Ethna-DEFENSIV | Proven anchor of stability in recent crises

2022 represents a watershed. The era of negative interest rates is finally over, with markets continuing to be driven by geopolitics and high inflation. This marks a paradigm shift and constitutes an extremely challenging environment for equity and bond investors alike. Investors need to rethink their approach and focus, more than ever before, on strategies that enable them to respond to changing circumstances in a flexible, active manner. In this new world for investors, solutions that promise (and deliver) a steady income stream and exhibit low volatility at a tumultuous time are in demand. As a bond-focused multi-asset fund, the Ethna-DEFENSIV fits the bill and represents an anchor of stability in a changing landscape.

Thus far, 2022 has been an extremely challenging year for investors and marks a turning point. Inflation hasn't gone away; it is persistently high on both sides of the Atlantic – and in some cases reaching double digits. Central banks have implemented substantial rate hikes in a bid to get inflation under control. In addition, the war in Ukraine has brought enormous political risks to the fore. On top of that, there are growing signs that Europe, at least, is heading for a bout of recession. This very difficult set of circumstances is consequently leading to a recalibration of the capital market environment.

There is finally an alternative to stocks, with investors now pulling out of equity markets against the backdrop of a further increase in interest rates around the world. However, the most direct impact of the massive change in central-bank policy is on bond markets. Although investors are increasingly unsettled, turning their back completely on the markets isn't a realistic option. Patience and concentration are required in order to offer the right strategies and solutions in such a challenging environment.

Conservative character in turbulent markets

Investors are searching for the right mix between security and return. Multi-asset funds – where the fund manager can diversify into equities as well as bonds – are aimed at precisely this approach. Furthermore, a positioning in commodities and currencies, for example, often creates additional opportunities for investment. The Ethna-DEFENSIV is a multi-asset fund that is geared in particular to conservative investors.

The allocation is determined by the portfolio management via a top-down approach, based on in-depth assessment of macroeconomic developments, coupled with a bottom-up approach for selecting bonds. Corporate bonds with very good/good issuer credit quality are the focal point of the fund and constitute the basis of its core income. The position in AAA-rated bonds was increased in 2022. Bonds with a lower rating are added by the fund management if necessary, provided the additional return compensates for the greater risks involved. The Ethna-DEFENSIV was approximately 90.5% invested in bonds as of 31 October 2022.

Does that mean equities don't usually play a role in asset allocation? No, because the ability to be flexible and act appropriately is what marks out this multi-asset fund. The Ethna-DEFENSIV is heavily bond-weighted but can also invest a maximum of 10% in equities. The equity allocation in November 2021, for instance, was 9%. As things stand (i.e. 31 October), however, it is 0%.

Low volatility target and promise of steady returns

Due to a raft of different factors, markets were dealt a sustained blow in 2022. Volatility has become an issue again: after a relatively calm summer, the VIX index of expected volatility is now above the 30-point mark – well above the long-term average. This is fairly scary for conservative investors who prefer products with manageable volatility. Since the Ethna-DEFENSIV was launched in April 2007, the fund management has set itself the goal of keeping volatility below 4%. Annualised volatility (12 months) stood at 3.04% at the end of October 2022 (Ethna-DEFENSIV (T)).

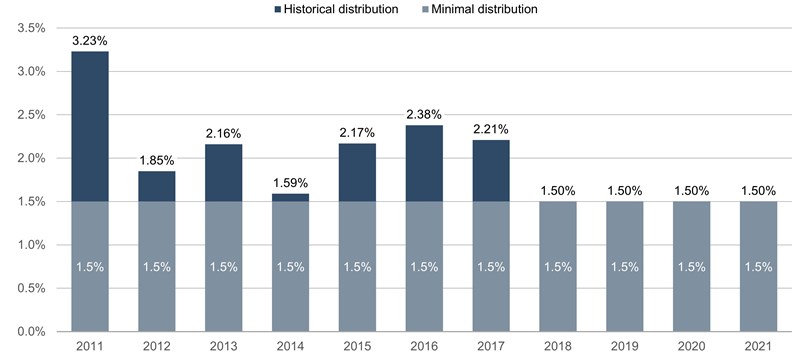

The income generated by the fund should enable a minimum distribution of 1.5% annually – and looking back that has always been the case. The fund ended crisis year 2020 with a respectable performance of 2.6%, thanks, once again, to active management of the portfolio. In October 2022, the Ethna-DEFENSIV (T) showed an annual performance of -3.17%. Due to the fund's balanced, diversified investment strategy, however, the setback is much less significant compared with multi-asset funds that have relatively high equity exposure as well as funds with overly aggressive positioning on the bond side.

In addition, the characteristics of the fund include the fund management's clear preference for short-dated issues in order to keep interest rate sensitivity at a low level. As of 31 October, bonds with a residual maturity of between 0 and 3 years accounted for around 52% of the fund assets. In anticipation of further increases in interest rates, the duration has been lowered significantly since February 2022 through the occasional use of interest rate futures.

The Ethna-DEFENSIV has a clearly discernible focus on the U.S. market. USD-denominated bonds account for about two thirds of the portfolio and are largely hedged against currency fluctuations. In the eyes of the fund management, the U.S. offers clear advantages over Europe.

The ESG topic is also addressed by the fund, which has been awarded a four-globes Morningstar Sustainability Rating. The ESG investment approach consists of a three-step process, as is the case with the other Ethna funds. In this connection, management is supported by the external expertise of Morningstar Sustainalytics.

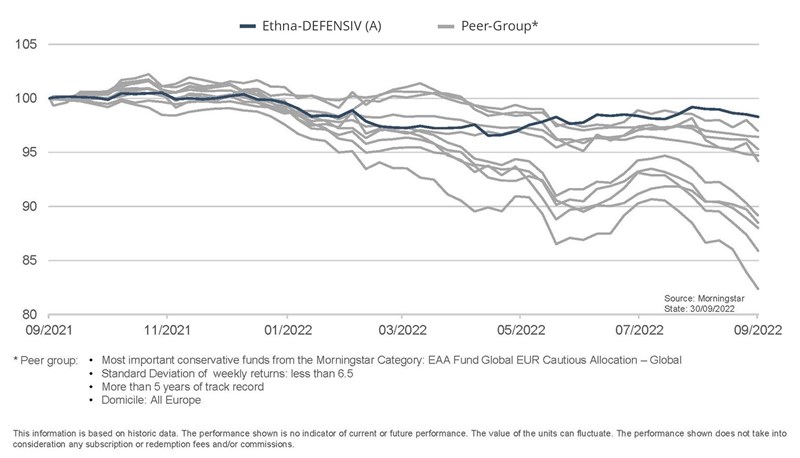

Ahead of the competition

The fund easily holds its own in a peer-group comparison: the Ethna-DEFENSIV puts its rivals in the shade on a 1-year view; the portfolio management also impresses with strong performance in a medium and longer-term comparison.

Ethna-DEFENSIV is an actively-managed, bond-oriented multi-asset fund. The core of the portfolio consists of high-quality and carefully selected corporate bonds with good ratings. Through adequate adjustments to the portfolio, the fund management team repeatedly succeeds in keeping volatility on a very low level of below 4 percent, even in very dynamic market phases. The 5-star overall Morningstar rating confirms to the fund's excellent performance.

Strong arguments for a strategy that stands for stability in turbulent market phases and is thus particularly suitable for conservative investors as a long-term basic investment.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

Esta comunicación publicitaria es únicamente para fines informativos. Está prohibida su transmisión a personas en países donde el fondo no está autorizado para su distribución, especialmente en EE.UU. o a personas estadounidenses. La información no constituye una oferta ni una invitación para comprar o vender valores o instrumentos financieros y no sustituye el asesoramiento personalizado al inversor o al producto. No tiene en cuenta los objetivos de inversión individuales, la situación financiera ni las necesidades particulares del destinatario. Antes de tomar una decisión de inversión, deben leerse cuidadosamente los documentos de venta vigentes (folleto, documentos de información clave/PRIIPs-KIDs, informes semestrales y anuales). Estos documentos están disponibles en alemán y en traducción no oficial en la sociedad gestora ETHENEA Independent Investors S.A., en el depositario, en los agentes de pago o de información nacionales, así como en www.ethenea.com. Los términos técnicos más importantes se encuentran en el glosario de www.ethenea.com/glosario/. La información detallada sobre oportunidades y riesgos de nuestros productos se encuentra en el folleto vigente. La rentabilidad pasada no es un indicador fiable de la rentabilidad futura. Los precios, valores y rendimientos pueden subir o bajar y pueden llevar a la pérdida total del capital invertido. Las inversiones en divisas extranjeras están sujetas a riesgos de tipo de cambio adicionales. No se pueden derivar compromisos ni garantías vinculantes para resultados futuros a partir de la información proporcionada. Las suposiciones y el contenido pueden cambiar sin previo aviso. La composición de la cartera puede cambiar en cualquier momento. Este documento no constituye una información completa sobre riesgos. La distribución del producto puede dar lugar a remuneraciones para la sociedad gestora, empresas vinculadas o socios de distribución. Son determinantes los datos sobre remuneraciones y costes que figuran en el folleto vigente. Una lista de los agentes de pago e información nacionales, un resumen de los derechos de los inversores y las advertencias sobre los riesgos de un cálculo erróneo del valor liquidativo están disponibles en www.ethenea.com/avisos-legales/. En caso de error en el cálculo del valor liquidativo, la compensación se realizará conforme a la Circular CSSF 24/856; para participaciones suscritas a través de intermediarios financieros, la compensación puede estar limitada. Información para inversores en Suiza: El país de origen del fondo de inversión colectiva es Luxemburgo. El representante en Suiza es IPConcept (Schweiz) AG, Bellerivestrasse 36, CH-8008 Zúrich. El agente de pagos en Suiza es DZ PRIVATBANK (Schweiz) AG, Bellerivestrasse 36, CH-8008 Zúrich. El folleto, los documentos de información clave (PRIIPs-KIDs), los estatutos y los informes anuales y semestrales pueden obtenerse gratuitamente del representante. Información para inversores en Bélgica: El folleto, los documentos de información clave (PRIIPs-KIDs), los informes anuales y semestrales del subfondo están disponibles gratuitamente en francés a petición de ETHENEA Independent Investors S.A., 16, rue Gabriel Lippmann, 5365 Munsbach, Luxemburgo y del representante: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxemburgo. A pesar del máximo cuidado, no se garantiza la exactitud, integridad o actualidad de la información. Solo los documentos originales en alemán son vinculantes; las traducciones son solo para fines informativos. El uso de formatos publicitarios digitales es bajo su propia responsabilidad; la sociedad gestora no asume ninguna responsabilidad por fallos técnicos o violaciones de la protección de datos por parte de proveedores externos de información. El uso solo está permitida en países donde esté legalmente autorizado. Todos los contenidos están protegidos por derechos de autor. Cualquier reproducción, distribución o publicación, total o parcial, solo está permitida con el consentimiento previo por escrito de la sociedad gestora. Copyright © ETHENEA Independent Investors S.A. (2025). Todos los derechos reservados. 22-11-2022