Ethna-AKTIV | The name says it all

The multi-asset fund weathered the storm in a show of strength

The years 2022 and 2023 are characterised by a high degree of macroeconomic uncertainty and numerous government interventions in the economy. On the one hand, fears of rampant inflation have forced central banks to embark on the most drastic cycle of interest rate hikes in decades. On the other hand, huge fiscal stimulus packages were implemented to counteract an expected slowdown in growth. In addition, two armed conflicts added to the already high level of complexity. As a result, the capital market has been characterised by high volatility over the past two years. While interest rates at both the short and long ends of the market moved in only one direction, global equity markets experienced both a significant correction and a respectable recovery. It has been a very challenging time for investors.

But not everyone was so badly caught out. It was and still is possible despite a volatile and very uncertain market to stay in control and not be relegated to the role of mere bystander. Looking back over the past two years, the Ethna-AKTIV’s management team has managed to do just that. Both the reduction of losses in 2022 and the timely unwinding of hedges have contributed to the outperformance compared to the well-known peer group. Central to this performance is the underlying approach and investment philosophy. The Ethna-AKTIV is an actively managed, flexible multi-asset fund, which is benchmark agnostic and prioritises the preservation of investor capital.

Active, flexible and preserving capital – what does that mean in reality?

Actively managing portfolio allocation means that we always have the freedom to dynamically re-allocate the positions we entered into and to adjust to changing circumstances. Fixed allocations are a no-no. In other words, the basis for creating added value under the multi-asset approach is the mix of asset classes held in the portfolio. The mix provides an optimal risk/return ratio, and to put it together, the Ethna-AKTIV can use instruments with daily liquidity from among bonds, equities, commodities, cash and currencies. The matter of relative attractiveness of the individual asset classes at any given time is addressed both at strategic and tactical level. The strategic asset allocation is based on the portfolio managers’ macro-economic assessment, while the tactical allocation tends to account for short-term momentum and sentiment factors.

Flexibility is also central to what we do. The Ethna-AKTIV is not constrained by a benchmark. What’s important is absolute rather than relative performance. The same goes for our investment positions. This is another important differentiator. It is this flexibility that enables us to seize opportunities that arise and occasionally to take up unconventional positionings, and to go the distance. It doesn’t end there, though.

This, combined with the principle of capital preservation, makes for a overarching philosophy that is instrumental in our decision-making process. We are very aware of the fine line between capital growth and capital preservation. Therefore, the aim of our approach is to generate a attractive risk-adjusted return over a 3 to 5 year cycle. The year to date has made it abundantly clear how unpredictable the international financial markets can be and that huge drawdowns are possible. We have to avoid such extremes, which of course also have an emotional impact on investors and sometimes lead to irrational actions like selling at the worst possible time. Furthermore, the preservation of capital in times of crisis also means lower losses that would otherwise have to be recouped for capital to be increased long-term. This is why it is essential for us to find an attractive relationship between risk and return for every position we enter into.

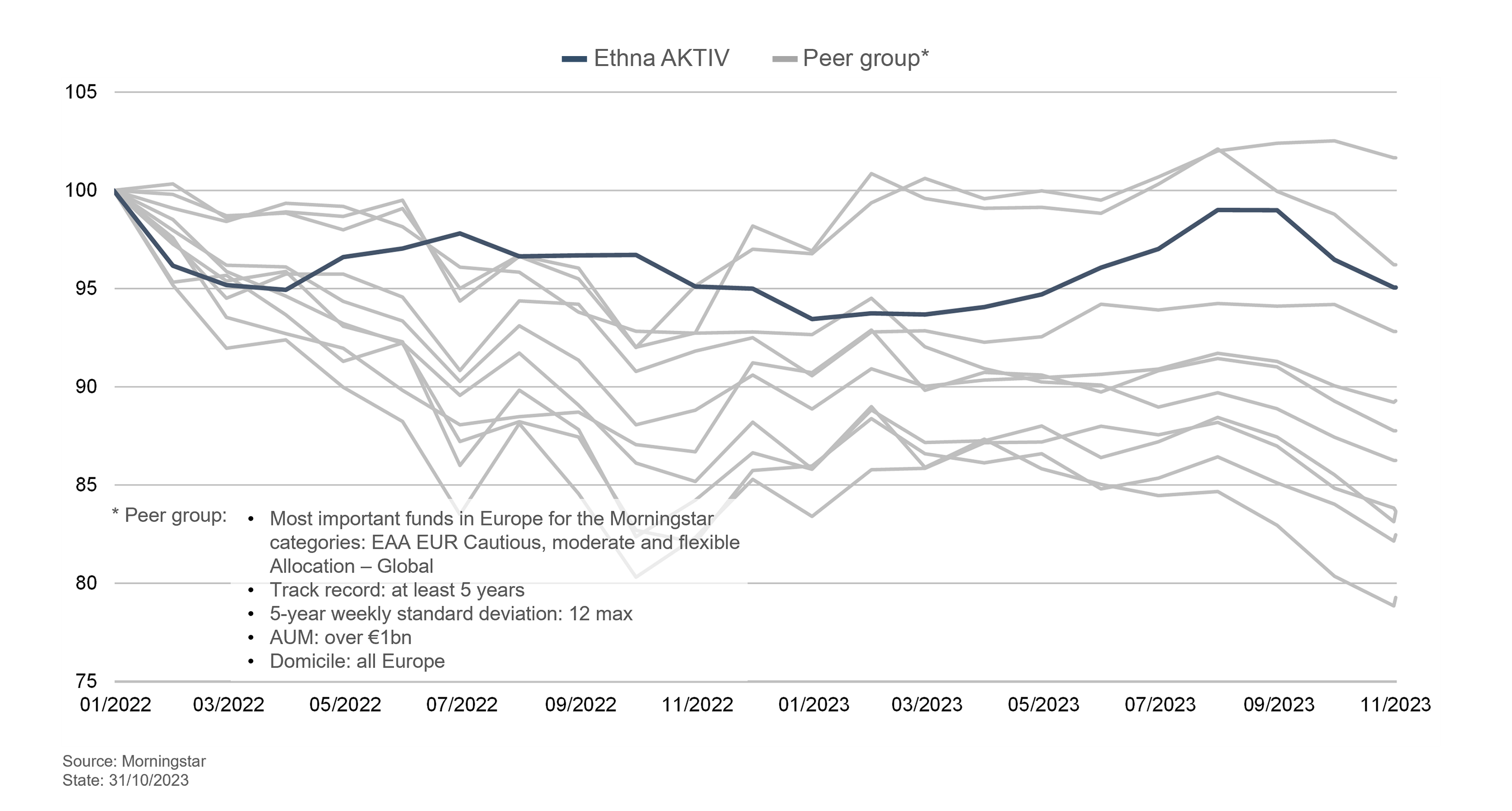

Peer group comparison 2022/23

The investment environment in 2022/23 was very challenging for multi-asset funds, given the lack of diversification of bonds and the high volatility of equities. This made a flexible approach to asset allocation all the more necessary. Ethna-AKTIV showed sustained relative strength and was able to both withstand the adversities and participate appropriately in the opportunities during this period.

How did we actually achieve this?

The answer lies in our investment philosophy. Guided by the principles of active management, benchmark-agnosticism and capital preservation, we have made substantial and repeated adjustments to the fund exposure in the past two years. The result for the period from January 2022 to the end of the third quarter of 2023 is a comparatively moderate decline of 3.5%. Compare this with a traditional 60/40 portfolio, which is trading more than ten percentage points lower at this point in time¹. This also illustrates that static investment concepts can quickly reach their limits in a very challenging capital market environment.

¹The comparison was made between the accumulating share class of the Ethna-AKTIV (after fees) and the index reweighted monthly by Bloomberg, which is made up of 40 % equities and 60 % bonds (ticker: BMADM46 Index).

2022

Our team were quite quick to see which way the wind was blowing at the beginning of 2022. We anticipated a global economy where growth rates, rather than increasing, were falling sharply. The central banks also instituted a change of policy. Not only did they end their large-scale securities purchases and, in fact, switched over to selling them, but they took up the fight against persistently high inflation with great determination by hiking interest rates rises, and this became a stress factor. A highly restrictive monetary policy in an environment of waning growth stood in stark contrast to the valuations that were still at record highs at the beginning of the year. Instead of reacting to market movements, we tried to act in anticipation of interest rates that were obviously going to rise and share prices that were going to fall. While the credit quality of the portfolio was significantly improved before 2022, a strict hedging of the equity exposure and even an over-hedging of the interest rate sensitivity was the means of choice until autumn 2022. This approach saved the risk budget a great deal in the course of 2022 and allowed us to maintain our ability to act and take advantage of opportunities as they arose.

2023

These opportunities were also present at the beginning of 2023. Global equity markets reached a new low in the fourth quarter, but subsequently recovered with the tailwind of large fiscal packages and improved liquidity. In contrast to previous periods, we increased the equity allocation relatively quickly. By early 2023, we had ruled out with a high degree of probability the global recession that had been forecast for many quarters. Inflation data had started to fall, and we expected less pressure from central banks. Even the crisis in the US regional banks was quickly overcome. All in all, this was reason enough for us to increase our exposure to the S&P500 again, at clearly attractive valuations. The complete reduction of the technology underweight, which helped enormously in 2022, paid off at the latest with the markets' reaction to the AI hype. The duration overlay, which contributed to the positive performance of the FI segment in 2022 despite one of the worst bond years in decades, was also gradually reduced.

It could be argued that there was a lot of luck involved; after all, one swallow does not make a summer. While the latter is true, the underlying philosophy and the process arising out of it ensures that such results are reproducible. it will always be important for us not only to absorb some of the losses, but also to participate appropriately in the next bull market. This is the only way to generate an attractive risk-adjusted return over the cycle as a whole. We are very well positioned to achieve this. By avoiding heavy losses in recent months, we have at least cleared the first hurdle towards reaching this goal.

The current 5-star rating from Morningstar proves that we have nothing to hide when it comes to generating returns. The Ethna-AKTIV is a suitable core investment for both existing and potential investors that will not lose sight of its objective, even in turbulent times.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

This marketing communication is for information purposes only. It may not be passed on to persons in countries where the fund is not authorized for distribution, in particular in the USA or to US persons. The information does not constitute an offer or solicitation to buy or sell securities or financial instruments and does not replace investor- and product-related advice. It does not take into account the individual investment objectives, financial situation, or particular needs of the recipient. Before making an investment decision, the valid sales documents (prospectus, key information documents/PRIIPs-KIDs, semi-annual and annual reports) must be read carefully. These documents are available in German and as non-official translations from ETHENEA Independent Investors S.A., the custodian, the national paying or information agents, and at www.ethenea.com. The most important technical terms can be found in the glossary at www.ethenea.com/glossary/. Detailed information on opportunities and risks relating to our products can be found in the currently valid prospectus. Past performance is not a reliable indicator of future performance. Prices, values, and returns may rise or fall and can lead to a total loss of the capital invested. Investments in foreign currencies are subject to additional currency risks. No binding commitments or guarantees for future results can be derived from the information provided. Assumptions and content may change without prior notice. The composition of the portfolio may change at any time. This document does not constitute a complete risk disclosure. The distribution of the product may result in remuneration to the management company, affiliated companies, or distribution partners. The information on remuneration and costs in the current prospectus is decisive. A list of national paying and information agents, a summary of investor rights, and information on the risks of incorrect net asset value calculation can be found at www.ethenea.com/legal-notices/. In the event of an incorrect NAV calculation, compensation will be provided in accordance with CSSF Circular 24/856; for shares subscribed through financial intermediaries, compensation may be limited. Information for investors in Switzerland: The home country of the collective investment scheme is Luxembourg. The representative in Switzerland is IPConcept (Suisse) AG, Bellerivestrasse 36, CH-8008 Zurich. The paying agent in Switzerland is DZ PRIVATBANK (Suisse) AG, Bellerivestrasse 36, CH-8008 Zurich. Prospectus, key information documents (PRIIPs-KIDs), articles of association, and the annual and semi-annual reports can be obtained free of charge from the representative. Information for investors in Belgium: The prospectus, key information documents (PRIIPs-KIDs), annual reports, and semi-annual reports of the sub-fund are available free of charge in German upon request from ETHENEA Independent Investors S.A., 16, rue Gabriel Lippmann, 5365 Munsbach, Luxembourg, and from the representative: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg. Despite the greatest care, no guarantee is given for the accuracy, completeness, or timeliness of the information. Only the original German documents are legally binding; translations are for information purposes only. The use of digital advertising formats is at your own risk; the management company assumes no liability for technical malfunctions or data protection breaches by external information providers. The use is only permitted in countries where this is legally allowed. All content is protected by copyright. Any reproduction, distribution, or publication, in whole or in part, is only permitted with the prior written consent of the management company. Copyright © ETHENEA Independent Investors S.A. (2025). All rights reserved. 21/11/2023