Hole in the hull: can the banks plug their money leaks?

Since mid-March, many American banks have seen record withdrawals of deposits. The liquidity crisis was triggered by the collapse of Silicon Valley Bank and Signature Bank, two of the biggest bank failures since the financial crisis, which have rattled the banking system and unsettled depositors. At almost the same time, Swiss traditional bank Credit Suisse was taken over by its arch-rival UBS in a forced merger after the share price of Credit Suisse tanked. For banks in the U.S. this meant great danger of further account closures. When banks lose the trust of customers, there is a risk that they will not be able to stem the rapid outflow of money from accounts. So where do we stand one month on?

Investors’ growing concerns over the current situation in the banking sector has exposed the difficult position that many banks find themselves in. A positive yield curve, which forms the basis of a functioning banking sector, has been absent since autumn 2022. What an inverse yield curve means for banks is that they are able to take in less money for long-term loans than they have to offer their customers for short-term deposits. In the long term no bank can survive such conditions.

“In the space of one month, we experienced

a rollercoaster of inflation risks and

even risks to financial stability,

but we are now back in the race.”

Illia Galka

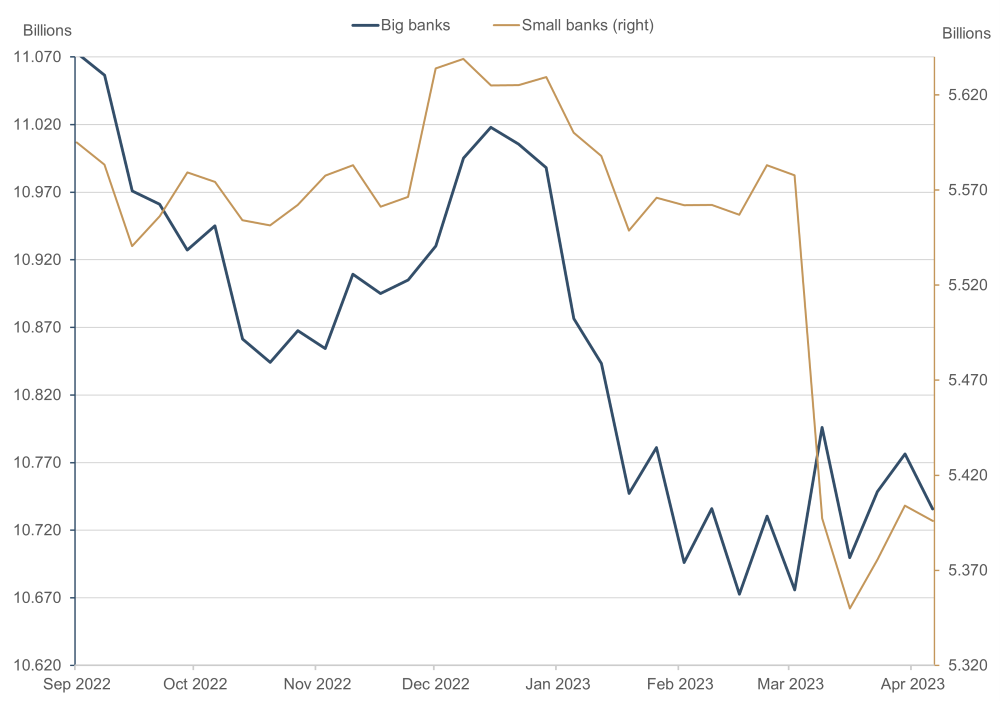

In the money market, investors can expect a one-year yield of approx. 4.5% in the U.S. and approx. 3% in Germany. This is tempting for many investors, especially considering the low interest rates that savings accounts earn at the moment. Under such circumstances, switching from savings account to money market instrument is more than understandable. On the other hand, many traditional banks cannot put up a serious fight considering the low average rate of interest of 0.39% for savings accounts in the U.S. at present. Emerging competition is also exerting pressure. American technology giant Apple, which is successively expanding its financial services offering, recently launched a savings account that yields 4.15%.

Figure 1: Money market yield vs interest rates on savings accounts

Source: Bloomberg

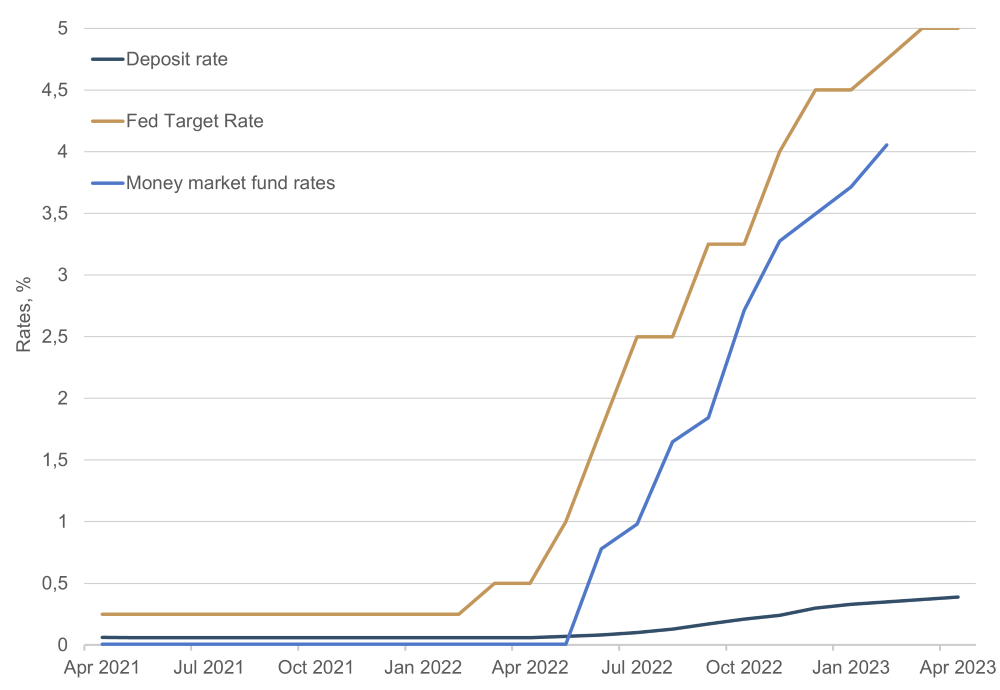

According to the Fed, deposits with U.S. banks have declined by USD 397 billion since March 2023. The bulk of this, USD 225 billion, was pulled from smaller regional banks, while large banks lost around USD 172 billion. As a first means of stopping the hemorrhage, the Fed made over USD 400 billion in liquidity available to affected banks. If we take a closer look at the individual companies, we see the outflows are unevenly distributed. On the one hand, some financial institutions saw substantial withdrawals of deposits. Of the banks that have released their quarterly figures to date, Charles Schwab saw deposits fall 11%, State Street 5% and M&T Bank 3%. First Republic Bank lost 35.5% of its customer deposits and now has to drastically reduce its assets: the bank is currently exploring the sale of assets to the tune of USD 50 to 100 billion and letting go up to 25% of its workforce. Further outflows are expected in the second quarter. On the other hand, JPMorgan Chase and Citigroup reported inflows in March and April, attributing this to the upheaval in the sector. Obviously, the flow of money is not all outward; some banks are benefiting from their beleaguered competitors.

Figure 2: Customer deposits with small and large U.S. banks, in billions

Source: Board of Governors of the Federal Reserve System (U.S.)

The latest data for the month of April also sent positive signals, since deposits with small U.S. banks began to grow again. Looking at the American equity indices, it appears as though the crisis that rattled the markets only a month ago never happened. Yields at the longer end of the curve were also up. In the space of one month, we experienced a rollercoaster of inflation risks and even risks to financial stability, but we are now back in the race. However, one month is a short length of time and even though sentiment has improved slightly, just one small, unexpected event will be enough to reopen the wound, and the subsequent countermeasures will have to be far greater.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com