Ethna-DEFENSIV | Proven anchor of stability in recent crises

2022 represents a watershed. The era of negative interest rates is finally over, with markets continuing to be driven by geopolitics and high inflation. This marks a paradigm shift and constitutes an extremely challenging environment for equity and bond investors alike. Investors need to rethink their approach and focus, more than ever before, on strategies that enable them to respond to changing circumstances in a flexible, active manner. In this new world for investors, solutions that promise (and deliver) a steady income stream and exhibit low volatility at a tumultuous time are in demand. As a bond-focused multi-asset fund, the Ethna-DEFENSIV fits the bill and represents an anchor of stability in a changing landscape.

Thus far, 2022 has been an extremely challenging year for investors and marks a turning point. Inflation hasn't gone away; it is persistently high on both sides of the Atlantic – and in some cases reaching double digits. Central banks have implemented substantial rate hikes in a bid to get inflation under control. In addition, the war in Ukraine has brought enormous political risks to the fore. On top of that, there are growing signs that Europe, at least, is heading for a bout of recession. This very difficult set of circumstances is consequently leading to a recalibration of the capital market environment.

There is finally an alternative to stocks, with investors now pulling out of equity markets against the backdrop of a further increase in interest rates around the world. However, the most direct impact of the massive change in central-bank policy is on bond markets. Although investors are increasingly unsettled, turning their back completely on the markets isn't a realistic option. Patience and concentration are required in order to offer the right strategies and solutions in such a challenging environment.

Conservative character in turbulent markets

Investors are searching for the right mix between security and return. Multi-asset funds – where the fund manager can diversify into equities as well as bonds – are aimed at precisely this approach. Furthermore, a positioning in commodities and currencies, for example, often creates additional opportunities for investment. The Ethna-DEFENSIV is a multi-asset fund that is geared in particular to conservative investors.

The allocation is determined by the portfolio management via a top-down approach, based on in-depth assessment of macroeconomic developments, coupled with a bottom-up approach for selecting bonds. Corporate bonds with very good/good issuer credit quality are the focal point of the fund and constitute the basis of its core income. The position in AAA-rated bonds was increased in 2022. Bonds with a lower rating are added by the fund management if necessary, provided the additional return compensates for the greater risks involved. The Ethna-DEFENSIV was approximately 90.5% invested in bonds as of 31 October 2022.

Does that mean equities don't usually play a role in asset allocation? No, because the ability to be flexible and act appropriately is what marks out this multi-asset fund. The Ethna-DEFENSIV is heavily bond-weighted but can also invest a maximum of 10% in equities. The equity allocation in November 2021, for instance, was 9%. As things stand (i.e. 31 October), however, it is 0%.

Low volatility target and promise of steady returns

Due to a raft of different factors, markets were dealt a sustained blow in 2022. Volatility has become an issue again: after a relatively calm summer, the VIX index of expected volatility is now above the 30-point mark – well above the long-term average. This is fairly scary for conservative investors who prefer products with manageable volatility. Since the Ethna-DEFENSIV was launched in April 2007, the fund management has set itself the goal of keeping volatility below 4%. Annualised volatility (12 months) stood at 3.04% at the end of October 2022 (Ethna-DEFENSIV (T)).

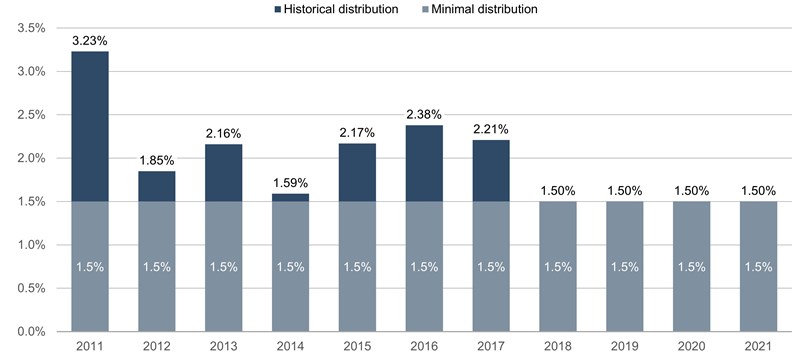

The income generated by the fund should enable a minimum distribution of 1.5% annually – and looking back that has always been the case. The fund ended crisis year 2020 with a respectable performance of 2.6%, thanks, once again, to active management of the portfolio. In October 2022, the Ethna-DEFENSIV (T) showed an annual performance of -3.17%. Due to the fund's balanced, diversified investment strategy, however, the setback is much less significant compared with multi-asset funds that have relatively high equity exposure as well as funds with overly aggressive positioning on the bond side.

In addition, the characteristics of the fund include the fund management's clear preference for short-dated issues in order to keep interest rate sensitivity at a low level. As of 31 October, bonds with a residual maturity of between 0 and 3 years accounted for around 52% of the fund assets. In anticipation of further increases in interest rates, the duration has been lowered significantly since February 2022 through the occasional use of interest rate futures.

The Ethna-DEFENSIV has a clearly discernible focus on the U.S. market. USD-denominated bonds account for about two thirds of the portfolio and are largely hedged against currency fluctuations. In the eyes of the fund management, the U.S. offers clear advantages over Europe.

The ESG topic is also addressed by the fund, which has been awarded a four-globes Morningstar Sustainability Rating. The ESG investment approach consists of a three-step process, as is the case with the other Ethna funds. In this connection, management is supported by the external expertise of Morningstar Sustainalytics.

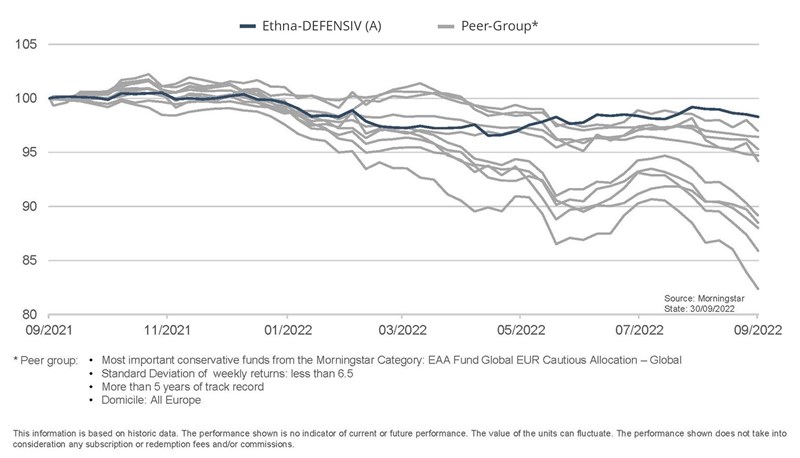

Ahead of the competition

The fund easily holds its own in a peer-group comparison: the Ethna-DEFENSIV puts its rivals in the shade on a 1-year view; the portfolio management also impresses with strong performance in a medium and longer-term comparison.

Ethna-DEFENSIV is an actively-managed, bond-oriented multi-asset fund. The core of the portfolio consists of high-quality and carefully selected corporate bonds with good ratings. Through adequate adjustments to the portfolio, the fund management team repeatedly succeeds in keeping volatility on a very low level of below 4 percent, even in very dynamic market phases. The 5-star overall Morningstar rating confirms to the fund's excellent performance.

Strong arguments for a strategy that stands for stability in turbulent market phases and is thus particularly suitable for conservative investors as a long-term basic investment.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

This is a marketing communication. It is for information purposes only and provides the addressee with guidance on our products, concepts and ideas. This does not form the basis for any purchase, sale, hedging, transfer or mortgaging of assets. None of the information contained herein constitutes an offer to buy or sell any financial instrument nor is it based on a consideration of the personal circumstances of the addressee. It is also not the result of an objective or independent analysis. ETHENEA makes no express or implied warranty or representation as to the accuracy, completeness, suitability, or marketability of any information provided to the addressee in webinars, podcasts or newsletters. The addressee acknowledges that our products and concepts may be intended for different categories of investors. The criteria are based exclusively on the currently valid sales prospectus. This marketing communication is not intended for a specific group of addressees. Each addressee must therefore inform themselves individually and under their own responsibility about the relevant provisions of the currently valid sales documents, on the basis of which the purchase of shares is exclusively based. Neither the content provided nor our marketing communications constitute binding promises or guarantees of future results. No advisory relationship is established either by reading or listening to the content. All contents are for information purposes only and cannot replace professional and individual investment advice. The addressee has requested the newsletter, has registered for a webinar or podcast, or uses other digital marketing media on their own initiative and at their own risk. The addressee and participant accept that digital marketing formats are technically produced and made available to the participant by an external information provider that has no relationship with ETHENEA. Access to and participation in digital marketing formats takes place via internet-based infrastructures. ETHENEA accepts no liability for any interruptions, cancellations, disruptions, suspensions, non-fulfilment, or delays related to the provision of the digital marketing formats. The participant acknowledges and accepts that when participating in digital marketing formats, personal data can be viewed, recorded, and transmitted by the information provider. ETHENEA is not liable for any breaches of data protection obligations by the information provider. Digital marketing formats may only be accessed and visited in countries in which their distribution and access is permitted by law. For detailed information on the opportunities and risks associated with our products, please refer to the current sales prospectus. The statutory sales documents (sales prospectus, key information documents (PRIIPs-KIDs), semi-annual and annual reports), which provide detailed information on the purchase of units and the associated risks, form the sole authoritative and binding basis for the purchase of units. The aforementioned sales documents in German (as well as in unofficial translations in other languages) can be found at www.ethenea.com and are available free of charge from the investment company ETHENEA Independent Investors S.A. and the custodian bank, as well as from the respective national paying or information agents and from the representative in Switzerland. The paying or information agents for the funds Ethna-AKTIV, Ethna-DEFENSIV and Ethna-DYNAMISCH are the following: Austria, Belgium, Germany, Liechtenstein, Luxembourg: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg; France: CACEIS Bank France, 1-3 place Valhubert, F-75013 Paris; Italy: State Street Bank International – Succursale Italia, Via Ferrante Aporti, 10, IT-20125 Milano; Société Génerale Securities Services, Via Benigno Crespi, 19/A - MAC 2, IT-20123 Milano; Banca Sella Holding S.p.A., Piazza Gaudenzio Sella 1, IT-13900 Biella; Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Spain: ALLFUNDS BANK, S.A., C/ Estafeta, 6 (la Moraleja), Edificio 3 – Complejo Plaza de la Fuente, ES-28109 Alcobendas (Madrid); Switzerland: Representative: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Paying Agent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. The paying or information agents for HESPER FUND, SICAV - Global Solutions are the following: Austria, Belgium, France, Germany, Luxembourg: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg; Italy: Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Switzerland: Representative: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Paying Agent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. The investment company may terminate existing distribution agreements with third parties or withdraw distribution licences for strategic or statutory reasons, subject to compliance with any deadlines. Investors can obtain information about their rights from the website www.ethenea.com and from the sales prospectus. The information is available in both German and English, as well as in other languages in individual cases. Explicit reference is made to the detailed risk descriptions in the sales prospectus. This publication is subject to copyright, trademark and intellectual property rights. Any reproduction, distribution, provision for downloading or online accessibility, inclusion in other websites, or publication in whole or in part, in modified or unmodified form, is only permitted with the prior written consent of ETHENEA. Copyright © 2024 ETHENEA Independent Investors S.A. All rights reserved. 22/11/2022