Are we facing a liquidity tsunami?

Many market participants are still surprised at the rise in risk assets in recent weeks and months. The new highs in equities and falls in credit spreads do not quite fit the narrative of a flagging global economy. The main culprit in the weak growth is the manufacturing sector. This branch of industry has been hit particularly hard by the trade war between the U.S. and China and by the tariffs imposed during it. The consequences have been dwindling orders and a lower production capacity utilisation.

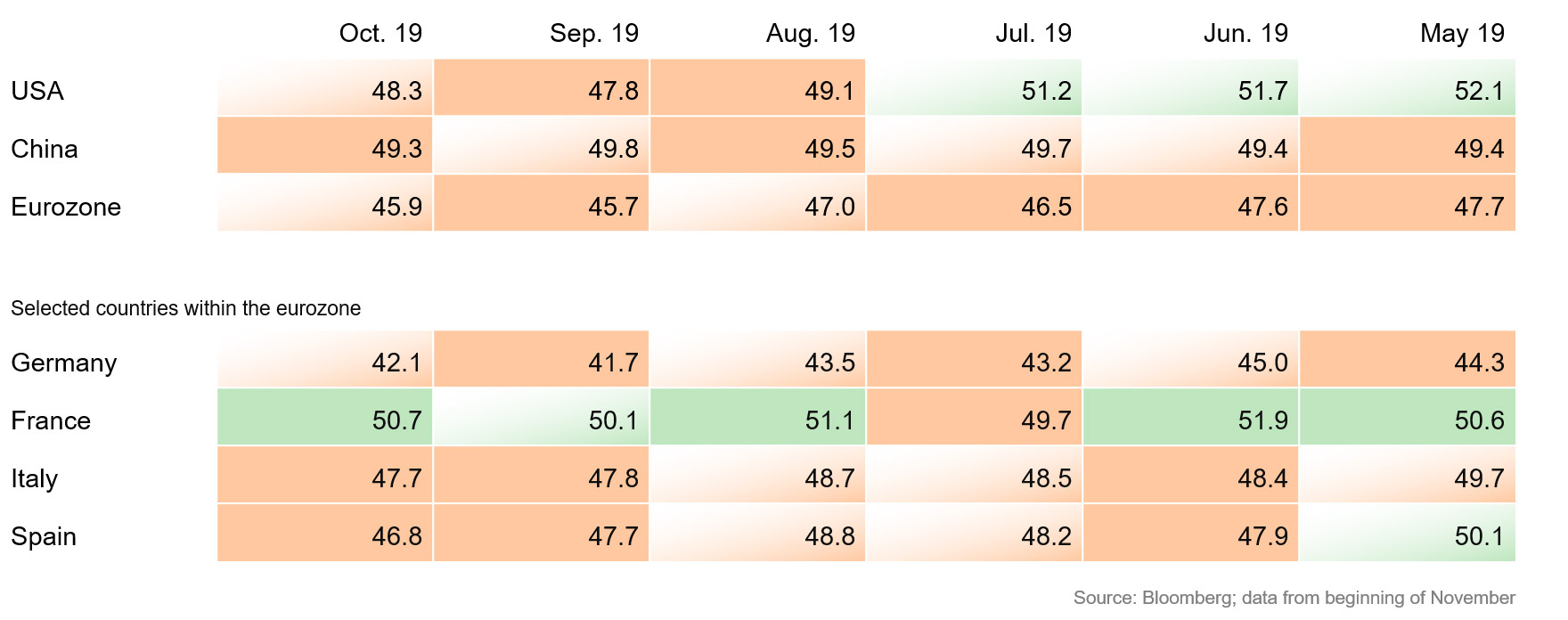

So, what is the explanation for the latest rise in risk assets? Are we seeing signs of recovery in the manufacturing sector? To determine this, we tend to look at leading indicators such as the purchasing managers’ indices (PMIs) to tell us the current sentiment in this industry. Readings of more than 50 signal economic expansion, while values of less than 50 indicate economic contraction. The large number of orange and light orange cells in Figure 1 is striking. The good news is that the downward trend in many economies has been halted for the time being. However, for the three biggest economies in the world – the U.S., China and the eurozone – we still see values below the growth mark of 50 points. That being said, in the case of the U.S. and the eurozone at least, there are signs of stabilisation at a low level versus the previous month.

Figure 1: Purchasing managers’ index for the manufacturing sector (calculated monthly)

Orange: deterioration below 50; Light orange: improvement below 50; Green: improvement above 50; Light green: deterioration above 50.

Germany remains bottom of the table by far in the eurozone at 42.1. This is due partly to the heavily export-oriented nature of the country’s industry and the weaker global economy as a result of the trade disputes, and partly to the Brexit uncertainty. For months now, the leading indicator for the biggest economy in the eurozone has been well below the growth mark of 50. One positive to note, however, is that the momentum of the German industry has not deteriorated further. This is backed up by the ifo Business Climate Index, with German firms’ expectations improving slightly of late. The French economy is the poster child within Europe. The PMI for the EU’s second-largest member state hardly went below 50 at all this year, climbing to 50.7 points in October. Italy – number three in the eurozone – is also showing signs of stabilisation. The country’s leading indicator changed marginally from 47.8 to 47.7 points. Only Spain recorded a further decline of almost one whole point. Its reading of 46.8 points for October is the lowest value since April 2013.

What goes down must come up at some point. We’re not quite there yet, but the leading indicators for the manufacturing sector have stabilised for the time being. While this could be the first sign of a bottoming out, we should keep a close eye on the PMIs to see whether a lasting recovery sets in. However, in our opinion this stabilisation does not justify such a high rise in risk assets.

On the positive side, there has been hardly any spillover effect from the manufacturing sector to the larger services sector. Should that happen, the probability of recession will increase significantly. We will also closely monitor this situation.

Looking at corporate profits isn’t much help in finding an explanation either because analysts’ consensus estimates for corporate profits have been successively revised downwards this year. The crucial factor seems more to be the change in central bank policy over the course of the year. Liquidity in capital markets has greatly increased thanks to numerous key rate cuts and the resumption of the ECB’s asset purchase programme.

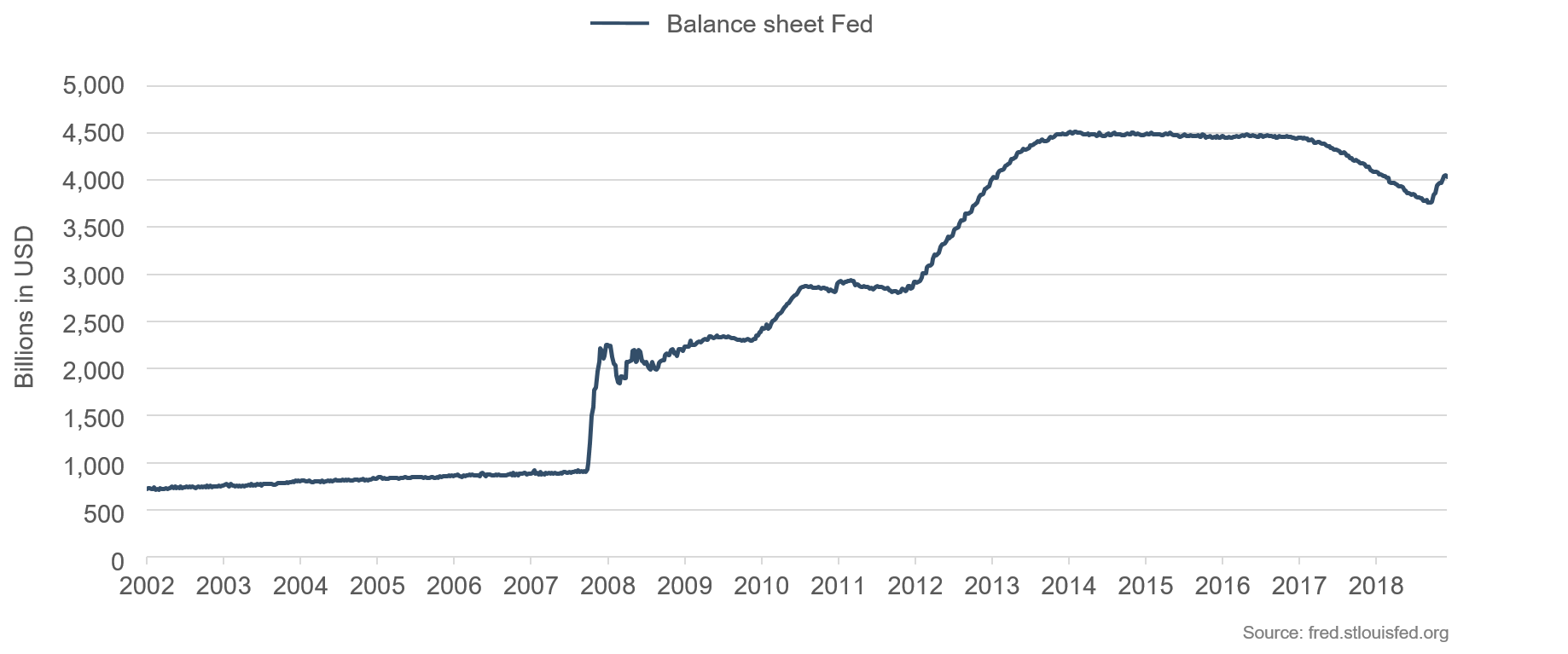

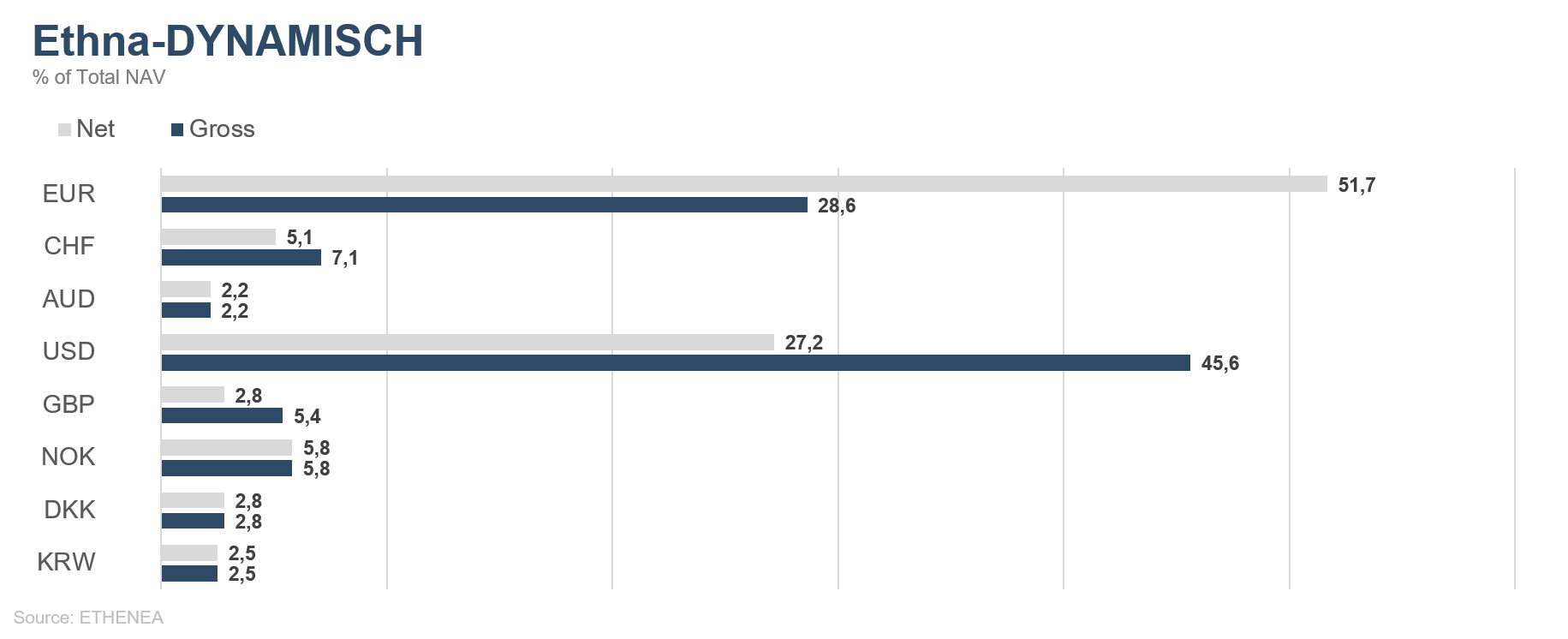

The U.S. central bank, the Federal Reserve, made a U-turn in its money market policy: in the space of just 20 months up to the end of August 2019, around USD 700 billion was taken out of the market and the central bank’s balance sheet went from around USD 4.5 trillion to around USD 3.8 trillion (see Figure 2). The Fed resumed buying Treasury Bills in mid-October to the tune of around USD 60 billion a month to ease tensions in the money market. Even though the Fed insists that under no circumstances should this be taken for a Quantitative Easing (QE) programme, these purchases clearly do appear in the central bank balance sheet and indicate an expansion of the balance sheet (Figure 2). In addition, the Fed has made several cuts to the Fed Funds rate. After nine interest rate hikes between December 2015 and December 2018, this year there were three successive rate cuts from July to October in order to mitigate the potential negative effects of the trade war on the U.S. economy. The interest rate level is currently within the range of 1.50% to 1.75%.

Figure 2: Fed balance sheet

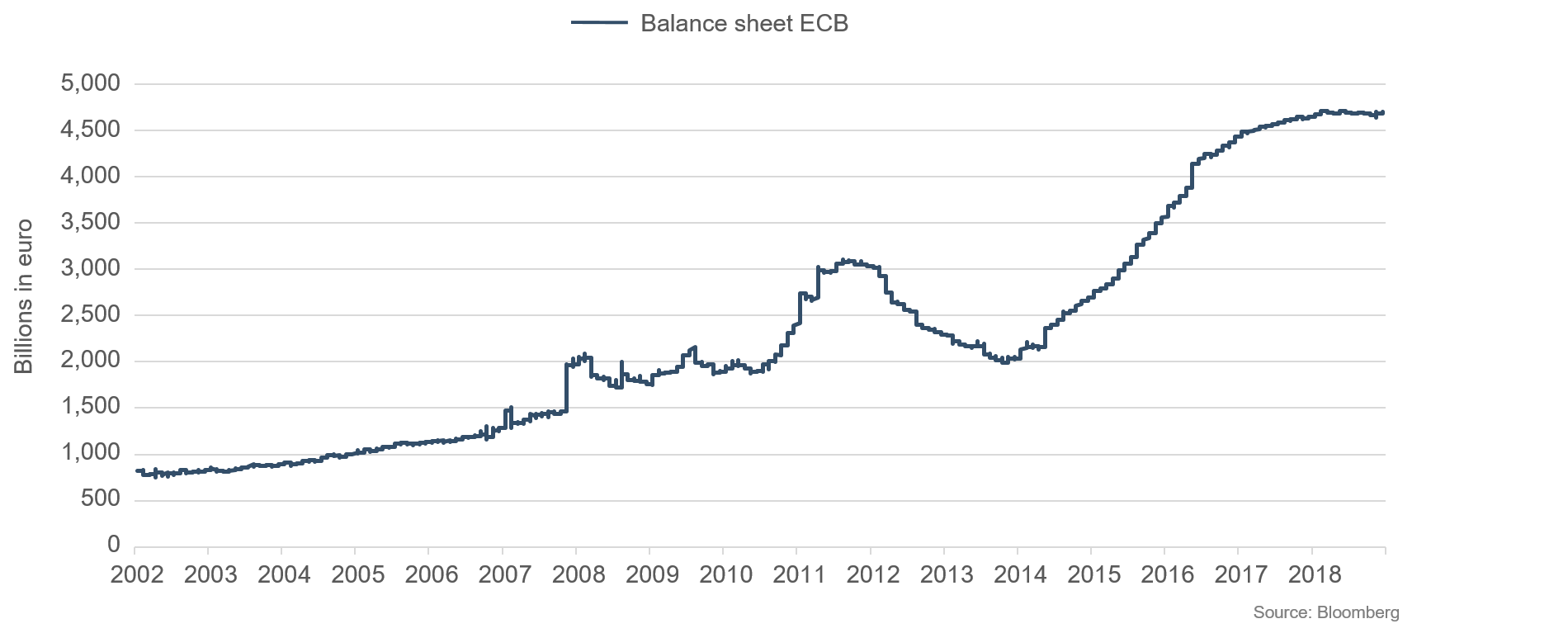

Figure 3: ECB balance sheet

On this side of the Atlantic, the ECB has also resumed providing the market with liquidity in the usual manner. Since the beginning of November it has been purchasing EUR 20 billion of sovereign and corporate bonds from the eurozone per month – and for an indefinite period at that! In addition, it is reinvesting the cash from maturing bonds in new securities. Through its last bond purchase programme, the ECB had already bought securities to the tune of EUR 2.6 trillion by the end of 2018. The central bank’s balance sheet then increased to almost EUR 4.7 trillion (see Figure 3). It will now expand successively once again due to the programme having restarted in November of this year. Since the key rate has been firmly fixed at 0% for some time now, banks can continue to obtain fresh money from the central banks at no cost.

In comparison with previous central bank liquidity programmes, these measures can hardly be described as a tsunami of liquidity, but are certainly a large wave of support. Central banks have already shown in the past that they are doing everything to ensure good (re)financing conditions for businesses, banks and governments as well, and to support the economy. That is very much still the case today. It is this very environment that is having such a positive effect on risk assets such as equities and credit spreads and explains how they have developed in recent months – even though the economic data does not reflect this. We are taking the fact that the leading indicators for the manufacturing sector are showing signs of a stabilisation at a low level globally as a first positive sign. However, in our opinion, what is much more significant is that the central banks have taken a distinct change in tack this year. This shows that they are prepared to do everything they can to kick-start the economy again. And that’s why they are supplying the markets with plenty of liquidity. For this reason, we at ETHENEA are confident of the positive medium-term performance of risk assets.

Bond selection – this is what is important for us!

More volatile bond markets make it more important than ever to actively select issuers from robust sectors and with solid business models. In our latest video, Martin Dreier explains the structured selection process that goes into each investment decision at ETHENEA. We invest with total conviction in securities selected in this manner.Kan de video niet weergegeven worden? Gelieve HIER TE KLIKKEN.

Positioning of the Ethna Funds

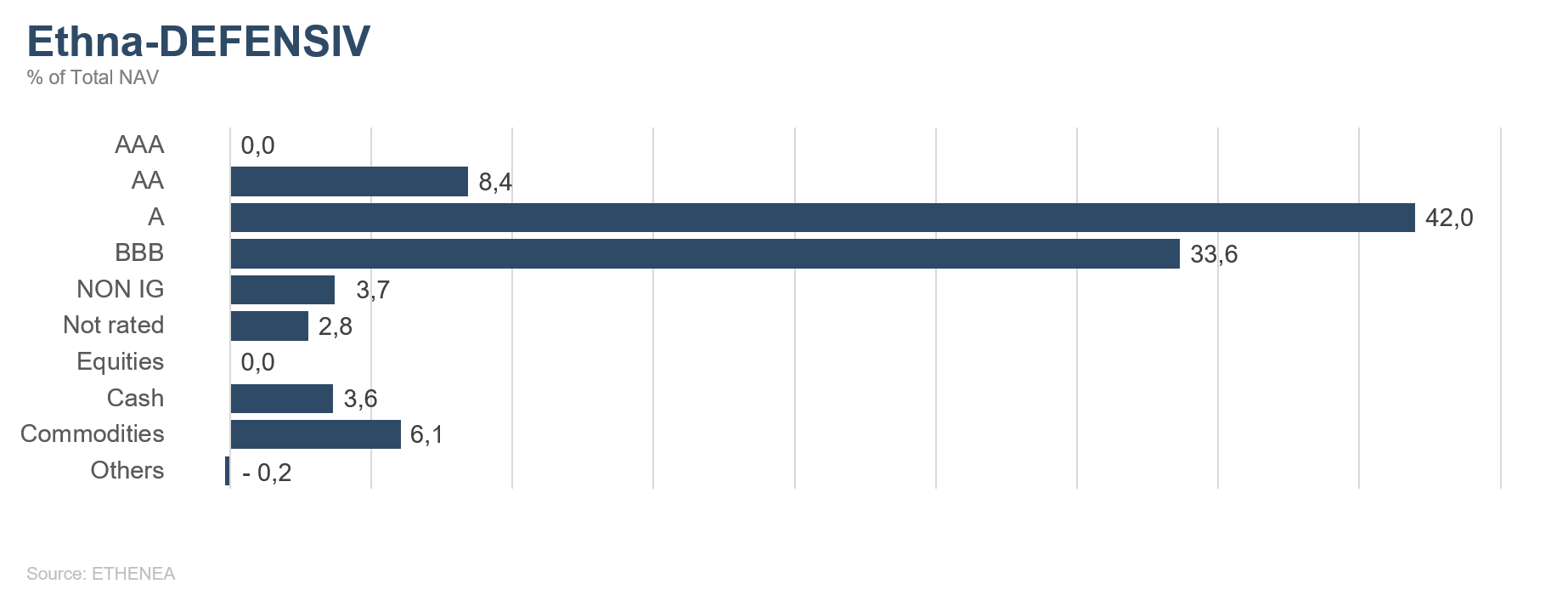

Ethna-DEFENSIV

The interest rate markets were driven at the beginning of the month by the expectation that agreement on the first phase of the U.S.-China trade deal would be reached. The agreement centred on which reciprocal tariffs would be rolled back. This gave rise to hopes of a pick-up in the global economy, leading initially to falls in the prices of long-dated sovereign bonds and prompting a rise in the yield on 10-year U.S. Treasuries to just under 2%. The news that the feared technical recession in Germany in the third quarter was averted led to a comparable movement in 10-year German Bunds. At the end of the month, hopes have – at least to some extent – given way to the realisation that an agreement is yet to be reached on the so-called phase one. Yields on long-dated Treasuries and Bunds have thus fallen back down to their values at the beginning of the month.

In this environment, the response from corporate bonds was a slight narrowing of risk premia. The significant new issuance was absorbed by investors without any problems. For instance, AbbVie issued bonds to the value of USD 30 billion in order to refinance the takeover of its competitor Allergan. For euro-denominated corporate bonds, the ECB is once again one of the most important net buyers in the market since the beginning of the month. The EssilorLuxottica group took advantage of this to raise EUR 5 billion in total in long-term debt. Here, too, the main reason the capital is required is to refinance the takeover of GrandVision.

In this environment, the Ethna-DEFENSIV remains cautious in its positioning and is being conservative in opting for high-quality bonds issued by companies that are diversified globally and are able to weather an economic downturn. As the primary indicator of credit quality, the rating is between A- and BBB+ and illustrates how robust the portfolio is. All in all, this positioning helped the fund achieve a slightly positive performance this November. Due to the uncertainty surrounding the trade war and in anticipation of a falloff in liquidity in December, we have slightly reduced the duration of the bond portfolio. The U.S. dollar rose again against the euro and this was the second key factor in the positive performance for the month. We still assume that the growth dynamics in the U.S. will remain stronger than in Europe, so that the euro will tend to weaken against the U.S. dollar.

Ethna-AKTIV

Equity markets performed well in October, and this continued in November. Although it became increasingly clear over the course of last month that the probability of agreement on phase one of the trade deal before the end of this year is becoming less and less, the risk-on environment persisted. Not even the Hong Kong law that the U.S. President signed last week amid threats of retaliation from China could do anything to change that. The stabilisation of fundamental macro data we anticipated was only partially confirmed during the month. The purchasing managers’ indices in Europe were stable at least, but economic data from Japan and China was rather poor.

However, the portfolio composition of the Ethna-AKTIV meant we were well prepared for this environment. As mentioned above, the headwind from the currency/interest rate front has abated and has even turned into a tailwind for our USD position. The bond exposure was slightly reduced over the course of the month and the duration was reduced minimally by way of rotation into shorter maturities. The gains from the narrowing of spreads were offset by losses from the movement in interest rates. Gold slightly detracted from the fund’s performance for the month, but the allocation was kept constant. Conversely, given the strength of the recent weeks of trading, we further expanded our equity exposure. The net allocation of well over 30% clearly shows our positive view of future developments. This positioning was rewarded with a position contribution to performance of more than 1% from the equity exposure alone.

Given the YTD returns for the various asset classes, the prerequisites for a quieter December than last year are in place. On the back of very positive results, fire sales are more or less out of the question for the majority of investors, with further follow-through buying if anything. For this reason, we expect the good environment to continue and volatility to remain low despite the packed December agenda – provided the trade war does not escalate further.

Ethna-DYNAMISCH

In last month’s Market Commentary we painted a very positive picture of equity markets, and the high equity allocation reflects this. This positioning paid off in November. Basically nothing about the snapshot that was taken then has changed. For instance, the profit warnings in the industrial sector, which shook single stocks on a daily basis until only a few weeks ago, have decreased drastically. While this is no reason to get overexcited about cyclicals, there are clear signs of an economic stabilisation in Europe. Economic indicators are also climbing from their lows and improved steadily, most recently with the ifo index, which is important for Germany. On the other hand, the vast majority of investors remain cautious or even pessimistic in their positioning. This can be inferred from low equity allocations and high holdings of money market and bond products. Only the sentiment indicators have begun to improve slightly in this respect. It can be assumed that the vast majority of investors missed out on the recent equity market rally. Since the rally was quite impressive, the existing pressure on many market participants to perform in the last few weeks of trading of the year is unlikely to let up and following-through buying could further boost the markets into the new year. Nor should there be a lack of monetary support; the central banks are on the shareholders’ side, while the zero-interest environment is becoming further entrenched in the European bond market.

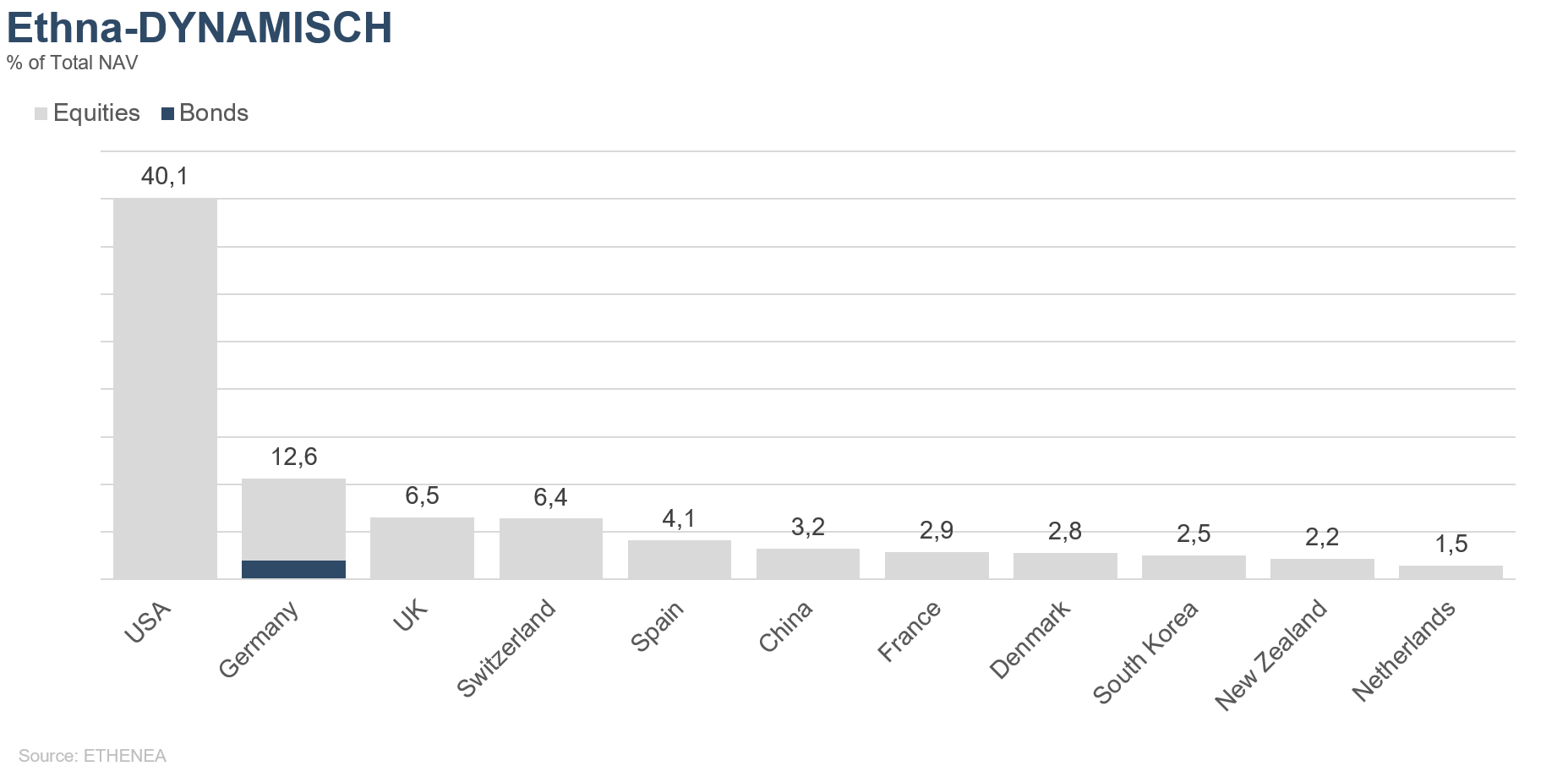

Thanks to well-placed asset allocation and well-chosen selection with a respectable result, the Ethna-DYNAMISCH has regained a considerable amount of ground in the past few weeks. At the allocation level, the equity exposure was raised early to its current level of 76%, and this provided a tailwind. The good selection results came on the back of a successful reporting season with mostly positive surprises. In addition to well-known Internet companies such as Alphabet and Alibaba, we were particularly impressed by our recent new additions. Strong quarterly figures drove up the prices of Planet Fitness and A2 Milk, with both companies’ shares posting double-digit gains (when converted into euro) this month. Biotech stocks such as BB Biotech benefited from the good growth outlook and the valuations (sometimes extremely low) in the sector. In November we sold the British supermarket chain Tesco and the Japanese telecommunications company Nippon Telegraph and Telephone (NTT), to name but two. In Tesco’s case, the fundamental momentum of the turnaround is slowing down while the NTT stock paid well of late in light of increasing competition in Japan. From the portfolio point of view, there are more attractive investment opportunities for us elsewhere; for instance, we stocked up on BB Biotech, A2 Milk, Associated British Foods and Berkshire Hathaway.

The options held for hedging purposes were renewed and the strike prices adjusted to the changes in market conditions. We continue to hold a small hedging position of approximately 5% in the S&P 500 future.

The bonds and gold positions in the portfolio remain unchanged.

2019 will go down in stock market history as a good year – maybe even a very good one. The fact that the sharp rises merely made up for the 2018 losses is often overlooked. For most European indices, there were no new all-time highs. Considering the promising position they are in, European stock markets should set new record highs in 2020 at the latest. The U.S. stock markets should be able to continue their record-breaking attempt. In short, we are retaining our high investment exposure to the equity market and are pleased with the well-balanced, high-quality portfolio.

Figure 4: Portfolio structure* of the Ethna-DEFENSIV

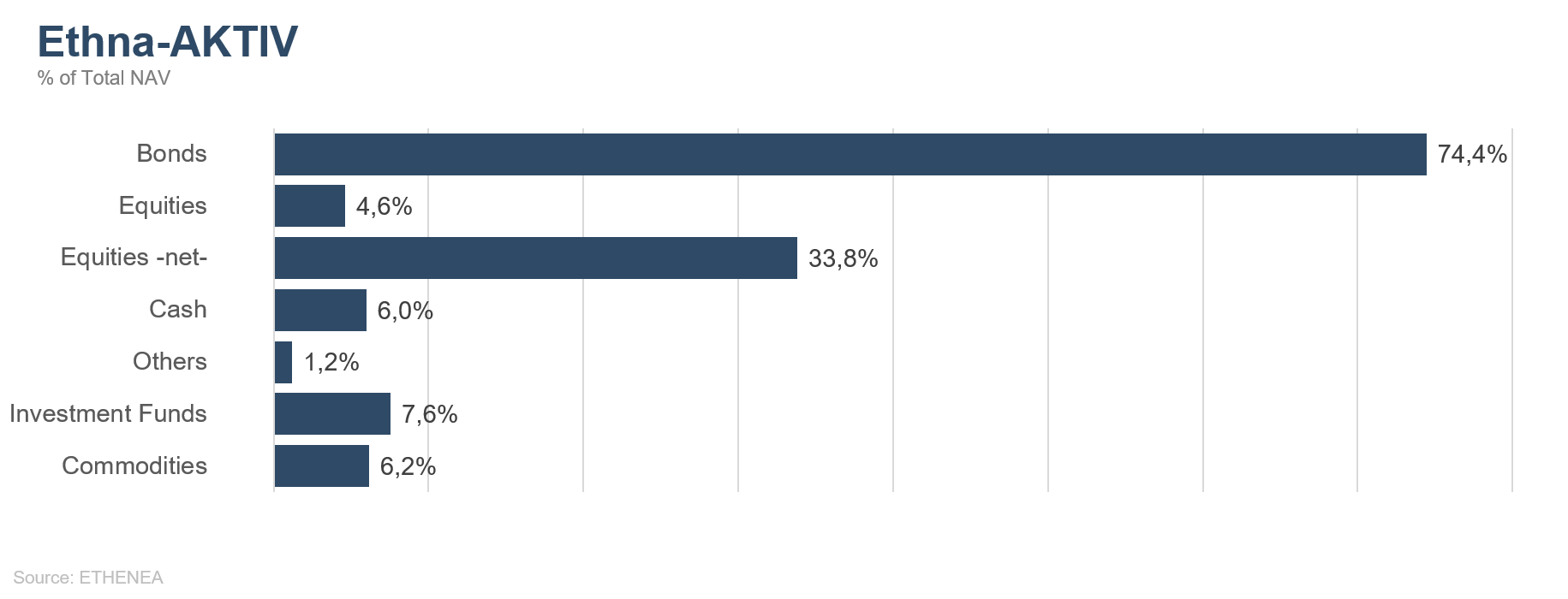

Figure 5: Portfolio structure* of the Ethna-AKTIV

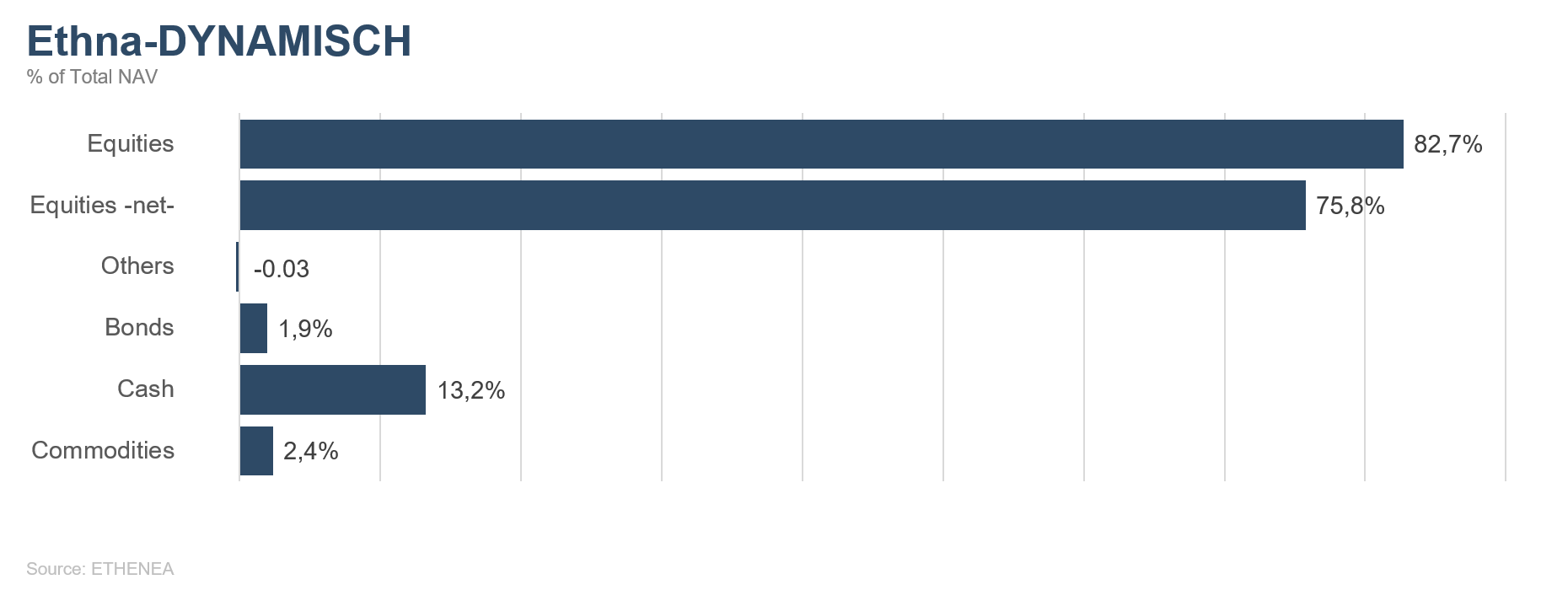

Figure 6: Portfolio structure* of the Ethna-DYNAMISCH

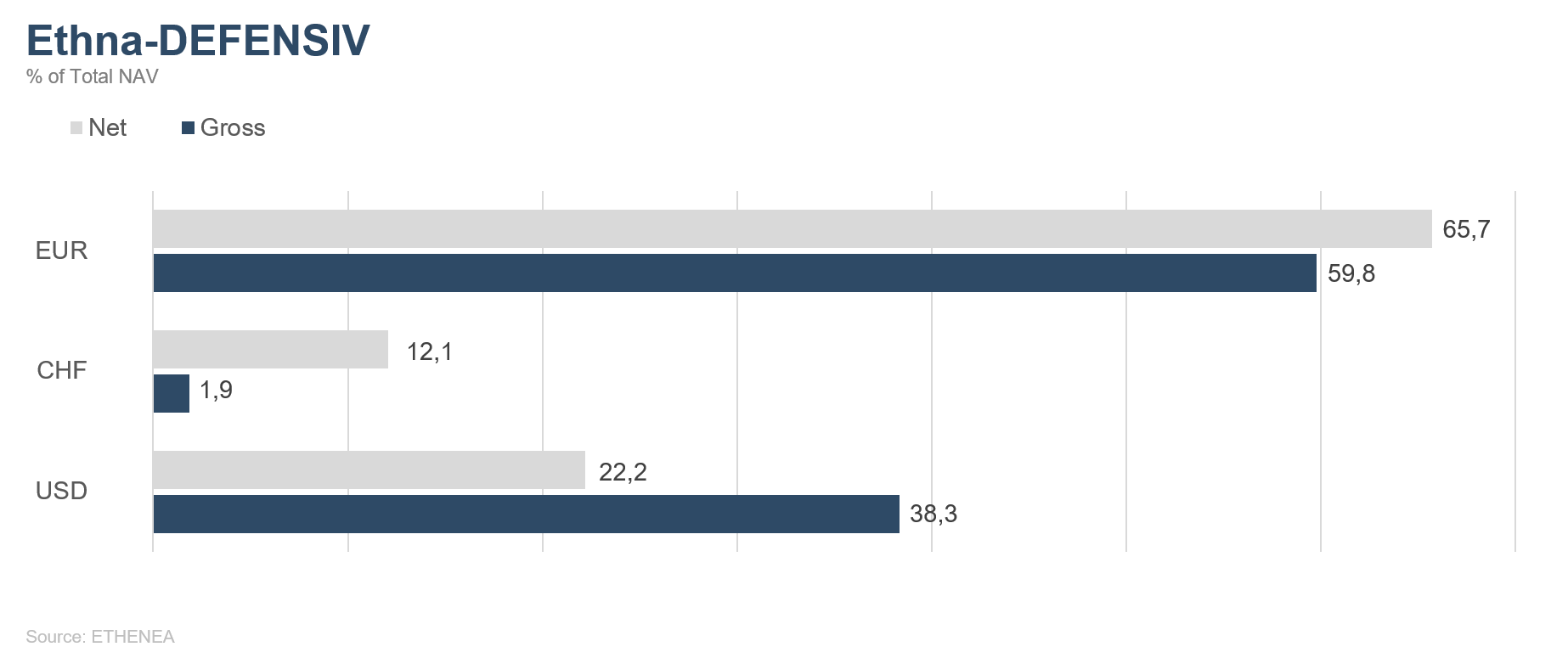

Figure 7: Portfolio composition of the Ethna-DEFENSIV by currency

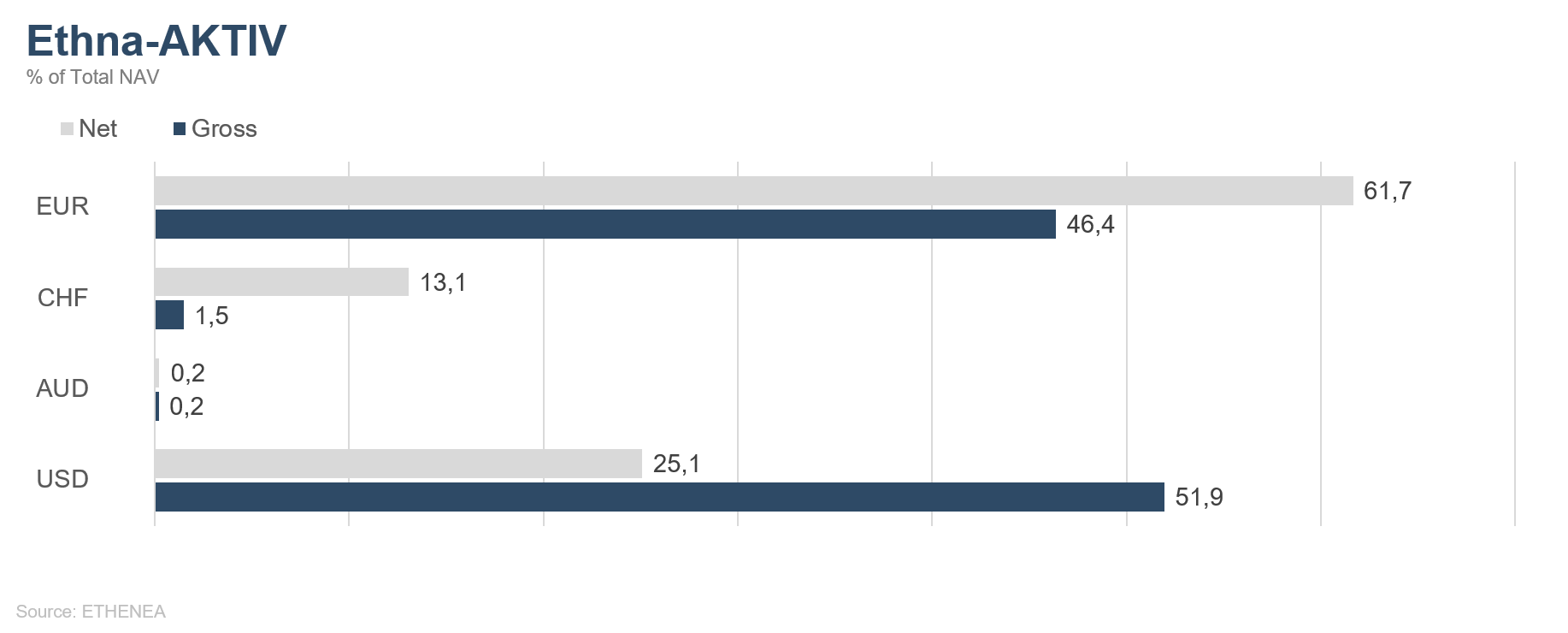

Figure 8: Portfolio composition of the Ethna-AKTIV by currency

Figure 9: Portfolio composition of the Ethna-DYNAMISCH by currency

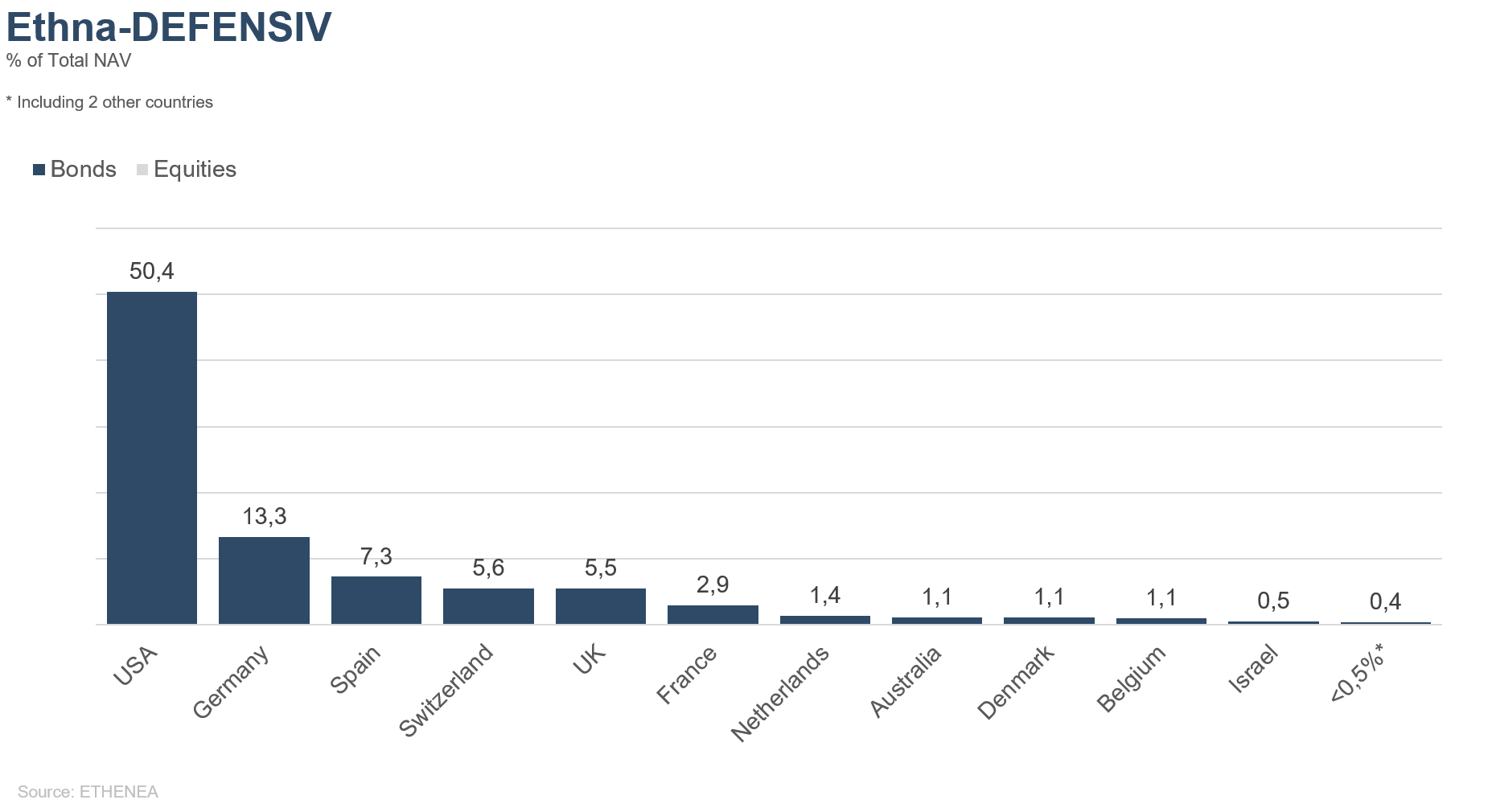

Figure 10: Portfolio composition of the Ethna-DEFENSIV by country

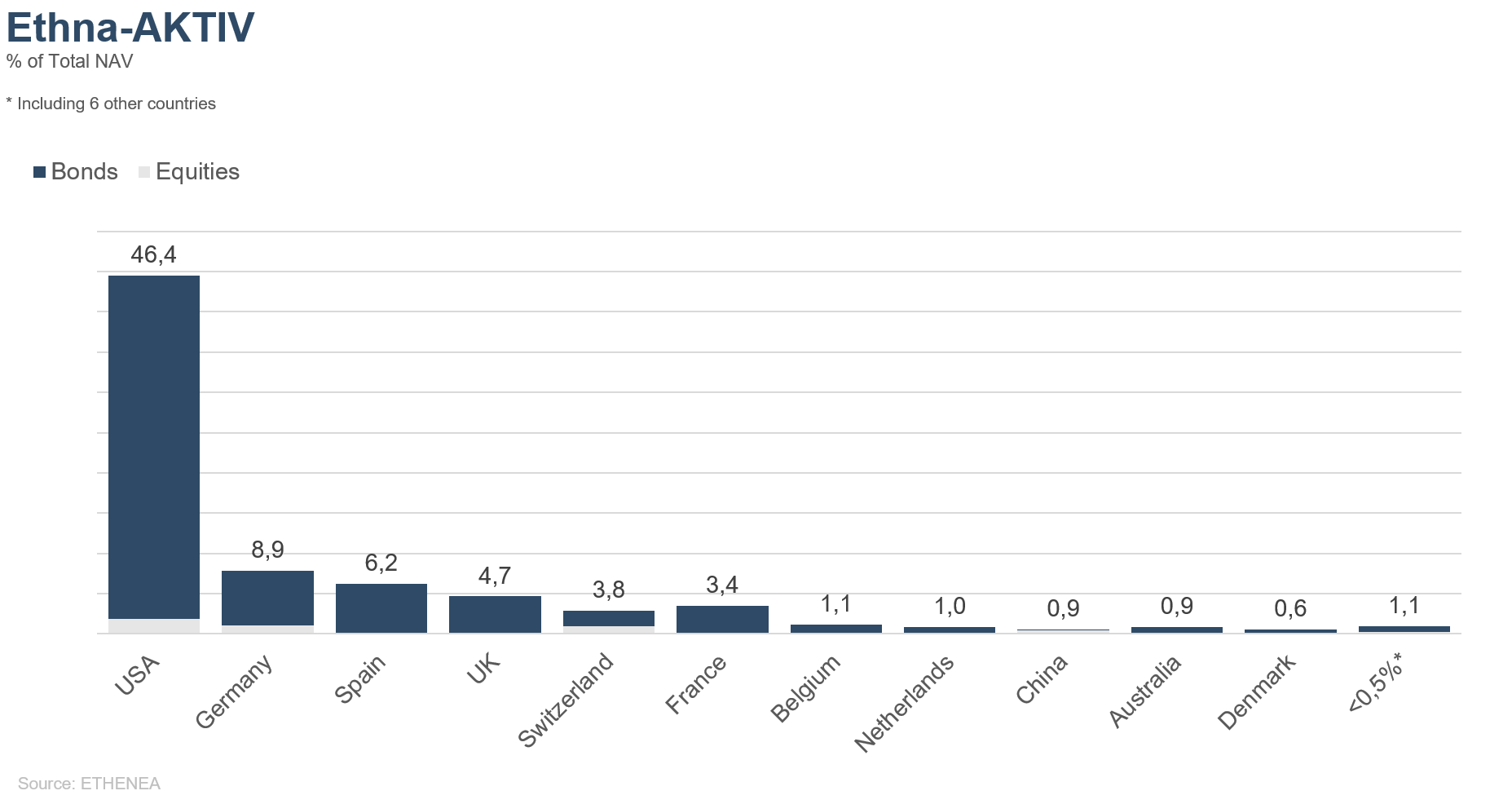

Figure 11 Portfolio composition of the Ethna-AKTIV by country

Figure 12: Portfolio composition of the Ethna-DYNAMISCH by country

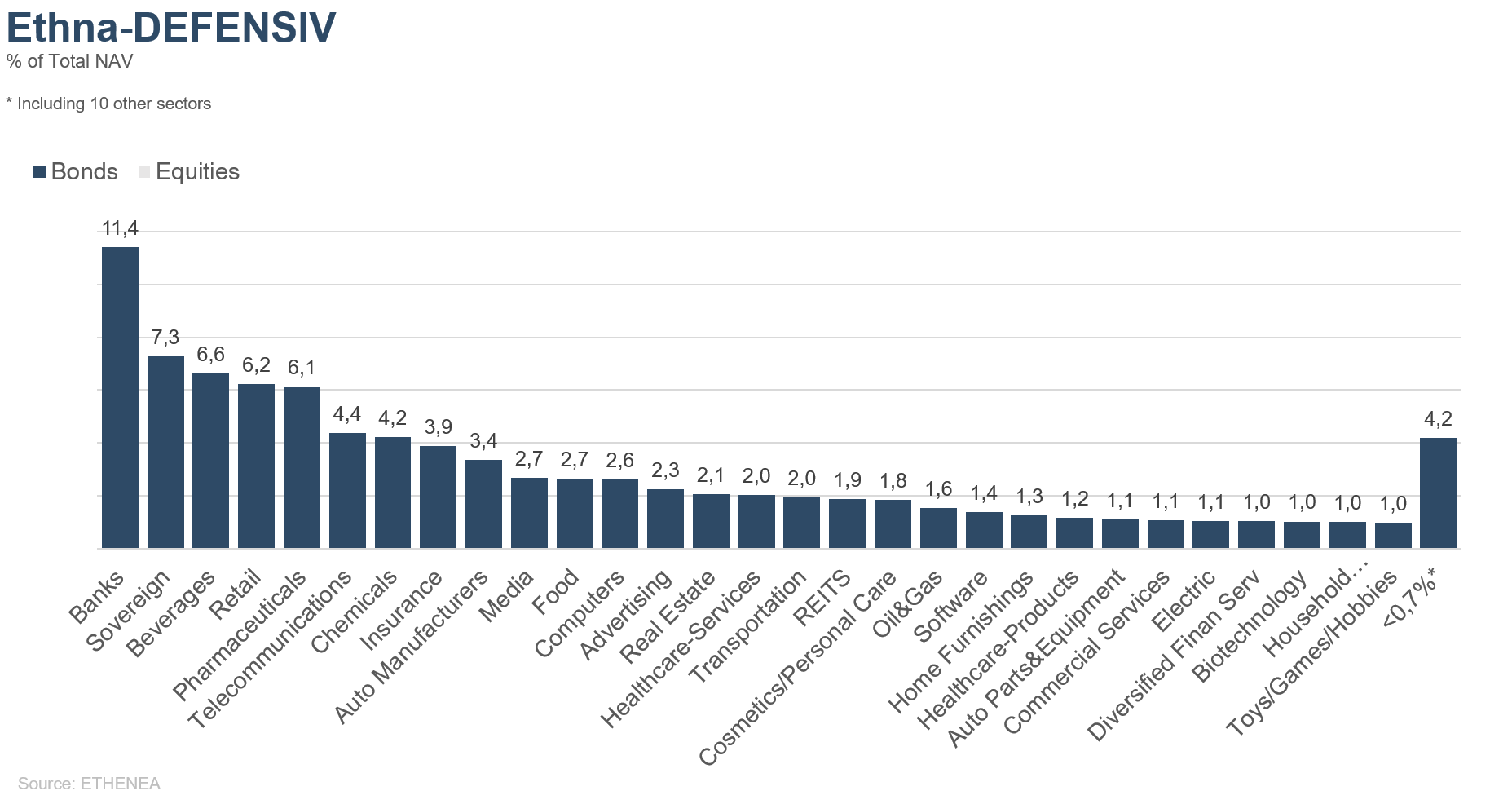

Figure 13: Portfolio composition of the Ethna-DEFENSIV by issuer sector

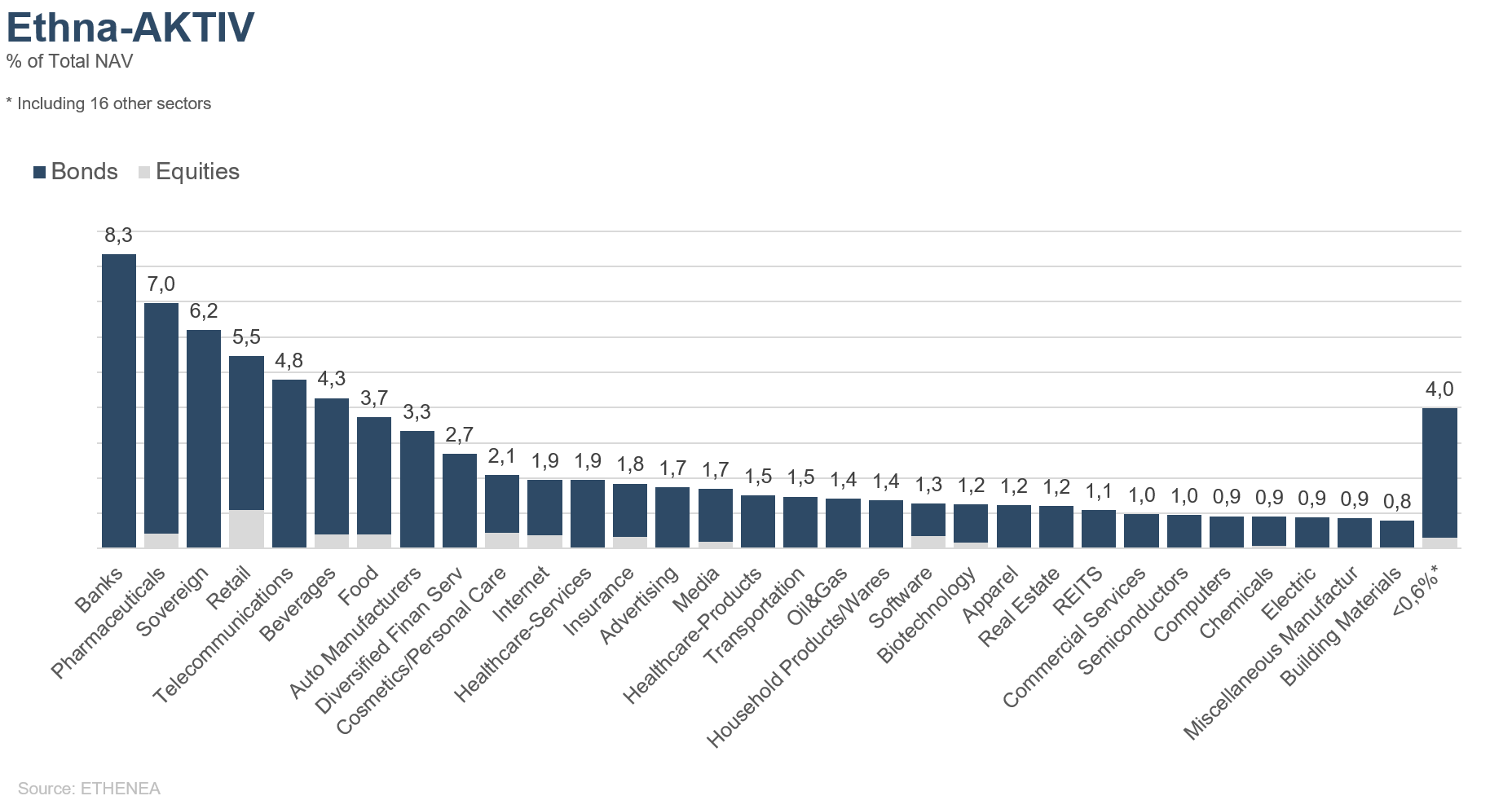

Figure 14: Portfolio composition of the Ethna-AKTIV by issuer sector

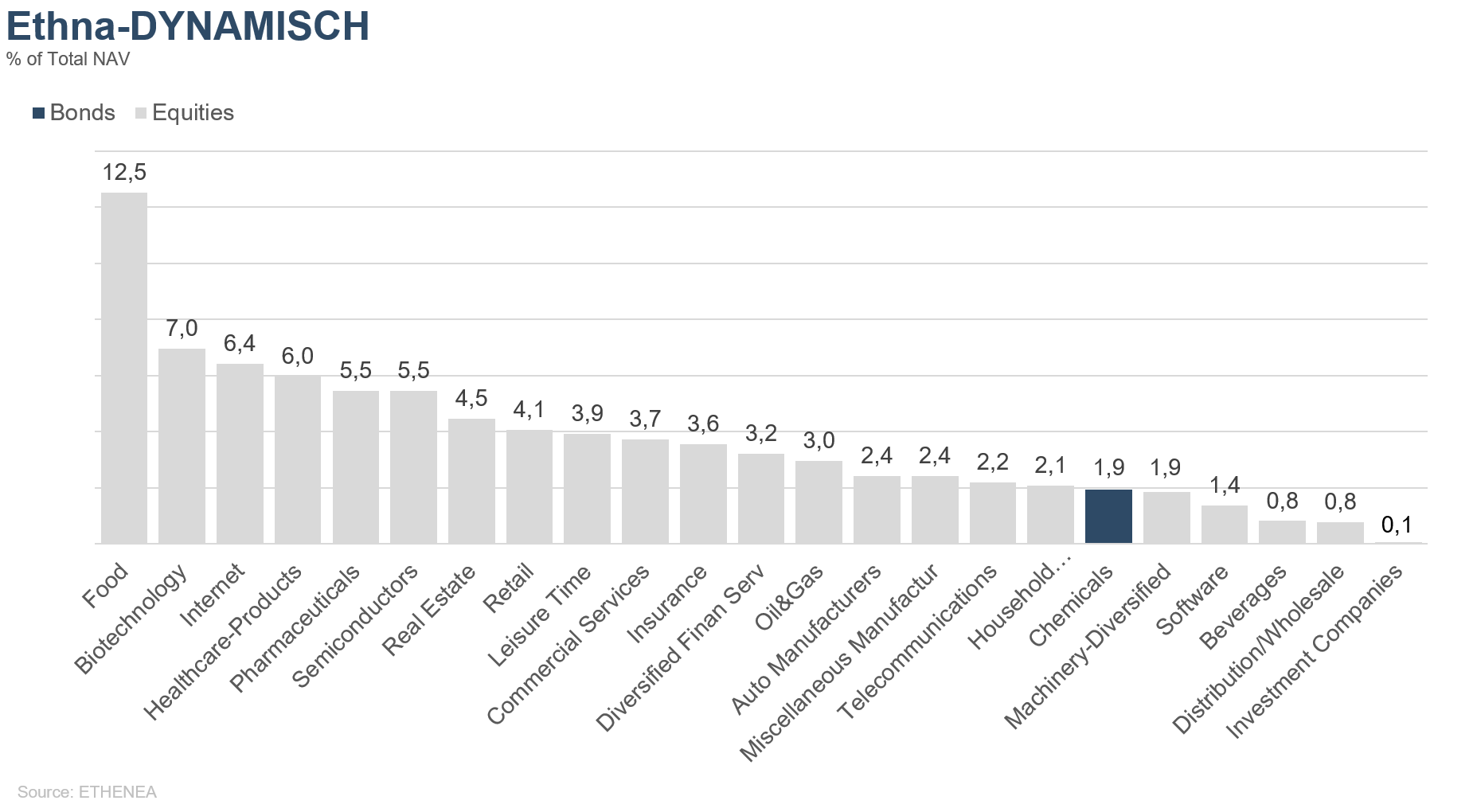

Figure 15: Portfolio composition of the Ethna-DYNAMISCH by issuer sector

* “Cash” comprises term deposits, call money and current accounts/other accounts. “Equities net” comprises direct investments and exposure resulting from equity derivatives.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

Dit is een marketing communicatie. Het is uitsluitend bedoeld om productinformatie te verstrekken en is geen verplicht wettelijk of regelgevend document. De informatie in dit document vormt geen verzoek, aanbod of aanbeveling om participaties in het fonds te kopen, te verkopen of om enige andere transactie aan te gaan. Het is uitsluitend bedoeld om de lezer inzicht te geven in de belangrijkste kenmerken van het fonds, zoals het beleggingsproces, en wordt noch geheel noch gedeeltelijk beschouwd als een beleggingsaanbeveling. De verstrekte informatie is geen vervanging voor de eigen overwegingen van de lezer of voor enige andere juridische, fiscale of financiële informatie en advies. Noch de beleggingsmaatschappij, noch haar werknemers of bestuurders kunnen aansprakelijk worden gesteld voor verliezen die rechtsreeks of onrechtstreeks worden geleden door het gebruik van de inhoud van dit document of in enig ander verband met dit document. De verkoopdocumenten in het Duits die op dit moment geldig zijn (verkoopprospectus, essentiële-informatiedocumenten (PRIIPs-KIDs) en de halfjaar- en jaarverslagen), die gedetailleerde informatie geven over de aankoop van participaties in het fonds en de bijbehorende kansen en risico's, vormen de enige wettelijke basis voor de aankoop van participaties. De bovengenoemde verkoopdocumenten in het Duits (evenals in onofficiële vertalingen in andere talen) zijn te vinden op www.ethenea.com en zijn naast de beleggingsmaatschappij ETHENEA Independent Investors S.A. en de depothoudende bank, ook gratis verkrijgbaar bij de respectieve nationale betaal- of informatieagenten en van de vertegenwoordiger in Zwitserland. De betaal- of informatieagenten voor de fondsen Ethna-AKTIV, Ethna-DEFENSIV en Ethna-DYNAMISCH zijn de volgende: België, Duitsland, Liechtenstein, Luxemburg, Oostenrijk: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxemburg; Frankrijk: CACEIS Bank France, 1-3 place Valhubert, F-75013 Paris; Italië: State Street Bank International – Succursale Italia, Via Ferrante Aporti, 10, IT-20125 Milano; Société Génerale Securities Services, Via Benigno Crespi, 19/A - MAC 2, IT-20123 Milano; Banca Sella Holding S.p.A., Piazza Gaudenzio Sella 1, IT-13900 Biella; Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Spanje: ALLFUNDS BANK, S.A., C/ Estafeta, 6 (la Moraleja), Edificio 3 – Complejo Plaza de la Fuente, ES-28109 Alcobendas (Madrid); Zwitserland: Vertegenwoordiger: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Betaalagent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. De betaal- of informatieagenten voor HESPER FUND, SICAV - Global Solutions zijn de volgende: België, Duitsland, Frankrijk, Luxemburg, Oostenrijk: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxemburg; Italië: Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Zwitserland: Vertegenwoordiger: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Betaalagent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. De beleggingsmaatschappij kan bestaande distributieovereenkomsten met derden beëindigen of distributievergunningen intrekken om strategische of statutaire redenen, mits inachtneming van eventuele deadlines. Beleggers kunnen informatie over hun rechten verkrijgen op de website www.ethenea.com en in de verkoopprospectus. De informatie is zowel in het Duits als in het Engels beschikbaar, en in individuele gevallen ook in andere talen. Opgemaakt door: ETHENEA Independent Investors S.A. Het is verboden om dit document te verspreiden aan personen die wonen in landen waar het fonds geen vergunning heeft of waar er een toestemming vereist is voor verspreiding. Participaties mogen enkel aangeboden worden aan personen in landen waarin dit aanbod in overeenstemming is met de toepasselijke wettelijke bepalingen en waar ervoor wordt gezorgd dat de verspreiding en publicatie van dit document, evenals een aanbod of verkoop van participaties, aan geen enkele beperking is onderworpen in het betreffende rechtsgebied. Het fonds wordt met name niet aangeboden in de Verenigde Staten van Amerika of aan Amerikaanse burgers (volgens Rule 902 of Regulation S of the U.S. Securities Act of 1933, in de huidige versie) of personen die namens hen, in hun rekening of ten voordele van een Amerikaanse burger handelen. Resultaten die in het verleden behaald zijn, mogen niet worden opgevat als indicatie of garantie voor toekomstige prestaties. Schommelingen in de waarde van onderliggende financiële instrumenten of hun rendementen, evenals veranderingen in rentetarieven en valutakoersen, zorgen ervoor dat de waarde van participaties in een fonds, evenals de daaruit voortvloeiende rendementen, zowel kunnen dalen als stijgen en zijn niet gegarandeerd. De waarderingen die hierin opgenomen zijn, zijn gebaseerd op een aantal factoren, waaronder, maar niet beperkt tot, huidige prijzen, schattingen van de waarde van de onderliggende activa en marktliquiditeit, evenals andere veronderstellingen en openbaar beschikbare informatie. In principe kunnen prijzen, waarden en rendementen zowel stijgen als dalen, tot en met het totale verlies van het geïnvesteerde kapitaal, en aannames en informatie kunnen zonder voorafgaande kennisgeving worden gewijzigd. De waarde van het belegde vermogen of de prijs van participaties, evenals de daaruit voortvloeiende rendementen en uitkeringsbedragen, zijn onderhevig aan schommelingen of kunnen geheel verdwijnen. Positieve prestaties in het verleden zijn daarom geen garantie voor positieve prestaties in de toekomst. Met name het behoud van het geïnvesteerde vermogen kan niet worden gegarandeerd; er is dan ook geen garantie dat de waarde van het belegde kapitaal of de aangehouden participaties bij verkoop of terugkoop zal overeenkomen met het oorspronkelijk belegde kapitaal. Beleggingen in vreemde valuta zijn onderhevig aan bijkomende wisselkoersschommelingen of valutarisico's, d.w.z. het rendement van dergelijke beleggingen hangt ook af van de volatiliteit van de vreemde valuta, wat een negatieve impact kan hebben op de waarde van het belegde kapitaal. Beleggingen en toewijzingen kunnen gewijzigd worden. De beheer- en depotvergoedingen, evenals alle andere kosten die overeenkomstig de contractuele bepalingen ten laste van het fonds zijn, worden in de berekening opgenomen. De prestatieberekening is gebaseerd op de BVI-methode (Duitse Federale Vereniging voor Beleggings- en Vermogensbeheer), dat wil zeggen dat uitgiftekosten, transactiekosten (zoals order- en makelaarskosten), evenals bewaar- en andere beheervergoedingen niet inbegrepen zijn in de berekening. Het beleggingsrendement zou lager zijn indien rekening zou worden gehouden met de uitgiftetoeslag. Er kan geen garantie worden gegeven dat de marktprognoses gehaald worden. Om het even welke risicobehandeling in deze publicatie mag niet worden beschouwd als een onthulling van alle risico's of een sluitende behandeling van de genoemde risico's. In de verkoopprospectus wordt expliciet verwezen naar de gedetailleerde risicobeschrijvingen. Er kan geen garantie worden gegeven dat de informatie juist, volledig of actueel is. De inhoud en de informatie zijn auteursrechtelijk beschermd. Er kan geen garantie worden gegeven dat het document voldoet aan alle wettelijke of regelgevende vereisten die andere landen dan Luxemburg hebben vastgesteld. Opmerking: De belangrijkste technische termen kunnen worden gevonden in de woordenlijst op www.ethenea.com/lexicon. Informatie voor beleggers in België: Het prospectus, de statuten en de periodieke verslagen, alsmede de essentiële-informatiedocumenten (PRIIPs-KIDs), zijn kosteloos verkrijgbaar in het Frans bij de beheermaatschappij, ETHENEA Independent Investors S.A., 16, rue Gabriel Lippmann, 5365 Munsbach, Luxemburg en bij de vertegenwoordiger: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxemburg. Informatie voor beleggers in Zwitserland: Het vestigingsland van de collectieve beleggingsregeling is Luxemburg. De vertegenwoordiger in Zwitserland is IPConcept (Schweiz) AG, Münsterhof 12, P.O. Box, CH-8022 Zürich. De betaalagent in Zwitserland is DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zurich. Het prospectus, de essentiële-informatiedocumenten (PRIIPs-KIDs) en de statuten, evenals de jaar- en halfjaarverslagen zijn kosteloos verkrijgbaar bij de vertegenwoordiger. Copyright © ETHENEA Independent Investors S.A. (2024) Alle rechten voorbehouden. 03-12-2019