Promised and delivered!

It was all go on the markets for a long time. But sometimes things change in a flash. Unforeseeable events suddenly turn the tide. Concern spreads among investors. Fears of excruciating, severe falls, which cannot easily be turned round, run deep. So it’s no wonder that hedging against falling prices after the turbulence of recent months and years seems more important now than in the past. Also, there are solutions out there that do not lose sight of returns, even in this environment. The HESPER FUND – Global Solutions – a flexible, multi-faceted multi asset fund – offers certainty whatever the market conditions. It’s a concept that delivers and keeps its promises – time and time again!

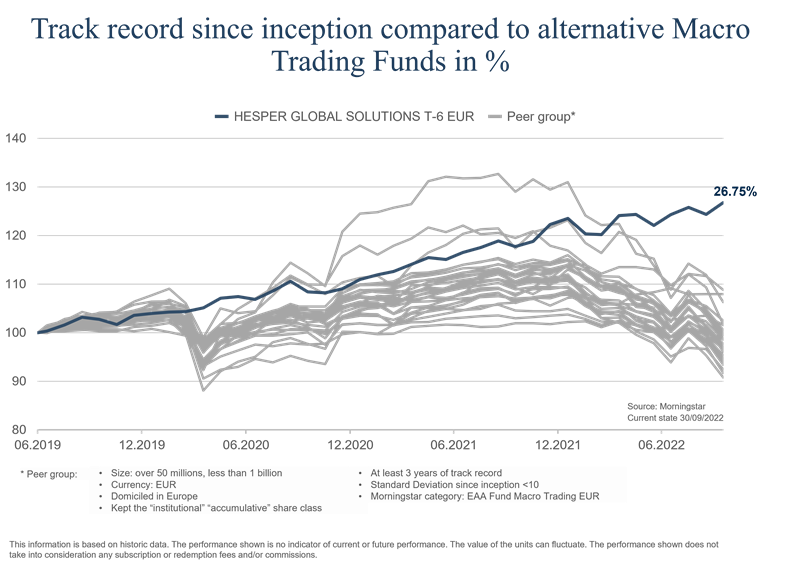

The HESPER FUND − Global Solutions has generated solid performance since launch in July 2019 – in highly turbulent market environments. The ingredients for sustained success are the underlying risk and return targets. The top priority is capital preservation. It doesn’t end there, however. The fund management has set itself the goal of achieving a target return of 7% to 9% on moderate target volatility of 7% to 9% based on a diversified portfolio coupled with high-functioning risk management.

In the scant three years since fund launch, the markets have been severely tested many times over and in some cases have taken a terrible battering. Over and over, new twists and turns have driven movements in prices and caused the market barometer to record highs and lows.

Time and time again, the actively managed global macro fund has passed the litmus test. Many funds within the macro trading peer group lost out, both in terms of performance and in term of drawdown.

Put through its paces

Promises are all well and good, but what about the reality? Let’s have a look at the results over the past three years. The trade conflict between the US and China in 2019 was an issue with serious implications that dominated markets around the world. That summer, the often hard-line US President Donald Trump put the kibosh on trade negotiations. The HESPER FUND − Global Solutions overcame the difficulties in August 2019 brilliantly, thanks to the flexibility of our fund approach.

The cash position was increased; equities and corporate bonds reduced. This rapid action, flexibility and the underlying low correlation with traditional asset classes saw the fund through these choppy waters relatively unscathed. At the end of 2019, performance stood at a respectable 3.69%.

A one-off? Not at all!

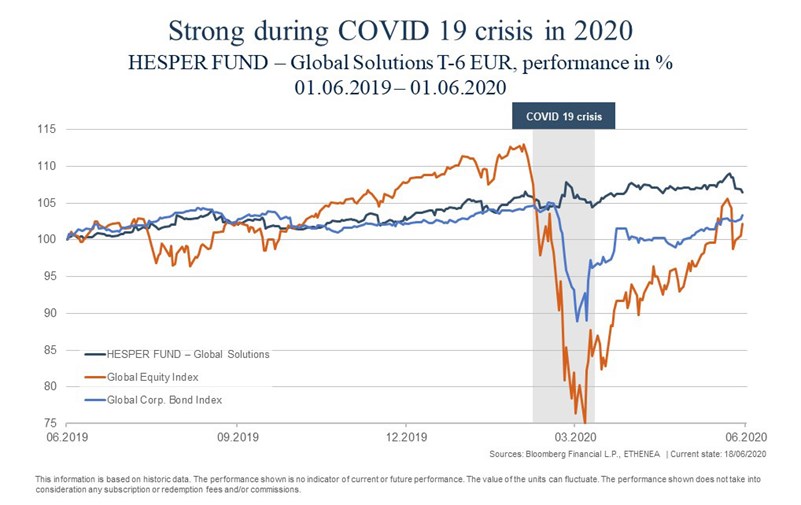

In the years 2020 to 2022, too, unforeseeable events on a global scale cast a dark shadow over the macro situation. When coronavirus spread around the world in early 2020, there were massive sell-offs in markets in a short space of time. Investors were very nervous, and volatility shot up. Even during this scary time, the HESPER FUND − Global Solutions stood strong.

Our fund management team under Dr. Andrea Siviero and Federico Frischknecht managed to cope well with this period of stress. To avoid getting swept up in the backdraught of plummeting stocks, the equity allocation was hedged by futures, and an additional (net) short position was built up/expanded.

The fund passed its second test with flying colours and closed full-year 2020 with plus 6.75%. 2021 was the second year of the pandemic, and performance rose to a very impressive 11.29%.

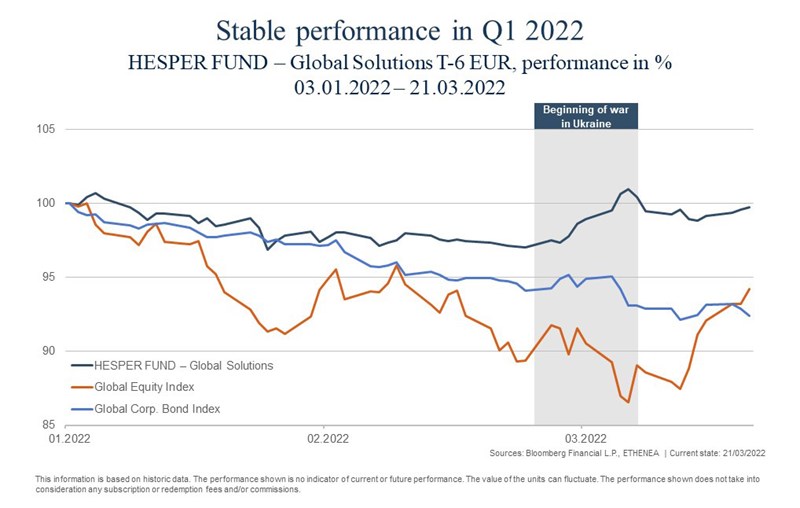

The outbreak of war in Ukraine in February 2022 was a historic turning point. This was yet another unforeseeable crisis, but the fund management again navigated the fund through these stormy seas. The equity allocation was halved and the fund stocked up on bonds with a high rating and upped the US dollar exposure.

The result? Again convincing in relation to the Global Equity Index/Global Corporate Bond Index.

What was impressive was that, in the weakest month since launch, performance was only down 2.5% – whereas many equity and bond funds were well inside negative territory.

The strategy behind this success

Sailing through three tough macro-economic challenges with ease has nothing to do with luck. Rather, these positive results are based on the strategic thrust of the fund and the HESPER FUND - Global Solutions’ investment process.

Active flexibility is the key to sustained success. This enables the fund to invest in various asset classes depending on the market – such as equities, bonds, currencies and commodities – and also to be flexible with duration management. In addition, derivatives are used to hedge or increase exposure. This range makes it possible for the fund to enter into dynamic and innovative positions and also keep volatility under control. The fund management remains agile at all times – acting rather than just looking on.

What is the underlying investment philosophy? The tried-and-tested investment approach is based on a three-step process. It considers secular growth themes (such as demographics, technological progress and climate change) as well as the macro outlook on events over the coming 12 to 18 months and, ultimately, market sentiment, which is used for tactical allocation.

Is this process set in stone? As always, we monitor and tweak fund exposure to the various asset classes in order to remain flexible and dynamic. This is an element, indeed an essential element, of the fund’s success.

The actively managed global macro fund HESPER FUND − Global Solutions has proven itself yet again in difficult circumstances. Thanks to its above-average performance and comparatively low volatility even in challenging markets, the fund was given a 5-star rating by Morningstar as soon as it turned three years old.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

This marketing communication is for information purposes only. It may not be passed on to persons in countries where the fund is not authorized for distribution, in particular in the USA or to US persons. The information does not constitute an offer or solicitation to buy or sell securities or financial instruments and does not replace investor- and product-related advice. It does not take into account the individual investment objectives, financial situation, or particular needs of the recipient. Before making an investment decision, the valid sales documents (prospectus, key information documents/PRIIPs-KIDs, semi-annual and annual reports) must be read carefully. These documents are available in German and as non-official translations from ETHENEA Independent Investors S.A., the custodian, the national paying or information agents, and at www.ethenea.com. The most important technical terms can be found in the glossary at www.ethenea.com/glossary/. Detailed information on opportunities and risks relating to our products can be found in the currently valid prospectus. Past performance is not a reliable indicator of future performance. Prices, values, and returns may rise or fall and can lead to a total loss of the capital invested. Investments in foreign currencies are subject to additional currency risks. No binding commitments or guarantees for future results can be derived from the information provided. Assumptions and content may change without prior notice. The composition of the portfolio may change at any time. This document does not constitute a complete risk disclosure. The distribution of the product may result in remuneration to the management company, affiliated companies, or distribution partners. The information on remuneration and costs in the current prospectus is decisive. A list of national paying and information agents, a summary of investor rights, and information on the risks of incorrect net asset value calculation can be found at www.ethenea.com/legal-notices/. In the event of an incorrect NAV calculation, compensation will be provided in accordance with CSSF Circular 24/856; for shares subscribed through financial intermediaries, compensation may be limited. Information for investors in Switzerland: The home country of the collective investment scheme is Luxembourg. The representative in Switzerland is IPConcept (Suisse) AG, Bellerivestrasse 36, CH-8008 Zurich. The paying agent in Switzerland is DZ PRIVATBANK (Suisse) AG, Bellerivestrasse 36, CH-8008 Zurich. Prospectus, key information documents (PRIIPs-KIDs), articles of association, and the annual and semi-annual reports can be obtained free of charge from the representative. Information for investors in Belgium: The prospectus, key information documents (PRIIPs-KIDs), annual reports, and semi-annual reports of the sub-fund are available free of charge in German upon request from ETHENEA Independent Investors S.A., 16, rue Gabriel Lippmann, 5365 Munsbach, Luxembourg, and from the representative: DZ PRIVATBANK AG, Niederlassung Luxemburg, 4, rue Thomas Edison, L-1445 Strassen, Luxembourg. Despite the greatest care, no guarantee is given for the accuracy, completeness, or timeliness of the information. Only the original German documents are legally binding; translations are for information purposes only. The use of digital advertising formats is at your own risk; the management company assumes no liability for technical malfunctions or data protection breaches by external information providers. The use is only permitted in countries where this is legally allowed. All content is protected by copyright. Any reproduction, distribution, or publication, in whole or in part, is only permitted with the prior written consent of the management company. Copyright © ETHENEA Independent Investors S.A. (2025). All rights reserved. 13/07/2022