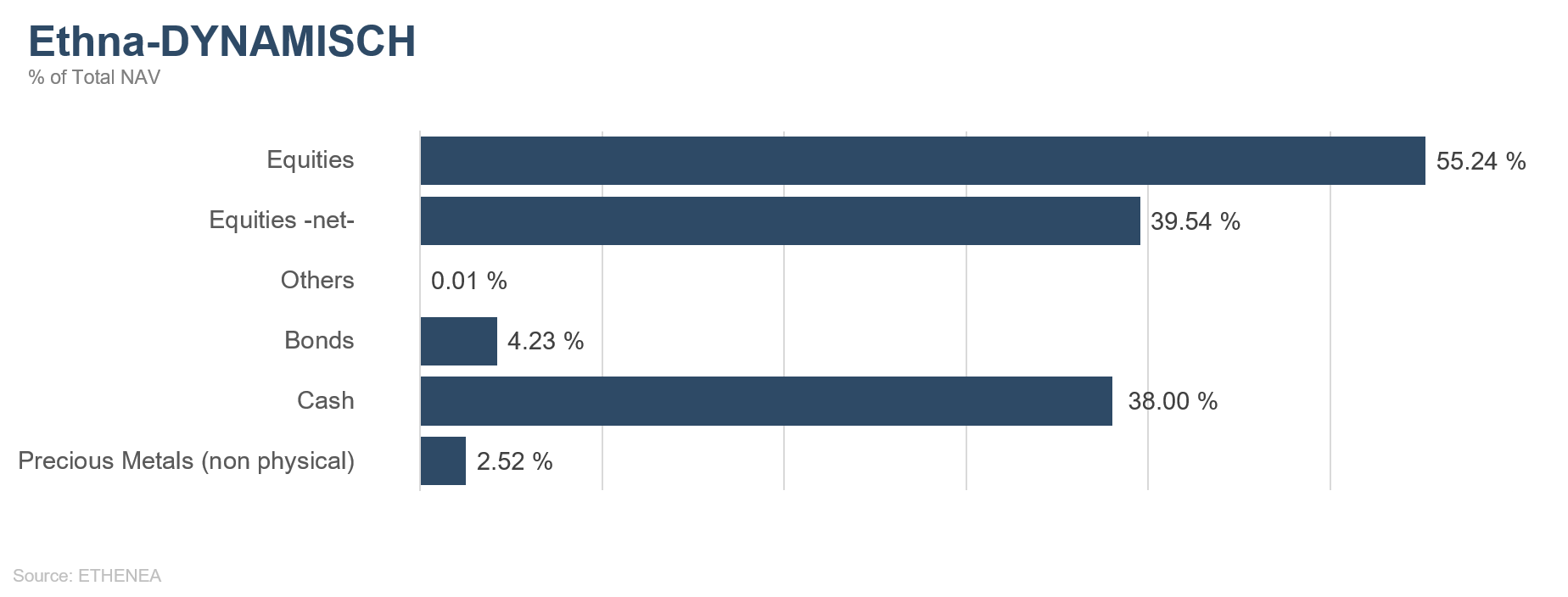

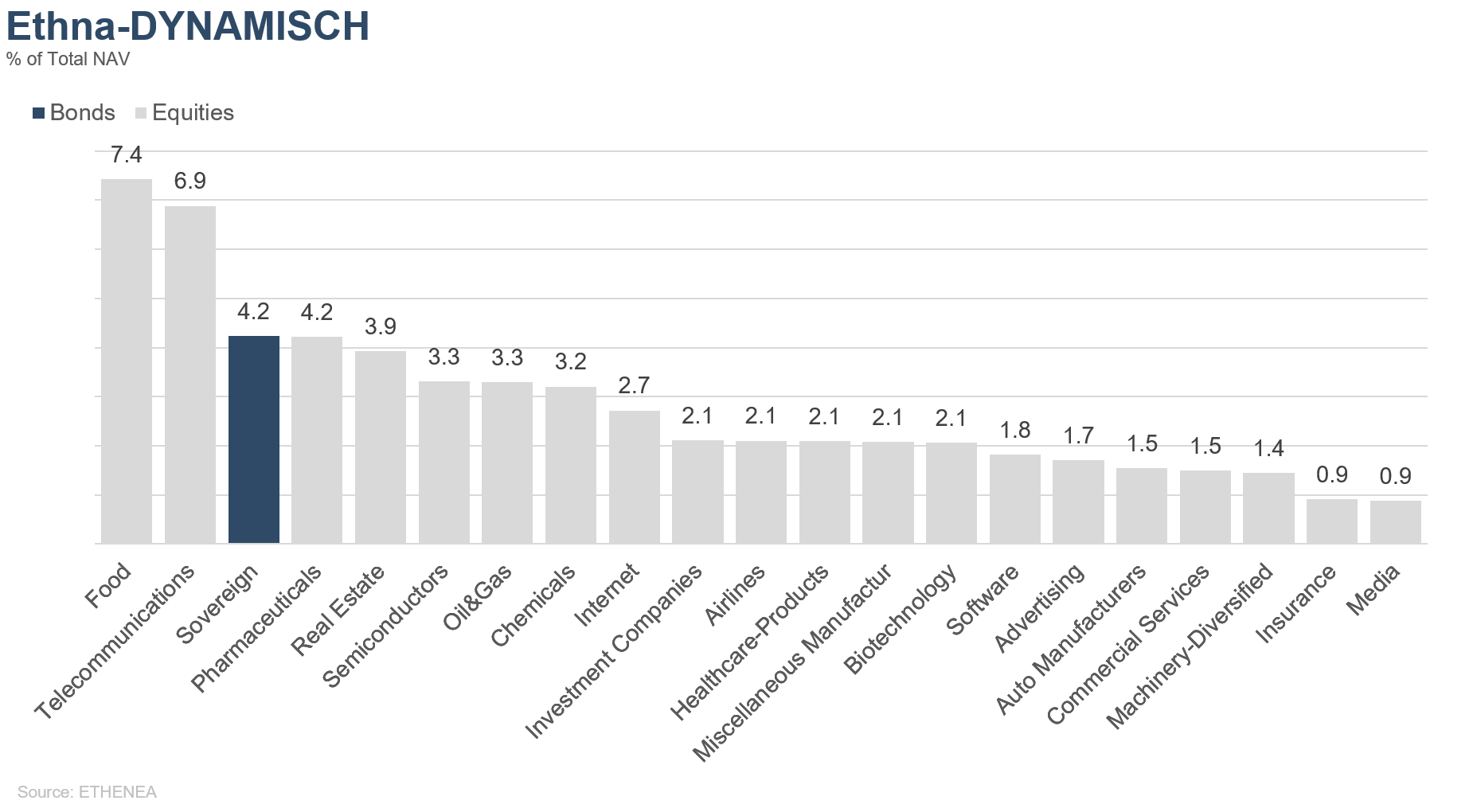

Figure 16: Portfolio composition of Ethna-DYNAMISCH by issuer sector

* “Cash” comprises term deposits, call money and current accounts/other accounts. “Equities net” comprises direct investments and exposure resulting from equity derivatives.

In the eye of the storm?

Under the shadow of the fourth quarter of 2018, we hazarded a look ahead to the new year and forecasted turmoil. But then the first month of 2019 turned out quite benign, at least in terms of what happened in capital markets. On the political front, on the other hand, it was same old, same old. The chaos surrounding Brexit makes it almost impossible to predict what will happen after 29 March. In Italy, the populists are doing what populists always do, and the danger of a fresh election is increasing. However, to speak of danger in this context is overstating it somewhat, considering that Italy has had no fewer than 65 governments since 1946. The yellow vest movement in France is continuing to cause unrest. Donald Trump’s wish for a wall still hasn’t been granted. The resulting government shutdown has come to an end, at least for the time being, but it’s likely to have cost U.S. economic growth more than the controversial wall. As before, China is not expected to spring any growth surprises. The media spotlight has shifted away from Syria and Yemen to some extent and onto the new topic of the chaos in Venezuela. Since interim president Guaidó has been openly opposing sitting president Maduro, the Caribbean nation’s (self-imposed) hardship has gripped the world’s attention. There is no news from eastern Ukraine either, other than the football match of Shakhtar Donetsk against Eintracht Frankfurt won’t be a home game but will be moved to the safer city of Kharkiv, 300 km away.

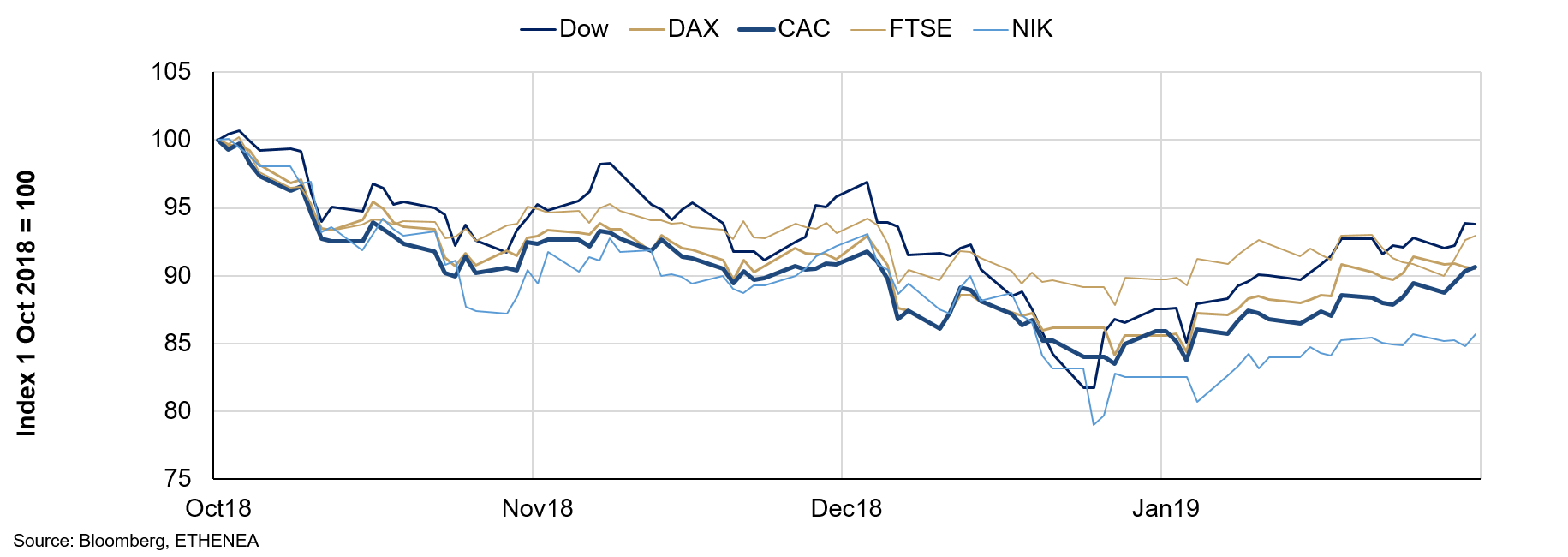

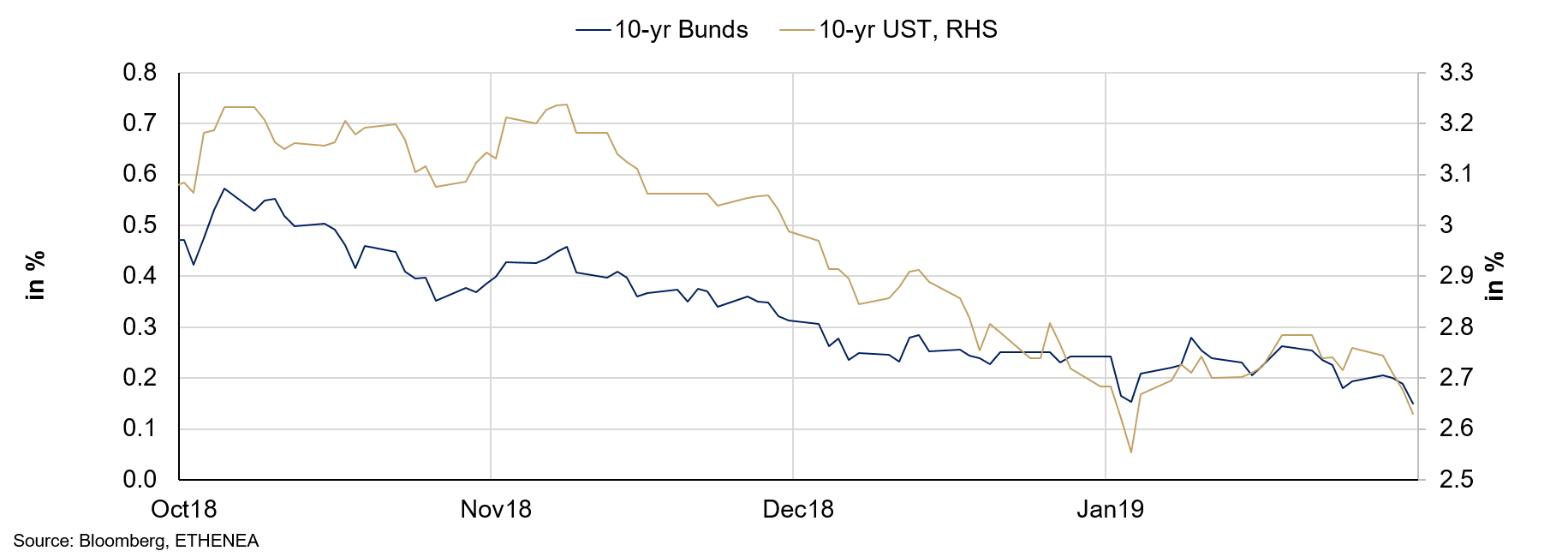

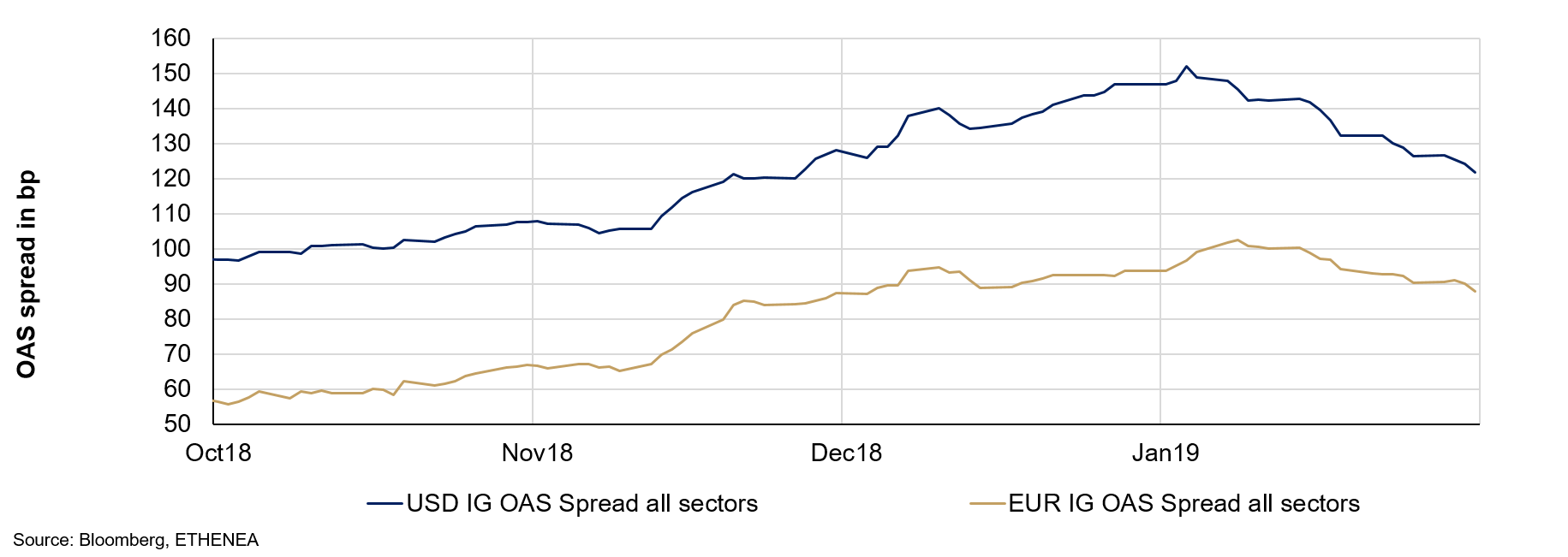

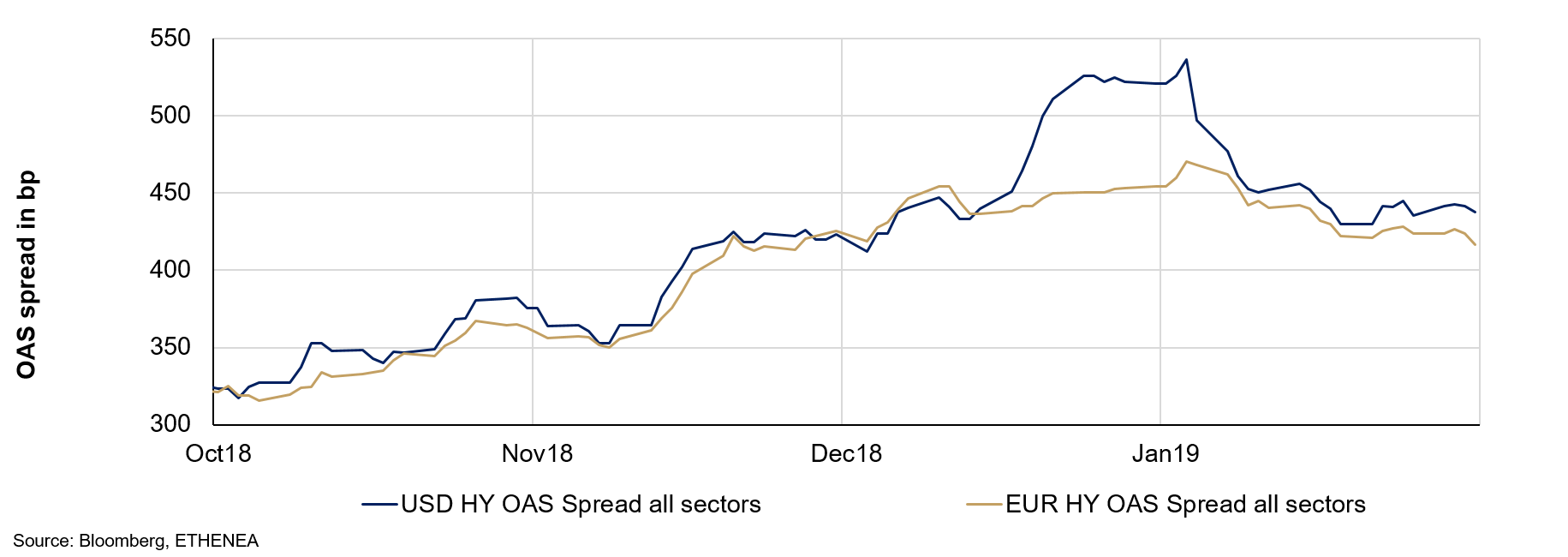

However, in January the markets were more or less untouched by the political goings-on. Equity markets recovered from their lows in December (Figure 1), concerns about recession in interest rate markets seem to have abated for now (Figure 2), spreads on better corporate bonds are rapidly falling from their highs (Figure 3) and even the collapse in high yield bonds seems to have passed (Figure 4).

Figure 1: Equity market performance

Figure 2: Interest rate market development

Figure 3: Corporate bond spreads

Figure 4: High yield bond spreads

However, in its first meeting of 2019 the U.S. central bank shifted policy towards a neutral stance for the first time in this cycle of interest rate hikes. It is therefore just as likely that the next rate change will be a hike as a cut. The Powell Put, as it were, has come into effect, which means that the central bank seems to have done the equity markets a favour. The fact is, however, that the Federal Reserve was able to spot a weakness in growth. The longest government shutdown in U.S. history alone has cost up to 1% in economic growth according to estimates from various sources. In this context, the central bank’s wait-and-see stance seems totally understandable. In the risk markets, the shift has caused equities to rise and the spreads on corporate bonds to decrease again.

What next? In January 2019’s Market Commentary we explained in detail that, to all appearances, we are entering a phase of economic weakness. So far, nothing has happened to change this assessment. Indeed, in the U.S. the central bank has come to the same conclusion. Various indicators confirm this expectation, including the Chicago Purchasing Manager Index for January. In the eurozone, Italy has once again slipped into a technical recession. Considering that since the euro was introduced Italy has achieved real quarterly growth of only 0.12% on average, one can understand – at least from Italy’s perspective – why there are certain doubts about the success of the euro for the country. But we are not going to delve further into that here. In Germany, the government’s rather optimistic growth estimate for 2019 of 1.8% in October 2018 was revised to a mere 1% in January 2019. The import/export data for China published mid-January gives us another indication that the global economy is weakening, pointing to a noticeable weakening in Chinese growth. Last but not least, let’s not forget about Donald Trump. The Department of Commerce is still probing whether car imports from the EU pose a national security risk and, if so, it would levy a 25% tariff on them. The results of this probe are expected to be announced before 17 February 2019.

All in all, our expectation of a phase of global economic weakness seems accurate without painting a picture of immediate global recession. After all, central banks do seem prepared to slightly prolong the longest period of economic growth in history, if they follow the example set by the U.S. central bank.

For the capital markets, however, this means that now and again we will probably have another January with periods of recovery but just as often we will have more Decembers in which risk markets get punished. On the whole, therefore, we are likely to have little more than a lot of fuss and volatility. In this respect, a steady hand is required and a fund structure that can adapt to this environment. All three Ethna funds have precisely this aim and each one pursues this in its own way.

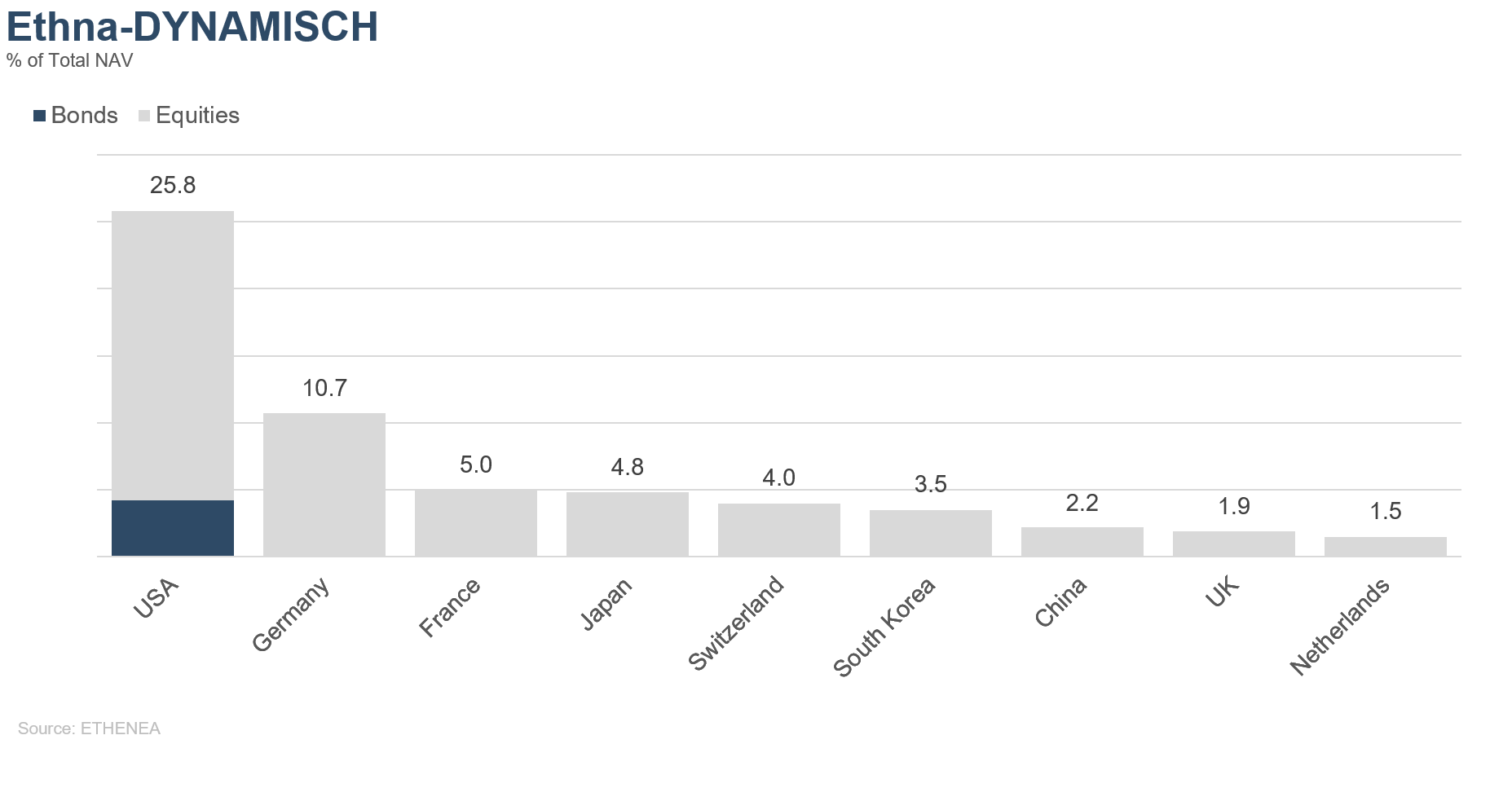

If you are having video playback issues, please click HERE.

In January, we at last managed to put the final touches on the bond portion of the Ethna-DEFENSIV. We sold the last remaining long maturity bonds denominated in USD (-16%) and also sold the rest of the old-style subordinated bonds (-2.4%), thanks to the opportunity the brief recovery in bond markets presented. Over 90% of the bond portfolio is now denominated in EUR, which greatly reduces our currency hedging costs. Furthermore, we were able to reduce the maturities of holdings to the extent that more than 78% of bonds now have a residual maturity of less than seven years. This substantially reduces the cost of duration hedging because we can now use shorter-dated futures with a lower negative carry. Apart from a few remaining subordinates (1.6%), the Ethna-DEFENSIV is largely free of (incalculable) risks in this respect.

We increased the gold position to just over 5% because we remain confident that prices will rise in times of greater uncertainty.

Our equity position at the end of January was 0% because we are still waiting for suitable entry levels.

“Why should I care about what I said before?” Fed Chair Jerome Powell must have been thinking along these lines when making his almost complete about-turn following on from a statement in December that was found to be overly hawkish. He is now much more dovish about forthcoming rate rises, which brought about broad-based price gains over the course of January. As a result, the corresponding U.S. interest rate futures no longer imply an interest rate rise for this year. However, we think the market is overly euphoric in this regard. In our estimation, if the capital market appears, on the face of it, to be calming and (wage) inflation is resurgent due to full employment, the central bank will once again have reason to raise interest rates over the course of the year. The fact is that the about-turn in the central bank’s statements demonstrated earlier than expected that a Powell Put is in force. However, we mustn’t forget on this point that while such a put limits the potential of the market to correct, it does not determine the upside potential. Rather, the actual and expected rates of growth in corporate turnovers and profits are the determining factors. The current reporting season is painting a mixed picture in this regard. To sum up so far, we can say that the published figures have not been as bad as the sharp falls in the equity market implied as recently as mid-December. On the other hand, however, the trend towards slower growth is being confirmed. On the subject of a slowdown, it’s no longer a secret that the longest government shutdown in U.S. history and the still unresolved trade conflict with China are having an impact on real figures and on the general mood as well. We expect that global economic growth for 2019 – revised to 3.5% – will slow further, which does not boost upside potential. As such, we expect the equity market to remain highly volatile, with limited upside and downside potential.

Performance in January can largely be attributed to the bond portfolio and the extended duration we carried into the first week of January. Having limited losses in December by reducing the equity allocation, we saw the flip side of this positioning in January, participating less in rising markets. At the moment, the equity allocation is approx. 8%, with option structures in the U.S. equity market accounting for almost all of this. In keeping with the picture painted above of a volatile trading range, we will take advantage of declines to make purchases and rallies to make sales via index futures. In the course of January, we also re-established a gold position of 5%. In our view, last year’s prevailing correlation between gold and various asset classes has been broken, meaning that the addition of gold to the mix both for diversification and performance reasons is once again an attractive prospect. Both our relatively substantial dollar position of 17.5% and our tendency to reduce U.S. duration reflect our interest rate opinion as described at the outset, which is that U.S. interest rates will tend to rise.

The new year for the stock markets started as positively as the last year closed negatively. This is what we in the industry call volatility. What’s behind the high levels of volatility in capital markets is the ongoing considerable uncertainty about future economic growth. The macroeconomic environment has rarely been as hazy as it is at the moment. The economic barometer tends still to point towards a slowdown in growth in the key economies. After the sharp falls in prices, however, a great deal is priced in at the moment and trading the capital markets has always been a matter of weighing up risk against opportunity. This balance – potential reward vs possible risk – is gradually tipping back slightly into the positive. In interpreting the parameters, it’s important to remember the leading nature of stock markets. Stock markets do not wait until the uncertainty has subsided and official growth figures have been revised upwards. Share prices react positively even if things turn out less badly than feared. And an array of the indicators we have analysed are now heading in that direction. Here’s a good example of what we mean: rarely has the uncertainty in planning for companies been as pronounced as it is now. The lack of clarity surrounding Brexit and the simmering trade conflict are hampering investment in the real economy across the board. Slowly but surely this is manifesting in the relevant micro- and macroeconomic figures. That said, whichever Brexit scenario we end up with – a hard Brexit, a perfectly negotiated Brexit or no Brexit at all – companies will soon have certainty in planning again, and they will be able to adapt to the circumstances and make the necessary investments they postponed. After all, in the past the times we had the greatest uncertainty were the times we had more attractive entry points in equity markets.

Given the fund positioning as outlined above and the small gold position, which still makes up around 2.5% of the portfolio mix, we believe the Ethna-DYNAMISCH remains well set up for times of high – and possibly soon falling – uncertainty and volatility.

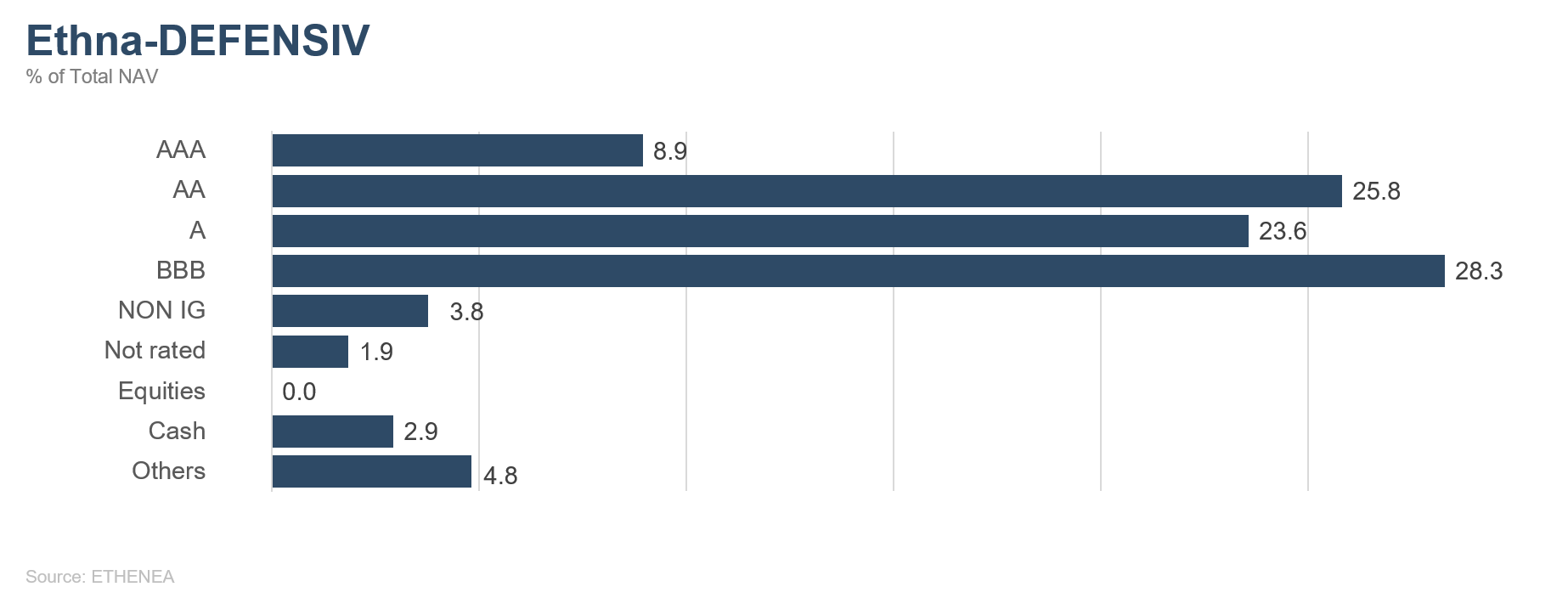

Figure 5: Portfolio ratings for Ethna-DEFENSIV

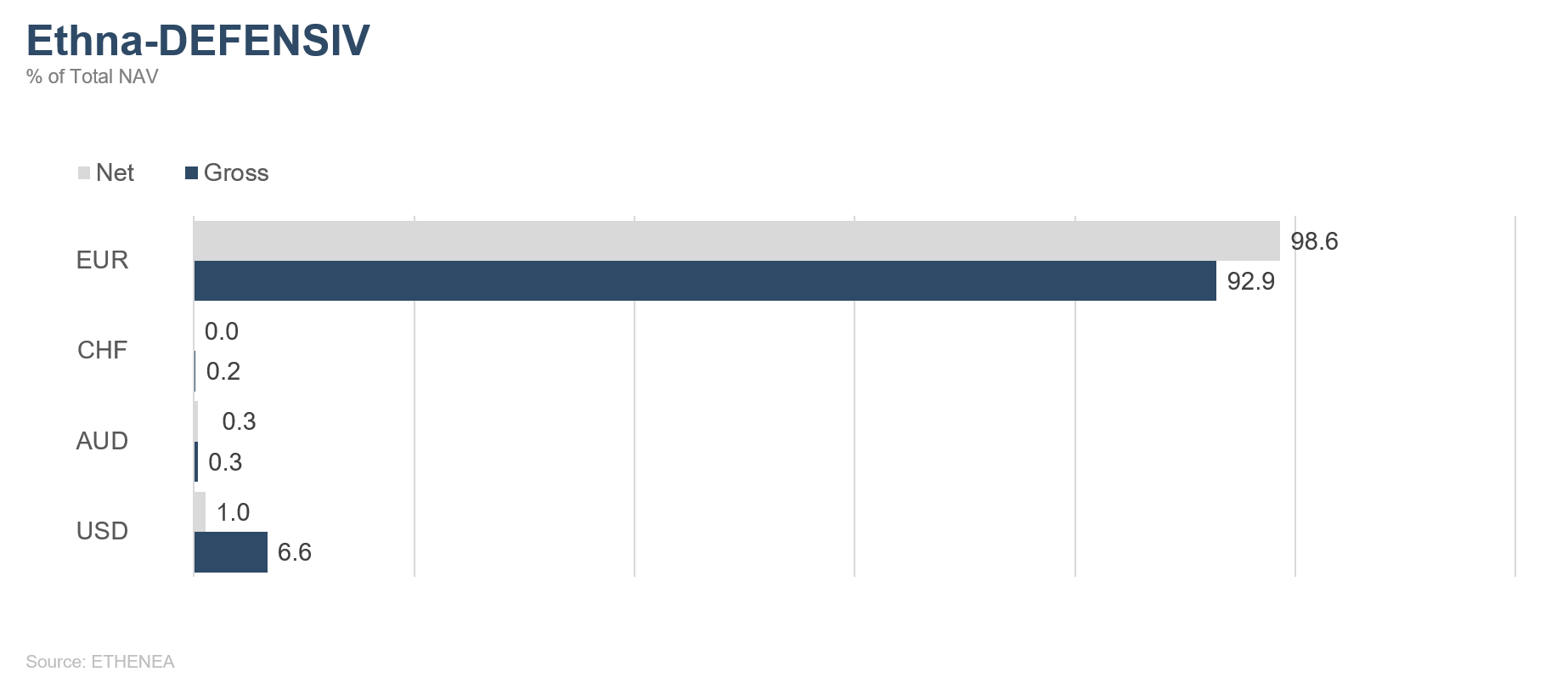

Figure 6: Portfolio composition of Ethna-DEFENSIV by currency

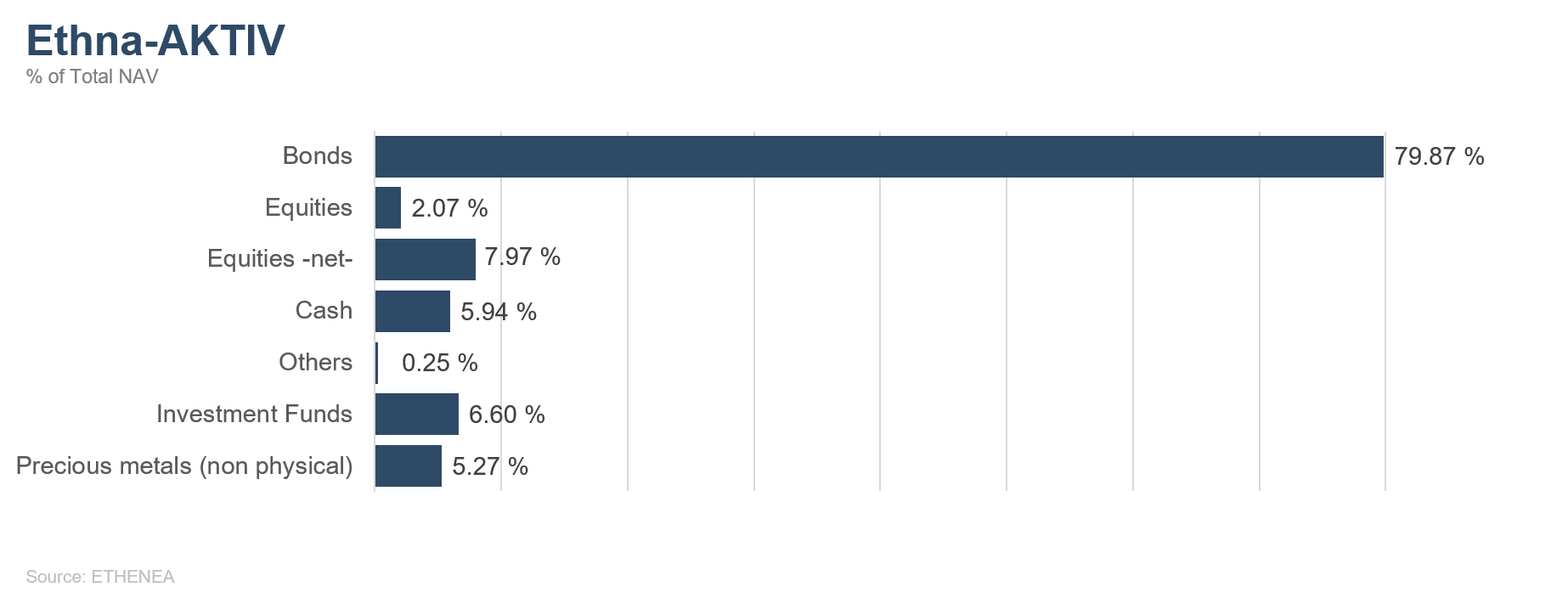

Figure 7: Portfolio structure* of Ethna-AKTIV

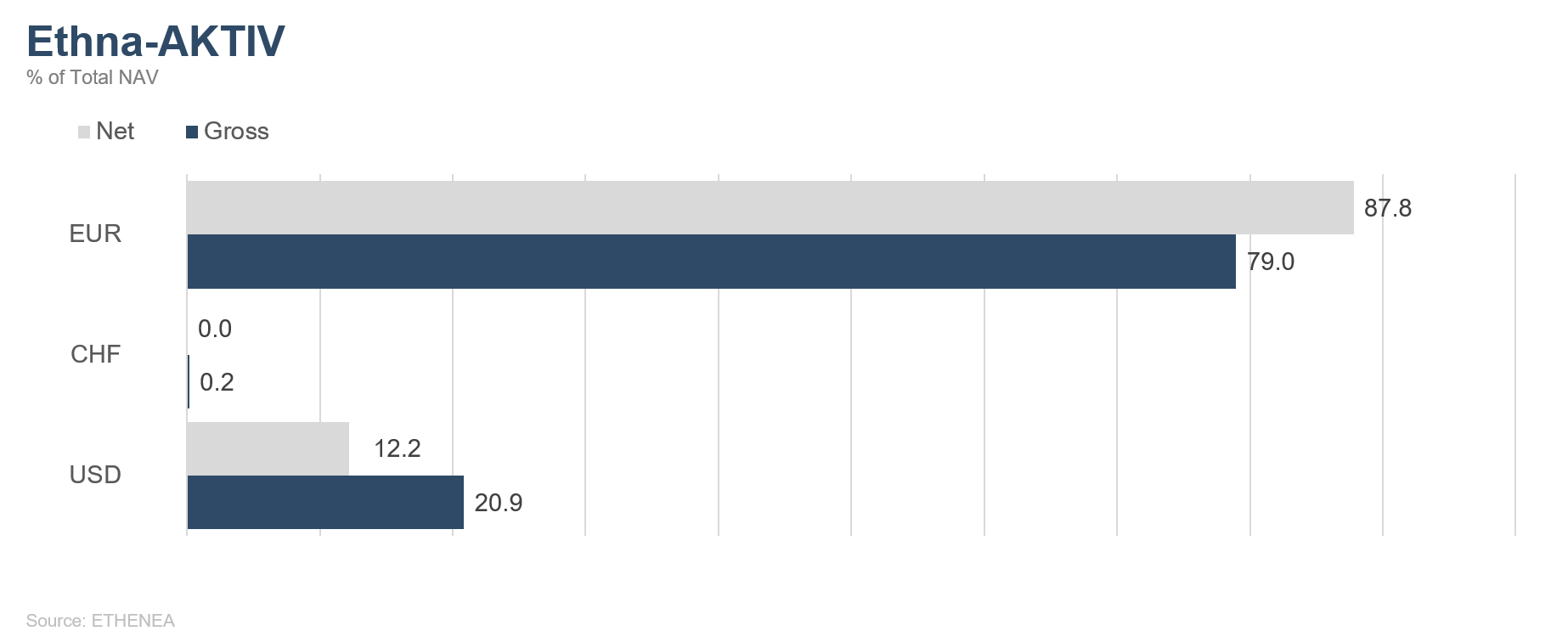

Figure 8: Portfolio composition of Ethna-AKTIV by currency

Figure 9: Portfolio structure* of Ethna-DYNAMISCH

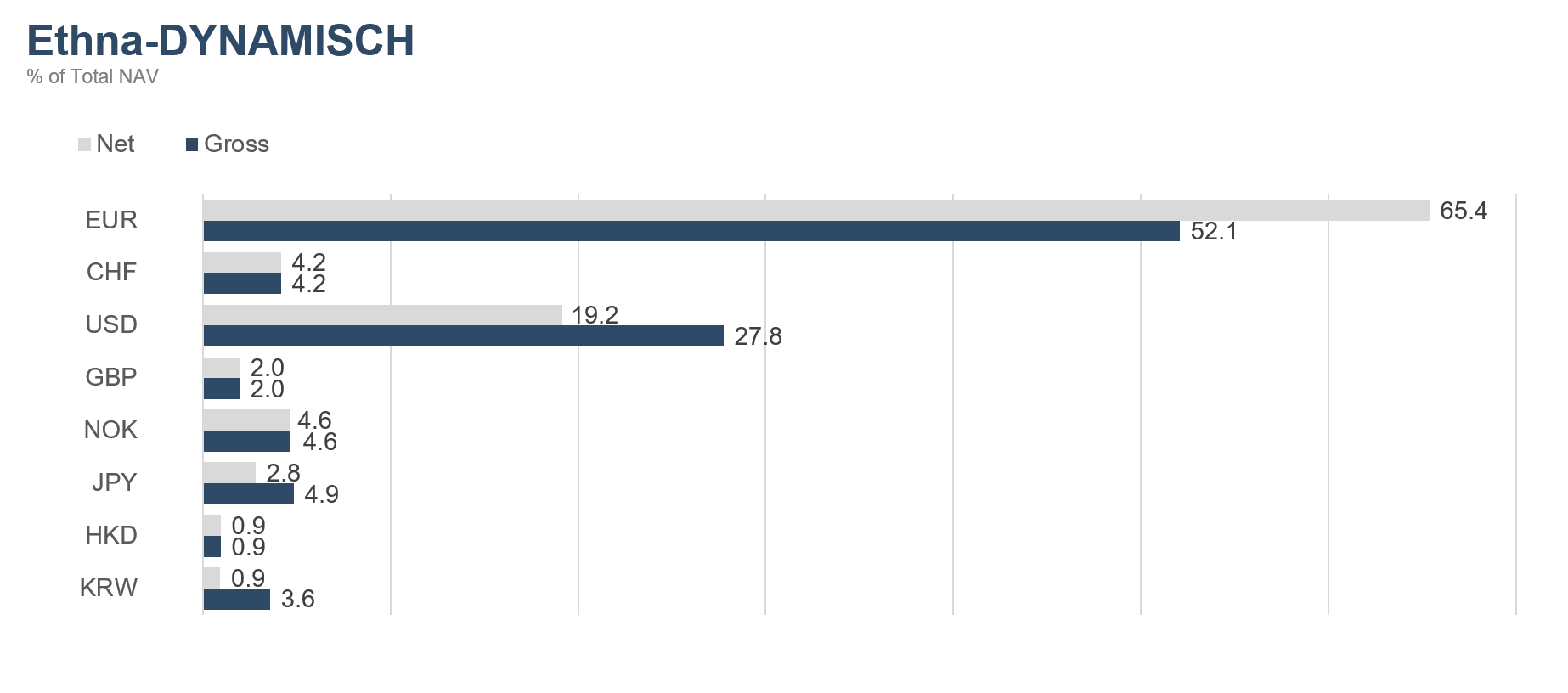

Figure 10: Portfolio composition of Ethna-DYNAMISCH by currency

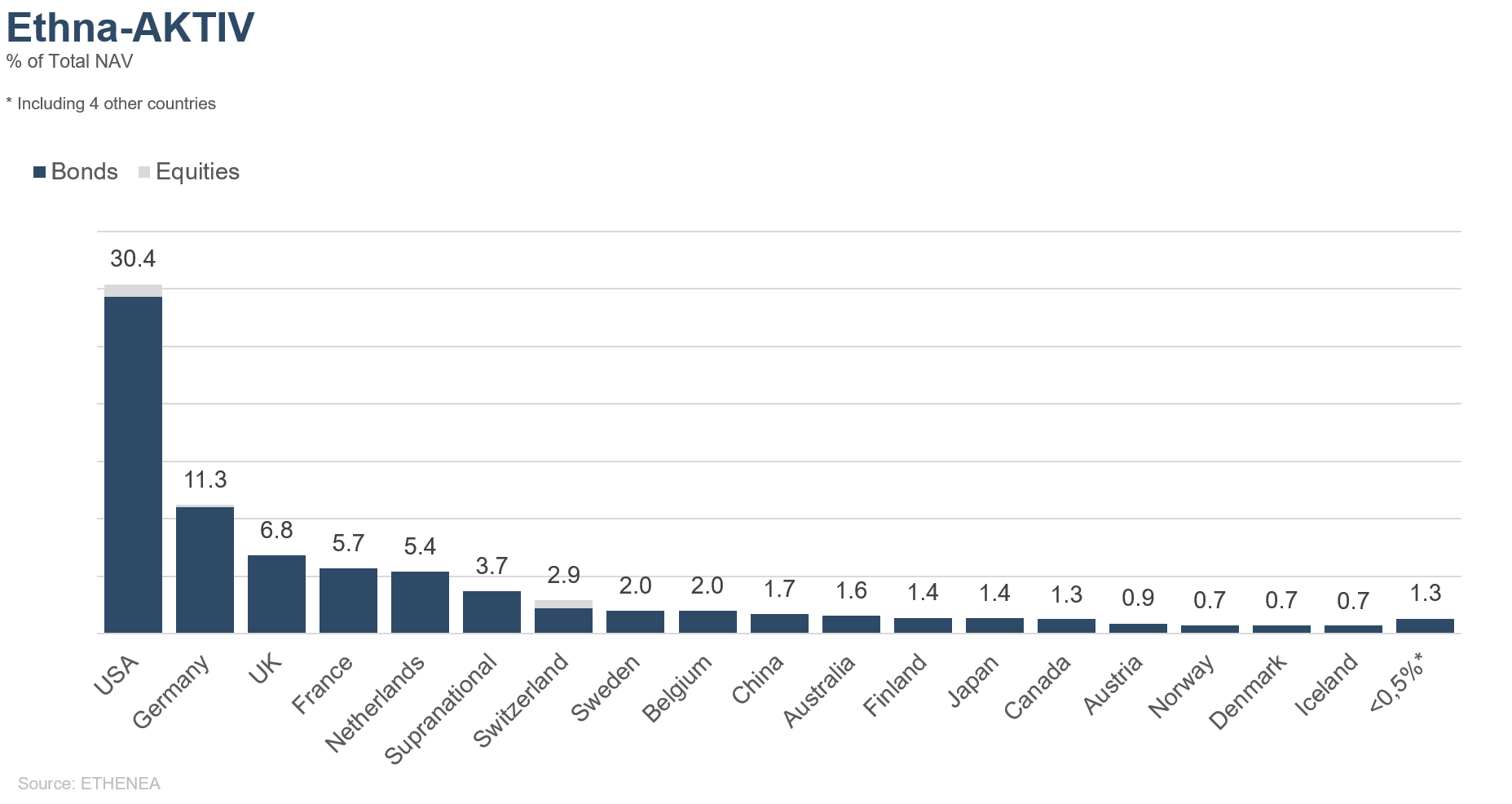

Figure 11: Portfolio composition of Ethna-AKTIV by country

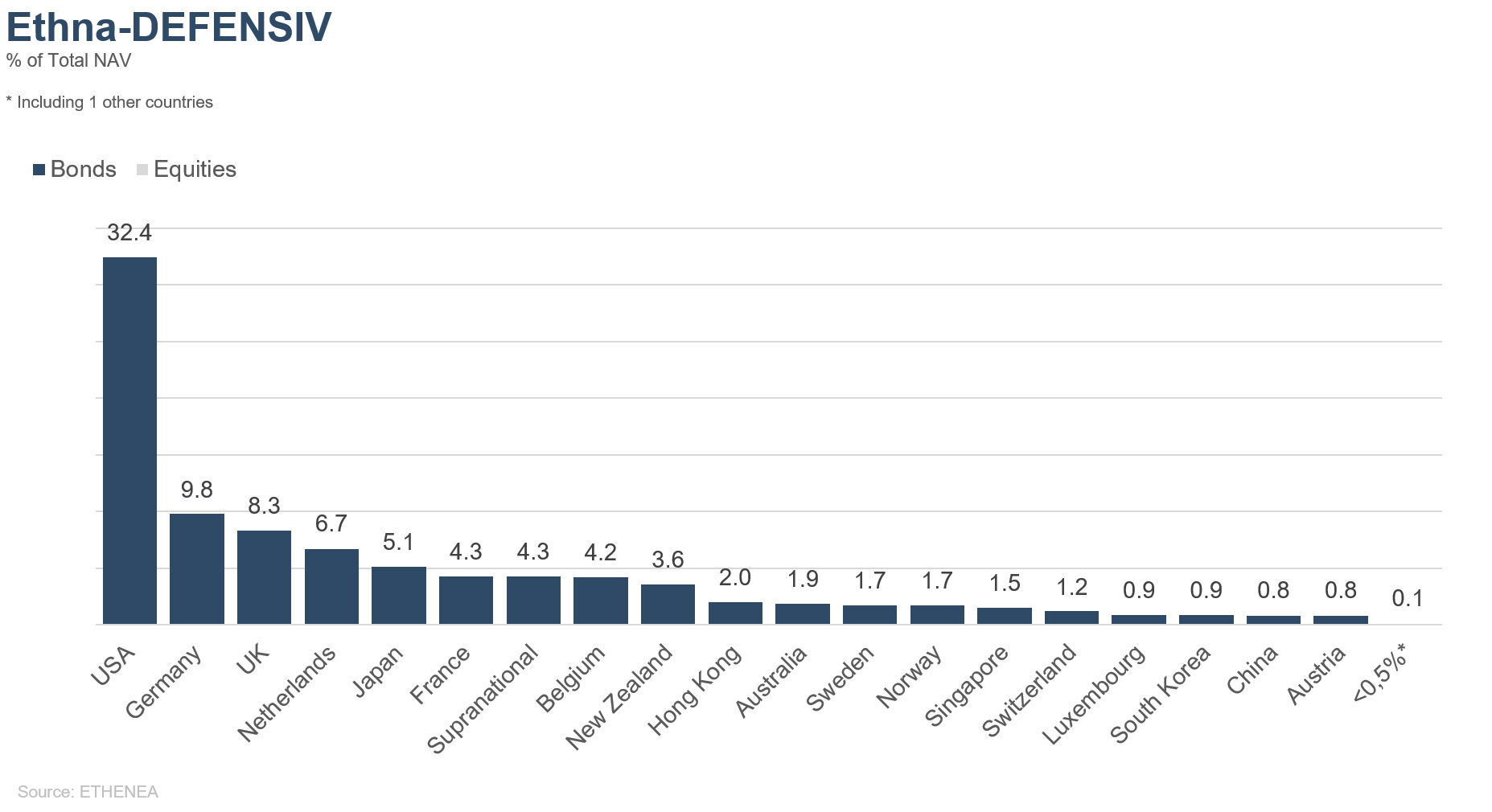

Figure 12: Portfolio composition of Ethna-DEFENSIV by country

Figure 13: Portfolio composition of Ethna-DYNAMISCH by country

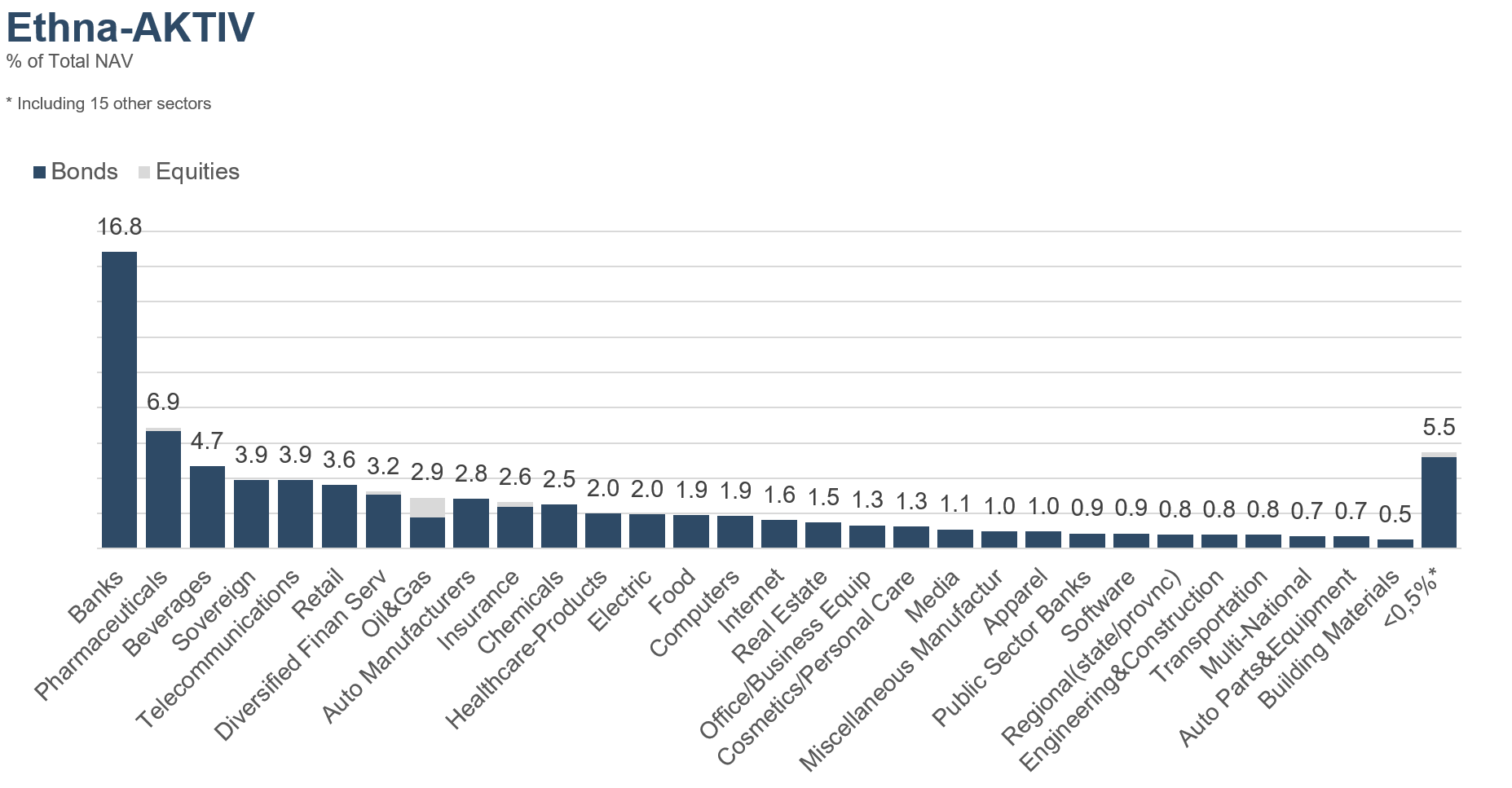

Figure 14: Portfolio composition of Ethna-AKTIV by issuer sector

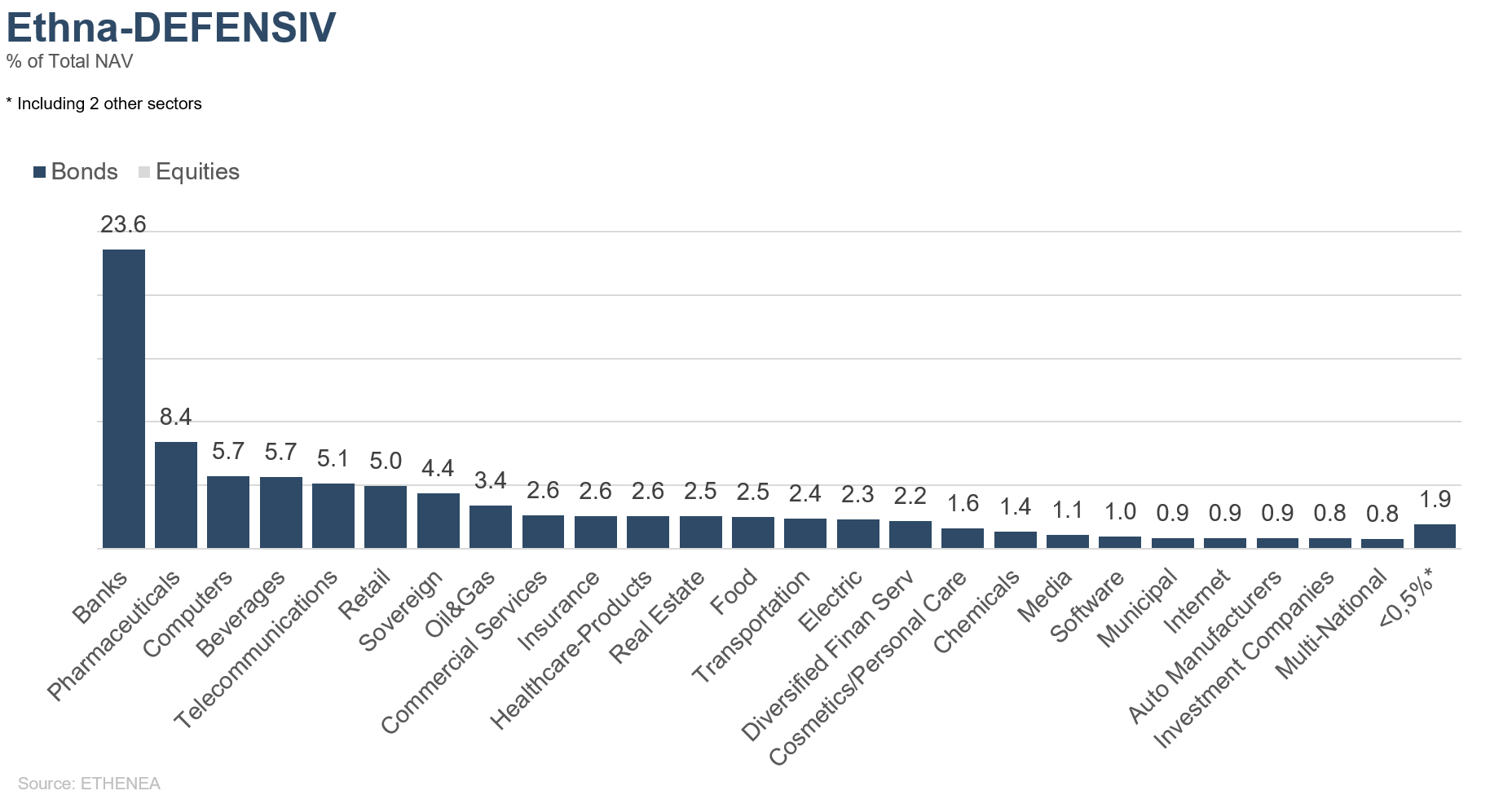

Figure 15: Portfolio composition of Ethna-DEFENSIV by issuer sector

Figure 16: Portfolio composition of Ethna-DYNAMISCH by issuer sector

* “Cash” comprises term deposits, call money and current accounts/other accounts. “Equities net” comprises direct investments and exposure resulting from equity derivatives.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

Esta comunicação publicitária tem apenas fins informativos. A distribuição a pessoas localizadas em países nos quais o fundo não está autorizado para comercialização, especialmente nos EUA ou a cidadãos norte-americanos, é proibida. As informações não constituem uma oferta ou recomendação de compra ou venda de valores mobiliários ou instrumentos financeiros, e não substituem uma consultoria específica para o investidor ou para o produto. Não consideram os objetivos de investimento individuais, a situação financeira ou as necessidades particulares do destinatário. Antes de tomar qualquer decisão de investimento, é necessário ler atentamente os documentos de venda aplicáveis (prospeto de venda, documentos informativos básicos/PRIIPs-KIDs, relatórios semestrais e anuais). Esses documentos estão disponíveis em alemão e em traduções não oficiais junto da sociedade gestora ETHENEA Independent Investors S.A., da entidade depositária, das entidades nacionais de pagamento ou de informação, bem como em www.ethenea.com. Os principais termos técnicos podem ser encontrados no glossário disponível em www.ethenea.com/glossary/. Para informações detalhadas sobre as oportunidades e riscos de nossos produtos, consulte o prospeto de venda atual. O desempenho passado não é um indicador fiável de resultados futuros. Os preços, valores e rendimentos podem subir ou descer e resultar na perda total do capital investido. Os investimentos em moedas estrangeiras estão sujeitos a riscos cambiais adicionais. As informações fornecidas não implicam quaisquer garantias ou compromissos vinculativos relativamente a resultados futuros. Os pressupostos e conteúdos podem ser alterados sem aviso prévio. A composição da carteira pode ser alterada a qualquer momento. Este documento não constitui uma explicação completa sobre os riscos. A comercialização do produto pode envolver comissões para a sociedade gestora, empresas associadas ou parceiros de distribuição. As informações sobre comissões e custos são as constantes no prospeto de venda atual. Uma lista das entidades nacionais de pagamento e informação, um resumo dos direitos dos investidores e informações sobre os riscos de erro no cálculo do NAV podem ser encontradas em www.ethenea.com/avisos-legais. Em caso de erro no cálculo do NAV, será oferecida uma compensação de acordo com o comunicado CSSF 24/856; para unidades adquiridas através de intermediários financeiros, a compensação poderá ser limitada. Informações para investidores na Suíça: O país de origem do fundo coletivo de investimento é o Luxemburgo. O representante na Suíça é a IPConcept (Schweiz) AG, Bellerivestrasse 36, CH-8008 Zurique. O agente pagador na Suíça é a DZ PRIVATBANK (Schweiz) AG, Bellerivestrasse 36, CH-8008 Zurique. O prospeto, os documentos informativos básicos (PRIIPs-KIDs), os estatutos, bem como os relatórios anuais e semestrais podem ser obtidos gratuitamente junto ao representante. Informações para investidores na Bélgica: O prospeto de venda, os documentos informativos principais (PRIIPs-KIDs), os relatórios anuais e semestrais do fundo estão disponíveis gratuitamente em português, mediante solicitação, junto da sociedade gestora ETHENEA Independent Investors S.A., 16, rue Gabriel Lippmann, 5365 Munsbach, Luxemburgo, e do representante: DZ PRIVATBANK AG, Niederlassung Luxemburg, 4, rue Thomas Edison, L-1445 Strassen, Luxemburgo. Apesar de toda a diligência, não é assumida qualquer garantia quanto à exatidão, integridade ou atualidade das informações. Somente os documentos originais em alemão são válidos; as traduções são fornecidas apenas para fins informativos. A utilização de formatos digitais de publicidade é feita por própria conta e risco; a sociedade gestora não se responsabiliza por falhas técnicas ou violações de dados causadas por fornecedores externos de informações. A utilização só é permitida em países onde seja legalmente permitida. Todo o conteúdo está sujeito a direitos de autor. Qualquer reprodução, distribuição ou publicação, total ou parcial, só é permitida com a autorização prévia por escrito da sociedade gestora. 04/02/2019

Escolha o seu perfil