“Do (not) believe the hype”

Battery technology, the hydrogen economy and blockchain technology are themes that have received a lot of attention on the stock market of late. They are based on innovations that are promising but not (yet) matured. For that reason, valuations are difficult and controversial and, accordingly, market participants’ expectations are wide-ranging and prone to changing, going all the way from singing the innovation’s praises to writing it off completely. In a manifestation of these expectations, the share prices also vary wildly. They are generally highly volatile and, depending on the market sentiment, can differ greatly from the fundamental reality of the underlying innovation.

The hype cycle

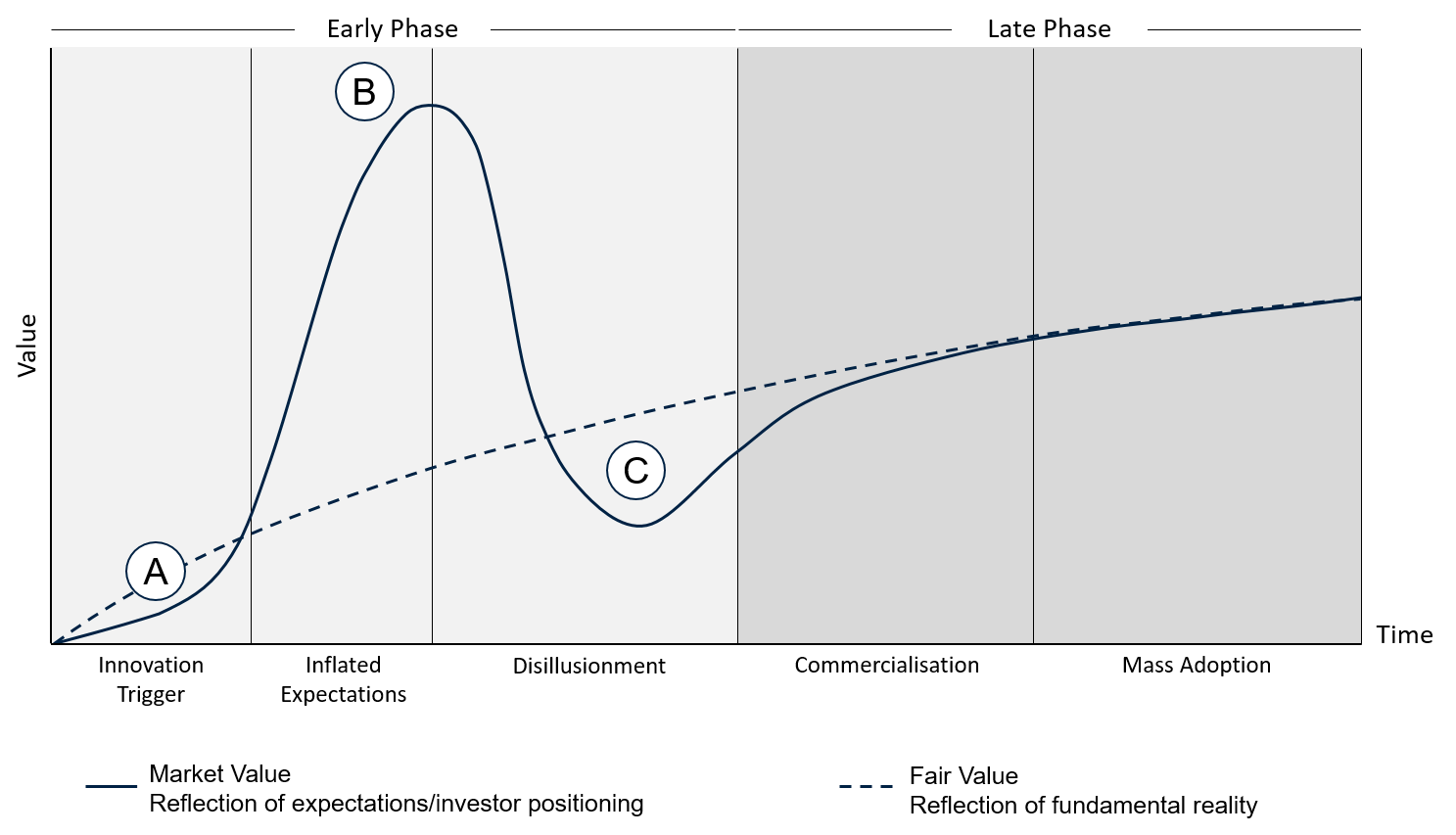

This gap between expectations and fundamental reality can be graphically depicted in the so-called hype cycle. It was originally developed by IT market research company Gartner to represent the evolution of new technologies. However, the pattern can be applied to the share valuation of young, innovative companies. The cycle, shown in the following diagram, differentiates between five phases.

- Innovation Trigger: An innovation, often at an experimental, small-scale stage, attracts attention – frequently among experts at first.

- Inflated Expectations: The innovation is taken up by the media as a would-be breakthrough and declared as the new answer to various applications. The innovator moves into the public spotlight. The share price rises – often accompanied by promising market outlooks and supported by analyst commentaries – as a function of market participants’ aggressive expectations. The price rise attracts further market players in a self-reinforcing upward trend. In this phase, the market value increasingly departs from the fundamental reality.

- Disillusionment: A reality check in the form of protracted, large-scale implementation trials lays bare the extent of the early exuberance. In addition, the innovator’s financial requirements, often met by capital increases that dilute value, creates pressure to sell. The market players who created upward momentum in the second phase now drive the downward trend. The great interest in the innovator wanes and the market value falls short of the fair value.

- Commercialisation: Over time, the innovator obtains large-scale proof of concept, which, with a growing customer base, facilitates greater commercialisation. Growth in sales and earnings secure the internal financing to develop the innovation further. Expectations, as represented by the market value, approaches the reality once again.

- Mass adoption: The original innovation is accepted as a market-ready application standard. At this stage, reality and expectation – temporary differences aside – largely coincide.

Figure: The hype cycle

Source: own diagram

That’s the theory. The innovations surrounding the whole area of the internet are a prime practical example of this depiction. In the 1990s, the internet became popular thanks to web browsers providing access to the World Wide Web (1.). A huge number of newly established companies wanted to tap into the up-and-coming New Economy areas of business. Companies (in most cases unprofitable) met their capital requirements through IPOs at valuations that, divorced from the fundamental reality, were an expression of market participants’ excessive optimism (2.). With many companies on the verge of bankruptcy, the Dotcom bubble burst in early 2000 and resulted in sustained disenchantment with the New Economy (3.). Once they could demonstrate that they had a sustainable business model, however, some of these technology companies were able to prove their economic raison d’être (4.). Today, the products and services of Amazon.com or Alphabet (Google) for example have permeated many areas of life as the application standard (5.).

Difficulty with positioning during the early phase

Time after time, the hype cycle can be observed in new, innovative market segments because the underlying driver – investor psychology – follows the same patterns. However, it is not an exact science. Both the expectation and time dimension vary. For that reason, identifying hype and where exactly it is in the cycle only has retrospective validity. The principle on which the hype cycle is based, however, is universal: the initial disconnect between expectation and reality will disappear over time. We can derive rules of thumb for the early stage of the hype cycle.

A. Games of chance: Taking a position in the first phase requires timely knowledge of the innovation and the ability to make a sound assessment of it based on technical and economic standards. This second requirement is inherently a contradiction, as it is only possible to make a rudimentary judgement based on assumptions at this point in time. For this reason, investment in a single company at this stage can largely be characterised as a game of chance.

B. Irrationality: Sky-rocketing prices driven purely by hope are generally not sustainable. Making an opportunistic entry at the Inflated Expectations stage is also highly risky given an obvious disconnect between fundamental reality and market value because experience shows that it is hard to predict when the irrationality on which the price rise is based will rationalise and, when it does, it happens very quickly.

C. Potential opportunity: The disillusionment phase can be a suitable stage to build up a long-term position. On the one hand, the validity of the assessment of its commercialisation ability is greater. And on the other hand, the downtrend that comes before it may have resulted in an attractive valuation. But in this phase, too, investment is risky as the level of uncertainty is still high and the success – depending on the investment horizon – also depends on the timing.

How we handle hype and innovation

Hype is understandable: the greater the prospects for future growth, the more attractive it is to get in on it as early as possible. This is what leads to the initial momentum in the hype cycle. The flip side is temporarily inflated, sometimes excessive, expectations. In time, it can happen that the fundamental reality cannot meet these initial expectations.

This ambivalence gives rise to our basic attitude towards hyped themes. We tend to be cautious in the early stage of the cycle because the probability of identifying companies that will have long-term success at this early stage is relatively low. But future growth is the main driver behind a company’s valuation, and it makes sense to tap this expected growth as early as possible. We pull off this balancing act by using the early stage of the hype cycle to analyse the innovation, select potential candidates for investment and follow their market momentum. Armed with this information, we can generally make an adequate assessment of growth potential and valuation risks on the cusp of the late stage of the hype cycle.

To achieve risk-controlled investment in innovative themes, we take advantage of different possibilities depending on the specific case and fund. In the equity-focused Ethna-DYNAMISCH, small investments in young, innovative companies can make for an attractive addition to the core portfolio. To take account of the comparatively higher uncertainty, the size of equity positions in such companies is much smaller than with established quality companies. The more risk-averse Ethna-AKTIV tends to make investments in innovations through broadly diversified thematic ETFs. In addition, both funds are positioned in attractive industrial and technology companies, which also devote a not insignificant portion of their research and development to future innovations. Thus, there are various ways, both direct and indirect, in which these two Ethna funds participate in the opportunities presented by new, promising technologies.

Portfolio Manager update & fund positioning

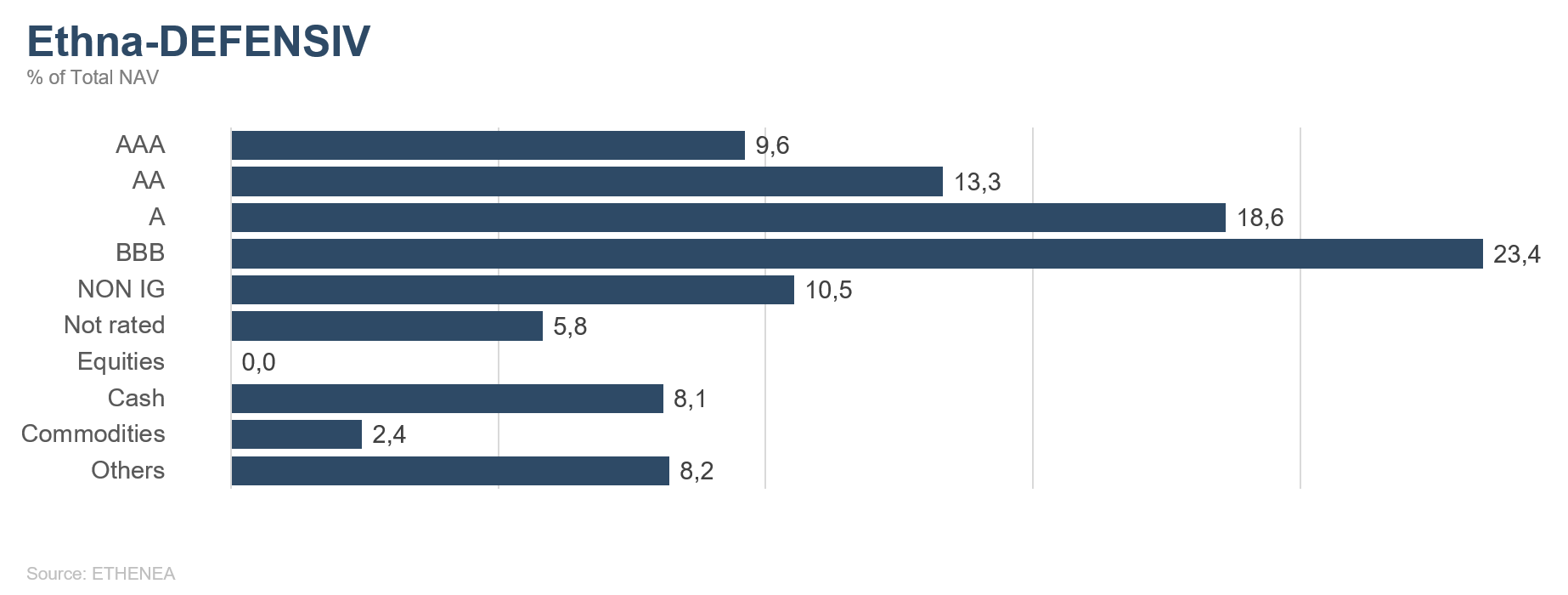

Ethna-DEFENSIV

In the first half of 2021, two themes dominated bond markets, especially in the US: inflation and rising yields. On 6 January Democrats, won the two seats in the Georgia runoff election, giving them a majority in Congress. This enables them to pass economic programmes even in the face of opposition from Republicans. The Biden administration’s first COVID-19 relief package amounting to USD 2 trillion was passed shortly thereafter and – combined with rapid progress on vaccinations, an economy that was already recovering and a weaker US dollar compared with the previous year – led to mounting inflation concerns. The rise in consumer prices quickly accelerated and was exaggerated by ever greater supply bottlenecks. Inflation reached 5% in May, and average annual expected inflation for the coming 10 years rose to a peak of around 2.6%. Yields on 10-year US Treasuries similarly climbed from 0.9% at the beginning of the year to 1.7% at the end of the first quarter.

However, the Fed continued its monetary support in the form of low interest rates at the short end and bond purchases because the US is still far off the target of full employment (currently 9.8 million unemployed compared with 5.7 million pre-pandemic in February 2020); and, according to the US central bank, the current inflationary spikes are only a temporary phenomenon.

The Fed is therefore sticking with its monetary policy for the time being, but the tone is increasingly hawkish. In the June meeting, it was cautiously hinted for the first time that a gradual tapering of the support programmes was being considered. The Fed’s signalling that it is going to keep a very close eye on inflationary movement as well as the demand from pension funds and foreign investors for USD-denominated bonds put a stop to rising interest rates in the second quarter, and yields on 10-year US Treasuries dropped back to 1.5%. The ECB, on the other hand, has stepped up the pace of sovereign and corporate bond-buying since the beginning of the second quarter. Nevertheless, it too could only moderate the rise in the long-term yield and not prevent it entirely. The yields on 10-year German sovereign bonds have risen from -0.6% at the beginning of the year to -0.2% currently. Central banks’ monetary policy provided favourable financing conditions. For example, most companies were able to raise money on the capital market at favourable terms and have thus made provision for the coming years as well. This led to risk premia for corporate bonds falling sharply and nearing historical lows across all risk categories. In the US, the yield on CCC-rated bonds in great danger of defaulting, for example, is only 4.77% higher than US Treasuries. By concentrating on corporate bonds with a moderate duration close to 5, we therefore managed to achieve a neutral performance in the fixed income segment. This result was underpinned by flexible duration management and the use of futures to hedge against further yield increases but, in some cases, also to increase duration at short notice after an excessive rise in yields.

We kept the equity allocation close to our maximum exposure of 10% for almost the entire six-month period. This was a key factor in the positive overall performance of the Ethna-DEFENSIV in the first half of the year. In addition, we built up a position in gold again in the second quarter, which made a strong positive contribution, in particular since we closed half of the position again in May close to the high of USD 1,900 per ounce.

A number of smaller central banks, such as the Bank of Canada and the Bank of England, have already begun gradually to scale back their accommodative monetary policy (see the June Market Commentary). The US central bank is likely to follow suit in the coming months, which is likely to lead to rising yields in the medium term. If the central bank lets the programmes continue contrary to expectations, that is likely to boost the prospect of low US yields but carries the risk of inflation rates overshooting by a clear margin.

Our positioning thus remains prudent and we have reduced the bond portfolio duration to around five years. We are very comfortable at this level at the moment, since the risk to fund performance caused by overshooting inflation rates and rising yields is limited, while the yields in this maturity segment are still decent, especially in USD. At the same time, we invest in renowned issuers with a good-to-very-good-rating (the fund’s average credit rating lies between A- and A), which are the core of our bond portfolio. These are supplemented with high yield issuers with the objective of delivering additional performance. Here, we invest in companies with stable business models operating in relatively non-cyclical sectors, such as consumer goods and pharmaceuticals.

The Ethna-DEFENSIV (T class) gained 0.55% in June and its year-to-date performance is therefore 0.73%. Looking ahead, we believe that yields have levelled off at the current level for now or will fall slightly further. However, in the longer term further rises in yields are more likely. Active duration management is therefore essential in the current market environment to adjust the duration both up and down with flexibility. We want to continue to take the opportunities in equity markets in an environment where yields are only rising slowly, economic growth is decent and company earnings are rising, and are entering the second half of the year with an equity allocation of close to 10% as well.

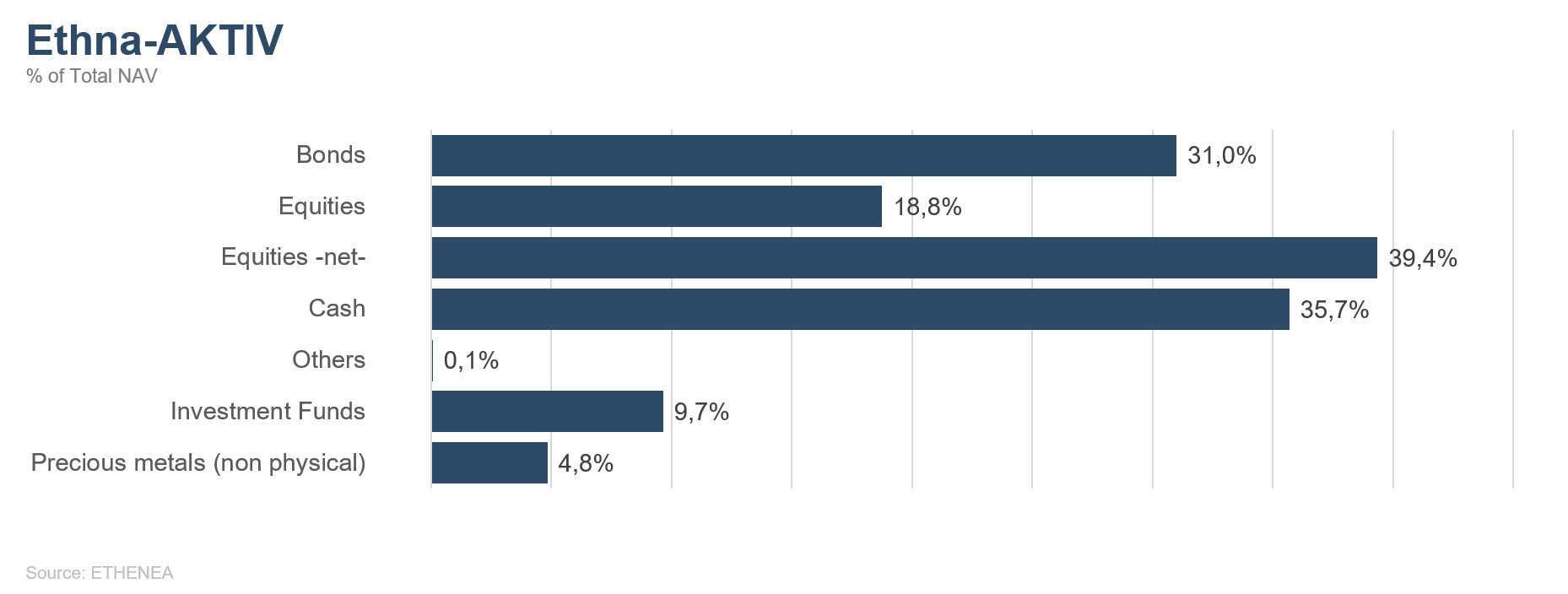

Ethna-AKTIV

Last month brought a close to the first half of the year. This gives us an opportunity to look back over not just one but six months. The Ethna-AKTIV managed to participate in the positive developments in the capital market with little volatility, and posted a performance of just under 2% at the end of the first half of the year.

The start of 2021 in stock markets was dominated by two opposing factors: the ongoing great uncertainty about the pandemic that has been rampaging for a year now, and the certainty of massive monetary and fiscal support. Underpinned by the sustained success of vaccination campaigns worldwide, the global economy continued to recover even more strongly than assumed. The fact that the recovery was not synchronised globally was to be expected and was confirmed by growth figures that were greatly influenced by the various lockdown measures. Another observation was that the valuation gap between the real economy and the capital market that opened due to the growth surprises over the past year normalised in some cases. While the price gains last year were based mainly on an expansion of the valuation multiple in expectation of future growth, the price gains this year, which are again attractive, stem mainly from actual growth in earnings. On the premise that the global economic upturn will sooner or later bring about higher inflation and a normalisation of the interest rate environment, it was the names termed as “reflation trades” in particular that replaced technology stocks as the driving force of the bull run. Over a certain period of time, which was also characterised by a sharp rise in interest rates at the long end, value, financial and commodity assets were the top performers. While no major swings could be discerned at the equity index level, this change of preferences below the surface was in fact very significant. Only a shift in the tone of the most important central bank at the moment, the Fed, towards the possibility of tackling earlier the signs of inflation now emerging led to long-term interest rates falling once again and another change of preferences in equities to growth stocks.

This shift incidentally fits in with the theory that we have now moved from the initial to the middle phase of a shorter cycle compared with the previous economic upturn. Looking ahead, this last statement in particular is fundamentally important. Even though we are speaking of historically high valuations in equities, and even more so in bond investments, it is clear that the underlying companies and economies have grown as a whole; in fact, this is true to an even greater extent than before the pandemic, not least thanks to the aforementioned support measures. Overall, these measures will slowly lessen, but the fact is they are still there.

In summary, it can be said that little about the positive statements made at the start of the year has changed. The weight of the supportive factors may be a little less, but it is still enough to enable us to invest to the maximum extent in equities, as before. Unlike at the beginning of the year, however, almost half of the exposure is allocated to index products to cushion the current fluctuation in style. As was the case in the past few months, we maintain a 20% allocation to the US dollar (or 15.9% without taking option exposures into account) as a counterbalance. We remain cautious in relation to bonds. Of the not-quite 31% allocation to fixed income instruments, a good third is still invested in US Treasuries. The gold allocation is 4.8% and our approach here remains opportunistic.

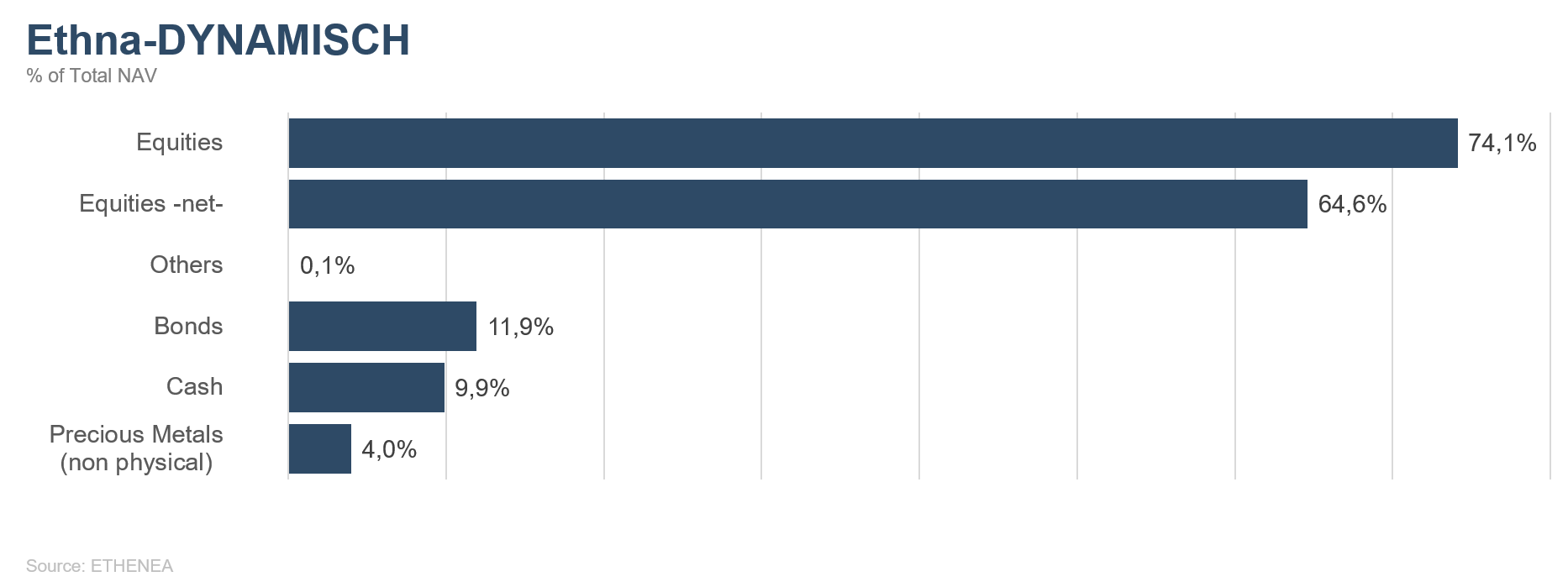

Ethna-DYNAMISCH

Good communication should be a constant. It should regularly tie in with previous statements and place new information in the context previously communicated. With this in mind, it seems sensible to tie in a review of the first half of 2021 with the outlook from six months ago for that very period. Back then we wrote:

“Given the unpredictability of this past pandemic year, 2021 seems almost too predictable. A number of factors argue in favour of a continuation of the upward trends in the global equity markets that have been strengthening of late: the starting situation where it seems possible for the pandemic gradually to be brought under control, signs of strong economic growth, positive effects of the immense fiscal programmes, record-low interest rates and ongoing bond purchase programmes from the central banks as well as more and more investor groups regaining an appetite for risk. Meanwhile, at the beginning of the year, hardly anything seems to oppose this trend.”

These supportive factors have actually further driven the upward movement in global equity markets in the first few months of the year. Accordingly, the equity allocation in the Ethna-DYNAMISCH was high, and we were able to participate in the movements. We then went on to say:

“We are keeping potential dangers in check mainly by weighing up (growth) opportunities against (valuation) risks in a disciplined fashion. For the time being, we see any price corrections that arise in the overall market mainly as an attractive opportunity to expand the portfolio. That said, no trend lasts forever, and so we are also curious to seeing how the relevant parameters will develop over the course of the year.”

In retrospect, we can flesh out this part of the outlook. Valuation risks in previously greatly hyped growth segments of the markets actually did become obvious as of mid-February and in places have led to sharp declines in prices. Both the broad market indices and the carefully balanced Ethna-DYNAMISCH portfolio, however, were able to escape this selling pressure in spots. It is more interesting to take a look at how the previous conditions of almost unlimited support have developed. Almost all the factors listed have waned over recent weeks, but essentially remain supportive. For example, in many economies and companies we are currently seeing growth rates peak temporarily, long-term interest rates/bond yields are much higher today than at the end of 2020, central banks are trying to find a conceivable path out of their ultra-accommodative monetary policy for markets without harming them, and decisions on further economic programmes cannot be expected for the moment (but potential tax rises probably can). In line with this new information, we successively reduced fund risk as of mid-April, so that, with a net equity allocation of 65% (gross equity exposure 74% excluding hedging components) as at the end of June, the Ethna-DYNAMISCH is still able to participate to a significant extent in the upside potential that is certainly there. However, at the same time, it takes the increased risks into account.

There was relatively little turnover in the portfolio itself over recent months. This is due in particular to the robust positioning without extremes. This deliberate focus on the happy medium has effectively protected the fund against the sometimes hefty fluctuations in some market segments and enabled us to have a relatively high equity allocation coupled with manageable fluctuations in the fund. Looking ahead to the second half of the year and the prevailing market environment, we do not expect any major changes to this strategic bias for the time being. The same goes for bonds and gold which, with their respective weightings standing at 12% and 4% most recently, do not have a major influence on the overall consideration of the fund.

And thus we have only to make a minor change in the final quotation from the market outlook from six months ago to complete the current report:

“The tools required to navigate these waters successfully – the Ethna-DYNAMISCH having the necessary flexibility and a well-positioned portfolio a̶t̶ ̶t̶h̶e̶ ̶t̶u̶r̶n̶ ̶o̶f̶ ̶t̶h̶e̶ ̶y̶e̶a̶r̶ as of mid-2021 – are in place and make us optimistic about the future.”

We will hold this constant – in communication and in the positioning of the Ethna-DYNAMISCH – in the second half of the year as well.

HESPER FUND - Global Solutions (*)

IThis year, the old Wall Street adage “sell in May and go away” did not hold true. In June, US stocks outperformed most equity markets, with many broad indices reaching new highs amid heavy rotation across sectors and indices. The US dollar strengthened, technology stocks rebounded, and many reflation trades were unwound. With regard to the bond market, it was not a bad month either. Though struggling for direction, and despite all the narrative about inflation and tapering, yields declined during the month of June, with the 10-year US Treasury yield dropping from 1.60% to 1.46%. At the same time, credit spread remained tight, hovering near record low levels. Cryptocurrencies fluctuated widely, as the Chinese crackdown continued. However, Bitcoin, the largest and most famous cryptocurrency, did not break the key support level of USD 30,000.

For the month, the S&P 500 rose 2.2% to close at a record high and the Nasdaq Composite surged 5.5% to end near its all-time high. The Russell 2000 increased 1.8% while the Dow Jones Industrial Average (DJIA) remained flat, posting a slight decrease of -0.08%. In Europe, the Euro Stoxx 50 index edged 0.6% higher (a decrease of 2.5% when calculated in USD) and the Swiss Market Index caught up to the other indices, surging 5.1% (+2% in dollar terms). Asian markets lagged, with the Shanghai Shenzhen CSI 300 index decreasing by 2% (-3.3% in USD terms).

Although the month was not at all an easy ride, as market sentiment changed many times, overall, the last six months have been good for equity markets, as measured by the MSCI Total Return World Index with a 13.3% surge in USD terms (+16.4% measured in euros). Pandemic restrictions went back and forth. The recovery was uneven, as vaccination availability and roll-out speed differed significantly from country to country. Stock rotation among sectors was choppy and rapid. Though in general volatility was low, the last six months also included some dramatic moments like the surge in US Treasury yields during the first quarter, the GameStop saga, the Archegos meltdown, the rise and fall of cryptocurrencies, and geopolitical tensions between the US and China. Recently, the spread of the Delta variant of Covid-19 has raised doubts about the strength and length of the recovery. Therefore, inflation fears, which dominated the narrative during the second quarter, finally subsided.

The HESPER FUND – Global Solutions continues to operate under the scenario of a world recovery supported by accommodative monetary and fiscal policies and vaccination roll-outs. Currently the fund is long equities, high yield bonds and commodities. A better economic outlook and a slow and gradual monetary normalisation in the US should progressively lead to higher yields. For that reason, we have short positions on 10-year US Treasuries. However, exposure to the various asset classes is monitored and calibrated permanently to adjust to market sentiment and changes in the macroeconomic baseline scenario.

On the currency front, the fund kept its long USD exposure (currently at 21%). Given the strength of oil prices, we recently decided to double our exposure to the Norwegian krone - up to 9%. The fund is also long the Swiss Franc (6.6%).

In June, the HESPER FUND - Global Solutions EUR T-6 rose 1.26%. Year-to-date performance was 4.99%. Over the last 12 months, the fund has gained 9.06%. Volatility has remained stable and low at 6.7%.

*Der HESPER FUND - Global Solutions ist aktuell nur zum Vertrieb in Deutschland, Luxemburg, Frankreich und der Schweiz zugelassen.

Figure 1: Portfolio structure* of the Ethna-DEFENSIV

Figure 2: Portfolio structure* of the Ethna-AKTIV

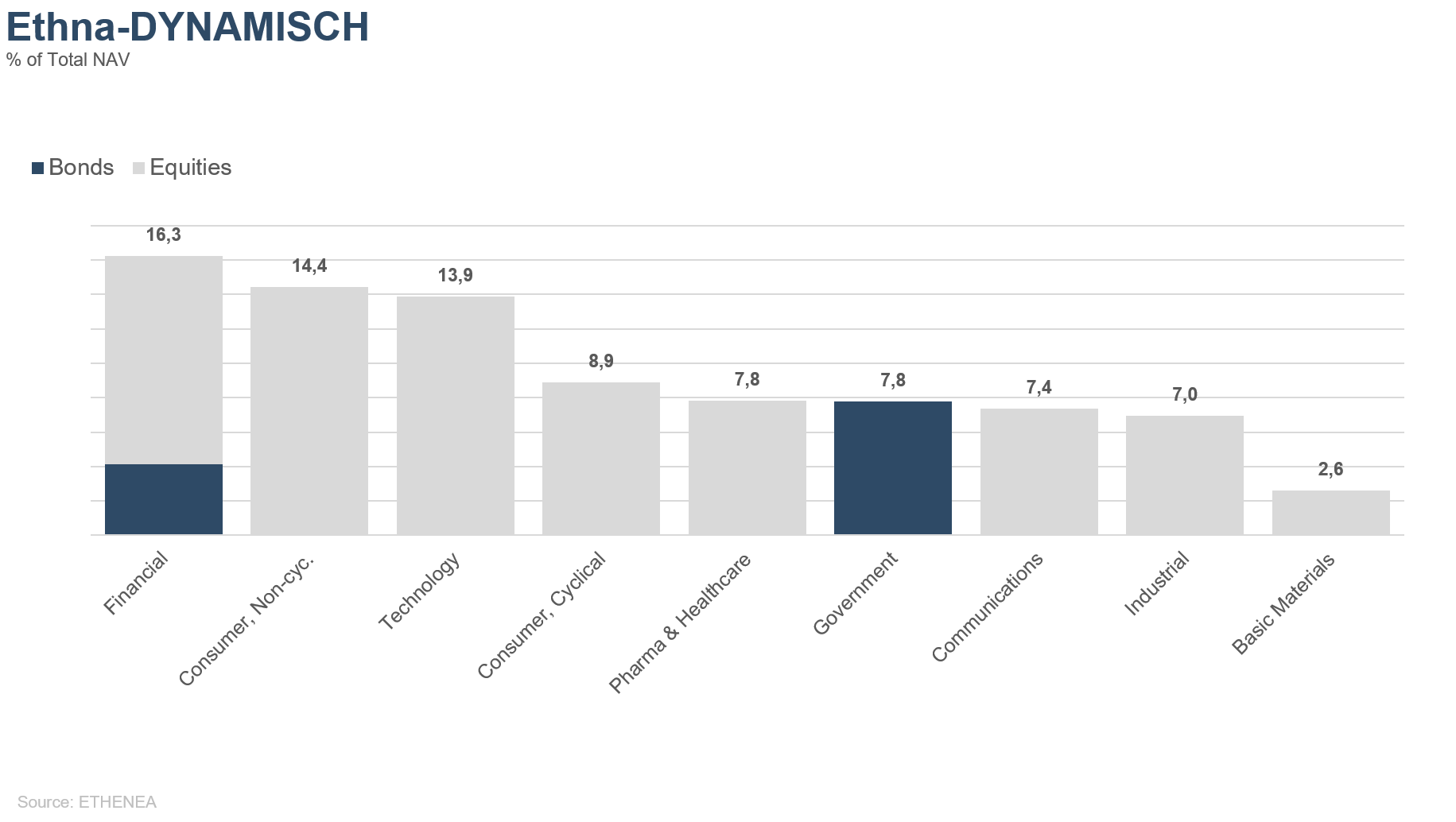

Figure 3: Portfolio structure* of the Ethna-DYNAMISCH

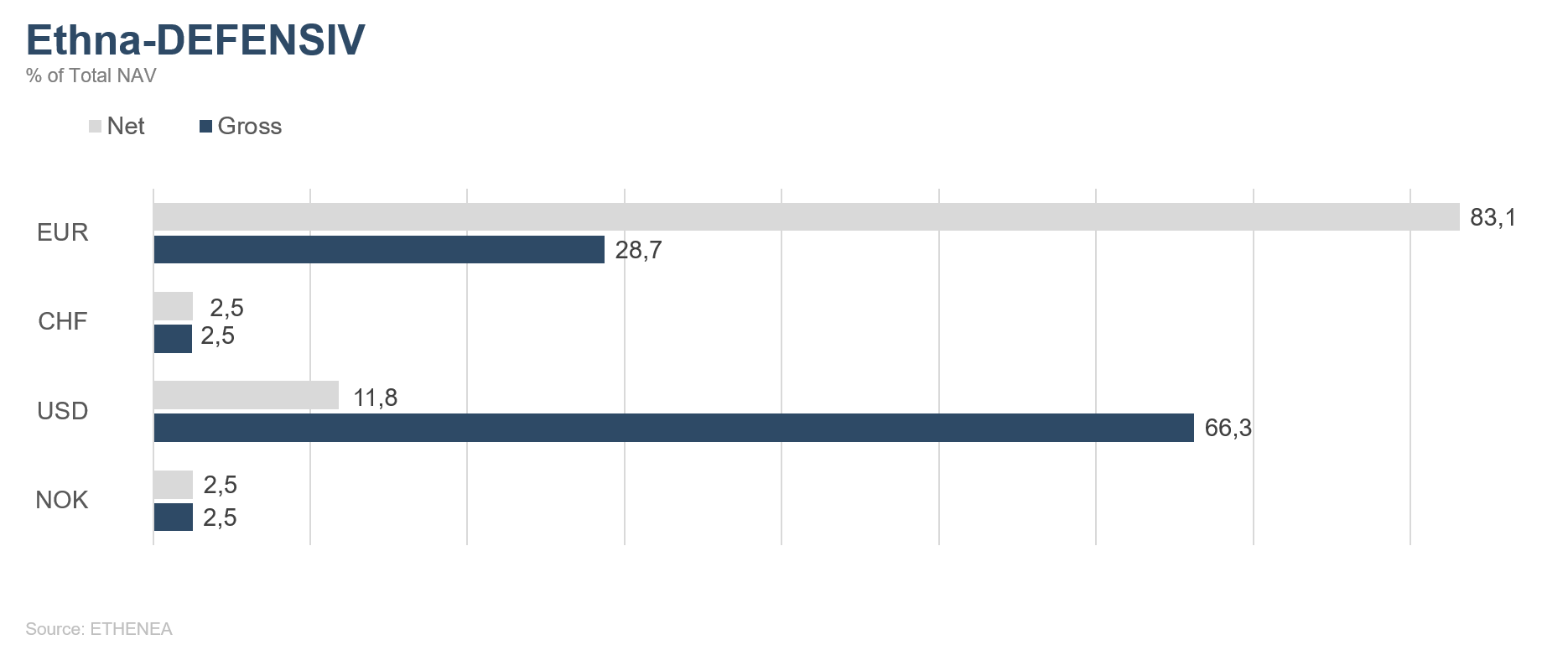

Figure 4: Portfolio composition of the Ethna-DEFENSIV by currency

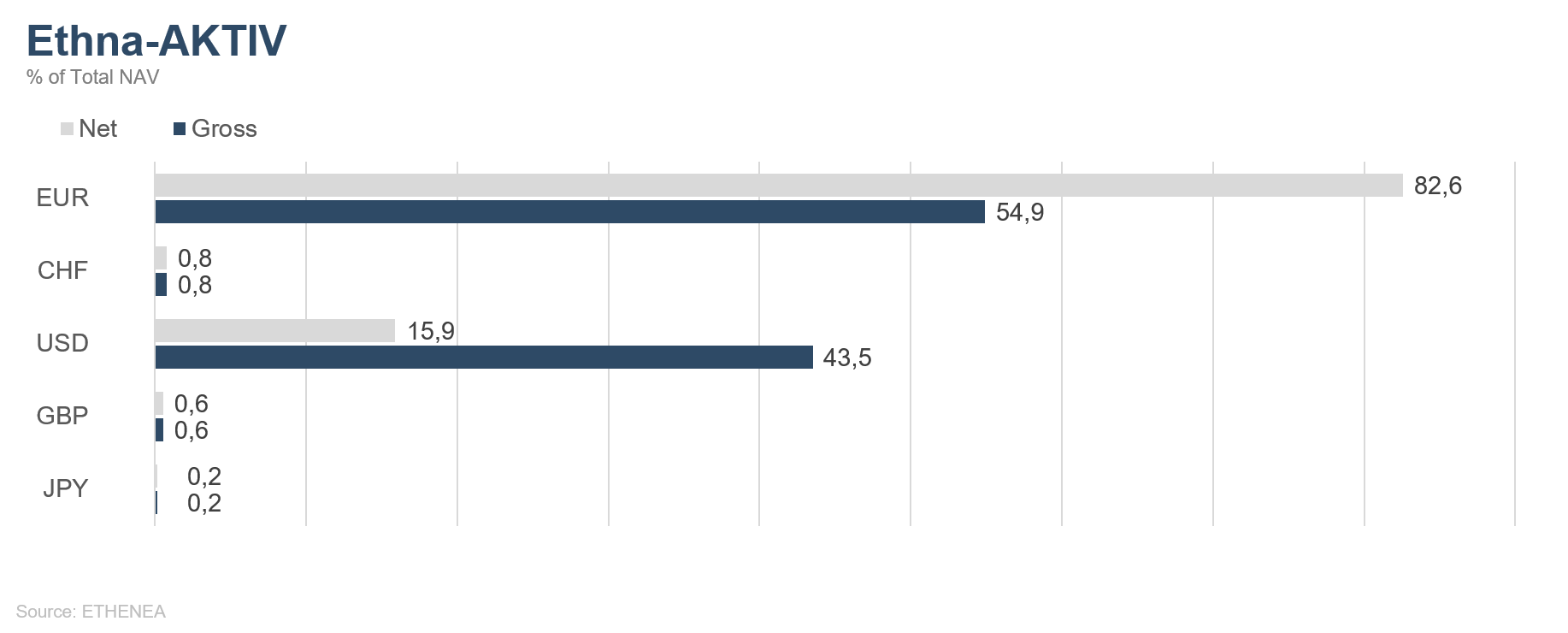

Figure 5: Portfolio composition of the Ethna-AKTIV by currency

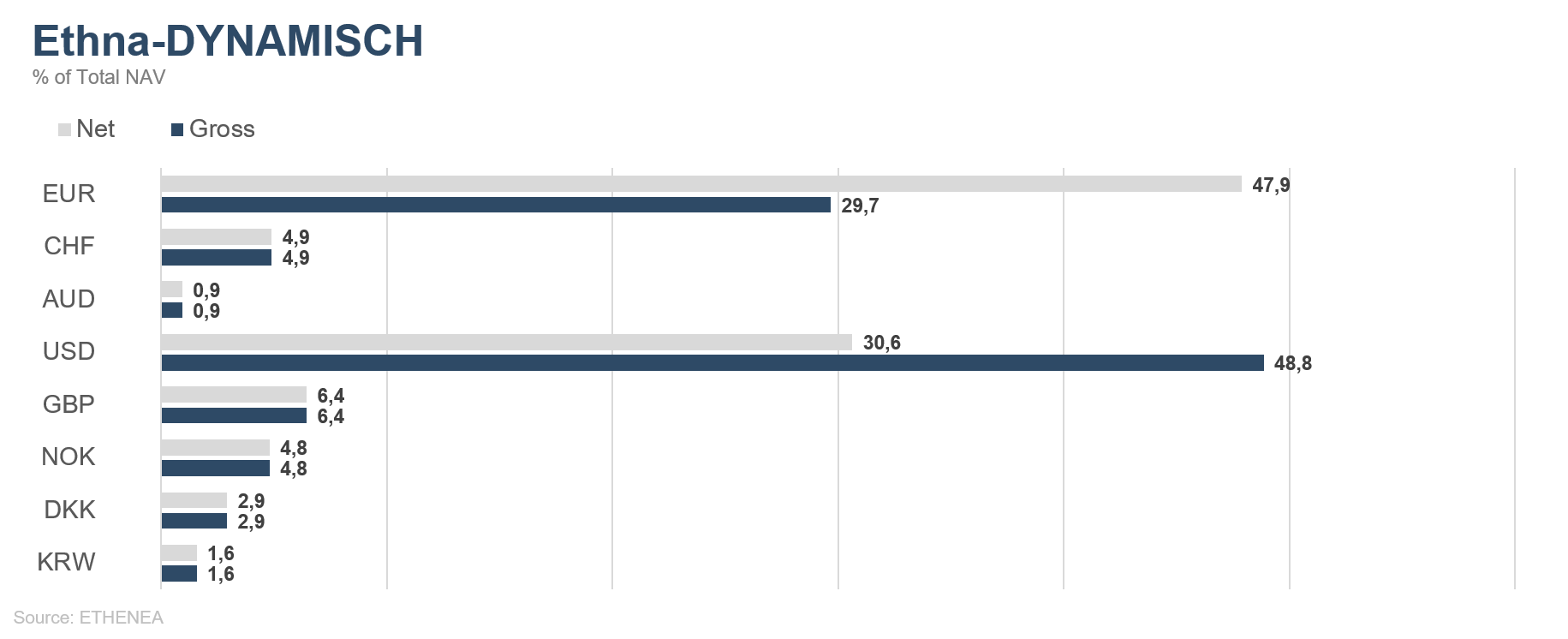

Figure 6: Portfolio composition of the Ethna-DYNAMISCH by currency

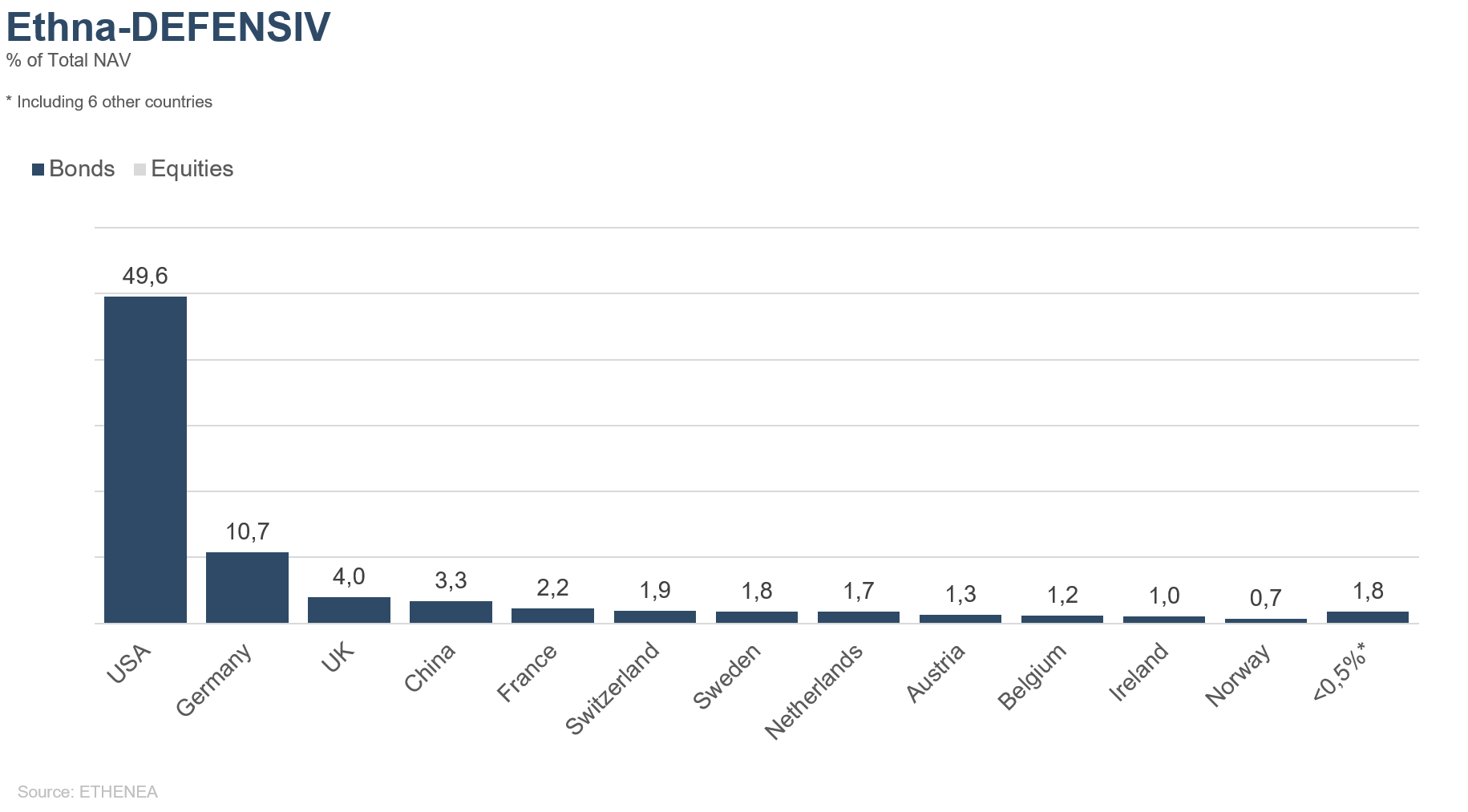

Figure 7: Portfolio composition of the Ethna-DEFENSIV by country

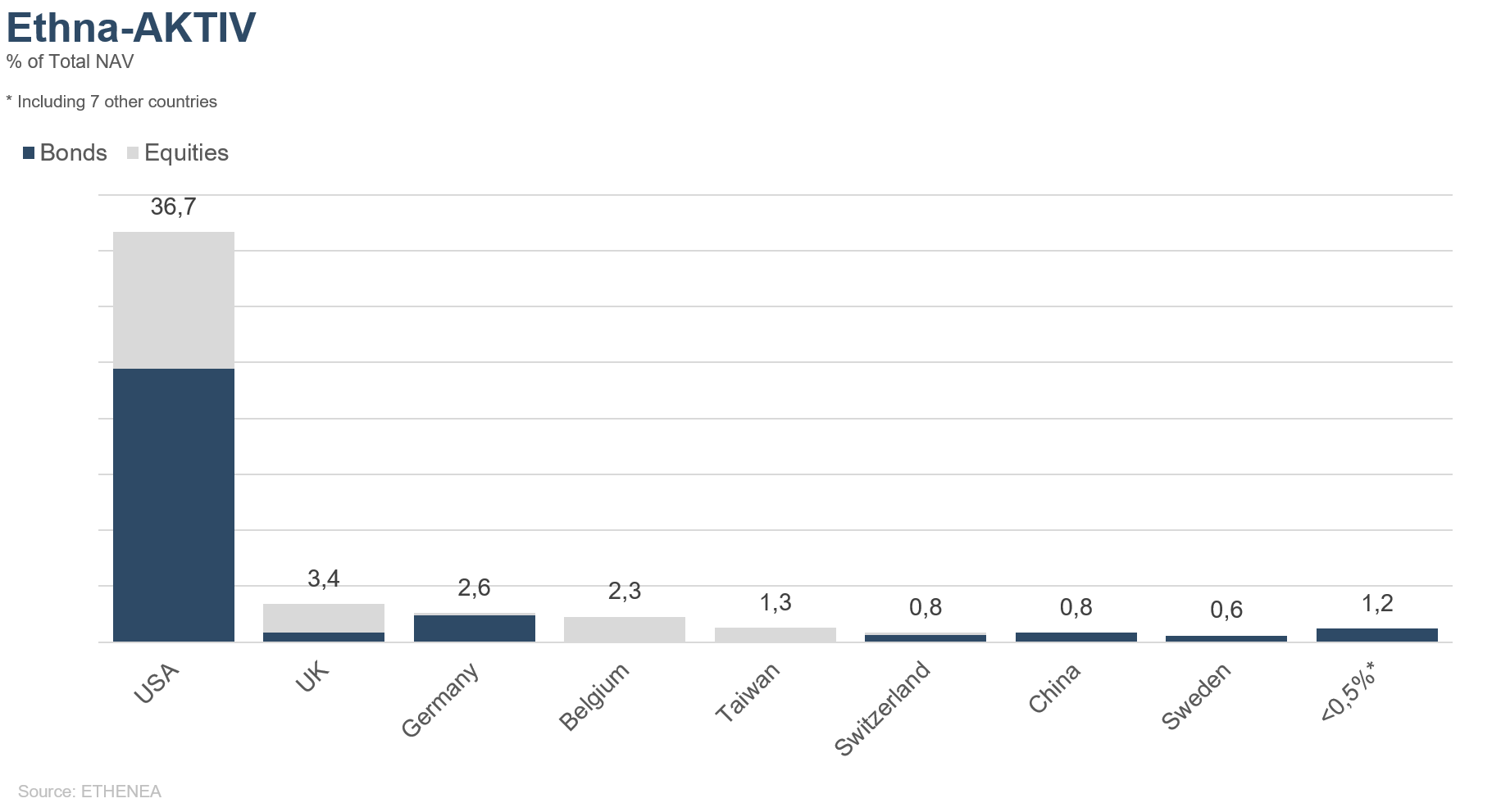

Figure 8: Portfolio composition of the Ethna-AKTIV by country

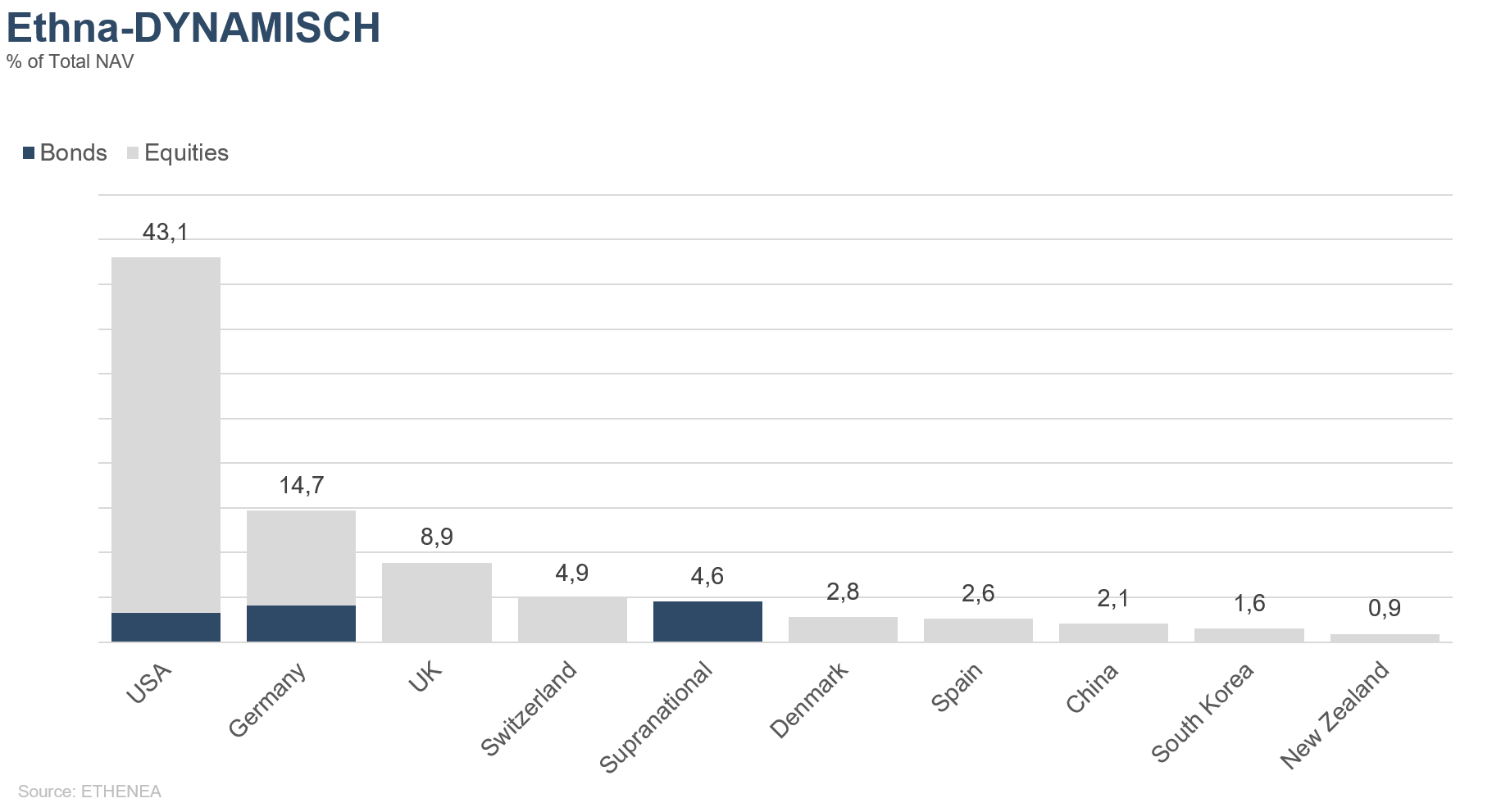

Figure 9: Portfolio composition of the Ethna-DYNAMISCH by country

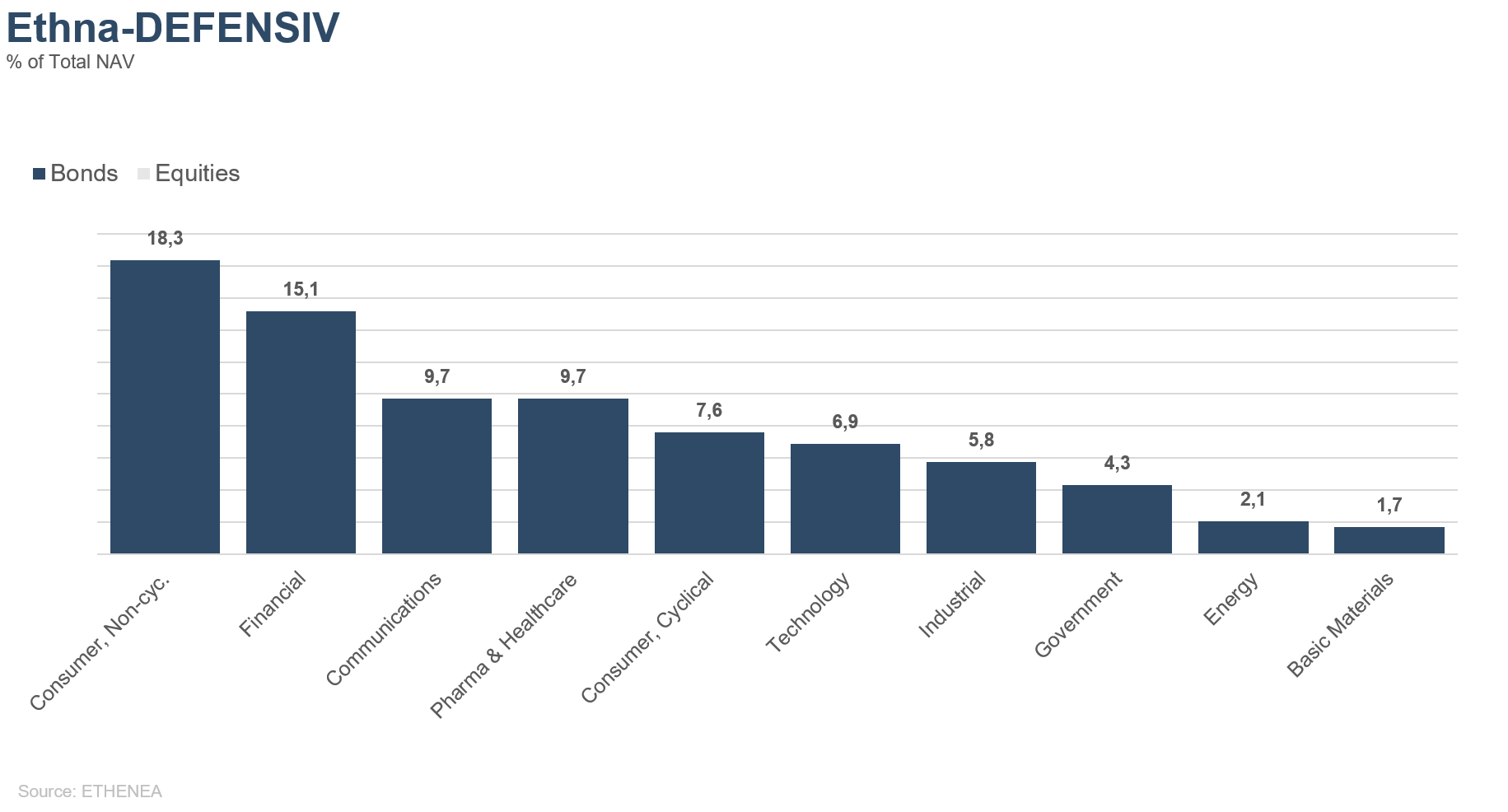

Figure 10: Portfolio composition of the Ethna-DEFENSIV by issuer sector

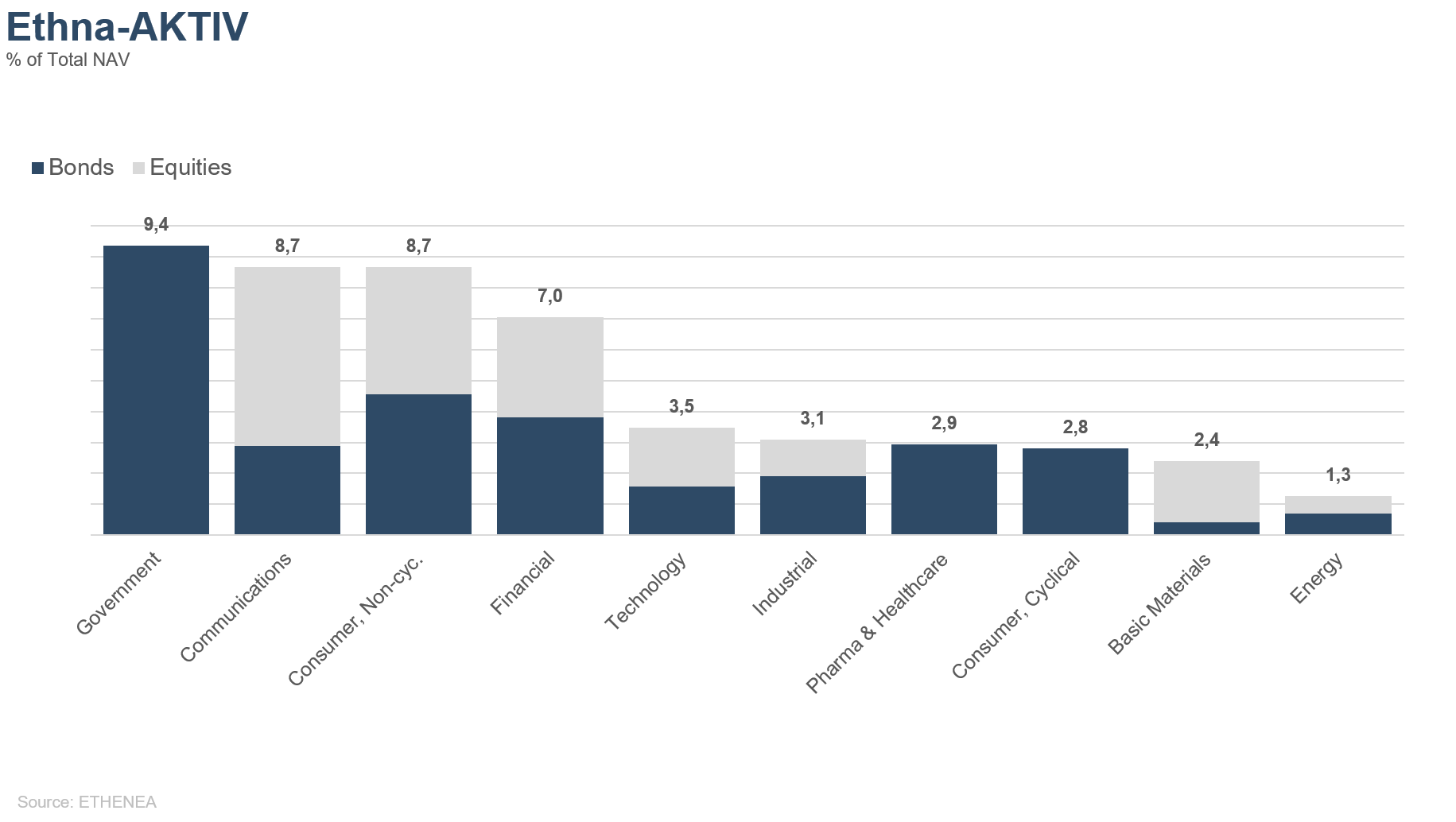

Figure 11: Portfolio composition of the Ethna-AKTIV by issuer sector

Figure 12: Portfolio composition of the Ethna-DYNAMISCH by issuer sector

* “Cash” comprises term deposits, call money and current accounts/other accounts. “Equities net” comprises direct investments and exposure resulting from equity derivatives.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

Dit is een marketing communicatie. Het is uitsluitend bedoeld om productinformatie te verstrekken en is geen verplicht wettelijk of regelgevend document. De informatie in dit document vormt geen verzoek, aanbod of aanbeveling om participaties in het fonds te kopen, te verkopen of om enige andere transactie aan te gaan. Het is uitsluitend bedoeld om de lezer inzicht te geven in de belangrijkste kenmerken van het fonds, zoals het beleggingsproces, en wordt noch geheel noch gedeeltelijk beschouwd als een beleggingsaanbeveling. De verstrekte informatie is geen vervanging voor de eigen overwegingen van de lezer of voor enige andere juridische, fiscale of financiële informatie en advies. Noch de beleggingsmaatschappij, noch haar werknemers of bestuurders kunnen aansprakelijk worden gesteld voor verliezen die rechtsreeks of onrechtstreeks worden geleden door het gebruik van de inhoud van dit document of in enig ander verband met dit document. De verkoopdocumenten in het Duits die op dit moment geldig zijn (verkoopprospectus, essentiële-informatiedocumenten (PRIIPs-KIDs) en de halfjaar- en jaarverslagen), die gedetailleerde informatie geven over de aankoop van participaties in het fonds en de bijbehorende kansen en risico's, vormen de enige wettelijke basis voor de aankoop van participaties. De bovengenoemde verkoopdocumenten in het Duits (evenals in onofficiële vertalingen in andere talen) zijn te vinden op www.ethenea.com en zijn naast de beleggingsmaatschappij ETHENEA Independent Investors S.A. en de depothoudende bank, ook gratis verkrijgbaar bij de respectieve nationale betaal- of informatieagenten en van de vertegenwoordiger in Zwitserland. De betaal- of informatieagenten voor de fondsen Ethna-AKTIV, Ethna-DEFENSIV en Ethna-DYNAMISCH zijn de volgende: België, Duitsland, Liechtenstein, Luxemburg, Oostenrijk: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxemburg; Frankrijk: CACEIS Bank France, 1-3 place Valhubert, F-75013 Paris; Italië: State Street Bank International – Succursale Italia, Via Ferrante Aporti, 10, IT-20125 Milano; Société Génerale Securities Services, Via Benigno Crespi, 19/A - MAC 2, IT-20123 Milano; Banca Sella Holding S.p.A., Piazza Gaudenzio Sella 1, IT-13900 Biella; Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Spanje: ALLFUNDS BANK, S.A., C/ Estafeta, 6 (la Moraleja), Edificio 3 – Complejo Plaza de la Fuente, ES-28109 Alcobendas (Madrid); Zwitserland: Vertegenwoordiger: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Betaalagent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. De betaal- of informatieagenten voor HESPER FUND, SICAV - Global Solutions zijn de volgende: België, Duitsland, Frankrijk, Luxemburg, Oostenrijk: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxemburg; Italië: Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Zwitserland: Vertegenwoordiger: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Betaalagent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. De beleggingsmaatschappij kan bestaande distributieovereenkomsten met derden beëindigen of distributievergunningen intrekken om strategische of statutaire redenen, mits inachtneming van eventuele deadlines. Beleggers kunnen informatie over hun rechten verkrijgen op de website www.ethenea.com en in de verkoopprospectus. De informatie is zowel in het Duits als in het Engels beschikbaar, en in individuele gevallen ook in andere talen. Opgemaakt door: ETHENEA Independent Investors S.A. Het is verboden om dit document te verspreiden aan personen die wonen in landen waar het fonds geen vergunning heeft of waar er een toestemming vereist is voor verspreiding. Participaties mogen enkel aangeboden worden aan personen in landen waarin dit aanbod in overeenstemming is met de toepasselijke wettelijke bepalingen en waar ervoor wordt gezorgd dat de verspreiding en publicatie van dit document, evenals een aanbod of verkoop van participaties, aan geen enkele beperking is onderworpen in het betreffende rechtsgebied. Het fonds wordt met name niet aangeboden in de Verenigde Staten van Amerika of aan Amerikaanse burgers (volgens Rule 902 of Regulation S of the U.S. Securities Act of 1933, in de huidige versie) of personen die namens hen, in hun rekening of ten voordele van een Amerikaanse burger handelen. Resultaten die in het verleden behaald zijn, mogen niet worden opgevat als indicatie of garantie voor toekomstige prestaties. Schommelingen in de waarde van onderliggende financiële instrumenten of hun rendementen, evenals veranderingen in rentetarieven en valutakoersen, zorgen ervoor dat de waarde van participaties in een fonds, evenals de daaruit voortvloeiende rendementen, zowel kunnen dalen als stijgen en zijn niet gegarandeerd. De waarderingen die hierin opgenomen zijn, zijn gebaseerd op een aantal factoren, waaronder, maar niet beperkt tot, huidige prijzen, schattingen van de waarde van de onderliggende activa en marktliquiditeit, evenals andere veronderstellingen en openbaar beschikbare informatie. In principe kunnen prijzen, waarden en rendementen zowel stijgen als dalen, tot en met het totale verlies van het geïnvesteerde kapitaal, en aannames en informatie kunnen zonder voorafgaande kennisgeving worden gewijzigd. De waarde van het belegde vermogen of de prijs van participaties, evenals de daaruit voortvloeiende rendementen en uitkeringsbedragen, zijn onderhevig aan schommelingen of kunnen geheel verdwijnen. Positieve prestaties in het verleden zijn daarom geen garantie voor positieve prestaties in de toekomst. Met name het behoud van het geïnvesteerde vermogen kan niet worden gegarandeerd; er is dan ook geen garantie dat de waarde van het belegde kapitaal of de aangehouden participaties bij verkoop of terugkoop zal overeenkomen met het oorspronkelijk belegde kapitaal. Beleggingen in vreemde valuta zijn onderhevig aan bijkomende wisselkoersschommelingen of valutarisico's, d.w.z. het rendement van dergelijke beleggingen hangt ook af van de volatiliteit van de vreemde valuta, wat een negatieve impact kan hebben op de waarde van het belegde kapitaal. Beleggingen en toewijzingen kunnen gewijzigd worden. De beheer- en depotvergoedingen, evenals alle andere kosten die overeenkomstig de contractuele bepalingen ten laste van het fonds zijn, worden in de berekening opgenomen. De prestatieberekening is gebaseerd op de BVI-methode (Duitse Federale Vereniging voor Beleggings- en Vermogensbeheer), dat wil zeggen dat uitgiftekosten, transactiekosten (zoals order- en makelaarskosten), evenals bewaar- en andere beheervergoedingen niet inbegrepen zijn in de berekening. Het beleggingsrendement zou lager zijn indien rekening zou worden gehouden met de uitgiftetoeslag. Er kan geen garantie worden gegeven dat de marktprognoses gehaald worden. Om het even welke risicobehandeling in deze publicatie mag niet worden beschouwd als een onthulling van alle risico's of een sluitende behandeling van de genoemde risico's. In de verkoopprospectus wordt expliciet verwezen naar de gedetailleerde risicobeschrijvingen. Er kan geen garantie worden gegeven dat de informatie juist, volledig of actueel is. De inhoud en de informatie zijn auteursrechtelijk beschermd. Er kan geen garantie worden gegeven dat het document voldoet aan alle wettelijke of regelgevende vereisten die andere landen dan Luxemburg hebben vastgesteld. Opmerking: De belangrijkste technische termen kunnen worden gevonden in de woordenlijst op www.ethenea.com/lexicon. Informatie voor beleggers in België: Het prospectus, de statuten en de periodieke verslagen, alsmede de essentiële-informatiedocumenten (PRIIPs-KIDs), zijn kosteloos verkrijgbaar in het Frans bij de beheermaatschappij, ETHENEA Independent Investors S.A., 16, rue Gabriel Lippmann, 5365 Munsbach, Luxemburg en bij de vertegenwoordiger: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxemburg. Informatie voor beleggers in Zwitserland: Het vestigingsland van de collectieve beleggingsregeling is Luxemburg. De vertegenwoordiger in Zwitserland is IPConcept (Schweiz) AG, Münsterhof 12, P.O. Box, CH-8022 Zürich. De betaalagent in Zwitserland is DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zurich. Het prospectus, de essentiële-informatiedocumenten (PRIIPs-KIDs) en de statuten, evenals de jaar- en halfjaarverslagen zijn kosteloos verkrijgbaar bij de vertegenwoordiger. Copyright © ETHENEA Independent Investors S.A. (2025) Alle rechten voorbehouden. 02-07-2021