Promised and delivered!

It was all go on the markets for a long time. But sometimes things change in a flash. Unforeseeable events suddenly turn the tide. Concern spreads among investors. Fears of excruciating, severe falls, which cannot easily be turned round, run deep. So it’s no wonder that hedging against falling prices after the turbulence of recent months and years seems more important now than in the past. Also, there are solutions out there that do not lose sight of returns, even in this environment. The HESPER FUND – Global Solutions – a flexible, multi-faceted multi asset fund – offers certainty whatever the market conditions. It’s a concept that delivers and keeps its promises – time and time again!

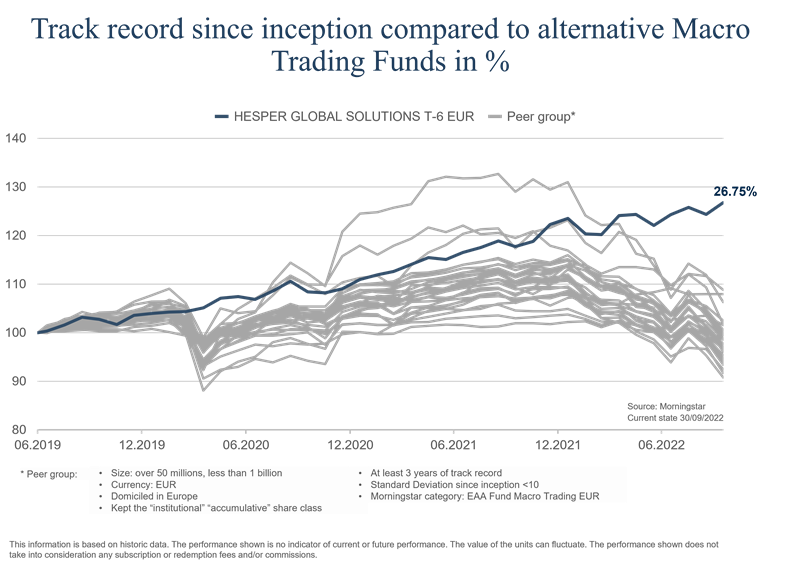

The HESPER FUND − Global Solutions has generated solid performance since launch in July 2019 – in highly turbulent market environments. The ingredients for sustained success are the underlying risk and return targets. The top priority is capital preservation. It doesn’t end there, however. The fund management has set itself the goal of achieving a target return of 7% to 9% on moderate target volatility of 7% to 9% based on a diversified portfolio coupled with high-functioning risk management.

In the scant three years since fund launch, the markets have been severely tested many times over and in some cases have taken a terrible battering. Over and over, new twists and turns have driven movements in prices and caused the market barometer to record highs and lows.

Time and time again, the actively managed global macro fund has passed the litmus test. Many funds within the macro trading peer group lost out, both in terms of performance and in term of drawdown.

Put through its paces

Promises are all well and good, but what about the reality? Let’s have a look at the results over the past three years. The trade conflict between the US and China in 2019 was an issue with serious implications that dominated markets around the world. That summer, the often hard-line US President Donald Trump put the kibosh on trade negotiations. The HESPER FUND − Global Solutions overcame the difficulties in August 2019 brilliantly, thanks to the flexibility of our fund approach.

The cash position was increased; equities and corporate bonds reduced. This rapid action, flexibility and the underlying low correlation with traditional asset classes saw the fund through these choppy waters relatively unscathed. At the end of 2019, performance stood at a respectable 3.69%.

A one-off? Not at all!

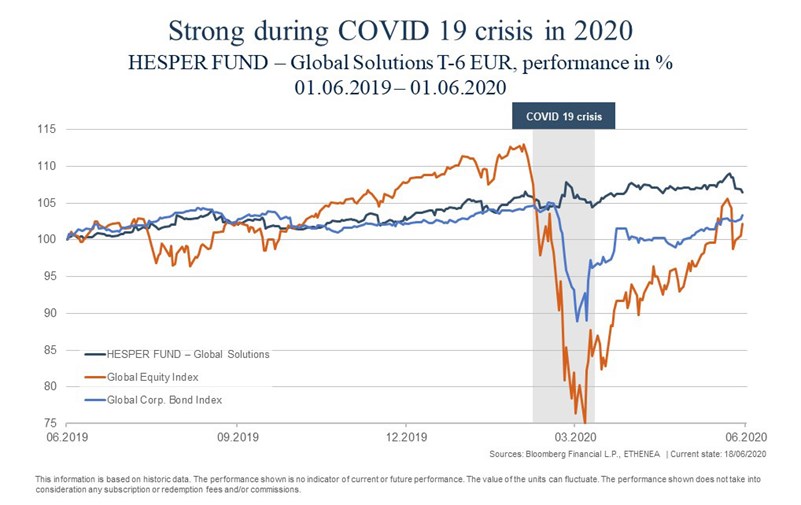

In the years 2020 to 2022, too, unforeseeable events on a global scale cast a dark shadow over the macro situation. When coronavirus spread around the world in early 2020, there were massive sell-offs in markets in a short space of time. Investors were very nervous, and volatility shot up. Even during this scary time, the HESPER FUND − Global Solutions stood strong.

Our fund management team under Dr. Andrea Siviero and Federico Frischknecht managed to cope well with this period of stress. To avoid getting swept up in the backdraught of plummeting stocks, the equity allocation was hedged by futures, and an additional (net) short position was built up/expanded.

The fund passed its second test with flying colours and closed full-year 2020 with plus 6.75%. 2021 was the second year of the pandemic, and performance rose to a very impressive 11.29%.

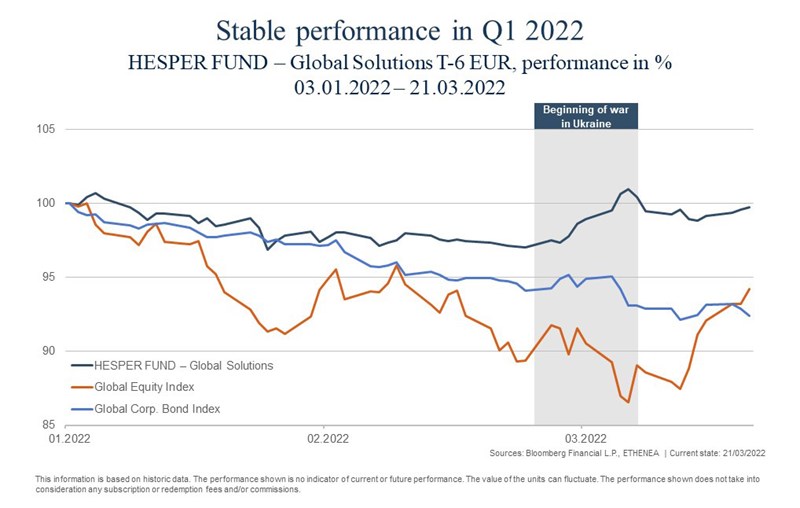

The outbreak of war in Ukraine in February 2022 was a historic turning point. This was yet another unforeseeable crisis, but the fund management again navigated the fund through these stormy seas. The equity allocation was halved and the fund stocked up on bonds with a high rating and upped the US dollar exposure.

The result? Again convincing in relation to the Global Equity Index/Global Corporate Bond Index.

What was impressive was that, in the weakest month since launch, performance was only down 2.5% – whereas many equity and bond funds were well inside negative territory.

The strategy behind this success

Sailing through three tough macro-economic challenges with ease has nothing to do with luck. Rather, these positive results are based on the strategic thrust of the fund and the HESPER FUND - Global Solutions’ investment process.

Active flexibility is the key to sustained success. This enables the fund to invest in various asset classes depending on the market – such as equities, bonds, currencies and commodities – and also to be flexible with duration management. In addition, derivatives are used to hedge or increase exposure. This range makes it possible for the fund to enter into dynamic and innovative positions and also keep volatility under control. The fund management remains agile at all times – acting rather than just looking on.

What is the underlying investment philosophy? The tried-and-tested investment approach is based on a three-step process. It considers secular growth themes (such as demographics, technological progress and climate change) as well as the macro outlook on events over the coming 12 to 18 months and, ultimately, market sentiment, which is used for tactical allocation.

Is this process set in stone? As always, we monitor and tweak fund exposure to the various asset classes in order to remain flexible and dynamic. This is an element, indeed an essential element, of the fund’s success.

The actively managed global macro fund HESPER FUND − Global Solutions has proven itself yet again in difficult circumstances. Thanks to its above-average performance and comparatively low volatility even in challenging markets, the fund was given a 5-star rating by Morningstar as soon as it turned three years old.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

This is a marketing communication. It is for information purposes only and provides the addressee with guidance on our products, concepts and ideas. This does not form the basis for any purchase, sale, hedging, transfer or mortgaging of assets. None of the information contained herein constitutes an offer to buy or sell any financial instrument nor is it based on a consideration of the personal circumstances of the addressee. It is also not the result of an objective or independent analysis. ETHENEA makes no express or implied warranty or representation as to the accuracy, completeness, suitability, or marketability of any information provided to the addressee in webinars, podcasts or newsletters. The addressee acknowledges that our products and concepts may be intended for different categories of investors. The criteria are based exclusively on the currently valid sales prospectus. This marketing communication is not intended for a specific group of addressees. Each addressee must therefore inform themselves individually and under their own responsibility about the relevant provisions of the currently valid sales documents, on the basis of which the purchase of shares is exclusively based. Neither the content provided nor our marketing communications constitute binding promises or guarantees of future results. No advisory relationship is established either by reading or listening to the content. All contents are for information purposes only and cannot replace professional and individual investment advice. The addressee has requested the newsletter, has registered for a webinar or podcast, or uses other digital marketing media on their own initiative and at their own risk. The addressee and participant accept that digital marketing formats are technically produced and made available to the participant by an external information provider that has no relationship with ETHENEA. Access to and participation in digital marketing formats takes place via internet-based infrastructures. ETHENEA accepts no liability for any interruptions, cancellations, disruptions, suspensions, non-fulfilment, or delays related to the provision of the digital marketing formats. The participant acknowledges and accepts that when participating in digital marketing formats, personal data can be viewed, recorded, and transmitted by the information provider. ETHENEA is not liable for any breaches of data protection obligations by the information provider. Digital marketing formats may only be accessed and visited in countries in which their distribution and access is permitted by law. For detailed information on the opportunities and risks associated with our products, please refer to the current sales prospectus. The statutory sales documents (sales prospectus, key information documents (PRIIPs-KIDs), semi-annual and annual reports), which provide detailed information on the purchase of units and the associated risks, form the sole authoritative and binding basis for the purchase of units. The aforementioned sales documents in German (as well as in unofficial translations in other languages) can be found at www.ethenea.com and are available free of charge from the investment company ETHENEA Independent Investors S.A. and the custodian bank, as well as from the respective national paying or information agents and from the representative in Switzerland. The paying or information agents for the funds Ethna-AKTIV, Ethna-DEFENSIV and Ethna-DYNAMISCH are the following: Austria, Belgium, Germany, Liechtenstein, Luxembourg: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg; France: CACEIS Bank France, 1-3 place Valhubert, F-75013 Paris; Italy: State Street Bank International – Succursale Italia, Via Ferrante Aporti, 10, IT-20125 Milano; Société Génerale Securities Services, Via Benigno Crespi, 19/A - MAC 2, IT-20123 Milano; Banca Sella Holding S.p.A., Piazza Gaudenzio Sella 1, IT-13900 Biella; Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Spain: ALLFUNDS BANK, S.A., C/ Estafeta, 6 (la Moraleja), Edificio 3 – Complejo Plaza de la Fuente, ES-28109 Alcobendas (Madrid); Switzerland: Representative: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Paying Agent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. The paying or information agents for HESPER FUND, SICAV - Global Solutions are the following: Austria, Belgium, France, Germany, Luxembourg: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg; Italy: Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Switzerland: Representative: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Paying Agent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. The investment company may terminate existing distribution agreements with third parties or withdraw distribution licences for strategic or statutory reasons, subject to compliance with any deadlines. Investors can obtain information about their rights from the website www.ethenea.com and from the sales prospectus. The information is available in both German and English, as well as in other languages in individual cases. Explicit reference is made to the detailed risk descriptions in the sales prospectus. This publication is subject to copyright, trademark and intellectual property rights. Any reproduction, distribution, provision for downloading or online accessibility, inclusion in other websites, or publication in whole or in part, in modified or unmodified form, is only permitted with the prior written consent of ETHENEA. Copyright © 2024 ETHENEA Independent Investors S.A. All rights reserved. 13/07/2022