“New economy” – 20 years on and a look at what’s happening today

March 2020 marks 20 years since the end of the world’s biggest wave of speculation in “new economy” businesses. What happened? Two new technologies, whose success stories had started in the early 1990s, set about transforming the world. The mobile phone and internet age had begun. In the mid-1990s, a large number of European telecommunications companies in state ownership went public with substantial offerings. In Germany, the successful IPO of Deutsche Telekom and the subsequent share price gains sent investors into raptures. The myth of the so-called people’s share came into being and investors bought anything and everything that came on the market. In the frenzy of speculation, and to sate investors’ appetite for shares, the telecommunications companies placed more and more shares on the market. This gave countries in Europe a welcome opportunity to sell off the family silver. A similar process had taken place in the U.S. at the beginning of the 1980s. AT&T, which had become a monopoly, was broken up into a number of regional providers of telephone services, giving rise to the so-called Baby Bells (Bell South, Bell Labs etc.). However, U.S. speculation at the beginning of the 1980s was restrained compared with what went on in Europe in the 1990s. The Baby Bells were again at the centre of incredible speculation at the end of the 1990s; but more about that later.

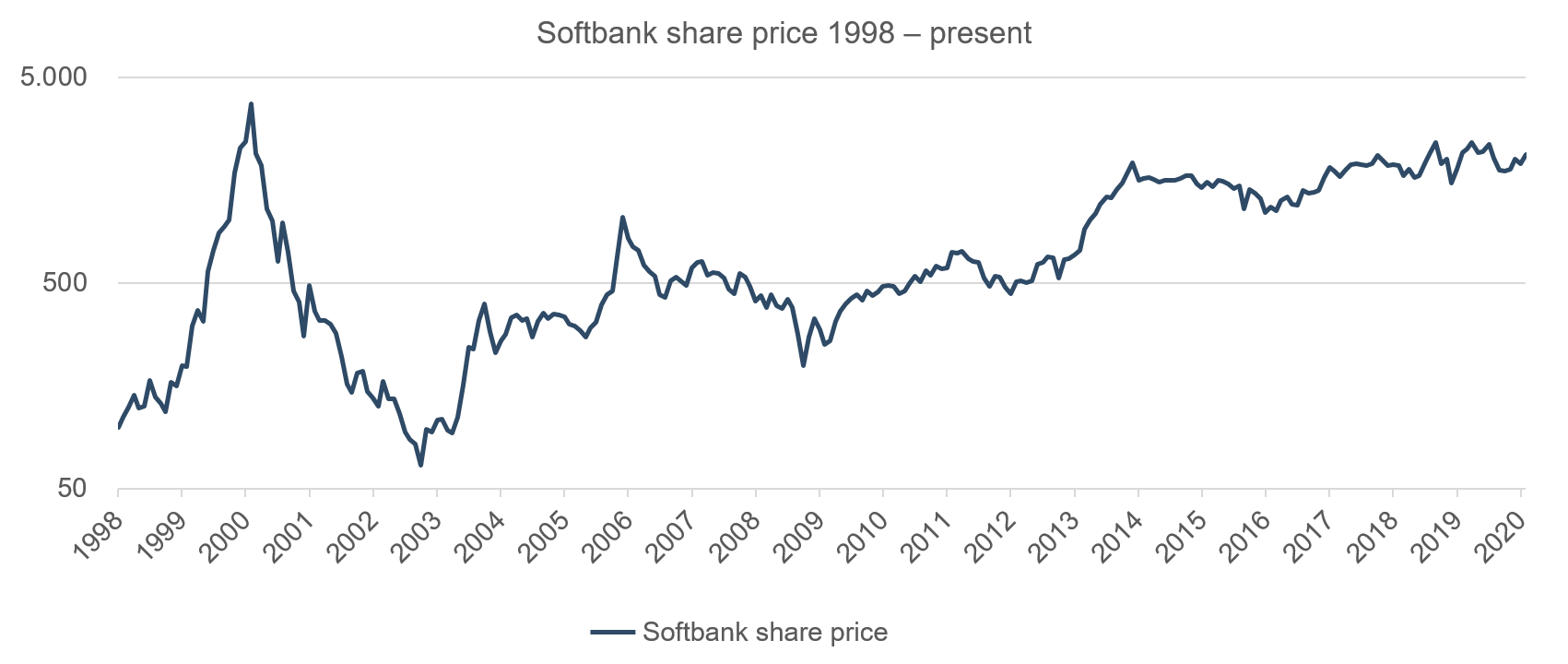

On the heels of telecommunications, a second, revolutionary technology slowly but surely conquered the market: the internet. Drawn by high valuations and soaring prices, more and more dotcoms took the IPO plunge. Though slow to start, by the end of the 1990s it had totally eclipsed even the telecommunications speculation and had swept up sectors that were only indirectly connected with the internet. Thus began the unstoppable rise of TMT shares (telecoms, media and technology). The companies of the “old economy” prepared for the new age by investing heavily in software and infrastructure. The first websites were created and online stores opened their doors to curious customers who wanted to experience the new way of shopping first-hand and online. It was at the time that internet pioneers such as eBay and Amazon took their first tentative steps. Amazon was initially exclusively a book seller and eBay focused on online auctions. The search-engine business, on which Google has a firm grip today, was dominated by Yahoo at that time. There was major investment in internet and technology shares worldwide, albeit in a different order of magnitude in a technophile U.S. In Japan, two investment companies caused a furore. Jafco and Softbank made their investors rich in a matter of months. Jafco surged by a whopping 1,000% in 1999 before disappearing into insignificance. Softbank managed to surpass that, rising by more than 1,300% in just one year. Unlike Jafco, Softbank still plays a key role in financing tech start-ups today. Softbank has a significant stake in the Chinese internet giant Alibaba and in Uber Technologies, among others. The Japanese internet pioneer also operates in Germany, for example, with a shareholding in Munich-based FinTech company Wirecard via a convertible bond. Softbank has been financially very successful in the past 10 years. However, the share price never managed to live up to the successes of the 1990s and today is still well below its level at the beginning of 2000.

Figure 1: Softbank share price 1998–present

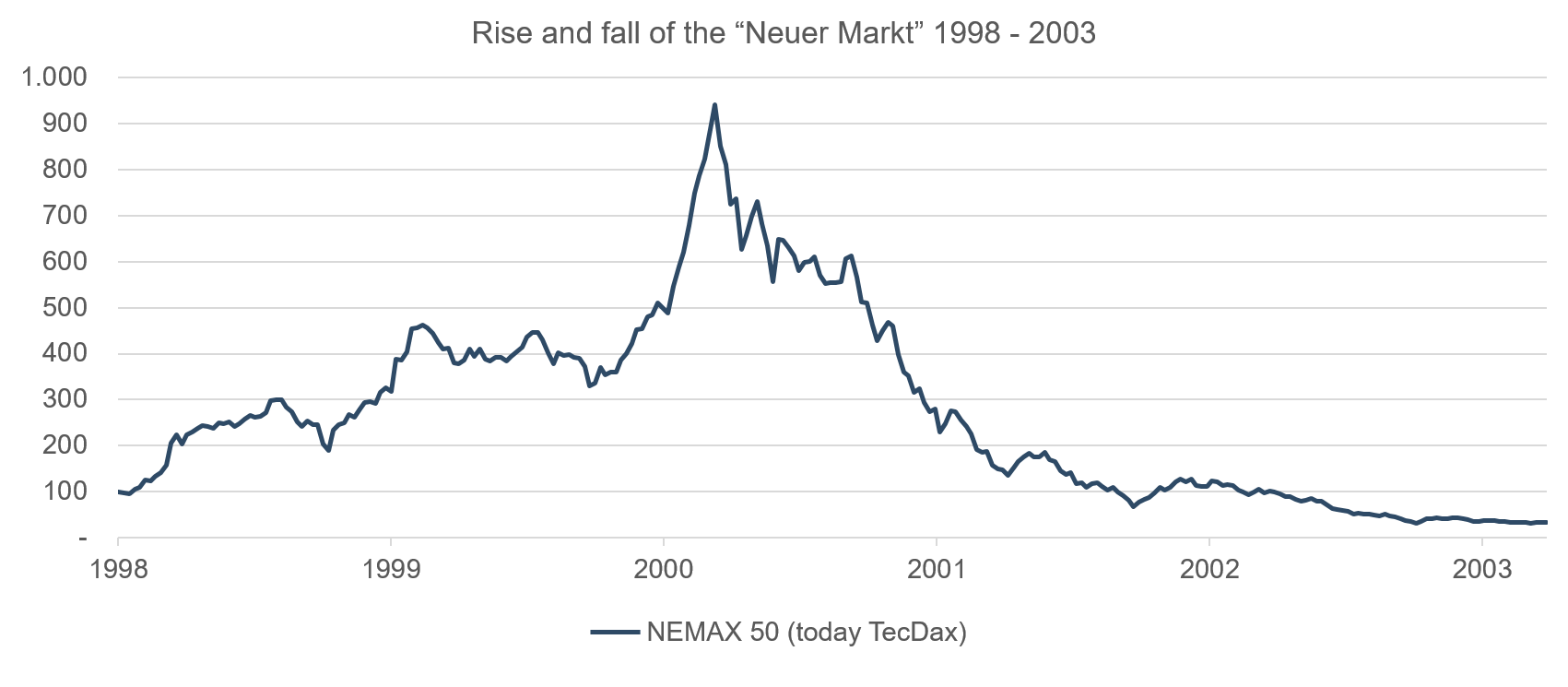

The “Neuer Markt” was set up as Germany’s answer to the Nasdaq in the U.S.: a segment for financing young, innovative companies. The newest German stock exchange index at the time, it skyrocketed as soon as it launched at the beginning of 1997. The first new issues – just like what happened in the U.S. – were many times oversubscribed, and share price gains were regarded as a certainty. Even jumps of 100% on the first day were a possibility. It’s true that IPOs in the U.S. at the time were on a different scale, but at least Germany now had its own Wall Street, albeit somewhat smaller. The first bright lights of the “Neuer Markt” were Mobilcom, Singulus and LHS Group. The share prices of these companies soared and made overnight millionaires of their major shareholders. Attracted by the successes, more and more companies strove to obtain a listing on the “Neuer Markt”. A large number of new issues followed and the success of the “Neuer Markt” eclipsed all other indices, such as the MDax and the SDax. For investment banks, this was a very profitable time and technology fund managers were treated like popstars. Even the number of Porsche registrations and sales of other luxury goods shot up as the new economy created fresh millionaires. The stock market boom was in full swing. Not even the Asian financial crisis in Autumn 1998, which caused a temporary fall of 40% in the Dax, could hold back the “Neuer Markt”. From the end of 1999 until March 2000, the world of finance finally let loose. The stock market was all about TMT and nothing else. The “old economy” business activities, such as automotive, energy and industry, were sidelined. Although the indices continued to break records, most “old economy” stocks lost value. The indices only got a boost from the technology and telecommunications sectors, as well as from audacious takeovers such as Vodafone’s takeover of Mannesmann. Thus fate ran its inevitable course.

What began as a smart idea to finance young companies ultimately led to a gigantic bubble of speculation, which ended with a loud bang: news of the first scandals broke in March 2000. It transpired that many business models were unsound and could never have been profitable. Some companies turned out to be shady, their balance sheets weak, run by managers who were often out to line their pockets. The decline of the technology scene began.

As ever, the scandals in the U.S. were on a different scale than those in Europe. Multinationals such as WorldCom and Lucent Technologies were taken to court for alleged balance sheet misrepresentation, and their share prices plummeted. Both WorldCom and Lucent were two of the Baby Bells that were a product of the breakup of AT&T in the 1980s and had been among the high-achievers of the sector for years. Lawsuits against these icons of the U.S. economy rattled the whole sector. The party was finally over. Both the Nasdaq and the “Neuer Markt” plummeted. The subsequent downtrend in the stock markets, with many bankruptcies and further scandals, did not end for three years.

Figure 2: Rise and fall of the “Neuer Markt” 1998–2003

What about today? Many parallels can certainly be drawn between then and now. The economic cycle is at an advanced stage and is being shored up by exceptionally low interest rates and tax cuts in the U.S. Similarly, national debt is a multiple of what it was in 1999. The high level of debt has financially paralysed some countries (such as Greece), and without assistance from central banks other countries (such as Italy) would be caught in this same debt trap. Many companies have also greatly increased their debt ratio, and bought back shares on credit. In addition, their balance sheets in many cases consist of intangible assets. The fact that the supply of liquidity from central banks is slowly drying up and that interest rates have the potential to rise poses an additional risk with unforeseeable consequences for borrowers. The resulting investment crisis could, however, cause stock markets to heat up further, and current valuations allow for further price rises.

Aside from these current risks, however, it must be said that the starting situation today is completely different. On closer inspection, comparisons with 1999 don’t hold up at all. Firstly, the major indices in Europe and the U.S. are exhibiting no extreme valuations; after the latest correction at the end of February they are in or around the historical average. So, we have some way to go before we get to the valuation levels of 1999. Secondly, there may be some worrying speculation in some equities but overall it is too insignificant to cause pronounced fluctuations in the stock markets. Moreover, those companies do not have the economic clout that multinationals like WorldCom, Lucent and Enron did in 2000. So, what we have here is isolated, regional, sectoral phenomena. Furthermore, there are only a few new issues in Europe, and mass oversubscriptions are the absolute exception whereas in 1999 hardly a day went by without a new TMT issue whose IPO was being following with great interest. Besides, today’s indices have a much greater market breadth whereas in 1999 only a few equities with a very substantial index weight were the driving force behind the stock markets. While the present measures to contain coronavirus pose economic risks, excessive speculation similar to the dotcom bubble can be ruled out at the moment. There should therefore be further potential for the bull run on stock markets that has lasted for more than ten years – driven mostly by technology shares.

Positioning of the Ethna Funds

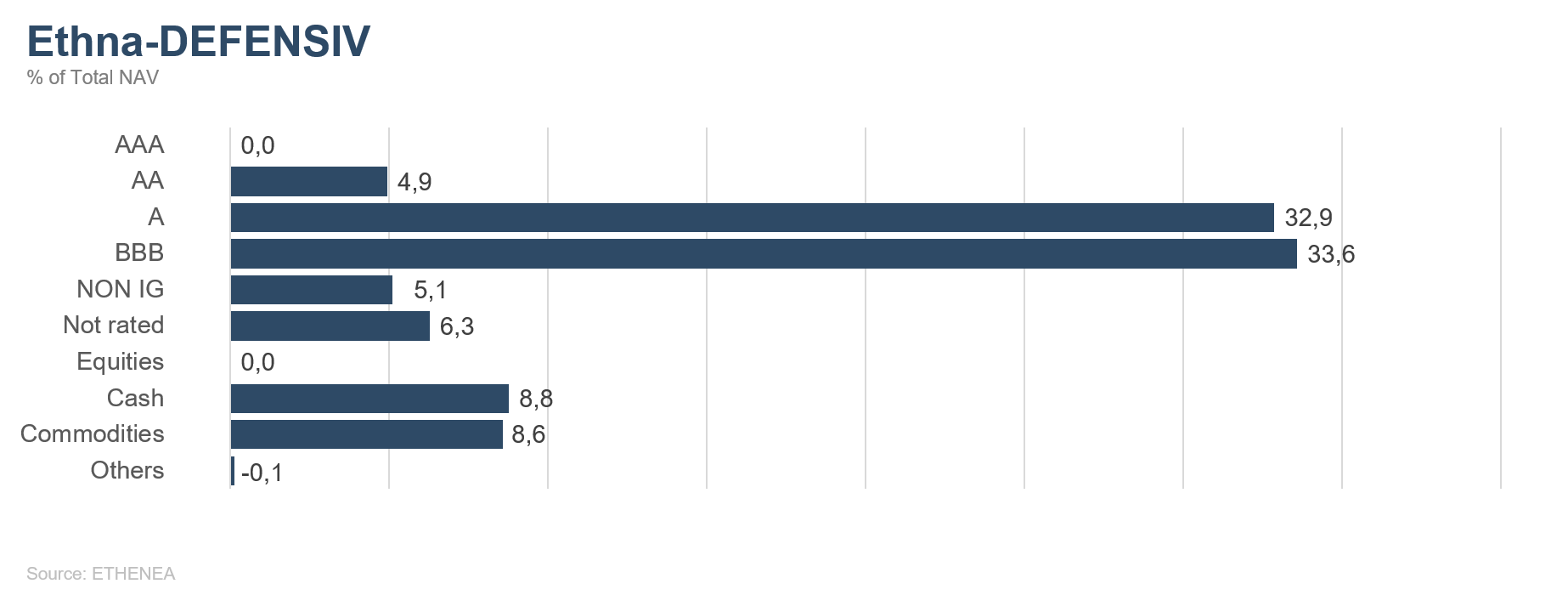

Ethna-DEFENSIV

The markets were dominated in February by the worsening of the COVID-19 epidemic in China and its potential to become a global pandemic.

Uncertainty about future global consumer demand, and in particular concerns about the possible collapse of international supply chains, led in the last week of February to a sell-off of risk assets and flight to safe havens, such as German or U.S. sovereign bonds.

European and U.S. equity markets lost between 8% and 10% in February while the yields on 10-year German Bunds fell by 20 basis points over the course of the month to -0.61% and yields on 10-year Treasuries even fell by 36 basis points to 1.15%.

Investors initially fled to gold, which at times gained up to 4.4% in USD, but lost all the gains in the last few days of the month. We interpret the sell-off as a sign that market participants have a greater need for liquidity, as outflows and margin calls have to be met. For the same reason, carry trades were reversed: euro-financed investments in USD-denominated emerging markets assets were reversed and converted back into euro, which led to an increase in the EUR/USD exchange rate in the context of the escalation of the COVID-19 crisis in the last week of February.

Corporate bonds with investment grade rating managed to do relatively well in this environment: euro-denominated corporate bonds trended slightly downward, at -0.5%, while USD-denominated corporate bonds were up over 1% on the back of the sharp fall in U.S. yields.

The Ethna-DEFENSIV’s performance was stable in February, up 0.55%. YTD performance stands at 2.28%.

The Ethna-DEFENSIV saw positive contributions from all asset classes in which it was invested. In particular, the strong credit quality of corporate bonds, whose ratings average between BBB+ and A-, led only to slight widening of the credit risk premia in the portfolio. In addition, in an environment of falling yields, the portfolio’s duration was to its advantage. On 19 February, before the sharp fall in yields, we closed our short position in 10-year Treasury futures – which made up approximately 10% of the net asset value – and scaled back the duration to the same as bonds: 6.4 years.

At the same time, we sold some of the higher-yielding but riskier positions. These included cyclical chemical stocks that could be particularly affected by a decline in global economic activity. Lastly, we sold off all our Spanish sovereign bonds in order to give the portfolio additional stability.

It is hard at the moment to provide an outlook for the coming months. Our baseline scenario is still based on the assumption that the economic impact of the COVID-19 pandemic will be easier to estimate in the coming months and there will be return to normality. Nevertheless, given the conservative risk profile of the fund, we deem it appropriate to maintain the cautious positioning for the time being in order to cushion the impact of any further escalation of the crisis. In this situation, flexibility is and remains top priority at ETHENEA.

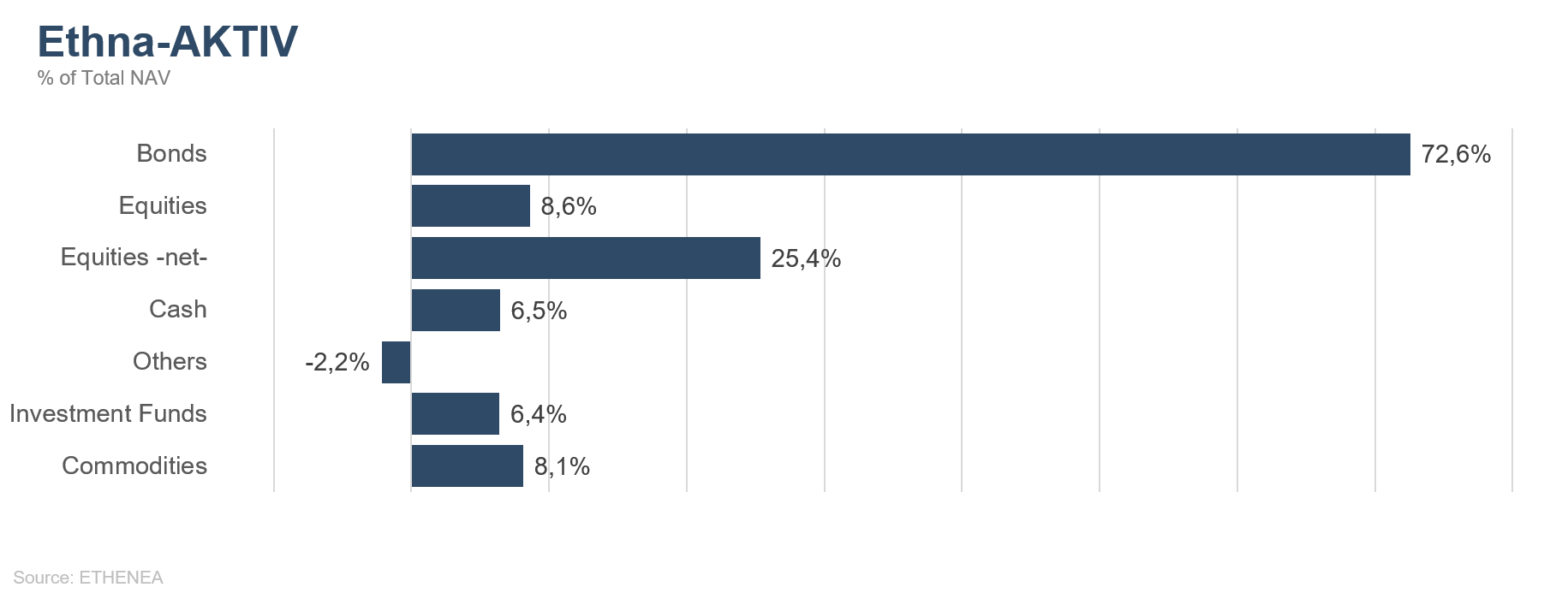

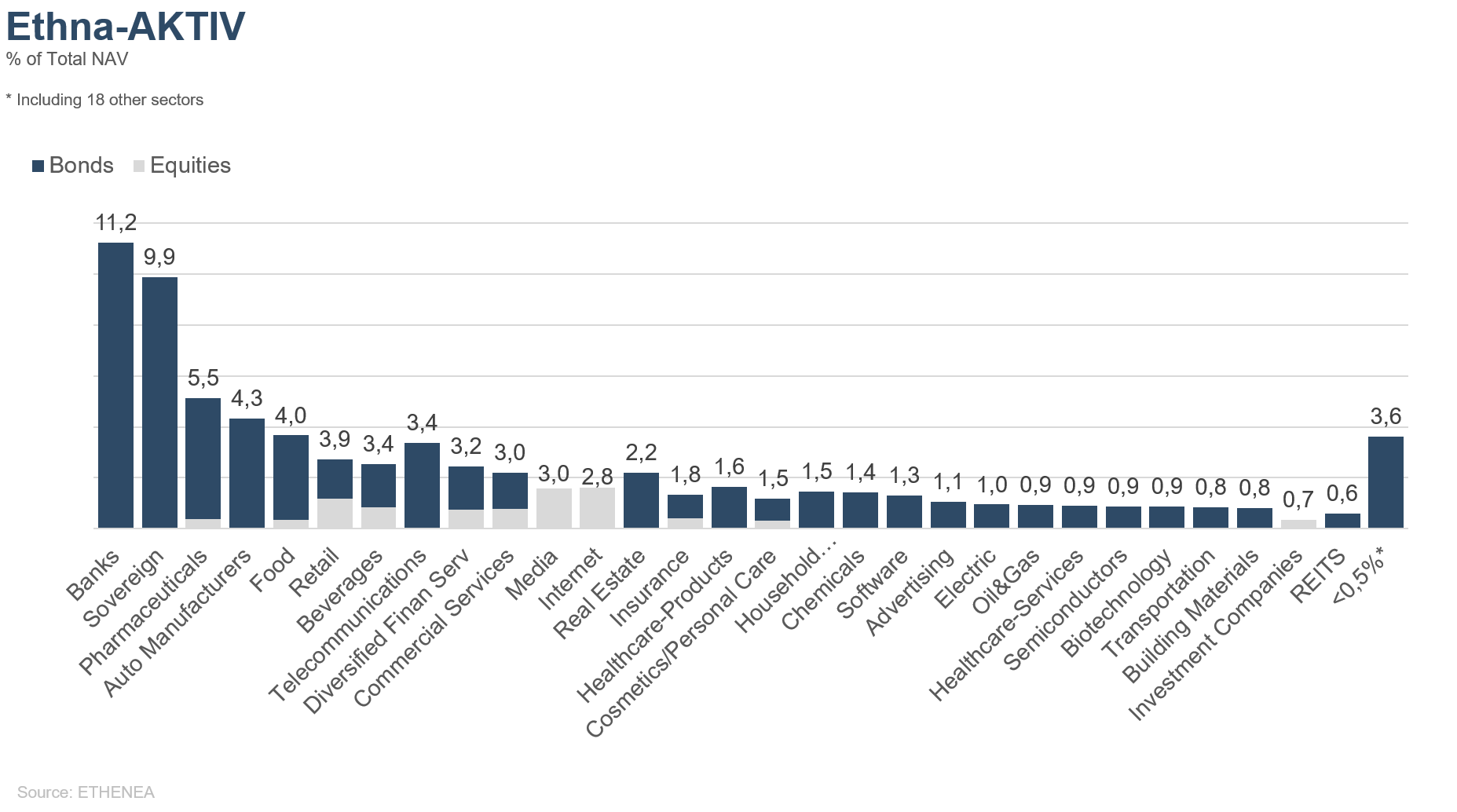

Ethna-AKTIV

The month of February was dominated by news about the outbreak and possible implications of coronavirus. The fact that the rate of new infections in China soon fell, coupled with a certain recklessness on the part of market participants, caused global equity indices to rise strongly again after the losses in the last week of January. As part of this rise, a whole array of indices reached new all-time highs over the course of the month. However, what happened next was a new record for the history books on the stock markets: fuelled by rising numbers of cases outside China – especially in Italy, Iran and South Korea – stock markets saw a sell-off in the last week of February the like of which was never before seen so soon after reaching an all-time high. The fear, if not outright panic, that this supply-side shock caused by disease could plunge the global economy into recession suddenly gained the upper hand. Corporate bond premia could not escape this sentiment swing. The fact that sovereign bond yields fell to new lows for the year and the Chinese Purchasing Manager Index was lower at the end of the month than ever before is further confirmation of these negative expectations. Also unhelpful with regard to the general risk perception of the market is the intensification of clashes between Syria and Turkey, including the implications for NATO partners, and the fact that Bernie Sanders is currently in the lead to win the Democratic nomination for the upcoming U.S. presidential election.

This means an increase in volatility, not only for the markets in general but also for our portfolio specifically. Within the portfolio context of the Ethna-AKTIV, however, the diversifying effect of a multi-asset approach and the advantages of active management again came to bear. While it was not possible to make up for the losses sustained by the equity portfolio, they were mitigated by the disciplined, countercyclical and procyclical reduction of the equity allocation, by the positive contribution made by bonds, and by currency positions. While we had increased portfolio duration back at the beginning of the month by closing the short positions in U.S. interest rate futures, we increased our USD and CHF currency positions by 10% at the end of the month. We are confident that the strength of the euro we are seeing in the meantime will turn out merely to be a flash in the pan and that we will reach the targets of 1.05 USD/EUR and 1.00 CHF/EUR over the course of the year.

In light of recent events, our view of the global economy and thus also the capital markets is much more neutral than last month, when it was still cautiously optimistic. This has to do not only with the fact that the OECD has reduced its global growth estimate to 2.4% but also with our doubt that central banks’ previous and expected actions will have the desired effect on this occasion. Until the effects of the epidemic on the global economy can be better estimated, we see fit to position the portfolio more conservatively. As part of this process, we will continue to improve the quality of the bond portfolio and will soon bring the equity allocation closer to 10%.

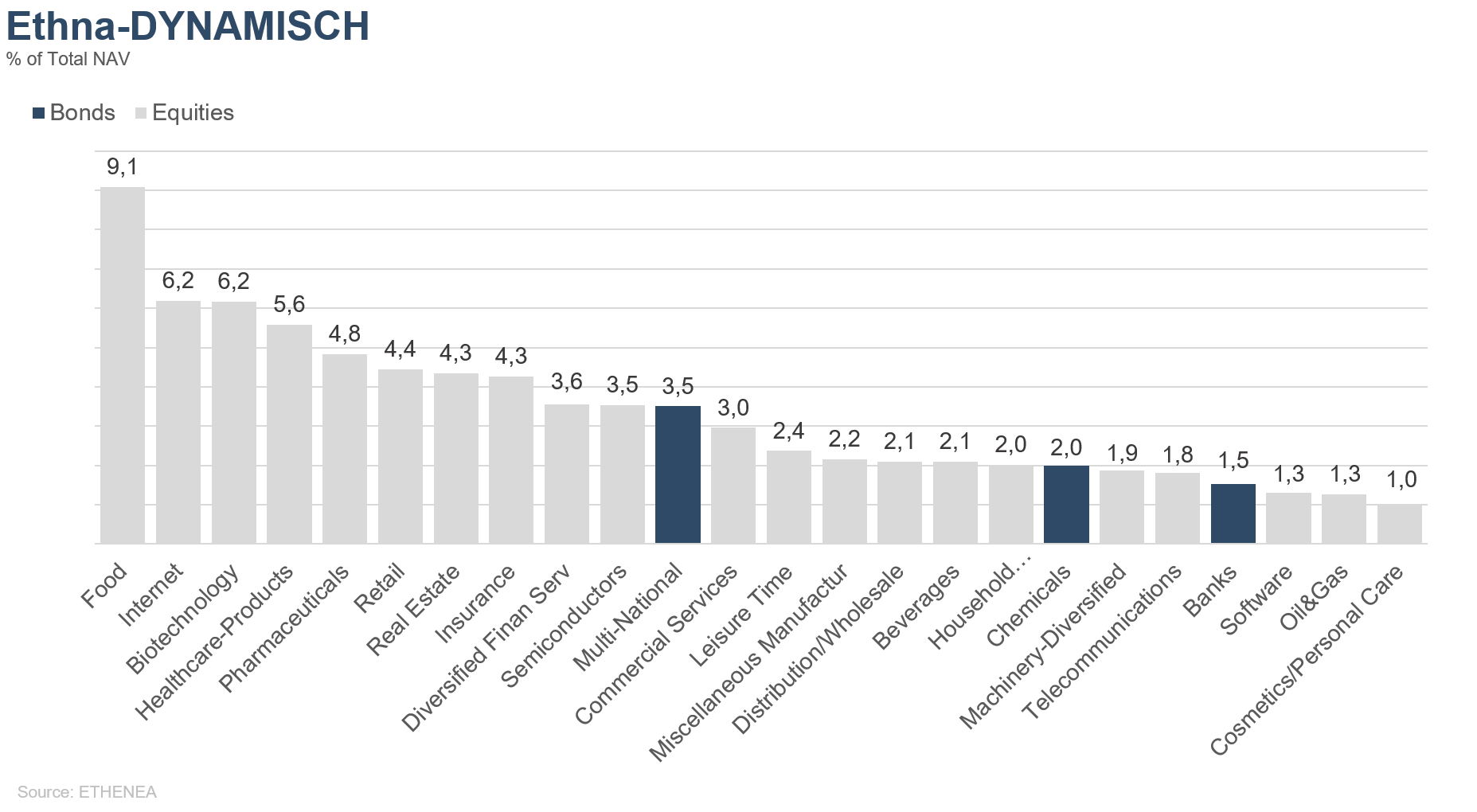

Ethna-DYNAMISCH

February was all about coronavirus and its continued spread, which is now continuing further outside China. The good mood in equity markets that held until the middle of the month and the increasing recklessness of many investors made markets open to correction, which set in with a vengeance in the second half of the month. Within a matter of days the global leading indices had recorded double-digit losses, pushing equity markets well into negative territory compared with the beginning of the year. The driver behind the current uncertainty is the lack of clarity about the severity of the further spread of the coronavirus – now officially named SARS-CoV-2 – and the extent to which the economy will be further crippled as a result.

Admittedly, we know just as little as every other investor what the ultimate scale of the virus will be. But investing always involves uncertainty. It is about weighing up risks and opportunities. Regardless of the human suffering – considering that in all likelihood more people die in a normal flu season than will die in the current coronavirus outbreak – an epidemic such as the one we’re having is almost always a temporary event in the context of both the economy and the stock exchange. In other words, after the overwhelmingly flu-like wave of infections passes, the world will return to normality, as we are slowing starting to see in China.

What does this mean for the Ethna-DYNAMISCH? Since the beginning of the year we have steadily reduced the equity allocation and expanded the hedging components because – especially at tactical level – the risk/return ratio has became increasingly unattractive. Strategically, however, the investment case for equities remained intact, so we didn’t venture too far below 50% equity allocation in order to remain significantly invested in equities. We believe the current downturn came to an initial culmination in the final days of trading in February, when the recklessness described above had turned to panic and fear after a brutal slump in prices lasting several days. In equity markets this is frequently the ideal breeding ground for future price gains. With this in mind, we successively increased the equity allocation into the fall in prices, reversed some of the hedging and raised the net equity allocation from around 45% back up to almost 70%. We also took similar countercyclical action two days earlier when, once the yield reached a new all-time low, we sold the last 2% of our position in long-dated U.S. Treasuries at a profit.

Even though we expect that, in terms of scale, the bulk of the correction is behind us, the volatility and uncertainty that has risen of late is sure to remain with us for some time to come. There have recently been price movements in capital markets in a matter of hours that otherwise take weeks. This opens up opportunities successively to add further high-quality companies to the portfolio at much more attractive entry prices. At the same time, we will adjust the overriding net equity allocation actively via derivatives, as before, in order to generate added value in this respect as well.

Figure 3: Portfolio structure* of Ethna-DEFENSIV

Figure 4: Portfolio structure* of Ethna-AKTIV

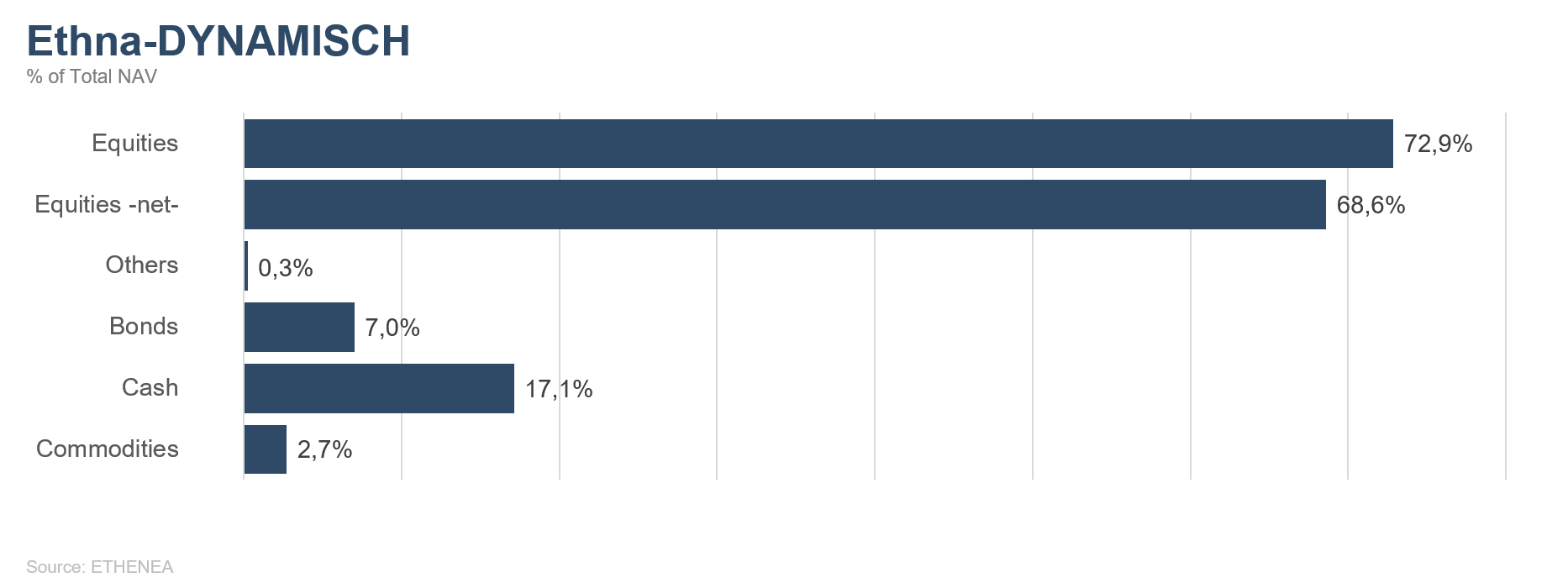

Figure 5: Portfolio structure* of the Ethna-DYNAMISCH

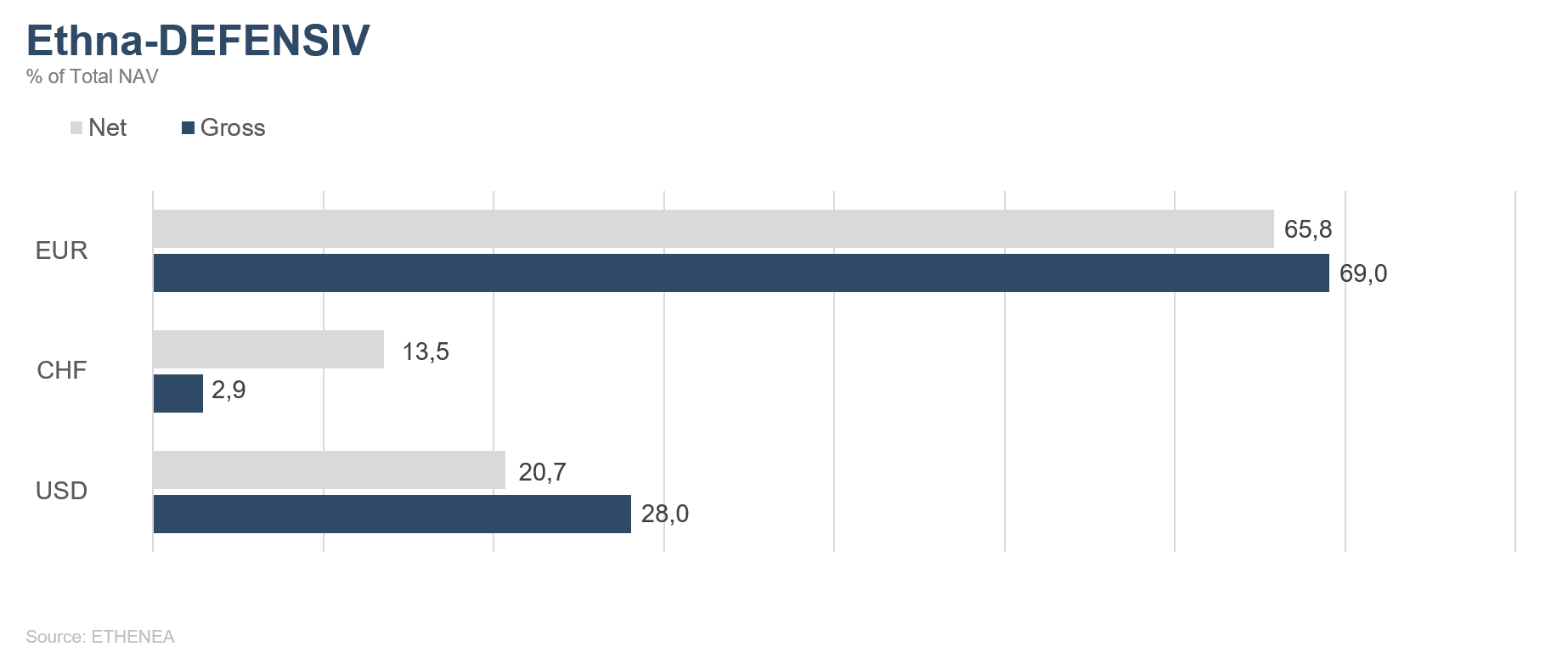

Figure 6: Portfolio composition of the Ethna-DEFENSIV by currency

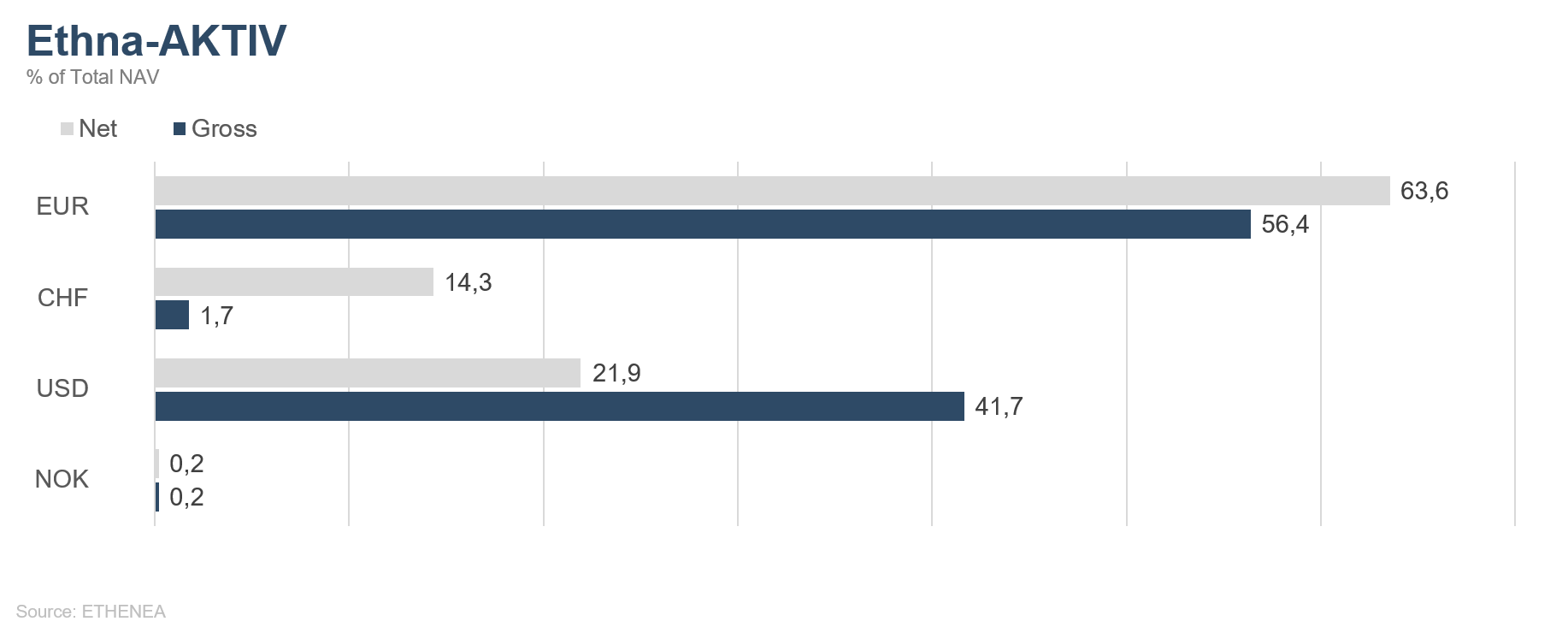

Figure 7: Portfolio composition of the Ethna-AKTIV by currency

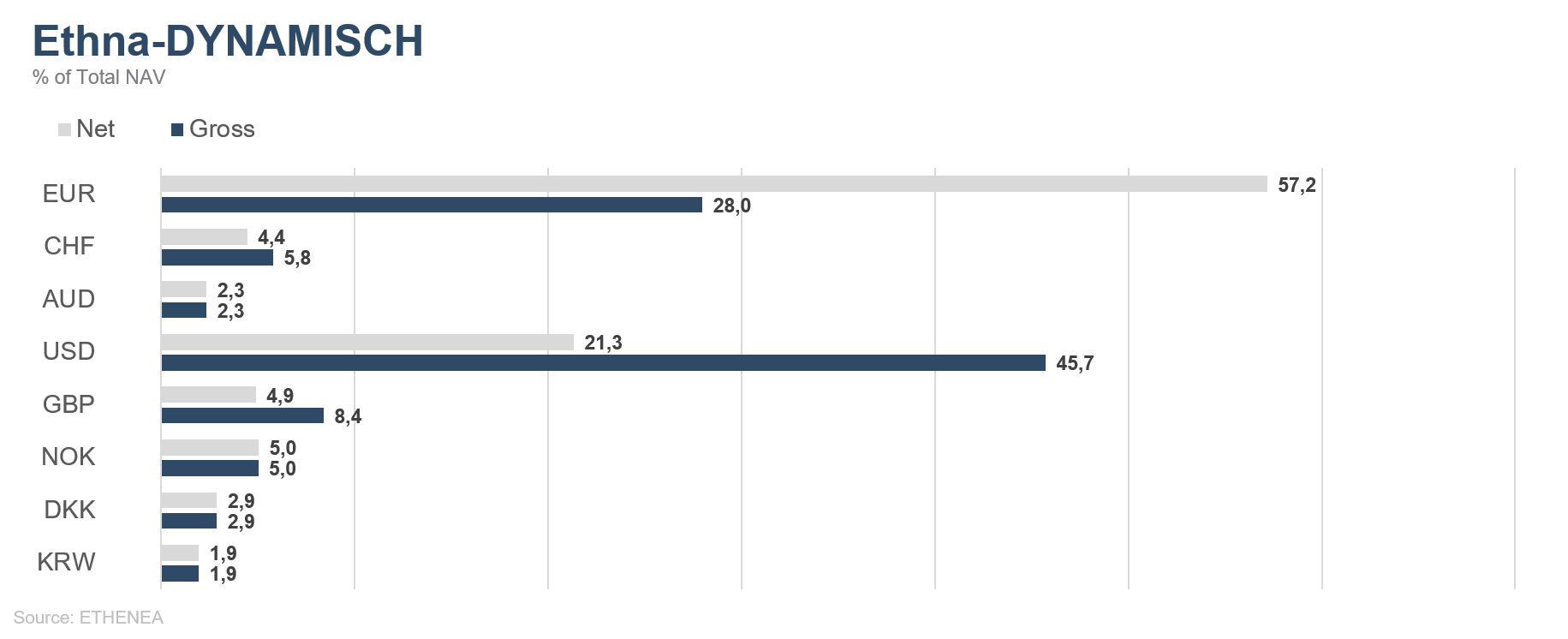

Figure 8: Portfolio composition of the Ethna-DYNAMISCH by currency

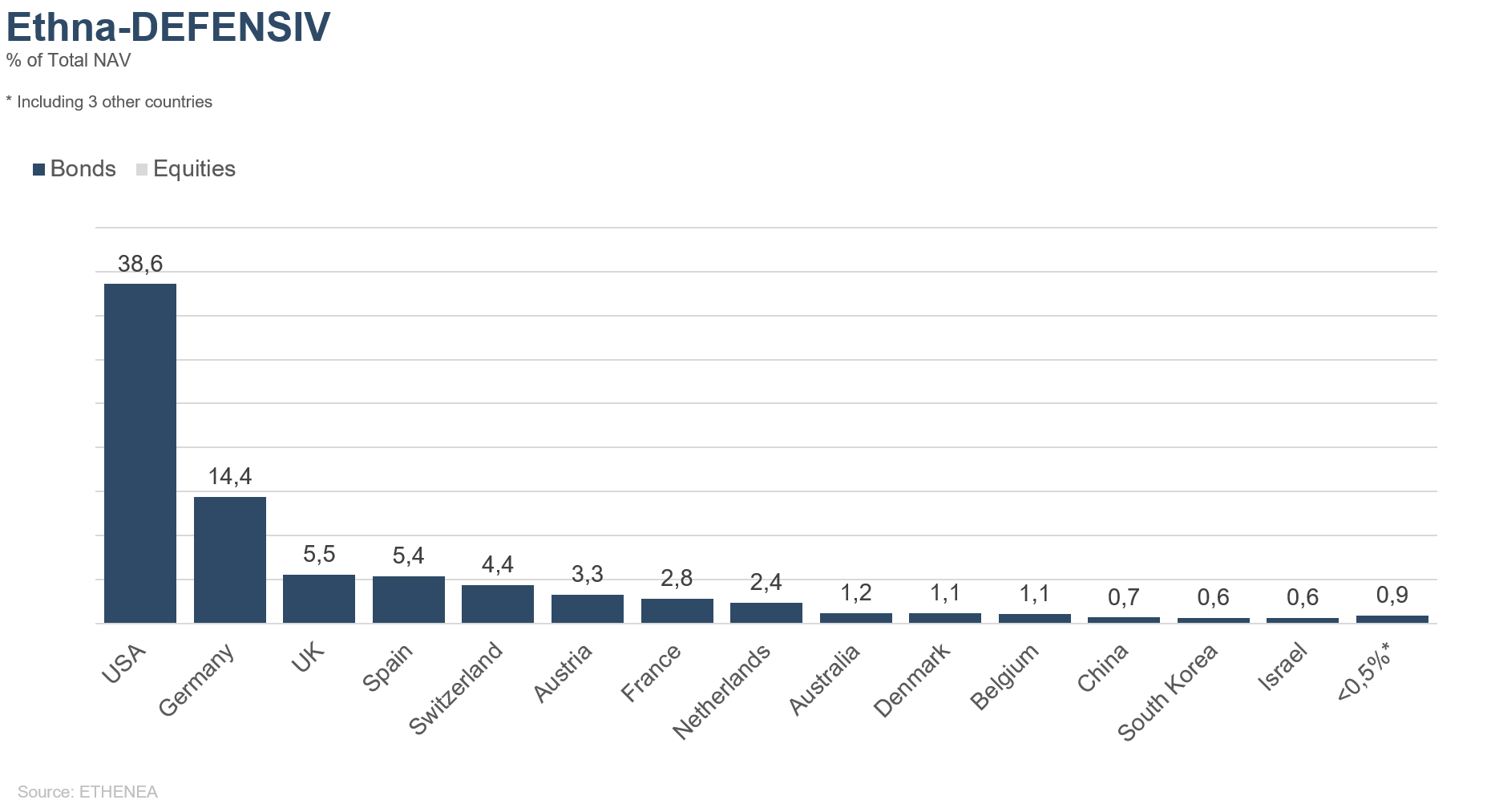

Figure 9: Portfolio composition of the Ethna-DEFENSIV by country

Figure 10: Portfolio composition of the Ethna-AKTIV by country

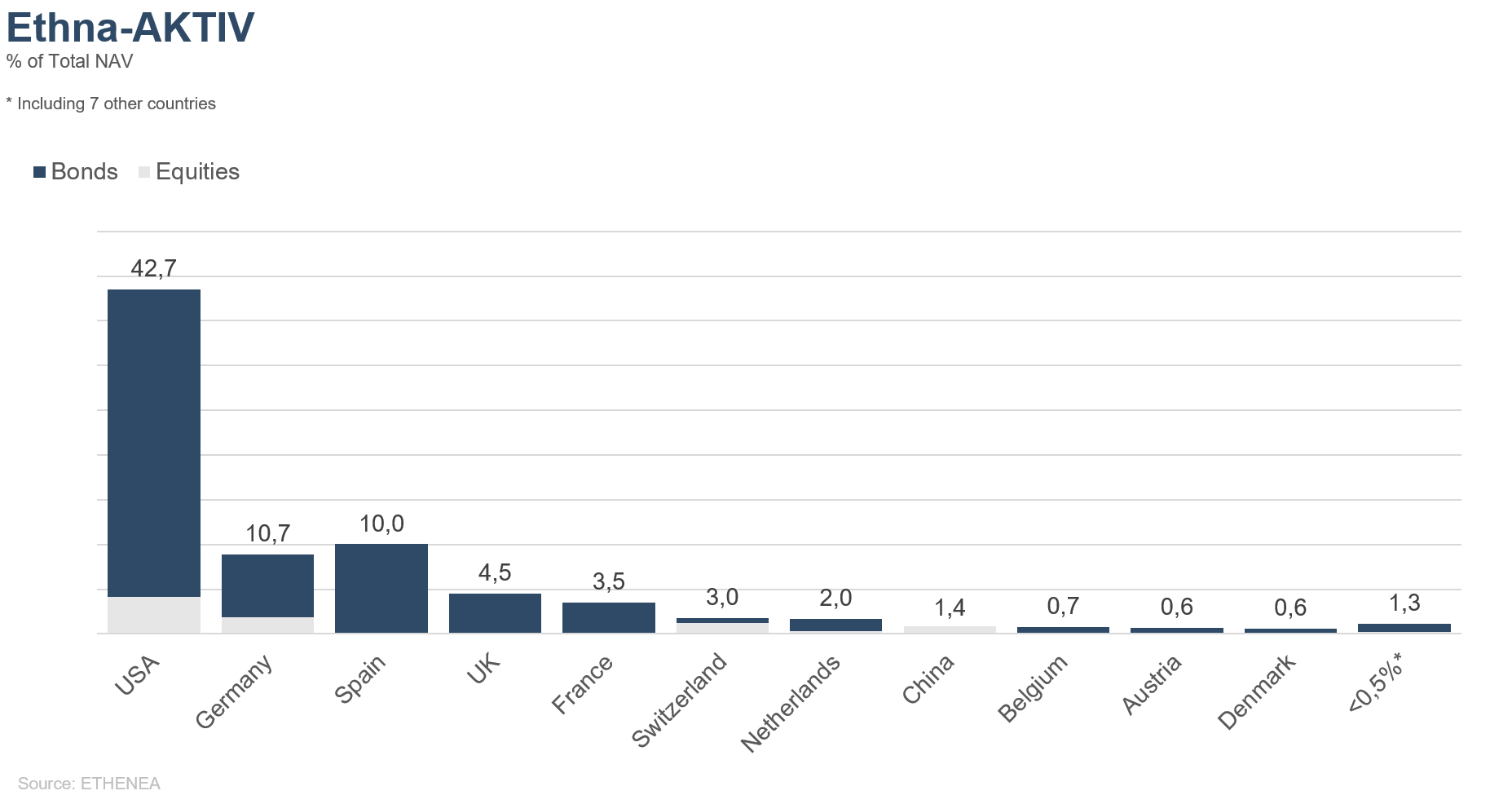

Figure 11: Portfolio composition of the Ethna-DYNAMISCH by country

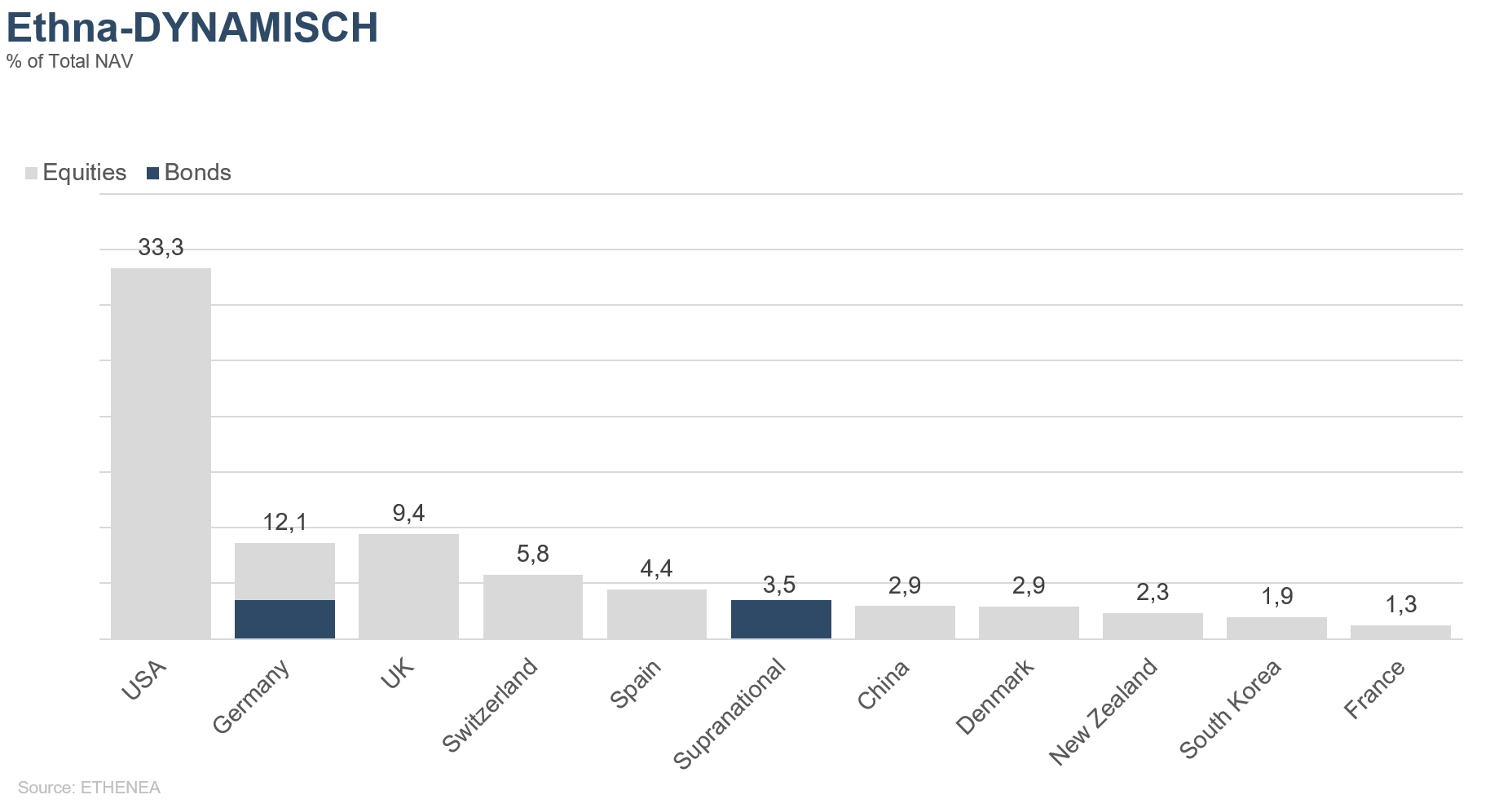

Figure 12: Portfolio composition of the Ethna-DEFENSIV by issuer sector

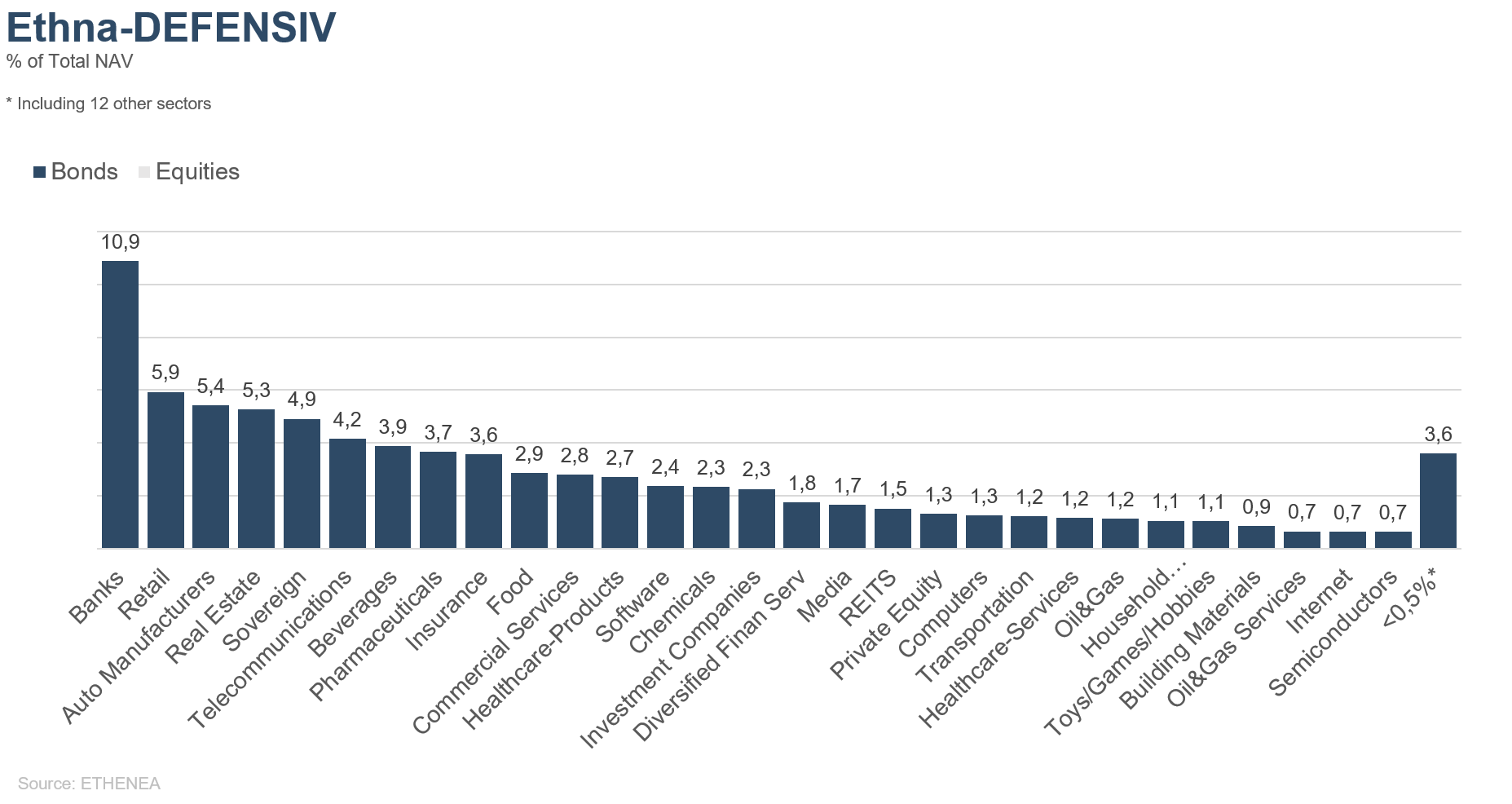

Figure 13: Portfolio composition of the Ethna-AKTIV by issuer sector

Figure 14: Portfolio composition of the Ethna-DYNAMISCH by issuer sector

* “Cash” comprises term deposits, call money and current accounts/other accounts. “Equities net” comprises direct investments and exposure resulting from equity derivatives.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

This is a marketing communication. It is for product information purposes only and is not a mandatory statutory or regulatory document. The information contained in this document does not constitute a solicitation, offer or recommendation to buy or sell units in the fund or to engage in any other transaction. It is intended solely to provide the reader with an understanding of the key features of the fund, such as the investment process, and is not deemed, either in whole or in part, to be an investment recommendation. The information provided is not a substitute for the reader's own deliberations or for any other legal, tax or financial information and advice. Neither the investment company nor its employees or Directors can be held liable for losses incurred directly or indirectly through the use of the contents of this document or in any other connection with this document. The currently valid sales documents in German (sales prospectus, key information documents (PRIIPs-KIDs) and, in addition, the semi-annual and annual reports), which provide detailed information about the purchase of units in the fund and the associated opportunities and risks, form the sole legal basis for the purchase of units. The aforementioned sales documents in German (as well as in unofficial translations in other languages) can be found at www.ethenea.com and are available free of charge from the investment company ETHENEA Independent Investors S.A. and the custodian bank, as well as from the respective national paying or information agents and from the representative in Switzerland. The paying or information agents for the funds Ethna-AKTIV, Ethna-DEFENSIV and Ethna-DYNAMISCH are the following: Austria, Belgium, Germany, Liechtenstein, Luxembourg: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg; France: CACEIS Bank France, 1-3 place Valhubert, F-75013 Paris; Italy: State Street Bank International – Succursale Italia, Via Ferrante Aporti, 10, IT-20125 Milano; Société Génerale Securities Services, Via Benigno Crespi, 19/A - MAC 2, IT-20123 Milano; Banca Sella Holding S.p.A., Piazza Gaudenzio Sella 1, IT-13900 Biella; Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Spain: ALLFUNDS BANK, S.A., C/ Estafeta, 6 (la Moraleja), Edificio 3 – Complejo Plaza de la Fuente, ES-28109 Alcobendas (Madrid); Switzerland: Representative: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Paying Agent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. The paying or information agents for HESPER FUND, SICAV - Global Solutions are the following: Austria, Belgium, France, Germany, Luxembourg: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg; Italy: Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Switzerland: Representative: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Paying Agent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. The investment company may terminate existing distribution agreements with third parties or withdraw distribution licences for strategic or statutory reasons, subject to compliance with any deadlines. Investors can obtain information about their rights from the website www.ethenea.com and from the sales prospectus. The information is available in both German and English, as well as in other languages in individual cases. Producer: ETHENEA Independent Investors S.A.. Distribution of this document to persons domiciled in countries in which the fund is not authorised for distribution, or in which authorisation for distribution is required, is prohibited. Units may only be offered to persons in such countries if this offer is in accordance with the applicable legal provisions and it is ensured that the distribution and publication of this document, as well as an offer or sale of units, is not subject to any restrictions in the respective jurisdiction. In particular, the fund is not offered in the United States of America or to US persons (within the meaning of Rule 902 of Regulation S of the U.S. Securities Act of 1933, in its current version) or persons acting on their behalf, on their account or for the benefit of a US person. Past performance should not be taken as an indication or guarantee of future performance. Fluctuations in the value of the underlying financial instruments or their returns, as well as changes in interest rates and currency exchange rates, mean that the value of units in a fund, as well as the returns derived from them, may fall as well as rise and are not guaranteed. The valuations contained herein are based on a number of factors, including, but not limited to, current prices, estimates of the value of the underlying assets and market liquidity, as well as other assumptions and publicly available information. In principle, prices, values, and returns can both rise and fall, up to and including the total loss of the capital invested, and assumptions and information are subject to change without prior notice. The value of the invested capital or the price of fund units, as well as the resulting returns and distribution amounts, are subject to fluctuations or may cease altogether. Positive performance in the past is therefore no guarantee of positive performance in the future. In particular, the preservation of the invested capital cannot be guaranteed; there is therefore no warranty given that the value of the invested capital or the fund units held will correspond to the originally invested capital in the event of a sale or redemption. Investments in foreign currencies are subject to additional exchange rate fluctuations or currency risks, i.e. the performance of such investments also depends on the volatility of the foreign currency, which may have a negative impact on the value of the invested capital. Holdings and allocations are subject to change. The management and custodian fees, as well as all other costs charged to the fund in accordance with the contractual provisions, are included in the calculation. The performance calculation is based on the BVI (German federal association for investment and asset management) method, i.e. an issuing charge, transaction costs (such as order fees and brokerage fees), as well as custodian and other management fees are not included in the calculation. The investment performance would be lower if the issuing surcharge were taken into account. No guarantee can be given that the market forecasts will be achieved. Any discussion of risks in this publication should not be considered a disclosure of all risks or a conclusive handling of the risks mentioned. Explicit reference is made to the detailed risk descriptions in the sales prospectus. No guarantee can be given that the information is correct, complete or up to date. The content and information are subject to copyright protection. No guarantee can be given that the document complies with all statutory or regulatory requirements which countries other than Luxembourg have defined for it. Note: The most important technical terms can be found in the glossary at www.ethenea.com/glossary. Information for investors in Belgium: The prospectus, the key information documents (PRIIPs-KIDs), the annual reports and the semi-annual reports of the sub-fund are available in French free of charge upon request from the investment company ETHENEA Independent Investors S.A., 16, rue Gabriel Lippmann, 5365 Munsbach, Luxembourg and from the representative: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg. Information for investors in Switzerland: The country of origin of the collective investment scheme is Luxembourg. The representative in Switzerland is IPConcept (Schweiz) AG, Münsterhof 12, P.O. Box, CH-8022 Zurich. The paying agent in Switzerland is DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zurich. The prospectus, the key information documents (PRIIPs-KIDs), and the Articles of Association, as well as the annual and semi-annual reports, can be obtained free of charge from the representative. Copyright © ETHENEA Independent Investors S.A. (2024) All rights reserved. 03/03/2020