À nouveau reportée : la Renaissance de la valeur

When investors talk about what’s happening in equity markets, one topic is often uppermost in their minds: the huge differences in the performance of the value and growth investment styles. For years, growth equities have far outperformed value stocks. In 11 of the past 12 years, growth equities outperformed globally. After the 2008/09 global financial crisis, 2016 was the only calendar year in which value stocks pushed growth stocks into second place. The more vociferously a trend reversal and thus the renaissance of value was touted in the past, the more pronounced the continuation of growth stocks’ outperformance subsequently turned out to be. The would-be renaissance only lasted a few weeks to months in each case – reason enough for us to take a closer look at this topic.

Even the definition of value and growth takes various forms, which differ in their level of sophistication. The simpler and more popular approach is based on relatively straightforward valuation metrics, such as the price-earnings ratio (P/E) or the price-to-book ratio (P/B). Their values determine whether a stock is cheap and is assigned to a value index, or whether it is a high-growth stock and part of a growth index. Almost all quantitative statements on the subject are based on such assumptions and indices – including the statistics given above.

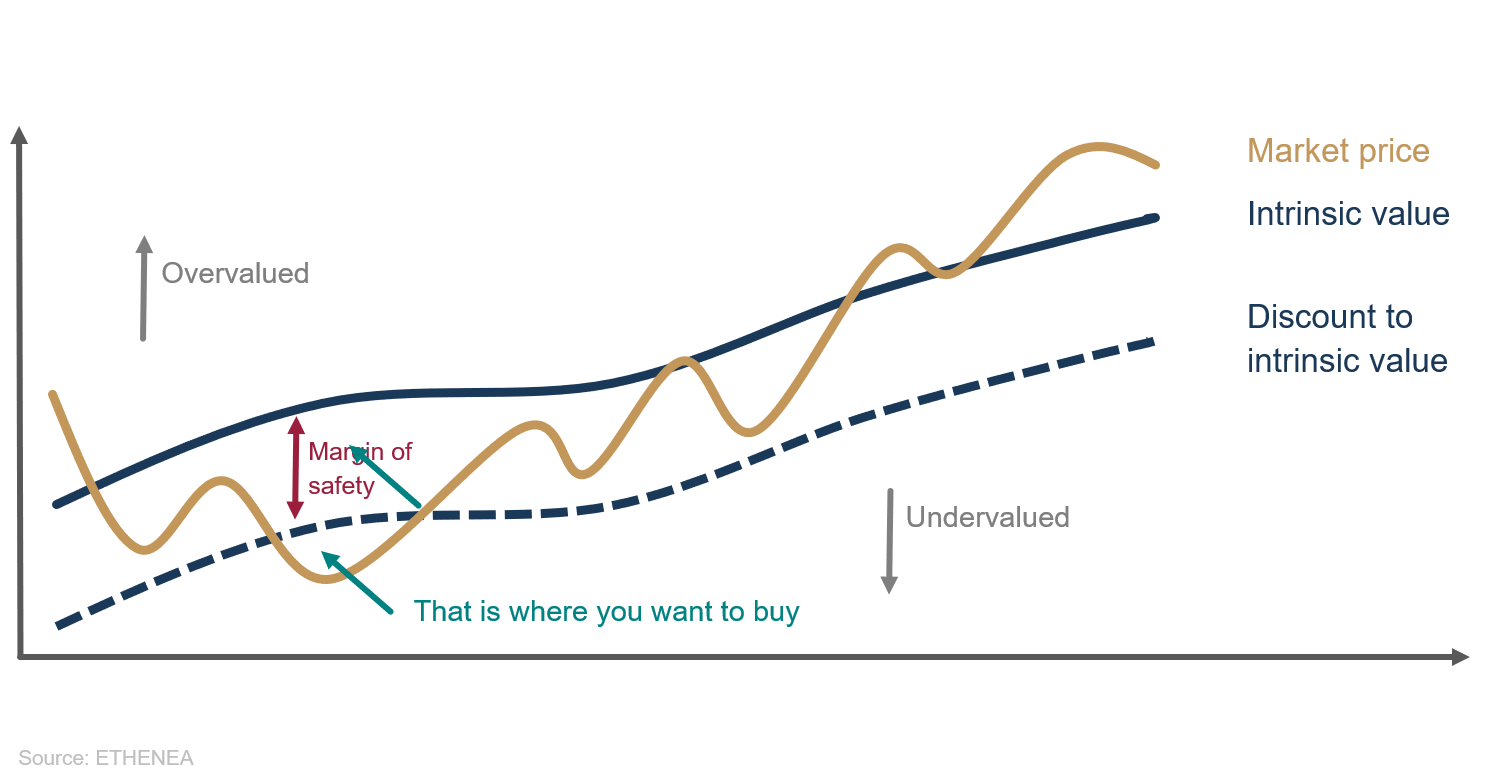

But there’s a more sophisticated method. Professional value investors argue not with the comparatively simple methodology of the index providers, but with the concept of the margin of safety. The basic idea of value investing is that an intrinsic or economic value of the share can be calculated for each company, which, ideally, takes into consideration all the relevant expectations for the future, as well as the current capital market environment. If the market price of the share is far enough below this intrinsic value, then, in theory, the share can be bought at a discount and in future sold on (hopefully) at a higher price for a profit. This scenario is shown a hundred times over in investor presentations, which have the same basic structure as the following Figure 1:

Figure 1: This is how it’s presented in the promotional material

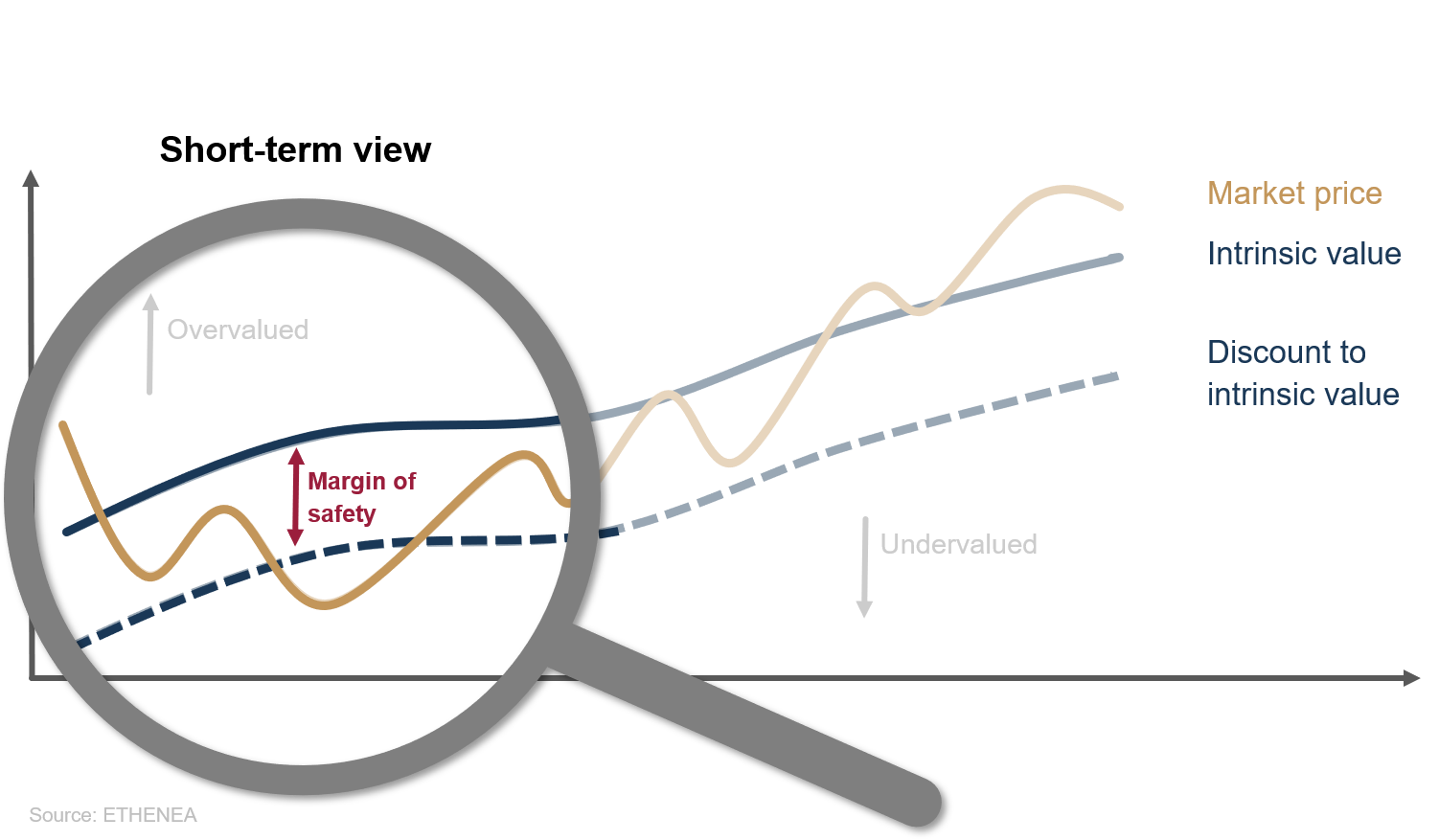

As impressively as Figure 1 illustrates the benefits of the value strategy, it contains an implicit assumption that can by all means be challenged in practice and many investors are often not aware of. The clear focus of the value strategy is on the valuation; that is, on the current deviation of the price from the expected fair or intrinsic value of the share, as highlighted in Figure 2:

Figure 2: A question of (short-term) focus

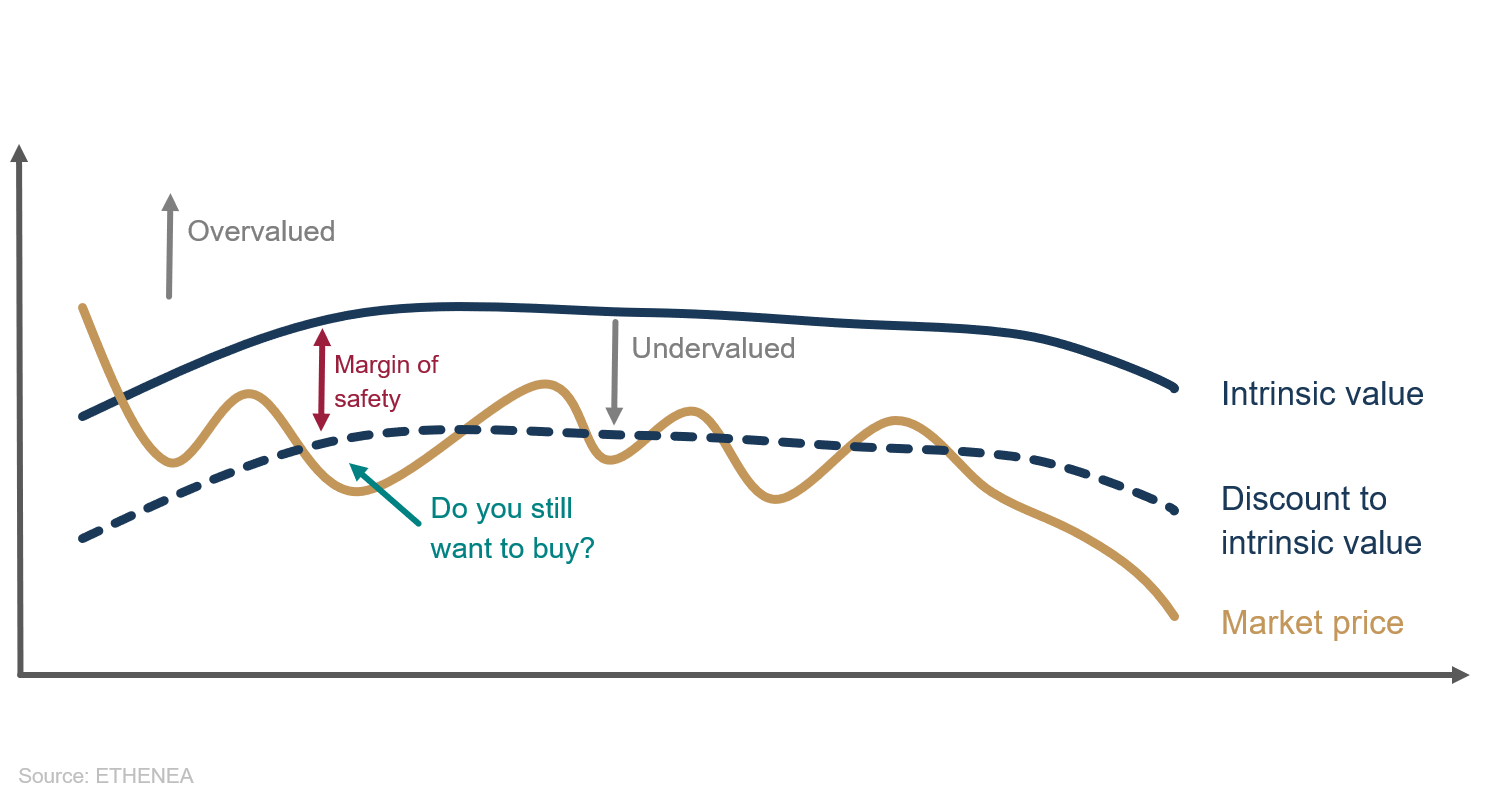

It is not a foregone conclusion that the intrinsic value will rise in the future – as suggested on the right-hand side of Figure 2. Structural growth has become a scarce commodity for many companies. But without any growth to speak of, the question arises why should the value of a company rise in the long term? The error here lies in the fundamental valuation assumption. Many valuation models use differentiated growth forecasts for the detailed planning horizon, which is generally five years in the future. In addition, it is generally assumed that the company will go on forever and have a constant rate of growth. However, in the absence of this assumed growth, Figure 3 gives a much more realistic picture of how the intrinsic value will change than the hopeful picture in Figures 1 and 2. Realistic it may be, but it hardly makes for attractive promotional material.

Figure 3: Caught in the value trap

Everything is cheap for a reason. This is true for all but a very few value investors. However, the question still stands: why should a discount to the intrinsic value of a share today disappear in future or even turn into a fair value premium? Nearly all aspects of economic life go through extreme processes of transformation that produce both winners and losers. Unless we respond to this development with due objectivity and flexibility, as investors we run the risk of backing ourselves both mentally and physically into a corner, which is very hard to get out of.

For years, the automotive sector has been a perfect example is the automotive sector of this. Value investors point to the sometimes extremely low valuations of traditional car makers, who have for years been languishing at the bottom of the equity valuations with P/Es in single digits. The valuation argument gains traction because overall market valuation has successively gone up in the context of low interest rates. But what about the other perspective? Growth investors like to refer to the disruptive business models of today’s growth stars, who often – such as the U.S. electric car pioneer Tesla – are direct competitors of the companies with cheap valuations. However, with these, the current valuation of the expected future revenues and profits is getting pushed more and more into the background. The problem is that, in essence, both camps are (in)correct. The growth of the former is curtailed by their disruptive competitors, which can cast doubt on the price nearing its intrinsic value in the future. The latter uncouple from their intrinsic value on the upside, which can lead to sharp price falls if the growth predicted by the market is not achieved. Thus, neither value nor growth stocks are all good or all bad investments.

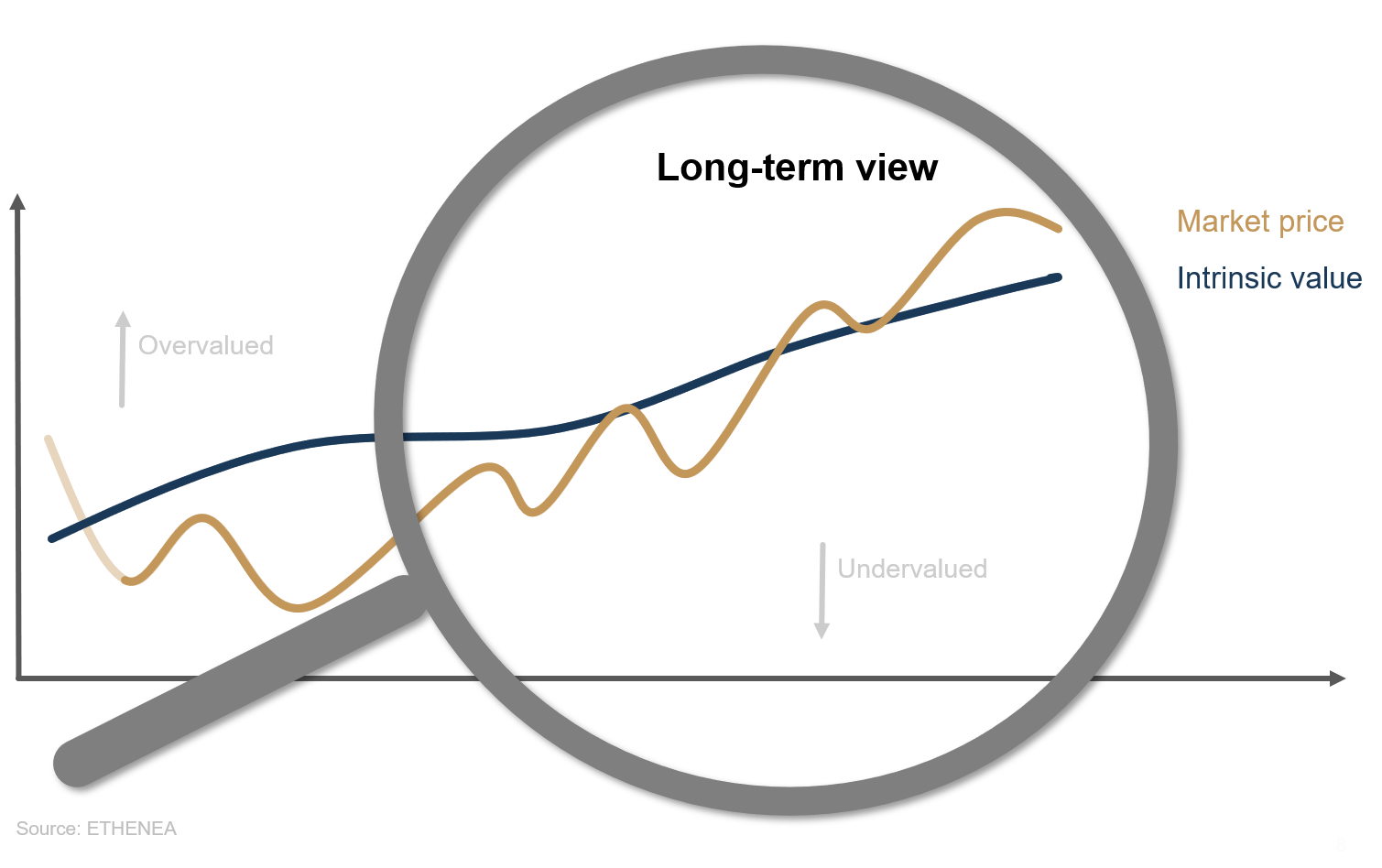

Figure 4: A question of (long-term) focus

How does an investor resolve the value-growth dilemma? By keeping the respective pros and cons of both styles of investment in mind, an investor can avoid making bad mistakes. Quite simply, both growth and valuation are important. However, the further ahead you look and the longer-term an investment idea is, the more dominant the existence of structural growth drivers becomes. The influence of shorter-term fluctuations in the valuation loses power in time, as Figure 4 shows.

As long as the extremes on the valuation margins come with elevated risks, prudent investors should steer a course down the middle. The middle should not be confused with mediocrity; rather, it stands for high-quality companies with structural growth drivers and solid balance sheets coupled with a fair valuation. With its focus on these very companies, the equity-focused Ethna-DYNAMISCH – the most offensive of the three Ethna funds – has also succeeded in avoiding the sometimes tricky value trap in recent years. Like with the other Ethna funds, it generally makes sense to pursue an investment strategy set to maximum flexibility in order to generate a sustained, attractive return over various market phases without getting overly dependent on changing market conditions, such as value or growth cycles.

Portfolio Manager Update & Fund positioning

Ethna-DEFENSIV

Are interest rates on the rise again? What we mean by interest rates in this context is, first and foremost, the yields on long-dated, 10-year German and U.S. sovereign bonds. The short-term interest rates set by the ECB and Fed will not change that fast. The Fed will deliver its first interest rate hike no earlier than the end of next year, but a lot can happen between now and then. We will have to wait even longer until the ECB raises interest rates once more.

Yields on German 10-year sovereign bonds rose in September from -0.4% to -0.2%, while their U.S. counterparts went from 1.31% to 1.51%. We also responded to this by further expanding the hedges we had already started building up in August and further reducing the duration of our bond portfolio to less than 2. This went a long way towards limiting the losses on our bond portfolio (82% of the overall portfolio). The question is why are yields rising now, having been stable or falling in the summer?

Even before the summer inflation rose sharply both in the eurozone and in the U.S. Therefore, the inflation trend does not help to explain the rise in yields, particularly since the ECB’s and Fed’s assertion that this sharp rise was only temporary also became the consensus view of the majority of investors. The acceleration in inflation in the eurozone is expected to peak in November before falling back to below 3% in January after some base effects drop out (e.g. carbon tax and expiry of the VAT reduction in Germany at the end of 2020). The acceleration in inflation in the U.S. may even have already reached its peak in August. However, the recent escalation in electricity and gas prices, as well as supply chain bottlenecks, suggest that it could take longer than expected for inflation rates to come down to the ECB’s and Fed’s inflation targets of 2%.

Against this backdrop, the two central banks are currently talking about tapering their asset purchase programmes worth billions. In their September meeting, the Federal Reserve confirmed that tapering is very likely to be formally announced in their meeting at the beginning of November. Purchases are then set to end completely in summer 2022. Having increased the pace of purchases under its Pandemic Emergency Purchase Program (PEPP) in Q2 and Q3 2021, the ECB announced in its meeting in September that this would be scaled back slightly to Q1 levels for the coming quarter. However, it insists that this is just a recalibration rather than a tapering. If its purchases continue at the current pace, it will have spent the full EUR 1.85 trillion envelope shortly before the official end in March 2022. However, at its next meeting at the end of October, the ECB will also have to think about what it wants to do after April 2022 when the PEPP is likely to end.

Up until now, the central bank purchases were a strong counterweight to the higher inflation rates and prevented long-dated sovereign bond yields from rising sharply. Central bank purchases will still be substantial, at least in the first quarter of 2022, so we expect only a moderate rise in 10-year U.S. Treasuries to 1.75%–2% and in 10-year German Bunds to 0%. It is also unlikely that Treasuries will rise much further than that because they will once again present an increasingly attractive investment for international investors at around the 2% mark. Even after the cost of hedging currency risks, investors would still be able to make a much higher return than with domestic sovereign bonds. But that is still some way off yet. In the meantime, we will greatly reduce the bond portfolio duration using our hedges.

However, there are no rate rises expected from the central banks in the near future. In its dot plots – the outlook for future interest rates – the Federal Reserve only expects a rise in the key rate to between 1.75% and 2% by the end of 2024. However, there is absolutely no guarantee that there will be constant economic growth without crisis for the next two years. And it is uncertain whether, in the event of fresh crises, the central banks will be prepared to see past the event itself and defer to the fundamental growth path, which is a kind of average growth target based on the average inflation target. There is also a potential for the explosion in energy prices and the worsening in supply chain bottlenecks to plunge the global economy into crisis and to slow down growth considerably. But we have not reached that stage yet.

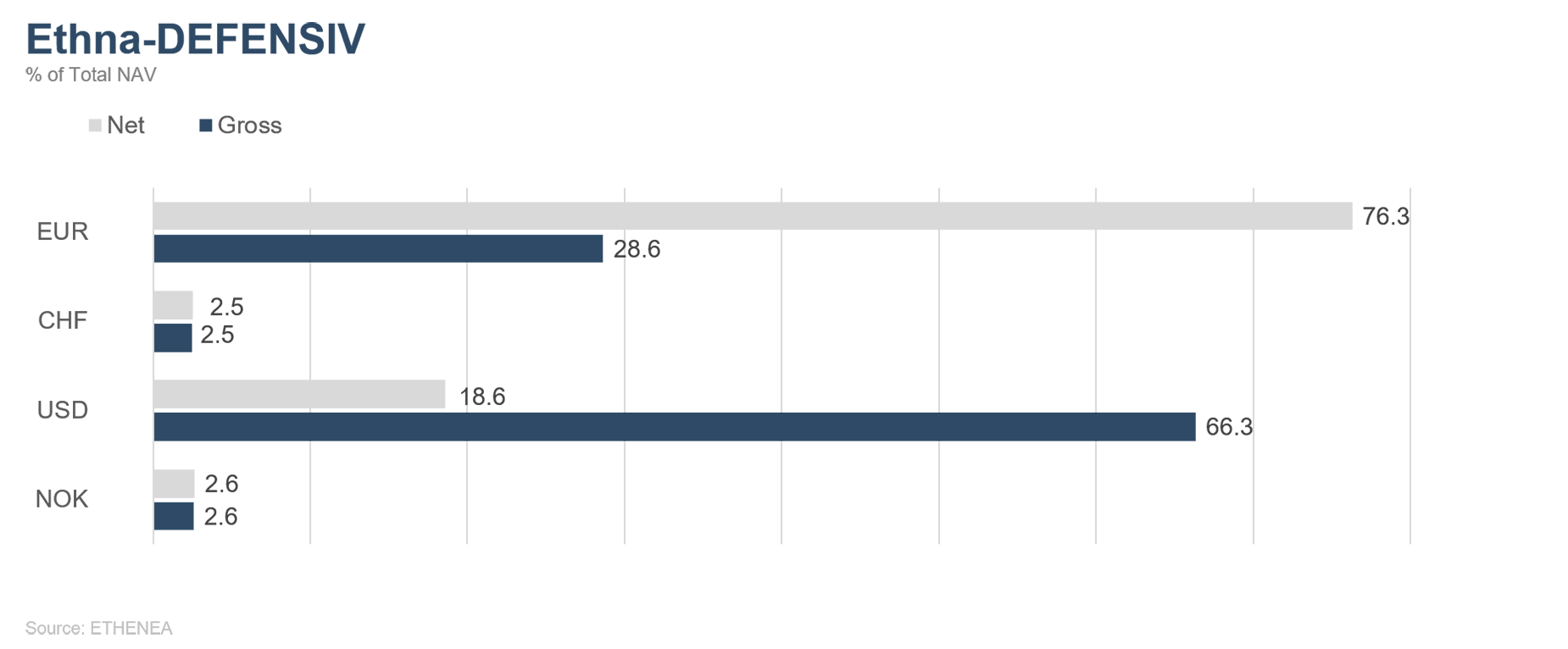

In light of the interest rate risks, therefore, the Ethna-DEFENSIV remains cautious and we have kept the duration below 2. We will keep our equity investments via ETFs close to the maximum of 10%. Gold is playing a lesser role at the moment and was therefore reduced to 2.5%. Rising interest rates are hurting the precious metal and lessening the protection against inflation it affords. Our USD allocation is currently just shy of 20% and, with a positive contribution of 0.3%, it helped to limit the losses on bonds thanks to hedging (approx. -0.3%), equities (-0.35%) and gold (-0.15%) in September. Overall, the Ethna-DEFENSIV (T class) lost 0.55% in September but at the end of September the year-to-date performance remains positive, at +1.17%.

Ethna-AKTIV

At month-end exactly 40 years ago, the 10-year U.S. Treasury was at just under 16% – a historical high. Since then, steadily falling interest rates have provided bonds with a structural tailwind. The end of the bull market was often proclaimed, but time and time again the interest rate rises turned out to be unsustainable. This month we have again seen a substantial uptrend in sovereign bond yields. It is our view that it was the U.S. Federal Reserve’s meeting in particular, in addition to higher inflation expectations, that triggered this movement. Only a very poor labour market report is likely to prevent the announcement of tapering in November. This fact and the higher probability of an interest rate hike before the end of next year caused a rise in U.S. Treasury yields the entire length of the curve. Even if we assume that risk assets, especially equities, can rise in step with interest rates in the current phase, September lived up to its bad reputation and caused broad-based corrections in prices. The looming default of the second-largest Chinese property developer Evergrande naturally had an adverse effect. With debts of approximately USD 300 billion, the company has been excluded from refinancing on the capital market for a good year and a half due to regulatory interventions to curb speculation in the property market, and it at least briefly threatened to be China’s “Lehman moment”. Since Evergrande doesn’t even nearly play such a central role in the global financial system and a dismantling – albeit not loss-free but at least an orderly one – by the Chinese state can be expected, this moment of stress passed relatively quickly. We expect to see a stabilisation in the currently still declining growth figures, despite all the uncertainties, which however are known and are therefore priced in. The coming reporting season will bring more clarity in relation to this.

We continue to manage the Ethna-AKTIV portfolio with an overweight in equities, focusing on U.S. stocks, growth companies, as well as the healthcare and consumer sectors. In terms of the path we anticipate, where we assume reflation rather than stagflation, top-quality equities should deliver an above-average performance. In the fixed income segment, just over 20% of the portfolio remains invested in quality bonds. As reported last month, we responded to the movement in interest rates by shortening the duration slightly through the sale of interest rate derivatives. The expansion of the U.S. dollar position (also mentioned last month) paid off. Over the course of the month, the U.S. dollar reached a new high for the year versus the euro. This validated our positive attitude towards the currency, which is attractive not only because of the growth differential but also because of its safe haven properties. Consequently, we increased the U.S. dollar allocation to 36% and are planning to increase it further towards 40% in October.

Ethna-DYNAMISCH

There were hardly any changes in the portfolio last month compared with the previous month. Autumn has taken hold in Central Europe in recent days. A wide range of temperatures over the course of the day is typical of the current transition period from September into October. While nights and mornings can be quite chilly and you would definitely need a warm jacket, you could sit in the sun in your t-shirt in the afternoon and wonder why you brought your jumper and jacket with you. It’s a similar story on the capital markets at the moment; they’re neither here nor there. So contextualisation and suitable positioning is a complex task. To help explain the complexity, the weather offers lots of illustrative analogies. The seasons and the weather are connected – and more broadly the climate plays an important part – but it makes sense to look at each in turn.

Let’s all take a step back and look first at the climatic conditions in the capital markets. One of the overriding climatic conditions in the medium term remains the low/zero/negative interest rate environment, which has been entrenched by high levels of state debt and moderate economic growth and ultimately causes the high valuations in all asset classes. With that said, in our view equities remain the structurally preferred asset class, as they have by far the most attractive valuation in relative terms and are one of the few investment alternatives from which investors can expect positive real returns (after inflation) at all. For years what this has essentially boiled down to for the Ethna-DYNAMISCH is a slightly higher equity allocation than five or ten years ago. The most extreme form of this climate change in capital markets is reflected in the raising of the fund’s maximum equity allocation from 70% to 100% on 1 July 2019. Having said that, the subject is as valid today as ever and is taken into account in each and every strategic investment decision.

Just as global warming does not mean we don’t need our winter coats, a structural bull market does not mean we can ignore the seasons and the appropriate portfolio response to them. While nature is bracing itself for autumn at the moment, in the economic cycle we are making the transition from spring to summer so to speak. Spring, or rather the early stage of the cycle, saw extremely robust growth. We can now build on that. Although the transition does not always go smoothly and there will always be one or two market participants who are sensitive to changes in the weather, we can safely leave the winter coat in the wardrobe. Or to put it in equity market terms: broadly speaking, sharp price corrections of over 10% are not expected, so radical hedging measures like at the beginning of 2020 are not necessary. Economic growth is making for solid company performance, economic and investment programmes are taking effect and the growing employment figures are supporting the economic upturn. Summer tends to bring other challenges with it, such as local droughts in region A while region B experiences torrential rain. In the global portfolio context, healthy diversification is essential to deal with such scenarios. But on the other hand, as a rule, many such events arise in the markets over time. For example, in China neither the excesses in the property market nor state regulations have come out of the blue, even though their extent may amaze us every now and then. Nor should price corrections in market segments characterised by excessive valuations, such as electromobility, hydrogen, SPACs, IPOs and cryptocurrencies come as a surprise to anyone with a keen eye in 2021. Both in the specific and in general we always have to weigh up risks and opportunities objectively. This is the main focus of our day-to-day work in portfolio management at the moment. With a portfolio that is suitably robustly positioned, we can bear up very well against the vagaries of weather that the seasons bring. What this means in practical terms for the Ethna-DYNAMISCH is, at the core of allocation, to continue to run an equity portfolio that is balanced in many respects, that excludes as best possible the aforementioned risks, and does not take on any additional credit or interest rate risks on the poorly rewarded bond side.

Thus, the patch of weather recently had only a comparatively minor effect on the positioning. Of course, nobody likes to get wet – us included – but we sometimes have to put up with the odd passing(!) shower, as happened on a few occasions last month. However, it wouldn’t make sense not to leave the house the whole summer long just because showers such as these are inevitable. Nevertheless, we pay close attention to the general weather pattern in the markets, because, unfortunately, the trend at least has been clear of late – the clouds are gathering. In our market analysis, almost all the supporting factors to date have weakened recently to the point where short-term negative factors and positive factors perfectly balance each other out. Thus, we are following further developments closely so as not to get caught out in the rain unsuitably dressed. But no decisions have been made yet.

As we come to the end of this slightly longer and more figurative commentary on the Ethna-DYNAMISCH, there is unfortunately no simple way to sum up a highly complex starting situation, but it is hoped readers will have a keener sense of the climate we find ourselves in, the season and the general weather forecast for the capital markets. What this translates to for the portfolio is something we take care of on a daily basis and, as always, we will keep you posted in this Market Commentary.

HESPER FUND - Global Solutions (*)

After the strong rebound that characterised the first half of 2021, the global recovery is now facing a period of uncertainty. We are seeing a slowdown of output growth in comparison to the breath-taking speed experienced in the first two quarters of the year, while inflationary pressures are more persistent than previously expected. The capital markets are also facing some headwinds. Pandemic-induced supply chain bottlenecks and energy shortages are fuelling inflation worries and driving sovereign bond yields higher. The major central banks are now setting the stage for tapering the monetary stimuli they introduced as a result of the pandemic. At the same time, many emerging market countries have already started to increase interest rates. In the US, intra-party fighting in Congress is blocking a bipartisan infrastructure bill, which could result in the nation facing a government shutdown and ultimately a default if Congress fails to lift the national debt ceiling. The crackdown by Chinese regulators and the potential that the scandal involving the heavily-indebted Evergrande Real Estate Group could spread amplified growth concerns.

In September, equity markets were particularly weak, as higher bond yields ended a long run of monthly gains. Softening growth momentum and accelerating inflation impacted both equity markets, which were trading near historic highs, and bond markets. The US dollar strengthened and energy commodity prices climbed. The recovery of cryptocurrencies faltered, as China banned trading and all related activities.

In the US, the technology-weighted Nasdaq Composite led the September slump, posting a loss of 5.3%. The S&P 500 fell by 4.8%, the Dow Jones Industrial Average (DJIA) lost 4.3%, and the small-cap-focused Russell 2000 Index decreased by 3.1%. However, year-to-date, all of these indices are still posting double-digit figures of between 10% and almost 15%.

In Europe, although the new political landscape in Germany did not negatively impact the market, global growth concerns did. The Euro Stoxx 50 Index (13.9% ytd) lost 3.5% (a decrease of 6.5% when calculated in USD), while in the UK the FTSE 100 (9.7% ytd) edged down by 0.5% (-2.6% in USD). The Swiss Market Index (6.7% ytd) lost momentum, falling 6.2% (-7% in US dollar terms) over the month.

Asian equity markets were mixed. In China, the Shanghai Shenzhen CSI 300 Index increased 1.3% (+1.2% in USD terms), while the Hang Seng Index in Hong Kong decreased by 5% in August amid real estate concerns. In Japan, the Nikkei rebounded by 4.9% (-8% in US dollar terms).

Above-target inflation and solid growth led to a more hawkish tone by both the Fed and the Bank of England, which appear ready to start reducing their historic monetary policy support. With the European economic cycle lagging, the ECB is still far from any tightening of its policy. However, the major central banks seem to agree that the current inflation spike is transitory and should revert to a more traditional path once pandemic-related bottlenecks disappear.

The HESPER FUND – Global Solutions continues to operate under the scenario of a progressive recovery in global growth supported by accommodative monetary and fiscal policies and vaccination rollouts. However, we have already passed peak sequential growth and, as the recovery matures through a mid-cycle phase, the environment is becoming more challenging for both policy makers and the markets. In light of a less clear macroeconomic picture, the fund has slightly reduced its exposure to equities and is more actively looking to generate performance through exposure to the currency market.

For the month, the fund reacted flexibly to market fluctuations by closing and then reopening certain positions. By the end of the month, our equity exposure was at 34% of NAV. We see an unwarranted rise in sovereign bond yields and a tightening of financing conditions due to the persistent supply shortages as the major risks for equity markets. Therefore, we have gradually reduced the duration of our portfolio down to one and a half years.

The asset allocation of the HESPER FUND – Global Solutions is monitored and calibrated on an ongoing basis to adapt to market sentiment and changes in the macroeconomic baseline scenario.

On the currency front, in September, the fund increased its long USD exposure up to 63%, mainly through the short sale of the GBP against the greenback. The British economy is facing a difficult scenario of weakening growth, energy and labour shortages, inflationary pressure well above target, and no prospect of a bilateral trade agreement with the US. All these problems may have been exacerbated by Brexit. In addition, the fund has kept its long Swiss franc exposure at almost 11% and opened a small position in Norwegian krone.

In September, the HESPER FUND - Global Solutions EUR T-6 decreased by 0.98%. Year-to-date performance was 6.1%. Over the last 12 months, the fund has gained 8.6%. Annual volatility has remained low at 6.4%, retaining an interesting risk/reward profile.

*The HESPER FUND – Global Solutions is currently only authorised for distribution in Germany, Luxembourg, Italy, France, and Switzerland.

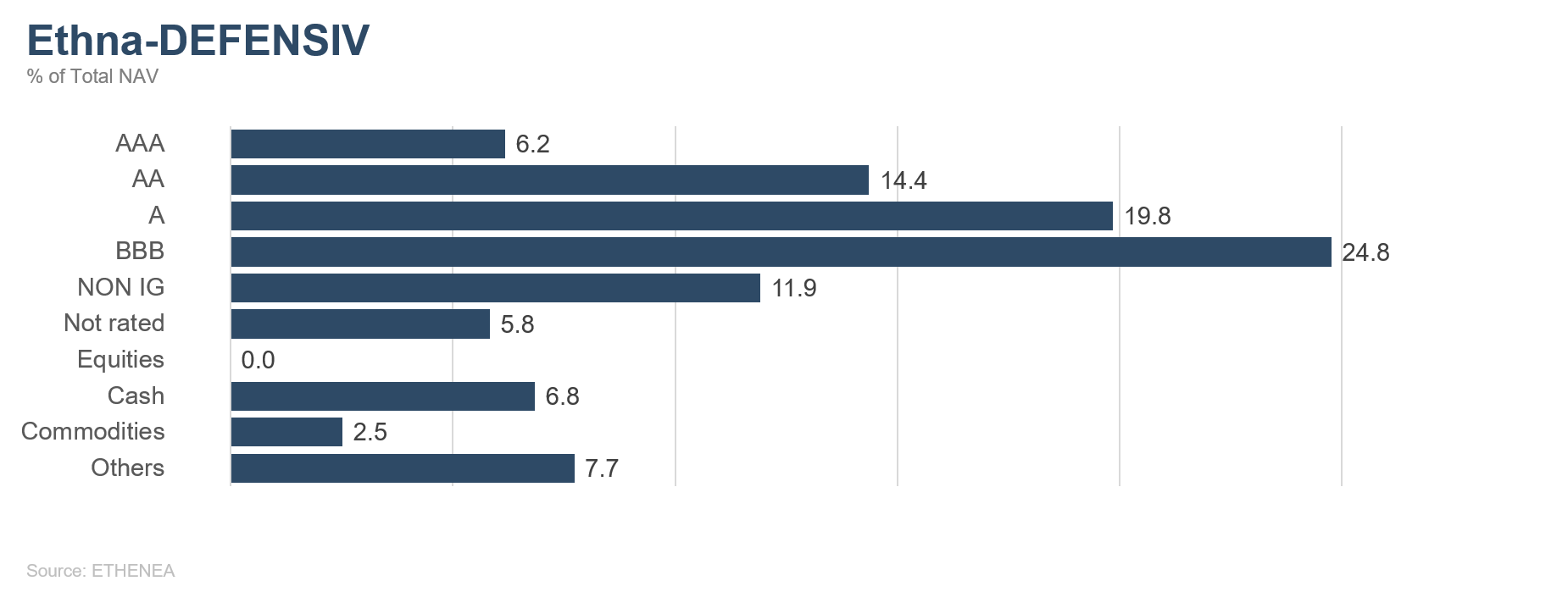

Figure 5: Portfolio structure* of the Ethna-DEFENSIV

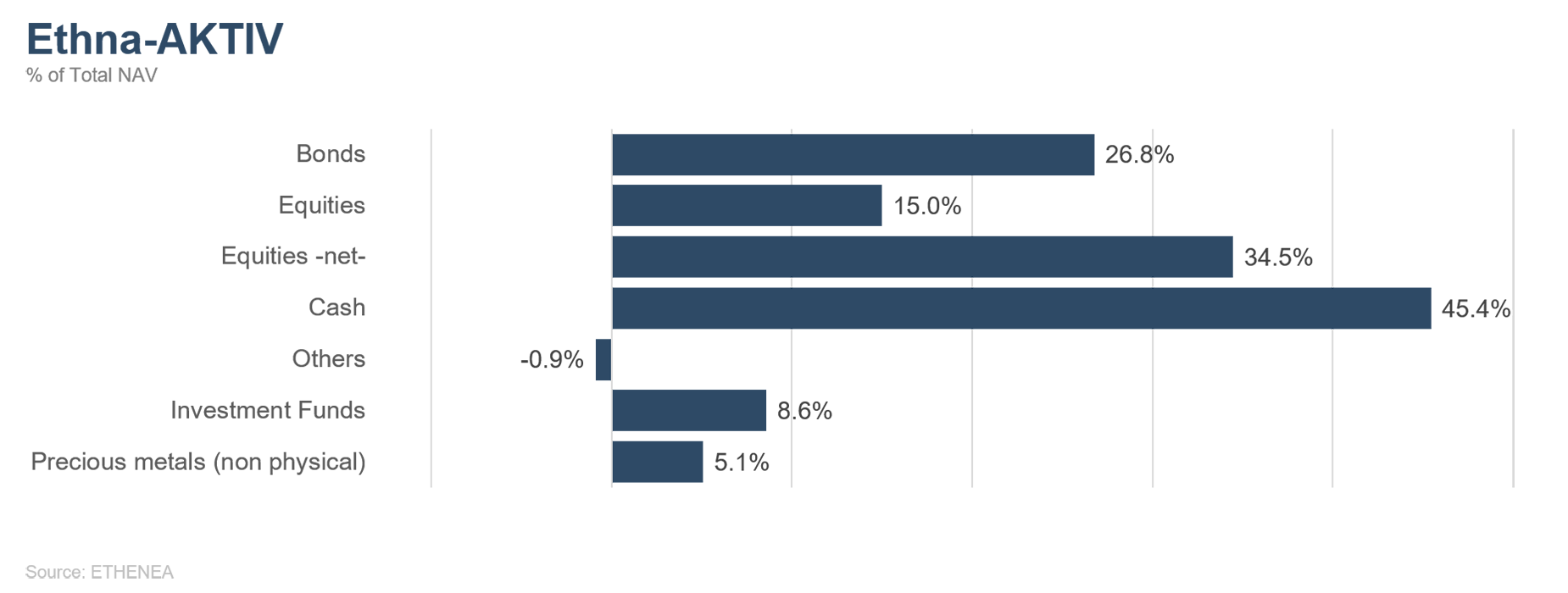

Figure 6: Portfolio structure* of the Ethna-AKTIV

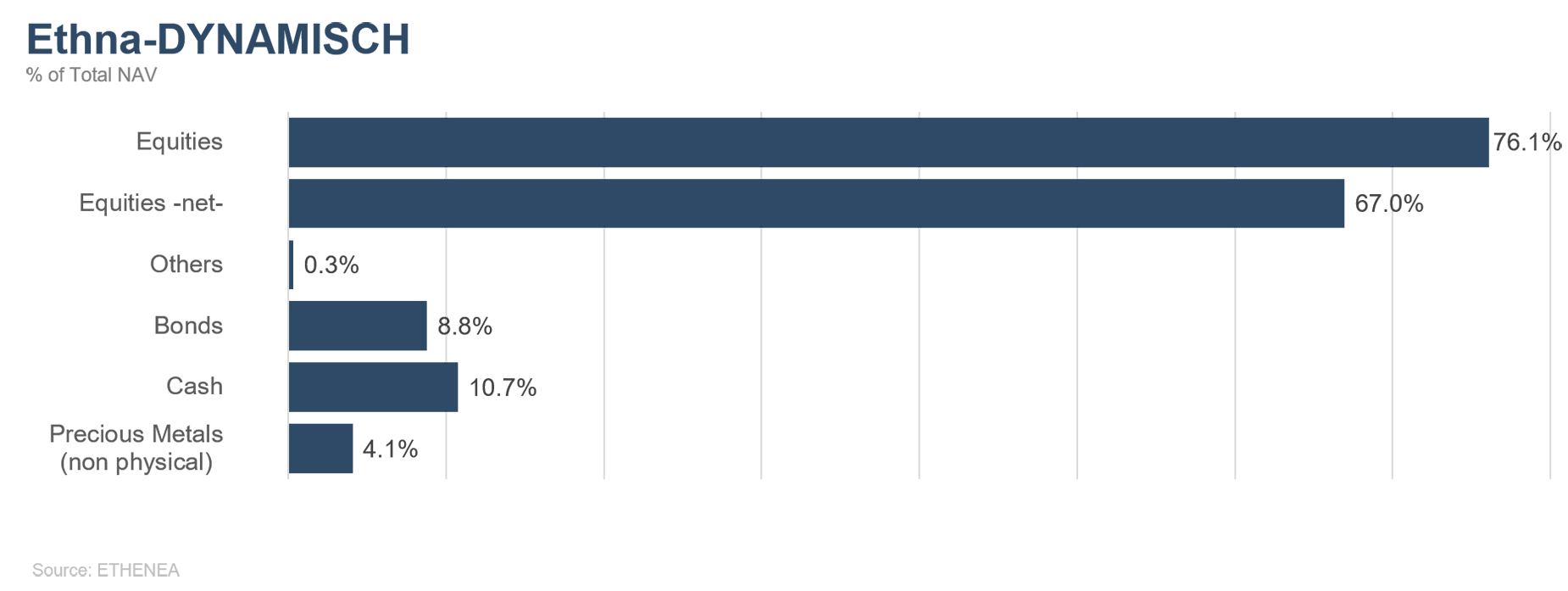

Figure 7: Portfolio structure* of the Ethna-DYNAMISCH

Figure 8: Portfolio composition of the Ethna-DEFENSIV by currency

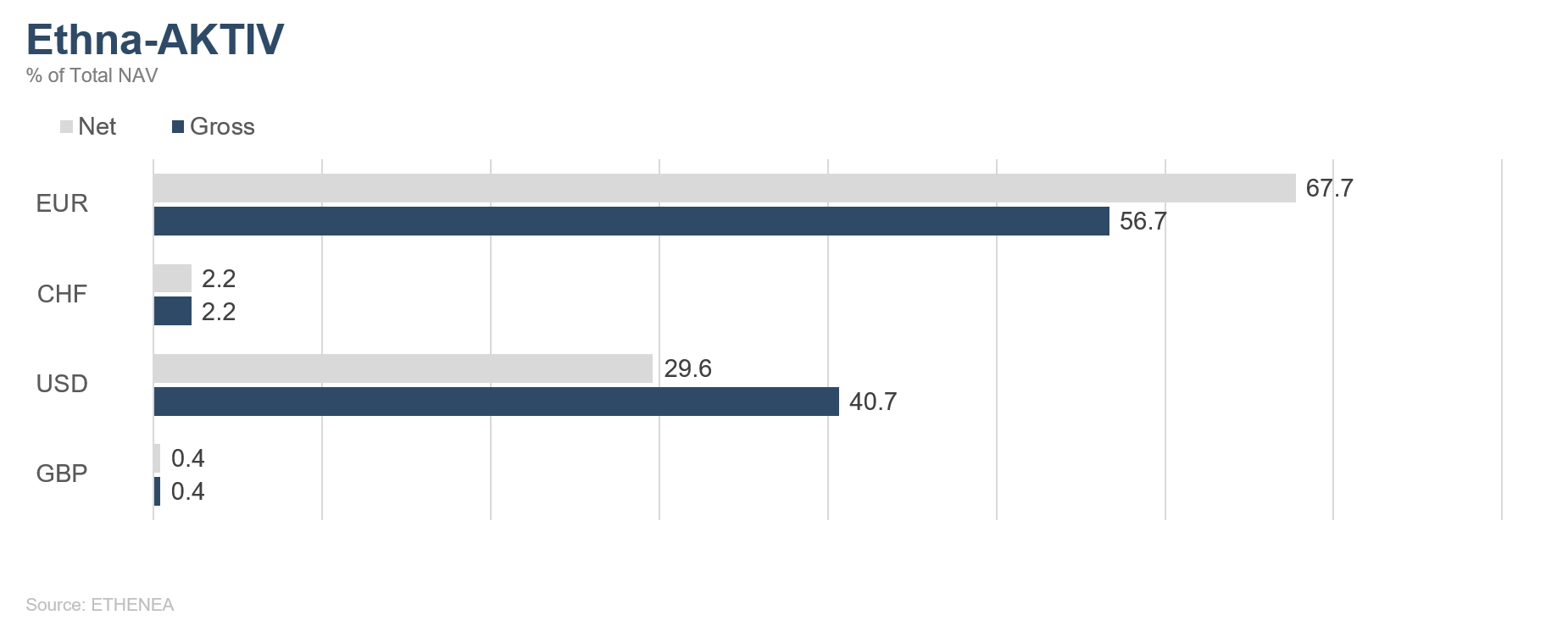

Figure 9: Portfolio composition of the Ethna-AKTIV by currency

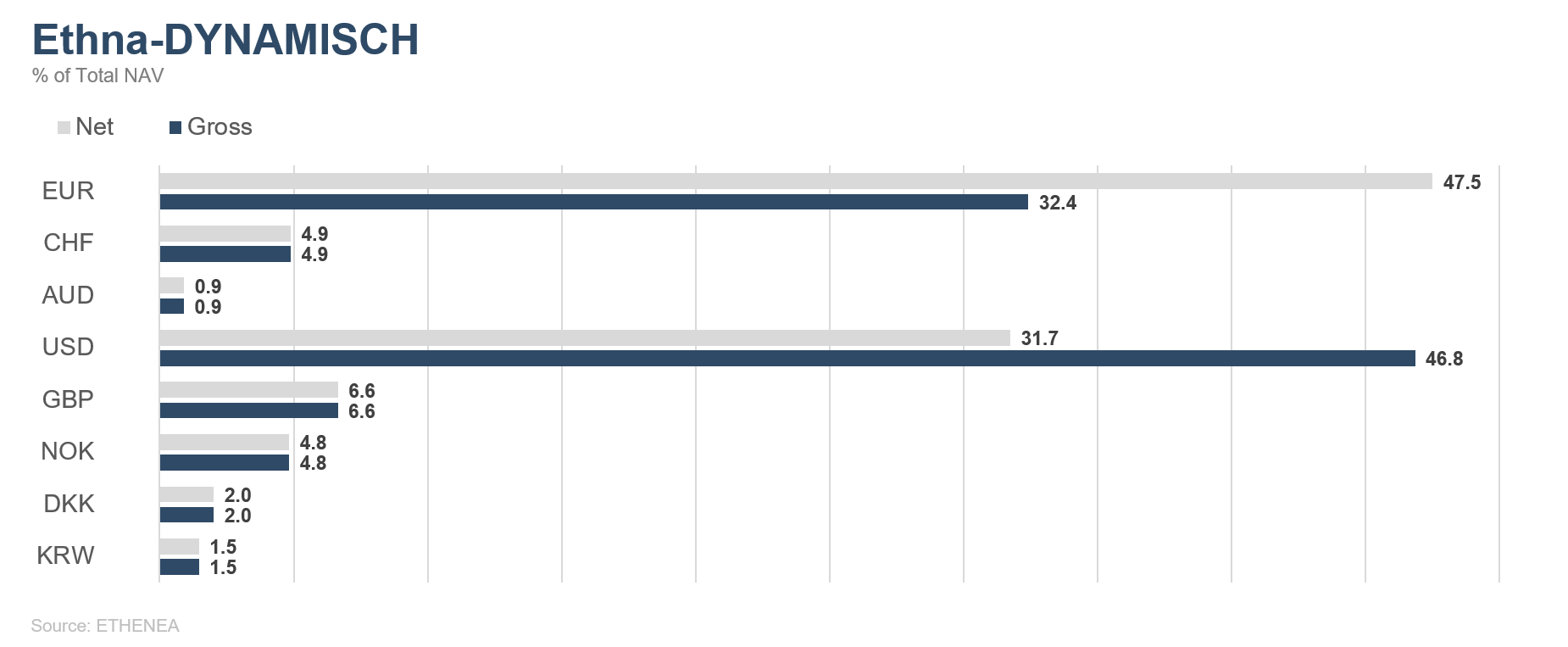

Figure 10: Portfolio composition of the Ethna-DYNAMISCH by currency

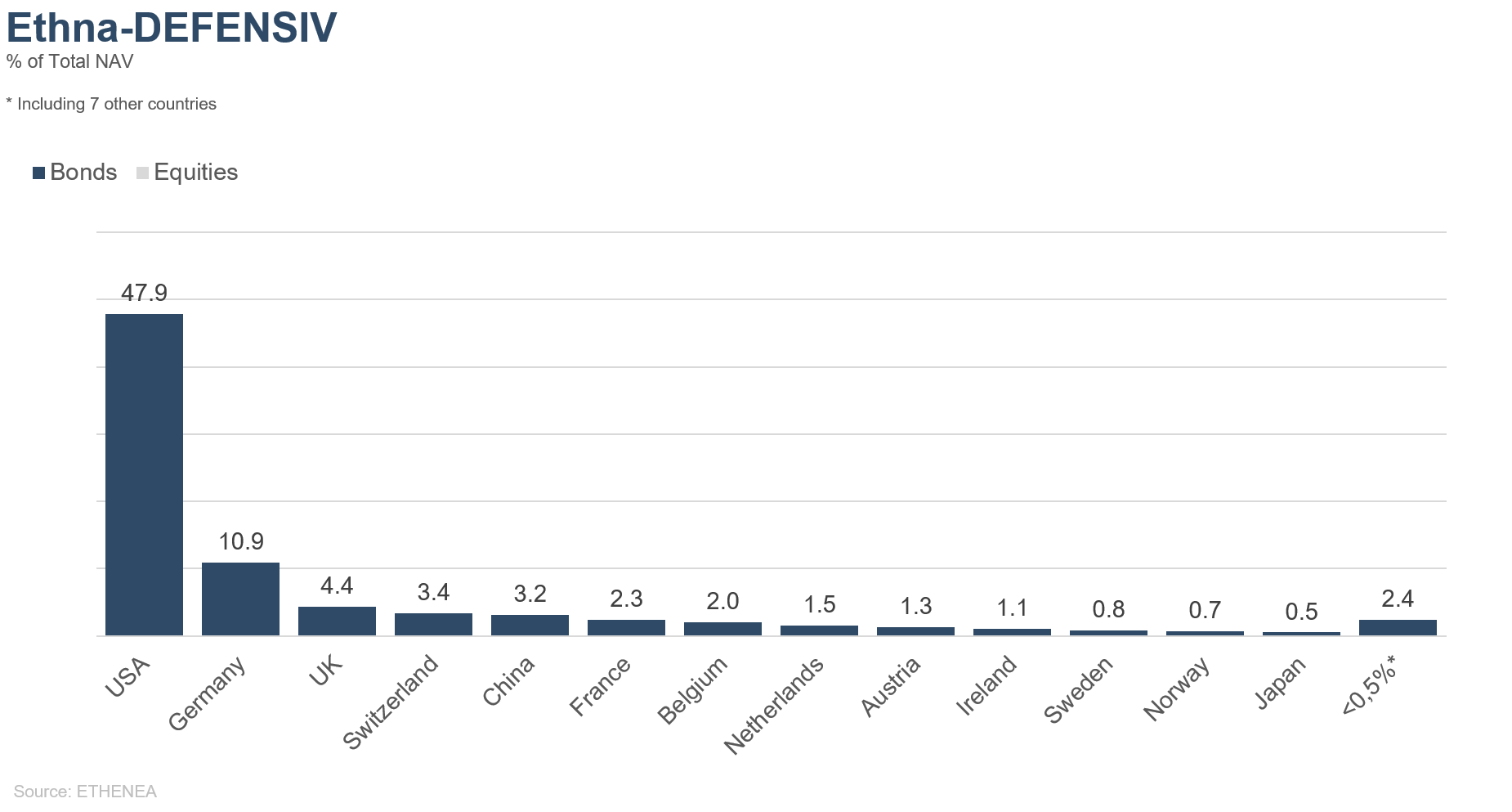

Figure 11: Portfolio composition of the Ethna-DEFENSIV by country

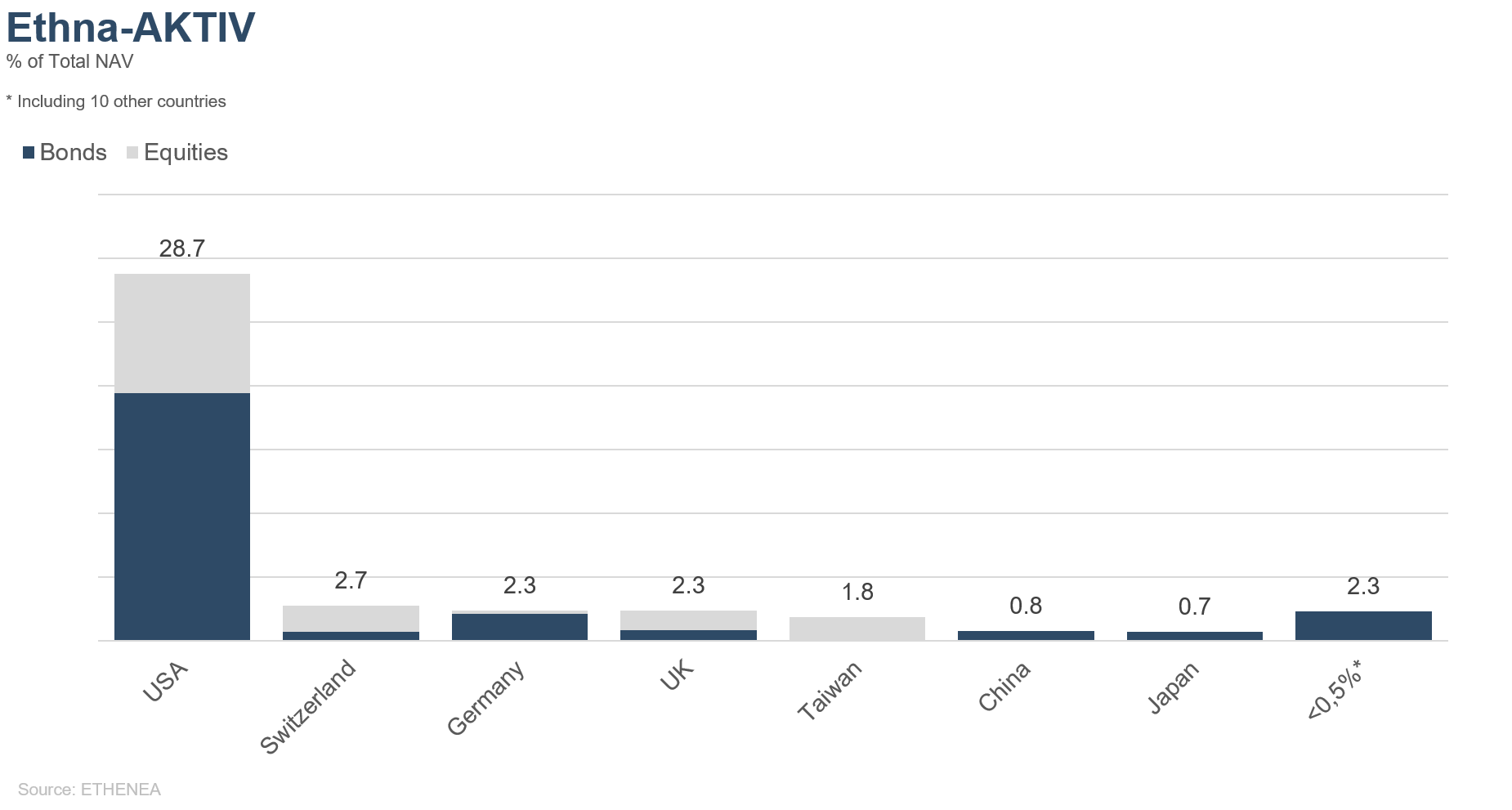

Figure 12: Portfolio composition of the Ethna-AKTIV by country

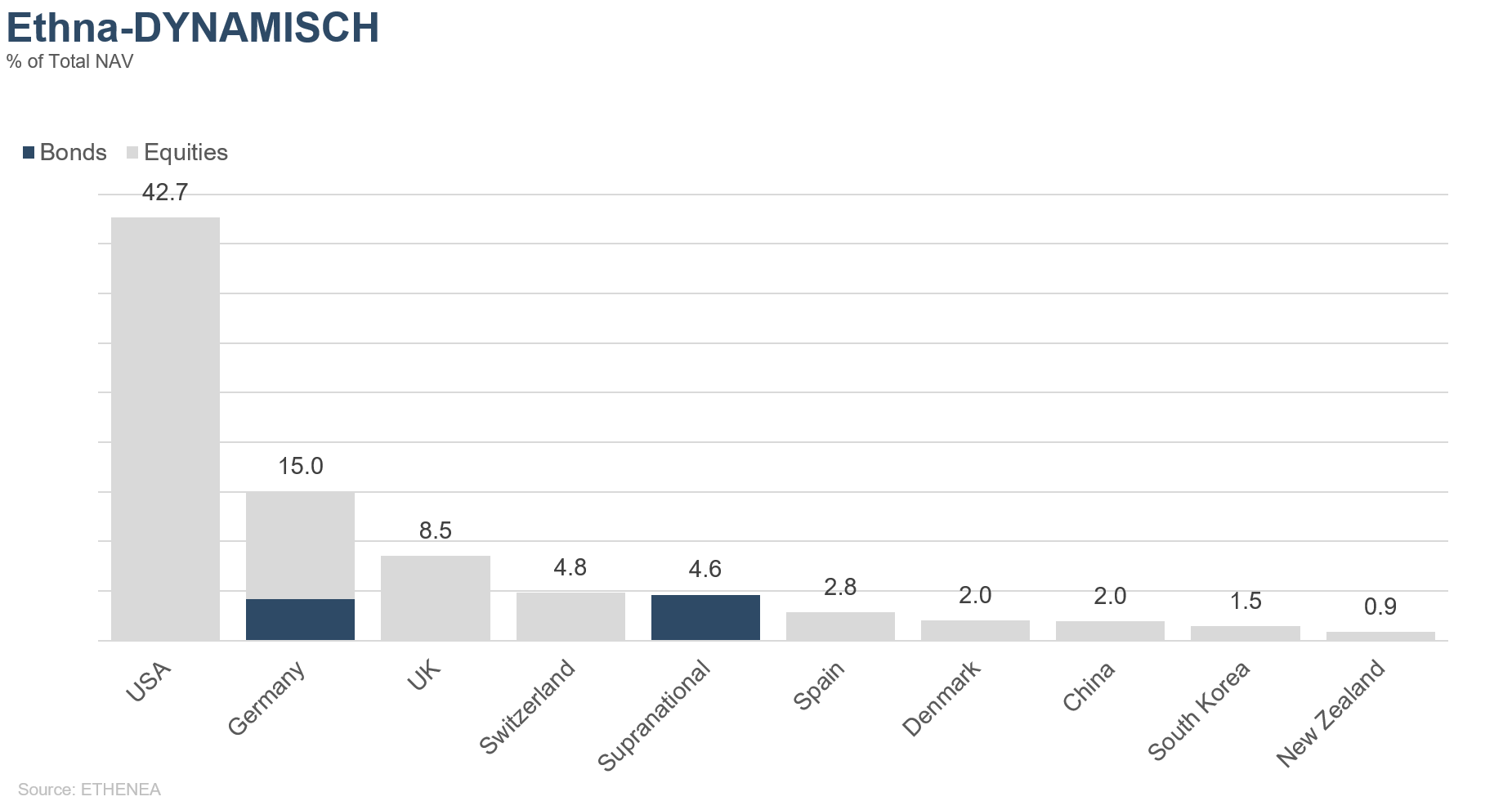

Figure 13: Portfolio composition of the Ethna-DYNAMISCH by country

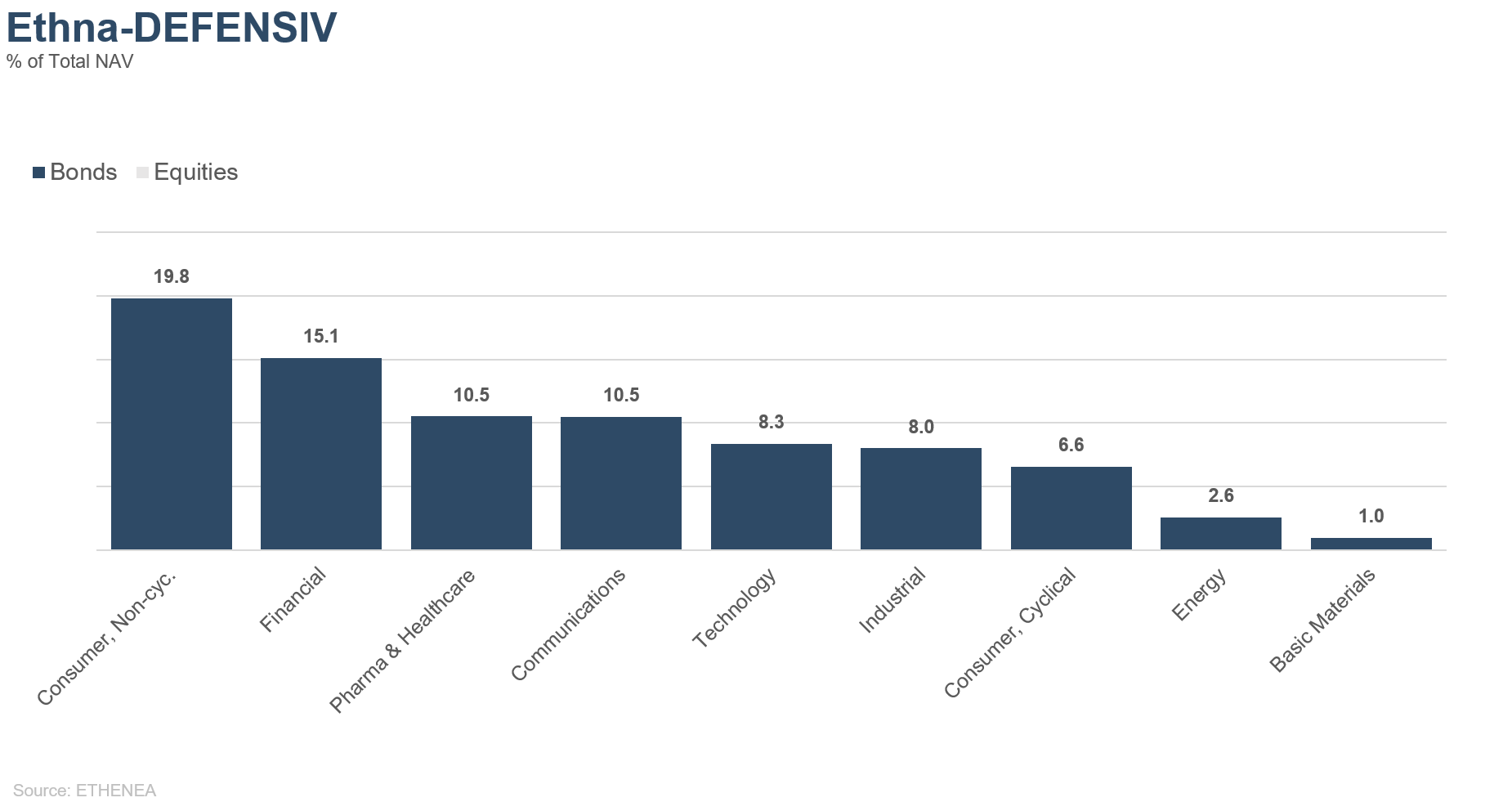

Figure 14: Portfolio composition of the Ethna-DEFENSIV by issuer sector

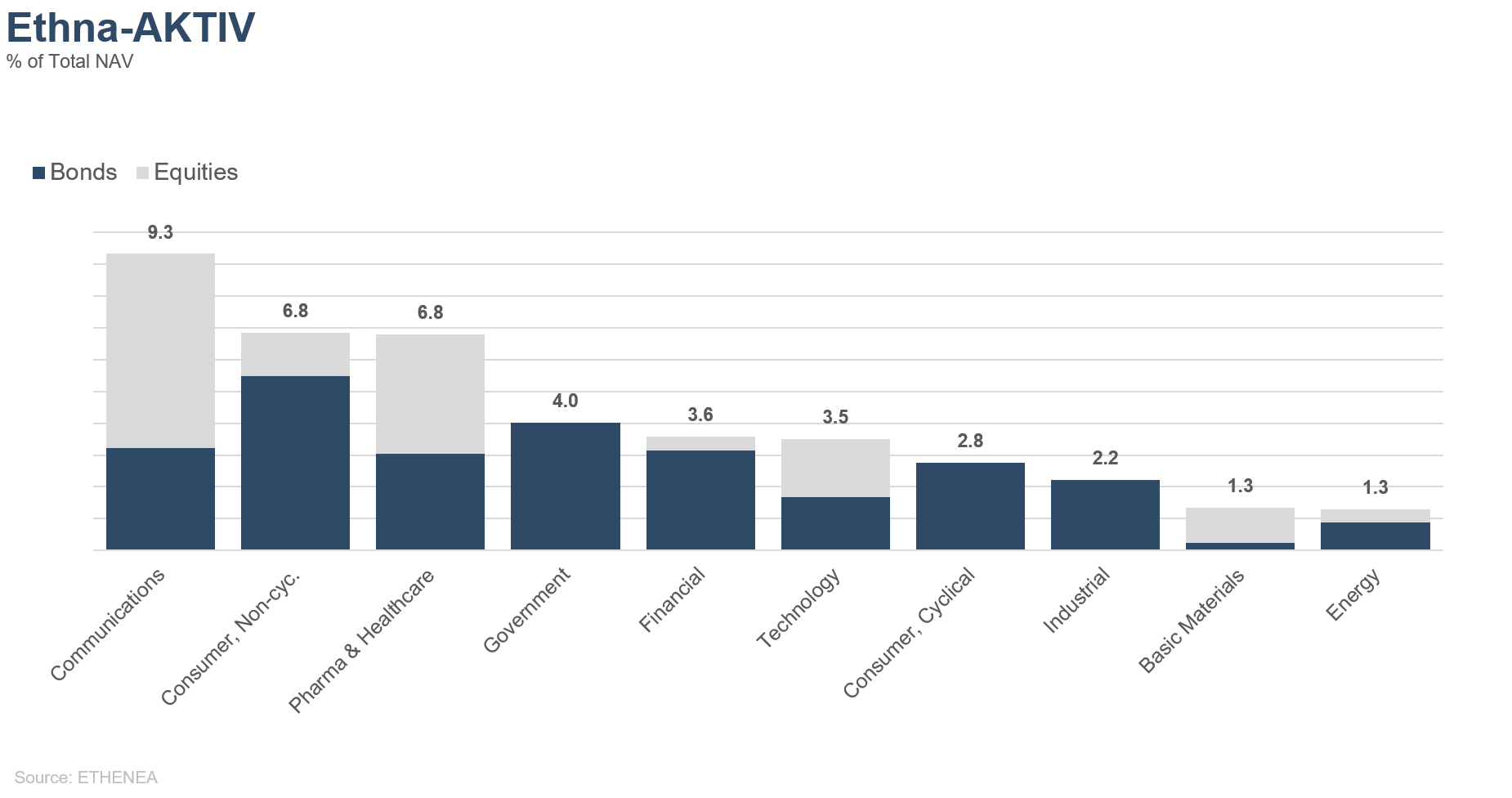

Figure 15: Portfolio composition of the Ethna-AKTIV by issuer sector

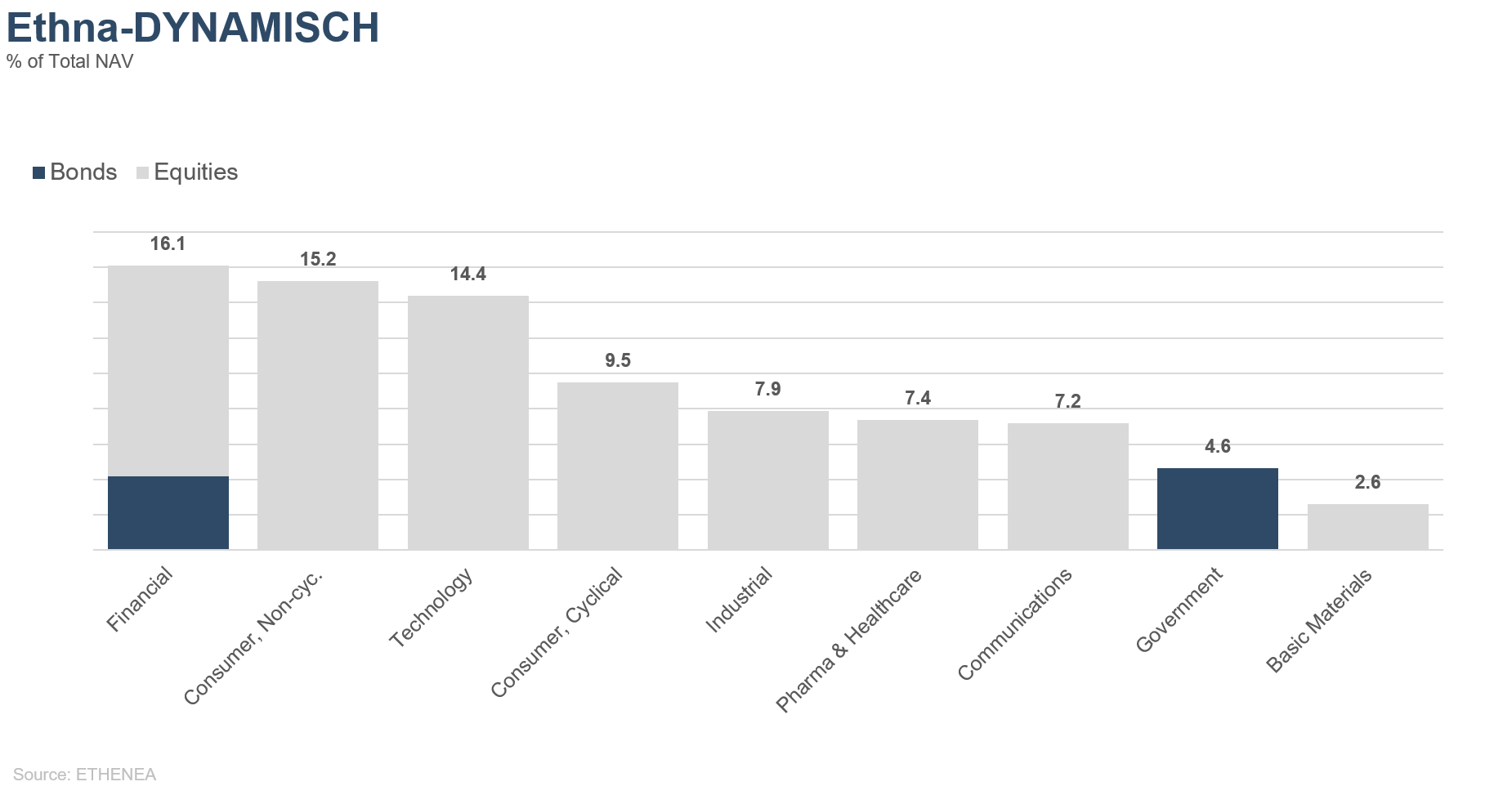

Figure 16: Portfolio composition of the Ethna-DYNAMISCH by issuer sector

* “Cash” comprises term deposits, call money and current accounts/other accounts. “Equities net” comprises direct investments and exposure resulting from equity derivatives.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

Dit is een marketing communicatie. Het is uitsluitend bedoeld om productinformatie te verstrekken en is geen verplicht wettelijk of regelgevend document. De informatie in dit document vormt geen verzoek, aanbod of aanbeveling om participaties in het fonds te kopen, te verkopen of om enige andere transactie aan te gaan. Het is uitsluitend bedoeld om de lezer inzicht te geven in de belangrijkste kenmerken van het fonds, zoals het beleggingsproces, en wordt noch geheel noch gedeeltelijk beschouwd als een beleggingsaanbeveling. De verstrekte informatie is geen vervanging voor de eigen overwegingen van de lezer of voor enige andere juridische, fiscale of financiële informatie en advies. Noch de beleggingsmaatschappij, noch haar werknemers of bestuurders kunnen aansprakelijk worden gesteld voor verliezen die rechtsreeks of onrechtstreeks worden geleden door het gebruik van de inhoud van dit document of in enig ander verband met dit document. De verkoopdocumenten in het Duits die op dit moment geldig zijn (verkoopprospectus, essentiële-informatiedocumenten (PRIIPs-KIDs) en de halfjaar- en jaarverslagen), die gedetailleerde informatie geven over de aankoop van participaties in het fonds en de bijbehorende kansen en risico's, vormen de enige wettelijke basis voor de aankoop van participaties. De bovengenoemde verkoopdocumenten in het Duits (evenals in onofficiële vertalingen in andere talen) zijn te vinden op www.ethenea.com en zijn naast de beleggingsmaatschappij ETHENEA Independent Investors S.A. en de depothoudende bank, ook gratis verkrijgbaar bij de respectieve nationale betaal- of informatieagenten en van de vertegenwoordiger in Zwitserland. De betaal- of informatieagenten voor de fondsen Ethna-AKTIV, Ethna-DEFENSIV en Ethna-DYNAMISCH zijn de volgende: België, Duitsland, Liechtenstein, Luxemburg, Oostenrijk: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxemburg; Frankrijk: CACEIS Bank France, 1-3 place Valhubert, F-75013 Paris; Italië: State Street Bank International – Succursale Italia, Via Ferrante Aporti, 10, IT-20125 Milano; Société Génerale Securities Services, Via Benigno Crespi, 19/A - MAC 2, IT-20123 Milano; Banca Sella Holding S.p.A., Piazza Gaudenzio Sella 1, IT-13900 Biella; Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Spanje: ALLFUNDS BANK, S.A., C/ Estafeta, 6 (la Moraleja), Edificio 3 – Complejo Plaza de la Fuente, ES-28109 Alcobendas (Madrid); Zwitserland: Vertegenwoordiger: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Betaalagent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. De betaal- of informatieagenten voor HESPER FUND, SICAV - Global Solutions zijn de volgende: België, Duitsland, Frankrijk, Luxemburg, Oostenrijk: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxemburg; Italië: Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Zwitserland: Vertegenwoordiger: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Betaalagent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. De beleggingsmaatschappij kan bestaande distributieovereenkomsten met derden beëindigen of distributievergunningen intrekken om strategische of statutaire redenen, mits inachtneming van eventuele deadlines. Beleggers kunnen informatie over hun rechten verkrijgen op de website www.ethenea.com en in de verkoopprospectus. De informatie is zowel in het Duits als in het Engels beschikbaar, en in individuele gevallen ook in andere talen. Opgemaakt door: ETHENEA Independent Investors S.A. Het is verboden om dit document te verspreiden aan personen die wonen in landen waar het fonds geen vergunning heeft of waar er een toestemming vereist is voor verspreiding. Participaties mogen enkel aangeboden worden aan personen in landen waarin dit aanbod in overeenstemming is met de toepasselijke wettelijke bepalingen en waar ervoor wordt gezorgd dat de verspreiding en publicatie van dit document, evenals een aanbod of verkoop van participaties, aan geen enkele beperking is onderworpen in het betreffende rechtsgebied. Het fonds wordt met name niet aangeboden in de Verenigde Staten van Amerika of aan Amerikaanse burgers (volgens Rule 902 of Regulation S of the U.S. Securities Act of 1933, in de huidige versie) of personen die namens hen, in hun rekening of ten voordele van een Amerikaanse burger handelen. Resultaten die in het verleden behaald zijn, mogen niet worden opgevat als indicatie of garantie voor toekomstige prestaties. Schommelingen in de waarde van onderliggende financiële instrumenten of hun rendementen, evenals veranderingen in rentetarieven en valutakoersen, zorgen ervoor dat de waarde van participaties in een fonds, evenals de daaruit voortvloeiende rendementen, zowel kunnen dalen als stijgen en zijn niet gegarandeerd. De waarderingen die hierin opgenomen zijn, zijn gebaseerd op een aantal factoren, waaronder, maar niet beperkt tot, huidige prijzen, schattingen van de waarde van de onderliggende activa en marktliquiditeit, evenals andere veronderstellingen en openbaar beschikbare informatie. In principe kunnen prijzen, waarden en rendementen zowel stijgen als dalen, tot en met het totale verlies van het geïnvesteerde kapitaal, en aannames en informatie kunnen zonder voorafgaande kennisgeving worden gewijzigd. De waarde van het belegde vermogen of de prijs van participaties, evenals de daaruit voortvloeiende rendementen en uitkeringsbedragen, zijn onderhevig aan schommelingen of kunnen geheel verdwijnen. Positieve prestaties in het verleden zijn daarom geen garantie voor positieve prestaties in de toekomst. Met name het behoud van het geïnvesteerde vermogen kan niet worden gegarandeerd; er is dan ook geen garantie dat de waarde van het belegde kapitaal of de aangehouden participaties bij verkoop of terugkoop zal overeenkomen met het oorspronkelijk belegde kapitaal. Beleggingen in vreemde valuta zijn onderhevig aan bijkomende wisselkoersschommelingen of valutarisico's, d.w.z. het rendement van dergelijke beleggingen hangt ook af van de volatiliteit van de vreemde valuta, wat een negatieve impact kan hebben op de waarde van het belegde kapitaal. Beleggingen en toewijzingen kunnen gewijzigd worden. De beheer- en depotvergoedingen, evenals alle andere kosten die overeenkomstig de contractuele bepalingen ten laste van het fonds zijn, worden in de berekening opgenomen. De prestatieberekening is gebaseerd op de BVI-methode (Duitse Federale Vereniging voor Beleggings- en Vermogensbeheer), dat wil zeggen dat uitgiftekosten, transactiekosten (zoals order- en makelaarskosten), evenals bewaar- en andere beheervergoedingen niet inbegrepen zijn in de berekening. Het beleggingsrendement zou lager zijn indien rekening zou worden gehouden met de uitgiftetoeslag. Er kan geen garantie worden gegeven dat de marktprognoses gehaald worden. Om het even welke risicobehandeling in deze publicatie mag niet worden beschouwd als een onthulling van alle risico's of een sluitende behandeling van de genoemde risico's. In de verkoopprospectus wordt expliciet verwezen naar de gedetailleerde risicobeschrijvingen. Er kan geen garantie worden gegeven dat de informatie juist, volledig of actueel is. De inhoud en de informatie zijn auteursrechtelijk beschermd. Er kan geen garantie worden gegeven dat het document voldoet aan alle wettelijke of regelgevende vereisten die andere landen dan Luxemburg hebben vastgesteld. Opmerking: De belangrijkste technische termen kunnen worden gevonden in de woordenlijst op www.ethenea.com/lexicon. Informatie voor beleggers in België: Het prospectus, de statuten en de periodieke verslagen, alsmede de essentiële-informatiedocumenten (PRIIPs-KIDs), zijn kosteloos verkrijgbaar in het Frans bij de beheermaatschappij, ETHENEA Independent Investors S.A., 16, rue Gabriel Lippmann, 5365 Munsbach, Luxemburg en bij de vertegenwoordiger: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxemburg. Informatie voor beleggers in Zwitserland: Het vestigingsland van de collectieve beleggingsregeling is Luxemburg. De vertegenwoordiger in Zwitserland is IPConcept (Schweiz) AG, Münsterhof 12, P.O. Box, CH-8022 Zürich. De betaalagent in Zwitserland is DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zurich. Het prospectus, de essentiële-informatiedocumenten (PRIIPs-KIDs) en de statuten, evenals de jaar- en halfjaarverslagen zijn kosteloos verkrijgbaar bij de vertegenwoordiger. Copyright © ETHENEA Independent Investors S.A. (2025) Alle rechten voorbehouden. 04-10-2021