Ethna-DEFENSIV | The anchor of stability in uncertain times

Simple, understandable, transparent - the anchor of stability in uncertain times

Capital markets always have unexpected developments in store. In recent months, they have proved more resilient than many expected at the beginning of the year. Nevertheless, the road to taming inflation and achieving the central bank's announced target is long and arduous. Combined with potential economic downturns, the ongoing war and other geopolitical risk scenarios will not make it any easier for investors to navigate in the future. Stability and reliability in choppy, sometimes stormy seas are called for. With a good compass, we steer a clear course: the actively managed Ethna-DEFENSIV serves as an ideal anchor of stability in any portfolio, navigating investors through both turbulent and calm times.

Change of Direction

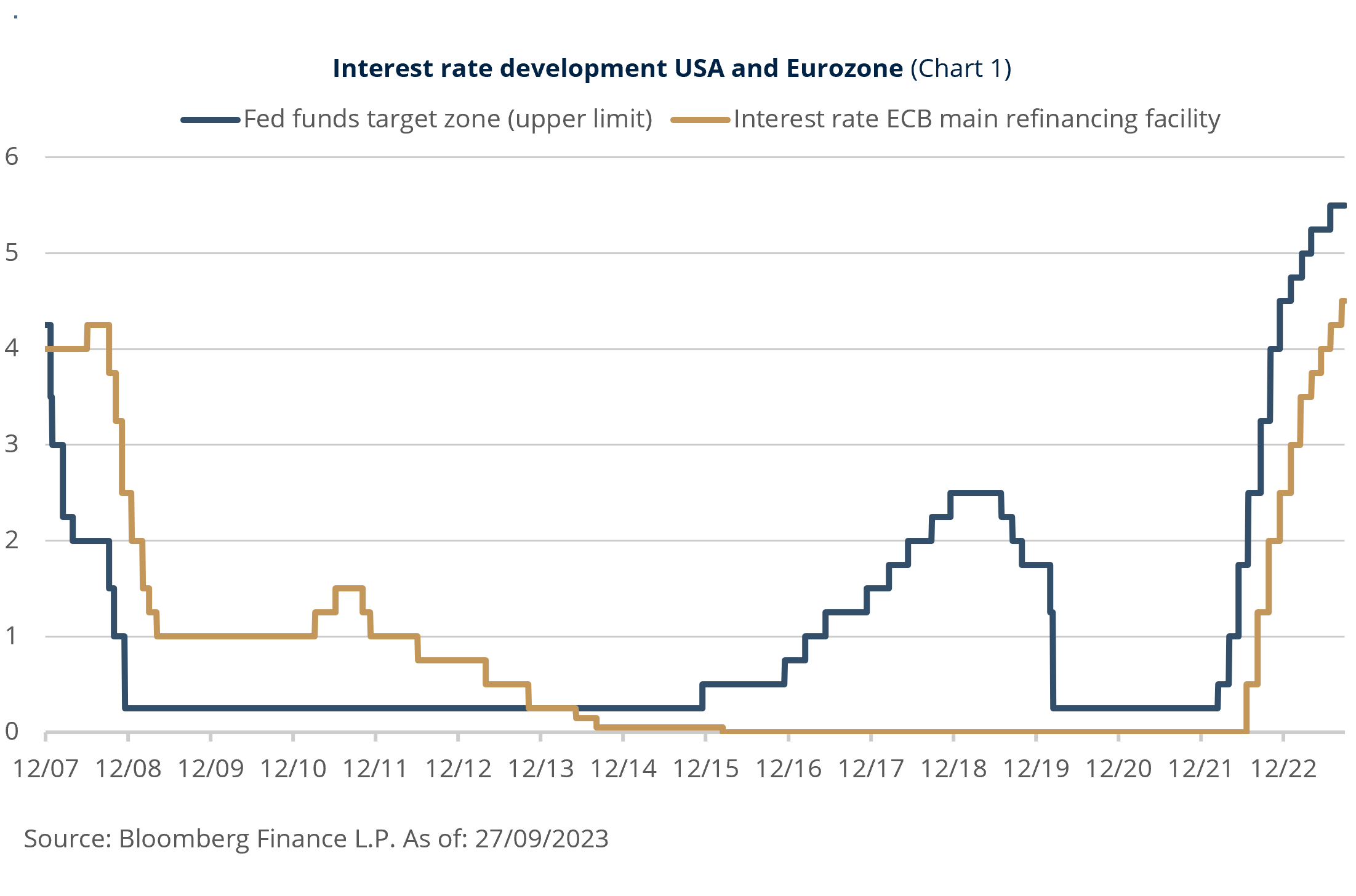

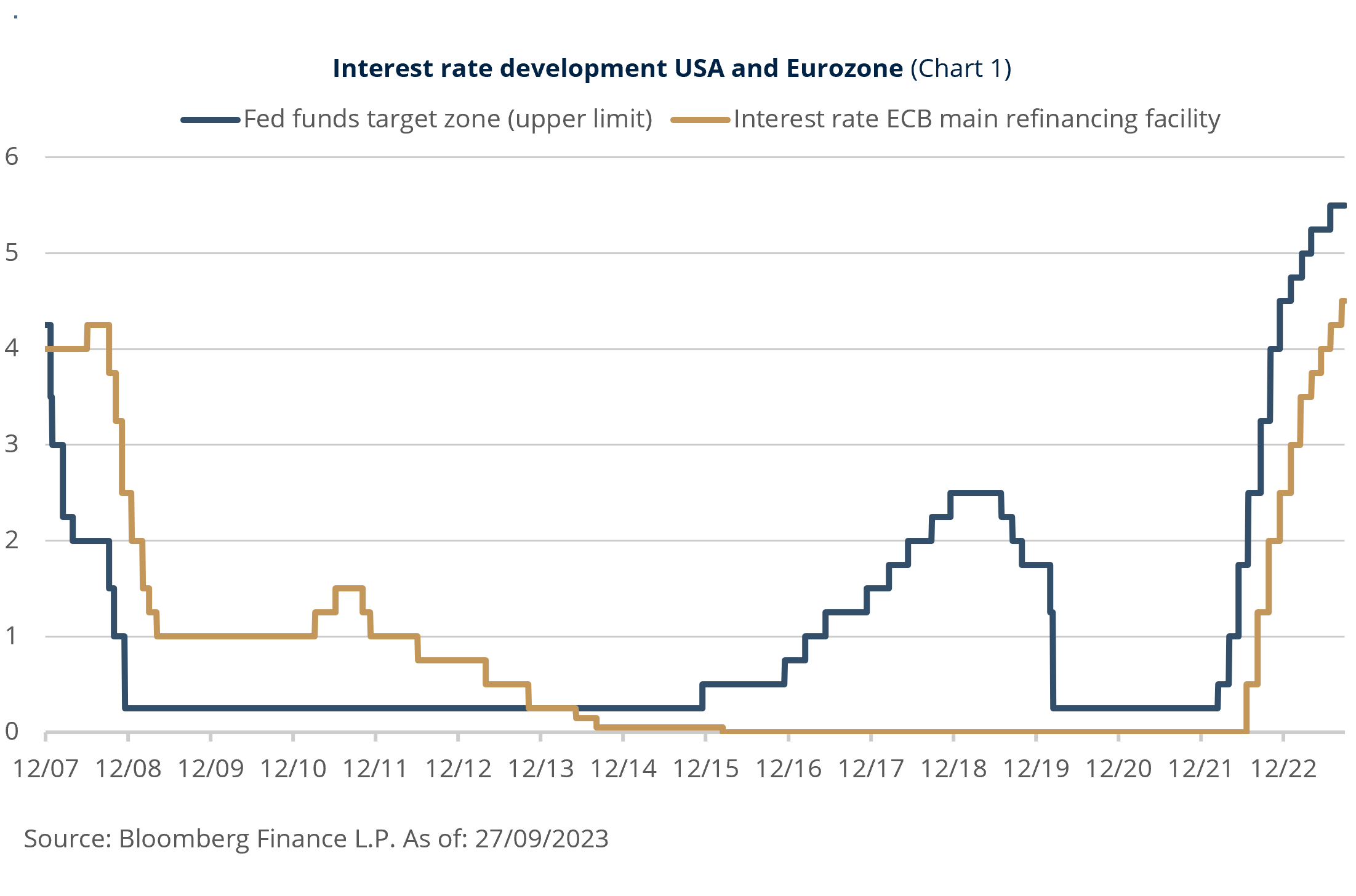

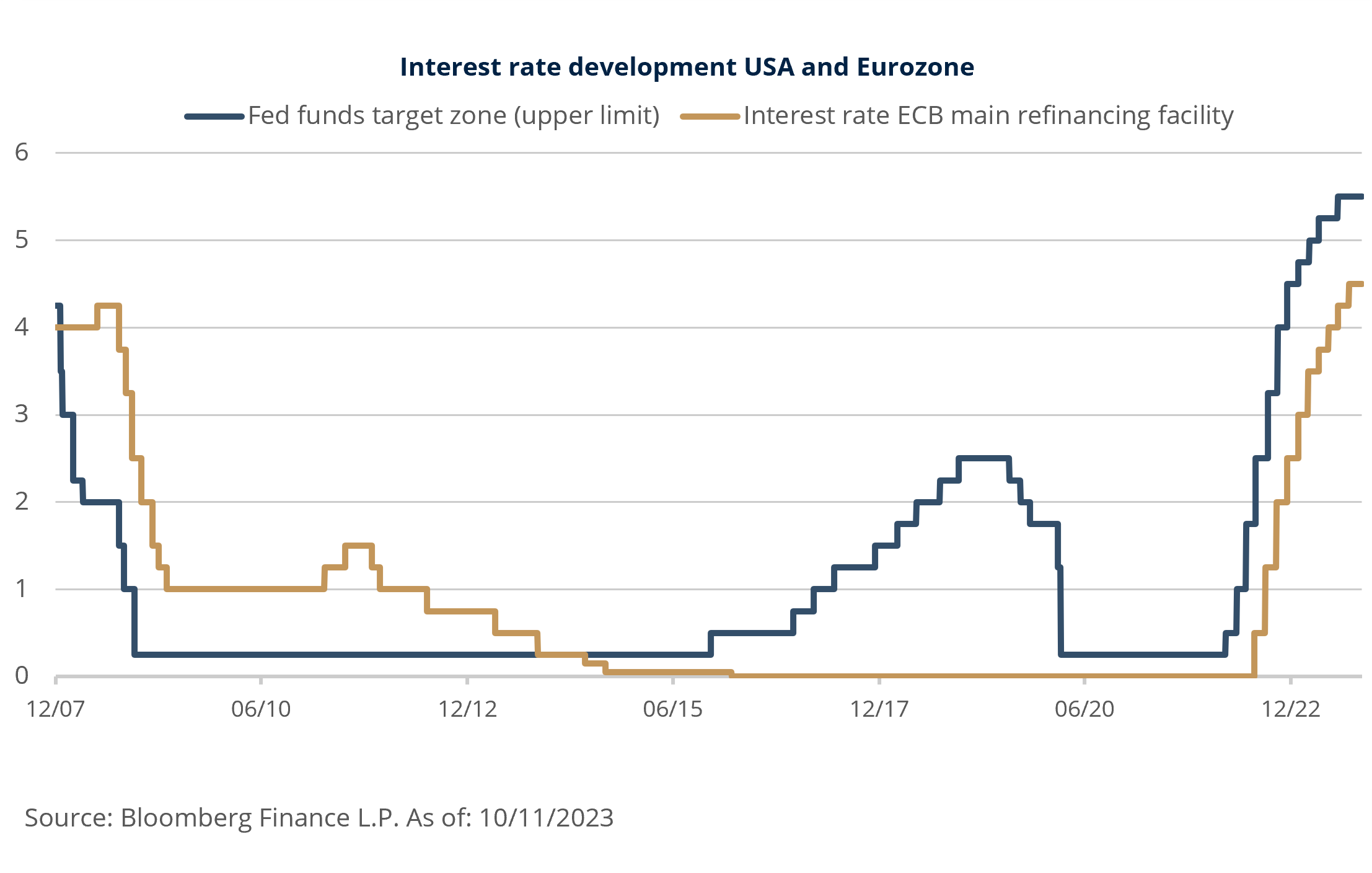

Investors need to prepare for a new era. The past years, or even two decades, have been characterised by a low-inflation environment. The spectre of inflation seemed to have disappeared, with core inflation in the G7 countries averaging 1.5 percent. It is now many times higher. Central banks are therefore still obliged to adjust their monetary policies in a way that brings them much closer to the objective of price stability. The interest rate turnaround in March 2022 in the US and in July 2022 in the euro area was therefore a turning point. Since then, there have been a number of rate hikes on both sides of the Atlantic. And they have made possible what was not foreseeable until 2022.

New target in sight?

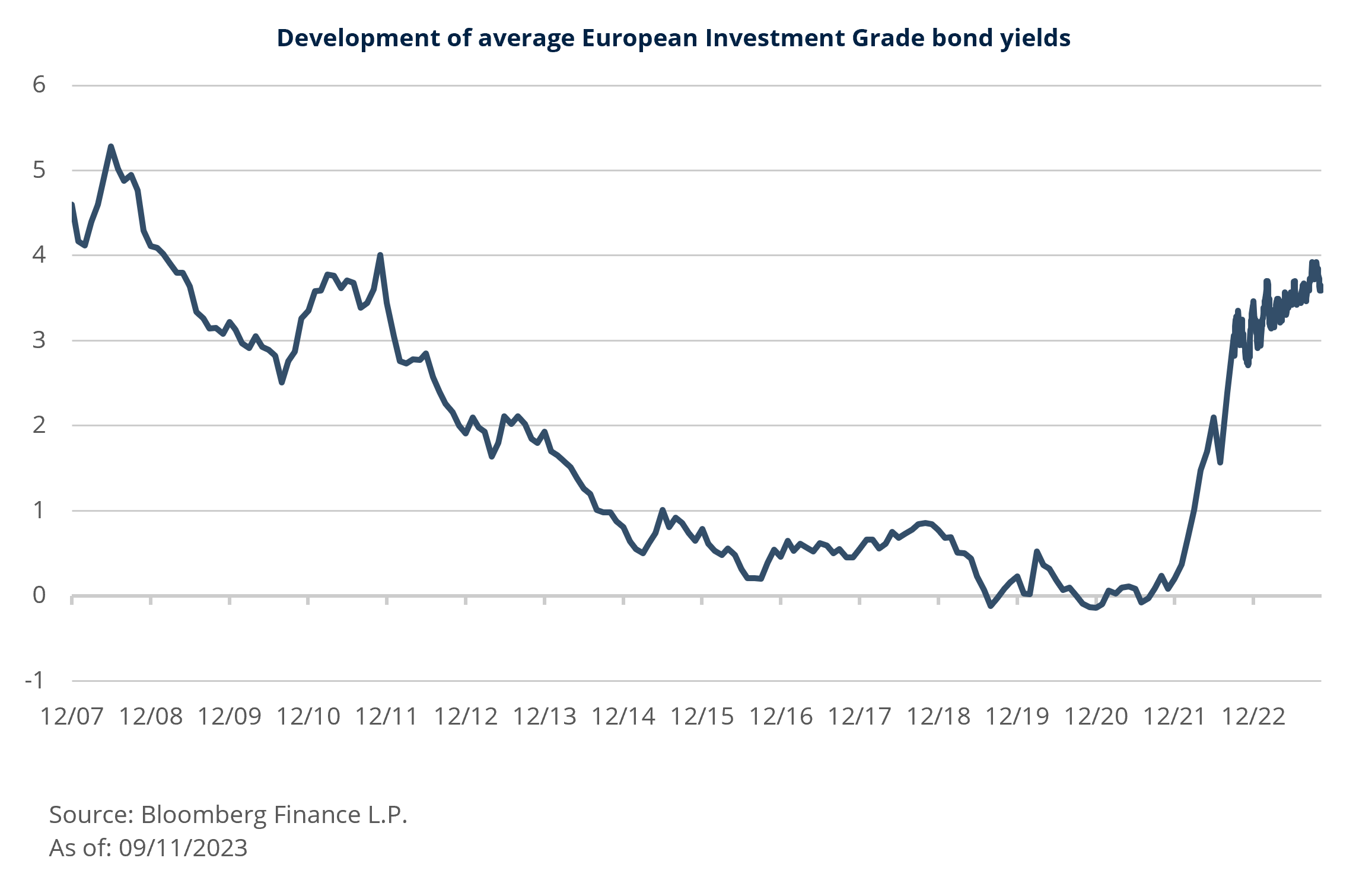

Uncertain as times are, one thing is certain: interest rates are back. Higher interest rates, particularly in Europe and the US, have contributed to a significant rise in bond yields - and therefore their return potential. A look at the chart below, which shows the evolution of the average yield on European investment-grade bonds since the beginning of 2022, makes this clear. This presents an interesting opportunity for investors seeking stable income opportunities. In addition, equities are likely to come under pressure in the event of a slide into a prolonged recession. A look at the diverse bond universe is therefore worthwhile for several reasons: Bonds provide resilience in uncertain times, offer diversification potential in the overall portfolio context and the returns are quite respectable.

Bond markets in focus: recalibrating for a safer course

In metrology and engineering, regular calibration ensures the quality and long-term performance of a product, while adjustment refers to the process of fine-tuning components or mechanisms. In active portfolio management too, both calibration and adjustment are key aspects of ensuring that a fund achieves its intended objectives without losing sight of risk.

Anticipated market developments have already led to a calibration of the investment strategy of the Ethna-DEFENSIV fund at the beginning of 2021. The remaining bond maturities were shortened and the equity and commodity allocations were gradually reduced. The aim was to optimise the fund’s risk-return expectations. After the rally at the end of 2021 was largely completed in November, all equity investments were sold and profits realised.

A reopening of the equity position in 2022 was not implemented for the time being due to the war in Ukraine and the resulting rapid economic slowdown, the rapidly rising energy prices and the debate on energy security, especially in Europe. On the fixed income side, maturities were adjusted in line with our expectations of rising inflation and tighter monetary policy, in order to prepare the Fund for a forthcoming cycle of interest rate hikes.

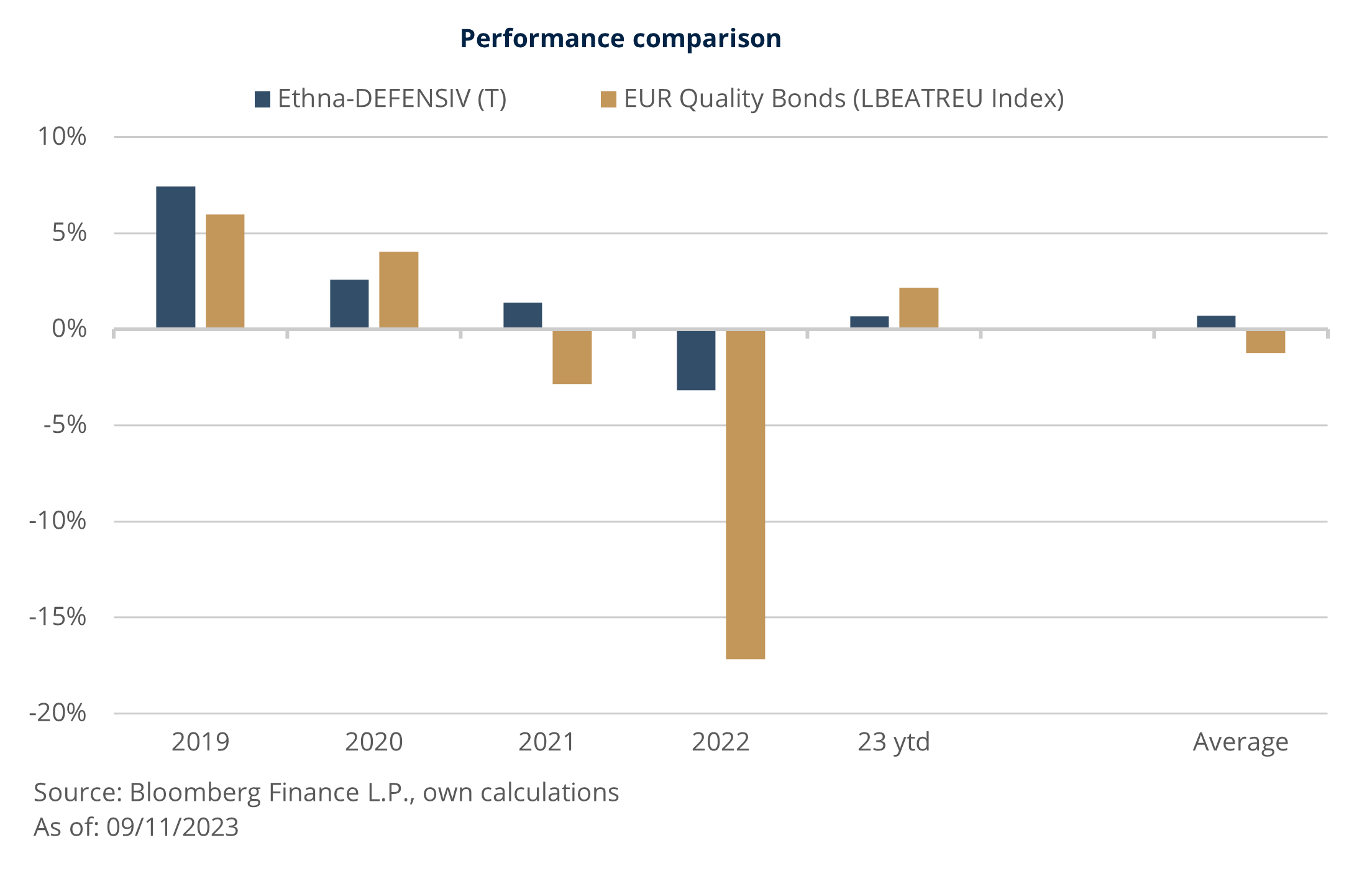

The result was already impressive at the end of 2022, and a look at the performance clearly shows that the approach works: in 2022, the Ethna-DEFENSIV significantly outperformed the euro-denominated investment-grade bond universe, as shown in the chart below. This was achieved by rebalancing towards shorter-dated and safer bonds, adding a futures overlay and reducing the equity exposure to zero. This confirms the success of the calibration and the decision to stay the course with this investment strategy and focus on bonds and currencies for the long term.

In order to achieve these results in the future, it has been decided to permanently remove the equity and commodity quotas from the asset allocation as part of a recalibration process, making Ethna-DEFENSIV a pure bond fund. As a result, the Ethna fund offers an optimal investment opportunity tailored to the conservative investor.

Conservative character with a focus on capital preservation and returns

Launched in 2007, the actively managed and non-benchmarked Ethna-DEFENSIV is characterised by its conservative character with a credo of capital preservation and a clear payout promise combined with low volatility of less than 4 percent. The underlying investment process and allocation are adjusted and determined by the portfolio management team using a top-down approach based on an assessment of macroeconomic developments and the potential risk dynamics of exogenous influencing factors. Combined with a bottom-up bond selection process, this approach allows the fund to select the most attractive investment opportunities while limiting potential risks and actively managing volatility and drawdowns.

The core of the fund consists of issuers from OECD countries with a focus on government and corporate bonds with very good to good credit ratings - these form the basis of the returns ("core income"). In addition, the Ethna-DEFENSIV can use the entire range of the bond segment, in line with the principle of the maximum flexibility, and thus increase the return potential.

The strategy is supported by overlay management, which controls the selection of maturities, currencies and quality to keep interest rate and spread sensitivity low, for example in times of crisis. In addition, interest rate sensitivity can be optimised and reduced by using forward contracts. Liquid instruments can be used to hedge lower value limits and reduce potential opportunity costs by re-entering the market at an early stage when markets are rising.

In addition, as an Article 8 fund, Ethna-DEFENSIV pursues an ESG strategy in accordance with the EU Regulation (SFDR) 2019/2088, implemented through a three-step process that includes comprehensive exclusions based on ESG assessments as well as individual ESG analysis. As part of this process, we exclude companies in the tobacco, armaments, commodity speculation, adult entertainment and coal production/trade sectors. We also exclude issuers whose overall ESG scores do not meet our minimum environmental, social and governance standards.

A firm eye on the future: Ethna-DEFENSIV as an anchor of stability in uncertain times

Simple, understandable and transparent: the actively managed Ethna-DEFENSIV is the ideal conservative investment solution and the perfect addition to a balanced portfolio. With an investment strategy focused on capital preservation and a clear payout promise, the fund guides investors safely through both turbulent and calm times. The recalibration has shown that we are on the right track and that our focus on bonds and currencies is paying off. As an Article 8 fund with a robust ESG strategy, we are committed to ethical and sustainable principles. At the same time, in an increasingly complex market environment, Ethna-DEFENSIV provides clear and simple access to the bond markets and serves as a valuable compass for investors to navigate with confidence.

The current 5-star rating from Morningstar proves that we have nothing to hide when it comes to generating returns. The Ethna-DEFENSIV is a suitable core investment for existing and potential investors, navigating them through both turbulent and calm times.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

La presente es una comunicación promocional. Tiene exclusivamente fines informativos y ofrece al destinatario indicaciones sobre nuestros productos, conceptos e ideas. No constituye una base para comprar, vender, cubrir, transferir o hipotecar activos. Nada de la información incluida en el presente documento representa una oferta de compra o venta de un instrumento financiero, ni tiene en cuenta las circunstancias personales del destinatario. Tampoco es el resultado de un análisis objetivo o independiente. ETHENEA no ofrece ninguna garantía o declaración expresa o implícita por lo que respecta a la exactitud, integridad, idoneidad o comerciabilidad de cualquier información proporcionada al destinatario en los webinarios, podcasts o boletines. El destinatario reconoce que nuestros productos y conceptos pueden ir dirigidos a diferentes clases de inversores. Los criterios se basan exclusivamente en el folleto que está en vigor en la actualidad. Esta comunicación promocional no va dirigida a un grupo específico de destinatarios. Por consiguiente, cada destinatario debe informarse individualmente y bajo su propia responsabilidad sobre las disposiciones correspondientes de los documentos de venta actualmente vigentes, que constituyen la única base para la adquisición de participaciones. De los contenidos ofrecidos o de nuestro material promocional no pueden emanar promesas o garantías vinculantes de resultados futuros. Ni la lectura ni la escucha dan lugar a una relación de asesoramiento. Todos los contenidos tienen un carácter meramente informativo y no pueden sustituir al asesoramiento profesional e individual en materia de inversión. El destinatario solicitó el boletín de noticias o se inscribió en un webinario o podcast por su propia cuenta y riesgo, o bien utiliza otros medios publicitarios digitales por iniciativa propia. El destinatario y participante acepta que los formatos publicitarios digitales son producidos técnicamente y facilitados al participante por un proveedor de información externo que no guarda relación con ETHENEA. El acceso a los formatos publicitarios digitales y la participación en estos se realizan a través de infraestructuras fundamentadas en Internet. ETHENEA declina toda responsabilidad sobre las interrupciones, anulaciones, fallos de funcionamiento, cancelaciones, incumplimientos o retrasos en relación con la provisión de los formatos publicitarios digitales. El participante reconoce y acepta que, al participar en los formatos publicitarios digitales, los datos personales pueden ser visualizados, registrados y transmitidos por el proveedor de información. ETHENEA no se hace responsable del incumplimiento de las obligaciones de protección de datos por parte del proveedor de información. El acceso y la visita a los formatos publicitarios digitales únicamente puede realizarse en los países en los que su acceso y visita estén permitidas por ley. Si desea obtener información detallada sobre las oportunidades y los riesgos asociados a nuestros productos, consulte el folleto actual. Los documentos legales de venta (folleto, documentos de datos fundamentales para el inversor, informes semestrales y anuales) de los que se puede obtener información detallada sobre la compra de participaciones y los riesgos asociados constituyen la única base autorizada y vinculante para la compra de participaciones. Los mencionados documentos de venta en alemán (así como sus versiones no oficiales traducidas a otros idiomas) pueden consultarse en www.ethenea.com y obtenerse de forma gratuita en la sociedad gestora, ETHENEA Independent Investors S.A. y el depositario, así como en los respectivos agentes de pago o de información de cada país y el representante en Suiza. Los agentes de pago o de información son los siguientes para los fondos Ethna-AKTIV, Ethna-DEFENSIV y Ethna-DYNAMISCH: Alemania, Austria, Bélgica, Liechtenstein, Luxemburgo: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxemburgo; España: ALLFUNDS BANK, S.A., C/ Estafeta, 6 (la Moraleja), Edificio 3 – Complejo Plaza de la Fuente, ES-28109 Alcobendas (Madrid); Francia: CACEIS Bank France, 1-3 place Valhubert, F-75013 Paris; Italia: State Street Bank International – Succursale Italia, Via Ferrante Aporti, 10, IT-20125 Milano; Société Génerale Securities Services, Via Benigno Crespi, 19/A - MAC 2, IT-20123 Milano; Banca Sella Holding S.p.A., Piazza Gaudenzio Sella 1, IT-13900 Biella; Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Suiza: Representante: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Agente de pagos: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. Los agentes de pago o de información son los siguientes para HESPER FUND, SICAV - Global Solutions: Alemania, Austria, Bélgica, Francia, Luxemburgo: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxemburgo; Italia: Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Suiza: Representante: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Agente de pagos: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. La sociedad gestora podrá rescindir los acuerdos de distribución vigentes con terceros o retirar los permisos de distribución por razones estratégicas o exigidas por ley, respetando los plazos. Los inversores pueden obtener información sobre sus derechos en el sitio web www.ethenea.com y en el folleto. La información se encuentra disponible en alemán e inglés y, en ciertos casos, también otros idiomas. En el folleto figura la descripción detallada expresa de los riesgos. Esta publicación está sujeta a derechos de autor, de marca y de propiedad industrial. La reproducción, distribución, puesta a disposición para su recuperación o acceso en Internet, transferencia a otros sitios web, publicación total o parcial, de forma modificada o sin modificar, únicamente se permite con el previo consentimiento por escrito de ETHENEA. Copyright © 2024 ETHENEA Independent Investors S.A. Todos los derechos reservados. 07/11/2023