Is inflation about to make a comeback?

These days, the media is forever warning that inflation is about to make a comeback, raising the spectre of the hyperinflation of the 1920s. The question is, are fears of inflation in general, or indeed hyperinflation, really justified?

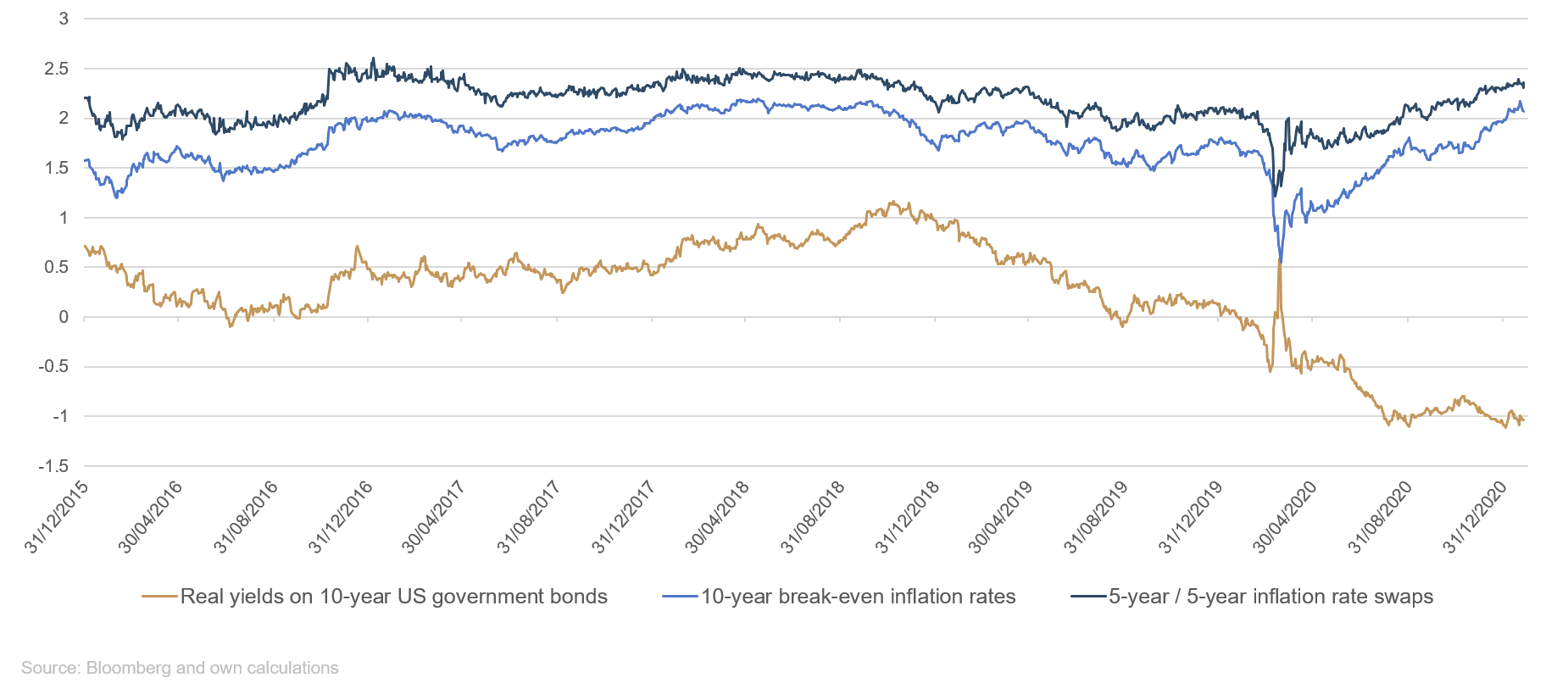

If we take a look at market sentiment, it seems to be anticipating a rise in inflation at the very least. Market-based inflation expectations in the form of five-year forward inflation swaps (i.e. average expected inflation over five years, five years from now) and 10-year breakeven inflation rates have recently hit a two-year high (Figure 1).

Figure 1: Inflation expectations are rising

A sharp rise in inflation would have dramatic consequences. Already, after inflation, U.S. Treasuries and around a third of investment grade bonds denominated in USD are in negative territory. A great many of these companies are therefore being paid for taking on debt. At the same time, this is also increasing investor risk. A rise in inflation would also push up yields again in the long term. This would be disastrous for bond investors, as the price of low-yielding securities in particular could be expected to fall sharply. Central banks are trying to combat this at the moment with their accommodative monetary policy, but doubts about the effectiveness of the measures are already becoming more widespread.

One-off effects could cause inflationary pressure in the short term

In the near term, there does seem to be plenty to suggest a rise in consumer prices. The main reason is an array of technical effects. The price of oil reached record lows in March and April of last year. It has since recovered from these lows. However, since the inflation rate is the percentage change in the price index of a period compared with the same period the previous year, this “basis effect” will cause palpable inflationary pressure purely on a mathematical basis. Even if you were to exclude the price of oil from inflation and limit yourself to core inflation, it could indirectly reach the consumer due to rising producer prices.

Furthermore, VAT rates were reduced in many countries, including Germany, in the middle of last year in order to boost consumption. The low VAT rates seem to have been passed on to end consumers, at least in some cases. While this did rein in price inflation, the return to the previous standard rates at the beginning of the year is likely to boost consumer prices.

In addition, since the beginning of this year, a charge of EUR 25 per tonne of carbon dioxide emitted in the burning of diesel, petrol, heating oil and natural gas applies to the manufacturers and providers of goods and services as part of the new German carbon tax regime. If these additional costs are passed on to consumers, goods and services that impact the climate will become more expensive and inflation will increase. Finally, the incremental increase in the statutory minimum wage from EUR 9.35 to EUR 9.50 and, in July this year, to EUR 9.60 could have a positive effect on inflation in the short term.

Signs of a speculative bubble are mounting

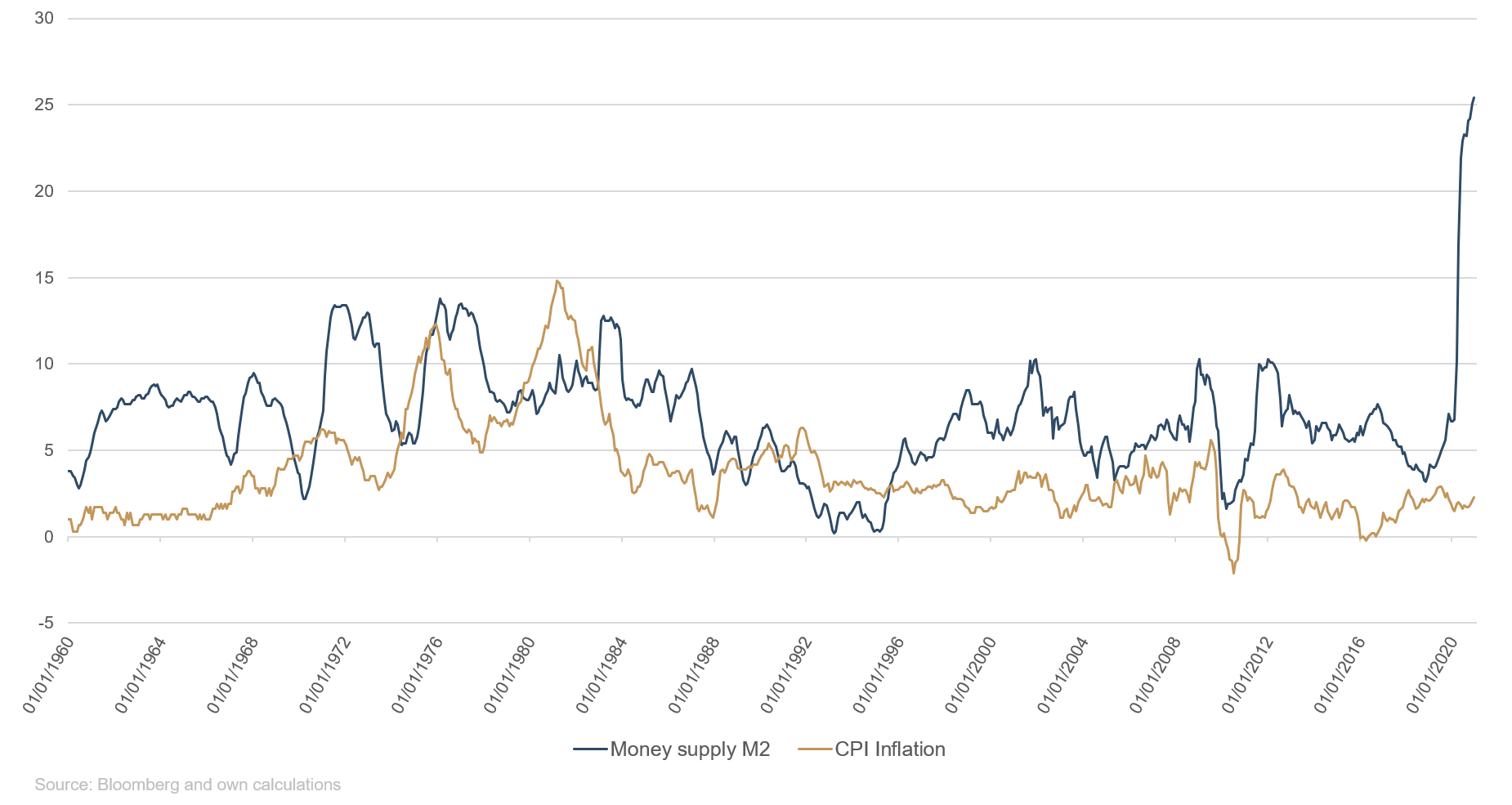

Furthermore, expansionary fiscal and monetary policy is likely to further drive inflation. Last year, the U.S. central bank cut the key rate to zero and massively expanded its bond purchases by buying USD 80 billion in U.S. Treasuries and USD 40 billion in mortgage-backed securities a month. In the U.S. alone, the money supply grew by 25% between March and November 2020 (Figure 2).

Then there’s the unprecedented level of fiscal stimuli. The U.S. Congress approved a new USD 900 billion pandemic relief package back in December and U.S. President Joe Biden has proposed a further rescue plan of USD 1.9 trillion. It includes top-ups of the USD 600 provided to millions of Americans in the previous bill, bringing the direct payment to USD 2,000 in total.

Figure 2: The increase in the U.S. money supply last year was the biggest in 60 years

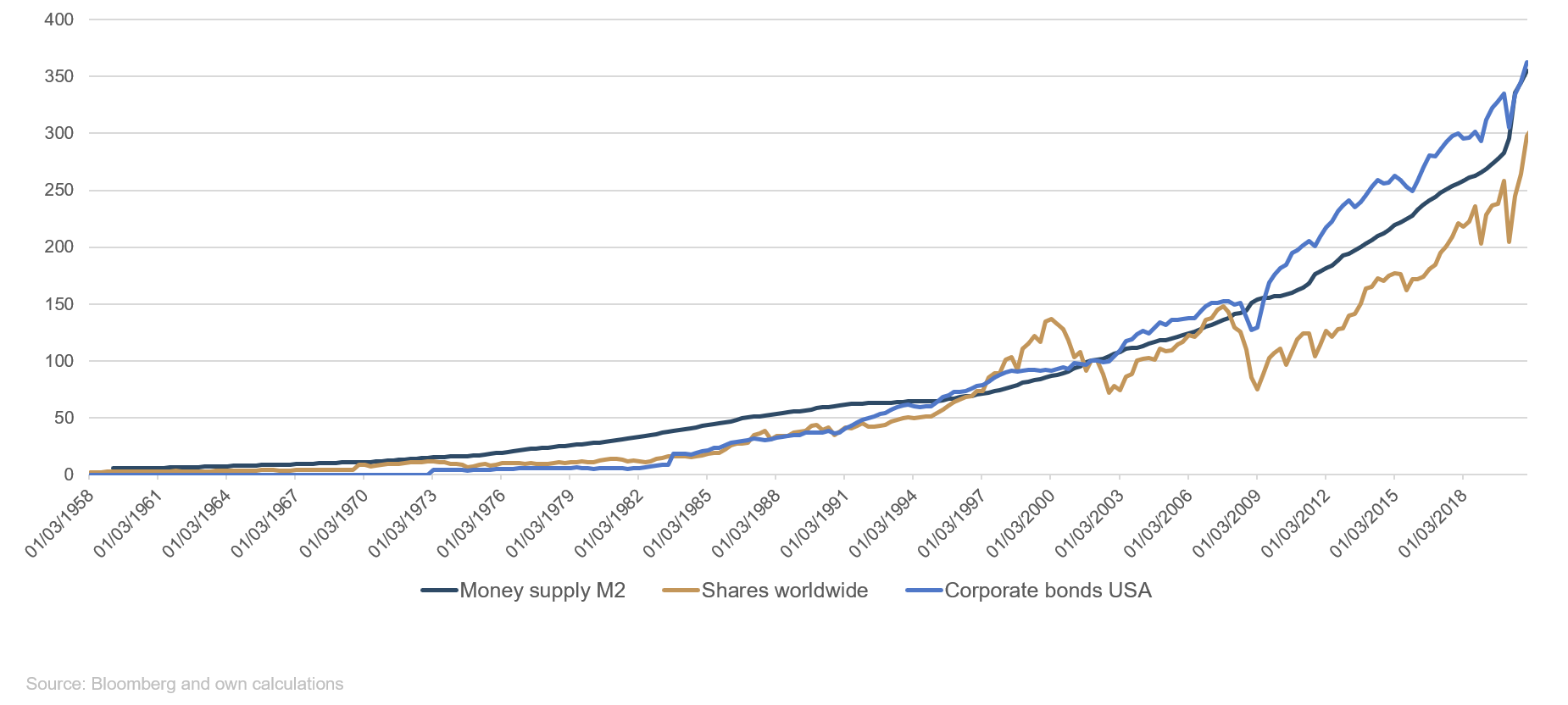

Despite massive government spending supported by huge injections of liquidity by the central banks, inflation hasn’t really picked up yet. The reason for this is one of the oldest theories in economics: that inflation is a function not only of money supply but also of the velocity of money, i.e. how often a currency is used to buy goods and services. If the money supply increases but the velocity of money remains constant or decreases, then people are saving or investing their income instead of spending it. This leads to an increase in assets instead of the desired increase in consumer prices, which is what we are seeing at the moment: equities, bonds and real estate have hit record highs of late despite the sustained high level of uncertainty in the market (Figure 3).

Figure 3: Money supply growth is driving asset prices

The search for high-return investment opportunities has now reached incredible proportions and is borne out in investors’ greater risk appetite – Bitcoin, Tesla and GameStop have all rallied spectacularly this year – and in Wall Street’s increasing inventiveness. Last year, there was a veritable boom in special-purpose acquisition companies (SPACs). These are shell companies that are floated with the purpose of buying a company at a later date. In times of heated markets, companies thus save a great deal of time on traditional IPO marketing events and roadshows, and can benefit from attractive market conditions. However, SPACs are risky prospects for private investors because their success hinges on the SPAC management team’s selection abilities. Of course, they do not reveal their acquisition target in advance. According to a study conducted by the Wall Street Journal, after merging with the new company, the value of a SPAC falls by 12% on average.

Structural trends remain intact

On balance, therefore, despite the huge increase in money supply and the warnings from many economists about rising consumer prices in 2020, inflation has actually fallen rather than risen. Another reason for this (in addition to the aforementioned persistently low velocity of money) is a number of structural trends that have been developing for some years and will also exert deflationary pressure in the near future.

Alongside consumers’ unwillingness or inability to spend, a number of structural factors are contributing to the current low inflation rates. The economic collapse associated with the coronavirus pandemic has brought much of the economy to a temporary standstill. At the same time, this has broken down old structures and, at least in part, led to structural change. Digitisation was accelerated and more people than ever before can work from home and benefit from the flexibility this entails. This is making expensive cities relatively unattractive and is slowing down the increase in rents. Because rents account for a substantial portion of the consumer price index and there are questions about whether and to what extent they will regain their previous level of growth, we expect no significant rise in inflation until rent growth has recovered.

In addition, demographic change has been affecting the course of inflation for decades. Japan is a prime example. For years, it has been faced with falling birth rates and an aging population. This reduces the ratio of working people to retired people. The problem with this is that the number of people of working age is crucial to gross domestic product growth. If this sector of the population shrinks, GDP declines and overall demand falls. For companies to maintain their sales figures, they cut costs and wages, which in turn has a deflationary effect.

What does this mean for investors?

Inflationary pressure could therefore rise sharply in the coming months. We consider a short-term rise in consumer prices of around 3% to be highly realistic, at least in the U.S. While consumer behaviour is still restrained, if we get over the coronavirus pandemic this year, catch-up effects could result in a demand-side price rise. Prices in the transport and tourism sector in particular are still well below previous years’ levels. Plus there’s the aforementioned technical effects surrounding the price of oil. In Europe, on the other hand, we expect a much more moderate rise. In particular, the appreciation in the euro against the dollar will be good for imports of low-price goods and curb inflation in the eurozone.

So there is no reason to panic at the moment. Firstly, based on the Federal Reserve’s declared strategy of flexible average inflation targeting, short-term movement in inflation above the target is expressly desired and an interest rate hike before 2023 has effectively been ruled out. Secondly, central banks are continuing to purchase sovereign bonds on a grand scale, which will keep the general interest rate level low in the coming years regardless of inflation expectations. Lastly, economic recovery from the crisis caused by the pandemic is slow; major deflationary forces, such as digitalisation and an aging population, remain in effect and are likely to intensify in the coming years.

Positioning of our funds

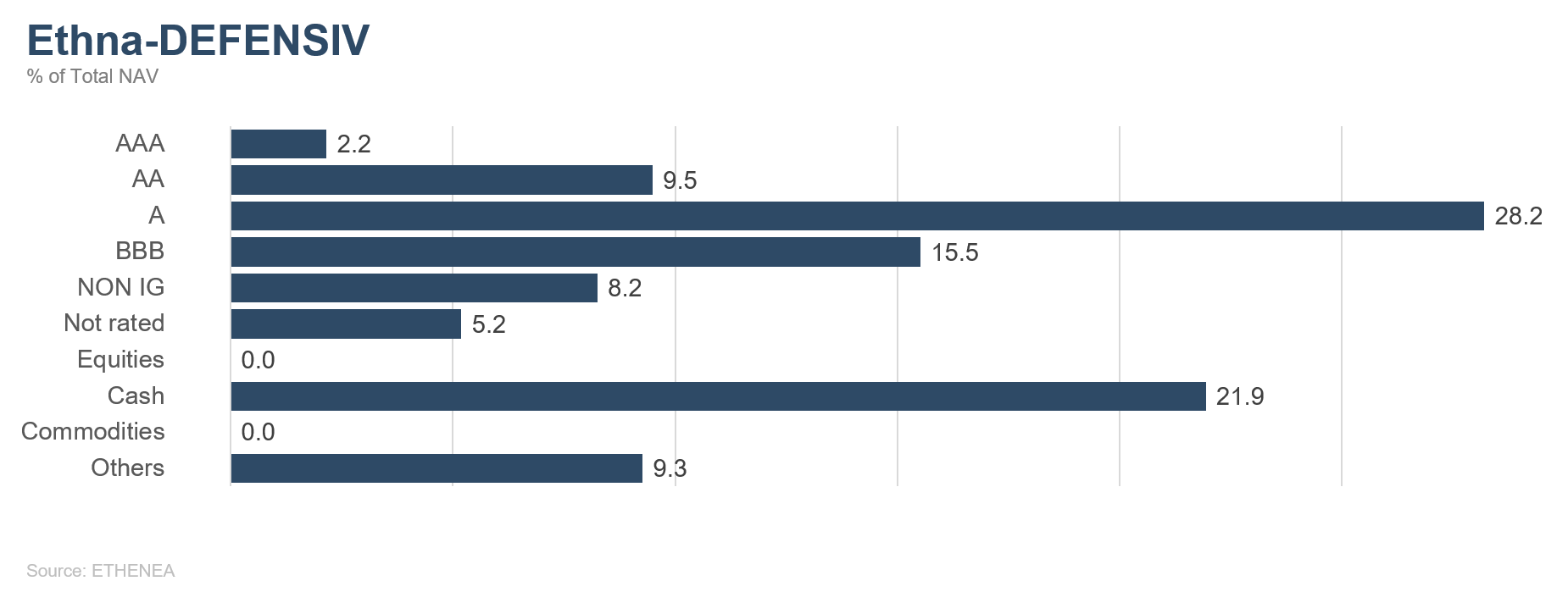

Ethna-DEFENSIV

Last year was a turbulent year full of ups and downs, for both equities and bonds. However, markets have recovered well in the meantime and have even regained fresh highs. So now it’s time to look ahead. There has been plenty of good news and cause for optimism of late.

Markets are getting good support from various developments at the moment. It is worth mentioning the Brexit deal, which was struck at the 11th hour. Even though many companies involved in trade between the EU and the UK are still grappling with the formalities at the moment, markets welcomed the Brexit deal. At least it removed one further uncertainty, and the pound sterling has since stabilised. In addition, shortly before the end of the year another U.S. fiscal package worth USD 900 billion was approved. This includes one-time stimulus checks, which will be paid directly to eligible Americans. This, combined with the progress of vaccinations, is likely to boost consumption. After the Senate wins for the Democrats in Georgia and Joe Biden’s inauguration as U.S. President, talks on a package worth a further USD 1.9 trillion are underway. Despite the accelerating dynamic and any one-off effects, the likelihood of a long-term overheating of the economy and a sharp rise in inflation remains low. The unemployment rate is still too high for that to happen, especially in the floundering services sector. The rise in wages is also moderate at best. Ongoing technological progress and structural trends – increasingly noticeable in the form of working from home and much slower growth in rents – are having an added deflationary effect.

For bonds, we expect a quiet year in terms of carry; that is, in terms of the collection of coupon payments given a largely unchanged market environment. Making the case for this is the fact that companies took advantage of the low interest rate environment last year to secure sufficient liquidity and extend debt maturity. As a result we expect lower issuance in 2021 and, accordingly, stable to slightly lower yields. This is confirmed by the primary market’s sluggish start to January, but it is a different story for sovereign and supranational issuers. These have to finance their fiscal spending arising from the pandemic relief packages and will increasingly be tapping the bond market in 2021 as well. The EU in particular, with its SURE and Next Generation EU recovery plans, has become the largest non-government issuer. New issues of more than EUR 1 trillion can be expected in the coming years. However, the European Central Bank will be on standby with its bond purchase programmes to prevent a significant rise in interest rates.

It’s the same story across the Atlantic. There too, more and more bonds will be issued to finance the additional budget deficit. However, the Fed has slowed its purchases of U.S. Treasuries in recent months. At the current level, these will not be enough to refinance at least most of the government’s new debt as a result of the adopted relief packages and the current deficit. For that reason, the Senate wins for the Democrats in Georgia and the expectation of additional deficits caused 10-year U.S. Treasury yields to rise to 1.2%. However, we do not expect a sustained rise in 10-year Treasuries yields above 1.5%, since the Fed would then have to intervene with greater purchases. The verbal intervention has already begun, with Fed Chair Powell reiterating on 27 January that now was not the time to be talking about exiting from bond purchases. We therefore think it unlikely that 10-year U.S. Treasury rates will go much higher than the 1.50% mark.

The Ethna-DEFENSIV (T class) began the year with a positive performance of 0.11%. This is particularly positive against the backdrop of rising U.S. Treasury yields and falling U.S. corporate bond prices and highlights the strengths of the Ethna-DEFENSIV. Regardless of the current market situation, the fund is in a position to generate a stable and positive return. In particular, the decision to max out the equity allocation of 10% and invest in Japanese and U.S. equity ETFs proved correct. With a positive performance of around 0.37%, the equity ETFs more than made up for the bond portfolio’s losses. Selected equity investments currently offer an attractive risk/return ratio and also help to diversify the portfolio. At the same time, we reduced the average duration and the risks within the bond portfolio by selling bonds with lower-quality ratings and increasing the average issuer rating from between BBB+ and A- to between A- and A. We used the resulting liquidity to increase our cash allocation to around 14%. This will enable us to take advantage of future opportunities and short-term falls in the market. Lastly, our currency positions made an additional positive contribution of around 0.07% to portfolio performance, in particular the Japanese yen.

Ethna-AKTIV

Hopes that the end of pandemic-stricken 2020 would also put an end to concerns about infection rates and the progress of vaccinations were dashed, as expected. Nevertheless, the capital market did its best to look beyond this crisis and focus on the positive.

In January, the positive sentiment and the upward trend of the prior quarter essentially continued – at least in the first three weeks. Even though the reflation trade (interest rates and equities rising simultaneously) was treading water for a time, we saw 10-year U.S. Treasuries hitting the magic 1% mark at the very beginning of the year. This closely watched rate even climbed to 1.18% for a time before falling back to the breakout level of 1%, ultimately closing the month at 1.07%. At month-end, higher-than-expected U.S. inflation data pushed interest rates up again.

January was not resoundingly positive in equity markets. While almost all indices made comfortable gains towards the middle of the month after a somewhat bumpy start, only Asian indices and the Nasdaq showed positive performance at the end of the month. The Ethna-AKTIV’s strong positioning in technology-oriented securities and a 5% positioning in both emerging markets and the leading Japanese index thus paid off. Despite the good start to the reporting season and ongoing strong monetary support from central banks, the last week of January saw a consolidation set in directly after the Fed meeting. Again this went hand in hand with a sharp rise in volatility, and is – we believe – wholly in keeping with the trading adage “Buy the rumour, sell the news”. The fact that these dramatic price movements coincided with the excesses involving GameStop and other much-lauded stocks in the “wallstreetbets” forum of internet platform Reddit is probably no accident. However, what we felt was an almost worryingly strong appetite for risk assets over the course of the month did normalise relatively quickly in the last week of January.

In general, for 2021 we expect robust economic growth and positive capital markets, not least owing to the ongoing support from central banks and in anticipation of another massive U.S. stimulus package. We can even imagine a growth surprise provided there are no unexpected delays or other problems on the vaccination front. With regard to the valuation of certain equity subsectors, we are aware of the risk of a bubble forming. However, it should be made clear that the likely bigger deviation from the norm can be found in bonds and there needs to be a clear catalyst for a bubble to burst. In the past, this catalyst was often the shift to a more restrictive monetary policy. However, we are not anywhere near that at the moment.

Looking ahead, we expect markets to regain their former strength once the first concrete plans to reopen the economy and further loosening of coronavirus measures crystallise, if not before, and the temporary lows will then be ancient history again. The high equity weighting mentioned counterbalanced by a much-reduced and high-quality bond portfolio are ideal to take advantage of the opportunities in these volatile times and, at the same time, to guarantee enough flexibility if a downside event occurs. The Japanese yen and the U.S. dollar are currently being used for diversification purposes rather than gold and the Swiss franc. We divested ourselves of gold and the Swiss franc in January, although the long-term case for both still stands. However, gold is currently too strongly correlated with risk assets and is itself undergoing consolidation. In addition, it is rather unlikely at the moment that the Swiss National Bank will refrain from devaluing its own currency. Thus, we consider the current Ethna-AKTIV portfolio to be well prepared for this environment.

Ethna-DYNAMISCH

It was a bumpy start to the new year. After a euphoric first week, global equity markets consolidated before closing the month slightly down after a correction set in during the last week of January. However, this correction did not entirely come as a surprise due to the number of signs pointing to it beforehand. Sentiment indicators attested to exuberance, manifesting in excessive movements in the prices of thematic ETFs, speculation in the IPO and SPAC market and a rush into microcaps. While the exuberance centred on certain market segments, the correction also put pressure on the overall market. As we pointed out last December, we had been closely watching the tendencies towards a tactical correction for some time and we regard this as a purging of the market. Even though the short-term turbulence gives the impression of market fragility, the longer-term parameters continue to paint a very positive picture. Despite fresh concerns about Covid-19 sparked by the very slow progress of vaccination programmes, new variants of the virus and further lockdown measures, the pandemic will soon be less daunting and the economic recovery will have fiscal and monetary support.

In a trade-off between short-term fragility and long-term strength, we kept the net equity allocation of the Ethna-DYNAMISCH between 55% and 75% in January. On the one hand, we used hedging positions to temporarily reduce downside risks in turbulent market phases. On the other hand, based on our medium-term positive outlook, we took advantage of temporary weaknesses in the market to build up new positions, balancing growth opportunities and valuation risks in a disciplined fashion. These include Salesforce.com, a provider of customer relationship management solutions. Salesforce met our requirements firstly because the plan to take over the instant messaging service Slack recently caused a dip in the price, which we expect to be temporary on account of Salesforce’s expertise in acquisitions (as demonstrated with Tableau, MuleSoft and Demandware). Secondly, we expect that Salesforce’s revenue – driven by rapid market growth and greater market penetration – could double over the next five years.

The recent increase in volatility is likely to continue for a short time. In the long term, however, equity markets are on a much more solid footing than generally thought. Thanks to our tried-and-tested strategy – taking opportunities to buy quality companies cheaply and using temporary hedging instruments – we believe that the Ethna-DYNAMISCH remains well prepared for the current market environment.

HESPER FUND - Global Solutions (*)

Despite renewed lockdowns in most of the advanced economies, January started on a positive note for the financial markets. The roll-out of Covid-19 vaccines, continued monetary and fiscal policy support, and the Democrat’s control of the US Senate made for a positive environment that was supportive of equity markets.

The S&P 500 gained 2.6% in the first 25 days of the month, reaching an all-time high of 3,855 on 25 January. In the last week of the month, we experienced an explosion in trading volumes, as well as a spike in volatility. This was due to a battle royal between retail investors, who were operating through options and betting on cheap stocks, and hedge funds, who were shorting those same stocks. As a result, the market experienced its biggest drop since the beginning of the year and the S&P 500 ended the month with a loss of 1.12%.

Our base scenario for 2021 remains that of a cyclical recovery supported by vaccine roll-outs and policy support. However, this recovery remains uncertain and will be uneven across regions, due to the increasing number of infections and the slow roll-out of vaccines around the world. As such, economic activity in 2021 will continue to be significantly affected by the development of the pandemic.

In light of the still uncertain economic recovery, coupled with the aforementioned delays in the roll-out of the vaccination campaigns, market valuations are quite high. After a strong start to the year, the stock market is balancing rising optimism fuelled by the Covid-19 vaccines and further US fiscal stimulus against stretched valuations, the rising number of Covid-19 cases and the slower than expected roll-out of the vaccines. To maintain its current valuations, the market needs good economic data and an improvement on the pandemic front, at the same time it remains exposed to potential short-term corrections.

The HESPER FUND – Global Solutions started the year in a bullish mood, with a well-diversified exposure to equity markets of approximately 60%. During January, we implemented an option strategy to lock in some performance by selling S&P 500 puts for about 10% of the market, while reducing our equity exposure by 10%. We then further reduced our equity exposure – ending January with an overall equity exposure of approximately 49%.

Over the course of the month, we progressively increased our long positions in the US dollar. We believe that the USD’s weakening cycle may have largely run its course and we consider it a good hedge against a possible sudden tightening in financial conditions. We have also slightly increased the exposure of the HESPER FUND – Global Solutions to commodities, as they continue to benefit from the cyclical recovery and may serve as a hedge against initial signs of rising prices.

*The HESPER FUND – Global Solutions is currently only authorised for distribution in Germany, Luxembourg, France, and Switzerland.

Figure 4: Portfolio structure* of the Ethna-DEFENSIV

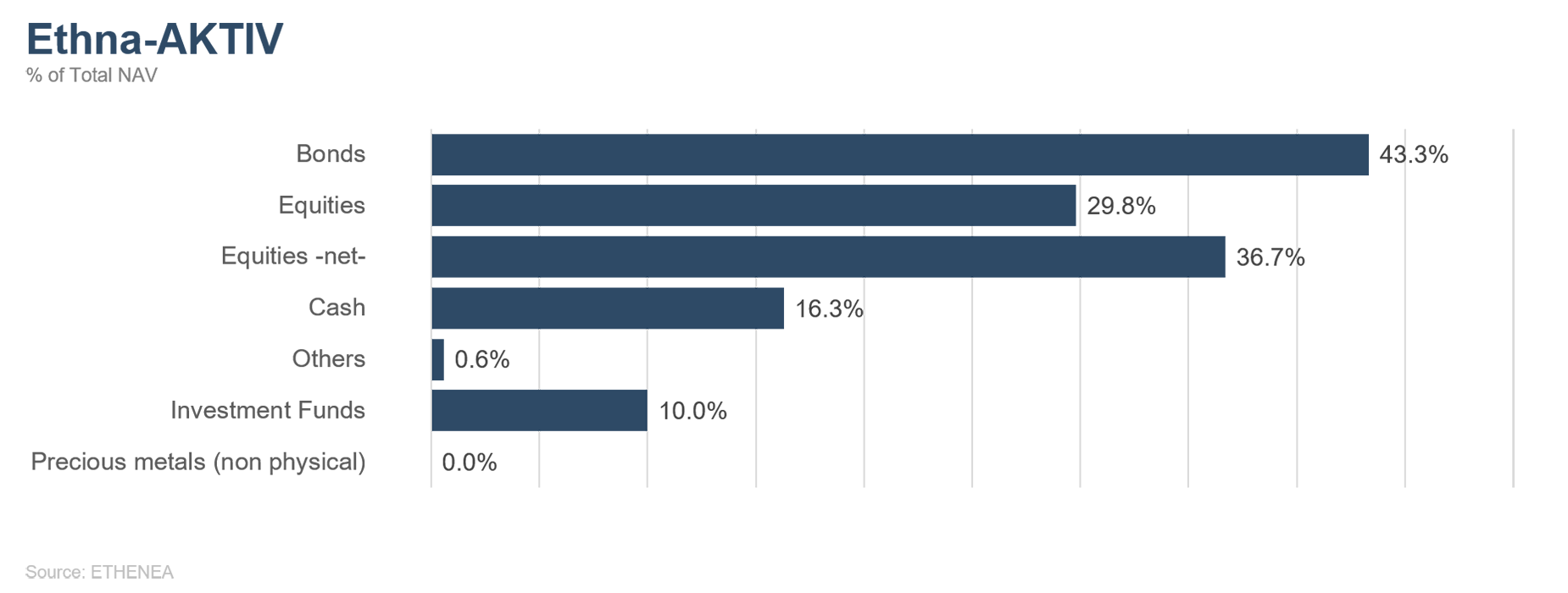

Figure 5: Portfolio structure* of the Ethna-AKTIV

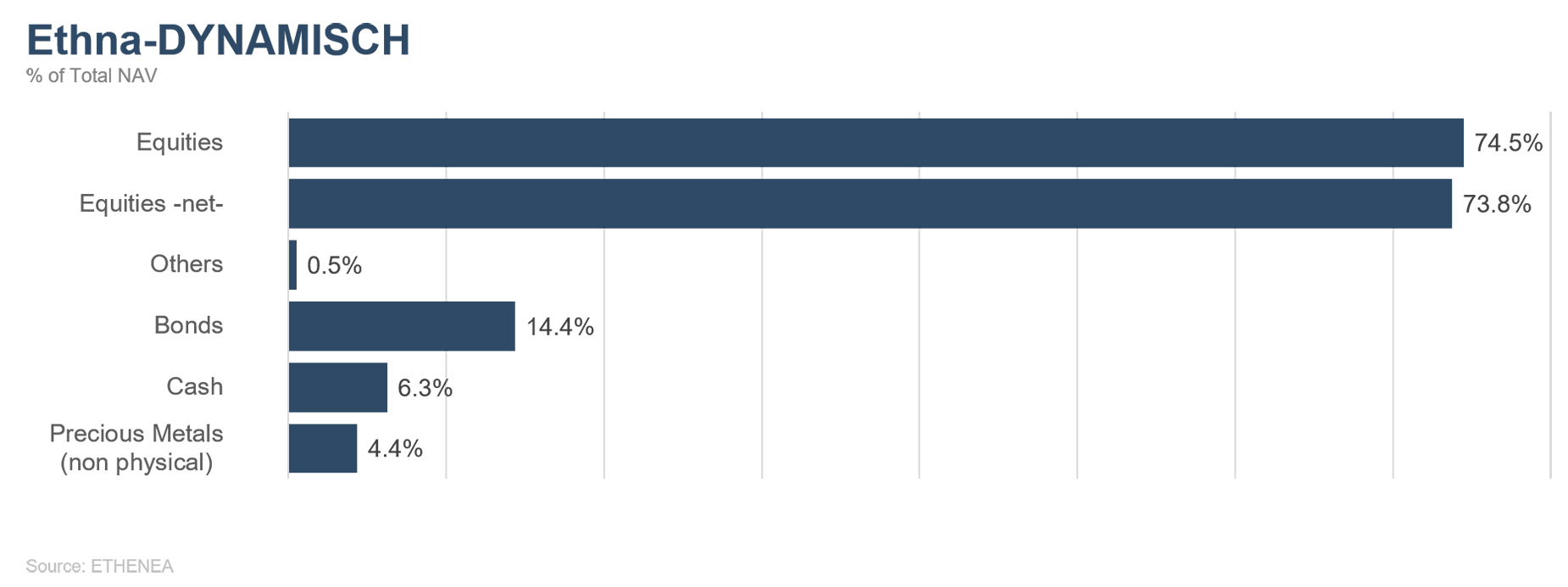

Figure 6: Portfolio structure* of the Ethna-DYNAMISCH

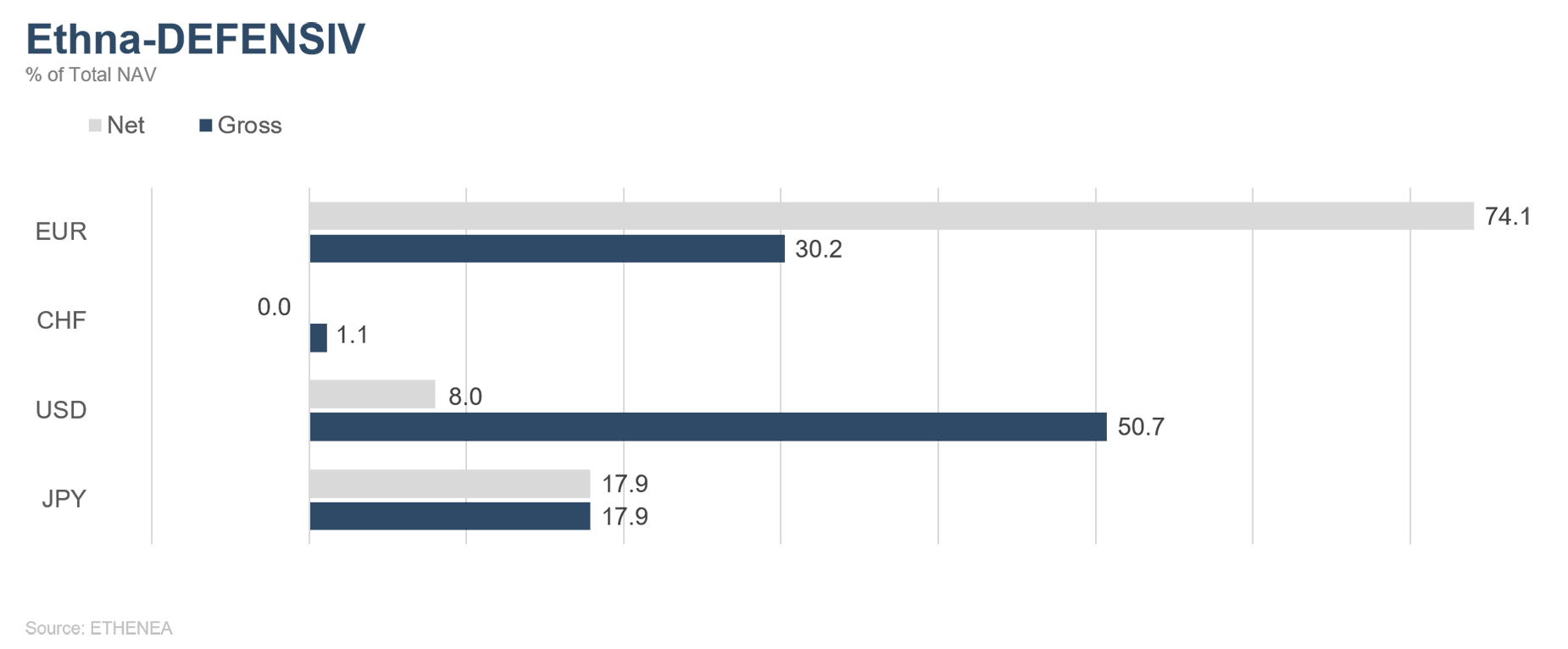

Figure 7: Portfolio composition of the Ethna-DEFENSIV by currency

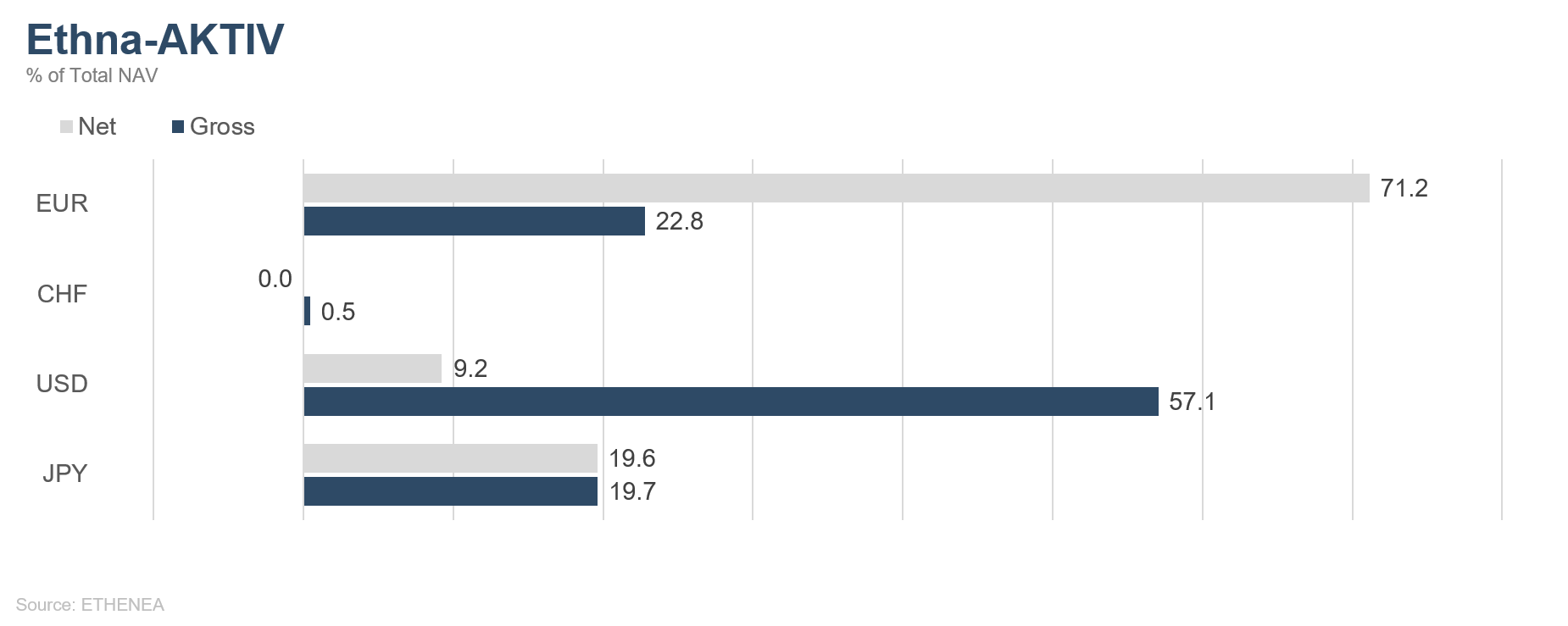

Figure 8: Portfolio composition of the Ethna-AKTIV by currency

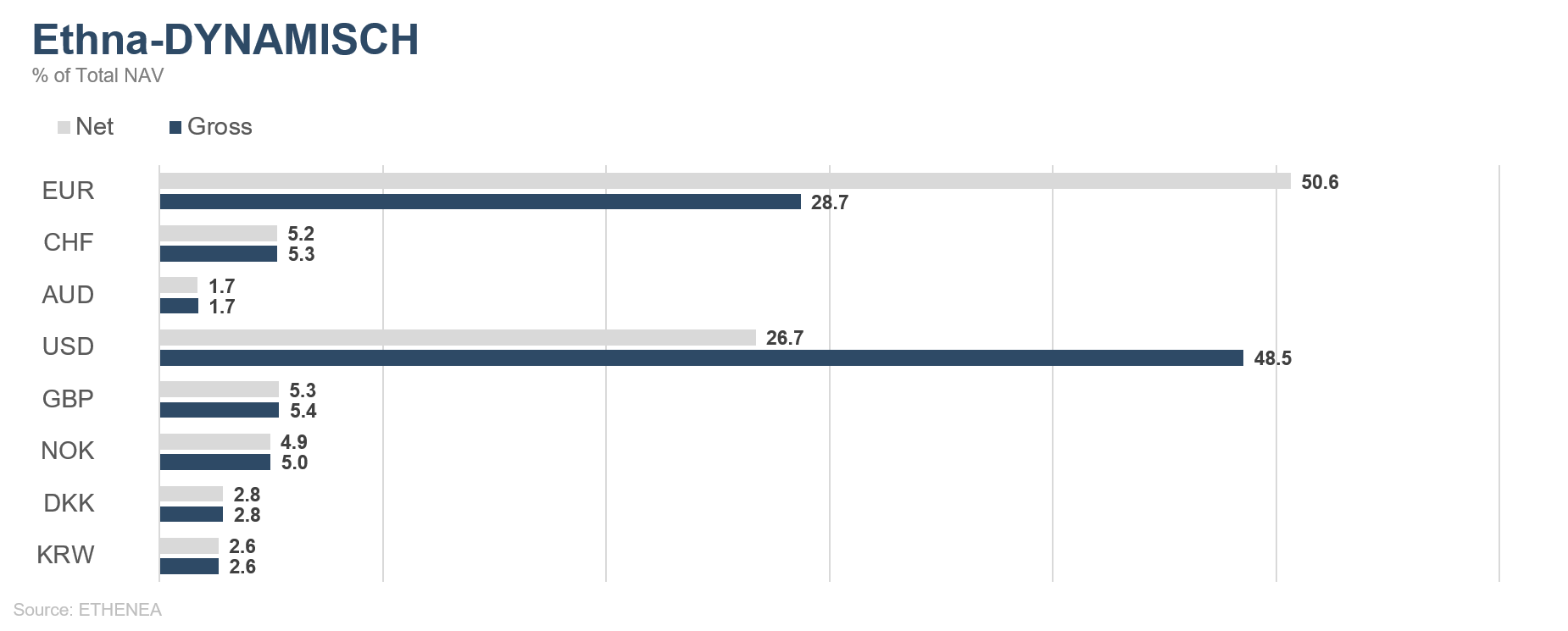

Figure 9: Portfolio composition of the Ethna-DYNAMISCH by currency

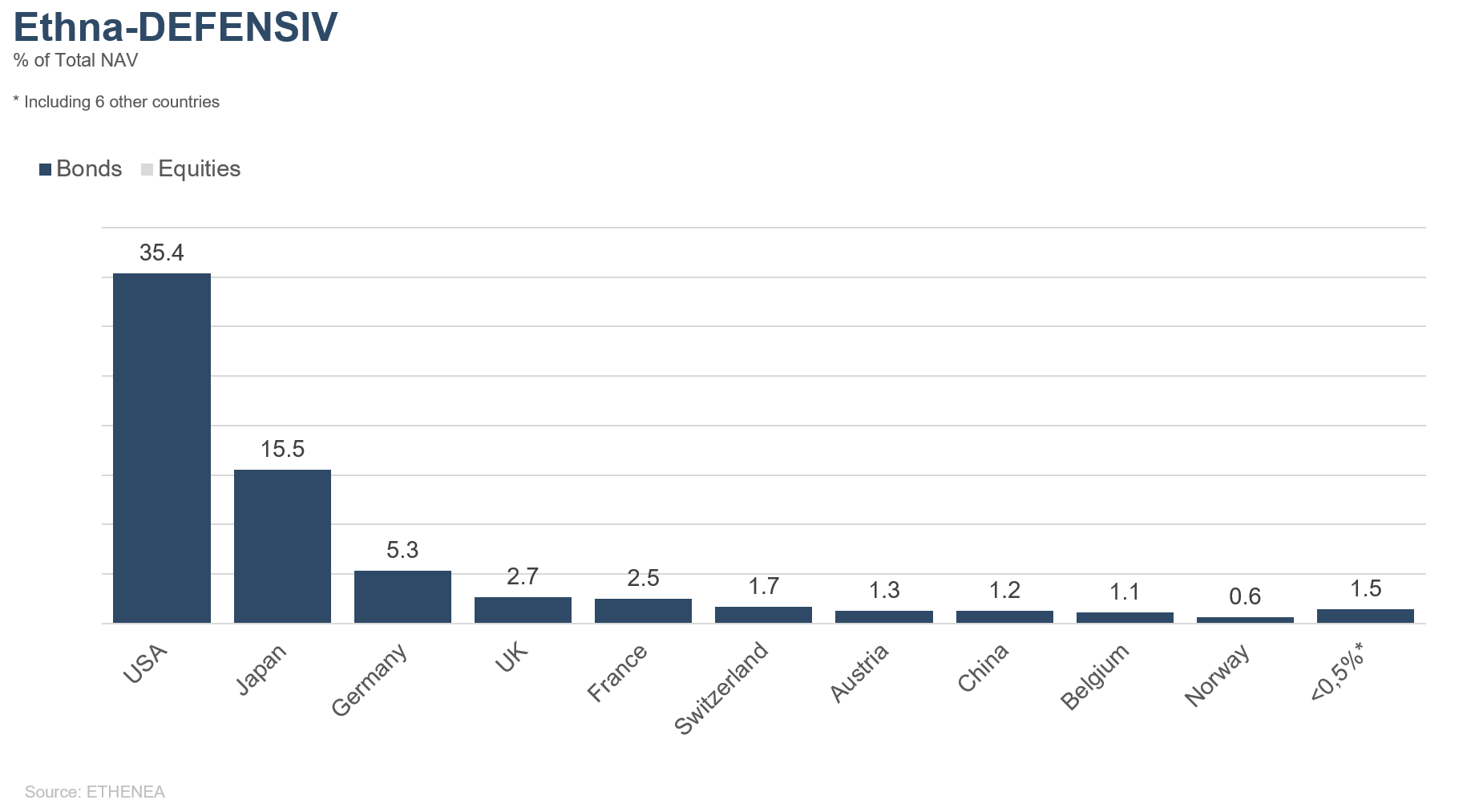

Figure 10: Portfolio composition of the Ethna-DEFENSIV by country

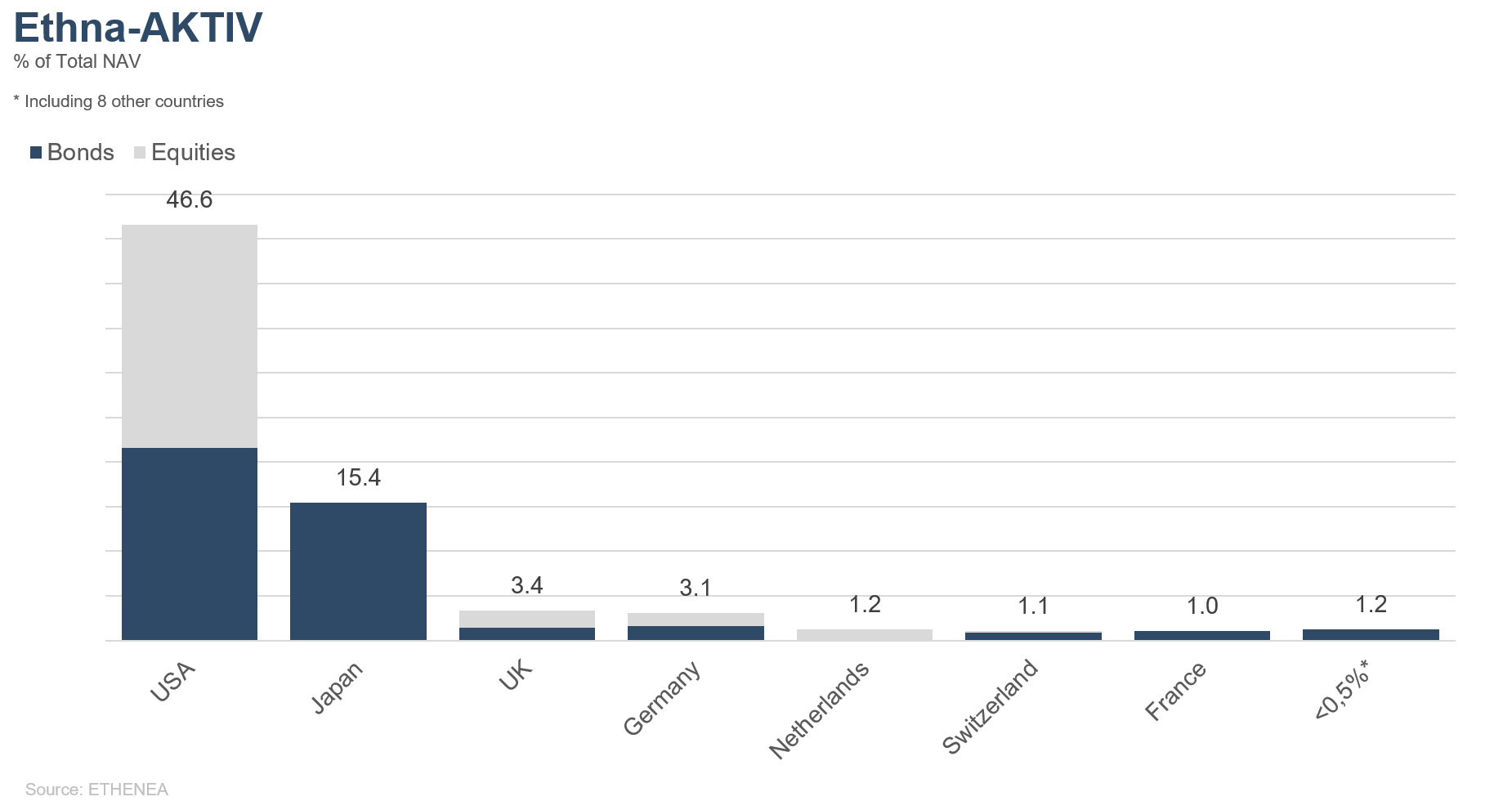

Figure 11: Portfolio composition of the Ethna-AKTIV by country

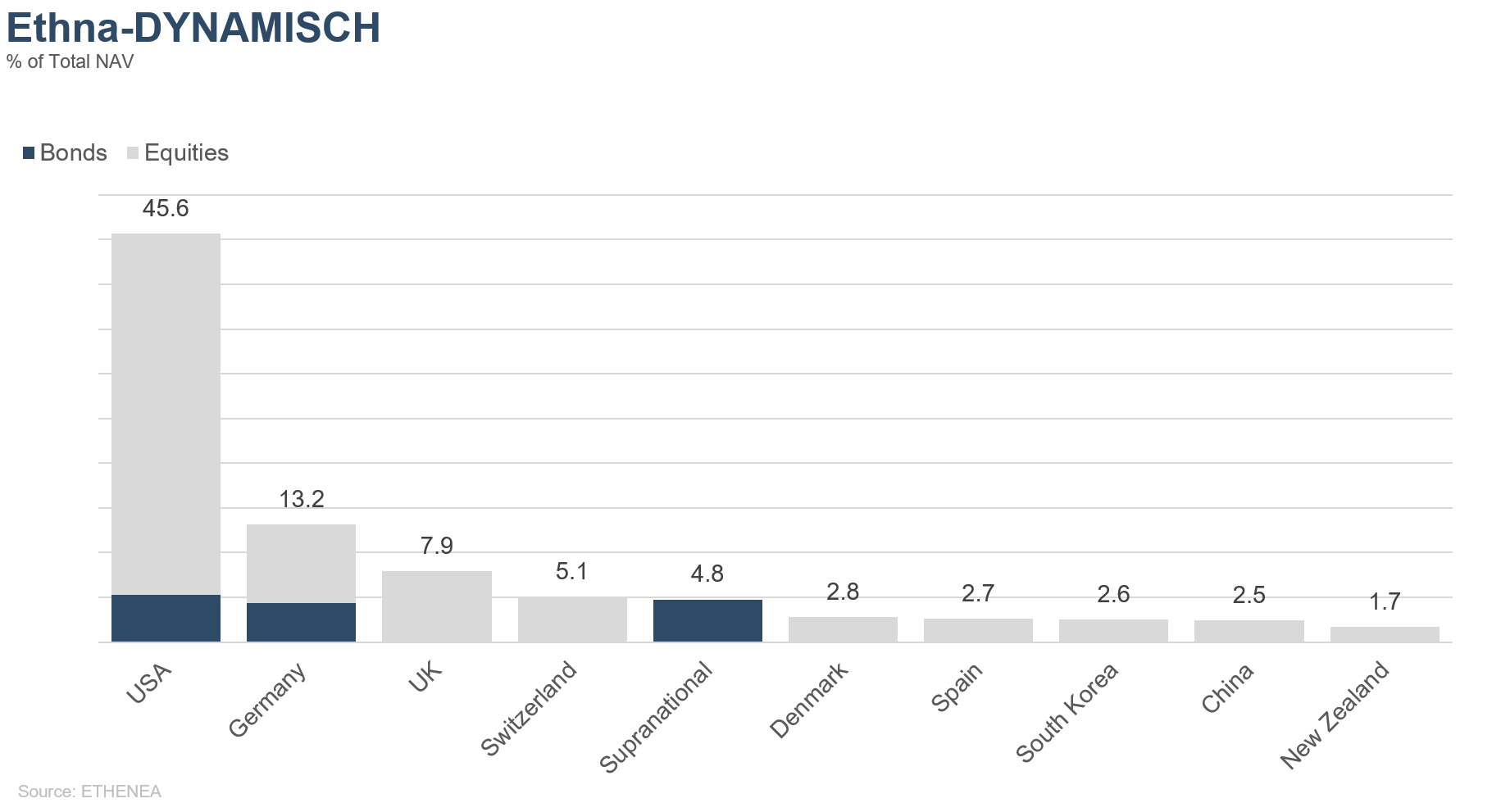

Figure 12: Portfolio composition of the Ethna-DYNAMISCH by country

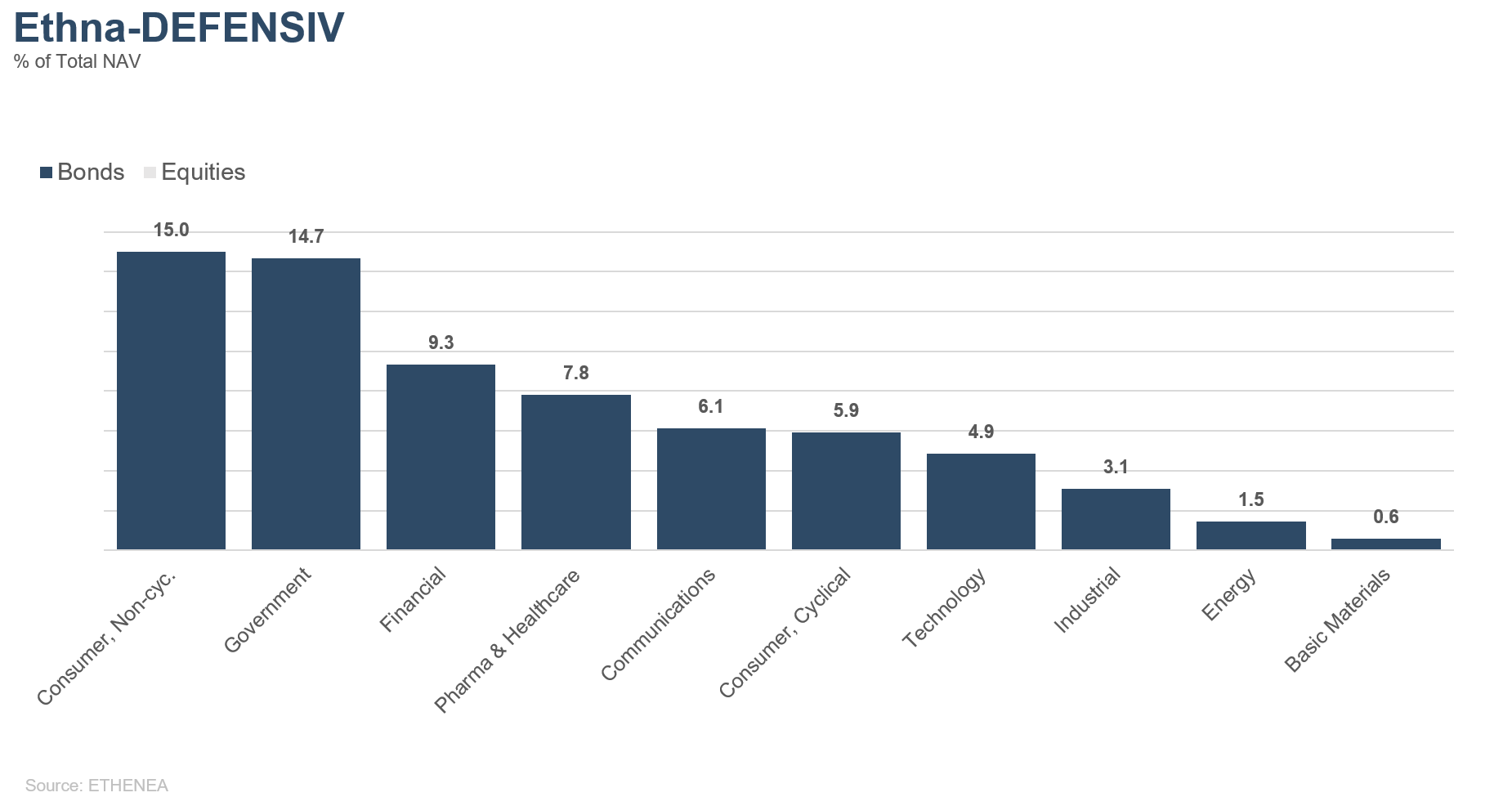

Figure 13: Portfolio composition of the Ethna-DEFENSIV by issuer sector

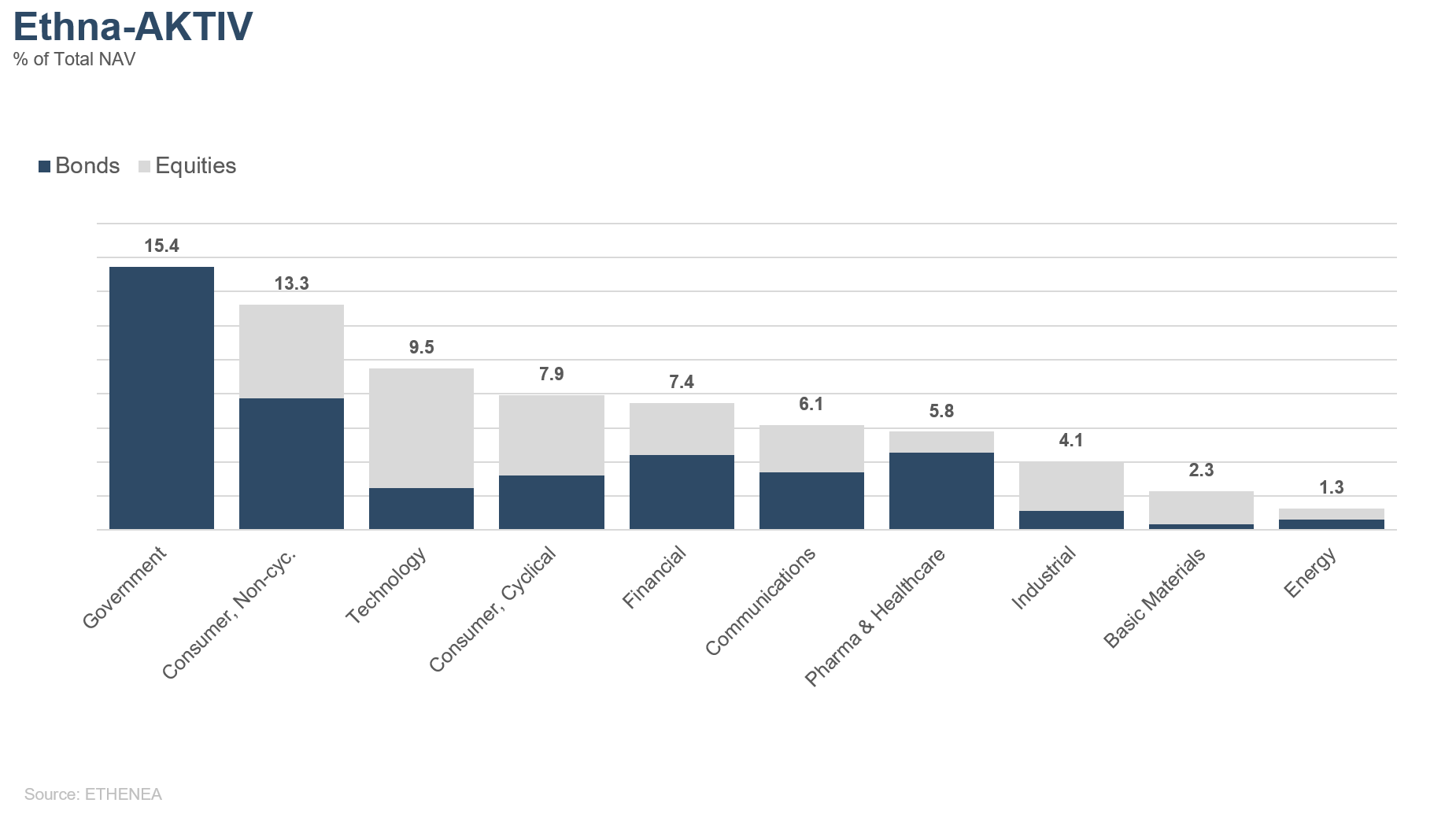

Figure 14: Portfolio composition of the Ethna-AKTIV by issuer sector

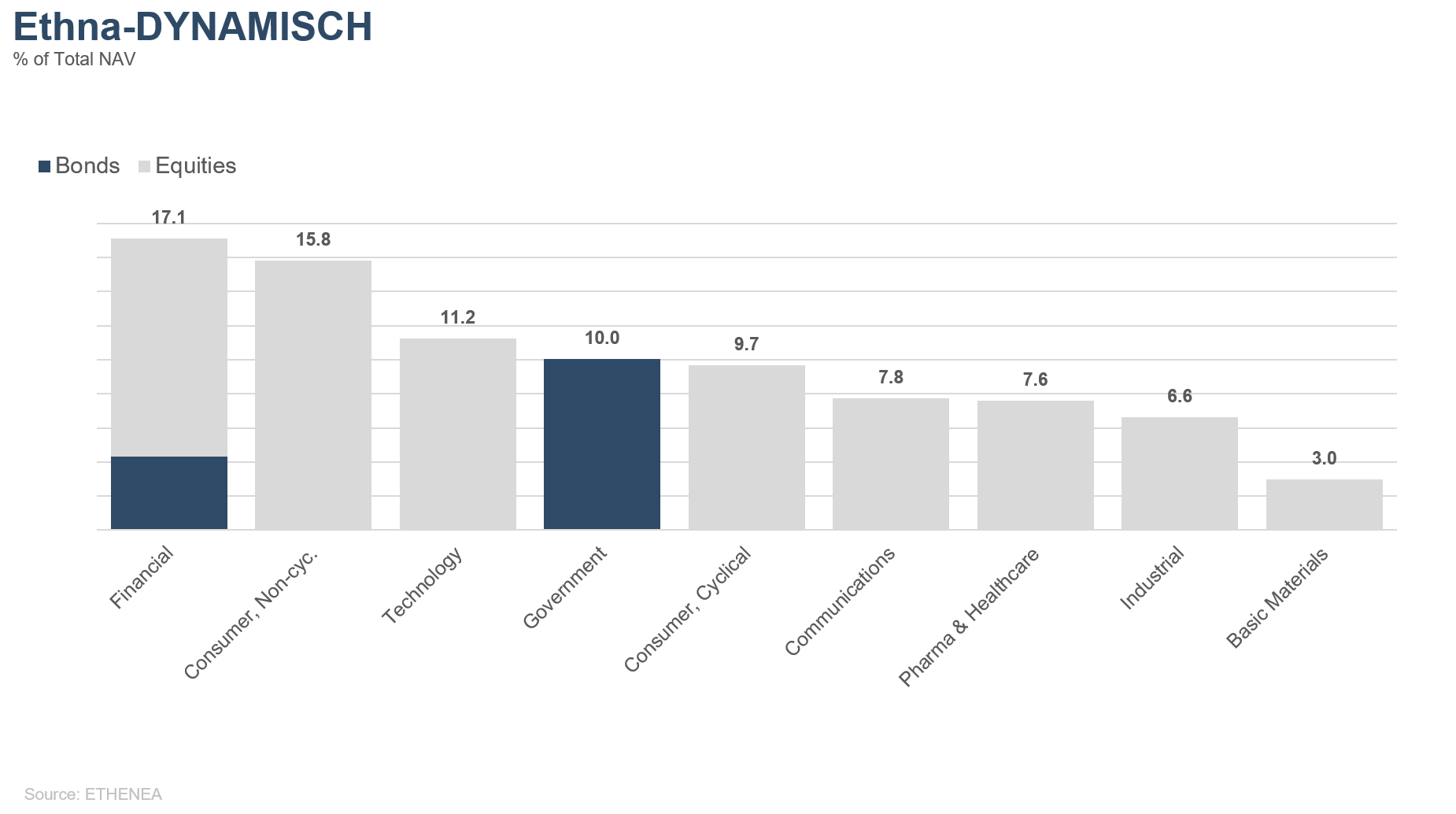

Figure 15: Portfolio composition of the Ethna-DYNAMISCH by issuer sector

* “Cash” comprises term deposits, call money and current accounts/other accounts. “Equities net” comprises direct investments and exposure resulting from equity derivatives.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

This is a marketing communication. It is for product information purposes only and is not a mandatory statutory or regulatory document. The information contained in this document does not constitute a solicitation, offer or recommendation to buy or sell units in the fund or to engage in any other transaction. It is intended solely to provide the reader with an understanding of the key features of the fund, such as the investment process, and is not deemed, either in whole or in part, to be an investment recommendation. The information provided is not a substitute for the reader's own deliberations or for any other legal, tax or financial information and advice. Neither the investment company nor its employees or Directors can be held liable for losses incurred directly or indirectly through the use of the contents of this document or in any other connection with this document. The currently valid sales documents in German (sales prospectus, key information documents (PRIIPs-KIDs) and, in addition, the semi-annual and annual reports), which provide detailed information about the purchase of units in the fund and the associated opportunities and risks, form the sole legal basis for the purchase of units. The aforementioned sales documents in German (as well as in unofficial translations in other languages) can be found at www.ethenea.com and are available free of charge from the investment company ETHENEA Independent Investors S.A. and the custodian bank, as well as from the respective national paying or information agents and from the representative in Switzerland. The paying or information agents for the funds Ethna-AKTIV, Ethna-DEFENSIV and Ethna-DYNAMISCH are the following: Austria, Belgium, Germany, Liechtenstein, Luxembourg: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg; France: CACEIS Bank France, 1-3 place Valhubert, F-75013 Paris; Italy: State Street Bank International – Succursale Italia, Via Ferrante Aporti, 10, IT-20125 Milano; Société Génerale Securities Services, Via Benigno Crespi, 19/A - MAC 2, IT-20123 Milano; Banca Sella Holding S.p.A., Piazza Gaudenzio Sella 1, IT-13900 Biella; Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Spain: ALLFUNDS BANK, S.A., C/ Estafeta, 6 (la Moraleja), Edificio 3 – Complejo Plaza de la Fuente, ES-28109 Alcobendas (Madrid); Switzerland: Representative: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Paying Agent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. The paying or information agents for HESPER FUND, SICAV - Global Solutions are the following: Austria, Belgium, France, Germany, Luxembourg: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg; Italy: Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Switzerland: Representative: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Paying Agent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. The investment company may terminate existing distribution agreements with third parties or withdraw distribution licences for strategic or statutory reasons, subject to compliance with any deadlines. Investors can obtain information about their rights from the website www.ethenea.com and from the sales prospectus. The information is available in both German and English, as well as in other languages in individual cases. Producer: ETHENEA Independent Investors S.A.. Distribution of this document to persons domiciled in countries in which the fund is not authorised for distribution, or in which authorisation for distribution is required, is prohibited. Units may only be offered to persons in such countries if this offer is in accordance with the applicable legal provisions and it is ensured that the distribution and publication of this document, as well as an offer or sale of units, is not subject to any restrictions in the respective jurisdiction. In particular, the fund is not offered in the United States of America or to US persons (within the meaning of Rule 902 of Regulation S of the U.S. Securities Act of 1933, in its current version) or persons acting on their behalf, on their account or for the benefit of a US person. Past performance should not be taken as an indication or guarantee of future performance. Fluctuations in the value of the underlying financial instruments or their returns, as well as changes in interest rates and currency exchange rates, mean that the value of units in a fund, as well as the returns derived from them, may fall as well as rise and are not guaranteed. The valuations contained herein are based on a number of factors, including, but not limited to, current prices, estimates of the value of the underlying assets and market liquidity, as well as other assumptions and publicly available information. In principle, prices, values, and returns can both rise and fall, up to and including the total loss of the capital invested, and assumptions and information are subject to change without prior notice. The value of the invested capital or the price of fund units, as well as the resulting returns and distribution amounts, are subject to fluctuations or may cease altogether. Positive performance in the past is therefore no guarantee of positive performance in the future. In particular, the preservation of the invested capital cannot be guaranteed; there is therefore no warranty given that the value of the invested capital or the fund units held will correspond to the originally invested capital in the event of a sale or redemption. Investments in foreign currencies are subject to additional exchange rate fluctuations or currency risks, i.e. the performance of such investments also depends on the volatility of the foreign currency, which may have a negative impact on the value of the invested capital. Holdings and allocations are subject to change. The management and custodian fees, as well as all other costs charged to the fund in accordance with the contractual provisions, are included in the calculation. The performance calculation is based on the BVI (German federal association for investment and asset management) method, i.e. an issuing charge, transaction costs (such as order fees and brokerage fees), as well as custodian and other management fees are not included in the calculation. The investment performance would be lower if the issuing surcharge were taken into account. No guarantee can be given that the market forecasts will be achieved. Any discussion of risks in this publication should not be considered a disclosure of all risks or a conclusive handling of the risks mentioned. Explicit reference is made to the detailed risk descriptions in the sales prospectus. No guarantee can be given that the information is correct, complete or up to date. The content and information are subject to copyright protection. No guarantee can be given that the document complies with all statutory or regulatory requirements which countries other than Luxembourg have defined for it. Note: The most important technical terms can be found in the glossary at www.ethenea.com/glossary. Information for investors in Belgium: The prospectus, the key information documents (PRIIPs-KIDs), the annual reports and the semi-annual reports of the sub-fund are available in French free of charge upon request from the investment company ETHENEA Independent Investors S.A., 16, rue Gabriel Lippmann, 5365 Munsbach, Luxembourg and from the representative: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg. Information for investors in Switzerland: The country of origin of the collective investment scheme is Luxembourg. The representative in Switzerland is IPConcept (Schweiz) AG, Münsterhof 12, P.O. Box, CH-8022 Zurich. The paying agent in Switzerland is DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zurich. The prospectus, the key information documents (PRIIPs-KIDs), and the Articles of Association, as well as the annual and semi-annual reports, can be obtained free of charge from the representative. Copyright © ETHENEA Independent Investors S.A. (2024) All rights reserved. 02/02/2021