Ethna-DEFENSIV | The anchor of stability in uncertain times

Simple, understandable, transparent - the anchor of stability in uncertain times

Capital markets always have unexpected developments in store. In recent months, they have proved more resilient than many expected at the beginning of the year. Nevertheless, the road to taming inflation and achieving the central bank's announced target is long and arduous. Combined with potential economic downturns, the ongoing war and other geopolitical risk scenarios will not make it any easier for investors to navigate in the future. Stability and reliability in choppy, sometimes stormy seas are called for. With a good compass, we steer a clear course: the actively managed Ethna-DEFENSIV serves as an ideal anchor of stability in any portfolio, navigating investors through both turbulent and calm times.

Change of Direction

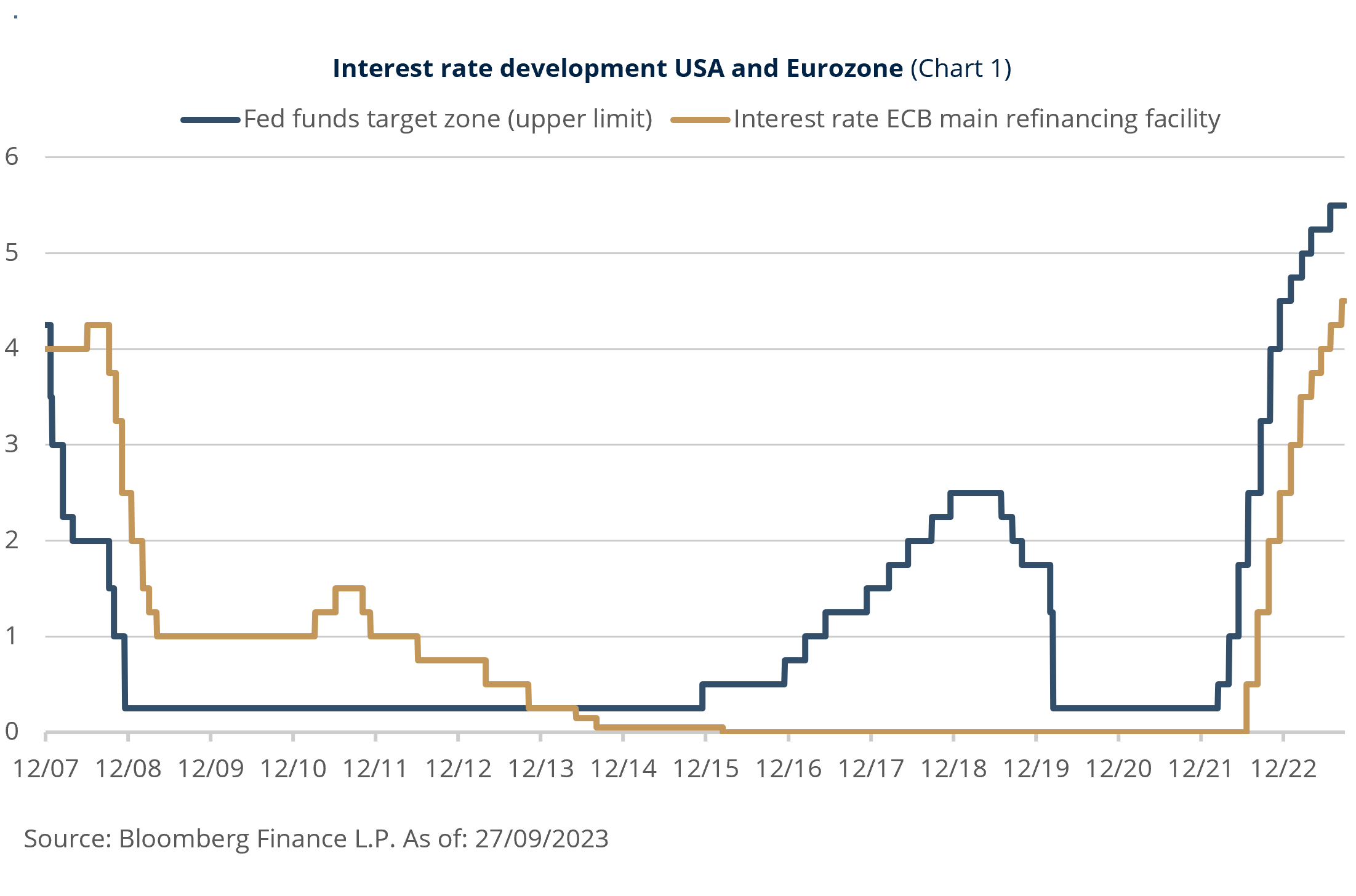

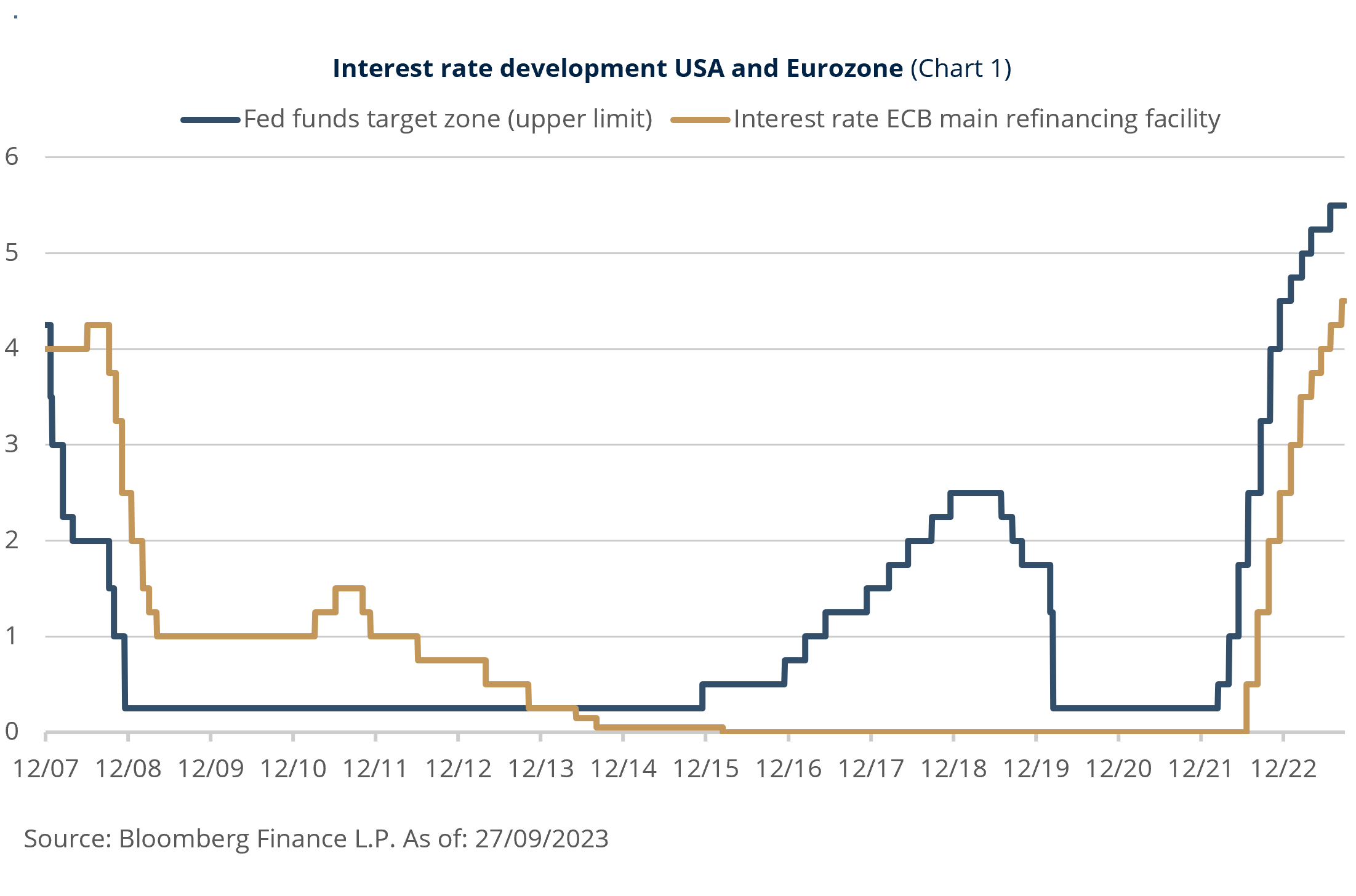

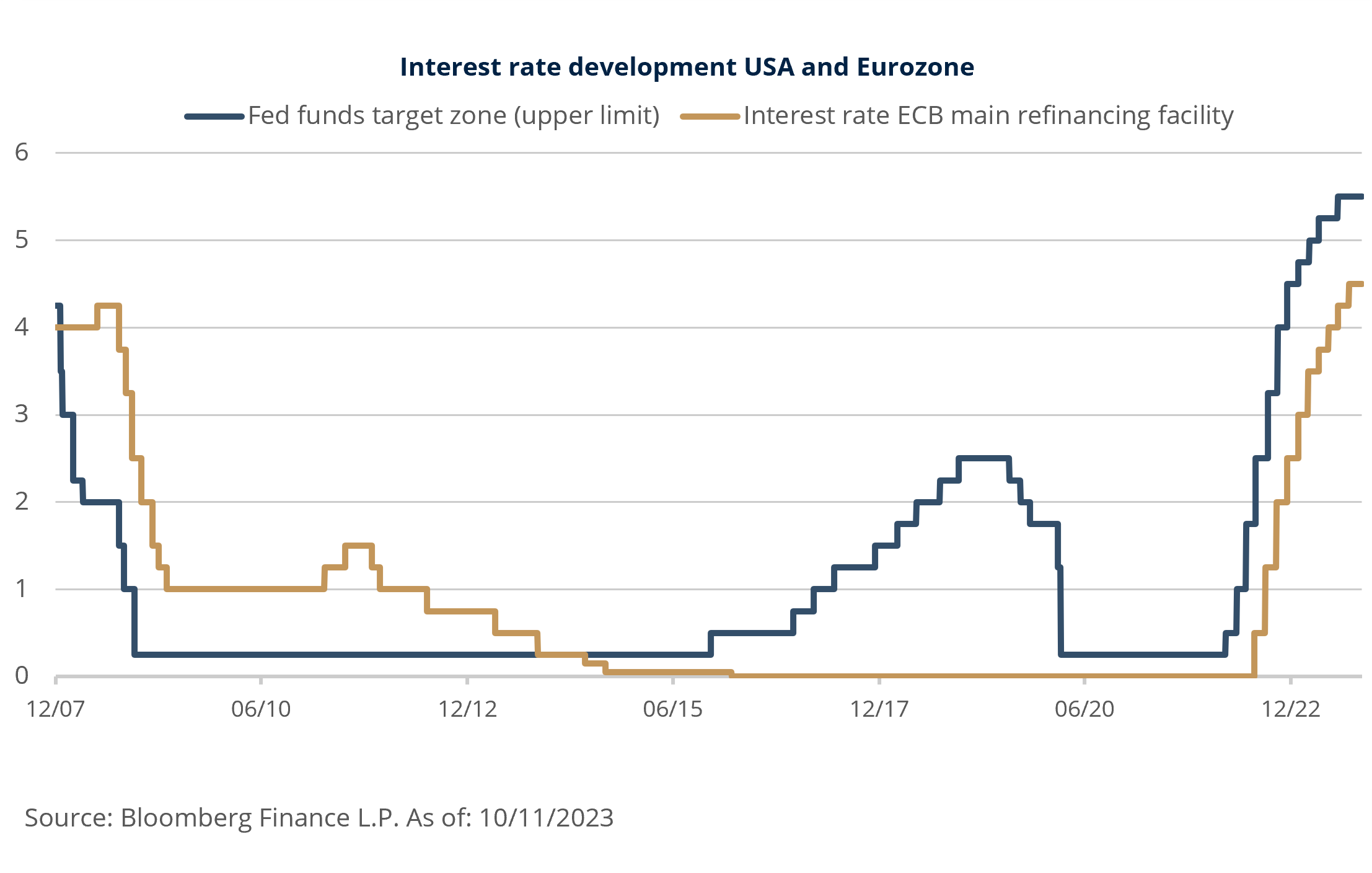

Investors need to prepare for a new era. The past years, or even two decades, have been characterised by a low-inflation environment. The spectre of inflation seemed to have disappeared, with core inflation in the G7 countries averaging 1.5 percent. It is now many times higher. Central banks are therefore still obliged to adjust their monetary policies in a way that brings them much closer to the objective of price stability. The interest rate turnaround in March 2022 in the US and in July 2022 in the euro area was therefore a turning point. Since then, there have been a number of rate hikes on both sides of the Atlantic. And they have made possible what was not foreseeable until 2022.

New target in sight?

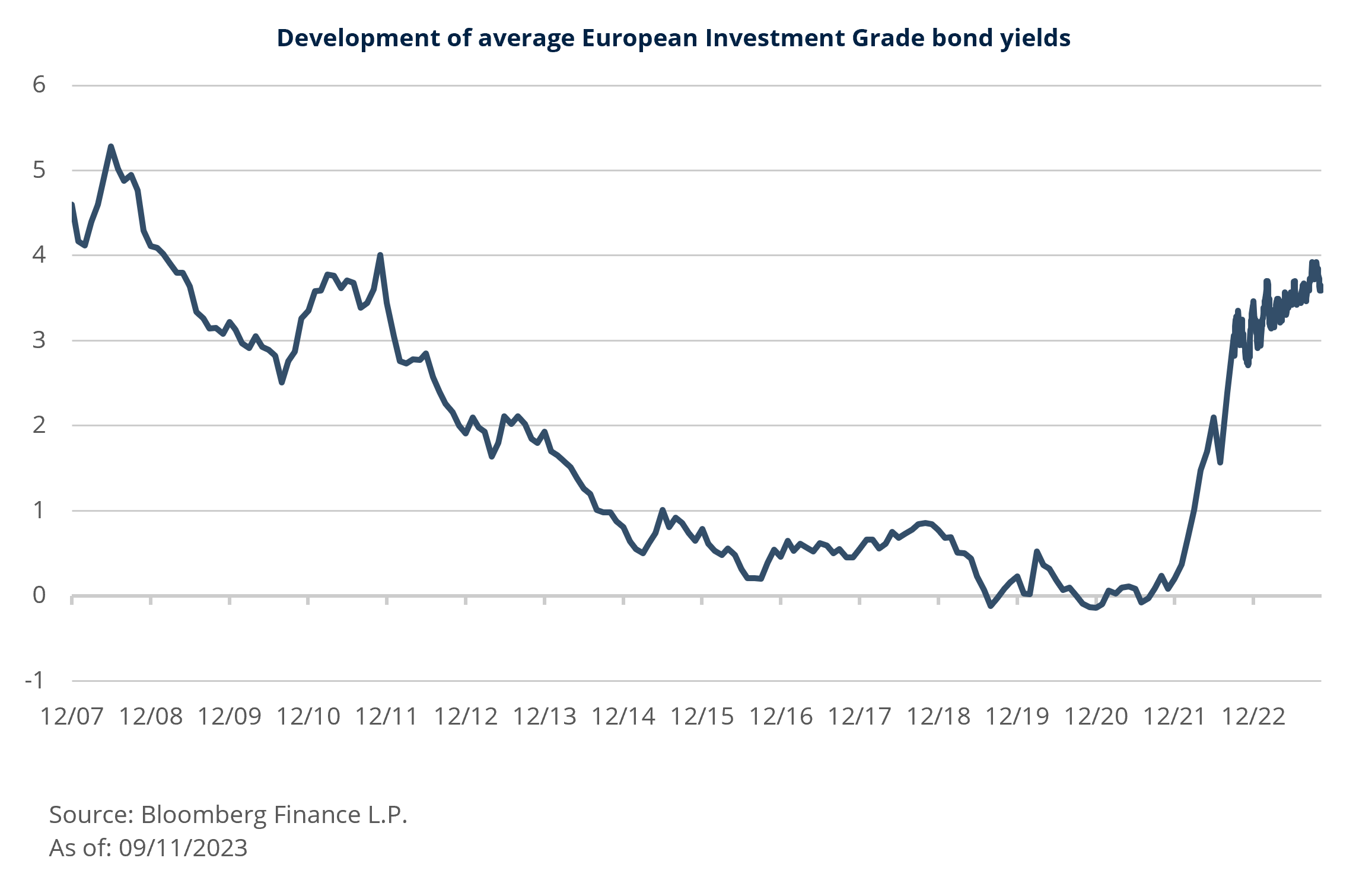

Uncertain as times are, one thing is certain: interest rates are back. Higher interest rates, particularly in Europe and the US, have contributed to a significant rise in bond yields - and therefore their return potential. A look at the chart below, which shows the evolution of the average yield on European investment-grade bonds since the beginning of 2022, makes this clear. This presents an interesting opportunity for investors seeking stable income opportunities. In addition, equities are likely to come under pressure in the event of a slide into a prolonged recession. A look at the diverse bond universe is therefore worthwhile for several reasons: Bonds provide resilience in uncertain times, offer diversification potential in the overall portfolio context and the returns are quite respectable.

Bond markets in focus: recalibrating for a safer course

In metrology and engineering, regular calibration ensures the quality and long-term performance of a product, while adjustment refers to the process of fine-tuning components or mechanisms. In active portfolio management too, both calibration and adjustment are key aspects of ensuring that a fund achieves its intended objectives without losing sight of risk.

Anticipated market developments have already led to a calibration of the investment strategy of the Ethna-DEFENSIV fund at the beginning of 2021. The remaining bond maturities were shortened and the equity and commodity allocations were gradually reduced. The aim was to optimise the fund’s risk-return expectations. After the rally at the end of 2021 was largely completed in November, all equity investments were sold and profits realised.

A reopening of the equity position in 2022 was not implemented for the time being due to the war in Ukraine and the resulting rapid economic slowdown, the rapidly rising energy prices and the debate on energy security, especially in Europe. On the fixed income side, maturities were adjusted in line with our expectations of rising inflation and tighter monetary policy, in order to prepare the Fund for a forthcoming cycle of interest rate hikes.

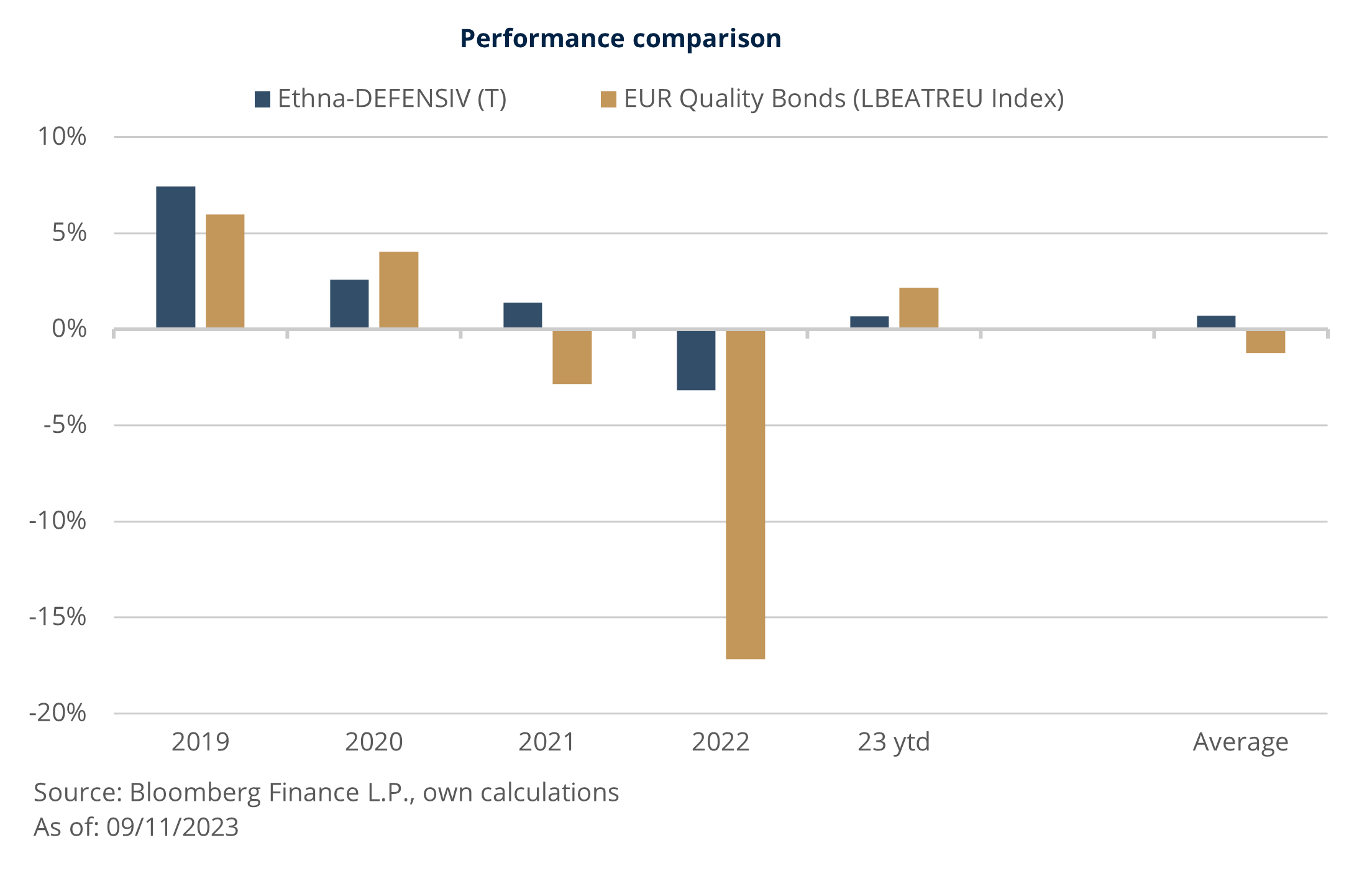

The result was already impressive at the end of 2022, and a look at the performance clearly shows that the approach works: in 2022, the Ethna-DEFENSIV significantly outperformed the euro-denominated investment-grade bond universe, as shown in the chart below. This was achieved by rebalancing towards shorter-dated and safer bonds, adding a futures overlay and reducing the equity exposure to zero. This confirms the success of the calibration and the decision to stay the course with this investment strategy and focus on bonds and currencies for the long term.

In order to achieve these results in the future, it has been decided to permanently remove the equity and commodity quotas from the asset allocation as part of a recalibration process, making Ethna-DEFENSIV a pure bond fund. As a result, the Ethna fund offers an optimal investment opportunity tailored to the conservative investor.

Conservative character with a focus on capital preservation and returns

Launched in 2007, the actively managed and non-benchmarked Ethna-DEFENSIV is characterised by its conservative character with a credo of capital preservation and a clear payout promise combined with low volatility of less than 4 percent. The underlying investment process and allocation are adjusted and determined by the portfolio management team using a top-down approach based on an assessment of macroeconomic developments and the potential risk dynamics of exogenous influencing factors. Combined with a bottom-up bond selection process, this approach allows the fund to select the most attractive investment opportunities while limiting potential risks and actively managing volatility and drawdowns.

The core of the fund consists of issuers from OECD countries with a focus on government and corporate bonds with very good to good credit ratings - these form the basis of the returns ("core income"). In addition, the Ethna-DEFENSIV can use the entire range of the bond segment, in line with the principle of the maximum flexibility, and thus increase the return potential.

The strategy is supported by overlay management, which controls the selection of maturities, currencies and quality to keep interest rate and spread sensitivity low, for example in times of crisis. In addition, interest rate sensitivity can be optimised and reduced by using forward contracts. Liquid instruments can be used to hedge lower value limits and reduce potential opportunity costs by re-entering the market at an early stage when markets are rising.

In addition, as an Article 8 fund, Ethna-DEFENSIV pursues an ESG strategy in accordance with the EU Regulation (SFDR) 2019/2088, implemented through a three-step process that includes comprehensive exclusions based on ESG assessments as well as individual ESG analysis. As part of this process, we exclude companies in the tobacco, armaments, commodity speculation, adult entertainment and coal production/trade sectors. We also exclude issuers whose overall ESG scores do not meet our minimum environmental, social and governance standards.

A firm eye on the future: Ethna-DEFENSIV as an anchor of stability in uncertain times

Simple, understandable and transparent: the actively managed Ethna-DEFENSIV is the ideal conservative investment solution and the perfect addition to a balanced portfolio. With an investment strategy focused on capital preservation and a clear payout promise, the fund guides investors safely through both turbulent and calm times. The recalibration has shown that we are on the right track and that our focus on bonds and currencies is paying off. As an Article 8 fund with a robust ESG strategy, we are committed to ethical and sustainable principles. At the same time, in an increasingly complex market environment, Ethna-DEFENSIV provides clear and simple access to the bond markets and serves as a valuable compass for investors to navigate with confidence.

The current 5-star rating from Morningstar proves that we have nothing to hide when it comes to generating returns. The Ethna-DEFENSIV is a suitable core investment for existing and potential investors, navigating them through both turbulent and calm times.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

This is a marketing communication. It is for information purposes only and provides the addressee with guidance on our products, concepts and ideas. This does not form the basis for any purchase, sale, hedging, transfer or mortgaging of assets. None of the information contained herein constitutes an offer to buy or sell any financial instrument nor is it based on a consideration of the personal circumstances of the addressee. It is also not the result of an objective or independent analysis. ETHENEA makes no express or implied warranty or representation as to the accuracy, completeness, suitability, or marketability of any information provided to the addressee in webinars, podcasts or newsletters. The addressee acknowledges that our products and concepts may be intended for different categories of investors. The criteria are based exclusively on the currently valid sales prospectus. This marketing communication is not intended for a specific group of addressees. Each addressee must therefore inform themselves individually and under their own responsibility about the relevant provisions of the currently valid sales documents, on the basis of which the purchase of shares is exclusively based. Neither the content provided nor our marketing communications constitute binding promises or guarantees of future results. No advisory relationship is established either by reading or listening to the content. All contents are for information purposes only and cannot replace professional and individual investment advice. The addressee has requested the newsletter, has registered for a webinar or podcast, or uses other digital marketing media on their own initiative and at their own risk. The addressee and participant accept that digital marketing formats are technically produced and made available to the participant by an external information provider that has no relationship with ETHENEA. Access to and participation in digital marketing formats takes place via internet-based infrastructures. ETHENEA accepts no liability for any interruptions, cancellations, disruptions, suspensions, non-fulfilment, or delays related to the provision of the digital marketing formats. The participant acknowledges and accepts that when participating in digital marketing formats, personal data can be viewed, recorded, and transmitted by the information provider. ETHENEA is not liable for any breaches of data protection obligations by the information provider. Digital marketing formats may only be accessed and visited in countries in which their distribution and access is permitted by law. For detailed information on the opportunities and risks associated with our products, please refer to the current sales prospectus. The statutory sales documents (sales prospectus, key information documents (PRIIPs-KIDs), semi-annual and annual reports), which provide detailed information on the purchase of units and the associated risks, form the sole authoritative and binding basis for the purchase of units. The aforementioned sales documents in German (as well as in unofficial translations in other languages) can be found at www.ethenea.com and are available free of charge from the investment company ETHENEA Independent Investors S.A. and the custodian bank, as well as from the respective national paying or information agents and from the representative in Switzerland. The paying or information agents for the funds Ethna-AKTIV, Ethna-DEFENSIV and Ethna-DYNAMISCH are the following: Austria, Belgium, Germany, Liechtenstein, Luxembourg: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg; France: CACEIS Bank France, 1-3 place Valhubert, F-75013 Paris; Italy: State Street Bank International – Succursale Italia, Via Ferrante Aporti, 10, IT-20125 Milano; Société Génerale Securities Services, Via Benigno Crespi, 19/A - MAC 2, IT-20123 Milano; Banca Sella Holding S.p.A., Piazza Gaudenzio Sella 1, IT-13900 Biella; Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Spain: ALLFUNDS BANK, S.A., C/ Estafeta, 6 (la Moraleja), Edificio 3 – Complejo Plaza de la Fuente, ES-28109 Alcobendas (Madrid); Switzerland: Representative: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Paying Agent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. The paying or information agents for HESPER FUND, SICAV - Global Solutions are the following: Austria, Belgium, France, Germany, Luxembourg: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg; Italy: Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Switzerland: Representative: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Paying Agent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. The investment company may terminate existing distribution agreements with third parties or withdraw distribution licences for strategic or statutory reasons, subject to compliance with any deadlines. Investors can obtain information about their rights from the website www.ethenea.com and from the sales prospectus. The information is available in both German and English, as well as in other languages in individual cases. Explicit reference is made to the detailed risk descriptions in the sales prospectus. This publication is subject to copyright, trademark and intellectual property rights. Any reproduction, distribution, provision for downloading or online accessibility, inclusion in other websites, or publication in whole or in part, in modified or unmodified form, is only permitted with the prior written consent of ETHENEA. Copyright © 2024 ETHENEA Independent Investors S.A. All rights reserved. 07/11/2023