Ethna-DEFENSIV | Proven anchor of stability in recent crises

2022 represents a watershed. The era of negative interest rates is finally over, with markets continuing to be driven by geopolitics and high inflation. This marks a paradigm shift and constitutes an extremely challenging environment for equity and bond investors alike. Investors need to rethink their approach and focus, more than ever before, on strategies that enable them to respond to changing circumstances in a flexible, active manner. In this new world for investors, solutions that promise (and deliver) a steady income stream and exhibit low volatility at a tumultuous time are in demand. As a bond-focused multi-asset fund, the Ethna-DEFENSIV fits the bill and represents an anchor of stability in a changing landscape.

Thus far, 2022 has been an extremely challenging year for investors and marks a turning point. Inflation hasn't gone away; it is persistently high on both sides of the Atlantic – and in some cases reaching double digits. Central banks have implemented substantial rate hikes in a bid to get inflation under control. In addition, the war in Ukraine has brought enormous political risks to the fore. On top of that, there are growing signs that Europe, at least, is heading for a bout of recession. This very difficult set of circumstances is consequently leading to a recalibration of the capital market environment.

There is finally an alternative to stocks, with investors now pulling out of equity markets against the backdrop of a further increase in interest rates around the world. However, the most direct impact of the massive change in central-bank policy is on bond markets. Although investors are increasingly unsettled, turning their back completely on the markets isn't a realistic option. Patience and concentration are required in order to offer the right strategies and solutions in such a challenging environment.

Conservative character in turbulent markets

Investors are searching for the right mix between security and return. Multi-asset funds – where the fund manager can diversify into equities as well as bonds – are aimed at precisely this approach. Furthermore, a positioning in commodities and currencies, for example, often creates additional opportunities for investment. The Ethna-DEFENSIV is a multi-asset fund that is geared in particular to conservative investors.

The allocation is determined by the portfolio management via a top-down approach, based on in-depth assessment of macroeconomic developments, coupled with a bottom-up approach for selecting bonds. Corporate bonds with very good/good issuer credit quality are the focal point of the fund and constitute the basis of its core income. The position in AAA-rated bonds was increased in 2022. Bonds with a lower rating are added by the fund management if necessary, provided the additional return compensates for the greater risks involved. The Ethna-DEFENSIV was approximately 90.5% invested in bonds as of 31 October 2022.

Does that mean equities don't usually play a role in asset allocation? No, because the ability to be flexible and act appropriately is what marks out this multi-asset fund. The Ethna-DEFENSIV is heavily bond-weighted but can also invest a maximum of 10% in equities. The equity allocation in November 2021, for instance, was 9%. As things stand (i.e. 31 October), however, it is 0%.

Low volatility target and promise of steady returns

Due to a raft of different factors, markets were dealt a sustained blow in 2022. Volatility has become an issue again: after a relatively calm summer, the VIX index of expected volatility is now above the 30-point mark – well above the long-term average. This is fairly scary for conservative investors who prefer products with manageable volatility. Since the Ethna-DEFENSIV was launched in April 2007, the fund management has set itself the goal of keeping volatility below 4%. Annualised volatility (12 months) stood at 3.04% at the end of October 2022 (Ethna-DEFENSIV (T)).

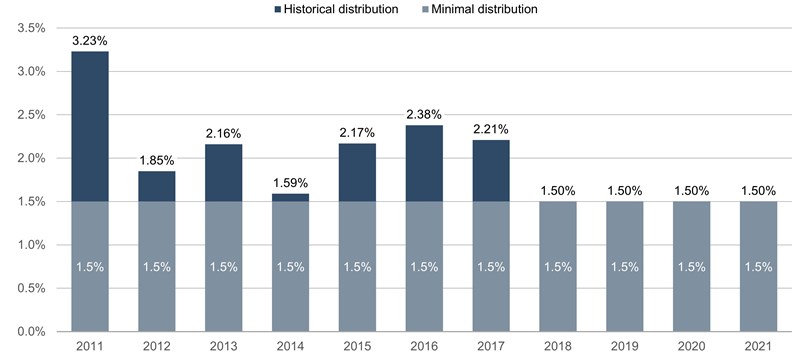

The income generated by the fund should enable a minimum distribution of 1.5% annually – and looking back that has always been the case. The fund ended crisis year 2020 with a respectable performance of 2.6%, thanks, once again, to active management of the portfolio. In October 2022, the Ethna-DEFENSIV (T) showed an annual performance of -3.17%. Due to the fund's balanced, diversified investment strategy, however, the setback is much less significant compared with multi-asset funds that have relatively high equity exposure as well as funds with overly aggressive positioning on the bond side.

In addition, the characteristics of the fund include the fund management's clear preference for short-dated issues in order to keep interest rate sensitivity at a low level. As of 31 October, bonds with a residual maturity of between 0 and 3 years accounted for around 52% of the fund assets. In anticipation of further increases in interest rates, the duration has been lowered significantly since February 2022 through the occasional use of interest rate futures.

The Ethna-DEFENSIV has a clearly discernible focus on the U.S. market. USD-denominated bonds account for about two thirds of the portfolio and are largely hedged against currency fluctuations. In the eyes of the fund management, the U.S. offers clear advantages over Europe.

The ESG topic is also addressed by the fund, which has been awarded a four-globes Morningstar Sustainability Rating. The ESG investment approach consists of a three-step process, as is the case with the other Ethna funds. In this connection, management is supported by the external expertise of Morningstar Sustainalytics.

Ahead of the competition

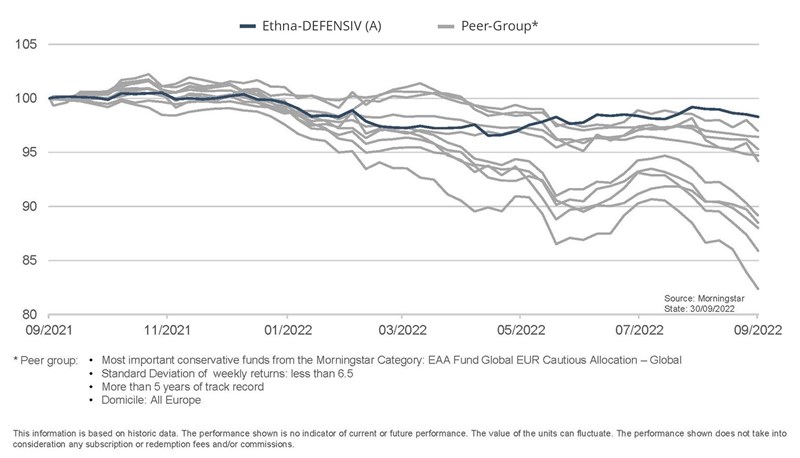

The fund easily holds its own in a peer-group comparison: the Ethna-DEFENSIV puts its rivals in the shade on a 1-year view; the portfolio management also impresses with strong performance in a medium and longer-term comparison.

Ethna-DEFENSIV is an actively-managed, bond-oriented multi-asset fund. The core of the portfolio consists of high-quality and carefully selected corporate bonds with good ratings. Through adequate adjustments to the portfolio, the fund management team repeatedly succeeds in keeping volatility on a very low level of below 4 percent, even in very dynamic market phases. The 5-star overall Morningstar rating confirms to the fund's excellent performance.

Strong arguments for a strategy that stands for stability in turbulent market phases and is thus particularly suitable for conservative investors as a long-term basic investment.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

Deze marketingmededeling dient uitsluitend ter informatie. Het mag niet worden doorgegeven aan personen in landen waar het fonds niet voor distributie is toegestaan, met name in de VS of aan Amerikaanse personen. De informatie vormt noch een aanbod noch een uitnodiging tot koop of verkoop van effecten of financiële instrumenten en vervangt geen op de belegger of het product toegesneden advies. Er wordt geen rekening gehouden met de individuele beleggingsdoelstellingen, financiële situatie of bijzondere behoeften van de ontvanger. Lees vóór een beleggingsbeslissing zorgvuldig de geldende verkoopdocumenten (prospectus, essentiële informatiedocumenten/PRIIPs-KIDs, halfjaar- en jaarverslagen). Deze documenten zijn beschikbaar in het Duits en als niet-officiële vertaling bij ETHENEA Independent Investors S.A., de bewaarbank, de nationale betaal- of informatiekantoren en op www.ethenea.com. De belangrijkste vaktermen vindt u in de lexicon op www.ethenea.com/lexicon/. Uitgebreide informatie over kansen en risico's van onze producten vindt u in het actuele prospectus. In het verleden behaalde resultaten bieden geen betrouwbare indicatie voor toekomstige prestaties. Prijzen, waarden en opbrengsten kunnen stijgen of dalen en kunnen leiden tot volledig verlies van het geïnvesteerde kapitaal. Beleggingen in vreemde valuta zijn onderhevig aan extra valutarisico's. Aan de verstrekte informatie kunnen geen bindende toezeggingen of garanties voor toekomstige resultaten worden ontleend. Aannames en inhoud kunnen zonder voorafgaande kennisgeving worden gewijzigd. De samenstelling van de portefeuille kan op elk moment wijzigen. Dit document vormt geen volledige risico-informatie. De distributie van het product kan vergoedingen opleveren voor de beheermaatschappij, verbonden ondernemingen of distributiepartners. De informatie over vergoedingen en kosten in het actuele prospectus is doorslaggevend. Een lijst van nationale betaal- en informatiekantoren, een samenvatting van de beleggersrechten en informatie over de risico's van een foutieve netto-inventariswaarde-berekening vindt u op www.ethenea.com/juridische-opmerkingen/. In geval van een foutieve NIW-berekening wordt compensatie verleend volgens CSSF-circulaire 24/856; bij via financiële intermediairs aangeschafte participaties kan de compensatie beperkt zijn. Informatie voor beleggers in Zwitserland: Het land van herkomst van de collectieve belegging is Luxemburg. De vertegenwoordiger in Zwitserland is IPConcept (Schweiz) AG, Bellerivestrasse 36, CH-8008 Zürich. De betaalagent in Zwitserland is DZ PRIVATBANK (Schweiz) AG, Bellerivestrasse 36, CH-8008 Zürich. Prospectus, essentiële informatiedocumenten (PRIIPs-KIDs), statuten en de jaar- en halfjaarverslagen zijn gratis verkrijgbaar bij de vertegenwoordiger. Informatie voor beleggers in België: Het prospectus, de essentiële informatiedocumenten (PRIIPs-KIDs), de jaarverslagen en de halfjaarverslagen van het subfonds zijn op verzoek gratis in het Duits verkrijgbaar bij ETHENEA Independent Investors S.A., 16, rue Gabriel Lippmann, 5365 Munsbach, Luxemburg en bij de vertegenwoordiger: DZ PRIVATBANK AG, Niederlassung Luxemburg, 4, rue Thomas Edison, L-1445 Strassen, Luxemburg. Ondanks de grootst mogelijke zorg wordt geen garantie gegeven voor de juistheid, volledigheid of actualiteit van de informatie. Alleen de originele Duitstalige documenten zijn juridisch bindend; vertalingen dienen alleen ter informatie. Het gebruik van digitale advertentieformaten is op eigen risico; de beheermaatschappij aanvaardt geen aansprakelijkheid voor technische storingen of schendingen van gegevensbescherming door externe informatieaanbieders. Het gebruik is alleen toegestaan in landen waar dit wettelijk is toegestaan. Alle inhoud is auteursrechtelijk beschermd. Elke reproductie, verspreiding of publicatie, geheel of gedeeltelijk, is alleen toegestaan met voorafgaande schriftelijke toestemming van de beheermaatschappij. Copyright © ETHENEA Independent Investors S.A. (2025). Alle rechten voorbehouden. 22-11-2022