Your questions, our answers

As we’re approaching the last days of 2022, it´s safe to say that the era of negative interest rates is over, and the markets remain under the spell of geopolitics and inflation, which continue to stay at a high level on both sides of the Atlantic. In our 4th and thus last quarterly update of the year, portfolio managers addressed the following participant questions, among others, and provided their perspective.

Ethna-DYNAMISCH

- Do you think that the stock markets have already bottomed out? Will you be increasing equity exposure again towards the end of the year and/or in 2023?

- Can you explain your current stock selection? And what is the strategy going forward?

Ethna-DEFENSIV

Ethna-AKTIV

- Which asset class has contributed the most and least to performance so far and how do you expect performance contribution by the end of 2022?

- What do we plan to do with our cash position? Continue to hold as much or are new investment opportunities already in sight?

- Currently, the equity positions consist almost entirely of U.S. equities. Can you see yourself allocating more European equities here soon?

Global macro view

- Current market: Bad economic data makes for good stock markets, and fears of sharply rising interest rates are dampened as a result. At what point is bad news bad again?

- Do you expect a prolonged period of high inflation? How long will this phase last? How will you react if your assessment does not come true?

Ethna-DYNAMISCH

Do you think the equity market has already bottomed out? Will you increase the equity exposure again towards the end of the year and/or in 2023?

The bottom of the stock market cannot be pinned down to a date or an index level. With the disinflationary impulses from the U.S., the market has already come a long way from its interim low for the year in mid-October. Nevertheless, we would not give a blanket all-clear that the bear market is over. This is because the downstream effects of inflation, which is still too high - including central bank policy, consumer buying behaviour, margin developments and valuation adjustments - are not new and are already well advanced in some cases but will continue to weigh on the medium term.

We took account of this mixed situation in the 4th quarter by slightly increasing the net equity ratio from around 30% toward 40%. On the one hand, this increase reflects a gradually improving risk-reward profile, as the immediate pressure from numerous stress factors has eased somewhat. On the other hand, the current level of net equity exposure continues to reflect our strategic caution, as the same stress factors will remain with us for some time. We will make strategic and tactical adjustments to net equity exposure depending on a changed market assessment - derived objectively and in a disciplined manner from our ETHENEA Market Balance Sheet. This may be the case as early as the end of the year or as late as 2023.

Ethna-DYNAMISCH

According to your monthly update, you have recently added new positions in high quality stocks. Can you give us some names and explain your future strategy for stock selection?

Even quality companies that continue to be fundamentally robust were unable to escape the pull of the difficult market environment of recent months. From a bottom-up perspective, attractive entry opportunities have thus presented themselves. Our new positions include:

- PayPal Holdings: an investment candidate that exemplifies our investment focus - growth at a reasonable price. PayPal's valuation, which was excessive during the Covid era, has now more than returned to normal, while fundamental growth has continued regardless of valuation turbulence. Most recently, short-term catalysts such as the share buyback program and cost discipline initiatives (triggered, among other things, by the involvement of an activist investor) have also convinced us to buy in.

- Coloplast: The Danish medical technology company is a leader in the field of artificial bodily outlets (bowel, urinary and trachea) - a non-cyclical market segment. Coloplast has an above-average organic growth rate with an operating margin of over 20% and uses its cash for both dividend payments and share buybacks. We have used the recent relatively moderate valuation to enter this defensive growth stock.

- Erste Group Bank: The Austrian bank has an attractive return on equity, a solid capitalization, pays a mid-single-digit dividend yield and is considering the option of a share buyback program in 2023. Nevertheless, the stock recently traded near a historical valuation low. We assume the market is overestimating the bank's idiosyncratic and sector-specific risks, while failing to appreciate the upside from interest rate dynamics. The (exaggerated) pessimism around European cyclicals was also a reason for us to take a closer look here.

Despite our strategic restraint (as explained in the previous response), we continue to focus on building up and expanding individual stocks, thus laying the foundation for more attractive returns again in the future. In doing so, we continue to focus on quality stocks that are characterized by fundamental strength, a solid balance sheet, and an adequate valuation, among other things.

Ethna-DEFENSIV

The Ethna-DEFENSIV has a minimum distribution of 1.5% (A-class). Which key interest rates (EUR and US) or which market scenario are necessary to be able to move towards 3%?

Yes, class A of Ethna-DEFENSIV has a minimum payout of 1.5% defined in the prospectus. Ordinary fund income primarily relates to interest income, while the costs can be approximated by taking the total expense ratio, which is 1.15% for the year 2021. The current yield of the fund as a measure of the ordinary income is currently at 2.1%, while the average yield to maturity is slightly below 5%. The significant difference is due to the rapidly rising yields, while the bond investments haven’t been adjusted with the pace. So, it is a question of time and reinvestment and the deliberate decision by the asset manager to get the current yield toward the level of the yield to maturity. Recently, the Ethna-DEFENSIV bought Euro-denominated corporate bonds carrying an IG rating, and having a medium-term maturity as well as a yield and coupon around 4%. If we can shift the whole portfolio this way, without a compromise on quality and duration, the fund is very close to generating an ordinary income sufficient to pay 3%.

The coupons and yields of recently issued USD denominated bonds are between 4.5% and 5.5% in our preferred investment universe of high-quality bonds with a short maturity. But, we have to reduce the risk against a USD devaluation as we have to preserve the conservative nature of the fund. The hedging costs can be calculated by taking money-market yields in EUR and deducting the corresponding USD yield, which leads to annual costs of 2.5%, at the moment. These costs are not part of the ordinary income, but the realized losses. Nevertheless, we incorporate the costs in our investment decisions and require a USD yield of 6.5% to come close to a 3% payout, if the hedging costs stay unchanged.

The management company ETHENEA Independent Investors S.A., decides the size of the distribution, which may include ordinary income, realized and unrealized profits, as well as other assets.

Ethna-AKTIV

Which asset class has contributed the most and least to performance to date, and how do you expect performance to be contributed by the end of 2022?

For the market, 2022 has so far been characterized by a simultaneous loss in equities and bonds on a historic scale. The fundamental investment conditions for a multi-asset fund were negative to the maximum. Against this backdrop, active management, which translates into an appropriate overlay in terms of equity, interest rate and also currency risks, was the key to differentiation. The investment result of the Ethna-AKTIV is quite respectable in this context.

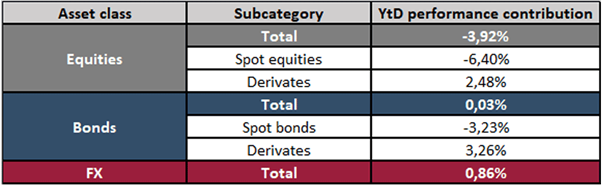

As of November 23, the performance contributions of the various asset classes including the corresponding overlays are as follows:

On the one hand, the almost balanced result in bonds and the positive contribution from the currency side should be highlighted. While the former is due to a conservative fixed income portfolio and, above all, a properly implemented interest rate hedge, the latter benefited from our overweight in the U.S. dollar. Before the recent correction of the U.S. dollar, this performance contribution was even above 3.2%, which clearly shows the added value that an appropriate diversification across asset classes can provide.

Based on the current positioning, moderate performance contributions from equities, currencies and bonds are possible until the end of the year. In all asset classes, we are currently foregoing an overlay and are taking a manageable risk in line with our market expectations.

Ethna-AKTIV

What do we plan to do with our cash position? Continue to hold so much or already new investment opportunities in sight?

The cash position of the Ethna-AKTIV is currently 15%. In a challenging year 2022, a higher cash position was a strategic decision that has so far had a positive impact on the stability of the fund's performance. Against the backdrop of initial signs of stabilization and a return to more attractive risk premiums, we will gradually reduce the cash position in favor of spot investments in both equities and bonds. As a result, the fund ratio should tend to fall back below 10% towards the end of the year.

Ethna-AKTIV

Currently, the equity positions consist almost exclusively of US stocks. Can you imagine that you will soon allocate more European stocks here as well?

Indeed, on the equity side, the base portfolio of the Ethna-AKTIV consists almost 100% of US blue chips. Despite the valuation premium that has existed for years, we have deliberately chosen this focus and away from a global portfolio. After all, this is not just about not investing in European stocks, but also in attractive Asian stocks where appropriate. The main reason for this is the resulting robustness of the portfolio. Despite a global business model, European and also Asian stocks often suffer disproportionately from regional problems, whether of a political or economic nature. Nonetheless, we also observe that this quasi clan liability has led to increasingly significant valuation discounts, which at the very least prompts us to rethink this positioning. For this reason, we do not currently rule out the possibility that the portfolio will be positioned somewhat more globally again next year.

Global macro view

Current market: Bad economic data makes for good stock markets; fears of sharply rising interest rates are curbed as a result. At what point is bad news bad again?

2022 has been a very challenging year for the global economy as well as for financial markets. Inflation has been rising to multi-decade highs, and central banks around the world have been aggressively tightening their policies. With high inflation, depressing consumption and investment as well as monetary tightening constraining demand, the risks of a recession have increased considerably. In this environment, weak economic data have been considered as positive by the markets as they point to weakening inflation pressures, and may prompt central banks to slow down, or even reverse, their tightening path providing relief to asset markets. The way the market is looking at economic developments depends strongly on the underlying economic scenario. The current dynamic could reverse and lead to a recession scenario with declining inflation. In the event of a rapidly deteriorating economic growth or a global downturn, negative economic news would be more likely to be scrutinised for its negative impact on consumption, investment and corporate profits, and would have a negative impact on equity markets.

Global macro view

You expect a prolonged period of high inflation? How long will this period last? At what point will you react if your assessment in this regard does not materialize?

The Covid-pandemic and unprecedented policy support from advanced economies have created an imbalance between surging demand and impaired demand that has triggered a surge in inflation. The situation deteriorated this year when the global economy was hit by two major negative shocks (the war in Ukraine and the Covid outbreak in China), which globally caused additional price pressures. Inflation dynamics vary across regions, but headline inflation has gradually expanded to various sectors of the economy, reaching more structural areas such as wages, services and rents. Headline inflation seems to have peaked in the US thanks to the Fed’s aggressive tightening, while it may continue to rise in other advanced economies. However, we expect core inflation to remain high for some time, declining only gradually in 2023 to reach a level more in line with central banks targets in 2024. In recent months, markets have already started to price in a disinflationary environment in 2023 and a much less hawkish central bank stance. Equity markets have recovered from their September lows, and we have progressively adjusted our positioning to the market sentiment. However, we remain cautious and will monitor how growth and inflation data will develop in the coming months and adjust our positions accordingly.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

This is a marketing communication. It is for information purposes only and provides the addressee with guidance on our products, concepts and ideas. This does not form the basis for any purchase, sale, hedging, transfer or mortgaging of assets. None of the information contained herein constitutes an offer to buy or sell any financial instrument nor is it based on a consideration of the personal circumstances of the addressee. It is also not the result of an objective or independent analysis. ETHENEA makes no express or implied warranty or representation as to the accuracy, completeness, suitability, or marketability of any information provided to the addressee in webinars, podcasts or newsletters. The addressee acknowledges that our products and concepts may be intended for different categories of investors. The criteria are based exclusively on the currently valid sales prospectus. This marketing communication is not intended for a specific group of addressees. Each addressee must therefore inform themselves individually and under their own responsibility about the relevant provisions of the currently valid sales documents, on the basis of which the purchase of shares is exclusively based. Neither the content provided nor our marketing communications constitute binding promises or guarantees of future results. No advisory relationship is established either by reading or listening to the content. All contents are for information purposes only and cannot replace professional and individual investment advice. The addressee has requested the newsletter, has registered for a webinar or podcast, or uses other digital marketing media on their own initiative and at their own risk. The addressee and participant accept that digital marketing formats are technically produced and made available to the participant by an external information provider that has no relationship with ETHENEA. Access to and participation in digital marketing formats takes place via internet-based infrastructures. ETHENEA accepts no liability for any interruptions, cancellations, disruptions, suspensions, non-fulfilment, or delays related to the provision of the digital marketing formats. The participant acknowledges and accepts that when participating in digital marketing formats, personal data can be viewed, recorded, and transmitted by the information provider. ETHENEA is not liable for any breaches of data protection obligations by the information provider. Digital marketing formats may only be accessed and visited in countries in which their distribution and access is permitted by law. For detailed information on the opportunities and risks associated with our products, please refer to the current sales prospectus. The statutory sales documents (sales prospectus, key information documents (PRIIPs-KIDs), semi-annual and annual reports), which provide detailed information on the purchase of units and the associated risks, form the sole authoritative and binding basis for the purchase of units. The aforementioned sales documents in German (as well as in unofficial translations in other languages) can be found at www.ethenea.com and are available free of charge from the investment company ETHENEA Independent Investors S.A. and the custodian bank, as well as from the respective national paying or information agents and from the representative in Switzerland. The paying or information agents for the funds Ethna-AKTIV, Ethna-DEFENSIV and Ethna-DYNAMISCH are the following: Austria, Belgium, Germany, Liechtenstein, Luxembourg: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg; France: CACEIS Bank France, 1-3 place Valhubert, F-75013 Paris; Italy: State Street Bank International – Succursale Italia, Via Ferrante Aporti, 10, IT-20125 Milano; Société Génerale Securities Services, Via Benigno Crespi, 19/A - MAC 2, IT-20123 Milano; Banca Sella Holding S.p.A., Piazza Gaudenzio Sella 1, IT-13900 Biella; Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Spain: ALLFUNDS BANK, S.A., C/ Estafeta, 6 (la Moraleja), Edificio 3 – Complejo Plaza de la Fuente, ES-28109 Alcobendas (Madrid); Switzerland: Representative: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Paying Agent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. The paying or information agents for HESPER FUND, SICAV - Global Solutions are the following: Austria, Belgium, France, Germany, Luxembourg: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg; Italy: Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Switzerland: Representative: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Paying Agent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. The investment company may terminate existing distribution agreements with third parties or withdraw distribution licences for strategic or statutory reasons, subject to compliance with any deadlines. Investors can obtain information about their rights from the website www.ethenea.com and from the sales prospectus. The information is available in both German and English, as well as in other languages in individual cases. Explicit reference is made to the detailed risk descriptions in the sales prospectus. This publication is subject to copyright, trademark and intellectual property rights. Any reproduction, distribution, provision for downloading or online accessibility, inclusion in other websites, or publication in whole or in part, in modified or unmodified form, is only permitted with the prior written consent of ETHENEA. Copyright © 2024 ETHENEA Independent Investors S.A. All rights reserved. 25/11/2022