Hard times

The global economy currently finds itself at a critical juncture and uncertainty has surged. While recovering from the recession brought on by the Covid-19 pandemic and grappling with rising inflation, it has been hit by a major negative supply and demand shock, which threatens to trigger a new recession.

A swift recovery and a short cycle with dangerous inflationary pressures

The Covid-19 pandemic ended the longest economic cycle of the post-war period, a cycle that lasted more than 10 years between June 2008 and February 2020. Due to unprecedented monetary and fiscal policy stimulus, the Covid-19 recession proved to be the shortest in US history, but it also resulted in the steepest gross domestic product (GDP) decline since the recession of 1945.

An exceptional shock requires an exceptional policy response. Therefore, mindful of the mistakes made during the global financial crisis (GFC) of 2008, policymakers reacted swiftly, enacting unprecedented fiscal and monetary policy stimulus measures that prevented an economic depression and produced an unusual and particularly rapid economic recovery.

With the service sector suffering from Covid-19-related restrictions, demand was concentrated in the goods sector. Here, inflation skyrocketed, as supply chains were overwhelmed and bottlenecks prevented the supply from matching a turbocharged demand. The sudden and sharp increase in demand for energy, coupled with the early phase of energy transition¹ and diminished investment in fossil fuel energy, pushed oil and gas prices to multi-year highs. The labour market slack that traditionally follows a recession failed to materialise. As a result, labour markets are extremely tight and wages are rising sharply in some advanced economies.

We have been experiencing an extremely condensed business cycle. The global economy has rapidly transitioned from the early phase of the recovery to the mid-cycle expansion with intensifying inflationary pressures. Although economic growth remains healthy, it has likely peaked in a wide section of the global economy. With supply constraints lasting longer than expected, inflation has become broader and more persistent, and it is starting to impact areas such as wages and rents.

Although central banks had hoped that when supply chain bottlenecks clear, this would dampen inflation without the need for them to excessively tighten their policies, they realised that decisive action was required to lower inflation and adopted a resolutely hawkish stance at the end of 2021.

Geopolitical crisis

At the end of February, the picture took a dramatic turn for the worse. What seemed to be merely a dangerous tail risk for the global economy just a few weeks prior, suddenly became a devastating reality. The Russian invasion of Ukraine has shocked the world, resulted in immense suffering for the Ukrainian people, and damaged the global economy.

The already complicated scenario of persistently high inflation and central banks withdrawing their accommodative policies has been exacerbated by the war. Uncertainty and downside risks have increased significantly. The war, coupled with the sanctions subsequently imposed by the US and Europe, has caused energy and commodity prices to spike dramatically. Ukraine and Russia are among the main suppliers of all types of raw materials: oil, gas, grain, minerals, metals, etc. A sustained surge in energy and commodity prices is feeding into price pressures and poses a significant risk that inflation will remain high for longer and become entrenched, triggering longer lasting second-round effects.

The global economy faces the risk of a new recession. It has been hit by a combined negative supply and demand shock that will further damage global supply chains, intensify inflationary pressures, and lead to slower growth by undermining confidence and hampering international trade. This type of external stagflationary shock is particularly challenging for policymakers, as they are faced with an increasingly difficult trade-off between curbing stubbornly high inflation and supporting growth, just as they have begun to scale back their ultra-expansionary pandemic policies.

How will policymakers react? It is a heterogenous situation and it is likely that the conflict will further exacerbate economic divergences, as countries are affected in different ways by the war. In light of this new reality, fiscal and monetary authorities will carefully reassess their plans to tighten policies. As uncertainty increases, the macroeconomic policy mix (of monetary and fiscal policies) will become a crucial factor in keeping inflation under control, without driving the global economies back into recession. Central banks will push ahead with their normalisation plans to curb inflationary expectations and prevent it from becoming entrenched. We expect fiscal policy will remain largely supportive in order to avoid a combined monetary and fiscal tightening that could trigger a new recession.

Facing solid growth, full employment, and strong wage pressures, in March, the Fed embarked on its normalisation path, sending a clear message that it is fully committed to lowering inflation. The Fed also signalled that the US economy is strong and that it can withstand aggressive tightening with little risk of a recession. The Biden administration is likely to try to revive its ‘Build Back Better’ programme to provide support to households and business hit by the increase in energy and commodity prices. The European economy, which is heavily dependent on Russian energy and has close economic ties with Russia, will be the hardest hit by the consequences of the war. The ECB has indicated its intention to accelerate its exit from the quantitative easing programme, however, in light of the economic uncertainties, it will be more hesitant (than the Fed) to aggressively tighten its policy. With the disbursement of the EU Recovery plan, a revision of the Stability and Growth Pact, further possible measures to cushion the economy from increasing energy prices, and in order to increase defence spending, fiscal policy will remain expansionary. In China, which is still struggling with the effects of the Covid-19 pandemic, macroeconomic policy will remain strongly expansionary in order to achieve the objective of 5.5% GDP growth set by the National People’s Congress for 2022.

Although the path to a soft landing is still there, it is increasingly becoming narrower. A swift resolution of the conflict in Ukraine seems to be a crucial factor to reduce stagflationary risks. To achieve a soft landing, an appropriate economic policy mix is needed, including a gradual normalisation of monetary policy and supportive fiscal policies that provide central banks with the necessary room to scale back accommodative measures without triggering a recession. Avoiding policy missteps is crucial but this will be increasingly complicated in the current environment. Finally, a global resolution to the pandemic crisis remains key to resolving supply chains constraints, curbing inflationary pressures, and supporting the global recovery. A double dip recession is not the baseline scenario, but a soft landing might start to look like wishful thinking.

Portfolio Manager Update & Fund positioning

Ethna-DEFENSIV

For the first time since 2018, in March, the U.S. Federal Reserve raised the Fed funds rate by 25 basis points to a target range of 0.25% to 0.50%. With inflation nearing the 10% mark and the U.S. close to reaching full employment, further rate hikes before the end of the year are taken as a given. In addition, the U.S. economy is less directly affected by the war in Ukraine and is more independent in terms of its energy supply: it is virtually self-sufficient in oil and gas. We expect the Federal Reserve to raise interest rates by at least 25 basis points, in some cases even 50 basis points, in each of the remaining six FOMC (Federal Open Market Committee) meetings this year. This would take the target range for the Fed funds rate to between 2% and 2.25% by the end of the year. 2023 will see further rate rises, meaning the Fed funds rate could be around 3% by the end of 2023; that is, above the peak of the last interest rate cycle in 2018.

Yields on 10-year U.S. Treasuries have risen by a further 68 basis points to 2.4% over the last month, after concerns over the war in Ukraine, especially among U.S. investors, faded into the background and central bank policy came to the fore. At the same time, the yield spread between 2-year and 10-year Treasuries – often taken as an early indicator of an impending economic slowdown – narrowed considerably and most recently stood at only 4 basis points. Capital markets are even pricing in an inversion of the yield curve for the coming months. Economic growth will slow markedly in the coming quarters, but it remains to be seen whether a recession will actually hit. After all, consumer sentiment is good and the desire to eat out and go on holiday remains high, so catch-up effects may balance out other risk factors.

The eurozone is also gearing up for tighter monetary policy even though the pace here will be much slower and the rate hikes will not be nearly as steep. We consider it possible that the current deposit rate in the eurozone of -0.5% could be raised to 0%. Given that inflation was 7.2% in March in Germany, that is still extremely low, especially since the ECB is purchasing EUR 40 million in bonds per month under the Asset Purchase Programme (APP). As such, the real interest rate in the eurozone will remain well below zero for the foreseeable future.

This means that the omens for risk assets such as equities and corporate bonds are mixed. There are signs that the economy is weakening and growth this year will be much lower than expected just a few months ago. In addition, high energy prices and the uncertainty over the Ukraine crisis are negative factors. The fact that, at this stage of the economic slowdown, central banks worldwide are starting to tighten monetary policy to tackle runaway inflation is the correct course of action and long overdue, but is an additional stress factor for capital markets.

Even though not much has happened yet in terms of interest rates, risk assets have taken the first rate hike surprisingly well. Having widened by a clear margin since the beginning of the year, corporate bond risk premia narrowed slightly in March. Premia for investment grade bonds fell by 8 basis points in March in the U.S. and by no less than 17 basis points in the eurozone. The high yield segment saw even greater declines (45 basis points in U.S. high yield and 53 basis points in EUR high yield).

Despite the greatly reduced duration and the fall in risk premia, the fund lost 0.91% in March (T class). Secure investments such as the U.S. dollar were, as expected, in strong demand even though interest has waned slightly due to an apparent easing of the situation in Ukraine and a greatly overbought U.S. dollar. For the year to date, the fund stands at -2.98%.

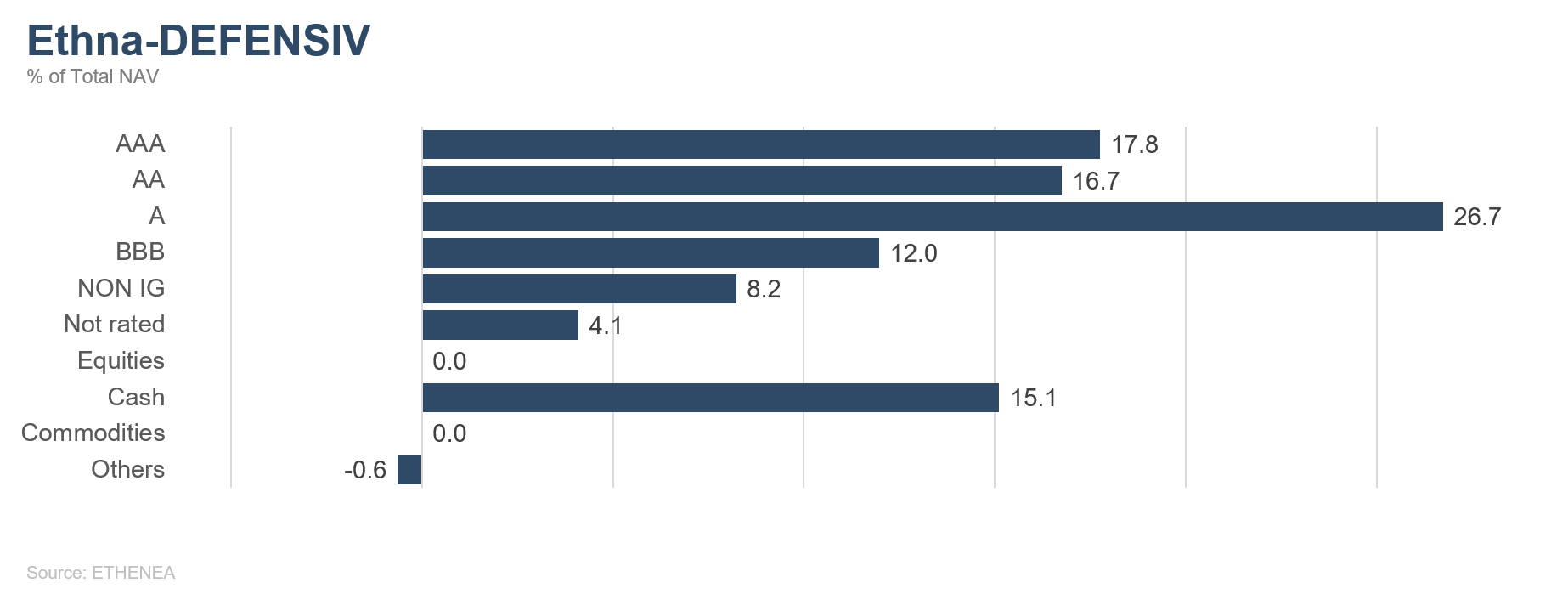

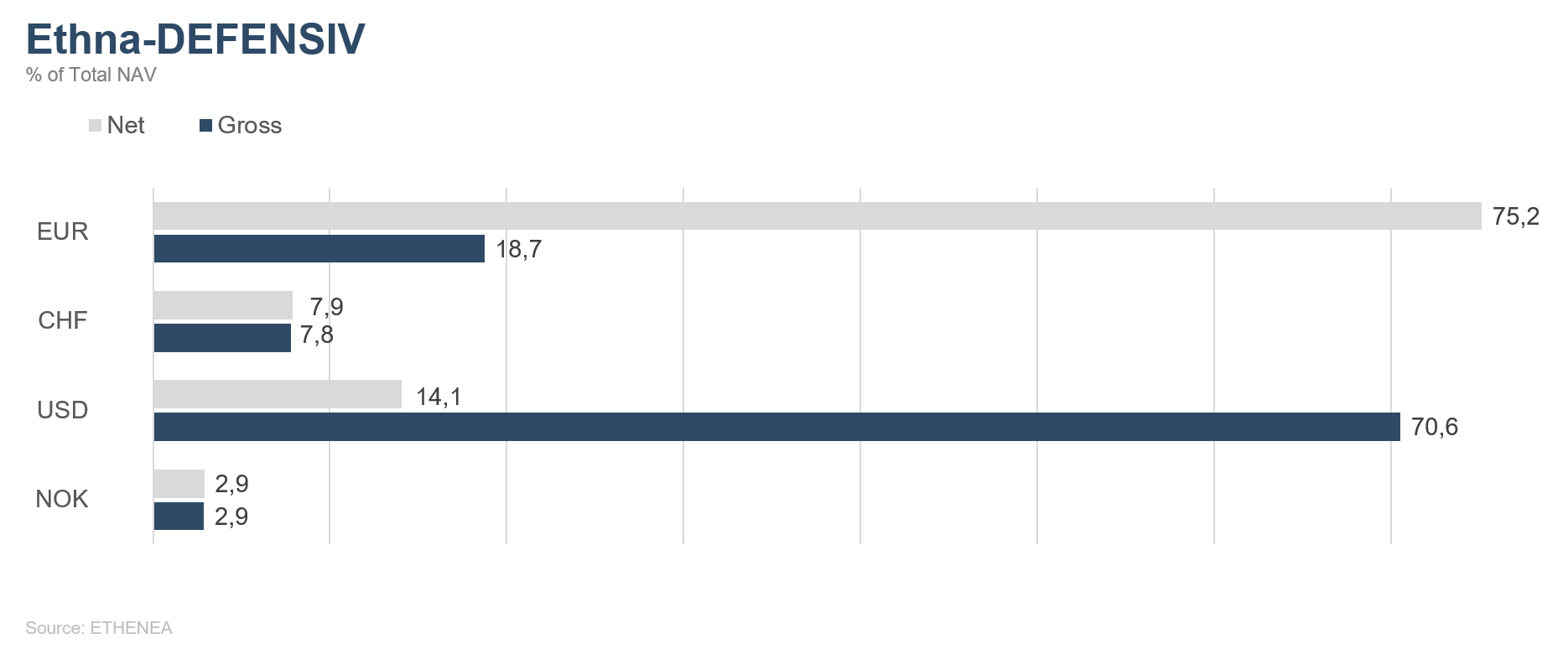

Considering the ongoing uncertainties, the positioning of the Ethna-DEFENSIV remains conservative. In the bond segment, we are concentrating on issuers with stable business models, good credit ratings and robust balance sheets. In addition, we are making sure to invest in well-known, liquid names, so that positions can quickly be scaled back again in the event of a major upheaval. We also remain extremely cautious in terms of duration management, as interest rates are expected to rise further, and we favour bonds with short and medium maturities (less than 5 years). We will avoid equity investments for the time being.

Ethna-AKTIV

The first quarter of the year is already over. Unfortunately, the situation on the eastern borders of Europe escalated into war. Facing major changes as it was, the capital market was shaken up even further. Consumers and businesses not only saw the sharpest first-quarter increases in commodity prices since 1915, but are now also facing rapidly rising interest rates.

In terms of recent movements in equity, fixed income and commodity markets, the contrast with the previous monthly report could scarcely be greater. A period of falling interest rates and equities and simultaneously high oil prices briefly continued at the beginning of the month before a remarkable turnaround set in. While interest rates in the U.S. and Europe across all maturities hit their highest levels for a number of years, equity markets are now comfortably back above the levels they were at before the outbreak of war in Ukraine. Even oil has almost returned to its February level after soaring by more than 30% at the beginning of the month.

Considering persistently high inflation and, above all, the central banks’ reaction to it, the interest rate movement absolutely makes sense. Over the course of the month, the Fed raised its the Fed funds rate by 25 basis points for the first time. An implied rate of approximately 2.5% is now expected by the end of the year, which would mean more than eight more rate hikes. Since there is virtually full employment in the U.S., the central bank can obviously tackle inflation – one of the two goals in its dual mandate – without hindrance. Whether it brings about a soft landing for the U.S. economy remains to be seen. The U.S. yield curve has already inverted and this could be a sign that the central bank has made a policy error. There are a number of reasons indicating the contrary. However, we are sceptical and are particularly concerned about the impact on risk assets. It is a mystery to us at the moment what the basis for the current strength of the equity market is. We are well aware that the equity market often looks far into the future, but we fail to see how what are already record margins can be maintained with growth slowing and inflation not yet under control. Especially against the backdrop of a war on Europe’s doorstep, which is still ongoing, and the withdrawal of vast amounts of liquidity by Western central banks, we expect further consolidation in equities. On the whole, we are confident that the rally in the past two weeks has already eaten up much of the risk premium to be had.

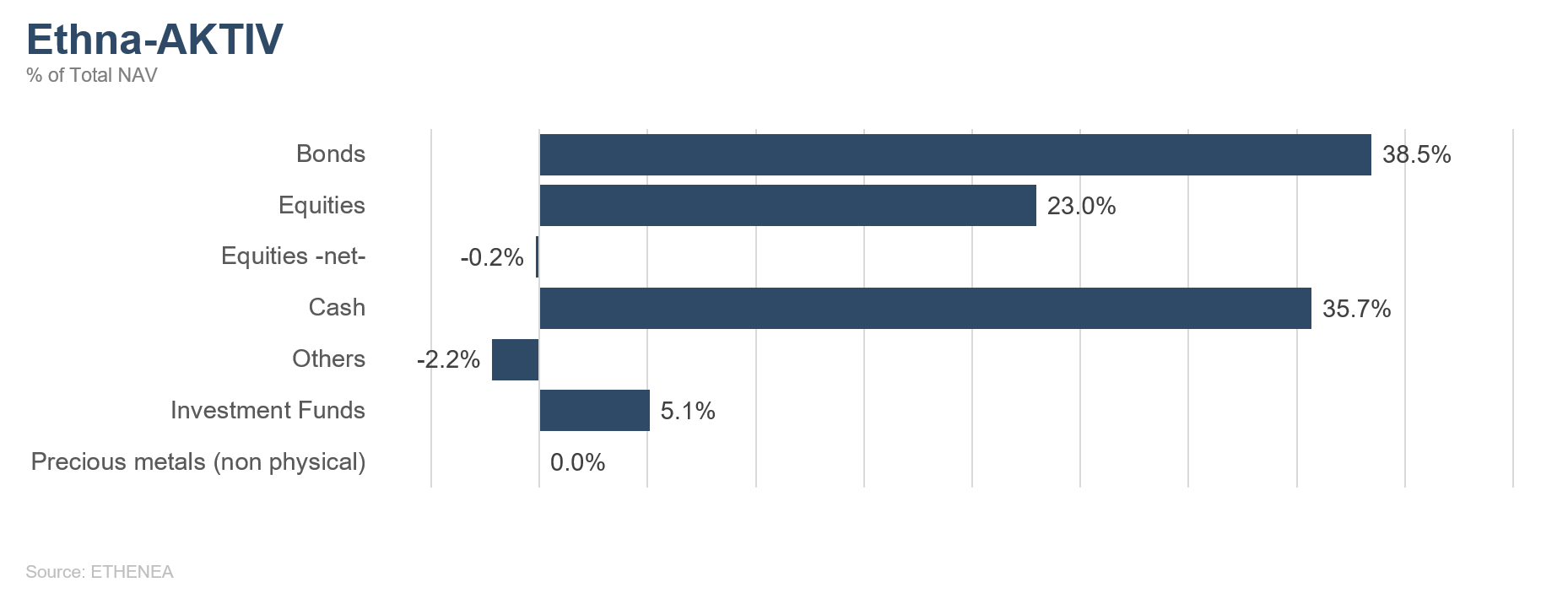

For these reasons, the Ethna-AKTIV has taken up a very defensive positioning for the time being. We took advantage of strong markets in recent days to hedge any remaining equity exposure using futures. In anticipation of interest rates rising further, duration was shortened using derivatives on interest rates. Owing to the low risk exposure, we were also able to reduce the USD allocation to just over 20%. The focus in this critical phase is on capital preservation. We firmly believe that much better situations will come along this year to take on risk again and generate an attractive return.

Ethna-DYNAMISCH

Equity indices in Europe and the U.S. have quickly absorbed the exogenous shock of the Ukraine war. After a steady rally in the second half of March, they were already back above their pre-war levels by the end of the month. However, we think the sustainability of this recovery is fragile.

While there have been signs of a willingness to compromise from both parties directly involved in the war, the situation remains one of acute conflict. Besides, it is unlikely that Western sanctions against Russia – even if the war ends – will be lifted all of a sudden in their entirety, not to mention a reversal of the measures taken to lessen the West’s dependence on Russia for resources. The sanctions and the path of resource independence come at a price that will be reflected in high commodity prices – particularly in Europe but also in the world market – in the longer term.

These inflation drivers have further intensified the pressure on central banks to move towards a tighter monetary policy, a pressure that was already high before the war due to supply chain issues caused by the pandemic. The monetary measures taken by central banks represent a structural headwind for capital markets because of the withdrawal of liquidity and owing to the negative impact of higher interest rates on the valuations of asset classes such as equities and bonds. This headwind should not be underestimated, as, for the first time in decades, the mandate of central banks compels them to put price stability before their usual deference to the capital markets (the Fed put).

In addition, the increase in commodities prices is squeezing business margins, which had been at record highs of late. While businesses can pass on higher costs by raising prices to some extent, maintaining margins depends on their pricing power and their ability to effectively control costs, two things not every company has.

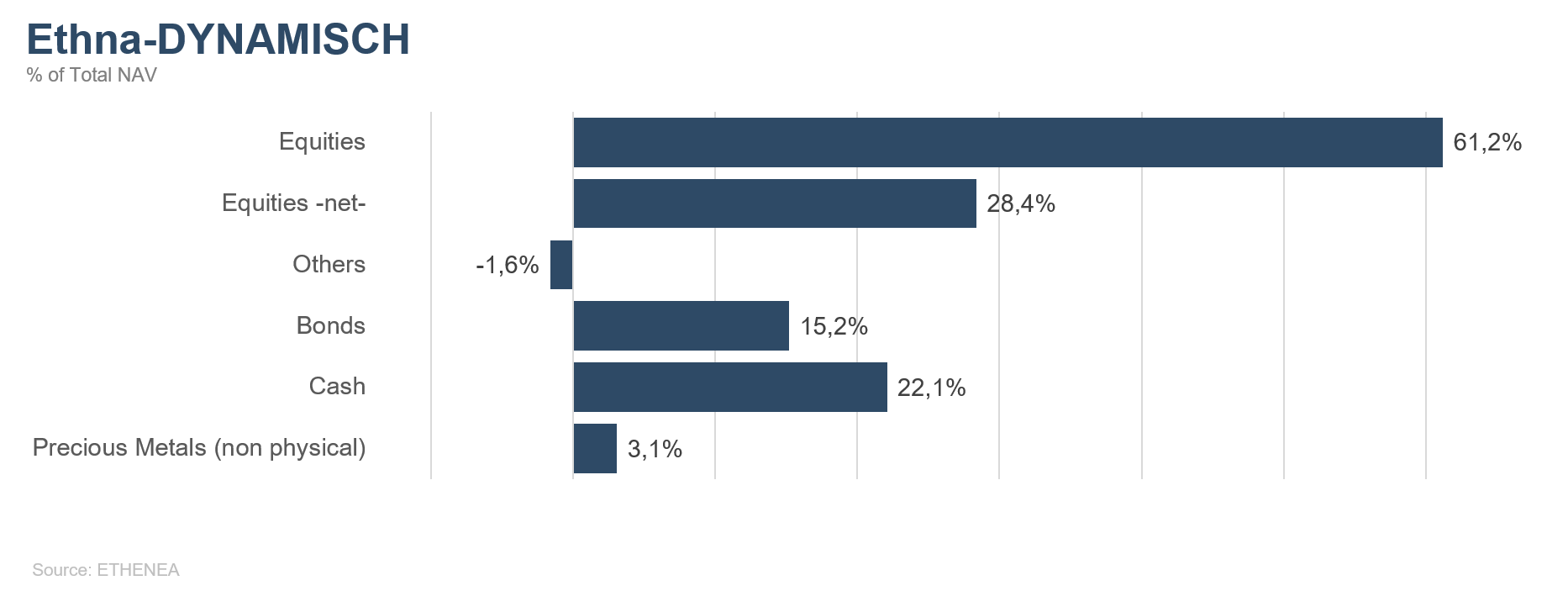

Given this negative market environment, we classify the rally in equity indices in the second half of March as more of a temporary reversal than a sustainable recovery. In the Ethna-DYNAMISCH we even took advantage of the strong patch to further reduce our net equity allocation from around 36% at the beginning of March to just under 30%. Against the backdrop of structural increases in interest rates, we are also continuing to avoid traditional bonds with interest rate risks, even through most of the yield rises should be behind us now. Instead, the Ethna-DYNAMISCH is currently dominated by a greatly increased cash position, with 22% held directly in cash, 15% in short-dated AAA bonds as a cash substitute and 33% in synthetic cash via equity hedges. In contrast to equities and bonds, cash does not offer a systemic risk premium, but in a market environment in which equities and bonds are facing a structural headwind, the cash position gains in relative attractiveness for a time. With this flexibility in terms of allocation, we have positioned the Ethna-DYNAMISCH to enable it to overcome the expected process of adjustment in the current, difficult market environment without taking major capital market risks.

HESPER FUND - Global Solutions (*)

Most equity markets have rebounded from their lows of March 7, as Russia and Ukraine launched several rounds of talks to de-escalate the conflict. Throughout the month of March, there were a number of conflicting reports about the latest developments on the ground and diplomatic efforts around the world. However, the war remains intense, and the world is continuing to witness widespread human suffering and destruction across the country. Western countries have also triggered a wave of unprecedented economic and financial sanctions to hit the Russian economy and isolate it. However, the markets are already anticipating an agreement of some kind between Ukraine and Russia, which will hopefully lead to a ceasefire in the near future. It is difficult to have a clear overview of such a complex matter, but, on a positive note, talks have started and the opponents are discussing a concrete peace plan.

March was another difficult and very volatile month for the capital markets. In light of the sharp setbacks and swift rebounds in stocks and commodity prices amid skyrocketing yields, it was not easy to adjust the portfolio. A deteriorating global economic outlook, with higher inflation and slower growth, is the logical consequence of the events since Russia’s invasion of Ukraine. The trade-off between supporting growth and curbing inflation makes the task of central bankers and government very difficult. The increase in inflation in many countries and regions is putting pressure on central banks to raise interest rates, just as the global economy was attempting to recover from the Covid-19 pandemic. The risk of stagflation is now much higher, particularly in hard-hit Europe, which is heavily dependent on Russian gas and oil.

In the US, the Fed has kicked off its tightening cycle, with a quarter-point rise against the backdrop of a strong job market, and remains particularly hawkish. It’s Chair, Jerome Powell, has indicated that he may be ready to support a half-point hike in May if necessary. The strong economic performance of the US and the hawkish turn of the Fed is contributing to the current strength of the US dollar.

After the sharp losses in the first week of the month, the US stock markets recovered, ending March in positive territory. For the month, the S&P 500 increased by 3.6% and the Dow Jones surged by 2.3%. The Nasdaq Composite, first plunged then rebounded strongly, to soar by 3.4% in a strong comeback, given that by March 7, the index was sitting at -7% MTD. The small-caps Russell 2000 Index jumped by 1.1% during the month. In Canada, the S&P Toronto Stock exchange rose by 3.6% (+5.8% in USD terms). High volatility and significant rotation were again the hallmarks of a rollercoaster month with sharp ups and downs.

In Europe, where stock markets were particularly hard hit during the first two weeks of the war, the stock market rebounded to limit the monthly damage. The large-cap Euro Stoxx 50 Index recouped most of its intra-month losses, ending March with only a slight decrease of 0.6% (a decrease of 1.6% when calculated in USD), while in the UK, the FTSE 100 increased by 0.8% (-1.1% in USD). The defensive Swiss Market Index rose by 1.5% (1.1% in US dollar terms) over the month.

Asian markets delivered a mixed performance, with Chinese shares continuing their sell-off while others rose. The Shanghai Shenzhen CSI 300 Index fell by 7.6% (-8.3% in USD terms) and the Hang Seng Index lost 3.2%. In Japan, the blue-chip Nikkei 225 rose by 4.9% (-0.7% in USD terms due to the weakness in the yen). The Korean stock market continued its recovery, as the KOSPI Index rose by 2.2% (+1.4% in dollar terms). India’s BSE Sensex stock market rose by 4.1% (+3.6% in USD terms).

So far, the HESPER FUND – Global Solutions has been able to manage this very challenging scenario. The conflict in Ukraine continues to pose serious challenges to our macro scenario for 2022. Solid global growth and inflation slowly reverting to central bank targets are at significant risk in an environment of decisively tighter monetary policies. The economic and financial isolation of Russia - a major hub for the supply of energy and raw materials - and its effect on inflation and international trade represent a considerable challenge for global growth. Policymakers, who were just starting to withdraw their extraordinary pandemic support, are reassessing their normalisation plans in light of their specific situations. Given the different economic strength among regions, this might lead to widening policy divergence among countries, as well as to possible policy mistakes which should provide trading opportunities in the currency space.

The path for a soft landing for the major advanced economies in 2023 is still open but becoming increasingly narrower. Inflationary risks are tilted to the upside and, with growth softening further due to the conflict in Ukraine, central banks face even tougher trade-offs between growth and employment.

In March, the fund posted a solid performance under very challenging conditions. Exiting European assets and currencies paid off. Our exposure to gold and commodities helped performance in the first two weeks. Holding a net short duration through shorting the Bund was also a performance driver during the last half of month. During the first part of the month, we also swiftly reduced our equity exposure to 4%, before increasing it to end the month with a 27% allocation.

As we head into April, the fund is maintaining a cautious stance. The fund’s net equity exposure is at 27%, this is allocated primarily to North American indices. On the bond side, we currently have a 20% allocation in sovereign bonds with short maturities. High yield and corporate bonds each have a 7% allocation, investment grade bonds are also sitting at 7%, and we have a 3% allocation in gold, while the fund currently has no further commodity exposure. On the currency front, the HESPER FUND – Global Solutions has the following exposure: 32% to the US dollar, 21% to the Swiss franc and, 6% to the Canadian dollar. In addition, it is short 23% against the British pound.

As always, we continue to monitor and calibrate the fund’s exposure to the various asset classes on an ongoing basis to adapt to market sentiment and changes in the macroeconomic baseline scenario. During the last couple of months, geopolitical events also played a decisive role in our asset allocation.

In March, the HESPER FUND - Global Solutions EUR T-6 increased by 3.26%. YTD the fund is at +0.49%. Volatility for the last 250 days has remained stable at 6.6%, retaining an interesting risk/return profile. The annualised return since inception is at 8.03%.

*The HESPER FUND – Global Solutions is currently only authorised for distribution in Germany, Luxembourg, Italy, France, and Switzerland.

Figure 1: Portfolio structure* of the Ethna-DEFENSIV

Figure 2: Portfolio structure* of the Ethna-AKTIV

Figure 3: Portfolio structure* of the Ethna-DYNAMISCH

Figure 4: Portfolio composition of the Ethna-DEFENSIV by currency

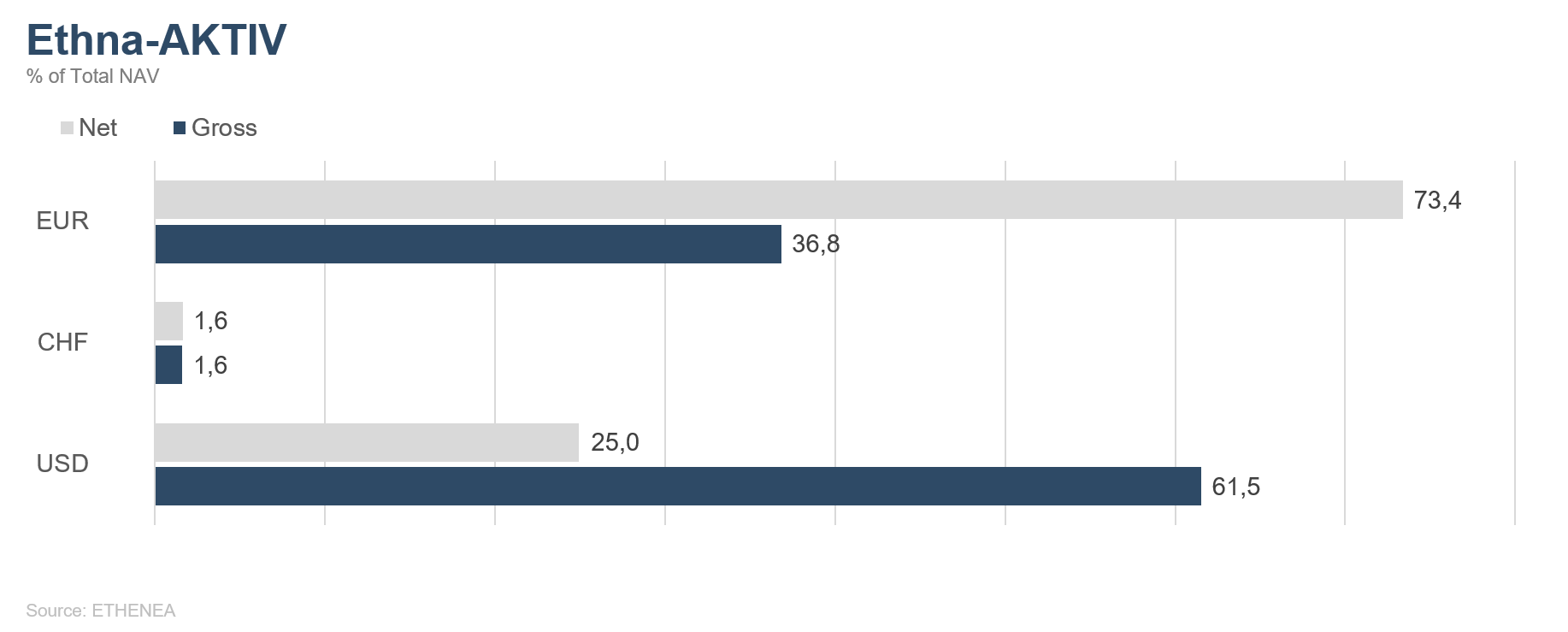

Figure 5: Portfolio composition of the Ethna-AKTIV by currency

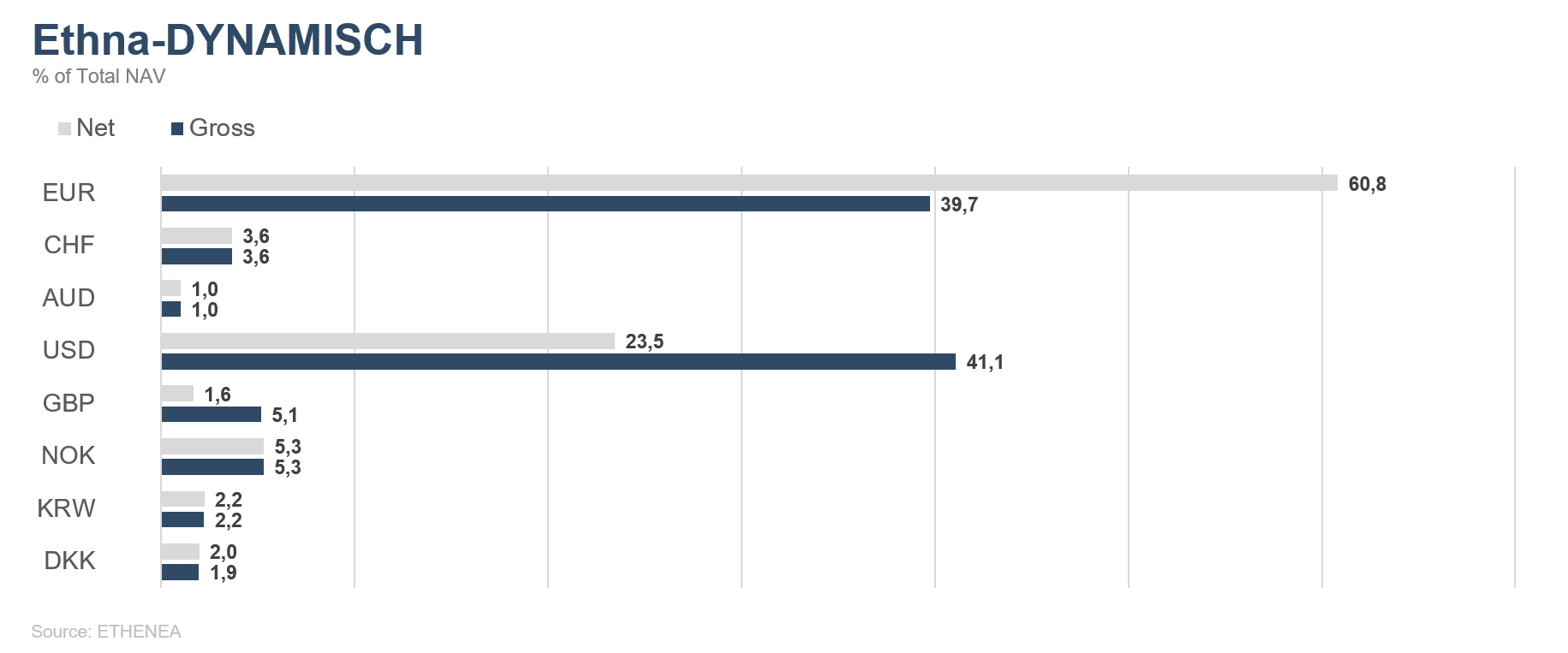

Figure 6: Portfolio composition of the Ethna-DYNAMISCH by currency

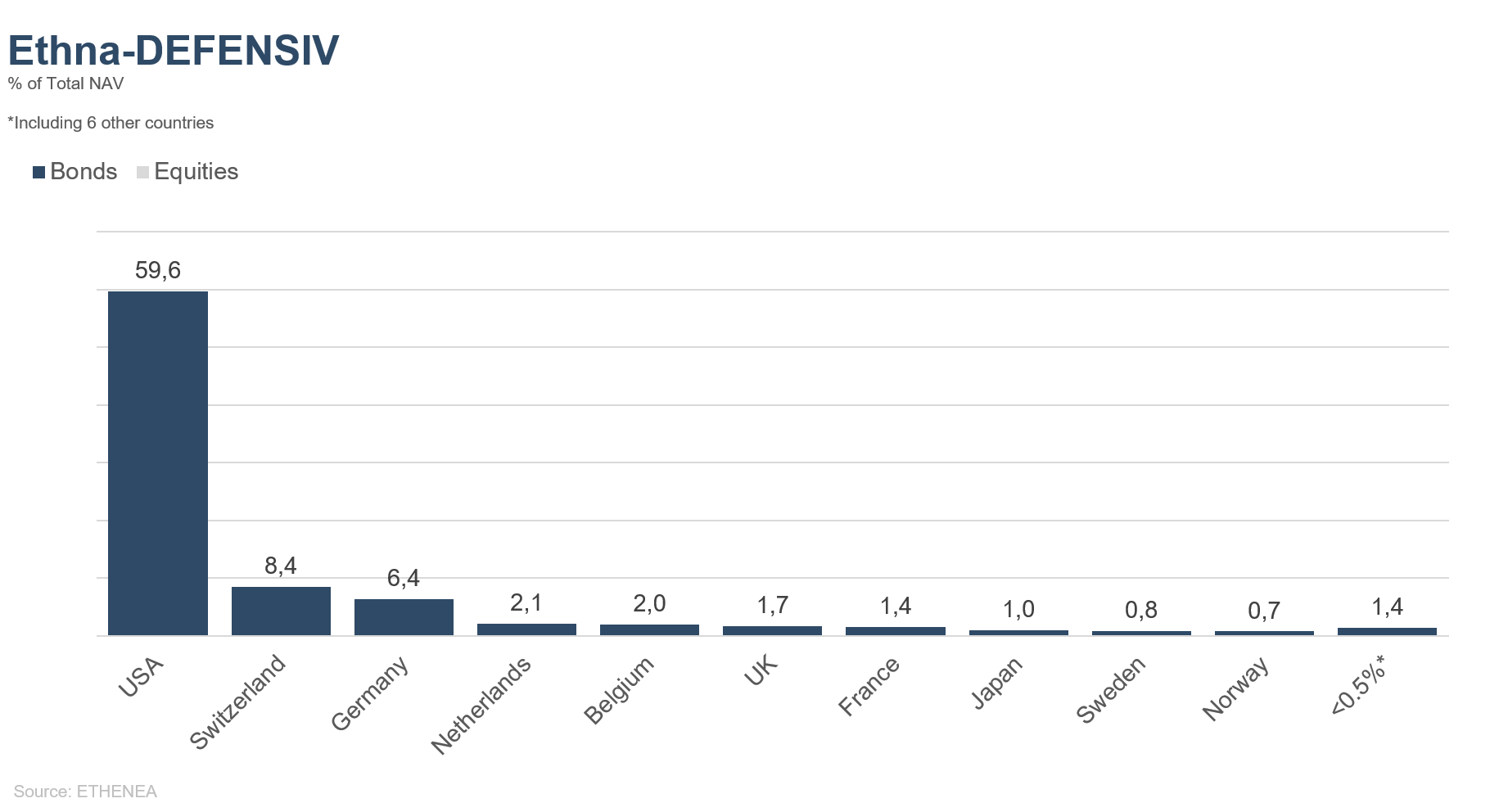

Figure 7: Portfolio composition of the Ethna-DEFENSIV by country

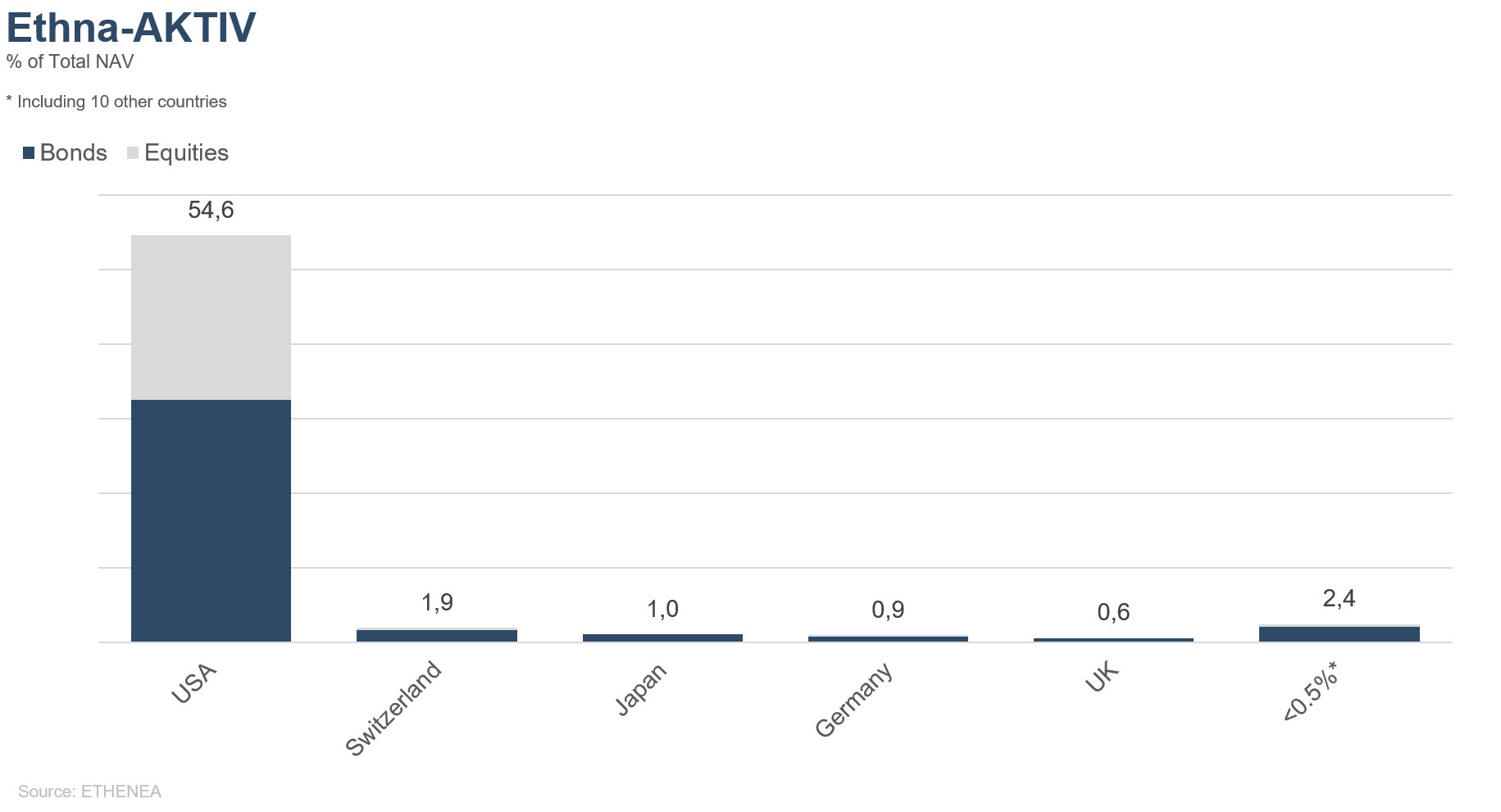

Figure 8: Portfolio composition of the Ethna-AKTIV by country

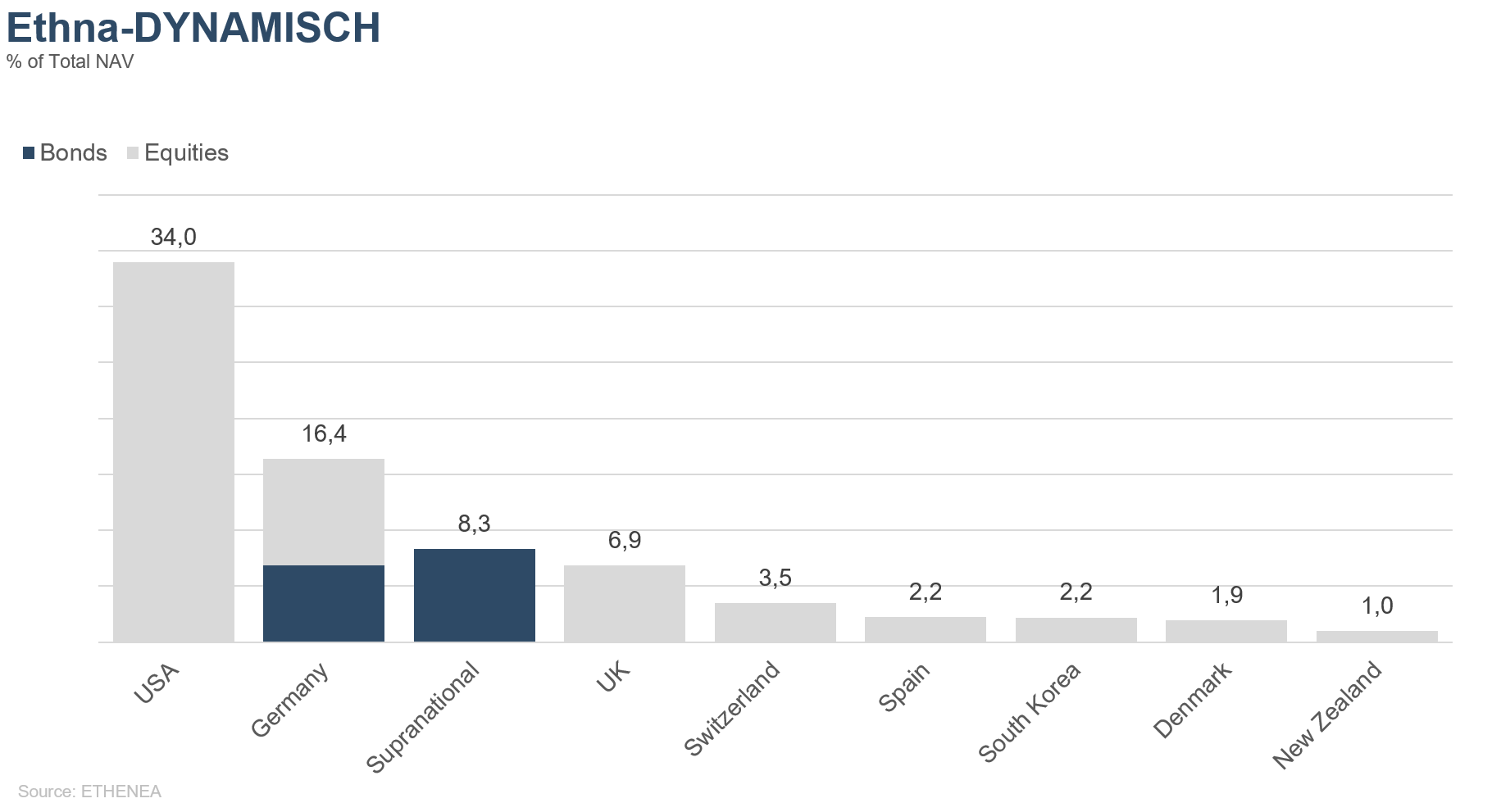

Figure 9: Portfolio composition of the Ethna-DYNAMISCH by country

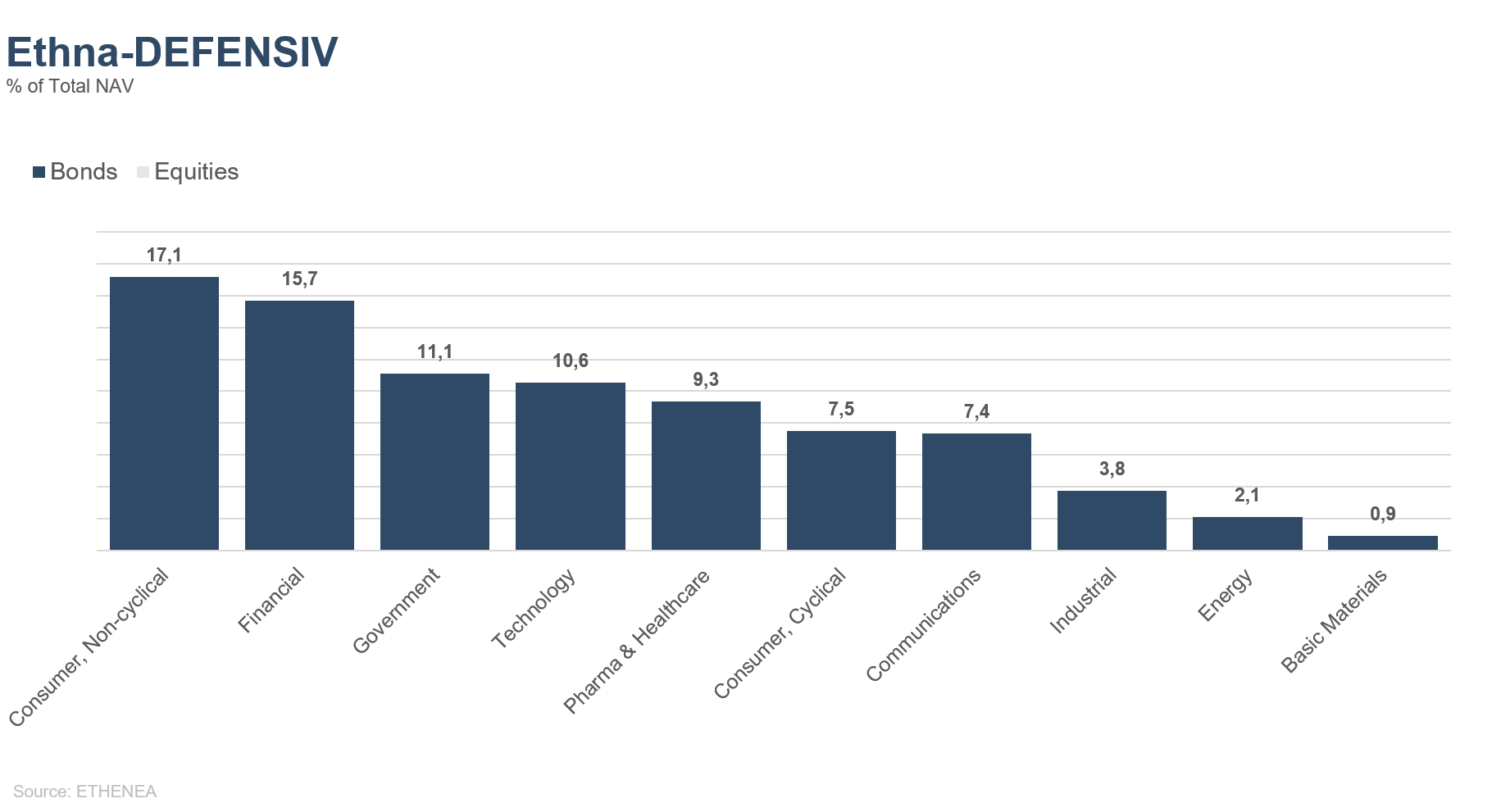

Figure 10: Portfolio composition of the Ethna-DEFENSIV by issuer sector

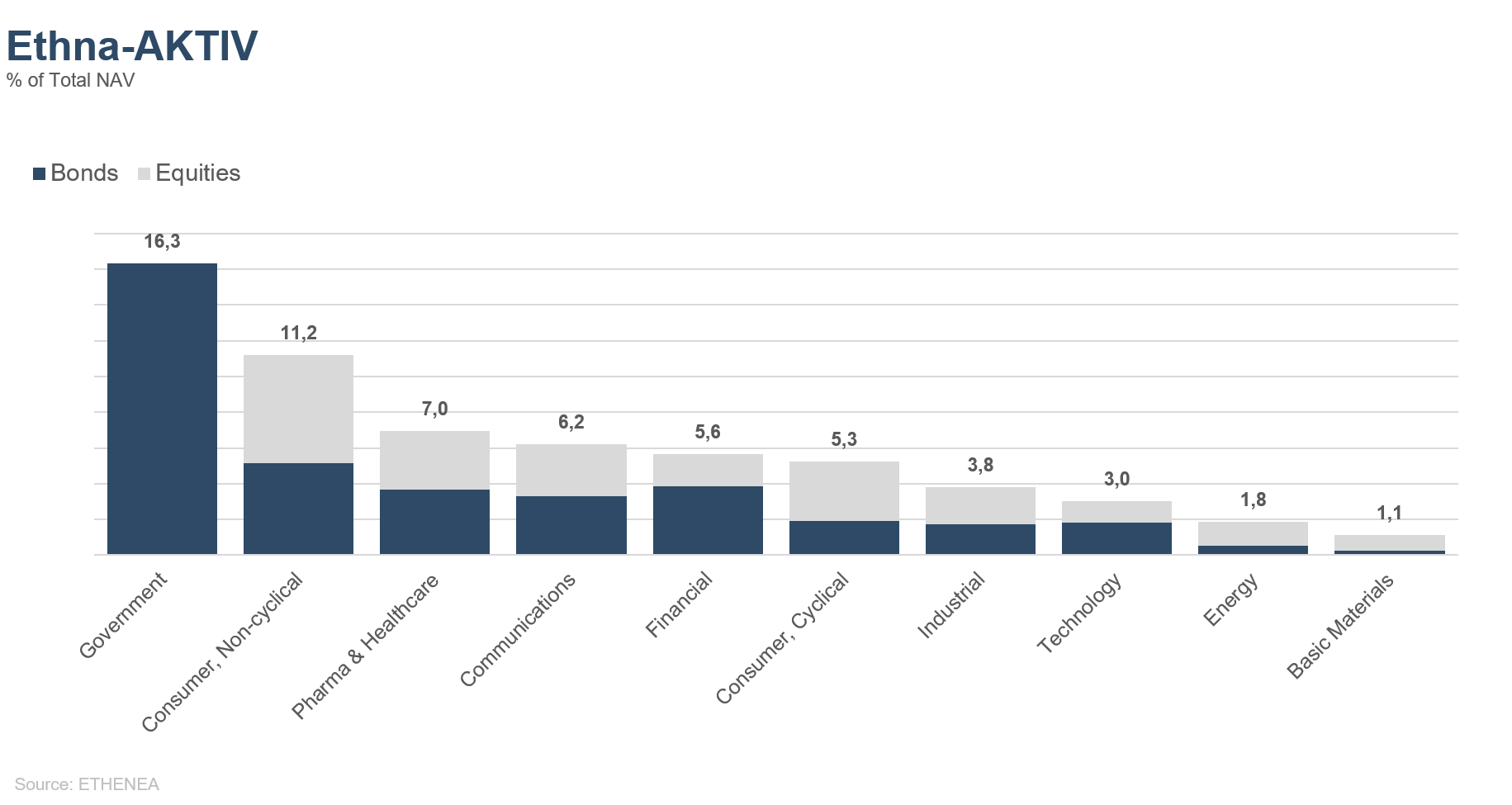

Figure 11: Portfolio composition of the Ethna-AKTIV by issuer sector

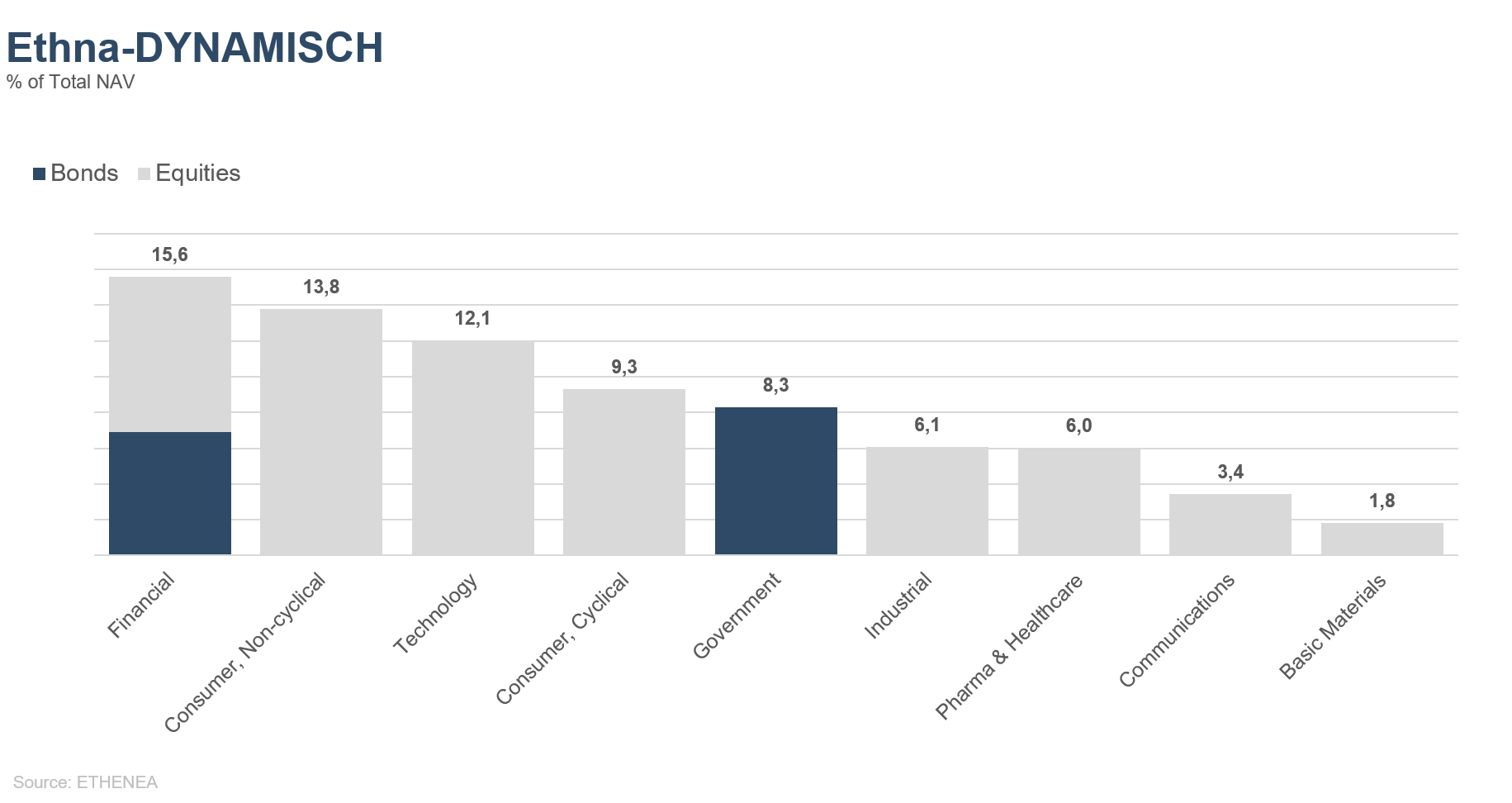

Figure 12: Portfolio composition of the Ethna-DYNAMISCH by issuer sector

* “Cash” comprises term deposits, call money and current accounts/other accounts. “Equities net” comprises direct investments and exposure resulting from equity derivatives.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

This is a marketing communication. It is for product information purposes only and is not a mandatory statutory or regulatory document. The information contained in this document does not constitute a solicitation, offer or recommendation to buy or sell units in the fund or to engage in any other transaction. It is intended solely to provide the reader with an understanding of the key features of the fund, such as the investment process, and is not deemed, either in whole or in part, to be an investment recommendation. The information provided is not a substitute for the reader's own deliberations or for any other legal, tax or financial information and advice. Neither the investment company nor its employees or Directors can be held liable for losses incurred directly or indirectly through the use of the contents of this document or in any other connection with this document. The currently valid sales documents in German (sales prospectus, key information documents (PRIIPs-KIDs) and, in addition, the semi-annual and annual reports), which provide detailed information about the purchase of units in the fund and the associated opportunities and risks, form the sole legal basis for the purchase of units. The aforementioned sales documents in German (as well as in unofficial translations in other languages) can be found at www.ethenea.com and are available free of charge from the investment company ETHENEA Independent Investors S.A. and the custodian bank, as well as from the respective national paying or information agents and from the representative in Switzerland. The paying or information agents for the funds Ethna-AKTIV, Ethna-DEFENSIV and Ethna-DYNAMISCH are the following: Austria, Belgium, Germany, Liechtenstein, Luxembourg: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg; France: CACEIS Bank France, 1-3 place Valhubert, F-75013 Paris; Italy: State Street Bank International – Succursale Italia, Via Ferrante Aporti, 10, IT-20125 Milano; Société Génerale Securities Services, Via Benigno Crespi, 19/A - MAC 2, IT-20123 Milano; Banca Sella Holding S.p.A., Piazza Gaudenzio Sella 1, IT-13900 Biella; Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Spain: ALLFUNDS BANK, S.A., C/ Estafeta, 6 (la Moraleja), Edificio 3 – Complejo Plaza de la Fuente, ES-28109 Alcobendas (Madrid); Switzerland: Representative: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Paying Agent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. The paying or information agents for HESPER FUND, SICAV - Global Solutions are the following: Austria, Belgium, France, Germany, Luxembourg: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg; Italy: Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Switzerland: Representative: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Paying Agent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. The investment company may terminate existing distribution agreements with third parties or withdraw distribution licences for strategic or statutory reasons, subject to compliance with any deadlines. Investors can obtain information about their rights from the website www.ethenea.com and from the sales prospectus. The information is available in both German and English, as well as in other languages in individual cases. Producer: ETHENEA Independent Investors S.A.. Distribution of this document to persons domiciled in countries in which the fund is not authorised for distribution, or in which authorisation for distribution is required, is prohibited. Units may only be offered to persons in such countries if this offer is in accordance with the applicable legal provisions and it is ensured that the distribution and publication of this document, as well as an offer or sale of units, is not subject to any restrictions in the respective jurisdiction. In particular, the fund is not offered in the United States of America or to US persons (within the meaning of Rule 902 of Regulation S of the U.S. Securities Act of 1933, in its current version) or persons acting on their behalf, on their account or for the benefit of a US person. Past performance should not be taken as an indication or guarantee of future performance. Fluctuations in the value of the underlying financial instruments or their returns, as well as changes in interest rates and currency exchange rates, mean that the value of units in a fund, as well as the returns derived from them, may fall as well as rise and are not guaranteed. The valuations contained herein are based on a number of factors, including, but not limited to, current prices, estimates of the value of the underlying assets and market liquidity, as well as other assumptions and publicly available information. In principle, prices, values, and returns can both rise and fall, up to and including the total loss of the capital invested, and assumptions and information are subject to change without prior notice. The value of the invested capital or the price of fund units, as well as the resulting returns and distribution amounts, are subject to fluctuations or may cease altogether. Positive performance in the past is therefore no guarantee of positive performance in the future. In particular, the preservation of the invested capital cannot be guaranteed; there is therefore no warranty given that the value of the invested capital or the fund units held will correspond to the originally invested capital in the event of a sale or redemption. Investments in foreign currencies are subject to additional exchange rate fluctuations or currency risks, i.e. the performance of such investments also depends on the volatility of the foreign currency, which may have a negative impact on the value of the invested capital. Holdings and allocations are subject to change. The management and custodian fees, as well as all other costs charged to the fund in accordance with the contractual provisions, are included in the calculation. The performance calculation is based on the BVI (German federal association for investment and asset management) method, i.e. an issuing charge, transaction costs (such as order fees and brokerage fees), as well as custodian and other management fees are not included in the calculation. The investment performance would be lower if the issuing surcharge were taken into account. No guarantee can be given that the market forecasts will be achieved. Any discussion of risks in this publication should not be considered a disclosure of all risks or a conclusive handling of the risks mentioned. Explicit reference is made to the detailed risk descriptions in the sales prospectus. No guarantee can be given that the information is correct, complete or up to date. The content and information are subject to copyright protection. No guarantee can be given that the document complies with all statutory or regulatory requirements which countries other than Luxembourg have defined for it. Note: The most important technical terms can be found in the glossary at www.ethenea.com/glossary. Information for investors in Belgium: The prospectus, the key information documents (PRIIPs-KIDs), the annual reports and the semi-annual reports of the sub-fund are available in French free of charge upon request from the investment company ETHENEA Independent Investors S.A., 16, rue Gabriel Lippmann, 5365 Munsbach, Luxembourg and from the representative: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg. Information for investors in Switzerland: The country of origin of the collective investment scheme is Luxembourg. The representative in Switzerland is IPConcept (Schweiz) AG, Münsterhof 12, P.O. Box, CH-8022 Zurich. The paying agent in Switzerland is DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zurich. The prospectus, the key information documents (PRIIPs-KIDs), and the Articles of Association, as well as the annual and semi-annual reports, can be obtained free of charge from the representative. Copyright © ETHENEA Independent Investors S.A. (2024) All rights reserved. 04/04/2022