Never catch a falling knife!?

The title of this month’s commentary is one of the best-known trading adages. If investors followed the rule this year, for example, they would have been able to watch the Wirecard debacle from the sidelines. Then again, those same investors would have missed many opportunities to buy into attractive equities that have reversed the downward trend since the turmoil in spring. So what is the value of the falling knife adage in general? And what is the smart thing to do in future if prices fall again?

Here’s a little anecdote to begin with: at the investment club’s annual cookery event, a heavy, sharp kitchen knife falls off the worktop straight towards an attendee’s foot. A nearby technical analyst sees this and his initial reaction is to catch the knife but then he withdraws his hand at the last second. The consequences for the person standing beside him, a classic value investor, are not pleasant. He lets out a cry of pain and rounds on the analyst for not catching the knife, while the latter stubbornly responds that one of his principles is never to catch a falling knife! The astonished analyst then asks the value investor why he didn’t simply move his foot. The investor simply replies, “I didn’t think the knife would fall that far.”

The punchline illustrates why comparing falling prices to a falling knife is flawed. Whereas a falling kitchen knife is very visual and can be explained down to the smallest detail both by Newton’s law of gravity and by Einstein’s General Theory of Relativity, neither Isaac Newton, Albert Einstein or any other brilliant mind has been able to come up with a half-decent formula for falling prices yet. On the contrary; it was said that Isaac Newton lost much of his wealth by speculating on the stock market. The following quote expresses his despair over the capital markets: “I can calculate the motion of heavenly bodies but not the madness of people.”

How dangerous is a falling knife in the stock market now? As is so often the case in life, the answer to this is that it depends on the circumstances. Pretty much anything is possible when it comes to a single stock, as the former German DAX company Wirecard demonstrated in spectacular style. It was an experience such as this that led Isaac Newton to say what he did. Single stocks really do regularly fall to the floor like a kitchen knife and any investor who attempts to catch them on the way down always ends up bleeding. It doesn’t matter at what point the investor tries to catch them. Even if the price has already fallen 98%, a new buyer at that time will lose half of their investment between there and -99%. That said, the probability of total loss or excessive price declines can effectively be minimised. A healthy balance sheet, a stable business model, an existing track record and a transparent valuation are important criteria for risk assessment. Apart from that, here is one overarching piece of advice the importance of which cannot be overestimated when investing: diversify. A well-diversified portfolio can cushion the impact of a good deal of turmoil. We’ve talked about the small economic entity, the individual company, but what about the large economic entity, the overall market?

The overall equity market, especially at global level, can be regarded as a well-diversified equity portfolio. Looking back, it has seen a lot of crises come and go. The knife has often been in free fall, so to speak, but it has staged a turnaround each and every time. Does the law of gravity break down here? Actually, it does not! Though in the equity markets it is better known as “mean reversion”. The mean refers to an intrinsic or true value, but this value is unknown at the time of price determination due to various political and economic uncertainties. What is certain, however, is that this value will always be well above zero. Thus, for every percentage point fall in the global equity market, the probability of securing an attractive gain in the medium term increases.

In comparatively quiet times in the capital markets, too, the mean reversion principle meets with little opposition. But investors will be sorry if they have skin in the game for any length of time when the market is in free-fall. Investor psychology is now a very well-researched field, and to say that the human psyche experiences discomfort in times of high volatility in equity markets is putting it mildly. “Buy on the sound of cannons!” and “Be greedy when others are fearful!” are accepted arguments that it is worth catching the knife. Obviously, this is easier said than done (at the right time).

An ounce of prevention is better than a pound of cure. Against this backdrop, we at ETHENEA offer the appropriate multi-asset fund for the three basic investor risk profiles with the three Ethna funds.

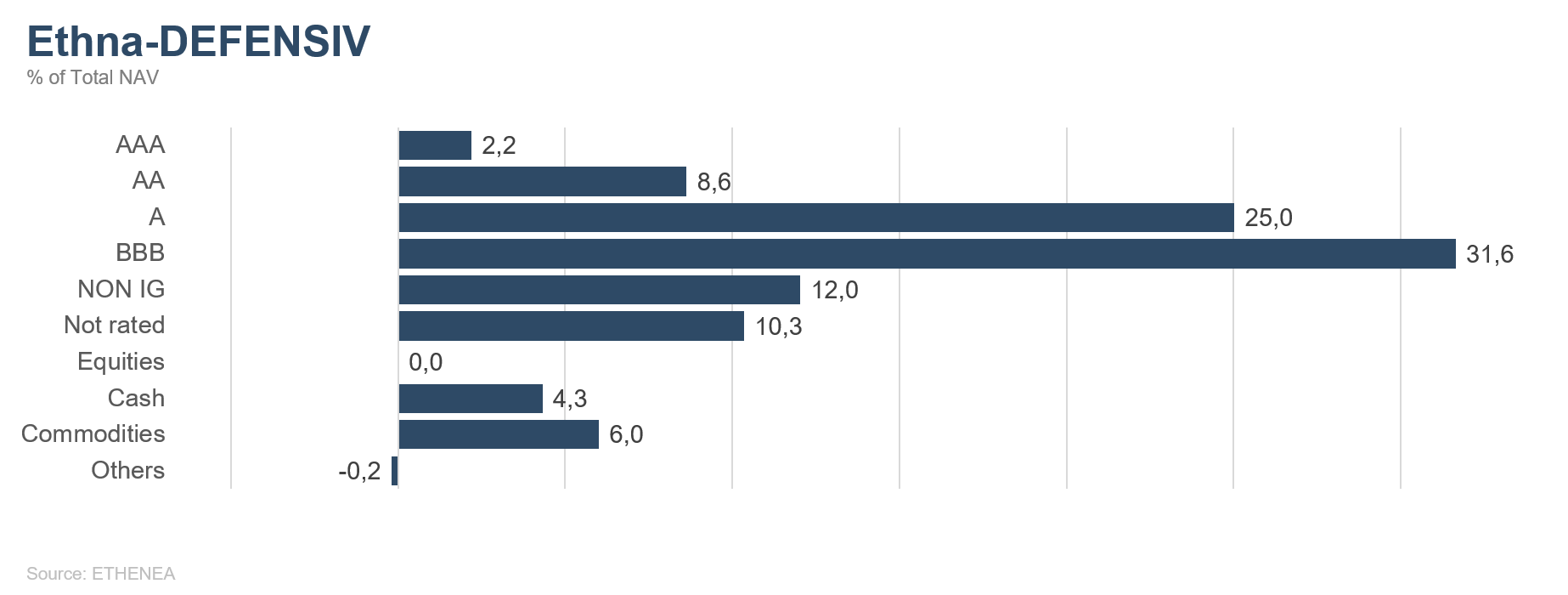

Ethna-DEFENSIV investors don’t need to worry about falling knives in the equity market at all. They prefer the high level of stability that fixed-income investments provide.

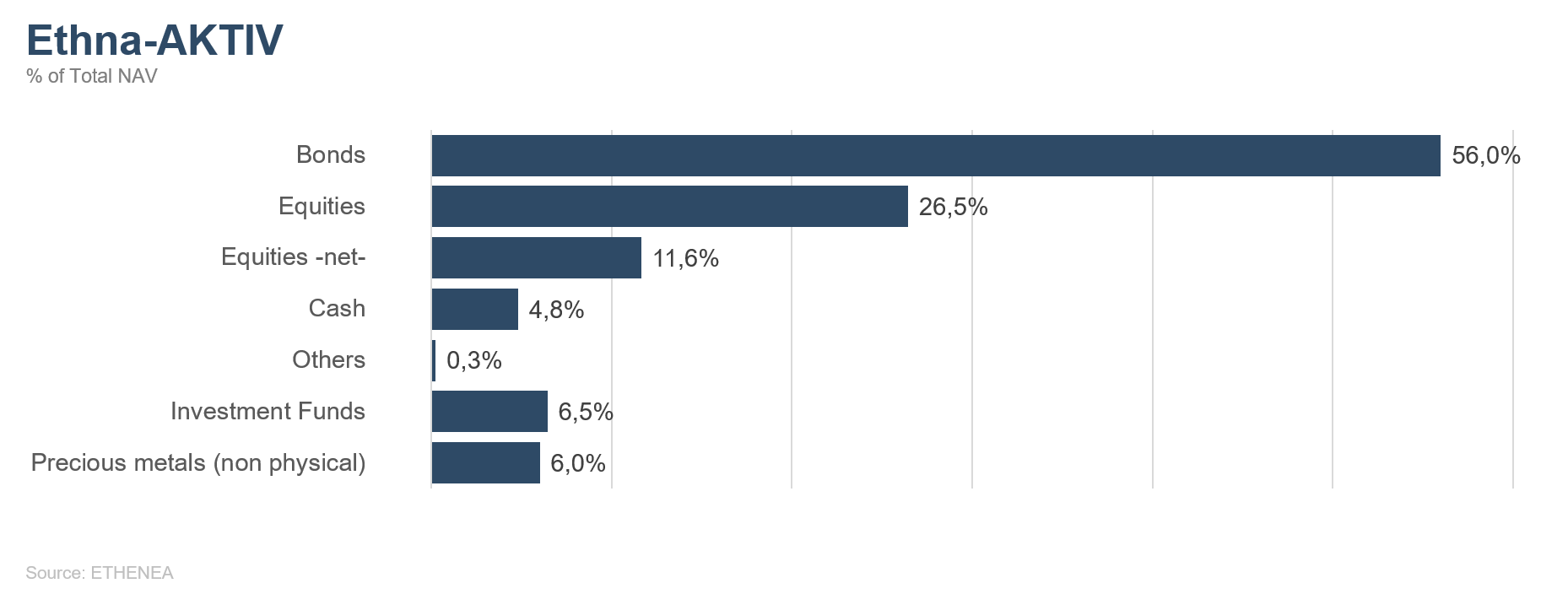

This applies to a lesser extent to the broad group of investors in the Ethna-AKTIV. While investors in our flagship fund are aware that significant portions of the fund assets are invested for periods in the high-return equity markets, ideally they do not want to take much notice of the fluctuations in value inherent in this volatile asset class.

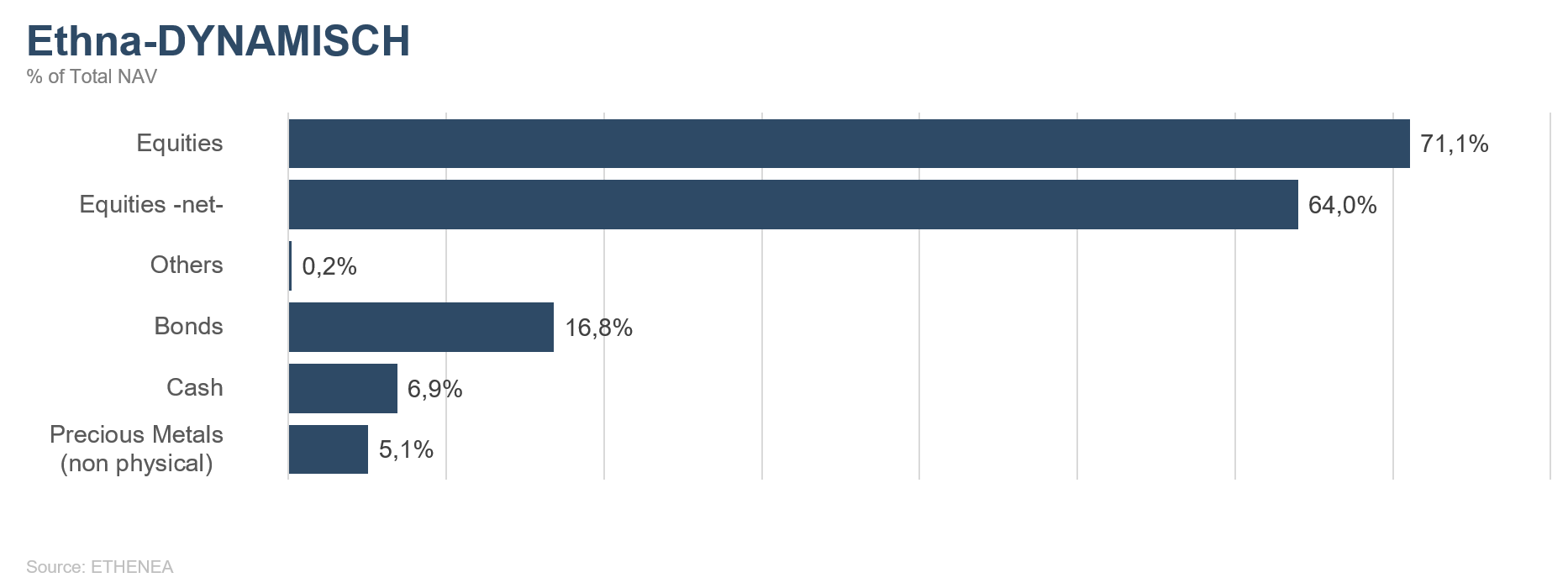

Ethna-DYNAMISCH investors have the greatest affinity for equities. This asset management fund launched in 2009 offers risk-controlled access to global equity markets and, accordingly, its priorities lie in this segment. The Ethna-DYNAMISCH’s investors possess a good understanding of the potential opportunities in the equity markets, but, at the same time, have respect for the sometimes hefty falls in prices. They leave the decision as to which knife might be worth catching up to the experienced experts at ETHENEA.

The title of this month’s commentary is one of the best-known trading adages. If investors followed the rule this year, for example, they would have been able to watch the Wirecard debacle from the sidelines. Then again, those same investors would have missed many opportunities to buy into attractive equities that have reversed the downward trend since the turmoil in spring. So what is the value of the falling knife adage in general? And what is the smart thing to do in future if prices fall again?

Here’s a little anecdote to begin with: at the investment club’s annual cookery event, a heavy, sharp kitchen knife falls off the worktop straight towards an attendee’s foot. A nearby technical analyst sees this and his initial reaction is to catch the knife but then he withdraws his hand at the last second. The consequences for the person standing beside him, a classic value investor, are not pleasant. He lets out a cry of pain and rounds on the analyst for not catching the knife, while the latter stubbornly responds that one of his principles is never to catch a falling knife! The astonished analyst then asks the value investor why he didn’t simply move his foot. The investor simply replies, “I didn’t think the knife would fall that far.”

The punchline illustrates why comparing falling prices to a falling knife is flawed. Whereas a falling kitchen knife is very visual and can be explained down to the smallest detail both by Newton’s law of gravity and by Einstein’s General Theory of Relativity, neither Isaac Newton, Albert Einstein or any other brilliant mind has been able to come up with a half-decent formula for falling prices yet. On the contrary; it was said that Isaac Newton lost much of his wealth by speculating on the stock market. The following quote expresses his despair over the capital markets: “I can calculate the motion of heavenly bodies but not the madness of people.”

How dangerous is a falling knife in the stock market now? As is so often the case in life, the answer to this is that it depends on the circumstances. Pretty much anything is possible when it comes to a single stock, as the former German DAX company Wirecard demonstrated in spectacular style. It was an experience such as this that led Isaac Newton to say what he did. Single stocks really do regularly fall to the floor like a kitchen knife and any investor who attempts to catch them on the way down always ends up bleeding. It doesn’t matter at what point the investor tries to catch them. Even if the price has already fallen 98%, a new buyer at that time will lose half of their investment between there and -99%. That said, the probability of total loss or excessive price declines can effectively be minimised. A healthy balance sheet, a stable business model, an existing track record and a transparent valuation are important criteria for risk assessment. Apart from that, here is one overarching piece of advice the importance of which cannot be overestimated when investing: diversify. A well-diversified portfolio can cushion the impact of a good deal of turmoil. We’ve talked about the small economic entity, the individual company, but what about the large economic entity, the overall market?

The overall equity market, especially at global level, can be regarded as a well-diversified equity portfolio. Looking back, it has seen a lot of crises come and go. The knife has often been in free fall, so to speak, but it has staged a turnaround each and every time. Does the law of gravity break down here? Actually, it does not! Though in the equity markets it is better known as “mean reversion”. The mean refers to an intrinsic or true value, but this value is unknown at the time of price determination due to various political and economic uncertainties. What is certain, however, is that this value will always be well above zero. Thus, for every percentage point fall in the global equity market, the probability of securing an attractive gain in the medium term increases.

In comparatively quiet times in the capital markets, too, the mean reversion principle meets with little opposition. But investors will be sorry if they have skin in the game for any length of time when the market is in free-fall. Investor psychology is now a very well-researched field, and to say that the human psyche experiences discomfort in times of high volatility in equity markets is putting it mildly. “Buy on the sound of cannons!” and “Be greedy when others are fearful!” are accepted arguments that it is worth catching the knife. Obviously, this is easier said than done (at the right time).

Positioning of the Ethna Fonds

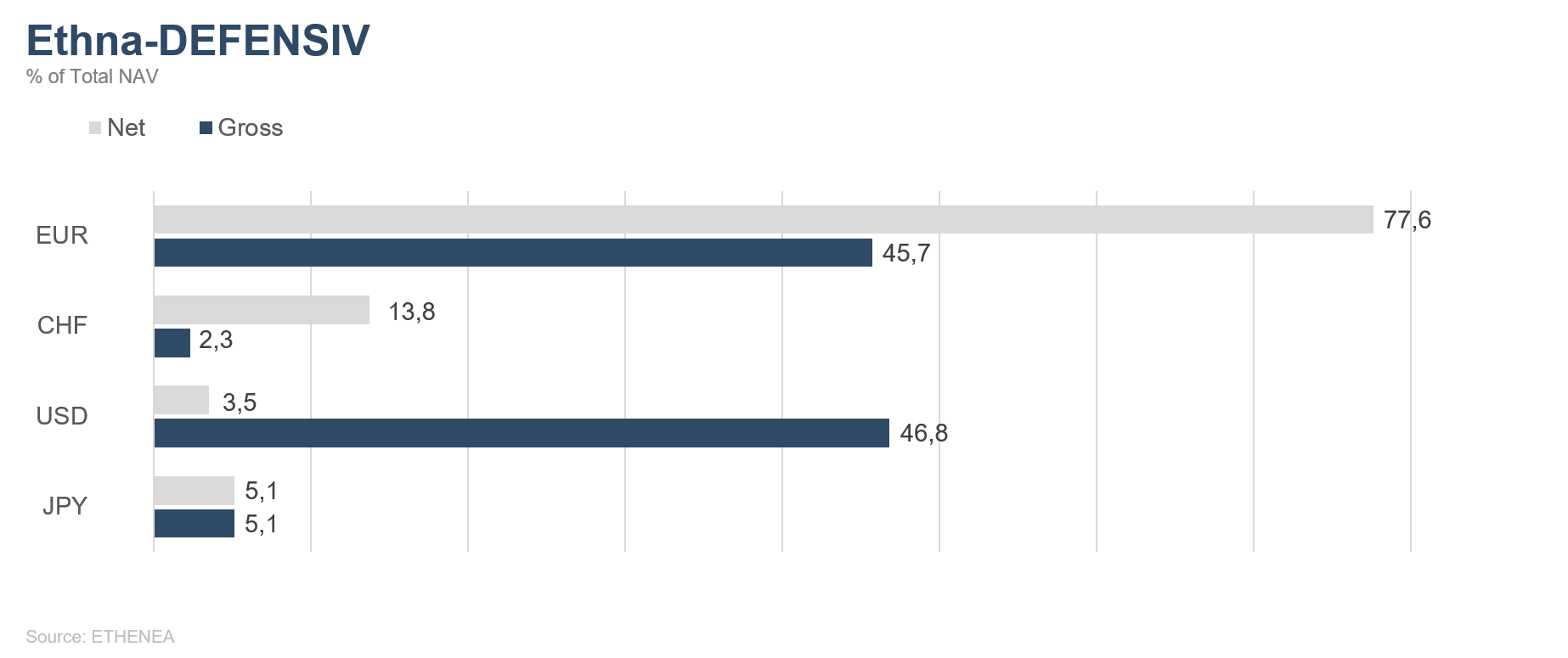

Ethna-DEFENSIV

Market volatility remains high, and the three big market-moving issues remain the U.S. elections, Covid-19 and Brexit. At least the first of these can be taken off the list of uncertainties after 3 November. Only a narrow victory for Joe Biden followed by contested election result could cause fresh upheaval in the markets and render the government less functional in the short-term. Both alternative scenarios – a clear victory for the Democrats or the Republicans – are likely to get a favourable reception from the markets and merely shift the pool of winners. If Joe Biden wins, higher taxes would be counterbalanced by predictable foreign policy and higher infrastructural spending. If Donald Trump wins, oil and technology companies would benefit.

While sentiment remains poor due to the soaring number of coronavirus cases, the fundamental picture seems to be brightening up slightly. Mirroring the previous month, the manufacturing sector improved further, while on the other hand the services sector continues to suffer the consequences of the pandemic and the related restrictions. However, we think any upheaval as a result of the latest lockdowns is unlikely to be as great as what we saw at the beginning of the year. Firstly, governments and companies are better prepared for the successive step-ups in restrictions than in March of this year, and secondly the current “work yes, party no” policy largely allows business to continue and supply chains to be maintained. Government compensation seems to have halted the collapse in the turnover of restaurants and SMEs for the time being, in Germany at least.

In addition, companies can still refinance at good terms. The PEPP emergency bond purchase programme launched in the course of the coronavirus crisis offers sufficient reserves that can be put to use if need be and mitigate short-term shocks. While the ECB left the key interest rate at 0.0% for now and the PEPP envelope at EUR 1,350 billion at its meeting on 29 October, the latest inflation figure of 0.1% still gives the central banks enough room to manoeuvre, since the inflation target of 2% will still be missed by a wide margin despite the extensive monetary measures. Against the backdrop of the second wave of the pandemic, central bankers have already signalled their readiness to act and have held out the prospect of further measures in December.

Demand for corporate bonds is still strong, and there is strong support for the prices of investment grade bonds denominated in EUR and USD. In our opinion, corporate bonds still offer a healthy risk-return ratio and a crisis-proof haven, while the going is getting increasingly tough for Bunds. 10-year German Bunds are already yielding less than -0.65% again. 10-year U.S. Treasury yields again rose slightly to 0.8% towards the end of the month. In the search for returns and given an increase in risk appetite, bonds from peripheral countries were back in strong demand recently. The yields on 10-year Italian sovereign bonds dipped below the 0.7% mark, putting them well below pre-pandemic level and bringing them close to their all-time low. Italian bonds benefited from monetary policy hopes and from the improvement in rating agency S&P’s outlook from “BBB negative” to “BBB stable”. In addition, for the first time the EU issued a EUR 17 billion social bond by the name of SURE (Support to mitigate Unemployment Risks in an Emergency) to combat unemployment in the eurozone with a 10-year and 20-year maturity. With orders of EUR 233 billion, the bond was oversubscribed by a factor of 13, which shows the enormous demand from investors for bonds with social, green and sustainable components.

Performance of the Ethna-DEFENSIV (T class) was +0.37% in October and is thus +1.61% year-to-date. The bond portfolio consisting of high-quality securities made a positive contribution to performance once again with 0.41%, which goes to show the defensive character of the Ethna-DEFENSIV, enabling it to offer a stable return even in volatile market phases. Currencies (CHF, JPY and USD) also made a positive contribution of 0.1% to fund performance. Due to the expected short-term turbulence in the market, we bought Japanese sovereign bonds denominated in Japanese yen (in the amount of 5%), which are considered a secure investment in times of crisis and which should see the Ethna-DEFENSIV through the volatility of the coming weeks. Based on a comprehensive fundamental analysis, we will also be looking for opportunities in corporate bonds, primarily from quality companies with an investment grade rating, but also in selective high yield bonds in future, as we still see attractive risk/return profiles here.

Ethna-AKTIV

September was characterised by high volatility in global capital markets and this trend continued in October. However, the rally that started at the end of September only lasted until the second week of October and did not bring any new index highs with it. Although the current reporting season has had really solid results to offer and there were a large number of positive surprises, as the month progressed the global equity indices lost the gains they had made and closed much lower, especially in Europe. As the current Covid-19 situation deteriorates further and as lockdown measures are reinstated, it’s not hard to find reasons for the losses. However, it must be said that for many companies just slightly exceeding profit expectations this month was not enough, having put in a truly remarkable rally since the lows of March and trading at much higher valuations as a result. Disappointing quarterly figures – as was the case with the German industry leader SAP – were punished with heavy falls in prices. Thanks to the central banks’ ongoing purchase programmes, corporate bonds generally traded on very stable lines in this environment. The debt securities held in the fund therefore made a slightly positive contribution to the result for the month. Despite a very weak market overall, Ethna-AKTIV’s equity portfolio made a positive contribution. This was due to single stock selection as well as active trading in index futures. In the middle of the month we took profits on our long positions in good time, and in the last week of trading we reduced the equity exposure by more than a half (down from almost 30% beforehand) in anticipation of further lockdowns and on account of the upcoming U.S. election. This helped the fund produce a slightly positive result in what was fundamentally a challenging month.

Looking ahead, however, we are not quite as pessimistic as the defensive positioning at month-end would suggest. As soon as the tiresome matter of the U.S. election is over, market participants can once again focus on economic matters. Provided that the current measures to curb the pandemic are effective, we assume that the economy will also continue to recover. A U.S. fiscal package will be more likely then, and, on the back of this and the generally positive seasonal sentiment, we will reposition the fund accordingly in anticipation of rising prices.

At the end of the month, the European Central Bank provided additional support – at least for the European market – when it spoke of further supports that are to be announced in the upcoming meeting in December. Even though these statements tended to impact the single currency, they were not the reason why we expanded the fund’s foreign currency exposure further. During the month, we build up a 10% position in Japanese sovereign bonds in two increments. With the Japanese yield curve under active control, this is almost exclusively a currency position, the advantages of which are that it produces no negative carry and acts as a safe-haven currency.

Overall, October was a month in which the Ethna-AKTIV demonstrated its strengths, thanks to its flexible, value-preserving management approach.

Ethna-DYNAMISCH

Last month, investors endured the entire spectrum of current uncertainties. On the one hand, many economic indicators point to a continued economic recovery from the impacts of the first wave of Covid-19. Backing up this impression is the fact that the reporting season is turning out better than expected. On the other hand, infection rates are rising, especially in the U.S. and Europe, reaching new record levels. While the U.S. debate about the nature of further fiscal support shored up the markets in the first weeks of October, an agreement looked increasingly uncertain and was finally put off until after the U.S. presidential election. The imposition of fresh lockdowns to control the second wave of the pandemic in Europe and concerns about similar preventive measures in the U.S. dominated markets in the last week of October, which in turn led to sharp falls in equity markets.

However, we do not expect a fall in prices comparable with the decline in spring. In countries such as Israel, which experienced the second wave of the pandemic earlier, the markets priced in the negative implications when lockdown was announced and have tended to recover since then. In addition, the latest lockdowns have been a lot less hard on the economy, and the strong support coming from central banks and governments will be with us for the foreseeable future. While there were no major changes to the composition of the portfolio over the course of the past month, looking ahead we will continue with the counter-cyclical approach we have taken in the Ethna-DYNAMISCH lately, even in the current period of weakness. As we successfully managed to do in September, we again plan to take advantage of the market weakness that has recently set in to steadily expand our equity market exposure. The net equity allocation of 64% at the end of October gives us plenty of scope to do so.

Despite all the short-term uncertainty about the further course of the pandemic, we are confident that quality companies will not be subsumed by this crisis but will actually emerge from it in a better competitive position afterwards. For this reason, we continue to focus our single stock selection on companies with lasting quality that will survive the short-term Covid-19 restrictions and be able to prosper once more in the post-pandemic world over the long-term.

Figure 1: Portfolio structure* of the Ethna-DEFENSIV

Figure 2: Portfolio structure* of the Ethna-AKTIV

Figure 3: Portfolio structure* of the Ethna-DYNAMISCH

Figure 4: Portfolio composition of the Ethna-DEFENSIV by currency

Figure 5: Portfolio composition of the Ethna-AKTIV by currency

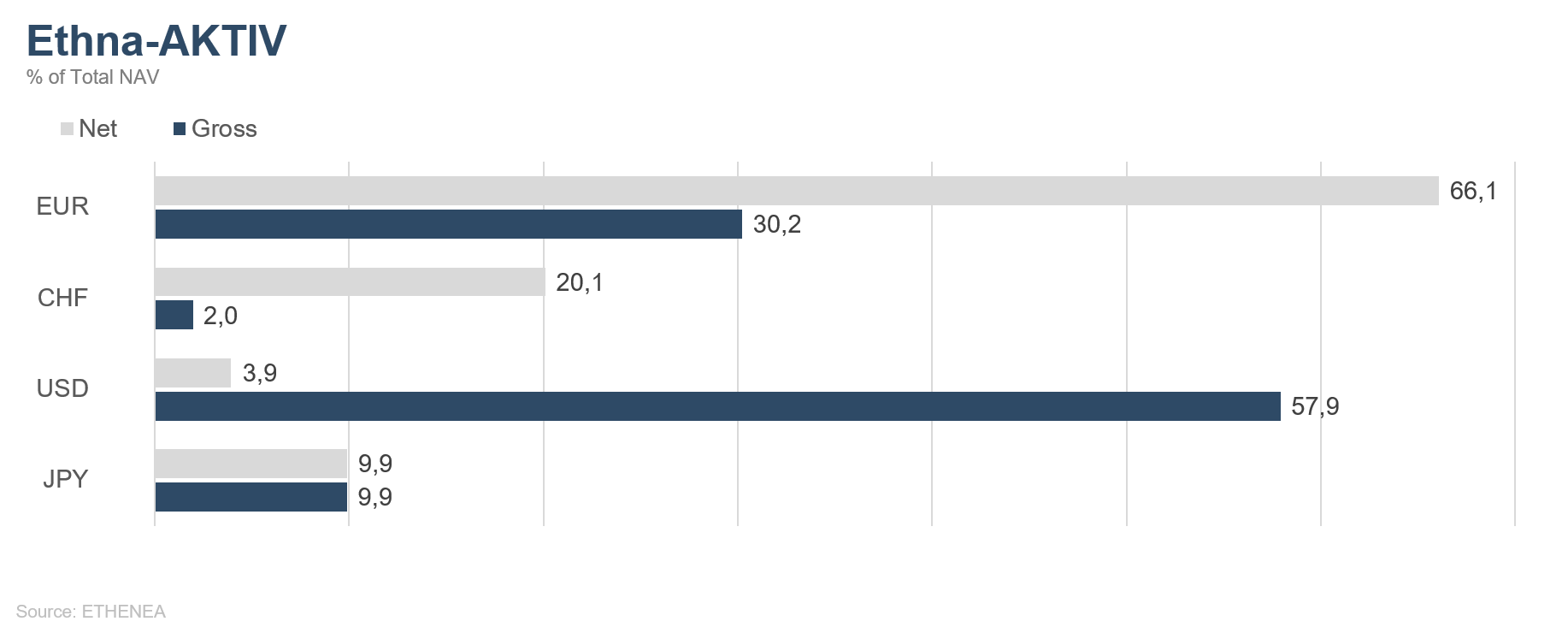

Figure 6: Portfolio composition of the Ethna-DYNAMISCH by currency

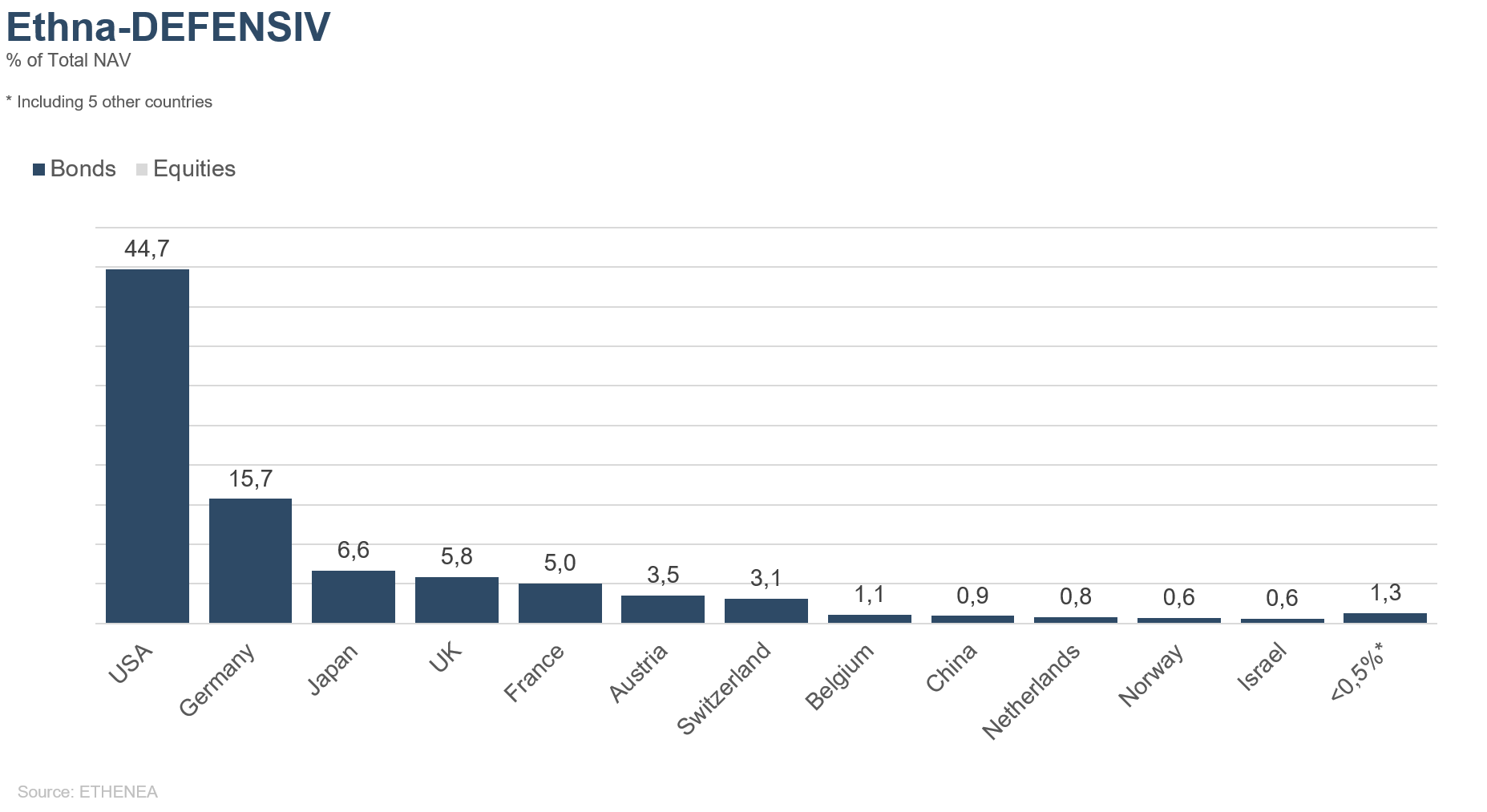

Figure 7: Portfolio composition of the Ethna-DEFENSIV by country

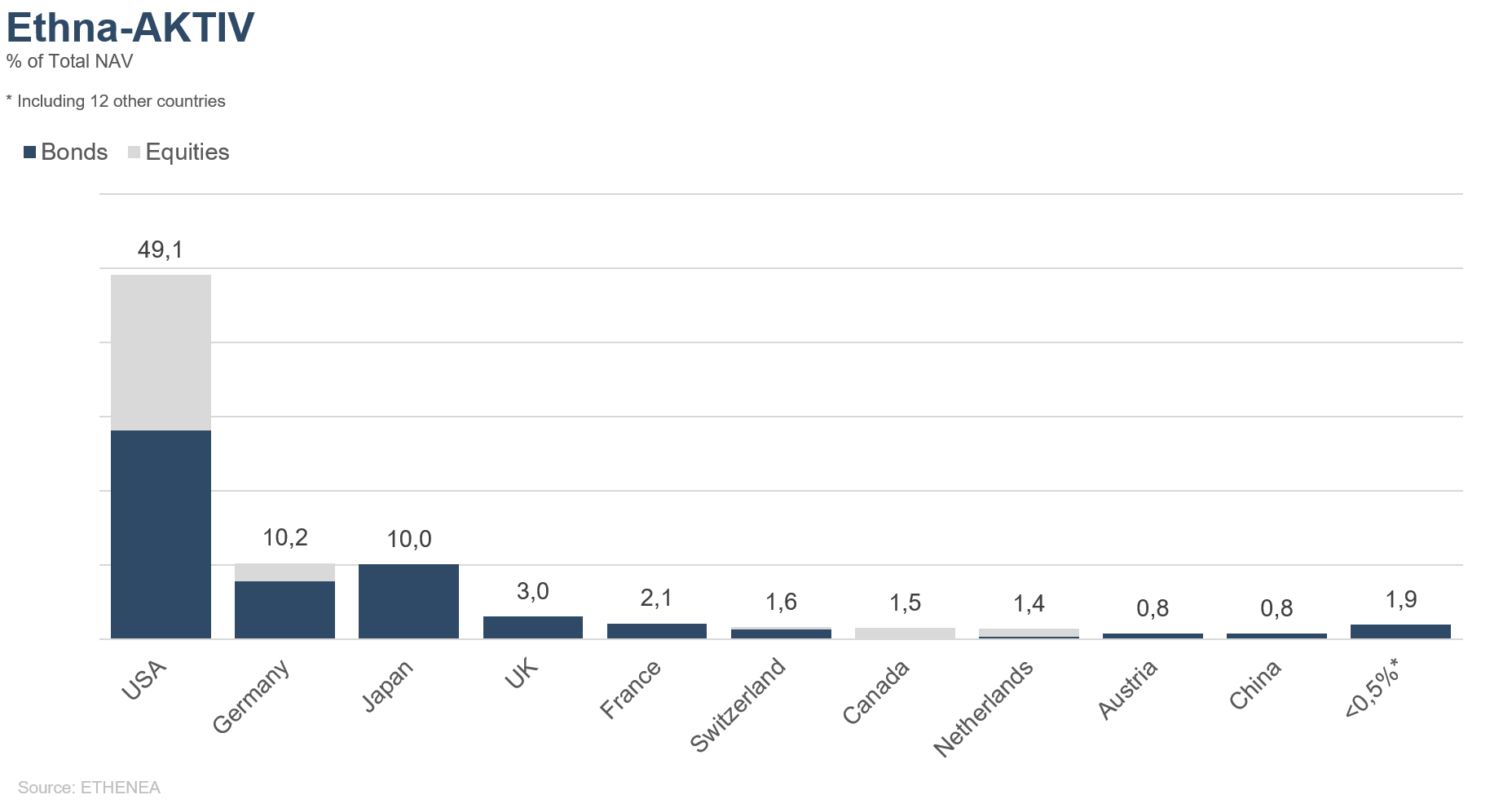

Figure 8: Portfolio composition of the Ethna-AKTIV by country

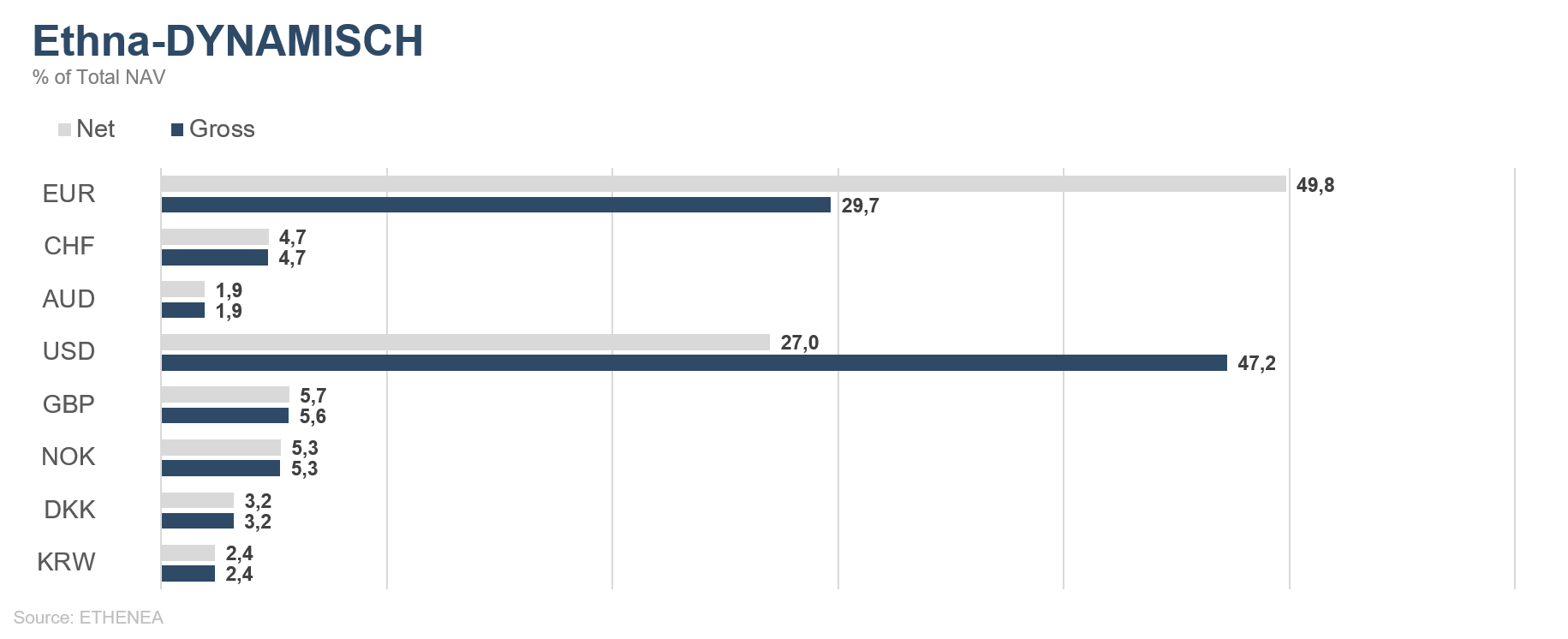

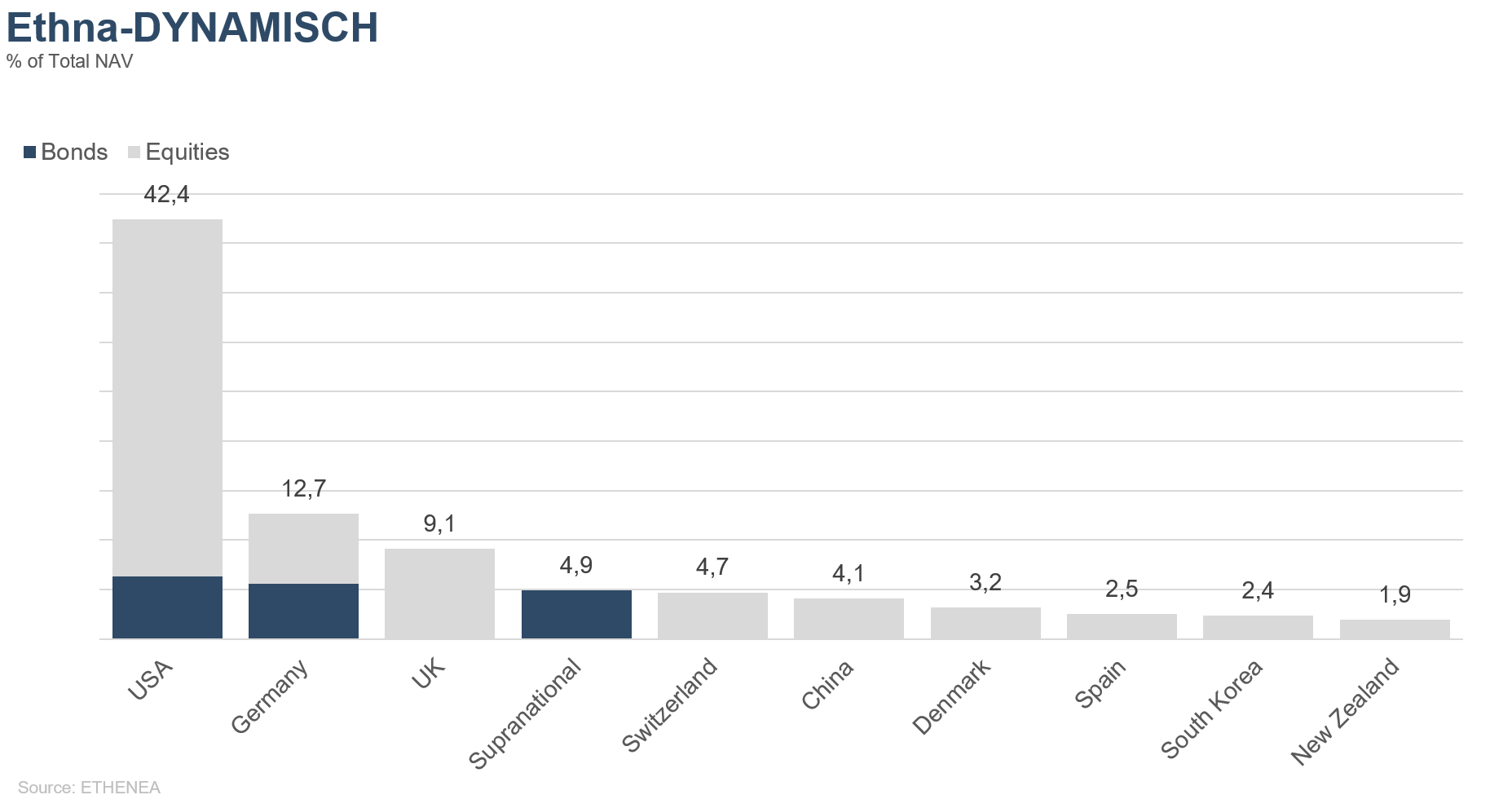

Figure 9: Portfolio composition of the Ethna-DYNAMISCH by country

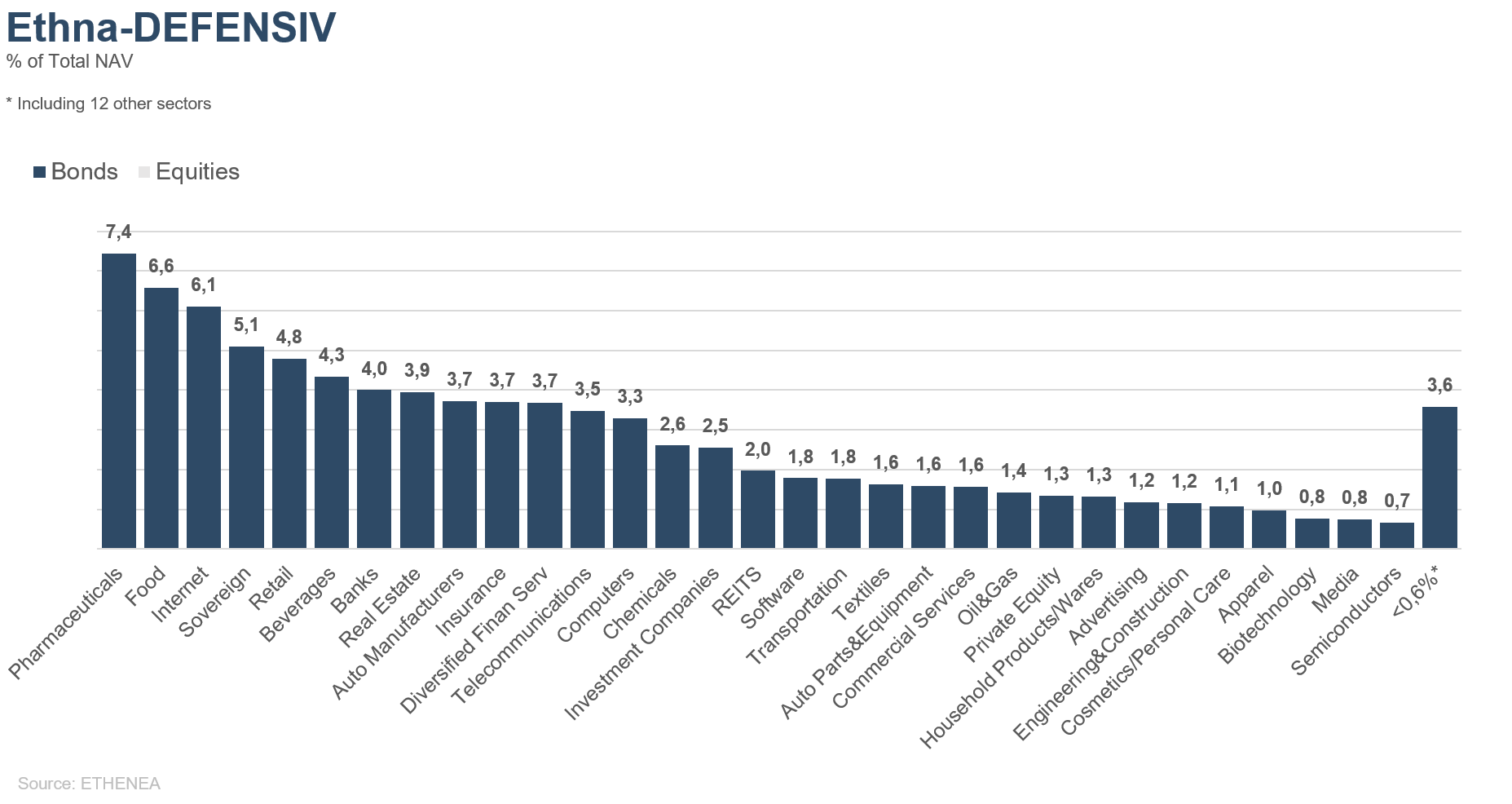

Figure 10: Portfolio composition of the Ethna-DEFENSIV by issuer sector

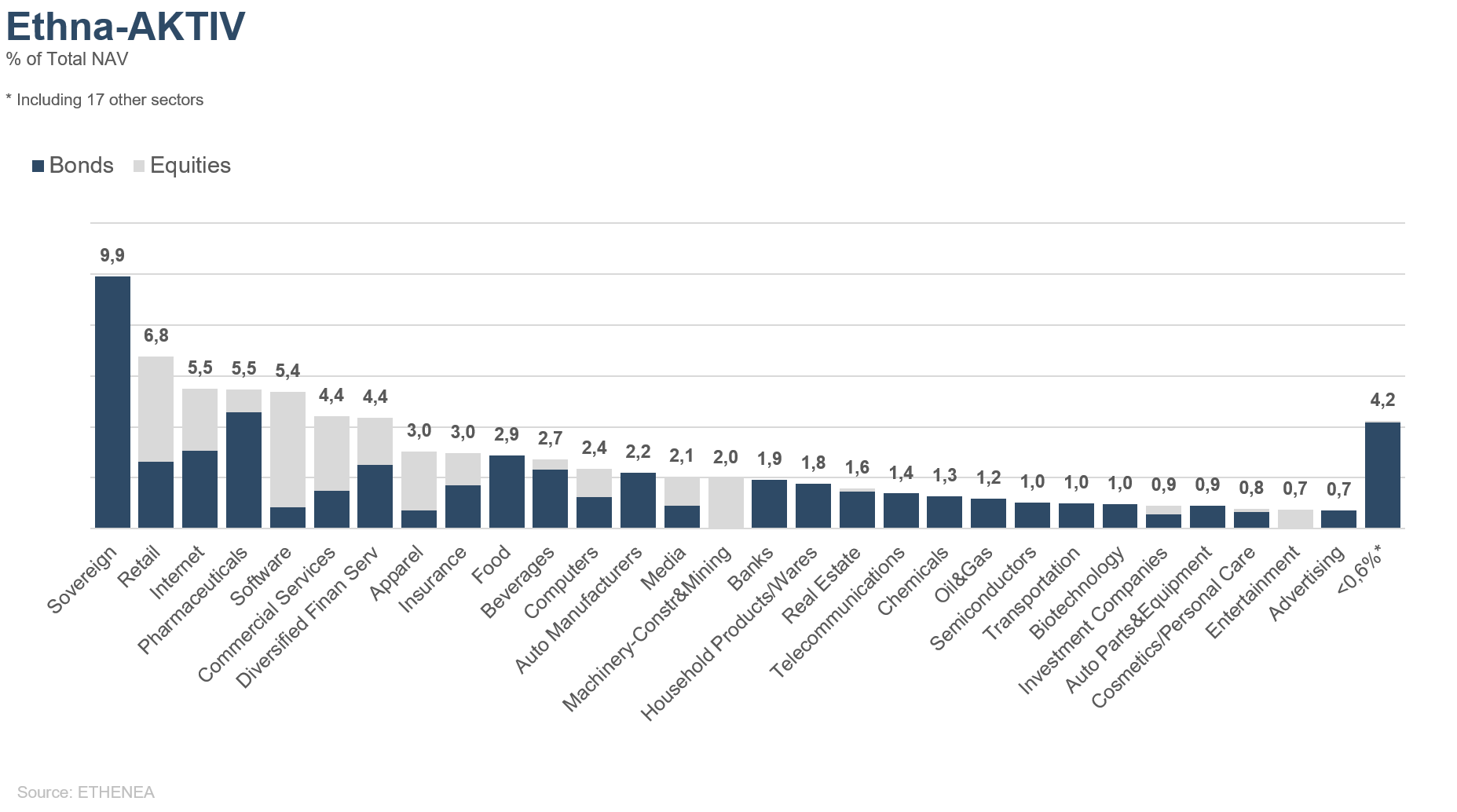

Figure 11: Portfolio composition of the Ethna-AKTIV by issuer sector

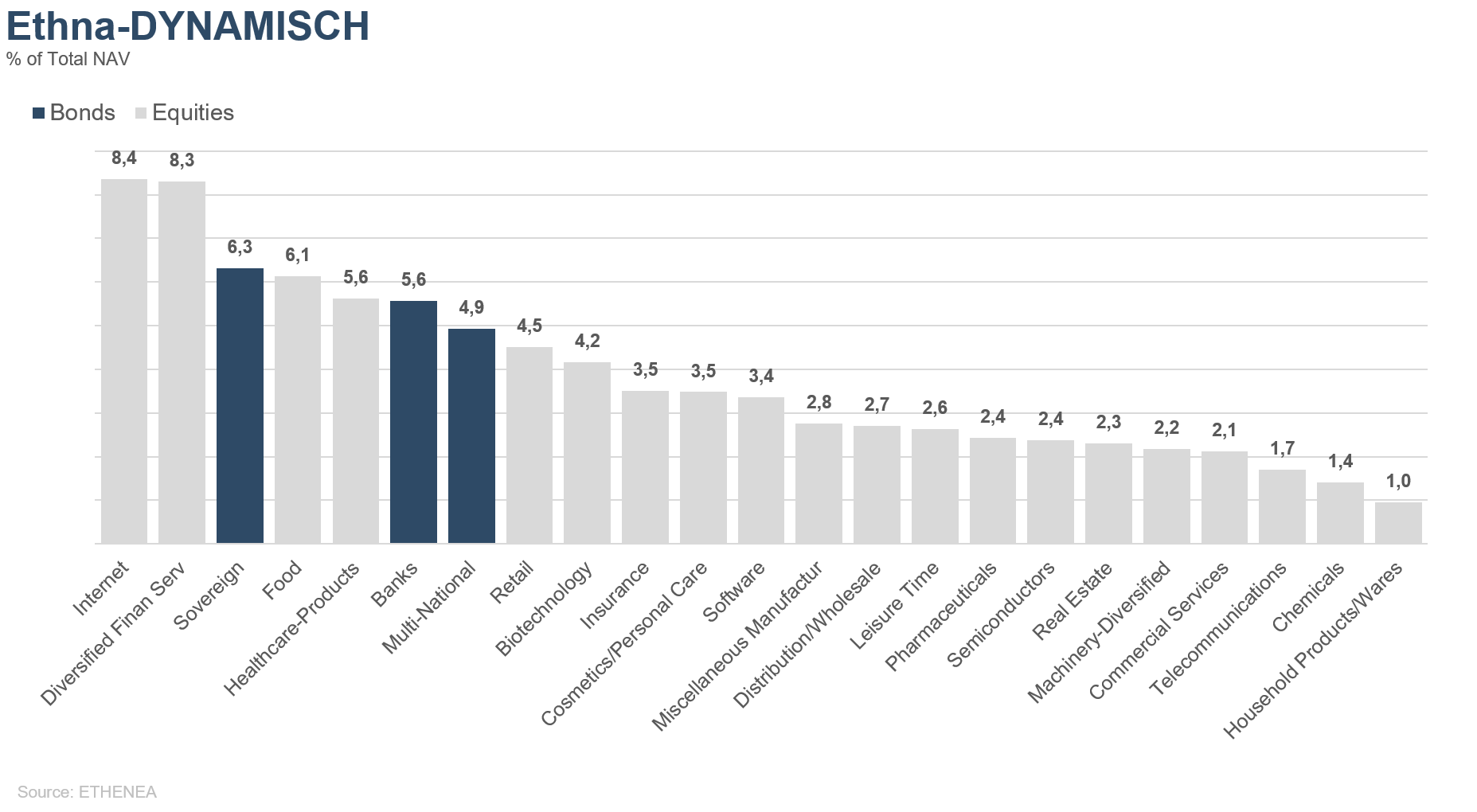

Figure 12: Portfolio composition of the Ethna-DYNAMISCH by issuer sector

* “Cash” comprises term deposits, call money and current accounts/other accounts. “Equities net” comprises direct investments and exposure resulting from equity derivatives.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

La presente es una comunicación promocional. Tiene exclusivamente para transmitir información del producto y no constituye un documento exigido por la ley o la normativa. La información incluida en el presente documento no representa una solicitud, oferta o recomendación para comprar o vender acciones del fondo o para realizar cualquier otra transacción. Su objetivo no es otro que ayudar al lector a entender las características principales del fondo como, por ejemplo, el proceso de inversión y no pretende ser, en todo o en parte, una recomendación de inversión. No sustituye a su propia consideración ni a otra información y asesoramiento de carácter legal, fiscal o financiero. Ni la sociedad gestora ni sus empleados u órganos podrán ser considerados responsables de las pérdidas incurridas, directa o indirectamente, por el uso del contenido del presente documento o en relación con este. Los documentos de venta actualmente vigentes en alemán (folleto, documentos de datos fundamentales (PRIIPs-KIDs), junto con los informes anual y semestral), en los que figura información detallada sobre la suscripción del fondo y los riesgos y las oportunidades y riesgos relacionados, constituyen la única base vinculante para la suscripción de acciones. Los mencionados documentos de venta en alemán (así como sus versiones no oficiales traducidas a otros idiomas) pueden consultarse en www.ethenea.com y obtenerse de forma gratuita en la sociedad gestora, ETHENEA Independent Investors S.A. y el depositario, así como en los respectivos agentes de pago o de información de cada país y el representante en Suiza. Los agentes de pago o de información son los siguientes para los fondos Ethna-AKTIV, Ethna-DEFENSIV y Ethna-DYNAMISCH: Alemania, Austria, Bélgica, Liechtenstein, Luxemburgo: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxemburgo; España: ALLFUNDS BANK, S.A., C/ Estafeta, 6 (la Moraleja), Edificio 3 – Complejo Plaza de la Fuente, ES-28109 Alcobendas (Madrid); Francia: CACEIS Bank France, 1-3 place Valhubert, F-75013 Paris; Italia: State Street Bank International – Succursale Italia, Via Ferrante Aporti, 10, IT-20125 Milano; Société Génerale Securities Services, Via Benigno Crespi, 19/A - MAC 2, IT-20123 Milano; Banca Sella Holding S.p.A., Piazza Gaudenzio Sella 1, IT-13900 Biella; Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Suiza: Representante: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Agente de pagos: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. Los agentes de pago o de información son los siguientes para HESPER FUND, SICAV - Global Solutions: Alemania, Austria, Bélgica, Francia, Luxemburgo: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxemburgo; Italia: Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Suiza: Representante: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Agente de pagos: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. La sociedad gestora podrá rescindir los acuerdos de distribución vigentes con terceros o retirar los permisos de distribución por razones estratégicas o exigidas por ley, respetando los plazos. Los inversores pueden obtener información sobre sus derechos en el sitio web www.ethenea.com y en el folleto. La información se encuentra disponible en alemán e inglés y, en ciertos casos, también otros idiomas. Creado por: ETHENEA Independent Investors S.A. Se prohíbe transmitir el presente documento a personas domiciliadas en países en los que la distribución del fondo no está permitida o en los que se requiere autorización para su distribución. Las acciones únicamente podrán ofrecerse a personas de dichos países si la oferta cumple con las disposiciones legales aplicables y se garantiza que la distribución y publicación del presente documento, así como la oferta o venta de acciones, no están sujetas a ninguna restricción en la jurisdicción en cuestión. En particular, el fondo no se ofrece ni en Estados Unidos de América ni a personas estadounidenses (en el sentido de la norma 902 del Reglamento S de la Ley de valores de EE. UU. de 1933, en su versión vigente) ni a personas que actúen en representación, por cuenta o en beneficio de una persona estadounidense. La rentabilidad histórica no debe considerarse una indicación o garantía de la rentabilidad futura. Las fluctuaciones del valor de los instrumentos financieros subyacentes, sus rendimientos y las variaciones de los tipos de interés y los tipos de cambio implican que el valor de las acciones de un fondo y los rendimientos que de ellas se derivan pueden incrementarse o disminuir, y no están garantizados. Las valoraciones incluidas en el presente documento se basan en varios factores, entre los que cabe incluir los precios actuales, la estimación del valor de los activos subyacentes y la liquidez del mercado, así como otros supuestos e información disponible al público. En general, los precios, los valores y los rendimientos pueden incrementarse o disminuir, hasta la pérdida total del capital invertido, y los supuestos y la información pueden cambiar sin previo aviso. El valor del capital invertido o el precio de las acciones del fondo, así como los rendimientos y los importes de reparto derivados de este, pueden oscilar o quedar totalmente anulados. Por tanto, una rentabilidad histórica positiva (revalorización) no constituye una garantía de una rentabilidad positiva en el futuro. En particular, no puede garantizarse la preservación del capital invertido, por lo que, en caso de venta o reembolso, no se garantiza que el valor del capital invertido o de las acciones mantenidas en el fondo se corresponderá con el capital invertido inicialmente. Las inversiones en divisas están sujetas a fluctuaciones adicionales del tipo de cambio o riesgos cambiarios, es decir, la rentabilidad de dichas inversiones depende también de la volatilidad de la divisa, lo que puede incidir de forma negativa en el valor del capital invertido. Las posiciones y asignaciones pueden variar. En el cálculo se incluyen las comisiones de gestión y custodia, así como todos los demás gastos aplicados al fondo según lo estipulado en el contrato. El cálculo de la rentabilidad se basa en método BVI, es decir, no incluye la comisión de venta, los costes de transacción (como las comisiones de órdenes e intermediación) ni las comisiones de custodia y otros gastos de gestión. El resultado de la inversión sería inferior si se tuviese en cuenta la comisión de venta. No puede garantizarse que las previsiones del mercado vayan a cumplirse. Cualquier alusión a los riesgos en esta publicación no debe considerarse que constituye la divulgación de todos los riesgos o la gestión definitiva de los riesgos mencionados. En el folleto figura la descripción detallada expresa de los riesgos. No puede garantizarse la exactitud, integridad o vigencia. El contenido y la información están sujetos a la protección de los derechos de autor. No puede garantizarse que el documento cumpla todos los requisitos legales o reglamentarios estipulados para él en países distintos a Luxemburgo. Nota: los términos técnicos más importantes pueden consultarse en el glosario que figura en www.ethenea.com/glossar. Información para los inversores en Suiza: El país de origen de la institución de inversión colectiva es Luxemburgo. El representante en Suiza es IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zúrich. El agente de pagos en Suiza es DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zúrich. El folleto, los documentos de datos fundamentales (PRIIPs-KIDs), los estatutos y los informes anual y semestral pueden obtenerse de forma gratuita a través del representante. Copyright © ETHENEA Independent Investors S.A. (2024) Todos los derechos reservados. 02/11/2020