Good news and bad news

“The only financial market bubble is in sovereign debt” said Jamie Dimon, CEO of JPMorgan Chase &Co, in a recent interview at this year’s World Economic Forum in Davos. What led him to this conclusion? To find an answer, let’s first take a look at the facts.

U.S. national debt has now climbed to over USD 23 trillion, and the budget deficit for the current fiscal year alone – which doesn’t end until September 2020 – is expected to top USD 1 trillion. This deficit is the difference between the spending projection of USD 4.6 trillion and the revenue projection of USD 3.6 trillion. The interest portion of spending is estimated at USD 370 billion. This brings the national debt to around the same level as the U.S. Gross National Product (GNP). On a global scale, this in itself is not worrying: Italy’s national debt, for example, already exceeds GNP by approx. 35%. What’s more alarming is the CBO’s (Congressional Budget Office) projection that federal deficits will average USD 1.3 trillion over the next 10 years. Thus, every year the budget deficit will amount to more than 4% of the Gross National Product. The only comparable rise in new debt over a prolonged period in the U.S. was directly following World War II.

Without figuring out the details, it is clear that this is not a sustainable development and financing it would be virtually impossible even in a zero-interest environment. While money from national budget deficits does not go out of circulation, it is not directly used to refinance them. Nobody except for the U.S. Federal Reserve is in a position to buy this record amount of additional U.S. Treasuries. This means that the U.S. central bank will not be able to withdraw from the purchase program they have just resumed anytime soon. We can therefore expect to continue to rely on the Fed’s support in the coming years. In the highly unlikely event that the Fed doesn’t follow this logic and, say, even hikes key rates again due to an unexpected rise in inflation, U.S. Treasury holders would be at risk of considerable losses. In short, while the bubble in U.S. Treasuries is growing, it does not look set to burst anytime soon.

As long as international investors get a distinctly positive yield on U.S. Treasuries in this low interest rate environment, they will continue to readily buy them and thus support the Fed. In addition, the strength of the U.S. currency is another reason for investors outside the USD region to buy. If these two factors – positive yield and currency strength – are no longer in play, then the U.S. central bank will soon be on its own. Pressure on the U.S. government to restore balance to the budget will then increase at that point, if not earlier.

And what about German sovereign bonds? While in the U.S. the bubble is in the quantity of sovereign bonds, in Germany the bubble is in the prices and yields. 10-year German Bund yields reached a low of -0.7% last year and are headed down the same path again after a temporary recovery. Like the Fed, the ECB has recently resumed its asset purchase programme and started buying German sovereign bonds. At the moment, fears over the coronavirus and the resulting global economic slowdown is driving Bund yields back down, currently at -0.5%. Who would want to add these to their portfolio when it means buying into a certain loss if held until maturity? Probably very few of us. Having said that, many investors and banks do take this option if the only alternative is for them to invest the money at a deposit interest rate of -0.5%. In any case, the ECB has already announced that it will proceed with its asset purchases and not raise central bank rates until inflation approaches the 2% target. However, since such a rise in inflation is not expected in 2020, we will have to live with negative yields for German sovereign bonds for a while longer. At least there is good news to be gleaned for investors: this bubble will not burst this year either!

Responsible investing at ETHENEA

The term ESG (Environmental, Social, Governance) has become well established in the world of finance. We at ETHENEA want to do our part by offering our clients responsible and sustainable investment solutions. For this reason, ESG criteria play an important role in our investment decisions.

Kan de video niet weergegeven worden? Gelieve HIER TE KLIKKEN.

Positioning of the Ethna Funds

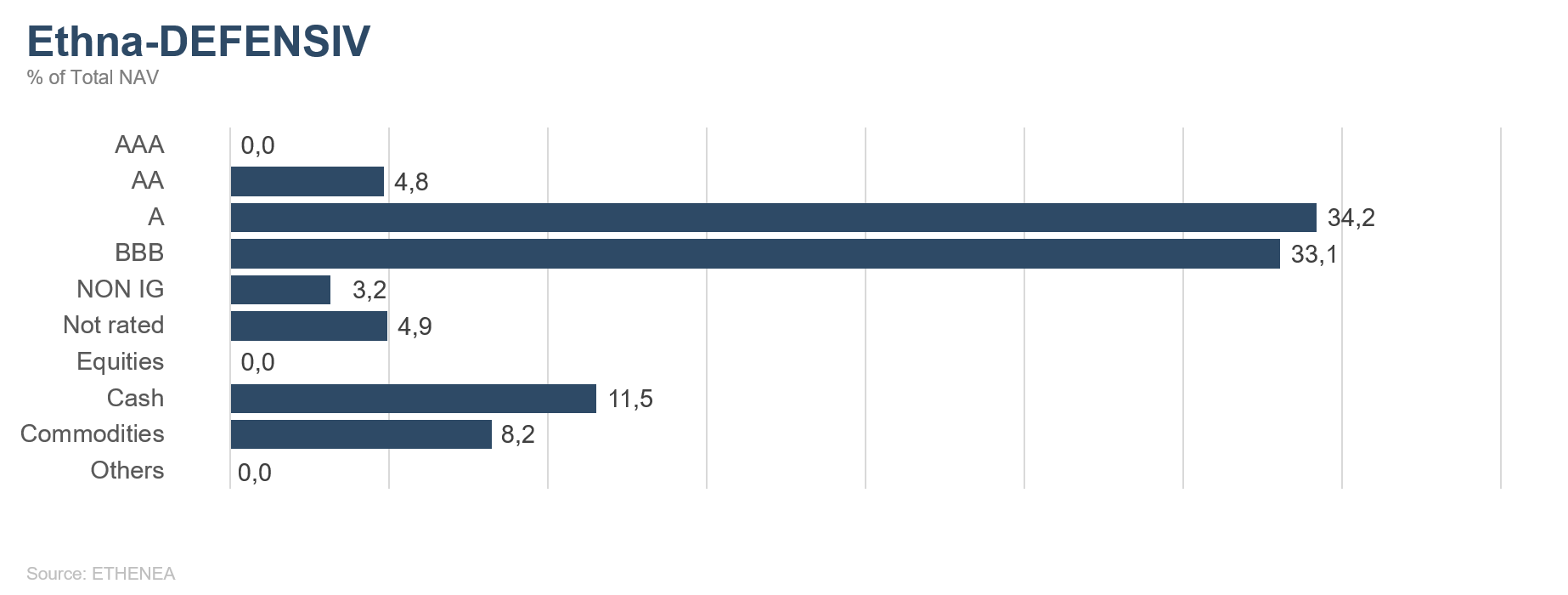

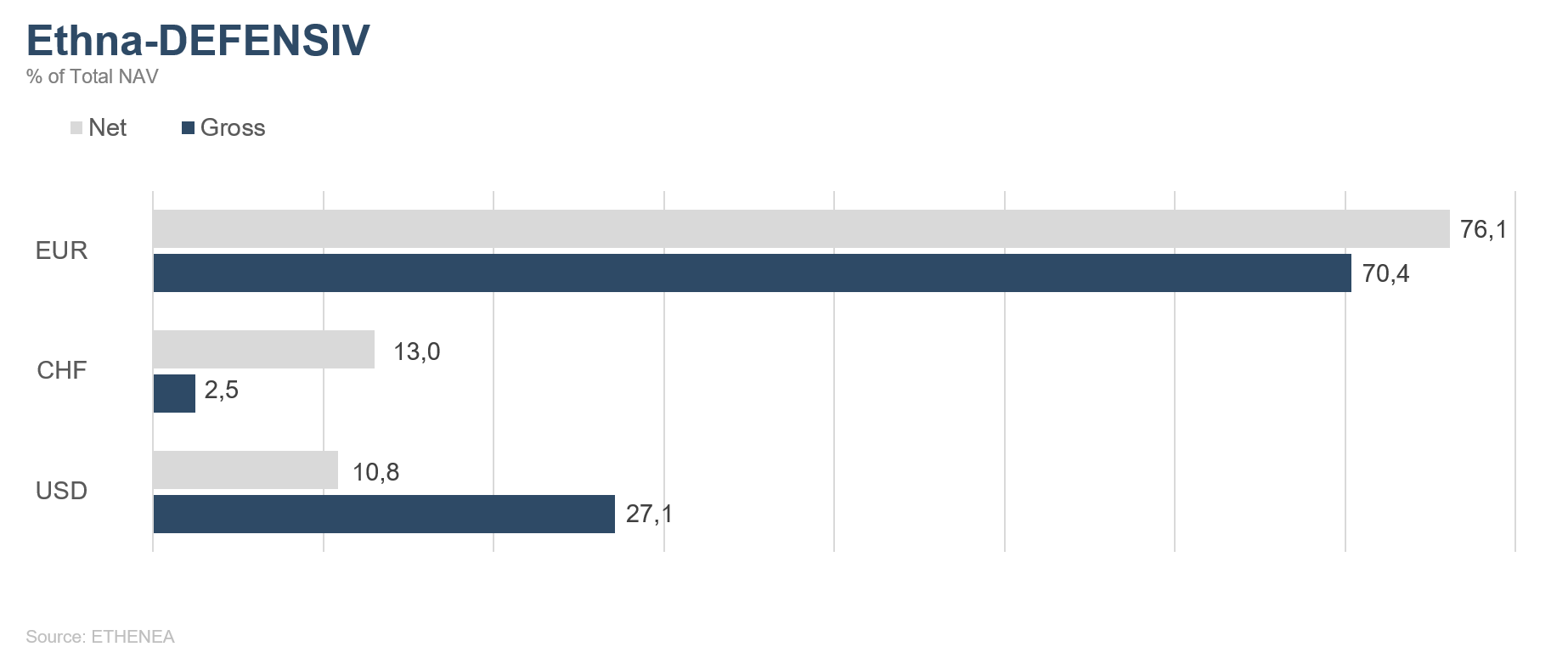

Ethna-DEFENSIV

January was a month of all-time highs in equity markets and sharp falls in interest rates in bond markets.

Around 22 months after the trade war broke out, the U.S. and China have come to a so-called phase one agreement. In mid-January, U.S. President Donald Trump and Chinese Vice Premier Liu He signed a phase one deal to de-escalate the trade war, as announced at the end of 2019. The positive signals in the run-up to signing the deal alone caused risk assets (such as equities) to climb since the beginning of the year. Thanks to our early allocation, the fund was in a position to participate in the positive equity market trend. Not even the geopolitical tensions between Iran and the U.S. were able to put a dent in the positive market sentiment in the first half of the month.

However, market developments were influenced by something that, of course, nobody saw coming: the coronavirus outbreak, which was reminiscent of the SARS epidemic in 2003. As the virus spread, investor sentiment turned risk-off, which caused a veritable buying spree in bond markets. For example, in recent weeks the yield on 10-year German Bunds fell 20 basis points. Developments in the U.S. bond markets were largely identical. The 10-year U.S. Treasury yield fell 24 basis points.

The high duration of 6.6 years enabled the Ethna-DEFENSIV’s bond portfolio to benefit to a considerable extent from falling interest rates. The slight overall widening of risk premia was more than offset by the decline in interest rates. The bond allocation is currently approximately 80% and the focus remains on high quality securities issued by globally diversified companies. The average rating lies between A- and BBB+. The temporary equity allocation of approximately 9% also contributed to the fund’s very positive performance in January (+1.7%). Due to the uncertainties surrounding the coronavirus, we had recently fully closed this allocation and took profits on the positions. We are maintaining our gold position. Other safe haven assets, such as gold, the U.S. dollar and the Swiss franc also benefited from this environment and made a positive contribution to the fund.

It is still too early to draw conclusions as to the possible economic consequences of the coronavirus outbreak. However, market participants around the globe are increasingly concerned that the coronavirus could take a visible toll on microeconomic and macroeconomic developments. Current developments urge us to be cautious. Should the news improve, we can well imagine taking on more risk again soon, for instance by increasing the equity allocation.

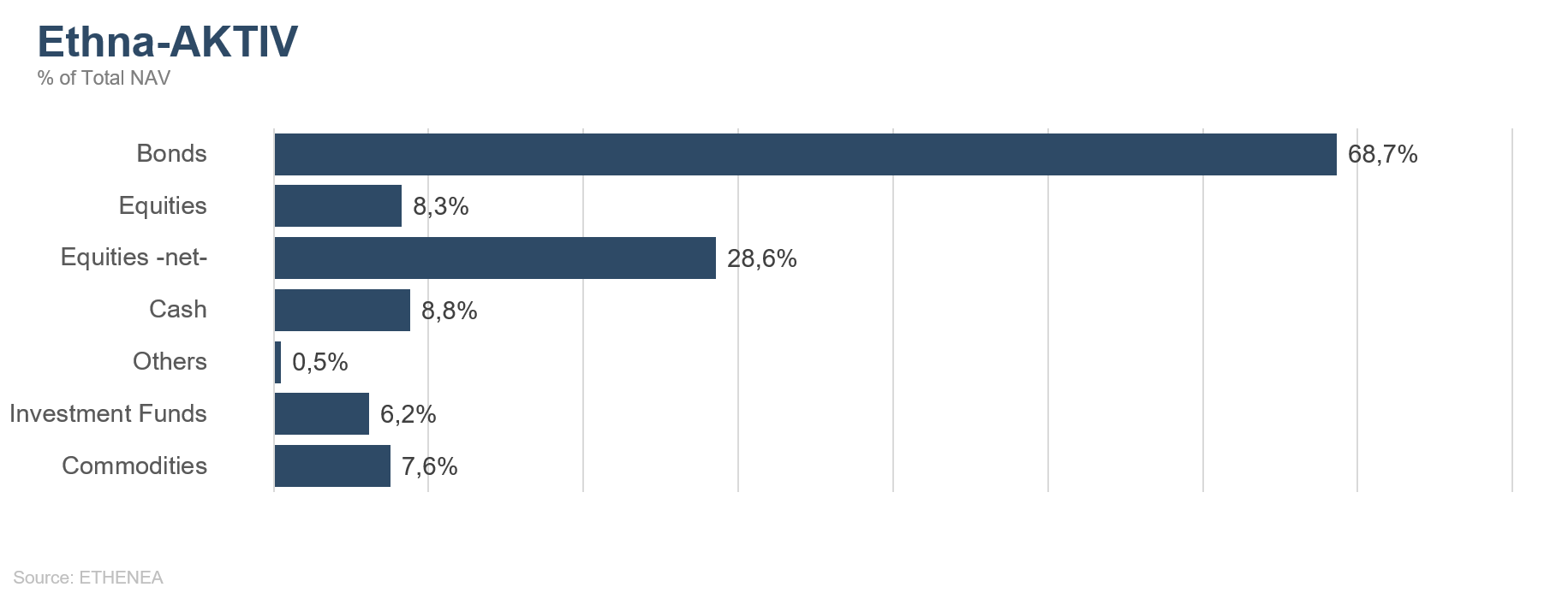

Ethna-AKTIV

The Ethna-AKTIV began 2020 with a very encouraging start. Despite a turbulent January for stock markets, the fund posted an attractive result for the month, which was supported by all the asset classes in which we were invested.

After a stunning year-end rally, the upward trend in stock exchanges worldwide initially continued almost unabated in the first month of the new year. In retrospect, the geopolitical escalation and almost immediate de-escalation between the U.S. and Iran had barely any impact on the price progressions of global risk assets. The phase one trade deal – which temporarily defused a trade conflict lasting almost two years – and the long, unpleasant Brexit deadlock finally being broken were nothing more than formalities in people’s minds. Against the backdrop of the divergence observed between valuations and fundamental data, stock market trading concentrated on the current reporting season and the start of the U.S. presidential election campaign. Since macroeconomic leading indicators still point to a distinct bottoming-out phase, earnings publications and corporate expectations are all the more important. There was more good news in this respect from the U.S. technology sector in particular. Therefore it is no surprise that the U.S. equity market – especially technology stocks – are delivering better returns than their European and Asian counterparts, both before and after the coronavirus emerged. However, growing fears and uncertainties about the effects of the virus brought the low-volatility upward trend to an abrupt end shortly before the end of the month. Not having forgotten their experience with SARS, Asian stock markets in particular reacted with sharp falls in prices. Neither the other equity indices nor corporate bond spreads were able to escape this trend, though it was somewhat milder for them. Towards the end of the month, the mood, and thus the behaviour of investors, had turned risk-off. The hallmark of this is not only the drop in equity prices, but also further sharp falls in interest rates, which in the U.S. have already reached the lows of last year.

Within the Ethna-AKTIV portfolio, the gains from the fall in interest rates exceeded the losses from the widening of spreads. In terms of the equity allocation, we were proven correct in our almost exclusive exposure to the U.S. and in tactically reducing the equity allocation – which was maxed out at the beginning of the month – before the interim correction set in. Since we assume that the economic effects of the coronavirus will be a one-off, we see the reduced price level as a buy level rather than a sell level. We do not expect the markets to calm down immediately. However, we will take advantage of the volatility in the coming months to gradually increase the equity allocation again. Our currency position in the Swiss franc and in the U.S. dollar both made a positive contribution to the month’s performance. The reduction of the USD position in December will be gradually reversed over the next few days. Although Brexit is now finalised, we are confident that the forthcoming negotiations and associated disputes will put further pressure on the single currency.

The fact that all asset classes made a positive contribution is noteworthy, but this is likely to be the exception rather than the rule in future. Overall, it’s fair to say that the Ethna-AKTIV’s balanced multi-asset approach worked well in January, even against a challenging backdrop for stock exchanges.

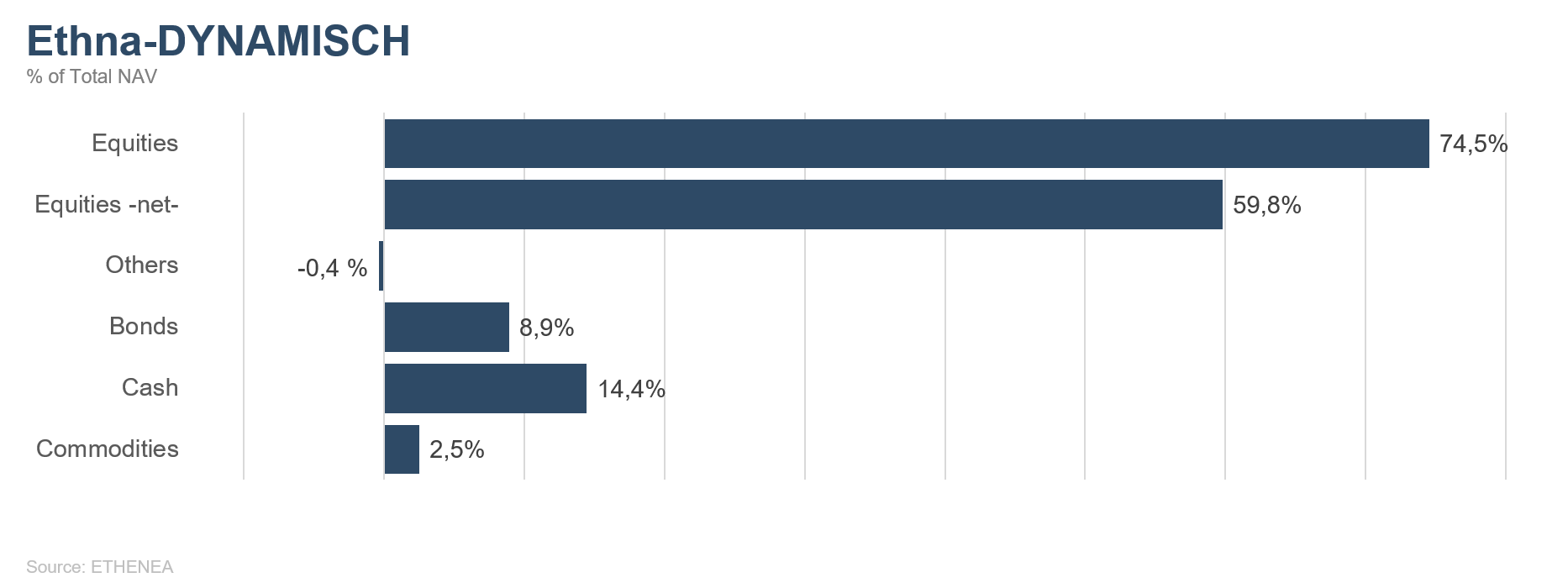

Ethna-DYNAMISCH

The world is divided, and will remain so in 2020 based on our preliminary conclusion for the new year. While equity markets in the U.S. rose, Europe and Asia fell. Scratch the surface and the discrepancy was even greater, as the price of expensive growth and technology securities and defensive blue chips climbed, while the already attractively priced value and cyclical equities fell very sharply. Not only did the divergent development of growth and value equities continue unabated, but the fronts between the two camps also hardened. Both extremes still have inherent risks and are giving us pause for thought. Therefore, for the Ethna-DYNAMISCH’s equity portfolio, we are still striking a happy medium, focusing on high-quality business models with structural growth and attractive valuations.

The overall very positive equity market trend of recent months left an unmissable mark at the beginning of January. Equity market valuations had climbed further and many individual securities had reached the upper limits of their historical valuation range, with some even exceeding it. At the same time, many investors began to display the euphoria that had been missing from the latest bull run for so long, which was reflected in strong inflows into equity index products and in a much lower willingness to hedge. Taken together, these sounded sufficient alarm bells for us to expect a greater risk of an equity market correction in the short to medium term. As a result, we gradually reduced risk within the Ethna-DYNAMISCH from the beginning of the month by decreasing the size of the positions we held in many individual securities (gross allocation went from 82.9% to 74.5% over the course of the month) as well as strengthening the hedging components (net allocation reduced from 80.0% to 59.8%). All this happened in time before the news of the coronavirus outbreak in China hit equity markets and sent prices lower, especially in the second half of the month.

Unilever was a new addition to the equity portfolio. After a consolidation phase lasting around a year, we found a very attractive entry point at the beginning of the month. With more than EUR 50 billion in revenue, Unilever is one of the largest consumer goods and food companies in the world. Almost all of the group’s segments and products are not dependent on the economic cycle, which is also reflected in the stability and level of profit margins. Since we bought it, the share has already gained more than 5%, whereas the price of the Porsche Automobil Holding share we sold in return fell well over 5% after selling it. The holding company, which holds a stake of just over 50% in Volkswagen ordinary shares, remains in very uncertain territory, and after the share price rose strongly in the fourth quarter of 2019, the returns were no longer sufficient in our view. We then took profits on this position.

In addition, by month-end we had halved the position in long-dated U.S. Treasuries, from 4% to 2%. After the 30-year U.S. Treasury yield fell again from almost 2.4% at the beginning of the month to close to 2.0% at month-end, we were able to realise a gain of around 7% in just a few weeks on the bond sale alone.

As a result of all transactions, the Ethna-DYNAMISCH’s cash position at month-end rose to just over 14%. This, together with the reduction of the net equity allocation to just shy of 60%, first and foremost gives the fund the necessary stability to better tactically absorb the risks mentioned above, as well as the ability to remain invested in equities to a strategically significant extent.

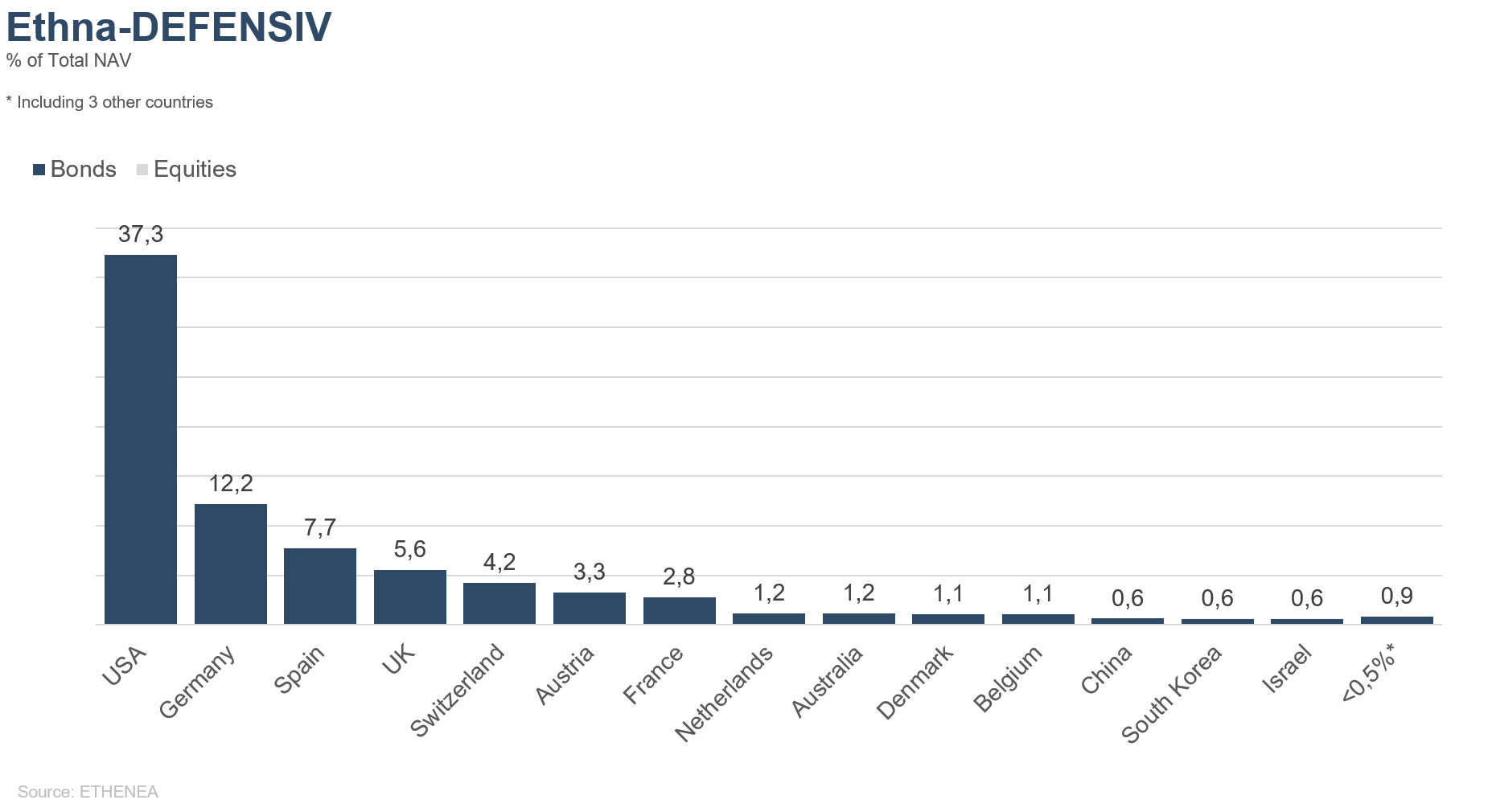

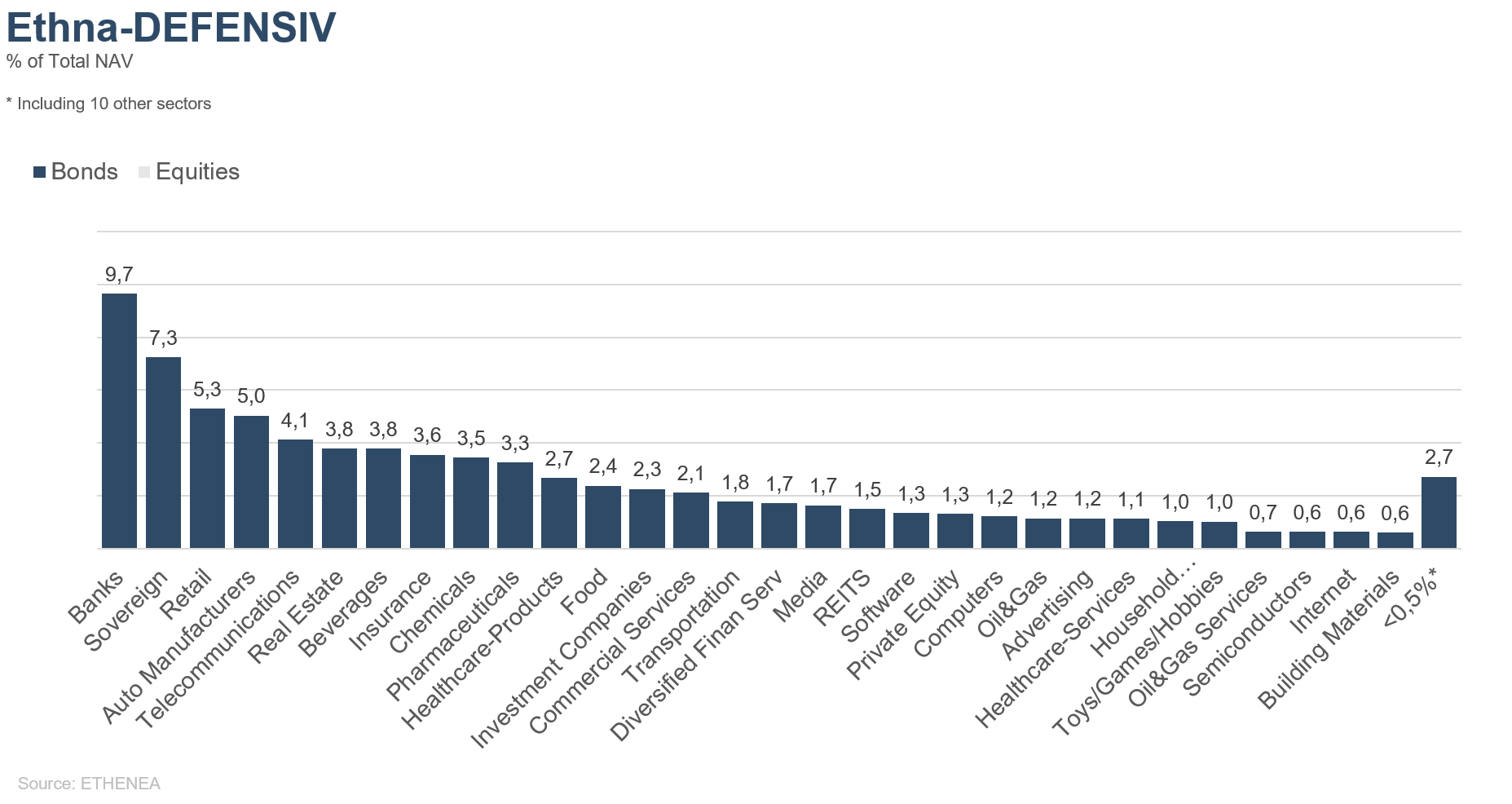

Figure 1: Portfolio structure* of the Ethna-DEFENSIV

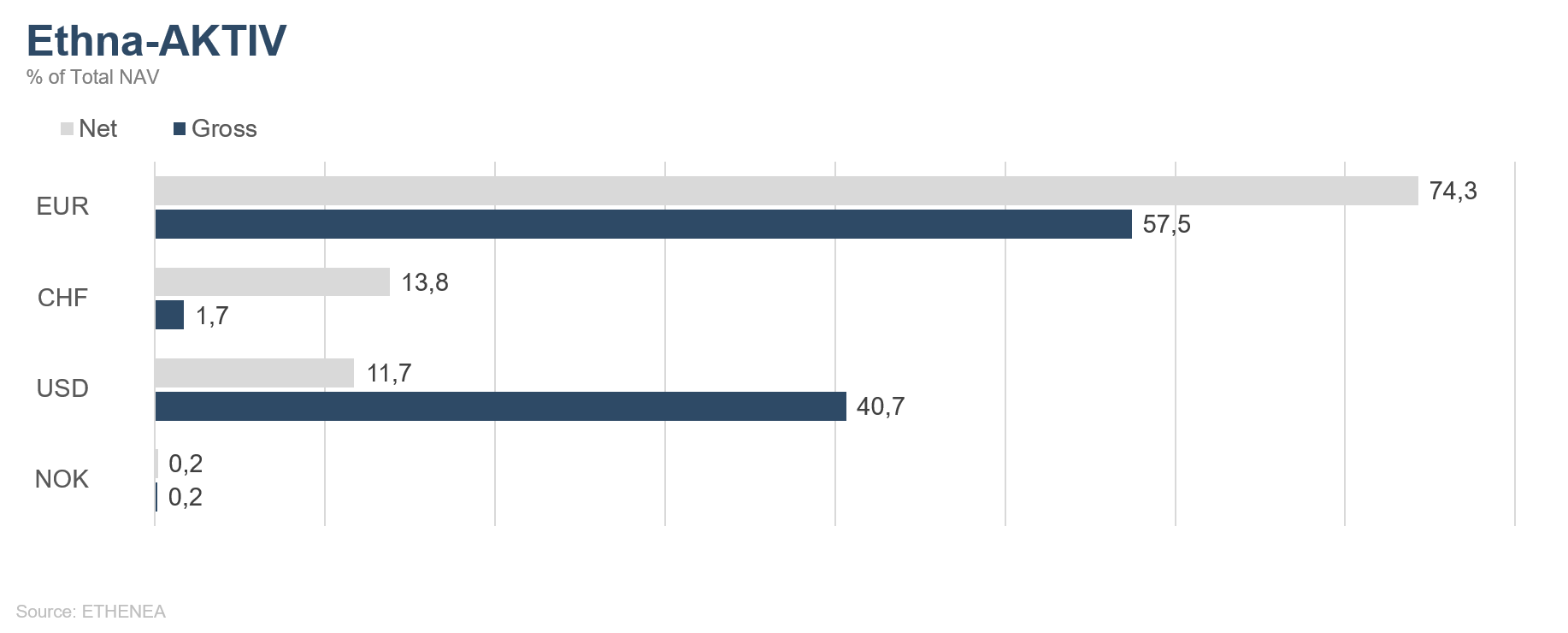

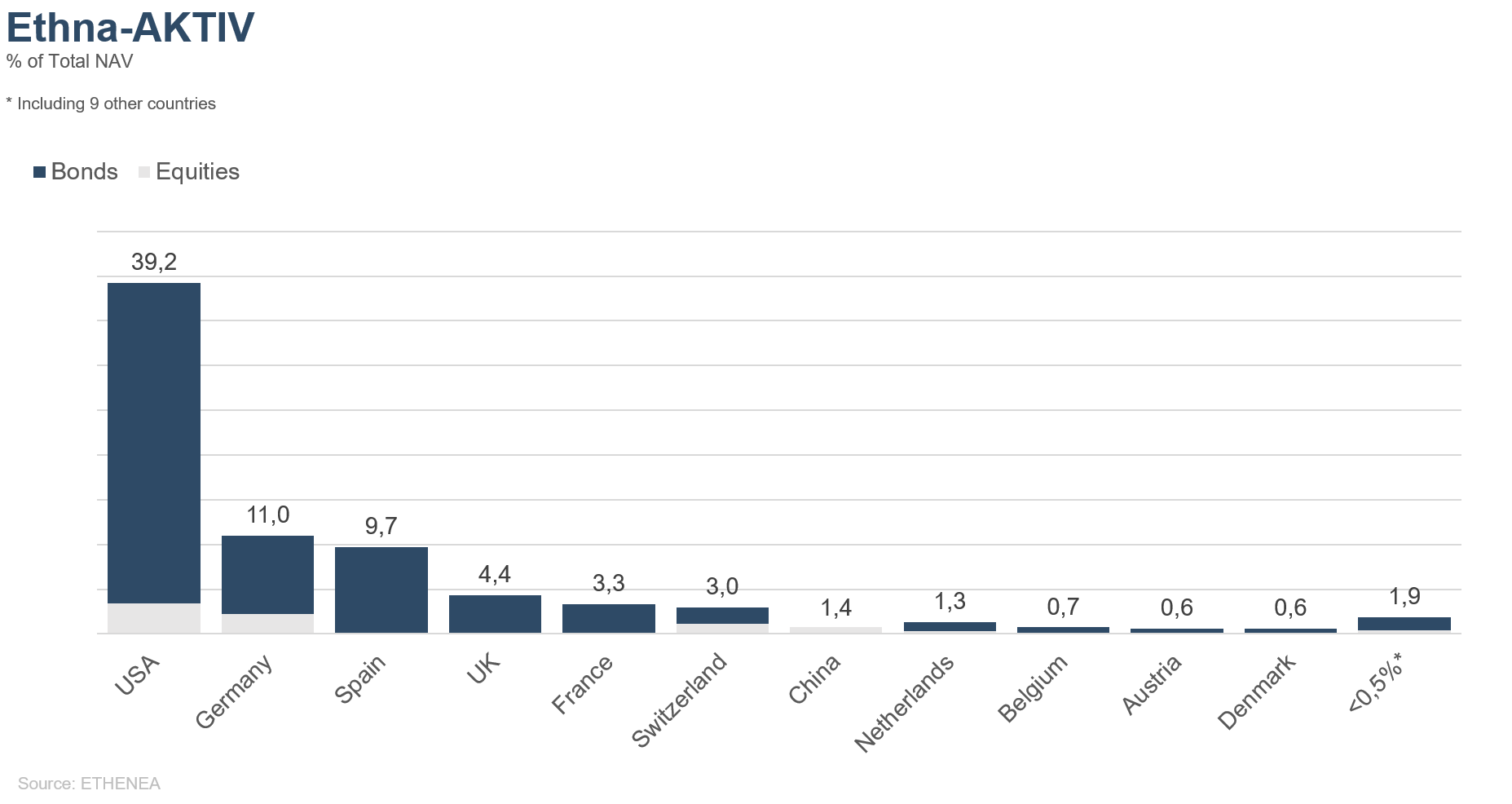

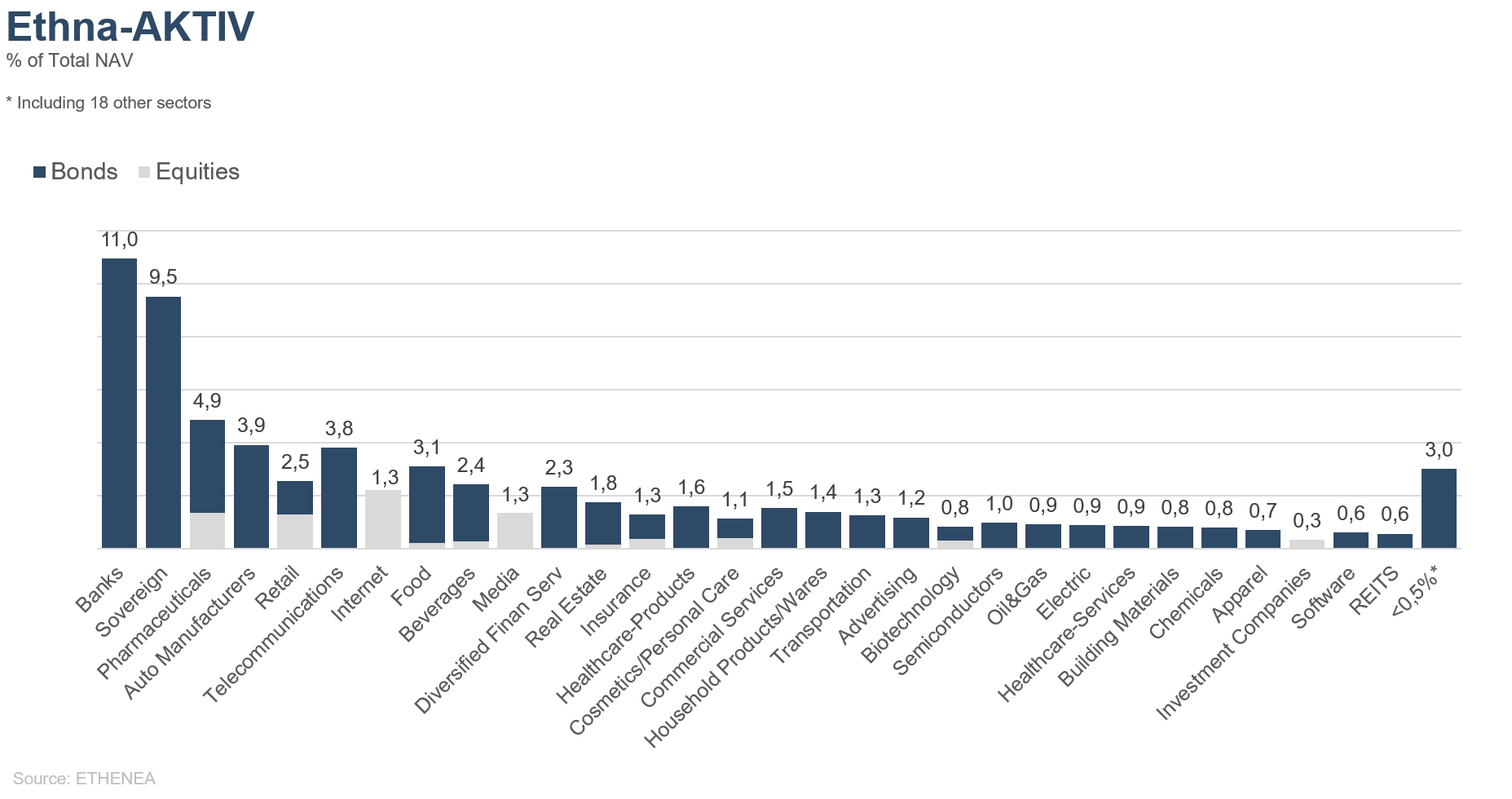

Figure 2: Portfolio structure* of the Ethna-AKTIV

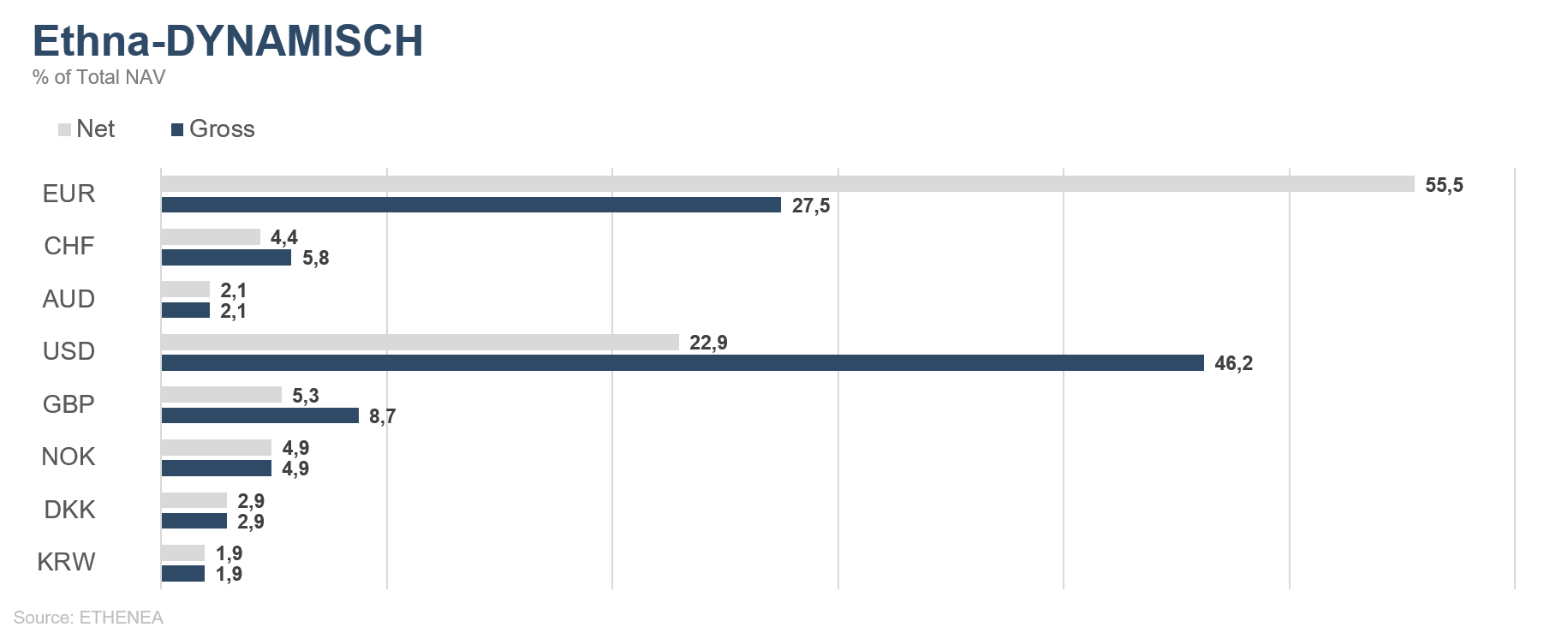

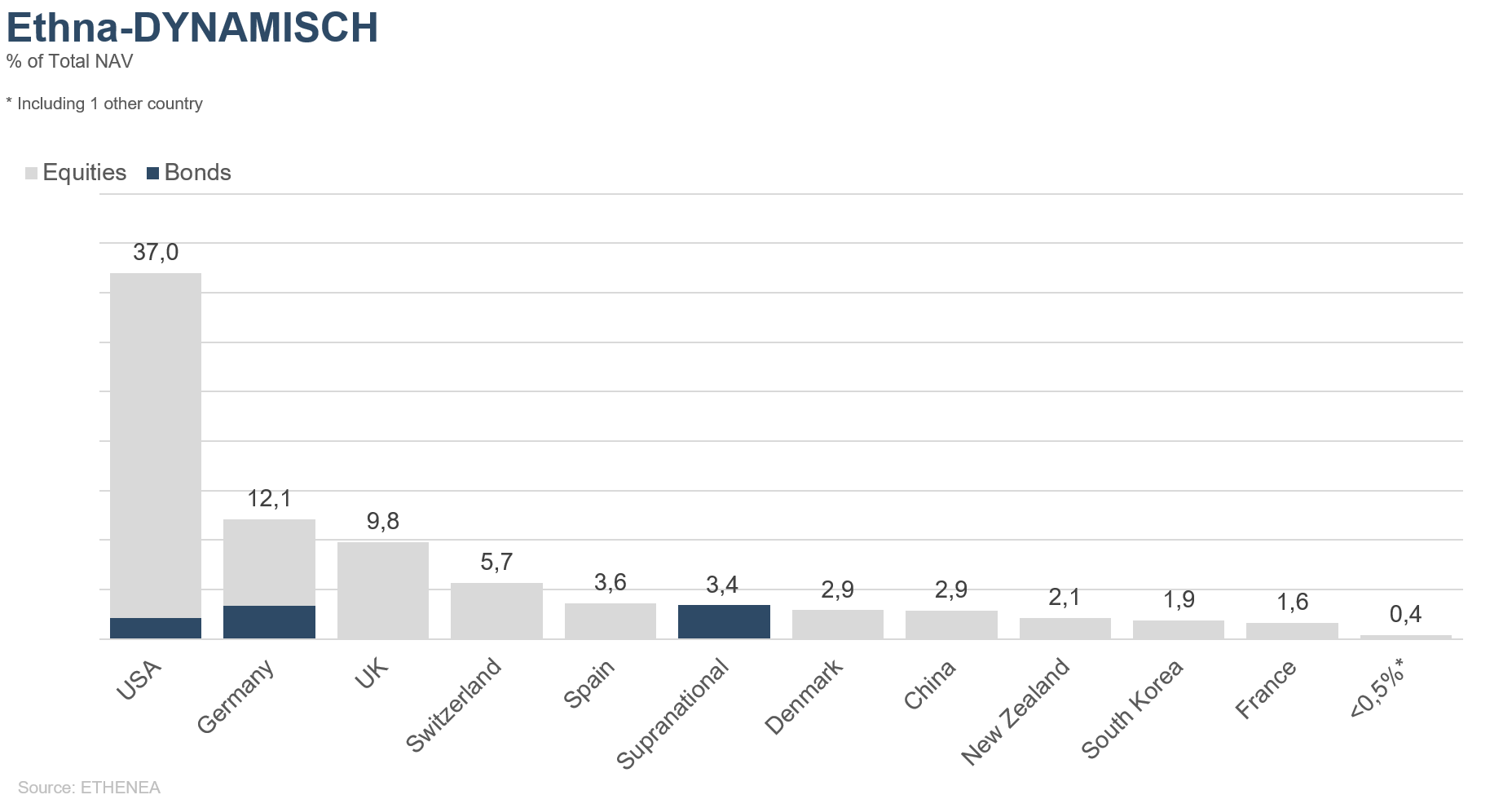

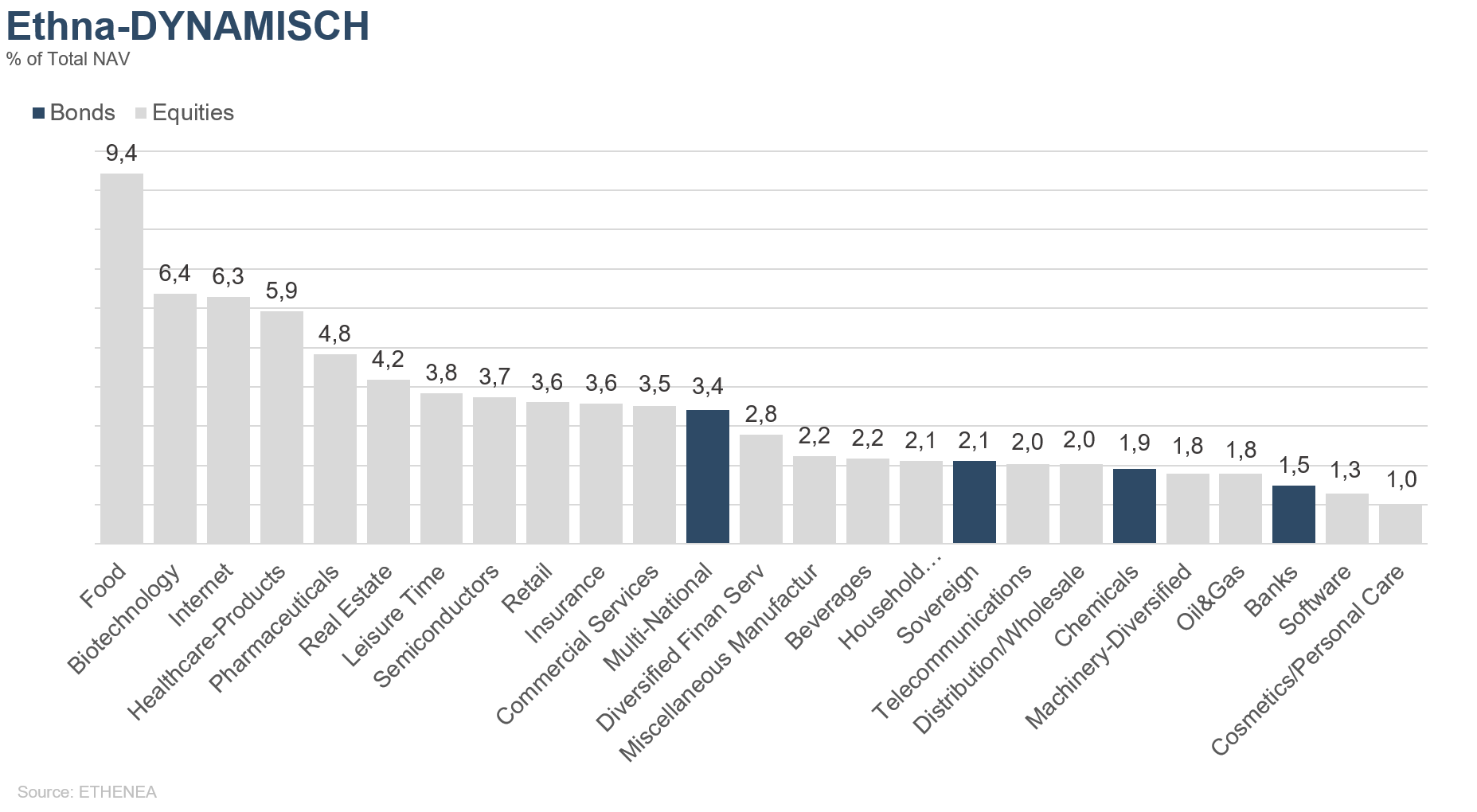

Figure 3: Portfolio structure* of the Ethna-DYNAMISCH

Figure 4: Portfolio composition of the Ethna-DEFENSIV by currency

Figure 5: Portfolio composition of the Ethna-AKTIV by currency

Figure 6: Portfolio composition of the Ethna-DYNAMISCH by currency

Figure 7: Portfolio composition of the Ethna-DEFENSIV by country

Figure 8: Portfolio composition of the Ethna-AKTIV by country

Figure 9: Portfolio composition of the Ethna-DYNAMISCH by country

Figure 10: Portfolio composition of the Ethna-DEFENSIV by issuer sector

Figure 11: Portfolio composition of the Ethna-AKTIV by issuer sector

Figure 12: Portfolio composition of the Ethna-DYNAMISCH by issuer sector

* “Cash” comprises term deposits, call money and current accounts/other accounts. “Equities net” comprises direct investments and exposure resulting from equity derivatives.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

Deze marketingmededeling dient uitsluitend ter informatie. Het mag niet worden doorgegeven aan personen in landen waar het fonds niet voor distributie is toegestaan, met name in de VS of aan Amerikaanse personen. De informatie vormt noch een aanbod noch een uitnodiging tot koop of verkoop van effecten of financiële instrumenten en vervangt geen op de belegger of het product toegesneden advies. Er wordt geen rekening gehouden met de individuele beleggingsdoelstellingen, financiële situatie of bijzondere behoeften van de ontvanger. Lees vóór een beleggingsbeslissing zorgvuldig de geldende verkoopdocumenten (prospectus, essentiële informatiedocumenten/PRIIPs-KIDs, halfjaar- en jaarverslagen). Deze documenten zijn beschikbaar in het Duits en als niet-officiële vertaling bij ETHENEA Independent Investors S.A., de bewaarbank, de nationale betaal- of informatiekantoren en op www.ethenea.com. De belangrijkste vaktermen vindt u in de lexicon op www.ethenea.com/lexicon/. Uitgebreide informatie over kansen en risico's van onze producten vindt u in het actuele prospectus. In het verleden behaalde resultaten bieden geen betrouwbare indicatie voor toekomstige prestaties. Prijzen, waarden en opbrengsten kunnen stijgen of dalen en kunnen leiden tot volledig verlies van het geïnvesteerde kapitaal. Beleggingen in vreemde valuta zijn onderhevig aan extra valutarisico's. Aan de verstrekte informatie kunnen geen bindende toezeggingen of garanties voor toekomstige resultaten worden ontleend. Aannames en inhoud kunnen zonder voorafgaande kennisgeving worden gewijzigd. De samenstelling van de portefeuille kan op elk moment wijzigen. Dit document vormt geen volledige risico-informatie. De distributie van het product kan vergoedingen opleveren voor de beheermaatschappij, verbonden ondernemingen of distributiepartners. De informatie over vergoedingen en kosten in het actuele prospectus is doorslaggevend. Een lijst van nationale betaal- en informatiekantoren, een samenvatting van de beleggersrechten en informatie over de risico's van een foutieve netto-inventariswaarde-berekening vindt u op www.ethenea.com/juridische-opmerkingen/.In geval van een foutieve NIW-berekening wordt compensatie verleend volgens CSSF-circulaire 24/856; bij via financiële intermediairs aangeschafte participaties kan de compensatie beperkt zijn. Informatie voor beleggers in Zwitserland: Het land van herkomst van de collectieve belegging is Luxemburg. De vertegenwoordiger in Zwitserland is IPConcept (Schweiz) AG, Bellerivestrasse 36, CH-8008 Zürich. De betaalagent in Zwitserland is DZ PRIVATBANK (Schweiz) AG, Bellerivestrasse 36, CH-8008 Zürich. Prospectus, essentiële informatiedocumenten (PRIIPs-KIDs), statuten en de jaar- en halfjaarverslagen zijn gratis verkrijgbaar bij de vertegenwoordiger. Informatie voor beleggers in België: Het prospectus, de essentiële informatiedocumenten (PRIIPs-KIDs), de jaarverslagen en de halfjaarverslagen van het subfonds zijn op verzoek gratis in het Frans verkrijgbaar bij ETHENEA Independent Investors S.A., 16, rue Gabriel Lippmann, 5365 Munsbach, Luxemburg en bij de vertegenwoordiger: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxemburg. Ondanks de grootst mogelijke zorg wordt geen garantie gegeven voor de juistheid, volledigheid of actualiteit van de informatie. Alleen de originele Duitstalige documenten zijn juridisch bindend; vertalingen dienen alleen ter informatie. Het gebruik van digitale advertentieformaten is op eigen risico; de beheermaatschappij aanvaardt geen aansprakelijkheid voor technische storingen of schendingen van gegevensbescherming door externe informatieaanbieders. Het gebruik is alleen toegestaan in landen waar dit wettelijk is toegestaan. Alle inhoud is auteursrechtelijk beschermd. Elke reproductie, verspreiding of publicatie, geheel of gedeeltelijk, is alleen toegestaan met voorafgaande schriftelijke toestemming van de beheermaatschappij. Copyright © ETHENEA Independent Investors S.A. (2025). Alle rechten voorbehouden. 04-02-2020