the equity market

We are always on the search for divergent developments in capital markets in order to avoid risks or seize opportunities. We also keep a eye out for imbalances as part of our risk-reward analysis. An increase in such imbalances was very noticeable recently in the equity market in particular.

Notably in the U.S. we noticed that equity market developments were being determined by only a few large caps. This imbalance becomes obvious when we compare the well-known – market-capitalisation-weighted – S&P 500 with the less-well-known equal-weight variant of the major market barometer. The latter has been hovering close to zero year-to-date while the S&P 500 traded up in the double digits for a time. The average stock is therefore treading water while the S&P 500 is gaining. This phenomenon is sometimes referred to as a lack of market breadth.

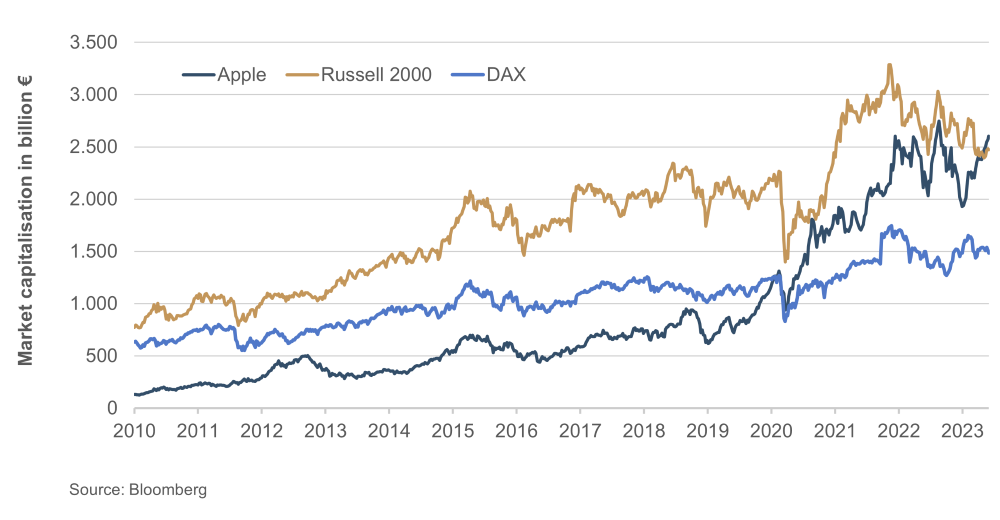

The five largest stocks (Apple, Microsoft, Alphabet, Amazon and NVIDIA) now make up almost a quarter of the index capitalisation. Apple alone has a market capitalisation of more than EUR 2.5 trillion, which is actually slightly higher than the entire market capitalisation of the Russell 2000 (a world-renowned equity index of U.S. small caps). The following chart shows the impressive development of Apple’s market capitalisation and of the index, which comprises around 2000 stocks, since the year 2010. For additional reference, the market capitalisation of the leading index of German shares DAX is shown, which recently amounted to around EUR 1.5 trillion, around 60% of the absolute market valuation of Apple:

Most of the other examples of the decrease in the market breadth we are seeing also come from the U.S. For instance, during the recent banking crisis, the market capitalisation of the largest U.S. bank J.P. Morgan far exceeded the combined market capitalisation of the 143 regional banks represented in the S&P Regional Banks Index. The development of the share of U.S. car maker Tesla compared with all other automobile manufacturers in the global market has tracked this development in recent years. Within the top 5 stocks in the S&P 500, the same – with a twist – goes for Amazon and chip manufacturer NVIDIA, whose market capitalisation is now roughly 30 times its last annual sales figure (not earnings).

Despite the generally negative overtone, at the end of the day the observations outlined are just that: observations; little pieces of the puzzle that is the overall market. The mostly very good fundamental development of all these individual stocks could well continue, and the imbalances in the market could consequently intensify. Equally, the segments of the market that have been left behind could catch up – the valuations provide scope for this – and reduce the imbalances accordingly. In any case, it is important to be aware of and keep abreast of the developments we have described, so we know what’s what when the word is that "the market is doing this or that…”

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com