Why should I care about what I said before?

… a famous statesman is supposed to have said, and then continued with “I reserve the right to be smarter today than I was yesterday.” This quotation is often attributed to the first Federal Chancellor of the Federal Republic of Germany, Konrad Adenauer. Whether he said it or not, the phrase expresses the key to dealing with unforeseen and rapidly evolving situations: flexibility. A certain degree of flexibility is required to succeed in adapting to changing circumstances. Stubbornly sticking to what one said or did before may come across as reliability, but can have fatal consequences if foresight is lacking. In this Market Commentary, we would like to give you a closer look at the advantages that flexible portfolio management offers, and explain to you why investors’ opinions on what direction markets will take vary so widely at the moment.

We’re just four months into 2020. In this short time, we have all seen things hardly anyone would have thought possible at the beginning of the year. On the basis of governmental lockdown orders, much of the global economy as well as private and social life were forced to come to a standstill. At the same time, it has been a veritable rollercoaster ride in the capital markets; the magnitude and speed of diverse price movements are without precedent. While unparalleled asset purchase programmes from central banks and fiscal rescue packages from governments were to be expected in response, the fact that the all-important West Texas Intermediate (WTI) oil price dipped well below zero is likely to have been the big surprise in April. And to think that only in January we were justified in expecting a rather uneventful year – we definitely know better today!

In light of recent history, current predictions about the remaining eight months of the year are on a spectrum, which can be described as “everything and nothing is possible”. With predictions, there is usually a baseline scenario, flanked above and below by two alternatives. With regard to the economic fallout in particular, the scenarios currently being debated among investors cover the entire spectrum. We do not claim to have deeper and better insights than other, much larger firms of economic analysts. What’s more crucial to long-term investment success is asking where possible scenarios fit into the bigger macro picture and taking intelligent action within the portfolio. For example, where are there risks of sustained capital losses? What real economic developments have the markets already anticipated? Thus, the problem can soon be rephrased as: what is already priced into the market and where could there be opportunities and risks for our funds?

At ETHENEA, this is a question we have always asked ourselves each and every day. In fact, of late, if prices were 5% higher or lower than they were just that morning, we’ve been asking it multiple times a day. Flexibility is the order of the day, as is trust in the experience and prudence of a selected portfolio manager. Looking at ETHENEA’s guiding principles we see that, for us, care, foresight, responsibility and partnership are the key to long-term success and inform what we do. These strong values are not something to be dismissed as ‘yesterday’s chatter’, but will continue to be the foundation for the sustained success of all of the Ethna funds.

In addition to the great uncertainty about how the economy will develop, there is a second reason for the extreme differences of opinion in the capital markets at the moment, which must not be underestimated: a lack of flexibility. The strategic positioning of the Ethna funds, with their high degree of flexibility, was a real distinguishing feature in the market when the Ethna-AKTIV was launched in 2002 – and still is to this day. Over the years, we have continuously enhanced the adaptability of our focused fund range. This is why we are not backed into a corner in the current market environment and have plenty of room to manoeuvre at all times. Only those who are unconstrained by a benchmark and thus have a full range of asset allocation and security selection options at their disposal can be truly free to make decisions in all conscience. Without this room to manoeuvre, subjectivity all too quickly overrides objectivity. Then a portfolio positioning over which one has limited control can colour one’s expectations for future market development, whereas it should be the other way around.

If, however, an investor chooses one of the three funds from ETHENEA – be it the Ethna-DEFENSIV, the Ethna-AKTIV or the Ethna-DYNAMISCH – they are deliberately handing over a great deal of responsibility into the experienced hands of our active portfolio managers. We are conscious of this responsibility day in day out, and act with the necessary intuition and as much objectivity as possible. Depending on the individual investor’s risk appetite, we want the Ethna funds to offer suitable investment solutions whatever the conditions in the capital markets. So far this year we have succeeded in what have been difficult conditions. Because our multi-asset funds are highly flexible we can actively seize the opportunities that arise, while managing the risks and looking forward with an open mind – even when entering uncharted territory, as is currently the case.

Thank you for placing your trust in us.

Stay safe and well!

Positioning of the Ethna Funds

Ethna-DEFENSIV

The U.S. also felt the full force of the COVID-19 pandemic in April. Whereas the number of confirmed cases there was less than 200,000 at the end of March, only one month later the U.S. had taken the unenviable lead with more than 1,000,000 confirmed cases. And the number of cases continues to climb worldwide. The central banks – the ECB and the Federal Reserve in particular – meanwhile did their best to bring about a recovery in financial markets by announcing in April various supports and purchase programmes.

Corporate bonds, which have a very high weighting in the Ethna-DEFENSIV, benefited from the ECB’s two purchase programmes in particular, the CSPP (Corporate Sector Purchase Programme) and the PEPP (Pandemic Emergency Purchase Programme). The CSPP (introduced back in 2016) was expanded, and from the end of March purchases under the temporary PEPP began. The Primary Market Corporate Credit Facility (PMCCF) and Secondary Market Corporate Credit Facility (SMCCF) are the names of their U.S. counterparts. Even though these two programmes are not yet up and running, the mere proposal by the Federal Reserve to support the market to the tune of USD 750 billion was enough to give market participants confidence. Companies can now once again obtain liquidity in the capital market on attractive terms and reduce the credit lines they had drawn down. The easing of the current restrictions is in sight, which is another argument for the positive performance of corporate bonds. It gives hope of a return to normality as much and as soon as possible. However, we cannot imagine all areas returning to business as usual before the end of the year. In particular, events that involve large gatherings of people, such as in the case of sport, concerts and demonstrations, will not be seen any time soon.

Aside from corporate bonds, sovereign bonds are also clearly benefiting from central bank purchases. Since it began its emergency bond buying in March, the Fed has purchased USD 1.3 trillion in U.S. Treasuries. However, the yield on 10-year U.S. Treasuries has fallen only slightly over the month to 0.6%. The high level of demand from the central bank stands in contrast to an enormous budget deficit, which must be financed by issuing bonds. Even though many investors are asking whether the debt mountain cannot but lead to much higher inflation in the long run, in the near term we think lower price pressure initially and perhaps even slight deflation is more likely. The price of gold resumed its climb in April and closed the month at around USD 1,700 per ounce of fine gold. Gold continues to be regarded more as a safe-haven instrument than as inflation protection.

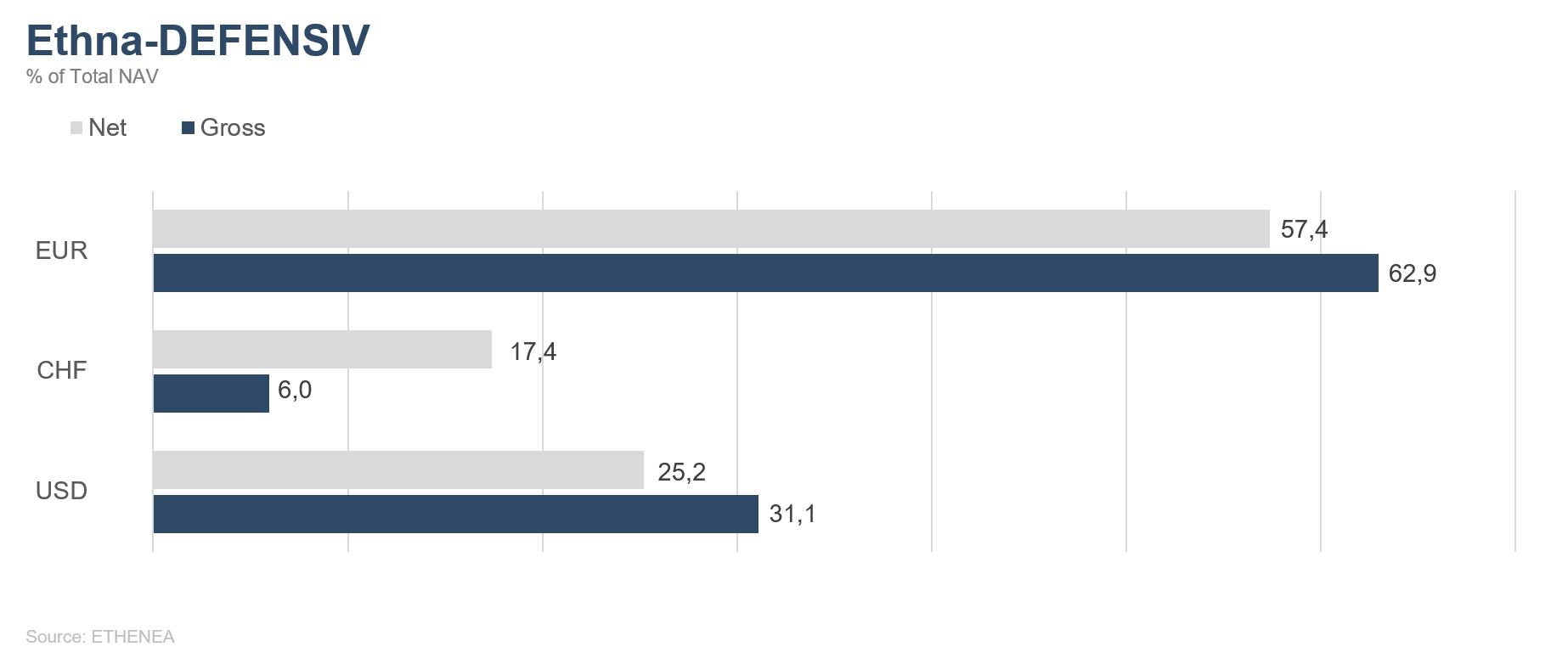

With a performance of +4.55% in April, the Ethna-DEFENSIV (T class) easily recouped more than half of the previous month’s losses. This brings the YTD performance of the Ethna-DEFENSIV (T class) to -1.91%. At the moment, we see no reason to deviate from the portfolio allocation; that is, corporate bonds with high credit quality (almost 80%), a gold position of over 8% and liquidity of just over 10%. We expect that corporate bond performance will continue to be supported by central bank purchases and hopes of economic recovery. Gold will retain its status as a safe haven. Diversification in USD (currently 25%) and CHF (almost 25%) has been in place since as far back as the beginning of the year, with slight variations in weighting. This diversification demonstrated its strength not only in April, but also in the months prior. CHF remains in demand as a safe haven, and the Swiss central bank is finding it hard to prevent it from gaining further against the euro. The arguments for the USD are not as clear-cut. While the U.S. no longer has a growth advantage the fact that, given the disunity among eurozone member states about how to finance the current crisis, the problems – including those of weaker countries, especially Italy – cannot be solved is an argument against the euro and thus in favour of the U.S. dollar.

Ethna-AKTIV

While March was marked by panic-selling in the various asset class, prices in April have soared to an almost euphoric extent. Almost as quickly as the fall in prices happened, a rapid recovery set in – both in equities and in corporate bonds. A V-shaped recovery of equity markets – which we had ruled out in last month’s Market Commentary – has largely come about, at least in the major benchmark indices. While in the first three days of trading of the month we felt vindicated in our belief that the lows would be retested, we were brought back to earth with a bang as early as the fourth day of trading when prices began their steep climb. Even though the data on sentiment, flows and positioning give a good explanation for this movement, in our opinion, the economic reality has been pushed too much into the background.

The crisis caused by COVID-19 and its implications, not just on public health but also on the economy, are still the dominant issue. We are already seeing in the statistics the consequences of the lockdowns in the form of revised corporate forecasts, dramatic rises in unemployment and collapsing consumption and investment. Estimates for economic growth in 2020 are no longer ruling out the possibility of as much as double-digit negative growth in Europe. GDP in the U.S. fell by 4.8% in the first quarter, even though this figure only includes the two weeks of lockdown at the end of March. By comparison, figures for the global financial crisis of more than ten years ago are relatively modest. Future growth figures depend heavily on finding a vaccine, or at least a drug to treat the virus. But even if the search is successful, the return to normality will be very slow and incremental. Considering what we have experienced so far, the best-case scenario – where all layoffs are quickly reversed and consumers are gripped by the urge to spend – is hard to imagine. While there are many question marks over the resumption of economic activity, it seems as if the equity market has already forgotten this year’s losses and is looking through the crisis and into the future. Central banks’ and governments’ swift, albeit uncoordinated, responses obviously helped a lot in this respect.

The fact that, post-rally, the valuation of the broad equity market is already back at the lofty pre-crisis level does not exactly give us cause for optimism about further price gains. More than anything, the current movement strikes us as FOMO (fear of missing out), and is not unusual for a bear market. In terms of portfolio construction, we therefore remain cautious about equities. Exposure to equities currently harbours the risk of further, sometimes sharp, earnings revisions. We think that the enormous central bank purchases are currently providing better support for corporate bonds. For that reason, we have not deviated from our positioning in April either, which is focused on high-quality corporate bonds, and we used the returning liquidity to offload securities with less potential and also to seize fresh opportunities. Neither has our positioning in relation to the U.S. dollar and the Swiss franc changed, as we remain confident about these positions. Despite the wholesale provision of liquidity by the Fed and thanks to the persistent efforts of the Swiss central bank to prevent the safe-haven currency that is the Swiss franc from gaining against the euro, both currencies remain strong.

Once again this year it is tempting to heed the investment adage “Sell in May and go away”. However, we will do so only in relation to our equity exposure and continue to actively seize the opportunities that come our way.

Ethna-DYNAMISCH

Exactly one month ago, we concluded the Market Commentary with the following:

“At the moment, no one is able to give a halfway decent outlook on the coming weeks and months, as the situation is too special and unique at present. Current predictions expect a moderate to severe recession. Then there are the economic stimulus packages on an unprecedented scale. And central banks are also doing all in their power to support politics and business. So, both optimists and pessimists have plenty to back up their respective arguments. After the strong rally in prices in the last few days of March, we are going into April with an overall rather conservative equity allocation of slightly less than 40%. We consider it highly likely that capital market prices will fluctuate strongly over the next few weeks. As in the previous weeks, we will take a countercyclical approach to take advantage of the opportunities that arise as best possible, as well as to keep in check the risks that no doubt exist.”

One month on, we have little to add to this. From an economic perspective, the downside risk resulting from the extensive restrictions on economic and social life continues to dominate. For non-essential, high-contact sectors that require a lot of manpower, such as the hospitality industry, tourism and entertainment, even a fantasist would find it hard to imagine a return to normality for the time being. Growth expectation figures continue to be constantly revised downwards and the timing of a possible economic recovery is shifting.

The fact that, despite all the bad news in April, capital markets painted a very rosy picture may, at first glance, seem at odds with the fundamental environment but there is a whole array of good explanations for this. First, there’s the flooding of markets with liquidity, by the central banks in particular. In addition, generous and swift fiscal packages have helped to alleviate the situation. In the case of equities in particular, since the outbreak of the crisis there has been extreme divergence beneath the surface in how individual sectors and business models have performed. Little-affected companies bounced back quickly from the first selloff, while more-cyclical business fields continue to trade at high premia relative to their pre-crisis levels. Last but not least, share prices reflect future expectations; i.e. after index losses ranging from 30% to 40%, markets have successively begun to price in a positive turnaround.

The Ethna-DYNAMISCH meanwhile was able to take advantage of the opportunities that arose, and by the end of the month had made up for most of the falls in markets that occurred. Hedging was initially reduced multiple times in April, as the rise in prices obviously caught the majority of market participants off guard. This is clear from published positioning data and investor surveys. At the same time, the equity portfolio was deliberately positioned slightly on the offensive side, which the new addition of BASF and the successive reduction of more defensive securities, such as Pfizer and General Mills, shows. On the other hand, we completely sold the Intel share, which had done very well. Shortly before the end of the month we got off lightly with the German payment provider Wirecard. We were stunned by the content of the KPMG audit report released on the morning of 28 April and it prompted us to sell the entire position swiftly. This meant losses for this one day, but the position made gains for the portfolio for the month, as well as year to date and since the position was launched last year.

Looking ahead, we’ve come full circle back to the top of the piece. In short, we are keeping our eyes wide open and are using the Ethna-DYNAMISCH’s flexibility to continue to navigate this special, once-in-a-lifetime crisis successfully.

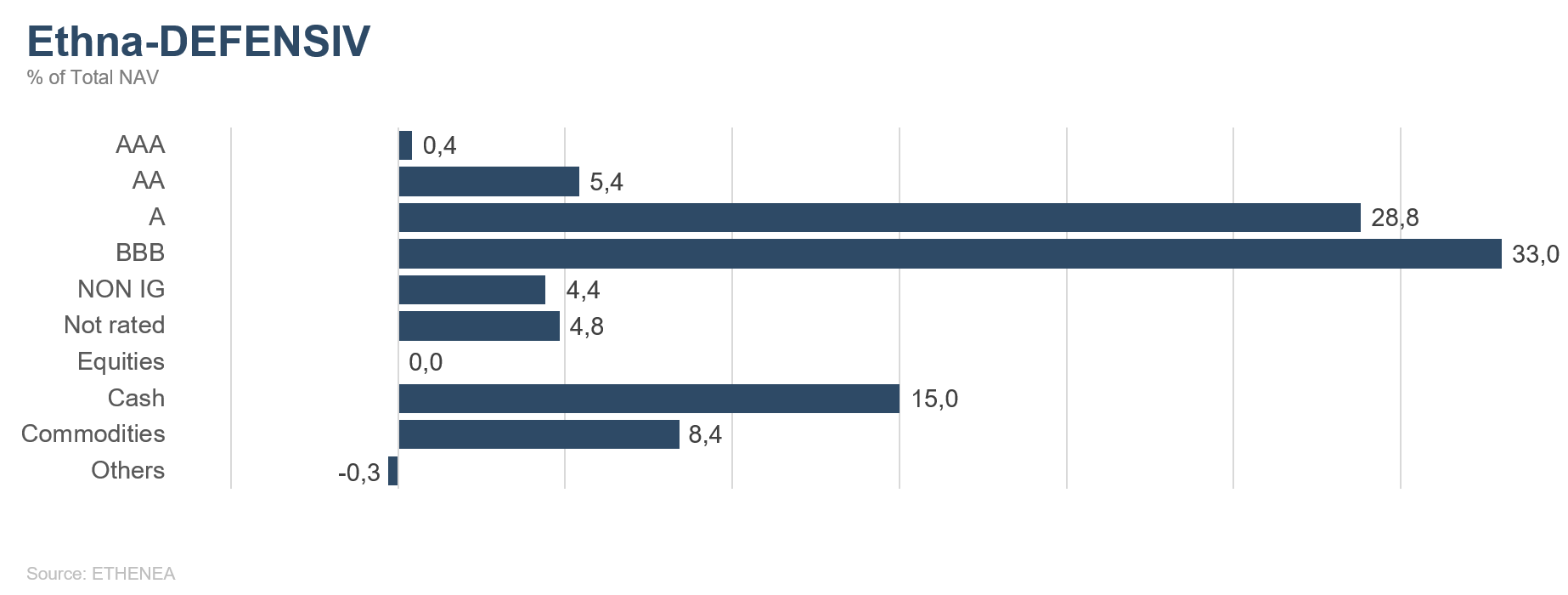

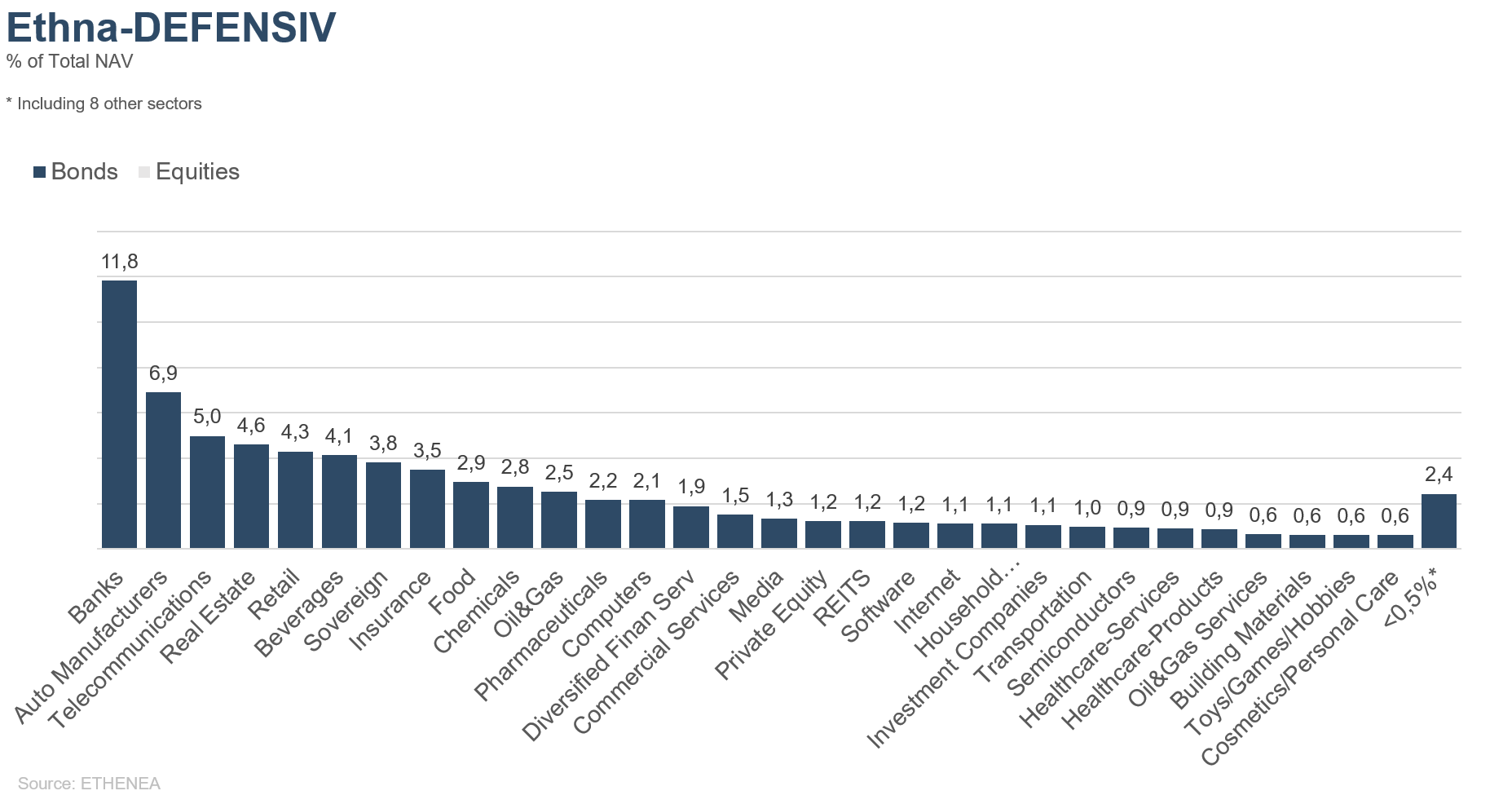

Figure 1: Portfolio structure* of the Ethna-DEFENSIV

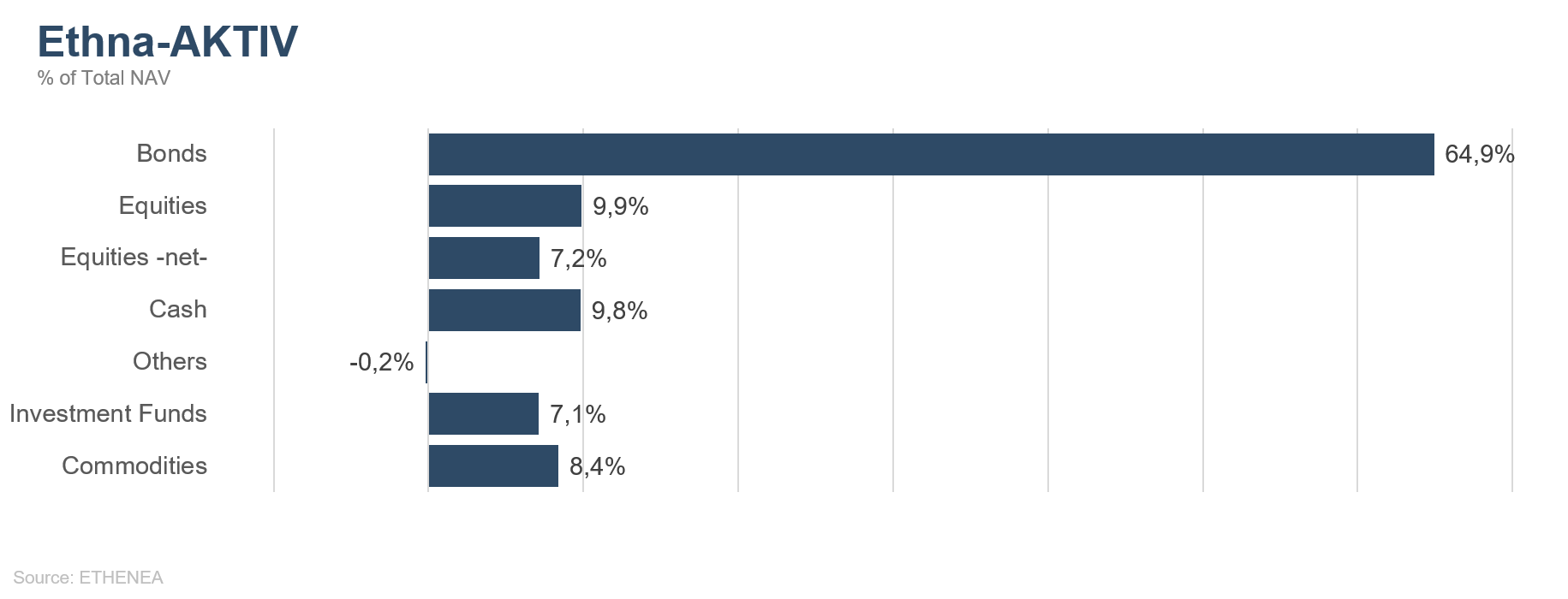

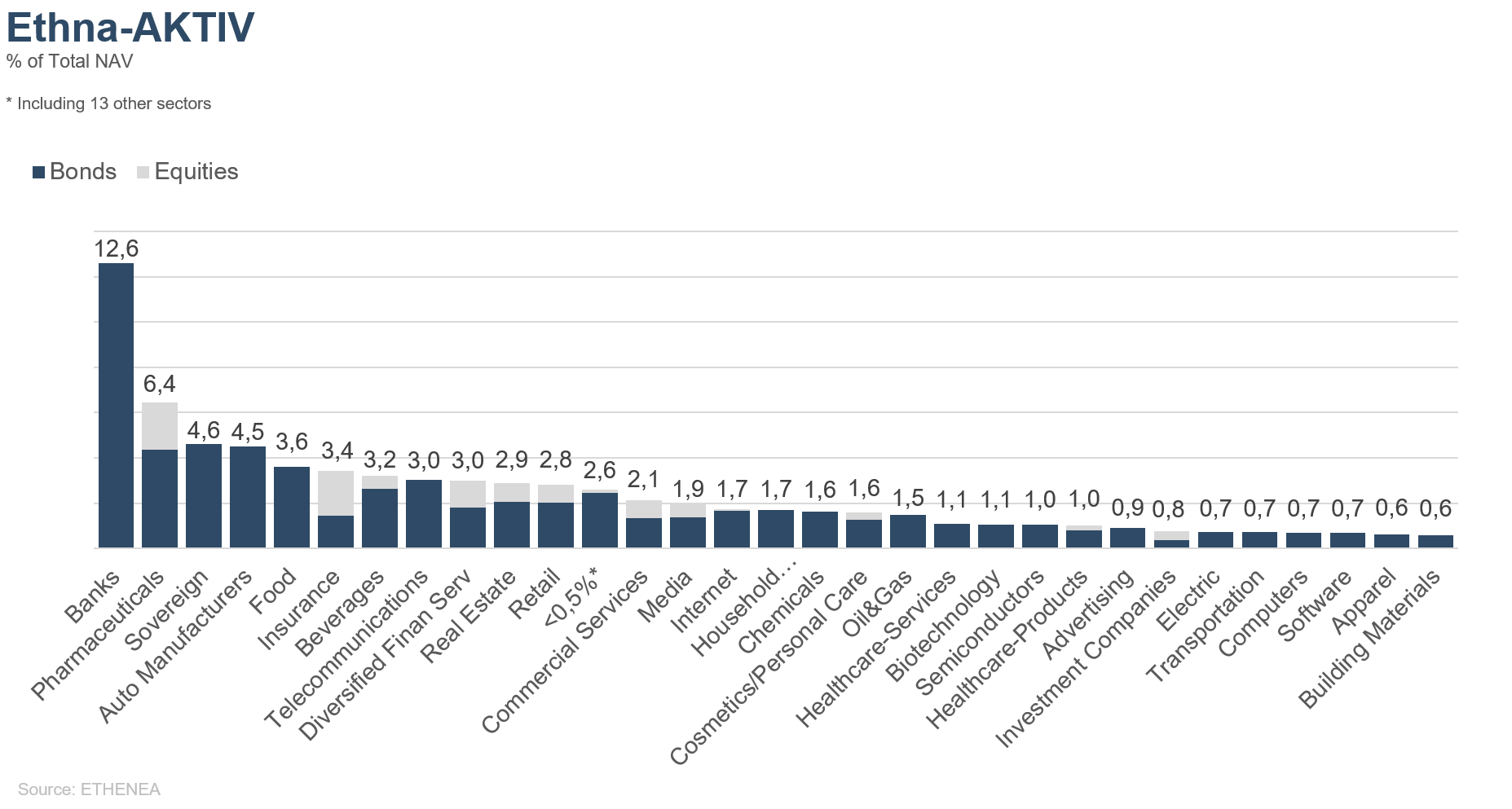

Figure 2: Portfolio structure* of the Ethna-AKTIV

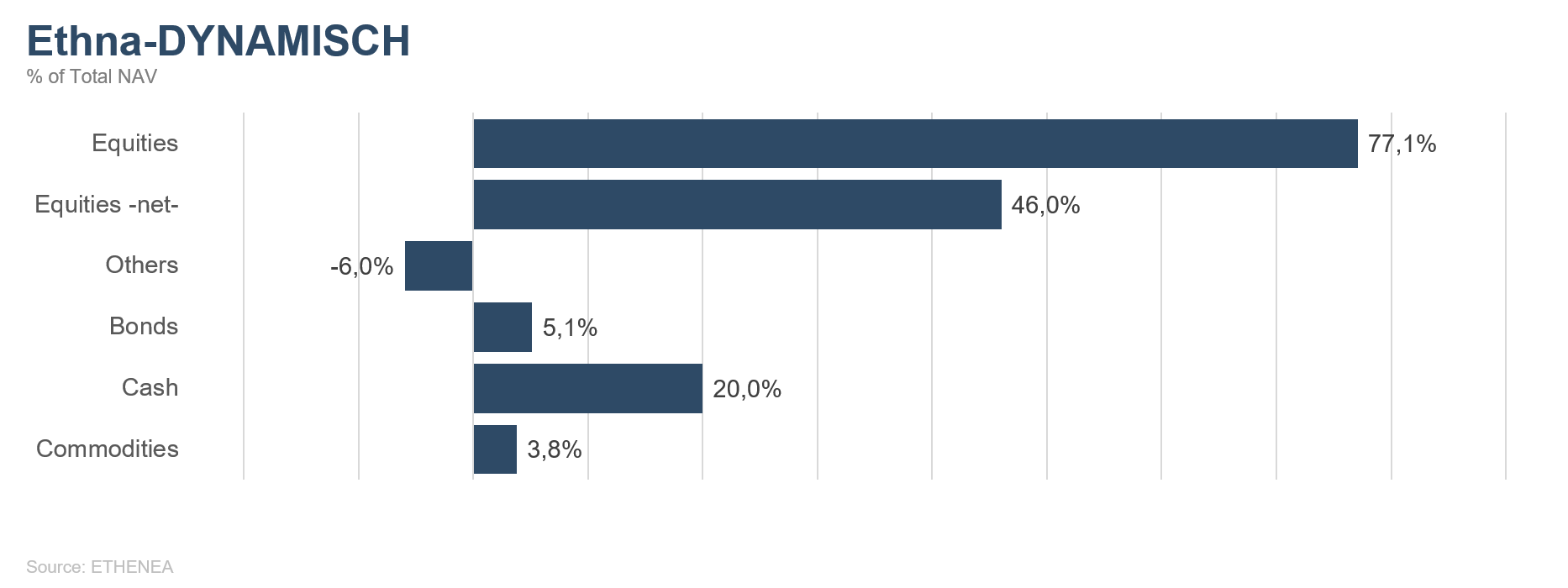

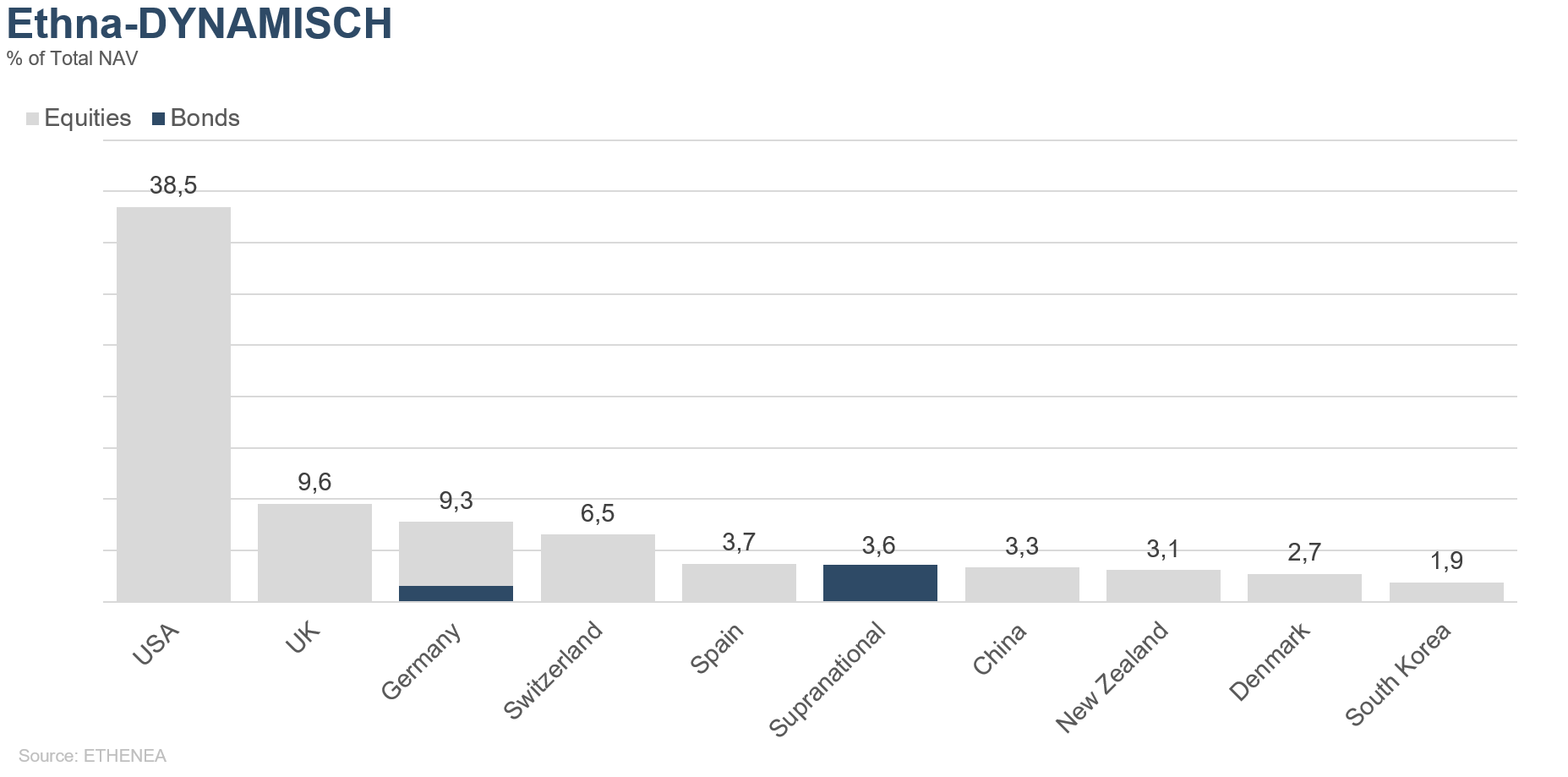

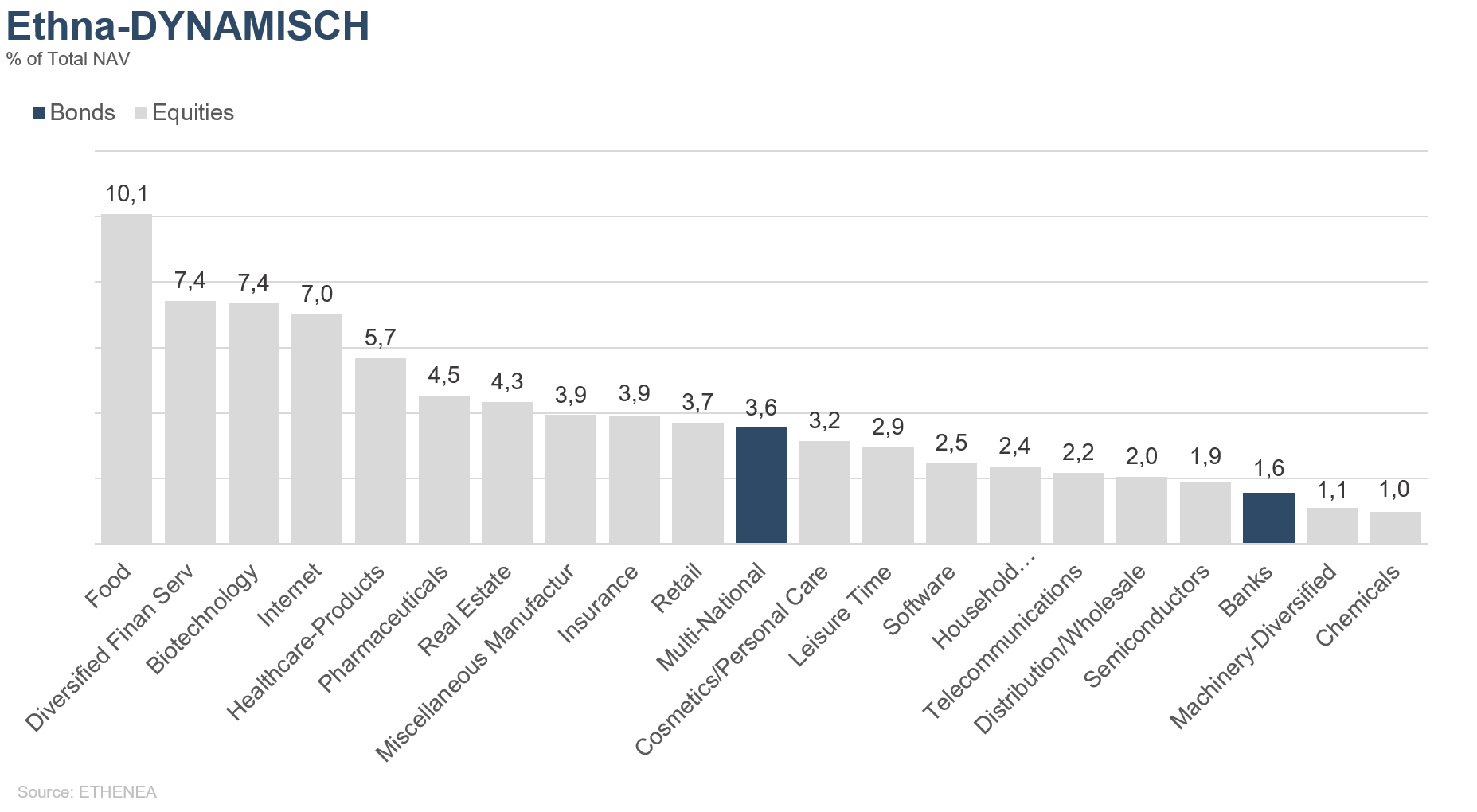

Figure 3: Portfolio structure* of the Ethna-DYNAMISCH

Figure 4: Portfolio composition of the Ethna-DEFENSIV by currency

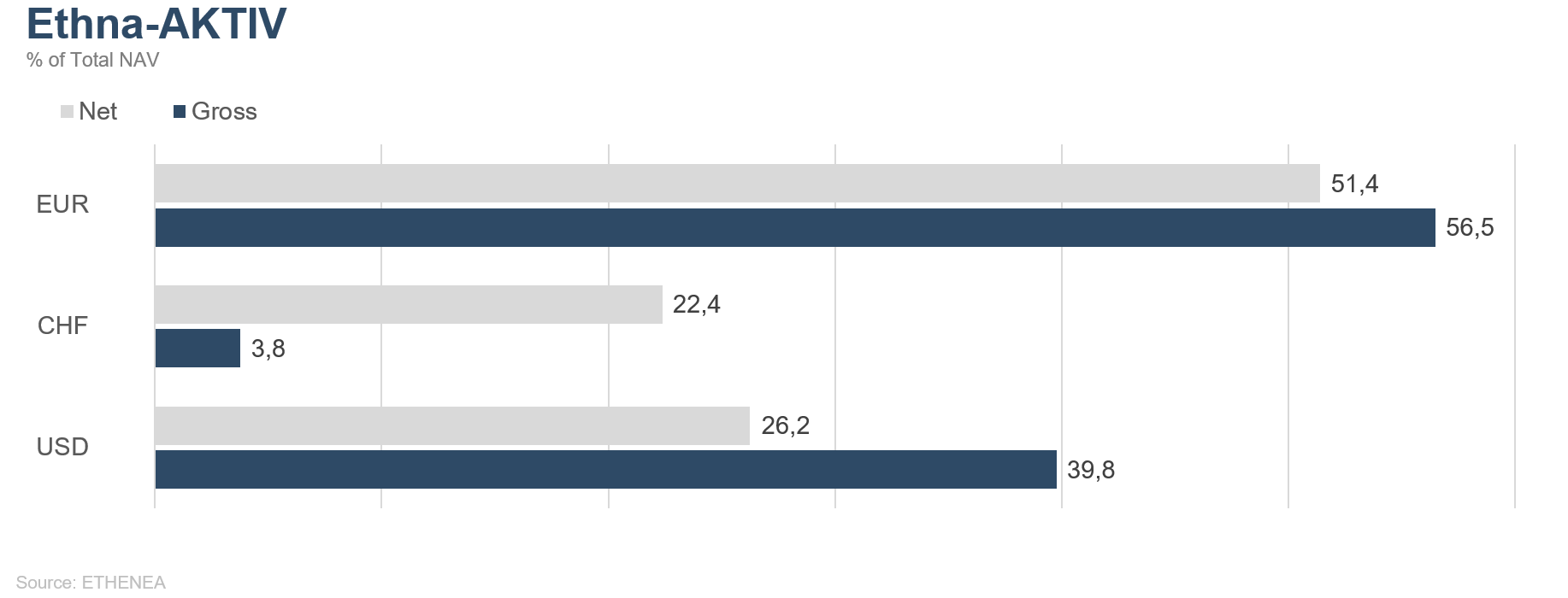

Figure 5: Portfolio composition of the Ethna-AKTIV by currency

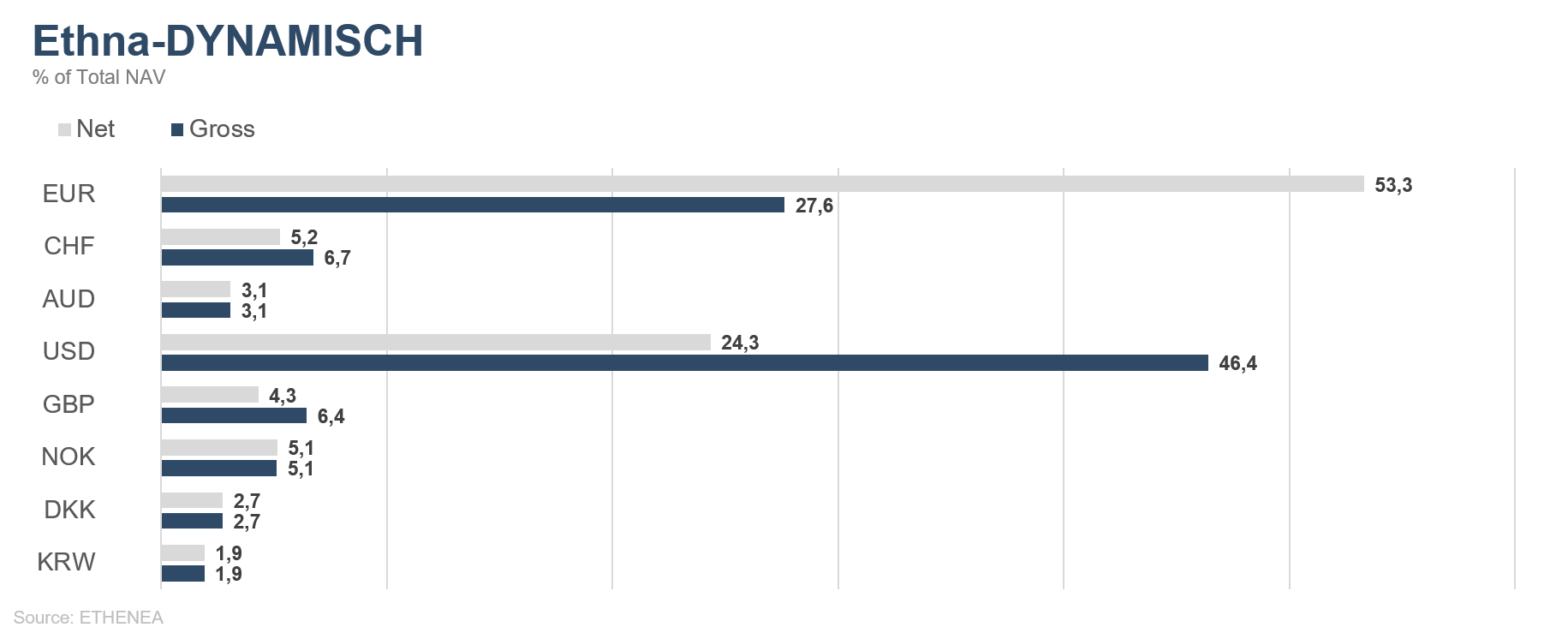

Figure 6: Portfolio composition of the Ethna-DYNAMISCH by currency

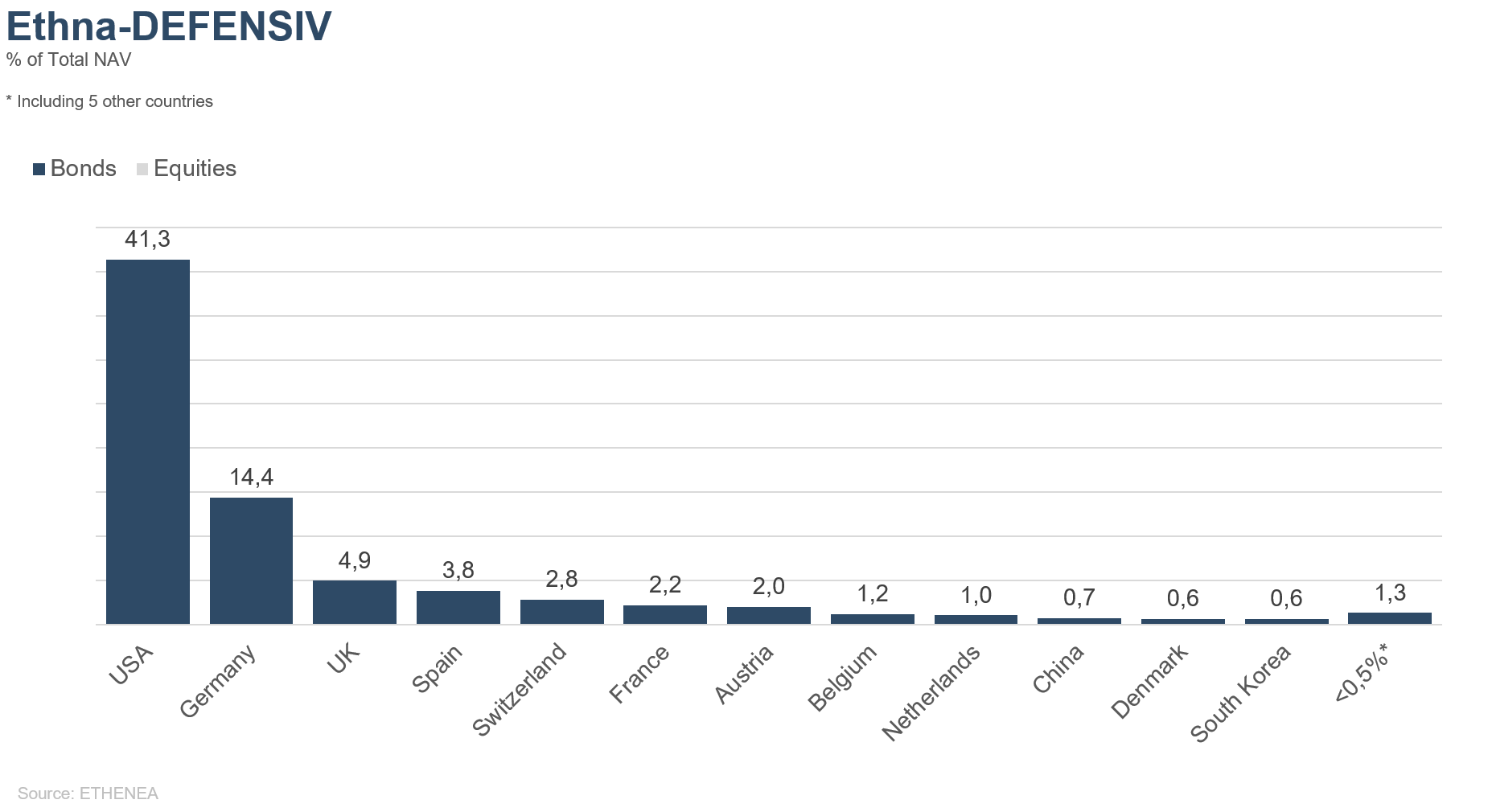

Figure 7: Portfolio composition of the Ethna-DEFENSIV by country

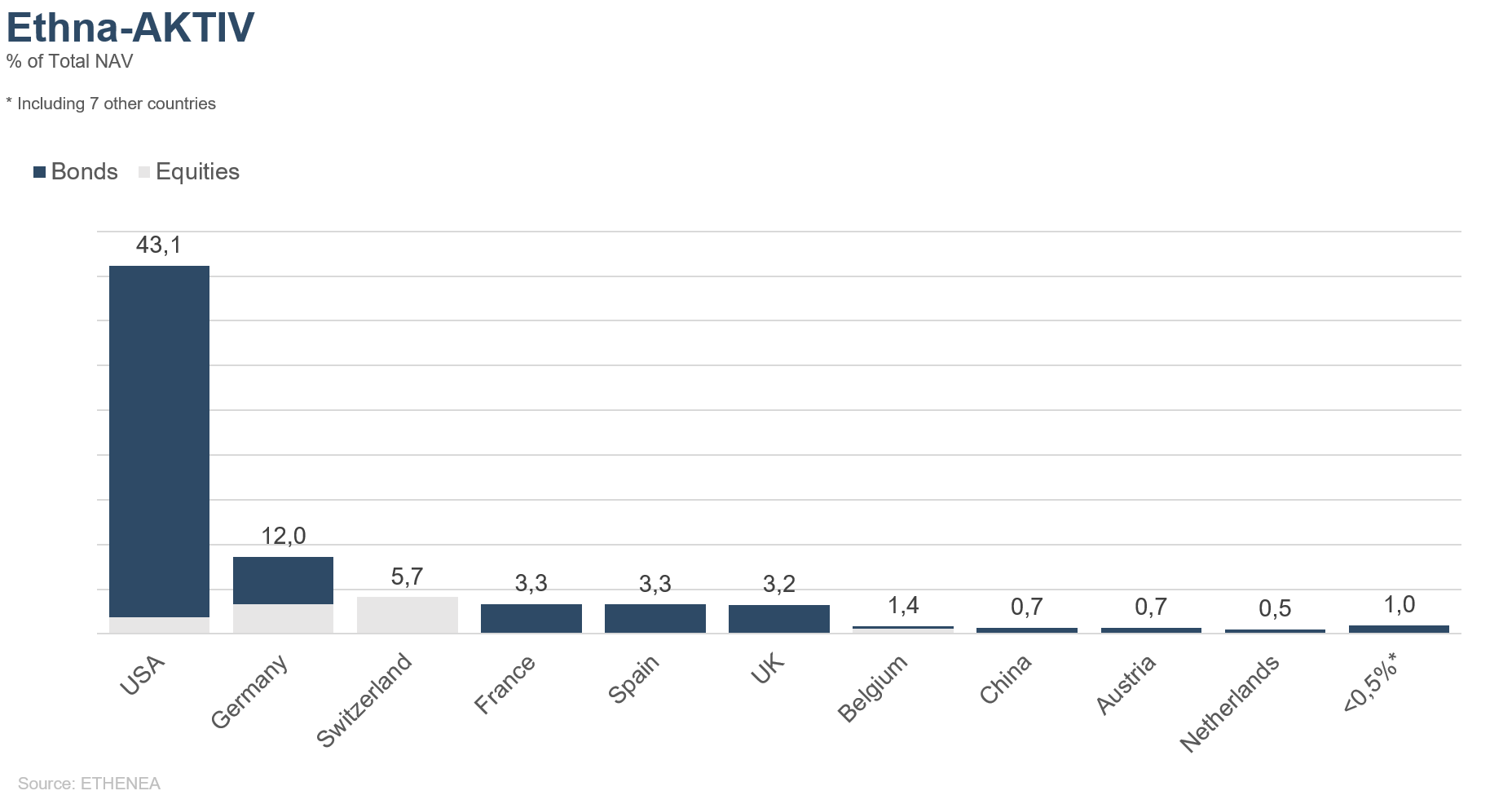

Figure 8: Portfolio composition of the Ethna-AKTIV by country

Figure 9: Portfolio composition of the Ethna-DYNAMISCH by country

Figure 10: Portfolio composition of the Ethna-DEFENSIV by issuer sector

Figure 11: Portfolio composition of the Ethna-AKTIV by issuer sector

Figure 12: Portfolio composition of the Ethna-DYNAMISCH by issuer sector

* “Cash” comprises term deposits, call money and current accounts/other accounts. “Equities net” comprises direct investments and exposure resulting from equity derivatives.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

Dit is een marketing communicatie. Het is uitsluitend bedoeld om productinformatie te verstrekken en is geen verplicht wettelijk of regelgevend document. De informatie in dit document vormt geen verzoek, aanbod of aanbeveling om participaties in het fonds te kopen, te verkopen of om enige andere transactie aan te gaan. Het is uitsluitend bedoeld om de lezer inzicht te geven in de belangrijkste kenmerken van het fonds, zoals het beleggingsproces, en wordt noch geheel noch gedeeltelijk beschouwd als een beleggingsaanbeveling. De verstrekte informatie is geen vervanging voor de eigen overwegingen van de lezer of voor enige andere juridische, fiscale of financiële informatie en advies. Noch de beleggingsmaatschappij, noch haar werknemers of bestuurders kunnen aansprakelijk worden gesteld voor verliezen die rechtsreeks of onrechtstreeks worden geleden door het gebruik van de inhoud van dit document of in enig ander verband met dit document. De verkoopdocumenten in het Duits die op dit moment geldig zijn (verkoopprospectus, essentiële-informatiedocumenten (PRIIPs-KIDs) en de halfjaar- en jaarverslagen), die gedetailleerde informatie geven over de aankoop van participaties in het fonds en de bijbehorende kansen en risico's, vormen de enige wettelijke basis voor de aankoop van participaties. De bovengenoemde verkoopdocumenten in het Duits (evenals in onofficiële vertalingen in andere talen) zijn te vinden op www.ethenea.com en zijn naast de beleggingsmaatschappij ETHENEA Independent Investors S.A. en de depothoudende bank, ook gratis verkrijgbaar bij de respectieve nationale betaal- of informatieagenten en van de vertegenwoordiger in Zwitserland. De betaal- of informatieagenten voor de fondsen Ethna-AKTIV, Ethna-DEFENSIV en Ethna-DYNAMISCH zijn de volgende: België, Duitsland, Liechtenstein, Luxemburg, Oostenrijk: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxemburg; Frankrijk: CACEIS Bank France, 1-3 place Valhubert, F-75013 Paris; Italië: State Street Bank International – Succursale Italia, Via Ferrante Aporti, 10, IT-20125 Milano; Société Génerale Securities Services, Via Benigno Crespi, 19/A - MAC 2, IT-20123 Milano; Banca Sella Holding S.p.A., Piazza Gaudenzio Sella 1, IT-13900 Biella; Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Spanje: ALLFUNDS BANK, S.A., C/ Estafeta, 6 (la Moraleja), Edificio 3 – Complejo Plaza de la Fuente, ES-28109 Alcobendas (Madrid); Zwitserland: Vertegenwoordiger: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Betaalagent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. De betaal- of informatieagenten voor HESPER FUND, SICAV - Global Solutions zijn de volgende: België, Duitsland, Frankrijk, Luxemburg, Oostenrijk: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxemburg; Italië: Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Zwitserland: Vertegenwoordiger: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Betaalagent: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. De beleggingsmaatschappij kan bestaande distributieovereenkomsten met derden beëindigen of distributievergunningen intrekken om strategische of statutaire redenen, mits inachtneming van eventuele deadlines. Beleggers kunnen informatie over hun rechten verkrijgen op de website www.ethenea.com en in de verkoopprospectus. De informatie is zowel in het Duits als in het Engels beschikbaar, en in individuele gevallen ook in andere talen. Opgemaakt door: ETHENEA Independent Investors S.A. Het is verboden om dit document te verspreiden aan personen die wonen in landen waar het fonds geen vergunning heeft of waar er een toestemming vereist is voor verspreiding. Participaties mogen enkel aangeboden worden aan personen in landen waarin dit aanbod in overeenstemming is met de toepasselijke wettelijke bepalingen en waar ervoor wordt gezorgd dat de verspreiding en publicatie van dit document, evenals een aanbod of verkoop van participaties, aan geen enkele beperking is onderworpen in het betreffende rechtsgebied. Het fonds wordt met name niet aangeboden in de Verenigde Staten van Amerika of aan Amerikaanse burgers (volgens Rule 902 of Regulation S of the U.S. Securities Act of 1933, in de huidige versie) of personen die namens hen, in hun rekening of ten voordele van een Amerikaanse burger handelen. Resultaten die in het verleden behaald zijn, mogen niet worden opgevat als indicatie of garantie voor toekomstige prestaties. Schommelingen in de waarde van onderliggende financiële instrumenten of hun rendementen, evenals veranderingen in rentetarieven en valutakoersen, zorgen ervoor dat de waarde van participaties in een fonds, evenals de daaruit voortvloeiende rendementen, zowel kunnen dalen als stijgen en zijn niet gegarandeerd. De waarderingen die hierin opgenomen zijn, zijn gebaseerd op een aantal factoren, waaronder, maar niet beperkt tot, huidige prijzen, schattingen van de waarde van de onderliggende activa en marktliquiditeit, evenals andere veronderstellingen en openbaar beschikbare informatie. In principe kunnen prijzen, waarden en rendementen zowel stijgen als dalen, tot en met het totale verlies van het geïnvesteerde kapitaal, en aannames en informatie kunnen zonder voorafgaande kennisgeving worden gewijzigd. De waarde van het belegde vermogen of de prijs van participaties, evenals de daaruit voortvloeiende rendementen en uitkeringsbedragen, zijn onderhevig aan schommelingen of kunnen geheel verdwijnen. Positieve prestaties in het verleden zijn daarom geen garantie voor positieve prestaties in de toekomst. Met name het behoud van het geïnvesteerde vermogen kan niet worden gegarandeerd; er is dan ook geen garantie dat de waarde van het belegde kapitaal of de aangehouden participaties bij verkoop of terugkoop zal overeenkomen met het oorspronkelijk belegde kapitaal. Beleggingen in vreemde valuta zijn onderhevig aan bijkomende wisselkoersschommelingen of valutarisico's, d.w.z. het rendement van dergelijke beleggingen hangt ook af van de volatiliteit van de vreemde valuta, wat een negatieve impact kan hebben op de waarde van het belegde kapitaal. Beleggingen en toewijzingen kunnen gewijzigd worden. De beheer- en depotvergoedingen, evenals alle andere kosten die overeenkomstig de contractuele bepalingen ten laste van het fonds zijn, worden in de berekening opgenomen. De prestatieberekening is gebaseerd op de BVI-methode (Duitse Federale Vereniging voor Beleggings- en Vermogensbeheer), dat wil zeggen dat uitgiftekosten, transactiekosten (zoals order- en makelaarskosten), evenals bewaar- en andere beheervergoedingen niet inbegrepen zijn in de berekening. Het beleggingsrendement zou lager zijn indien rekening zou worden gehouden met de uitgiftetoeslag. Er kan geen garantie worden gegeven dat de marktprognoses gehaald worden. Om het even welke risicobehandeling in deze publicatie mag niet worden beschouwd als een onthulling van alle risico's of een sluitende behandeling van de genoemde risico's. In de verkoopprospectus wordt expliciet verwezen naar de gedetailleerde risicobeschrijvingen. Er kan geen garantie worden gegeven dat de informatie juist, volledig of actueel is. De inhoud en de informatie zijn auteursrechtelijk beschermd. Er kan geen garantie worden gegeven dat het document voldoet aan alle wettelijke of regelgevende vereisten die andere landen dan Luxemburg hebben vastgesteld. Opmerking: De belangrijkste technische termen kunnen worden gevonden in de woordenlijst op www.ethenea.com/lexicon. Informatie voor beleggers in België: Het prospectus, de statuten en de periodieke verslagen, alsmede de essentiële-informatiedocumenten (PRIIPs-KIDs), zijn kosteloos verkrijgbaar in het Frans bij de beheermaatschappij, ETHENEA Independent Investors S.A., 16, rue Gabriel Lippmann, 5365 Munsbach, Luxemburg en bij de vertegenwoordiger: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxemburg. Informatie voor beleggers in Zwitserland: Het vestigingsland van de collectieve beleggingsregeling is Luxemburg. De vertegenwoordiger in Zwitserland is IPConcept (Schweiz) AG, Münsterhof 12, P.O. Box, CH-8022 Zürich. De betaalagent in Zwitserland is DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zurich. Het prospectus, de essentiële-informatiedocumenten (PRIIPs-KIDs) en de statuten, evenals de jaar- en halfjaarverslagen zijn kosteloos verkrijgbaar bij de vertegenwoordiger. Copyright © ETHENEA Independent Investors S.A. (2024) Alle rechten voorbehouden. 05-05-2020