Your questions, our answers

As we’re approaching the last days of 2022, it´s safe to say that the era of negative interest rates is over, and the markets remain under the spell of geopolitics and inflation, which continue to stay at a high level on both sides of the Atlantic. In our 4th and thus last quarterly update of the year, portfolio managers addressed the following participant questions, among others, and provided their perspective.

Ethna-DYNAMISCH

- Do you think that the stock markets have already bottomed out? Will you be increasing equity exposure again towards the end of the year and/or in 2023?

- Can you explain your current stock selection? And what is the strategy going forward?

Ethna-DEFENSIV

Ethna-AKTIV

- Which asset class has contributed the most and least to performance so far and how do you expect performance contribution by the end of 2022?

- What do we plan to do with our cash position? Continue to hold as much or are new investment opportunities already in sight?

- Currently, the equity positions consist almost entirely of U.S. equities. Can you see yourself allocating more European equities here soon?

Global macro view

- Current market: Bad economic data makes for good stock markets, and fears of sharply rising interest rates are dampened as a result. At what point is bad news bad again?

- Do you expect a prolonged period of high inflation? How long will this phase last? How will you react if your assessment does not come true?

Ethna-DYNAMISCH

Do you think the equity market has already bottomed out? Will you increase the equity exposure again towards the end of the year and/or in 2023?

The bottom of the stock market cannot be pinned down to a date or an index level. With the disinflationary impulses from the U.S., the market has already come a long way from its interim low for the year in mid-October. Nevertheless, we would not give a blanket all-clear that the bear market is over. This is because the downstream effects of inflation, which is still too high - including central bank policy, consumer buying behaviour, margin developments and valuation adjustments - are not new and are already well advanced in some cases but will continue to weigh on the medium term.

We took account of this mixed situation in the 4th quarter by slightly increasing the net equity ratio from around 30% toward 40%. On the one hand, this increase reflects a gradually improving risk-reward profile, as the immediate pressure from numerous stress factors has eased somewhat. On the other hand, the current level of net equity exposure continues to reflect our strategic caution, as the same stress factors will remain with us for some time. We will make strategic and tactical adjustments to net equity exposure depending on a changed market assessment - derived objectively and in a disciplined manner from our ETHENEA Market Balance Sheet. This may be the case as early as the end of the year or as late as 2023.

Ethna-DYNAMISCH

According to your monthly update, you have recently added new positions in high quality stocks. Can you give us some names and explain your future strategy for stock selection?

Even quality companies that continue to be fundamentally robust were unable to escape the pull of the difficult market environment of recent months. From a bottom-up perspective, attractive entry opportunities have thus presented themselves. Our new positions include:

- PayPal Holdings: an investment candidate that exemplifies our investment focus - growth at a reasonable price. PayPal's valuation, which was excessive during the Covid era, has now more than returned to normal, while fundamental growth has continued regardless of valuation turbulence. Most recently, short-term catalysts such as the share buyback program and cost discipline initiatives (triggered, among other things, by the involvement of an activist investor) have also convinced us to buy in.

- Coloplast: The Danish medical technology company is a leader in the field of artificial bodily outlets (bowel, urinary and trachea) - a non-cyclical market segment. Coloplast has an above-average organic growth rate with an operating margin of over 20% and uses its cash for both dividend payments and share buybacks. We have used the recent relatively moderate valuation to enter this defensive growth stock.

- Erste Group Bank: The Austrian bank has an attractive return on equity, a solid capitalization, pays a mid-single-digit dividend yield and is considering the option of a share buyback program in 2023. Nevertheless, the stock recently traded near a historical valuation low. We assume the market is overestimating the bank's idiosyncratic and sector-specific risks, while failing to appreciate the upside from interest rate dynamics. The (exaggerated) pessimism around European cyclicals was also a reason for us to take a closer look here.

Despite our strategic restraint (as explained in the previous response), we continue to focus on building up and expanding individual stocks, thus laying the foundation for more attractive returns again in the future. In doing so, we continue to focus on quality stocks that are characterized by fundamental strength, a solid balance sheet, and an adequate valuation, among other things.

Ethna-DEFENSIV

The Ethna-DEFENSIV has a minimum distribution of 1.5% (A-class). Which key interest rates (EUR and US) or which market scenario are necessary to be able to move towards 3%?

Yes, class A of Ethna-DEFENSIV has a minimum payout of 1.5% defined in the prospectus. Ordinary fund income primarily relates to interest income, while the costs can be approximated by taking the total expense ratio, which is 1.15% for the year 2021. The current yield of the fund as a measure of the ordinary income is currently at 2.1%, while the average yield to maturity is slightly below 5%. The significant difference is due to the rapidly rising yields, while the bond investments haven’t been adjusted with the pace. So, it is a question of time and reinvestment and the deliberate decision by the asset manager to get the current yield toward the level of the yield to maturity. Recently, the Ethna-DEFENSIV bought Euro-denominated corporate bonds carrying an IG rating, and having a medium-term maturity as well as a yield and coupon around 4%. If we can shift the whole portfolio this way, without a compromise on quality and duration, the fund is very close to generating an ordinary income sufficient to pay 3%.

The coupons and yields of recently issued USD denominated bonds are between 4.5% and 5.5% in our preferred investment universe of high-quality bonds with a short maturity. But, we have to reduce the risk against a USD devaluation as we have to preserve the conservative nature of the fund. The hedging costs can be calculated by taking money-market yields in EUR and deducting the corresponding USD yield, which leads to annual costs of 2.5%, at the moment. These costs are not part of the ordinary income, but the realized losses. Nevertheless, we incorporate the costs in our investment decisions and require a USD yield of 6.5% to come close to a 3% payout, if the hedging costs stay unchanged.

The management company ETHENEA Independent Investors S.A., decides the size of the distribution, which may include ordinary income, realized and unrealized profits, as well as other assets.

Ethna-AKTIV

Which asset class has contributed the most and least to performance to date, and how do you expect performance to be contributed by the end of 2022?

For the market, 2022 has so far been characterized by a simultaneous loss in equities and bonds on a historic scale. The fundamental investment conditions for a multi-asset fund were negative to the maximum. Against this backdrop, active management, which translates into an appropriate overlay in terms of equity, interest rate and also currency risks, was the key to differentiation. The investment result of the Ethna-AKTIV is quite respectable in this context.

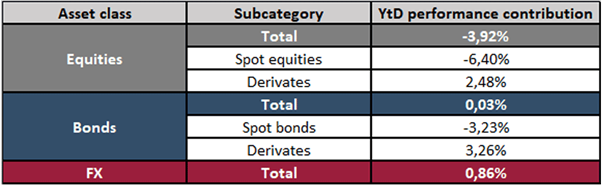

As of November 23, the performance contributions of the various asset classes including the corresponding overlays are as follows:

On the one hand, the almost balanced result in bonds and the positive contribution from the currency side should be highlighted. While the former is due to a conservative fixed income portfolio and, above all, a properly implemented interest rate hedge, the latter benefited from our overweight in the U.S. dollar. Before the recent correction of the U.S. dollar, this performance contribution was even above 3.2%, which clearly shows the added value that an appropriate diversification across asset classes can provide.

Based on the current positioning, moderate performance contributions from equities, currencies and bonds are possible until the end of the year. In all asset classes, we are currently foregoing an overlay and are taking a manageable risk in line with our market expectations.

Ethna-AKTIV

What do we plan to do with our cash position? Continue to hold so much or already new investment opportunities in sight?

The cash position of the Ethna-AKTIV is currently 15%. In a challenging year 2022, a higher cash position was a strategic decision that has so far had a positive impact on the stability of the fund's performance. Against the backdrop of initial signs of stabilization and a return to more attractive risk premiums, we will gradually reduce the cash position in favor of spot investments in both equities and bonds. As a result, the fund ratio should tend to fall back below 10% towards the end of the year.

Ethna-AKTIV

Currently, the equity positions consist almost exclusively of US stocks. Can you imagine that you will soon allocate more European stocks here as well?

Indeed, on the equity side, the base portfolio of the Ethna-AKTIV consists almost 100% of US blue chips. Despite the valuation premium that has existed for years, we have deliberately chosen this focus and away from a global portfolio. After all, this is not just about not investing in European stocks, but also in attractive Asian stocks where appropriate. The main reason for this is the resulting robustness of the portfolio. Despite a global business model, European and also Asian stocks often suffer disproportionately from regional problems, whether of a political or economic nature. Nonetheless, we also observe that this quasi clan liability has led to increasingly significant valuation discounts, which at the very least prompts us to rethink this positioning. For this reason, we do not currently rule out the possibility that the portfolio will be positioned somewhat more globally again next year.

Global macro view

Current market: Bad economic data makes for good stock markets; fears of sharply rising interest rates are curbed as a result. At what point is bad news bad again?

2022 has been a very challenging year for the global economy as well as for financial markets. Inflation has been rising to multi-decade highs, and central banks around the world have been aggressively tightening their policies. With high inflation, depressing consumption and investment as well as monetary tightening constraining demand, the risks of a recession have increased considerably. In this environment, weak economic data have been considered as positive by the markets as they point to weakening inflation pressures, and may prompt central banks to slow down, or even reverse, their tightening path providing relief to asset markets. The way the market is looking at economic developments depends strongly on the underlying economic scenario. The current dynamic could reverse and lead to a recession scenario with declining inflation. In the event of a rapidly deteriorating economic growth or a global downturn, negative economic news would be more likely to be scrutinised for its negative impact on consumption, investment and corporate profits, and would have a negative impact on equity markets.

Global macro view

You expect a prolonged period of high inflation? How long will this period last? At what point will you react if your assessment in this regard does not materialize?

The Covid-pandemic and unprecedented policy support from advanced economies have created an imbalance between surging demand and impaired demand that has triggered a surge in inflation. The situation deteriorated this year when the global economy was hit by two major negative shocks (the war in Ukraine and the Covid outbreak in China), which globally caused additional price pressures. Inflation dynamics vary across regions, but headline inflation has gradually expanded to various sectors of the economy, reaching more structural areas such as wages, services and rents. Headline inflation seems to have peaked in the US thanks to the Fed’s aggressive tightening, while it may continue to rise in other advanced economies. However, we expect core inflation to remain high for some time, declining only gradually in 2023 to reach a level more in line with central banks targets in 2024. In recent months, markets have already started to price in a disinflationary environment in 2023 and a much less hawkish central bank stance. Equity markets have recovered from their September lows, and we have progressively adjusted our positioning to the market sentiment. However, we remain cautious and will monitor how growth and inflation data will develop in the coming months and adjust our positions accordingly.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

Dit is een marketing communicatie. Het dient enkel informatieve doeleinden en geeft de geadresseerden advies over onze producten, concepten en ideeën. Dit vormt geen basis voor enige aankoop, verkoop, hedging, overdracht of het hypothekeren van activa. De informatie die hierin is opgenomen, vormt geen aanbod om enig financieel instrument te kopen of te verkopen, noch is het gebaseerd op een beschouwing van de persoonlijke omstandigheden van de geadresseerde. Het is ook geen resultaat van een objectieve of onafhankelijke analyse. ETHENEA geeft geen expliciete of impliciete garantie of verklaring met betrekking tot de nauwkeurigheid, volledigheid, geschiktheid of verhandelbaarheid van de informatie die aan de geadresseerde wordt verstrekt in webinars, podcasts of nieuwsbrieven. De geadresseerde erkent dat onze producten en concepten bedoeld kunnen zijn voor verschillende categorieën van beleggers. De criteria zijn uitsluitend gebaseerd op de verkoopprospectus die op dit moment geldig is. Deze marketinginformatie is niet bedoeld voor een specifieke groep van geadresseerden. Elke geadresseerde dient zich daarom individueel en onder eigen verantwoordelijkheid te informeren over de relevante bepalingen van de verkoopdocumenten die op dat moment geldig zijn en waar de aankoop van aandelen uitsluitend op is gebaseerd. Noch de aangeboden inhoud, noch onze marketinginformatie vormen bindende beloften of garanties voor toekomstige resultaten. Er komt geen adviesrelatie tot stand door het lezen of beluisteren van de inhoud. Alle content wordt uitsluitend voor informatieve doeleinden verleend en kan geen vervanger zijn voor professioneel en individueel beleggingsadvies. De geadresseerde heeft de nieuwsbrief opgevraagd, heeft zich aangemeld voor een webinar of podcast, of maakt op eigen initiatief en voor eigen risico gebruik van andere digitale marketingmedia. De geadresseerde of de deelnemer aanvaardt dat digitale marketingformaten op een technische manier worden opgemaakt en beschikbaar worden gesteld aan de deelnemer door een externe informatieverstrekker die niet verbonden is aan ETHENEA. Toegang tot en de deelname aan digitale marketingformaten vindt plaats via online infrastructuren. ETHENEA aanvaardt geen aansprakelijkheid voor eventuele onderbrekingen, annuleringen, onderbrekingen, opschortingen, vertragingen of het niet nakomen van elementen met betrekking tot de levering van de digitale marketingformaten. De deelnemer erkent en aanvaardt dat bij deelname aan digitale marketingformaten persoonlijke gegevens gezien, vastgelegd en verzonden kunnen worden door de informatieverstrekker. ETHENEA is niet aansprakelijk voor eventuele schendingen van de gegevensbeschermingsverplichtingen door de informatieverstrekker. Digitale marketingformaten mogen alleen geopend en bezocht worden in landen waar distributie en toegang wettelijk is toegestaan. Voor gedetailleerde informatie over de kansen en risico's van onze producten verwijzen wij u naar de huidige verkoopprospectus. De wettelijke verkoopdocumenten (verkoopprospectus, essentiële-informatiedocumenten (PRIIPs-KIDs), halfjaar- en jaarverslagen), die gedetailleerde informatie verlenen over de aankoop van participaties en de bijbehorende risico's, vormen de enige erkende en bindende basis voor de aankoop van participaties. De bovengenoemde verkoopdocumenten in het Duits (evenals in onofficiële vertalingen in andere talen) zijn te vinden op www.ethenea.com en zijn naast de beleggingsmaatschappij ETHENEA Independent Investors S.A. en de depothoudende bank, ook gratis verkrijgbaar bij de respectieve nationale betaal- of informatieagenten en van de vertegenwoordiger in Zwitserland. De betaal- of informatieagenten voor de fondsen Ethna-AKTIV, Ethna-DEFENSIV en Ethna-DYNAMISCH zijn de volgende: België, Duitsland, Liechtenstein, Luxemburg, Oostenrijk: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxemburg; Frankrijk: CACEIS Bank France, 1-3 place Valhubert, F-75013 Paris; Italië: State Street Bank International – Succursale Italia, Via Ferrante Aporti, 10, IT-20125 Milano; Société Génerale Securities Services, Via Benigno Crespi, 19/A - MAC 2, IT-20123 Milano; Banca Sella Holding S.p.A., Piazza Gaudenzio Sella 1, IT-13900 Biella; Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Spanje: ALLFUNDS BANK, S.A., C/ Estafeta, 6 (la Moraleja), Edificio 3 – Complejo Plaza de la Fuente, ES-28109 Alcobendas (Madrid); Zwitserland: Vertegenwoordiger: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Betaalagent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. De betaal- of informatieagenten voor HESPER FUND, SICAV - Global Solutions zijn de volgende: België, Duitsland, Frankrijk, Luxemburg, Oostenrijk: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxemburg; Italië: Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Zwitserland: Vertegenwoordiger: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Betaalagent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. De beleggingsmaatschappij kan bestaande distributieovereenkomsten met derden beëindigen of distributievergunningen intrekken om strategische of statutaire redenen, mits inachtneming van eventuele deadlines. Beleggers kunnen informatie over hun rechten verkrijgen op de website www.ethenea.com en in de verkoopprospectus. De informatie is zowel in het Duits als in het Engels beschikbaar, en in individuele gevallen ook in andere talen. In de verkoopprospectus wordt expliciet verwezen naar de gedetailleerde risicobeschrijvingen. Op deze publicatie rusten auteursrechten, handelsmerken en intellectuele eigendomsrechten. Elke reproductie, distributie, voorziening voor downloads of online toegankelijkheid, opname in andere websites, of gehele of gedeeltelijke publicatie, in gewijzigde of ongewijzigde vorm, is enkel toegestaan met de voorafgaande schriftelijke toestemming van ETHENEA. Copyright © 2024 ETHENEA Independent Investors S.A. Alle rechten voorbehouden. 25-11-2022