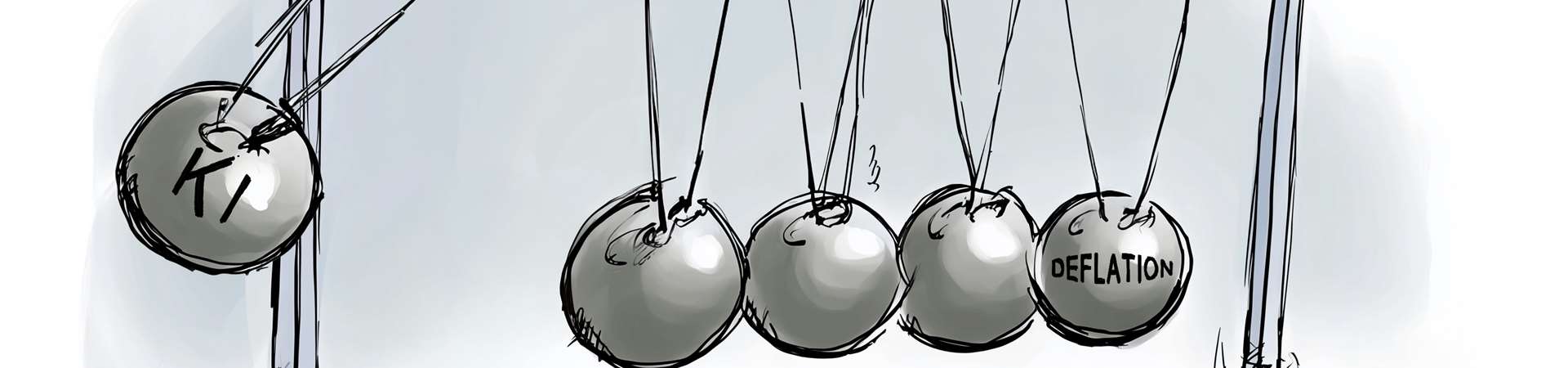

The Silent Price Revolution – AI as the perpetual mobile of deflation

Read the market analysis and fund positioning

Some forces don’t move the market with noise, but with quiet momentum. Artificial intelligence is one of them. For years, it was written off as little more than an academic play - a backroom bet of start-ups and think tanks. Now the evidence is stacking up that AI isn’t just speeding up workflows, it’s rewriting entire pricing structures. A self-reinforcing flywheel of efficiency gains and cost cuts is shaping up—potentially the ultimate “perpetual mobile” of deflation.

Macro: When Numbers Speak a New Language

The latest Q2 2025 release from the U.S. Bureau of Labor Statistics made the market sit up: labor productivity in the nonfarm business sector jumped +2.4%, while hours worked rose just +1.3% and unit labor costs edged up a modest +1.6%.

On the surface, it looks like a technical footnote. In reality, it’s an early signal of something deeper. Production processes are being rewired. Companies are squeezing more output from less input—driven by AI-powered automation, advanced analytics, and predictive operations.

BNP Paribas Research puts numbers to the shift: every percentage point of productivity growth can shave up to a full point of annual inflation. The Bank for International Settlements (BIS) reaches the same conclusion: when total factor productivity climbs, supply outpaces demand - and prices slow, stall, or even turn south.

More efficiency → lower costs → stronger investment incentives → even more efficiency.

A self-reinforcing deflationary cycle is emerging - a “perpetual motion machine of price stabilization,” powered by massive infrastructure investment. Gartner estimates global public-cloud spending will reach USD 675 billion in 2024 - up more than 20%. The fastest-growing slice: Infrastructure as a Service (+25.6%), fueled by generative AI workloads.

The hardware side tells the same story at scale. NVIDIA, the sector’s bellwether, booked USD 26.3 billion in Q2 2025 Data Center revenue alone -

up 154% year-on-year. These numbers are not outliers; they are proof of the capital wave behind AI-ready infrastructure.

Supply Chains on an Efficiency Diet

Anyone who sees AI as just a coder’s tool misses its bigger play in the real economy. In supply chains AI functions like a performance coach for global trade flows. McKinsey finds that 61% of manufacturers report lower costs after adopting AI, 53% report higher revenues—and most striking, 41% achieved cost savings of 10–19%.

The reason is simple: forecasting is sharper, downtime shorter and resources deployed with greater precision. What was once a bumpy road has become an AI-driven fast lane for efficiency and margin gains.

Labor Market: Less Sweat per Unit of Output

What does AI mean for jobs and wages? An analysis by the Tony Blair Institute estimates that full AI adoption in the UK could free up nearly a quarter of private-sector working hours, the equivalent of six million full-time employees annually.

The implications:

- The sensitivity of price inflation to unemployment decreases by 17%.

- The sensitivity of wage inflation to unemployment decreases by 9%.

MIT economist Daron Acemoglu reaches a similar conclusion: AI reduces the labor costs of automatable tasks by 27% - which can translate into economy-wide savings of up to 15%. Put differently: output rises without wages growing at the same pace - a textbook disinflationary effect.

Corporate First Movers

AI’s deflationary force isn’t just theory - it’s showing up in the numbers of global leaders. Maersk has cut vessel idle time by 30% through AI, unlocking more than USD 300 million in annual savings.

Amazon runs over 520,000 AI-powered robots in its fulfillment centers, trimming order-processing costs by 20% and lifting efficiency by 40%.

Walmart saves roughly USD 1.5 billion each year with AI-driven inventory management - while keeping product availability at 99.2%.

These gains don’t just fatten margins; they quietly translate into lower prices for consumers - a slow but steady deflationary engine.

Investment Implications: Navigating with a Dual Compass

Markets are currently pricing in moderate to medium-term inflation (5y5y break evens at 2.3 – 2.5%). Yet the structural disinflationary effects of AI remain underrepresented in many models. We believe that once these deflationary forces are factored in, price pressures could prove lower than consensus expects. At the very least, this reduces the case for structurally higher interest rates.

This argues for a quality-focused duration strategy - allocating primarily to medium and longer maturities to capture higher yields. At the same time, maintaining some exposure to shorter maturities preserves flexibility.

Conclusion: AI as the Economy’s Pilot

Artificial intelligence is no panacea - but it is a powerful lever. It doesn’t just accelerate processes. It is reshaping the architecture of the economy itself: more efficient, more predictive, more productive.

Annual productivity gains of 0.1 to 1.5 percentage points, double-digit cost savings in supply chains, multi-billion-dollar infrastructure investments, and measurable dampening effects on wages and prices all point toward a disinflationary trajectory.

The path won’t be linear. Investment spikes, integration costs, and skills gaps may trigger temporary price pressures. But over the long term, AI may achieve what once seemed physically impossible: a perpetual mobile that keeps the engine of inflation in a state of permanent moderation.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

This marketing communication is for information purposes only. It may not be passed on to persons in countries where the fund is not authorized for distribution, in particular in the USA or to US persons. The information does not constitute an offer or solicitation to buy or sell securities or financial instruments and does not replace investor- and product-related advice. It does not take into account the individual investment objectives, financial situation, or particular needs of the recipient. Before making an investment decision, the valid sales documents (prospectus, key information documents/PRIIPs-KIDs, semi-annual and annual reports) must be read carefully. These documents are available in German and as non-official translations from ETHENEA Independent Investors S.A., the custodian, the national paying or information agents, and at www.ethenea.com. The most important technical terms can be found in the glossary at www.ethenea.com/glossary/. Detailed information on opportunities and risks relating to our products can be found in the currently valid prospectus. Past performance is not a reliable indicator of future performance. Prices, values, and returns may rise or fall and can lead to a total loss of the capital invested. Investments in foreign currencies are subject to additional currency risks. No binding commitments or guarantees for future results can be derived from the information provided. Assumptions and content may change without prior notice. The composition of the portfolio may change at any time. This document does not constitute a complete risk disclosure. The distribution of the product may result in remuneration to the management company, affiliated companies, or distribution partners. The information on remuneration and costs in the current prospectus is decisive. A list of national paying and information agents, a summary of investor rights, and information on the risks of incorrect net asset value calculation can be found at www.ethenea.com/legal-notices/. In the event of an incorrect NAV calculation, compensation will be provided in accordance with CSSF Circular 24/856; for shares subscribed through financial intermediaries, compensation may be limited. Information for investors in Switzerland: The home country of the collective investment scheme is Luxembourg. The representative in Switzerland is IPConcept (Suisse) AG, Bellerivestrasse 36, CH-8008 Zurich. The paying agent in Switzerland is DZ PRIVATBANK (Suisse) AG, Bellerivestrasse 36, CH-8008 Zurich. Prospectus, key information documents (PRIIPs-KIDs), articles of association, and the annual and semi-annual reports can be obtained free of charge from the representative. Information for investors in Belgium: The prospectus, key information documents (PRIIPs-KIDs), annual reports, and semi-annual reports of the sub-fund are available free of charge in German upon request from ETHENEA Independent Investors S.A., 16, rue Gabriel Lippmann, 5365 Munsbach, Luxembourg, and from the representative: DZ PRIVATBANK AG, Niederlassung Luxemburg, 4, rue Thomas Edison, L-1445 Strassen, Luxembourg. Despite the greatest care, no guarantee is given for the accuracy, completeness, or timeliness of the information. Only the original German documents are legally binding; translations are for information purposes only. The use of digital advertising formats is at your own risk; the management company assumes no liability for technical malfunctions or data protection breaches by external information providers. The use is only permitted in countries where this is legally allowed. All content is protected by copyright. Any reproduction, distribution, or publication, in whole or in part, is only permitted with the prior written consent of the management company. Copyright © ETHENEA Independent Investors S.A. (2025). All rights reserved. 01/09/2025