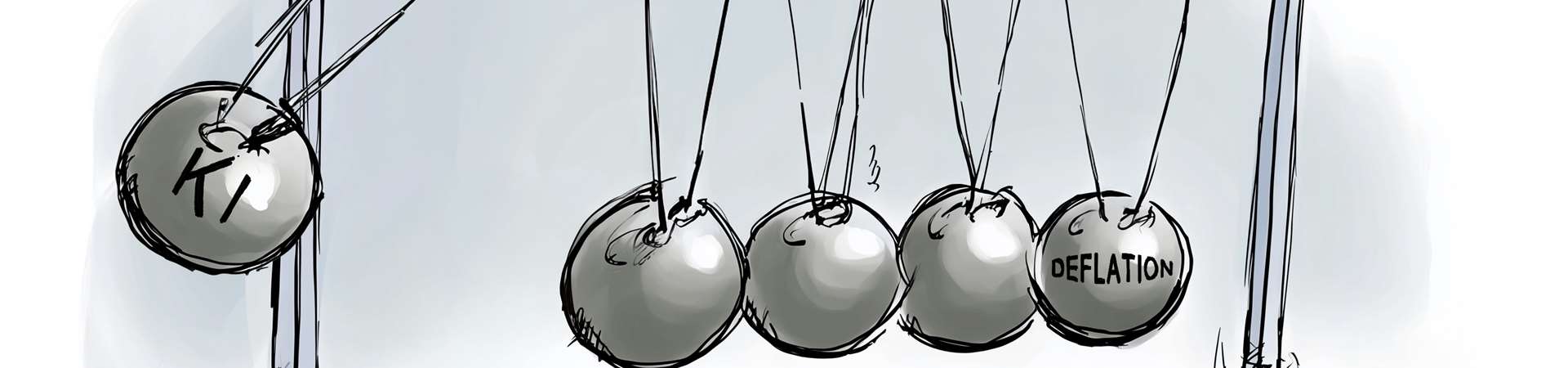

The Silent Price Revolution – AI as the perpetual mobile of deflation

Read the market analysis and fund positioning

Some forces don’t move the market with noise, but with quiet momentum. Artificial intelligence is one of them. For years, it was written off as little more than an academic play - a backroom bet of start-ups and think tanks. Now the evidence is stacking up that AI isn’t just speeding up workflows, it’s rewriting entire pricing structures. A self-reinforcing flywheel of efficiency gains and cost cuts is shaping up—potentially the ultimate “perpetual mobile” of deflation.

Macro: When Numbers Speak a New Language

The latest Q2 2025 release from the U.S. Bureau of Labor Statistics made the market sit up: labor productivity in the nonfarm business sector jumped +2.4%, while hours worked rose just +1.3% and unit labor costs edged up a modest +1.6%.

On the surface, it looks like a technical footnote. In reality, it’s an early signal of something deeper. Production processes are being rewired. Companies are squeezing more output from less input—driven by AI-powered automation, advanced analytics, and predictive operations.

BNP Paribas Research puts numbers to the shift: every percentage point of productivity growth can shave up to a full point of annual inflation. The Bank for International Settlements (BIS) reaches the same conclusion: when total factor productivity climbs, supply outpaces demand - and prices slow, stall, or even turn south.

More efficiency → lower costs → stronger investment incentives → even more efficiency.

A self-reinforcing deflationary cycle is emerging - a “perpetual motion machine of price stabilization,” powered by massive infrastructure investment. Gartner estimates global public-cloud spending will reach USD 675 billion in 2024 - up more than 20%. The fastest-growing slice: Infrastructure as a Service (+25.6%), fueled by generative AI workloads.

The hardware side tells the same story at scale. NVIDIA, the sector’s bellwether, booked USD 26.3 billion in Q2 2025 Data Center revenue alone -

up 154% year-on-year. These numbers are not outliers; they are proof of the capital wave behind AI-ready infrastructure.

Supply Chains on an Efficiency Diet

Anyone who sees AI as just a coder’s tool misses its bigger play in the real economy. In supply chains AI functions like a performance coach for global trade flows. McKinsey finds that 61% of manufacturers report lower costs after adopting AI, 53% report higher revenues—and most striking, 41% achieved cost savings of 10–19%.

The reason is simple: forecasting is sharper, downtime shorter and resources deployed with greater precision. What was once a bumpy road has become an AI-driven fast lane for efficiency and margin gains.

Labor Market: Less Sweat per Unit of Output

What does AI mean for jobs and wages? An analysis by the Tony Blair Institute estimates that full AI adoption in the UK could free up nearly a quarter of private-sector working hours, the equivalent of six million full-time employees annually.

The implications:

- The sensitivity of price inflation to unemployment decreases by 17%.

- The sensitivity of wage inflation to unemployment decreases by 9%.

MIT economist Daron Acemoglu reaches a similar conclusion: AI reduces the labor costs of automatable tasks by 27% - which can translate into economy-wide savings of up to 15%. Put differently: output rises without wages growing at the same pace - a textbook disinflationary effect.

Corporate First Movers

AI’s deflationary force isn’t just theory - it’s showing up in the numbers of global leaders. Maersk has cut vessel idle time by 30% through AI, unlocking more than USD 300 million in annual savings.

Amazon runs over 520,000 AI-powered robots in its fulfillment centers, trimming order-processing costs by 20% and lifting efficiency by 40%.

Walmart saves roughly USD 1.5 billion each year with AI-driven inventory management - while keeping product availability at 99.2%.

These gains don’t just fatten margins; they quietly translate into lower prices for consumers - a slow but steady deflationary engine.

Investment Implications: Navigating with a Dual Compass

Markets are currently pricing in moderate to medium-term inflation (5y5y break evens at 2.3 – 2.5%). Yet the structural disinflationary effects of AI remain underrepresented in many models. We believe that once these deflationary forces are factored in, price pressures could prove lower than consensus expects. At the very least, this reduces the case for structurally higher interest rates.

This argues for a quality-focused duration strategy - allocating primarily to medium and longer maturities to capture higher yields. At the same time, maintaining some exposure to shorter maturities preserves flexibility.

Conclusion: AI as the Economy’s Pilot

Artificial intelligence is no panacea - but it is a powerful lever. It doesn’t just accelerate processes. It is reshaping the architecture of the economy itself: more efficient, more predictive, more productive.

Annual productivity gains of 0.1 to 1.5 percentage points, double-digit cost savings in supply chains, multi-billion-dollar infrastructure investments, and measurable dampening effects on wages and prices all point toward a disinflationary trajectory.

The path won’t be linear. Investment spikes, integration costs, and skills gaps may trigger temporary price pressures. But over the long term, AI may achieve what once seemed physically impossible: a perpetual mobile that keeps the engine of inflation in a state of permanent moderation.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

Esta comunicación publicitaria es únicamente para fines informativos. Está prohibida su transmisión a personas en países donde el fondo no está autorizado para su distribución, especialmente en EE.UU. o a personas estadounidenses. La información no constituye una oferta ni una invitación para comprar o vender valores o instrumentos financieros y no sustituye el asesoramiento personalizado al inversor o al producto. No tiene en cuenta los objetivos de inversión individuales, la situación financiera ni las necesidades particulares del destinatario. Antes de tomar una decisión de inversión, deben leerse cuidadosamente los documentos de venta vigentes (folleto, documentos de información clave/PRIIPs-KIDs, informes semestrales y anuales). Estos documentos están disponibles en alemán y en traducción no oficial en la sociedad gestora ETHENEA Independent Investors S.A., en el depositario, en los agentes de pago o de información nacionales, así como en www.ethenea.com. Los términos técnicos más importantes se encuentran en el glosario de www.ethenea.com/glosario/. La información detallada sobre oportunidades y riesgos de nuestros productos se encuentra en el folleto vigente. La rentabilidad pasada no es un indicador fiable de la rentabilidad futura. Los precios, valores y rendimientos pueden subir o bajar y pueden llevar a la pérdida total del capital invertido. Las inversiones en divisas extranjeras están sujetas a riesgos de tipo de cambio adicionales. No se pueden derivar compromisos ni garantías vinculantes para resultados futuros a partir de la información proporcionada. Las suposiciones y el contenido pueden cambiar sin previo aviso. La composición de la cartera puede cambiar en cualquier momento. Este documento no constituye una información completa sobre riesgos. La distribución del producto puede dar lugar a remuneraciones para la sociedad gestora, empresas vinculadas o socios de distribución. Son determinantes los datos sobre remuneraciones y costes que figuran en el folleto vigente. Una lista de los agentes de pago e información nacionales, un resumen de los derechos de los inversores y las advertencias sobre los riesgos de un cálculo erróneo del valor liquidativo están disponibles en www.ethenea.com/avisos-legales/. En caso de error en el cálculo del valor liquidativo, la compensación se realizará conforme a la Circular CSSF 24/856; para participaciones suscritas a través de intermediarios financieros, la compensación puede estar limitada. Información para inversores en Suiza: El país de origen del fondo de inversión colectiva es Luxemburgo. El representante en Suiza es IPConcept (Schweiz) AG, Bellerivestrasse 36, CH-8008 Zúrich. El agente de pagos en Suiza es DZ PRIVATBANK (Schweiz) AG, Bellerivestrasse 36, CH-8008 Zúrich. El folleto, los documentos de información clave (PRIIPs-KIDs), los estatutos y los informes anuales y semestrales pueden obtenerse gratuitamente del representante. Información para inversores en Bélgica: El folleto, los documentos de información clave (PRIIPs-KIDs), los informes anuales y semestrales del subfondo están disponibles gratuitamente en alemán a petición de ETHENEA Independent Investors S.A., 16, rue Gabriel Lippmann, 5365 Munsbach, Luxemburgo y del representante: DZ PRIVATBANK AG, Niederlassung Luxemburg, 4, rue Thomas Edison, L-1445 Strassen, Luxemburgo. A pesar del máximo cuidado, no se garantiza la exactitud, integridad o actualidad de la información. Solo los documentos originales en alemán son vinculantes; las traducciones son solo para fines informativos. El uso de formatos publicitarios digitales es bajo su propia responsabilidad; la sociedad gestora no asume ninguna responsabilidad por fallos técnicos o violaciones de la protección de datos por parte de proveedores externos de información. El uso solo está permitida en países donde esté legalmente autorizado. Todos los contenidos están protegidos por derechos de autor. Cualquier reproducción, distribución o publicación, total o parcial, solo está permitida con el consentimiento previo por escrito de la sociedad gestora. Copyright © ETHENEA Independent Investors S.A. (2025). Todos los derechos reservados. 01-09-2025