Whatever it takes 2.0

The crisis triggered by the coronavirus is escalating day by day. In the war against the exponential spread of the virus, and to prevent national healthcare systems from becoming overwhelmed, there have been profound changes in life outside the home.

Most countries in the world have imposed restrictions on movement, as well as other measures ranging from limiting gatherings of people, through a total shutdown of all non-essential businesses up to the closure of borders. Many people are also self-isolating as a precaution.

In addition to the restrictions on life outside the home, the fight against the pandemic is having a profound effect on the real economy. Not only are factory closures leading to lost production but the livelihood of much of the services industry – direct contact with the customer – has gone. People’s uncertainty about how much the crisis will threaten their job security is further curtailing what consumer spending there is.

The number of new unemployment claims reported in the last week of March in the U.S. gives a first impression of the impact of the crisis on what until then had been a very solid U.S. labour market. Almost 3.8 million claims were filed. This is a sharp spike compared to the average of 311,000 new claims per week over the past 10 years.

The sudden collapse in demand has repercussions for all stages of the value chains. According to a survey conducted by the Association of German Chambers of Industry and Commerce (DIHK) published on 27 March, one in five of the firms polled felt itself at acute risk of insolvency. In times of quarantine or self-isolation no revenue is coming in while current expenses, such as wages and rents, are sucking liquidity out of companies. Until they get clarity on the duration and scale of the coronavirus crisis, companies are trying to conserve liquidity as much as possible. They are placing no more orders and are also giving themselves short- to medium-term financial leeway by drawing down their revolving lines of credit. The resulting outflow of funds is causing serious refinancing problems for banks. While large firms have the option to draw on their lines of credit, small enterprises already cannot pay interest and coupons. In addition, tremendous efforts are being made on the markets to sell assets in order to create liquidity. But selling in the absence of buyers results in prices that may even be below their fundamentally justified prices. Panic breaks out and the crisis begins to fuel itself.

In recent decades, intervention by central banks has been a proven method of putting out the fires. As the ultimate source of liquidity, they have a central role in curbing systemic crises. What’s important is that early signs of support and resolute intervention occur at the right time – this is something past crises have taught us.

The emergency programmes introduced by the ECB and the Federal Reserve in the last few days of March have the potential to take the immediate stress out of the system. The Federal Reserve’s alphabet soup of measures, for example, is aimed at highly diverse sectors of the financial system in order to satisfy the various demands for liquidity. On 23 March, the Fed announced the following programmes to support bank liquidity and lending to private households and companies:

- It will purchase U.S. Treasuries and agency Mortgage Backed Securities in the market in unlimited amounts to provide liquidity in the sovereign bond market.

- The Money Market Mutual Funding Liquidity Facility (MMMFLF) enables banks to buy assets from money market funds that need to meet redemptions.

- The Commercial Paper Funding Facility (CPFF) enables U.S. corporations to refinance short-term debt instruments, and will directly provide the corporate sector with liquidity.

- The Primary Dealer Credit Facility (PDCF) enables banks who are allowed to trade directly with the Fed to pledge business loans, commercial paper, municipal bonds and even equities as collateral for credit. It is designed to allow lending to households and to the corporate sector to become fully functional again.

- The Primary Market Corporate Credit Facility (PMCCF) is intended for the purchase of new investment-grade U.S. corporate issuances with a residual maturity of up to four years. The Federal Reserve’s intention is to secure funding for large companies.

- The Secondary Market Corporate Credit Facility (SMCCF) enables banks to sell outstanding bonds. It gives brokers an opportunity to offload credit risks that cannot be sold in the market. This relieves the bank books and will in turn mean that brokers start to trade in credit risk again. For unsaleable assets, there is an out.

- The Federal Reserve has restarted the Term Asset Backed Security Loan Facility (TALF), which people will be familiar with from the financial crisis, to facilitate loans to consumers. Securitised auto loans, student loans, credit card receivables and the like can be pledged by banks as collateral for new loans.

These programmes amount to up to USD 4 trillion in addition to the unlimited purchase programmes for U.S. Treasuries and U.S. agency debt.

In the eurozone the ECB decided back on 18 March to launch a new, time-limited purchase programme. The Pandemic Emergency Purchase Programme (PEPP) will enable the ECB to buy up to EUR 750 billion in sovereign bonds, asset-backed securities, covered bonds, and corporate bonds with an investment-grade rating. At the same time, the ECB announced that under PEPP it would be able to deviate from the central bank capital key, paving the way for bonds from peripheral countries whose debt levels are already high, like Italy, to be purchased to a greater degree. In addition, it is making an exception for Greek sovereign bonds, since Greece’s high yield rating does not meet the standards for asset purchases. The ECB’s intention is also to provide liquidity to the markets, reduce refinancing costs and avert a systemic crisis in financial markets.

The scale of the monetary packages just announced by the central banks in the U.S. and Europe exceeds all historic stimulus packages introduced in the 2008 global financial crisis and in the 2011/12 euro crisis.

However, liquidity measures are not enough to solve the problems in the real economy. This requires coordinated fiscal programmes that specifically assist employers and employees affected by what is – it is hoped – just a temporary shutdown. This strikes us as much easier to implement in the U.S. than in a fragmented European Union where the national governments pursue their own interests.

No programme, be it fiscal or monetary, can fund a long-lasting suspension of people’s public lives and economic life. So, first and foremost, it is absolutely essential to get the spread of coronavirus under control, primarily to limit the human toll but also to give planning certainty back to employers and employees. The measures of central banks and the emergency lifelines in Europe and the U.S. are the first important steps in cushioning the blow of the coronavirus crisis, and at the same time a positive signal to the economy and capital markets. However, they certainly won’t be the last.

This market commentary takes into account all publicly known and accessible information at the time of writing (01.04.2020).

Positioning of the Ethna Funds

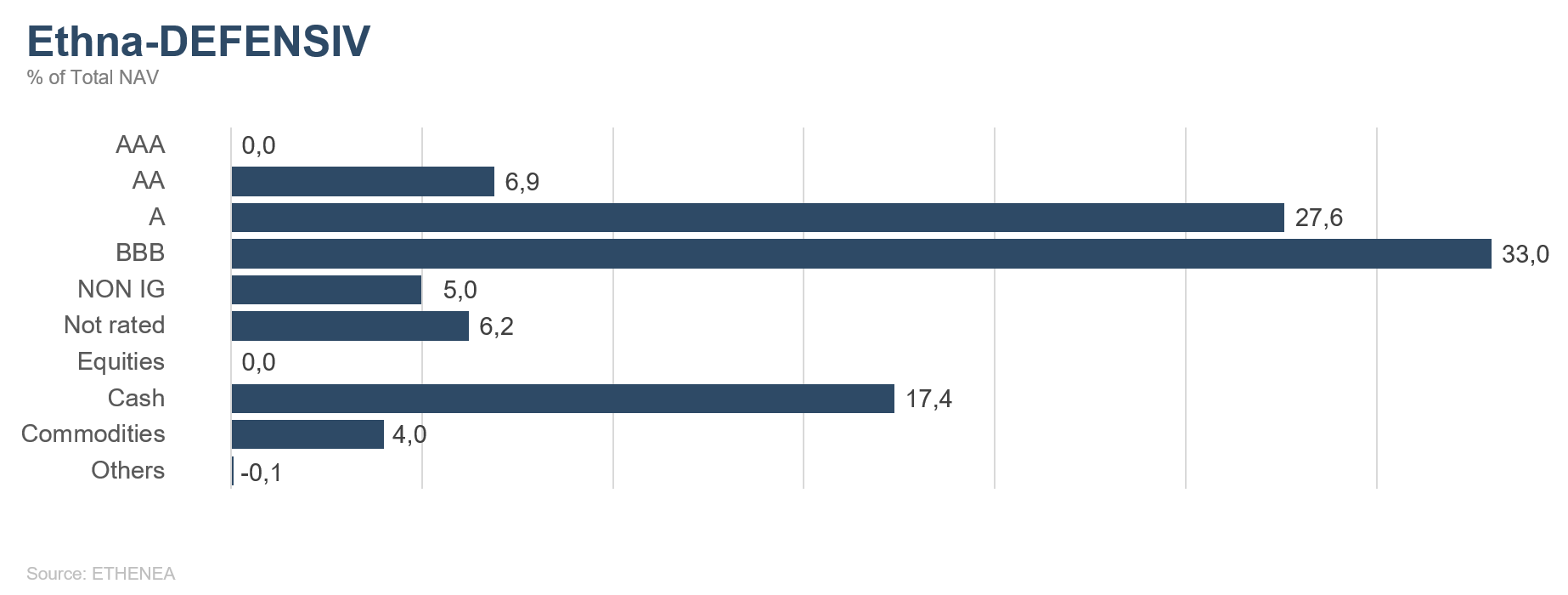

Ethna-DEFENSIV

Fears that the intensifying COVID-19 epidemic in China would become a global pandemic were realised in March. This has further heightened uncertainty over future global consumer demand and concerns about the possible breakdown of international supply chains, and led to a deep selloff of almost all asset classes. In March, European and U.S. equity markets again shed between 13% and 17%, having already suffered painful losses in February. Investment grade corporate bonds were also caught up in this selloff. The performance of EUR-denominated corporate bonds for the month was -6.9% whereas for USD-denominated corporate bonds it was -7.1%. In the hunt for liquidity even safe-haven assets, such as secure sovereign bonds and gold, were affected by this selloff for a time. For example, at the beginning of the month, uncertainty caused the 10-year U.S. Treasury yield initially to fall from 1.15% to 0.54%. As the month progressed it the rose to approximately 1.2% and finished the month on 0.68%. The yield on the 10-year Bund, which initially dropped to an historical low of -0.91%, closed March on -0.47%. The price of gold was similarly volatile in the search for liquidity in March. Initially gold rose by around 6% to USD 1,680 before falling to USD 1,471 in the space of 10 days. It stood at USD 1,577 at month-end.

Two factors played a role in the price of oil this month. COVID-19 caused a sharp fall right at the beginning of the month. In addition, the OPEC+ members were unable to agree on further cuts in oil supplies. Instead, Saudi Arabia announced that it would increase production as of April, which caused a veritable collapse in the price of oil. Brent crude cost around USD 50 a barrel at the beginning of March but at the end of the month the price stood at around USD 25. This meant added pressure for the international capital markets.

Fears about the impact of coronavirus on the economy and capital markets led many countries and central banks to take extraordinary measures. As well as fiscal programmes in various countries, many central banks across the world have recently announced monetary easing. Undoubtedly the clearest signal was the U.S. Fed’s 100-basis point (bp) rate cut. With that, the benchmark interest rate is now in the range of 0% to 0.25%. In addition, among other measures, it restarted a USD 700 billion bond purchase programme. The European Central Bank also reacted to the much gloomier economic outlook and the resulting increases in spreads and yields in the European bond market by announcing in an emergency meeting a EUR 750 billion asset purchase program entitled Pandemic Emergency Purchase Programme (PEPP). The extraordinary and extensive support measures put in place by central banks managed to stabilise the bond markets towards the end of the month.

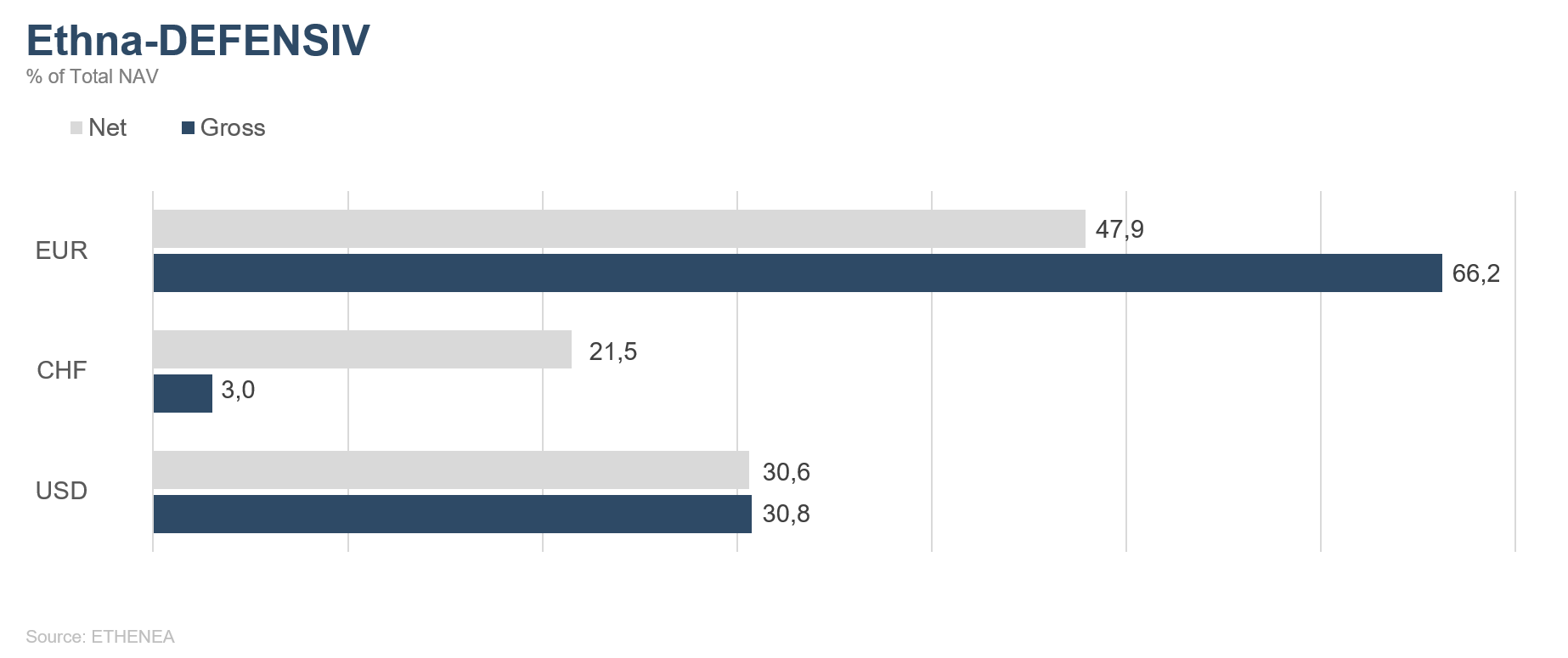

The U.S. dollar and the Swiss franc also played their role as a safe haven and advanced until well into March. Once the markets settled down towards the end of the month, however, both currencies lost some of their gains.

Despite the strong credit quality of its corporate bonds, which have an average rating of between BBB+ and A-, the Ethna-DEFENSIV was not entirely unaffected by the deep selloff of all asset classes in the month of March. Within our bond portfolio, we swapped some EUR-denominated corporate bonds for USD-denominated corporate bonds. The portfolio duration is currently 5.9 years. We are using a small short position in the Euro Stoxx 50 as an additional hedge. The high liquidity level of around 17% gives us flexibility going forward.

It is hard at the moment to provide an outlook for the coming months. Our baseline scenario is still based on the assumption that it will be months until the economic impact of the COVID-19 pandemic can better be estimated. The fund’s focus is still on high-quality bonds, which constitute 80% of the portfolio. In view of central banks’ greater demand for bonds, we are confident that we can expect the fund to recover in the coming weeks and months, and indeed beyond. We are maintaining the fund’s conservative risk profile.

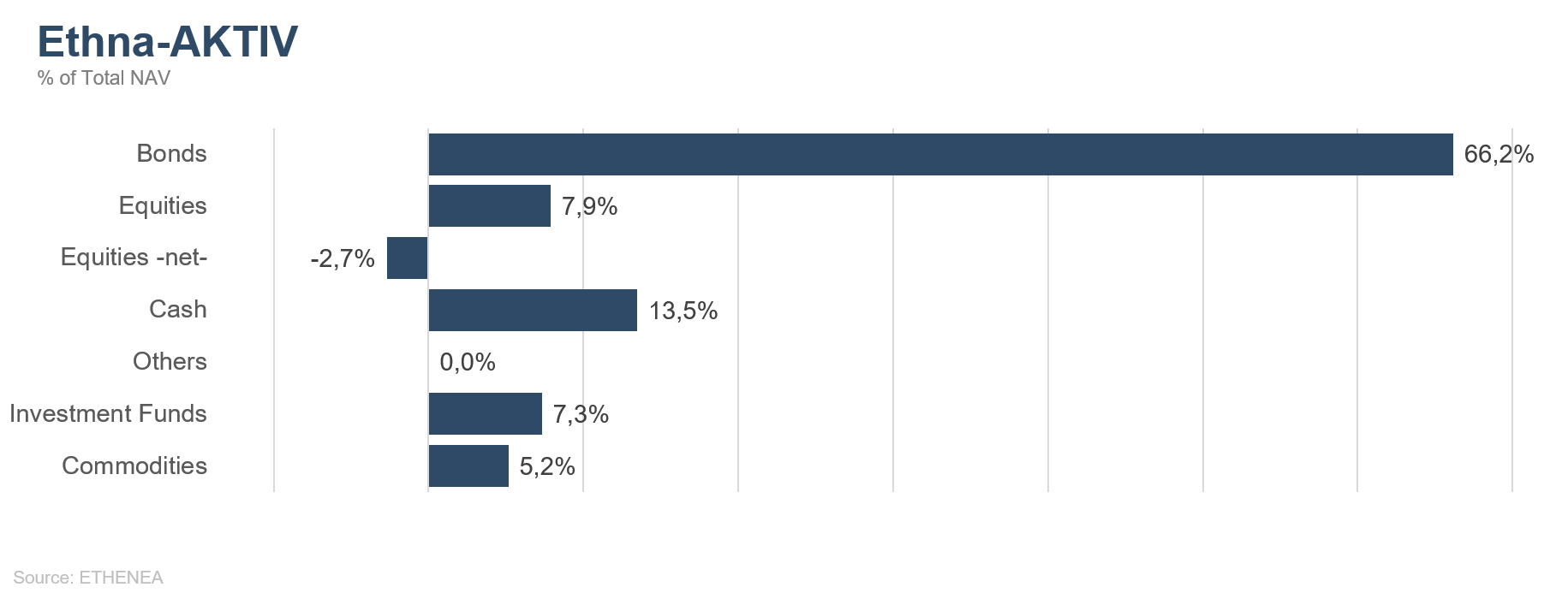

Ethna-AKTIV

The month of March was dominated by fears of COVID-19 and by uncertainty about the consequences for public health and the economy. The exponential rise in the number of cases worldwide led to severe restrictions on private and economic life. Social distancing has put an abrupt end to interpersonal and economic interaction. The adjustments to growth and earnings outlooks that can be expected were priced into global capital markets within a very short space of time, leading to dramatic corrections in equities and bonds alike. The turbulence in stock markets was further stoked by the price war in the oil market, which led to an historic fall in the price of the commodity. The colossal monetary and fiscal support measures did calm the markets for the time being but it remains to be seen to what extent they can alleviate the damage that millions of companies have suffered. Another matter entirely, of course, is the long-term fallout of these debt-financed measures. However, that will not be dealt with until after the crisis. It is our view that the economic situation will not ease in the short term until the restrictions imposed on business and society can be lifted without healthcare systems collapsing. At the moment we cannot say when this will be the case. Given the extent of the current cutbacks, long-term we expect a global recession and are also aligning the portfolio structure to such an environment. We are ruling out a V-shaped recovery of the economy and the equity markets. We think it quite likely that further correction will be needed; however, the probability does depend greatly on the duration of the current economic shutdown.

In response to the current bear market, we have lowered the strategic range for the fund’s equity allocation. We took tactical advantage of the temporary bear market rally, which we believe was already out of steam at the end of the month, to sell futures to build up what is actually a slightly negative exposure. The very sharp widening of spreads in the bond market did not go unfelt even by our high-quality portfolio, which is why they were the biggest contributor to the negative performance in March. In an ongoing process since the beginning of the year, we continued reducing bonds towards the prospective figure of 50% of the portfolio. The purchase programmes announced by central banks presented a good opportunity to do so. However, the dollar rally we anticipated has slowed to a crawl. The U.S. central bank has since pulled out all the stops to supply the world with U.S. dollars. The fact that the latest countermovement in the U.S. dollar was not more pronounced only reinforces our belief that an even stronger dollar can be expected in the medium term.

In the current environment, we believe this defensive fund positioning is appropriate. At the same time, given the falls in prices, the yields in the bond portfolio are relatively attractive once again, and we will have reached the peak of the crisis in the next few months. Historically, bear phases have shown that equity indices generally reach a low point before that. Please rest assured that the Ethna-AKTIV’s active and flexible management approach also takes account of this scenario and is not just seeing through the crisis with the aim of preserving capital.

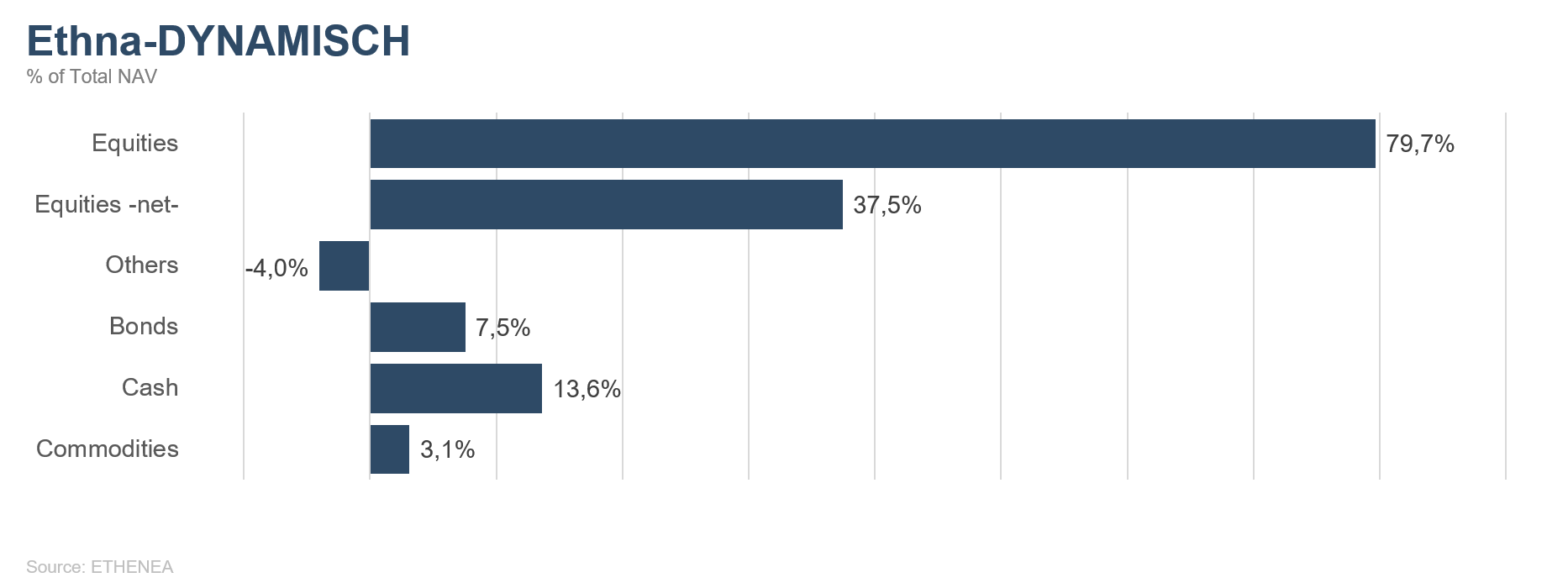

Ethna-DYNAMISCH

Initial uncertainty at the end of February about how the coronavirus would develop became the certainty in March of a global pandemic with far-reaching consequences for the capital markets and civil society. To protect people and to slow the spread of the virus, severe restrictions were placed on life outside the home in many European countries within a very short space of time. Schools, non-essential businesses and companies were closed; the whole economy is in emergency mode – far-reaching measures that not long ago nobody would have imagined. There was panic in stock markets, and losses that recall the 2008/2009 financial crisis. It wasn’t just the equity market that saw extreme movements: the Brent crude price fell to USD 25 and the yield on 10-year German Bunds fell for a time during the month to a new all-time low of -0.91%.

In this environment, the Ethna-DYNAMISCH showed its defensive mettle and clearly limited the negative effects on the portfolio compared with the overall market. In particular, the equity portfolio – which last year focused on quality stocks with plenty of market leaders and hardly any cyclical business models – paid off, whereas countless traditional value equities were very badly hit by recent developments. The hedging opportunities the fund has thanks to its high level of flexibility also helped to limit volatility and losses in March. The net equity allocation was between 30% and 70% in March and was adjusted multiple times – mainly countercyclically – to the current market situation. The major indices saw daily fluctuations of up to 15% in some cases, which corresponds to one year’s return under normal circumstances. Accordingly, we acted very prudently in managing the fund. Mostly we set pre-defined price limits for single stock transactions and for hedging in order to use the sometimes ferocious volatility to our advantage. We utilised the strong recovery in equity markets in the last full week of March to take profits and reduce the equity allocation to slightly less than 40%.

There were also a few reallocations in the equity portfolio due to the upheaval. We closed our positions in soft drinks manufacturer Fever-Tree and oil company Total. Both companies have been hit hard by current events. The future financial performance of these companies will be impacted for the foreseeable future. In other respects, the fall in prices has thrown up interesting opportunities. For example, BlackRock and Visa were new additions. BlackRock is ideally positioned mainly in the booming ETF business and has very attractive free cashflows. BlackRock should be a winner post-crisis and should be able to expand its already excellent market position. Visa is the world’s leading credit card company alongside Mastercard. The business model has very high margins, which the oligopolistic competitive structure is likely to protect long-term. Thanks to its recurring revenue streams, Visa is hardly affected by the crisis at all.

At the moment, no one is able to give a halfway decent outlook on the coming weeks and months, as the situation is too special and unique at present. Current predictions expect a moderate to severe recession. Then there are the economic stimulus packages on an unprecedented scale. And central banks are also doing all in their power to support politics and business. So, both optimists and pessimists have plenty to back up their respective arguments. After the strong rally in prices in the last few days of March, we are going into April with an overall rather conservative equity allocation of slightly less than 40%. We consider it highly likely that capital market prices will fluctuate strongly over the next few weeks. As in the previous weeks, we will take a countercyclical approach to take advantage of the opportunities that arise as best possible, as well as to keep in check the risks that no doubt exist.

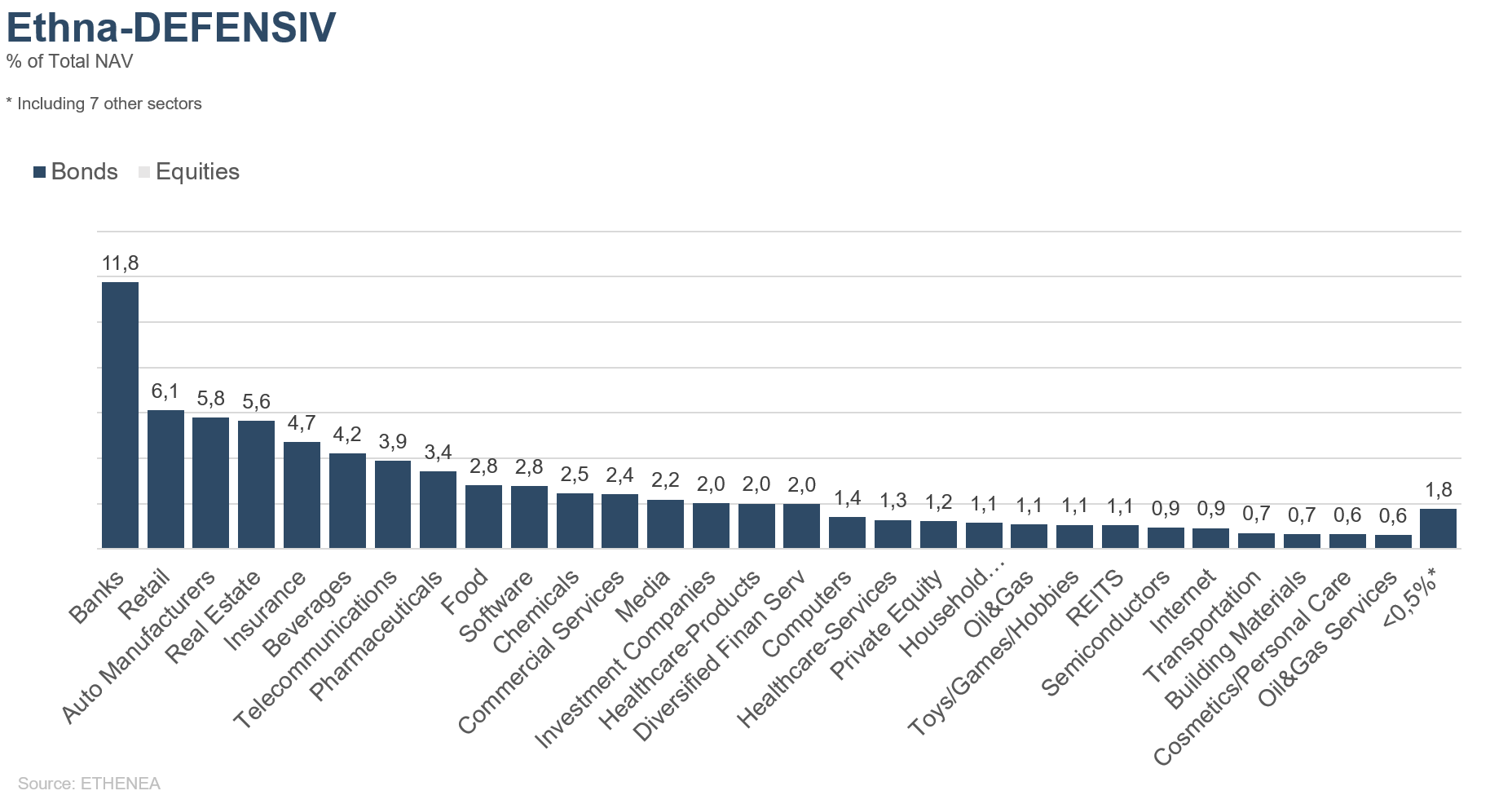

Figure 1: Portfolio structure* of the Ethna-DEFENSIV

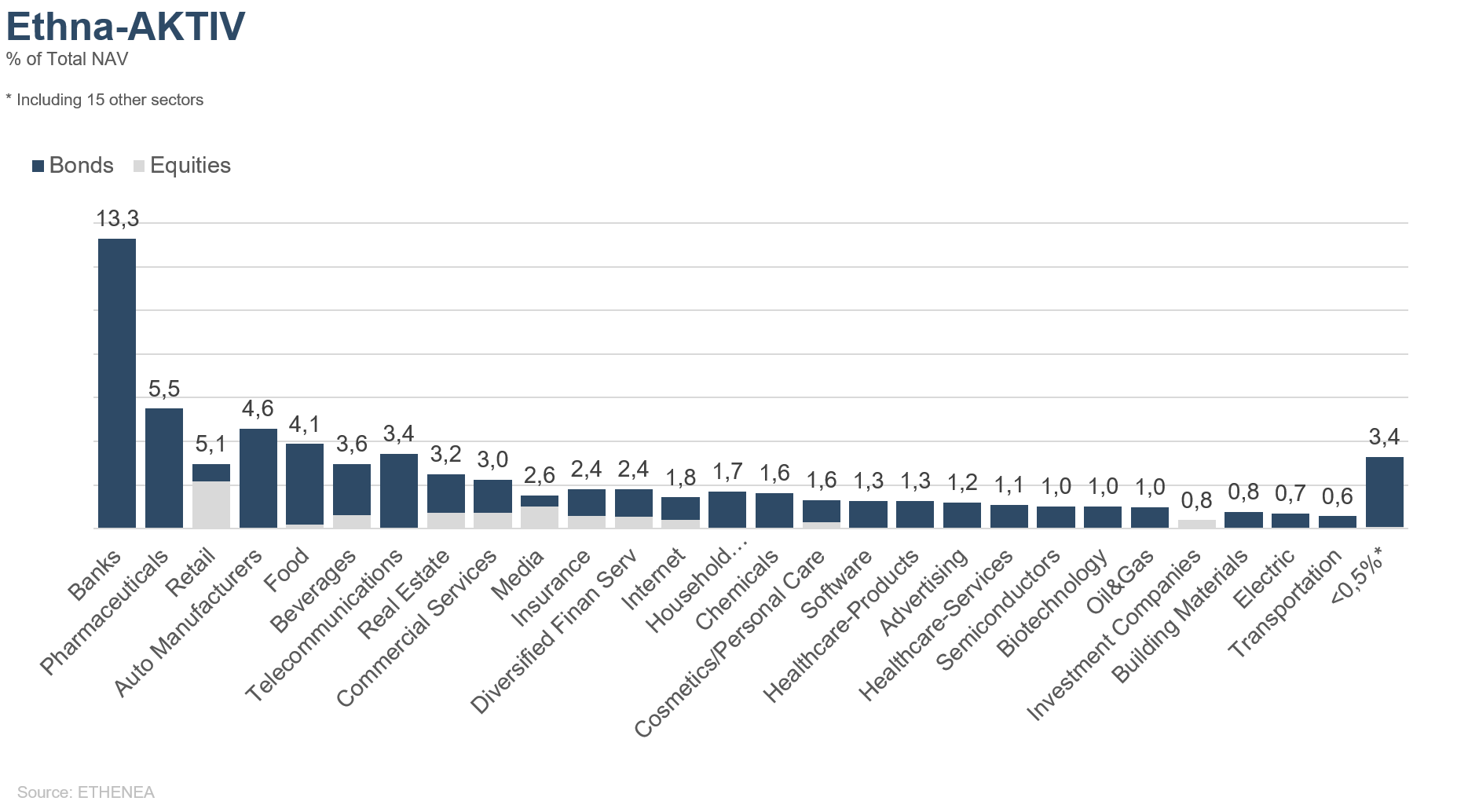

Figure 2: Portfolio structure* of the Ethna-AKTIV

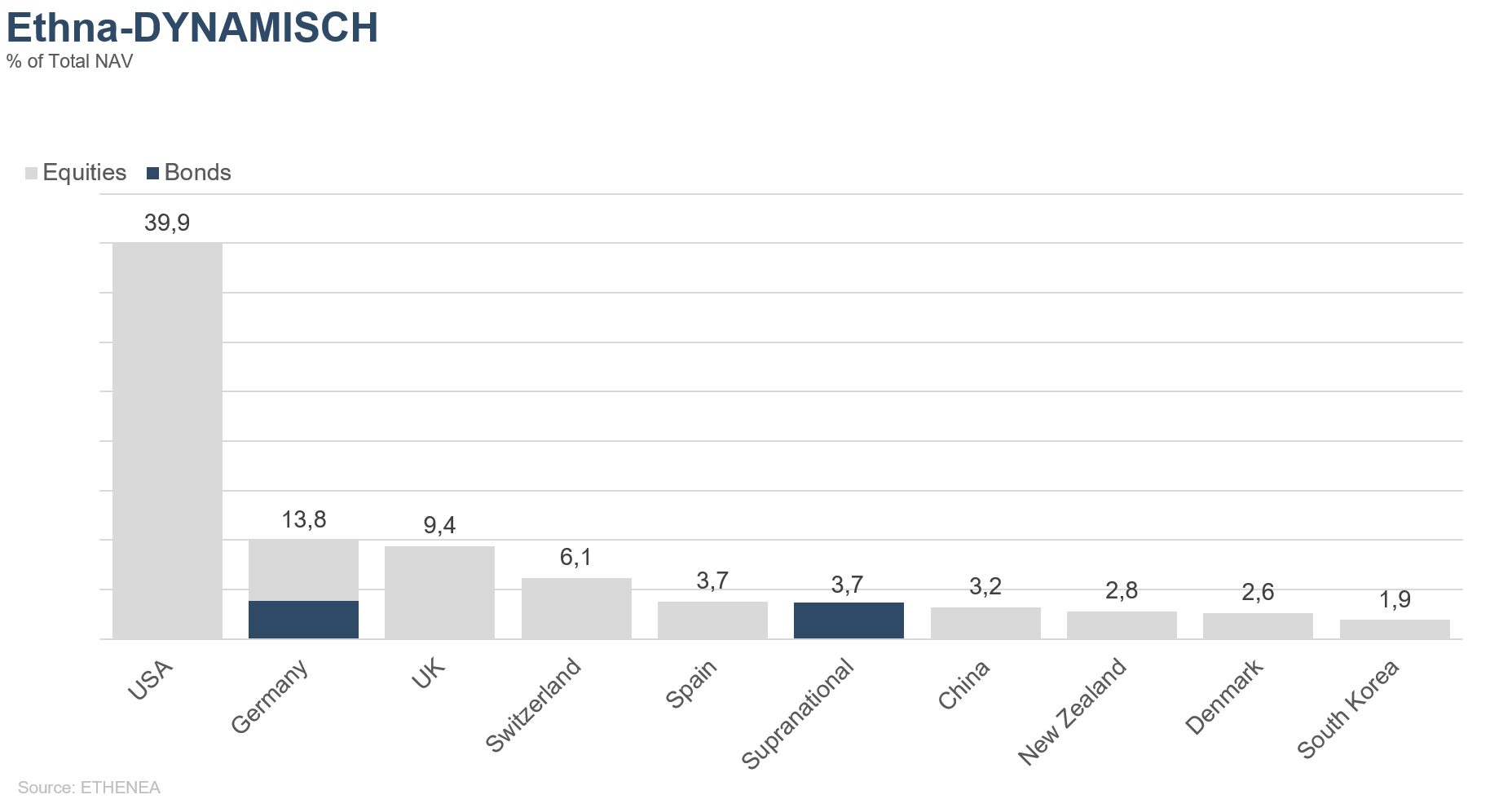

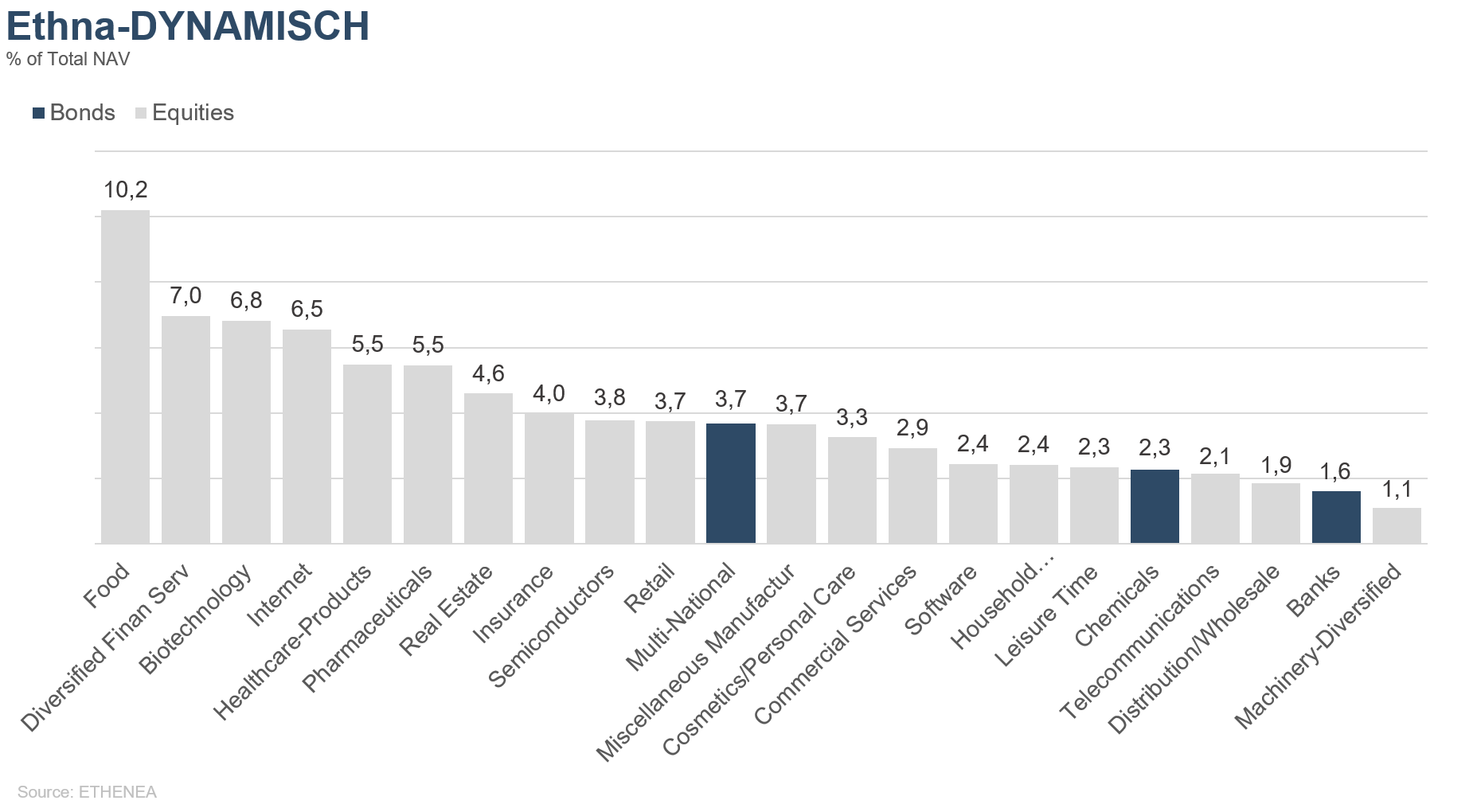

Figure 3: Portfolio structure* of the Ethna-DYNAMISCH

Figure 4: Portfolio composition of the Ethna-DEFENSIV by currency

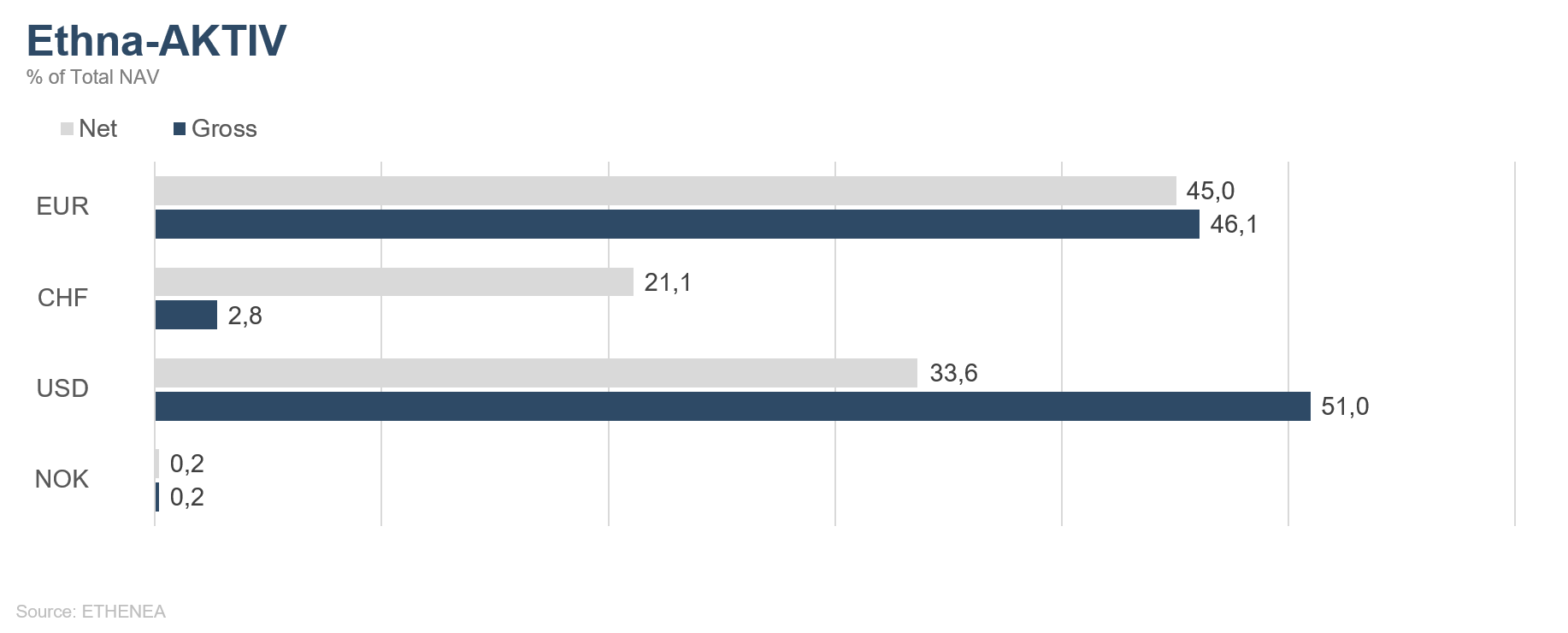

Figure 5: Portfolio composition of the Ethna-AKTIV by currency

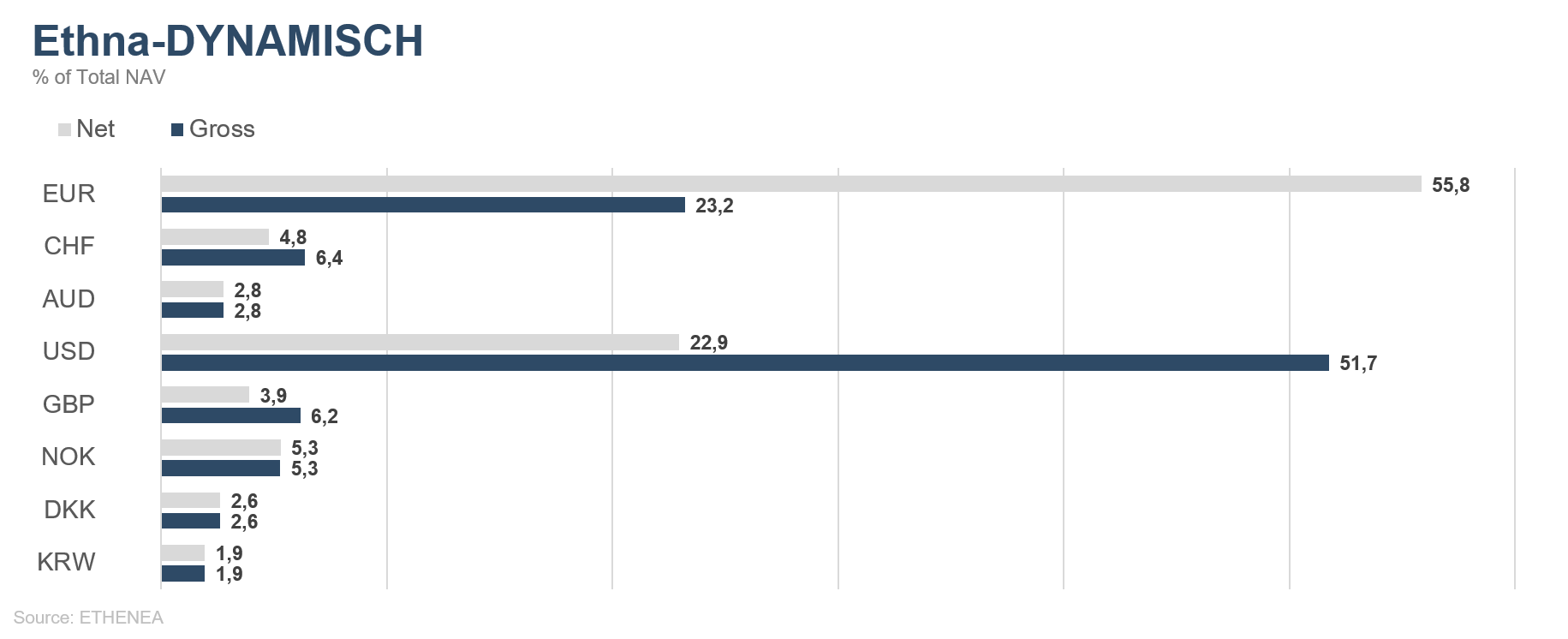

Figure 6: Portfolio composition of the Ethna-DYNAMISCH by currency

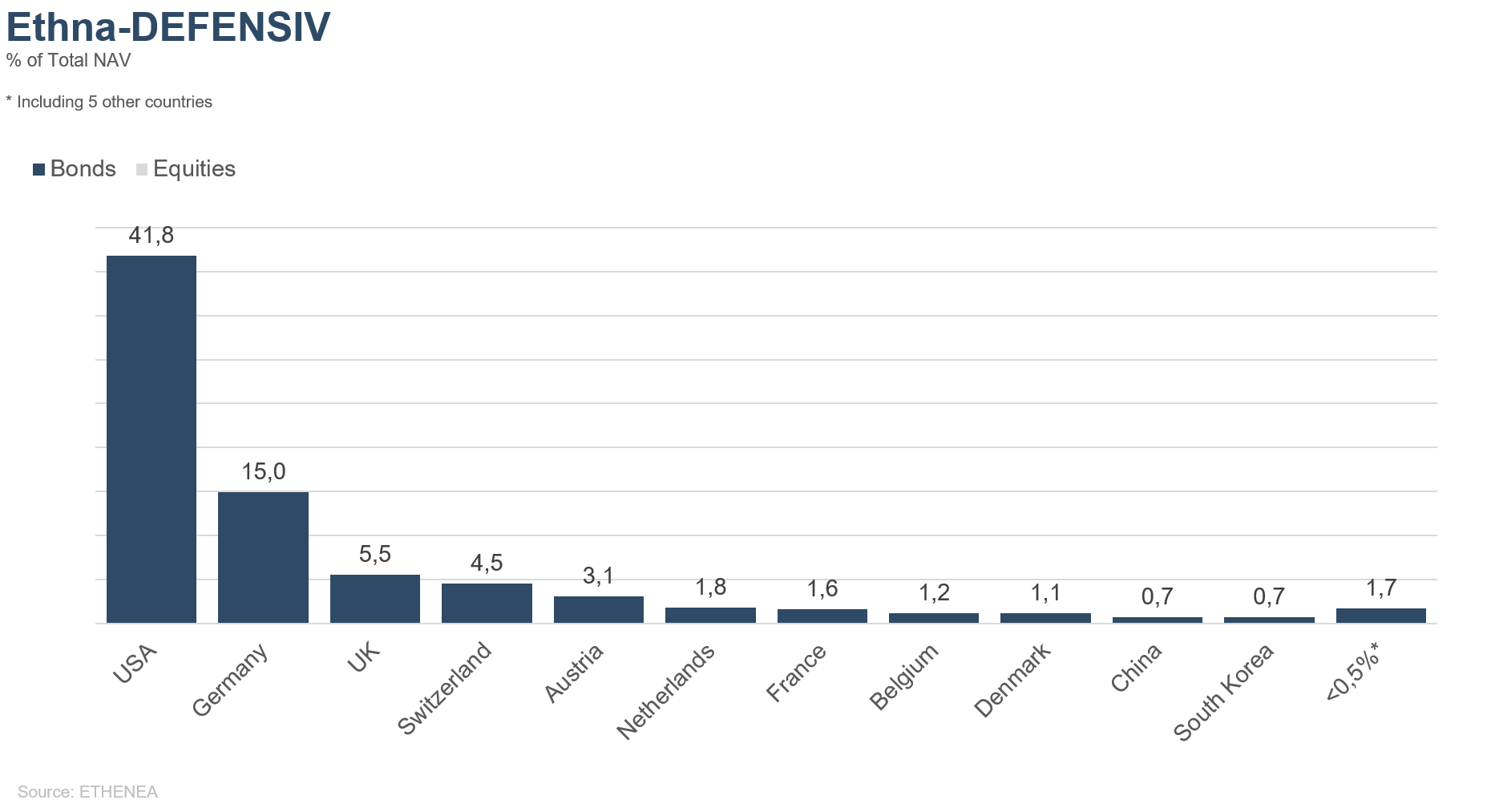

Figure 7: Portfolio composition of the Ethna-DEFENSIV by country

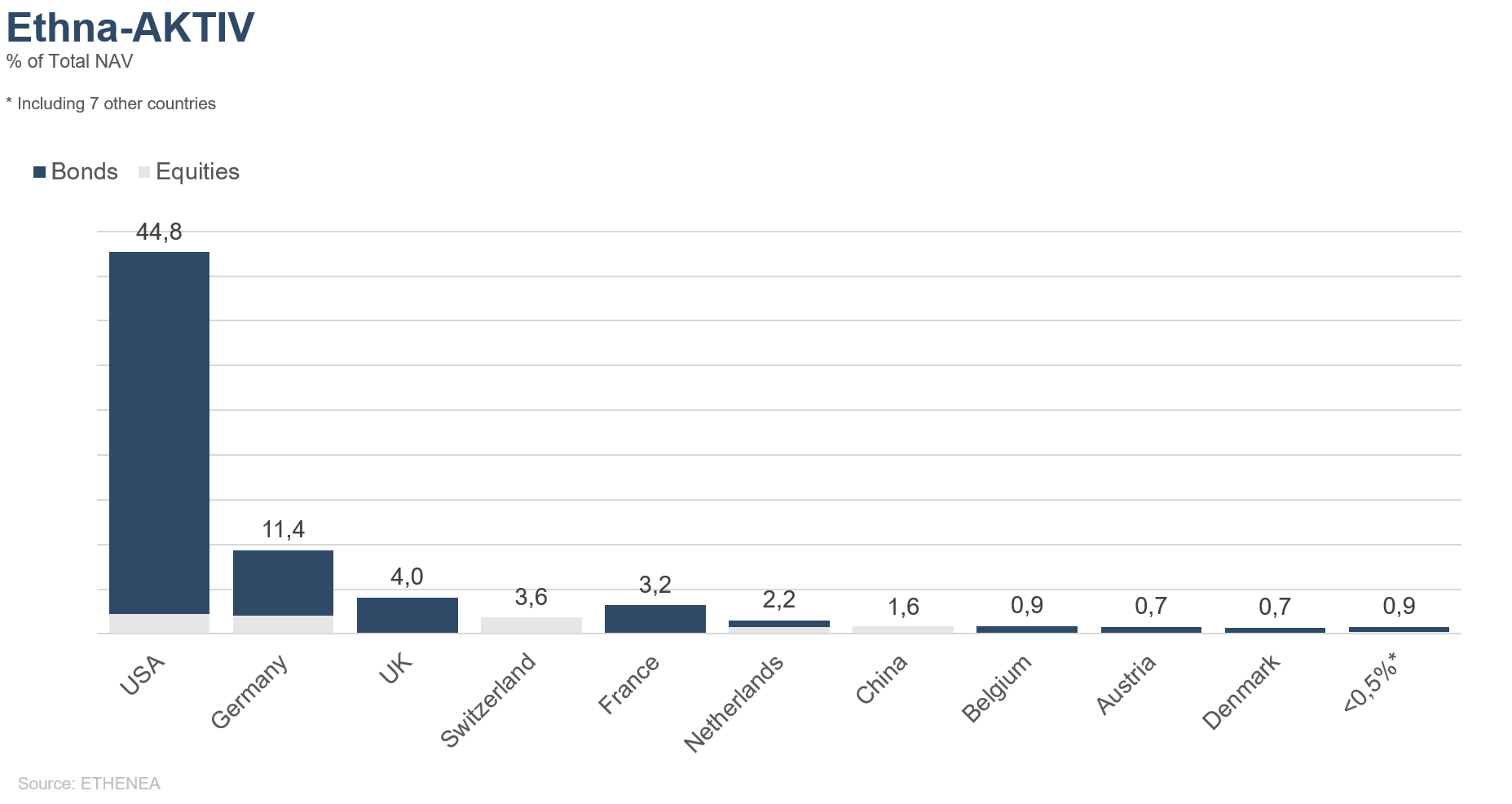

Figure 8: Portfolio composition of the Ethna-AKTIV by country

Figure 9: Portfolio composition of the Ethna-DYNAMISCH by country

Figure 10: Portfolio composition of the Ethna-DEFENSIV by issuer sector

Figure 11: Portfolio composition of the Ethna-AKTIV by issuer sector

Figure 12: Portfolio composition of the Ethna-DYNAMISCH by issuer sector

* “Cash” comprises term deposits, call money and current accounts/other accounts. “Equities net” comprises direct investments and exposure resulting from equity derivatives.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

Dit is een marketing communicatie. Het is uitsluitend bedoeld om productinformatie te verstrekken en is geen verplicht wettelijk of regelgevend document. De informatie in dit document vormt geen verzoek, aanbod of aanbeveling om participaties in het fonds te kopen, te verkopen of om enige andere transactie aan te gaan. Het is uitsluitend bedoeld om de lezer inzicht te geven in de belangrijkste kenmerken van het fonds, zoals het beleggingsproces, en wordt noch geheel noch gedeeltelijk beschouwd als een beleggingsaanbeveling. De verstrekte informatie is geen vervanging voor de eigen overwegingen van de lezer of voor enige andere juridische, fiscale of financiële informatie en advies. Noch de beleggingsmaatschappij, noch haar werknemers of bestuurders kunnen aansprakelijk worden gesteld voor verliezen die rechtsreeks of onrechtstreeks worden geleden door het gebruik van de inhoud van dit document of in enig ander verband met dit document. De verkoopdocumenten in het Duits die op dit moment geldig zijn (verkoopprospectus, essentiële-informatiedocumenten (PRIIPs-KIDs) en de halfjaar- en jaarverslagen), die gedetailleerde informatie geven over de aankoop van participaties in het fonds en de bijbehorende kansen en risico's, vormen de enige wettelijke basis voor de aankoop van participaties. De bovengenoemde verkoopdocumenten in het Duits (evenals in onofficiële vertalingen in andere talen) zijn te vinden op www.ethenea.com en zijn naast de beleggingsmaatschappij ETHENEA Independent Investors S.A. en de depothoudende bank, ook gratis verkrijgbaar bij de respectieve nationale betaal- of informatieagenten en van de vertegenwoordiger in Zwitserland. De betaal- of informatieagenten voor de fondsen Ethna-AKTIV, Ethna-DEFENSIV en Ethna-DYNAMISCH zijn de volgende: België, Duitsland, Liechtenstein, Luxemburg, Oostenrijk: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxemburg; Frankrijk: CACEIS Bank France, 1-3 place Valhubert, F-75013 Paris; Italië: State Street Bank International – Succursale Italia, Via Ferrante Aporti, 10, IT-20125 Milano; Société Génerale Securities Services, Via Benigno Crespi, 19/A - MAC 2, IT-20123 Milano; Banca Sella Holding S.p.A., Piazza Gaudenzio Sella 1, IT-13900 Biella; Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Spanje: ALLFUNDS BANK, S.A., C/ Estafeta, 6 (la Moraleja), Edificio 3 – Complejo Plaza de la Fuente, ES-28109 Alcobendas (Madrid); Zwitserland: Vertegenwoordiger: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Betaalagent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. De betaal- of informatieagenten voor HESPER FUND, SICAV - Global Solutions zijn de volgende: België, Duitsland, Frankrijk, Luxemburg, Oostenrijk: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxemburg; Italië: Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Zwitserland: Vertegenwoordiger: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Betaalagent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. De beleggingsmaatschappij kan bestaande distributieovereenkomsten met derden beëindigen of distributievergunningen intrekken om strategische of statutaire redenen, mits inachtneming van eventuele deadlines. Beleggers kunnen informatie over hun rechten verkrijgen op de website www.ethenea.com en in de verkoopprospectus. De informatie is zowel in het Duits als in het Engels beschikbaar, en in individuele gevallen ook in andere talen. Opgemaakt door: ETHENEA Independent Investors S.A. Het is verboden om dit document te verspreiden aan personen die wonen in landen waar het fonds geen vergunning heeft of waar er een toestemming vereist is voor verspreiding. Participaties mogen enkel aangeboden worden aan personen in landen waarin dit aanbod in overeenstemming is met de toepasselijke wettelijke bepalingen en waar ervoor wordt gezorgd dat de verspreiding en publicatie van dit document, evenals een aanbod of verkoop van participaties, aan geen enkele beperking is onderworpen in het betreffende rechtsgebied. Het fonds wordt met name niet aangeboden in de Verenigde Staten van Amerika of aan Amerikaanse burgers (volgens Rule 902 of Regulation S of the U.S. Securities Act of 1933, in de huidige versie) of personen die namens hen, in hun rekening of ten voordele van een Amerikaanse burger handelen. Resultaten die in het verleden behaald zijn, mogen niet worden opgevat als indicatie of garantie voor toekomstige prestaties. Schommelingen in de waarde van onderliggende financiële instrumenten of hun rendementen, evenals veranderingen in rentetarieven en valutakoersen, zorgen ervoor dat de waarde van participaties in een fonds, evenals de daaruit voortvloeiende rendementen, zowel kunnen dalen als stijgen en zijn niet gegarandeerd. De waarderingen die hierin opgenomen zijn, zijn gebaseerd op een aantal factoren, waaronder, maar niet beperkt tot, huidige prijzen, schattingen van de waarde van de onderliggende activa en marktliquiditeit, evenals andere veronderstellingen en openbaar beschikbare informatie. In principe kunnen prijzen, waarden en rendementen zowel stijgen als dalen, tot en met het totale verlies van het geïnvesteerde kapitaal, en aannames en informatie kunnen zonder voorafgaande kennisgeving worden gewijzigd. De waarde van het belegde vermogen of de prijs van participaties, evenals de daaruit voortvloeiende rendementen en uitkeringsbedragen, zijn onderhevig aan schommelingen of kunnen geheel verdwijnen. Positieve prestaties in het verleden zijn daarom geen garantie voor positieve prestaties in de toekomst. Met name het behoud van het geïnvesteerde vermogen kan niet worden gegarandeerd; er is dan ook geen garantie dat de waarde van het belegde kapitaal of de aangehouden participaties bij verkoop of terugkoop zal overeenkomen met het oorspronkelijk belegde kapitaal. Beleggingen in vreemde valuta zijn onderhevig aan bijkomende wisselkoersschommelingen of valutarisico's, d.w.z. het rendement van dergelijke beleggingen hangt ook af van de volatiliteit van de vreemde valuta, wat een negatieve impact kan hebben op de waarde van het belegde kapitaal. Beleggingen en toewijzingen kunnen gewijzigd worden. De beheer- en depotvergoedingen, evenals alle andere kosten die overeenkomstig de contractuele bepalingen ten laste van het fonds zijn, worden in de berekening opgenomen. De prestatieberekening is gebaseerd op de BVI-methode (Duitse Federale Vereniging voor Beleggings- en Vermogensbeheer), dat wil zeggen dat uitgiftekosten, transactiekosten (zoals order- en makelaarskosten), evenals bewaar- en andere beheervergoedingen niet inbegrepen zijn in de berekening. Het beleggingsrendement zou lager zijn indien rekening zou worden gehouden met de uitgiftetoeslag. Er kan geen garantie worden gegeven dat de marktprognoses gehaald worden. Om het even welke risicobehandeling in deze publicatie mag niet worden beschouwd als een onthulling van alle risico's of een sluitende behandeling van de genoemde risico's. In de verkoopprospectus wordt expliciet verwezen naar de gedetailleerde risicobeschrijvingen. Er kan geen garantie worden gegeven dat de informatie juist, volledig of actueel is. De inhoud en de informatie zijn auteursrechtelijk beschermd. Er kan geen garantie worden gegeven dat het document voldoet aan alle wettelijke of regelgevende vereisten die andere landen dan Luxemburg hebben vastgesteld. Opmerking: De belangrijkste technische termen kunnen worden gevonden in de woordenlijst op www.ethenea.com/lexicon. Informatie voor beleggers in België: Het prospectus, de statuten en de periodieke verslagen, alsmede de essentiële-informatiedocumenten (PRIIPs-KIDs), zijn kosteloos verkrijgbaar in het Frans bij de beheermaatschappij, ETHENEA Independent Investors S.A., 16, rue Gabriel Lippmann, 5365 Munsbach, Luxemburg en bij de vertegenwoordiger: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxemburg. Informatie voor beleggers in Zwitserland: Het vestigingsland van de collectieve beleggingsregeling is Luxemburg. De vertegenwoordiger in Zwitserland is IPConcept (Schweiz) AG, Münsterhof 12, P.O. Box, CH-8022 Zürich. De betaalagent in Zwitserland is DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zurich. Het prospectus, de essentiële-informatiedocumenten (PRIIPs-KIDs) en de statuten, evenals de jaar- en halfjaarverslagen zijn kosteloos verkrijgbaar bij de vertegenwoordiger. Copyright © ETHENEA Independent Investors S.A. (2024) Alle rechten voorbehouden. 02-04-2020