Your questions, our answers

Markets continue to be influenced by geopolitics and persistently high inflation on both sides of the Atlantic. In our second quarterly update of the year, portfolio managers responded to the following questions, among others, to explain their views.

Ethna-DEFENSIV

Ethna-AKTIV

Ethna-DYNAMISCH

Ethna-DEFENSIV

When do you think it is time to invest in or switch to longer-dated bonds? What would be your criteria for selecting longer-dated bonds?

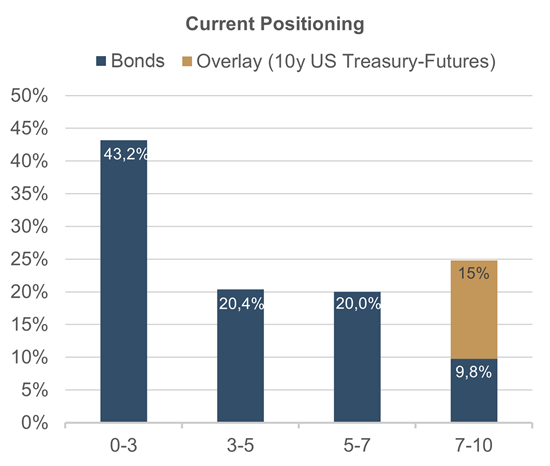

From our point of view, this time has already come. In recent weeks, we have invested opportunistically in the corporate bonds with maturities between 2028 and 2032. The slowdown of the global economy, especially in the industrialised countries such as the US and the EU, as well as falling inflation rates give us reason to expect lower yields at the longer end of the yield curve. An increase in duration therefore seems attractive to us. So far, we have increased the interest rate sensitivity of our portfolio to 4.4 by investing in new issues and building a 15% position in 10-year US Treasuries.

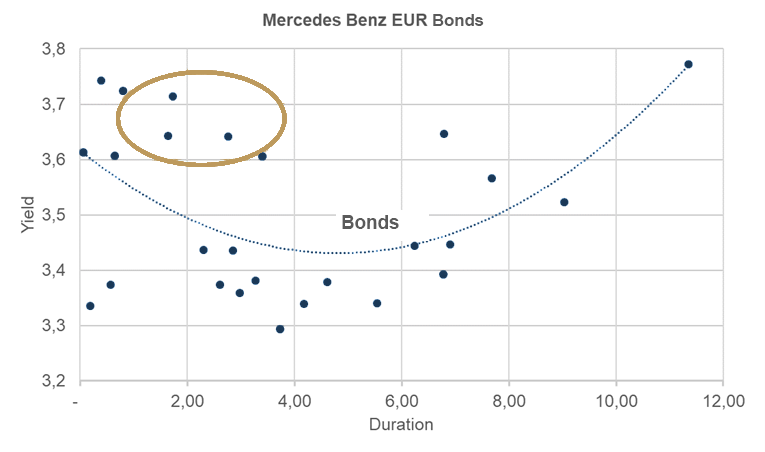

There are two factors to consider when selecting individual positions. The first is yield. In the current economic environment, we can achieve higher returns without taking on more risk. Yields above 4.5% are attractive to us at the moment, and we are closely monitoring new issues in this area. At the same time, the second factor is the inversion of the government yield curve. For some safer companies, the risk premium is not sufficient to form an inverted curve (government yield + risk premium). For example, the government yield at the short end and the risk premium at the long end of the Mercedes Benz yield curve have a greater impact, leading to a U-shaped curve (blue line in Figure 1).

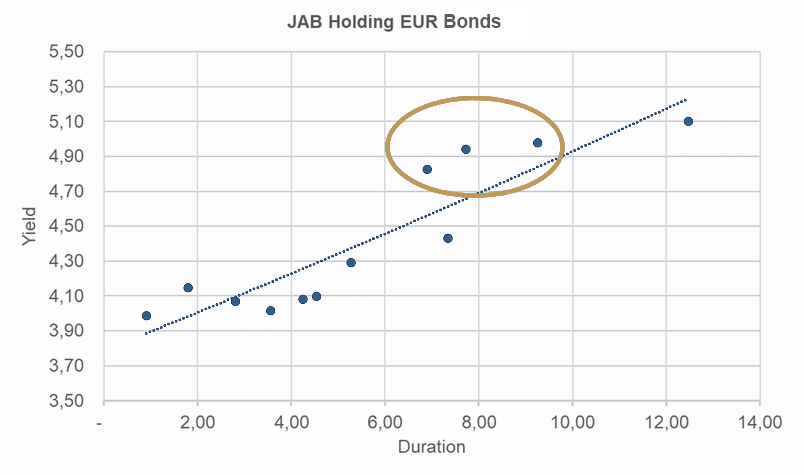

Other companies offer higher risk premiums. Companies such as JAB Holdings, Autostrade per L'Italia Autostrade, Fiserv or VW have linearly rising yield curves:

We are therefore currently positioned to benefit from the inversion with 43.2% exposure in the 0-3 year maturities and 24.8% (incl. futures overlay) at the long end.

Ethna-AKTIV

Ethna-AKTIV has always been a very conservative fund, so the equity allocation is surprising, especially given the current situation on the capital markets. Can you please explain this?

The Ethna-AKTIV is still the right choice for the conservative and risk-conscious investor. However, the attributes active and flexible are also part of our offering. Our task is to find the optimal asset allocation for attractive long-term capital growth, depending on the market environment. This is usually derived from an assessment of the macroeconomic situation, valuation parameters and positioning data. At the end of the first quarter, we noted a clear disconnect between the available macro data, including our forecasts, and the measurable reaction of market participants (flows and positioning). Despite declining inflation, stable to positive markets for months, and an economic outlook that was relatively constructive to us, the sentiment and positioning of many market participants was very negative. We recognised this opportunity and our flexible approach allowed us to adjust the portfolio accordingly. It is important to note that this does not contradict the conservative nature of the portfolio. On a risk/reward basis, the opportunities outweighed the risks at the time. Firstly, a market that everyone expects to fall is relatively well supported. You have usually hedged accordingly. Second, when prices are stable, it often only takes a catalyst to adjust positioning and follow a new narrative. The shift from the recession to the soft-landing narrative and the hype about the potential efficiency gains from artificial intelligence were just such catalysts. But adjusting the equity exposure was not the only adjustment. We have also significantly increased the duration of the bond portfolio this year and hedged all currency risks. This means that changing a specific allocation is never an isolated decision but must always be seen in the context of the entire portfolio. In the meantime, however, the starting position on the equity side has changed to the extent that we are currently discussing a return to a more neutral position. Always in the spirit of: Taking active and flexible advantage of opportunities.

Ethna-DYNAMISCH

Looking at the hype around AI and NVIDIA's spectacular performance: Do you think it is sustainable? Do you want to allocate part of Ethna-DYNAMISCH to this segment to participate in the potential gains of this industry?

Although Artificial Intelligence (AI) is nothing new, it is the ChatGPT application that seems to have really caught the public's imagination. So much so that hardly a day goes by without another company announcing its AI solutions and capabilities. The stock market is taking notice.

We don't want to underestimate the fact that AI has the potential to change many things. From efficiency gains to new products and services. But we are sceptical that this will happen as suddenly as the recent performance of some stocks suggests. Spectacular really is the appropriate description.

Well, not everything is fantasy, some of it is already reality: NVIDIA's latest quarterly results were huge. The fundamental performance is of course impressive. But to be considered for an investment, the valuation must also be right. Keyword: "growth at a reasonable price" (GARP). In any case, we are not entirely comfortable with an expected P/E ratio of around 50. The potential for setbacks is too great if the high growth expectations are not met. Experience shows that over-hyped themes and stocks that are flooded with inflows into active or passive fund structures have a hard time meeting expectations - and thus their valuation levels - in the future.

It is true that over a longer time horizon, valuation plays an increasingly subordinate role if the fundamentals are right. But the past has also shown that it is very difficult to identify the long-term winners in technological (r)evolutions, even if they seem obvious in retrospect. In any case, Alphabet was considered the leader in the field of AI language models until OpenAI’s ChatGPT, which is essentially funded by Microsoft, took off. Competition is very dynamic.

We are already invested in several AI companies, although this was not the basis of our initial investment decision. We also have a number of relevant stocks on our watch list. We will not hesitate to invest when opportunities arise. Until then, however, we prefer companies that are thriving outside the hype. Those with solid fundamental growth (preferably with good visibility) and attractive valuations, i.e. GARP stocks.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

This is a marketing communication. It is for information purposes only and provides the addressee with guidance on our products, concepts and ideas. This does not form the basis for any purchase, sale, hedging, transfer or mortgaging of assets. None of the information contained herein constitutes an offer to buy or sell any financial instrument nor is it based on a consideration of the personal circumstances of the addressee. It is also not the result of an objective or independent analysis. ETHENEA makes no express or implied warranty or representation as to the accuracy, completeness, suitability, or marketability of any information provided to the addressee in webinars, podcasts or newsletters. The addressee acknowledges that our products and concepts may be intended for different categories of investors. The criteria are based exclusively on the currently valid sales prospectus. This marketing communication is not intended for a specific group of addressees. Each addressee must therefore inform themselves individually and under their own responsibility about the relevant provisions of the currently valid sales documents, on the basis of which the purchase of shares is exclusively based. Neither the content provided nor our marketing communications constitute binding promises or guarantees of future results. No advisory relationship is established either by reading or listening to the content. All contents are for information purposes only and cannot replace professional and individual investment advice. The addressee has requested the newsletter, has registered for a webinar or podcast, or uses other digital marketing media on their own initiative and at their own risk. The addressee and participant accept that digital marketing formats are technically produced and made available to the participant by an external information provider that has no relationship with ETHENEA. Access to and participation in digital marketing formats takes place via internet-based infrastructures. ETHENEA accepts no liability for any interruptions, cancellations, disruptions, suspensions, non-fulfilment, or delays related to the provision of the digital marketing formats. The participant acknowledges and accepts that when participating in digital marketing formats, personal data can be viewed, recorded, and transmitted by the information provider. ETHENEA is not liable for any breaches of data protection obligations by the information provider. Digital marketing formats may only be accessed and visited in countries in which their distribution and access is permitted by law. For detailed information on the opportunities and risks associated with our products, please refer to the current sales prospectus. The statutory sales documents (sales prospectus, key information documents (PRIIPs-KIDs), semi-annual and annual reports), which provide detailed information on the purchase of units and the associated risks, form the sole authoritative and binding basis for the purchase of units. The aforementioned sales documents in German (as well as in unofficial translations in other languages) can be found at www.ethenea.com and are available free of charge from the investment company ETHENEA Independent Investors S.A. and the custodian bank, as well as from the respective national paying or information agents and from the representative in Switzerland. The paying or information agents for the funds Ethna-AKTIV, Ethna-DEFENSIV and Ethna-DYNAMISCH are the following: Austria, Belgium, Germany, Liechtenstein, Luxembourg: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg; France: CACEIS Bank France, 1-3 place Valhubert, F-75013 Paris; Italy: State Street Bank International – Succursale Italia, Via Ferrante Aporti, 10, IT-20125 Milano; Société Génerale Securities Services, Via Benigno Crespi, 19/A - MAC 2, IT-20123 Milano; Banca Sella Holding S.p.A., Piazza Gaudenzio Sella 1, IT-13900 Biella; Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Spain: ALLFUNDS BANK, S.A., C/ Estafeta, 6 (la Moraleja), Edificio 3 – Complejo Plaza de la Fuente, ES-28109 Alcobendas (Madrid); Switzerland: Representative: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Paying Agent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. The paying or information agents for HESPER FUND, SICAV - Global Solutions are the following: Austria, Belgium, France, Germany, Luxembourg: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg; Italy: Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Switzerland: Representative: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Paying Agent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. The investment company may terminate existing distribution agreements with third parties or withdraw distribution licences for strategic or statutory reasons, subject to compliance with any deadlines. Investors can obtain information about their rights from the website www.ethenea.com and from the sales prospectus. The information is available in both German and English, as well as in other languages in individual cases. Explicit reference is made to the detailed risk descriptions in the sales prospectus. This publication is subject to copyright, trademark and intellectual property rights. Any reproduction, distribution, provision for downloading or online accessibility, inclusion in other websites, or publication in whole or in part, in modified or unmodified form, is only permitted with the prior written consent of ETHENEA. Copyright © 2024 ETHENEA Independent Investors S.A. All rights reserved. 20/06/2023