Charting a course for a sustainable future

Over the past few years, the consideration of sustainability factors has become an integral part of investing. Investments have always been assessed in terms of earnings potential, risk and liquidity, and these days it is also a matter of course to assess them using ESG criteria. The fact that ESG stands for Environment, Social and Governance does not need to be spelled out in 2021. However, what does need to be explained is precisely how sustainability factors are considered.

There are plenty of conventional investment indicators for performance, risk (e.g. volatility, maximum drawdown) and liquidity, and these allow for the objective comparison of various investments options. Though this evaluation is mainly ex-post, even when used ex-ante it can give informed investors a very good idea of the expected results. Given the various interpretations of sustainability, this does not really apply to ESG criteria. First and foremost, the interpretation of sustainability factors has so far invariably reflected the product provider’s subjective point of view.

To establish more solid and objective criteria for assessing the sustainability of individual investment products, the European Union has enacted the Sustainable Finance Disclosure Regulation (SFDR), which comes into force on 10 March 2021. The prime objective of this EU Regulation is to provide the transparency and comparability that has been lacking to date. Even though the Regulation will not be fully implemented right from the start and further important ESG-relevant provisions will follow, such as the EU Taxonomy and amendments to the MiFID II Directive, it can without doubt be seen as agenda-setting for investment funds.

Initially, the most visible distinguishing feature for all funds will be the classification based on their ESG strategy, with all mutual funds having to decide on one of the following three product categories:

- Article 6 funds are normal funds that do not pursue any explicit sustainability strategy.

- Article 8 funds pursue a sustainability strategy. The companies in which they invest must follow good governance (G) practices and the fund must take environmental (E) and/or social (S) criteria into account in its investment process.

- Article 9 funds target sustainable investments often described as impact strategies. They must have a specific sustainability objective, such as reducing carbon emissions.

Regardless of the particular classification, in future all funds must make disclosures on whether and how sustainability risks are integrated in the investment decision-making process. In addition, regular reports on the main adverse sustainability impacts of the investment must be made by 30 December 2022 at the latest.

At ETHENEA, both the three Ethna funds and the HESPER FUND – Global Solutions are classified as Article 8 funds under the new Sustainable Finance Disclosure Regulation. This reaffirms our resolve to offer our clients responsible investment solutions with a competitive and sustainable return. ESG is and will remain a cornerstone. Furthermore, we thereby ensure that our funds can continue to serve as a core investment in our investors’ allocation.

The high degree of flexibility of the Ethna Funds has always been key to their success in adapting to changing markets and circumstances over time. The products are constantly evolving in order to move with the times while remaining timeless. Our investment funds’ sustainability strategy has also undergone continual development and refinement in recent years.

What started in 2013 with the first product-related exclusion criteria, such as tobacco, has developed over time into a fully-fledged three-stage investment process in order to give due weight to the matter of sustainability in the selection of portfolio securities.

In a first step, we reduce the universe available for investment by setting broad exclusions: when selecting securities, it is our policy not to consider companies whose core activity is the area of armaments, tobacco, pornography, food speculation and/or the mining/distribution of coal.

We also do not invest in a company if it has been found to be in serious breach of the principles of the UN Global Compact and there is no convincing plan in place to remedy the situation.

In the case of sovereign issuers, we exclude investments in countries that have been designated as ‘Not Free’ in the annual analysis carried out by Freedom House (www.freedomhouse.org). This list of exclusions was recently aligned with the joint proposal of the German Investment Funds Association (Fondsverband – BVI), the German Derivatives Association (Deutsche Derivate Verband – DDV) and the German Banking Industry Committee (Deutsche Kreditwirtschaft – DK), to ensure that it would meet the generally accepted criteria for sustainable products going forward.

On top of the aforementioned exclusions, which primarily relate to fixed standards and company products, the second step sees the exclusion of equity and bond issuers that do not meet the minimum threshold for our combined environmental, social and governance requirements. An ESG risk assessment is conducted to measure the extent to which the economic value of a company is put jeopardised by ESG factors or – in more technical terms – the magnitude of a company’s exposure to unmanaged ESG risks. This risk assessment can be done quickly and efficiently for a large investment universe by working with a specialised provider: Sustainalystics.

Lastly, an individual assessment of each issuer of a stock or bond forms an integral part of every investment decision. When deciding whether investments are suitable for our portfolios, we consider the individual ESG criteria in addition to traditional parameters for expected risk and earnings as well as liquidity. Thus, every issuer and every single security is individually assessed under the environmental, social and governance headings. In addition, any existing controversies are considered in the analysis. This enables us to increase the sustainability of our portfolios overall without having to compromise on the risk/return profile.

In the not-too-distant future, investment advisors will have to ask their clients by default whether ESG aspects are to be taken into consideration in their investment. At ETHENEA, we firmly believe that a true core product has to meet the higher sustainability standards of today’s investors. At the same time, earnings potential, risks and liquidity cannot be sidelined. With the entry into force of the Sustainable Finance Disclosure Regulation in March 2021, we have set the three Ethna Funds and the HESPER FUND – Global Solutions on course to strike a successful balance between these four elementary investment objectives.

Positioning of our funds

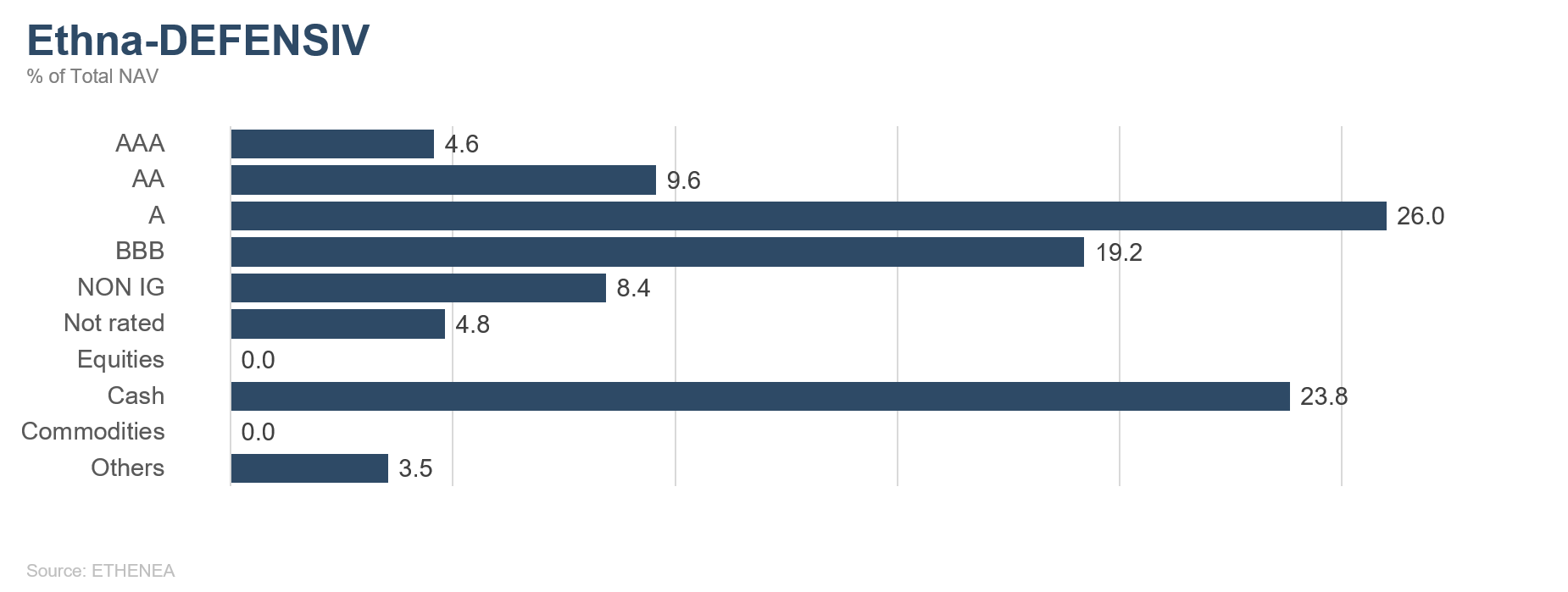

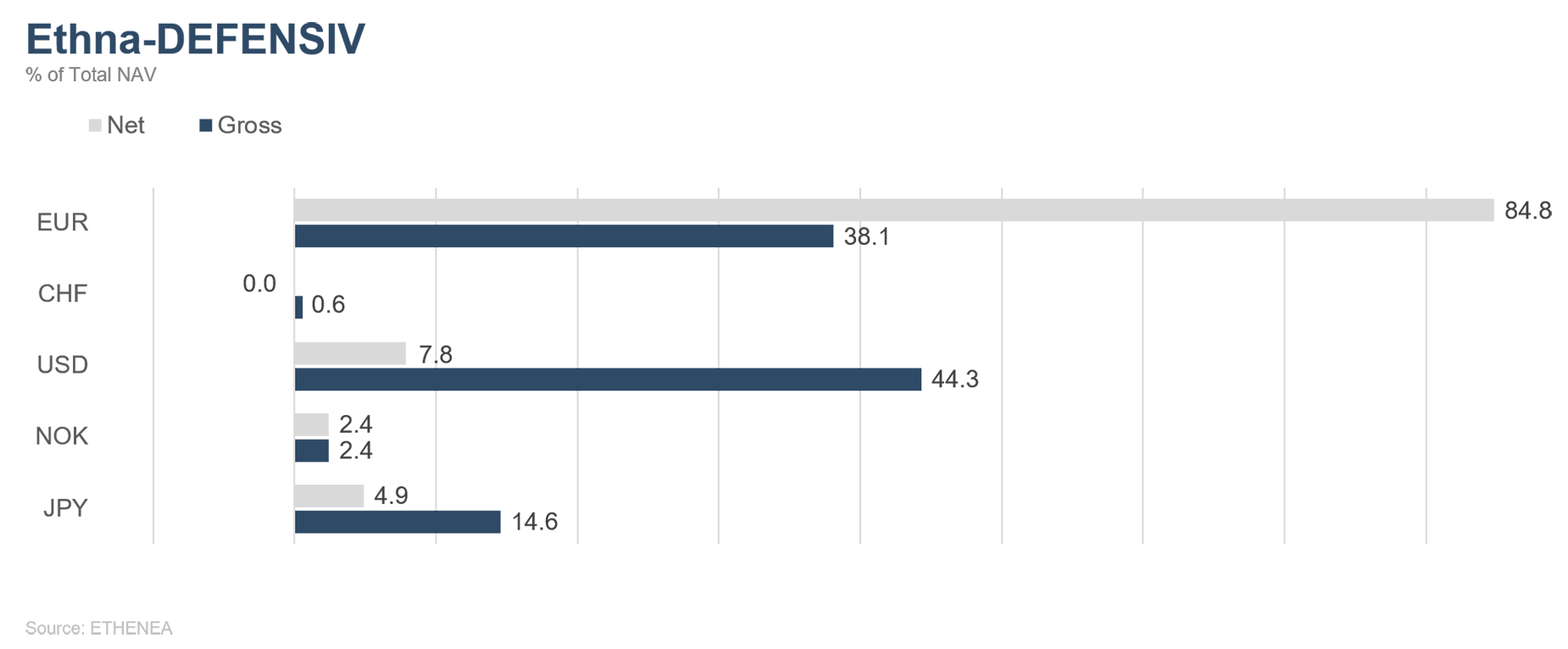

Ethna-DEFENSIV

It was the worst start of year for the global bond market since 2015. Yields on 10-year U.S. Treasuries briefly topped the 1.5% mark for the first time since the beginning of the pandemic, with yields at the long end rising the most and the yield curve steepening sharply. The U.S. pressure to sell also spread to Europe, with yields on UK, French, German and Italian sovereign bonds rising. German Bunds yielded around -0.25% for a short time, compared to a yield of -0.55% at the beginning of the year.

The fall in price is the latest manifestation of a broad exodus from sovereign bonds regarded as safe, driven by the roll-out of Covid-19 vaccines and a rapid economic recovery. At the same time, for the first time in decades, concerns about a serious rise in inflation are mounting. That said, we are of the opinion that the economy has a long road to recovery ahead of it and the first signs of rising prices will not necessarily lead to persistently high inflation. As we wrote in last month’s Market Commentary, we believe that price rises are largely due to short-term effects, such as rising oil prices and semiconductor supply shortages. The unemployment rate remains high and the labour market is a long way off full employment, so unit labour costs are likely to remain under pressure. At the same time, central banks on both sides of the Atlantic have made it clear that monetary policy will remain supportive for the foreseeable future and that, should it come to that, they will intervene if yields rise further.

However, this barely seems to have calmed investors at all for now. Corporate bonds followed the downward trend in sovereign bonds, and the risk premia scarcely changed at all on average. While less interest-rate-sensitive high yield bonds as well as cyclical sectors such as banks and commodities producers did comparatively well, the performance of other investment grade bonds slipped. The broad Bloomberg Barclays Index for investment grade bonds in Europe lost around 0.90% since the beginning of the year, with February alone accounting for around 0.78% of that. Investment grade bonds denominated in USD actually lost 4.12% since the beginning of the year. Note that the average corporate bond denominated in USD has a duration of almost 9, while the bonds denominated in USD in the Ethna-DEFENSIV have a duration of less than 5 and, accordingly, lost less. The pressure in the bond market to sell spread to the equity market to some extent. However, both markets stabilised again towards the end of the month.

We reduced the duration within the bond portfolio of the Ethna-DEFENSIV (T class) early (back at the beginning of February), which enabled us to limit the price losses on the bond side. However, we sold the U.S. Treasury futures we had been using as a hedge against the interest rate rise too early. As a result, the fund was not completely unaffected by the global rises in yields: the bonds denominated in USD in the Ethna-DEFENSIV lost around 0.70% last month while bonds denominated in EUR remained largely stable and closed the month with a performance of plus/minus zero. With sustainability in mind, we also switched our equity exposure into sustainable equity ETFs. The fund’s sustainable net equity allocation is currently around 3%. On balance, while the Ethna-DEFENSIV put in a solid performance considering the quite significant and greater-than-expected rises in yield, as well as the losses on the U.S. equity markets, it still posted a negative YTD performance of -0.75%. In this turbulence caused by the interest rate changes, all asset classes were down at the same time, and equities/currencies were unable to compensate in our bond-focused portfolio. However, we are optimistic looking ahead. There were signs of a turnaround in U.S. yields in the last few trading days in February and it seems to be continuing in March.

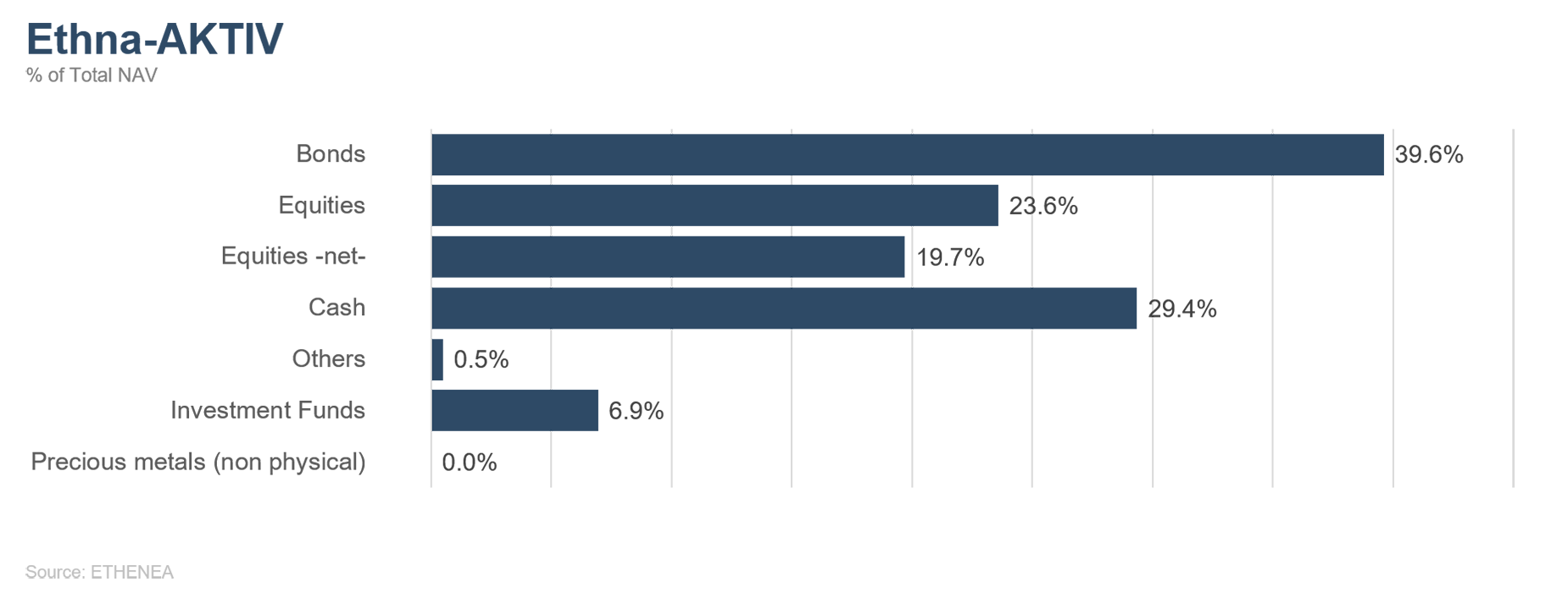

Ethna-AKTIV

The accelerating steepening of yield curves both in Europe and in the U.S. again interrupted the equity market rally that has been under way for a good year now. In particular, technology securities, which are regarded as highly interest-rate-sensitive due to their high expected growth being discounted, made losses from mid-February onwards. The picture is not quite so dramatic, though, on closer examination. For example, the rate for 10-year U.S. Treasuries increased over the month from 1.04% to more than 1.6%, closing most recently, however, at 1.4%. While this is a historically fast rise, it has not even regained its pre-crisis level in absolute terms. While the rise in interest rates can actually be regarded as a positive sign for economic development, in this instance it was the speed of the rise that led to volatility, originally in the bond market and spreading to the market as a whole. However, this too must be put into perspective. Despite the equity market losses suffered during the month, most indices still closed inside positive territory for the month. In fact, many capital investors are still running a positive performance for 2021, which is why no panic selling is to be expected at the moment.

Even though we still stand by our forecasts with regard to a growth surprise and higher equity prices during the year, we took advantage of the strong performance in the first two weeks to take some of the accrued profits for tactical reasons. While the indices for the Japanese market and emerging markets were sold just before the correction, the position in European banks futures, which we had also closed out, also climbed almost unwaveringly. We also took profits early on the duration management, which was designed for rising interest rates. We did not expect that movement in interest rates would accelerate to such an extent towards the end of the month. Since we expect volatility in equity markets to last for a while yet, we reduced the net equity allocation (including funds) to 26.6% towards the end of the month. We want to see a calming of the interest rate market as well as a stabilisation of equity prices before we raise the equity allocation back up to the maximum level based on fundamentals. The currency positions contained in the fund for balancing purposes detracted from performance this month. Obviously, the demand for safe-haven currencies was not sustainable in the context of this correction. In principle, this can be regarded as a positive sign going forward. Given that we reduced equity risk, we also reduced the currency position to 20%. Thanks to the measures we carried out, we are in the comfortable position of being able to observe the current price fluctuations from the sidelines to some extent. As soon as the reflation trade – which we believe is absolutely still valid – picks up again, we will increase our risk allocation in the fund again.

All in all, the Ethna-AKTIV got through the first two months of the year with relatively low volatility and was rewarded with a YTD performance of more than 1% for consistently adhering to the fundamental assessment but also taking tactical management measures.

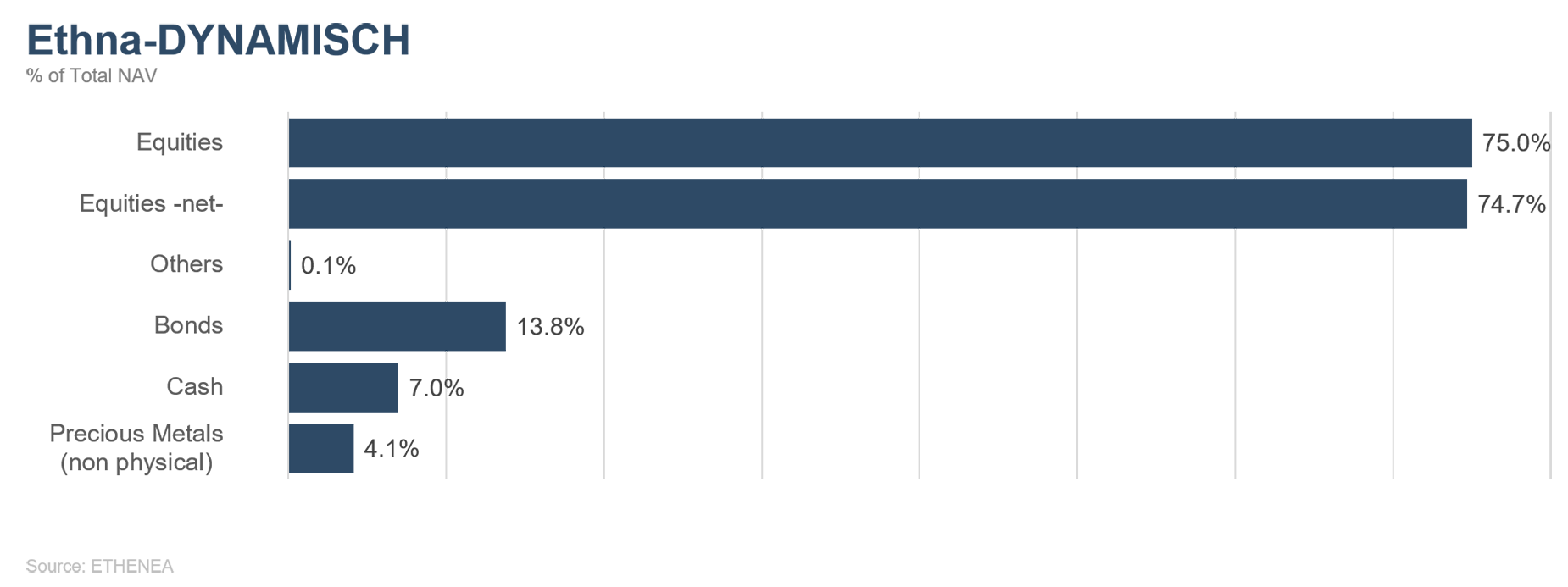

Ethna-DYNAMISCH

Global equity markets were unsettled in the shortest month of the year. The beginning of February saw a record weekly inflow (of almost USD 60 billion) into global equity funds, which for one can be seen as a manifestation of worldwide progress in the fight against the pandemic and of the prospect of economic recovery. Underpinned by this liquidity and coupled with a strong reporting season, equity markets reached new all-time highs. After a temporary consolidation around mid-month, the sharply rising yields on long-dated (U.S.) Treasuries ultimately brought about a market correction in the second half of the month.

Inflation expectations continue to increase, manifesting in higher yields and increasing the risk of a departure from the ultra-accommodative monetary policy, which has been a major driver for equity markets since the 2007/2008 financial crisis. At the same time, the central banks are unrelenting in their desire to maintain current monetary policy. The U.S. central bank, the Fed, has expressed that it is prepared to live with a potential inflation overshoot without coming under pressure to hike interest rates. Thus the recent rise in yields, while comparatively steep in a short length of time, remains structurally low. Since national debt levels, which have already taken on new dimensions due to the pandemic, could quickly become unsustainable at high interest rates levels – especially in Japan and the eurozone (Italy) – we consider a substantial rise very unlikely. Central banks have also demonstrated many times over that they do not wish to go down that road.

In that respect, we regard the interest-driven correction as a purging of the market because it mainly affected those market segments that, as mentioned in last month’s Market Commentary, had overheated. We do not see any risk to boarder market valuations in the medium term. On the contrary, the other structural equity market drivers – fiscal support, accelerated economic growth and base effects – are still intact.

In this environment, we retained our equity allocation of around 75%. On the one hand, we closed positions that no longer met our original investment case. Cisco Systems is one example of this. We are no longer convinced that more attractive areas of the company’s business (e.g. Cybersecurity) can overcome the headwind in the network solutions segment. On the other hand, we built up new positions in structural quality companies. These include Dynatrace, a leading provider of monitoring solutions in cloud environments. Dynatrace is benefiting from the acceleration of digitisation in companies and the complexity of hybrid and/or multi-cloud architectures that goes with it. We assume that the company, which is profitable thanks partly to its penetration of related market segments (e.g. Cybersecurity), can maintain its annual turnover growth rate in the region of plus/minus 20%. In addition, we participated in the AUTO1 IPO in February with a small allocation. Its sales platforms (Wirkaufendeinauto.de, AUTO1.com and Autohero) make the German AUTO1 Group a digital disruptor in the European used car market. Since online penetration is still in its infancy and AUTO1 already has an established competitive position, we expect the company to benefit disproportionately more from a maturing market.

We will continue to focus on such quality companies into the future, paying attention to the balance of attractive growth and appealing valuation to avoid biased positionings; for example, towards value or growth stocks. Thus, the Ethna-DYNAMISCH remains well positioned in the current stock market environment.

HESPER FUND - Global Solutions (*)

In February, expectations of a quick post-pandemic recovery caused a worldwide surge in long-term yields. The Treasury selloff quickly moved US yields from 1.15% to 1.6% and then back to 1.4 %, while in the United Kingdom and the eurozone, sovereign bond yields jumped even further. The long-end of the German yield curve has also moved into positive territory. Despite assurances from both Christine Lagarde and Jerome Powell that the central banks are monitoring the situation closely, at times we saw recovery expectations mixed with fears and angst about inflation. Investors in mortgage-backed securities who are protecting long duration portfolios may have exacerbated the rate move. Although the reflation trade continued, higher yields started to hurt equity markets, which are currently experiencing higher valuations, and triggered an increase in volatility.

Despite a good quarterly earnings showing, equity markets were choppy. Although US equities set an all-time high on 12 February, they ended the month on a weak note. The equity market rotation continued to penalise technology stocks; however, the move was not as pronounced as at the end of 2020. For the month, the S&P500 posted a 2.6% gain, the Nasdaq 100 dropped slightly by 0.1%, the Nasdaq Composite edged up 0.9% and the Russell 2000 rose by 6.1%.

As we have mentioned previously, our base scenario for 2021 remains that of a cyclical recovery underpinned by vaccine rollouts and policy support. However, this recovery is still facing a number of hurdles and will be uneven across regions and sectors, due to a still high number of infections and the slow roll-out of vaccines around the world. As such, economic activity in 2021 will continue to be significantly affected by the development of the pandemic.

In light of the still uncertain economic recovery, coupled with the aforementioned delays in the roll-out of the vaccination campaigns, market valuations are quite high. After a strong start to the year, equity markets are balancing rising optimism fuelled by the Covid-19 vaccines and further US fiscal stimulus against rising yields across the board, stretched valuations, and the slower than expected roll-out of the vaccines. To maintain its current valuations, the market needs good economic data and an improvement on the pandemic front. At the same time, a rapid rise in inflation expectations, along with the corresponding swift increase in sovereign bond yields, expose the equity market to potential short-term corrections.

As convexity hedging began to haunt markets already reeling from the bond rout, the HESPER FUND – Global Solutions reduced its equity exposure, as many stop loss limits were triggered. We reduced duration markedly, shorting Treasuries and divesting ourselves of long investment grade bonds. The overall equity exposure fell to 28% but was soon partially rebuilt to 40%. We sold our gold position completely and continued to back reflation, holding a very diversified range of equity indices, commodities, and high yield corporate bonds. Although we remain confident regarding the economic fundamentals that underpin the long-term appreciation of the Swiss franc, we have reduced our exposure to zero, as the currency does not fit with the reflation trade in the short term. On the currency front, we still hold a 20% USD exposure, as we believe that the currency’s weakening cycle may be nearing its end. Moreover, we built up an opportunistic position of 4% in the Russian rouble, given the fact that, for political reasons, this emerging currency is lagging, despite the sharp increase in commodity prices.

As we have seen many times, higher yields may have significant knock-on effect on equities, credit and more, particularly when the rise in yields is sudden and rapid. Nevertheless, given the still very early phase of the economic cycle and the considerable uncertainties about the future of the pandemic, we believe authorities will remain very cautious on the timing of any policy tightening and will be careful to avoid any policy mistakes. Therefore, we expect to continue to ride the risk-on waves throughout the year in a cautious manner while continuously looking for the appropriate hedges to reduce any potential drawdown in the portfolio.

In February, the HESPER FUND - Global Solutions EUR T-6 shares rose 0.61%, putting it at +1.46 ytd.

*The HESPER FUND – Global Solutions is currently only authorised for distribution in Germany, Luxembourg, France, and Switzerland.

Figure 1: Portfolio structure* of the Ethna-DEFENSIV

Figure 2: Portfolio structure* of the Ethna-AKTIV

Figure 3: Portfolio structure* of the Ethna-DYNAMISCH

Figure 4: Portfolio composition of the Ethna-DEFENSIV by currency

Figure 5: Portfolio composition of the Ethna-AKTIV by currency

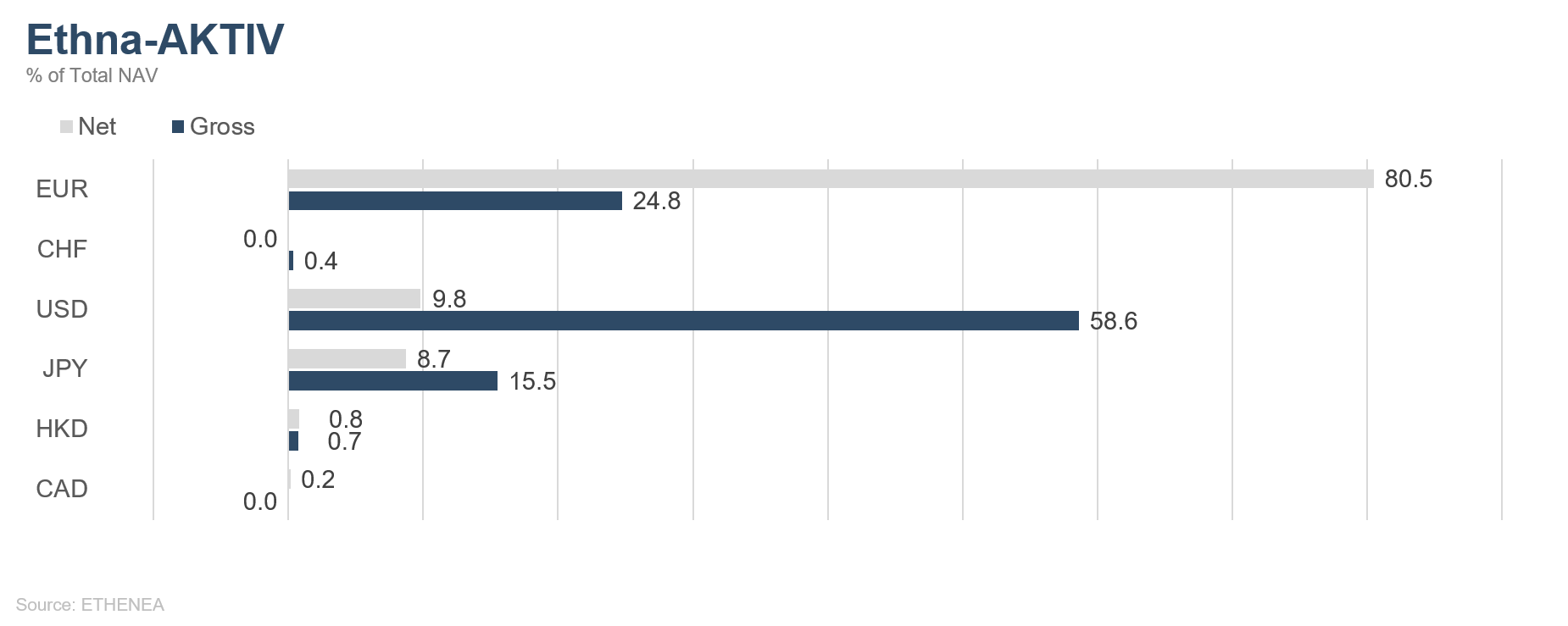

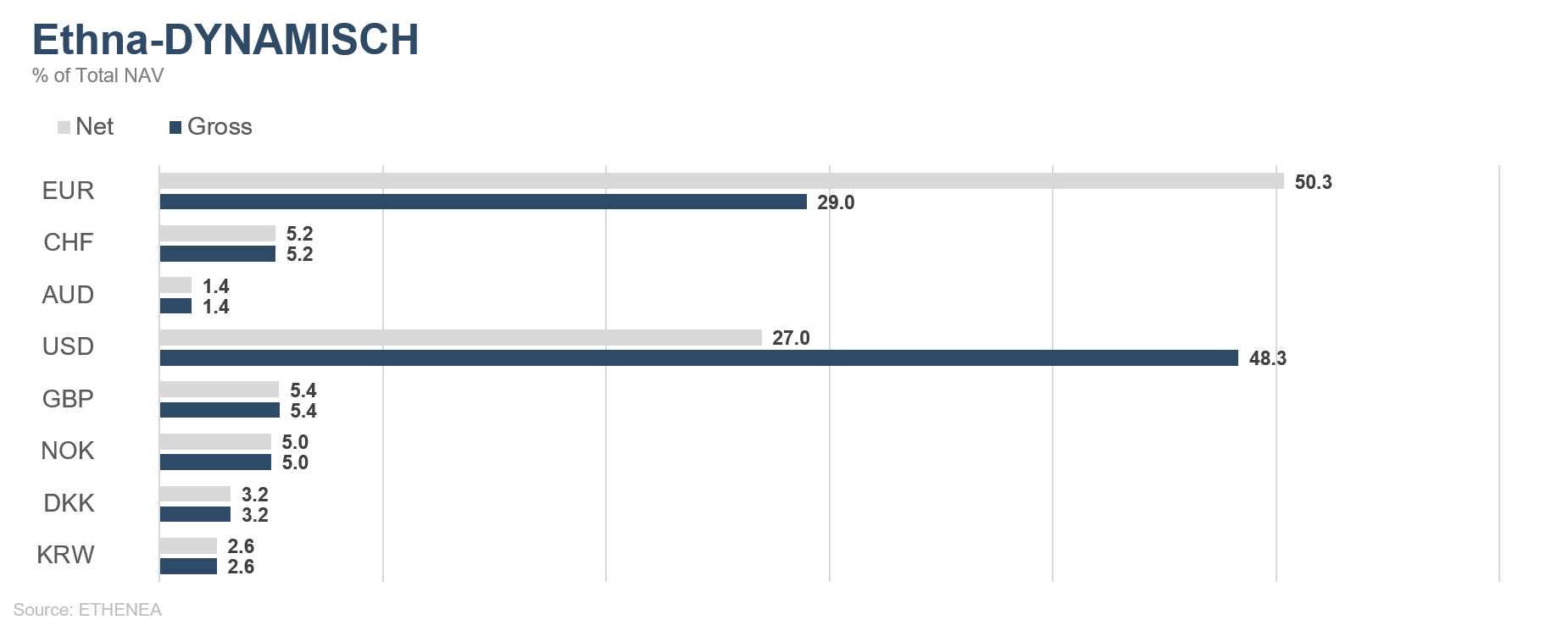

Figure 6: Portfolio composition of the Ethna-DYNAMISCH by currency

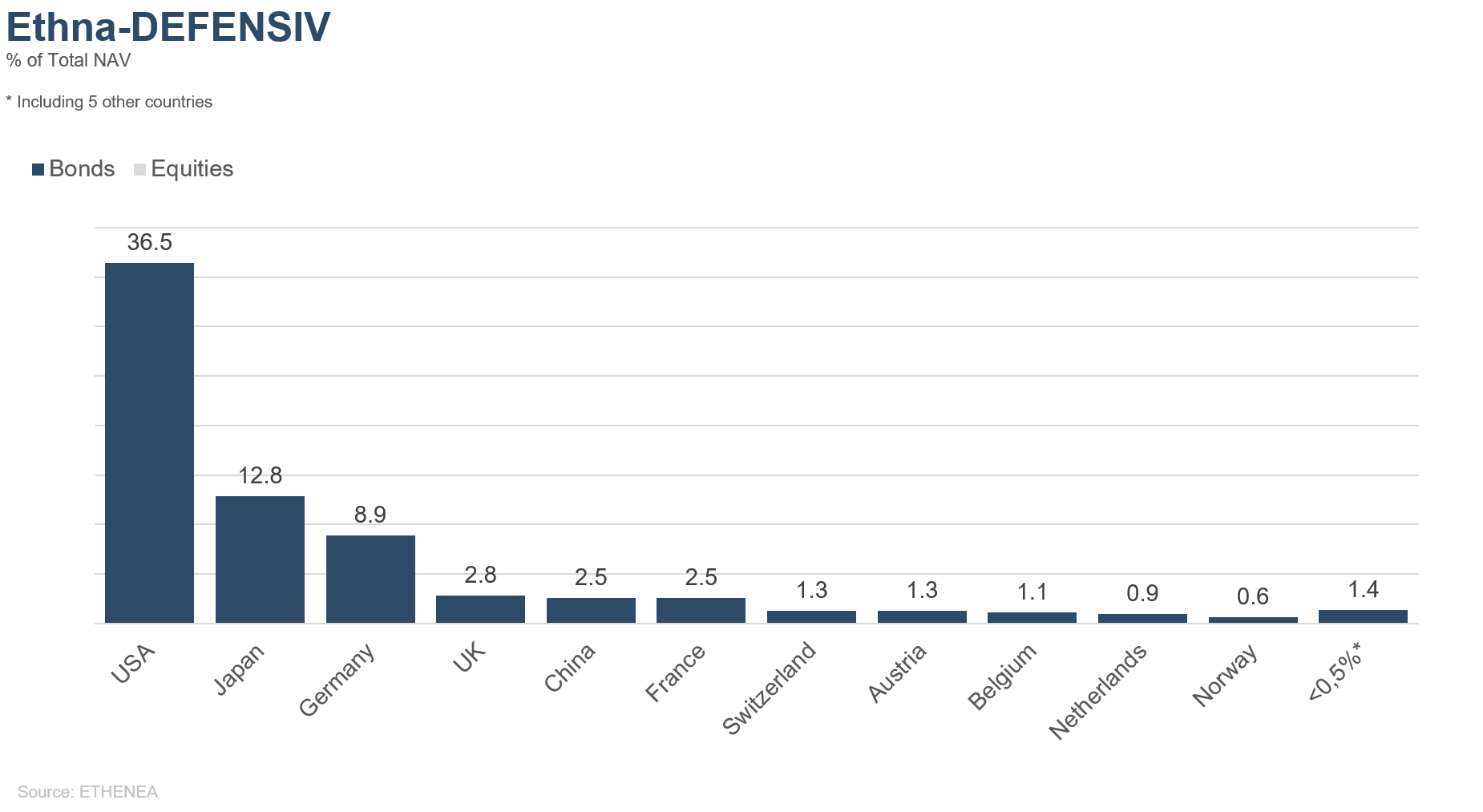

Figure 7: Portfolio composition of the Ethna-DEFENSIV by country

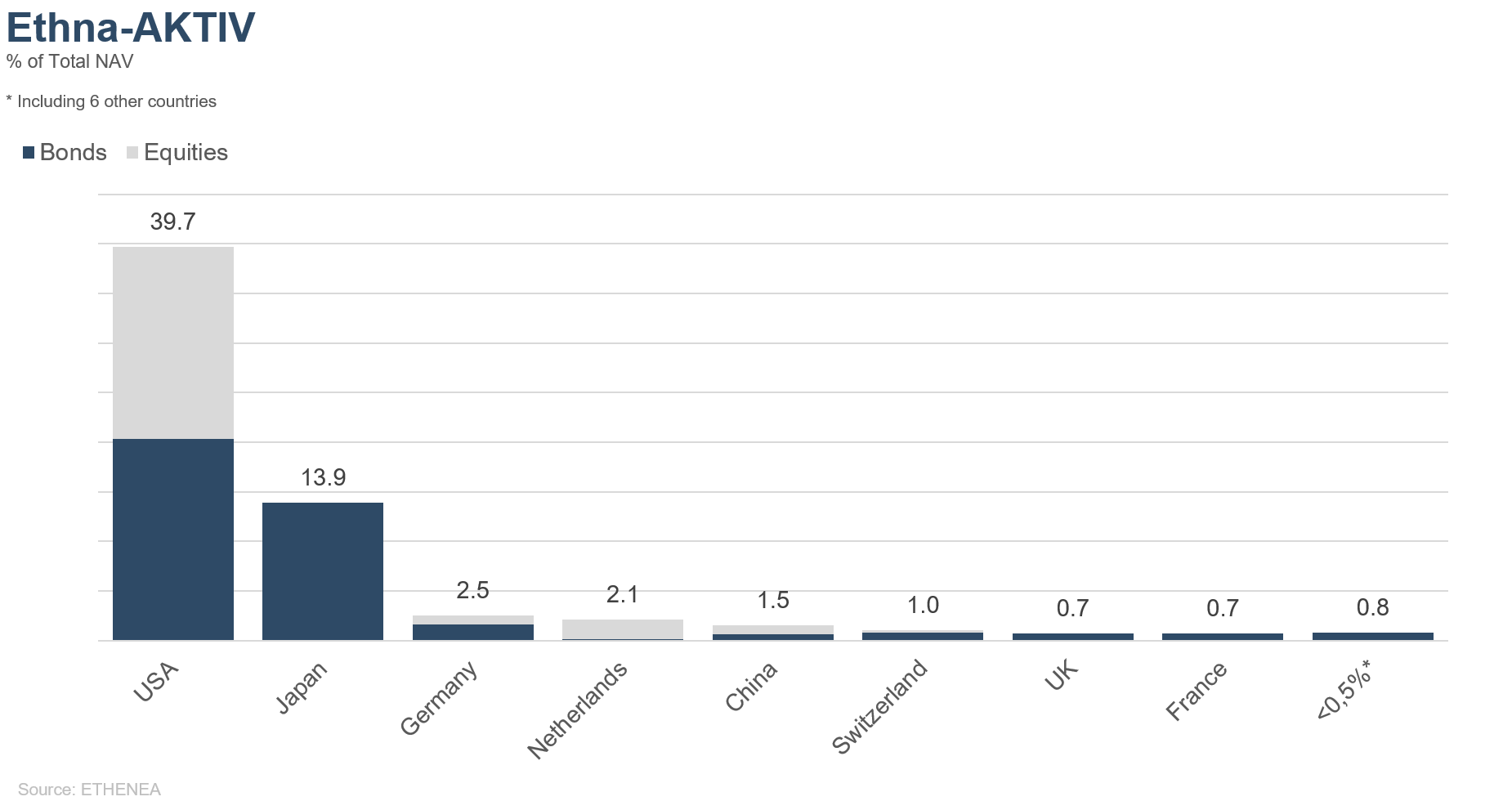

Figure 8: Portfolio composition of the Ethna-AKTIV by country

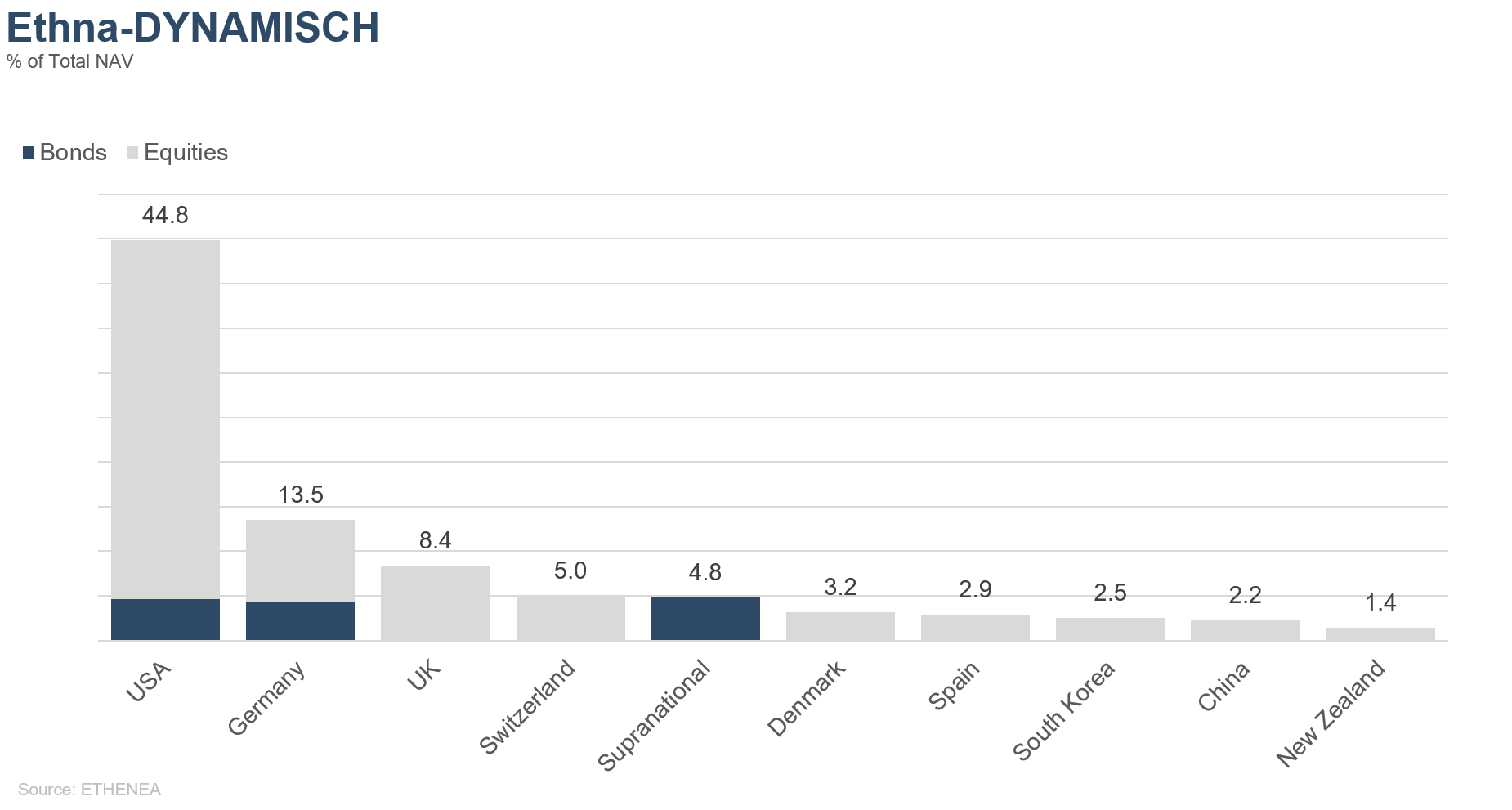

Figure 9: Portfolio composition of the Ethna-DYNAMISCH by country

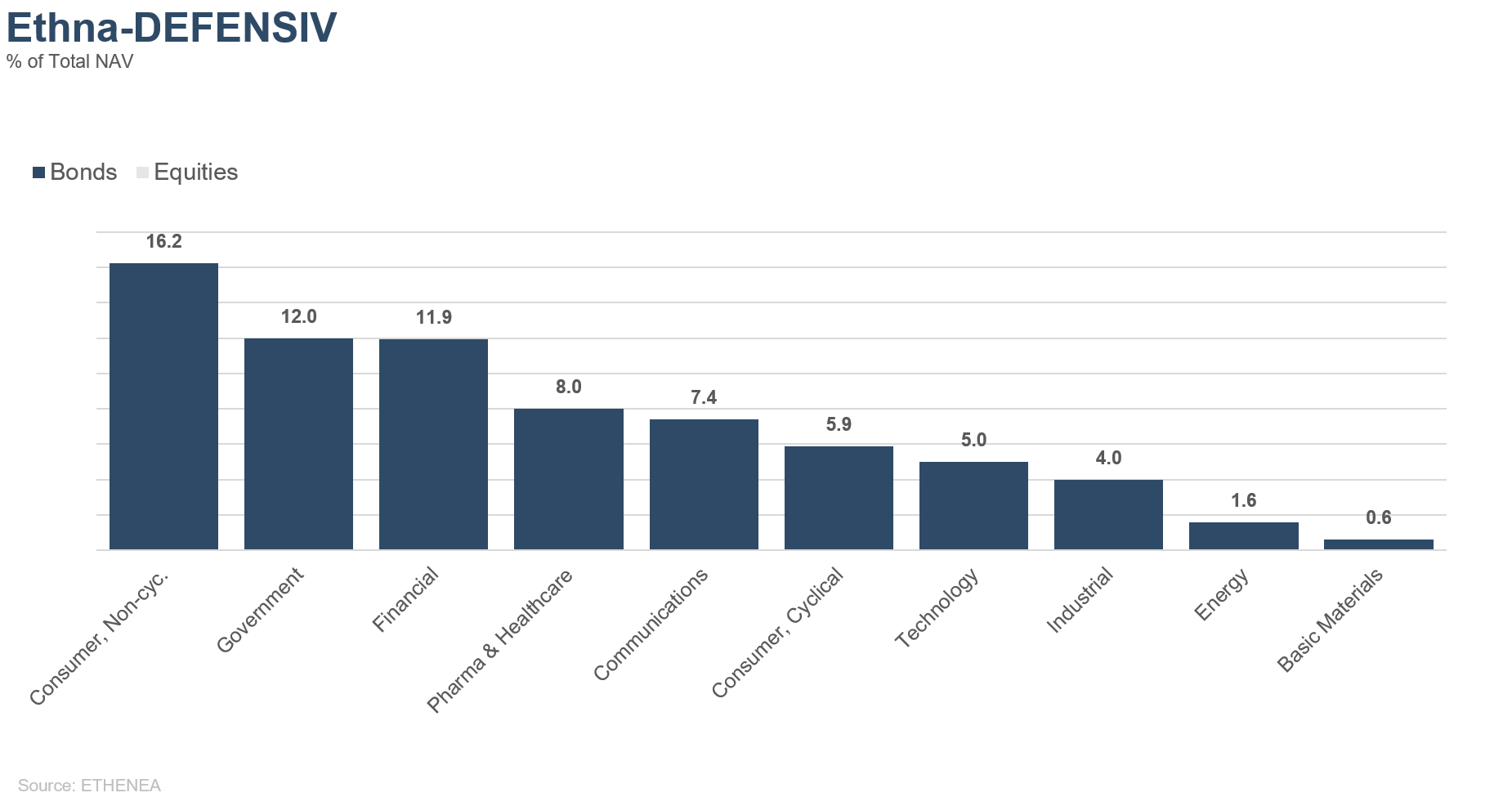

Figure 10: Portfolio composition of the Ethna-DEFENSIV by issuer sector

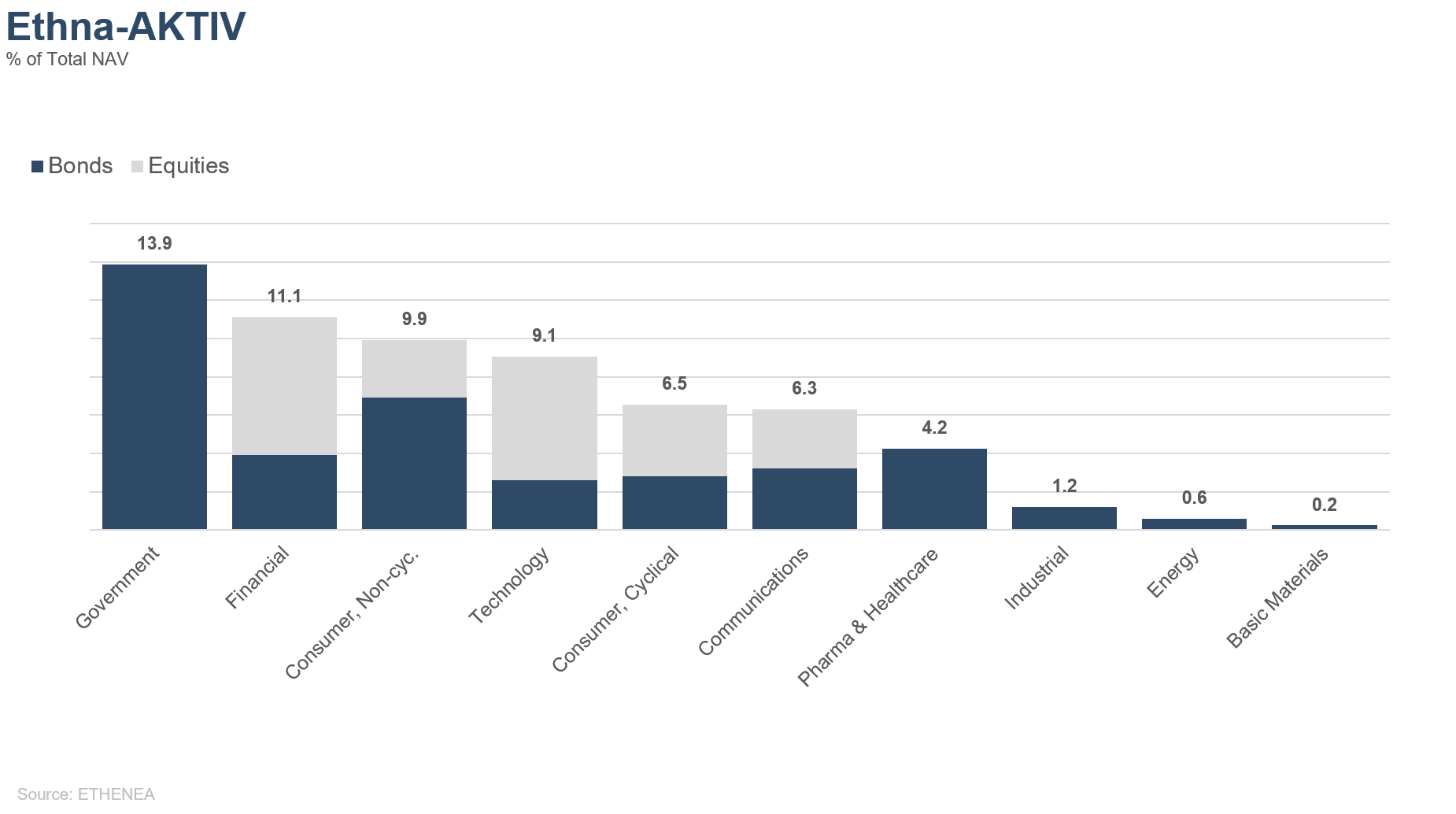

Figure 11: Portfolio composition of the Ethna-AKTIV by issuer sector

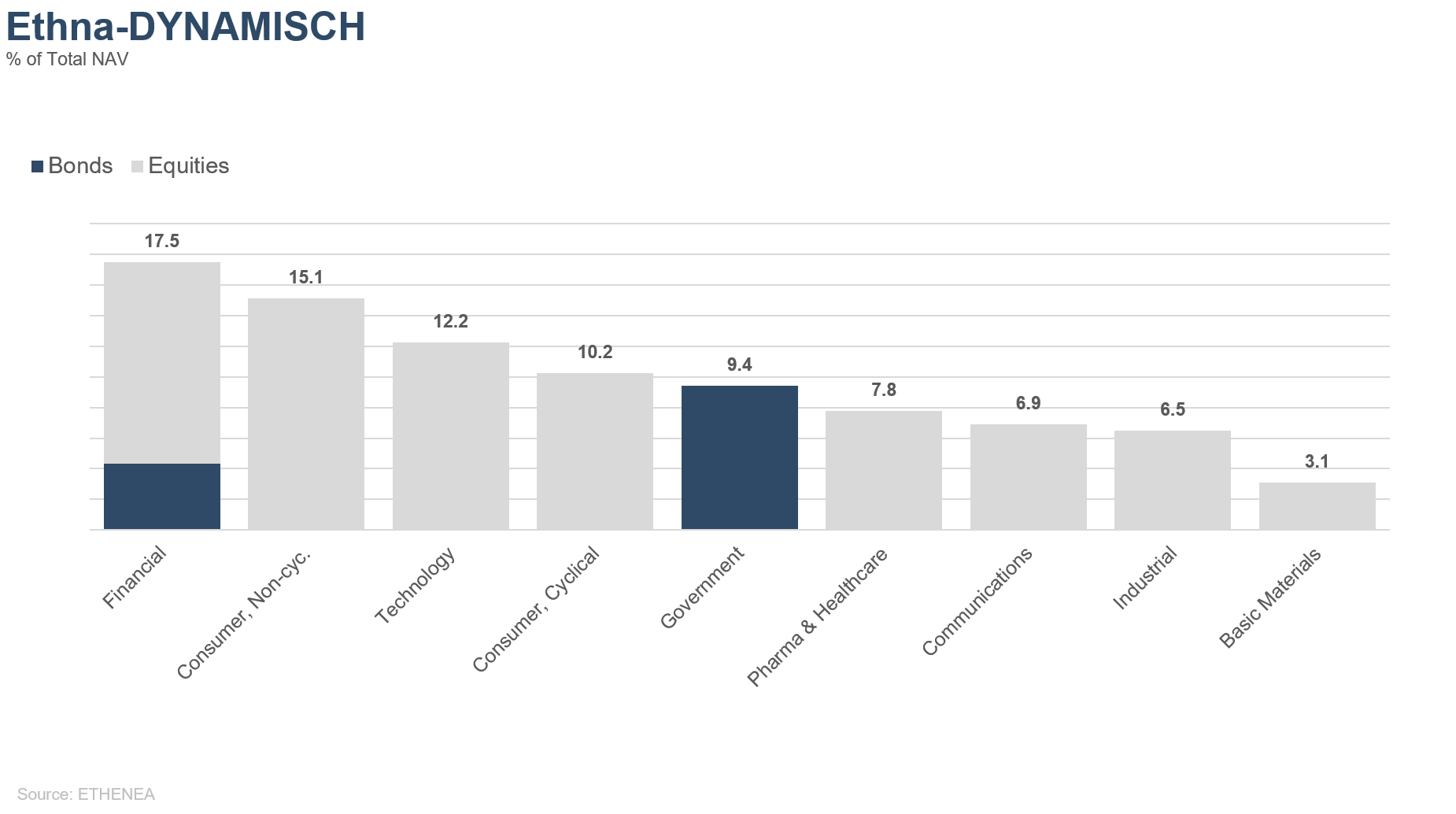

Figure 12: Portfolio composition of the Ethna-DYNAMISCH by issuer sector

* “Cash” comprises term deposits, call money and current accounts/other accounts. “Equities net” comprises direct investments and exposure resulting from equity derivatives.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

This is a marketing communication. It is for product information purposes only and is not a mandatory statutory or regulatory document. The information contained in this document does not constitute a solicitation, offer or recommendation to buy or sell units in the fund or to engage in any other transaction. It is intended solely to provide the reader with an understanding of the key features of the fund, such as the investment process, and is not deemed, either in whole or in part, to be an investment recommendation. The information provided is not a substitute for the reader's own deliberations or for any other legal, tax or financial information and advice. Neither the investment company nor its employees or Directors can be held liable for losses incurred directly or indirectly through the use of the contents of this document or in any other connection with this document. The currently valid sales documents in German (sales prospectus, key information documents (PRIIPs-KIDs) and, in addition, the semi-annual and annual reports), which provide detailed information about the purchase of units in the fund and the associated opportunities and risks, form the sole legal basis for the purchase of units. The aforementioned sales documents in German (as well as in unofficial translations in other languages) can be found at www.ethenea.com and are available free of charge from the investment company ETHENEA Independent Investors S.A. and the custodian bank, as well as from the respective national paying or information agents and from the representative in Switzerland. The paying or information agents for the funds Ethna-AKTIV, Ethna-DEFENSIV and Ethna-DYNAMISCH are the following: Austria, Belgium, Germany, Liechtenstein, Luxembourg: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg; France: CACEIS Bank France, 1-3 place Valhubert, F-75013 Paris; Italy: State Street Bank International – Succursale Italia, Via Ferrante Aporti, 10, IT-20125 Milano; Société Génerale Securities Services, Via Benigno Crespi, 19/A - MAC 2, IT-20123 Milano; Banca Sella Holding S.p.A., Piazza Gaudenzio Sella 1, IT-13900 Biella; Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Spain: ALLFUNDS BANK, S.A., C/ Estafeta, 6 (la Moraleja), Edificio 3 – Complejo Plaza de la Fuente, ES-28109 Alcobendas (Madrid); Switzerland: Representative: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Paying Agent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. The paying or information agents for HESPER FUND, SICAV - Global Solutions are the following: Austria, Belgium, France, Germany, Luxembourg: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg; Italy: Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Switzerland: Representative: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Paying Agent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. The investment company may terminate existing distribution agreements with third parties or withdraw distribution licences for strategic or statutory reasons, subject to compliance with any deadlines. Investors can obtain information about their rights from the website www.ethenea.com and from the sales prospectus. The information is available in both German and English, as well as in other languages in individual cases. Producer: ETHENEA Independent Investors S.A.. Distribution of this document to persons domiciled in countries in which the fund is not authorised for distribution, or in which authorisation for distribution is required, is prohibited. Units may only be offered to persons in such countries if this offer is in accordance with the applicable legal provisions and it is ensured that the distribution and publication of this document, as well as an offer or sale of units, is not subject to any restrictions in the respective jurisdiction. In particular, the fund is not offered in the United States of America or to US persons (within the meaning of Rule 902 of Regulation S of the U.S. Securities Act of 1933, in its current version) or persons acting on their behalf, on their account or for the benefit of a US person. Past performance should not be taken as an indication or guarantee of future performance. Fluctuations in the value of the underlying financial instruments or their returns, as well as changes in interest rates and currency exchange rates, mean that the value of units in a fund, as well as the returns derived from them, may fall as well as rise and are not guaranteed. The valuations contained herein are based on a number of factors, including, but not limited to, current prices, estimates of the value of the underlying assets and market liquidity, as well as other assumptions and publicly available information. In principle, prices, values, and returns can both rise and fall, up to and including the total loss of the capital invested, and assumptions and information are subject to change without prior notice. The value of the invested capital or the price of fund units, as well as the resulting returns and distribution amounts, are subject to fluctuations or may cease altogether. Positive performance in the past is therefore no guarantee of positive performance in the future. In particular, the preservation of the invested capital cannot be guaranteed; there is therefore no warranty given that the value of the invested capital or the fund units held will correspond to the originally invested capital in the event of a sale or redemption. Investments in foreign currencies are subject to additional exchange rate fluctuations or currency risks, i.e. the performance of such investments also depends on the volatility of the foreign currency, which may have a negative impact on the value of the invested capital. Holdings and allocations are subject to change. The management and custodian fees, as well as all other costs charged to the fund in accordance with the contractual provisions, are included in the calculation. The performance calculation is based on the BVI (German federal association for investment and asset management) method, i.e. an issuing charge, transaction costs (such as order fees and brokerage fees), as well as custodian and other management fees are not included in the calculation. The investment performance would be lower if the issuing surcharge were taken into account. No guarantee can be given that the market forecasts will be achieved. Any discussion of risks in this publication should not be considered a disclosure of all risks or a conclusive handling of the risks mentioned. Explicit reference is made to the detailed risk descriptions in the sales prospectus. No guarantee can be given that the information is correct, complete or up to date. The content and information are subject to copyright protection. No guarantee can be given that the document complies with all statutory or regulatory requirements which countries other than Luxembourg have defined for it. Note: The most important technical terms can be found in the glossary at www.ethenea.com/glossary. Information for investors in Belgium: The prospectus, the key information documents (PRIIPs-KIDs), the annual reports and the semi-annual reports of the sub-fund are available in French free of charge upon request from the investment company ETHENEA Independent Investors S.A., 16, rue Gabriel Lippmann, 5365 Munsbach, Luxembourg and from the representative: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxembourg. Information for investors in Switzerland: The country of origin of the collective investment scheme is Luxembourg. The representative in Switzerland is IPConcept (Schweiz) AG, Münsterhof 12, P.O. Box, CH-8022 Zurich. The paying agent in Switzerland is DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zurich. The prospectus, the key information documents (PRIIPs-KIDs), and the Articles of Association, as well as the annual and semi-annual reports, can be obtained free of charge from the representative. Copyright © ETHENEA Independent Investors S.A. (2024) All rights reserved. 02/03/2021