Herd mentality

Observations, though not necessarily hard evidence, do give us clear indications all the same. I strongly suspect that the majority of market participants are behaving like lemmings at the moment. It is understandable in a way, as we are all working with exactly the same information, which we get from the same sources at the same time. It’s almost inevitable that we should draw the same conclusions from it. Of course, the fact that it’s all the same doesn’t mean it’s wrong, but one must be extremely careful not to follow the lemmings over the edge of the cliff. One must extricate oneself from the herd in time.

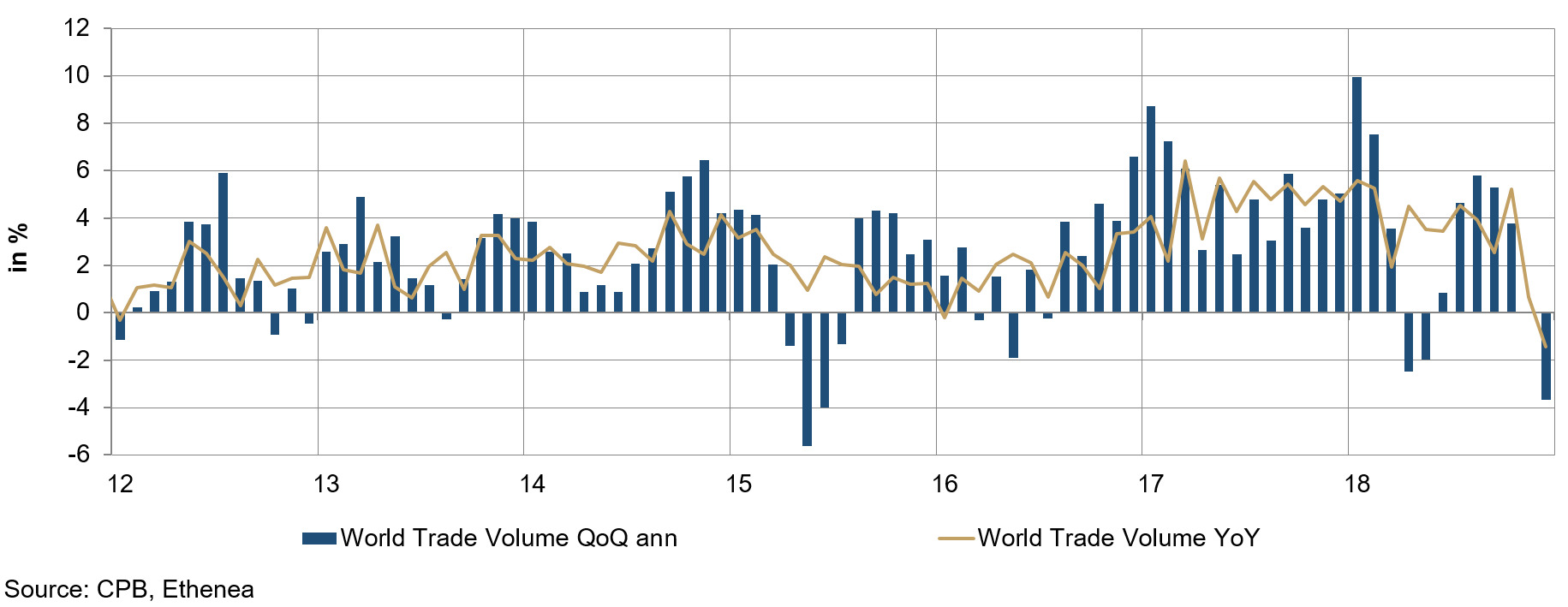

As we wrote of the global economy at the beginning of this year, we expect a bumpy landing¹ rather than a crash landing. Now that the first quarter is behind us, it would take some effort to disregard the signs of weakness. Figure 1 shows the global trade volume based on data from CPB, the Bureau for Economic Policy Analysis of the Netherlands, which is regarded as very reliable. To take some of the edge off the volatility in the data series, we look at the three-month average. Here, too, one can see a distinct slowdown in trade flow volumes at the end of 2018, which is also in keeping with the global weakness in the manufacturing sector that we are currently observing. The trade war between China and the US seems to be leaving its mark after all.

Figure 1: Global trade volume (three-month average)

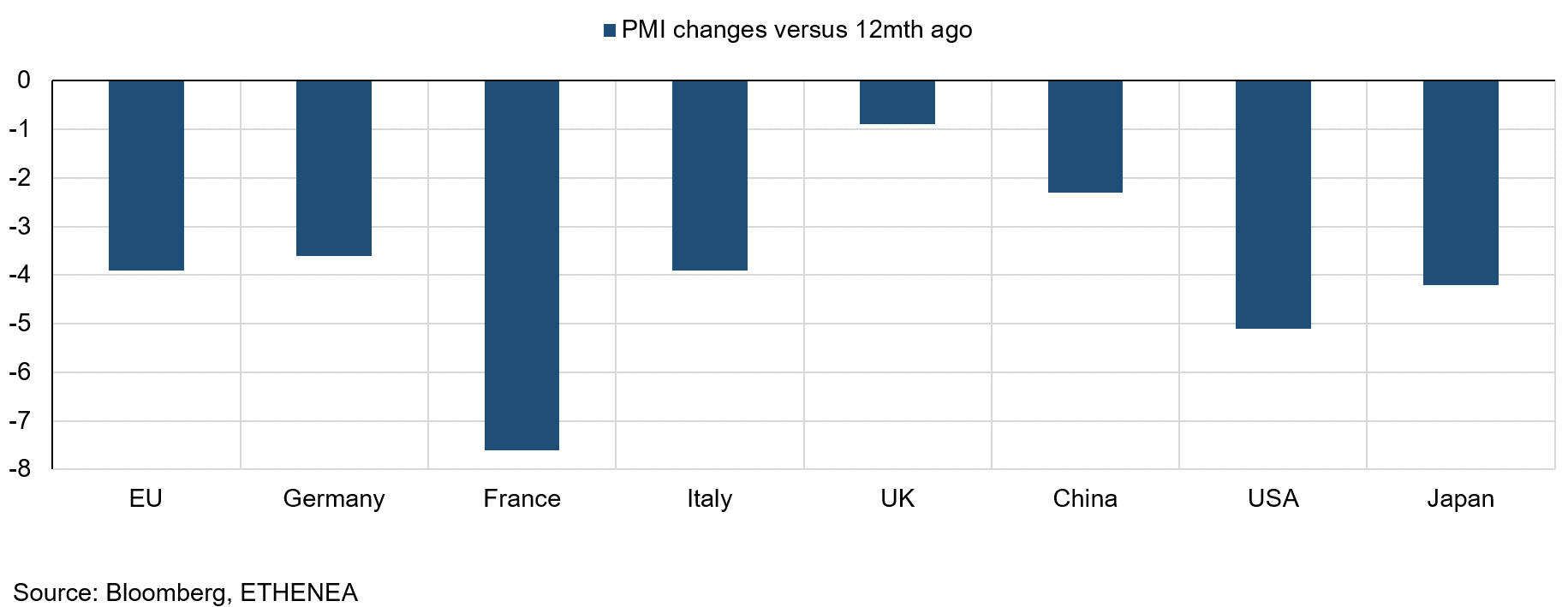

Figure 2: Purchasing managers’ index

The purchasing managers’ indices also deteriorated appreciably. Figure 2 shows the change in the PMI compared to 12 months ago. What is surprising about this chart is the very slight deterioration in the index for the UK, which is causing nothing but chaos with Brexit and has been holding European politics to ransom for many months. All I can do at this point is send a message to the British parliament. This quote is attributed to the Belfast-born author C.S. Lewis: You can’t go back and change the beginning, but you can start where you are and change the ending. Perhaps MPs will take heed. The rest of Europe would appreciate it.

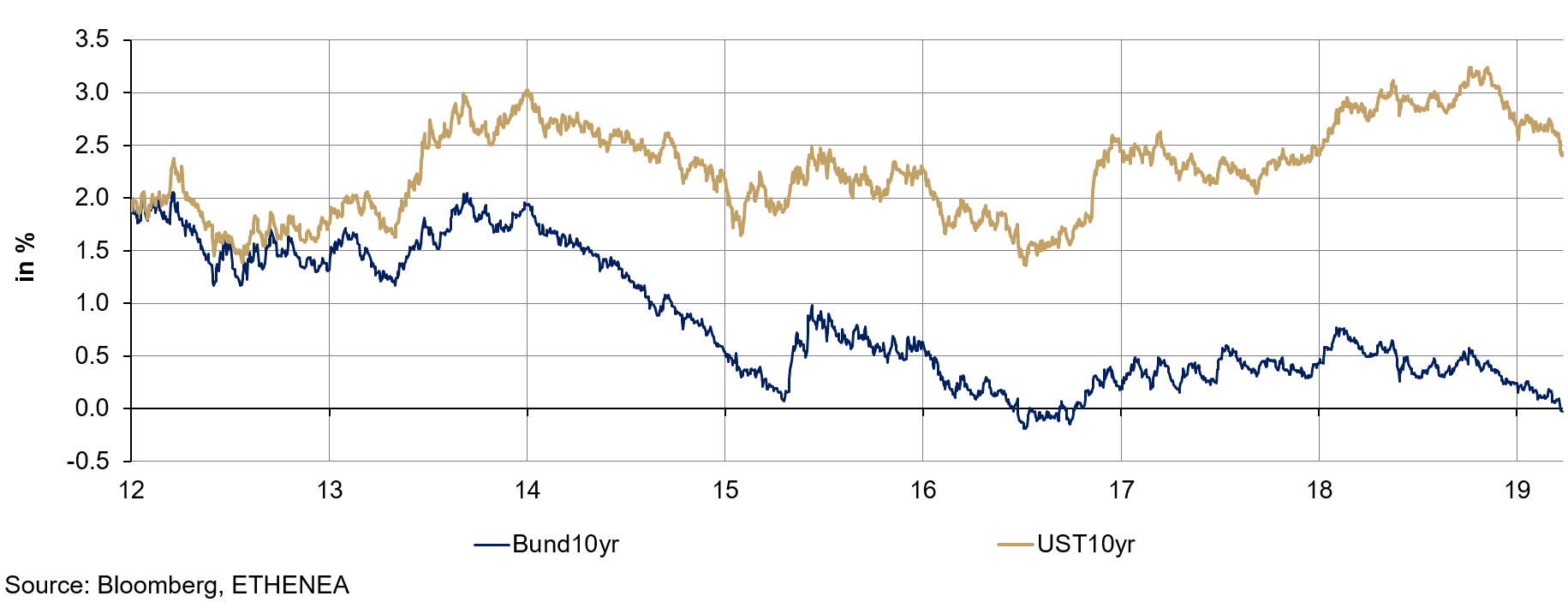

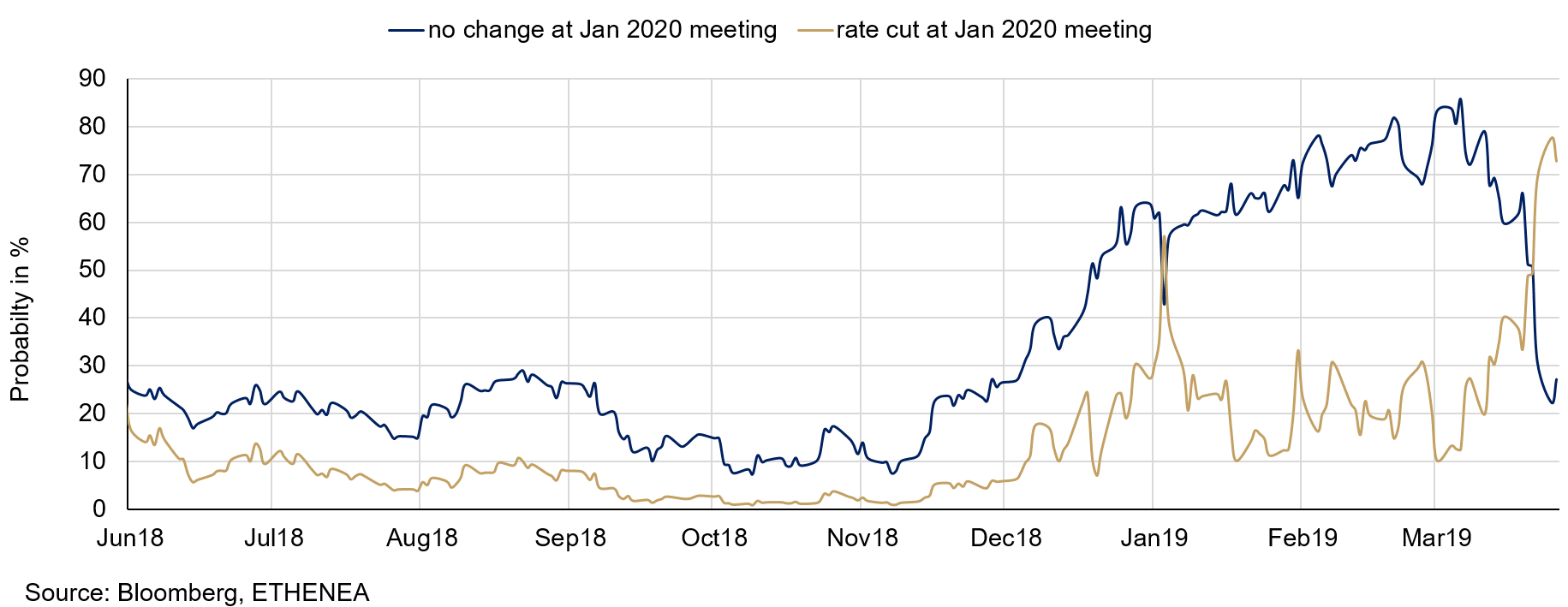

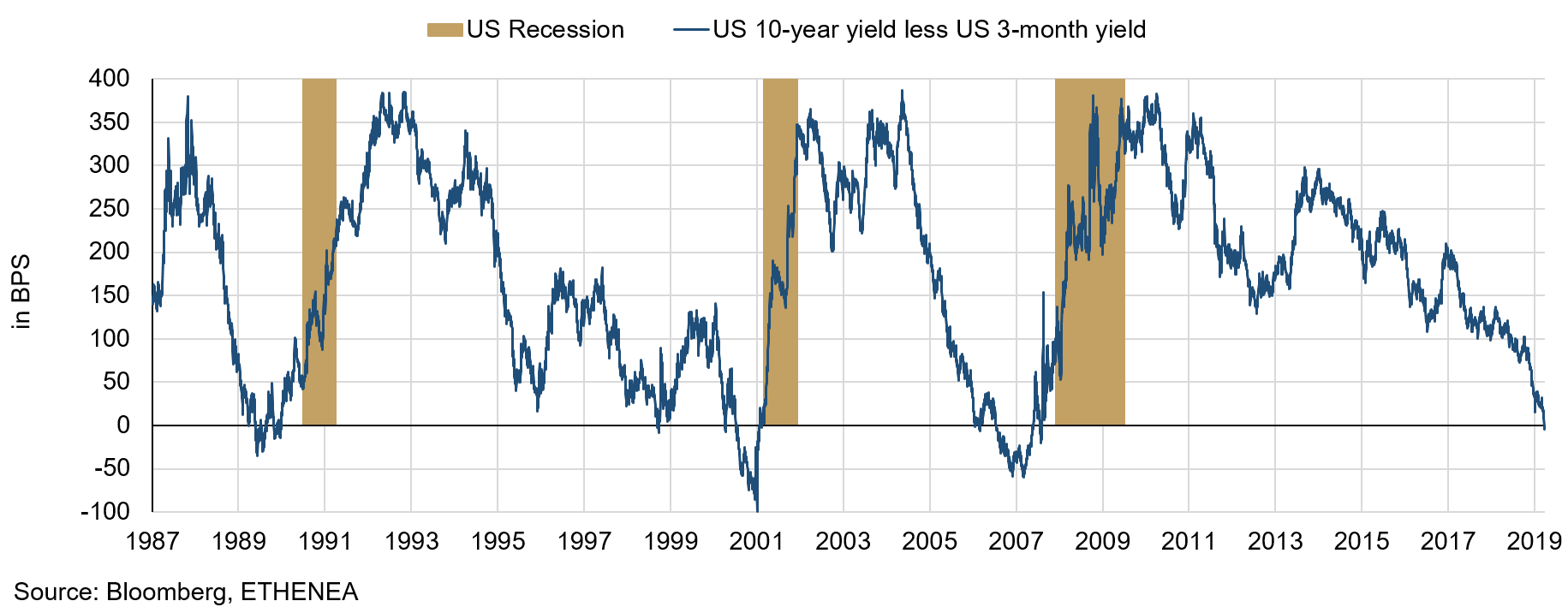

Another strong indicator of the market view of the future economy is the yield level of the 10-year Bund and US Treasury (see Figure 3). On Friday, 22 March 2019, the current 10-year Bund traded at a negative yield for the first time since 2016. This may not be due solely to the market view in relation to a future economic downturn, but also to the fear of possible chaos, if a disorderly Brexit does happen on 12 April 2019. The yield on the 10-year US Treasury thus also fell below 2.5%. This level is not all that important in itself. However, what startled market participants was the fact that for the first time since 2006 the yield curve in the US inverted, with 10-year yields falling below 3-month yields (see Figure 5). The past six recessions in the US were always preceded by a yield curve inversion 12 to 18 months beforehand. To that extent, it was understandable that the market reacted by re-assessing future rate changes by the US central bank (see Figure 4). After the curve inverted, the market (on the basis of US interest rate futures) markedly increased the probability of a rate cut by the Federal Reserve in its meeting at the end of January 2020, from almost 50% to almost 80%, while the probability of no rate change fell by a corresponding degree!

Figure 3: Yield on 10-year Bund and 10-year US Treasury

Figure 4: Implied probability of US central bank’s action at their meeting in January 2020, based on money market futures.

Figure 5: Yield differential between the 10-year and the 3-month Treasury.

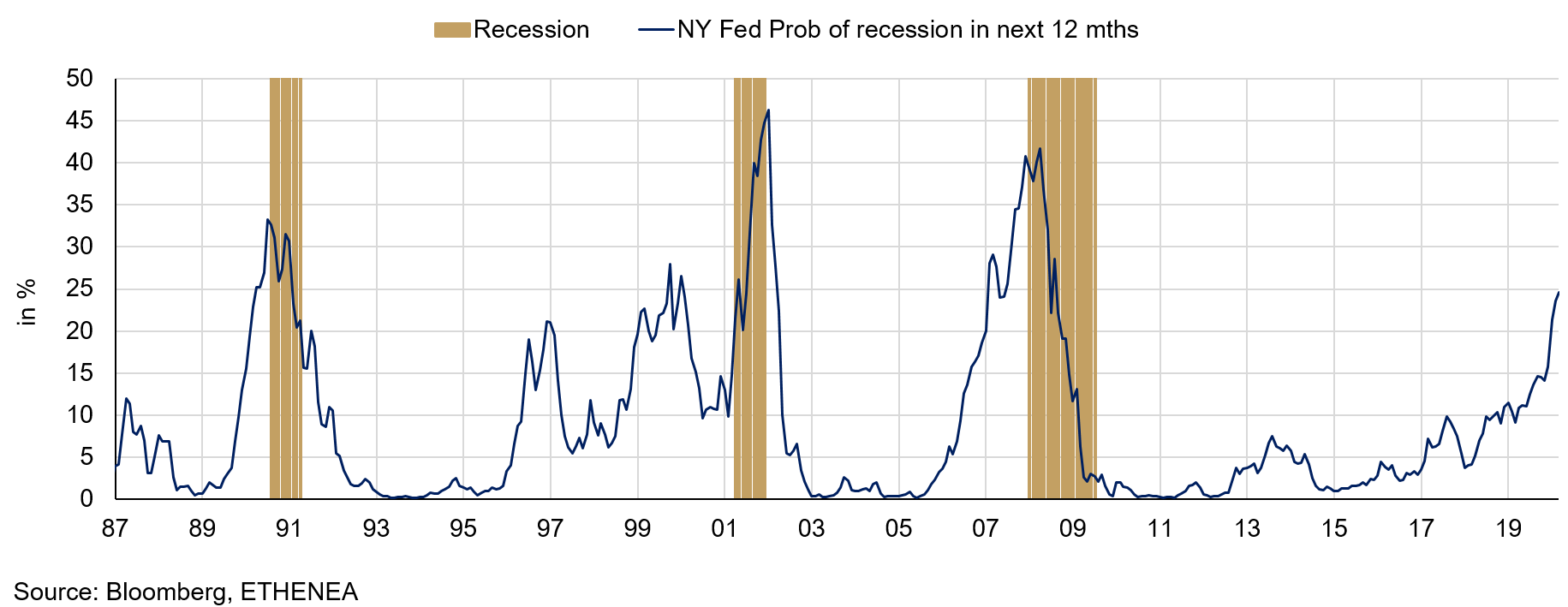

Figure 6: Implied probability of a recession in the next 12 months, calculated by the NY Fed.

The probability of recession in the coming year as calculated by the New York Federal Reserve – a widely regarded metric – also rose steadily (see Figure 6). Yet another sign.

It is now important to distance ourselves a little from the herd. The indicators described above all point to a recession in the US starting in the next 12 months and, thus, doubtless in the rest of the developed world as well. Now, this doesn’t necessarily mean that things will turn out that way. We are working with probabilities, and not with a deterministic system! It is by all means possible for a soft landing – that is, a gradual slowdown without a subsequent recession – to be engineered through the skilful interplay of monetary and fiscal measures. However, that would require the presence of an interplay in the first place. It worked well during the financial market crisis, and could do so again. After all, no one has any interest in a recession actually occurring, neither governments nor central bankers.

The opinion we have advanced quite frequently in the recent past therefore stands: that we see a slowdown on the cards and also think further worse economic data are quite possible. However, we rely on the skill of those responsible to avoid a real recession. Until the masses realise this, however, one can and should run on the flanks of the herd.

Are bonds currently a good investment?

In his role as Senior Portfolio Manager, Dr Volker Schmidt assists with composition of the Ethna-AKTIV bond portfolio. In our latest video, the bonds expert goes into how a positive performance contribution is currently possible with bonds.If you are having video playback issues, please click HERE.

Positioning of the Ethna Funds

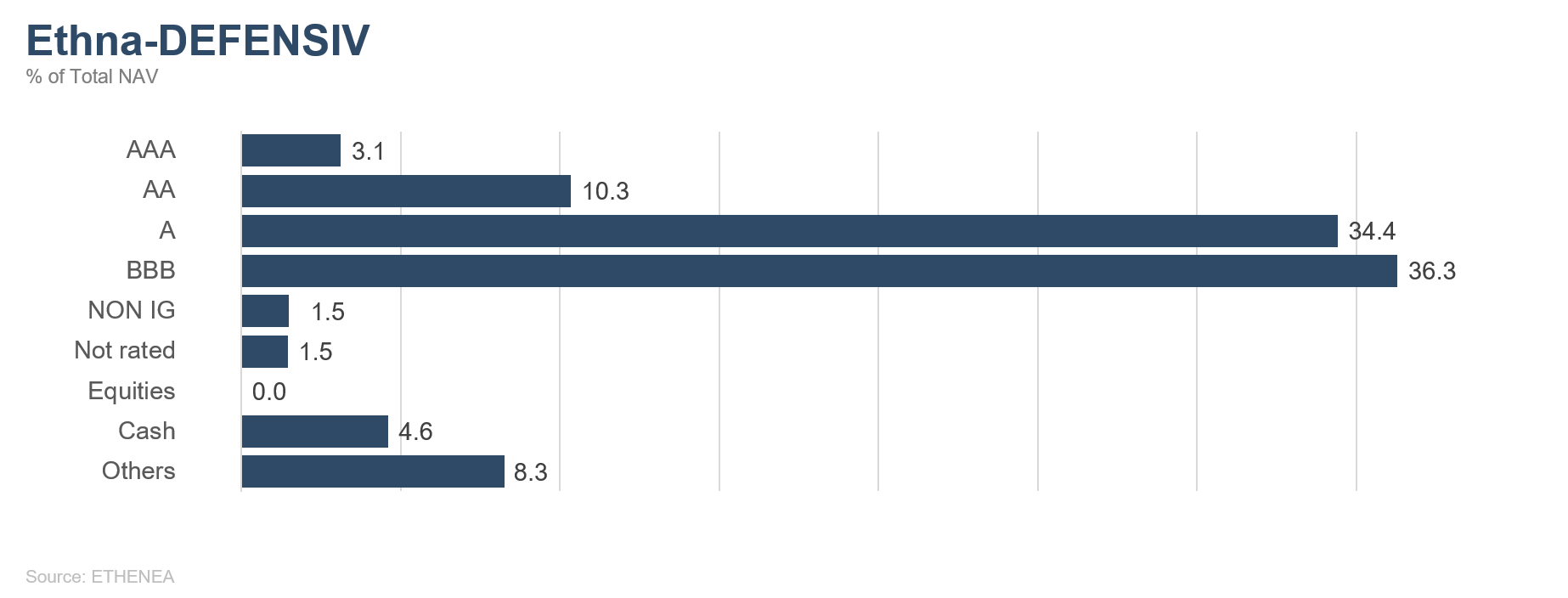

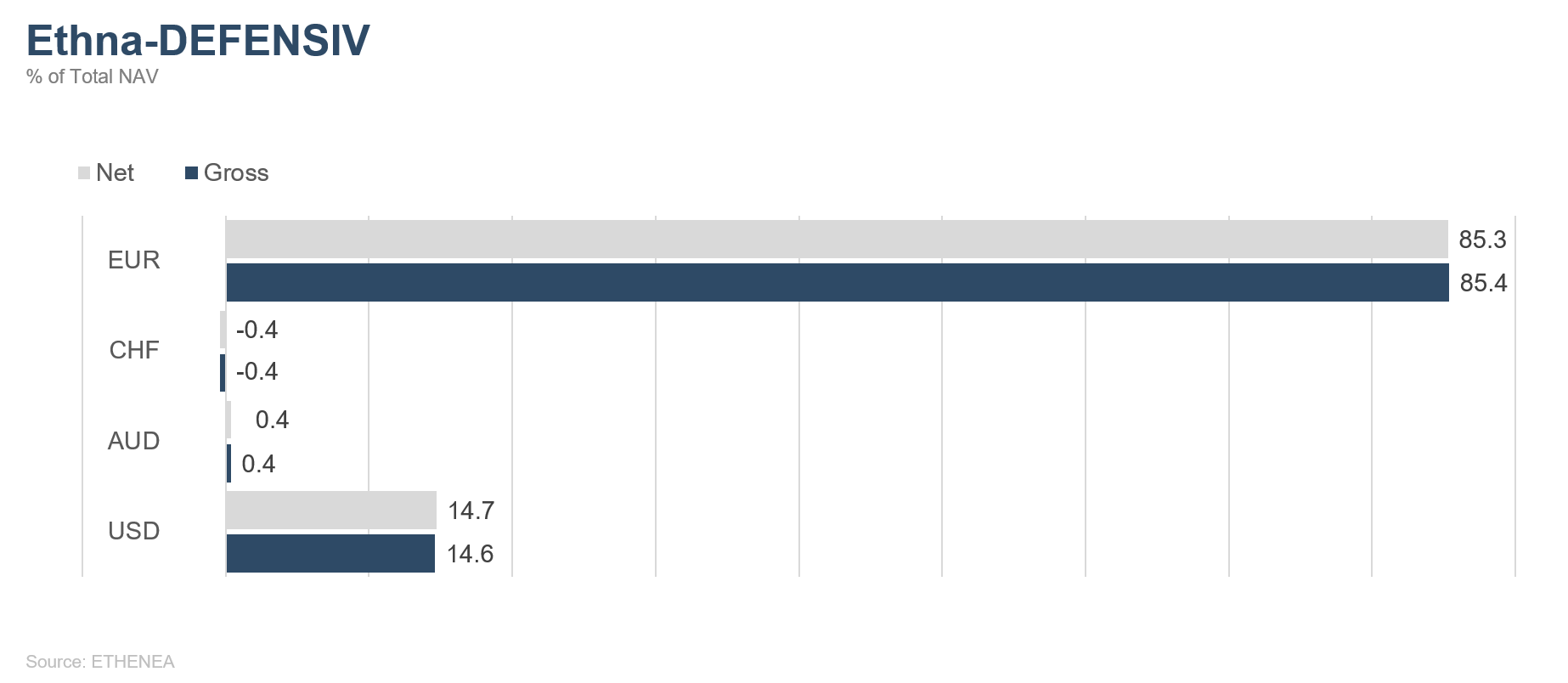

Ethna-DEFENSIV

Last month more or less confirmed the weakness in global economic growth. New data back up the theory that we are heading for a recession. However, we still believe that a soft landing – that is, a pronounced downturn without real negative growth rates – is possible, as stated above.

We have closed the equity position in the Ethna-DEFENSIV that we had built up to 4% (50% Europe, 50% US) and instead further expanded our risk position in the USD duration. We also increased the foreign currency allocation to USD by 6%, to almost 15%.

The modified duration of the overall portfolio was extended significantly, from 3.05 to its current level of 8.7, by reducing the short position in French OAT futures and at the same time purchasing US long bond futures.

Overall, taking profits on short-dated AAA and AA bonds, the yields on some of which were well down, reduced the average rating by one notch, to between A and A-. Despite that, almost 78% of the paper in the portfolio has a very good rating of between AAA and BBB+.

We also had to make adjustments to the maturities. Short-dated bonds, mainly denominated in euro, simply were no longer profitable enough from a carry point of view to hold them in the portfolio. We therefore extended our maturities. Despite that, almost 60% of bonds still have a residual maturity of between one and seven years.

Ethna-AKTIV

In our estimation, 2019 will, in all likelihood, be characterised by high volatility, and not just in equities. The month of March is a good example of this. While global equity indices, led by a strong Wall Street, climbed to new highs for the year right at the start of the month, prices fell for a few days immediately thereafter, before resuming their rally with even greater momentum just a short time later. In the meantime, the broad S&P500, for example, is back up more than 20% from the lows in December and valuations are again at levels that are more above-average than below-average. To our mind, this is not what fear of recession looks like.

However, one must admit that statements from central banks are likely to have fed into these movements. The ECB is starting up its TLTRO (Targeted Longer-Term Refinancing Operations) programme again and has let the market know that the way forward for the coming quarters is “lower for longer”. The Fed, on the other hand, is being patient. Not only has it announced the end of balance sheet reduction, but it has also virtually ruled out the probability of rate hikes in 2019. In the meantime, the market expects at least two rate cuts between now and the end of 2020. While, on the one hand, these supportive measures are no doubt positive for so-called risk assets, on the other hand, one wonders what (negative) growth prospects have prompted the central banks to make this relatively abrupt about-turn. The interest rate market seems to have answered this question for itself seeing as it’s been all one-way traffic since mid-November – downwards.

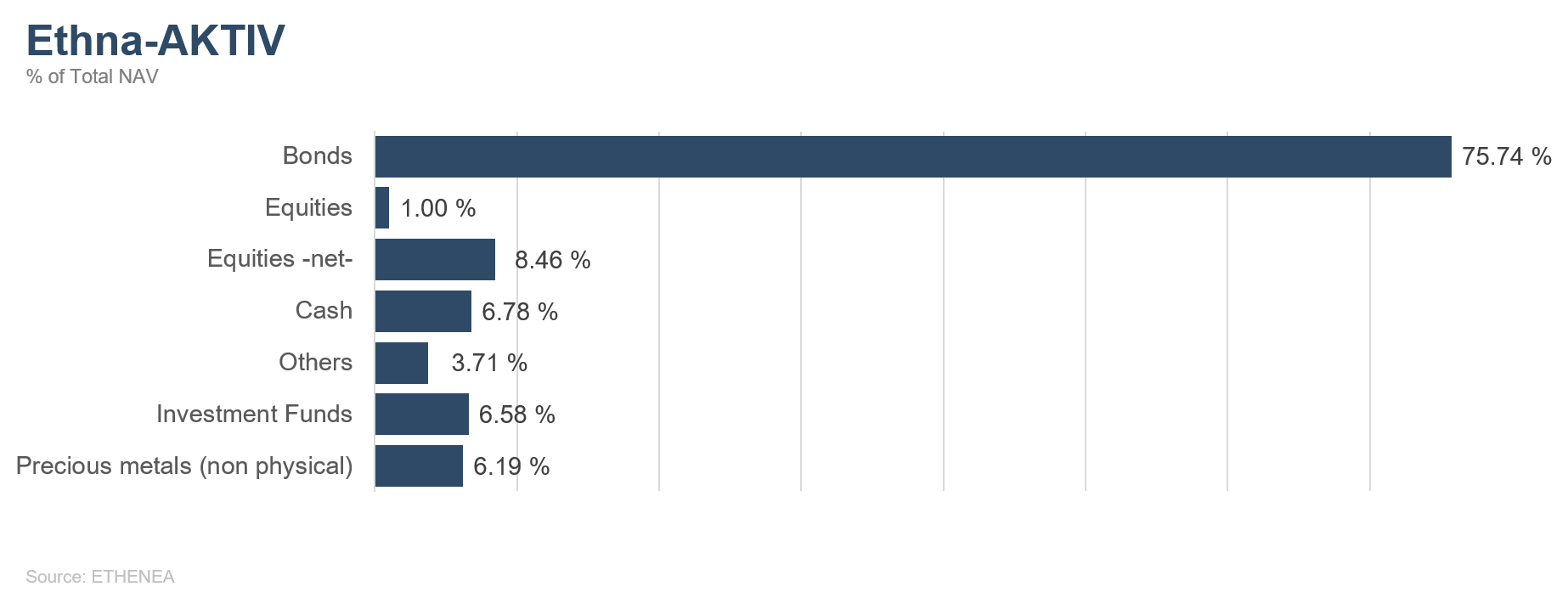

We are currently of the opinion that, in anticipation of weaker growth data, interest rates will continue to fall, and the upside potential for equities this year is relatively modest without further catalysts. For this reason, we are retaining a high duration, especially in the US, and sticking with an equity exposure of less than 20%, which is moderate for us.

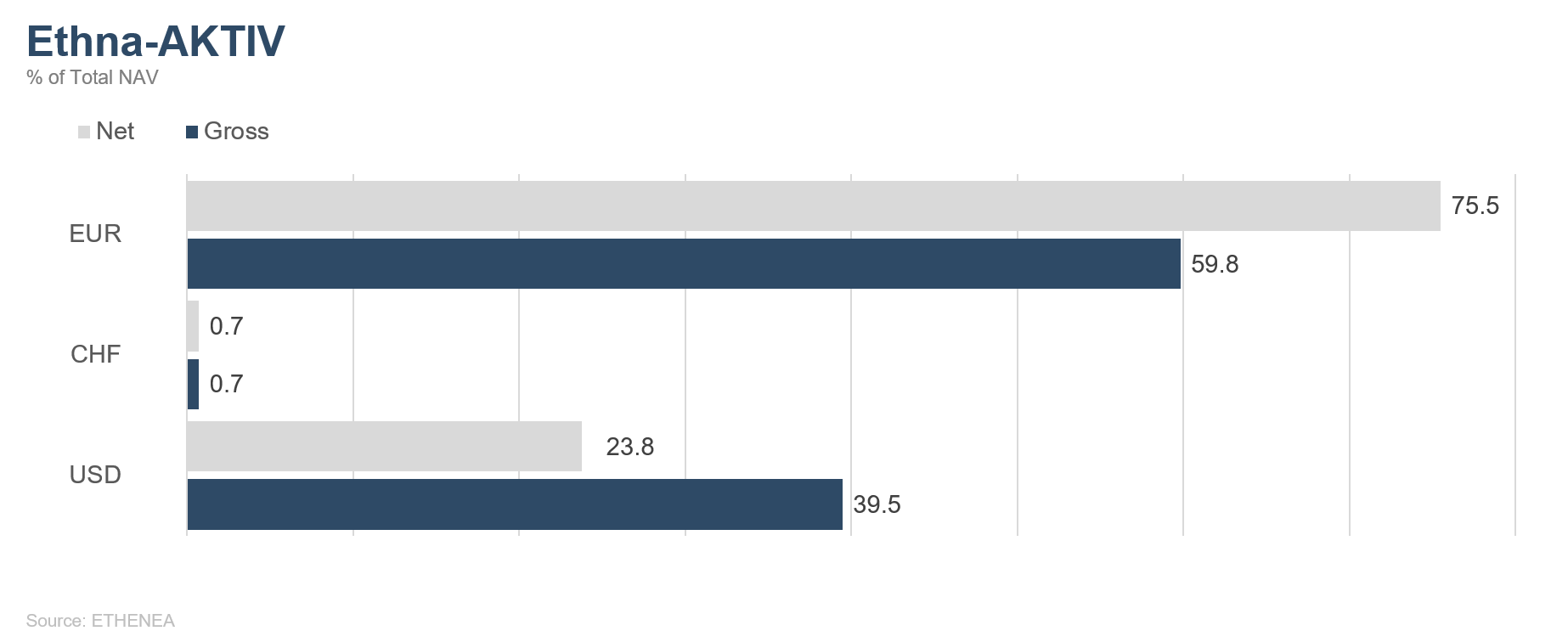

Given the current spread level, we will also successively reduce the current bond exposure of 80%, since the additional credit risk is not adequately compensated, in our view. Rounding off this positioning is an open dollar allocation of more than 20%, which reflects our opinion that the US dollar will be structurally strong in the next three to six months.

In March we began investing in oil certificates and have now reached an allocation of 3.6%. Together with the gold certificate position (6.2%), commodities thus account for almost 10% of the fund assets.

Ethna-DYNAMISCH

March ended on a positive note for most of the major stock exchanges, even though gains were much more moderate than in the months prior. Considering the extremely strong start to the year, however, this development is not surprising. On the whole, the first quarter of 2019 was one of the strongest in stock market history. Valuations on the global stock markets have returned to normal thanks to the continued price rises in recent weeks. The temporary undervaluation following the correction in the fourth quarter of 2018 has been offset. We see current equity market valuations as neutral. Compared with bond yields, which fell sharply in March both in the eurozone and in the US, equities still offer the most attractive risk/return ratio for the Ethna-DYNAMISCH. Our market analysis, our proprietary Market Balance Sheet (MBS), depicts a distinct improvement in the picture since the beginning of March 2019 in comparison with previous months. The shorter-term indicators in particular show a distinctly supportive trend. Equity markets are currently in a risk-on mode, without being overbought in the short term. Since the global economy is in a cooling-off phase, the biggest challenge for markets is to realistically gauge expectations for corporate profits in the coming months. This and sharp price rises present a risk that developments in prices could be misjudged. We will keep an eye on this.

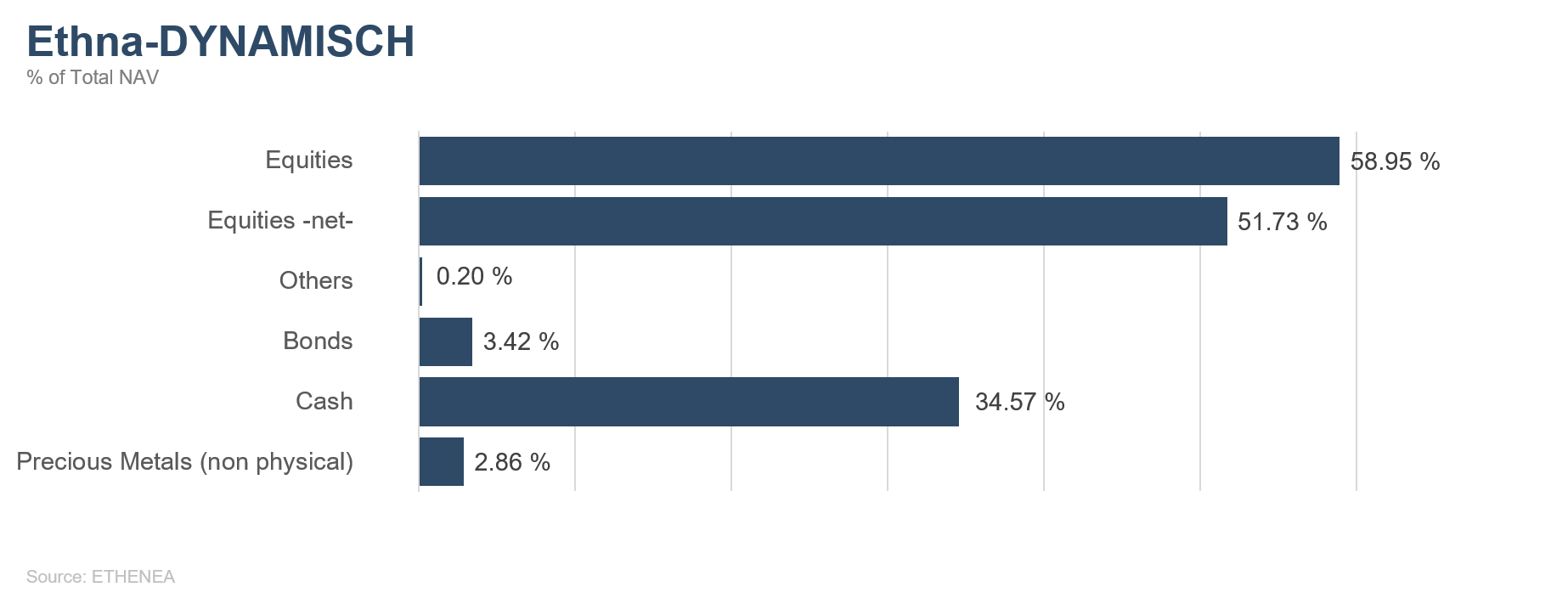

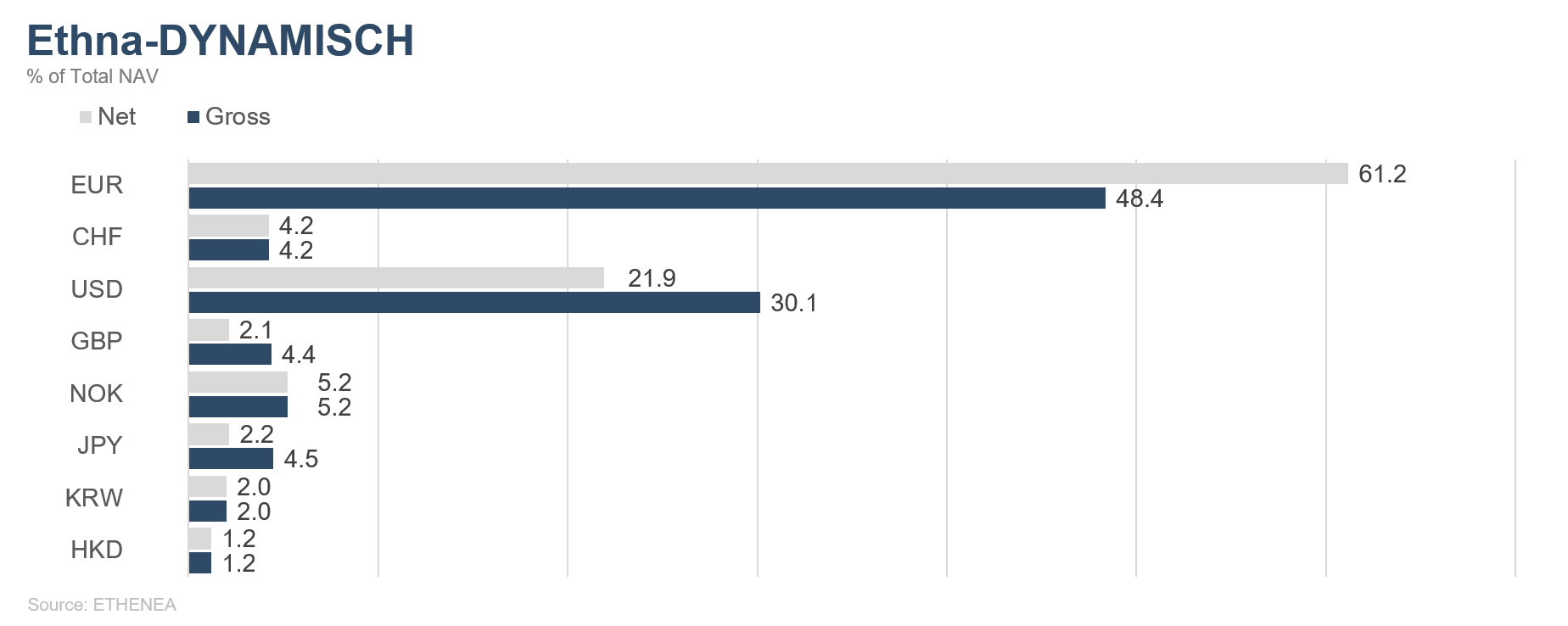

There were a few changes in the Ethna-DYNAMISCH’s equity portfolio last month. Two high-quality companies were bought: Reckitt Benckiser and Middleby. While the name Reckitt Benckiser is unfamiliar to many people, the company’s products are more widely known. With strong brands such as Calgon, Vanish and Cillit Bang, Reckitt is a leader in the counter-cyclical consumer sector. If the economic outlook dims further, Reckitt, with its defensive qualities, should be a winner. Middleby holds a similarly strong position. The US company makes high-quality kitchen appliances and boasts an impressive growth trajectory. In the past 10 years, earnings and revenues have multiplied, as has the share price. The company is planning to grow in the coming years, which should give the share a further boost in the medium term, especially since the valuation, over a prolonged period of consolidation, has again reached an attractive level. We sold KDDI and LG Uplus – two Asian telecoms companies – as we regard their upside potential as limited. In addition, we closed the Publicis and Lufthansa positions, which hold too much cyclical risk for us in light of the uncertain macroeconomic situation. The gross equity allocation of the fund over the course of the month was successively increased and is currently almost 59%. Exiting the futures positions raised the net equity allocation to approx. 52%. The expansions stem from a much better environment according to our market analysis (MBS).

March saw further, in some cases significant, falls in yields on the bond markets. As a result, the 10-year Bund traded in negative territory for the first time since 2016. In the US, too, there was a marked decline in interest rates in March. We further reduced our position in long-dated US Treasuries towards the end of March and took strong profits on them. Thus, they only hold a weighting of around 3% of the overall portfolio. With yields down again, investments in the bond market have become less attractive for us in the medium term. We remain cautious about this segment, and are not planning any significant expansion in the Ethna-DYNAMISCH for the time being.

Gold did not shine in the last month, almost completely losing the gains it had made since the beginning of the year. With a portfolio weighting of less than 3%, however, gold had only a slight influence on the performance of the Ethna-DYNAMISCH.

In our view, the fresh falls in interest rates continue to justify a substantial equity allocation in the portfolio. Then there’s the fragile economic outlook, at least in the short term. In this environment, we want to hold on to equities but are placing great emphasis on a hedging component that protects the portfolio in the event of high volatility.

Figure 7: Portfolio ratings for the Ethna-DEFENSIV

Figure 8: Portfolio composition of the Ethna-DEFENSIV by currency

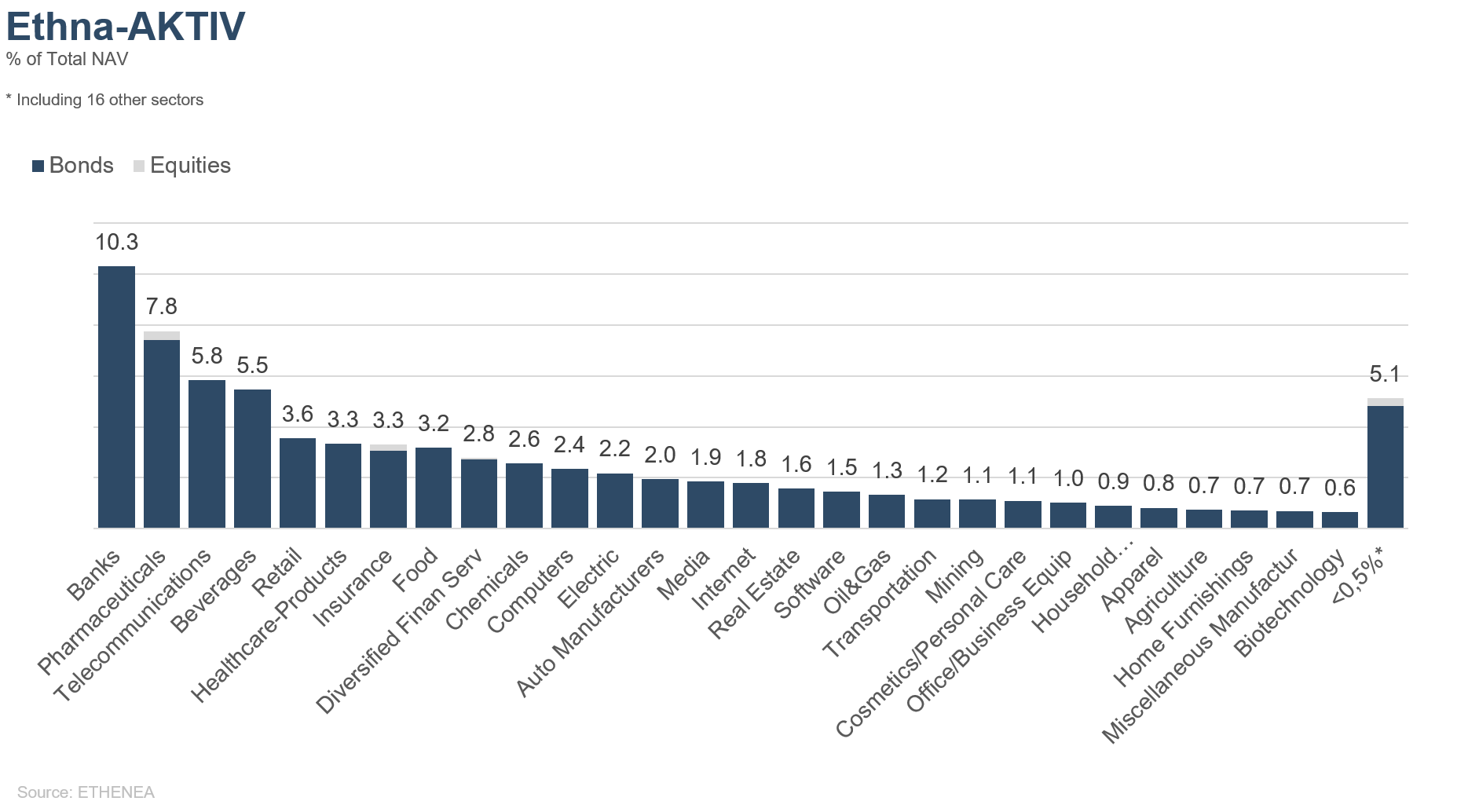

Figure 9: Portfolio structure* of the Ethna-AKTIV

Figure 10: Portfolio composition of the Ethna-AKTIV by currency

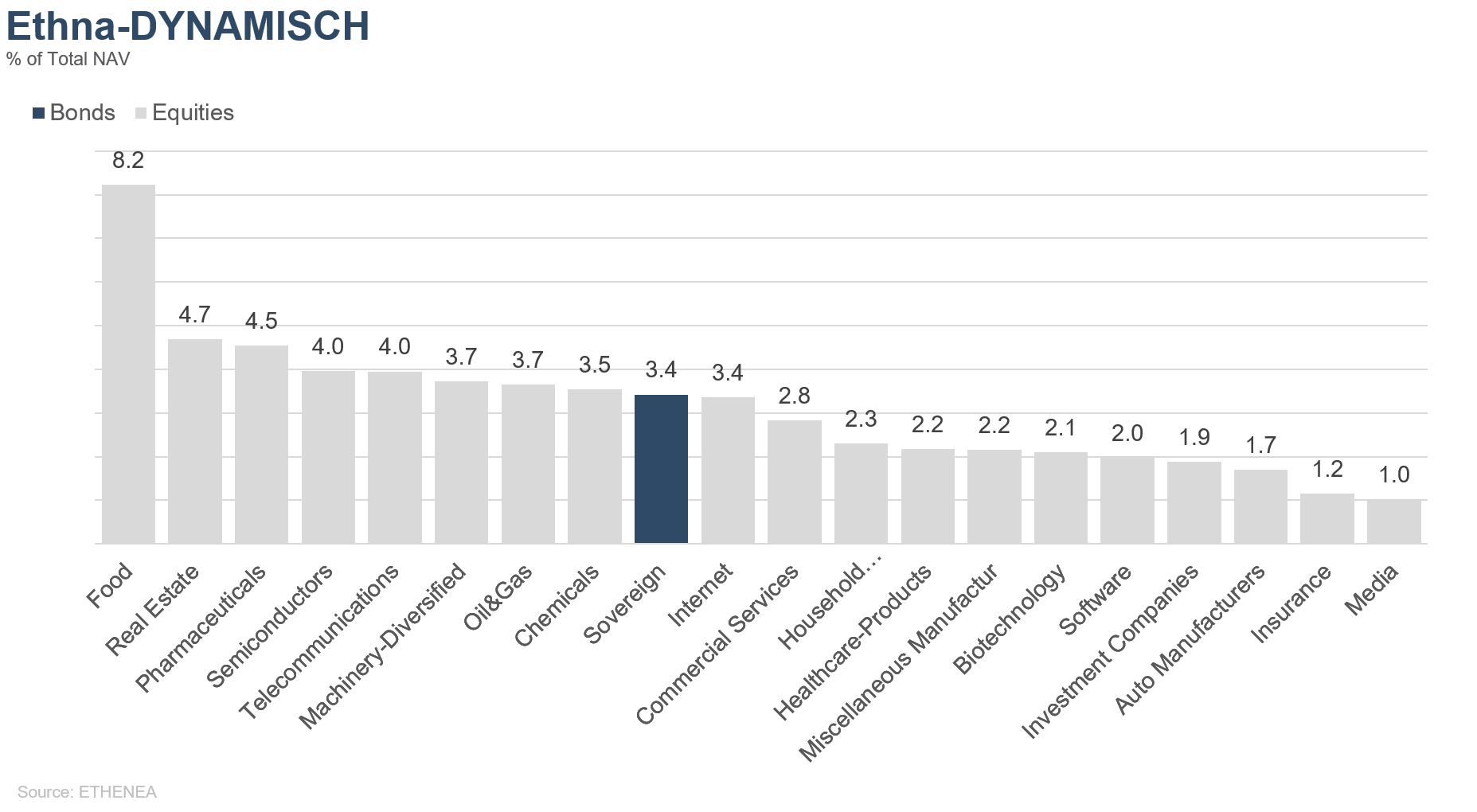

Figure 11: Portfolio structure* of the Ethna-DYNAMISCH

Figure 12: Portfolio composition of the Ethna-DYNAMISCH by currency

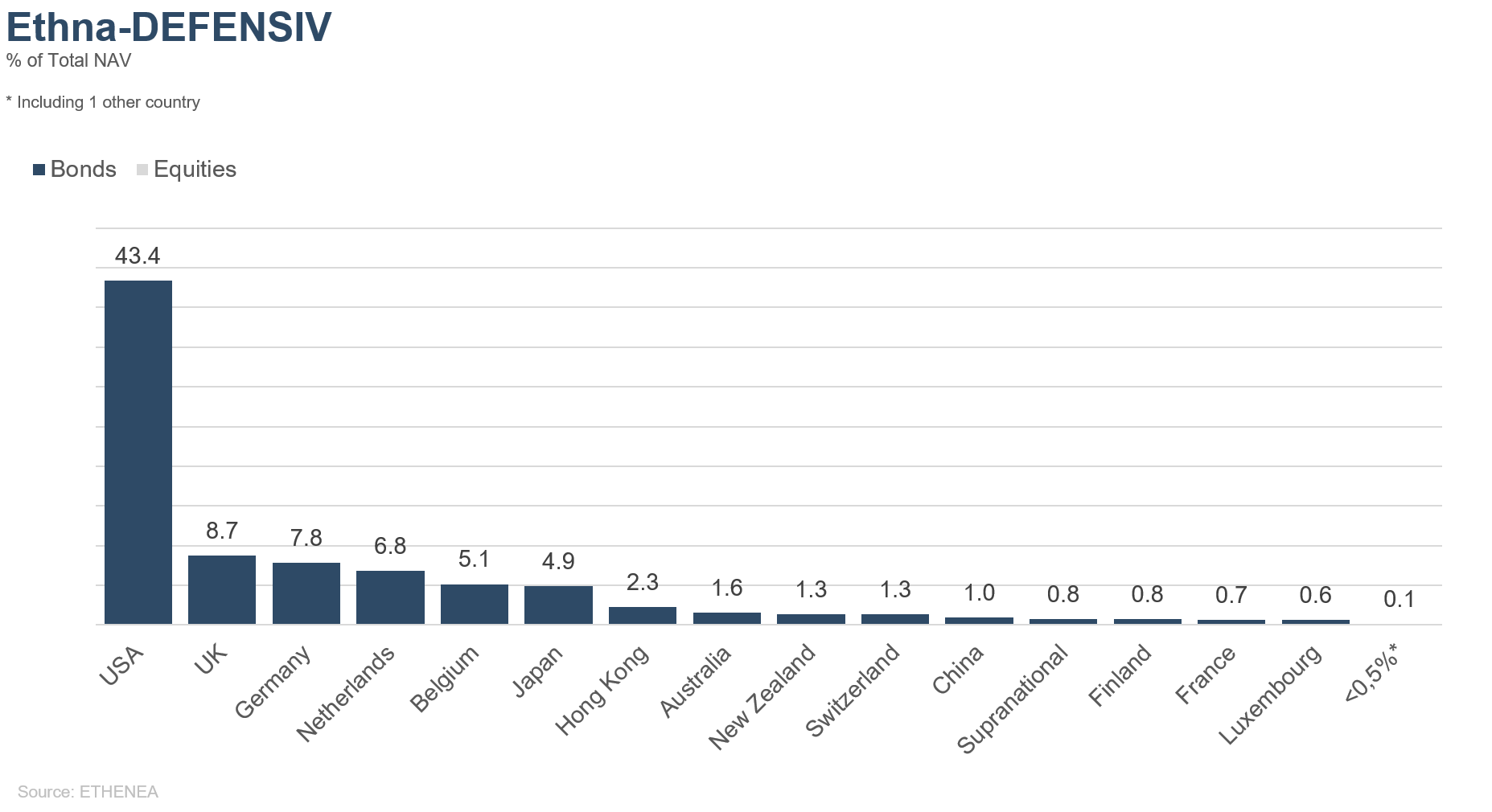

Figure 13: Portfolio composition of the Ethna-DEFENSIV by country

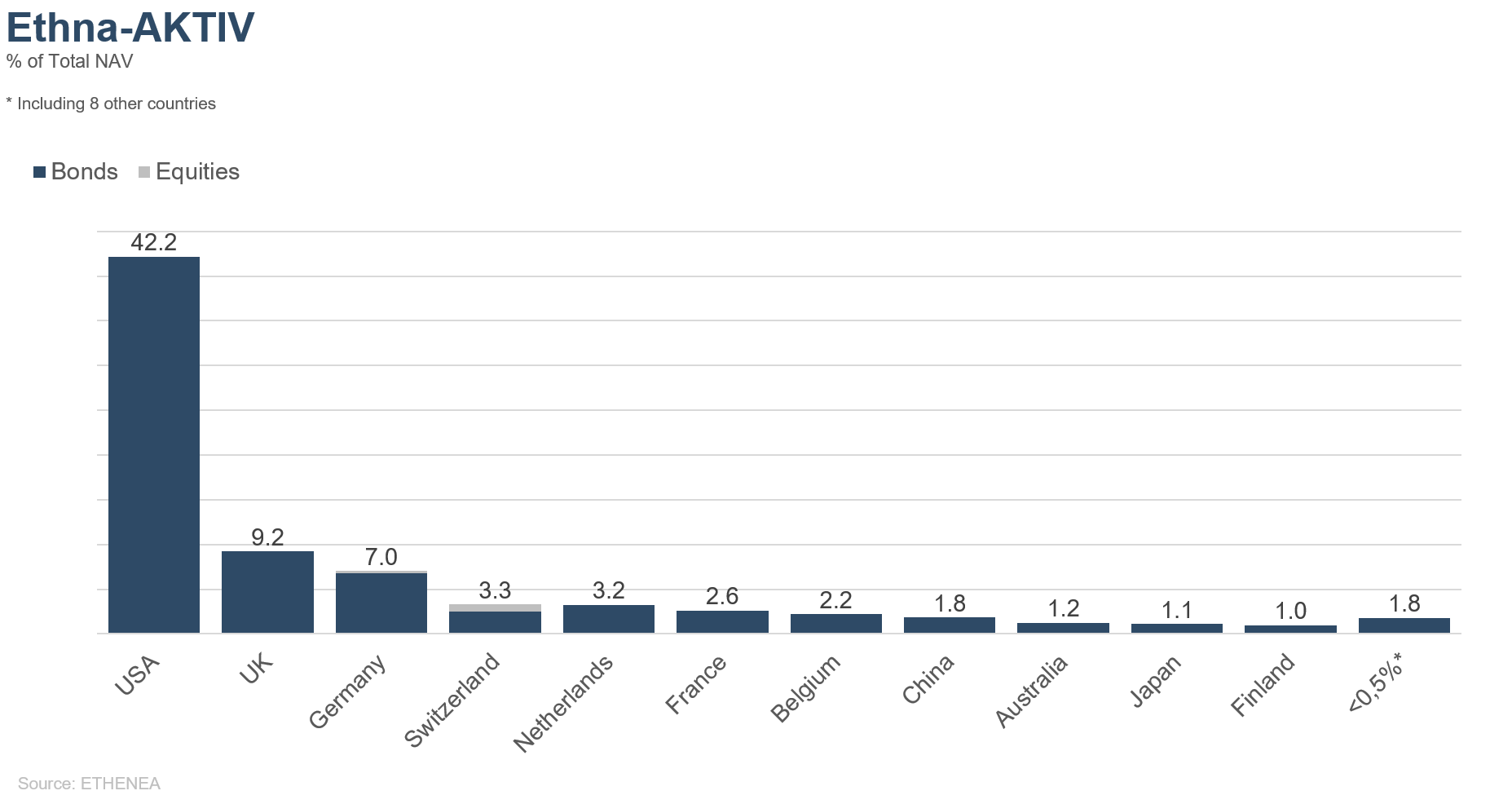

Figure 14: Portfolio composition of the Ethna-AKTIV by country

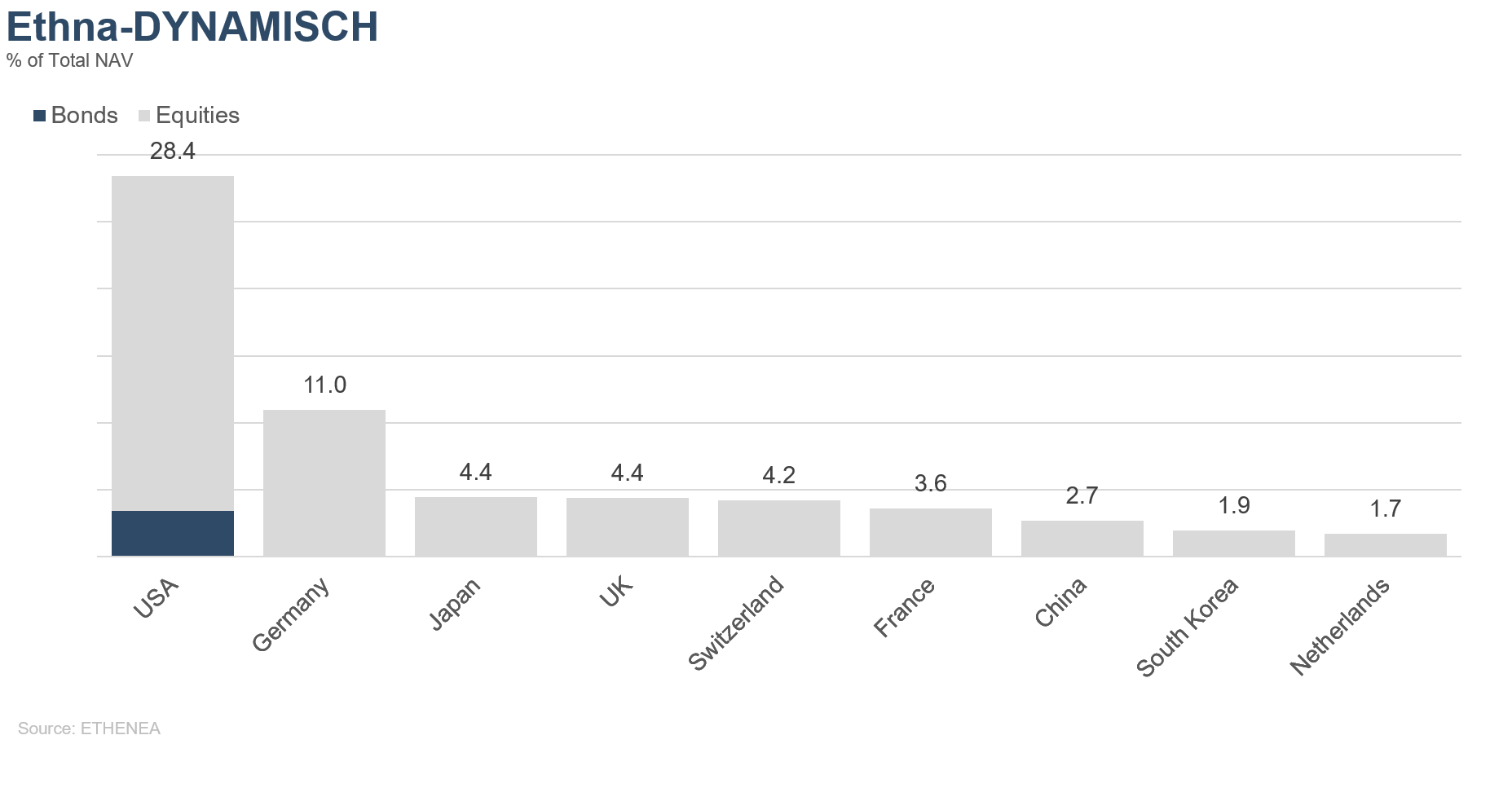

Figure 15: Portfolio composition of the Ethna-DYNAMISCH by country

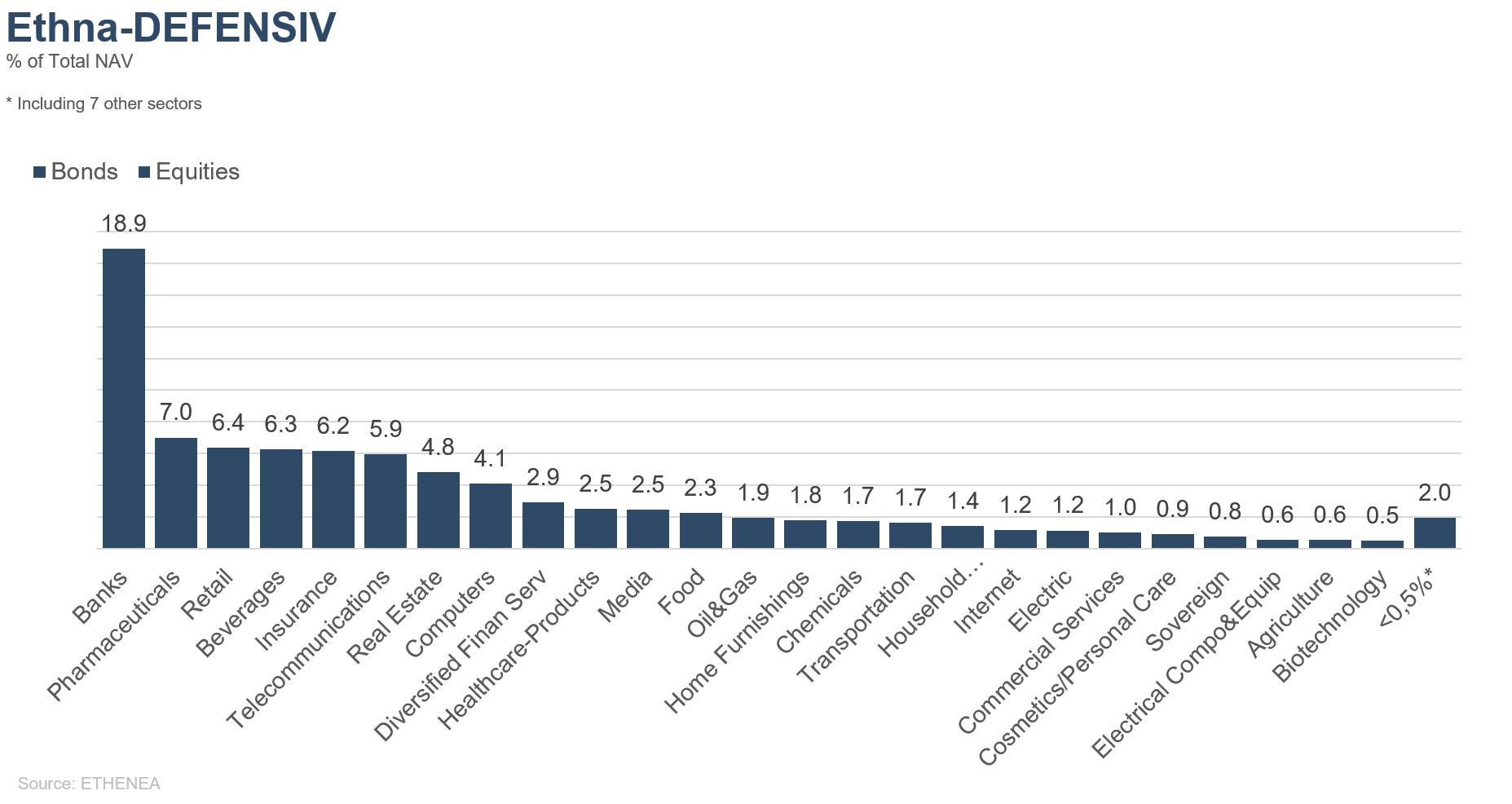

Figure 16: Portfolio composition of the Ethna-DEFENSIV by issuer sector

Figure 17: Portfolio composition of the Ethna-AKTIV by issuer sector

Figure 18: Portfolio composition of the Ethna-DYNAMISCH by issuer sector

* “Cash” comprises term deposits, call money and current accounts/other accounts. “Equities net” comprises direct investments and exposure resulting from equity derivatives.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

This is a marketing communication. It is for product information purposes only and is not a mandatory statutory or regulatory document. The information contained in this document does not constitute a solicitation, offer or recommendation to buy or sell units in the fund or to engage in any other transaction. It is intended solely to provide the reader with an understanding of the key features of the fund, such as the investment process, and is not deemed, either in whole or in part, to be an investment recommendation. The information provided is not a substitute for the reader's own deliberations or for any other legal, tax or financial information and advice. Neither the investment company nor its employees or Directors can be held liable for losses incurred directly or indirectly through the use of the contents of this document or in any other connection with this document. The currently valid sales documents in German (sales prospectus, key information documents (PRIIPs-KIDs) and, in addition, the semi-annual and annual reports), which provide detailed information about the purchase of units in the fund and the associated opportunities and risks, form the sole legal basis for the purchase of units. The aforementioned sales documents in German (as well as in unofficial translations in other languages) can be found at www.ethenea.com and are available free of charge from the investment company ETHENEA Independent Investors S.A. and the custodian bank, as well as from the respective national paying or information agents and from the representative in Switzerland. The paying or information agents for the funds Ethna-AKTIV, Ethna-DEFENSIV and Ethna-DYNAMISCH are the following: Austria, Belgium, Germany, Liechtenstein, Luxembourg: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg; France: CACEIS Bank France, 1-3 place Valhubert, F-75013 Paris; Italy: State Street Bank International – Succursale Italia, Via Ferrante Aporti, 10, IT-20125 Milano; Société Génerale Securities Services, Via Benigno Crespi, 19/A - MAC 2, IT-20123 Milano; Banca Sella Holding S.p.A., Piazza Gaudenzio Sella 1, IT-13900 Biella; Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Spain: ALLFUNDS BANK, S.A., C/ Estafeta, 6 (la Moraleja), Edificio 3 – Complejo Plaza de la Fuente, ES-28109 Alcobendas (Madrid); Switzerland: Representative: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Paying Agent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. The paying or information agents for HESPER FUND, SICAV - Global Solutions are the following: Austria, Belgium, France, Germany, Luxembourg: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg; Italy: Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Switzerland: Representative: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Paying Agent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. The investment company may terminate existing distribution agreements with third parties or withdraw distribution licences for strategic or statutory reasons, subject to compliance with any deadlines. Investors can obtain information about their rights from the website www.ethenea.com and from the sales prospectus. The information is available in both German and English, as well as in other languages in individual cases. Producer: ETHENEA Independent Investors S.A.. Distribution of this document to persons domiciled in countries in which the fund is not authorised for distribution, or in which authorisation for distribution is required, is prohibited. Units may only be offered to persons in such countries if this offer is in accordance with the applicable legal provisions and it is ensured that the distribution and publication of this document, as well as an offer or sale of units, is not subject to any restrictions in the respective jurisdiction. In particular, the fund is not offered in the United States of America or to US persons (within the meaning of Rule 902 of Regulation S of the U.S. Securities Act of 1933, in its current version) or persons acting on their behalf, on their account or for the benefit of a US person. Past performance should not be taken as an indication or guarantee of future performance. Fluctuations in the value of the underlying financial instruments or their returns, as well as changes in interest rates and currency exchange rates, mean that the value of units in a fund, as well as the returns derived from them, may fall as well as rise and are not guaranteed. The valuations contained herein are based on a number of factors, including, but not limited to, current prices, estimates of the value of the underlying assets and market liquidity, as well as other assumptions and publicly available information. In principle, prices, values, and returns can both rise and fall, up to and including the total loss of the capital invested, and assumptions and information are subject to change without prior notice. The value of the invested capital or the price of fund units, as well as the resulting returns and distribution amounts, are subject to fluctuations or may cease altogether. Positive performance in the past is therefore no guarantee of positive performance in the future. In particular, the preservation of the invested capital cannot be guaranteed; there is therefore no warranty given that the value of the invested capital or the fund units held will correspond to the originally invested capital in the event of a sale or redemption. Investments in foreign currencies are subject to additional exchange rate fluctuations or currency risks, i.e. the performance of such investments also depends on the volatility of the foreign currency, which may have a negative impact on the value of the invested capital. Holdings and allocations are subject to change. The management and custodian fees, as well as all other costs charged to the fund in accordance with the contractual provisions, are included in the calculation. The performance calculation is based on the BVI (German federal association for investment and asset management) method, i.e. an issuing charge, transaction costs (such as order fees and brokerage fees), as well as custodian and other management fees are not included in the calculation. The investment performance would be lower if the issuing surcharge were taken into account. No guarantee can be given that the market forecasts will be achieved. Any discussion of risks in this publication should not be considered a disclosure of all risks or a conclusive handling of the risks mentioned. Explicit reference is made to the detailed risk descriptions in the sales prospectus. No guarantee can be given that the information is correct, complete or up to date. The content and information are subject to copyright protection. No guarantee can be given that the document complies with all statutory or regulatory requirements which countries other than Luxembourg have defined for it. Note: The most important technical terms can be found in the glossary at www.ethenea.com/glossary. Information for investors in Belgium: The prospectus, the key information documents (PRIIPs-KIDs), the annual reports and the semi-annual reports of the sub-fund are available in French free of charge upon request from the investment company ETHENEA Independent Investors S.A., 16, rue Gabriel Lippmann, 5365 Munsbach, Luxembourg and from the representative: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg. Information for investors in Switzerland: The country of origin of the collective investment scheme is Luxembourg. The representative in Switzerland is IPConcept (Schweiz) AG, Münsterhof 12, P.O. Box, CH-8022 Zurich. The paying agent in Switzerland is DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zurich. The prospectus, the key information documents (PRIIPs-KIDs), and the Articles of Association, as well as the annual and semi-annual reports, can be obtained free of charge from the representative. Copyright © ETHENEA Independent Investors S.A. (2024) All rights reserved. 02/04/2019