Portefeuillebeheerder update

Ethna-DEFENSIV

Key points at a glance

- Fed and ECB expected to start cutting interest rates in June 2024

- Normalisation of yield curves not expected until interest rate cuts go ahead

- Positioning: Percentage of floating rate bonds raised to 20%, portfolio continues to hold short positions in futures on 10-year US Treasuries

- Very strong performance in March

31 March 2024 - In March, investors again waited expectantly for decisions from central banks. While the ECB and the Fed did not change key rates, the Swiss SNB pressed ahead and made its first cut, bringing interest rates back down to 1.5%. This was somewhat unexpected, but is not surprising given inflation rates in Switzerland and the SNB predicting average inflation of 1.4% in 2024, 1.2% in 2025 and 1.1% in 2026.

Leading ECB central bankers have held out the prospect of a first rate cut in June 2024. The Fed is also getting close to making its first rate cut. We share the expectation that a rate cut will come in the eurozone and in the U.S. However, we have little confidence that further rate cuts will follow in 2024. In neither economic area has inflation met the critical mark of 2%. Wage pressure remains high on both sides of the Atlantic but is falling. On the one hand, components such as rents and the prices of services are propping up inflation. On the other hand, components such as energy and the prices of goods have been falling for some time now. Overly steep interest rate cuts could give the economy a strong boost, the consequence being that price pressure would be felt by the very components of the market basket that have of late brought inflation down.

What does this mean for the yields of longer-dated sovereign and corporate bonds? The yield curves of German and U.S. sovereign bonds have inverted since November 2022 and July 2022. For investors this means a lower yield for longer residual maturities. This situation is unusual. We expect that this will not be resolved until cuts by the central bank go ahead. Therefore, it may take a bit longer before yield curves fully return to normal, if our prediction that central banks will proceed slowly on interest rate cuts is accurate.

We raised our percentage of floating-rate bonds to 20% in order to maximise interest income. The Ethna-DEFENSIV continues to hold short positions in futures on 10-year U.S. Treasuries, as we expect the slight rises in the yields to continue. Overall, the Ethna-DEFENSIV was able to benefit from the slight falls in EUR yields and the solid interest income in March, and close the month with a very positive performance (T class). The yields on 10-year U.S. Treasuries ended the month virtually unchanged, so our futures position did not detract from performance.

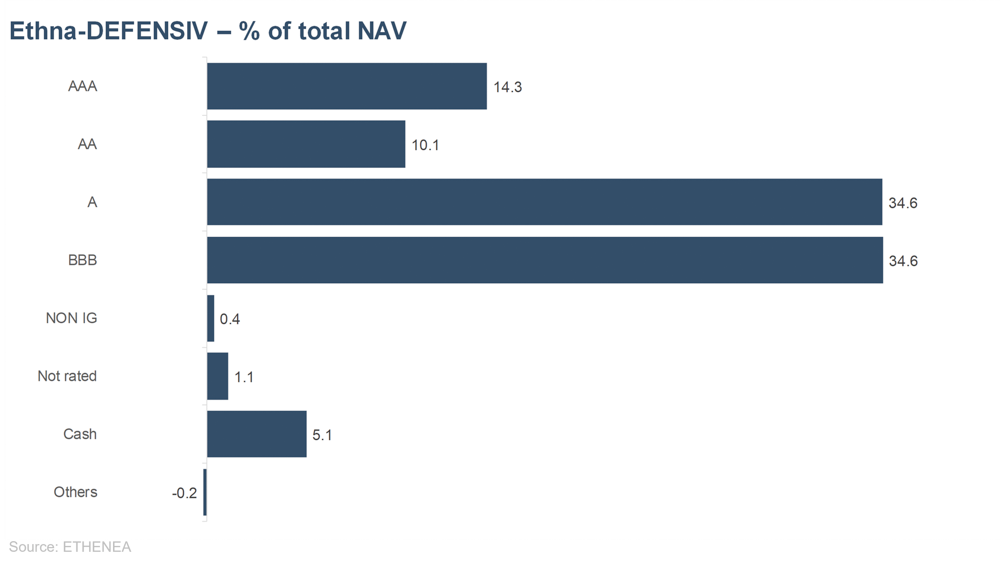

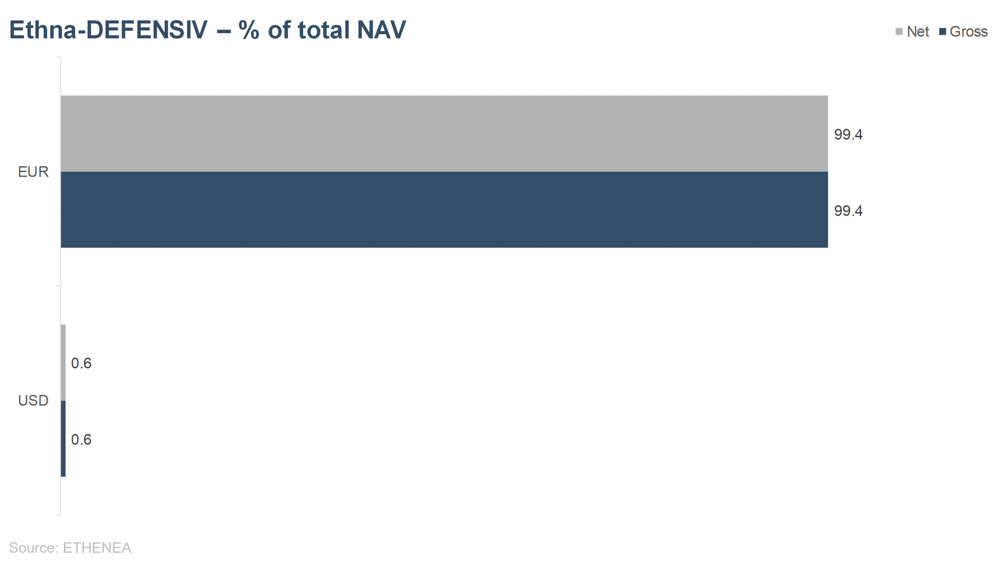

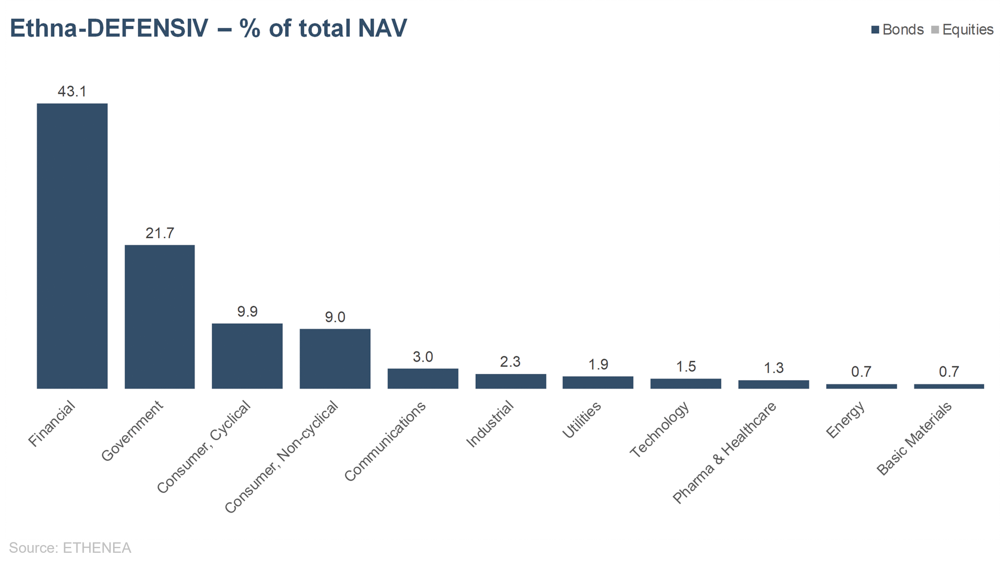

Fund positioning

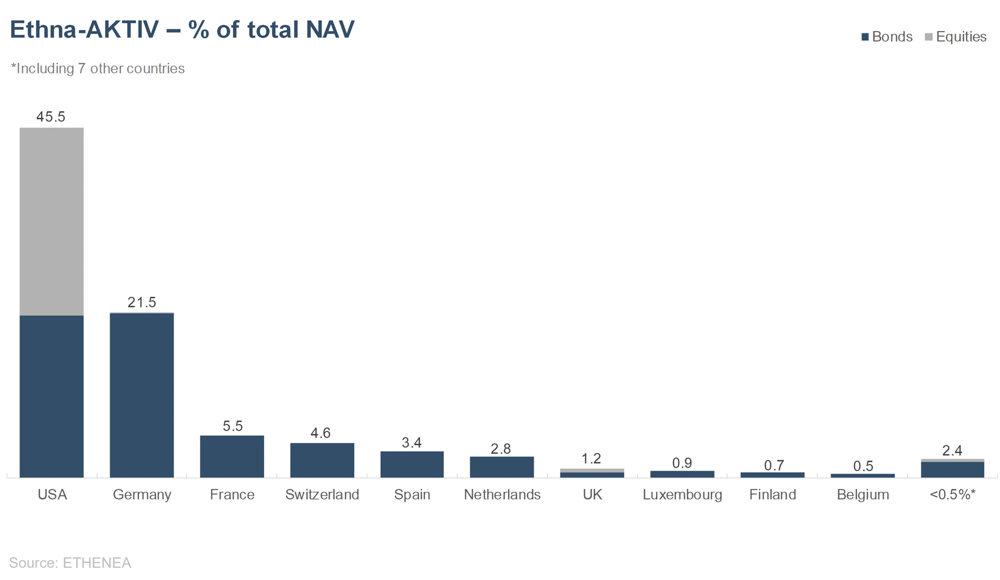

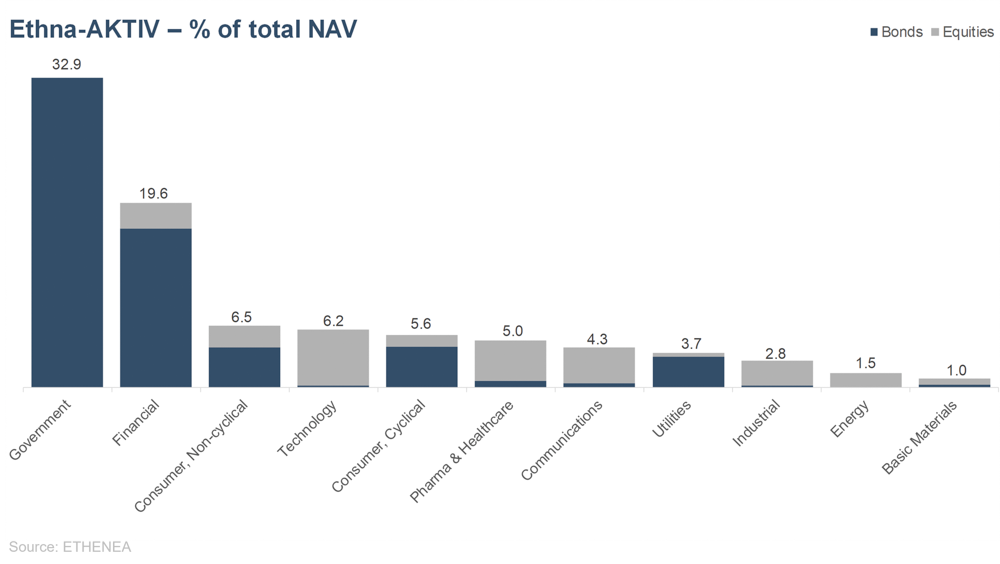

Ethna-AKTIV

Key points at a glance

- Portfolio remains geared towards an environment of moderate growth, falling but stubborn inflation and a rising stock market trend.

- At 30%, the equity component is in neutral territory, and is exclusively invested in U.S. large caps

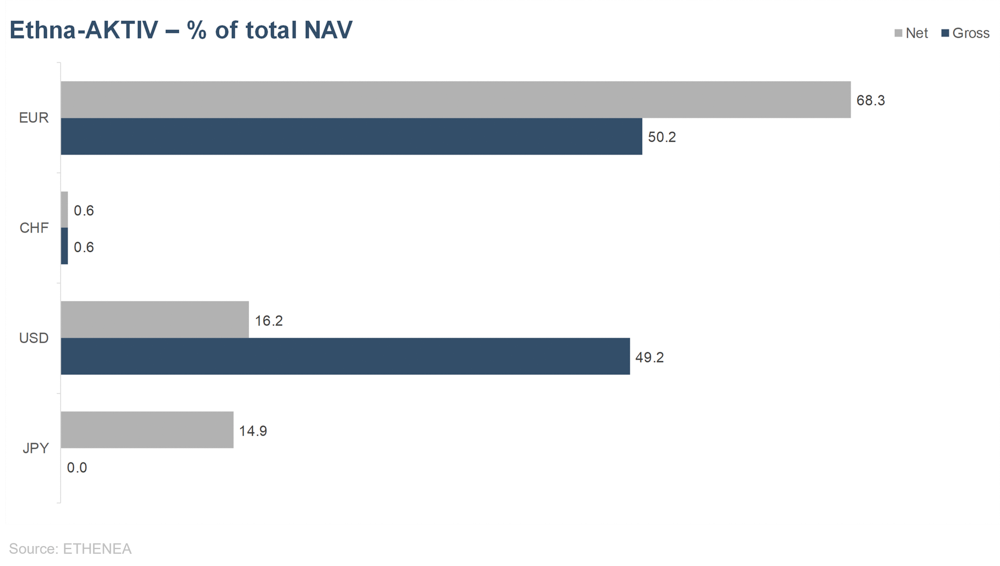

- High quality and short maturities continue to characterise the bond portfolio. Modified duration was dialled back down to 0.6.

- We opened an initial 15% position in the Japanese yen.

31 March 2024 - While reviewing the month of March, we noticed that the same themes arose as the previous month. There is no news in relation to the central bank meetings. Nor is there anything on the macro front to change our narrative of moderate growth and persistent inflation. We are in between earnings seasons. For the S&P500, for example, we still expect slightly higher than 10% earnings growth for this year. With margins again at record levels, the expectation for next year is in fact approx. 15%, leading to a risk-on environment on all fronts. Equities are rising, as well as bonds, and gold continues to rise. We are seeing all-time highs everywhere we look, not to mention the soaring cryptomarket on the back of institutional investment. The exuberance of market participants in this regard is the only thing we believe cannot build up much more. This urges us at least to exercise some caution. However, this does not mean that the current rally is about to end abruptly. On the contrary; such trend markets tend to last longer than the bears like. Especially since market breadth is increasing and sentiment works as a better contraindicator in market lows than market highs. However, we shouldn’t chase new highs by maxing out allocations. The Ethna-AKTIV has therefore returned to its neutral equity allocation of 30%, the entirety of which is invested in S&P500 stocks. We continue to stick by our disinvestment of Magnificent Seven stocks, completed in February. We are of the opinion that the winners in the past twelve months will not be the price drivers in the future. The bond portfolio is similarly stability and has changed little. We took advantage of the slight fall in the longer-term U.S. interest rate over the course of the month to reduce portfolio interest-rate sensitivity once again. Modified duration has been reduced from 2 to 0.6 by the overlay. Even though, by making a first rate cut, the Swiss National Bank (SNB) has opened the door for other Western central banks to follow suit, we do not think there will be all that many cuts for the time being and we are confident of further rises at the long end of the yield curve. On the currency front, we kept the USD exposure constant. In addition, we opened an initial 15% position in the Japanese yen mid-month. Both the fact that the yen is now massively undervalued and the Bank of Japan’s (BoJ) active communication that it will intervene and move away from the zero-interest policy and yield curve control are the main tenets of our theory on this. However, a much greater factor in the interest rate differential – which is so key to the currency pairs – is the interest rate moves the ECB makes. Thus, the arguments for a weak yen are getting fewer.

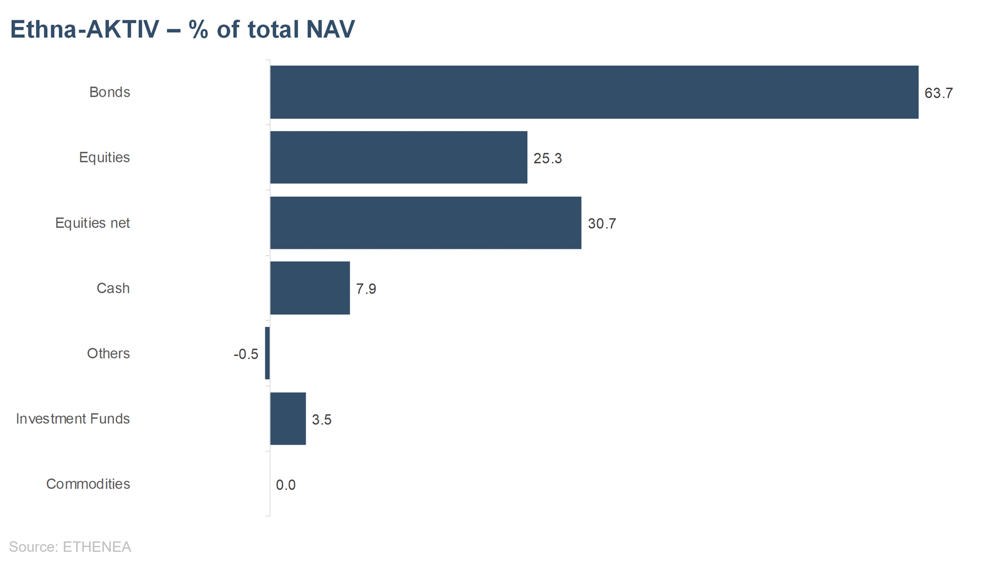

Fund positioning

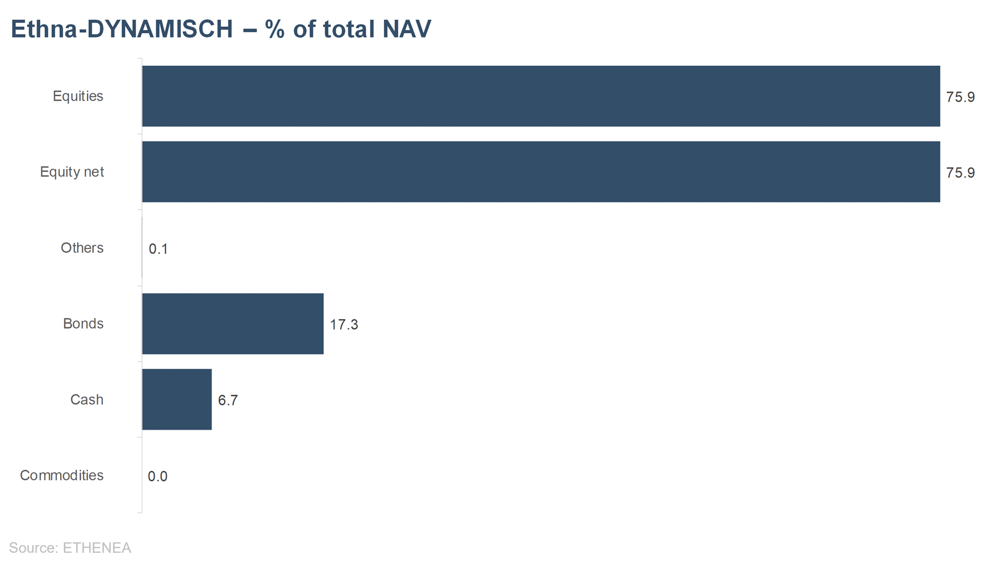

Ethna-DYNAMISCH

Key points at a glance

- The positive momentum seen in equity markets in recent months continued.

- Looking ahead, our view of the market remains constructive, on the basis of robust fundamentals and fair valuations.

- We are responding to rotations below the surface by making smaller adjustments to individual portfolio weights.

- Our in-depth analysis of Japanese equities culminated in a position in the Japanese yen.

31 March 2024 - The fundamental starting situation has not changed much; on the whole, we still consider it constructive, without too much exuberance. Perhaps it is precisely the absence of this exuberance that in March again contributed to the further steady rise of equity markets. We are also very closely following the valuation of the overall market in these weeks, in addition to the sentiment of market participants. While very attractive opportunities have become increasingly rare as prices have increased, on the whole, equity market valuations remain fair. In our opinion, there are still some excesses to be seen, but these remain very localised and, above all, they are being viewed by the majority of investors for what they are – excesses – and are therefore being avoided. At the same time, economic leading indicators are improving both in the U.S. (e.g. the ISM Manufacturing Index is expanding again for the first time since October 2022) and in Europe (e.g. the expectations surveyed as part of the German ifo Business Climate Index are much better than in previous months). This growing momentum is likely to produce correspondingly positive economic development.

For the portfolio, the environment described means comparatively little movement. We have kept the equity allocation relatively constant around 75%. Similar to the market, there is lots going on at the moment in the form of rotations below the surface, albeit not particularly pronounced either in the market or in the portfolio. First and foremost, we have reduced the size of a number of positions that have done particularly well of late and consequently are no longer as attractive as they were a few months ago. We reinvested the proceeds in other portfolio positions that became more attractive in the meantime. We reduced, for example, the size of the portfolio positions Inditex, ResMed, Salesforce, Visa and Vontier. In particular, we further built up General Mills, Medtronic and Unilever.

We have also been looking more closely at Japan for quite some time now. There is a number of valid reasons to support various investment ideas for the Japanese equity market. In analysing potential equity investments in Japan, however, we mostly came to the conclusion that the predominant factor affecting Japanese equities is the currency, which has been very weak to date. Consequently, we have been reluctant to open positions in Japanese equities. Meanwhile, the currency itself inevitably attracted our attention. The weakness in the Japanese yen (JPY) has so far been moving in step with the yield and interest rate differential between it and the USD or EUR, but has recently started widening to a disproportionate extent. Since the BoJ raised interest rates in March for the first time in 17 years while the Fed and ECB stuck to the prospect of interest rate cuts in summer, and the JPY also faced record-high short positions, we saw a very attractive opportunity to take a position in the yen. This was executed by way of currency derivatives on a scale of around 10% of the fund at prices just shy of 165 in the EUR-JPY currency pair. Against this backdrop, we see enormous upside potential for the yen in the short- to medium-term, while the risks should be limited by potential currency intervention by Japan.

On the whole, we thus consider the Ethna-DYNAMISCH still to be well equipped to take advantage of market opportunities accordingly.

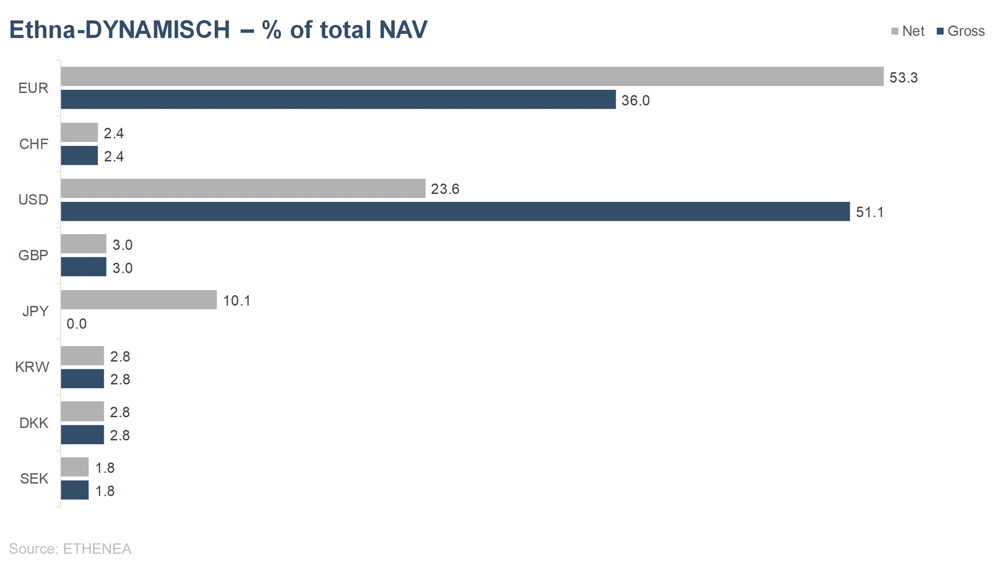

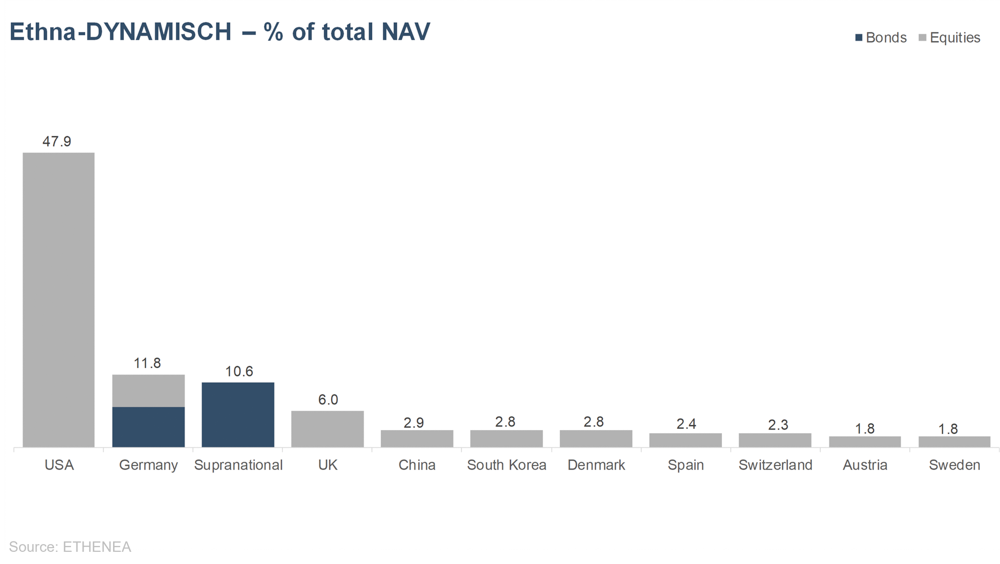

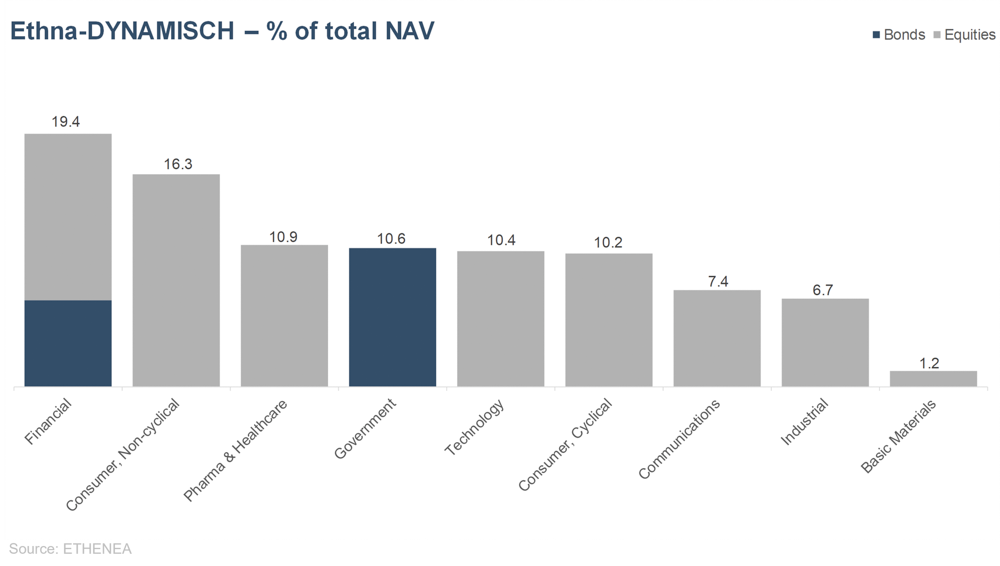

Fund positioning

* “Cash” comprises term deposits, call money and current accounts/other accounts. “Equities net” comprises direct investments and exposure resulting from equity derivatives.

HESPER FUND – Global Solutions (*)

The most important at a glance

Major central banks hint at rate cuts

- Central banks are getting eager to cut interest rates, but the timing and depth remain uncertain.

- Global yields drifted without a clear trend as rate cut expectations moderated further.

- Global equities extended their rally, with the S&P hitting new records with better breadth on a soft-landing outlook and despite the Fed’s adjustment to more realistic rate cut expectations.

- After 17 years, the Bank of Japan ended the era of negative rates.

- Geopolitical tensions rose as a deadly terrorist attack in Moscow left the Russian government suspicious of Western involvement. The Security Council approved a long-awaited resolution on Gaza, calling for an immediate ceasefire, and the unconditional release of all hostages.

- Chinese equities struggled to follow the global rally.

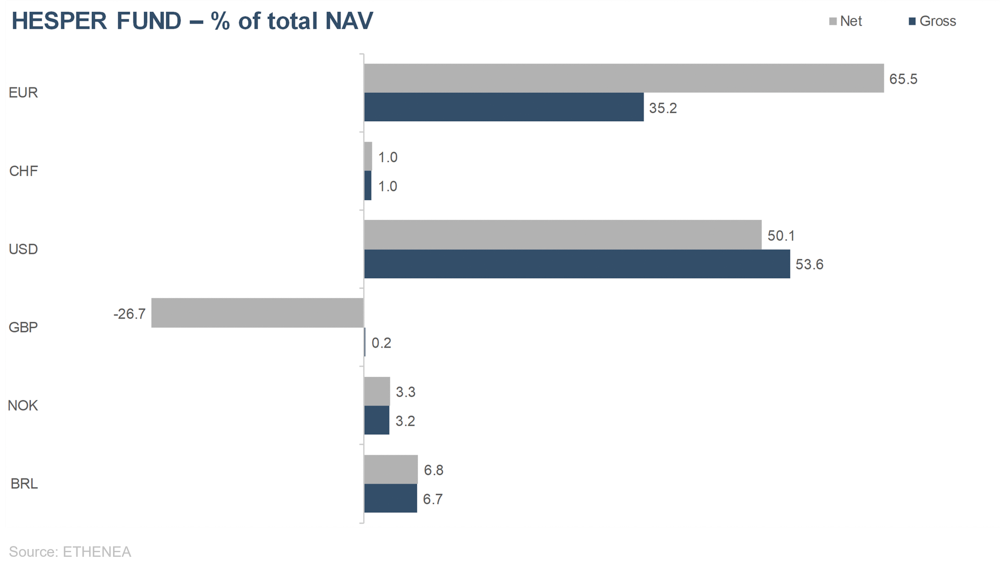

- The HESPER FUND – Global Solutions fine-tuned its portfolio allocation. Net equity exposure was kept above 50% and duration close to neutral most of the time. In FX, the fund sharply reduced the long exposure to the Norwegian krone to 3%, kept the US dollar at around 50%, took profit on the Swiss franc short exposure of -17% and cut GBP short exposure to -27%.

31.03.24 - A lot of action and clues from central banks in March

A soft landing or even a “no landing” scenario seems more realistic than the gloomy fears of a US recession. The tightening cycle did not kill the US economic expansion last year. The path of rate cuts in the US is still uncertain, but the direction is clear, and the Fed will start reversing policy in 2024. With no recession in sight, we expect the still inverted yield curve to return to a normal slope in the future.

Central banks in the advanced western economies are becoming keener to cut rates as early as June. Market expectations of deep and rapid rate cuts have been progressively adjusting to a more realistic path but are still somewhat optimistic. The Swiss National Bank (SNB) started the rate-cutting season, surprising the market with a 0.25% cut and raising expectations that other European central banks will soon follow suit. Japan, on the other hand, ended an era of negative interest rates but left few hints as to further hikes. Surprisingly, the yen dropped on the Bank of Japan’s (BoJ) dovish tone and global yields were not dragged up as feared. As the yen slid to its weakest level since 1990, the BoJ stepped up its intervention warnings.

It will be the year of the Fed’s pivot to a less restrictive policy, but it is also the year of global elections. Domestic politics will influence policy and markets, with more than over 70 countries holding elections in 2024. In the US, the Biden vs. Trump rematch is likely to result in continued fiscal stimulus and more protectionist policies, which will likely support growth but also make the disinflation path more uncertain. Volatility is also something we should keep in mind as we approach election day in November.

A soft landing scenario for the US economy has pushed global equities higher

US equities extended a five-month rally, with most indices hitting new hights. the prospect of a soft landing has become the key driver of higher share prices. The US equity market has adjusted to the Fed’s wait-and-see approach and has hit a series of all-time hights despite multiple delays in the expected timing of rate cuts

In the US, the major indices hit new record highs as the equity rally broadened, favouring laggard sectors. The S&P 500 gained 3.1%, the DJIA increased by 2.1%, the tech-heavy NASDAQ rose 1.8% and the small cap index Russel 2000 jumped 3.4%.

In Europe, the Euro Stoxx Index surged 4.2% (+4.2% in USD), while the FTSE 100 rose 4.2% (+4.3% in USD) on hopes of interest rate cuts. The Swiss Market Index gained 2.5% (0.6% in USD as the Swiss franc weakened further).

In Asia, China’s efforts to stabilise its financial markets stalled in March. The Hang Seng barely rose by 0.2% and the CSI 300 gained 0.6% (+0.2% in USD). The Korean stock market jumped 3.9% (+3% in USD) and the Indian Sensex gained 1.6% (+1% in USD). The Japanese stock market weathered a historic change in monetary policy as the Nikkei jumped 3.1% (+1.5% in USD).

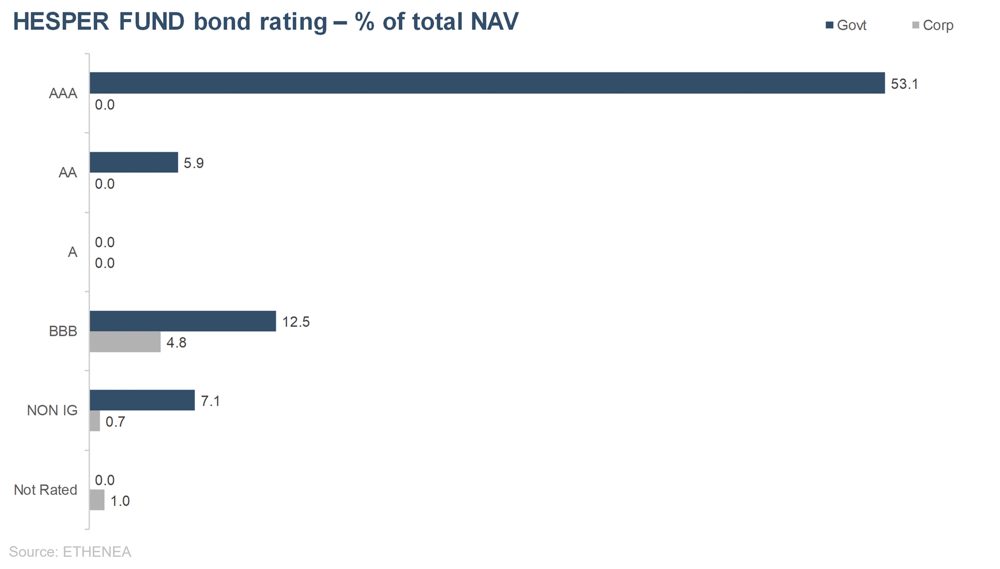

HESPER FUND – Macro Scenario: be ready for slow-motion rate cuts

Central banks are navigating a challenging scenario of uncertain disinflation, slowing economic activity amid political elections, and rising geopolitical tensions. Central banks need to carefully assess the risks of remaining hawkish for too long, with the risk of cutting rates too soon and missing their target. In the US, recent inflation readings have been disappointing, but the Fed is sticking to its story of a disinflationary path. However, the disinflation process may be slower and bumpier than is priced in by the markets. As long as the economy holds up, long-term yields remain well behaved and the carrot-on-a-stick of multiple rate cuts remains in sight, equity markets should however continue to perform decently.

With the supply side of the inflation equation already delivering its benefits, we may still need to see some softening in demand to achieve the central banks’ inflation targets. The combination of a strong fiscal support, a healthy labour market, solid consumer confidence and geopolitical tensions could still delay or even spoil the disinflationary path.

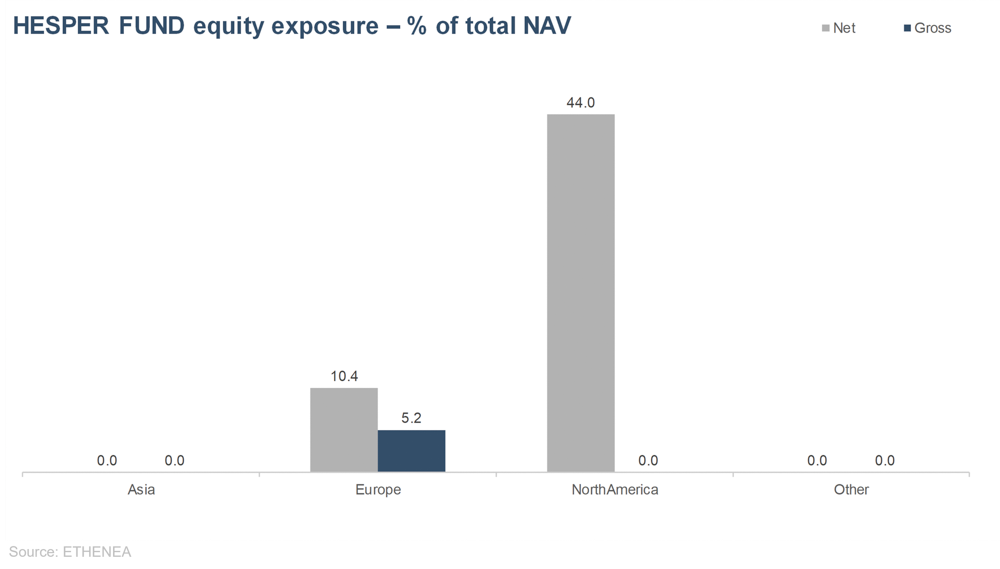

Positionierung und Monatsperformance

The HESPER FUND – Global Solutions increased in March (unit class T-6 EUR +1.52%), supported by equities, a slightly negative duration exposure and FX bets. YTD, the fund is up 3.56%.

The HESPER FUND maintained an overall equity exposure of over 50%. Duration exposure was kept neutral to slightly negative most of the time. The fund continued to trade actively in the FX space, maintaining the US dollar exposure at 50%. GBP short exposure was reduced to -27% as we dismantled long NOK bets. We took profits on several trades against the CHF, which we might re-open if the Swiss franc recoups some strength

The breakdown of MTD (+1.52%) was +0.20% fixed income (+0.49% long positions, -0.29% short future positions), +1.32% equities, +0% commodities, +0.10% currencies and -0.10% fees and expenses. Equities, hedging duration and the depreciation of the Swiss franc contributed to performance. Decorrelation with traditional assets such as equities and bonds remained high.

Total assets fell to EUR 58.6 million at the end of the month. The unit class T-6 EUR unit class was 7.18% below its all-time high on 29 September 2022.

Volatility over the last 250 days rose up to 6%, maintaining an attractive risk/return profile. The annualised return since inception has risen to 3.56%.

Looking ahead to next month, the fund has continued to stay far from its reference currency and to trade actively in the FX space. Currently, the currency exposure of the HESPER FUND – Global Solutions is as follows: USD 50%, BRL 6.7%, CHF 1% and GBP -27%.

As in the past, we will continue to monitor and calibrate the fund’s exposure to the various and different asset classes in line with market sentiment and changes in the macroeconomic baseline scenario.

*Der HESPER FUND – Global Solutions ist aktuell nur zum Vertrieb in Deutschland, Luxemburg, Belgien, Italien, Frankreich, Österreich und der Schweiz zugelassen.

Fund positioning

De inhoud van deze pagina is uitsluitend bedoeld voor professionele beleggers.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

Dit is een marketing communicatie. Het is uitsluitend bedoeld om productinformatie te verstrekken en is geen verplicht wettelijk of regelgevend document. De informatie in dit document vormt geen verzoek, aanbod of aanbeveling om participaties in het fonds te kopen, te verkopen of om enige andere transactie aan te gaan. Het is uitsluitend bedoeld om de lezer inzicht te geven in de belangrijkste kenmerken van het fonds, zoals het beleggingsproces, en wordt noch geheel noch gedeeltelijk beschouwd als een beleggingsaanbeveling. De verstrekte informatie is geen vervanging voor de eigen overwegingen van de lezer of voor enige andere juridische, fiscale of financiële informatie en advies. Noch de beleggingsmaatschappij, noch haar werknemers of bestuurders kunnen aansprakelijk worden gesteld voor verliezen die rechtsreeks of onrechtstreeks worden geleden door het gebruik van de inhoud van dit document of in enig ander verband met dit document. De verkoopdocumenten in het Duits die op dit moment geldig zijn (verkoopprospectus, essentiële-informatiedocumenten (PRIIPs-KIDs) en de halfjaar- en jaarverslagen), die gedetailleerde informatie geven over de aankoop van participaties in het fonds en de bijbehorende kansen en risico's, vormen de enige wettelijke basis voor de aankoop van participaties. De bovengenoemde verkoopdocumenten in het Duits (evenals in onofficiële vertalingen in andere talen) zijn te vinden op www.ethenea.com en zijn naast de beleggingsmaatschappij ETHENEA Independent Investors S.A. en de depothoudende bank, ook gratis verkrijgbaar bij de respectieve nationale betaal- of informatieagenten en van de vertegenwoordiger in Zwitserland. De betaal- of informatieagenten voor de fondsen Ethna-AKTIV, Ethna-DEFENSIV en Ethna-DYNAMISCH zijn de volgende: België, Duitsland, Liechtenstein, Luxemburg, Oostenrijk: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxemburg; Frankrijk: CACEIS Bank France, 1-3 place Valhubert, F-75013 Paris; Italië: State Street Bank International – Succursale Italia, Via Ferrante Aporti, 10, IT-20125 Milano; Société Génerale Securities Services, Via Benigno Crespi, 19/A - MAC 2, IT-20123 Milano; Banca Sella Holding S.p.A., Piazza Gaudenzio Sella 1, IT-13900 Biella; Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Spanje: ALLFUNDS BANK, S.A., C/ Estafeta, 6 (la Moraleja), Edificio 3 – Complejo Plaza de la Fuente, ES-28109 Alcobendas (Madrid); Zwitserland: Vertegenwoordiger: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Betaalagent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. De betaal- of informatieagenten voor HESPER FUND, SICAV - Global Solutions zijn de volgende: België, Duitsland, Frankrijk, Luxemburg, Oostenrijk: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxemburg; Italië: Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Zwitserland: Vertegenwoordiger: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Betaalagent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. De beleggingsmaatschappij kan bestaande distributieovereenkomsten met derden beëindigen of distributievergunningen intrekken om strategische of statutaire redenen, mits inachtneming van eventuele deadlines. Beleggers kunnen informatie over hun rechten verkrijgen op de website www.ethenea.com en in de verkoopprospectus. De informatie is zowel in het Duits als in het Engels beschikbaar, en in individuele gevallen ook in andere talen. Opgemaakt door: ETHENEA Independent Investors S.A. Het is verboden om dit document te verspreiden aan personen die wonen in landen waar het fonds geen vergunning heeft of waar er een toestemming vereist is voor verspreiding. Participaties mogen enkel aangeboden worden aan personen in landen waarin dit aanbod in overeenstemming is met de toepasselijke wettelijke bepalingen en waar ervoor wordt gezorgd dat de verspreiding en publicatie van dit document, evenals een aanbod of verkoop van participaties, aan geen enkele beperking is onderworpen in het betreffende rechtsgebied. Het fonds wordt met name niet aangeboden in de Verenigde Staten van Amerika of aan Amerikaanse burgers (volgens Rule 902 of Regulation S of the U.S. Securities Act of 1933, in de huidige versie) of personen die namens hen, in hun rekening of ten voordele van een Amerikaanse burger handelen. Resultaten die in het verleden behaald zijn, mogen niet worden opgevat als indicatie of garantie voor toekomstige prestaties. Schommelingen in de waarde van onderliggende financiële instrumenten of hun rendementen, evenals veranderingen in rentetarieven en valutakoersen, zorgen ervoor dat de waarde van participaties in een fonds, evenals de daaruit voortvloeiende rendementen, zowel kunnen dalen als stijgen en zijn niet gegarandeerd. De waarderingen die hierin opgenomen zijn, zijn gebaseerd op een aantal factoren, waaronder, maar niet beperkt tot, huidige prijzen, schattingen van de waarde van de onderliggende activa en marktliquiditeit, evenals andere veronderstellingen en openbaar beschikbare informatie. In principe kunnen prijzen, waarden en rendementen zowel stijgen als dalen, tot en met het totale verlies van het geïnvesteerde kapitaal, en aannames en informatie kunnen zonder voorafgaande kennisgeving worden gewijzigd. De waarde van het belegde vermogen of de prijs van participaties, evenals de daaruit voortvloeiende rendementen en uitkeringsbedragen, zijn onderhevig aan schommelingen of kunnen geheel verdwijnen. Positieve prestaties in het verleden zijn daarom geen garantie voor positieve prestaties in de toekomst. Met name het behoud van het geïnvesteerde vermogen kan niet worden gegarandeerd; er is dan ook geen garantie dat de waarde van het belegde kapitaal of de aangehouden participaties bij verkoop of terugkoop zal overeenkomen met het oorspronkelijk belegde kapitaal. Beleggingen in vreemde valuta zijn onderhevig aan bijkomende wisselkoersschommelingen of valutarisico's, d.w.z. het rendement van dergelijke beleggingen hangt ook af van de volatiliteit van de vreemde valuta, wat een negatieve impact kan hebben op de waarde van het belegde kapitaal. Beleggingen en toewijzingen kunnen gewijzigd worden. De beheer- en depotvergoedingen, evenals alle andere kosten die overeenkomstig de contractuele bepalingen ten laste van het fonds zijn, worden in de berekening opgenomen. De prestatieberekening is gebaseerd op de BVI-methode (Duitse Federale Vereniging voor Beleggings- en Vermogensbeheer), dat wil zeggen dat uitgiftekosten, transactiekosten (zoals order- en makelaarskosten), evenals bewaar- en andere beheervergoedingen niet inbegrepen zijn in de berekening. Het beleggingsrendement zou lager zijn indien rekening zou worden gehouden met de uitgiftetoeslag. Er kan geen garantie worden gegeven dat de marktprognoses gehaald worden. Om het even welke risicobehandeling in deze publicatie mag niet worden beschouwd als een onthulling van alle risico's of een sluitende behandeling van de genoemde risico's. In de verkoopprospectus wordt expliciet verwezen naar de gedetailleerde risicobeschrijvingen. Er kan geen garantie worden gegeven dat de informatie juist, volledig of actueel is. De inhoud en de informatie zijn auteursrechtelijk beschermd. Er kan geen garantie worden gegeven dat het document voldoet aan alle wettelijke of regelgevende vereisten die andere landen dan Luxemburg hebben vastgesteld. Opmerking: De belangrijkste technische termen kunnen worden gevonden in de woordenlijst op www.ethenea.com/lexicon. Informatie voor beleggers in België: Het prospectus, de statuten en de periodieke verslagen, alsmede de essentiële-informatiedocumenten (PRIIPs-KIDs), zijn kosteloos verkrijgbaar in het Frans bij de beheermaatschappij, ETHENEA Independent Investors S.A., 16, rue Gabriel Lippmann, 5365 Munsbach, Luxemburg en bij de vertegenwoordiger: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxemburg. Informatie voor beleggers in Zwitserland: Het vestigingsland van de collectieve beleggingsregeling is Luxemburg. De vertegenwoordiger in Zwitserland is IPConcept (Schweiz) AG, Münsterhof 12, P.O. Box, CH-8022 Zürich. De betaalagent in Zwitserland is DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zurich. Het prospectus, de essentiële-informatiedocumenten (PRIIPs-KIDs) en de statuten, evenals de jaar- en halfjaarverslagen zijn kosteloos verkrijgbaar bij de vertegenwoordiger. Copyright © ETHENEA Independent Investors S.A. (2024) Alle rechten voorbehouden. 08-06-2021