The ECB: on a mission to stabilise European peripheral bond yields

At its July meeting, the ECB not only raised key rates for the first time in a long time but also explained how it proposed to prevent yields on the sovereign bonds of various eurozone member states from drifting apart. In doing so, the ECB is again pushing the scope of its mandate to the limit.

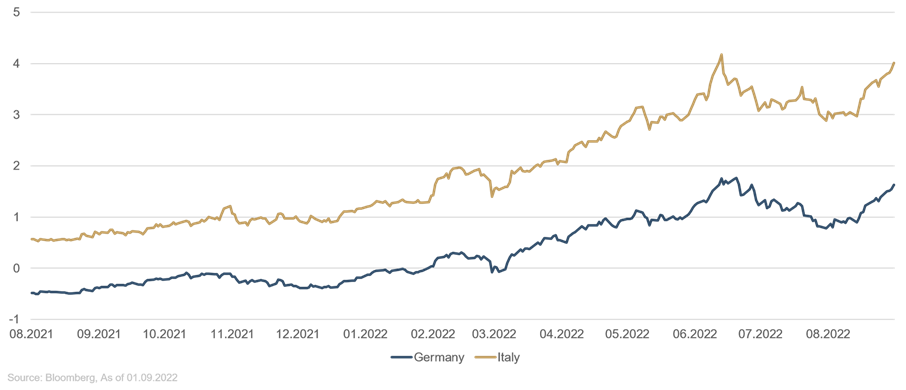

Not only has it summarily created a new instrument in the so-called Transmission Protection Instrument (TPI) but it has also introduced a new term into the debate. We do not yet have the exact details on what it entails. In addition, the ECB reaffirmed its intention to use to full potential the flexibility of the preceding PEPP and to reinvest monies with flexibility as they fall due. This reaffirmation came promptly at the beginning of August, and the holdings of German, French and Dutch bonds fell by EUR 18.9 billion. The monies that fell due were immediately reinvested into government securities, primarily from Italy, but also Spain, Portugal and Greece. The flexibility of the PEPP has often been called the ECB’s first line of defence. But is this defence strong enough? The next few months will soon tell. A critical factor is the premium that Italian sovereign bonds pay over German sovereign bonds. The differential is currently around 250 basis points and thus around 150 basis points higher than last year’s level. No doubt the fresh government crisis in Italy played a part in this. On the other hand, the 1% increase in GDP in Italy in the second quarter of 2022 was a positive surprise, which should also help cast a positive light on Italian sovereign bonds.

“We expect that the steady flow of money from the ECB should be enough

to bring the yield differential back down.”

Dr Volker Schmidt

Is there a risk of credit spreads drifting further apart? No, we expect that the steady flow of money from the ECB should be enough to bring the yield differential back down. However, for this to happen, a stable government that the financial markets can trust must be elected on 25 September 2022. Only in August rating agency Moody’s changed the outlook on Italy’s Baa3 rating – the lowest investment grade rating – to negative, thus making it clear once again how urgent a stable political framework and the resumption of economic reforms is.

Figure: Yield on 10-year sovereign bonds

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

This marketing communication is for information purposes only. It may not be passed on to persons in countries where the fund is not authorized for distribution, in particular in the USA or to US persons. The information does not constitute an offer or solicitation to buy or sell securities or financial instruments and does not replace investor- and product-related advice. It does not take into account the individual investment objectives, financial situation, or particular needs of the recipient. Before making an investment decision, the valid sales documents (prospectus, key information documents/PRIIPs-KIDs, semi-annual and annual reports) must be read carefully. These documents are available in German and as non-official translations from ETHENEA Independent Investors S.A., the custodian, the national paying or information agents, and at www.ethenea.com. The most important technical terms can be found in the glossary at www.ethenea.com/glossary/. Detailed information on opportunities and risks relating to our products can be found in the currently valid prospectus. Past performance is not a reliable indicator of future performance. Prices, values, and returns may rise or fall and can lead to a total loss of the capital invested. Investments in foreign currencies are subject to additional currency risks. No binding commitments or guarantees for future results can be derived from the information provided. Assumptions and content may change without prior notice. The composition of the portfolio may change at any time. This document does not constitute a complete risk disclosure. The distribution of the product may result in remuneration to the management company, affiliated companies, or distribution partners. The information on remuneration and costs in the current prospectus is decisive. A list of national paying and information agents, a summary of investor rights, and information on the risks of incorrect net asset value calculation can be found at www.ethenea.com/legal-notices/. In the event of an incorrect NAV calculation, compensation will be provided in accordance with CSSF Circular 24/856; for shares subscribed through financial intermediaries, compensation may be limited. Information for investors in Switzerland: The home country of the collective investment scheme is Luxembourg. The representative in Switzerland is IPConcept (Suisse) AG, Bellerivestrasse 36, CH-8008 Zurich. The paying agent in Switzerland is DZ PRIVATBANK (Suisse) AG, Bellerivestrasse 36, CH-8008 Zurich. Prospectus, key information documents (PRIIPs-KIDs), articles of association, and the annual and semi-annual reports can be obtained free of charge from the representative. Information for investors in Belgium: The prospectus, key information documents (PRIIPs-KIDs), annual reports, and semi-annual reports of the sub-fund are available free of charge in German upon request from ETHENEA Independent Investors S.A., 16, rue Gabriel Lippmann, 5365 Munsbach, Luxembourg, and from the representative: DZ PRIVATBANK AG, Niederlassung Luxemburg, 4, rue Thomas Edison, L-1445 Strassen, Luxembourg. Despite the greatest care, no guarantee is given for the accuracy, completeness, or timeliness of the information. Only the original German documents are legally binding; translations are for information purposes only. The use of digital advertising formats is at your own risk; the management company assumes no liability for technical malfunctions or data protection breaches by external information providers. The use is only permitted in countries where this is legally allowed. All content is protected by copyright. Any reproduction, distribution, or publication, in whole or in part, is only permitted with the prior written consent of the management company. Copyright © ETHENEA Independent Investors S.A. (2025). All rights reserved. 02/09/2022