Is a no-deal Brexit becoming a reality?

The members of the British Conservative Party have elected Boris Johnson as their new leader. He therefore succeeds Theresa May as Prime Minister of Great Britain. And the shake-up has already started. A dubious reputation preceded the former Mayor of London and Foreign Secretary. He is a staunch Brexiteer and has called for the renegotiation of the agreement reached between the EU and representatives of the previous government under Theresa May. He quickly reshuffled the cabinet and announced that, if the EU made no concessions and insisted upon the agreement negotiated with Theresa May, his intention was to withdraw without a deal if need be. To drive home this threat, he formed a cabinet committee tasked solely with handling preparations for a no-deal Brexit. The EU and the heads of government of the member states, however, have already announced that they are not prepared to renegotiate. The withdrawal deadline remains 31 October of this year. Will the UK leave the EU on 31 October without a deal?

No doubt the final decision will not be made until just before the deadline. The British public and Parliament, too, are deeply divided on the issue. There isn’t a majority in favour of any of the three options – a no-deal Brexit, the withdrawal agreement negotiated by Theresa May and the EU or the UK remaining in the EU – indeed, a majority opposes each of them. Furthermore, Boris Johnson’s government holds only the slimmest of majorities in the UK Parliament, by just one seat. There is therefore a very a real danger of a successful vote of no confidence if Johnson leads the UK into a no-deal Brexit undeterred.

The biggest stumbling block in the withdrawal negotiations remains the status of the border between the Republic of Ireland and Northern Ireland. When a final border solution could not be arrived at, an arrangement known as the Backstop was introduced into the negotiated deal. Under the Backstop, the UK and the EU remain in a customs union for as long as the border issue remains unresolved, even after a transition period. This is unacceptable to hardline Brexiteers, who fear they will be stuck forever in a customs union with the EU.

However, it is hard to imagine a workable solution that isn’t an open border for people and goods between the two Irish jurisdictions (Northern Ireland remains part of the EU single market) or a hard border with border controls. The former is rejected by Brexiteers while the latter is opposed by Ireland in particular. Another solution, of course, would be a united Ireland, but that is certainly not an aspiration of the government in London. For those in favour of uniting the two territories on the island of Ireland, however, opportunity is knocking. The existence of the all-Ireland national rugby union team shows – at least on a small scale – that uniting can work.

Ambitions for Scottish independence have also been reignited by Boris Johnson’s uncompromising attitude. Even in Wales (where a majority voted Leave in the Brexit referendum), independence aspirations are growing. The possibility of Little Britain – that is, England – is thus increasing, bearing in mind that it is already a reality in football.

By voting Leave, Great Britain has steered itself into a cul-de-sac and at the moment it seems unable to navigate its way out. Those who voted Leave are split into proponents of a no-deal Brexit and those who do not want to leave the EU without a deal. None of the options – including remaining in the EU – has a majority, and an election will do nothing to change that. The harm it is doing to the economy is already enormous, and at least some of it is irreversible. The unexpectedly strong economic growth at the beginning of the year is due solely to stockpiling in anticipation of the original Brexit deadline of 31 March. Property prices are falling sharply, retailers are collapsing, foreign workers have already left the country and industry has long ago scaled back investments and shut down plants because of the uncertainty. The leading owner of shopping centres in the UK, Intu Properties plc, for example, has already written down the value of its properties in the first half of 2019 by almost 10% to GBP 8.4 billion. Rental income fell by 8% due to the insolvencies of the two retail chains Debenhams and Arcadia. According to information from the Society of Motor Manufacturers & Traders (SMMT), foreign investment in the automotive industry in the first half of 2019 dropped to a low of GBP 90 million, compared to investment of GBP 347 million in the same period of 2018. The figure for 2017 was an impressive GBP 647 million. Car production in the UK has been particularly hard hit, as not only is it being hurt by Brexit but also by the general structural change in the sector. Ford, Nissan, Honda and Jaguar Land Rover have all already announced layoffs, production relocations or even total factory shutdowns. The value of the pound sterling has therefore also fallen steeply of late.

The coming publications of economic indicators will make the damage clear. Whatever course the UK takes, things are not going to get any better for the foreseeable future. None of the familiar players is capable of resolving the mess. In Reykjavik, comedian Jon Gnarr was elected mayor in 2010, and he acquitted himself well. In the Ukraine, comedian Volodymyr Zelensky was recently elected President. It remains to be seen whether he can fulfil expectations. The UK is well known for its sense of humour. Which comedian could help it out of its predicament?

The duel: central banks against the economy – who will win?

The Fed has recently cut the benchmark rate by 0.25%. In our latest video, Harald Berres, one of the Lead Portfolio Managers of the Ethna-DYNAMISCH, goes into the factors that led the central bank to take this step.If you are having video playback issues, please click HERE.

Positioning of the Ethna Funds

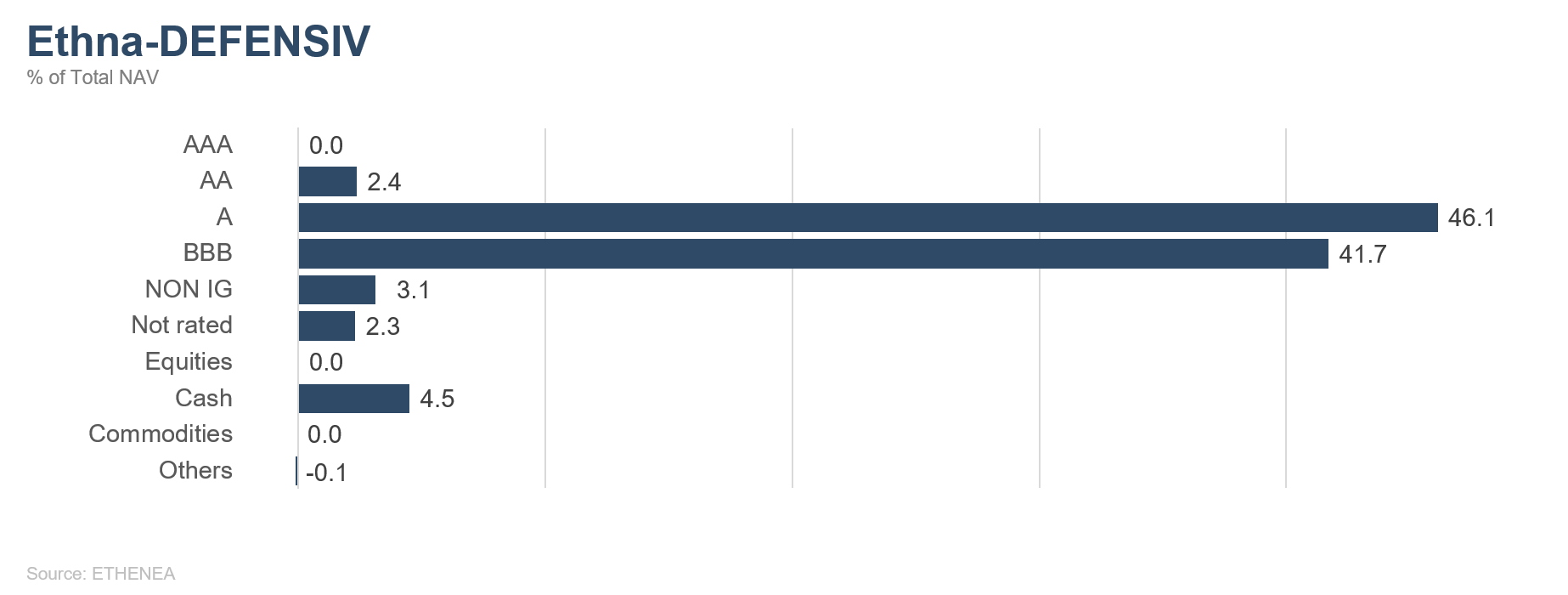

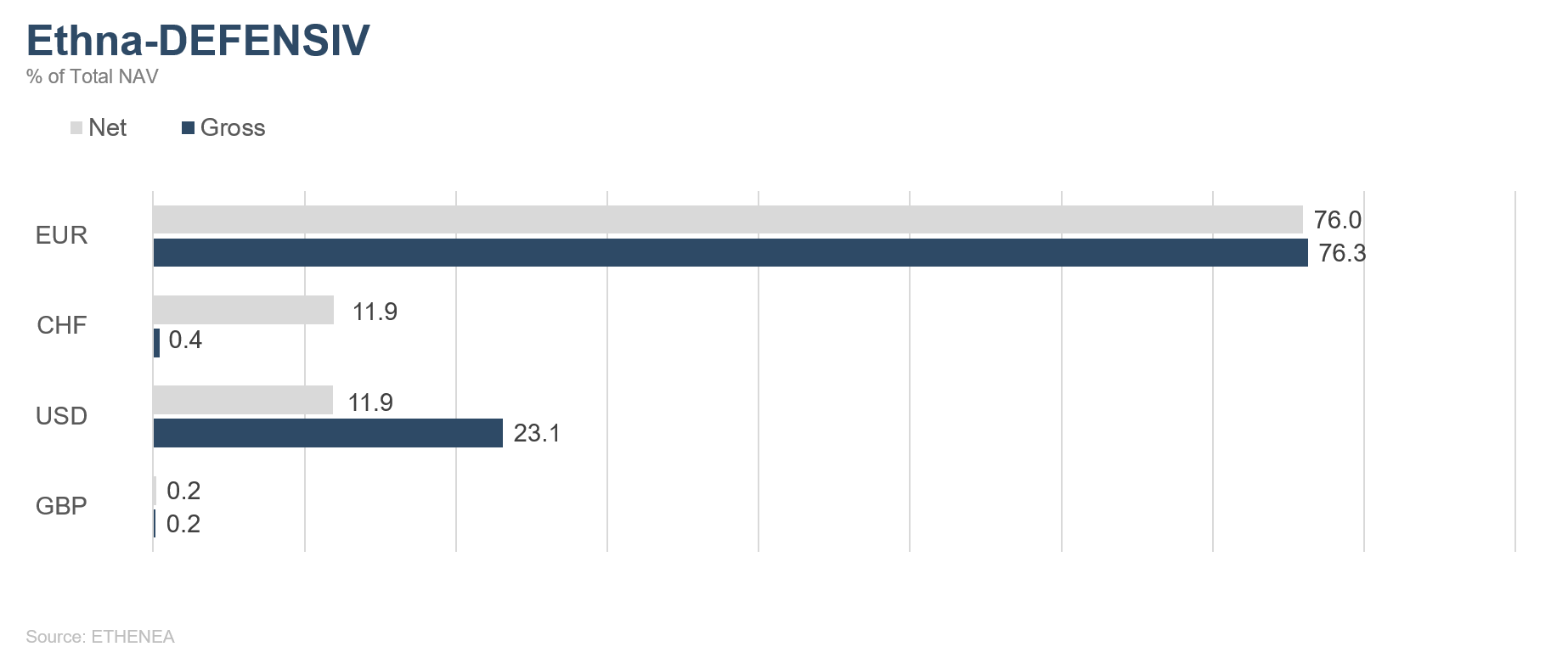

Ethna-DEFENSIV

In summertime the detailed analysis of data and information often quickly fades into the background. But this July there were economic data to be analysed in addition to countless tweets, political declarations and other trivialities. And the published indicators paint a mixed picture.

In Europe – Italy and France in particular – industrial data came as a positive surprise to markets. Industrial production in the eurozone rose again in July, but it is still down on last year’s figures. European industry is finding it hard to look ahead. The European Commission’s forward-looking Business Climate Indicator has fallen for the ninth time in succession. Companies are pessimistic about current and future production and about their order books. There are a number of contributing factors here. The increased likelihood of a disorderly Brexit, the global fall in demand for cars, the burden of tariffs – both those already imposed and possible additional ones – the reconfiguration of international supply chains and last, but not least, the rise in the price of oil are weighing on the manufacturing sector in the eurozone. Consequently, private consumers are also refraining from purchases, with the result that growth in retail sales in the core euro area is below expectations and the inflation figure for the euro area as a whole, at 1.1%, is well short of the ECB’s target of just under 2%.

Consumer sentiment in the US has restabilised recently. Record-low unemployment levels, higher hourly wages and rising real estate prices are boosting confidence among US consumers. Having said that, the uncertainty about future trade relations is still weighing on companies, which are exercising restraint in their investment decisions. The sentiment of US purchasing managers in the manufacturing sector continues to deteriorate, hitting the critical mark of 50 in July; anything below that is a sign of contraction in the sector. At the same time, the sentiment of purchasing managers in the US services sector slightly improved of late, but remains well below first-quarter levels.

In the decisions they made last month, both the ECB and the US central bank made it clear that they will continue their policy of easy money in order to boost inflation and protect the economy from sliding into recession. This helped US bonds and equities in particular, while in Europe concerns about a disorderly Brexit as well as mixed corporate results impacted on equities towards the end of the month. The Ethna-DEFENSIV benefited in particular from further increases in prices for corporate bonds in July, to the tune of 1.78%.

In light of the uncertainty about what direction the economy will take in the future, the Ethna-DEFENSIV remains invested in high-quality bonds from sectors with low cyclicality (percentage of the overall portfolio: 96%). In the expectation that interest rates will fall further, we have successively increased the bond duration from 6.5 to 6.7 by reallocating somewhat to bonds denominated in USD. In order to get extra benefit from falling interest rates in the US and possibly in the UK too, we have allocated 10% of the exposure to 10-year Gilt futures in addition to the existing 10-year US Treasury futures (percentage of the bond portfolio: 12%).

Lastly, we increased the existing position in the safe-haven currency Swiss franc by three percentage points, to 12%. The open USD exposure also increased by 2 percentage points to 12%.

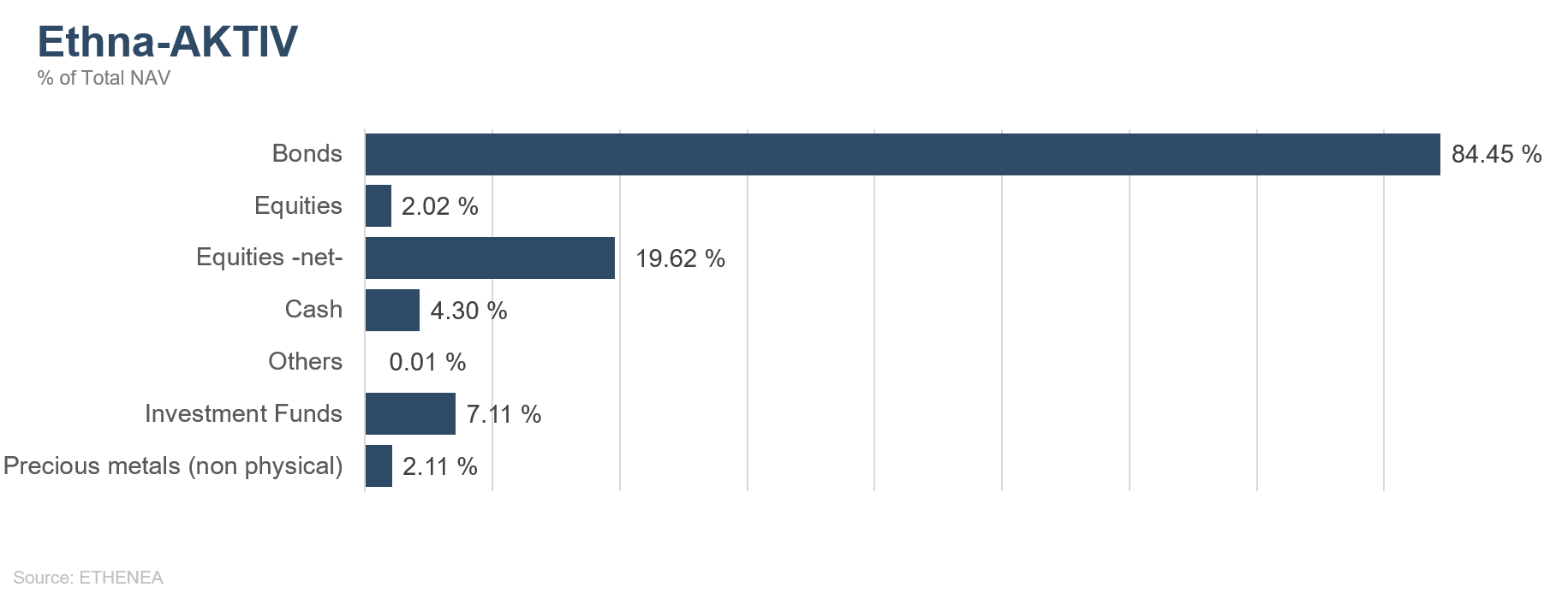

Ethna-AKTIV

In July, too, the Ethna-AKTIV portfolio, with its low volatility, benefited from the good conditions in capital markets. Credit spreads fell worldwide, interest rates fell further – at least in Europe – the US dollar was strong and the US equity market was slightly up; all of which had a positive effect on the portfolio.

In light of these market movements and another underperformance from European and Asian equities, the portfolio, which remains focused on bonds and with a relative overweighting in US equities (15% exposure) and USD (23% exposure), was well positioned. The bond allocation, which exceeds 80%, remains the portfolio’s main performance driver. While this component of the portfolio contributed around two thirds to the performance for the month, the YTD contribution already amounts to about four fifths of the YTD performance. We participated relatively little in the stunning rally in equities, as we deliberately allocated the available risk budget to other asset classes, particularly at the beginning of the year, but also when equities hit fresh highs as the year went on due to low interest rates. In light of the new global cycle of rate cuts, on which the Fed also embarked on 31 July, we will maintain this positioning. Both the current reporting season and some leading indicators paint a mixed picture of the global economy.

This, combined with falling inflation figures and expectations, creates for us a baseline scenario with weaker global growth, which is to be forestalled by further falls in interest rates and possibly fresh quantitative easing. Whether or not this is successful depends not least on the outcome of the ongoing trade talks between the US and China. We, however, remain sceptical about a swift resolution and about the benefit of monetary measures. For the positioning of our portfolio, this means that we expect further falls in interest rates, especially in the US, and we have therefore increased the duration overlay again after closing out in June. The Swiss franc position was expanded last month, to 12%.

We are of the opinion that the Swiss National Bank (SNB) has less scope to make cuts than the ECB, and that this safe-haven currency will therefore become more attractive in the event that the ECB reduces interest rates. After things had quietened down somewhat on the Brexit front for a time, the Boris Johnson-led government is setting the ball rolling again on withdrawal negotiations. We believe it very likely that the Bank of England will take supportive action, not only because the probability of a no-deal Brexit is again increasing, but also because some of the economic fallout of the exit discussion has already occurred. For this reason, we expanded our position in UK sovereign bonds to 12% over the course of the month.

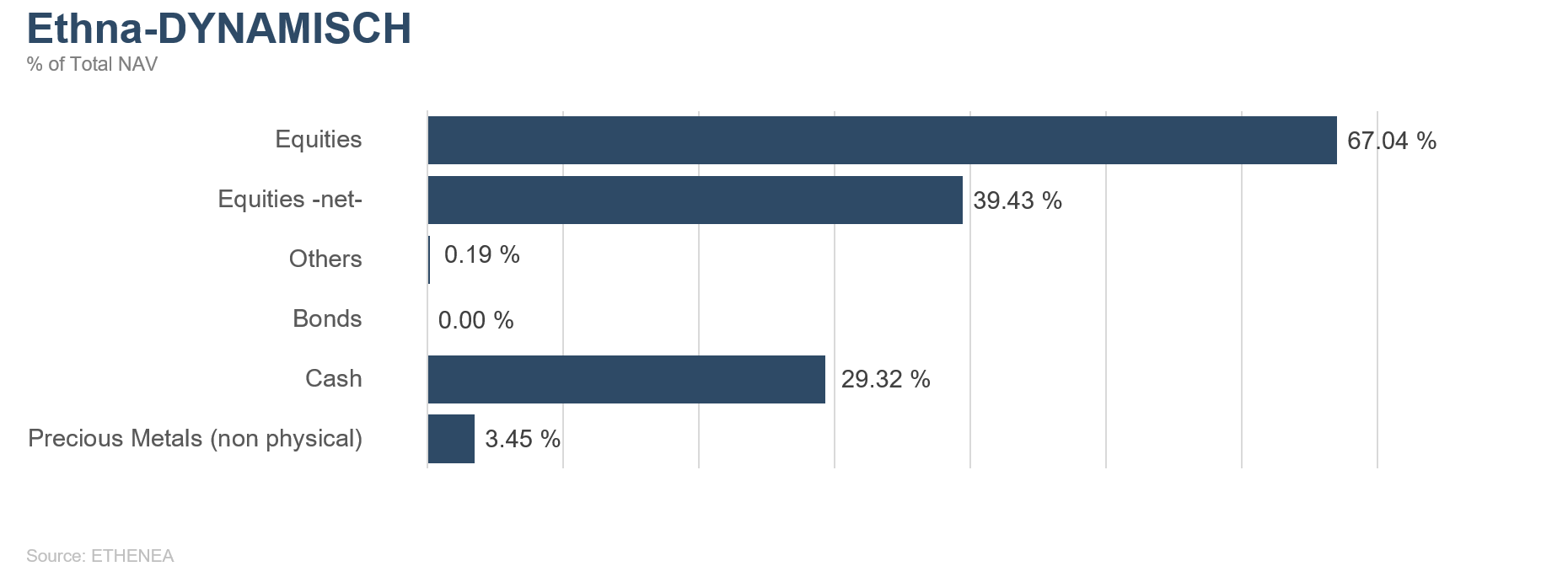

Ethna-DYNAMISCH

Despite a number of flashpoints in the world, equity markets were unstoppable in July, too, and remained positive. Many of the leading indices – above all in the US – climbed to new all-time highs. What’s amazing is the uniformity of performance in Europe and the US. YTD the S&P 500 and the STOXX Europe 600 are almost neck and neck. In July, too, stock exchanges were driven more by the looser monetary policy worldwide than by fundamental data.

The ECB came across as very supportive in its latest meeting, and signalled that it would remain so. Given that the economic situation in the US remains robust, the Fed was slightly more moderate in its choice of words. Still, it made the first rate cut (0.25%) in 10 years at the end of July. And this is where the conflict lies. While the stock exchanges are largely in positive unison, the economic divide between the US and the rest of the world is widening, and the European industrial sector is feeling it in particular. While the sentiment indicators in the services sector are stable, they have been dropping off in the manufacturing sector for months, and are now reaching a critical level.

As the top location for industry in Europe, Germany in particular is struggling with low expectations. A number of profit warnings from major companies, such as BASF and Daimler, go to show how poor sentiment is in those sectors. The crucial question in the coming weeks will be: can the measures announced and implemented by the central banks reanimate the economy, or are we slowly getting into uncomfortable territory, and perhaps a recession? Stock markets are close to their highs, and are not prepared for a downturn. This is precisely where the danger lies in the seasonally rather weaker summer months of August and September. In the short term, there is too much euphoria and recklessness at play, which makes the stock markets very vulnerable to corrections. From an economic perspective, another rate cut by the Fed is not essential; rather, politicians (note the comments from US President Trump) and public opinion are calling for further cuts. If the Fed does not adopt a clear position in relation to further rate cuts in the next few weeks, US markets could react huffily.

Within the portfolio, we closed the position in BASF stocks following a profit warning, and further reduced the cyclical component of the fund. Relative to the severity of the profit warning, the share’s reaction was mild, with a single-digit percentage share price loss. However, the valuation rose due to the lower estimates. This leaves the share vulnerable to further losses in the current environment.

Due to the current high expectations of the markets, the weak performance of the stock market over the summer months and the still unresolved conflicts (Brexit and trade war), the average equity allocation in July was a moderate 40%.

If the central bank measures announced bring about positive growth in the coming weeks, our cash position means we are well placed to increase the allocation significantly at any time. Given the extremely low interest rates in the US and the low-for-longer-perhaps-forever interest rate policy that is more and more evident, especially in Europe, equities will remain a core investment within the Ethna-DYNAMISCH portfolio in the medium term.

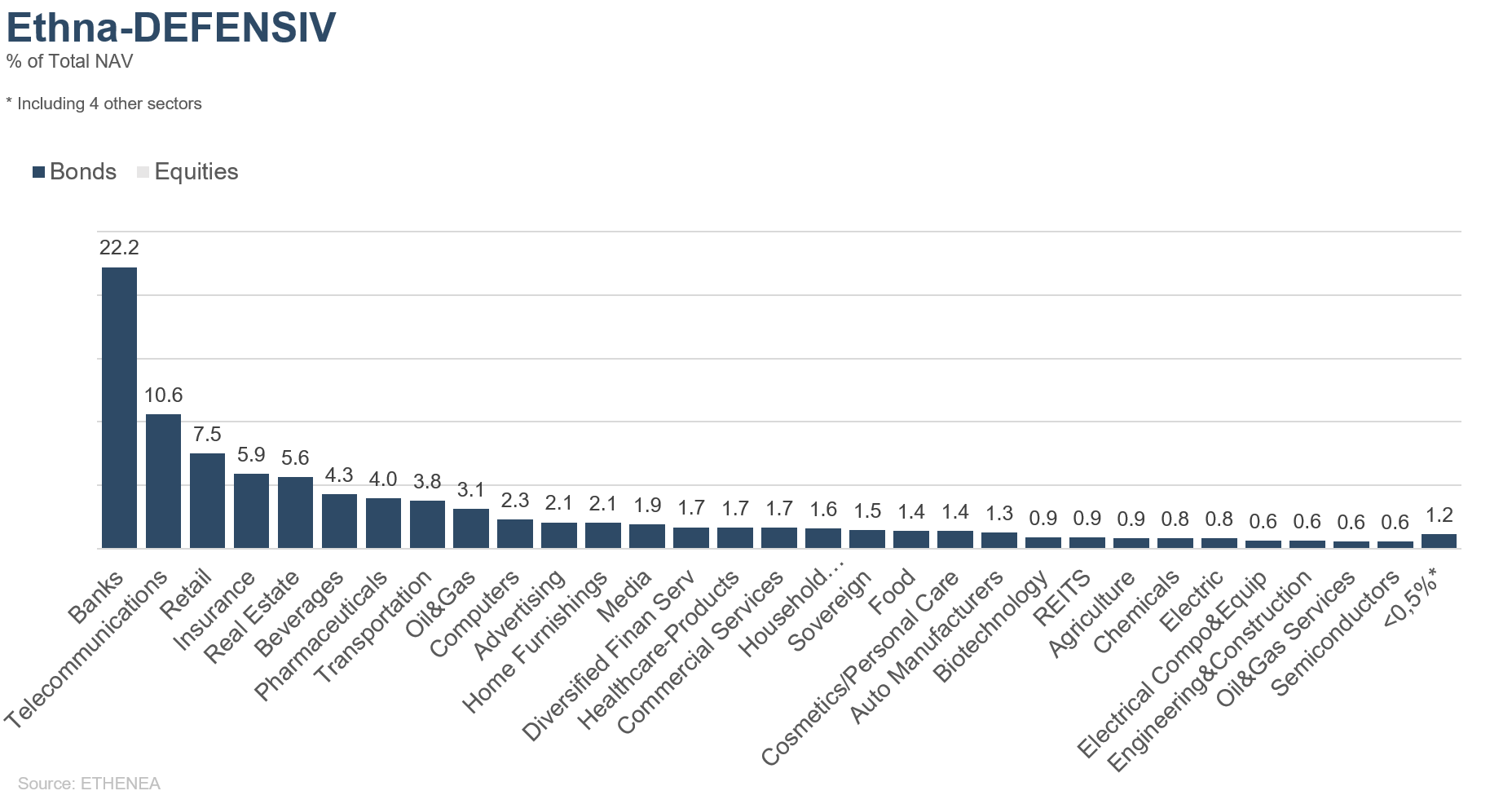

Figure 1: Portfolio structure* of the Ethna-DEFENSIV

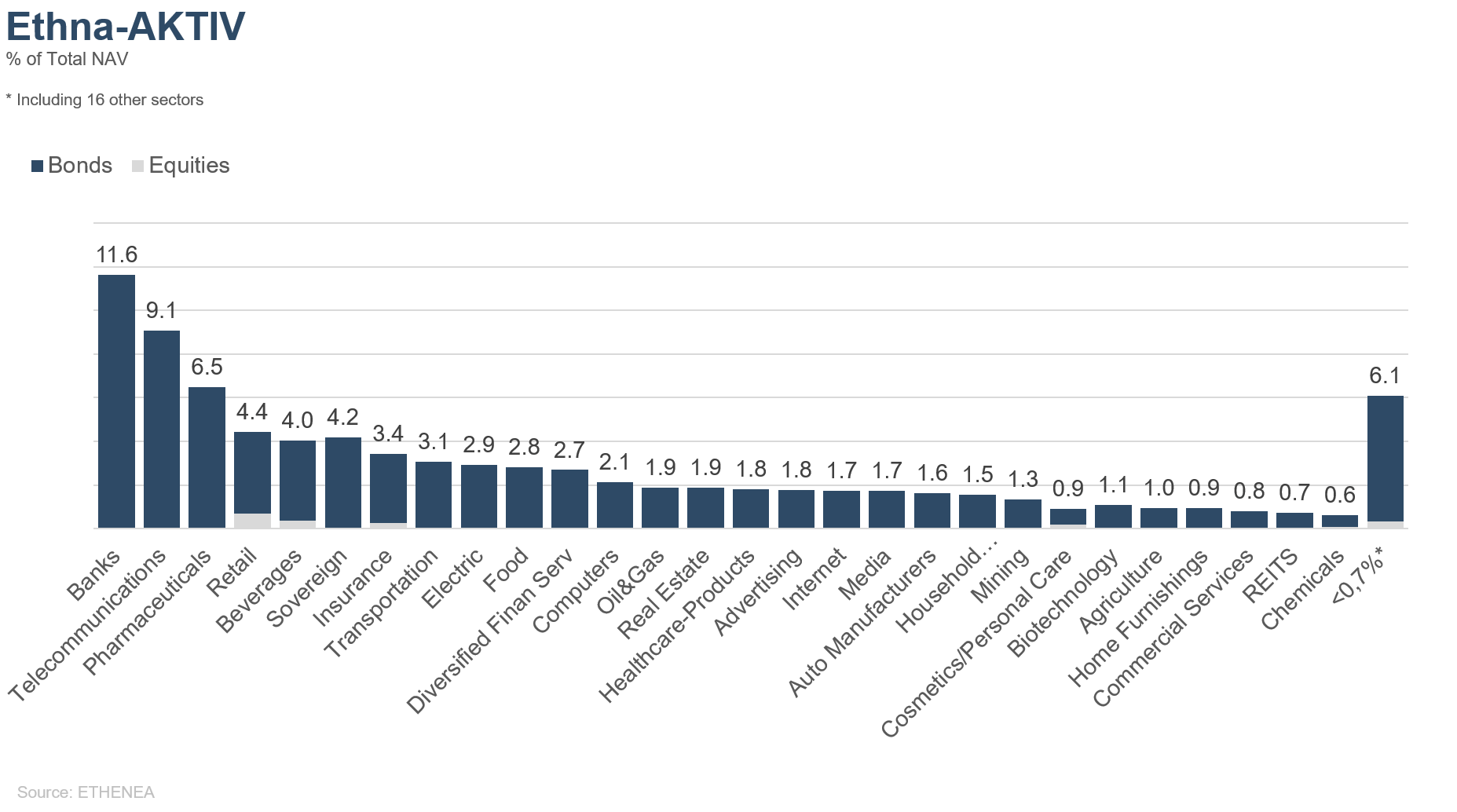

Figure 2: Portfolio structure* of the Ethna-AKTIV

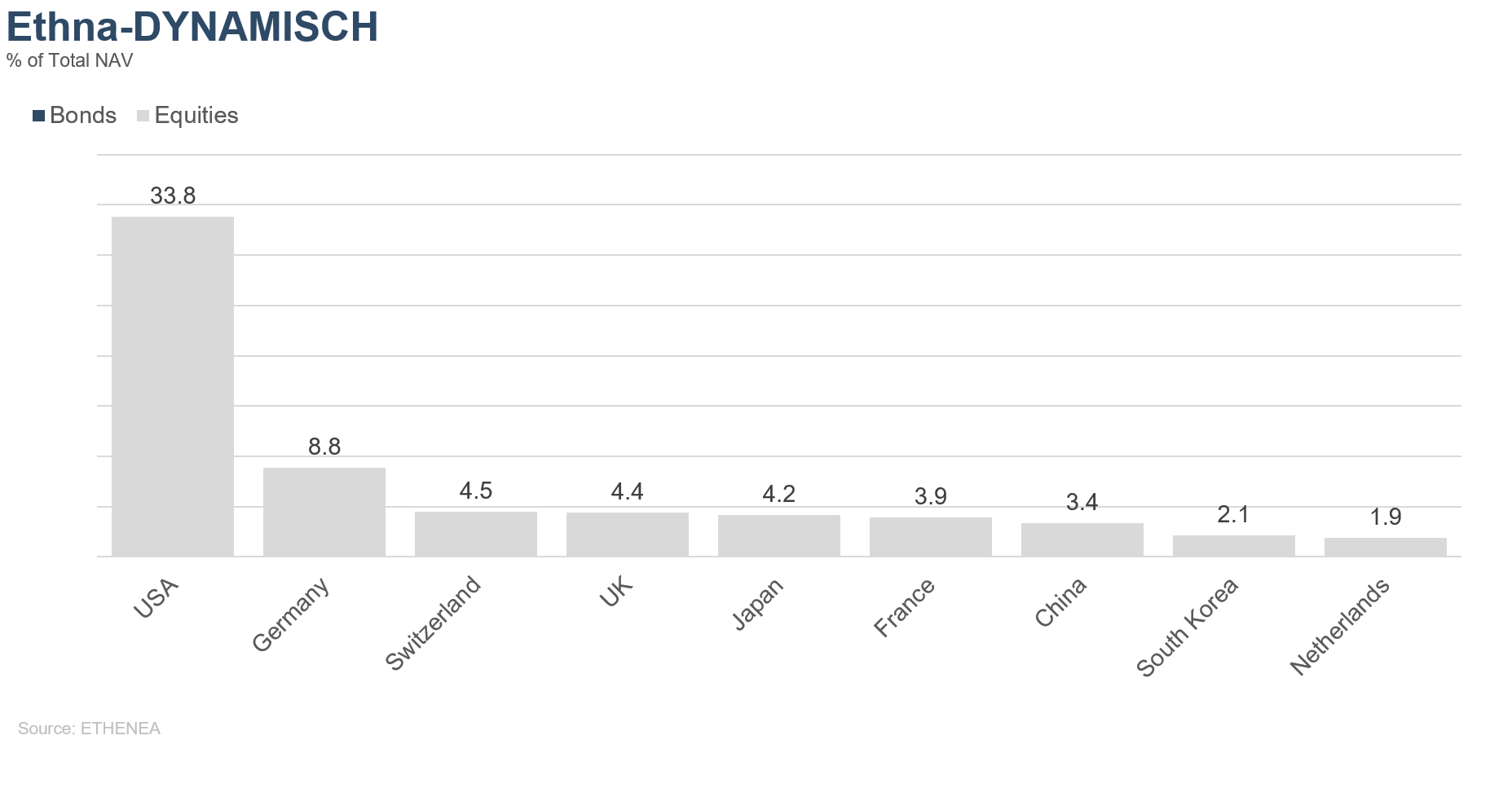

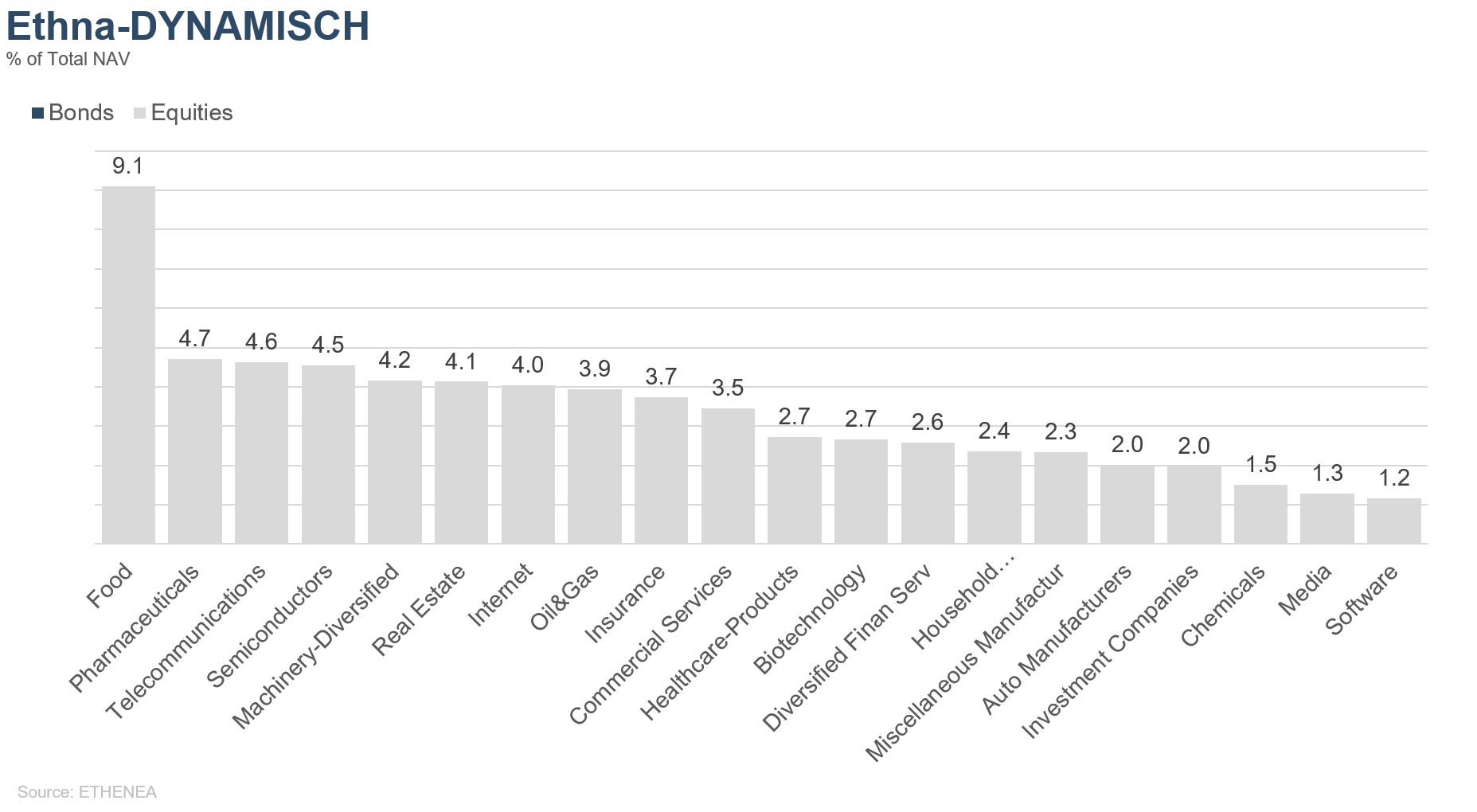

Figure 3: Portfolio structure* of the Ethna-DYNAMISCH

Figure 4: Portfolio composition of the Ethna-DEFENSIV by currency

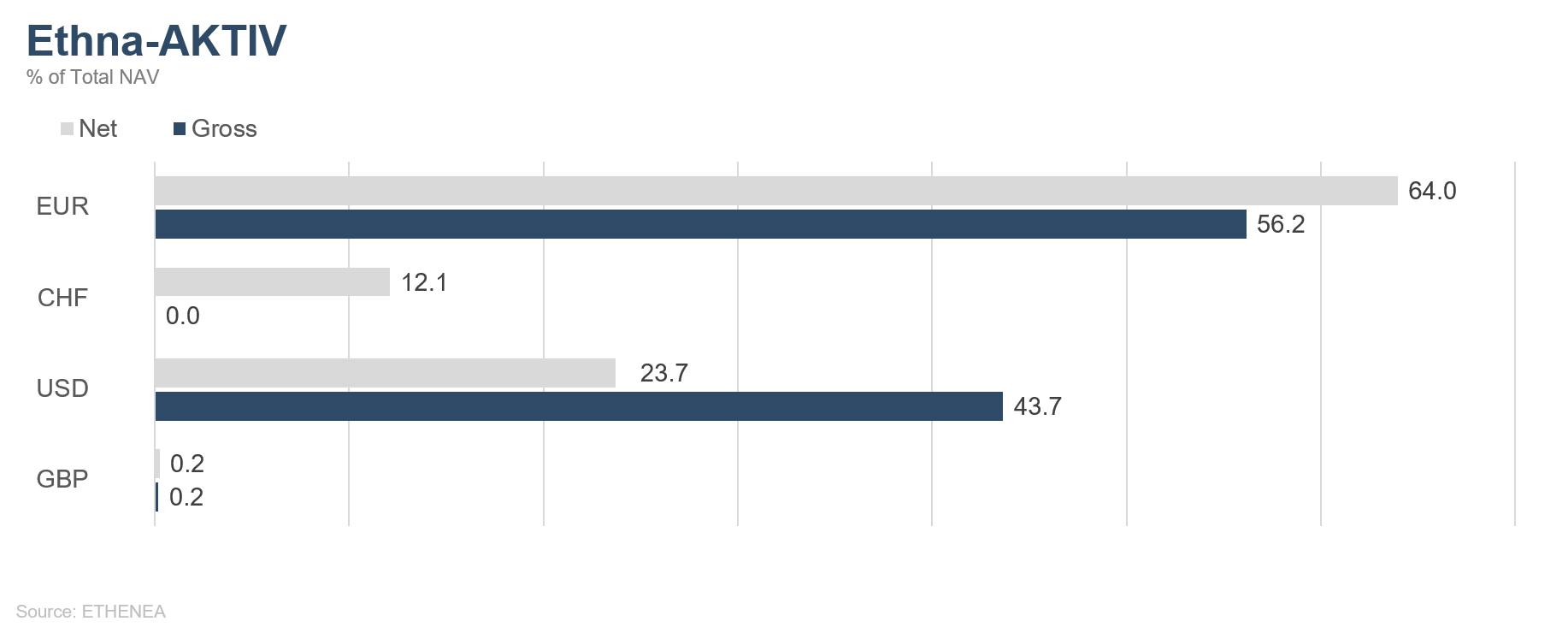

Figure 5: Portfolio composition of the Ethna-AKTIV by currency

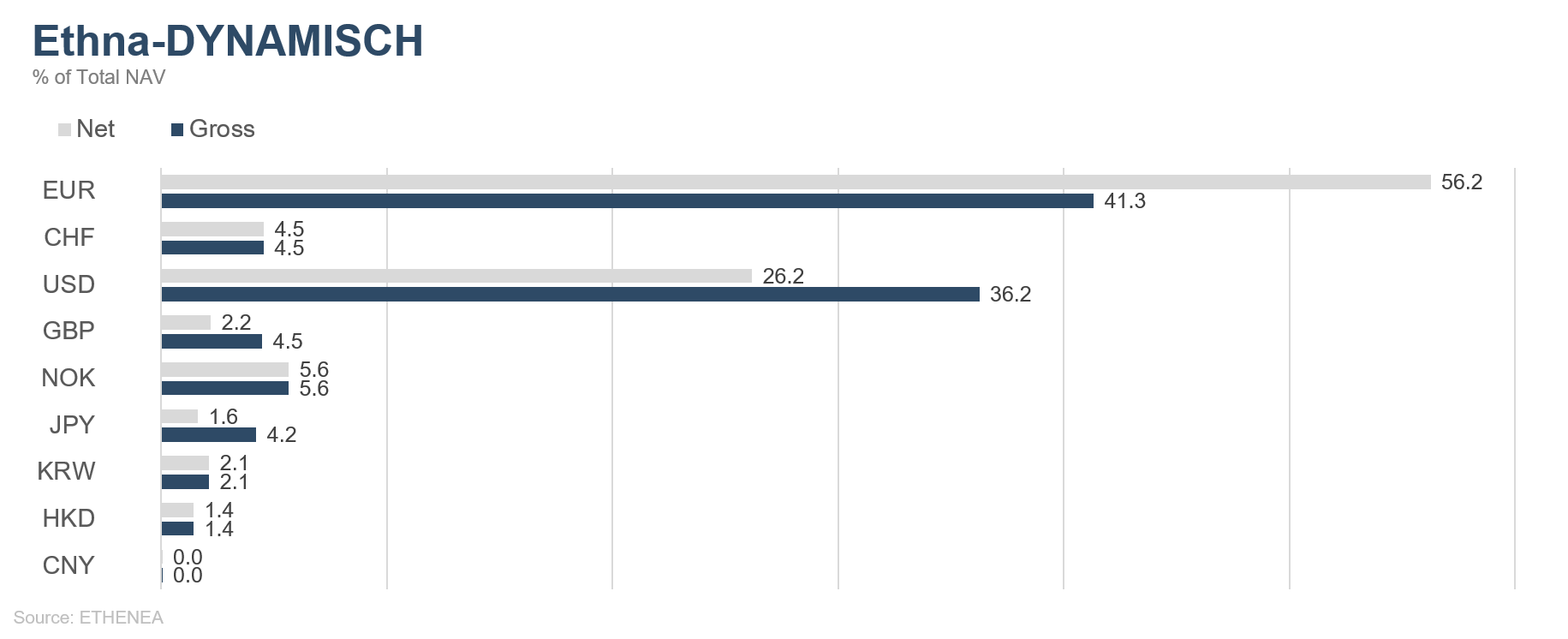

Figure 6: Portfolio composition of the Ethna-DYNAMISCH by currency

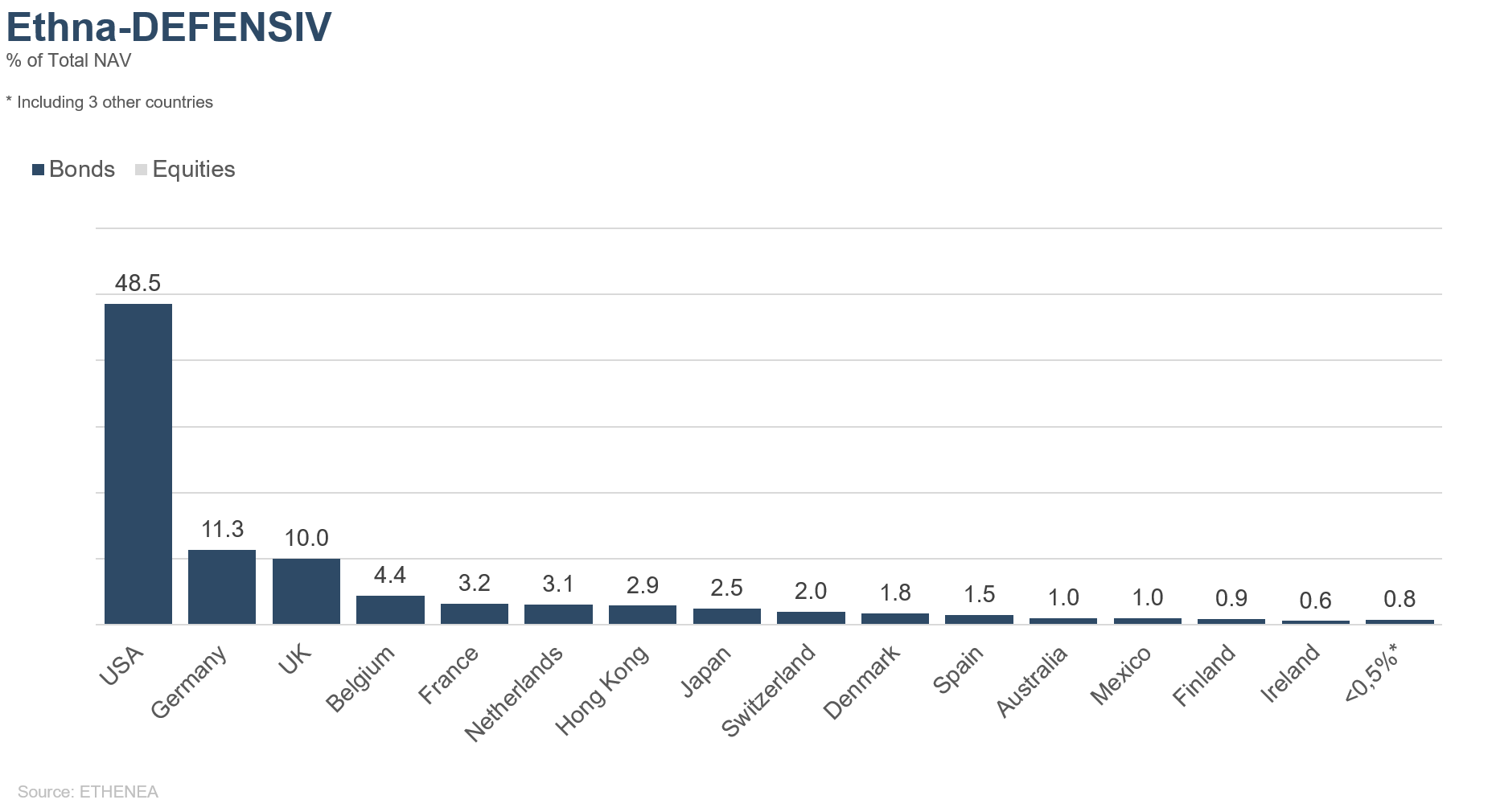

Figure 7: Portfolio composition of the Ethna-DEFENSIV by country

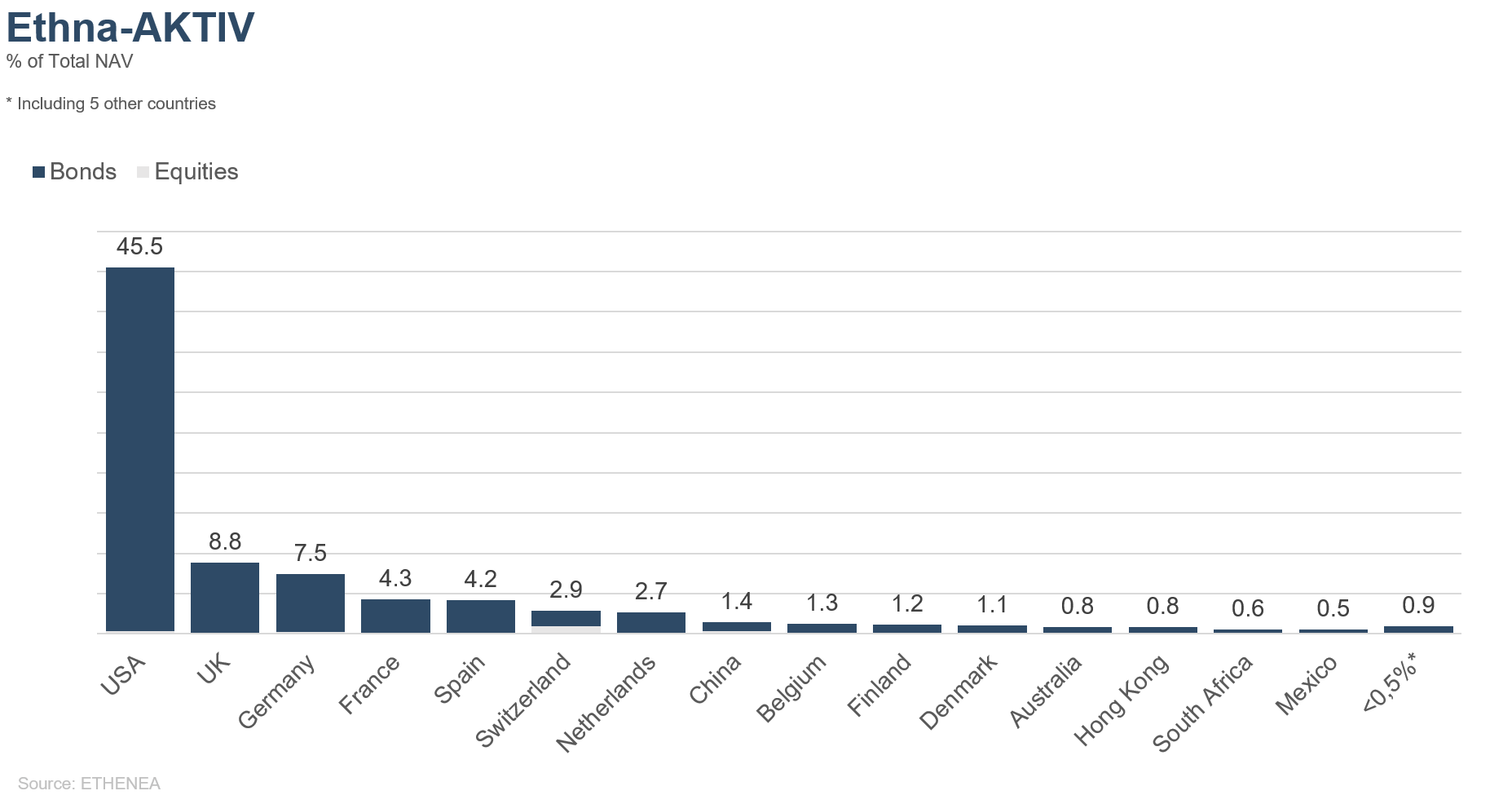

Figure 8: Portfolio composition of the Ethna-AKTIV by country

Figure 9: Portfolio composition of the Ethna-DYNAMISCH by country

Figure 10: Portfolio composition of the Ethna-DEFENSIV by issuer sector

Figure 11: Portfolio composition of the Ethna-AKTIV by issuer sector

Figure 12: Portfolio composition of the Ethna-DYNAMISCH by issuer sector

* “Cash” comprises term deposits, call money and current accounts/other accounts. “Equities net” comprises direct investments and exposure resulting from equity derivatives.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

This marketing communication is for information purposes only. It may not be passed on to persons in countries where the fund is not authorized for distribution, in particular in the USA or to US persons. The information does not constitute an offer or solicitation to buy or sell securities or financial instruments and does not replace investor- and product-related advice. It does not take into account the individual investment objectives, financial situation, or particular needs of the recipient. Before making an investment decision, the valid sales documents (prospectus, key information documents/PRIIPs-KIDs, semi-annual and annual reports) must be read carefully. These documents are available in German and as non-official translations from ETHENEA Independent Investors S.A., the custodian, the national paying or information agents, and at www.ethenea.com. The most important technical terms can be found in the glossary at www.ethenea.com/glossary/. Detailed information on opportunities and risks relating to our products can be found in the currently valid prospectus. Past performance is not a reliable indicator of future performance. Prices, values, and returns may rise or fall and can lead to a total loss of the capital invested. Investments in foreign currencies are subject to additional currency risks. No binding commitments or guarantees for future results can be derived from the information provided. Assumptions and content may change without prior notice. The composition of the portfolio may change at any time. This document does not constitute a complete risk disclosure. The distribution of the product may result in remuneration to the management company, affiliated companies, or distribution partners. The information on remuneration and costs in the current prospectus is decisive. A list of national paying and information agents, a summary of investor rights, and information on the risks of incorrect net asset value calculation can be found at www.ethenea.com/legal-notices/. In the event of an incorrect NAV calculation, compensation will be provided in accordance with CSSF Circular 24/856; for shares subscribed through financial intermediaries, compensation may be limited. Information for investors in Switzerland: The home country of the collective investment scheme is Luxembourg. The representative in Switzerland is IPConcept (Suisse) AG, Bellerivestrasse 36, CH-8008 Zurich. The paying agent in Switzerland is DZ PRIVATBANK (Suisse) AG, Bellerivestrasse 36, CH-8008 Zurich. Prospectus, key information documents (PRIIPs-KIDs), articles of association, and the annual and semi-annual reports can be obtained free of charge from the representative. Information for investors in Belgium: The prospectus, key information documents (PRIIPs-KIDs), annual reports, and semi-annual reports of the sub-fund are available free of charge in German upon request from ETHENEA Independent Investors S.A., 16, rue Gabriel Lippmann, 5365 Munsbach, Luxembourg, and from the representative: DZ PRIVATBANK AG, Niederlassung Luxemburg, 4, rue Thomas Edison, L-1445 Strassen, Luxembourg. Despite the greatest care, no guarantee is given for the accuracy, completeness, or timeliness of the information. Only the original German documents are legally binding; translations are for information purposes only. The use of digital advertising formats is at your own risk; the management company assumes no liability for technical malfunctions or data protection breaches by external information providers. The use is only permitted in countries where this is legally allowed. All content is protected by copyright. Any reproduction, distribution, or publication, in whole or in part, is only permitted with the prior written consent of the management company. Copyright © ETHENEA Independent Investors S.A. (2025). All rights reserved. 02/08/2019