Your questions, our answers

Markets continue to be influenced by geopolitics and persistently high inflation on both sides of the Atlantic. In our second quarterly update of the year, portfolio managers responded to the following questions, among others, to explain their views.

Ethna-DEFENSIV

Ethna-AKTIV

Ethna-DYNAMISCH

Ethna-DEFENSIV

When do you think it is time to invest in or switch to longer-dated bonds? What would be your criteria for selecting longer-dated bonds?

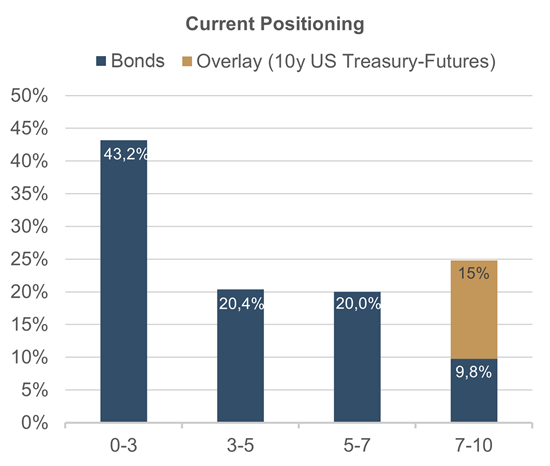

From our point of view, this time has already come. In recent weeks, we have invested opportunistically in the corporate bonds with maturities between 2028 and 2032. The slowdown of the global economy, especially in the industrialised countries such as the US and the EU, as well as falling inflation rates give us reason to expect lower yields at the longer end of the yield curve. An increase in duration therefore seems attractive to us. So far, we have increased the interest rate sensitivity of our portfolio to 4.4 by investing in new issues and building a 15% position in 10-year US Treasuries.

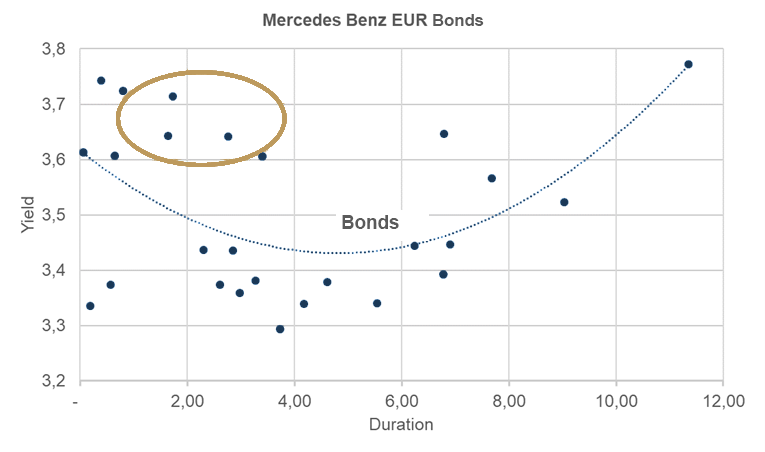

There are two factors to consider when selecting individual positions. The first is yield. In the current economic environment, we can achieve higher returns without taking on more risk. Yields above 4.5% are attractive to us at the moment, and we are closely monitoring new issues in this area. At the same time, the second factor is the inversion of the government yield curve. For some safer companies, the risk premium is not sufficient to form an inverted curve (government yield + risk premium). For example, the government yield at the short end and the risk premium at the long end of the Mercedes Benz yield curve have a greater impact, leading to a U-shaped curve (blue line in Figure 1).

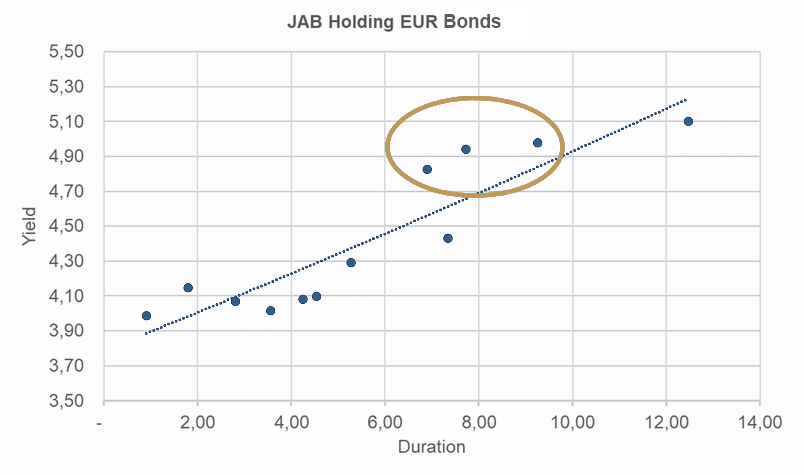

Other companies offer higher risk premiums. Companies such as JAB Holdings, Autostrade per L'Italia Autostrade, Fiserv or VW have linearly rising yield curves:

We are therefore currently positioned to benefit from the inversion with 43.2% exposure in the 0-3 year maturities and 24.8% (incl. futures overlay) at the long end.

Ethna-AKTIV

Ethna-AKTIV has always been a very conservative fund, so the equity allocation is surprising, especially given the current situation on the capital markets. Can you please explain this?

The Ethna-AKTIV is still the right choice for the conservative and risk-conscious investor. However, the attributes active and flexible are also part of our offering. Our task is to find the optimal asset allocation for attractive long-term capital growth, depending on the market environment. This is usually derived from an assessment of the macroeconomic situation, valuation parameters and positioning data. At the end of the first quarter, we noted a clear disconnect between the available macro data, including our forecasts, and the measurable reaction of market participants (flows and positioning). Despite declining inflation, stable to positive markets for months, and an economic outlook that was relatively constructive to us, the sentiment and positioning of many market participants was very negative. We recognised this opportunity and our flexible approach allowed us to adjust the portfolio accordingly. It is important to note that this does not contradict the conservative nature of the portfolio. On a risk/reward basis, the opportunities outweighed the risks at the time. Firstly, a market that everyone expects to fall is relatively well supported. You have usually hedged accordingly. Second, when prices are stable, it often only takes a catalyst to adjust positioning and follow a new narrative. The shift from the recession to the soft-landing narrative and the hype about the potential efficiency gains from artificial intelligence were just such catalysts. But adjusting the equity exposure was not the only adjustment. We have also significantly increased the duration of the bond portfolio this year and hedged all currency risks. This means that changing a specific allocation is never an isolated decision but must always be seen in the context of the entire portfolio. In the meantime, however, the starting position on the equity side has changed to the extent that we are currently discussing a return to a more neutral position. Always in the spirit of: Taking active and flexible advantage of opportunities.

Ethna-DYNAMISCH

Looking at the hype around AI and NVIDIA's spectacular performance: Do you think it is sustainable? Do you want to allocate part of Ethna-DYNAMISCH to this segment to participate in the potential gains of this industry?

Although Artificial Intelligence (AI) is nothing new, it is the ChatGPT application that seems to have really caught the public's imagination. So much so that hardly a day goes by without another company announcing its AI solutions and capabilities. The stock market is taking notice.

We don't want to underestimate the fact that AI has the potential to change many things. From efficiency gains to new products and services. But we are sceptical that this will happen as suddenly as the recent performance of some stocks suggests. Spectacular really is the appropriate description.

Well, not everything is fantasy, some of it is already reality: NVIDIA's latest quarterly results were huge. The fundamental performance is of course impressive. But to be considered for an investment, the valuation must also be right. Keyword: "growth at a reasonable price" (GARP). In any case, we are not entirely comfortable with an expected P/E ratio of around 50. The potential for setbacks is too great if the high growth expectations are not met. Experience shows that over-hyped themes and stocks that are flooded with inflows into active or passive fund structures have a hard time meeting expectations - and thus their valuation levels - in the future.

It is true that over a longer time horizon, valuation plays an increasingly subordinate role if the fundamentals are right. But the past has also shown that it is very difficult to identify the long-term winners in technological (r)evolutions, even if they seem obvious in retrospect. In any case, Alphabet was considered the leader in the field of AI language models until OpenAI’s ChatGPT, which is essentially funded by Microsoft, took off. Competition is very dynamic.

We are already invested in several AI companies, although this was not the basis of our initial investment decision. We also have a number of relevant stocks on our watch list. We will not hesitate to invest when opportunities arise. Until then, however, we prefer companies that are thriving outside the hype. Those with solid fundamental growth (preferably with good visibility) and attractive valuations, i.e. GARP stocks.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

La presente es una comunicación promocional. Tiene exclusivamente fines informativos y ofrece al destinatario indicaciones sobre nuestros productos, conceptos e ideas. No constituye una base para comprar, vender, cubrir, transferir o hipotecar activos. Nada de la información incluida en el presente documento representa una oferta de compra o venta de un instrumento financiero, ni tiene en cuenta las circunstancias personales del destinatario. Tampoco es el resultado de un análisis objetivo o independiente. ETHENEA no ofrece ninguna garantía o declaración expresa o implícita por lo que respecta a la exactitud, integridad, idoneidad o comerciabilidad de cualquier información proporcionada al destinatario en los webinarios, podcasts o boletines. El destinatario reconoce que nuestros productos y conceptos pueden ir dirigidos a diferentes clases de inversores. Los criterios se basan exclusivamente en el folleto que está en vigor en la actualidad. Esta comunicación promocional no va dirigida a un grupo específico de destinatarios. Por consiguiente, cada destinatario debe informarse individualmente y bajo su propia responsabilidad sobre las disposiciones correspondientes de los documentos de venta actualmente vigentes, que constituyen la única base para la adquisición de participaciones. De los contenidos ofrecidos o de nuestro material promocional no pueden emanar promesas o garantías vinculantes de resultados futuros. Ni la lectura ni la escucha dan lugar a una relación de asesoramiento. Todos los contenidos tienen un carácter meramente informativo y no pueden sustituir al asesoramiento profesional e individual en materia de inversión. El destinatario solicitó el boletín de noticias o se inscribió en un webinario o podcast por su propia cuenta y riesgo, o bien utiliza otros medios publicitarios digitales por iniciativa propia. El destinatario y participante acepta que los formatos publicitarios digitales son producidos técnicamente y facilitados al participante por un proveedor de información externo que no guarda relación con ETHENEA. El acceso a los formatos publicitarios digitales y la participación en estos se realizan a través de infraestructuras fundamentadas en Internet. ETHENEA declina toda responsabilidad sobre las interrupciones, anulaciones, fallos de funcionamiento, cancelaciones, incumplimientos o retrasos en relación con la provisión de los formatos publicitarios digitales. El participante reconoce y acepta que, al participar en los formatos publicitarios digitales, los datos personales pueden ser visualizados, registrados y transmitidos por el proveedor de información. ETHENEA no se hace responsable del incumplimiento de las obligaciones de protección de datos por parte del proveedor de información. El acceso y la visita a los formatos publicitarios digitales únicamente puede realizarse en los países en los que su acceso y visita estén permitidas por ley. Si desea obtener información detallada sobre las oportunidades y los riesgos asociados a nuestros productos, consulte el folleto actual. Los documentos legales de venta (folleto, documentos de datos fundamentales para el inversor, informes semestrales y anuales) de los que se puede obtener información detallada sobre la compra de participaciones y los riesgos asociados constituyen la única base autorizada y vinculante para la compra de participaciones. Los mencionados documentos de venta en alemán (así como sus versiones no oficiales traducidas a otros idiomas) pueden consultarse en www.ethenea.com y obtenerse de forma gratuita en la sociedad gestora, ETHENEA Independent Investors S.A. y el depositario, así como en los respectivos agentes de pago o de información de cada país y el representante en Suiza. Los agentes de pago o de información son los siguientes para los fondos Ethna-AKTIV, Ethna-DEFENSIV y Ethna-DYNAMISCH: Alemania, Austria, Bélgica, Liechtenstein, Luxemburgo: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxemburgo; España: ALLFUNDS BANK, S.A., C/ Estafeta, 6 (la Moraleja), Edificio 3 – Complejo Plaza de la Fuente, ES-28109 Alcobendas (Madrid); Francia: CACEIS Bank France, 1-3 place Valhubert, F-75013 Paris; Italia: State Street Bank International – Succursale Italia, Via Ferrante Aporti, 10, IT-20125 Milano; Société Génerale Securities Services, Via Benigno Crespi, 19/A - MAC 2, IT-20123 Milano; Banca Sella Holding S.p.A., Piazza Gaudenzio Sella 1, IT-13900 Biella; Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Suiza: Representante: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Agente de pagos: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. Los agentes de pago o de información son los siguientes para HESPER FUND, SICAV - Global Solutions: Alemania, Austria, Bélgica, Francia, Luxemburgo: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxemburgo; Italia: Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Suiza: Representante: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Agente de pagos: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. La sociedad gestora podrá rescindir los acuerdos de distribución vigentes con terceros o retirar los permisos de distribución por razones estratégicas o exigidas por ley, respetando los plazos. Los inversores pueden obtener información sobre sus derechos en el sitio web www.ethenea.com y en el folleto. La información se encuentra disponible en alemán e inglés y, en ciertos casos, también otros idiomas. En el folleto figura la descripción detallada expresa de los riesgos. Esta publicación está sujeta a derechos de autor, de marca y de propiedad industrial. La reproducción, distribución, puesta a disposición para su recuperación o acceso en Internet, transferencia a otros sitios web, publicación total o parcial, de forma modificada o sin modificar, únicamente se permite con el previo consentimiento por escrito de ETHENEA. Copyright © 2024 ETHENEA Independent Investors S.A. Todos los derechos reservados. 20-06-2023