Jackson Hole: once every year

At the end of August, the Federal Reserve Bank of Kansas City once again hosted central bankers from all over the world at the annual symposium in Jackson Hole, Wyoming, U.S.. If you’re travelling to Yellowstone National Park from the south, as I did around 30 years ago, you’ll pass through the stunning valley of Jackson Hole. However, I don’t remember the beautiful landscape. It wasn’t until I was writing about it for this Market Commentary and looked up the geographical location of Jackson Hole that I realised I must have travelled through the valley on my trip all those years ago. In contrast, I, and probably one or two others, do remember some of the speeches and articles written on the Jackson Hole conferences since the first meeting in 1978.

At the meeting in 2010, for example, the Fed Chair at the time, Ben Bernanke, announced a further bond buying programme by the name of QE2. In 2013, Bernanke announced the prospect of imminent tapering at the Fed’s earlier meeting in June and then didn’t even attend the Jackson Hole symposium. Last year the current – and probably incoming – Fed Chair Jerome Powell introduced the concept of “average inflation targeting”. This states that the central bank will allow short-term inflation target overshooting or undershooting without taking any countermeasures, as long as inflation is expected to return to its target in the long term. The U.S. economy has been in this very situation since May 2021, with inflation rates of 5% or more. However, the U.S. Federal Reserve is sticking with its outlook that inflation will come back down to 2% in the coming year.

This year, too, investors’ turned their attention once again to the expected tapering of asset purchases by the Fed. Many central bankers have recently commented on this subject and – depending on their personal assessment – called for earlier or later tapering. But, as is so often the case in recent times, the U.S. central bank and Jerome Powell did not live up to expectations in this regard and gave no clear indication of when tapering would begin. While he did warn the markets of imminent tapering, it remains very unclear when asset purchases will be reduced to zero.

This is not a complete surprise, even though it means that this year’s symposium in Jackson Hole will not be one of the more memorable ones. However, the scheduled Fed meetings held in June and September each year are important dates, they are when the U.S. Federal Reserve regularly revises its economic outlook and the forecasts for the future movement in central bank interest rates known as its “dot plot”. At these meetings, the U.S. central bankers discuss, among other things, the pace of future asset purchases. So, it’s worth noting the date of the next meeting – 21 and 22 September – the final outcome of which is not usually announced until the second day.

A crucial factor in tapering will be how the U.S. labour market develops in the future. According to the statistics from the U.S. Department of Labor, the employment rate outside of agriculture is still almost six million lower than the February 2020 rate. While Jerome Powell noted the labour market’s rapid recovery, it still wasn’t enough to justify tapering. He also stressed that the figures incorrectly show the status of some workers as employed. So it is understandable that the Fed is exercising a certain degree of caution. However, an unexpectedly strong recovery in the labour market could prospectively result in faster tapering. Reduced asset purchases remain a positive monetary stimulus, albeit with less impact and decreasing to zero impact once the last bond is purchased. Although the Federal Reserve’s asset purchases are only one factor in what happens with long-term yields, they will limit any rise in yields that could come from higher inflation expectations for a certain length of time.

Of course, the U.S. central bank’s cautious approach also harbours the risk that it will have to raise interest rates much higher than expected in the future. This at least suggests that the U.S. yield curve will steepen. It is still very hard to read the inflation trend. How many of the factors – such as the rise in used car prices, timber prices or transport costs, which are responsible for the recent rise in consumer prices to 5% – will slow or reverse? And which will last? Unless wages – and subsequently rents – rise sharply, a lasting increase in inflation to over 2% will scarcely be possible. The current overshooting of inflation will produce the opposite effect next summer and offset a potential long-standing upward trend in inflation. It is not all that unlikely that the U.S. inflation rate next summer will again be below 2% although price growth continues to accelerate beneath the surface. On the other hand, the Fed’s forecasts could prove correct, with U.S. inflation settling down at 2% again. In this regard, investors should be careful in interpreting the figures. Sustained uncertainty is also a cause of higher yields at the long end of the U.S. curve.

As such, we are awaiting the upcoming Fed meetings with bated breath and wondering whether next year’s Jackson Hole symposium will be another one for the history books.

Portfolio Manager Update & Fund positioning

Ethna-DEFENSIV

This summer, August was characterised by low volatility on the financial markets. Many market participants had a restful holiday and saw equities make further price gains. Only in China is the regulator exerting pressure. Under new legislation, high-tech companies in China are to ensure greater data security, reconsider U.S. IPOs, and clearly declare and better monitor their activities in the financial sector. Many market participants were eagerly awaiting the speech of U.S. central bank chair Jerome Powell at the symposium in Jackson Hole. How long does the central bank intend to keep long-term yields low in the U.S. as a result of their asset purchases, even though consumer prices are rising sharply and the labour market continues to recover? The Fed Chair warned the markets of imminent tapering but also made it clear that this did not mean an automatic raising of central bank rates (see this month’s Market Commentary). Shareholders readily made new equity investments based on current developments. Bond prices and the price of gold also rose on the back of Jerome Powell’s speech. Only the U.S. dollar reacted slightly huffily and lost some of its previous gains against the euro.

In August we began to reduce the moderate duration of the bond portfolio denominated in U.S. dollars in the Ethna-DEFENSIV down from approximately 5 to 2.7 using future hedges. The central bank remains patient and is holding off on tapering, but continues to insist that the sharp rise in consumer prices is temporary. That said, the U.S. central bank is striving for a normalisation of its interest rate policy. For this reason, we think that yields on 10-year U.S. Treasuries will not fall below 1.25% again.

The Ethna-DEFENSIV (T class) again posted a positive performance of 0.21% in August. On this occasion, it was our equity investments in the form of ETFs that accounted for the majority of the positive performance. In addition, we increased our weighting again to 9.5% in good time, almost to the maximum permitted weighting of 10%. Bonds, which naturally have by far the biggest weighting in the fund, maintained their gains from the previous month and put in a very stable performance. Overall, the fund price saw its positive development continue with very low volatility and generated a positive performance in seven out of eight months (T class). In fact, annualised price volatility recently fell to the very low level of 2.1%.

Ethna-AKTIV

Despite the much-discussed summer slump, capital markets were also positive in August. While interest rates on sovereign bonds effectively treaded water on both sides of the Atlantic, global equity indices improved in the low single digits while risk premia continued to narrow in the bond segment. A prime example and, of course, one of the best-performing indices this year is the S&P500, which by the end of the month had already recorded its 53rd all-time high this year. Nor could inflation data (which remains surprisingly high), fears about the Delta variant of SARS-CoV-2 or consumers’ and purchasing managers’ flagging confidence dampen this fundamental risk-on sentiment. The eagerly awaited central bankers’ meeting in Jackson Hole held no major surprises. Without actually giving specifics, Fed Chair Jerome Powell continues to very deftly frame the imminent tapering of the Fed’s asset purchase programme. The reference to additional, necessary improvements in the labour market pushed back the expected timing of a key rate hike in the U.S. once again. At this point it is hard to say whether the most influential central bank in the world is providing too much support for too long with this approach and will be too late to the party with the anticipated tighter monetary policy. However, the fact is that, overall, the fiscal tailwind and the as yet unforeseeable monetary headwind continue to be supportive to capital markets. As stated in last month’s Market Commentary, the strong fundamental data at company level is naturally also providing support. After very strong growth figures – both for turnover and earnings – we expect a normalisation, which would also be natural for this point in the economic cycle. We are heading into September, which historically is the month in which equity performance is the weakest. Nevertheless, as we will soon have transitioned into the middle phase of that cycle that lasts multiple quarters, we remain optimistic about risk assets.

As such, our overall equity exposure remains in excess of 40%. The majority are still U.S. equities, although smaller positions in the SMI and CSI300 were purchased this month in addition. The bond allocation remained relatively constant at almost 25%, of which 4% are short-dated U.S. Treasuries. Overall, the bonds held in the portfolio remain very conservative and have a short duration. The duration was reduced further in August from 5.3 to 4.4 by switching to shorter maturities. If the rise in bond interest rates were to materialise in the next few weeks as we expect, we will further reduce interest rate sensitivity through active duration management. In addition, our expectation that the U.S. dollar would strengthen has come to pass over the course of the year. We took advantage of the short-term countermovement in recent days to increase the allocation from 25% to 30%.

Ethna-DYNAMISCH

Our assessment of the market has not changed significantly from previous months. While fiscal and monetary supports will be dialed back in the foreseeable future, this is neither a surprise nor a cause for concern. After all, their deceleration is an indicator of the strength of the economic recovery. We saw the latter in the second-quarter reporting season in particular. Compared with the prior-year quarter, S&P 500 companies’ turnover rose by an average of almost 26% and corporate earnings climbed 93%, no less. Although exceptionally strong growth had been expected due to the base effect, analysts’ consensus estimates were on average exceeded by a clear margin. This strong fundamental data was one of the reasons why global equity markets hit new highs in August and supported the valuation level, which has tended to be high of late. In addition, we are seeing ongoing unchecked demand for equities, due to a renewed step-up in company share buyback programmes and historically high inflows from investors. Given these constructive circumstances, we kept the positioning of the Ethna-DYNAMISCH largely unchanged in August.

This year’s summer slump was offset by the interventions in China. After a double-digit fall in prices over recent weeks, investors are deeply divided on whether Chinese equities currently present an opportunity or harbour further risks. Fundamentally, this is not a new issue and the risk of state intervention in China is well known. However, while in the past the focus was primarily on the tech giants (whose economic dominance had increased), the new regulations are aimed at the private tutoring sector, food delivery platforms and gaming and streaming providers, among others. The interventions are in keeping with Xi Jinping’s repeated emphasis on improving the wealth of society as a whole, but the regulations, with their new breadth and character, have tended to become much more unpredictable and the interventionist welfare state now seems to be fully cemented in practice. Its forward-looking risk management is keeping the direct and indirect implications for the Ethna-DYNAMISCH in check.

Foreign companies operating in China that come under the regulations are indirectly affected. Within the Ethna-DYNAMISCH, this mainly concerns U.S. games developer Activision Blizzard, which sells mobile versions of its franchises in China. However, since the China business contributes a relatively small amount to turnover, we regard this indirect risk as unproblematic at present. In the context of the overall portfolio, the Ethna-DYNAMISCH’s wide diversification across sectors, as well as the focus on the European and U.S. sales market in particular, are preventing this risk and will also do so in the future.

On the other hand, the sole portfolio stock of Chinese origin, Alibaba Group, is directly affected, and it was a negative outlier in the portfolio last month, falling almost 18%. On the one hand, what we see as a fundamental undervaluation presents the opportunity for a substantial price rise; and on the other hand, it is hard to predict how long it will take this time to rebuild trust in the Chinese capital market. Based on a position size of 1.8% of net asset value at the end of August, which is acceptable in terms of fund risk-bearing capacity, and having weighed up the risks and opportunities, we are retaining this position for the time being. Furthermore, apart from Alibaba, we have deliberately avoided building up further direct exposure to China to date. In terms of our goal to offer clients risk-controlled access to the equity markets, this approach seems to be a prudent and sensible strategy from the point of view of opportunity and risk, for the time being at least.

HESPER FUND - Global Solutions (*)

In August, equity markets in the advanced economies again overcame fears related to both the worldwide spread of the Covid-19 Delta variant and supply bottlenecks, an as a result extended their uninterrupted positive streak to nine months. Despite softening growth momentum, US equities reached new highs, thanks to solid quarterly earnings and lower Treasury yields. Jerome Powell’s dovish performance at the Jackson Hole Symposium helped the markets to close the month on a positive note. Powell reassured the markets that policy normalisation would be very gradual and clarified that the Fed is in no rush to hike interest rates. He spent much of his speech explaining the specific nature of the recent inflationary spike and pointing out that an early reversal of the policy stimulus could be particularly damaging.

Conversely, the Chinese government continued a regulatory crackdown that affected the most dynamic and valuable Chinese companies, which exacerbated the decline of the overall equity market.

The US dollar’s strength over the month did not last. Its reversal accelerated after the aforementioned dovish speech from Fed Chair Jerome Powell and it finished the month close to 1.18 against the EUR. Cryptocurrencies continued to rally, but this was not enough to lift the Bitcoin quotation above USD 50,000. Commodity prices fluctuated during the month. They dipped during the first half of the August due to growth concerns and the spread of the Covid-19 Delta variant, but most of them ended the month on a strong note.

In the US, the S&P 500 Index took the lead for the year (20.4%) with a surge of 3% for the month. The technology-weighted Nasdaq Composite regained momentum (18.4% ytd), posting a 4% increase for the month. The Dow Jones Industrial Average (DJIA) (15.5% ytd) rose 1.6%, showing that cyclical stocks are losing steam. Small caps were up 2.3%, as measured by the Russell 2000 Index (15.1% ytd), but were still 3.7% below their historic peak of mid-March 2021.

In Europe, the Euro Stoxx 50 Index (18.1% ytd) gained 2.6% (an increase of 2.2% when calculated in USD), while in the UK the FTSE 100 (10.2% ytd) edged 1.2% higher (+1.7% in USD). The Swiss Market Index (15.9% ytd) retained its momentum, rising 2.4% (+1.4% in dollar terms) over the month.

Asian markets lagged again, plagued by increasing Covid-19 cases and renewed lockdowns. The Shanghai Shenzhen CSI 300 Index decreased by 0.1% (-0.12% in USD terms). The Hang Seng Index in Hong Kong decreased by 0.3% in August. Beijing’s regulatory crackdown on fintech, ride-hail, gaming, and private education companies continued and this has spooked investors. Xi Jinping’s goal of “common prosperity”, which calls for even distribution of wealth, is being carefully – and fearfully - monitored by markets.

Despite above-target inflation, the Fed and the ECB are continuing to keep interest rates at historic lows and, for the time being, are keeping their asset purchase programmes unchanged. Although the large-scale stimulus will not last forever, and tapering is getting closer in the US, central bankers are convinced that economies still need expansionary policy support to regain a stronger footing.

The HESPER FUND – Global Solutions continues to operate under the scenario of a world recovery supported by accommodative monetary and fiscal policies and vaccination roll-outs. As we are convinced that the main central banks will follow an extremely careful and gradual path before announcing any sort of tapering or policy change, the fund continues to be exposed to risk assets.

In August, the fund maintained an equity exposure of close to 50%, (currently at 56%). Its portfolio of risk assets is complemented by high yield bonds (15%) and commodities (15%, including gold). Given the low interest rate environment, we have built up a position in investment grade bonds (7%). We tried once more to short 10-year US Treasuries, but growth concerns and a relatively dovish Fed forced us to quickly abandon the attempt. We are constantly monitoring and calibrating our exposure to the various asset classes to reflect both market sentiment and changes in the macroeconomic baseline scenario.

On the currency front, in August, the fund increased its long USD exposure up to 39%, mainly for hedging purposes. The fund maintained its long Swiss Franc exposure at almost 12%.

In August, the HESPER FUND - Global Solutions EUR T-6 rose by 1.2%. Year-to-date performance was 7.1%. Over the last 12 months, the fund has gained 7.5%. Volatility has remained stable and low at 6.6%, keeping an interesting risk/reward profile.

*The HESPER FUND – Global Solutions is currently only authorised for distribution in Germany, Luxembourg, Italy, France, and Switzerland.

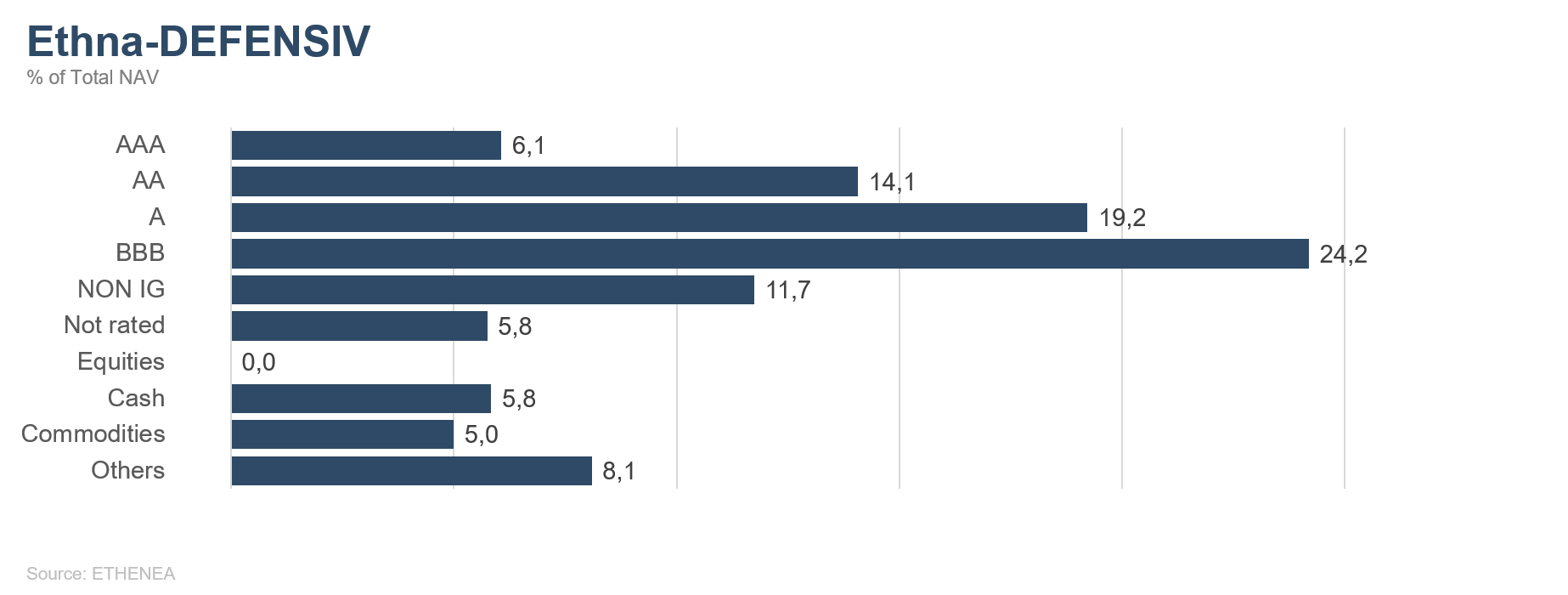

Figure 1: Portfolio structure* of the Ethna-DEFENSIV

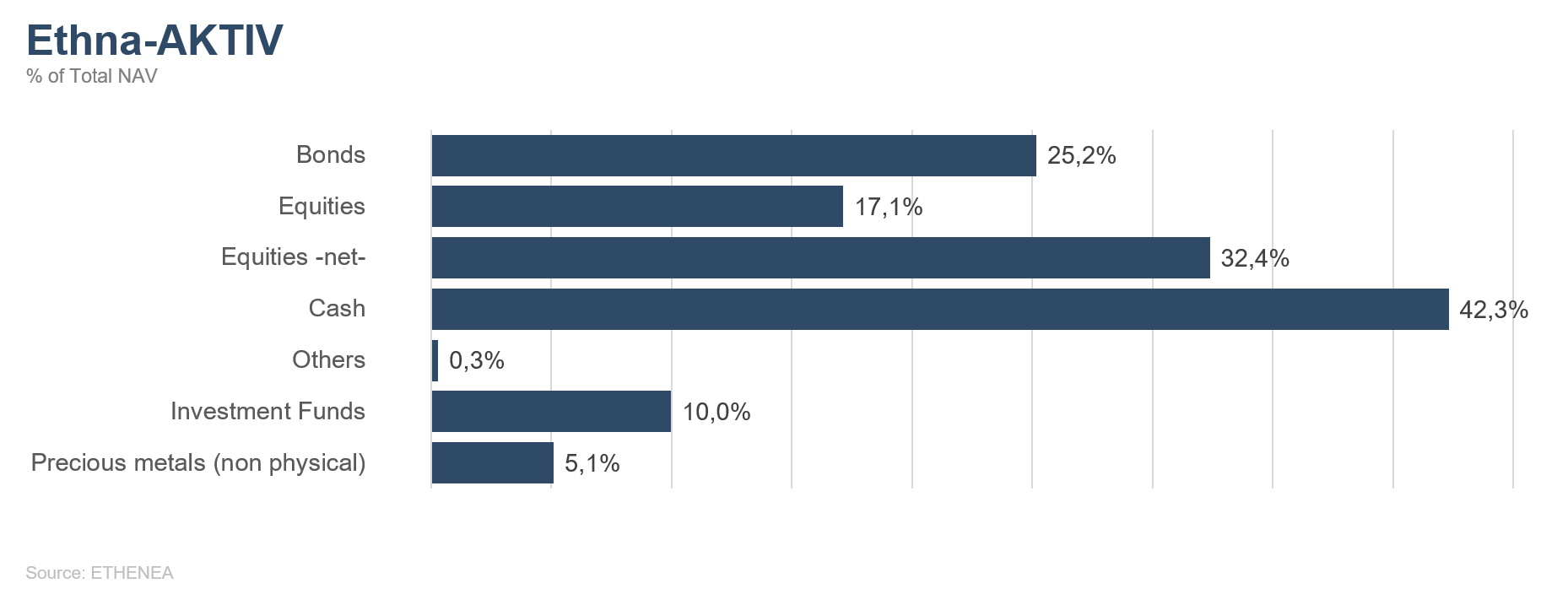

Figure 2: Portfolio structure* of the Ethna-AKTIV

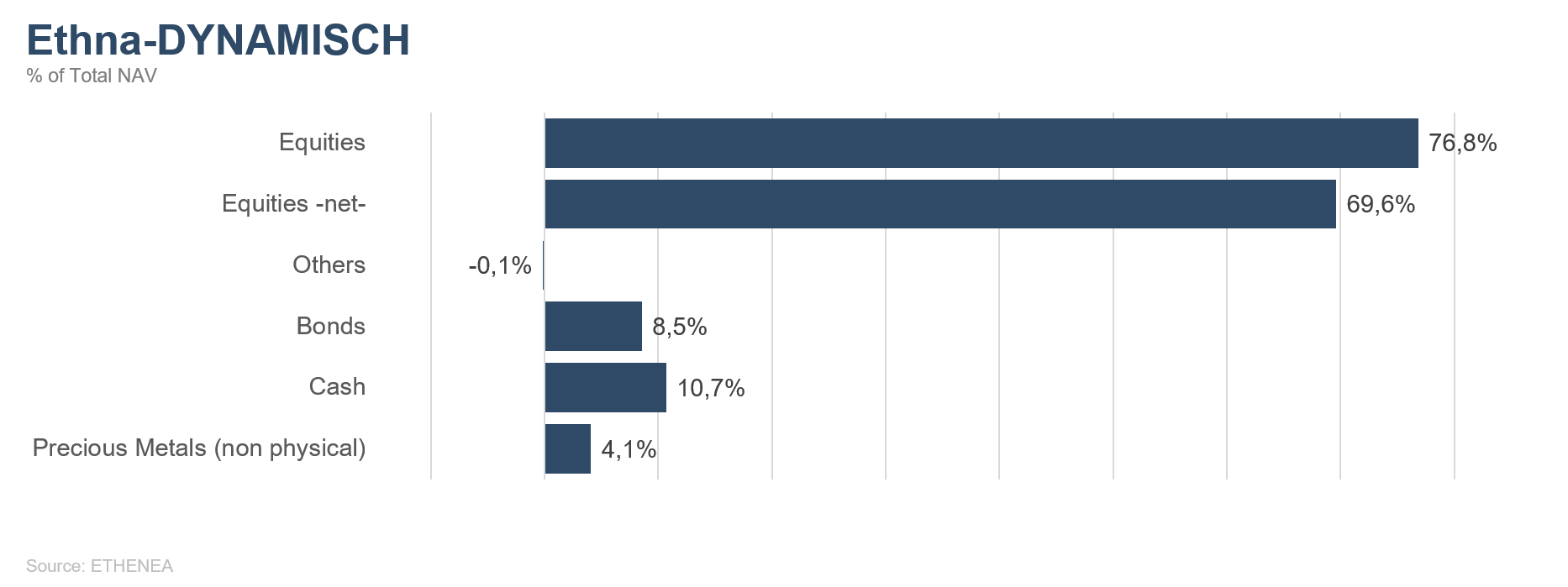

Figure 3: Portfolio structure* of the Ethna-DYNAMISCH

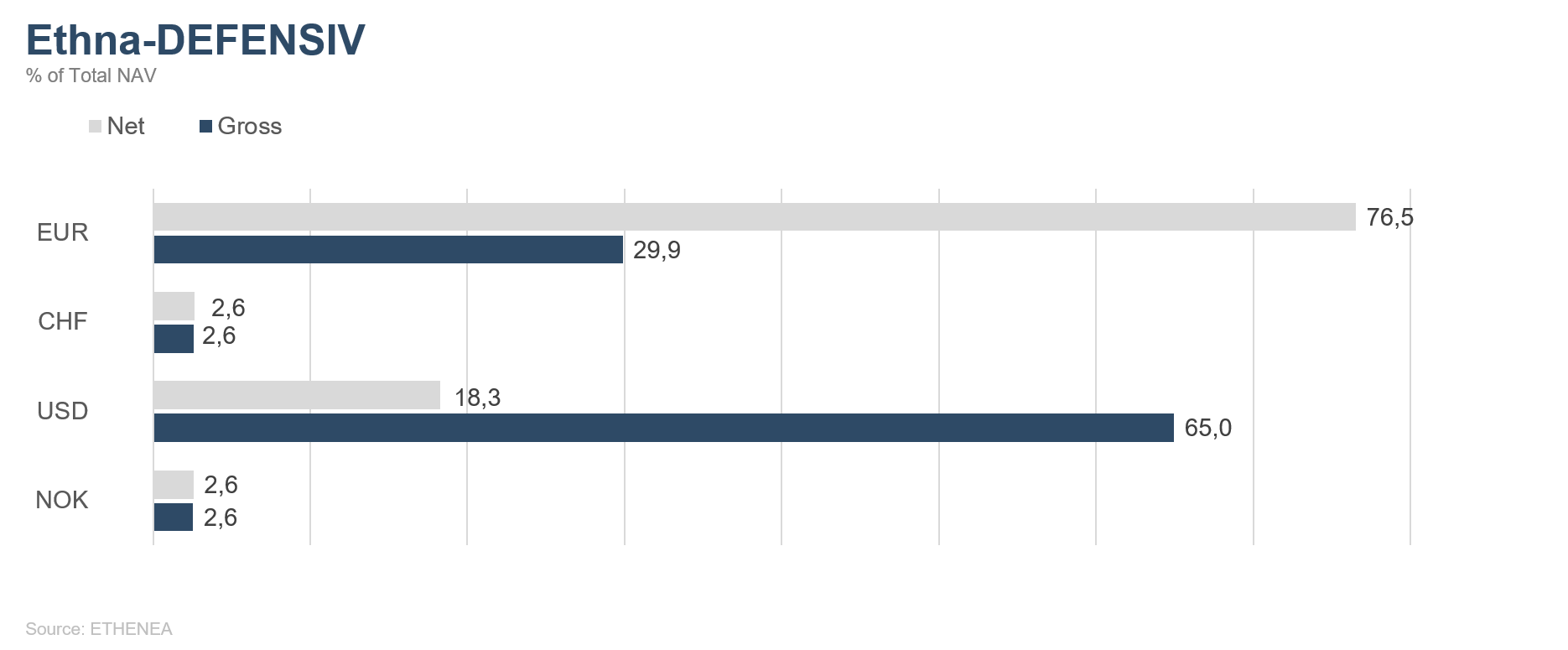

Figure 4: Portfolio composition of the Ethna-DEFENSIV by currency

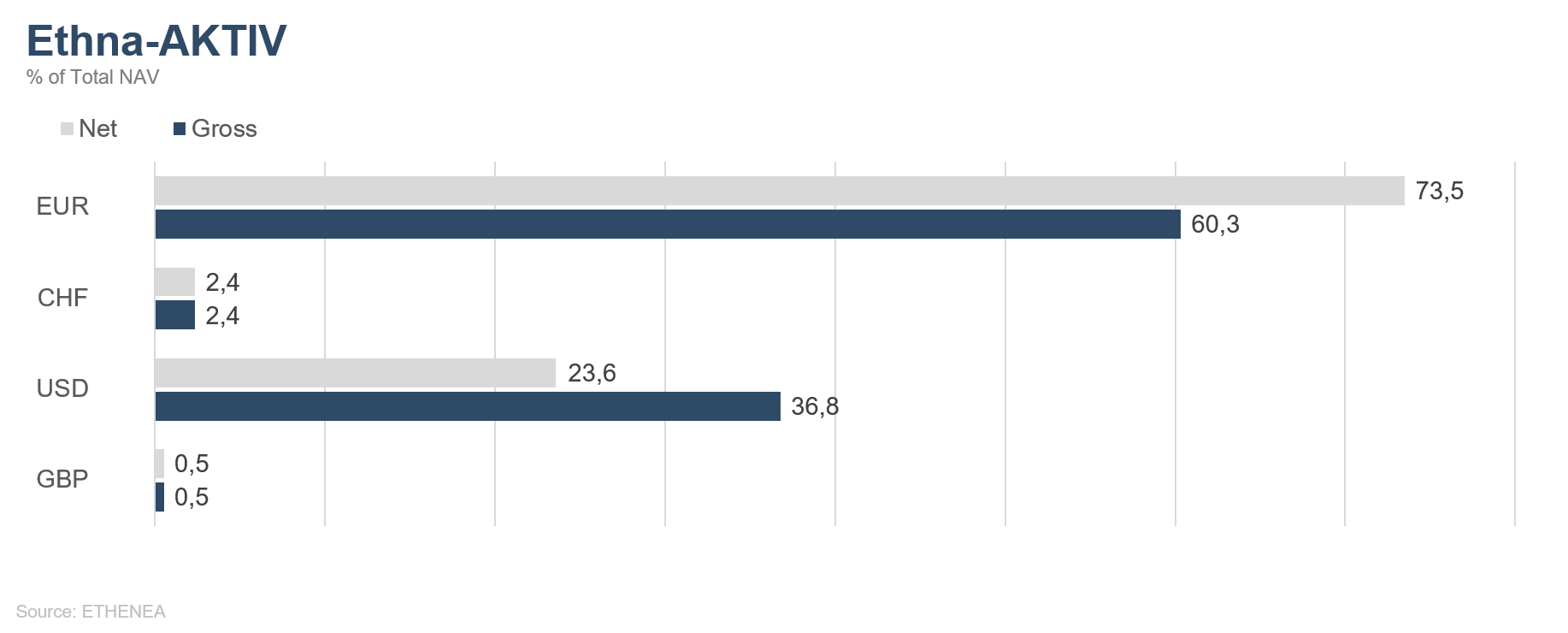

Figure 5: Portfolio composition of the Ethna-AKTIV by currency

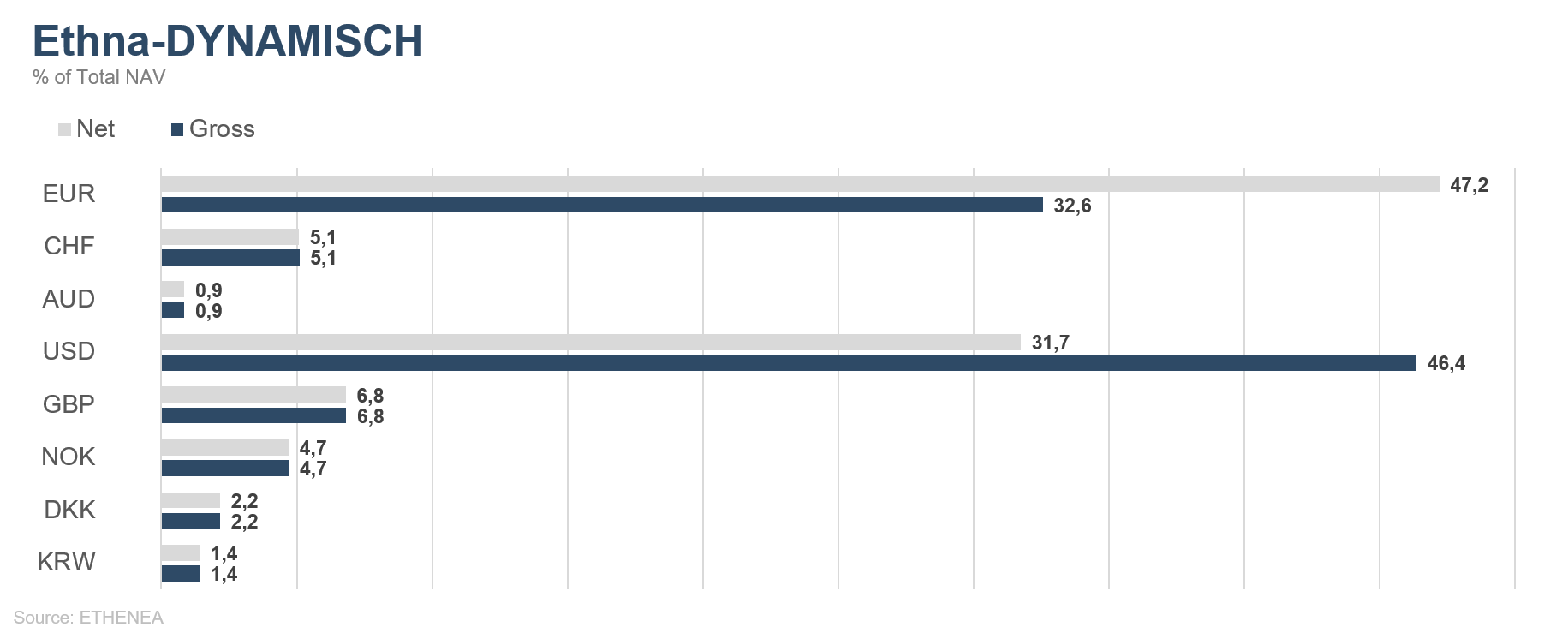

Figure 6: Portfolio composition of the Ethna-DYNAMISCH by currency

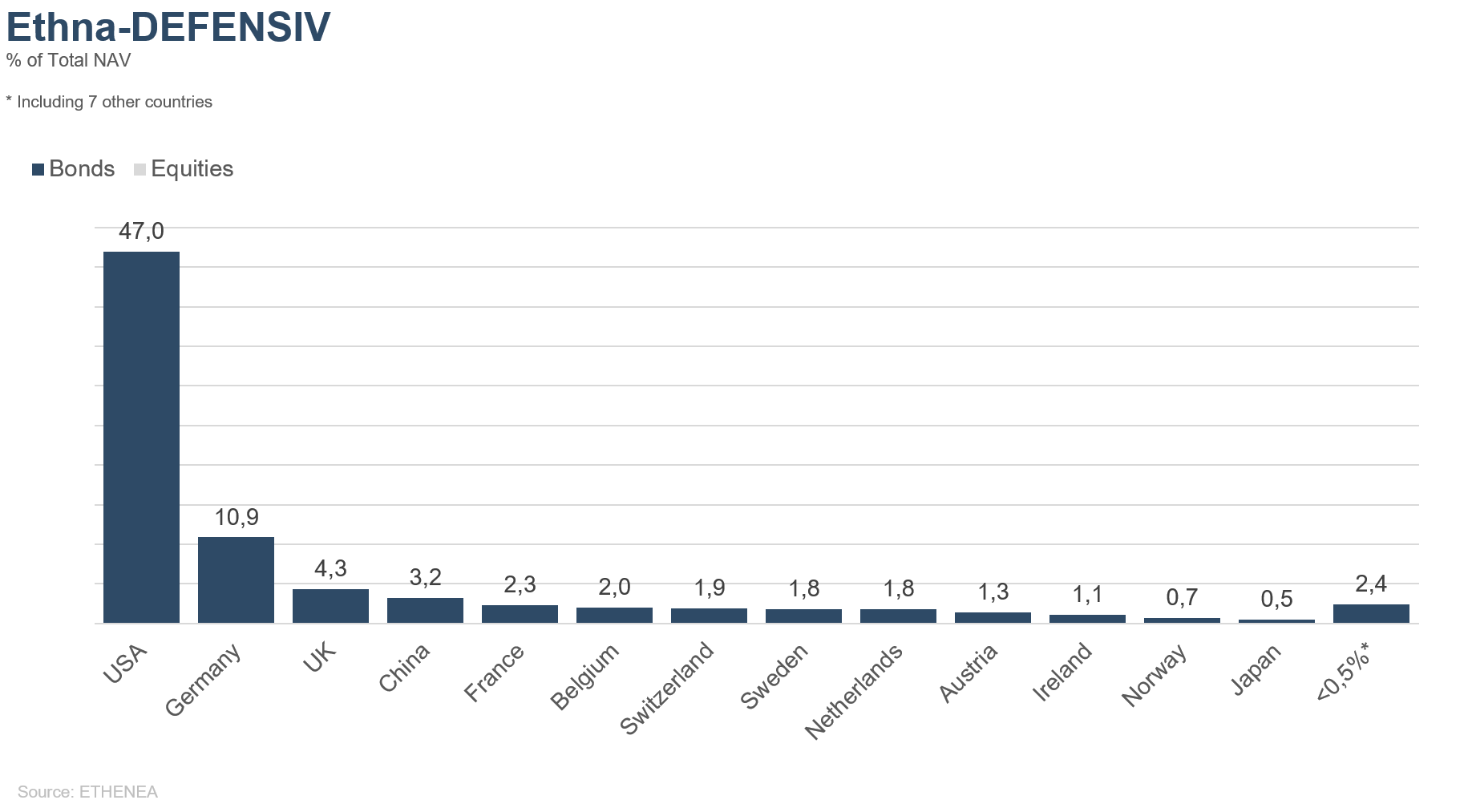

Figure 7: Portfolio composition of the Ethna-DEFENSIV by country

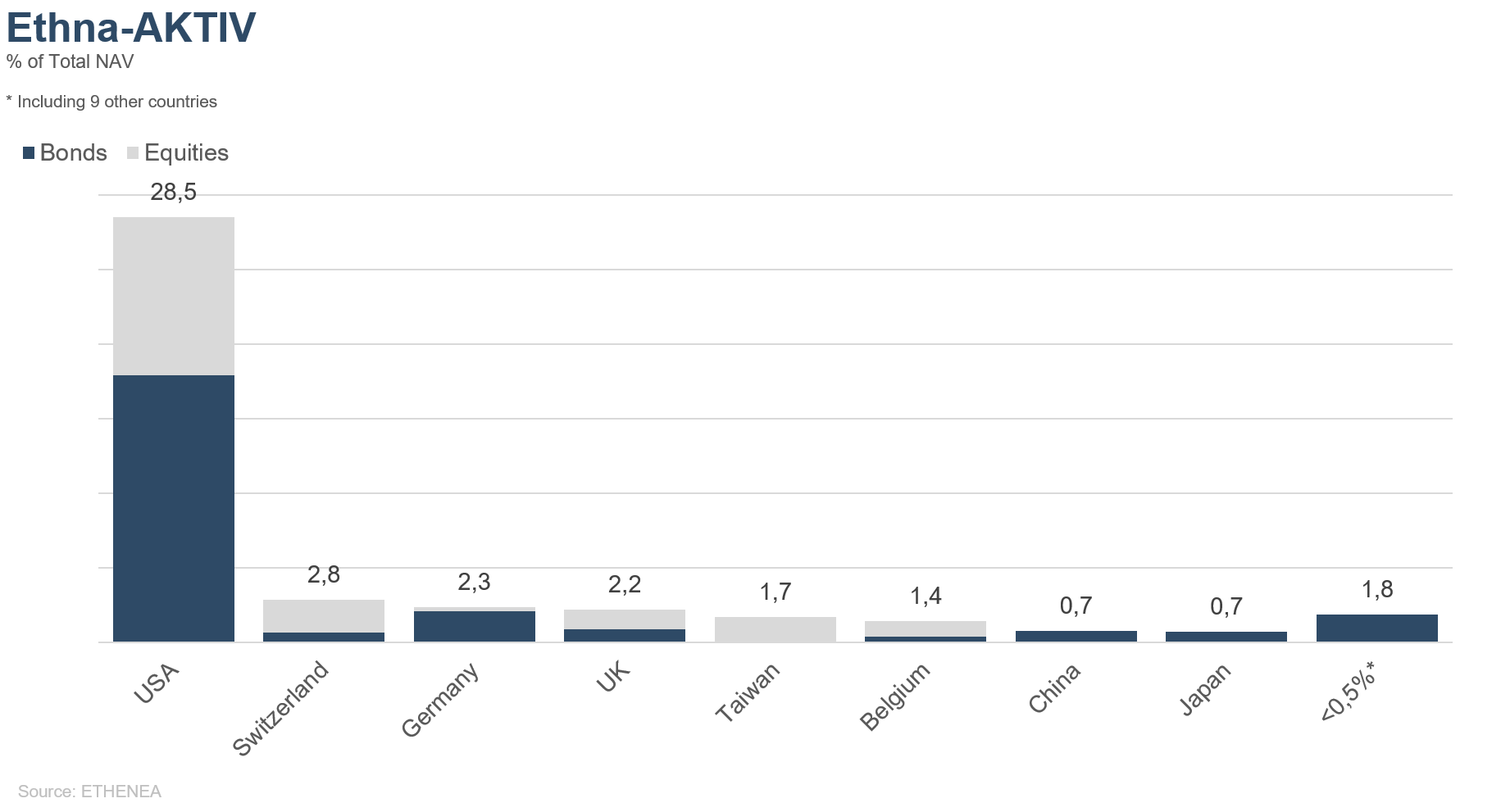

Figure 8: Portfolio composition of the Ethna-AKTIV by country

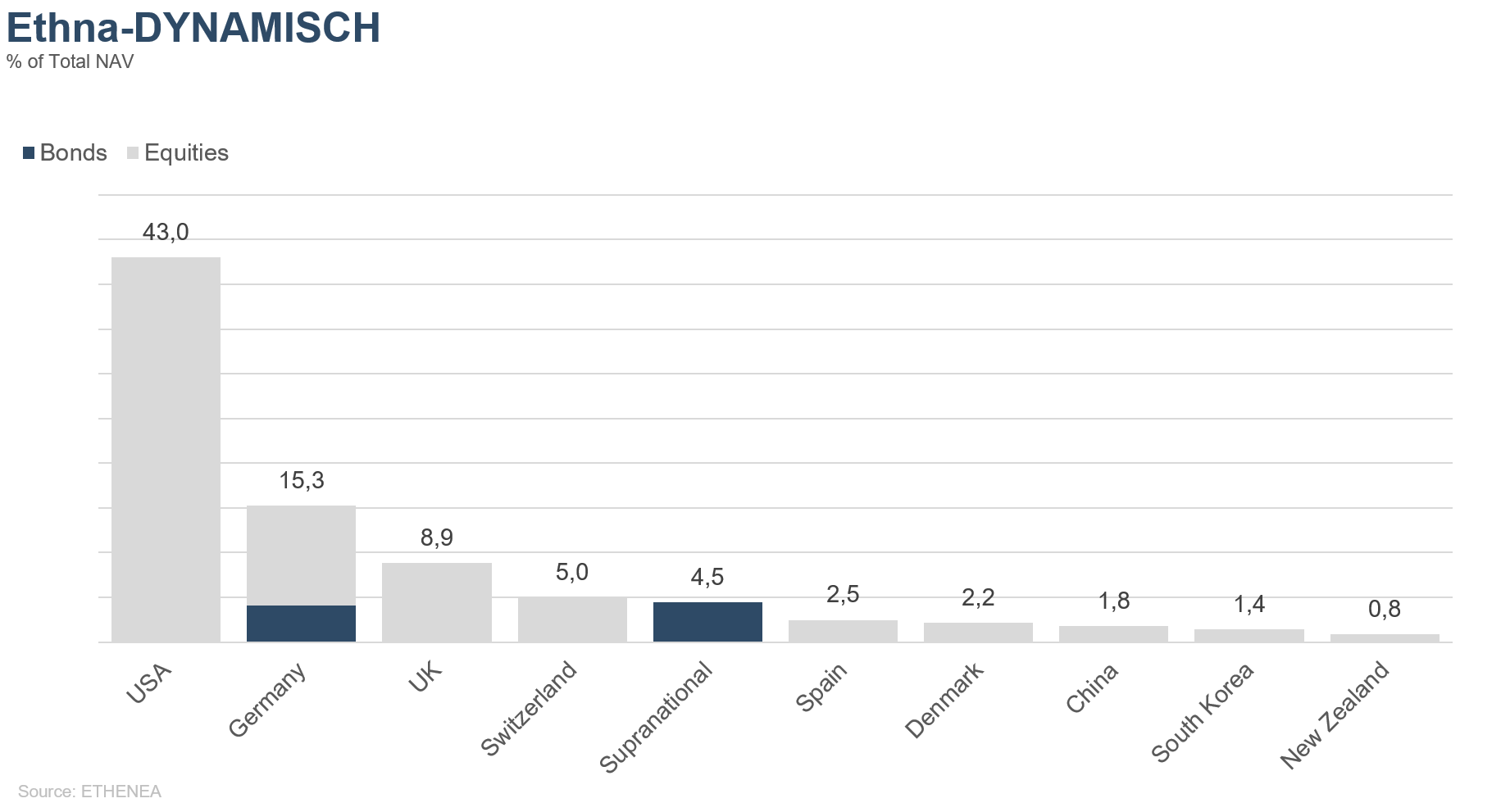

Figure 9: Portfolio composition of the Ethna-DYNAMISCH by country

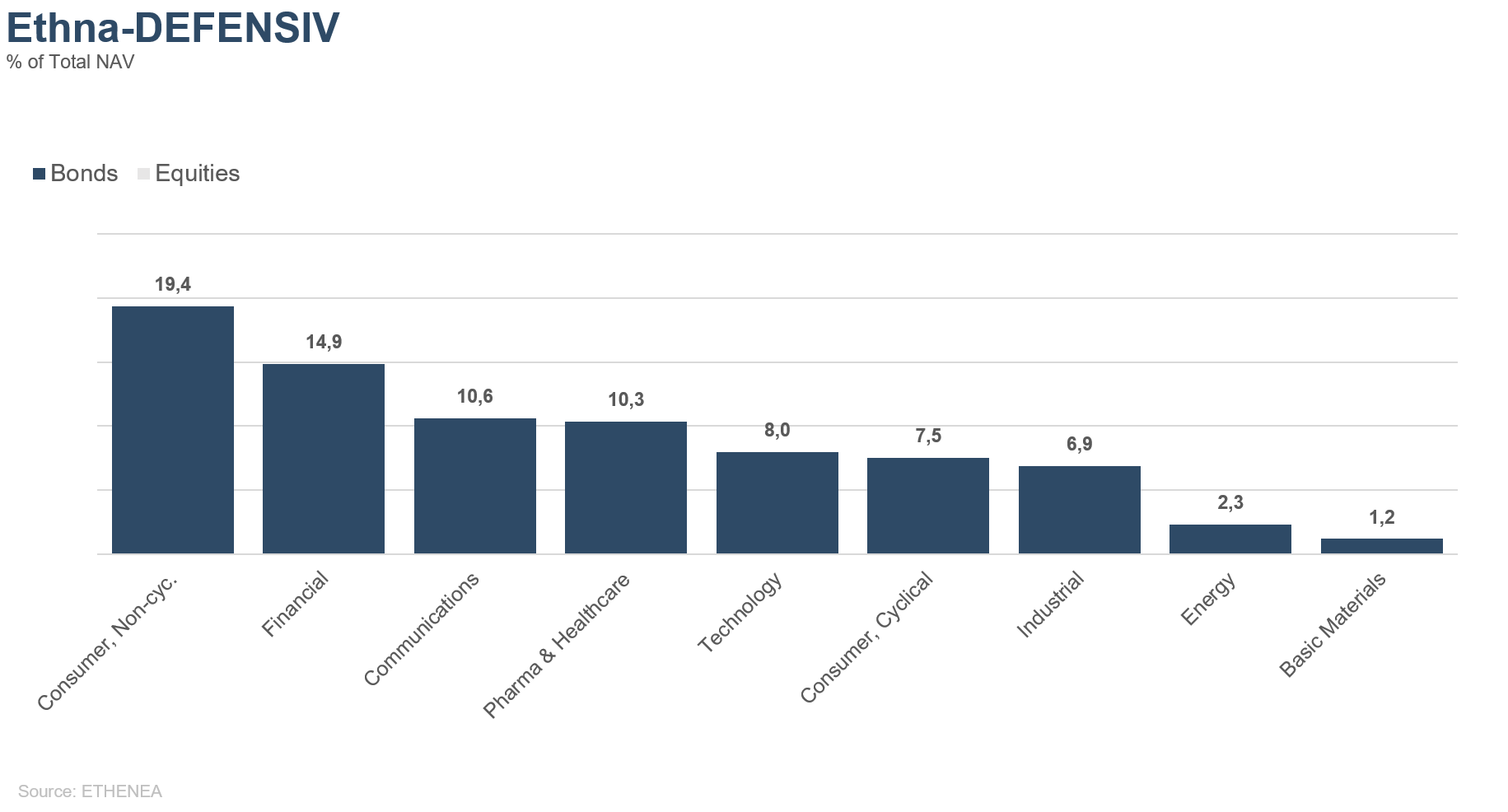

Figure 10: Portfolio composition of the Ethna-DEFENSIV by issuer sector

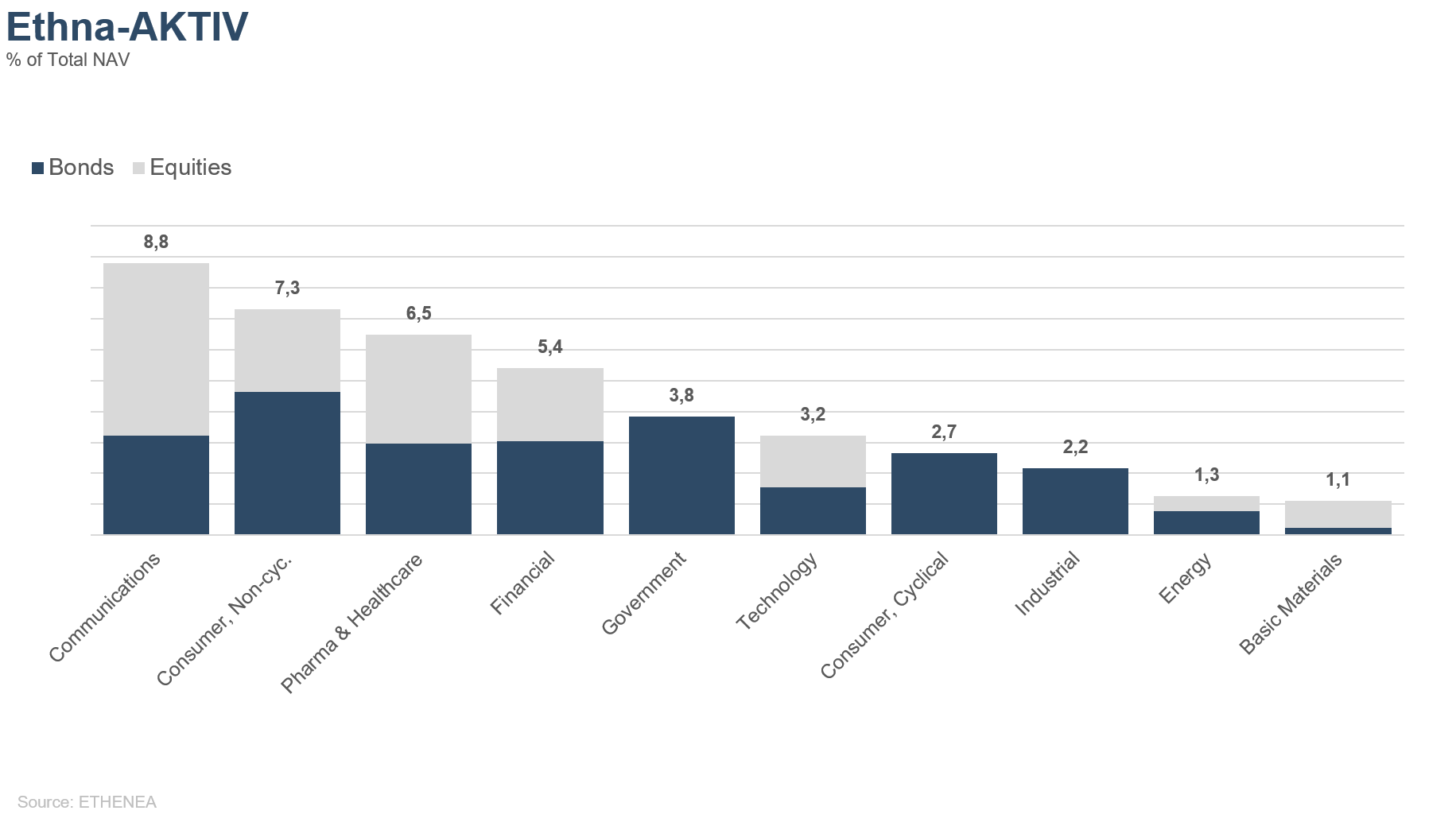

Figure 11: Portfolio composition of the Ethna-AKTIV by issuer sector

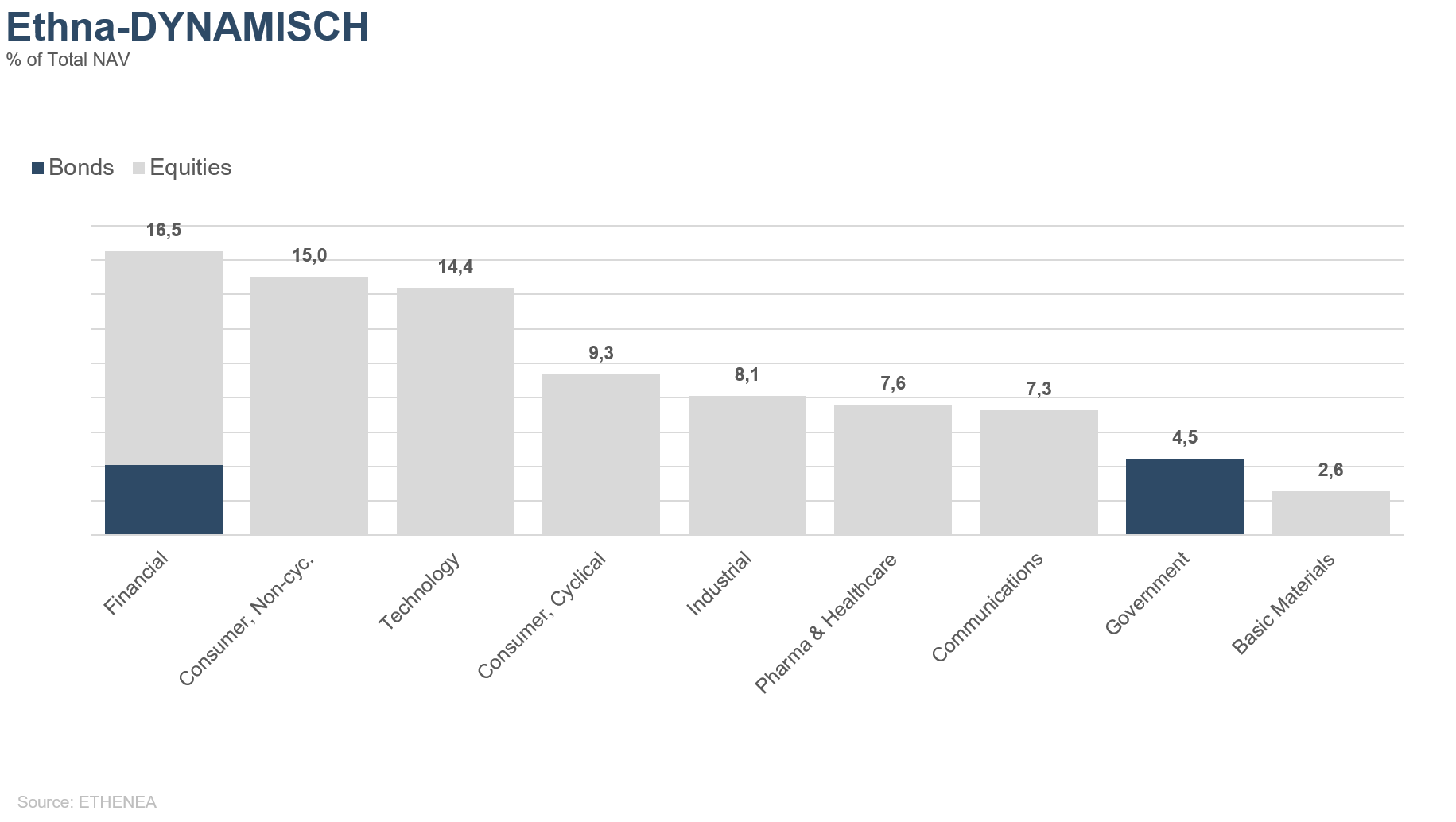

Figure 12: Portfolio composition of the Ethna-DYNAMISCH by issuer sector

* “Cash” comprises term deposits, call money and current accounts/other accounts. “Equities net” comprises direct investments and exposure resulting from equity derivatives.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

Dit is een marketing communicatie. Het is uitsluitend bedoeld om productinformatie te verstrekken en is geen verplicht wettelijk of regelgevend document. De informatie in dit document vormt geen verzoek, aanbod of aanbeveling om participaties in het fonds te kopen, te verkopen of om enige andere transactie aan te gaan. Het is uitsluitend bedoeld om de lezer inzicht te geven in de belangrijkste kenmerken van het fonds, zoals het beleggingsproces, en wordt noch geheel noch gedeeltelijk beschouwd als een beleggingsaanbeveling. De verstrekte informatie is geen vervanging voor de eigen overwegingen van de lezer of voor enige andere juridische, fiscale of financiële informatie en advies. Noch de beleggingsmaatschappij, noch haar werknemers of bestuurders kunnen aansprakelijk worden gesteld voor verliezen die rechtsreeks of onrechtstreeks worden geleden door het gebruik van de inhoud van dit document of in enig ander verband met dit document. De verkoopdocumenten in het Duits die op dit moment geldig zijn (verkoopprospectus, essentiële-informatiedocumenten (PRIIPs-KIDs) en de halfjaar- en jaarverslagen), die gedetailleerde informatie geven over de aankoop van participaties in het fonds en de bijbehorende kansen en risico's, vormen de enige wettelijke basis voor de aankoop van participaties. De bovengenoemde verkoopdocumenten in het Duits (evenals in onofficiële vertalingen in andere talen) zijn te vinden op www.ethenea.com en zijn naast de beleggingsmaatschappij ETHENEA Independent Investors S.A. en de depothoudende bank, ook gratis verkrijgbaar bij de respectieve nationale betaal- of informatieagenten en van de vertegenwoordiger in Zwitserland. De betaal- of informatieagenten voor de fondsen Ethna-AKTIV, Ethna-DEFENSIV en Ethna-DYNAMISCH zijn de volgende: België, Duitsland, Liechtenstein, Luxemburg, Oostenrijk: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxemburg; Frankrijk: CACEIS Bank France, 1-3 place Valhubert, F-75013 Paris; Italië: State Street Bank International – Succursale Italia, Via Ferrante Aporti, 10, IT-20125 Milano; Société Génerale Securities Services, Via Benigno Crespi, 19/A - MAC 2, IT-20123 Milano; Banca Sella Holding S.p.A., Piazza Gaudenzio Sella 1, IT-13900 Biella; Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Spanje: ALLFUNDS BANK, S.A., C/ Estafeta, 6 (la Moraleja), Edificio 3 – Complejo Plaza de la Fuente, ES-28109 Alcobendas (Madrid); Zwitserland: Vertegenwoordiger: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Betaalagent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. De betaal- of informatieagenten voor HESPER FUND, SICAV - Global Solutions zijn de volgende: België, Duitsland, Frankrijk, Luxemburg, Oostenrijk: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxemburg; Italië: Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Zwitserland: Vertegenwoordiger: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Betaalagent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. De beleggingsmaatschappij kan bestaande distributieovereenkomsten met derden beëindigen of distributievergunningen intrekken om strategische of statutaire redenen, mits inachtneming van eventuele deadlines. Beleggers kunnen informatie over hun rechten verkrijgen op de website www.ethenea.com en in de verkoopprospectus. De informatie is zowel in het Duits als in het Engels beschikbaar, en in individuele gevallen ook in andere talen. Opgemaakt door: ETHENEA Independent Investors S.A. Het is verboden om dit document te verspreiden aan personen die wonen in landen waar het fonds geen vergunning heeft of waar er een toestemming vereist is voor verspreiding. Participaties mogen enkel aangeboden worden aan personen in landen waarin dit aanbod in overeenstemming is met de toepasselijke wettelijke bepalingen en waar ervoor wordt gezorgd dat de verspreiding en publicatie van dit document, evenals een aanbod of verkoop van participaties, aan geen enkele beperking is onderworpen in het betreffende rechtsgebied. Het fonds wordt met name niet aangeboden in de Verenigde Staten van Amerika of aan Amerikaanse burgers (volgens Rule 902 of Regulation S of the U.S. Securities Act of 1933, in de huidige versie) of personen die namens hen, in hun rekening of ten voordele van een Amerikaanse burger handelen. Resultaten die in het verleden behaald zijn, mogen niet worden opgevat als indicatie of garantie voor toekomstige prestaties. Schommelingen in de waarde van onderliggende financiële instrumenten of hun rendementen, evenals veranderingen in rentetarieven en valutakoersen, zorgen ervoor dat de waarde van participaties in een fonds, evenals de daaruit voortvloeiende rendementen, zowel kunnen dalen als stijgen en zijn niet gegarandeerd. De waarderingen die hierin opgenomen zijn, zijn gebaseerd op een aantal factoren, waaronder, maar niet beperkt tot, huidige prijzen, schattingen van de waarde van de onderliggende activa en marktliquiditeit, evenals andere veronderstellingen en openbaar beschikbare informatie. In principe kunnen prijzen, waarden en rendementen zowel stijgen als dalen, tot en met het totale verlies van het geïnvesteerde kapitaal, en aannames en informatie kunnen zonder voorafgaande kennisgeving worden gewijzigd. De waarde van het belegde vermogen of de prijs van participaties, evenals de daaruit voortvloeiende rendementen en uitkeringsbedragen, zijn onderhevig aan schommelingen of kunnen geheel verdwijnen. Positieve prestaties in het verleden zijn daarom geen garantie voor positieve prestaties in de toekomst. Met name het behoud van het geïnvesteerde vermogen kan niet worden gegarandeerd; er is dan ook geen garantie dat de waarde van het belegde kapitaal of de aangehouden participaties bij verkoop of terugkoop zal overeenkomen met het oorspronkelijk belegde kapitaal. Beleggingen in vreemde valuta zijn onderhevig aan bijkomende wisselkoersschommelingen of valutarisico's, d.w.z. het rendement van dergelijke beleggingen hangt ook af van de volatiliteit van de vreemde valuta, wat een negatieve impact kan hebben op de waarde van het belegde kapitaal. Beleggingen en toewijzingen kunnen gewijzigd worden. De beheer- en depotvergoedingen, evenals alle andere kosten die overeenkomstig de contractuele bepalingen ten laste van het fonds zijn, worden in de berekening opgenomen. De prestatieberekening is gebaseerd op de BVI-methode (Duitse Federale Vereniging voor Beleggings- en Vermogensbeheer), dat wil zeggen dat uitgiftekosten, transactiekosten (zoals order- en makelaarskosten), evenals bewaar- en andere beheervergoedingen niet inbegrepen zijn in de berekening. Het beleggingsrendement zou lager zijn indien rekening zou worden gehouden met de uitgiftetoeslag. Er kan geen garantie worden gegeven dat de marktprognoses gehaald worden. Om het even welke risicobehandeling in deze publicatie mag niet worden beschouwd als een onthulling van alle risico's of een sluitende behandeling van de genoemde risico's. In de verkoopprospectus wordt expliciet verwezen naar de gedetailleerde risicobeschrijvingen. Er kan geen garantie worden gegeven dat de informatie juist, volledig of actueel is. De inhoud en de informatie zijn auteursrechtelijk beschermd. Er kan geen garantie worden gegeven dat het document voldoet aan alle wettelijke of regelgevende vereisten die andere landen dan Luxemburg hebben vastgesteld. Opmerking: De belangrijkste technische termen kunnen worden gevonden in de woordenlijst op www.ethenea.com/lexicon. Informatie voor beleggers in België: Het prospectus, de statuten en de periodieke verslagen, alsmede de essentiële-informatiedocumenten (PRIIPs-KIDs), zijn kosteloos verkrijgbaar in het Frans bij de beheermaatschappij, ETHENEA Independent Investors S.A., 16, rue Gabriel Lippmann, 5365 Munsbach, Luxemburg en bij de vertegenwoordiger: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxemburg. Informatie voor beleggers in Zwitserland: Het vestigingsland van de collectieve beleggingsregeling is Luxemburg. De vertegenwoordiger in Zwitserland is IPConcept (Schweiz) AG, Münsterhof 12, P.O. Box, CH-8022 Zürich. De betaalagent in Zwitserland is DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zurich. Het prospectus, de essentiële-informatiedocumenten (PRIIPs-KIDs) en de statuten, evenals de jaar- en halfjaarverslagen zijn kosteloos verkrijgbaar bij de vertegenwoordiger. Copyright © ETHENEA Independent Investors S.A. (2024) Alle rechten voorbehouden. 02-09-2021