Equity markets yesterday, today and tomorrow

The Ethna-DYNAMISCH turns 10 years old in November and we would like to take this opportunity to take an objective look at the current situation the equity markets find themselves in. Where are we right now? How did we get here? What could the future hold? And how do we position the Ethna-DYNAMISCH, our solution offering investors risk-controlled access to global equity markets, in this environment?

Objectivity: one really cannot overstate the importance of this word. In these times of increasing entrenchment – not just in society and politics but also when it comes to assessing the capital markets – objectivity, contextualisation and subsequent discussion seem to us to be more important than ever before.

At Ethenea we are aware of our responsibility in this regard. We are not a niche provider offering products with a narrow focus on individual asset classes, imposing fixed regional, sectoral or stylistic limits on them. The niche provider leaves the most important long-term investment decisions to the client to make alone. The core of ETHENEA’s philosophy, by contrast, is to take up the mantle at precisely this point. Active and flexible management is at the heart of what we do. The sole differentiator of our focussed product range is the underlying risk appetite of the three main investor categories – defensive, conservative balanced and offensive.

So it’s no wonder, but a logical conclusion, that the Ethna Funds have adapted over the years to changing markets and will continue to evolve in the future. In the ideal scenario, they adapt in anticipation of developments in the capital markets; that is, taking optimal consideration of expectations for the future. The Ethna-DYNAMISCH was practically born with this valuable quality in 2009. The following excerpt from an interview conducted in Summer 2019 sums this up this in a nutshell:

What made your firm launch the fund at a time when the financial crisis was in full swing and the Ethna-AKTIV was doing well precisely by not investing in equities?

Long-term, equities are the asset class that produces the highest return by far. At the same time, investment in equities is associated with higher fluctuations in value and greater risks. Having had negative experiences between 2000 and 2003 as well as during the global financial crisis of 2008/9, many investors were overly critical of equities. These were the very investors to whom the Ethna-DYNAMISCH was intended to offer risk-controlled access to global equity markets, to enable participation in the opportunities that undoubtedly existed but, at the same time, to control the risks. Incidentally, these arguments still hold true today and are becoming steadily more important in light of the persistent low interest rate environment.

The global financial crisis happened just about ten years ago. What has changed in equity markets and for investors in general since then? Everything! And almost nothing!

Everything, because interest is almost non-existent worldwide. Because technology and globalisation have made enormous strides. Because the concentration of business success and wealth that has come from it has steadily grown. Because the national debt of many countries has reached record levels. And because political and monetary influence over the capital markets has increased markedly at the same time.

Yet almost nothing has changed because an equity investment still represents a share of a company and its future commercial success. Because a bond investment still represents a debt instrument with very clearly defined parameters for future payment streams. Because economic development will continue to go in cycles. Because the human psyche is still a factor in the pricing of securities that cannot be underestimated. And also because each point in the past was shaped by a high degree of uncertainty about future developments – even if now, this perception is no doubt skewing more towards the positive the further we get from the past.

In short, Everything! And almost nothing! It’s complicated, as one would expect, because everything is interconnected in the end. The day-to-day work of the Portfolio Management Team consists of drawing the right conclusions from the data – structural, strategic, tactical – and applying them appropriately to the Ethna Funds.

One example of a structural decision for the Ethna-DYNAMISCH was to raise the 70% cap on equity investments, which applied up to 30 June 2019, to the current maximum of 100%. For one, this gives the fund a better chance to participate in strong bull markets in equities in future. Secondly, we are priming the Ethna-DYNAMISCH for a continuation of the low/zero interest rate environment. Investors’ desperate search for any return worth mentioning has in recent years steadily driven the valuations of fixed-income investments to record levels. The same goes for asset classes with very predictable yields, such as property. The first ripples of this have already reached the equity market: excellent-quality, high-visibility company shares have become very expensive. The equity market overall has also risen in recent years but this trend had less to do with valuations increasing and more to do with the positive fundamental development of the companies. Looking ahead, we therefore expect a strong tailwind for equity markets, accompanied by a structural increase in valuations, in which we in the Ethna-DYNAMISCH would like to participate as effectively possible.

This scenario provides some of the rationale for a few strategic considerations, which will determine our future actions within the Ethna-DYNAMISCH.

Downturns in equity markets are increasingly V-shaped. All this means is that falling prices at overall market level increase the relative attractiveness of equities (which they have anyway) and – ceteris paribus – cause rapid counter movements. In the past, such market movements were a weak point in the Ethna-DYNAMISCH’s performance, since upside participation was not satisfactory in our view. As a consequence, we have both slightly reduced the extent and optimised the additional hedging components.

In parallel, we have further upped the standard of underlying quality of the around 30 to 40 individual securities held in the equity portfolio. At the micro level, we are thus capturing a good portion of the risk management that was previously done more at the macro level. Specifically, we increasingly select potential candidates for investment based on the attractiveness of the company and then build up value in a more targeted manner at the level of the individual share. Selection methods that initially approach equities from a strictly generalised valuation perspective run a greater risk of falling victim to value traps. Behind this rationale is the conviction that, when in doubt, the quality of the company is more important than valuations that seem cheaper at first glance. Of course, this is not news to us, but until last year we achieved very good results with the value-centred approach. In light of increasingly more sophisticated competitors from the pure quant segment, which by design always focus on valuation parameters that can easily be mathematically modelled, and the structural changes in the market described at the outset, we see the appropriate development of equity selection as being the most important cornerstone of the Ethna-DYNAMISCH’s future success.

Subjectively speaking, it is always easier to sit in the corner and use easy-to-understand categories, such as value or growth, to argue one’s case or use superficial but widespread valuation measures, such as the price/earnings ratio to explain the markets and one’s own positioning. Objectively speaking, the world has become much too complex for this to be successful in the long run. We want the Ethna-DYNAMISCH to offer our investors the objectively correct and most promising approach for risk-controlled access to global equity markets at all times.

We are aware that the performance of the fund price in the year to date has not fully met expectations on the fund. This gives us even greater motivation heading into the Ethna-DYNAMISCH’s second decade to reinforce our current investors’ trust, to win back the trust of former investors and to gain the trust of future investors. This we intend to do using the formula and methods we have outlined in this month’s somewhat unusual Market Commentary.

With regards, your DYNAMISCH team

Follow my day – Behind the scenes at ETHENEA

Immerse yourself in the world of ETHENEA and watch the Portfolio Management Team at work. This video was produced in co-operation with IPConcept and the “Fonds im Fokus” platform.If you are having video playback issues, please click HERE.

Positioning of the Ethna Funds

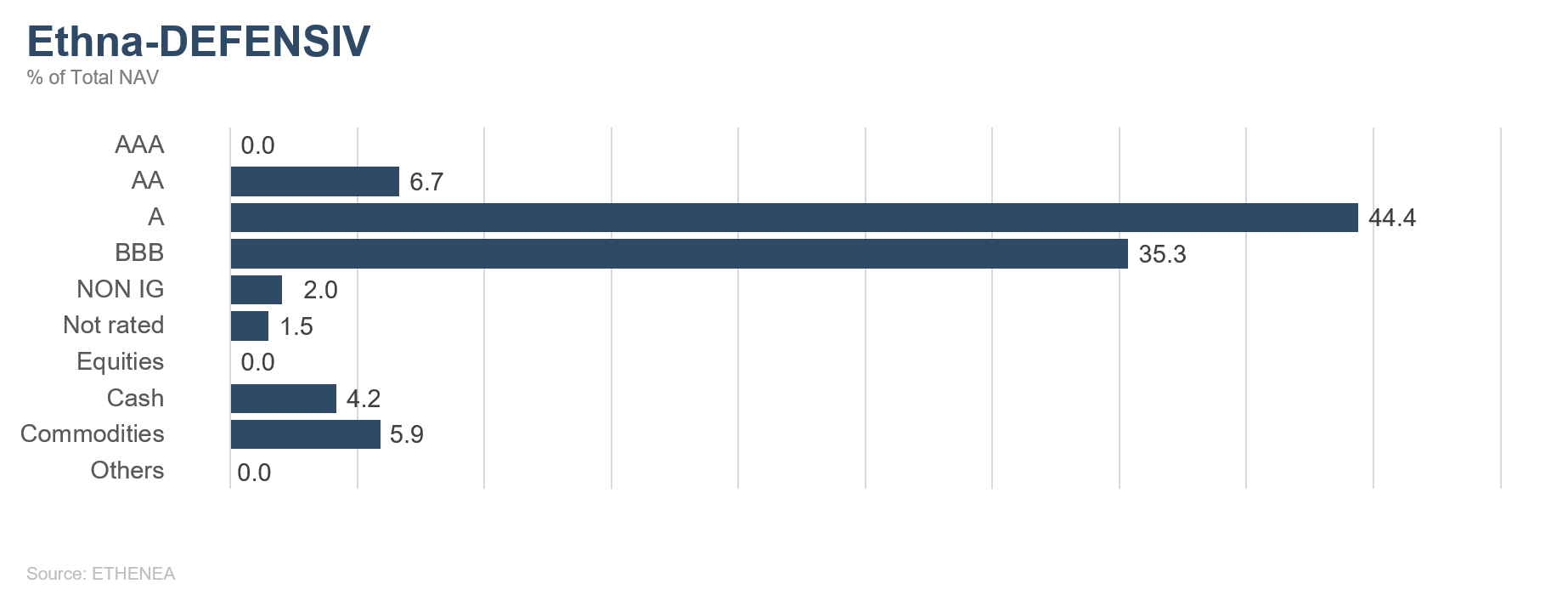

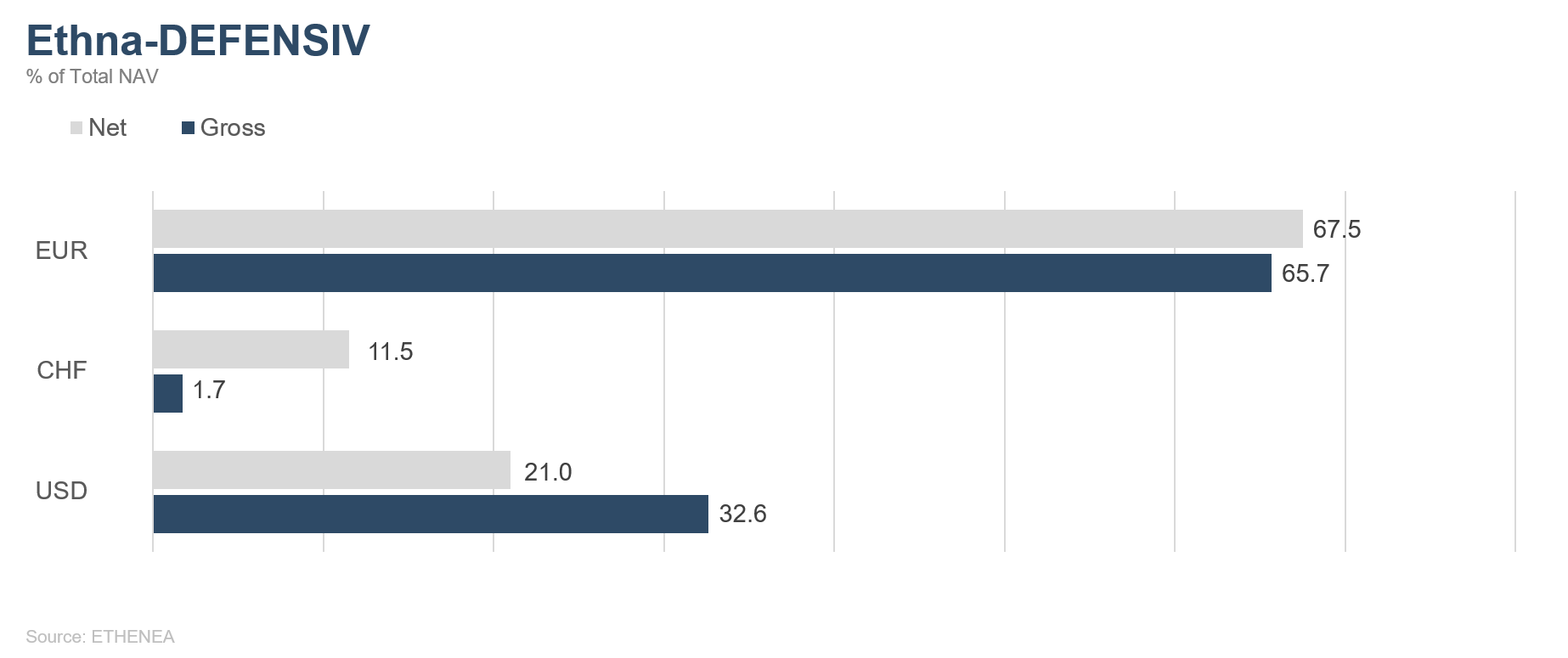

Ethna-DEFENSIV

October brought solutions, albeit temporary, for some topics that have been affecting the markets for some time: an interim deal has been reached in the trade conflict between China and the U.S., which rules out further escalation of ever higher tariffs for the time being. While Brexit still hasn’t happened, the UK has at least managed to agree a date for new elections. The EU then granted the UK another extension to the deadline for leaving the EU until 31 January 2020, which they are using to hold a general election on 12 December.

It is by no means clear who will win the election. And still, all options are on the table – from a hard Brexit to a second referendum to a retraction of the Withdrawal Bill. Nevertheless, the markets reacted positively when a no-deal Brexit was avoided for the time being.

In its final decision on interest rates under Mario Draghi, the European Central Bank left key rates unchanged, as expected, and lowered the deposit interest rate by 10 basis points to -0.5%. At the same time, the ECB communicated unequivocally that they would leave key rates at this accommodative, low level for a prolonged period. As of November, the previously announced Asset Purchase Programme is also being implemented. The U.S. central bank, the Fed, cut interest rates in its October meeting by 0.25% to between 1.5% and 1.75%, as widely expected, and has therefore reached its target level. Whether the U.S. central bank can actually leave interest rates at this level, or whether further increments have to be made, remains to be seen, as purchasing managers’ short-term confidence is falling and companies are holding off investing.

The ongoing corporate reporting season is painting a picture for last quarter of an environment that is still solid, but is slowly weakening. In particular, chief executives are increasingly holding back on their profit forecasts for next year.

In this environment, the Ethna-DEFENSIV remains cautious in its positioning and is being conservative in opting for high-quality bonds issued by companies that are diversified globally and are able to weather an economic downturn. As a rough indication of credit quality, the rating is between A- and BBB+ and illustrates how robust the portfolio is. However, during the month the fund was impacted by the slight rise in interest rates due to growing optimism about the trade conflict. Narrowing credit risk premia only partly compensated for this effect. Our positioning shouldn’t change radically in the remaining months of the year. We still assume that the growth dynamics in the U.S. will remain stronger than in Europe, that the euro will tend to weaken against the U.S. dollar, and that the bond markets will be bolstered by sustained low interest rates. This is all the more true given the fact that the ECB Asset Purchase Programme has been relaunched.

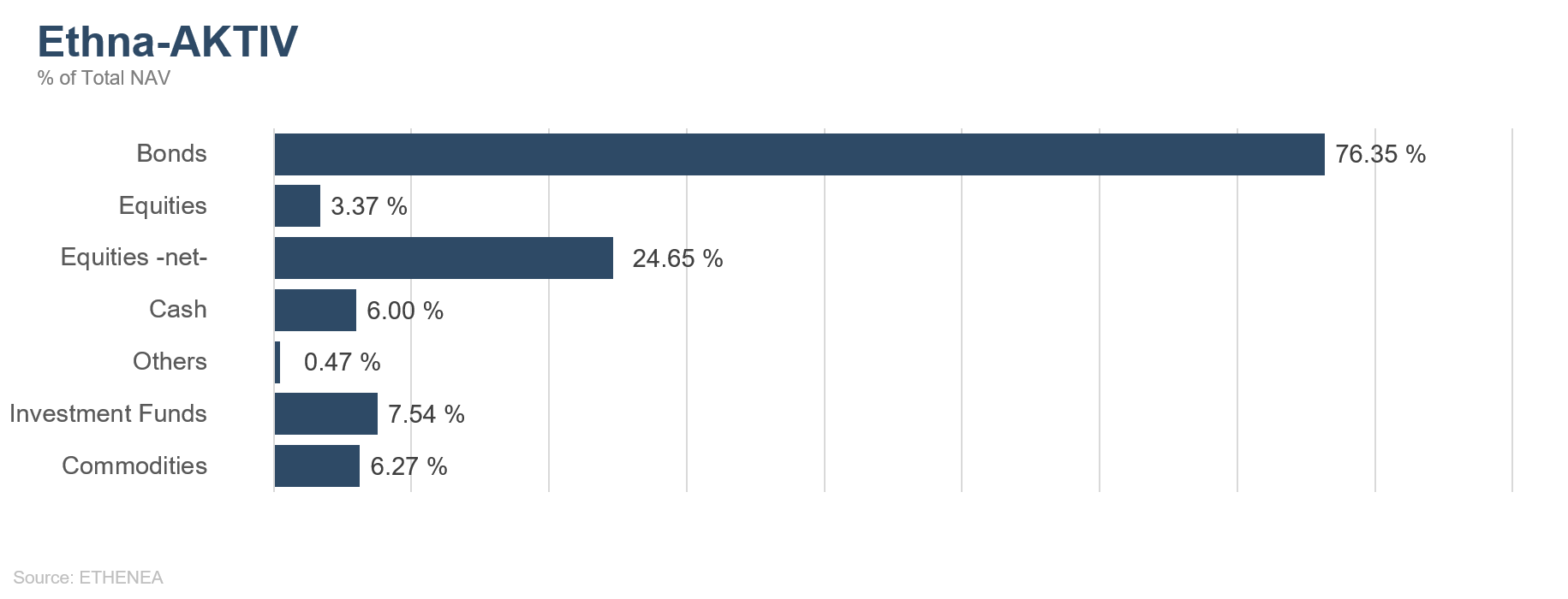

Ethna-AKTIV

In October, capital markets worldwide had a large number of events to deal with. For starters, there was the surprisingly poor ISM data from the U.S. Suddenly, the leading indicators were pointing to a slowdown in growth for the U.S. as well, something that was already a reality for the rest of the world. Thus, the first signs of skid marks caused by the trade conflict that had been sparked a year and a half prior were plain to see in the U.S. now too. Whether it is this realisation that prompted the American President to work with purpose on a mini deal is pure speculation.

However, the fact is that, on the one hand, the negative effects are now being felt in both camps and, on the other, the revelation of a plan consisting of multiple phases to solve the trade conflict turned out to be a sort of kickstarter. Following a period of correction at the beginning of the month, this positive turnaround in negotiations, together with a temporary breakthrough in the Brexit saga, brought about the next risk-on phase in risk assets. Despite the fact that the outcomes of the most recent central bank meetings in Frankfurt and New York were unknown at the time, the equity indices tested highs for the year, if not all-time highs, and the global interest rates were up from their historic lows. The central bank meetings did not hold any major surprises per se. As expected, after eight eventful years, Mario Draghi handed over the reins to his successor Christine Lagarde, and Fed chief Jerome Powell announced the third rate cut of this year. It went down well with the markets that an interest rate hike any time soon was described as very unlikely. A positive view was also taken of the fact that interest rate cuts can be halted for the time being because the central bank assesses the macro-economic situation as good.

We concur and believe that Americans will be able to avoid a recession in the upcoming election year by muddling through, and will thus also keep the capital markets safe from major mishaps.

The fund was only able to benefit from this environment last month to a limited extent. The gains on the equities side and from the further narrowing of spreads were not quite enough to make up for the losses on the movements in interest rates and currencies. Both the progress in the negotiations in the trade conflict and on Brexit, as well as the stabilisation in leading indicators for Europe strengthened the euro and thus hurt our foreign currency position of more than 30%. Diversification worked well this month, and in principle we regard this as positive and we are firmly convinced that a similar portfolio composition places us in a good position for the future. While we are convinced that long-term interest rates and the euro, too, are currently at the upper end of their respective correction ranges, we assume that in the coming months equities could rise further thanks to the tailwind produced by a deal, and considering that sentiment is still poor. Regionally, we continue to assign a higher weighting to American indices but we have also invested in the Euro Stoxx 50.

If what we expect happens, then the portfolio is not only well diversified, but is also in a position to benefit on a sustained basis because the headwind on the currency and interest rate front is weakening, and could even turn back into a tailwind. Given that the ECB’s purchase programme is starting up and with the Fed expanding its balance sheet – which is officially not being called QE – the liquidity environment for equities remains positive and there is relatively little room for long-term interest rates to rise. In order to benefit from this potential interest rate trend in addition to the duration of our corporate bonds, we have once again purchased Spanish sovereign bonds, and are just waiting for the right moment to further increase the rate sensitivity via Bunds and Treasuries as well.

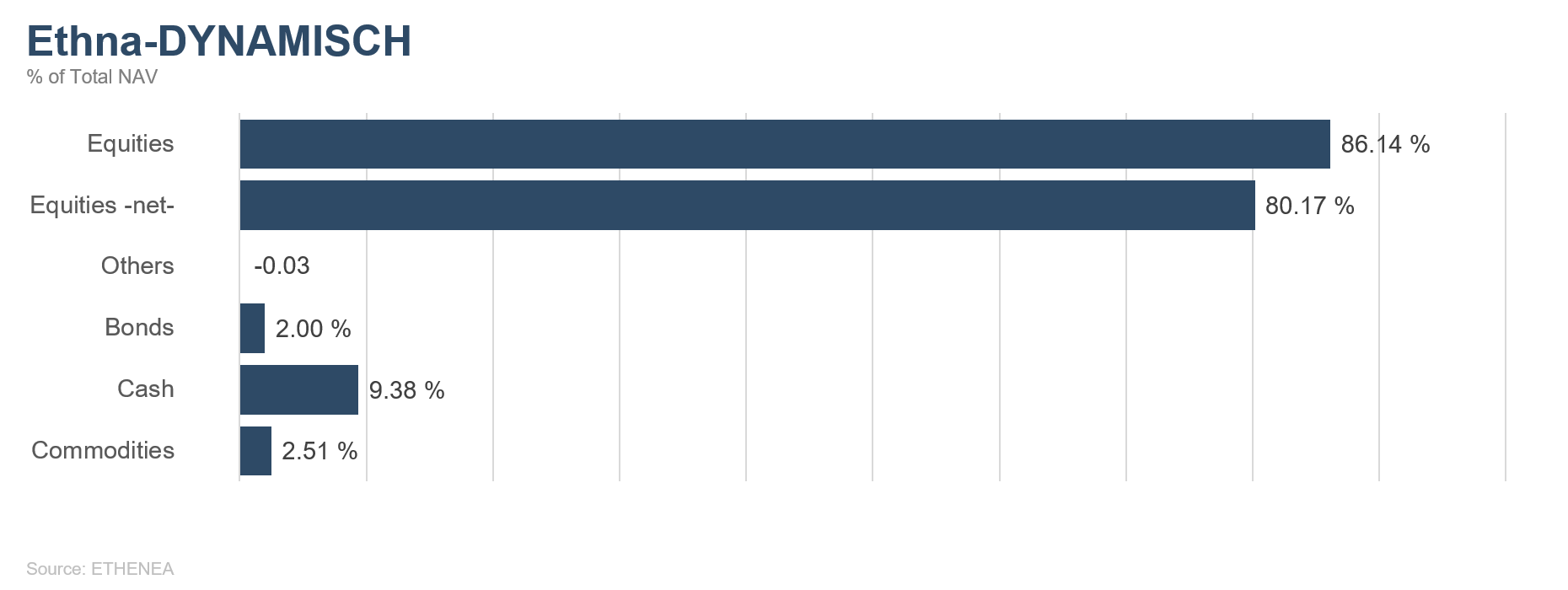

Ethna-DYNAMISCH

Slowly but surely, the bulls are taking the reins in the equity markets. Many stocks fell again at the beginning of October: pessimism, as measured by various sentiment indicators, was at a record high at the beginning of the month, and the investment ratios of many investors were commensurately low. Most of the economic data was also similarly weak. However, the markets’ reaction was increasingly constructive as the month went on, as investors’ expectations were extremely low and the current reporting season held positive surprises for many analysts. The phenomena observed are not new and in the past were often a sign that prices would climb further. Positive signals and the prospect of agreement in the long-running topics of Brexit and the trade conflict also contributed to the good mood. The EU and the UK have agreed a withdrawal deal, which now has to be passed by the UK parliament. Getting the deal through parliament could be just as arduous as the withdrawal negotiations themselves but the stock exchange interpreted any progress in October, no matter how small, as a positive development. Progress is just as tentative in the trade conflict. Market participants are currently placing high hopes on a meeting between the U.S. and China at the APEC summit in mid-November. The mere announcement of a planned meeting perceptibly improved sentiment in the markets. Seasonality, too, should help support the equity markets to a greater extent from now on. Summer and Autumn months tend to be weaker, and these are now behind us, and the end of the year is fast approaching. Since many investors are still under-invested, additional buying in the coming weeks could boost the stock markets further.

We further expanded the equity portfolio in October and added three new names: A2 Milk, Planet Fitness and BB Biotech. A2 Milk is a milk producer from New Zealand, whose product A2 milk is a very healthy milk that is experiencing a boom in China especially. A2 milk is suitable for children and is regarded as the best substitute for breast milk. We acquired Planet Fitness, which is a fast-growing chain of fitness centres in the U.S. The company currently has more than 1,750 gyms in North and South America, some of which are operated by the company itself and some under the franchise model. In the U.S. alone, Planet Fitness sees potential for up to 4,000 gyms; there is further potential for expansion in South America and Canada. BB Biotech is a Swiss investment company in the field of biotechnology. The biotechnology sector experienced a boom following the financial crisis, similar to the 1990s, but has been consolidating since mid-2015, which makes many stocks attractive. Since there are too many risks associated with individual investments in this specialist sector, we have decided on the promising BB Biotech portfolio. Other purchases of note were Alibaba and Inditex.

Portfolio hedging was scaled back considerably at the beginning of October. The existing DAX futures were completely reversed; smaller hedges still exist in the form of an S&P future and various put options. Following the reduction in the hedges and the equity purchases, the Ethna-DYNAMISCH’s net equity allocation is now approx. 80%.

The gold position was slightly reduced in October and is now around 2.5%. Just as high as the pessimism about equities was the recent optimism among market participants about the further development of the price of gold. In light of this, it is likely that further price advances in the precious metal will be limited for now, which led us to take profits.

On the whole, the Ethna-DYNAMISCH’s positioning is therefore comparatively offensive, to allow it to duly participate in further rises in share prices. Thus, for the first time, we are taking advantage of the lifting of the 70% cap on the equity allocation that came into effect on 1 July 2019.

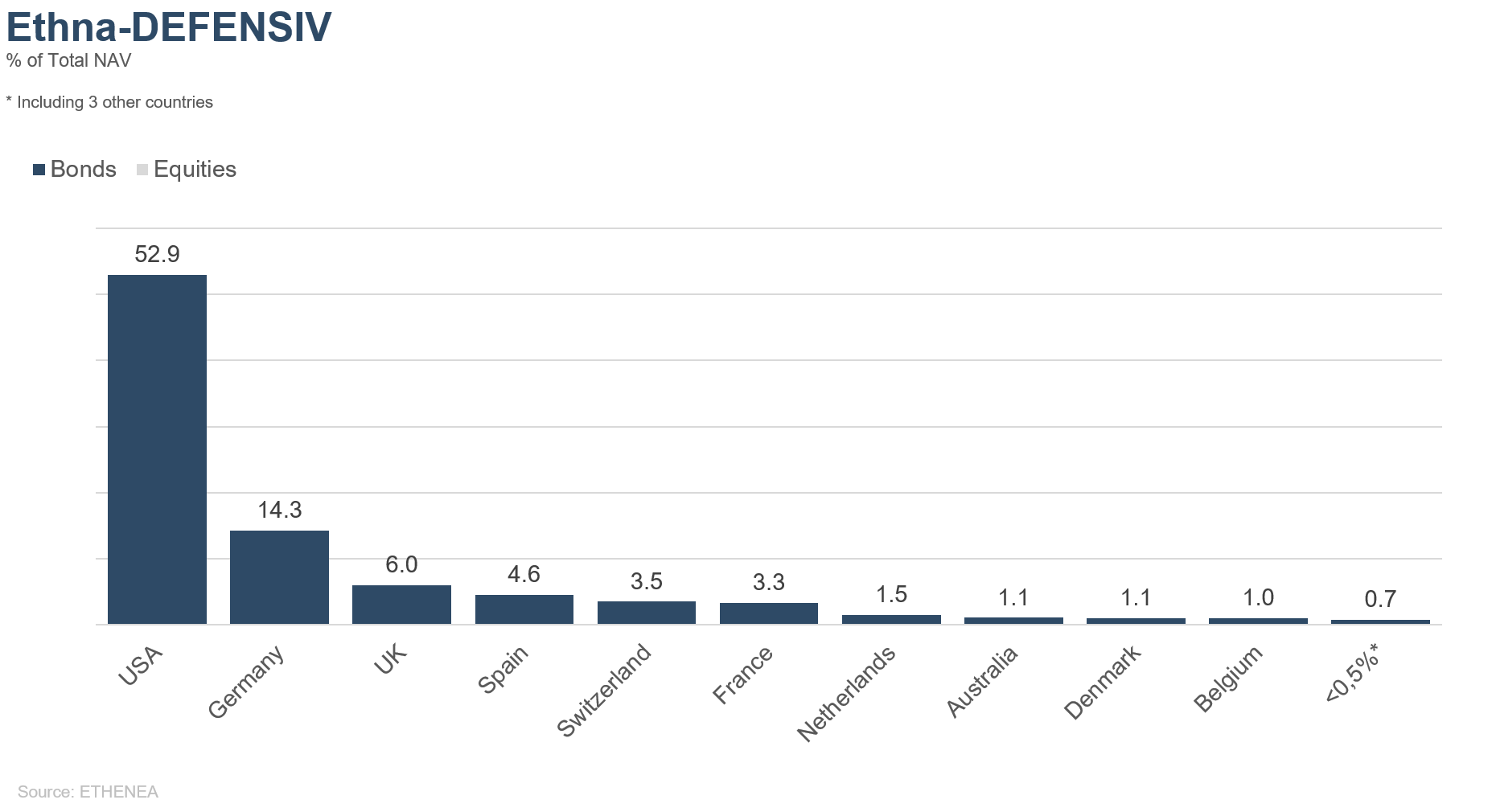

Figure 1: Portfolio structure* of the Ethna-DEFENSIV

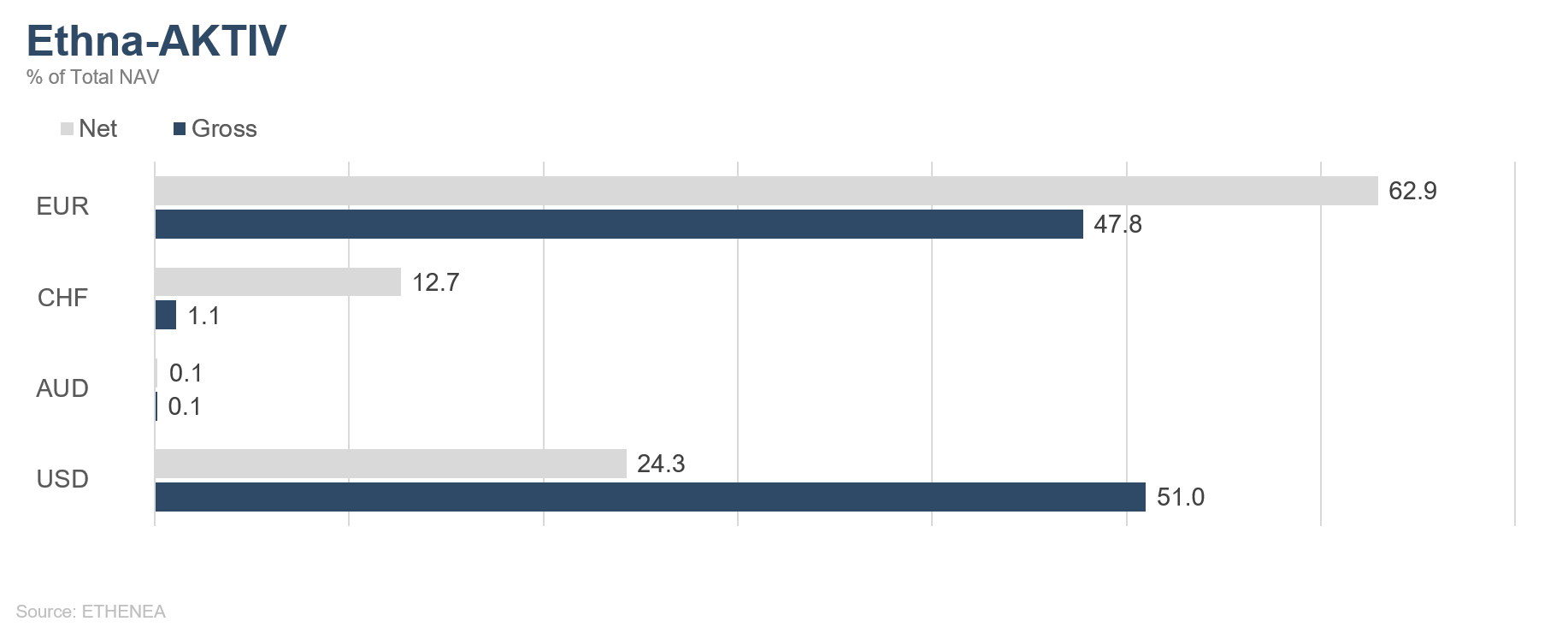

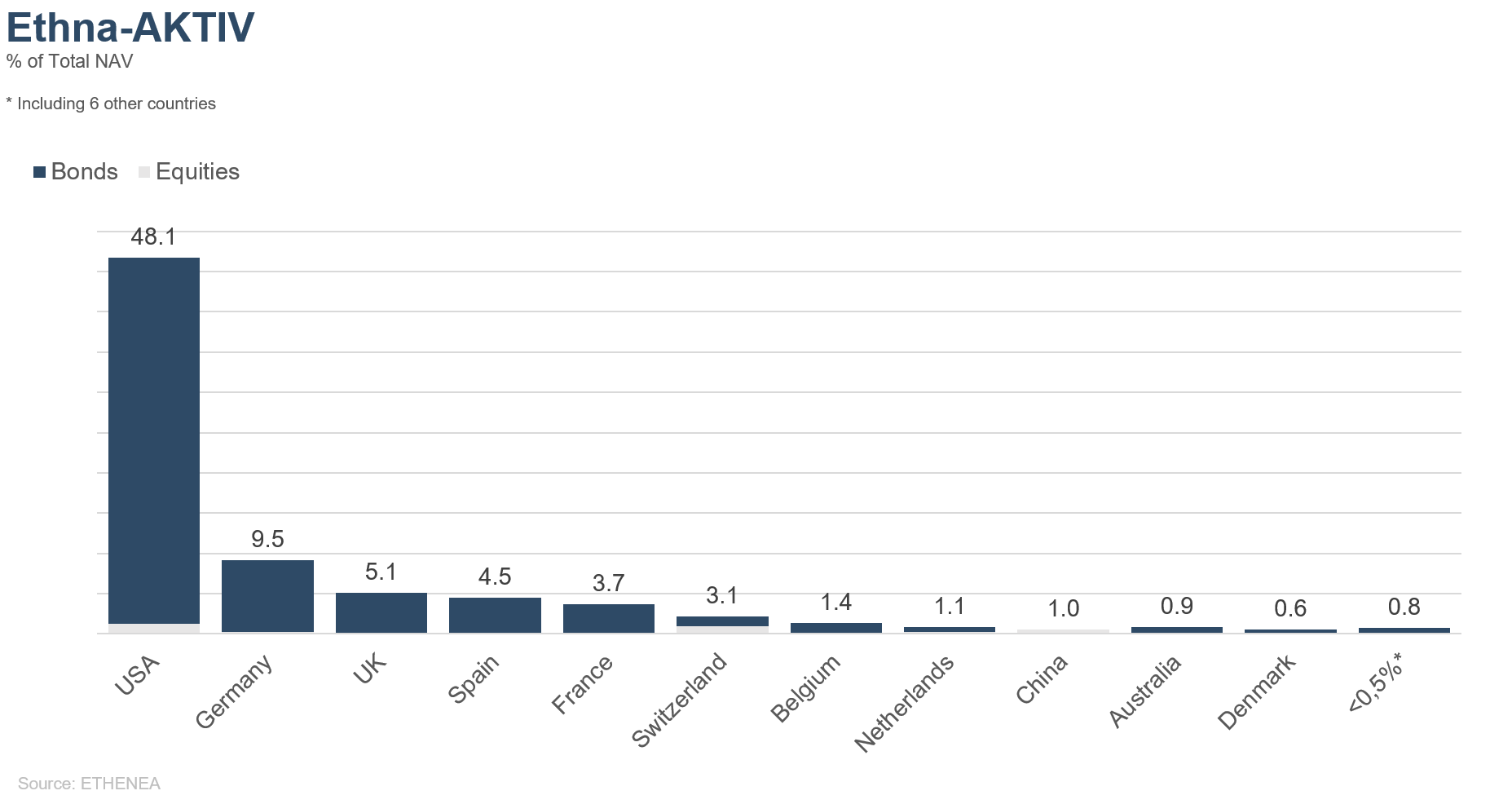

Figure 2: Portfolio structure* of the Ethna-AKTIV

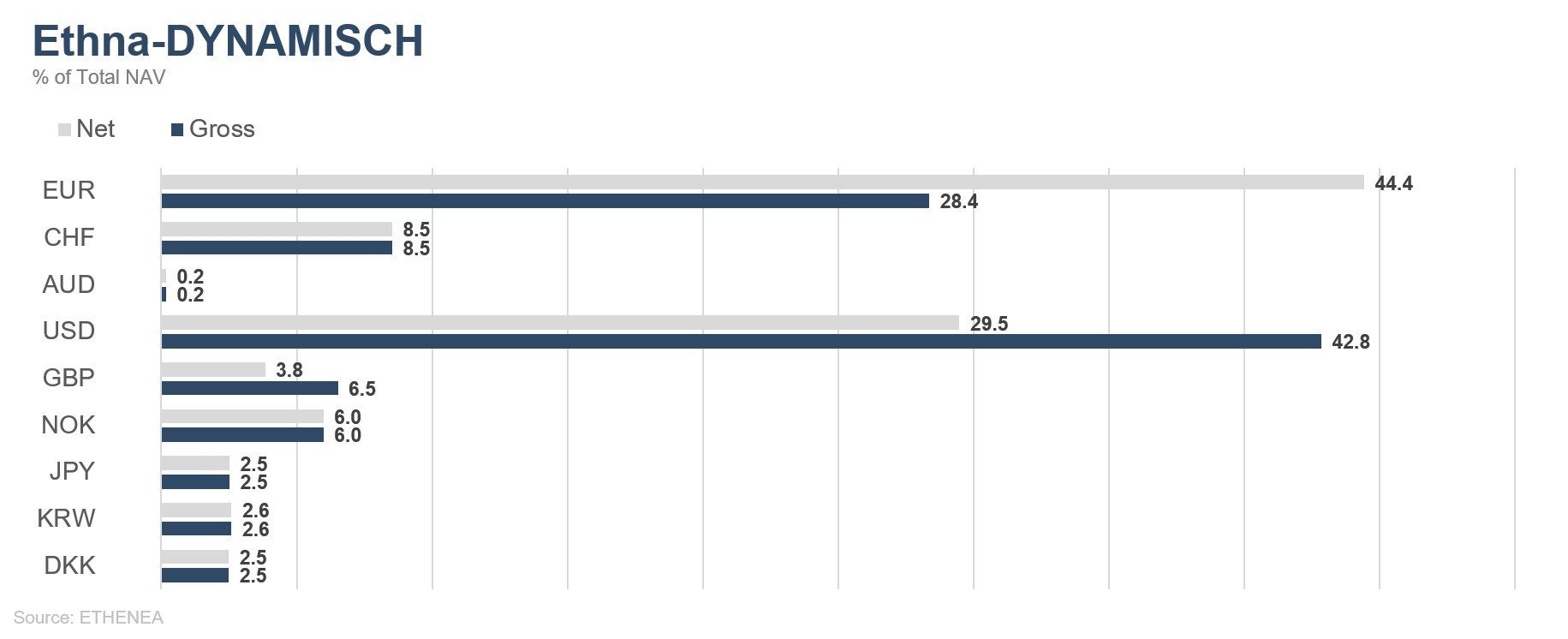

Figure 3: Portfolio structure* of the Ethna-DYNAMISCH

Figure 4: Portfolio composition of the Ethna-DEFENSIV by currency

Figure 5: Portfolio composition of the Ethna-AKTIV by currency

Figure 6: Portfolio composition of the Ethna-DYNAMISCH by currency

Figure 7: Portfolio composition of the Ethna-DEFENSIV by country

Figure 8: Portfolio composition of the Ethna-AKTIV by country

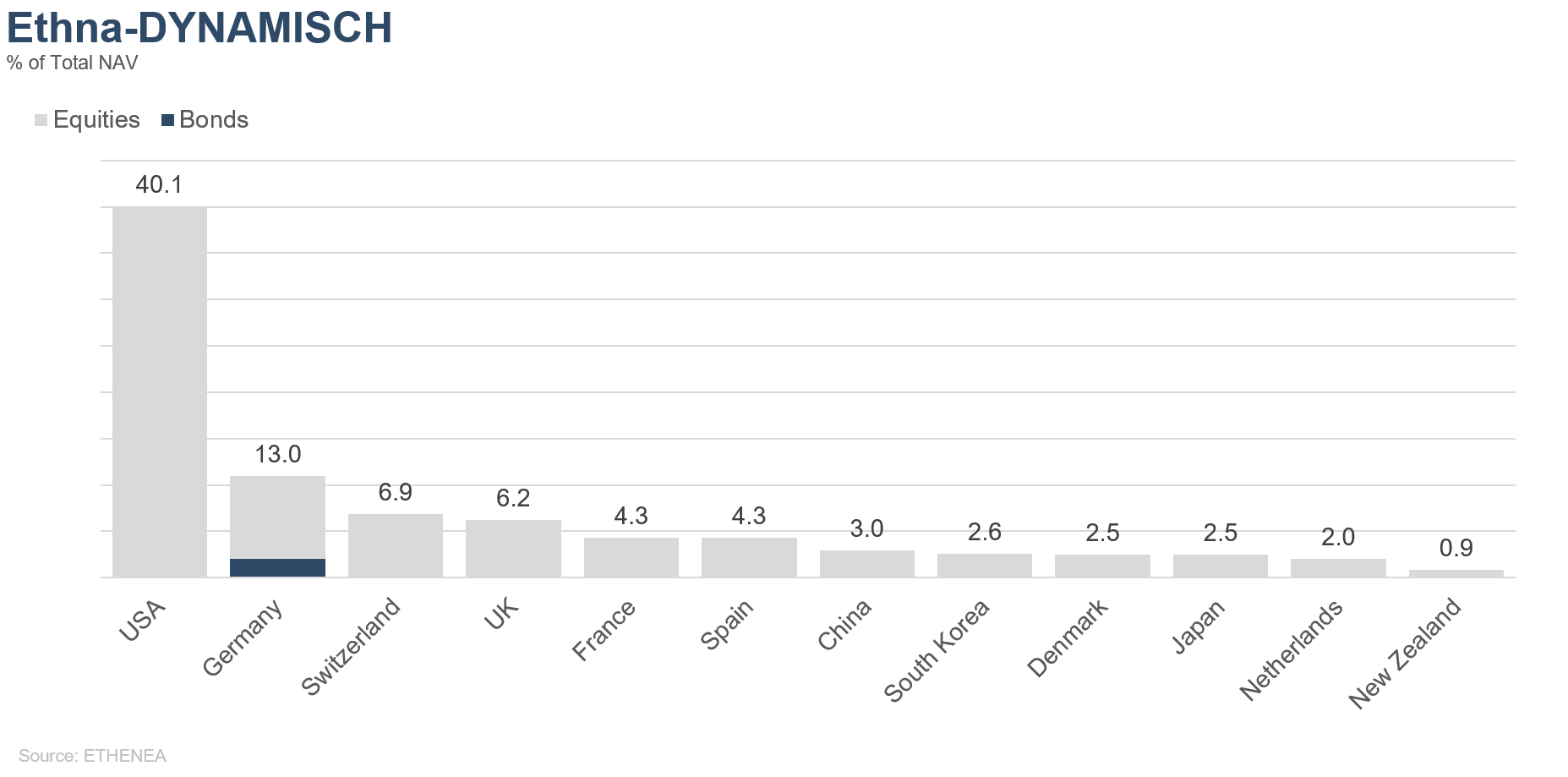

Figure 9: Portfolio composition of the Ethna-DYNAMISCH by country

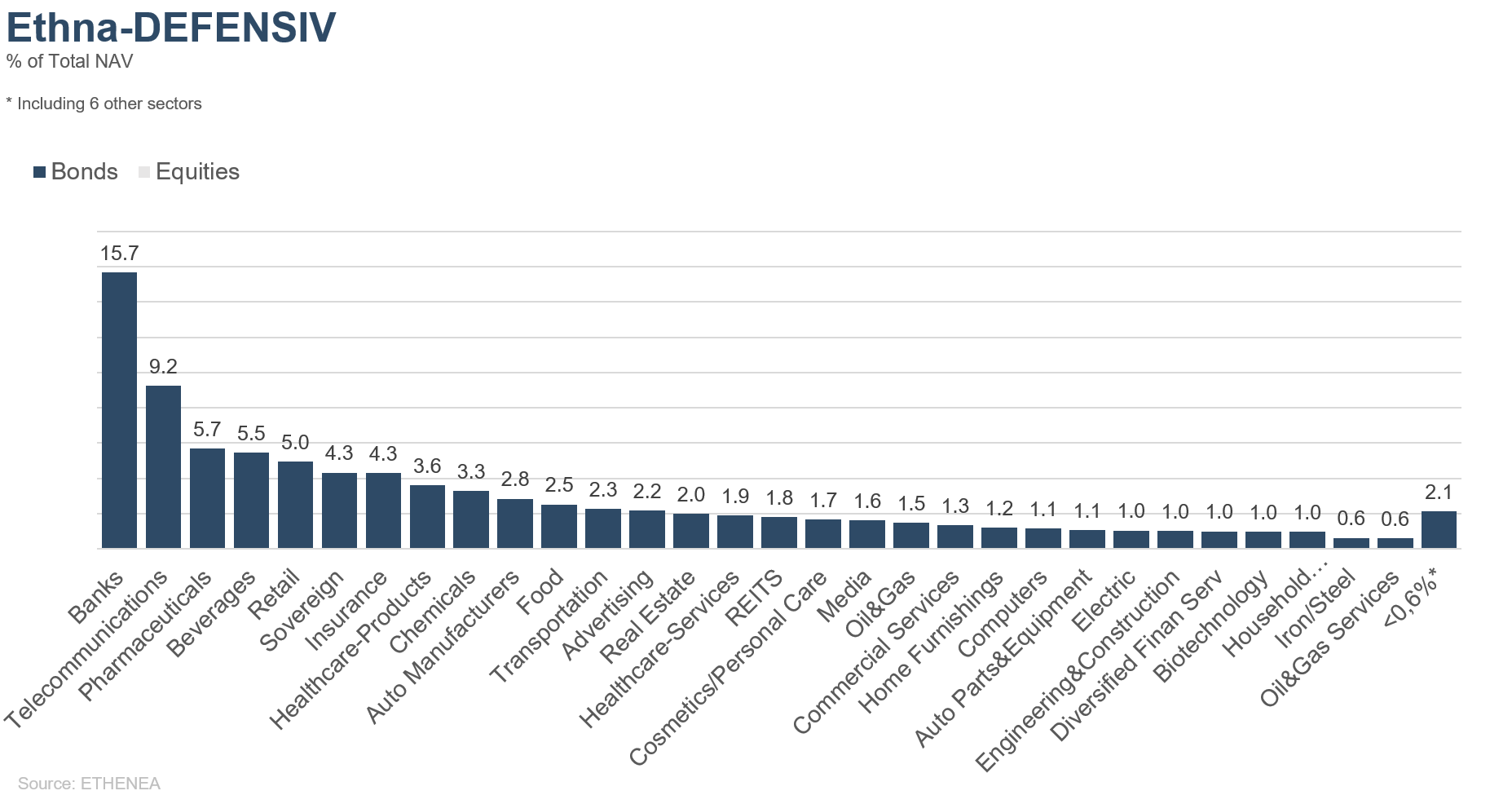

Figure 10: Portfolio composition of the Ethna-DEFENSIV by issuer sector

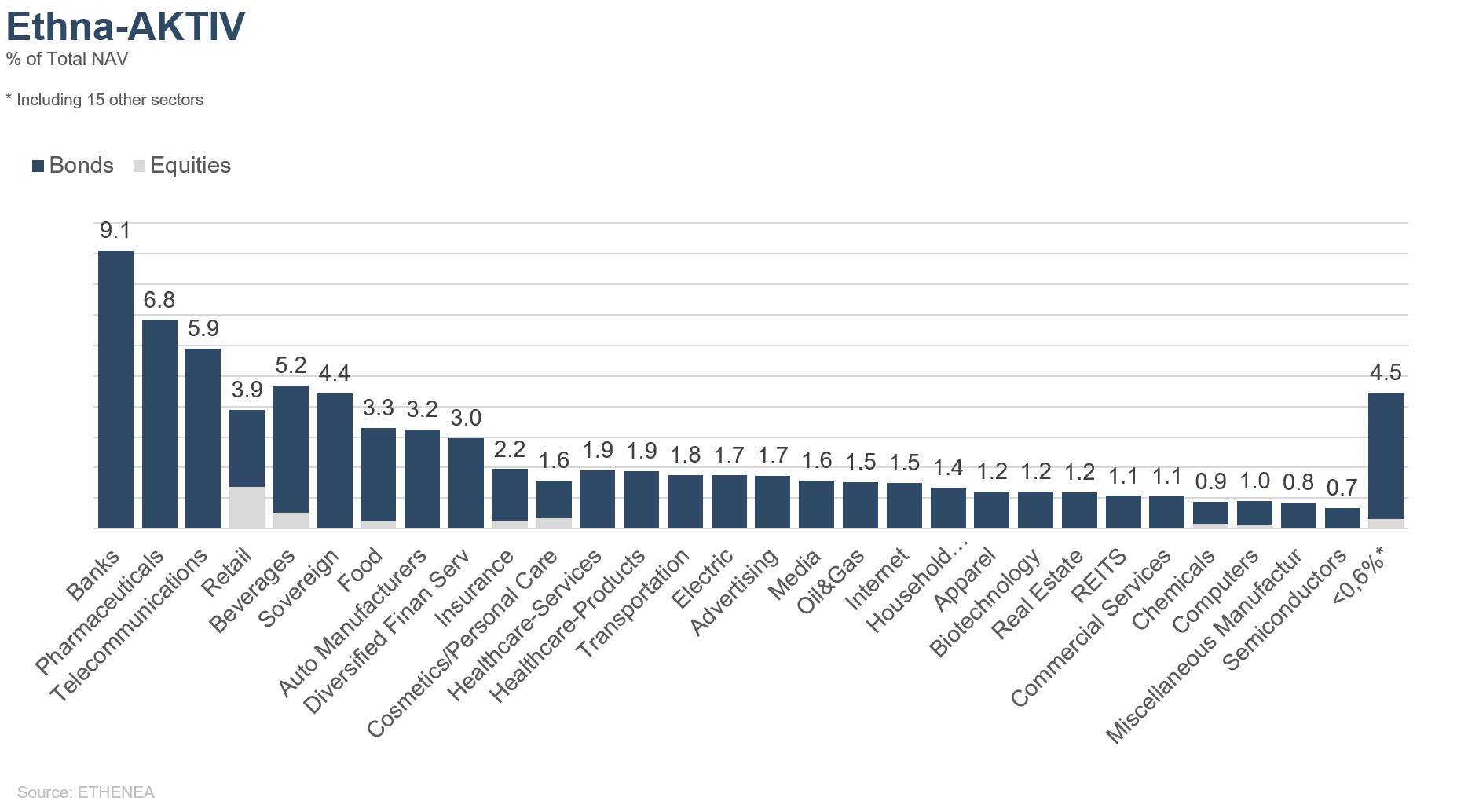

Figure 11: Portfolio composition of the Ethna-AKTIV by issuer sector

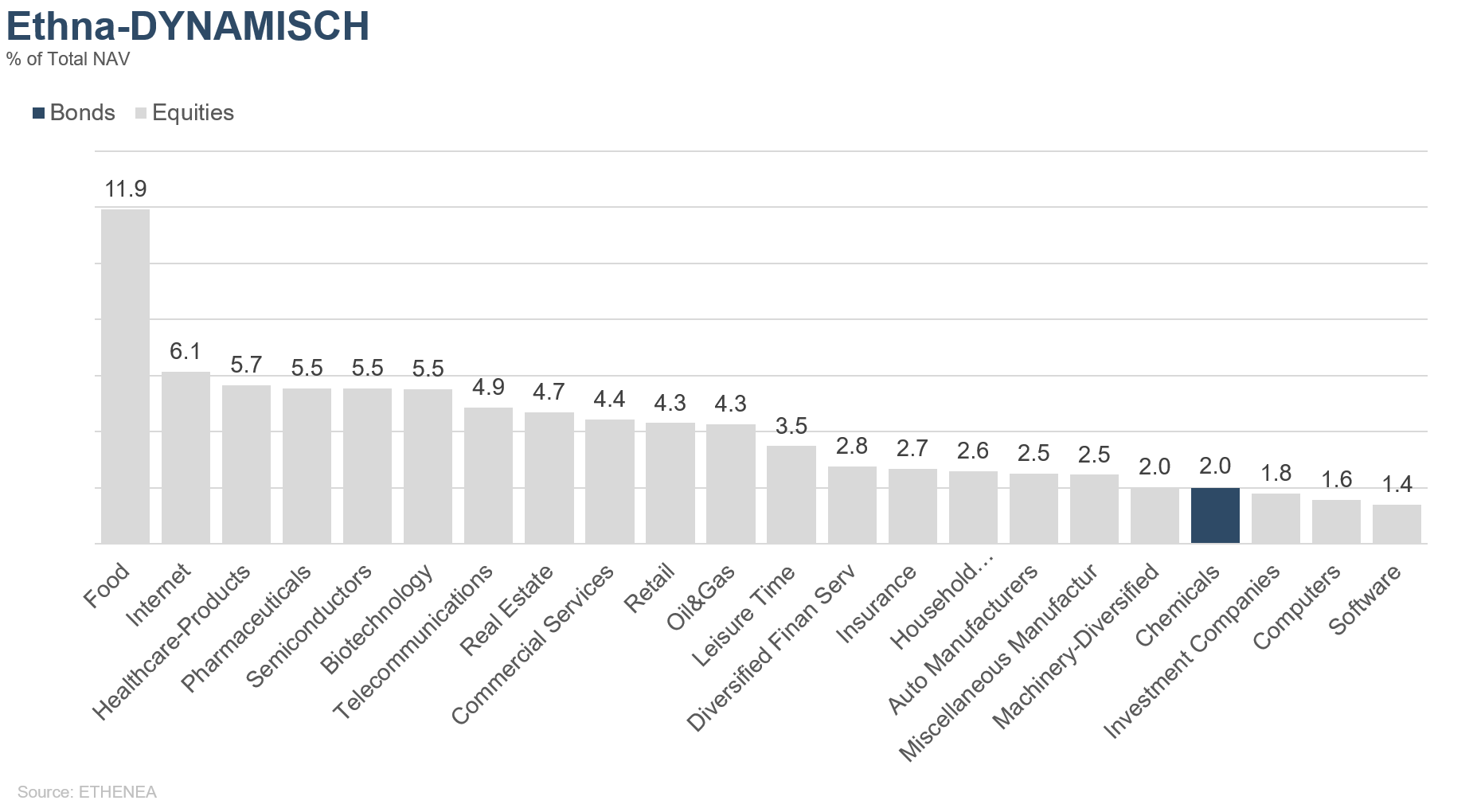

Figure 12: Portfolio composition of the Ethna-DYNAMISCH by issuer sector

* “Cash” comprises term deposits, call money and current accounts/other accounts. “Equities net” comprises direct investments and exposure resulting from equity derivatives.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

This is a marketing communication. It is for product information purposes only and is not a mandatory statutory or regulatory document. The information contained in this document does not constitute a solicitation, offer or recommendation to buy or sell units in the fund or to engage in any other transaction. It is intended solely to provide the reader with an understanding of the key features of the fund, such as the investment process, and is not deemed, either in whole or in part, to be an investment recommendation. The information provided is not a substitute for the reader's own deliberations or for any other legal, tax or financial information and advice. Neither the investment company nor its employees or Directors can be held liable for losses incurred directly or indirectly through the use of the contents of this document or in any other connection with this document. The currently valid sales documents in German (sales prospectus, key information documents (PRIIPs-KIDs) and, in addition, the semi-annual and annual reports), which provide detailed information about the purchase of units in the fund and the associated opportunities and risks, form the sole legal basis for the purchase of units. The aforementioned sales documents in German (as well as in unofficial translations in other languages) can be found at www.ethenea.com and are available free of charge from the investment company ETHENEA Independent Investors S.A. and the custodian bank, as well as from the respective national paying or information agents and from the representative in Switzerland. The paying or information agents for the funds Ethna-AKTIV, Ethna-DEFENSIV and Ethna-DYNAMISCH are the following: Austria, Belgium, Germany, Liechtenstein, Luxembourg: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg; France: CACEIS Bank France, 1-3 place Valhubert, F-75013 Paris; Italy: State Street Bank International – Succursale Italia, Via Ferrante Aporti, 10, IT-20125 Milano; Société Génerale Securities Services, Via Benigno Crespi, 19/A - MAC 2, IT-20123 Milano; Banca Sella Holding S.p.A., Piazza Gaudenzio Sella 1, IT-13900 Biella; Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Spain: ALLFUNDS BANK, S.A., C/ Estafeta, 6 (la Moraleja), Edificio 3 – Complejo Plaza de la Fuente, ES-28109 Alcobendas (Madrid); Switzerland: Representative: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Paying Agent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. The paying or information agents for HESPER FUND, SICAV - Global Solutions are the following: Austria, Belgium, France, Germany, Luxembourg: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg; Italy: Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Switzerland: Representative: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Paying Agent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. The investment company may terminate existing distribution agreements with third parties or withdraw distribution licences for strategic or statutory reasons, subject to compliance with any deadlines. Investors can obtain information about their rights from the website www.ethenea.com and from the sales prospectus. The information is available in both German and English, as well as in other languages in individual cases. Producer: ETHENEA Independent Investors S.A.. Distribution of this document to persons domiciled in countries in which the fund is not authorised for distribution, or in which authorisation for distribution is required, is prohibited. Units may only be offered to persons in such countries if this offer is in accordance with the applicable legal provisions and it is ensured that the distribution and publication of this document, as well as an offer or sale of units, is not subject to any restrictions in the respective jurisdiction. In particular, the fund is not offered in the United States of America or to US persons (within the meaning of Rule 902 of Regulation S of the U.S. Securities Act of 1933, in its current version) or persons acting on their behalf, on their account or for the benefit of a US person. Past performance should not be taken as an indication or guarantee of future performance. Fluctuations in the value of the underlying financial instruments or their returns, as well as changes in interest rates and currency exchange rates, mean that the value of units in a fund, as well as the returns derived from them, may fall as well as rise and are not guaranteed. The valuations contained herein are based on a number of factors, including, but not limited to, current prices, estimates of the value of the underlying assets and market liquidity, as well as other assumptions and publicly available information. In principle, prices, values, and returns can both rise and fall, up to and including the total loss of the capital invested, and assumptions and information are subject to change without prior notice. The value of the invested capital or the price of fund units, as well as the resulting returns and distribution amounts, are subject to fluctuations or may cease altogether. Positive performance in the past is therefore no guarantee of positive performance in the future. In particular, the preservation of the invested capital cannot be guaranteed; there is therefore no warranty given that the value of the invested capital or the fund units held will correspond to the originally invested capital in the event of a sale or redemption. Investments in foreign currencies are subject to additional exchange rate fluctuations or currency risks, i.e. the performance of such investments also depends on the volatility of the foreign currency, which may have a negative impact on the value of the invested capital. Holdings and allocations are subject to change. The management and custodian fees, as well as all other costs charged to the fund in accordance with the contractual provisions, are included in the calculation. The performance calculation is based on the BVI (German federal association for investment and asset management) method, i.e. an issuing charge, transaction costs (such as order fees and brokerage fees), as well as custodian and other management fees are not included in the calculation. The investment performance would be lower if the issuing surcharge were taken into account. No guarantee can be given that the market forecasts will be achieved. Any discussion of risks in this publication should not be considered a disclosure of all risks or a conclusive handling of the risks mentioned. Explicit reference is made to the detailed risk descriptions in the sales prospectus. No guarantee can be given that the information is correct, complete or up to date. The content and information are subject to copyright protection. No guarantee can be given that the document complies with all statutory or regulatory requirements which countries other than Luxembourg have defined for it. Note: The most important technical terms can be found in the glossary at www.ethenea.com/glossary. Information for investors in Belgium: The prospectus, the key information documents (PRIIPs-KIDs), the annual reports and the semi-annual reports of the sub-fund are available in French free of charge upon request from the investment company ETHENEA Independent Investors S.A., 16, rue Gabriel Lippmann, 5365 Munsbach, Luxembourg and from the representative: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg. Information for investors in Switzerland: The country of origin of the collective investment scheme is Luxembourg. The representative in Switzerland is IPConcept (Schweiz) AG, Münsterhof 12, P.O. Box, CH-8022 Zurich. The paying agent in Switzerland is DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zurich. The prospectus, the key information documents (PRIIPs-KIDs), and the Articles of Association, as well as the annual and semi-annual reports, can be obtained free of charge from the representative. Copyright © ETHENEA Independent Investors S.A. (2024) All rights reserved. 05/11/2019