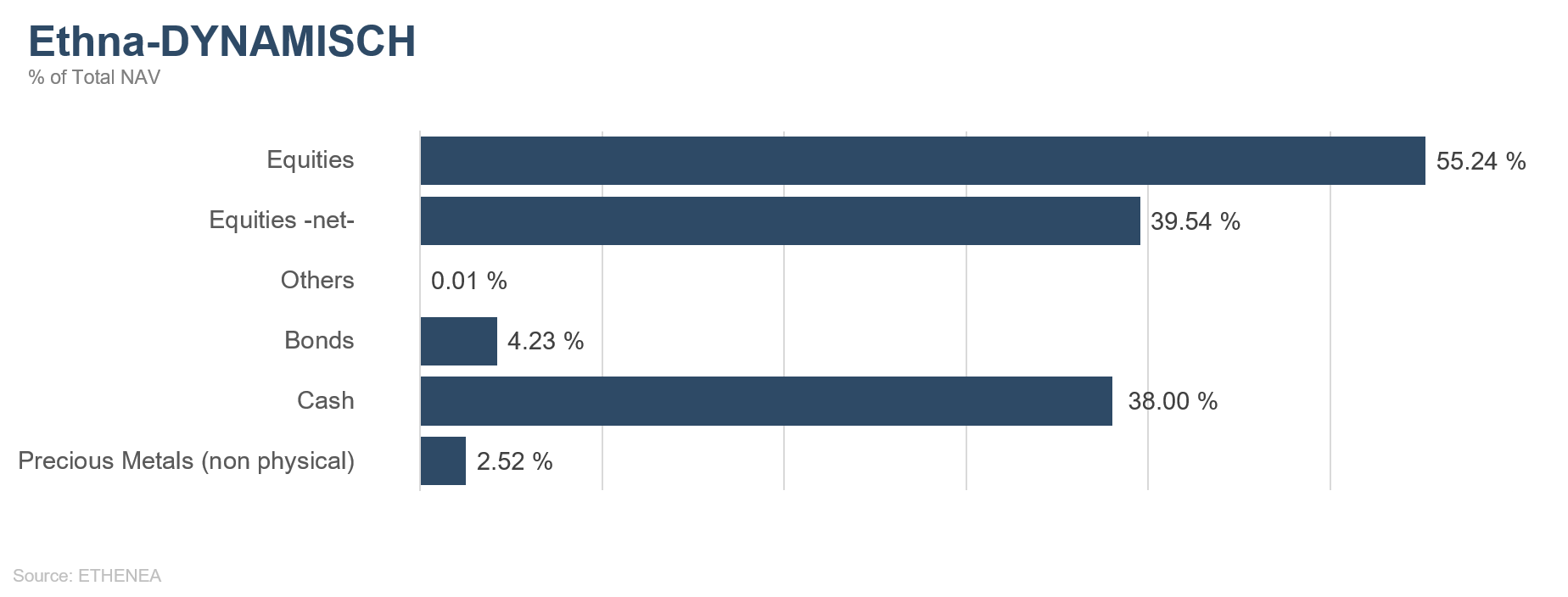

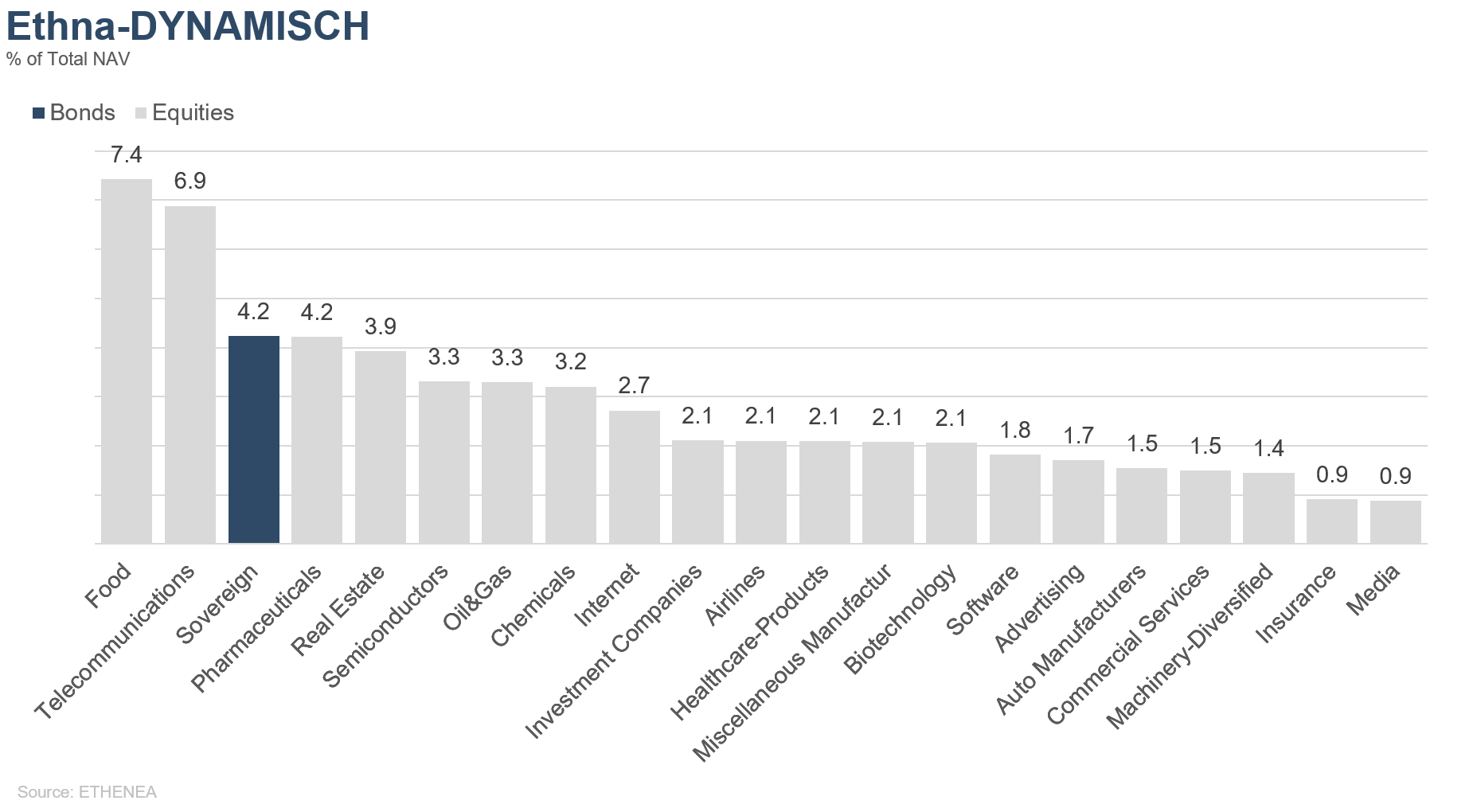

Figure 16: Portfolio composition of Ethna-DYNAMISCH by issuer sector

* “Cash” comprises term deposits, call money and current accounts/other accounts. “Equities net” comprises direct investments and exposure resulting from equity derivatives.

In the eye of the storm?

Under the shadow of the fourth quarter of 2018, we hazarded a look ahead to the new year and forecasted turmoil. But then the first month of 2019 turned out quite benign, at least in terms of what happened in capital markets. On the political front, on the other hand, it was same old, same old. The chaos surrounding Brexit makes it almost impossible to predict what will happen after 29 March. In Italy, the populists are doing what populists always do, and the danger of a fresh election is increasing. However, to speak of danger in this context is overstating it somewhat, considering that Italy has had no fewer than 65 governments since 1946. The yellow vest movement in France is continuing to cause unrest. Donald Trump’s wish for a wall still hasn’t been granted. The resulting government shutdown has come to an end, at least for the time being, but it’s likely to have cost U.S. economic growth more than the controversial wall. As before, China is not expected to spring any growth surprises. The media spotlight has shifted away from Syria and Yemen to some extent and onto the new topic of the chaos in Venezuela. Since interim president Guaidó has been openly opposing sitting president Maduro, the Caribbean nation’s (self-imposed) hardship has gripped the world’s attention. There is no news from eastern Ukraine either, other than the football match of Shakhtar Donetsk against Eintracht Frankfurt won’t be a home game but will be moved to the safer city of Kharkiv, 300 km away.

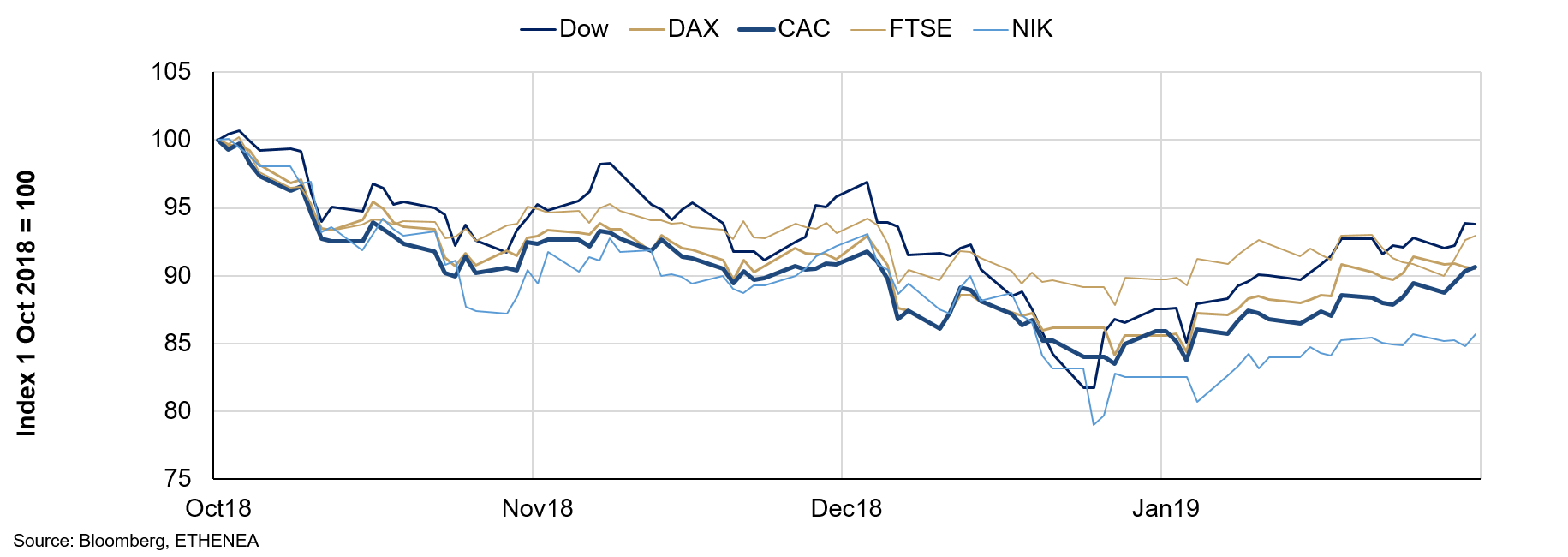

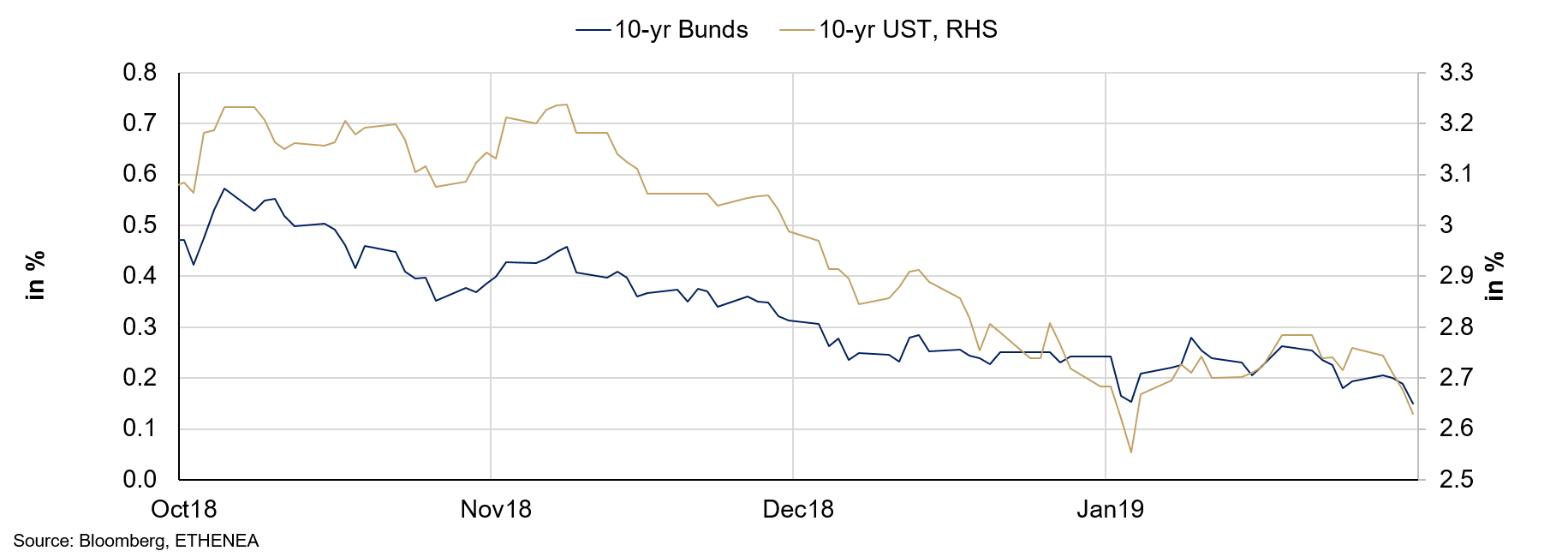

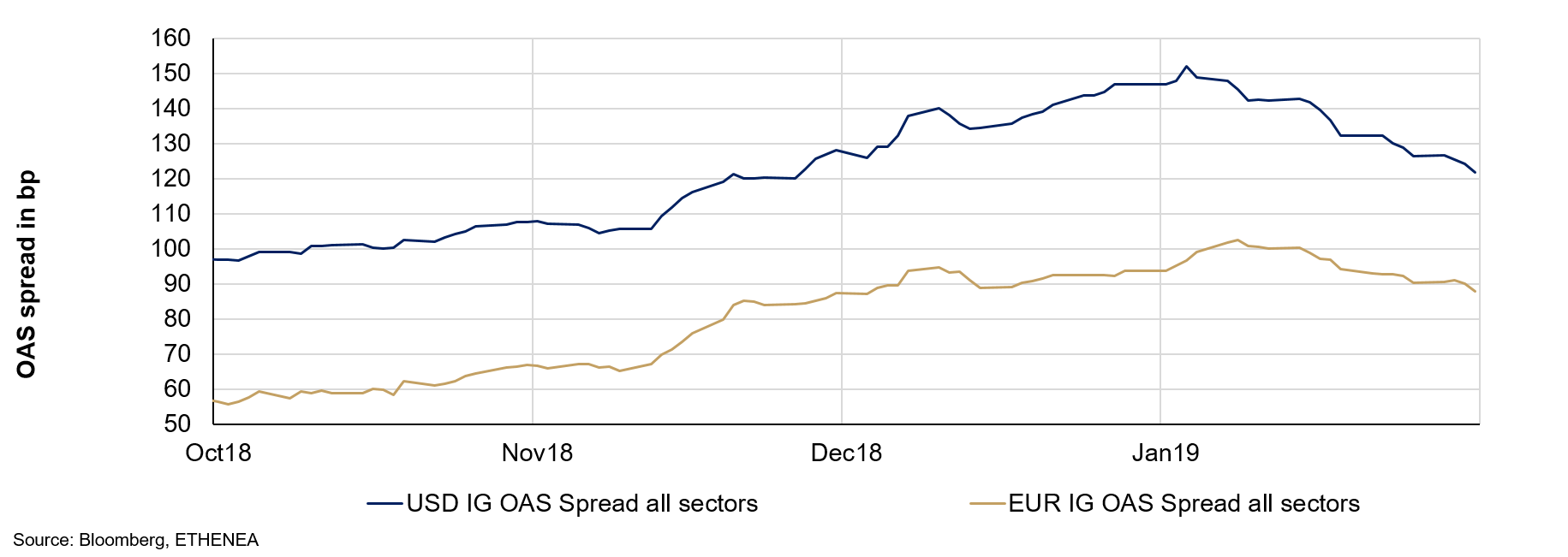

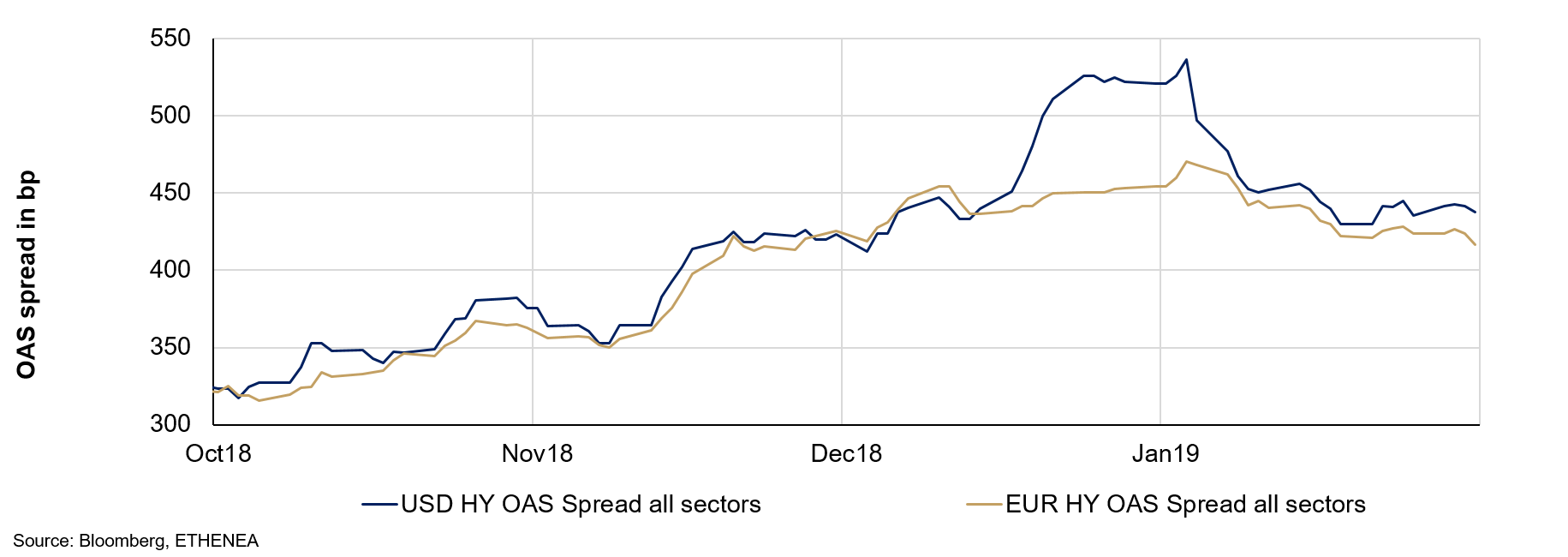

However, in January the markets were more or less untouched by the political goings-on. Equity markets recovered from their lows in December (Figure 1), concerns about recession in interest rate markets seem to have abated for now (Figure 2), spreads on better corporate bonds are rapidly falling from their highs (Figure 3) and even the collapse in high yield bonds seems to have passed (Figure 4).

Figure 1: Equity market performance

Figure 2: Interest rate market development

Figure 3: Corporate bond spreads

Figure 4: High yield bond spreads

However, in its first meeting of 2019 the U.S. central bank shifted policy towards a neutral stance for the first time in this cycle of interest rate hikes. It is therefore just as likely that the next rate change will be a hike as a cut. The Powell Put, as it were, has come into effect, which means that the central bank seems to have done the equity markets a favour. The fact is, however, that the Federal Reserve was able to spot a weakness in growth. The longest government shutdown in U.S. history alone has cost up to 1% in economic growth according to estimates from various sources. In this context, the central bank’s wait-and-see stance seems totally understandable. In the risk markets, the shift has caused equities to rise and the spreads on corporate bonds to decrease again.

What next? In January 2019’s Market Commentary we explained in detail that, to all appearances, we are entering a phase of economic weakness. So far, nothing has happened to change this assessment. Indeed, in the U.S. the central bank has come to the same conclusion. Various indicators confirm this expectation, including the Chicago Purchasing Manager Index for January. In the eurozone, Italy has once again slipped into a technical recession. Considering that since the euro was introduced Italy has achieved real quarterly growth of only 0.12% on average, one can understand – at least from Italy’s perspective – why there are certain doubts about the success of the euro for the country. But we are not going to delve further into that here. In Germany, the government’s rather optimistic growth estimate for 2019 of 1.8% in October 2018 was revised to a mere 1% in January 2019. The import/export data for China published mid-January gives us another indication that the global economy is weakening, pointing to a noticeable weakening in Chinese growth. Last but not least, let’s not forget about Donald Trump. The Department of Commerce is still probing whether car imports from the EU pose a national security risk and, if so, it would levy a 25% tariff on them. The results of this probe are expected to be announced before 17 February 2019.

All in all, our expectation of a phase of global economic weakness seems accurate without painting a picture of immediate global recession. After all, central banks do seem prepared to slightly prolong the longest period of economic growth in history, if they follow the example set by the U.S. central bank.

For the capital markets, however, this means that now and again we will probably have another January with periods of recovery but just as often we will have more Decembers in which risk markets get punished. On the whole, therefore, we are likely to have little more than a lot of fuss and volatility. In this respect, a steady hand is required and a fund structure that can adapt to this environment. All three Ethna funds have precisely this aim and each one pursues this in its own way.

If you are having video playback issues, please click HERE.

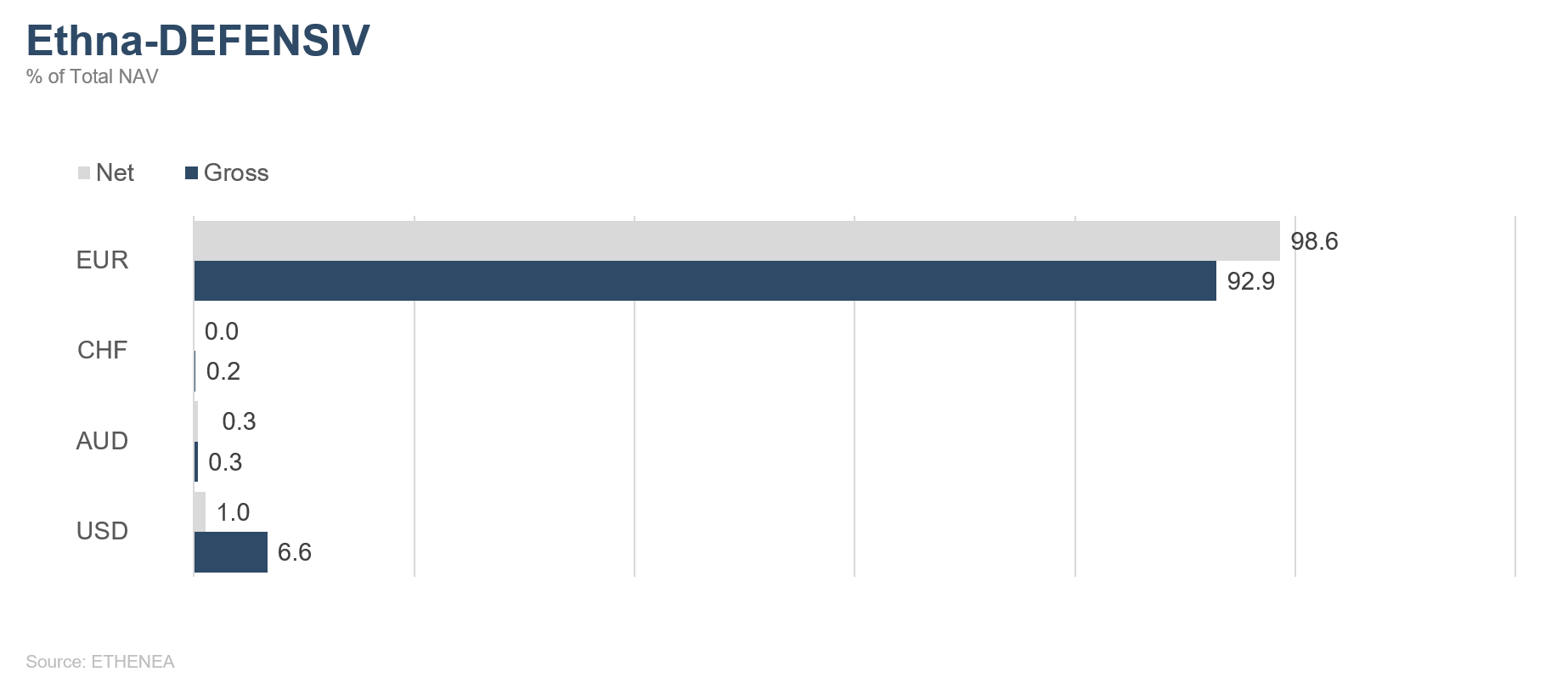

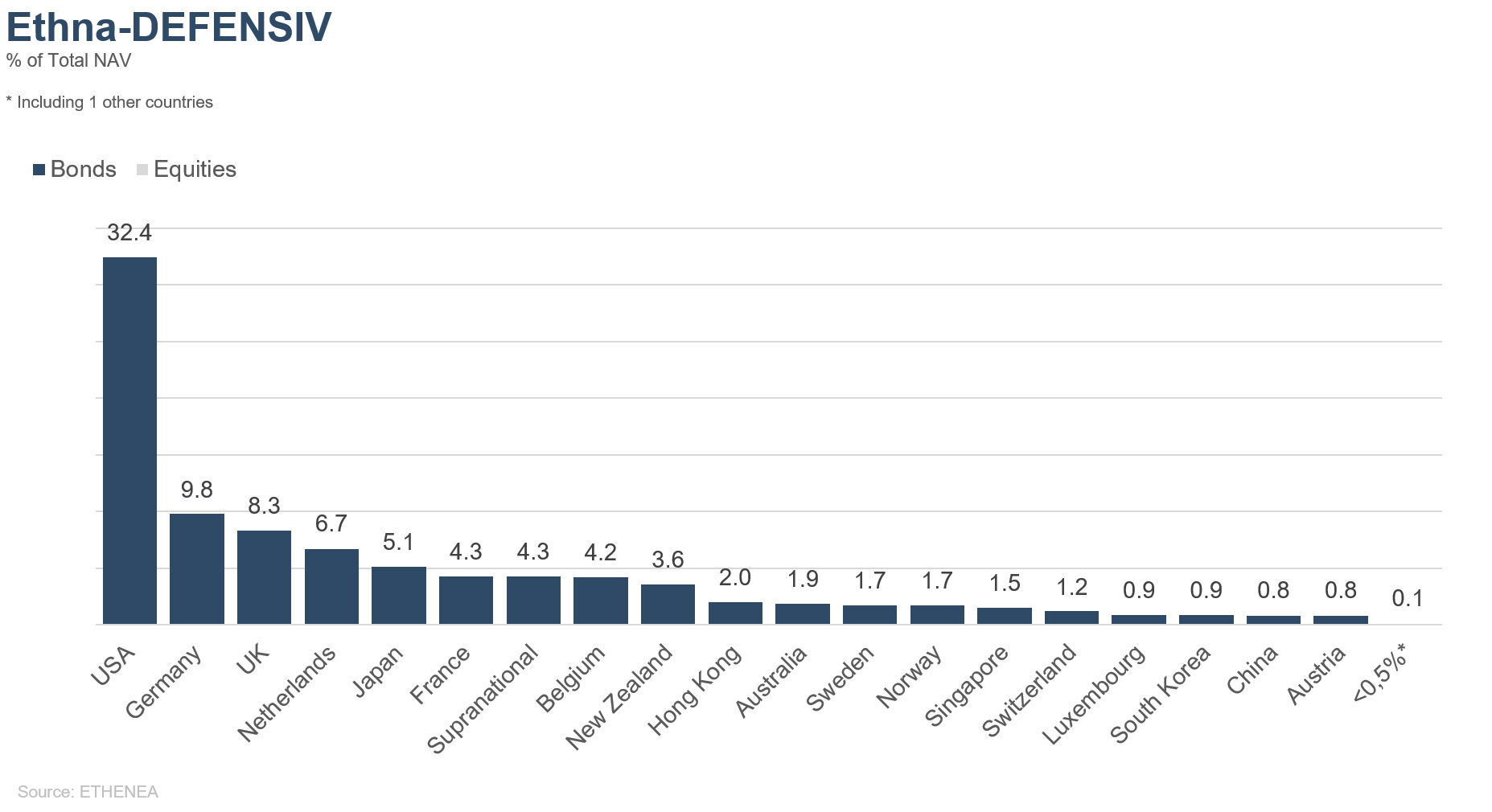

In January, we at last managed to put the final touches on the bond portion of the Ethna-DEFENSIV. We sold the last remaining long maturity bonds denominated in USD (-16%) and also sold the rest of the old-style subordinated bonds (-2.4%), thanks to the opportunity the brief recovery in bond markets presented. Over 90% of the bond portfolio is now denominated in EUR, which greatly reduces our currency hedging costs. Furthermore, we were able to reduce the maturities of holdings to the extent that more than 78% of bonds now have a residual maturity of less than seven years. This substantially reduces the cost of duration hedging because we can now use shorter-dated futures with a lower negative carry. Apart from a few remaining subordinates (1.6%), the Ethna-DEFENSIV is largely free of (incalculable) risks in this respect.

We increased the gold position to just over 5% because we remain confident that prices will rise in times of greater uncertainty.

Our equity position at the end of January was 0% because we are still waiting for suitable entry levels.

“Why should I care about what I said before?” Fed Chair Jerome Powell must have been thinking along these lines when making his almost complete about-turn following on from a statement in December that was found to be overly hawkish. He is now much more dovish about forthcoming rate rises, which brought about broad-based price gains over the course of January. As a result, the corresponding U.S. interest rate futures no longer imply an interest rate rise for this year. However, we think the market is overly euphoric in this regard. In our estimation, if the capital market appears, on the face of it, to be calming and (wage) inflation is resurgent due to full employment, the central bank will once again have reason to raise interest rates over the course of the year. The fact is that the about-turn in the central bank’s statements demonstrated earlier than expected that a Powell Put is in force. However, we mustn’t forget on this point that while such a put limits the potential of the market to correct, it does not determine the upside potential. Rather, the actual and expected rates of growth in corporate turnovers and profits are the determining factors. The current reporting season is painting a mixed picture in this regard. To sum up so far, we can say that the published figures have not been as bad as the sharp falls in the equity market implied as recently as mid-December. On the other hand, however, the trend towards slower growth is being confirmed. On the subject of a slowdown, it’s no longer a secret that the longest government shutdown in U.S. history and the still unresolved trade conflict with China are having an impact on real figures and on the general mood as well. We expect that global economic growth for 2019 – revised to 3.5% – will slow further, which does not boost upside potential. As such, we expect the equity market to remain highly volatile, with limited upside and downside potential.

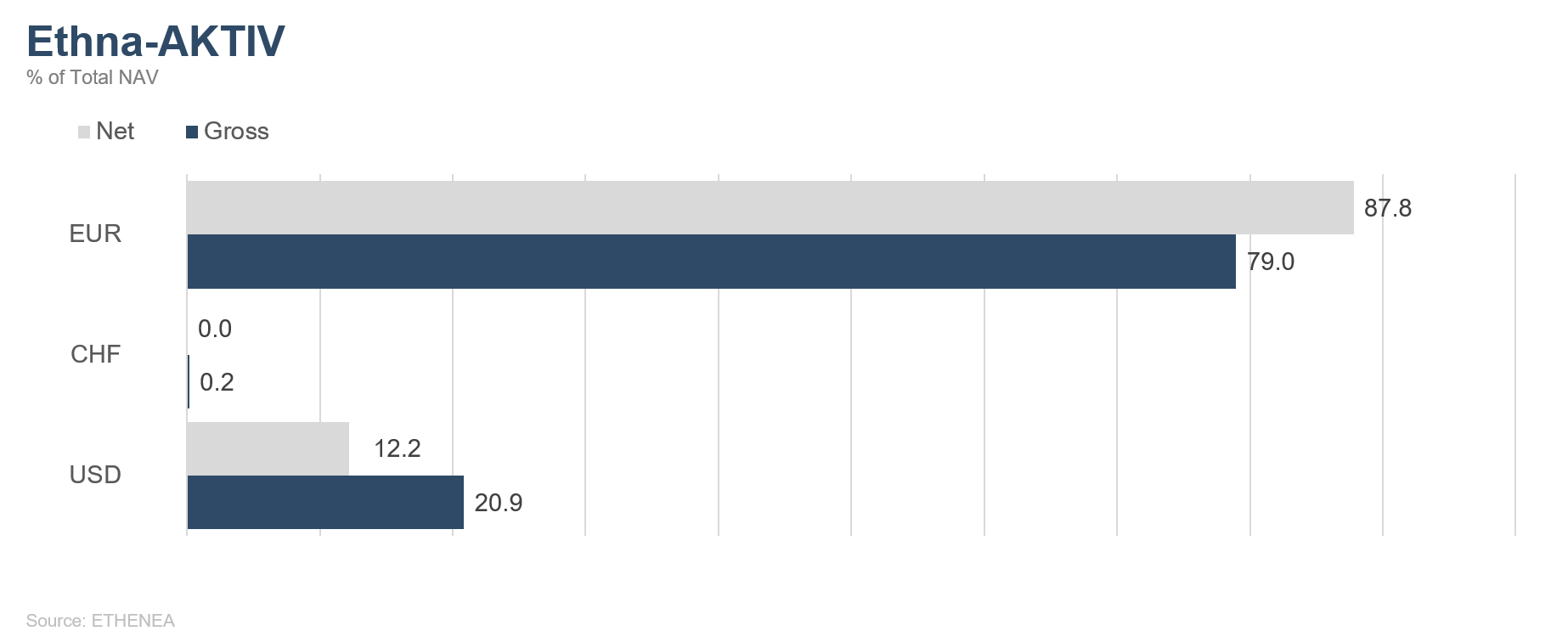

Performance in January can largely be attributed to the bond portfolio and the extended duration we carried into the first week of January. Having limited losses in December by reducing the equity allocation, we saw the flip side of this positioning in January, participating less in rising markets. At the moment, the equity allocation is approx. 8%, with option structures in the U.S. equity market accounting for almost all of this. In keeping with the picture painted above of a volatile trading range, we will take advantage of declines to make purchases and rallies to make sales via index futures. In the course of January, we also re-established a gold position of 5%. In our view, last year’s prevailing correlation between gold and various asset classes has been broken, meaning that the addition of gold to the mix both for diversification and performance reasons is once again an attractive prospect. Both our relatively substantial dollar position of 17.5% and our tendency to reduce U.S. duration reflect our interest rate opinion as described at the outset, which is that U.S. interest rates will tend to rise.

The new year for the stock markets started as positively as the last year closed negatively. This is what we in the industry call volatility. What’s behind the high levels of volatility in capital markets is the ongoing considerable uncertainty about future economic growth. The macroeconomic environment has rarely been as hazy as it is at the moment. The economic barometer tends still to point towards a slowdown in growth in the key economies. After the sharp falls in prices, however, a great deal is priced in at the moment and trading the capital markets has always been a matter of weighing up risk against opportunity. This balance – potential reward vs possible risk – is gradually tipping back slightly into the positive. In interpreting the parameters, it’s important to remember the leading nature of stock markets. Stock markets do not wait until the uncertainty has subsided and official growth figures have been revised upwards. Share prices react positively even if things turn out less badly than feared. And an array of the indicators we have analysed are now heading in that direction. Here’s a good example of what we mean: rarely has the uncertainty in planning for companies been as pronounced as it is now. The lack of clarity surrounding Brexit and the simmering trade conflict are hampering investment in the real economy across the board. Slowly but surely this is manifesting in the relevant micro- and macroeconomic figures. That said, whichever Brexit scenario we end up with – a hard Brexit, a perfectly negotiated Brexit or no Brexit at all – companies will soon have certainty in planning again, and they will be able to adapt to the circumstances and make the necessary investments they postponed. After all, in the past the times we had the greatest uncertainty were the times we had more attractive entry points in equity markets.

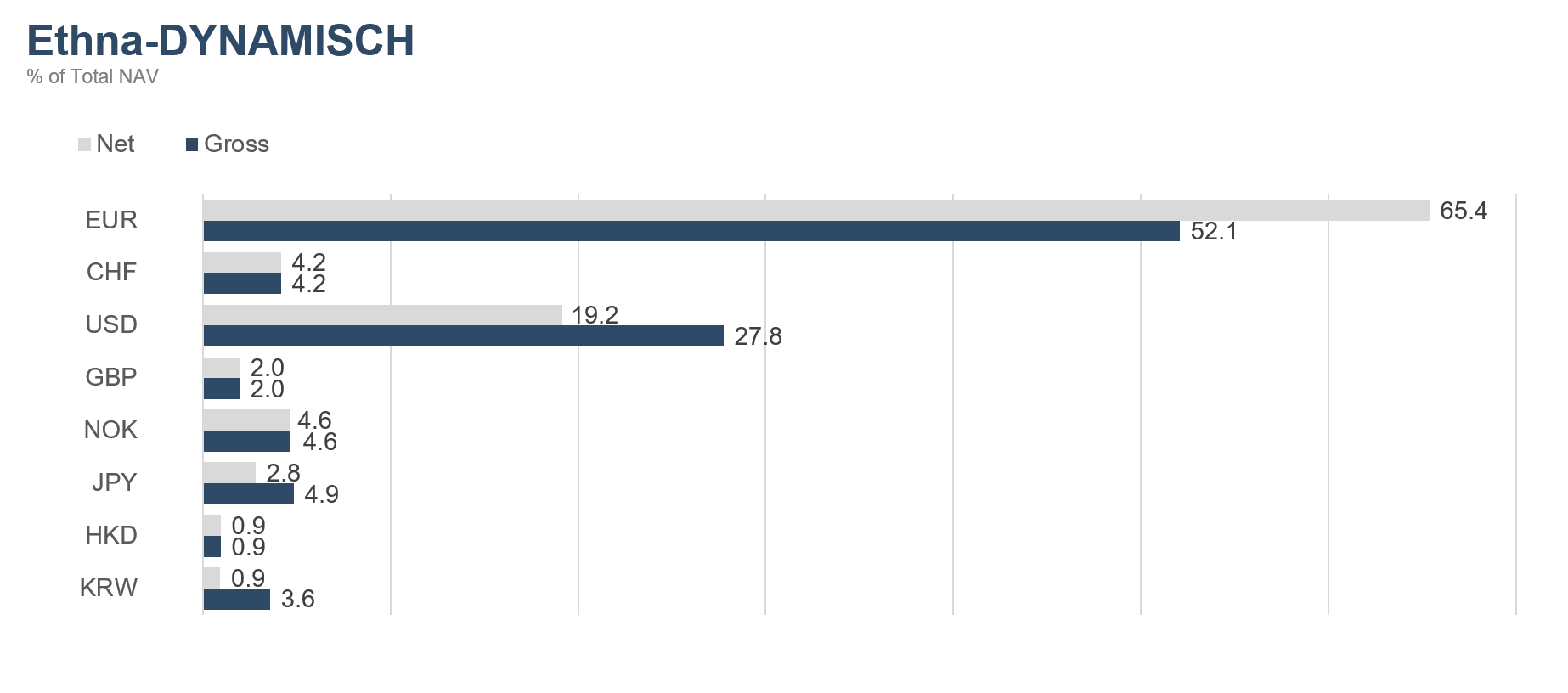

Given the fund positioning as outlined above and the small gold position, which still makes up around 2.5% of the portfolio mix, we believe the Ethna-DYNAMISCH remains well set up for times of high – and possibly soon falling – uncertainty and volatility.

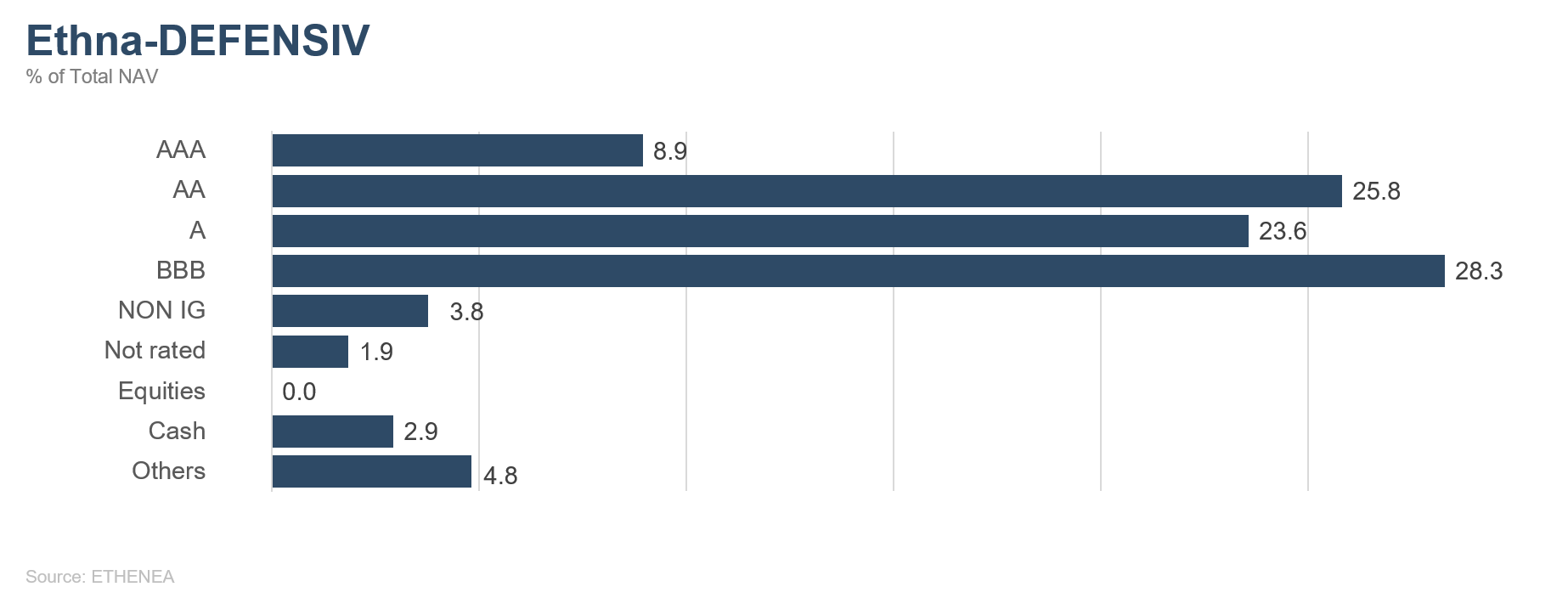

Figure 5: Portfolio ratings for Ethna-DEFENSIV

Figure 6: Portfolio composition of Ethna-DEFENSIV by currency

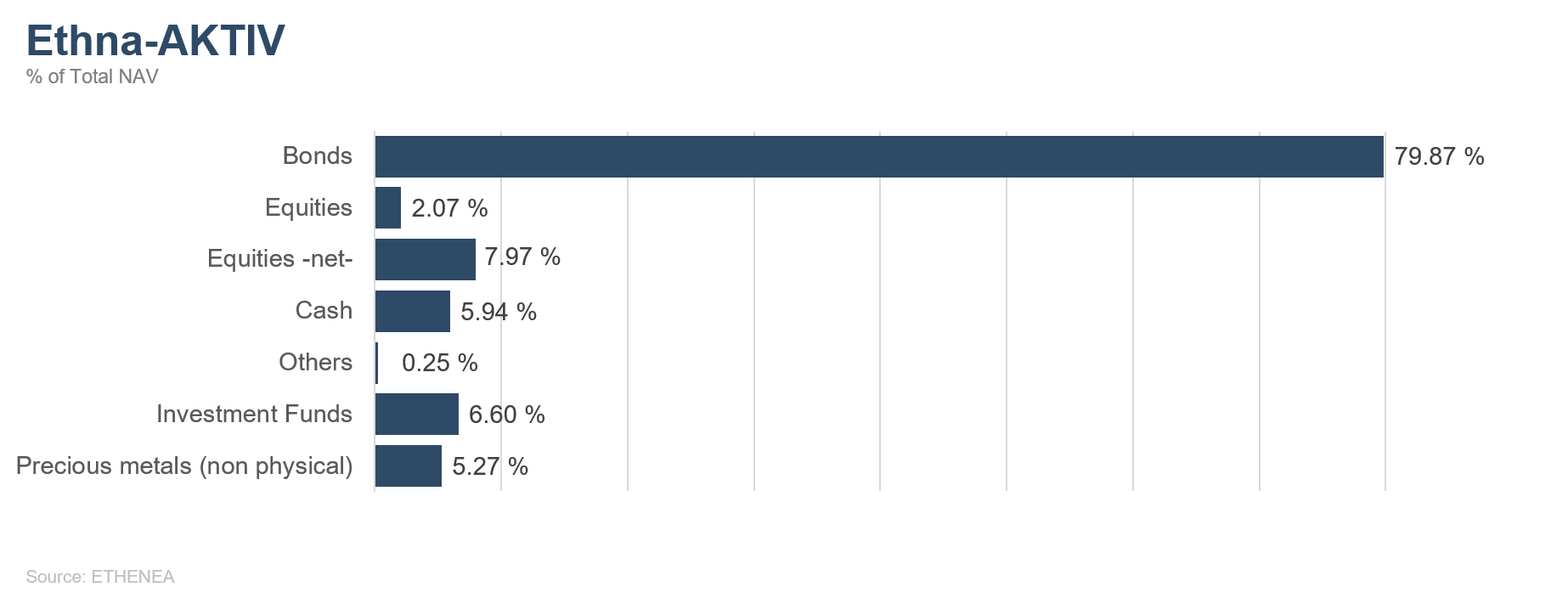

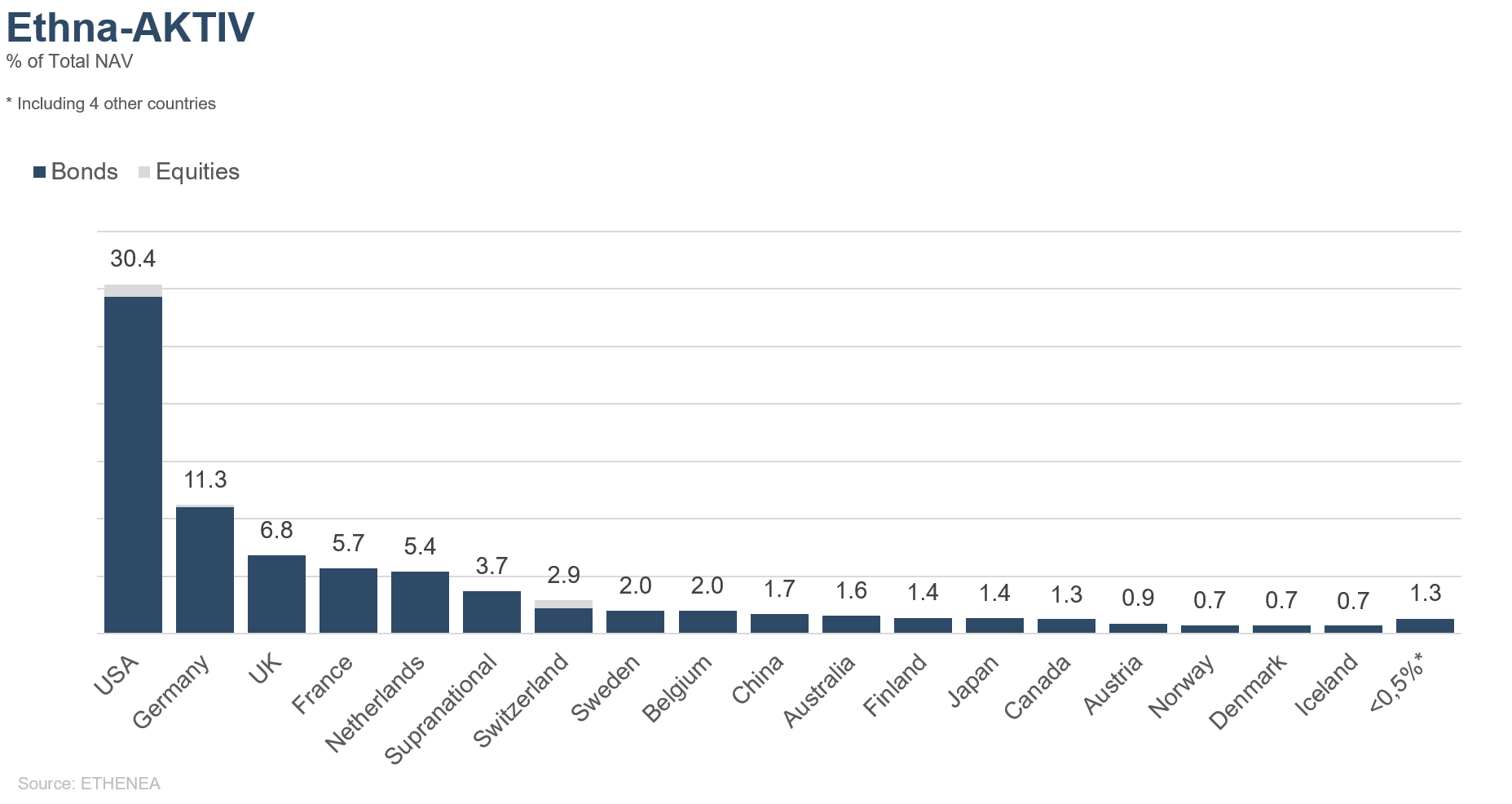

Figure 7: Portfolio structure* of Ethna-AKTIV

Figure 8: Portfolio composition of Ethna-AKTIV by currency

Figure 9: Portfolio structure* of Ethna-DYNAMISCH

Figure 10: Portfolio composition of Ethna-DYNAMISCH by currency

Figure 11: Portfolio composition of Ethna-AKTIV by country

Figure 12: Portfolio composition of Ethna-DEFENSIV by country

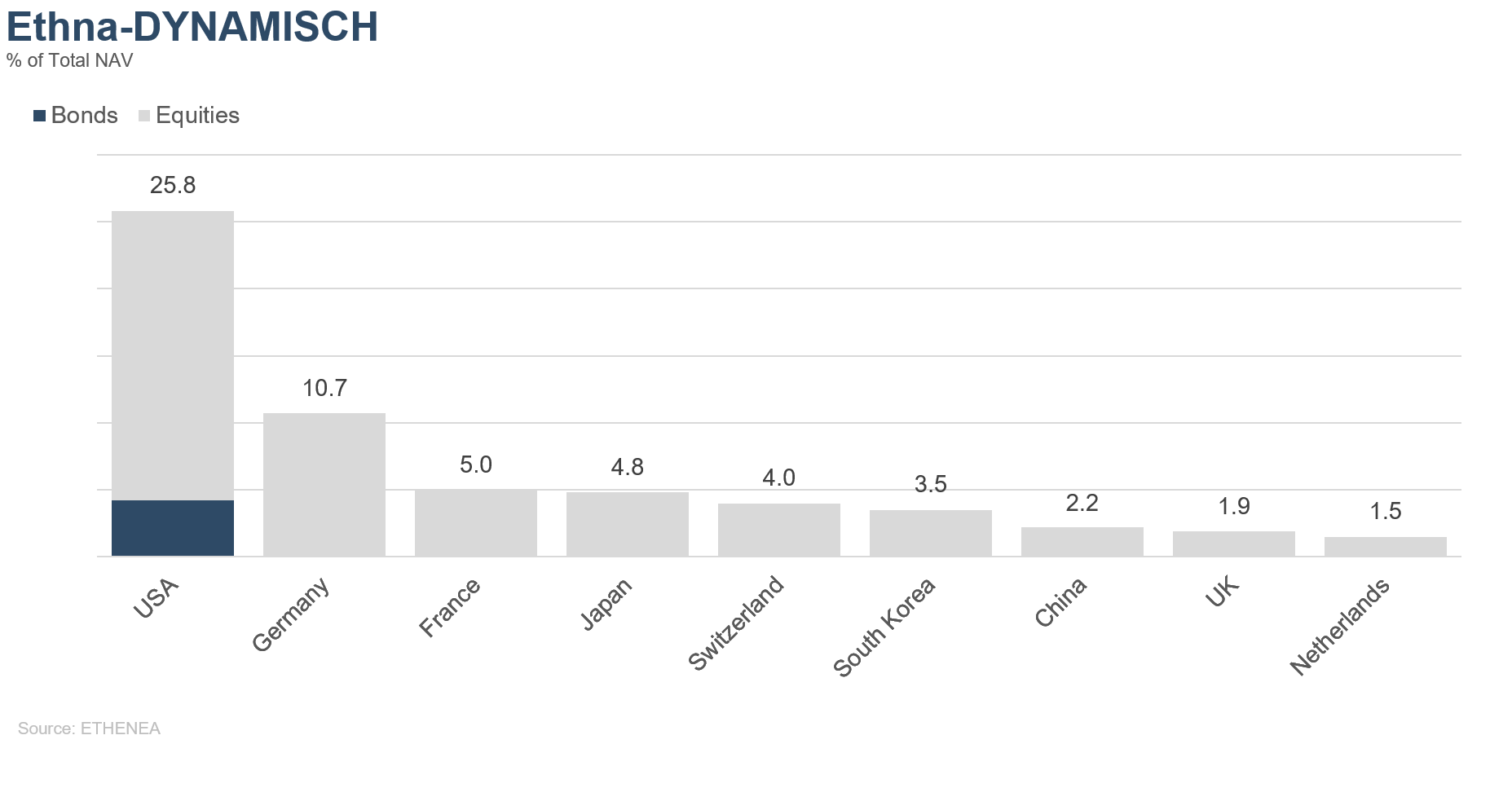

Figure 13: Portfolio composition of Ethna-DYNAMISCH by country

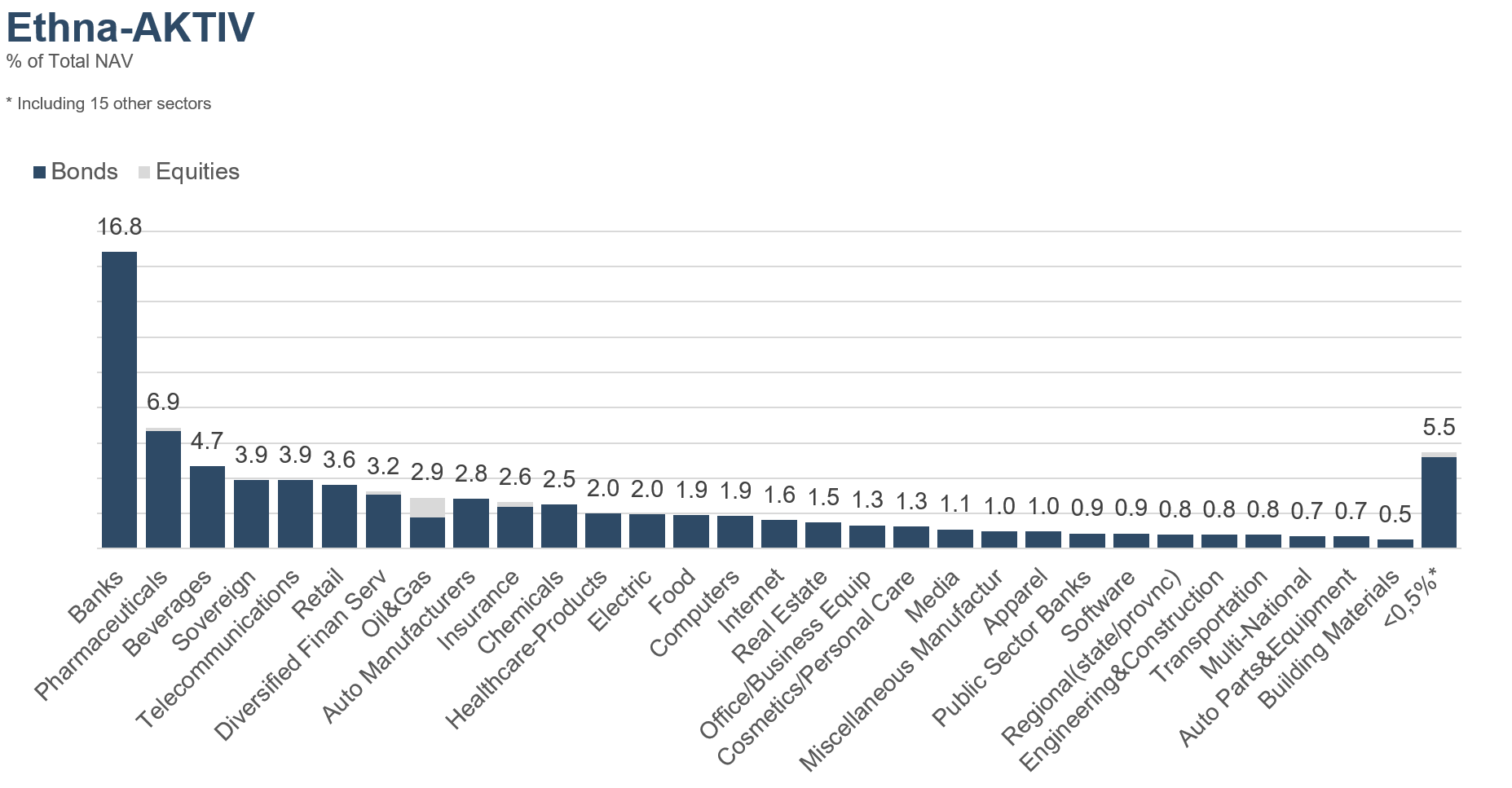

Figure 14: Portfolio composition of Ethna-AKTIV by issuer sector

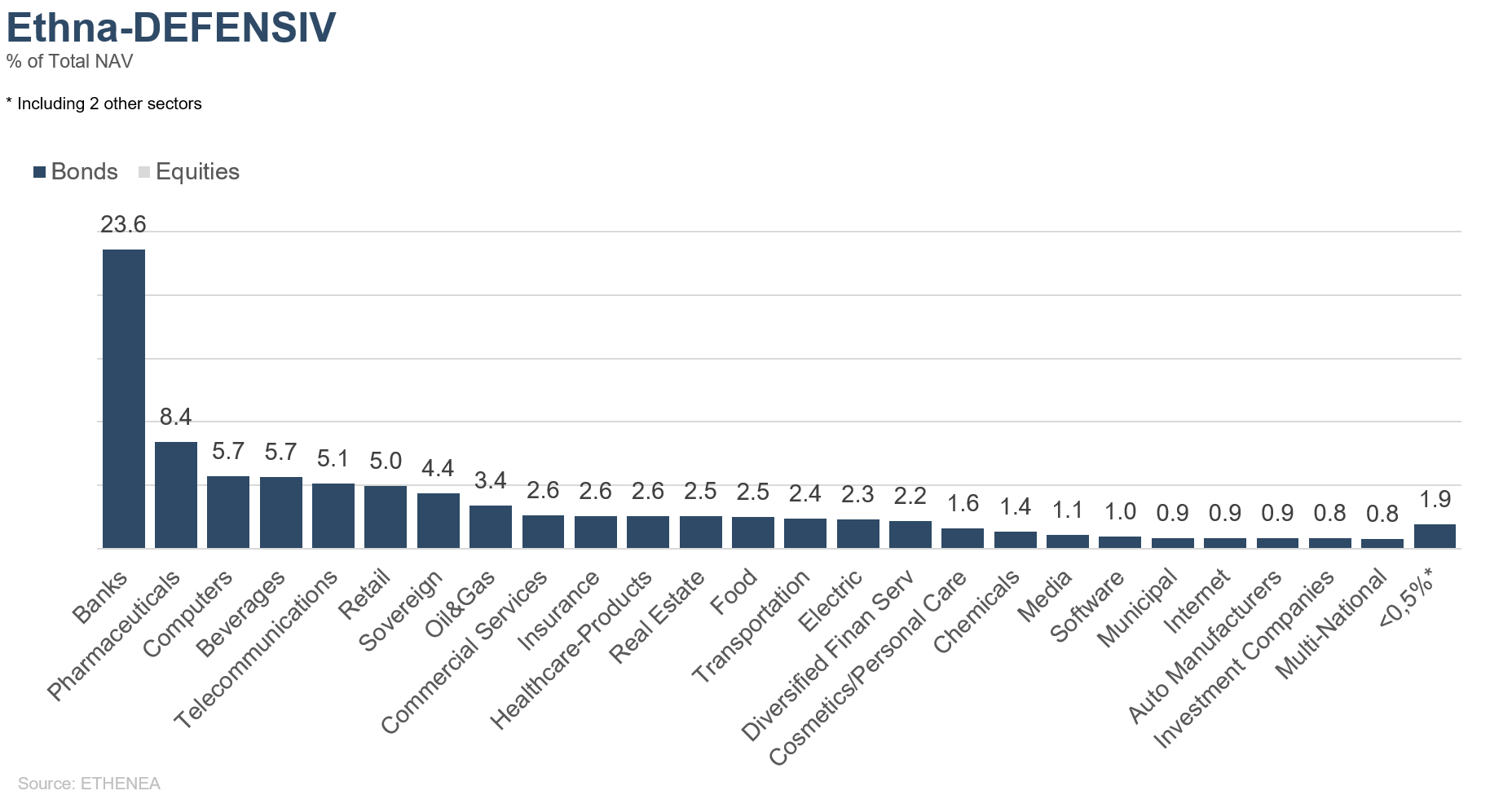

Figure 15: Portfolio composition of Ethna-DEFENSIV by issuer sector

Figure 16: Portfolio composition of Ethna-DYNAMISCH by issuer sector

* “Cash” comprises term deposits, call money and current accounts/other accounts. “Equities net” comprises direct investments and exposure resulting from equity derivatives.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

This is a marketing communication. It is for product information purposes only and is not a mandatory statutory or regulatory document. The information contained in this document does not constitute a solicitation, offer or recommendation to buy or sell units in the fund or to engage in any other transaction. It is intended solely to provide the reader with an understanding of the key features of the fund, such as the investment process, and is not deemed, either in whole or in part, to be an investment recommendation. The information provided is not a substitute for the reader's own deliberations or for any other legal, tax or financial information and advice. Neither the investment company nor its employees or Directors can be held liable for losses incurred directly or indirectly through the use of the contents of this document or in any other connection with this document. The currently valid sales documents in German (sales prospectus, key information documents (PRIIPs-KIDs) and, in addition, the semi-annual and annual reports), which provide detailed information about the purchase of units in the fund and the associated opportunities and risks, form the sole legal basis for the purchase of units. The aforementioned sales documents in German (as well as in unofficial translations in other languages) can be found at www.ethenea.com and are available free of charge from the investment company ETHENEA Independent Investors S.A. and the custodian bank, as well as from the respective national paying or information agents and from the representative in Switzerland. The paying or information agents for the funds Ethna-AKTIV, Ethna-DEFENSIV and Ethna-DYNAMISCH are the following: Austria, Belgium, Germany, Liechtenstein, Luxembourg: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg; France: CACEIS Bank France, 1-3 place Valhubert, F-75013 Paris; Italy: State Street Bank International – Succursale Italia, Via Ferrante Aporti, 10, IT-20125 Milano; Société Génerale Securities Services, Via Benigno Crespi, 19/A - MAC 2, IT-20123 Milano; Banca Sella Holding S.p.A., Piazza Gaudenzio Sella 1, IT-13900 Biella; Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Spain: ALLFUNDS BANK, S.A., C/ Estafeta, 6 (la Moraleja), Edificio 3 – Complejo Plaza de la Fuente, ES-28109 Alcobendas (Madrid); Switzerland: Representative: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Paying Agent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. The paying or information agents for HESPER FUND, SICAV - Global Solutions are the following: Austria, Belgium, France, Germany, Luxembourg: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg; Italy: Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Switzerland: Representative: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Paying Agent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. The investment company may terminate existing distribution agreements with third parties or withdraw distribution licences for strategic or statutory reasons, subject to compliance with any deadlines. Investors can obtain information about their rights from the website www.ethenea.com and from the sales prospectus. The information is available in both German and English, as well as in other languages in individual cases. Producer: ETHENEA Independent Investors S.A.. Distribution of this document to persons domiciled in countries in which the fund is not authorised for distribution, or in which authorisation for distribution is required, is prohibited. Units may only be offered to persons in such countries if this offer is in accordance with the applicable legal provisions and it is ensured that the distribution and publication of this document, as well as an offer or sale of units, is not subject to any restrictions in the respective jurisdiction. In particular, the fund is not offered in the United States of America or to US persons (within the meaning of Rule 902 of Regulation S of the U.S. Securities Act of 1933, in its current version) or persons acting on their behalf, on their account or for the benefit of a US person. Past performance should not be taken as an indication or guarantee of future performance. Fluctuations in the value of the underlying financial instruments or their returns, as well as changes in interest rates and currency exchange rates, mean that the value of units in a fund, as well as the returns derived from them, may fall as well as rise and are not guaranteed. The valuations contained herein are based on a number of factors, including, but not limited to, current prices, estimates of the value of the underlying assets and market liquidity, as well as other assumptions and publicly available information. In principle, prices, values, and returns can both rise and fall, up to and including the total loss of the capital invested, and assumptions and information are subject to change without prior notice. The value of the invested capital or the price of fund units, as well as the resulting returns and distribution amounts, are subject to fluctuations or may cease altogether. Positive performance in the past is therefore no guarantee of positive performance in the future. In particular, the preservation of the invested capital cannot be guaranteed; there is therefore no warranty given that the value of the invested capital or the fund units held will correspond to the originally invested capital in the event of a sale or redemption. Investments in foreign currencies are subject to additional exchange rate fluctuations or currency risks, i.e. the performance of such investments also depends on the volatility of the foreign currency, which may have a negative impact on the value of the invested capital. Holdings and allocations are subject to change. The management and custodian fees, as well as all other costs charged to the fund in accordance with the contractual provisions, are included in the calculation. The performance calculation is based on the BVI (German federal association for investment and asset management) method, i.e. an issuing charge, transaction costs (such as order fees and brokerage fees), as well as custodian and other management fees are not included in the calculation. The investment performance would be lower if the issuing surcharge were taken into account. No guarantee can be given that the market forecasts will be achieved. Any discussion of risks in this publication should not be considered a disclosure of all risks or a conclusive handling of the risks mentioned. Explicit reference is made to the detailed risk descriptions in the sales prospectus. No guarantee can be given that the information is correct, complete or up to date. The content and information are subject to copyright protection. No guarantee can be given that the document complies with all statutory or regulatory requirements which countries other than Luxembourg have defined for it. Note: The most important technical terms can be found in the glossary at www.ethenea.com/glossary. Information for investors in Belgium: The prospectus, the key information documents (PRIIPs-KIDs), the annual reports and the semi-annual reports of the sub-fund are available in French free of charge upon request from the investment company ETHENEA Independent Investors S.A., 16, rue Gabriel Lippmann, 5365 Munsbach, Luxembourg and from the representative: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg. Information for investors in Switzerland: The country of origin of the collective investment scheme is Luxembourg. The representative in Switzerland is IPConcept (Schweiz) AG, Münsterhof 12, P.O. Box, CH-8022 Zurich. The paying agent in Switzerland is DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zurich. The prospectus, the key information documents (PRIIPs-KIDs), and the Articles of Association, as well as the annual and semi-annual reports, can be obtained free of charge from the representative. Copyright © ETHENEA Independent Investors S.A. (2024) All rights reserved. 04/02/2019

Select your profile